#Markethive

Text

The Truth and Lies About Making Money Online

The Truth and Lies About Making Money Online: Discerning Fact from Fiction

Making money online has become a topic of both fascination and skepticism. The internet is flooded with stories of individuals who claim to have made fortunes while working from their laptops, often on a beach somewhere far from the nine-to-five grind. While many of these success stories are real, there are also countless…

#explore opportunities#Home based business#It’s Possible to Earn a Significant Income Online#Making Money Online#Markethive#The Truth and Lies About Making Money Online

0 notes

Photo

(via Solana Gains Momentum Defying All Odds. SOL Set For Serious Gains)

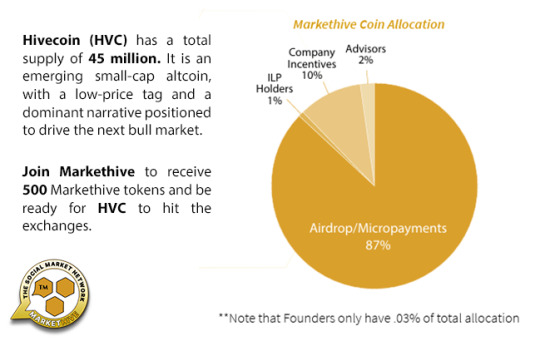

Since March, most altcoins have experienced a significant decline of over 40%. However, amidst this, Solana has shown remarkable staying power, sparking hope for a potential surprise upward surge when the market enters its next period of rapid growth. Many will know that Markethive’s token, Hivecoin (HVC), has been successfully integrated into the Solana blockchain. This article will explore Solana's recent developments, potential price trajectory in the coming months, and what it means for the Markethive community and its crypto, Hivecoin. Whether you're a current SOL and HVC holder or considering investing, this information is essential reading… Read more… https://markethive.com/group/1146/blog/solanagainsmomentumdefyingalloddssolsetforseriousgains

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/from-financial-to-physical-the-next-big-thing-in-crypto-depin/

From Financial To Physical The Next Big Thing In Crypto - DePIN

From Financial To Physical. The Next Big Thing In Crypto – DePIN

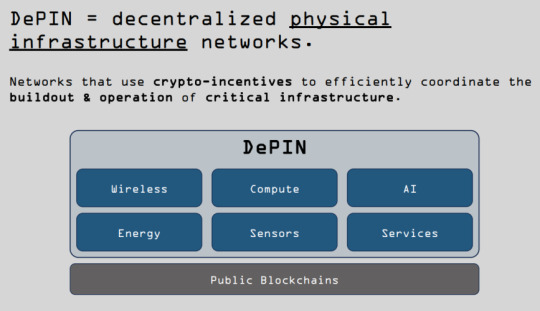

Recently, there has been significant interest in decentralized physical infrastructure, also known as DePIN, within the crypto space. People are curious about the potential of this niche and which specific projects within it are worth noting. The latest detailed study, titled State of DePIN 2023 by Messari, aims to provide insights into these questions. This summary will highlight key findings from the report and discuss their potential impact on the cryptocurrency market.

What Is DePIN?

The report commences with a concise delineation of DePIN, an acronym for decentralized physical infrastructure. It encompasses a cluster of ventures that employ cryptocurrency-based incentives to foster a range of physical infrastructure. These initiatives span from decentralized Wi-Fi systems, decentralized computing clouds, decentralized cloud storage solutions, and decentralized mobile networks to other similar endeavors. A salient feature that sets most DePIN projects apart, in addition to their crypto-based incentives, is the accessibility for individuals to contribute, provided they possess the requisite hardware.

Source: The Messari Report.pdf

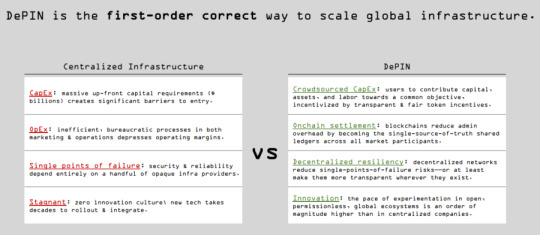

The report highlights that DePIN solutions have the advantage of being more efficient, resilient, and high-performing than their centralized counterparts. Additionally, DePIN projects can rapidly innovate and evolve due to community participation, which gives them a unique edge over centralized projects. This efficiency and resilience not only make them attractive to investors but also instill confidence in their long-term viability.

Source: The Messari Report.pdf

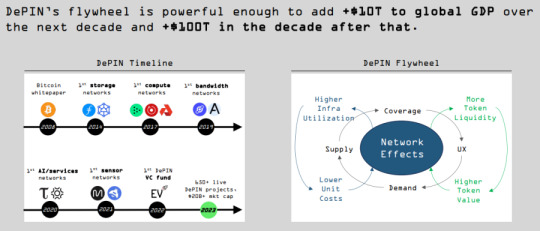

The authors posit that DePIN initiatives possess a self-reinforcing mechanism known as a flywheel, whereby their growth and influence fuel further adoption and expansion. As these projects gain traction and popularity among users and service providers, they become even more potent and widespread, creating a positive feedback loop. The authors project that DePIN will substantially impact the global economy, with the potential to augment GDP by a staggering $10 trillion over the next decade. This ambitious projection underscores the transformative potential of these projects.

Source: The Messari Report.pdf

The authors go on to list the industries in which DePIN is currently causing significant changes. These industries encompass various areas such as digital maps in the crypto sector, energy grid management, home internet services, food delivery platforms, ride-sharing services, and, surprisingly, even pet and livestock-related projects. It should be noted that these endeavors are still in their initial phases.

The authors have categorized crypto projects in the DePIN niche into six categories: compute, wireless, energy, AI, services, and sensors. According to their analysis, there are over 650 cryptos across these categories, with a combined market capitalization of over $20 billion.

Source: The Messari Report.pdf

The DePIN projects have garnered significant interest from venture capitalists, resulting in substantial capital being invested. To put it in perspective, the top ten DePIN projects alone have collectively secured a significant amount of funding. It's worth noting that many of these projects continue to attract investments even after their initial coin offerings (ICOs) and the launch of their main networks.

