#Photo Id Verification API

Explore tagged Tumblr posts

Text

Thailand Visa Exemptions

Thailand's visa exemption system operates under:

Immigration Act B.E. 2522 (1979)

Ministerial Regulations No. 14 (B.E. 2535)

Bilateral agreements with 64 countries (as of 2024)

The policy is administered by the Thai Immigration Bureau with oversight from the Ministry of Foreign Affairs. Unlike true visa-free entry, exemptions are technically "visas on arrival" granted under Section 12 of the Immigration Act.

2. Current Exemption Scheme Structure (2024)

A. Standard Exemption (Tourism Purpose Only)

Duration: 30 days (land/sea entry) or 30-90 days (air entry)

Nationalities: 64 eligible countries

Entry Points: All international airports, 26 land borders

Key Distinctions:

Air vs. Land Entry:

Air arrivals receive 30 days (57 nationalities) or 90 days (7 nationalities)

Land arrivals strictly limited to 30 days (extendable once)

B. Special Bilateral Agreements

90-Day Exemption: Brazil, Chile, Peru, South Korea

60-Day Exemption: Russia (temporary measure until 2025)

30-Day Exemption: Most ASEAN members (extendable to 90)

3. Technical Entry Requirements

Documentation Standards

Passport Validity:

Minimum 6 months remaining

At least 2 blank pages

Machine-readable or biometric only (no handwritten passports accepted)

Proof of Onward Travel:

Confirmed ticket within exemption period

Airlines may require at check-in (IATA TIM regulation)

Acceptable formats:

Flight itinerary (PNR must verify)

E-ticket with 13-digit ticket number

Bus/train tickets for land border exits

Financial Proof:

Official requirement: 20,000 THB/person (40,000/family)

Enforcement protocol:

Random checks at discretion of Immigration Officer

Cash or traveler's checks only (bank statements not accepted)

New 2024 measure: Credit limit verification for card holders

4. Operational Procedures at Entry Points

A. Airport Processing

Automated Verification:

Advance Passenger Information (API) screening

Interpol database cross-check

Previous immigration history review

Secondary Inspection Triggers:

More than 3 exemptions in 12 months

Previous overstays (even if paid fine)

Suspected "visa run" patterns

B. Land Border Specifics

Daily Quotas:

Poipet (Cambodia): 300/day

Sadao (Malaysia): 500/day

Time Restrictions:

No crossings after 18:00 at most borders

Mandatory 6-hour minimum stay abroad for re-entry

5. Extension Mechanisms

Official Extension Process

Eligibility: One 30-day extension permitted

Requirements:

TM.7 form + 1,900 THB fee

Proof of residence (hotel receipt or lease)

4x6cm photo (specific biometric standards)

Processing Time: 45 minutes to 3 hours (varies by office)

De Facto Alternatives

Border Run Limitations:

Maximum 2 land border exemptions per calendar year

Automated tracking via TM6 departure cards

Visa Conversion Option:

Change to Non-Immigrant visa possible at some offices

Requires showing 200,000 THB in Thai bank account

6. Special Cases and Exceptions

A. Diplomatic/Official Passports

90-day exemption for 46 countries

Must present note verbale for official visits

B. APEC Business Travel Card Holders

90-day stay privilege

Fast-track lane access at major airports

C. Crew Members

30-day exemption with valid:

Crew ID

Operator's letter

Layover schedule

7. Compliance and Enforcement Trends

A. New Monitoring Systems

Biometric Facial Recognition: Rolled out at 32 entry points

Advanced Passenger Processing (APP): Pre-arrival screening

Overstay Blacklist: Automated 1-10 year bans

B. Recent Policy Changes

2023 Digital Nomad Measure:

Exemption holders can now apply for 5-year LTR visa without exiting

2024 Financial Verification:

Pilot program at BKK/Suvarnabhumi for cashless proof of funds

Border Run Restrictions:

Electronic TM6 system flags frequent exempt entries

8. Practical Considerations for Travelers

A. High-Risk Scenarios

Previous Overstays:

Even 1-day overstay may trigger secondary inspection

Frequent Exemptions:

More than 6 exemptions in 24 months risks denial

Suspected Employment:

Carrying work equipment without proper visa

B. Recommended Protocols

Document Preparation:

Printed hotel confirmations for first 7 days

Embassy contact details

Health insurance (increasingly requested)

Entry Point Strategy:

Airports generally more lenient than land borders

Avoid "visa run" border crossings (e.g., Poipet)

9. Future Policy Directions

Digital Nomad Visa Integration:

Planned merger with exemption system

ASEAN Harmonization:

Potential 60-day standard for ASEAN+6 countries

Blockchain Verification:

Pilot program for digital proof of onward travel

Dynamic Pricing Model:

Proposed fee structure based on nationality risk factors

This technical breakdown demonstrates Thailand's visa exemption system as a carefully managed balance between tourism facilitation and immigration control, with increasingly sophisticated compliance mechanisms. The system continues evolving with new technologies while maintaining its core accessibility for legitimate travelers.

#immigration#thailand#thai#visa#thaivisa#thailandvisa#visainthailand#thailandvisaexemptions#immigrationinthailand#thaiimmigration

2 notes

·

View notes

Text

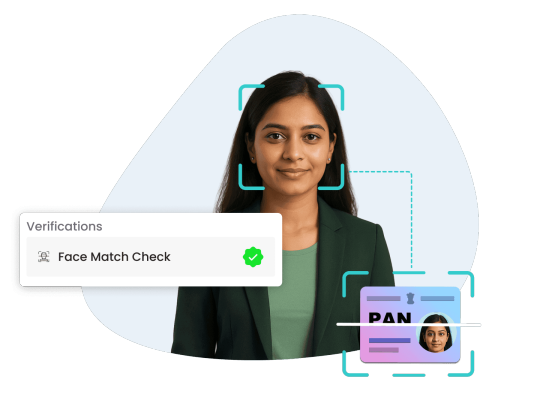

How AI is Transforming Online Identity Verification

As more services shift to digital platforms, the need for secure, accurate identity verification has never been greater. Financial institutions, government agencies, and private businesses are under increasing pressure to protect user data and prevent fraud. Advanced tools like face recognition online and ID document liveness detection are becoming essential in achieving this.

