#Importance of Managing Drawdowns

Explore tagged Tumblr posts

Text

Drawdown in Forex Trading with FTG

The blog titled "Drawdown in Forex Trading – Understanding and Managing Losses" delves into the concept of drawdown in forex trading, which refers to the decline in a trading account's equity from its peak due to a series of losing trades. The guide emphasizes the importance of effectively managing drawdowns to preserve capital, maintain confidence, and avoid impulsive decisions during challenging market phases. The blog explains the different types of drawdowns, including equity drawdown and maximum drawdown, and provides a simple formula for calculating drawdown percentages. It discusses common causes of drawdowns in forex trading, such as market volatility, unsuitable strategies, overleveraging, poor risk management, and external factors. The psychological impact of drawdowns on traders is highlighted, emphasizing the emotional toll they can take, leading to self-doubt and anxiety. The long-term effects of drawdowns on trading performance are explored, including capital erosion and missed opportunities. Strategies for managing drawdowns are extensively covered, including risk management techniques such as proper position sizing and setting stop-loss orders. Diversification and asset allocation, utilizing trailing stops, revisiting and adjusting trading strategies, and the importance of analyzing historical data are also discussed. The blog emphasizes the psychological aspects of dealing with drawdowns, including maintaining discipline, overcoming fear and greed, and the importance of keeping a trading journal for self-reflection and growth. The conclusion underscores that drawdowns are a natural part of forex trading and can be opportunities for growth rather than failures. It encourages continuous learning, adaptation, and using the support and resources provided by Funded Traders Global to navigate the challenges and successes of forex trading.

#Calculating the Drawdown Percentage#Common Causes of Drawdowns in Forex Trading#Drawdowns in Forex Trading#Continuous Learning#Definition and Explanation of Drawdown#Definition of Drawdown in Forex Trading#Diversification and Asset Allocation#Drawdown in Forex Trading - Understanding and Managing Losses#Evaluating Historical Drawdown Data#Forex Traders#Funded Traders Global#Identifying and Monitoring Drawdown Patterns#Impact of Drawdown on Trading Accounts#Importance of Keeping a Trading Journal#Importance of Managing Drawdowns#Maintaining Discipline and Emotional Control#Mitigating Drawdowns Through Analysis#Overcoming Fear and Greed#Proper Position Sizing#Psychological Aspects of Dealing with Drawdown#Revisiting Trading Strategies and Adjusting as Necessary#Risk Management Techniques#self-reflection#Strategies to Manage Drawdowns#The Long-Term Impact on Trading#The Psychological Effect of Drawdown on Traders#Types of Drawdowns: Equity Drawdown and Max Drawdown#Understanding Drawdown#Using Technical Indicators for Drawdown Prediction#Utilizing Trailing Stops

0 notes

Text

Ulcer Index

Unraveling the Ulcer Index: A Comprehensive Guide to Understanding and Utilizing Market Volatility Introduction: In the fast-paced world of investing, understanding market volatility is paramount to success. One tool that aids investors in this endeavor is the Ulcer Index. This comprehensive guide aims to demystify the Ulcer Index, shedding light on its significance, calculation, and practical…

View On WordPress

#Asset allocation#Behavioral Finance#Downside Risk#Drawdown Analysis#Financial Literacy#Financial Markets#Financial Planning#How to Calculate Ulcer Index#Importance of Ulcer Index in Investing#Investment Analysis#Investment education#Investment Performance#Investment Strategies#Investment Tools#Managing Drawdowns with Ulcer Index#Market Risk#Market Volatility#Peter Martin#Portfolio Management#Portfolio Optimization#Risk assessment#Risk Management#Stop-Loss Strategies#Ulcer Index#Ulcer Index and Risk Tolerance#Ulcer Index Applications#Ulcer Index Calculation#Ulcer Index Calculation Method#Ulcer Index in Fund Evaluation#Ulcer Index Interpretation

0 notes

Text

Good News - June 15-21

Like these weekly compilations? Tip me at $Kaybarr1735! And if you tip me and give me a way to contact you, at the end of the month I'll send you a link to all of the articles I found but didn't use each week!

1. Victory for Same-Sex Marriage in Thailand

“Thailand’s Senate voted 130-4 today to pass a same-sex marriage bill that the lower house had approved by an overwhelming majority in March. This makes Thailand the first country in Southeast Asia, and the second in Asia, to recognize same-sex relationships. […] The Thai Marriage Equality Act […] will come into force 120 days after publication in the Royal Gazette. It will stand as an example of LGBT rights progress across the Asia-Pacific region and the world.”

2. One of world’s rarest cats no longer endangered

“[The Iberian lynx’s] population grew from 62 mature individuals in 2001 to 648 in 2022. While young and mature lynx combined now have an estimated population of more than 2,000, the IUCN reports. The increase is largely thanks to conservation efforts that have focused on increasing the abundance of its main food source - the also endangered wild rabbit, known as European rabbit. Programmes to free hundreds of captive lynxes and restoring scrublands and forests have also played an important role in ensuring the lynx is no longer endangered.”

3. Planning parenthood for incarcerated men

“[M]any incarcerated young men missed [sex-ed] classroom lessons due to truancy or incarceration. Their lack of knowledge about sexual health puts them at a lifelong disadvantage. De La Cruz [a health educator] will guide [incarcerated youths] in lessons about anatomy and pregnancy, birth control and sexually transmitted infections. He also explores healthy relationships and the pitfalls of toxic masculinity. […] Workshops cover healthy relationships, gender and sexuality, and sex trafficking.”

4. Peru puts endemic fog oasis under protection

“Lomas are unique ecosystems relying on marine fog that host rare and endemic plants and animal species. […] The Peruvian government has formally granted conservation status to the 6,449-hectare (16,000-acre) desert oasis site[….] The site, the first of its kind to become protected after more than 15 years of scientific and advocacy efforts, will help scientists understand climatic and marine cycles in the area[, … and] will be protected for future research and exploration for at least three decades.”

5. Religious groups are protecting Pride events — upending the LGBTQ+ vs. faith narrative

“In some cases, de-escalation teams stand as a physical barrier between protesters and event attendees. In other instances, they try to talk with protesters. The goal is generally to keep everyone safe. Leigh was learning that sometimes this didn’t mean acting as security, but doing actual outreach. That might mean making time and space to listen to hate speech. It might mean offering food or water. […] After undergoing Zoom trainings this spring, the members of some 120 faith organizations will fan out across more than 50 Pride events in 16 states to de-escalate the actions of extremist anti-LGBTQ+ hate groups.”

6. 25 years of research shows how to restore damaged rainforest

“For the first time, results from 25 years of work to rehabilitate fire-damaged and heavily logged rainforest are now being presented. The study fills a knowledge gap about the long-term effects of restoration and may become an important guide for future efforts to restore damaged ecosystems.”

7. Audubon and Grassroots Carbon Announce First-of-its-Kind Partnership to Reward Landowners for Improving Habitats for Birds while Building Healthy Soils

“Participating landowners can profit from additional soil carbon storage created through their regenerative land management practices. These practices restore grasslands, improve bird habits, build soil health and drive nature-based soil organic carbon drawdown through the healthy soils of farms and ranches. […] Additionally, regenerative land management practices improve habitats for birds. […] This partnership exemplifies how sustainable practices can drive positive environmental change while providing tangible economic benefits for landowners.”

8. Circular food systems found to dramatically reduce greenhouse gas emissions, require much less agricultural land

“Redesigning the European food system will reduce agricultural land by 44% while dramatically reducing greenhouse gas emissions from agriculture by 70%. This reduction is possible with the current consumption of animal protein. “Moreover, animals are recyclers in the system. They can recycle nutrients from human-inedible parts of the organic waste and by-products in the food system and convert them to valuable animal products," Simon says.”