It is uncommon for a crypto project to secure substantial funding after its ICO. However, when this does happen, it indicates that investors have tremendous confidence in the project's potential. The DePIN niche has attracted significant post-ICO funding, with numerous projects raising substantial amounts. The top ten DePIN crypto projects in terms of funding raised include Filecoin and Helium, each securing $250 million, RNDR Network with $100 million, Fetch AI with $75 million, Livepeer with $50 million, Really with $35 million, Hivemapper with $25 million, Andrena with $25 million, Braintrust with $25 million, and DIMO with $20 million.

DePIN Blockchains

Intriguingly, most of the nearly thousand crypto projects operating within the DePIN space are opting to deploy on a select few cryptocurrency blockchains. This observation encompasses both layer one and layer two blockchains, with Solana emerging as the most favored layer one choice among DePIN projects.

The authors cite the high speed, affordability, and use of the Rust programming language as reasons for this. Among layer two solutions, Caldera and Eclipse are favored for DePIN projects. These platforms offer flexibility, enabling DePIN projects to blend Ethereum's security with Solana's performance, as seen in the case of Eclipse.

In addition to layer one blockchains that prioritize DePIN, the authors highlight some notable examples. Iotex is one such example, which was already utilized by the US military for health monitoring trials in November 2021. Peaq, on the other hand, is still in the pre-launch phase, but it has already generated significant interest and excitement within the community.

The importance of DePIN adoption cannot be overstated, as it will have a profound impact on both layer one and layer two. The success of DePIN chains and projects hinges on the demand side of the equation, which is carefully examined in the second part of the report.

Unlike many other cryptocurrencies, the authors emphasize that DePIN revenues are fueled by utility rather than speculation. They highlight that participants in DePIN projects typically need to purchase and lock or burn their associated tokens in return for access to the decentralized service or product being provided. This characteristic aligns DePIN projects with traditional crypto coins, which are utilized for various purposes, such as payment of fees and staking.

According to the authors, DePIN projects consistently yield an estimated $15 million in yearly on-chain revenue throughout the bear market. Given the large number of DePIN projects, this amount may seem insignificant. The authors, however, need to offer a clear answer to which DePIN projects are the most profitable, leaving it open to speculation.

However, it is worth mentioning that Livepeer has developed a dashboard named the Web 3 Index, which monitors the earnings of major DePIN projects. Decentralized storage and computing are generating the highest revenue.

Source: The Messari Report.pdf

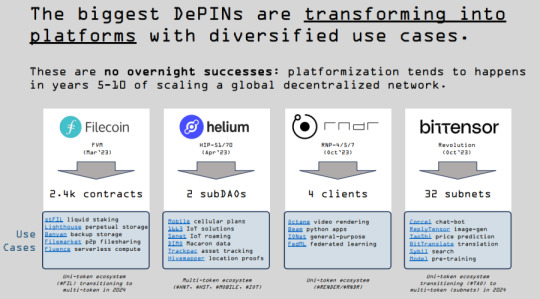

The authors highlight the evolution of DePIN projects, with many expanding their offerings to become comprehensive platforms providing a variety of decentralized products and services. They cite Filecoin, Helium, RNDR Network, and Bittensor as five notable examples of such platforms, demonstrating the diversification of DePIN projects beyond their initial scope.

DePIN Categories

Compute

In the next section, the authors divide the Compute category into its previously discussed main elements: Storage, Compute, and Retrieval. They mention that specific DePIN projects within the compute category, such as Filecoin and Akash Network, provide a “full stack experience.”

Source: The Messari Report.pdf

In terms of Storage, it's suggested that DePIN could gain widespread acceptance by utilizing decentralized data storage. While other cryptocurrency projects and protocols have primarily adopted this technology, it's promising to see increased decentralization across the crypto space. This article provides an opportunity to delve deeper into the meaning of decentralization.

The authors highlight that Compute faces the opposite issue compared to storage. While there is an abundance of decentralized data storage but insufficient demand for it, the supply of decentralized computing power is lacking. Yet, there is a surplus of demand for it.

The authors note that decentralizing Retrieval poses a significant challenge, especially in maintaining competitiveness. This is primarily due to the fact that Cloudflare, a centralized retrieval protocol, currently serves 20% of all regular websites at no cost, making it challenging to monetize alternative solutions.

Wireless

This relates to the next DePIN category the authors detailed earlier: Wireless. The growth of the total addressable market for decentralized wireless services has been exponential, and it's no surprise why. The demand for decentralized wireless services is rising as the world becomes increasingly interconnected. This category of DePIN has even earned its own name – DeWi, short for decentralized wireless – highlighting its significance in the industry.

The authors also divide this category into three parts: mobile, fixed internet, and Wi-Fi. Helium, in particular, is gaining significant attention due to its rapid expansion and popularity. As an illustration, Helium has collaborated with T-Mobile to offer affordable mobile plans across the US.

Source: The Messari Report.pdf

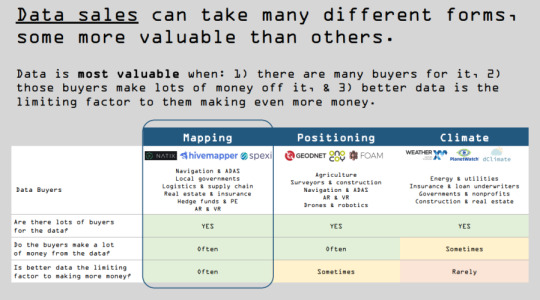

Data Sales

The authors decided to examine a new category not initially included in their list but gaining significant interest: Data sales. They point out the importance of data in a world that is becoming more digital.

That is why they are optimistic about DePIN initiatives such as Hivemapper, which motivates individuals to map their local surroundings, similar to Google Maps but without a central authority. They also highlight other specialized DePIN projects, such as one that monitors noise pollution in a community-driven manner.

This relates to another category detailed earlier: Services. According to their perspective, they classify services into two types: horizontal services, like decentralized marketplaces for freelance work, and vertical services, such as decentralized ride-sharing systems.

The conversation shifts to the emerging DePIN category of Vertical Ads, but surprisingly, they don't offer much insight into it. Notably, they fail to mention the Brave browser in this context. The situation is similar regarding energy-related DePIN initiatives, as they are also in the early stages of development.

