#NATIONAL BUSINESS ASSOCIATION

Text

LOMBARDI SOCIETY ORGANIZATIONOPSYS - TERRY I

TO WHOM IT CONCERNS THE NFL NATIONAL FOOTBALL LEAGUE

LOMBARDI SOCIETY IS A OFFSPRING SECT OF THE LOMBARDI PARTY A SEPERATE PIECE OF WRITTING LOMBARDI SOCIETY IS AN INTELLIGENT LEAGUE OF ADULT INDIVIDUAL FOUNDED AND FUNDED ON OUR EXISTENCE AMONG OUR ON AND OFF OR PROFESSIONAL OR NO PROFESSIONAL MERITT BE IT ON OR OFF THE FIELD OR IN THE FIELD OR DRAWN OUT OF THE FIELD WITH SUCCESS AND ACOMPLISHMENT AND AN ADULT LEAGUE SOCIETY DEMEANOR What is a person's demeanor ? Demeanor definition

Your demeanor is your outward behavior. It includes the way you stand, the way you talk, your facial expressions, and more . OUR ADULT LEAGUE SOCIETY VALUE AND PRINICIPLE GUIDE OURS THROUGH OUR VICTORIES AND NEVER SOUR OR MORALITY AND EVEN SO GIUDE THROUGH OUR MORE BITTER SOUR VICTORIES WITH SOUR CANDY BITTER SWEETNESS OUR POSITIVE HABITS OR MORALS PRINICIPLE AND HEART WE WEAR ON OUR SLEEVES LIKE BODY LANGAUGE THAT SHOWS OUR GOALS BE OUR LIMITATIONS OUR OBJECTIVES BE OUR BEYONG OUR GOALS OUR OBLIGATIONS BE JUSTFUL AS OUR RESPECT AND RESPONSIBILITY IS WITHOUT QUESTIONABLE ADORATION , LEADING EACH OF OURS TO OVERACHIEVEMENT CORE AND UNDERACHIEVEMENT LOW LEVEL OF ATTITUDE AND OR PERFORMANCE the action or process of carrying out or accomplishing an action, task, or function. TO ALL A TIME HIGHS BE IT A HIGH BALANCED IQ & IVY LEAGUE STYLE AND COLLEGIATE PROFESSIONAL UNITY GIFTED EACH WITH LIMITLESS POTENTIALITY AND THAT IS THE CERTAIN REALITY WITH IN CONSIDERATION OUR AWARDS FOR OUTSTANDING ACHIEVEMENT PARTICIPATION THOSE HONOR AWARDS , COLLEGE AND PROFESSIONAL OR ACADEMIC AWARDS academic award means an award conferred by an institution of tertiary education in recognition of achievement in a course conducted by the institution: Sample 1. academic award means a degree, diploma, certificate and other certification of academic achievement awarded by the College; Scholastic Award Your scholastic achievement or ability is your academic achievement or ability while you are at school . FOR THOSE ONLINE OR ONLINE AND OFFLINE EDUCATIONAL STUDENTS IN THE NFL WHO CONISDERED BEYOND FOOTBALL , ALSO THOSE WHO TAKE THE LOMBARD STREET WALK UNTIL YOUR WALKING ON LOMBARDI STREET AND ALCOHOLIC FUELS LIKE BARCARDI MAYBE A CAR A WAR A CARD AND AWARD AND SURE IN IT FOR LOMBARDI PARTY AND THE BAR EXAM IS ROUGHLY TRANSLATED 5 24 AM ANTE MERIDIEM AS X CHROMOSOME FOUND IN MALES AND FEMALES A LIKE AND F IS SIX OR FEMALE SEX AND CHROMOSOME XX IS NOT A MALE BUT LIKELY TWO STRIKES OUT IF MAN RUN WAS A HOME RUN FOR HOMER AND BASEBALL NOTED CONSIDERATION OF MILITARY BASES AND PRONUNCIATION LIKE TERRY OR MILITARY AS MANY FIND THEM SELF GOING ACTIVE OR OLYMPIANS SETTLING INTERNATIONAL DISPUTES WITH SPORTSMANSHIP CONDUCT . LOMBARDY SOCIETY IS THE NFL PROFESSIONALS WHO ARE LIKELY TO HAVE A LOMBARDI TROPHY FOR WHAT ONE MAY DAILY ROUTINE OR ONE WHOM IS LIKELY TO HAVE TROPHY NAMED AFTER FOR AWARD OF MERIT BE IT To be or make worthy of (as a reward not punishment). Usage example: the selfless act of heroism . OUR FIRST AWARD IS PROFESSIONAL IMPACT AWARD FOR THE OUTSTANDING IMPACT ONE HAS MADE IN THE NFL BY WHAT EVER MEANS ONE HAS AND DESERVINGLY IS ACKNOWLEDGED FOR SUCH , WELCOME TO THE LOMBARDI SOCIETY .

FOUNDED WRITTEN BY TERRY I.

BIRTH RECORD MARCH 11 1984 - TERRY LEE HAWKINS JR.

MOTHERS GRANDS SURNAME KAUFFMAN - ( LEE ) SECURED

TERRY KAUFFMAN LEE HAWKINS HAWKINGSON.

REGNALNAME TEREMIAH LEEUS HAWKINOS 1ST .

FOUNDING LOCATION BALTIMORE -311USSSECURED -

#nfl news#national football league#united nations#NATIONAL BACHELORS ASSOCIATION#NATIONAL BUSINESS ASSOCIATION#national football conference#NFC563-1463#pythagorean numerology#baltimore ravens#carolina panthers#san fransisco 49ers#pittsburgh steelers#national and international news#NATIONAL AND INTERNATIONAL SPORTS ASSOCIATION

8 notes

·

View notes

Link

The National Business League (NBL)®, National Medical Association (NMA)®, and National Bar Association (NBA)® are proud to announce a collaborative effort to address critical issues impacting Black communities. This initiative focuses on protecting educational pathways, enhancing wealth opportunities, improving healthcare access, reducing health disparities, and strengthening legal advocacy for Black Americans. On Thursday, June 27, 2024, the presidents of these organizations met with the White House and Congressional Black Caucus with a non-partisan agenda.