9. Could Treating Injured Raptors Help Lift a Population? Researchers found the work of rehabbers can have long-lasting benefits

“[“Wildlife professionals”] tend to have a dismissive attitude toward addressing individual animal welfare,” [… but f]or most raptor species, they found, birds released after rehabilitation were about as likely to survive as wild birds. Those released birds can have even broader impacts on the population. Back in the wild, the birds mate and breed, raising hatchlings that grow up to mate and breed, too. When the researchers modeled the effects, they found most species would see at least some population-level benefits from returning raptors to the wild.”

10. Indigenous people in the Amazon are helping to build bridges & save primates

“Working together, the Reconecta Project and the Waimiri-Atroari Indigenous people build bridges that connect the forest canopy over the BR-174 road[….] In the first 10 months of monitoring, eight different species were documented — not only monkeys such as the golden-handed tamarin and the common squirrel monkey (Saimiri sciureus), but also kinkajous (Potos flavus), mouse opossums (Marmosops sp.), and opossums (Didelphis sp.).”

Bonus: A rare maneless zebra was born in the UK

June 8-14 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#lgbtq#gay rights#gay marriage#same sex marriage#thailand#lynx#big cats#cats#endangered species#endangered#sex education#prison#peru#conservation#habitat#religion#pride#faith#pride month#lgbt pride#compassion#rainforest#birds#nature#climate change#wildlife rehab#wildlife#indigenous

1K notes

·

View notes

Text

100 solutions to global warming

This TED talk from 2018 discusses the research and conclusions from Project Drawdown. Drawdown is when concentrations of CO2 in the atmosphere begin to decline on a year-to-year basis. The Project Drawdown organization has been evaluating a variety of solutions for both reducing CO2 emissions and removing CO2 from the atmosphere. 100 solutions are described in the book that summarizes their research and evaluation. You really need to watch the video to get a good understanding of their work, but here are a few highlighted quotes from the video.

“We would want to implement these solutions whether or not global warming was even a problem, because they have cascading benefits to human and planetary well-being.” “When we implement these solutions, we shift the way we do business from a system that is inherently exploitative and extractive to a new normal that is by nature restorative and regenerative. We need to rethink our global goals, to move beyond sustainability towards regeneration, and along the way reverse global warming.”

“What surprised us, honestly, was that eight of the top 20 relate to the food system. The climate impact of food may come as a surprise to many people, but what these results show is that the decisions we make every day about the food we produce, purchase and consume are perhaps the most important contributions every individual can make to reversing global warming.”

“A plant-rich diet is not a vegan or a vegetarian diet, though I applaud any who make those choices. It's a healthy diet in terms of how much we consume, and particularly how much meat is consumed. Moreover, approximately a third of all food produced is not eaten, and wasted food emits an astounding eight percent of global greenhouse gases.”

“The single most impactful solution, according to this analysis, would be refrigeration management, or properly managing and disposing of hydrofluorocarbons, also known as HFCs, which are used by refrigerators and air conditioners to cool the air.”

“Rooftop solar comes in ranked number 10.”

10 notes

·

View notes

Text

you know the definition of "disinformation" is "false information" right, not just "anything a right-winger/russian/Chinese person said," right? even if we were to humor the claim that this talking point was initiated by "Russian bots"- a claim I do not find credible whatsoever, the evidence presented is extremely flimsy- it could still be true that the usa is neglecting Hawaii in favor of warfare. note that you have not bothered to actually address the substance of the claim At All, instead choosing to use a poison the well fallacy in lieu of an actual argument.

"Hawaii doesn’t need military equipment and weapons — it needs disaster response, and we’ve known for years that the Federal Emergency Management Agency (FEMA) is woefully unprepared, under-resourced, and understaffed given the increasing rate and severity of natural disasters in the U.S.

interestingly, money spent on military equipment and weapons could, hypothetically, be spent on disaster preparedness instead. crazy, I know.

and since this isn't my first rodeo I know you're about to say "uhm achktually the military equipment sent to Ukraine is usually old equipment ☝️🤓"

yeah, about that:

Military equipment for Ukraine ($25.7 billion) comprises the largest part of the funding and does three things. First, it replaces equipment that has been or will be sent to Ukraine through presidential drawdown authority (PDA) ($13.4 billion). This authority allows the president to take weapons and munitions from U.S. stockpiles and send them to Ukraine. Although there is no statutory requirement to replace the equipment, Congress has provided funding to do so.

[source]

while the equipment being sent may be old, that equipment is being replaced as it's sent out. the money spent replacing this equipment could- and should- be going to Hawaii instead.

not to mention replacing weapon stockpiles isn't the only way money is being spent on Ukraine:

Second, it provides Ukraine with funding through the State Department’s Foreign Military Financing (FMF) program ($1.6 billion). This program provides grants and loans for allies and partners such as Ukraine to purchase weapons and munitions in the United States.

The third and final element is enhancing the defense industrial base to increase production capabilities and develop more advanced weapons and munitions ($7.0 billion). For example, the bill includes funding to help the U.S. Army meet its monthly production goal of 100,000 155-millimeter (mm) shells by 2025. The United States currently produces around 40,000 shells per month, whereas Ukraine needs at least 100,000 shells per month and up to 180,000 for offensive operations.

if you think funding the military to maintain global US hegemony is more important than helping indigenous people in Hawaii, just say that. don't bullshit us with this irrelevant nonsense about "Russian bots."

[liberal voice]: the idea that you should care about the indigenous people being neglected in hawaii is just a right-wing narrative! the true, progressive, left-wing narrative is that we must increase military funding to defeat the nefarious threat of red china

10K notes

·

View notes

Text

Meta Bromo Anisole Prices Index: Trend, Chart, News, Graph, Demand, Forecast

In the first quarter of 2025, the global Meta Bromo Anisole market experienced a sustained decline in prices, shaped by a complex mix of economic uncertainty, shifting trade policies, supply-demand imbalances, and seasonal disruptions. Across major regions such as North America, Asia Pacific, and Europe, the pricing landscape was characterized by soft market fundamentals, weakening downstream demand, and volatility in international trade flows. In the United States, prices of Meta Bromo Anisole fell steadily as consumer confidence waned amid ongoing inflation concerns and a cooling labor market. These macroeconomic pressures led to reduced purchasing activity, particularly in the pharmaceutical and chemical sectors, which represent a significant portion of the downstream demand for this compound. Severe winter weather during January added to the headwinds, causing delays in logistics and hampering procurement activities. As a precautionary measure, many buyers accelerated their purchases early in the quarter to hedge against anticipated tariff changes related to U.S.-China trade tensions. This led to an artificial build-up in inventories, which later contributed to an oversupply situation that intensified downward pressure on prices.

In February, the situation in the U.S. market remained bearish despite improvements in global logistics and a decline in international shipping costs. Increased production activity in China further boosted global supply levels, creating additional surplus in the U.S. market. However, demand continued to lag as buyers adopted a cautious approach, delaying new orders and focusing on inventory drawdowns. The uncertainty surrounding future tariff hikes and the broader economic outlook led to subdued procurement strategies. Many buyers, already well-stocked from earlier purchases, refrained from engaging in fresh deals, thereby reinforcing the downward momentum in prices. The market sentiment remained fragile, with suppliers forced to reconsider pricing strategies in response to lackluster demand and growing competition. The oversupplied environment prompted sellers to offer competitive pricing and discounts in an effort to stimulate market interest and manage stock levels.

