#International Stock Market

Text

Browse Ajmera X-change to Find the Best Commodity Broker in India.

Visit Ajmera X-change to discover the outstanding services provided by the best commodity broker in India. They provide excellent commodity broking services that are customized to satisfy the various demands of traders and investors. The company is dedicated to quality and places a strong emphasis on client satisfaction. You can count on their experience, dependability, and modern technologies to confidently navigate the commodities market, regardless of your level of experience. Start your commodity trading experience with the best in the business with their services and enjoy easy trading, competitive pricing, and individualized service. To know more about their services, have a look at their website - https://www.ajmeraxchange.co.in/services/commoditybroking

#stock market advisory#international share market#share market advisory company#international stock market#equity investment advisory#mutual fund advisor

0 notes

Text

Explore the Global Playground: Uncover the nuances of the Indian stock market in comparison to its global counterparts. From trends to trading strategies, this comparative analysis sheds light on what sets the Indian market apart.

For more such blogs:

Visit our blog site today: https://tradingbells.com/blogs

And for Financial Advice reach us at: https://tradingbells.com/

Phone: +91 932 953 6100

#China Stock Market#Global Economy#Global Market#Indian stock Market#International Stock Market#Japan Stock Market#US Stock Market#global trends#global trading strategies

0 notes

Text

Trading View: A Stock Market Analysis App

The trading view app is used by more than 45 million traders. Traders and investors use Trading View, a US-based firm’s charting platform and social networking site, to identify good opportunities in a variety of international stock market.

Trading view is a platform where market enthusiasts, educators, traders, and investors can come together to discuss the market and share knowledge.

A high-level assessment of an asset’s performance over a specific period is provided by trading view charts. Users have the option to live broadcast themselves while they analyse charts, follow other traders, and publish their charts and investing theses.

Compared to the industry leader, Trade Ideas, the stock screening capabilities are limited.

Download Tarding View App at App Advisor View

0 notes

Text

Trading View: A Stock Market Analysis App

The trading view app is used by more than 45 million traders. Traders and investors use Trading View, a US-based firm’s charting platform and social networking site, to identify good opportunities in a variety of international stock market.

Trading view is a platform where market enthusiasts, educators, traders, and investors can come together to discuss the market and share knowledge.

A high-level assessment of an asset’s performance over a specific period is provided by trading view charts. Users have the option to live broadcast themselves while they analyse charts, follow other traders, and publish their charts and investing theses.

Compared to the industry leader, Trade Ideas, the stock screening capabilities are limited.

Download Tarding View App at App Advisor View

1 note

·

View note

Text

can we stop speedrunning history on repeat, please

#russia#russian coup#ukraine#pandemic#international conflict#economic crash#government corruption#stock market

601 notes

·

View notes

Text

Just as a heads up in regards to the ko-fi prompts:

I am not an expert on the stock market by any definition, and I do not recommend getting your financial advice from me.

If you send in a prompt on the subject, I'll do my research to answer it, but please know that stocks and investments are not my area. I've gotten three stock-related questions recently, and while I can guess why it's a popular subject, I really need you all to know, for legal reasons, that I am not an authority on this specific topic.

(While talking to my mom a few weeks ago, I mentioned a non-stock post I made for the ko-fi prompts project, and she very insistently told me that I need to tell everyone THIS IS NOT FINANCIAL ADVICE so I don't get sued if someone makes a bad call based on my commentary. So just. I'll do my research to answer to the best of my ability, but it will take some time and will come with a 'this is not professional advice' disclaimer.)

#ko fi prompts#economics#stock market#personal#I want to help but I need you guys to know this is not my field#my thing is international trade/communications and small businesses and some degree of government policy#so like. I can talk about supply and demand and all that. but I am not the person to go to for stock market advice

72 notes

·

View notes

Note

ok this isnt super serious so feel free to ignore but what do you think of Terry with a beloved who strongly prefers gold jewelry? i feel like he'd be a bit put off if they weren't a fan of silver

They will be.