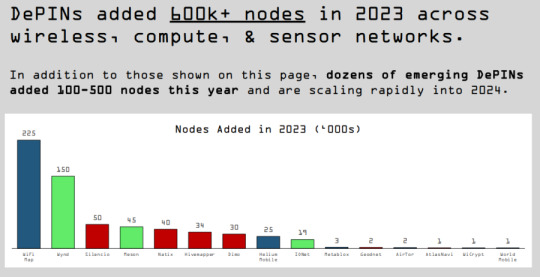

DePIN Growth, Potential

The report now shifts its attention to the supply side of the equation, specifically examining the remarkable growth and potential of DePIN nodes. The authors begin by presenting an interesting fact: The number of DePIN nodes continues to grow and has now surpassed 600,000. The graph below illustrates that the Wi-Fi map nodes are the most numerous, with more than 200,000 nodes being a part of the DePIN project.

Source: The Messari Report.pdf

The authors note a rapid increase in the quantity of DePIN nodes. This growth is attributed to DePIN initiatives addressing scalability challenges related to the expansion of physical infrastructure. Consequently, DePIN offerings are becoming more affordable and of higher quality. It is worth noting that the development of this physical infrastructure is being encouraged through the distribution of crypto incentives, particularly tokens awarded to individuals contributing to such infrastructure.

The tokenomics of these tokens are integral to the supply-side equation, and the authors recognize three distinct strategies. First, supply-based tokenomics encourages growth. Second, demand-based tokenomics promotes efficiency. Lastly, a combination of supply- and demand-based tokenomics strikes a balance between development and efficiency.

The advantages and disadvantages of the three methods are outlined in the image below. The authors also observe that certain strategies have been more effective for specific DePIN projects. For example, they note that projects that require a lot of hardware benefit the most from supply-based tokenomics, as it essentially rewards contributors with a large number of tokens. On the other hand, DePIN projects that are primarily software-based can expand by offering points that may eventually be converted into tokens.

Source: The Messari Report.pdf

In assessing the value of various DePIN projects, the authors recommend focusing on both the market cap and the fully diluted valuation. Their rationale is that DePIN projects often involve significant investments from venture capitalists, which can influence price movements.

Essentially, the authors suggest that the demand for specific DePIN offerings may be tempered by the influx of tokens from initial project backers. They imply that lower-quality DePIN projects may encounter challenges and predict that many early investors will opt to sell once their portfolios have appreciated five to tenfold.

Before making any investment decisions, it's crucial to thoroughly investigate cryptocurrencies, especially those in emerging sectors like DePIN. While some experts recommend investing in blockchains that support DePIN projects to mitigate risk, this approach may not yield returns as substantial as identifying and investing in promising DePIN projects early on, with their potential for 100x growth.

Source: The Messari Report.pdf

DePIN 2024 Forecast

The section of Messari's DePIN report that garnered the most excitement is the predictions for DePIN in 2024. According to the authors, the first theme you need to watch out for is the intersection of DePIN and AI, which is expected to play a crucial role in DePIN's development. DePIN AI has the potential to surpass centralized AI in terms of capabilities and effectiveness within the next one to two years.

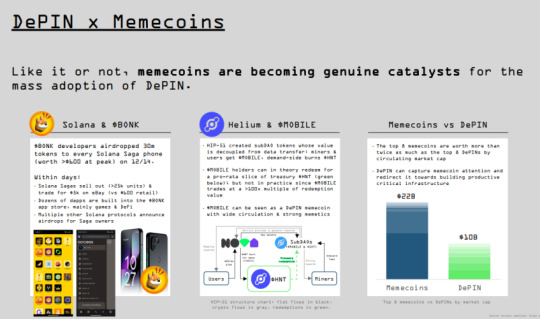

The second important topic is the intersection between DePIN and meme coins. While the idea may seem odd, the authors acknowledge this and use the Solana phone Bonk airdrop as an example to show how these two can be paired. This also hints at a future where physical infrastructure is encouraged through the use of meme coins.

The third important aspect to be mindful of is the intersection of DePIN with zero-knowledge technology. By leveraging advanced zero-knowledge technology, DePIN could carry out a form of cyber attack known as a vampire attack on Web 2, which involves taking control of users' content and activity.

The fourth theme to watch is similar to the third but focuses on the intersection between DePIN and gaming. Think of it as GameFi on steroids, where the cryptocurrency elements of gaming are integrated with cutting-edge gaming technology, such as VR headsets, to create a more immersive and interactive experience.

The fifth theme to be mindful of is the intersection between DePIN and privacy, with a particular focus on decentralized virtual private networks (VPNs) as a critical intersection area.

The authors highlight a curious trend in DePIN: The intersection between DePIN and Asia, referring to the continent, is expected to yield unexpected results. They foresee multiple top 10 DePIN projects emerging from this region, with most still in the nascent stages of development.

What It Means For Crypto

The DePIN report's findings have significant implications for the cryptocurrency market. In essence, they suggest that the most successful cryptocurrency narratives and niches during the current bull market will be those that are not financially focused. A previous article on crypto narratives supports this and is reinforced by the fact that some DePIN projects have already acknowledged this trend.

Several crypto initiatives acknowledge that applications related to finance will face increased scrutiny. In contrast, DePIN presents a significantly lower likelihood of antagonizing regulators, and its credibility is evident. The increasing presence of DePIN projects on global app stores and their partnerships with established companies and brands demonstrate that it operates within a safer realm, particularly in regulatory compliance.

Given its immense potential and the nascent stage of most DePIN projects, the DePIN niche is expected to be highly unpredictable from an investment standpoint. While some tokens may experience astronomical growth, others will likely plummet in value or become worthless. Despite the risks, the long-term outlook for DePIN indicates that it will have a lasting impact on the cryptocurrency landscape, contributing to increased adoption and mainstream acceptance.

Previously, the main factors driving cryptocurrency demand were primarily based on speculation. However, real-world adoption may occur with the rise of DePin and other non-financial sectors. This shift could make everyday individuals feel more at ease using and putting money into cryptocurrency, consequently boosting further adoption and investment. Advocates believe that the ultimate goal of cryptocurrency is to decentralize all aspects of life. If that is the desired outcome, we are on the right path.