Get Real time Prices for Meta Bromo Anisole: https://www.chemanalyst.com/Pricing-data/meta-bromo-anisole-1645

By March, trade tensions between the United States and China escalated significantly, with the U.S. government announcing a substantial increase in tariffs on a range of Chinese chemical imports, including Meta Bromo Anisole. This policy shift failed to provide the expected support to domestic prices. Instead, it contributed to a continued decline as buyers, wary of the implications of trade barriers, adopted a wait-and-see approach. The depreciation of the U.S. dollar further complicated the pricing dynamics, reducing the purchasing power of American importers and reinforcing cautious buying behavior. Suppliers, grappling with high inventories and limited order volumes, resorted to aggressive pricing strategies to maintain cash flows and reduce warehousing costs. This competitive environment added another layer of pressure, pushing prices further down. Overall, the U.S. market remained subdued throughout the quarter, shaped by weak demand, excess supply, and ongoing trade and economic uncertainty.

In the Asia Pacific region, China played a central role in influencing Meta Bromo Anisole price movements. The Chinese market experienced notable volatility over the course of the quarter, beginning with a spike in prices during January due to strong export demand and reduced manufacturing activity in anticipation of the Lunar New Year. Key end-user industries such as pharmaceuticals and agrochemicals showed robust demand early in the month, which combined with constrained supply to temporarily push prices upward. However, as the Lunar New Year holidays concluded and production lines resumed normal operations, the market quickly shifted into a state of oversupply. February saw a correction in prices as output increased and domestic demand weakened amid growing deflationary trends and sluggish industrial activity. The rise in U.S. tariffs on Chinese exports further dampened the competitiveness of Chinese shipments, prompting many suppliers to divert focus toward the domestic market. This shift, however, contributed to inventory accumulation and price reductions in local markets.

March saw continued downward pricing pressure in the Chinese market. Despite stable production levels, demand remained soft due to weakened confidence across downstream sectors. The strengthening of the Chinese yuan during this period also made exports less attractive, adding to the stockpile of unsold inventory. To mitigate the impact of rising tariffs and an unfavorable export environment, manufacturers began offering price concessions and discounts to clear excess stock. These measures, while necessary to maintain liquidity, reinforced the bearish sentiment in the regional market. Consequently, the Asia Pacific market ended the quarter with lower price levels, driven by a combination of improved supply, weakening demand, and external trade challenges.

In Europe, particularly in Germany, the pricing trend for Meta Bromo Anisole followed a similar trajectory, marked by a persistent decline throughout the quarter. Economic headwinds such as rising inflation, political uncertainty ahead of national elections, and lackluster industrial output led to subdued demand from key sectors. January began with cautious market activity, as buyers anticipated potential disruptions in global trade and delayed purchasing decisions. The shift in Chinese export focus toward European markets—spurred by reduced access to the U.S.—led to an influx of competitively priced imports. This influx contributed to an oversupplied market environment and exerted downward pressure on local prices. In February, the favorable exchange rate and declining freight costs further incentivized import activity, leading to increased inventory levels and reduced reliance on new procurement. Buyers opted to deplete existing stockpiles rather than engage in new purchases, reinforcing the soft market sentiment.

By March, the European market was characterized by continued oversupply, steady logistics conditions, and limited demand. Market participants prioritized inventory reduction and cash flow management, often at the expense of pricing. Suppliers, facing stiff competition and limited sales opportunities, responded with more flexible pricing and discounts. Despite the relative strength of the Euro and improved supply chain reliability, the underlying demand weakness prevented any meaningful recovery in prices. The cumulative effect of these regional dynamics resulted in a global Meta Bromo Anisole market that remained under consistent downward pressure throughout the first quarter of 2025. As manufacturers and buyers navigate through ongoing macroeconomic uncertainties, trade disruptions, and evolving demand patterns, price stability may remain elusive in the near term.

Get Real time Prices for Meta Bromo Anisole: https://www.chemanalyst.com/Pricing-data/meta-bromo-anisole-1645

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

How to Plan for Retirement in Australia: A Simple Guide for Every Stage of Life

Retirement planning is one of the most important financial journeys Australians can undertake. Whether you’re in your 20s, approaching your 60s, or somewhere in between, having a clear plan can help you build financial security and peace of mind for the years ahead.

In this guide, we’ll walk you through how to plan for retirement in Australia. We’ll cover simple tips, common mistakes to avoid, and key factors that can impact your financial future.

Why Retirement Planning Matters

Many Australians underestimate how much money they’ll need in retirement. The cost of living continues to rise, and Australians are living longer than ever. Without proper planning, you could risk outliving your savings.

Retirement planning helps you:

✅ Ensure you have enough income to cover your lifestyle needs ✅ Manage health and aged care costs ✅ Reduce financial stress in later years ✅ Support your family and loved ones

When Should You Start Planning?

The earlier, the better.

If you start in your 20s or 30s, you can take advantage of compound interest—earning returns on both your initial investment and on prior earnings.

But it’s never too late to begin. Even if you’re in your 40s or 50s, focused planning can help maximise your savings before retirement.

Key Components of Retirement Planning in Australia

1. Superannuation

Your super is likely to be your largest retirement asset.

Tips:

Regularly review your super fund’s performance and fees.

Make additional contributions (salary sacrifice or after-tax contributions) if you can.

Check if you’re eligible for the government co-contribution or spouse contribution schemes.

2. Budgeting and Saving

Know your expected retirement expenses. Include:

Housing (mortgage, rent, maintenance)

Utilities and insurance

Food and personal expenses

Healthcare costs

Travel and hobbies

Tip: Create a realistic budget and track progress annually.

3. Investments Outside of Super

Diversifying your investments can provide flexibility and extra income.

Options include:

Shares and managed funds

Property investment

Term deposits and bonds

Tip: Work with a financial adviser to align investments with your risk profile and retirement goals.

4. Government Support

Understand your eligibility for the Age Pension and related concessions. Check the latest income and assets test requirements on Services Australia.

Tip: Plan your retirement income mix to maximise Age Pension entitlements where possible.

Common Mistakes to Avoid

❌ Assuming superannuation alone will be enough ❌ Underestimating healthcare and aged care costs ❌ Not reviewing your investment strategy regularly ❌ Ignoring inflation and its impact on purchasing power

How Much Do You Need to Retire in Australia?

According to the Association of Superannuation Funds of Australia (ASFA):

A comfortable retirement currently requires about $70,000 per year for a couple and $50,000 per year for a single person (updated for 2025).

The amount you need depends on when you retire, life expectancy, lifestyle goals, and healthcare needs.

Tips for Every Stage of Life

In Your 20s–30s:

✅ Start contributing to super early ✅ Pay off high-interest debt ✅ Build a savings buffer

In Your 40s–50s:

✅ Increase super contributions ✅ Focus on investment diversification ✅ Review insurance and estate planning

Approaching Retirement (50s–60s):

✅ Develop a detailed retirement budget ✅ Understand drawdown strategies for your assets ✅ Seek professional financial advice

The Value of Professional Financial Planning

Every Australian’s retirement journey is unique. A professional financial planner can help you:

Build a tailored retirement plan

Manage risks

Optimise tax outcomes

Create a reliable retirement income stream

AMA Finance can help you navigate every step of the process. Our experienced team works with clients across Australia to build secure, stress-free retirement plans.

Final Thoughts

Planning for retirement is about much more than just money — it’s about creating the life you want to live after work. Whether you want to travel, support your family, or pursue hobbies, the right financial plan can help make it possible.

Start today The sooner you take control of your financial future, the more confident you’ll feel as you approach retirement.