Terry’s here very subtly convincing beloved silver is the nobler material. Certainly the more poetic one. The dark horse. Gold? Gold equals tackiness and kitsch in most cases. A marker of the Noveau Riche, gangsters and unrefined wealth. And then when the prices of silver mysteriously skyrocket around The Valley to the point it makes headlines and news he can point out it is the more coveted precious metal too. Not because he innately hates gold as much as he wants to be right and he wants to win this silent war beloved doesn't even realize means so much to Terry for his name's sake. Does Dynatox own and manage shady deals with Third World (illegal?) mining of silver among other things and does he literally have the ability to induce artificial domestic import scarcity for the petty and incredibly selfish reason of showcasing the sheer value of silver purely because such is the nature of commerce and capitalism and such is the nature of his need for control? Yes. Yes, he would. I think he's capable of literally anything, no matter how extreme, unnecessary and ludicrous and one forgets Terry Silver is first and foremost a crooked businessman who made his bones off of environmental hazards and the illicit disposal of dirty chemicals and contaminants as a trade. On the other side of the world, back home, all things connected, his beloved has a silver necklace fastened around their neck. A special gift from him. It now costs ten times more than what it usually does. Everyone wonders why those couple of years had such amped up prices around California and not even the most seasoned Economical Analysts could come up with a sound reason even after much debate and a barrage of articles of the issue. Beloved on the other hand? Oh, they get all the complements at that one gala party they attended with Terry. A silver necklace? Well, how downright...posh. How in-style. A la mode! Those are very expensive nowadays, you know, and harder and harder to come by. The silver mines in Argentina are all but running out they say, with a real upcoming scarcity in the making so to have a silver necklace...very exclusive. Much like Terry Silver himself is. Beloved is extremely lucky.

Terry can't help but grin into his chin at the praise.

#terry silver crashing the international stock market to prove a point#terry silver#kk3#cobra kai#terry silver x reader#terry silver x beloved#I LOVE HOW THIS ASK TURNED VERY SERIOUS ACTUALLY

28 notes

·

View notes

Text

FISKER DELIVERS FIRST 22 FISKER OCEAN SUVS, Establishing Presence in Competitive EV Market

Fisker Inc. achieves a major milestone by delivering the highly anticipated Fisker Ocean SUV to customers in the United States. Explore the groundbreaking features, sustainability, and investment potential of Fisker in the rapidly growing electric vehicle sector

Fisker Ocean SUV:

Innovation and Unmatched Features: The Fisker Ocean SUV represents a groundbreaking leap in automotive innovation. Designed to offer a sustainable and luxurious driving experience, it is equipped with cutting-edge features and impressive performance capabilities. Boasting a class-leading range of up to 360 miles, it surpasses other electric SUVs in its category. The SUV's all-wheel drive system and dual-motor setup deliver exceptional power and acceleration, providing a thrilling driving experience that surpasses traditional internal combustion

Read More

Other Topics Read:

10 Small Investment Ideas: Building Wealth

Stocks on Wall Street Show Resilience

South Korea Retains Position in MSCI Emerging Markets Index

Mastering the 5 EMA: A Powerful Indicator for Analyzing Price Trends

#Fisker #ElectricVehicles #Sustainability #Innovation #CustomerSatisfaction #InvestmentOpportunity #FuturePlans #Expansion #EVMarket

#: Fisker#electric vehicle manufacturer#Fisker Ocean SUV#innovation#sustainability#customer satisfaction#investment opportunity#strategic partnerships#global expansion#leadership team#market conditions#stock performance#Fisker Inc. achieves significant milestone by delivering the highly anticipated Fisker Ocean SUV to customers in the United States#Fisker Ocean SUV: A groundbreaking leap in automotive innovation and sustainability#Fisker Ocean SUV surpasses competitors with its class-leading range of up to 360 miles#Positive customer feedback solidifies Fisker's reputation as a forward-thinking electric vehicle manufacturer#Fisker's commitment to sustainability and eco-friendly materials reduces carbon footprint#Investment opportunity in Fisker as demand for electric SUVs continues to rise#Strategic partnerships strengthen Fisker's position in the competitive electric vehicle market#Fisker's expansion plans include ramping up production capacity and targeting international markets#Fisker's success in delivering the first 22 Fisker Ocean SUVs showcases innovation#and customer satisfaction#Fisker presents an exciting investment opportunity in the rapidly growing electric vehicle sector

2 notes

·

View notes

Text

How to Progress ahead with Mathematics?