7 notes

·

View notes

Text

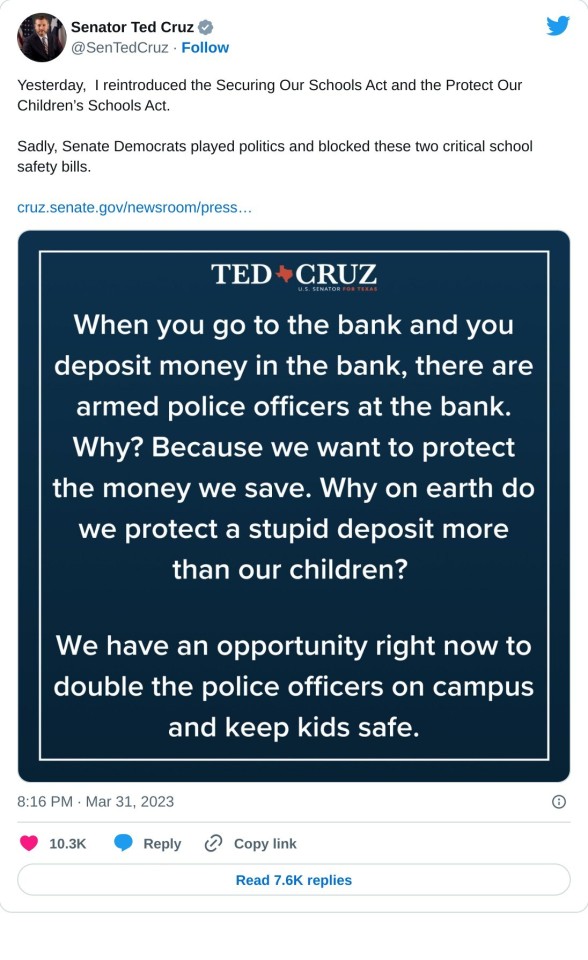

Texas Sen. Ted Cruz proposed a solution to school shootings: Stationing as many armed police officers in schools as there are in banks. Less than two weeks later, a shooter in Kentucky opened fire at a bank, killing at least five people and injuring eight others.

"You know, when you go to the bank, and you deposit money in the bank, there are armed police officers at the bank. Why? Because we want to protect the money we save. Why on earth do we protect a stupid deposit more than our children?" Cruz said on March 30.

"We have an opportunity right now to double the police officers on campus and keep kids safe," Cruz added.

He reiterated the sentiment in a tweet on March 31.

Cruz's proposed bill on school safety, which he has been pushing for months, was blocked in the Senate on March 30.

The Senator's insistence that banks are a paragon of safety and security came just days before a 25-year-old bank employee opened fire on his colleagues.

Cruz has, in the past, made widely panned suggestions on how to stop gun violence.

After the Uvalde school shooting, where a shooter killed 21 people, Cruz floated a bizarre idea for preventing school shootings: Having a "single point of entry" in schools.

"Fire exits should only open out. At that single point of entry, we should have multiple armed police officers or, if need be, military veterans trained to provide security and keep our children safe," Cruz said in an interview with Fox News, published on May 27.

Cruz was also booed at a September festival in Austin after his comments on gun legislation. At the festival, Cruz suggested that violence "is actually the only thing" that helps stop violence — a common, right-wing talking point often trotted out by the National Rifle Association (NRA).

Cruz is also an NRA-friendly GOP politician. Days after the Uvalde shooting, Cruz refused to cancel his appearance at the organization's leadership conference in Houston. Justifying his decision, he told CBS News that the NRA "stands up for your rights, stands up for my rights, and stands up for the rights of every American."

Texas has the highest firearm mortality rate of any state — 4,164 firearm-related deaths in 2020 — per statistics from the Centers for Disease Control and Prevention.

Representatives for Cruz did not immediately respond to Insider's request for comment sent outside regular business hours.

#us politics#news#business insider#2023#school shootings#armed guards#mass shooters#mass shootings#gun rights#gun control#gun violence#workplace violence#sen. ted cruz#republicans#conservatives#gop#gop policy#tweet#us senate#national rifle association#uvalde shooting#kentucky bank shooting#cbs news#center for disease control and prevention#texas#firearm mortality rate

23 notes

·

View notes

Text

"Empty Page" by The Crane Wives is a tHAW!Q-coded song

i have always said that many of the crane wives' songs have vivid thaw!quackity energy.

but this one song of theirs has such strong thaw!q energy in particular that it would feel out place to me if it went on my thaw!quackity playlist. so i thought i'd share my ideas about it here, since it's not going to be on the big playlist analysis ^_^

(click under the cut to see a lyrical breakdown explaining how it applies to early thaw!q)

"I'm just a ten-cent copy/ Of people far more advanced than me/ Every thought that I've ever had/ Could be ripped from a magazine"

in my mind, this song is q comparing himself to quackity. after all, they are the same person, even if they were pretty different from each other in the beginning. but as q started to share the same worldviews as quackity, he started seeing himself less as his own person and more as just a weaker version of quackity.

i mean, he said it himself in chapter 35, "His ‘character’, that he couldn’t really see as much of a character anymore, in fact he saw him as his own person, so different from himself that he couldn’t even fathom how the other thought they were the same person. If anything at times Q felt less like he was his own person than the opposite, maybe because he had had to be ‘Quackity’s past-self’, maybe because of what had almost happened , maybe because Q himself did not know who exactly he was anymore."

q has lost his own sense of identity in this world, instead beginning take on that of quackity's.

and the fact that he's having basically the exact same pivotal moments (even if in slightly different ways), as well as making the same mistakes, as quackity. that does not help that notion of him no longer feeling like he has his own identity.

"Cut me a path, and I will follow it"

this could probably also be seen as him with quackity, but i can't help but see it as him with the sky gods. even if he doesn't mean to, q is following the path that the sky gods have planned for him very well.

"Draw me a line, and I'll avoid it/ I'm nothing if not obedient/ You have my word/ You have my word"

near the beginning of their relationship, this was definitely how q was around quackity. how he tried to avoid doing anything to bring his other-self's ire back upon him. and quackity even made some remarks about how obedient q was to him too, interpretting it as a thing q learned from manberg.

on the topic, that 'i'm nothing if not obedient' line has a double meaning, with how much the ram drilled that idea into quackity's head during manberg

"I am an empty page/ A muddled shade of paint/ I am a light that's burning out/ I am a light that's burning out"

q used to be so bright and idealistic and happy, but as the world continues to beat him down more, he becomes less so. the person that he was slowly fading like the dying light of a candle, as he loses that brightness and hope that used to be so prominent within him.

as for the first two lines, i've already touched on that theme quite a bit. especially during the beginning of the story, q's identity is torn up between who he used to be and who he is becoming. he is no longer himself, but he is not on quackity's level yet either; he's somewhere in between, a muddled color between these two versions of himself.

"I have hands that shake/ When there are cuts to make/ You’ll do it better, show me how/ You'll do it better, show me how"

q wasn't always inclined to violence. he hesitated to kill when faced with the burgundy cosmos ram, even with the bad feeling he immediately gave him, something that quackity would never have done after learning to trust his gut instinct. and q knows this too. that quackity wouldn't have made his same mistakes.

q really does seem to believe that quackity is better, stronger, than him. even in recent chapters that thought has still been present for q, albeit different Kinds of strength than it was before.

ever since the burgundy cosmos, q has no longer been afraid of quackity, instead he begins to strive to be like him.