The Rise of Biometric Verification

Traditional passwords and PINs are no longer enough. They can be stolen, forgotten, or guessed. Biometric technology, especially facial recognition, has emerged as a powerful alternative. Using just a webcam or smartphone camera, face recognition online can quickly verify if someone is who they claim to be. It analyzes facial features in real time, making it nearly impossible to fake with static photos or videos.

This process not only streamlines user experiences but also reduces friction during sign-ups, logins, or sensitive transactions. For companies, it adds a vital layer of defense against identity fraud, while for users, it offers a fast and intuitive way to prove their identity.

What is ID Document Liveness Detection?

Pairing facial recognition with ID document liveness detection creates a powerful combo. Liveness detection ensures that the ID being presented is real, unaltered, and being shown by a live person—not a printed copy or digital screenshot. It works by analyzing micro-details like light reflections on the document, movement patterns, and subtle changes in angles during the scan.

This technology plays a crucial role in automated KYC (Know Your Customer) processes, particularly in industries like banking, insurance, and crypto where regulatory compliance is strict. By confirming the authenticity of both the face and the document, companies can dramatically reduce the risk of fraud without slowing down onboarding.

Benefits Across Industries

E-commerce, healthcare, travel, and even education platforms are beginning to adopt these technologies. Users can now open accounts, access sensitive information, or complete secure transactions in seconds. For global businesses, this opens up new opportunities to scale efficiently while maintaining strict security protocols.

Another key advantage is accessibility. With face recognition online, users no longer need to visit physical offices or mail paperwork. Everything can be done remotely, which is especially important in today’s mobile-first, post-pandemic world.

Challenges and Considerations

Despite its benefits, biometric verification isn’t without concerns. Privacy, data storage, and algorithmic bias are critical issues that technology providers must address. Systems need to be tested across diverse populations to ensure fairness and accuracy. Transparency around how data is collected, used, and stored is also essential for building user trust.

Companies implementing these tools must work with vendors who prioritize security and compliance, and who offer flexible, API-friendly solutions that can integrate smoothly into existing systems.

Conclusion: Smarter Security Starts Here

Face recognition and ID verification tools are quickly becoming the gold standard for secure digital interactions. When combined, face recognition online and ID document liveness detection create a seamless, safe, and scalable identity check process that works across industries.

For businesses looking to upgrade their verification process with cutting-edge AI technology, miniai.live offers robust, privacy-conscious solutions designed for real-world use. Whether you're protecting user accounts or streamlining sign-ups, their tools help you do it faster—and smarter.

0 notes

Text

Streamline Identity Checks with Individual Verification API by Nifi Payments

In an era where digital interactions are the norm, verifying the identity of individuals is more critical than ever — especially for businesses dealing with customers, employees, or partners online. Nifi Payments offers a robust Individual Verification API that enables real-time, secure, and government-compliant identity verification, simplifying your KYC (Know Your Customer) and onboarding processes.

What is the Individual Verification API?

The Individual Verification API by Nifi Payments allows businesses to instantly verify the identity of any individual using authentic government data sources such as Aadhaar, PAN, Voter ID, Driving License, and more. This API ensures the person you are engaging with is genuine, helping you build a safe and compliant business ecosystem.

Key Features:

Multiple Document Support Verify identities using PAN, Aadhaar, Voter ID, Driving License, Passport, and other supported documents.

Real-Time Validation Instantly fetch and validate individual details from official government databases.

Secure & Compliant Fully encrypted and compliant with data privacy and KYC norms, ensuring your verification process is safe and lawful.

Easy Integration Lightweight API that integrates smoothly with mobile apps, web platforms, CRMs, or internal systems.

Photo & Name Match Match the individual’s name and photo across databases to prevent impersonation or document misuse.

Bulk Verification Option Verify multiple identities at once — ideal for large-scale onboarding or audits.

Benefits for Your Business:

✅ Faster Onboarding: Complete verifications in seconds instead of days

✅ Fraud Prevention: Detect fake or tampered IDs before onboarding

✅ Regulatory Compliance: Stay aligned with KYC/AML guidelines

✅ Improved Trust & Security: Ensure that your users, customers, or employees are real and verified

✅ Operational Efficiency: Minimise manual document checks and reduce errors

Common Use Cases:

Fintechs & NBFCs verifying borrower or user identities

E-commerce Platforms authenticating delivery partners or vendors

Gig Economy Apps onboarding workers, drivers, or freelancers

Educational Platforms verifying students and staff

Corporate HR Teams conducting employee background verification

Final Thoughts

Whether you're running a tech startup, financial service, e-commerce platform, or HR tool — identity verification is non-negotiable. With Nifi Payments' Individual Verification API, you get speed, security, and scalability, all in one solution. It’s the simplest way to build trust while staying compliant.

Verify smarter, onboard faster – with Nifi Payments’ Individual Verification API.

0 notes

Text

Gridlines APIs: Powering Real-Time Verification and Smarter Compliance for the Digital Economy

In today’s high-speed digital economy, instant trust is currency. Whether it's a loan application, onboarding a business partner, or verifying a vehicle owner, digital platforms can't afford delays or compliance missteps. This is where Gridlines APIs step in as the silent engine powering smarter, faster, and more secure decision-making.

Gridlines, available at https://gridlines.io/, offers a powerful suite of APIs that enable fintechs, NBFCs, banks, and marketplaces to verify individuals and businesses in real-time, reduce risk, and stay compliant—all through a single, unified platform.

The Gridlines API Suite: Built for Fintechs, Designed for Scale

Gridlines’ ecosystem is built around modular and lightning-fast APIs, each serving a key function in the verification and fraud prevention lifecycle. Here's a snapshot of its major offerings:

1. MSME API

Instantly verifies a business's Udyam Registration Number, fetching data like business name, type, classification, and registration date. This is crucial for lenders evaluating loan eligibility or onboarding new vendors.

2. RC API (Registration Certificate)

With just a vehicle’s registration or chassis number, users can fetch accurate RC details to verify ownership, fitness validity, and insurance status—vital for vehicle financing, ride-sharing, or insurance underwriting.

3. KYB API (Know Your Business)

Go beyond individual KYC to verify businesses via GSTIN, PAN, and more. Ideal for platforms that deal with B2B partnerships, vendor onboarding, or SME underwriting.