#Mathematics graduates are versatile and can find opportunities in many other industries as well#depending on their specific interests and areas of expertise. The strong analytical and problem-solving skills acquired through a Mathemati#Market Research Analyst#As a market researcher for a company#you gather data from customers and competitors#assist in developing goals and strategies#improve your customer base#and beat your competitors.#As a market researcher#you will also design surveys#formulate reports#track market trends#and present information to executives. As you gain experience#there are plenty of scopes for you to manage a team of researchers and evaluate strategies.#The Faculty of Mathematics at Poddar International College is simply outstanding and proficient. Besides#the students have bright prospects as they have the best placements here.#Financial Planner#Financial planners assist individuals and companies in managing their financial assets. They are also involved in assisting individuals wit#Developing effective financial strategies for businesses and individuals.#Setting financial goals#assessing financial risks#and helping to ensure retirement or investment plans are among their primary duties.#They help companies formulate stock market investment strategies#real estate investing strategies#and new business ventures.#There are many professional skill and soft skills enhancement sessions for the students of Mathematics at Poddar International College.#Insurance Underwriter#Insurance underwriters are the ones who#on behalf of the insurance company#evaluate

0 notes

Text

Why Japanese stock market affected by US

Japanese stock markets took their biggest plunge since 1987 on Monday, sending shockwaves through global markets. But the next day, Japanese markets rallied strongly, recording their biggest daily gain since 2008, The Washington Post reports.

Chaos in global financial markets this week caused turmoil in Asia, the US and elsewhere. But Japan, the world’s fourth-largest economy, is having a particularly tumultuous time.

That’s partly because of what’s happening in the world’s largest economy: Unexpectedly low US employment numbers in July and rising unemployment, and the likelihood that the Federal Reserve will cut interest rates in response, have led to fears of slowing growth in the United States and around the world.

On top of that, rapid changes in the value of the Japanese currency and recent monetary policy decisions by the Bank of Japan have further fuelled panic in the market, experts say. Kyle Rodda, a senior market analyst at Capital.com who is based in Melbourne, Australia, said:

Signs of weakness in the US economy have acted as the spark for these events, while the technical factors in Japanese financial markets are the fuel.

Why have Japanese markets been hit so hard?

A combination of factors caused the Japanese market to suffer badly last week – Monday saw the biggest one-day drop since 1987 – including the rapid strengthening of the Japanese currency, experts said.

The yen has been weak against the dollar for the past five years, losing more than 40 per cent of its value, but it has strengthened in recent weeks, hitting its highest level against the dollar since March on Thursday.

That followed a rare decision by the central bank, the Bank of Japan, to raise interest rates.

According to Hirokazu Kabeya, chief global strategist at Daiwa Securities in Tokyo, the yen’s rise has fuelled fears that earnings at export-oriented Japanese companies will fall. Those concerns have contributed to falling stock prices and rising sales, Kabeya said.

Technology stocks around the world also fell after the Biden administration said last month it would impose further restrictions on semiconductor exports to China. The announcement affected markets with major chip makers such as Japan, South Korea and Taiwan.

Then the US jobs report on Friday fell short of market expectations, leading to uncertainty about the US economy and questions about whether the Federal Reserve would intervene. A few days earlier, the FED left interest rates unchanged, according to The Washington Post.