"Tie me up by my callow belief/ Someday I'll make something out of me"

"Years of imitating mastery/ Only made me a better thief"

q was definitely more callow, more inexperienced when he first ended up in this different world. back when he never saw himself as ever being a murderer nor a cannibal, and back when he was willing to go vegetarian to uphold his moral values. but the sky gods had other plans for him, and his idealistic morals ended up either backfiring and hurting him more or else being impossible to uphold.

ok so it hasn't been Years. but. the point still stands. q started out just faking it until he makes it, and having unrelated behaviors be misinterpreted as something else, but now he's at the point where that identity is more real for him than his previous one is.

vv here's the song btw vv

as always, you can read thaw here, do it./th(/SILLY)

#thaw nation#thaw#thaw analysis#thaw!q#long post#the house always wins#Spotify#this is basically the format that the thawquackity playlist analysis is in btw#the house always wins fic#im sure i could probably find a way to connect this song to quackity too but i just associate it w q sm that it'd still feel weird if i did#also not necessarily saying that some of these things are true. just that they are true in q's mind yk#tw cannibalism mention#tw murder mention#this is certainly not my most in-depth analysis post.#mostly bc i wrote this in less than a day. i cant let myself do more bc im busy w midterms and i wanted to post this soon#so sorry if it sucks or anything lol#ive missed doing analyses

9 notes

·

View notes

Text

Unveiling Real Estate Agent Compensation Realities

With the Buyer agency coming to the forefront of discussions about real estate purchases, there’s been a lot of criticism about the amount of Commission earned by a real estate professional on a transaction. The claim is that agents are overpaid because the commissions on most properties are so generous. (There is an extra claim that this somehow impacts house prices but let’s not waste time on…

#bill lublin#billlublin#Business#buyer agency#buyer agents#commissions#Compensation#NAR Settlement#National Association of Realtors#Real Estate#Real estate broker

0 notes

Text

ETA: Understanding the New Electronic Travel Authorisation (ETA) Requirement for UK Entry

As part of the UK government’s ongoing efforts to enhance border security, the Electronic Travel Authorisation (ETA) scheme was introduced in the March 2023 Statement of Changes to the Immigration Rules (HC 1160). The scheme is designed to ensure that all visitors and transit passengers who do not require a visa for short stays, or who do not already hold an immigration status, must obtain an ETA…

#Application#Application Process#Best Immigration Solicitors London#Borders#Business Visa#DJF Solicitors#European Community Association Agreement#European Nationals#Home Office#Immigration Policy#Immigration Solicitors#Lexvisa#london#London Immigration Solicitors#Non-Visa Nationals#Transit visa#UK Border Agency#UK Immigration#UK Immigration Advice#UK Immigration Solicitors/ Lawyers#Visitor in Transit Visa

0 notes

Text

Jamshedpur Business Leaders Secure Key CAIT National Positions

Suresh Sonthalia elected National Joint General Secretary, Kishore Golchha joins National Executive

Two Jamshedpur business leaders achieve prominent roles in the Confederation of All India Traders.

JAMSHEDPUR – Suresh Sonthalia and Kishore Golchha from Jamshedpur have been elected to key positions in the Confederation of All India Traders (CAIT).

The elections took place during CAIT’s National…

#बिजनेस#business#CAIT National Executive#Confederation of All India Traders#Indian business representation#Jamshedpur business leaders#Jamshedpur trade associations#Kishore Golchha National Executive#national business leadership#Singhbhum Chamber of Commerce#Smriti Irani trader empowerment#Suresh Sonthalia CAIT

0 notes

Text

Memorandum of Agreement (MOA) between Las Piñas City Government and Emapalico Homes HOA signed

Recently in the City of Las Piñas, a memorandum of agreement (MOA) between the City Government and the Emapalico Homes Inc. homeowners association (HOA) was formally signed which will pave the way for commercial development of a key property, according to a Manila Bulletin news report.

To put things in perspective, posted below is an excerpt from the Manila Bulletin news report. Some parts in…

#Aguilar#Asia#Barangay Talon Uno#Blog#blogger#blogging#business#CAA Road#Carlo Carrasco#City Government of Las Piñas#City of Las Piñas#commerce#economics#economy#Economy of the Philippines#Emapalico Homes#geek#governance#homeowners#homeowners association#Imelda Aguilar#jobs#journalism#Las Piñas#Las Piñas City#Manila Bulletin#Mayor Aguilar#Memorandum of Agreement (MOA)#Metro Manila#National Capital Region (NCR)

0 notes

Text

SBA Eliminates Self-Certification for SDVOSBs

The U.S. Small Business Administration (SBA) recently issued a direct final rule that eliminates self-certification for service-disabled veteran-owned small businesses (SDVOSBs). The SBA’s final rule — which implements a provision in the National Defense Authorization Act for Fiscal Year 2024 (NDAA 2024) — is effective August 5, 2024.

Background

To be awarded an SDVOSB set-aside or sole source…

View On WordPress

#Direct Final Rule#National Defense Authorization Act for Fiscal Year 2024#NDAA 2024#SBA#SDVOSBs#Section 864#service-disabled veteran-owned small businesses#Small Business Act#sole source contracts#US Small Business Association#VetCert#Veteran Small Business Certification

0 notes

Text

Invitation to the NBA-HRI National Human Rights Conference

Distinguished Colleagues,

We are pleased to announce that the Nigerian Bar Association Human Rights Institute (NBA-HRI) will be hosting its inaugural National Human Rights Conference. The theme for this year’s conference is “Human Rights in Business and the Workplace: Role of Lawyers.”

Save the date for this inspiring and impactful event:

Date: 10th and 11th July 2024

Venue: NBA National…

View On WordPress

#Abuja Conference#Business and Workplace#Human rights#LAWYERS#National Human Rights Conference#NBA National Secretariat#NBA-HRI#nigerian bar association

0 notes

Text

Image: Getty Images

American Universities Have An Incentive To Seem Extortionate

They are much cheaper than the “Crisis of College Affordability” suggests

— July 23, 2023

The Cost of Many Private Colleges in America has reached $80,000 a year. The median household income in America in 2021 was $71,000 a year. This shows that college is unaffordable. Or does it?

The consensus view is that America has a college-affordability crisis and things are getting worse. According to the Heritage Foundation, a conservative think-tank, “college costs are out of control”. Bernie Sanders, a senator from Vermont, and other progressives have pushed for free college and loan-forgiveness for years. The White House attempted a costly bail-out of student borrowers which the Supreme Court recently declared unconstitutional. Both sides are telling a similar, but mostly inaccurate, tale. Most undergraduate degrees in America are actually affordable, and in many cases going to college is getting cheaper.

