#NatWest

Text

#uk#politics#ukpol#media#nigel farage#nazi#far right#coutts#natwest#shorting#hedge funds#gb news#poverty

40 notes

·

View notes

Text

Been following the horrific news of the British banking giant NatWest closing down thousands of people's bank accounts because of their political beliefs, and keeping dossiers on them. This has all come to light and become mainstream news because of it being done to Nigel Farage, the main proponent of Brexit, which the majority of the country voted for, so does not represent any particularly radical fringe politics or terrorist organizations or whatever.

Very heartening to see the progression of these three videos all put out in the course of one day, today:

youtube

youtube

youtube

22 notes

·

View notes

Text

Avrupa Hükümetlerinin Banka Hisseleriyle İlgili Stratejileri

Avrupa'daki hükümetler, küresel mali krizin etkilerini aşmak için çeşitli önlemler geliştirmeye devam ederken, geçen yıl kurtarılan banka hisselerinin toplamda...

#avrupa#bankahisseleri#hükümetler#ingiltere#İtalya#kurtarmapaketi#malikriz#NatWest#satış#yatırım#Yunanistan

0 notes

Text

Avrupa Hükümetlerinin Banka Hisseleriyle İlgili Stratejileri

Avrupa'daki hükümetler, küresel mali krizin etkilerini aşmak için çeşitli önlemler geliştirmeye devam ederken, geçen yıl kurtarılan banka hisselerinin toplamda...

#avrupa#bankahisseleri#hükümetler#ingiltere#İtalya#kurtarmapaketi#malikriz#NatWest#satış#yatırım#Yunanistan

0 notes

Text

Avrupa Hükümetlerinin Banka Hisseleriyle İlgili Stratejileri

Avrupa'daki hükümetler, küresel mali krizin etkilerini aşmak için çeşitli önlemler geliştirmeye devam ederken, geçen yıl kurtarılan banka hisselerinin toplamda...

#avrupa#bankahisseleri#hükümetler#ingiltere#İtalya#kurtarmapaketi#malikriz#NatWest#satış#yatırım#Yunanistan

0 notes

Text

Avrupa Hükümetlerinin Banka Hisseleriyle İlgili Stratejileri

Avrupa'daki hükümetler, küresel mali krizin etkilerini aşmak için çeşitli önlemler geliştirmeye devam ederken, geçen yıl kurtarılan banka hisselerinin toplamda...

#avrupa#bankahisseleri#hükümetler#ingiltere#İtalya#kurtarmapaketi#malikriz#NatWest#satış#yatırım#Yunanistan

0 notes

Text

Avrupa Hükümetlerinin Banka Hisseleriyle İlgili Stratejileri

Avrupa'daki hükümetler, küresel mali krizin etkilerini aşmak için çeşitli önlemler geliştirmeye devam ederken, geçen yıl kurtarılan banka hisselerinin toplamda...

#avrupa#bankahisseleri#hükümetler#ingiltere#İtalya#kurtarmapaketi#malikriz#NatWest#satış#yatırım#Yunanistan

0 notes

Text

German government withdraws from Commerzbank

Germany plans to cut its stake in Commerzbank, currently valued at about €2.56 billion ($2.83 billion), according to The Wall Street Journal.

The German government bought a stake in the lender in 2008 and 2009 in an effort to protect financial stability. Now it wants to begin the process of exiting its stake in Commerzbank, which currently stands at 16.49 per cent, once the bank’s financial situation improves.

The trend intensified across Europe as bank shares rose after high interest rates boosted their earnings, with many of them splurging on shareholder returns. Irish group AIB said earlier this week it would buy back shares from the Irish government as part of a process to compensate taxpayers for their support.

In the UK, NatWest Group, formerly known as Royal Bank of Scotland, has been selling shares in recent years. Italy has also cut its stake in Banca Monte dei Paschi di Siena, while Spain has backed the merger of state-owned Bankia with CaixaBank.