Read more HERE

#world news#news#world politics#japan#japanese news#japanese#japan news#japanese politics#stock market#stock trading#stock broker#market#global news#global politics#global economy#global market#international#usa#usa news#usa politics#usa today#united states of america#united states#us politics#us news

1 note

·

View note

Photo

Establishing a diversified portfolio is essential for any investor

Looking to maximize their returns while minimizing risk. Ajmera X Change's US Share Market platform is an ideal solution for investors seeking to explore new investment opportunities and diversify their portfolio. With access to the International Share Market, investors can easily trade in international stocks and shares, providing a convenient and secure way to invest in foreign markets. Ajmera X Change's experienced advisors offer expert guidance, helping investors make informed decisions and build a diversified portfolio that meets their unique investment goals. Ajmera X Change is the perfect choice for anyone looking to establish a diversified portfolio and explore nInternational Stock Exchange.

#Us Share Market#Us Stock Market#International Share Market#International Stock Market#International Stock Exchange

1 note

·

View note

Text

Luxembourg: The Premier Hub for International Bond Listings

Luxembourg has long been recognized as a pivotal center for finance, but its role in the listing and trading of international bonds is particularly noteworthy. As the global leader in this domain, the Luxembourg Stock Exchange (LuxSE) offers a compelling case study of how a financial marketplace can achieve prominence through innovation, strategic positioning, and an investor-friendly regulatory…

View On WordPress

#European Investment Bank#Green Exchange#international bond market#Luxembourg#Luxembourg Stock Exchange#LuxSE#sovereign bonds#World Bank

0 notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel.

Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes

Text

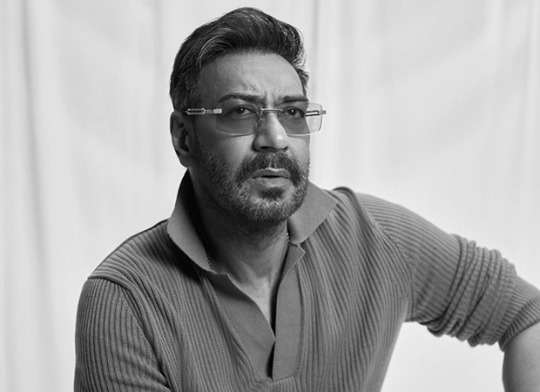

Ajay Devgn enters stock market; invests Rs 2.74 crores in Panorama Studios International

Ajay Devgn has entered the stock market by investing ₹2.74 crore in Panorama Studios International, a film production company.

Bollywood superstar Ajay Devgn has invested significantly in Panorama Studios International, a film production company experiencing a remarkable stock market rise. The Singham actor acquired 1 lakh equity shares through a preferential issue, injecting Rs 2.74 crores into the small-cap company.

Panorama Studios recently issued 10 lakh equity shares and 15.41 lakh warrants to promoters and non-promoters. Ajay joined nine other investors, collectively contributing Rs 24.66 crores to the preferential share allotment, as per regulatory filings. Devgn's investment translates to Rs 274 per share.

Panorama Studios International's stock price has seen a significant upward trend in 2024. It has gained over 176% year-to-date and a staggering 255% in the past three months. Notably, the stock has delivered exceptional multi-bagger returns exceeding 884% in the last year.

This investment holds additional significance as the 54-year-old actor has previously collaborated with Panorama Studios on successful films like Dil Toh Baccha Hai Ji, Raid, and Drishyam. A few weeks ago, Panorama Studios announced production agreements for three Punjabi films: Carry On Jettiye, Ardaas 3, and Manje Bistre 3, partnering with Humble Motion Pictures FZCO and Reliance Industries (JIO Studios).

Additionally, Panorama Studios is working on a Hollywood remake of the Drishyam franchise with Gulfstream Pictures and JOAT Films. The studio reportedly aims to produce Drishyam in 10 countries over the next three to five years.