4. Face Match API

Compare a selfie with the photo on an ID document to detect impersonation. Backed by liveness detection, this API adds a strong layer of security to remote onboarding.

Use Cases: Where Gridlines APIs Create Real Value

Lending Platforms use the MSME and KYB APIs to assess borrower eligibility and prevent shell company fraud.

Vehicle Financiers and insurers leverage the RC API to confirm ownership and vehicle compliance.

Gig Platforms can match faces with IDs to ensure only verified individuals are activated on their app.

Digital KYC Providers embed the Face Match API to detect deepfakes and spoofing attempts.

Advantages That Set Gridlines Apart

Real-Time Access: No delays—get verified results instantly.

Developer-Friendly: Easy integration with robust documentation.

Modular & Scalable: Pick and choose only what your use case demands.

Built for Compliance: Meet RBI, SEBI, and IRDAI norms with confidence.

Secure Infrastructure: Data is encrypted, compliant, and handled with care.

Conclusion: APIs That Empower Growth and Trust

Gridlines isn’t just another API provider—it’s a trust enabler. With Gridlines APIs, businesses can remove friction from onboarding, detect fraud early, and build compliance into their workflows. As India’s digital economy continues to accelerate, platforms that integrate smarter verification tools will lead the pack.

To explore how Gridlines can work for your use case, visit https://gridlines.io.Find us on Google: https://g.co/kgs/1Zp2QRj

#Gridlines APIs#MSME Verification#KYB#RC Status#Face Match#Fintech APIs#Fraud Prevention#API Integration#Digital Verification#Compliance Automation

0 notes

Text

Face Match API: Accelerate KYC with Secure Facial Verification

In the digital-first world, verifying someone's identity needs to be fast, reliable, and fraud-proof. That’s where a Face Match API comes in — offering businesses an automated, AI-powered way to confirm if a person’s selfie matches the photo on their ID document. Gridlines’ Face Match API is designed to do just that, enabling real-time identity verification for seamless KYC (Know Your Customer) processes.

What Is a Face Match API?

A Face Match API is a technology solution that compares two facial images — typically a selfie and an ID photo — to determine if they belong to the same person. It’s often used in KYC, onboarding, and fraud prevention workflows across fintech, insurance, and workforce platforms.

With Gridlines' API, businesses can integrate this capability into their mobile apps or platforms to instantly verify users, detect spoofing attempts, and maintain regulatory compliance.

Why Use Gridlines' Face Match API?

Gridlines offers a powerful and flexible Face Match API that delivers:

Real-time facial comparison with match scores

Liveness detection to stop spoofing (e.g., photo/video attacks)

Seamless integration via REST APIs

Scalability for high-volume verifications

Secure and encrypted data handling

Whether you're onboarding gig workers, verifying customers for loans, or conducting background checks, Gridlines’ face match API helps ensure the person is who they say they are.

Real-World Use Case

A digital lending platform needs to verify users quickly without manual intervention. By using the Face Match API from Gridlines, they can match a user’s selfie to the photo on their Aadhaar card in real-time. If the match score is above the set threshold and liveness is confirmed, the user is instantly approved — reducing drop-offs and increasing trust.

Benefits for Your Business

✅ Reduce onboarding time from days to seconds

✅ Prevent identity fraud with AI-based checks

✅ Stay compliant with digital KYC norms

✅ Offer users a smoother, mobile-friendly experience

Built for Developers

Gridlines make it easy to integrate facial matching into your existing system. The API is well-documented, comes with sample payloads, and is backed by technical support — so your team can go live faster.

Get Started Today

If your business relies on identity verification, the Face Match API from Gridlines is your key to faster, safer KYC. Explore the product to see how you can transform your verification process with just a few lines of code.

#face match API#facial recognition#digital KYC#identity verification#selfie match#upload ID#AI verification#liveness detection#Gridlines API#real-time KYC

0 notes

Text

How can startups implement a cost-effective KYC solution?

For startups navigating the fast-paced world of business, balancing compliance with cost efficiency is a constant challenge. One crucial area where this balance becomes vital is in the implementation of Know Your Customer (KYC) and identity verification processes. As regulations tighten and digital transactions become the norm, startups must find ways to meet KYC requirements without draining their resources.

So, how can startups implement a cost-effective KYC solution while maintaining accuracy, security, and regulatory compliance?

Understanding the Basics: What Is KYC?

KYC, or Know Your Customer, is a mandatory process that businesses use to verify the identity of clients before or during a transaction or partnership. It involves collecting and validating personal information such as a user’s name, government-issued ID, address, and sometimes biometric data.

KYC and identity verification are critical in preventing financial fraud, money laundering, and identity theft. For startups, especially those in finance, e-commerce, or digital services, a functional KYC framework isn’t just a legal requirement—it’s a foundation for trust and long-term success.

The Challenge for Startups

Startups often face tight budgets, lean teams, and the need to scale quickly. Traditional KYC methods—manual verification, in-person documentation, and lengthy onboarding procedures—are slow, expensive, and error-prone. These legacy systems are not practical for a startup environment where speed and efficiency are crucial.

To stay competitive, startups need smart, scalable, and affordable ways to verify customer identities without sacrificing compliance or customer experience.

Key Strategies for Implementing a Cost-Effective KYC Solution

1. Leverage Digital KYC Tools

One of the most efficient ways for startups to cut costs is by adopting digital KYC and identity verification tools. These tools automate the verification process, reducing the need for manual labor and minimizing human error.

Cloud-based KYC platforms offer flexible pricing models—often pay-as-you-go or usage-based—that allow startups to pay only for what they use. This scalability is perfect for growing businesses that need to onboard users gradually.

2. Choose Modular and API-Driven Solutions

Instead of investing in an expensive, end-to-end compliance suite, startups can opt for modular KYC tools that allow them to build customized solutions. API-driven KYC services let startups integrate identity verification directly into their platforms or apps.

By choosing only the features they need—such as document verification, facial recognition, or watchlist screening—startups avoid paying for unnecessary functionality. This modular approach ensures efficiency without compromising compliance.

3. Automate Where Possible

Automation can drastically reduce the cost and time involved in KYC. For example, using AI-powered optical character recognition (OCR) can automatically extract data from ID documents, while facial recognition can match a user’s selfie with their photo ID in real time.