There are three main types of colleges in America: public, non-profit private and for-profit private. Public colleges are much less expensive than private ones. According to us News & World Report, which ranks colleges, the average tuition fee for students at a public college studying in their home states is about $10,000, compared with nearly $40,000 for private colleges. And most American students benefit from these lower prices. In 2021, 77% of college students (about 12m) were enrolled in public colleges. Some states are cheaper than others. Tuition in Wyoming costs $6,000 per year for residents, whereas Vermont charges $19,000.

At first glance, public colleges in America look more expensive than most of their rich-country counterparts. America ranks second-highest for fees in the oecd, a club of mostly rich countries, behind England. However, this does not give a true picture.

American universities advertise a sticker price that few students actually pay. According to the National Association of College and University Business Officers, a non-profit organisation, private colleges discount tuition by over 50% on average. And contrary to the common narrative, the net cost (what students really pay) of public and private colleges has fallen.

Schools with large endowments are particularly generous. According to us News & World Report, the average student at Princeton University pays $16,600 for tuition and fees (compared with a $56,010 price tag), and tuition is free for families making $160,000 a year or less. With these tuition discounts, private colleges can sometimes cost less than public ones, though public colleges are usually cheaper.

Americans also have alternative paths to a four-year degree that can help them save money. Students can attend two-year public community colleges for less than the annual tuition cost of a four-year university degree. They can then apply those two years toward the four-year degree. The system is flexible: two-thirds of community-college students work and 70% attend part-time. This is an “interesting feature” of the American system that is less common in other countries, says Simon Roy of the oecd.

Though there are plenty of stories of students being landed with lots of debt for worthless degrees, college generally pays off. College-educated men earn $587,400 more over their lifetime than men who graduated from high school (women earn $425,100 more). This is much greater than the equivalent premium in Britain ($210,800 for men and $193,200 for women). “The expected gains from having a college degree are actually quite high in the us because the us is also one of the countries where income inequality is the highest,” says Abel Schumann of the oecd. This inequality makes college-going worth the initial cost for most people.

Why, then, is there a perception that there is some sort of general crisis in college affordability in America? One reason is that country-level comparisons, such as the analysis by the oecd, compare the sticker price of American universities with that of their peers. Sticker prices are rising while net costs remain steady and, in some cases, drop. A report from the College Board, a non-profit, shows that whereas published tuition and fees for private non-profit colleges increased from $29,000 in 2006-07 to $38,000 in 2021-22 (in 2021 dollars), the net price actually decreased from $17,000 to $15,000. The story is similar for public colleges. Published tuition and fees were nearly $8,000 in 2006-07 and rose to nearly $11,000 in 2021-22, but the net cost fell by $730.

This discrepancy between the sticker price and the net price creates confusion, but it continues because it is valuable to colleges, says Beth Akers of the American Enterprise Institute, a conservative think-tank. Wealthy students pay the full price, subsidising their poorer peers. The higher prices are also good for marketing. Consumers tend to associate higher prices with higher quality. And students (and their boastful parents) are flattered by tuition markdowns pitched as merit scholarships rather than discounts.

Yet even with decreasing costs and with discounts, college can still feel unaffordable to many. Plenty of citizens in countries with free or low tuition (such as Denmark) do in fact pay for college. Instead of paying a tuition bill, they pay over time with high taxes. Americans pay less in taxes, but that lump-sum tuition bill can be frightening. For those students and their families unable to pay cash, loans can be an answer. But accrued interest can quickly turn a reasonable cost into an unreasonable one. This may change soon for federal-loan borrowers: a new initiative by the Biden administration will prevent interest from accruing on federal loans for people making timely payments.

College does not benefit everyone, and the quality is highly variable. For-profit colleges are notorious for providing little value and targeting poor and non-white students. And certain majors and occupations pay better than others. College dropouts do not get the benefit of the degree (though they do get to keep the debt). On average college is affordable and worth attending, but that does not mean that every individual benefits.

Regardless of the reality, American confidence in college is declining. A poll by Gallup released this month shows that only 36% of Americans have “a great deal” or “quite a lot” of confidence in higher education. This is down from 48% in 2018 and 57% in 2015. The perceived high cost of college could be driving down these results, says Jeremy Wright-Kim, an education professor at the University of Michigan. College may be relatively affordable and worth the overall cost, but Americans are struggling to believe it.■

#United States 🇺🇸#Sticker Shocker#American Universities#Crisis#Affordability#College#Private Colleges#Heritage Foundation#Senator Bernie Sanders#Public Colleges#National Association of College and University Business Officers#Gallup Survey#Jeremy Wright-Kim#University of Michigan

0 notes

Text

Unveiling the NBA's Financial Powerhouse: Explore Sponsorships, Global Reach, and Strategic Partnerships

Discover the NBA’s financial landscape and global influence. Learn about sponsorship deals, strategic partnerships, and marketing initiatives that have made the league a powerhouse in the business of basketball.

Dive into the NBA’s financial empire and uncover its global reach and sponsorship deals.

This comprehensive report provides a detailed overview of the commercial landscape of the NBA, focusing on key aspects such as sponsorship revenue, media deals, ticketing, and the involvement of various brands and sectors.

The NBA stands tall as one of the most prominent and profitable sports leagues worldwide. With a rich history and a global fan base, the NBA has firmly established itself as a major player in the business of professional basketball. Let’s explore the factors that contribute to the NBA’s financial success and its global reach.

One of the crucial aspects of the NBA’s financial success lies in its broadcasting partnerships. The league has exclusive agreements with ESPN-ABC and Turner Sports-TNT, which have been the main platforms for NBA coverage for several decades. These long-term contracts, extending until 2025, ensure the league’s continued exposure and financial stability. ESPN’s partnership with ABC allows for extensive coverage of the NBA Finals and other key postseason games. Additionally, the rights held by ESPN have facilitated the growth of their streaming and online video content offerings, expanding the NBA’s digital reach.

Sponsorship plays a significant role in the NBA’s revenue generation. The league boasts an impressive roster of sponsors, including renowned brands such as Nike, PepsiCo, Rakuten, State Farm Insurance, Google, AT&T, and many others. Nike, for example, has solidified its presence in the NBA through a five-year deal, making it the official kit supplier for all NBA and WNBA teams. PepsiCo, a leading food and beverage company, has also secured a significant five-year deal with the league, demonstrating the appeal of NBA sponsorship to diverse industries.