0 notes

Text

Corrtech International IPO Date, Price, Company profile, risk & financial details

New Post has been published on https://wealthview.co.in/corrtech-international-ipo/

Corrtech International IPO Date, Price, Company profile, risk & financial details

Corrtech International IPO: Corrtech International is a leading provider of pipeline laying solutions in India, specializing in hydrocarbon pipelines. They also manufacture precision components for gas and steam turbines, and serve the aerospace and defense sectors. The company operates in a crucial industry for India’s energy infrastructure and economic growth.

Corrtech International IPO Key Details:

Status: Corrtech International’s IPO has not yet launched.

Issue Size: The planned IPO will consist of:

Fresh issue: Rs. 350 crore worth of new equity shares.

Offer for Sale: 40 lakh shares from existing shareholders.

Price Band: The price band for the issue is yet to be finalized.

News & Developments:

Corrtech International received SEBI approval for the IPO in July 2022, but no further updates have been announced since then.

Recent developments in the oil and gas sector, including rising energy prices, could potentially boost investor interest in the company.

Given the company’s established position in a critical industry and the potential benefits of rising energy prices, Corrtech International IPO could attract investor interest. However, the lack of updates on the issue timeline and uncertainties in the broader market may dampen enthusiasm.

Corrtech International IPO Offer Details:

Securities Offered:

Corrtech International IPO will offer equity shares only. These are units of ownership in the company, and investors who subscribe to the IPO will become shareholders.

Investor Category Reservation:

As the IPO details haven’t been finalized, the specific reservation percentages for different investor categories are still unknown. However, based on typical Indian IPOs, the reservation could be something like:

Retail Investors: 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors: 15%

Minimum Lot Size:

The minimum lot size for the IPO will likely be one bid lot. This typically represents a specific number of shares, for example, 100 shares. The final minimum lot size will be confirmed closer to the issue date.

Investment Amount:

The amount required to invest will depend on the minimum lot size and the final issue price. Once the price band is announced, you can multiply the minimum lot size by the lower and upper price band to estimate the minimum and maximum investment amounts.

Example:

If the minimum lot size is 100 shares and the price band is Rs. 20-25 per share, the minimum investment amount would be Rs. 2,000 (100 shares * Rs. 20), and the maximum investment amount would be Rs. 2,500 (100 shares * Rs. 25).

For more details refer Corrtech International Limited, Draft Offer Documents filed with SEBI.

Corrtech International Company profile:

History & Operations:

Founded in 1982: Corrtech has 41 years of experience in India’s crucial pipeline construction sector.

Core Businesses:

Pipeline Construction: Lays oil and gas pipelines with expertise in cross-country and directional drilling techniques.

Cathodic Protection Solutions: Protects pipelines from corrosion, ensuring their longevity and safety.

Precision Components: Manufactures high-quality parts for gas and steam turbines, catering to aerospace and defense sectors through subsidiary Corrtech Energy Limited (CEL).

Market Position & Share: A leading player in India’s pipeline laying segment, with a significant market share. Exact figures vary depending on project type and region.

Key Facts:

Headquarters: Ahmedabad, Gujarat, India

Employees: Over 1,000

Revenue: Over INR 500 crore (as of March 2021)

Awards & Recognitions: Received numerous awards for operational excellence, safety, and sustainability.

Prominent Brands & Partners:

Brands: “Corrtech” is the main brand, recognized for pipeline expertise.

Subsidiaries: CEL leverages the Corrtech brand while specializing in precision components.

Partnerships: Works with major oil and gas companies, engineering firms, and government agencies on various projects.

Milestones & Achievements:

Successfully completed over 10,000 km of pipeline projects.

Developed proprietary trenchless technology for environmentally friendly pipeline construction.

Established CEL as a leading supplier of precision components to high-profile clients.

Competitive Advantages & USP:

Experience & Expertise: Established track record, skilled workforce, and proven project execution capabilities.

Integrated Services: Offers end-to-end solutions from construction to corrosion protection.

Technological Innovation: Continuous investment in R&D for efficient and sustainable pipeline solutions.