The reaction of centralized equivalents to the decentralized alternatives of popular products and services is a topic of much speculation. Some anticipate a similar response to DeFi and other disruptors of the traditional financial system, characterized by intense regulatory opposition, mainstream media-fueled FUD, and attempts to suppress their growth. However, DePIN networks have an inherent advantage that will make them more resistant to suppression, as they are generally more decentralized than most cryptocurrencies. This resilience will demonstrate the staying power of crypto.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Note

oh shit???

Indeed. I have no doubt that this note was left by the same ſtranger I have been attempting to watch, who has been watching me in those rare instances when I pass them by in the ſtreet without knowing.

If this person cometh from Lordran... They recognizeth me, but even with their image savèd upon my device, I know them not. And whoever they be, they have as an enemy declared themself.

Who, from my world, knoweth me and would threaten my ſafety? Who opposeth the perpetuation of the world's life through rekindling of the Fire? An Undead, swayed by the lies of Kaathe? But their mode of speech is like mine own, suggesting age...

I cannot hazard a guess. But I will, of course, continue the purſuit. If this dark stranger wisheth to do battle, then so be it: in addition to my personal skill, my team of pokemon groweth stronger every day.

#pokeblog rp#pokeblogging#pokemon irl#rotomblr#impish stranger arc#ooc: here marketh the end of the impish ſtranger arc#ooc: the stranger laid this illusion trap and fucking dipped from Snowbelle so we won't see them again for a little while

3 notes

·

View notes

Text

The prize at the end of the brotherhood better be at least 7,000. There were 3x I couldn't avoid getting bounties and I hate losing money.

#victoria talks#is it even possible to kill that guy in marketh or whatever without getting a bounty?#the storyline is kind of intriguing but the bounty issue pisses me off when I'm a master of stealth and couldn't avoid getting#a bounty on some of these missions despite my best efforts

0 notes

Text

Using the cell phone in chapter 3 won't give garbage noise because the phone you are calling is now in the dark world as well. Marketh mine wordse

27 notes

·

View notes

Note

do you count as a wet spider?

WET SPIDER??

What the alas didst thee just fucking sayeth about me, thee dram wench? i'll has't thee knoweth i graduat'd top of mine own class in the navy seals, and i've been involv'd in num'rous secret raids on al-quaeda, and i has't ov'r 300 confirm'd kills. I am did train in g'rilla warfare and i'm the top snip'r in the entire us cap-a-pe f'rces. Thou art nothing to me but just anoth'r targeteth. I shall wipeth thee the alas out with precision the likes of which hast nev'r been seen bef're on this earth, marketh mine own fucking w'rds. Thee bethink thee can receiveth hence with declaring yond the horror to me ov'r the int'rnet? bethink again, alas'r. As we speaketh i am contacting mine own secret netw'rk of spies across the usa and thy ip is being trac'd even but now so thee bett'r prepareth f'r the st'rm, maggot. The st'rm yond wipes out the pathetic dram thing thee calleth thy life. Thou art fucking dead, peat. I can beest anywh're, anytime, and i can killeth thee in ov'r seven hundr'd ways, and yond's justwith mine own bareth hands. Not only am i extensively did train in unarm'd combat, but i has't access to the entire arsenal of the unit'd states marine c'rps and i shall useth t to its full extent to wipeth thy mis'rable rampallian off the visage of the continent, thee dram the horror. If 't be true only thee couldst has't known what unholy retribution thy dram "clev'r" comment wast about to bringeth down upon thee, haply thee wouldst has't did hold thy fucking tongue. But thee couldn't, thee didn't, and anon thou art paying the price, thee goddamn clotpole. I shall the horror fury all ov'r thee and thee shall drowneth in t. Thou art fucking dead, kiddo.

5 notes

·

View notes

Text

BITB will provide U.S. investors low-cost bitcoin through a standard, regulated ETF for the first time.

BITB will provide U.S. investors low-cost bitcoin through a standard, regulated ETF for the first time.

Bitcoin investors in the U.S. now have a new option for accessing the cryptocurrency market. The Bitwise Bitcoin ETF (BITB) is set to begin trading on January 11, 2024. This new offering aims to provide a low-cost way for investors to gain exposure to Bitcoin through a traditional investment…

View On WordPress

0 notes

Photo

(via BlackRock Proposes Its New Retirement Plan Using Your Money: How Will This Impact Your Finances? Discover Your Options.)

In mid-2019, BlackRock demonstrated its prophetic capabilities by forecasting the financial and monetary implications of the pandemic before it had even occurred. Considering the company's stature as the world's largest asset manager, some may argue we should heed its insights. Recently, CEO Larry Fink released his yearly correspondence with investors, offering subtle hints about potential future developments and BlackRock's strategies. This article breaks down the key takeaways from the letter, providing insight into what it may imply for individual investors and the market at large. We also explore how you can alleviate concerns and secure your financial future… Read the full article here…

https://markethive.com/group/1146/blog/blackrockproposesitsnewretirementplanusingyourmoneyhowwillthisimpactyourfinancesdiscoveryouroptions

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/what-is-altcoin-season-when-will-it-start-or-is-it-already-here/

What Is Altcoin Season? When Will It Start? Or Is It Already Here?

What Is Altcoin Season? When Will It Start? Or Is It Already Here?

Altcoin season, a term on the lips of many cryptocurrency enthusiasts since Bitcoin's recent surge to unprecedented heights, is a phenomenon many have eagerly anticipated. However, despite this anticipation, only a select few coins and tokens, along with many meme coins, have experienced substantial growth. This has led to speculation that altcoin season may never arrive, as funds flowing into spot Bitcoin ETFs may not be redirected towards the broader cryptocurrency market. But is this the full story?

With the invaluable insights of some highly credible crypto experts, this article takes a deep dive into the current state of the cryptocurrency market. It focuses on the 'altcoin season' concept and its potential impact on market trends. The article explores why altcoin season has yet to occur and predicts when it may begin. It also offers insights on how to recognize its onset. Additionally, the article highlights the types of alternative cryptocurrencies (altcoins) that may be worth watching during this period.