Automating these steps removes the need for large verification teams and shortens customer onboarding time, resulting in better user satisfaction and lower operational expenses.

4. Adopt Risk-Based KYC Approaches

Not all customers pose the same level of risk. A cost-effective KYC solution for startups involves using a risk-based approach—applying different levels of scrutiny depending on the risk profile of the customer.

Low-risk users may only need basic document verification, while high-risk clients might undergo enhanced due diligence. By tailoring the verification process based on risk, startups can optimize resources and reduce overhead costs.

5. Outsource When Necessary

Building a KYC infrastructure from scratch is resource-intensive. Many startups choose to outsource their KYC and identity verification processes to specialized third-party providers. This outsourcing can significantly lower initial setup costs and provide access to expert tools and regulatory updates without maintaining an in-house compliance team.

However, it’s essential to choose a reputable partner that complies with data protection regulations and offers secure and customizable services.

6. Monitor and Update Regularly

KYC isn’t a one-time task. Ongoing monitoring and periodic re-verification are essential, especially as regulations evolve. Startups should invest in tools that support continuous monitoring of user behavior and real-time alerts for suspicious activity.

Regular updates to the KYC process ensure the startup remains compliant, avoids penalties, and adapts to changing risks without major overhauls or expenses.

A Practical Example

Let’s imagine how a company like Xettle Technologies—a startup in the tech space—could implement a cost-effective KYC solution. Instead of building its own verification system, Xettle Technologies might integrate an API-based KYC provider offering facial recognition and document scanning. By selecting a pay-as-you-go pricing plan and automating the verification process, the company reduces manual workload and speeds up user onboarding.

Additionally, by classifying users based on transaction value or location, Xettle Technologies applies enhanced checks only where necessary, ensuring compliance without bloated costs.

Conclusion

Implementing a cost-effective KYC and identity verification system is not only possible for startups—it’s a strategic move that supports growth and builds trust. By embracing automation, leveraging digital tools, and tailoring verification processes to customer risk levels, startups can remain compliant while saving time and money.

The key lies in starting small, staying flexible, and scaling KYC systems as the business evolves. In today’s digital economy, a smart and lean approach to KYC isn’t just an option—it’s a necessity for startup success.

0 notes

Text

Unlock Flawless Visuals with an Advanced AI Face Enhancer

In today’s fast-moving digital space, images are everything. Whether you're running a photo-editing app, building a virtual try-on solution, or simply looking to offer users a better visual experience, an AI Face Enhancer can be a total game-changer. At API Market, we believe in empowering developers and businesses with powerful tools that can elevate user experience - and this technology is one of them.

What Exactly Is an AI Face Enhancer?

An AI Face Enhancer is an advanced application powered by artificial intelligence that improves facial features in photos or videos. It works by analyzing facial elements and enhancing skin texture, sharpness, lighting, and symmetry while maintaining natural aesthetics. The best part? It all happens in real-time or within seconds.

Why Developers Are Turning to AI Face Enhancers

When visuals are a key part of your product, even a slight improvement can lead to better engagement. Developers are actively integrating AI Face Enhancer APIs into their platforms for several reasons:

User Experience: It gives users smoother skin, brighter eyes, and better facial definition without looking artificial.

Speed: Quick processing enables seamless integration into real-time applications.

Scalability: You can run thousands of enhancements without performance dips.

And if you’re selling beauty or fashion tech services, this API is practically a must-have.

Real-World Use Cases

You don’t need to run a photo-editing app to benefit from this. An AI Face Enhancer can be used in:

Social media platforms to auto-enhance profile images

Video conferencing tools for real-time facial clarity

E-commerce apps for sharper product try-on displays

Virtual ID verification systems to clean up noisy images

It’s a small add-on with massive impact across industries.

Why Choose API Market for AI Face Enhancer APIs

At API Market, we simplify how you discover and integrate powerful tools like the AI Face Enhancer. Our marketplace features vetted and reliable APIs that are easy to implement and come with comprehensive documentation. You don’t have to dig through endless forums or worry about shady integrations - we’ve got you covered.

Ready to Get Started?

Explore the AI Face Enhancer APIs on API Market today. Whether you're a startup, an enterprise, or an indie developer, our platform gives you the access and confidence you need to build better, smarter apps. By bringing together trusted APIs in one place, we make innovation accessible for everyone. Let your visuals speak volumes - start enhancing with AI.

0 notes

Text

Revolutionizing KYC Verification with Advanced API Services

In today’s digital age, Know Your Customer (KYC) compliance is critical for businesses across industries. With the rise in digital transactions and financial services, the need to verify customer identities in real-time has never been greater. EKYCHub steps into this space, offering robust KYC verification API services to ensure secure, seamless, and automated identity verification for businesses.

What is KYC?

KYC (Know Your Customer) refers to the process of verifying the identity of clients to prevent fraud, money laundering, and ensure regulatory compliance. It’s an essential process for financial institutions, fintech startups, e-commerce platforms, and other businesses handling sensitive customer data. KYC involves several verification steps like document verification, biometric authentication, and face matching to confirm that the customer is who they claim to be.

The Need for KYC Verification

In the modern digital economy, KYC processes are necessary to ensure:

Fraud Prevention: Verifying customer identities helps reduce the risk of identity theft, account takeover, and other fraudulent activities.

Regulatory Compliance: Many industries, particularly finance, are heavily regulated, and KYC is a mandatory requirement to meet legal obligations.

Risk Management: Understanding your customers allows businesses to assess and mitigate potential risks.

Trust Building: Offering a secure platform where users’ identities are verified instills trust and credibility in your business.

EKYCHub KYC Verification API: A Game-Changer

EKYCHub offers a comprehensive KYC Verification API that allows businesses to integrate identity verification into their platforms easily. The API service provides an end-to-end solution for both individual and business KYC compliance, ensuring that users can authenticate their identities in seconds without compromising security.

Here’s a breakdown of the features and benefits of EKYCHub’s KYC Verification API:

1. Document Verification

EKYCHub’s API allows businesses to verify government-issued documents such as passports, driver’s licenses, and national IDs. The system checks for authenticity and ensures that the documents meet the required standards.

Supported Documents: Passports, National IDs, Driver’s Licenses, Bank Statements, Utility Bills, and more.