0 notes

Text

How to Start a White Label Prop Firm: Step-by-Step Guide

The proprietary trading industry is growing rapidly, and white label prop firms are becoming a popular choice for entrepreneurs who want to enter the market without building everything from scratch. With a white label solution, you get the infrastructure, software, and support under your own brand. In this step-by-step guide, we’ll walk you through how to start your own white label prop firms with the help of platforms like PropFirms Tech.

Understand the White Label Prop Firm Model

A white label prop firm allows you to offer funded trading programs under your own brand. You partner with a provider like PropFirms Tech, who supplies the backend technology, risk management systems, trader dashboards, and funding processes. This lets you focus on branding, marketing, and community-building without handling the technical complexities.

Choose the Right White Label Provider

Your choice of provider will directly impact your firm’s performance and credibility. Look for features such as:

Trader evaluation systems

Custom branding options

Automated payouts and scaling plans

MT4/MT5 or cTrader integration

24/7 technical support

PropFirms Tech is one of the leading providers, offering a robust platform with fully managed services and flexible plans tailored to your growth goals.

Define Your Business Model

Decide how you will structure your funded trading programs. Key questions include:

Will you offer one-phase or two-phase evaluations?

What account sizes and fees will you charge?

What are the rules for profit targets, drawdowns, and consistency?

Using a provider like PropFirms Tech, you can easily customize your programs to appeal to different trader profiles.

Set Up Your Brand and Website

Create a strong brand identity, including your logo, color scheme, and mission statement. You’ll also need a professional website with:

Clear program details

Easy sign-up process

Integrated client portal

FAQs and support options

PropFirms Tech offers white-labeled website templates and seamless onboarding tools that help you go live fast.

Implement Risk Management and Compliance

Even in a white label setup, you need proper risk management to protect your capital. Make sure your provider offers real-time monitoring, automated rules enforcement, and risk limit controls.

Compliance is equally important. Consult with a legal expert to ensure you meet regulations in your target markets.

Launch and Market Your Prop Firm

With your systems ready and brand in place, it’s time to launch. Use a combination of:

Social media campaigns

Influencer partnerships

Trading community outreach

SEO and content marketing

PropFirms Tech supports your growth with tools and analytics to optimize performance and attract top traders.

Final Thoughts

Starting a white label prop firm is one of the fastest ways to enter the proprietary trading industry. With the right partner like PropFirms Tech, you can launch a professional, scalable trading firm in weeks—not months.

0 notes

Text

High Win Rate Trading Strategies: Conquer Chaos & Finally Achieve Consistency

High Win Rate Trading Strategies: Conquer Chaos & Finally Achieve Consistency

If you’re tired of wild market swings derailing your progress, it’s time to discover high win rate trading strategies that deliver reliable results—no more guesswork, just proven performance.

Why High Win Rate Trading Strategies Matter

High win rate trading strategies offer clarity and confidence in volatile markets. According to a 2023 study, traders using systematic setups outperformed discretionary traders by 18%. Consistency is possible—if you adopt a rules-based approach. Let’s explore what works and why.

Simplicity Outperforms Complexity

Complex indicators can cloud judgment. A simple moving average crossover strategy, backtested on the S&P 500, yielded a 65% win rate over 10 years. Simplicity reduces errors and decision fatigue, keeping you focused on high-probability trades. Next, let’s look at risk management.

Risk Management: The Unsung Hero

Even the best high win rate trading strategies fail without disciplined risk control. Limiting losses to 1–2% per trade can protect your capital. As Jack Schwager notes, “Risk management is more important than the entry signal.” Now, onto optimizing your trade entries.

Backtesting for Unshakeable Confidence

Backtesting your strategy on historical data uncovers its real win rate. For example, a simple breakout system on EUR/USD produced a 70% win rate across 500+ trades. Data-driven insights take the emotion out of trading and boost your consistency. Let’s wrap it up with key takeaways.

Simple systems often outperform complex ones

Risk management is crucial for longevity

Backtest to verify your strategy’s real performance

Ready to conquer market chaos? Apply a high win rate trading strategy with strict risk rules and let data drive your decisions for lasting consistency.

FAQ: What’s the best high win rate trading strategy for beginners?

Start with a simple moving average crossover or breakout system. These strategies are easy to learn, have robust historical results, and can be backtested for confidence.

FAQ: How do I know if my trading strategy really works?

Backtest your approach on several years of historical data. Track win rate, drawdowns, and risk/reward. Only trade strategies with proven, consistent results over time.

What trading strategy has given you the most consistent results? Share your experiences or reblog if you found these tips helpful—let’s build a winning community together!

0 notes

Text

How to Pass a Prop Firm Challenge on Your First Try

Navigating the world of proprietary trading can feel daunting, but passing a prop firm challenge is your gateway to trading success. With the right strategies and mindset, you can transform your skills into a funded trading career, unlocking financial freedom and growth.

In this guide, we’ll unveil essential tips and techniques to help you conquer your first challenge with confidence. From developing a robust trading plan to mastering emotional control, prepare to elevate your trading game and seize the opportunity that awaits.

Understanding Prop Firm Challenges and The Concept Trading

What is a Prop Firm Challenge?

A prop firm challenge tests your trading skills. Proprietary trading firms use it to see if you can trade well under their rules. You trade on a demo or challenge account. They watch your moves against metrics like profit targets and risk limits.

If you pass, you join a funded trader program where you trade real money.

Purpose and Structure

The challenge’s goal is to find traders who handle money smartly. You get a challenge account to trade with. You must hit certain performance requirements in set timeframes. Each firm has a payout structure that usually shares profits once you’re funded.

Benefits for Aspiring Traders

Trying these challenges gives you some cool perks:

Funded trader benefits let you trade big without your own cash.

Financial freedom through trading can happen when you use firm capital.

Trading career growth comes from learning while proving yourself.

The Concept Trading's Challenge Rules and Criteria

Specific Requirements

At The Concept Trading, the challenge comes with clear trading rules that outline exactly what is and isn’t allowed during your evaluation. These rules are especially helpful for those new to the industry, making it one of the more approachable proprietary trading firms for beginners.

One of the most important aspects to monitor is your maximum drawdown—this limit defines the largest loss you can take before failing the evaluation. Staying within this threshold is key to moving forward and ultimately getting funded.

Profit Targets

You have to reach account growth targets in the time given. This proves you can make steady profits.

Drawdown Limits

Daily drawdown limits keep risk low every day. Sticking to them protects your spot in the challenge.

Understanding Challenge Requirements: Profit Targets and Drawdown Limits

You’ll need to plan for two main parts: profit targets and overall drawdown limits.

Profit target means how much profit you must earn during the challenge.

Overall drawdown limits show how much total loss you can have before failing.

Strategies for Meeting Targets

Good trading discipline techniques help here:

Follow your trading plan closely.

Stay calm even when markets jump around.

Doing this raises your chance to pass the prop firm challenge quickly!

Drawdown Management Techniques

Watch daily loss limits well to keep control:

Put stop-loss orders on every trade.

Check open trades often against daily loss caps.

Change position sizes based on market changes.

Trading Restrictions and Timeframes

Know which trading instruments are allowed and when markets open or close.

Permitted Trading Instruments

Each firm lets you trade certain instruments only—stocks, forex pairs, etc.—so check what’s permitted first.

Trading Hours

Market hours restrictions say when trades can happen. Missing this info could cost you penalties!

Leverage Restrictions

Leverage rules matter too! Firms set how much leverage you may use during the challenge. Knowing this helps balance profits with risks.

Getting familiar with prop firm challenges through The Concept Trading helps new traders understand what to expect as they aim for success!

Developing a Robust Trading Plan

A good trading plan helps you pass a prop firm challenge. It shows how you will trade and keeps you on track.

Your plan should list trading strategies for the instruments you choose, like forex or stocks. Use technical analysis tools such as moving averages and RSI to find trends and entry points.