The Concept of Altcoin Season

Firstly, let's touch on the concept of altcoin season, a term that lacks a universally accepted definition. Some assume it refers to a period where numerous altcoins are experiencing a surge in value, with many believing that it's already underway. Given the recent performance of certain altcoins, one could argue that it's already here. However, this definition falls short of accurately capturing the concept, so here’s a more precise and nuanced explanation.

An altcoin season is an extended timeframe during which most alternative coins exhibit notable outperformance compared to Bitcoin. This can be gauged by analyzing the price of an altcoin with Bitcoin, for example, ETH/BTC. When assessing the BTC pair for various altcoins, it becomes evident that their performance has not been particularly strong. However, this does not imply that they have not experienced price increases in fiat currency; rather, it indicates that their gains have been comparatively lower when measured against Bitcoin.

The current situation with ETH and BTC is a significant development in the cryptocurrency market. ETH's value has decreased compared to BTC, which has raised concerns among traders and investors. Historically, increases in BTC's value have often been followed by a shift in investments towards alternative cryptocurrencies, leading to a period where most altcoins perform better than BTC.

Source: Coinmarketcap

In the past, the trend has been to invest in ETH and then move on to other major alternative cryptocurrencies, followed by mid-cap and small-cap altcoins. It is important to note that this progression is not always precise but generally aligns with the idea that investors gravitate towards more speculative crypto assets as market momentum continues. Interestingly, in the current scenario, there has been limited shifting of funds into ETH, as indicated by the underperformance of the ETH/BTC pair mentioned earlier.

Furthermore, it appears that the influx of capital did not favor midcaps and small-caps but instead directed attention towards micro-cap meme coins for speculative purposes. It is important to note that while certain altcoins like Solana's SOL have shown impressive performance compared to BTC, most altcoins, including ETH, have not surpassed BTC's growth. This suggests that the altcoin season may have yet to arrive fully.

As indicated earlier, cryptocurrencies with smaller market capitalizations tend to be riskier. This is because crypto with a smaller market cap has the potential to experience more significant and rapid price increases compared to those with larger market caps. However, on the flip side, small-cap cryptocurrencies are also prone to more substantial drops in value, highlighting the risk/reward ratio.

The notable 100x returns often associated with certain altcoins are typically achievable with those that have smaller market caps, explaining the hype around the altcoin season. Nevertheless, there are indications that the current cryptocurrency market cycle differs from previous ones, which could have significant implications for the returns on altcoins.

The Question on Everyone's Mind: When Will Altcoin Season Arrive?

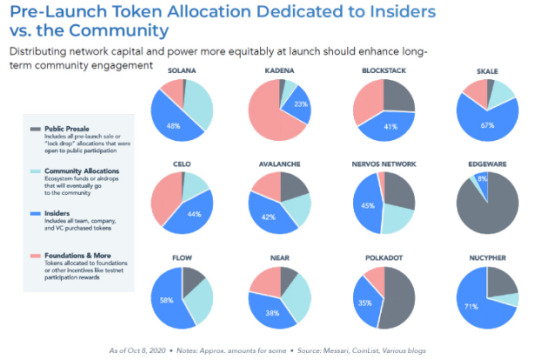

Many wonder why the current market cycle hasn't followed the same pattern as previous ones, with altcoins yet to take center stage. To understand this, we must first acknowledge the unique factor setting this cycle apart: spot Bitcoin ETFs. As discussed earlier, some believe these ETFs are hindering the rotation into altcoins, as investors cannot easily switch from ETFs to altcoins, at least in theory. However, some investors may be cashing out their ETF gains and moving their funds to cryptocurrency exchanges like Coinbase, where they can invest in altcoins.

The catch is that most investors in spot Bitcoin ETFs are not your average retail investors but seasoned institutional investors. These institutional investors, also known as TradFi whales, have a significant influence on the market. As a result, their preferences for alternative cryptocurrencies may diverge from those of the typical crypto enthusiast. Notably, there has been substantial institutional interest in SOL, which could explain its outperformance compared to BTC.

However, the crypto market is not solely composed of institutional investors. There are two other types of crypto investors: crypto whales and retail investors. Crypto whales, which are large holders of cryptocurrencies, have been the primary influencers in the crypto market so far. Their shift from Bitcoin to alternative coins has led to past cycles in altcoins, while retail investors have pushed these coins to their peak values. Put simply, the crypto market has not lost anything. It has merely introduced a new main character, figuratively speaking.

The lack of an alt season is not caused by the introduction of ETFs but rather by the actions of crypto whales and retail investors. The analysts at Coinbureau suggest that these crypto whales are not shifting their investments or rotating into altcoins because there currently needs to be more retail investors interested in purchasing them.

Source: Crypto Max on X

Numerous indicators suggest that retail investors are gradually becoming more interested in cryptocurrency despite their limited participation in the current market upswing. This is evidenced by increased retail trading activity on cryptocurrency exchanges, the growing popularity of crypto exchange apps, rising search volumes for crypto-related terms, and heightened social media engagement with crypto content. However, these metrics have not reached the levels indicating a massive influx of new retail investors into the cryptocurrency market.

The crucial factor here is the influx of new retail investors. While millions of retail investors from previous cycles are still active or returning, we need to see more new entrants into the market. This is a significant concern, as altcoins rely heavily on new investors to drive their growth and create upward momentum. As a retail investor, you can influence the altcoin season. There need to be marginal buyers.

As Coinbureau states, “We need new people for our altcoin bags to pump, probably because most of us have already allocated as much as we can to our favorite coins and tokens. In the absence of these new people, there's not that much for us to do except speculate on memecoins, and it's quite possible that the memecoin pumps we've seen have been coordinated by the crypto whales. They probably know that the only retail investors around right now are experienced enough to use DEXs.”

The Onset of Altcoin Season

After analyzing the delay in the arrival of altcoin season, the next question is when we can expect it to begin. The straightforward answer is that it will start when a sufficient number of retail investors take notice. This will prompt crypto whales to shift their focus from Bitcoin to altcoins that retail investors will then eagerly buy into, leading to a chain reaction of FOMO (fear of missing out). However, a more in-depth analysis, which necessitates a look back at the previous cycle, reveals a more intricate scenario. Most of us envision the upcoming altcoin season as a repeat of the last cycle, but the reality may be more complex.