The NBA’s ability to engage brands from various sectors showcases its desirability as a marketing platform. Brands such as Verizon, Coca-Cola, Kia, Lexus, Jack Daniel’s, and American Express have all embraced partnerships with the NBA. Verizon stands out as the most active brand, with 21 deals for the 2022–23 NBA season alone. These brand engagements not only contribute to the league’s revenue but also help promote the NBA’s global reach and popularity among diverse audiences.

In terms of sectors, a variety of industries actively participate in sponsoring NBA properties. The restaurant sector leads the way, having secured 244 deals. The beverages and financial services sectors also hold a significant presence in NBA sponsorship. Moreover, brands from 27 different sectors have partnered with the NBA, highlighting the league’s ability to attract a diverse range of businesses and establish itself as a desirable marketing platform.

The NBA’s annual sponsorship revenue amounts to an impressive $656.75 million, showcasing the financial success of the league’s business operations. This revenue, combined with broadcasting deals and other sources, contributes to the NBA’s overall financial strength as a sports league.

Ticket prices for NBA games vary depending on factors such as market, season stage, and game importance. In 2022, the average ticket price was $77.75, with prices ranging from as low as $10 to as high as $70,000 for premium seating and VIP experiences. The NBA All-Star Game, a highly anticipated event, has seen a significant increase in ticket prices, reaching an average of $2,600 in 2020.

In terms of viewership demographics, the NBA has traditionally attracted a younger audience, with 45% of viewers being under the age of 35 in 2013. However, the league has faced challenges in attracting female viewers, with only 30% of its viewership consisting of women. Racially, the NBA has a diverse viewership, with 45% of viewers identifying as black and 40% as white as of 2014. Notably, the NBA has a larger black viewership compared to other major sports leagues, reflecting the league’s efforts to promote diversity and inclusion.

The NBA’s global reach has been a key driver of its success. The league has actively pursued international expansion, playing games in different countries and forming partnerships with foreign entities. The NBA Global Games have been instrumental in expanding the league’s international fan base and attracting global sponsors. China, in particular, has emerged as a vital market for the NBA, with a significant fan following and various strategic partnerships.

The NBA’s success as a global powerhouse in the business of basketball can be attributed to its strong business relationships, global marketing initiatives, and efforts to embrace diversity and inclusion. The league’s financial success, driven by broadcasting partnerships, sponsorship deals, and global expansion, solidifies its position as an iconic sports brand.

Studying the NBA’s business model provides valuable insights into successful sports league management, strategic partnerships, sponsorship revenue generation, and global expansion strategies. As the league moves forward, it will undoubtedly explore new avenues for growth and continue to captivate audiences worldwide.

This blog is based on publicly available sources and information. While we strive to provide accurate and reliable content, we encourage readers to conduct their own research and verify the information provided. The views and opinions expressed in this blog are those of the author and do not necessarily reflect the official policy or position of any organization or entity mentioned. The information presented here is intended for general informational purposes only and should not be considered as professional or legal advice. Readers are advised to consult with relevant experts or professionals for specific guidance and recommendations. We do not make any warranties about the completeness, reliability, and accuracy of the information contained in this blog. Any action you take upon the information provided is strictly at your own risk, and we will not be liable for any losses or damages in connection with the use of this blog.

#NBA #Basketball #SportsBusiness #GlobalReach #Sponsorships #FinancialSuccess

#forex trading#stock#investing stocks#trader#traders#business#nba#national basketball association#nba finals#nba playoffs

0 notes

Text

You can have the attention of all the visitors and participants of NBAA-BACE 2023 on your brand, and for this, all you need to do is connect with us at https://rb.gy/l9ytv

##Nbaa2023 #Nbaashow #Nbaaexpo #NBAAexpo2023 #TradeshowBooth #TradeshowDisplay #TradeshowBoothRental #RentalDisplay #TradeshowRental #TradeshowBoothBuilder #TradeshowBoothDesign #ExhibitionBuilders #Event #ExpoStandService #ESS

#National Business Aviation Association 2023#Nbaa#Nbaa2023#Nbaashow#Nbaaexpo#NBAAexpo2023#Tradeshow#Trade show booth#booth rental#expostandservice#ess#tradeshowbooth#displayrental#event#boothrental#exhibitiondesign#boothbuilder#exhibitionbuilders

0 notes

Text

The President of McDonald's USA threw shade at California lawmakers for passing a fast-food law that he said would make it "all but impossible to run small business restaurants" in the state, Joe Erlinger said in a January 25 open letter.

AB 257, dubbed the FAST Act, signed into law last year, could raise hourly restaurant wages to $22 an hour in the state. The open letter was published after the state approved a referendum backed by fast-food chains that would put the law up for a vote in November 2024. The law was previously set to be enforced on January 1. But until the vote, state officials can't implement the law.

A majority of McDonald's, nearly 14,000 restaurants in the US, are run by franchisees, with hundreds of stores operating in California. The open letter was titled, "California keeps looking for ways to raise prices, drive away more businesses and destroy growth through bad policy and bad politics."

In the letter, Erlanger noted that the company wasn't against increasing the minimum wage. "Let me be clear: we support legislation that leads to meaningful improvements in our communities, including responsible increases to the minimum wage. Our business does well when our employees and our communities do well," he said.

"Whether you're a lawmaker, a business owner or leader, or an everyday voter, one thing is clear: California has become a dramatic case study of putting bad politics over good policy," Erlinger said. According to financial disclosures, Erlinger made about $7.4 million in salary, stock options, and other compensation from McDonald's in 2021, the latest year complete compensation history is available.

A coalition of restaurant industry organizations led by McDonald's, Chipotle, and In-N-Out supported the referendum.

Restaurant analyst John Gordon, a consultant for many McDonald's franchisees, said he's not surprised by Erlinger's remarks, which seem to be setting the stage for a battle leading up to the November 2024 vote, he said. 2024 is a presidential election year, and turnout is expected to be high.

McDonald's taking a public stance on anti-business legislation, he said.

Supporters of the union-backed FAST Act, signed by Governor Gavin Newsom on Labor Day, say the law would improve working conditions for thousands of fast-food workers in the state.

AB 257 creates a 10-member council of fast food workers, franchisees, franchisors, advocates for fast food employees, and representatives from the governor's office. The council will establish minimum standards on wages, working hours, and other working conditions related to the health and safety of workers. The law applies to food chains with more than 100 locations, including Starbucks, Wendy's, Burger King, and McDonald's.

The industry's trade organization, National Restaurant Association, said the law would hurt small business owners, including fast food franchisees who own one or two restaurants. The organization said higher wage mandates could raise costs for California fast-food restaurants by $3 billion.

Another main sticking point for the restaurant industry – state officials, including Newsom, would appoint members of the 10-person council.