Add rules to limit losses on every trade. This plan stops you from making emotional choices during market swings. Following your strategy all the time can boost your chances in any prop firm challenge.

Defining Your Trading Style

Your trading style decides how you trade each day. Whether you day trade or swing trade, discipline matters most. Stay consistent by sticking to your style, even when emotions get high.

Try techniques like deep breathing or writing in a journal after trades. These help manage stress and keep impulsive decisions away. This mindset can help your results stay steady during the challenge.

Choosing Your Markets

Picking the right markets can help in a forex trading challenge or other markets. Watch out for market hours restrictions some firms have. Trade when markets are open and you can watch closely.

Look at economic indicators like interest rates and job reports. They move prices a lot. Pick liquid markets that don’t jump around too much for easier trading.

Entry and Exit Rules

Clear rules for when to enter and exit trades bring steady profits in prop firm challenges. Set exact criteria, like signals from several technical indicators, before entering a trade.

Decide exit rules based on profit goals or stop-loss points. Use stop-loss to protect your money if the market moves against you fast.

Backtesting and Forward Testing Your Strategy

Test your strategy with past data before using real money. This backtesting shows if it works in different market times. Forward testing means trying it live on simulated accounts with no real risk.

Both tests find what works well and what needs fixing before you trade funded accounts in a prop firm challenge.

Backtesting Platforms and Tools

Platforms like TradingView and MetaTrader make backtesting simple and detailed. They let you try strategies on many instruments and show stats like win rate or drawdown clearly.

Interpreting Backtest Results

Don’t just look at profits in backtests. Check max drawdown too — this shows your biggest loss possible during bad times. Use these facts to tweak your plan, not just rely on past profits that might not happen again.

Forward Testing Methodology

Use demo accounts that copy real prices but risk no money when forward testing. This lets you practice under pressure safely before going live with funded challenges.

Essential Trading Strategy Elements: Entry and Exit Criteria

Good traders mix technical indicators like MACD or Bollinger Bands with price action clues such as support and resistance levels to pick exact spots for entry and exit inside their plans.

Position Sizing for Risk Management

Position sizing means deciding how much money to use per trade compared to your total account size. It helps control risk across all trades so one bad one won’t hurt too much.

Calculating Position Size

Figure out position size by choosing how much loss is okay per trade, usually 1-2% of your total capital. Example:

Position Size = Account Equity �� Risk Percentage / Stop-Loss Distance

This way, no single loss will wreck your account balance badly.

Risk Tolerance Assessment

Think about how much loss feels okay for you personally while following the firm’s capital rules. This balance helps keep growth chances without losing too much money fast.

Adjusting Position Size Based on Volatility

Markets move up and down in volatility daily. Make position sizes smaller when volatility spikes happen so risks lower during wild times. Grow size carefully when things calm down more steadily.

Work through these areas well with clear rules plus tested ideas, and you’ll feel ready to handle any prop firm challenge from start to end without much doubt or stress.

Implementing Effective Risk Management Techniques

Risk management matters a lot if you want to pass a prop firm challenge. It keeps your trading capital safe and helps you follow rules like maximum drawdown and daily drawdown limits. A good plan balances risks with possible rewards.

Try these key methods:

Stop-Loss Strategy: Use stop-loss orders to stop big losses early.

Take-Profit Levels: Set points where you take profits before the market turns.

Risk-Reward Ratio: Look for trades where profit is bigger than loss, like 2:1 or more.

Capital Protection: Don’t risk more than about 1% of your total money on one trade.

Drawdown Limits: Stick to the max and daily drawdown rules so you don’t get disqualified.

Using these steps regularly helps control your risk during the challenge.

Stop-Loss and Take-Profit Strategies

Good stop-loss and take-profit plans help control risk and improve how trades end. Here are some ideas:

Trailing Stops: Move stops up as price rises so you keep profits without losing out on gains.

Breakeven Orders: Once a trade makes some profit, move your stop to your entry price to avoid losing money.

Multiple Stop-Loss Levels: Use more than one stop based on support areas or how much price moves.

Clear rules for when to enter and exit trades keep things steady. For example:

Only enter when signals match your plan, like confirming a trend.

Put a stop-loss in right after you enter, based on how much price swings or a set percentage.

Pick take-profit points at key support/resistance or using risk-reward math.

These ways help stop emotional choices when markets move fast in prop firm challenges.

Managing Drawdown and Protecting Your Capital

Drawdowns show if your plan works and test your mindset during a prop firm challenge. Managing them well protects your account from hitting hard limits that can end the game early.

Do these:

Follow overall drawdown limits set by the firm closely; going over ends you no matter what.

Spread trades across different assets or timeframes to lower risk from big moves hitting all trades.

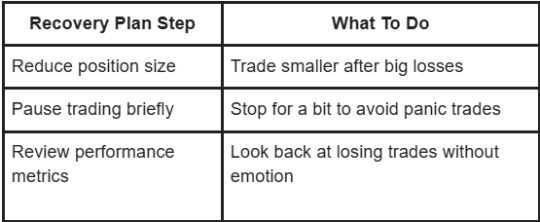

Plan ahead for recovery, like:

Doing this keeps your money safer while you work toward funding goals.

Developing Emotional Control and Trading Discipline

Emotional control is huge for passing any prop firm challenge. Fear of losing or wanting quick gains can mess up your plan and cause errors.

Try these mental tricks:

Practice staying focused on now instead of feelings

Set real goals about wins and losses

Keep a journal about how you feel with each trade

Knowing fear and greed—the two biggest feelings that mess with traders—helps build toughness needed in timed challenges.

Discipline means following your plan no matter what, even if markets swing wildly or past trades lost money. Traders who stick with this get better results over time.

Good risk management plus steady trading improves your chances to pass a prop firm challenge on your first try. These ideas keep your capital safe while building confidence.

Adapting to Trending, Ranging, and Volatile Markets

Passing a prop firm challenge means you gotta adjust your trading style to the market. Markets switch between trending, ranging, and volatile modes all the time. Each type needs a different approach and mindset.

Trending Markets: Prices move in one clear direction. Traders use momentum strategies to catch these moves.

Ranging Markets: Prices jump between support and resistance levels. Range-bound strategies work best here.

Volatile Markets: Prices swing wildly because of stuff like economic data, geopolitical events, or central bank moves. Risk management is key now.

Knowing how economic indicators and geopolitical risks affect markets helps you expect when volatility will spike. A flexible mindset lets you switch gears fast instead of sticking with one method.

Identifying Market Regimes

Figuring out what kind of market you’re in matters when adapting during a prop firm challenge evaluation.

Try these:

Technical Analysis: Look at chart patterns and technical indicators like moving averages or RSI to spot trends or ranges.

Fundamental Analysis: Watch news about the economy, company earnings, or policy changes that move prices.

Market Sentiment Metrics: Check trader feelings using volume or sentiment indexes.

Use trading evaluation metrics to see how you do in different regimes by tracking wins and losses under each condition. This helps you pick smarter trades based on current market mood.

Adjusting Strategies Accordingly

Changing your strategies depending on the market regime helps keep your trading steady in challenges where rules are strict.

Follow this approach:

Check recent price moves using both technical and fundamental info.

Pick tactics: trend-following for trending markets; mean reversion for ranging ones.

Adjust based on past trade results for each market type.

Stick to stop-losses that fit the current volatility level.

This method cuts down emotional decisions and makes you quicker to react — an edge when prop firms watch every move closely.

Utilizing Different Time Frames

Making the most of different time frames improves your trading schedule:

Use daily or weekly charts to find big picture trends.

Use shorter frames (like 15-minute or hourly) to time entries and exits better.