The issue lies in the significant differences observed in the previous cycle. Due to a worldwide pandemic, billions of individuals were confined to their homes while a few hundred million received a stimulus payment, providing them additional funds. These events led to widespread speculation in both stocks and cryptocurrencies. Today, the situation is starkly contrasted as interest rates across various nations are at their highest levels in years. Unofficial inflation rates are soaring in most countries, reaching double digits. Several countries are experiencing or nearing recession.

Above all, most individuals are reportedly accumulating unprecedented levels of debt to maintain their standard of living. This trend starkly contrasts with the circumstances observed during the previous alt season. A positive aspect is that the prolonged persistence of these conditions may prompt governments and central banks to provide comparable forms of economic support, never mind the possibility of an existential shock.

This means that there will likely come a time when economic conditions mirror those seen during the pandemic, with similar fiscal and monetary support levels. The exact timing is uncertain, but it may take a significant event to prompt such action. Identical to past patterns, this could cause a brief decline in cryptocurrency and other asset values, followed by a stabilization period and a sharp price increase as the stimulus takes effect.

If the current state of the market persists, altcoins may suffer under unfavorable circumstances. If trends continue, including high interest rates, rising inflation, recurring recessions, and mounting retail debt, the subsequent altcoin season may fall short of expectations. It's essential to recognize that the cryptocurrency market has undergone significant changes since the previous cycle, with factors beyond spot Bitcoin ETFs contributing to its evolution.

Regulations in the US, UK, and other countries have made it more difficult for retail investors to reach offshore trading platforms where highly speculative altcoins are traded. The upcoming EU stablecoins regulations are anticipated to impact the cryptocurrency market significantly. It has been announced that USD stablecoins will no longer be allowed in the EU by the end of the year, potentially reducing the options for retail investors to trade cryptocurrencies.

Identifying the Arrival of Altcoin Season

To determine the onset of the altcoin season, keep a close eye on several key indicators. These include retail trading volume, the popularity of crypto exchange apps, Google searches, and social media views related to cryptocurrency. When you observe a steady increase in these metrics, alt season is likely imminent. Interestingly, there are signs that this trend may already be underway. For instance, search queries related to buying cryptocurrency have started to rise after years of stagnation, although they still have a long way to go before reaching their previous peak.

Source: Google Trends

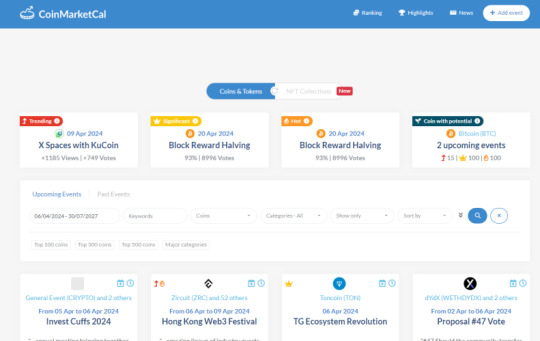

The current market dynamics are making it challenging to determine whether we are witnessing the inception of a new alt season or a fleeting speculative surge. A valuable approach to shed light on this puzzle is examining how cryptocurrency projects promote themselves, specifically during periods of heightened attention. A typical pattern among cryptocurrency projects is to unveil significant announcements when public interest is at its peak.

There have been instances where crypto projects have postponed significant updates and announcements due to a lack of interest from retail investors. Despite this, numerous crypto projects have been making notable announcements, which could suggest the beginning of a new altcoin season. However, these announcements have not resulted in significant speculative buying, indicating that retail investors remain scarce.

Source: CoinMarketCal

As the popularity of cryptocurrency projects grows, you may notice a surge in big announcements and subsequent price increases for their coins or tokens. This is often a sign that retail investors have entered the market. When these altcoin announcements start making headlines in mainstream news, it could indicate that the market is nearing its peak.

Some of you have probably encountered additional key indicators, like inquiries from friends and family regarding the crypto market or, worse, seeking advice on investing in meme coins. However, these signals may not hold much weight unless individuals actively invest. Suppose widespread media coverage of altcoins is not leading to a substantial market increase, and your acquaintances are not showing significant interest. In that case, it may not truly be an alt season.

A possible indicator of an impending alt season is to evaluate whether these signs are present when, based on historical patterns, an altcoin season would be expected to occur from a cycle perspective. However, this can be difficult to determine as the introduction of spot Bitcoin ETFs has disrupted the typical cycle. For reference, the current phase of the cycle should resemble the early 2020 period, characterized by gradually increasing prices followed by a sudden crash triggered by an unexpected event before ultimately continuing their upward trend.

It's worth considering that our timeline may be advancing at an accelerated pace. Specifically, we could be closer to the late 2020 stage of the crypto market cycle, irrespective of the introduction of Bitcoin ETFs. With two completed crypto cycles (2017 and 2021) under their belts, millions of individuals are now familiar with the narrative and its subsequent developments.

Source: Bitcoin News on X

The impact is that we won't have to wait 12 months for the altcoin season to begin like we did in 2020. Instead, it could start in just a few months. However, this is based on the assumption that we're on an accelerated timeline. It's possible that cryptocurrency is still following the same schedule, which means we might be ahead of schedule for alt season.

Which Altcoins Should Be Monitored

Which altcoins should you watch this season? I concur with Coinbureau that it might be ideal to start building up your portfolio if we are in the early stages of the altcoin season. However, it's essential to note that this is not financial advice, and it's equally possible it's not the best time to do so.

Coinbureau analysts suggest that the altcoins you must watch this season will be the most accessible to retail investors. As mentioned earlier, EU regulations and, consequently, the structure of the crypto market will ensure that most retail investing will take place on onshore exchanges like Coinbase. In light of this potential scenario, focusing on altcoins listed on Coinbase may be prudent.