Commerzbank received €18.20 billion in 2008 and 2009, of which about €13.15 billion has been paid out so far. The government retains a stake through its Financial Market Stabilisation Fund, the German financial agency said. The bank was profitable since 2021 and the government decided to take the first step to sell its stake, the agency added.

The government’s 16.49% stake in Commerzbank is currently valued at about 2.56 billion euros, based on Commerzbank’s market value of 15.51 billion euros at the close of trading on Tuesday. Commerzbank shares rose 22% since the start of the year, while the Stoxx Europe 600 Banks index climbed 17%.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#germany#germany news#german news#german politics#commerzbank#natwest#economics#economy#economy news#finance#economic growth#economic and financial crimes commission#economic events#economic impact#financial updates

0 notes

Link

We’re a business that understands when our customers and people succeed, our communities succeed, and our economy thrives.

#banking @NatWestgroup

0 notes

Text

The 51 year-old former senior manager at Natwest Gibraltar is accused of fraud and false accounting during her time at the bank dating back to between 2011 and 2017.

Gillian Balban has spent hours upon hours in the witness box responding to many of the accusations heard from other witnesses during the last eight weeks.

1 note

·

View note

Text

The Beauty Of London’s Windmill Street!

Windmill Street is a beautiful part of London best known for its incredible architecture, and the NatWest building shows the delicate attention to detail of London’s architectural landscape!

#shotoniphone #photography #london

View On WordPress

#Beautiful Destinations#iPhoneography#Landscape Photography#London#MN#NatWest#Photography#Shot on iPhone#Street#Travel#UK#United Kingdom#Windmill Street

0 notes

Text

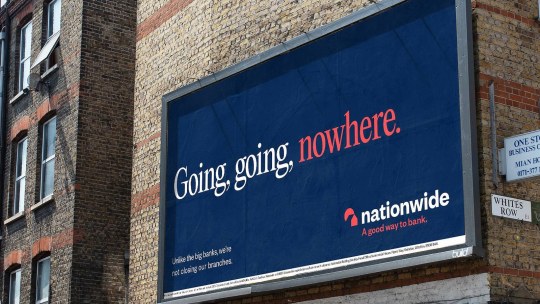

Nationwide

Another day another rebrand. This time it comes from building society, Nationwide. Taking a step into the modern digital world, Nationwide has revamped its look and feel. Simplifying their logo and iconography from a dated look and feel, they have replaced the serif font with a cleaner sans serif to compliment the lowercase wordmark. Whereas the serif is still being used outside the main wordmark. The circle and house icon have been changed into simple block shapes and negative space being used to create a 3D feel for the house.

One of the biggest talking points has been the colour scheme change. The red, blue and white have been kept the same but darker more toned-down shades of each. Just like the majority, it looks very much like NatWest. My initial thought was to have the two merged but they haven't. For me, the navy colour looks too similar to competitors and more corporate. I do like the rebrand however I would've preferred to see a blue more reflective of their original colour scheme.

0 notes

Text

Meanwhile, at the bank…….

0 notes

Text

NatWest and IBM Collaborate on Gen AI to Improve Customer Experience

NatWest and IBM collaboration

Today, NatWest and IBM unveiled improvements to Cora, the bank’s virtual assistant, which will leverage generative AI to give users conversational engagements and access to a greater variety of information. The bank will be among the first in the UK to implement generative AI with a virtual assistant, making its digital services safe, easy to use, and accessible.

As part of its broader goal, the bank is utilizing ethical and responsible AI, working with IBM and other specialists to provide individualized support to consumers in order to help them attain financial wellbeing. Teams are co-creating a digital concierge (Cora+) that advances the chatbot’s capabilities into a more engaging and conversational experience, which benefits clients, by utilizing IBM Watsonx, an enterprise-grade AI and data platform.

Conversational, individualized answers to challenging consumer questions

This cutting-edge feature was created to give users wishing to compare goods and services across the product suite or find information across the websites of the NatWest Group a more approachable and personalized experience.

Information regarding goods, services, bank details, and career prospects that was previously unavailable through chat alone will now be accessible to Cora+ through a variety of safe sources. Consumers can link to requested information and receive answers in a more conversational, natural way. They can examine the requested information right away or bookmark it for later. During business hours, customers will still be able to speak with branch representatives over the phone.