Mixing long-term views with short-term action sharpens timing without pushing you into too many trades — a mistake many make during fast markets.

Utilizing Essential Trading Technology and Tools

Trading tech can boost your accuracy and speed through the prop firm challenge:

Charting software such as TradingView gives real-time charts for spotting setups fast.

Trade monitoring tools keep tabs on open trades and risk limits so you avoid mistakes.

AI-powered analytics crunch tons of data to show likely moves beyond what people can spot.

Automated trading platforms like MetaTrader let you test strategies before going live to see how they perform.

Using these tools means less guesswork and more data-backed trading decisions.

Charting Software and Data Analysis Tools

Knowing how to use charting software plus solid data analysis steps up your decision game:

Use technical indicators like MACD or Bollinger Bands suited for current market types.

See price action clearly with candlestick charts plus volume overlays to catch patterns quick.

Backtest your strategy on past data right inside the platform; this shows if it works before risking money live.

Putting these tools into daily habits during your prop firm challenge builds confidence based on facts — not just gut feelings.

This way of working gets you ready not only in skills but also mentally so you pass a prop firm challenge right away while handling financial market volatility smartly by matching changes linked to economic shifts and geopolitical risks around the world.

Maintaining Consistency and Patience in Trading

Doing well in a prop firm challenge needs solid trading discipline and consistency. You gotta build a daily routine that helps you make steady progress.

A trading journal can be your best friend here. Write down every trade you make—entry points, take-profit targets, and even how you feel. This keeps you honest and shows what works or not.

Consistent trading means you follow your plan even if things get bumpy. Don’t jump into trades on impulse. Use trade monitoring tools to watch the market live and get alerts. When emotions spike, try emotional control techniques like deep breathing or short breaks. Staying calm helps you focus.

Patience matters a lot. Passing a prop firm challenge takes time. Stick to your habits, stay disciplined, and your chances for success grow.

Keep a detailed trading journal

Follow your strategy without flipping out

Use tools to track trades in real time

Practice simple ways to control emotions

Turning Failure into a Learning Opportunity

Everyone hits rough patches during the prop firm challenge. Don’t see losses as total failure. Instead, look at them as chances to learn something new. After each loss, do some losses analysis. Ask what went wrong—bad timing? Poor risk steps? Emotional mistakes?

Keep checking yourself with continuous self-evaluation. Ask questions like: What could I change next time? Did my feelings mess with this trade? Thinking this way turns setbacks into learning opportunities.

Being curious about failure builds strength. That’s a must-have trait for anyone who wants lasting success as a funded trader.

Review each losing trade carefully

Think about what triggered the mistake

Ask yourself honest questions often

Use losses as lessons to improve

Building a Support Network for Accountability

Trading alone can get lonely fast. A trader community or mastermind group can keep you motivated and help you learn from others. These groups share ideas and support each other through the prop firm challenge.

Mentorship in trading is another big help. Experienced traders show you what works and warn about common errors. Having a trading buddy also keeps you on track by sharing goals and progress regularly.

These support systems build good habits and cheer you on when things get tough.

Join a group of fellow traders

Find a mentor with experience

Team up with a trading buddy

Share goals to stay accountable

Planning for Long-Term Success with Funded Trading

Passing your first prop firm challenge is only the start of your trading career growth. You need smart capital allocation to handle risk well while growing your account little by little.

Account scaling is key—you want bigger profits without risking too much at once. Balancing solid money moves with patient growth brings financial stability over time.

Think beyond just passing the challenge now. Planning long-term helps keep your spot in funded programs and build wealth steadily through wise choices.

Manage risk by dividing capital wisely

Grow accounts gradually based on rules

Aim for steady profits over quick wins

Plan for steady financial stability over time

Fast-Tracking Your Funding with The Concept Trading

Passing a prop firm challenge can feel hard. But The Concept Trading makes it easier with its funded trader program. Proprietary trading firms want you to follow strict rules before giving access to funded accounts.

Our funding process helps you pass the prop firm challenge faster. This means you get capital and real market chances sooner.

We focus on clear steps and simple rules. The Concept Trading cuts out the usual obstacles in funded trading programs. That lets you focus on what matters: steady performance and smart risk management.

Overcoming Hesitation and Stress

Trading psychology matters a lot when passing any prop firm challenge. You need emotional control techniques to handle fear and greed. These feelings can mess up your decisions during live trades. Building mental resilience keeps you steady under pressure.

Try these ways to improve psychological resilience:

Do breathing exercises or mindfulness before trading.

Notice when impatience or frustration hits you.

Write down your feelings after trades in a journal.

These help you keep calm when markets get wild.

Building Confidence

Confidence comes from practice and the right mindset. Using trading discipline techniques keeps your approach steady. This stops you from making quick, bad choices.

To build confidence:

Follow your trade plan without changing it on the fly.

Look back at past trades and learn from them.

Slowly increase your position sizes as you feel more sure.

Regular practice makes confident choices easier over time.

Addressing Fear of Failure

Fear of failure can cause emotional decision-making that hurts profits. Managing risk well cuts down this fear by keeping losses small.

Focus on these tips:

Use stop-loss orders based on clear levels, not feelings.

Don’t try to get back losses with revenge trades; stick to your plan.

Accept small losses as part of learning, not as failures.

Controlling emotions linked to risk helps keep you grounded during the challenge.

Setting Realistic Goals

Setting clear profit targets and account growth goals helps reduce pressure during challenges. Unrealistic goals can make you stress and choose poorly.

The Concept Trading: Fast‑Track to Getting Funded

The Concept Trading’s challenge uses simple rules that are fair and easy to understand. It asks for steady profits while keeping drawdowns low. This helps you stay successful after passing the challenge too.

The payout system pays winners quickly—usually within 48 hours—so you don’t wait long for rewards during your funded trader journey.

Program Overview

The program gives traders:

A smooth application and funding process

Fast payouts in two days or less

Clear rules with real targets

Support any time, day or night

This setup lets traders focus without extra hassle or delays.

Eligibility Criteria

To join, traders must:

Open a special challenge account

Follow strict max drawdown limits based on account size

These rules protect both your money and the firm's funds.

Support and Resources

Success needs more than just chances—it needs help too:

We provide:

Mentoring tailored for each trader’s needs

Courses covering tech analysis and risk control

A community where traders share tips and feedback

Mentorship speeds skill growth by offering advice all along the way.

Free Trial Opportunities with The Concept Trading

youtube

Trying before committing is key when picking a funded trader program.

Benefits of a Free Trial

A demo challenge copies real-market conditions but uses fake money—letting new traders get used to platform tools and see what challenges come up during evaluations.

How To Get Started

Signing up is fast; register online then get instant access so you can start the trial right away.

Trial Specifics

Simulated accounts act like live risks but remove money danger so users learn at their own speed without worry.

FAQs

How Does the Payout Schedule Work in Funded Trading Programs?

Most proprietary trading firms offer biweekly payouts or profit splits. For instance, Concept Trading is known for its quick profit distributions, often processing payments within 48 hours.

What Role Does Trading Psychology Play in Passing a Prop Firm Challenge?

Trading psychology is crucial for managing emotions such as fear and greed. Techniques that enhance discipline and mental resilience can significantly improve a trader's performance, especially under pressure.

Can Mentorship in Trading Improve Success Chances?

Absolutely. Mentorship provides valuable guidance, constructive feedback, and proven trading strategies. It helps traders avoid common pitfalls and fosters a sense of accountability.

How Do Trading Fatigue and Emotional Decision-Making Affect Traders?

Trading fatigue can diminish focus, leading to suboptimal decision-making. Effectively managing trading schedules and stress levels can help reduce errors and enhance overall consistency.