Real-Time Verification: The system scans and verifies the document within seconds to provide immediate feedback.

2. Face Recognition

EKYCHub offers advanced facial recognition technology that matches a person’s live photo or selfie to the image on their government-issued ID. This reduces the risk of identity fraud and ensures that the individual in question is the one on the document.

Biometric Authentication: Facial recognition technology provides an added layer of security.

Selfie-to-ID Verification: Ensures that the customer is present and not using a stolen image.

3. Liveness Detection

The API also includes liveness detection, which ensures that the person is physically present during the verification process. This prevents fraudsters from using photos or videos to bypass authentication.

Anti-Spoofing Technology: Detects and prevents fraudulent activities such as using images or pre-recorded videos.

Real-Time Liveness Detection: Verifies user presence in real time during facial recognition.

4. AML and PEP Screening

EKYCHub’s KYC API includes AML (Anti-Money Laundering) and PEP (Politically Exposed Person) screening, ensuring that businesses are compliant with regulatory frameworks like the Financial Action Task Force (FATF).

Global Database Checks: Cross-referencing customers against global databases to identify potential risks.

AML Compliance: Helps businesses avoid financial crimes and penalties.

5. Scalability and Flexibility

EKYCHub’s KYC API can scale to meet the needs of businesses of all sizes. Whether you’re a startup looking for a small solution or a large enterprise with thousands of customers, EKYCHub’s infrastructure can handle the load.

Cloud-Based: No need for extensive hardware or software installations.

Customizable: The API can be tailored to fit specific business requirements.

6. Seamless Integration

Integrating EKYCHub’s KYC API into your existing platform is simple. The API supports multiple programming languages, including Python, Java, and PHP, making it developer-friendly.

Easy-to-Use Documentation: Comprehensive guides to assist with integration.

Multi-Platform Support: Works with web applications, mobile apps, and other platforms.

7. Cost-Effective

EKYCHub offers competitive pricing for its KYC API services, making it accessible for businesses of all sizes, from startups to large enterprises.

Pay-per-Use Model: You only pay for what you use, ensuring you can scale your KYC operations as needed without upfront costs.

Affordable Pricing Tiers: Flexible pricing based on transaction volume and business needs.

Benefits of Using EKYCHub’s KYC Verification API

Enhanced Security: Robust verification technologies help ensure that only genuine customers are onboarded.

Improved Customer Experience: Quick, seamless, and hassle-free verification processes result in a better user experience.

Regulatory Compliance: EKYCHub’s KYC solution ensures that your business remains compliant with global KYC and AML regulations.

Fraud Prevention: Reduces the risk of fraudulent activities through advanced document and biometric verification technologies.

Speed and Efficiency: Automated processes ensure that KYC checks are completed swiftly, reducing wait times for customers.

Who Can Benefit from EKYCHub’s KYC API?

EKYCHub’s KYC verification API is designed to cater to a wide range of industries and use cases:

Financial Institutions: Banks, fintech companies, and online lenders can use EKYCHub to comply with KYC regulations and prevent fraud.

Cryptocurrency Exchanges: KYC verification is crucial in crypto trading platforms to prevent illegal activities like money laundering.

E-commerce Platforms: Online retailers can verify their customers to ensure secure transactions and protect against fraud.

Online Marketplaces: Platforms with user-generated content or listings can use KYC to verify the identity of sellers and buyers.

Healthcare Providers: Verifying the identity of patients to ensure secure health record management.

Conclusion

EKYCHub’s KYC Verification API is an essential tool for businesses looking to streamline and secure their customer onboarding process. With its advanced features like document verification, face recognition, and AML screening, EKYCHub helps businesses comply with KYC regulations, reduce fraud, and enhance the user experience. Whether you’re a startup or an established enterprise, integrating EKYCHub’s KYC API can give you the confidence and security to operate in today’s digital world.

#tech#ekychub#techinnovation#identityvalidation#fintech#technews#technology#kycverificationapi#API#aadhaarverificationapi#apiverification#secureidentityauthentication#digitalverification#Aadhaarintegration#KYCVerificationAPI#identityverification#APIforKYC

1 note

·

View note

Text

The finance and banking sector is becoming increasingly digitized and globally accessible. Consequently, we are witnessing a sharp surge in the demand for remote identification services. The goal of KYC video identification services is to make life easy for banks and their customers.

The financial institutions of India face a number of issues. KYC and other compliance processes are a couple of them. At present, there are quite a few solutions provided by fintechs for digital transformation in the market. These are stable and secure enough for financial companies to adopt right off the board.

The Need for a Global Digital Trust System

Since the world is getting more and more connected, people today want to access services from the comfort of their homes. When it comes to the identification process, carrying out banking procedures becomes a hassle in these scenarios.

This is where ID Identification comes in. A KYC video identification process allows banks and other financial institutions to verify customers while onboarding them through video over the Internet.

This is an attractive option for financial companies. It eliminates security vulnerabilities and minimizes loopholes. Identity frauds deter our growth as a financial institution and as a nation. This will allow financial companies to build a global network of customers.

Used effectively, KYC video identification can help speed up customer onboarding. And, it helps with KYC/AML compliances. Online video KYC eliminates security gaps by combining human scrutiny with both software and AI and ML-enabled learning.

Use Cases and Applications of Video KYC

Video KYC has started it’s journey across the financial services industry. Institutions like banks, lenders, investor onboarding and ICO’s have shown a great interest in the potential of VideoKYC.

A KYC video identification system can allow all of these organizations to maintain excellent standards of compliance and trust while not compromising on the customer experience.

The Challenges with Legacy KYC Process

Traditionally the KYC process has been tedious and cumbersome in terms of:

Maintaining physical documents that occupy space, take time, and utilize manpower.

Processing documents offline which brings with it the threat of misuse of documents.

Delays in processing the files hamper the customer experience. Usually known as increases in the turnaround time (TAT).

In-person verification: Requires the person’s availability and beats the globalization of financial services.

The time and cost involved in the legacy KYC process hamper the efficiency of a banker. You can choose to eliminate this hindrance by using video KYC.

Choosing the right KYC Video solution

There are quite a few solutions available in the market that promise to transform the traditional KYC process and upgrade it. We encourage you to look for these indicators to make sure your investment in a video KYC solution brings maximum ROI.