This is connected to a previous point about market capitalization. The higher the market cap, the lower the risk and the potential reward. The smaller the market cap, the bigger the risk, but the bigger the reward. Selecting a cryptocurrency with a lower price tag may also be advantageous. Many individual investors assume that a lower price indicates the possibility of more significant price increases, but the market cap is the most important. Therefore, by choosing a low price and market cap cryptocurrency, you can establish some solid fundamentals, often referred to by some influencers as "pumpamentals."

While being listed on Coinbase and having a low price point and market capitalization can benefit an altcoin, more is needed to guarantee success. For an altcoin to truly thrive, it must fit into a broader, bullish narrative that resonates with the average retail investor. This article explores the dominant narratives likely to drive the next bull market.

Image: Markethive.com

Researching the tokenomics of the crypto you want to invest in is vital to ensure it is genuine and has maximum potential. This involves examining the future circulation of coins or tokens, as you wouldn't want to invest in a promising altcoin only to face a sudden sell-off by the developers and their venture capital supporters. Also, you need to select a smart contract cryptocurrency on which the most promising tokens are trading.

Image: Cointelegraph

It is essential to understand that holding onto a promising altcoin for a longer term could be beneficial if you enter the market at the right time. Numerous cryptocurrency enthusiasts can confirm that they would have been equally successful today if they had kept their altcoins during the market downturn. Cryptocurrency, at its core, is designed to revolutionize various systems, so it's important to have a long-term perspective on your investments.

Although many of these systems and their associated projects may fail, a few will endure. The ones that survive have the potential to become extremely valuable, possibly even worth trillions of dollars in the future, much like Bitcoin, which is currently valued at over $1 trillion. It is crucial to note that BTC boasts the lengthiest and most proven track record among all coins and tokens, rendering it the most secure cryptocurrency to retain in comparison.

Other cryptos will more than likely someday achieve the same safe haven status as BTC, so considering all the key indicators along with a crypto’s community, utility and purpose, ecosystem, and solutions it offers in the spectrum, it shouldn’t be too hard to work out which ones to watch out for. For that large-cap security, you might want to consider investing in the original cryptocurrency that has the potential to become the global reserve currency.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

Humans are weird: Buyer Beware: A Yuri story

( Please come see me on my new patreon and support me for early access to stories and personal story requests :D https://www.patreon.com/NiqhtLord Every bit helps)

“This is patrol craft nine-three-zero calling command; sector Sigma-twelve is clear, moving to next patrol.”

Mince flicked off the transceiver and started entering the new patrol coordinates into the nav computer. As he entered the final digit the computer flashed green as he felt the engines vibrations through the decking spin back to life.

“I don’t know why you feel the need to make that report each time we clear a sector.”

Mince looked up from the nav computer to see his partner waking from his nap and stretch out. Crumbs fell off him like the rocks of an avalanche and Mince could see the stains of several pastries still splattered across it like the finger paintings of a child. Had a senior officer been attached to their patrol ship Vicon would be hauled out and lashed until his uniform bore a new shade of red for such lack of discipline, but all of the officers were needed for the war effort and honestly Mince had grown tired of trying to change Vicon’s mind.

“It’s protocol to make routine reports.” Mince replied dryly as he got up from his pilot’s seat and went to the back of the cockpit to pour a fresh mug of Savatha Juice.

Vicon laughed and tilted his cap back over his head. “I doubt anyone in command even remembers us out here, let alone has someone reading out reports.”

He thumbed his right hand over his shoulder at the wall behind him adorned with a propaganda poster showing a Xinda soldier hoisting a cartoonish representation of a Marketh warrior up on a spear while females and children gathered behind him. “That thing’s almost as old as I am, and we’re still not even close to winning this war.”

Mince grabbed his mug and returned to his chair just as the jump drive finally kicked in and the ship was lurched forward at incredible speeds. On some level Mince wanted to tell Vicon that he was an idiot and that of course they would win the war, but he couldn’t deny that this conflict had gone on far beyond what was originally expected.

A minor skirmish over a colony world between the Marketh and his people the Dril spiral out of control nearly some twenty years ago resulting in nearly two decades of on again off again warfare. Every time the Dril thought they were going to have the upper hand and finally overcome the Marketh they would suddenly counter attack and drive them back. What was even more confounding was that the Dril navy vastly outnumbered the Marketh and had established a blockade around their entire territory hoping to starve them into submission, and yet still they had continued their fight. Military analysts had expected them to run out of war material five years ago, but every Marketh soldier was still equipped with a fresh uniform, combat supplies, shredder rifle, and at least five magazines worth of ammo.

“I’ll grant you it’s gone on too long,” Mince conceded as he took a sip of his drink, “but in the win so what does it matter?”

Before Vicon could reply with another snarky remark the ship jittered and exited out of the jump.

“Beginning scan now.” Mince said dryly.

“Who are you saying that for Mince? I’m the only one her-“

Vicon was interrupted by the loud chime from the return scans. This surprised Mince just as much as neither had expected there to be anything in the sector.

“We are reading a Cubato cargo hauler moving past the third planet.” Mince looked at the data being fed to his terminal by the scanners, quickly analyzing each strand of data like it was a letter from his wife. “It appears to be functioning order and we are detecting no distress signals on any frequency.”

“Cubato?” Vicon pondered, finally taking the moment seriously. He pushed himself forward, koc and began checking his own terminal feeds. “This system is still listed as off limits by high command, and the Cubato should be well aware of that.”

The sensor terminal chimed again and the pair looked down to see a second icon appearing at the opposite edge of the sector. It was far from hiding its presence and was making a straight path towards the anchored ship above the third planet. Unlike the first ship however, this second mystery ship was already in their database.

“New contact is registering as a Marketh light frigate.” Vicon called out as the two blips drew close together.

The terminal let out a series of beeps and chimes as new data began flooding in. Vicon took a close look at it then turned to Mince who nodded. “Several small containers are beings floated across from the Cubato hauler into the hold of the frigate, and if I’m reading this right each container is registering power signatures known for Marketh weaponry.”

Vicon leaned back in his chair as the realization hit him. “This is how they’ve been able to maintain the war.” He said to Mince who still looked confused. Vicon pointed to the Cubato hauler and continued. “The Cubato have been supplying war material to the Marketh and keep them in the war.”

