#Payday Loans

Text

“We are helping you actually.” -sincerely, your exploiters.

#“We are helping you actually.” -sincerely#your exploiters.#exploitation#exploitative#payday loans#fucking grifters#right wing grifters#opportunists#capitalism#poverty#homeless#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#eat the rich#eat the fucking rich#class war#oppression#repression#anti capitalist#washington capitals#capitalist hell#capitalist dystopia

181 notes

·

View notes

Text

Empower

Hey! Want $5? I've been using this app called Empower to get Cash Advances and it's been so helpful during tough times! Use my invite link and we'll both get $5 when you accept your first Cash Advance (eligibility requirements apply):

#money#america#freedom#news#usa#financial#emergency funds#payday loans#savings#budget#financial freedom#income#finance#cashapp#empower#help

4 notes

·

View notes

Text

How Payday Loans Can Help Maintain Financial Stability

Payday loans from Personal Cash USA INC can help keep your finances stable during emergencies. When you need money quickly for things like car repairs or medical bills, payday loans provide fast cash so you can pay for these unexpected expenses. They are especially helpful for people with poor credit who can't get traditional loans. With clear terms and quick approval, payday loans bridge the gap between paychecks, helping you avoid late fees and other financial problems. By offering a short-term solution, payday loans help maintain your financial stability during tough times.

2 notes

·

View notes

Text

Won't you please think of the poor payday loan lenders?? Everyone play the smallest saddest violin for the assholes who charged absurd interest on their loans upward of like 38-45%

Like sorry no I'm not helping predatory loans stay predatory, piss off I hope you go under and lose all of your money ok, suffer and die.

This is a good thing. Interest rates should never be as high as they've been allowed to be for loans.

6 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Oct. 2, 2023

"How the court rules, and the relief it orders, will have enormous implications for the future of the agency, the validity of its past rules and enforcement actions, and its ability to continue protecting consumers."

The corporate forces that have been gunning for the Consumer Financial Protection Bureau since its creation more than a decade ago are set to have their moment before the U.S. Supreme Court on Tuesday, with the justices poised to hear a predatory payday lending group's challenge to the agency's funding mechanism on the second day of their new term.

The case—Consumer Financial Protection Bureau v. Community Financial Services Association of America, Limited—poses an existential threat to the CFPB, which has aggressively pursued corporate criminals under the leadership of director Rohit Chopra, who has been dubbed "Wall Street's most hated regulator."

Depending on the scope of the Supreme Court's decision, the outcome of the case could have consequences that reach far beyond the consumer agency's budget, potentially throwing the U.S. mortgage market into chaos and undermining other regulatory agencies and federal programs—including Medicare and Social Security.

"How the court rules, and the relief it orders, will have enormous implications for the future of the agency, the validity of its past rules and enforcement actions, and its ability to continue protecting consumers against fraud and abuse in the sale of a broad range of financial products and services, from payday loans to mortgages and credit cards," Stephen Hall, legal director and securities specialist at Better Markets, said Monday.

"The case also threatens the viability of other critically important agencies that have essentially the same funding structure that fuels the CFPB, including the Federal Reserve and the other banking regulators," Hall added.

Last year, 5th Circuit Court of Appeals—a federal panel composed entirely of judges appointed by former President Donald Trump—ruled that the CFPB's funding structure is unconstitutional. Unlike other federal agencies, the CFPB's funding comes from the Federal Reserve system, not congressional appropriations, making it less subject to annual political fights and right-wing austerity sprees.

The CFPB appealed the ruling, which was authored by a judge who received donations from the banking industry when he was a Mississippi state lawmaker.

As The New York Timesobserved Sunday, the 5th Circuit didn't just take aim at the CFPB's funding mechanism.

"It concluded that all actions taken by the bureau in its 12-year existence should be 'rewound,'" the newspaper reported. "If the Supreme Court agrees that the bureau's funding is improper, it could, at minimum, force the agency to rely on congressional appropriations. Or the court could follow the 5th Circuit's suggestion and obliterate everything the agency has done to date."

The plaintiffs in the case, which brought their challenge in response to a CFPB rule targeting the abusive activities of payday lenders, contend that the bureau's funding structure violates the Constitution's appropriations clause because it falls outside the annual congressional appropriations process—a claim that legal experts say is both "wrong" and "incredibly dangerous."

Such reasoning, if accepted by the U.S. Supreme Court, "would invite challenges to a host of other federal financial regulators and could wreak havoc on the nation's economy," Brianne Gorod, Brian Frazelle, and Alex Rowell of the Constitutional Accountability Center argued last year.