The solution should an offer exceptional face match score. Comparing the following two will help to eliminate the possibility of any fraudulent activity: 1. Photo identity submitted by the customer, and 2. The real-time video session.

The solution should have AI and ML embedded to detect and eliminate static photographs or pre-recorded videos.

The offering should also be able to check the liveliness of the user by carrying out a speech test. This is where the user is prompted to speak a series of numbers or words which is then matched with the audio recorded on the live streaming.

The solution should be integrated with video forensics to detect tampering or misuse of any nature.

The software should be easy to implement with an API, SDK, and a webcam for video KYC.

The proposed offering should have a quick turnaround time and should ideally take only a few minutes to complete the verification process.

An added provision of completely automating the video KYC process should also be a part of the solution.

The solution is 100% compliant with the local regulations.

The proposed solution can reduce overheads and backlogs in operations by upto 70%.

Installation and usage is hassle free for most users as the solution is platform agnostic and follows a Plug-n-Play approach.

A seamless interface provides a superior customer experience for a competitive advantage in the market.

A vibrant, engaging solution reduces customer drop-offs by upto 50%.

Paperless video KYC can empower financial organizations and change the way customers are treated and brought onboard.

How Does Video KYC Work?

The customer fills up a registration form on your website.

The customer provides relevant document identities such as National IDs, driver’s licenses or Passports.

A customer verification specialist connects with the customer on video, or an automated process is triggered for video KYC.

Using their smartphone or a webcam, the customer can be directed through the video KYC process in a seamless manner. (To completely eliminate any chances of error, along with AI and ML, facial recognition technology can be leveraged here.)

Once the documents are verified and the user is identified over a live video, they are sent back to the bank’s website. Next, the user can submit the process of onboarding.

Advantages of Video KYC for Financial Companies

Financial institutions stand only to gain from Video KYC solutions.

Save time — Video KYC speeds up the onboarding process significantly. It allows you to process more applications at the same time and increase revenue. Also, you eliminate the need to train your staff on identity verifications because you have an automated system helping you with it.

Save money — Identity frauds can cost you money. Video KYC procedures save time and keep fraudulent people at bay.

Compliance — Meet the necessary Anti-money laundering and Know Your Customer compliances with a video KYC software that already complies with the Indian regulations.

Improve security — Video KYC software solutions are powered by AI, ML, and facial recognition technology. These are far superior and secure alternatives to traditional KYC processes.

Gather data — With video KYC, you can record all conversations and keep this data for future reference.

Video KYC Solution from Signzy

With the KYC video solution we offer, you can:

Match the provider of documents with their identity on the documents through face match algorithms.

Build trust with the customer through a live video feed.

Verify the actual documents with forgery detection algorithms.

Trust the document provider with algorithmic risk intelligence.

When our first client used our video KYC product for customer onboarding, they achieved jaw-dropping results:

Reduced TAT by 55%

Slashed rejections from 9% to 2%

Increased sales productivity three times.

Signzy is now completely integrated into the core customer onboarding process of over 15 enterprises in the BFSI sector.

Use our new-age trust protocol to improve customer experience, cut down costs, and simplify onboarding.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

0 notes

Text

Real-Time Facial Recognition for Quick Verification | ARGOS Identity

Real-time facial recognition verification ensures the security and privacy of personal information. Enhance information security with the ARGOS Face ID solution.

ARGOS Face ID Verification Technology

In the digital age, safeguarding personal information has never been more critical. Face ID leverages facial recognition technology to deliver a secure and efficient user onboarding process. This solution searches for matching faces within a collection of stored identifiers, ensuring that both individuals and organizations benefit from enhanced security and a faster authentication process.

How Does Face ID Work?

1. Instant Recognition: Submit a facial photo via our API, and Face ID swiftly extracts key facial data, converting it into a unique identifier. To protect your privacy, the original image is never stored, ensuring compliance with the highest standards of data protection.

2. Seamless Verification: When a facial photo is sent to our API again, Face ID compares it to the previously registered identifier. In seconds, it verifies the match, ensuring a smooth and secure authentication process without compromising privacy.

Why Choose Face ID?

Privacy-First Approach: Your privacy is their top priority. Facial images are never stored, ensuring that your personal data remains secure and confidential.

Effortless Integration:Face ID integrates seamlessly with your existing systems through their API, delivering a smooth transition for users and a superior experience.

Unmatched Accuracy:Using advanced technology, Face ID provides precise and reliable facial identification, reducing the chances of errors and strengthening security.

Versatile Applications:From banking to retail to security, Face ID adapts to a wide range of industries, offering flexible, high-performance solutions tailored to your needs.

If you are looking for real-time facial recognition verification, you can find them at ARGOS.

Click here to if you are interested inARGOS Identityproducts.

View more: Real-Time Facial Recognition for Quick Verification

0 notes

Text

Explore The Power of Identity Verification with Instantpay's RC Verification in 2024

In today's digital age, identity verification has become integral to various online transactions and services. Whether opening a bank account, applying for a loan, or accessing online platforms, verifying one's identity is crucial for security and compliance. With the advancement of technology, identity verification methods have evolved, offering more efficient and secure solutions.

Understanding Identity RC Verification

Simply put, RC verification involves checking the legitimacy of an RC issued by a regional transport authority (RTA) against official records. This process validates the vehicle's existence, ownership details, and other crucial information, reducing the risk of fraud and promoting transparency in transactions.

Instantpay, a leading modern business banking company, offers a cutting-edge identity verification solution called Identity RC Verification. This innovative solution leverages advanced technology to streamline identity verification while ensuring the utmost security and accuracy.

Why is RC Verification Important?

The importance of RC verification cannot be understated. Here are some key benefits it offers:

Fraud Prevention: Verifying RCs helps safeguard against fraudulent activities like using stolen vehicles or falsifying ownership documents. This mitigates financial losses and protects your business reputation.

Regulatory Compliance: Many industries, including automotive and logistics, are subject to regulations that mandate RC verification for specific transactions. A reliable verification system ensures compliance with these regulations and avoids legal repercussions.

Streamlined Operations: Manual RC verification can be time-consuming and error-prone. Automating the process through an API like Instantpay's RC Verification API significantly speeds up operations and improves efficiency.

Enhanced Customer Experience: Ensuring accurate and timely verification provides a smoother and more secure experience for your customers, fostering trust and satisfaction.