"The state is teaching us a powerful lesson about what our future could look like if this one-sided style of democracy is mimicked elsewhere or goes unchecked in the Golden State," said Erlinger, a native of California. "There are big, important issues that need the attention of lawmakers. Implementing costly and job-destroying legislation like AB257 is not the answer."

Mary Kay Henry, president of the Service Employees International Union, said chains like McDonald's, Chipotle, and Starbucks, who backed the referendum, "think they can buy their way out of anything."

Fast-food workers across California said they plan to strike Thursday and Friday to protest chain support of the referendum to overturn the FAST Act.

"California voters are about to teach them an expensive lesson: no corporation is more powerful than half a million workers joining together to demand a seat at the table," Henry said in response to the referendum. "As California fast-food workers defend this landmark law and assert their voice, SEIU is absolutely committed to standing with them in their fight."

#us politics#news#California#2023#AB 257#fast act#raise the minimum wage#minimum wage#living wage#wages#business insider#Joe Erlinger#McDonald's#chipotle#starbucks#In-N-Out#John Gordon#gov. gavin newsom#National Restaurant Association#Service Employees International Union#Mary Kay Henry#labor strikes

12 notes

·

View notes

Text

the great reddit API meltdown of '23, or: this was always bound to happen

there's a lot of press about what's going on with reddit right now (app shutdowns, subreddit blackouts, the CEO continually putting his foot in his mouth), but I haven't seen as much stuff talking about how reddit got into this situation to begin with. so as a certified non-expert and Context Enjoyer I thought it might be helpful to lay things out as I understand them—a high-level view, surveying the whole landscape—in the wonderful world of startups, IPOs, and extremely angry users.

disclaimer that I am not a founder or VC (lmao), have yet to work at a company with a successful IPO, and am not a reddit employee or third-party reddit developer or even a subreddit moderator. I do work at a startup, know my way around an API or two, and have spent twelve regrettable years on reddit itself. which is to say that I make no promises of infallibility, but I hope you'll at least find all this interesting.

profit now or profit later

before you can really get into reddit as reddit, it helps to know a bit about startups (of which reddit is one). and before I launch into that, let me share my Three Types Of Websites framework, which is basically just a mental model about financial incentives that's helped me contextualize some of this stuff.

(1) website/software that does not exist to make money: relatively rare, for a variety of reasons, among them that it costs money to build and maintain a website in the first place. wikipedia is the evergreen example, although even wikipedia's been subject to criticism for how the wikimedia foundation pays out its employees and all that fun nonprofit stuff. what's important here is that even when making money is not the goal, money itself is still a factor, whether it's solicited via donations or it's just one guy paying out of pocket to host a hobby site. but websites in this category do, generally, offer free, no-strings-attached experiences to their users.

(I do want push back against the retrospective nostalgia of "everything on the internet used to be this way" because I don't think that was ever really true—look at AOL, the dotcom boom, the rise of banner ads. I distinctly remember that neopets had multiple corporate sponsors, including a cookie crisp-themed flash game. yahoo bought geocities for $3.6 billion; money's always been trading hands, obvious or not. it's indisputable that the internet is simply different now than it was ten or twenty years ago, and that monetization models themselves have largely changed as well (I have thoughts about this as it relates to web 1.0 vs web 2.0 and their associated costs/scale/etc.), but I think the only time people weren't trying to squeeze the internet for all the dimes it can offer was when the internet was first conceived as a tool for national defense.)

(2) website/software that exists to make money now: the type that requires the least explanation. mostly non-startup apps and services, including any random ecommerce storefront, mobile apps that cost three bucks to download, an MMO with a recurring subscription, or even a news website that runs banner ads and/or offers paid subscriptions. in most (but not all) cases, the "make money now" part is obvious, so these things don't feel free to us as users, even to the extent that they might have watered-down free versions or limited access free trials. no one's shocked when WoW offers another paid expansion packs because WoW's been around for two decades and has explicitly been trying to make money that whole time.

(3) website/software that exists to make money later: this is the fun one, and more common than you'd think. "make money later" is more or less the entire startup business model—I'll get into that in the next section—and is deployed with the expectation that you will make money at some point, but not always by means as obvious as "selling WoW expansions for forty bucks a pop."

companies in this category tend to have two closely entwined characteristics: they prioritize growth above all else, regardless of whether this growth is profitable in any way (now, or sometimes, ever), and they do this by offering users really cool and awesome shit at little to no cost (or, if not for free, then at least at a significant loss to the company).

so from a user perspective, these things either seem free or far cheaper than their competitors. but of course websites and software and apps and [blank]-as-a-service tools cost money to build and maintain, and that money has to come from somewhere, and the people supplying that money, generally, expect to get it back...

just not immediately.

startups, VCs, IPOs, and you

here's the extremely condensed "did NOT go to harvard business school" version of how a startup works:

(1) you have a cool idea.

(2) you convince some venture capitalists (also known as VCs) that your idea is cool. if they see the potential in what you're pitching, they'll give you money in exchange for partial ownership of your company—which means that if/when the company starts trading its stock publicly, these investors will own X numbers of shares that they can sell at any time. in other words, you get free money now (and you'll likely seek multiple "rounds" of investors over the years to sustain your company), but with the explicit expectations that these investors will get their payoff later, assuming you don't crash and burn before that happens.

during this phase, you want to do anything in your power to make your company appealing to investors so you can attract more of them and raise funds as needed. because you are definitely not bringing in the necessary revenue to offset operating costs by yourself.

it's also worth nothing that this is less about projecting the long-term profitability of your company than it's about its perceived profitability—i.e., VCs want to put their money behind a company that other people will also have confidence in, because that's what makes stock valuable, and VCs are in it for stock prices.

(3) there are two non-exclusive win conditions for your startup: you can get acquired, and you can have an IPO (also referred to as "going public"). these are often called "exit scenarios" and they benefit VCs and founders, as well as some employees. it's also possible for a company to get acquired, possibly even more than once, and then later go public.

acquisition: sell the whole damn thing to someone else. there are a million ways this can happen, some better than others, but in many cases this means anyone with ownership of the company (which includes both investors and employees who hold stock options) get their stock bought out by the acquiring company and end up with cash in hand. in varying amounts, of course. sometimes the founders walk away, sometimes the employees get laid off, but not always.