What Is the Importance of a Trading Business Plan?

A well-structured trading business plan details specific strategies, risk management practices, and clear goals. It helps traders maintain discipline and ensures alignment with the requirements of their challenges.

How Can AI-Powered Analytics Assist Traders?

AI tools can analyze market sentiment, generate trading signals, and identify patterns. These capabilities enable traders to make data-driven adjustments, improving trade execution and outcomes.

Why Is Understanding Simulated Trading Risks Vital Before Live Accounts?

Simulated trading accounts replicate real market conditions without financial risk, allowing traders to test strategies and build confidence before transitioning to funded trading.

Additional Insights for Prop Firm Challenge Success

Trading Accountability: Use trade tracking apps or journals to monitor progress and stay focused on goals.

Trade Monitoring Tools: Employ software to track open trades and alert for risk threshold breaches.

Trading Flexibility: Adapt strategies based on economic events impact, central bank decisions, or geopolitical risk.

Profit Sharing & Scaling Plan Criteria: Understand how profit splits work and follow scaling rules to grow funded accounts.

Tax Planning for Traders: Prepare for tax obligations early by tracking earnings from funded trading activities.

Trading Automation & Algorithmic Trading Assistance: Use automation to reduce manual errors and maintain consistency.

Trading Schedule Optimization: Balance active hours to avoid fatigue while maximizing market opportunities.

Trader Community Support: Join mastermind groups or find a trading buddy for motivation and feedback.

Losses Analysis & Trading Setbacks: Review losses objectively to identify mistakes and refine strategies.

Evaluation Phase & Proving Phase: Stay consistent during these critical stages by following trade management rules.

Market Navigation Using Data-Driven Adjustments: Use AI-powered analytics to adapt quickly to market changes.

Capital Protection & Allocation: Manage position sizes carefully to preserve capital through volatile periods.

Clear Entry and Exit Points with Statistical Edge: Define precise trade triggers supported by backtested results.

Consistent Use of Risk Threshold Alerts: Set alerts for drawdown limits to avoid automatic disqualification.

Trading Fee Investment Awareness: Factor in fees when planning profit targets to ensure net gains.

Live Trading Conditions vs Demo Challenge Awareness: Recognize differences to prepare mentally for funded account challenges.

Trader Onboarding & Account Verification Process Clarity: Complete all steps accurately to avoid delays in funding access.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#proprietary trading#fx trading#prop trading challenge#Youtube

1 note

·

View note

Text

What You Need to Know Before Starting an SMSF in 2025

Self-managed superannuation funds (SMSFs) are growing in popularity among Australians seeking greater control over their retirement savings. While SMSFs offer autonomy and potential cost advantages, they also come with a range of legal, financial, and administrative responsibilities. As we head into 2025, there are several critical factors to consider before setting up an SMSF to ensure compliance, effectiveness, and long-term financial security. At Taxgain, we’re here to guide you through the complexities of self-managed superannuation fund accounting and help you make informed decisions every step of the way.

Understanding the Basics of an SMSF

An SMSF is a private superannuation fund that you manage yourself. Unlike industry or retail super funds, an SMSF is typically managed by its members, who also act as trustees. This gives you direct control over investment decisions and fund operations. However, this also means you carry full responsibility for complying with superannuation laws and regulations.

To establish an SMSF, you must first create a trust and obtain a trust deed. The fund must be registered with the Australian Taxation Office (ATO), and it must have a Tax File Number (TFN) and an Australian Business Number (ABN). Once these requirements are met, you can begin managing the fund’s investments in line with your retirement strategy.

Key Compliance Requirements in 2025

The regulatory landscape surrounding SMSFs continues to evolve. In 2025, trustees must be more vigilant than ever about compliance obligations. The ATO requires that every SMSF lodge an annual company tax return, financial statements, and an independent audit. These are not optional — failing to comply can lead to penalties or disqualification as a trustee.

It’s important to remember that your SMSF must remain compliant with the sole purpose test, meaning it must be maintained solely for providing retirement benefits to its members. Using SMSF assets for personal gain, even temporarily, is strictly prohibited and will attract severe penalties.

The Importance of Self-Managed Superannuation Fund Accounting

Effective self-managed superannuation fund accounting is crucial for maintaining compliance and achieving your long-term financial goals. Accurate and timely record-keeping is not only necessary for auditing and tax return purposes but also for making informed investment decisions.

SMSF accounting involves tracking all contributions, pension payments, investment income, expenses, and changes in asset value. These records must be updated regularly to reflect the true financial position of the fund. At Taxgain, our team of SMSF specialists ensures that your fund’s finances are managed professionally and in accordance with the latest regulatory standards.

Costs and Responsibilities of Running an SMSF

Contrary to the assumption that SMSFs are always cheaper than traditional super funds, the actual costs can vary significantly based on the size of the fund and the complexity of its investments. Trustees are responsible for setup fees, ongoing accounting, auditing, legal, and administrative costs. If you decide to outsource services such as tax preparation or investment management, these will add to your operating costs.

In 2025, trustees must also stay up-to-date with evolving tax laws and superannuation reforms. For instance, changes in contribution caps, pension drawdown rates, or tax offsets can all impact how your fund operates. Having access to expert advice — such as from Taxgain’s accounting professionals — is essential to navigating these changes efficiently.

Lodging Your SMSF Annual Company Tax Return

Every SMSF is required to lodge an annual company tax return with the ATO. This document provides a comprehensive summary of your fund’s income, deductions, and assessable contributions, as well as any tax liabilities. It’s submitted alongside your SMSF’s annual financial statements and audit report.

Completing the company tax return requires a deep understanding of superannuation tax law, including the treatment of franking credits, capital gains, and concessional vs non-concessional contributions. This process is not something to take lightly, as errors or omissions can trigger ATO scrutiny and potential penalties.

Choosing the Right Investments for Your SMSF

One of the main attractions of managing your own super fund is the flexibility it offers in investment choices. SMSFs can invest in a wide range of assets, including property, shares, managed funds, term deposits, and even collectibles under certain conditions.

However, all investments must align with your SMSF’s investment strategy, which should be documented and reviewed regularly. The strategy must consider risk, diversification, liquidity, and the retirement objectives of all members. Inappropriate or risky investments can lead to compliance issues and financial losses.

Professional Guidance from Taxgain

At Taxgain, we understand that starting and managing an SMSF in 2025 is not just about making investment decisions — it’s about meeting legal obligations, minimising risk, and securing your financial future. Our team specialises in self-managed superannuation fund accounting, offering tailored support from setup to ongoing compliance and annual company tax return lodgement.

Our services are designed to help you focus on growing your retirement wealth while we manage the complex administrative and tax aspects of your fund. Whether you're a first-time trustee or looking to improve the management of an existing SMSF, we can provide the expertise you need to achieve your goals.

Final Thoughts: Is an SMSF Right for You?

While SMSFs offer great flexibility and control, they are not suitable for everyone. You need sufficient financial knowledge, time, and discipline to manage the fund properly. The ATO recommends having a minimum balance of at least $200,000 to make the fund cost-effective, although this can vary depending on your investment strategy and associated costs.

Before making the leap, consider whether you are ready to take on the legal and financial responsibilities that come with being a trustee. Consult with a licensed financial adviser and an SMSF specialist to ensure you understand all your obligations.

At Taxgain, we're committed to supporting your journey with professional accounting services that simplify compliance and maximise the benefits of SMSF ownership. Reach out to us today to learn how we can help you confidently start and manage your SMSF in 2025.

0 notes

Text

Understanding Construction Loans: Guide for Home Builders

If you’re planning to build a new home or undertake a major renovation, you’ve likely come across the term construction loans. These specialised loans are designed to provide the necessary funding at different stages of a building project, offering financial flexibility and support throughout the construction process.