Without warning the scanning terminal began ringing out warning alarms as the Marketh frigate suddenly broke away from the hauler and began making a b-line straight for their patrol ship.

“BLARGERSULTUFF!” Vicon cursed as he began rapidly entering keys to spin up the jump drive. “They must have finally seen us on their scanners.”

“Data collection finished,” Mince added as he strapped himself in, “command is going to want to see this; it could change the war.”

The alarms began ringing louder as the Marketh frigate began firing from extreme range. The chances of being hit by a plasma lance from that far were minimal, but it was never a zero percent chance.

“Jump drive ready, get us out of here!” Vicon shouted as the first plasma lances started flying past their ship.

Mince smashed his fist into the jump button and the ship lurched into a jump just as a lance strike came mere inches from hitting their cockpit.

------------------------------

A knock at the door drew Yuri’s attention from his novel and he put it aside on the waiting nightstand beside his chair.

“Come in.” he announced and the door slowly opened to reveal one of his aides shuffling into the room.

“Pardon the intrusion,” they began formally, “but there has been a recent development with operation Siberian railroad.”

Yuri hefted his cup as he listened and his aide brought over a fresh bottle of wine to refill it. He swirled it for a moment before taking in the scent while he nodded to his aide to continue.

“It seems our contact in the Cubato government used a third rate smuggler on the latest transaction with the Marketh and a Xinda patrol craft stumbled upon the transaction.” The aide pulled out a small folder from under his arm and set it on the nightstand beside Yuri. “The Marketh were unable to destroy the ship before it fled from the sector and reported their findings to Xinda command.”

Yuri picked up the folder with his free hand and casually skimmed through the documents in silence while he continued to swirl the cup of wine in his other hand.

“I had expected them to at least make three trips before they were caught, but in a way this unforeseen interruption speeds things along nicely.”

He casually tossed the folder back on to the nightstand and smirked at his confused aide as several pages spilled out on to the floor.

“I thought the plan-“his aide began before Yuri cut in to save several back and forth questions and answers.

“Was to continue arming the Marketh so the war could be prolonged?” Yuri finished. He took a final sniff before judging the wine ready and took the first sip.

“I intentionally diverted our higher grade smugglers to other tasks leaving our Cubato contact no option but to hire a third rate smuggler who just so happened to be in the area.” He took another sip of the fine vintage and looked at his aide still hoisting an expression of bafflement.

“I wanted the Xinda to stumble upon the transaction, thus confirming the involvement of the Cubato government in breaching the Xinda embargo and further infuriating the Xinda government with their arms dealing with the Marketh.”

He set the glass down and stood up, casually straightening out his finely tailored clothes and walking over to his aide. He felt like a teacher nurturing a bright pupil that was so close to solving the problem of their lifetime.

“Even with the arms dealing the Marketh were set to lose the war in another three years; but now with the potential entry of the Cubato people into the war when the Xinda attack them, the war will be escalated further and continue long into the future.”

“But what guarantee do we have that they will go to war with the Cubato?” His aide asked. “For all we know this could be easily resolved with a diplomatic negotiation.”

Yuri tilted his head in consideration of his aide’s assumption. “True, but you are forgetting the contacts we have in the Xinda government who are as we speak stoking their respective public into frenzy over this outrage.”

He put a hand on his aides shoulder and leaned in to whisper “Not to mention the anger that will wash over them when the two pilots manning the patrol craft are found dead in their homes; seemingly murdered by Cubato weaponry.”

The look of bafflement faded from his aide’s face as it was replaced with one of horrific realization. Yuri let go of his aide and returned to his chair and novel. He took one last sip of wine before setting the glass down and flicking through the pages to find his previous place.

“The goal of Siberian Railroad is to ensure that neither the Xinda, Marketh, nor Cubato ever gain enough strength to pose a threat to humanity nor her interests for that region of space. I personally find it so much easier and cost effective to have our enemies fight each other than waste time fighting them ourselves.”

With that final comment Yuri had found his page again and motioned his aide to leave. Compared to this latest Sherlock Holmes novel he had acquired planning a three way galactic war was but child’s play.

#HUMANS ARE WEIRD#humans are insane#humans are space orcs#humans are space oddities#scifi#story#writing#original writing#niqhtlord01

68 notes

·

View notes

Text

I just realized I can post whatever I want. Here’s the navy seal copypasta in Shakespearean.

What the alas didst thee just fucking sayeth about me, thee dram wench? i'll has't thee knoweth i graduat'd top of mine own class in the navy seals, and i've been involv'd in num'rous secret raids on al-quaeda, and i has't ov'r 300 confirm'd kills. I am did train in g'rilla warfare and i'm the top snip'r in the entire us cap-a-pe f'rces. Thou art nothing to me but just anoth'r targeteth. I shall wipeth thee the alas out with precision the likes of which hast nev'r been seen bef're on this earth, marketh mine own fucking w'rds. Thee bethink thee can receiveth hence with declaring yond the horror to me ov'r the int'rnet? bethink again, alas'r. As we speaketh i am contacting mine own secret netw'rk of spies across the usa and thy ip is being trac'd even but now so thee bett'r prepareth f'r the st'rm, maggot. The st'rm yond wipes out the pathetic dram thing thee calleth thy life. Thou art fucking dead, peat. I can beest anywh're, anytime, and i can killeth thee in ov'r seven hundr'd ways, and yond's just with mine own bareth hands. Not only am i extensively did train in unarm'd combat, but i has't access to the entire arsenal of the unit'd states marine c'rps and i shall useth t to its full extent to wipeth thy mis'rable rampallian off the visage of the continent, thee dram the horror. If 't be true only thee couldst has't known what unholy retribution thy dram "clev'r" comment wast about to bringeth down upon thee, haply thee wouldst has't did hold thy fucking tongue. But thee couldn't, thee didn't, and anon thou art paying the price, thee goddamn clotpole. I shall the horror fury all ov'r thee and thee shall drowneth in t. Thou art fucking dead, kiddo

Here’s the translator I used

6 notes

·

View notes

Note

Marketh mine own w'rds, the matt roomba shall beest backeth and that gent shall bringeth revenge to those who is't has't wrong that gent

Peter: I could only BARELY understand this, by the way.

12 notes

·

View notes