"And nothing in the law requires this result: The decision is at odds with constitutional text and history, Supreme Court precedent, and long-standing historical practice," they added.

Last week, the watchdog group Americans for Financial Reform (AFR) stressed that "all bank regulators and numerous other agencies and programs likewise rely on funding outside annual appropriations, such as Social Security and Medicare."

"If the Supreme Court does not turn back this unprecedented interpretation of the Constitution, it will put all of these government agencies at the mercy of the increasingly unpredictable annual appropriations process," said Elyse Hicks, consumer policy counsel at AFR. "The gears behind important financial regulatory and rulemaking work would grind to halt any time Congress reached a budgetary impasse. The judiciary too could find itself unable to meet its financial obligations during a government shutdown."

Read more.

#consumer protection#government regulation#u.s. supreme court#financial regulations#CPFB#payday loans#annual appropriations#republicans are evil

4 notes

·

View notes

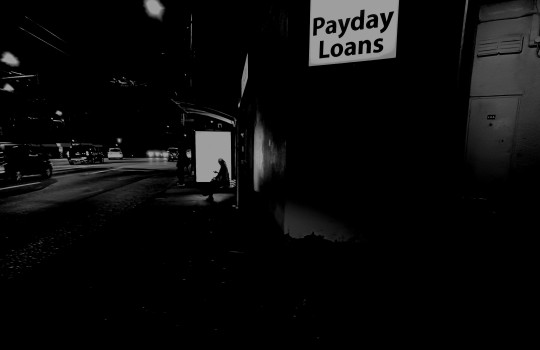

Text

#payday loans#usury#moneylenders#money lending#night city#night street photography#night photography#night#streetleaks#streetsnap#street photografie#street photographer#bnw life#bnw captures#bnwzone#bw life#blackandwhitephotography#everybodystreet#bnw addicted

27 notes

·

View notes

Text

Dubble Check Payday Loans, Winnemucca, Nevada, 2019.

#townscape#office building#payday loans#winnemucca#lander county#nevada#photographers on tumblr#2020

15 notes

·

View notes

Text

Need a loan? For a short period and fast? CoreLoans

Need a loan? For a short period and fast? Online Loans in South Africa

Online payday loans can help individuals in South Africa by providing them with quick and easy access to short-term cash loans when they need it the most. These loans are typically used to cover unexpected expenses, such as car repairs, medical bills, or other urgent financial needs.

Here are some ways in which online payday loans can be beneficial in South Africa:

Convenience: Online payday loans can be applied for and processed entirely online, making them a convenient option for people who cannot visit a physical lender in person.

Fast processing: Online payday loans can be approved within minutes or hours of submitting the application, and the funds are typically deposited into the borrower's bank account on the same day or within 24 hours.

Flexible loan amounts: Online payday lenders in South Africa typically offer loans ranging from R100 to R5,000 or more, depending on the lender and the borrower's creditworthiness.

Easy qualification: Payday loans are usually designed for people with lower credit scores or those who have been rejected by traditional lenders. Online payday lenders often have lenient eligibility criteria, making it easier for borrowers to qualify for a loan.

However, it is important to note that payday loans usually come with high-interest rates and fees, and borrowers should carefully consider their ability to repay the loan before applying. It is also recommended to only borrow from reputable lenders and to avoid taking out multiple payday loans at the same time to avoid getting trapped in a cycle of debt.

#online loans#payday loans#online loans south Africa#online bad credit loans#R100 Loans in South Africa#R200 Loans in South Africa

2 notes

·

View notes

Text

Just took a predatory payday loan to stay afloat with rent. Nobody is buying my motorcycle yet and it isn’t worth enough anyways. My partner is still telling me that I shouldn’t kill myself if he does. He claims I have a future where I help lots of people....

but goddammit with him I was finally being selfish sometimes. Enjoying myself. Building a future for ME instead of devoting myself to the service of others. That is all I had planned before. Help people and then die as a martyr in a protest. Then I fell in love and began working on a longterm future plan with him

I really just need shit to turn around. Maybe we can get lucky and die in an accident so people will be less sad than if we do a suicide. My mom would never have to know.

We have maybe a month or two of survival before we fail. I’m so tired of desperately keeping us from drowning. We both keep sacrificing so much.