Key Features of Identity RC Verification

Instantpay's Identity RC Verification harnesses the power of artificial intelligence (AI) to conduct real-time identity verification. This ensures the verification process is swift, seamless, and without any delays.

The system can analyze and process vast amounts of data rapidly through AI integration, allowing for instant verification results.

The platform offers advanced document verification capabilities, allowing users to upload various identity documents, such as passports, driver's licenses, and ID cards.

Utilizing optical character recognition (OCR) technology, the system can extract relevant information from uploaded documents accurately and efficiently.

Identity RC Verification incorporates facial recognition technology to match the individual's facial features with the photo on their identity document.

Biometric matching algorithms compare biometric data, such as fingerprints or iris scans, against stored records to verify the person's identity accurately.

The platform implements multi-factor authentication (MFA) mechanisms to bolster security, requiring users to provide multiple verification forms before accessing the system.

MFA may include a combination of factors such as passwords, SMS codes, biometric data, or security questions, adding layers of protection against unauthorised access.

Identity RC Verification offers customisable verification workflows, allowing businesses to tailor the verification process to their specific requirements.

Administrators can define rules and criteria for identity verification, such as the documents accepted, the sequence of verification steps, and the threshold for approval.

The platform conducts comprehensive compliance checks to ensure adherence to regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

By automating compliance checks, businesses can mitigate the risk of regulatory violations and penalties while maintaining compliance with industry standards.

Identity RC Verification is designed to easily handle high volumes of verification requests, making it suitable for businesses of all sizes.

The platform's scalability ensures it can accommodate growing verification needs without compromising performance or reliability.

For transparency and accountability, Identity RC Verification maintains detailed audit trails of all verification activities, including timestamps, user actions, and verification outcomes.

Administrators can generate comprehensive reports and analytics to gain insights into verification trends, compliance metrics, and system performance.

The platform offers cloud-based deployment options, enabling businesses to access identity verification services securely over the Internet.

Additionally, Identity RC Verification provides robust API integration capabilities, allowing seamless integration with existing systems, applications, and third-party services.

Leveraging machine learning algorithms, Identity RC Verification continuously learns and adapts to new verification patterns, emerging threats, and evolving regulatory requirements.

This ensures that the platform remains effective and up-to-date in detecting and preventing fraudulent activities while maintaining high accuracy and reliability.

Instantpay's Identity RC Verification offers a comprehensive suite of features and capabilities to streamline identity verification, enhance security, and ensure compliance with regulatory standards. By leveraging advanced technologies such as AI, biometrics, and machine learning, businesses can achieve efficient, accurate, and reliable identity verification outcomes while delivering a seamless user experience to their customers and clients. Read more on Instantpay's comprehensive suit of Identity verification - https://blog.instantpay.in/2023/10/12/introducing-instantpay-identity-verification-a-complete-guide/

Functionalities of the Vehicle RC Verification API

[wptb id=2780]

The API is a valuable tool for various industries and use cases, such as insurance companies, law enforcement agencies, vehicle buyers, and sellers, as it enables them to quickly and accurately verify the authenticity and status of a vehicle's registration. By integrating the Vehicle RC Verification API into their applications or systems, users can streamline processes related to vehicle information retrieval and enhance their decision-making processes.

Enhanced Security Measures:

Identity RC Verification employs advanced security measures to safeguard sensitive information and prevent unauthorised access. Businesses can significantly reduce the risk of identity theft, fraud, and data breaches by implementing robust encryption protocols, multi-factor authentication, and biometric verification.

With stringent security measures, Identity RC Verification provides peace of mind to businesses and their customers, ensuring that confidential information remains always protected.

Streamlined Compliance Processes:

Compliance with regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is essential for businesses operating in regulated industries. Identity RC Verification helps streamline compliance processes by automating identity verification procedures and ensuring adherence to regulatory requirements.

By automating compliance checks and maintaining comprehensive audit trails, businesses can demonstrate compliance with regulatory standards and mitigate the risk of non-compliance penalties.

Real-Time Verification:

Identity RC Verification offers real-time identity verification capabilities, allowing businesses to verify customer identities instantly. This eliminates the need for manual verification processes, reducing delays and improving operational efficiency.

With real-time verification, businesses can onboard customers quickly, accelerate transaction processing times, and deliver a seamless user experience.

Cost Savings and Operational Efficiency:

By automating identity verification processes, Identity RC Verification helps businesses save time and resources, leading to cost savings and improved operational efficiency. Manual verification processes are labor-intensive and time-consuming, requiring significant workforce and resources.

With Identity RC Verification, businesses can automate repetitive tasks, reduce manual errors, and streamline verification workflows, resulting in lower operational costs and increased productivity.

Improved Fraud Detection and Prevention:

Identity RC Verification utilizes advanced fraud detection algorithms and machine learning techniques to detect and prevent real-time fraudulent activities. The platform can identify suspicious behaviour and flag potentially fraudulent transactions by analysing patterns, anomalies, and risk factors.

By leveraging predictive analytics and behavioural biometrics, Identity RC Verification helps businesses stay ahead of emerging threats and protect against financial losses due to fraud.

Scalability and Flexibility:

Identity RC Verification is designed to scale seamlessly to accommodate growing verification needs and evolving business requirements. Whether businesses are processing a few hundred verifications per month or millions, the platform can scale up or down effortlessly to meet demand.

Additionally, Identity RC Verification offers flexibility in deployment options, allowing businesses to choose between cloud-based or on-premises deployments based on their preferences and infrastructure requirements.

Enhanced Customer Experience:

By providing a seamless and user-friendly verification experience, Identity RC Verification enhances the overall customer experience. Simplified verification processes, intuitive user interfaces, and quick response times increase customer satisfaction.

With Identity RC Verification, businesses can reduce customer friction during onboarding, improve conversion rates, and foster long-term customer loyalty and retention.

Identity RC Verification offers businesses a wide range of benefits, including enhanced security, streamlined compliance processes, real-time verification, cost savings, improved fraud detection and prevention, scalability, flexibility, and enhanced customer experience. By leveraging advanced technologies and automation from Instantpay, businesses can achieve efficient, accurate, and reliable identity verification outcomes while strengthening operational efficiency and customer satisfaction.