IPO: short for "initial public offering," this is when the company starts trading its stocks publicly, which means anyone who wants to can start buying that company's stock, which really means that VCs (and employees with stock options) can turn that hypothetical money into real money by selling their company stock to interested buyers.

drawing from that, companies don't go for an IPO until they think their stock will actually be worth something (or else what's the point?)—specifically, worth more than the amount of money that investors poured into it. The Powers That Be will speculate about a company's IPO potential way ahead of time, which is where you'll hear stuff about companies who have an estimated IPO evaluation of (to pull a completely random example) $10B. actually I lied, that was not a random example, that was reddit's valuation back in 2021 lol. but a valuation is basically just "how much will people be interested in our stock?"

as such, in the time leading up to an IPO, it's really really important to do everything you can to make your company seem like a good investment (which is how you get stock prices up), usually by making the company's numbers look good. but! if you plan on cashing out, the long-term effects of your decisions aren't top of mind here. remember, the industry lingo is "exit scenario."

if all of this seems like a good short-term strategy for companies and their VCs, but an unsustainable model for anyone who's buying those stocks during the IPO, that's because it often is.

also worth noting that it's possible for a company to be technically unprofitable as a business (meaning their costs outstrip their revenue) and still trade enormously well on the stock market; uber is the perennial example of this. to the people who make money solely off of buying and selling stock, it literally does not matter that the actual rideshare model isn't netting any income—people think the stock is valuable, so it's valuable.

this is also why, for example, elon musk is richer than god: if he were only the CEO of tesla, the money he'd make from selling mediocre cars would be (comparatively, lol) minimal. but he's also one of tesla's angel investors, which means he holds a shitload of tesla stock, and tesla's stock has performed well since their IPO a decade ago (despite recent dips)—even if tesla itself has never been a huge moneymaker, public faith in the company's eventual success has kept them trading at high levels. granted, this also means most of musk's wealth is hypothetical and not liquid; if TSLA dropped to nothing, so would the value of all the stock he holds (and his net work with it).

what's an API, anyway?

to move in an entirely different direction: we can't get into reddit's API debacle without understanding what an API itself is.

an API (short for "application programming interface," not that it really matters) is a series of code instructions that independent developers can use to plug their shit into someone else's shit. like a series of tin cans on strings between two kids' treehouses, but for sending and receiving data.

APIs work by yoinking data directly from a company's servers instead of displaying anything visually to users. so I could use reddit's API to build my own app that takes the day's top r/AITA post and transcribes it into pig latin: my app is a bunch of lines of code, and some of those lines of code fetch data from reddit (and then transcribe that data into pig latin), and then my app displays the content to anyone who wants to see it, not reddit itself. as far as reddit is concerned, no additional human beings laid eyeballs on that r/AITA post, and reddit never had a chance to serve ads alongside the pig-latinized content in my app. (put a pin in this part—it'll be relevant later.)

but at its core, an API is really a type of protocol, which encompasses a broad category of formats and business models and so on. some APIs are completely free to use, like how anyone can build a discord bot (but you still have to host it yourself). some companies offer free APIs to third-party developers can build their own plugins, and then the company and the third-party dev split the profit on those plugins. some APIs have a free tier for hobbyists and a paid tier for big professional projects (like every weather API ever, lol). some APIs are strictly paid services because the API itself is the company's core offering.

reddit's financial foundations

okay thanks for sticking with me. I promise we're almost ready to be almost ready to talk about the current backlash.

reddit has always been a startup's startup from day one: its founders created the site after attending a startup incubator (which is basically a summer camp run by VCs) with the successful goal of creating a financially successful site. backed by that delicious y combinator money, reddit got acquired by conde nast only a year or two after its creation, which netted its founders a couple million each. this was back in like, 2006 by the way. in the time since that acquisition, reddit's gone through a bunch of additional funding rounds, including from big-name investors like a16z, peter thiel (yes, that guy), sam altman (yes, also that guy), sequoia, fidelity, and tencent. crunchbase says that they've raised a total of $1.3B in investor backing.

in all this time, reddit has never been a public company, or, strictly speaking, profitable.

APIs and third-party apps

reddit has offered free API access for basically as long as it's had a public API—remember, as a "make money later" company, their primary goal is growth, which means attracting as many users as possible to the platform. so letting anyone build an app or widget is (or really, was) in line with that goal.

as such, third-party reddit apps have been around forever. by third-party apps, I mean apps that use the reddit API to display actual reddit content in an unofficial wrapper. iirc reddit didn't even have an official mobile app until semi-recently, so many of these third-party mobile apps in particular just sprung up to meet an unmet need, and they've kept a small but dedicated userbase ever since. some people also prefer the user experience of the unofficial apps, especially since they offer extra settings to customize what you're seeing and few to no ads (and any ads these apps do display are to the benefit of the third-party developers, not reddit itself.)

(let me add this preemptively: one solution I've seen proposed to the paid API backlash is that reddit should have third-party developers display reddit's ads in those third-party apps, but this isn't really possible or advisable due to boring adtech reasons I won't inflict on you here. source: just trust me bro)

in addition to mobile apps, there are also third-party tools that don’t replace the Official Reddit Viewing Experience but do offer auxiliary features like being able to mass-delete your post history, tools that make the site more accessible to people who use screen readers, and tools that help moderators of subreddits moderate more easily. not to mention a small army of reddit bots like u/AutoWikibot or u/RemindMebot (and then the bots that tally the number of people who reply to bot comments with “good bot” or “bad bot).

the number of people who use third-party apps is relatively small, but they arguably comprise some of reddit’s most dedicated users, which means that third-party apps are important to the people who keep reddit running and the people who supply reddit with high-quality content.

unpaid moderators and user-generated content

so reddit is sort of two things: reddit is a platform, but it’s also a community.

the platform is all the unsexy (or, if you like python, sexy) stuff under the hood that actually makes the damn thing work. this is what the company spends money building and maintaining and "owns." the community is all the stuff that happens on the platform: posts, people, petty squabbles. so the platform is where the content lives, but ultimately the content is the reason people use reddit—no one’s like “yeah, I spend time on here because the backend framework really impressed me."

and all of this content is supplied by users, which is not unique among social media platforms, but the content is also managed by users, which is. paid employees do not govern subreddits; unpaid volunteers do. and moderation is the only thing that keeps reddit even remotely tolerable—without someone to remove spam, ban annoying users, and (god willing) enforce rules against abuse and hate speech, a subreddit loses its appeal and therefore its users. not dissimilar to the situation we’re seeing play out at twitter, except at twitter it was the loss of paid moderators; reddit is arguably in a more precarious position because they could lose this unpaid labor at any moment, and as an already-unprofitable company they absolutely cannot afford to implement paid labor as a substitute.

oh yeah? spell "IPO" backwards

so here we are, June 2023, and reddit is licking its lips in anticipation of a long-fabled IPO. which means it’s time to start fluffing themselves up for investors by cutting costs (yay, layoffs!) and seeking new avenues of profit, however small.

this brings us to the current controversy: reddit announced a new API pricing plan that more or less prevents anyone from using it for free.

from reddit's perspective, the ostensible benefits of charging for API access are twofold: first, there's direct profit to be made off of the developers who (may or may not) pay several thousand dollars a month to use it, and second, cutting off unsanctioned third-party mobile apps (possibly) funnels those apps' users back into the official reddit mobile app. and since users on third-party apps reap the benefit of reddit's site architecture (and hosting, and development, and all the other expenses the site itself incurs) without “earning” money for reddit by generating ad impressions, there’s a financial incentive at work here: even if only a small percentage of people use third-party apps, getting them to use the official app instead translates to increased ad revenue, however marginal.