“NatWest are a relationship bank in a digital world, building trusted, long-term relationships with our customers through meaningful and personalised engagement,” stated Wendy Redshaw, Chief Digital Information Officer of the NatWest Group’s Retail Bank.

Expanding on Cora’s achievements in the previous five years, NatWest are collaborating with businesses such as IBM to use the most recent advancements in generative AI, which will contribute to Cora feeling even more ‘human’ and, above all, a dependable, safe, and trustworthy digital partner for our clients.”

In the age of digitalization, banks prioritize developing people, technology, and reliable partnerships

Attracting and keeping top technical talent has become a priority for the industry as banks transform into more and more digital organizations. As part of NatWest’s Digital X Strategy, which is centred around three pillars: Engineer, defend, and operate, mindful innovation and safe exploration are crucial. In order to deliver what matters most to consumers, this gives the bank the chance to partner with specialized industry experts like IBM and work together on cutting edge, new technologies.

The goal was to securely and quickly produce a viable generative AI digital assistant. To that end, the IBM Client Engineering team collaborated with the NatWest business and technology teams to quickly co-create, test, and certify the results.

According to John Duigenan, Distinguished Engineer and General Manager, Global Financial Services Industry at IBM, “NatWest and other forward-thinking leaders of financial institutions around the world are exploring the potential of AI technologies as part of their competitive business strategy.” The implementation of suitable regulations and oversight mechanisms to guarantee AI’s transparency, reliability, and focus can empower banks to offer a compelling value proposition that fosters even greater customer loyalty. IBM are thrilled to have the chance to work with NatWest on their customer service goal.”

Global leaders in the banking sector recognize the potential of generative AI and are carefully examining its applications

CEOs in the banking and financial sectors are using generative AI sparingly and thoughtfully, per a new report by IBM’s Institute for Business Value, CEO Decision-Making in the Age of AI. More than 40% of the leaders in banking and financial markets surveyed by 360 said that they anticipate generative AI, deep learning, and machine learning will contribute to financial performance in the next three years, demonstrating their recognition of its potential.

Financial services professionals expressed interest in implementing generative AI most frequently in the areas of talent, security, and customer experience. A whopping three quarters (75%) of the CEOs surveyed in the financial services sector feel that the institutions with the most advanced usage of generative AI will have a competitive edge. These business chiefs named customer care as one of their top technology goals.

Regarding NatWest

The NatWest Group serves as a digital world’s relationship bank. In order for the 19 million individuals, families, and companies they support in communities across the UK and Ireland to recover and prosper, they champion potential by tearing down obstacles and fostering financial confidence. They will prosper iftheir clients do.

Concerning IBM

IBM is one of the top suppliers of business AI, security, hybrid cloud architecture, and ESG analytics to the world’s financial services industry. Its broad range of services and solutions, in-depth knowledge of the sector, and strong network of fintech partners foster innovation, creativity, and teamwork among customers. IBM is a reliable partner for banks, insurers, capital markets, and payment providers. Through IBM Consulting, the company supports financial institutions at every step of their digital transformation journeys, and through IBM Technology, it provides the tested infrastructure, software, and services they require.

Read more on Govindhtech.com

0 notes

Text

Can you make another Cash App account after being closed

Can you make another Cash App account after being closed?

If your Cash App account was closed, you're not the only one. You can open a new one with a different email address or mobile number. You'll need to complete the verification process, which takes a few minutes.

#Farage#Sinead#Mitch#BritishGas#NatWest#CurrysFIFAWWC#LoveIsland#Hibs#jungkook#Poveda#JordanHenderson#GoodOmens2#BBNaijaAllStar#RomanticiseThis#Aliens#GlobalBoiling#Andorra#Lavia#UFOs#DavidSilva#Byram#SecretInvasion#AlisonRose#Ilebaye#Doyin#Bellingham#Scott#Russophobia#Coutts#NothingCompares2U

1 note

·

View note