#give me one reason to live#seriously just one#suicidal#die together#suicidal couple#shinju#capitalism#poverty#debt#payday loans#paydayloan#credit card debt#what can i do#this is why god is fake#personal#no way out

3 notes

·

View notes

Text

Looking for emergency loans in Ontario? We offer a range of financial solutions to suit your needs. From installment loans to bad credit payday loans, we're here to help.

0 notes

Text

Need a payday loan? Avoid common mistakes and make the most of your borrowing experience with Hup Hoe Credit's expert advice.

0 notes

Text

The Payday Loan Trap: A Cautionary Tale

This revealing piece dives into the harrowing financial descent of Leopold, a man ensnared by the predatory practices of payday loans. Highlighting the dangers and traps of these high-interest loans, it explores how desperation can lead to devastating financial decisions and the dire consequences that follow. Read more on 543magazine.com.

#payday loans#financial desperation#debt trap#interest rates#financial decisions#loan sharks#bankruptcy#personal finance#debt relief#credit issues

0 notes

Text

Need emergency cash but struggling with bad credit? Before you consider a payday loan, let's take a moment to think it through.

Representative APR 49.9%

Warning: Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk. We are a credit broker and not a direct lender.

#financialtips#cashcompare#borrowingoptions#finance#smart borrowing#payday loans#bad credit score#emergencyloan

0 notes

Text

Browsing the Ins and Outs of Payday Loans: What You Required to Know

""

Cash advance lendings can be a tempting option for those facing unforeseen economic emergencies or temporary cash money flow concerns. Nevertheless, it's critical to comprehend the ramifications and threats connected with these kinds of fundings. While cash advance car loans supply fast accessibility to funds with marginal needs, they commonly come with high interest prices and charges, making them an expensive borrowing alternative. It is necessary for customers to thoroughly evaluate their economic situation and capacity to pay back the financing in a timely manner to stay clear of falling under a cycle of debt.Before thinking about a cash advance finance, it's important to explore alternative choices such as budgeting, discussing with financial institutions, or seeking help from non-profit organizations. Understanding the terms of the financing, including payment terms and prospective fines for late payments, is vital to making a notified decision. Additionally, consumers need to be wary of aggressive lending institutions and illegal plans in the payday advance sector. By doing thorough study, comparing offers from various lenders, and seeking monetary suggestions if required, individuals can make sound economic selections and prevent the pitfalls associated with cash advance.

Read more here https://quickloanpro.com/baton-rouge-la/

0 notes

Text

Navigating the Ins and Outs of Payday Loans: What You Need to Know

""

Payday advance loan can be an appealing solution for those facing unanticipated financial emergency situations or short-term cash circulation issues. However, it's vital to recognize the implications and threats connected with these sorts of financings. While cash advance offer fast accessibility to funds with minimal demands, they often include high rates of interest and fees, making them a pricey borrowing option. It's crucial for consumers to thoroughly evaluate their monetary circumstance and ability to repay the funding in a timely manner to prevent falling under a cycle of debt.Before taking into consideration a payday advance loan, it's essential to explore different options such as budgeting, discussing with financial institutions, or looking for help from non-profit companies. Comprehending the conditions of the lending, consisting of repayment terms and possible charges for late repayments, is essential to making an educated choice. In addition, debtors need to watch out for predative lenders and deceitful plans in the cash advance industry. By doing detailed study, comparing deals from different lending institutions, and looking for monetary recommendations if needed, people can make audio economic selections and stay clear of the challenges connected with cash advance finances.

Read more here https://quickloanpro.com/

0 notes

Text

Browsing the Ins and Outs of Payday Loans: What You Required to Know

""

Payday advance loan can be a tempting remedy for those facing unexpected financial emergency situations or temporary capital concerns. However, it's crucial to understand the implications and dangers linked with these sorts of financings. While cash advance supply quick accessibility to funds with minimal needs, they often include high rates of interest and fees, making them a costly borrowing option. It is necessary for consumers to meticulously assess their financial circumstance and capacity to settle the lending on time to stay clear of dropping right into a cycle of debt.Before considering a cash advance, it's necessary to discover alternate choices such as budgeting, working out with creditors, or looking for assistance from charitable companies. Understanding the terms and problems of the funding, including repayment terms and potential penalties for late repayments, is key to making a notified decision. In addition, consumers should be cautious of predative lenders and deceptive plans in the payday financing industry. By doing thorough research study, comparing deals from different lending institutions, and seeking economic suggestions if needed, people can make sound economic options and stay clear of the mistakes connected with cash advance.

Read more here https://quickloanpro.com/lafayette-la/

0 notes