(also worth mentioning that chatGPT and other LLMs were trained via tools that used reddit's API to scrape post and content data, and now that openAI is reaping the profits of that training without giving reddit any kickbacks, reddit probably wants to prevent repeats of this from happening in the future. if you want to train the next LLM, it's gonna cost you.)

of course, these changes only benefit reddit if they actually increase the company’s revenue and perceived value/growth—which is hard to do when your users (who are also the people who supply the content for other users to engage with, who are also the people who moderate your communities and make them fun to participate in) get really fucking pissed and threaten to walk.

pricing shenanigans

under the new API pricing plan, third-party developers are suddenly facing steep costs to maintain the apps and tools they’ve built.

most paid APIs are priced by volume: basically, the more data you send and receive, the more money it costs. so if your third-party app has a lot of users, you’ll have to make more API requests to fetch content for those users, and your app becomes more expensive to maintain. (this isn’t an issue if the tool you’re building also turns a profit, but most third-party reddit apps make little, if any, money.)

which is why, even though third-party apps capture a relatively small portion of reddit’s users, the developer of a popular third-party app called apollo recently learned that it would cost them about $20 million a year to keep the app running. and apollo actually offers some paid features (for extra in-app features independent of what reddit offers), but nowhere near enough to break even on those API costs.

so apollo, any many apps like it, were suddenly unable to keep their doors open under the new API pricing model and announced that they'd be forced to shut down.

backlash, blackout

plenty has been said already about the current subreddit blackouts—in like, official news outlets and everything—so this might be the least interesting section of my whole post lol. the short version is that enough redditors got pissed enough that they collectively decided to take subreddits “offline” in protest, either by making them read-only or making them completely inaccessible. their goal was to send a message, and that message was "if you piss us off and we bail, here's what reddit's gonna be like: a ghost town."

but, you may ask, if third-party apps only captured a small number of users in the first place, how was the backlash strong enough to result in a near-sitewide blackout? well, two reasons:

first and foremost, since moderators in particular are fond of third-party tools, and since moderators wield outsized power (as both the people who keep your site more or less civil, and as the people who can take a subreddit offline if they feel like it), it’s in your best interests to keep them happy. especially since they don’t get paid to do this job in the first place, won’t keep doing it if it gets too hard, and essentially have nothing to lose by stepping down.

then, to a lesser extent, the non-moderator users on third-party apps tend to be Power Users who’ve been on reddit since its inception, and as such likely supply a disproportionate amount of the high-quality content for other users to see (and for ads to be served alongside). if you drive away those users, you’re effectively kneecapping your overall site traffic (which is bad for Growth) and reducing the number/value of any ad impressions you can serve (which is bad for revenue).

also a secret third reason, which is that even people who use the official apps have no stake in a potential IPO, can smell the general unfairness of this whole situation, and would enjoy the schadenfreude of investors getting fucked over. not to mention that reddit’s current CEO has made a complete ass of himself and now everyone hates him and wants to see him suffer personally.

(granted, it seems like reddit may acquiesce slightly and grant free API access to a select set of moderation/accessibility tools, but at this point it comes across as an empty gesture.)

"later" is now "now"

TL;DR: this whole thing is a combination of many factors, specifically reddit being intensely user-driven and self-governed, but also a high-traffic site that costs a lot of money to run (why they willingly decided to start hosting video a few years back is beyond me...), while also being angled as a public stock market offering in the very near future. to some extent I understand why reddit’s CEO doubled down on the changes—he wants to look strong for investors—but he’s also made a fool of himself and cast a shadow of uncertainty onto reddit’s future, not to mention the PR nightmare surrounding all of this. and since arguably the most important thing in an IPO is how much faith people have in your company, I honestly think reddit would’ve fared better if they hadn’t gone nuclear with the API changes in the first place.

that said, I also think it’s a mistake to assume that reddit care (or needs to care) about its users in any meaningful way, or at least not as more than means to an end. if reddit shuts down in three years, but all of the people sitting on stock options right now cashed out at $120/share and escaped unscathed... that’s a success story! you got your money! VCs want to recoup their investment—they don’t care about longevity (at least not after they’re gone), user experience, or even sustained profit. those were never the forces driving them, because these were never the ultimate metrics of their success.

and to be clear: this isn’t unique to reddit. this is how pretty much all startups operate.

I talked about the difference between “make money now” companies and “make money later” companies, and what we’re experiencing is the painful transition from “later” to “now.” as users, this change is almost invisible until it’s already happened—it’s like a rug we didn’t even know existed gets pulled out from under us.

the pre-IPO honeymoon phase is awesome as a user, because companies have no expectation of profit, only growth. if you can rely on VC money to stay afloat, your only concern is building a user base, not squeezing a profit out of them. and to do that, you offer cool shit at a loss: everything’s chocolate and flowers and quarterly reports about the number of signups you’re getting!

...until you reach a critical mass of users, VCs want to cash in, and to prepare for that IPO leadership starts thinking of ways to make the website (appear) profitable and implements a bunch of shit that makes users go “wait, what?”

I also touched on this earlier, but I want to reiterate a bit here: I think the myth of the benign non-monetized internet of yore is exactly that—a myth. what has changed are the specific market factors behind these websites, and their scale, and the means by which they attempt to monetize their services and/or make their services look attractive to investors, and so from a user perspective things feel worse because the specific ways we’re getting squeezed have evolved. maybe they are even worse, at least in the ways that matter. but I’m also increasingly less surprised when this occurs, because making money is and has always been the goal for all of these ventures, regardless of how they try to do so.

8K notes

·

View notes

Text

Four Things to Understand About the NAR Settlement

Photo by KATRIN BOLOVTSOVA on Pexels.com

The NAR settlement of the Sitzer-Burnett case has created some furor, and the media is exploding with speculation about the industry’s changes. This speculation is fueled mainly by people who aren’t in the industry, who rely upon or regurgitate articles someone else not in the industry wrote or just speculation shaped by that individual’s narrow view of…

View On WordPress

#bill lublin#billlublin#Business#Multiple Listing Service#National Association of Realtors#Real Estate#Real estate broker

0 notes