In this blog, we’ll explore what construction loans are, how they work, who they’re best suited for, and why understanding their structure is essential for making informed financial decisions.

What Are Construction Loans?

Construction loans are short-term loans used to finance the building of a new home or significant renovation. Unlike standard home loans, which provide a lump sum up front, construction loans release funds in stages—commonly referred to as progress payments—aligned with the phases of construction.

These stages often include:

Slab or base stage

Frame stage

Lock-up stage

Fixing stage

Completion

Borrowers only pay interest on the amount drawn at each stage, which helps manage cash flow during the construction period.

How Do Construction Loans Work?

When you apply for a construction loan, the lender will assess your building plans, construction contract, and financial position. Once approved, the loan amount is not released in full. Instead, funds are paid directly to your builder at the completion of each agreed-upon stage.

Key features of construction loans include:

Interest-only repayments during construction

Conversion to a standard home loan once the build is complete

Valuations at each stage to ensure work aligns with the payment request

Drawdowns or progress payments approved by both you and the lender

This structure reduces the risk of overpayment and ensures that funds are used specifically for construction.

Who Should Consider Construction Loans?

Construction loans are ideal for:

First-home buyers building their dream home

Property investors developing new projects

Homeowners planning major renovations or knockdown rebuilds

Owner-builders, although additional criteria may apply

Whether you're working with a licensed builder or managing the project yourself, a construction loan gives you control and financial backing from blueprint to completion.

Benefits of Construction Loans

There are several advantages to choosing a construction loan over a traditional home loan for building purposes:

1. Tailored to Building Projects

Construction loans are specifically designed for staged payments, making them a better fit for builds than conventional loans.

2. Cash Flow Management

You only pay interest on the amount used, helping to keep repayments lower during the build.

3. Progress Inspections

Each stage is inspected before funds are released, helping to ensure quality control and financial accountability.

4. Loan Conversion

Once the build is finished, the loan typically converts to a standard principal and interest mortgage, simplifying long-term repayments.

What to Consider Before Applying

Before applying for a construction loan, it’s important to prepare and understand your obligations:

1. Fixed-Price Contract

Most lenders require a fixed-price building contract from a licensed builder. This minimises cost blowouts and provides financial certainty.

2. Builder’s Insurance and Licences

Ensure your builder is licensed and insured. Lenders often require proof of Builder’s Risk Insurance or Home Warranty Insurance.

3. Deposit Requirements

Lenders typically require a deposit of 5–20%, depending on your financial situation and the lender’s criteria.

4. Approval Time

Construction loans can take longer to approve due to the additional documentation required. Factor this into your build timeline.

How to Find the Right Construction Loan

Not all construction loans are created equal. When comparing loans, consider:

Interest rates and fees

Loan flexibility

Repayment options

Customer service and support

Turnaround times for progress payments

Working with a mortgage broker can simplify the process and help you find a loan that suits your project and financial goals.

Final Thoughts

Whether you're building your forever home or investing in a new development, construction loans offer a practical and staged approach to financing your project. Understanding how they work, what’s required, and how to manage repayments can help you move forward with confidence.

To make the most of your construction journey, consult with a financial adviser or broker who can help navigate the loan landscape, negotiate terms, and ensure you're matched with the right lender for your needs.

0 notes

Text

Understanding Construction Loans: Guide for Home Builders

If you’re planning to build a new home or undertake a major renovation, you’ve likely come across the term construction loans. These specialised loans are designed to provide the necessary funding at different stages of a building project, offering financial flexibility and support throughout the construction process.

In this blog, we’ll explore what construction loans are, how they work, who they’re best suited for, and why understanding their structure is essential for making informed financial decisions.

What Are Construction Loans?

Construction loans are short-term loans used to finance the building of a new home or significant renovation. Unlike standard home loans, which provide a lump sum up front, construction loans release funds in stages—commonly referred to as progress payments—aligned with the phases of construction.

These stages often include:

Slab or base stage

Frame stage

Lock-up stage

Fixing stage

Completion

Borrowers only pay interest on the amount drawn at each stage, which helps manage cash flow during the construction period.

How Do Construction Loans Work?

When you apply for a construction loan, the lender will assess your building plans, construction contract, and financial position. Once approved, the loan amount is not released in full. Instead, funds are paid directly to your builder at the completion of each agreed-upon stage.

Key features of construction loans include:

Interest-only repayments during construction

Conversion to a standard home loan once the build is complete

Valuations at each stage to ensure work aligns with the payment request

Drawdowns or progress payments approved by both you and the lender

This structure reduces the risk of overpayment and ensures that funds are used specifically for construction.

Who Should Consider Construction Loans?

Construction loans are ideal for:

First-home buyers building their dream home

Property investors developing new projects

Homeowners planning major renovations or knockdown rebuilds

Owner-builders, although additional criteria may apply

Whether you're working with a licensed builder or managing the project yourself, a construction loan gives you control and financial backing from blueprint to completion.

Benefits of Construction Loans

There are several advantages to choosing a construction loan over a traditional home loan for building purposes:

1. Tailored to Building Projects

Construction loans are specifically designed for staged payments, making them a better fit for builds than conventional loans.

2. Cash Flow Management

You only pay interest on the amount used, helping to keep repayments lower during the build.

3. Progress Inspections

Each stage is inspected before funds are released, helping to ensure quality control and financial accountability.

4. Loan Conversion

Once the build is finished, the loan typically converts to a standard principal and interest mortgage, simplifying long-term repayments.

What to Consider Before Applying

Before applying for a construction loan, it’s important to prepare and understand your obligations:

1. Fixed-Price Contract

Most lenders require a fixed-price building contract from a licensed builder. This minimises cost blowouts and provides financial certainty.

2. Builder’s Insurance and Licences

Ensure your builder is licensed and insured. Lenders often require proof of Builder’s Risk Insurance or Home Warranty Insurance.

3. Deposit Requirements

Lenders typically require a deposit of 5–20%, depending on your financial situation and the lender’s criteria.

4. Approval Time

Construction loans can take longer to approve due to the additional documentation required. Factor this into your build timeline.

How to Find the Right Construction Loan

Not all construction loans are created equal. When comparing loans, consider:

Interest rates and fees

Loan flexibility

Repayment options

Customer service and support

Turnaround times for progress payments

Working with a mortgage broker can simplify the process and help you find a loan that suits your project and financial goals.

Final Thoughts

Whether you're building your forever home or investing in a new development, construction loans offer a practical and staged approach to financing your project. Understanding how they work, what’s required, and how to manage repayments can help you move forward with confidence.

To make the most of your construction journey, consult with a financial adviser or broker who can help navigate the loan landscape, negotiate terms, and ensure you're matched with the right lender for your needs.

0 notes

Text

Understanding Construction Loans: Guide for Home Builders

If you’re planning to build a new home or undertake a major renovation, you’ve likely come across the term construction loans. These specialised loans are designed to provide the necessary funding at different stages of a building project, offering financial flexibility and support throughout the construction process.

In this blog, we’ll explore what construction loans are, how they work, who they’re best suited for, and why understanding their structure is essential for making informed financial decisions.

What Are Construction Loans?

Construction loans are short-term loans used to finance the building of a new home or significant renovation. Unlike standard home loans, which provide a lump sum up front, construction loans release funds in stages—commonly referred to as progress payments—aligned with the phases of construction.

These stages often include:

Slab or base stage

Frame stage

Lock-up stage

Fixing stage

Completion

Borrowers only pay interest on the amount drawn at each stage, which helps manage cash flow during the construction period.

How Do Construction Loans Work?