Diversification: Strong presence in multiple sectors strengthens financial stability.

Corrtech International Financials:

Particulars March-2022 March-2021 March-2020 Total Assets 766.32 618.99 594.77 Total Expenses 990.21 956.21 733.88 Total Revenue 1065.75 995.97 784.72 Profit After Tax 49.72 28.55 34.94 EBITDA 120.71 95.62 97.87

Lead Managers and Registrar for Corrtech International IPO:

Lead Managers:

DAM Capital Advisors Limited:

Track record: Managed 14 IPOs in the past 2 years, including successful offerings for companies like Concord Enviro Systems Limited, Galaxy Surfactants Limited, and Astron Paper & Board Mills Limited.

Equirus Capital Private Limited:

Track record: Extensive experience managing over 80 IPOs across various sectors, including recent successful offerings for Karda Therapeutics Limited, Chemcon Specialities Limited, and Amber Enterprises India Limited.

Registrar:

Link Intime India Private Limited:

Role in the IPO process:

Handles investor account management and share allotment.

Processes refunds for unallocated bids.

Facilitates dematerialization of shares after listing.

Acts as a communication channel between the company and investors.

Potential Risks and Concerns for Corrtech International IPO:

Industry Headwinds:

The oil and gas industry, which is a major source of revenue for Corrtech, is cyclical and faces headwinds like fluctuations in oil prices, environmental regulations, and competition from renewable energy sources. These factors could impact the company’s future growth and profitability.

Company-Specific Challenges:

Reliance on a few major customers: Corrtech’s dependence on a limited number of customers, primarily oil and gas companies, exposes them to the risk of losing significant revenue if contracts are terminated or renegotiated.

Debt burden: The company has a significant debt load, which could limit its financial flexibility and impact its ability to invest in growth initiatives.

Financial track record: While the company has shown improvement in recent years, its past history of loan defaults raises concerns about its financial stability and ability to manage debt.

Competition: Corrtech faces intense competition from other established players in the pipeline laying and EPC services industry. This could put pressure on margins and limit growth potential.

Financial Health Analysis:

Revenue: While Corrtech has reported revenue growth in recent years, it is important to analyze the sustainability of this growth and its dependence on specific projects or contracts.

Profitability: The company’s profitability remains low compared to its peers. Investors should carefully assess the profitability margins and future growth projections to evaluate potential returns.

Debt-to-equity ratio: The high debt-to-equity ratio indicates a significant reliance on debt financing, which can increase financial risk. Investors should examine the company’s debt repayment plan and its ability to manage its debt burden.

Conclusion:

While Corrtech International IPO presents an opportunity for potential growth, it is crucial to be aware of the associated risks and uncertainties. Investors should carefully analyze the company’s financial health, industry headwinds, and market volatility before making any investment decisions. Thorough due diligence and seeking professional advice are essential steps towards a well-informed investment choice.

Also Read: How to Apply for an IPO?

#Corrtech International#debt reduction#expansion plans#Financial Performance#infrastructure sector#investor sentiment#IPO#Lead Managers#public issue#registrar#Stock market#UPCOMING IPO#valuation#News

0 notes

Text

Unlocking Wealth: Your Guide to Success in the Stock Market Course

Join us on a journey through the fundamentals of the stock market course, where you'll learn how to identify lucrative investment opportunities, navigate market fluctuations, and build a robust investment portfolio. Dive into engaging lessons, interactive tutorials, and real-world case studies that will equip you with practical strategies and insights from seasoned experts.

#Stock Market Education#Stock Market Course Program#Join Stock Market institute#What is stock market#Stock Market Training institute in india#share market training institute in Delhi#Best international stock market courses#Share Market Institute in Delhi#Best Institute of Stock Market in Delhi#Stock Market Course in Delhi#Stock Market institute in Delhi#professional trader course in Near Me#trading online course in Delhi#Stock Market Training in Delhi#us stock market courses#Options Trading Course#Stock Market Courses#Stock Market Course

0 notes