How Vehicle RC Verification API Works

Integration with Transport Authority Databases: The Vehicle RC Verification API integrates with databases maintained by transport authorities or regulatory bodies responsible for vehicle registration and documentation. These databases contain comprehensive records of registered vehicles, including their registration details, ownership information, and compliance status.

Input Parameters: Developers can interact with the Vehicle RC Verification API by passing specific input parameters, typically the vehicle's registration number, through their application or system. The registration number is the unique identifier for the car whose details are being verified.

Real-Time Validation: Upon receiving the input parameters, the Vehicle RC Verification API initiates a real-time validation process by querying the connected transport authority database. The API utilises secure communication protocols to retrieve the relevant information associated with the provided registration number.

Data Extraction: The API retrieves and extracts the corresponding information from the transport authority database based on the input parameters provided. This information typically includes the vehicle's make and model, registration date, chassis number, engine number, owner's name, address, and registration status.

Seamless Processing: The vehicle RC verification process facilitated by the API is seamless and efficient, ensuring minimal latency and quick response times. The API's streamlined workflow and optimised data retrieval mechanisms enable developers to integrate vehicle verification capabilities into their applications or systems seamlessly.

Instant Results: Upon successful validation and data extraction, the Vehicle RC Verification API returns the verified information to the requesting application or system in real time. This instant feedback lets users access accurate vehicle details promptly, facilitating informed decision-making and enhancing operational efficiency.

Secure Communication: The Vehicle RC Verification API prioritizes data security and privacy throughout the verification process. It employs robust encryption protocols and certain communication channels to safeguard sensitive information exchanged between the API and the transport authority database. This ensures that confidential vehicle details remain protected against unauthorised access or tampering.

Scalability and Reliability: The API is designed to accommodate varying levels of usage and traffic demands, ensuring scalability and reliability. Whether processing a few requests or handling high volumes of verification queries, the API maintains consistent performance and availability to meet user needs effectively.

The Vehicle RC Verification API streamlines the process of verifying vehicle registration details by seamlessly integrating with transport authority databases, accepting input parameters, initiating real-time validation, extracting relevant information, and delivering instant results. Its secure, efficient, and scalable architecture empowers developers to incorporate robust vehicle verification capabilities into their applications or systems, enhancing operational efficiency and facilitating informed decision-making.

Challenges in Implementing Vehicle RC Verification API

Data Availability and Integration: Accessing comprehensive and up-to-date vehicle registration databases from transport authorities or regulatory bodies can pose a significant challenge. Integration with these databases requires establishing partnerships and protocols to ensure seamless data exchange. Additionally, inconsistencies in data quality and accessibility across different regions may further complicate the integration process.

Data Privacy and Security: Handling sensitive vehicle information, including registration details and ownership records, necessitates robust data privacy and security measures. Implementing stringent encryption protocols, access controls, and authentication mechanisms is crucial to safeguarding against unauthorised access, data breaches, and identity theft. Compliance with regulatory standards such as GDPR (General Data Protection Regulation) adds another layer of complexity to ensuring data security and privacy.

Standardisation: Coordinating with multiple transport authorities or regulatory bodies to maintain a standardised data structure and format poses a significant challenge in API implementation. Each source may have its own data schema, terminology, and design for storing vehicle registration information, leading to consistency and interoperability issues. Establishing uniform standards and protocols for data exchange and integration is essential to ensure seamless interoperability and compatibility across different systems and jurisdictions.

Data Accuracy and Reliability: Ensuring the accuracy and reliability of the data retrieved from vehicle registration databases is paramount for the effective functioning of the API. Challenges such as outdated or incomplete records, data duplication, and inconsistencies in data entry can compromise the reliability of verification results. Implementing data validation mechanisms, error handling protocols, and periodic data updates is essential to mitigate these challenges and maintain data integrity.

Scalability and Performance: As the volume of verification requests increases, ensuring the scalability and performance of the API becomes crucial. Scaling infrastructure resources, optimising query processing algorithms, and implementing caching mechanisms are essential strategies to handle spikes in demand and maintain optimal response times. Balancing scalability with cost-effectiveness and resource utilisation adds complexity to API implementation and management.

Regulatory Compliance: Adhering to regulatory requirements and compliance standards governing vehicle registration data collection, storage, and processing poses additional challenges. Compliance with regulations such as the Motor Vehicles Act, data protection laws, and industry-specific guidelines requires thorough legal and regulatory analysis and ongoing monitoring and updates to ensure compliance with evolving requirements.

User Experience and Accessibility: Providing a seamless user experience and ensuring accessibility across various platforms and devices is essential for the widespread adoption of the API. Designing intuitive user interfaces, optimizing API endpoints for performance, and supporting multiple authentication methods are critical considerations to enhance usability and accessibility for developers and end-users.

Implementing a Vehicle RC Verification API entails overcoming various challenges related to data availability and integration, data privacy and security, standardisation, data accuracy and reliability, scalability and performance, regulatory compliance, and user experience.

Addressing these challenges requires a comprehensive approach encompassing technical, regulatory, and operational considerations to ensure the successful deployment and operation of the API.

Instantpay's RC Verification API is a powerful tool to simplify and streamline your RC verification process.

Here's what it offers:

Comprehensive Data Retrieval: The API facilitates comprehensive data retrieval by extracting key information from the Registration Certificate (RC). This includes vehicle details such as make, model, year of manufacture, engine specifications, owner information, registration status, and more. By providing access to a wide range of data points, the API offers users a holistic view of the vehicle's registration status and ownership details, enabling informed decision-making and regulatory compliance.

Real-time Verification: Users can leverage the API to perform real-time verification of the RC against official Regional Transport Authority (RTA) records. By accessing up-to-date data directly from the RTA database, the API delivers instant results on the validity of the RC, minimising delays and enabling prompt decision-making. This real-time verification capability enhances operational efficiency and reduces the risk of relying on outdated or inaccurate information.

Nationwide Coverage: The API provides national coverage, allowing users to verify RCs issued by any RTA across India. This ensures comprehensive coverage and accessibility regardless of the vehicle's location or the issuing authority. Whether the RC originates from a metropolitan city or a rural area, the API offers seamless verification capabilities, facilitating nationwide compliance and operational consistency.

Seamless Integration: With its seamless integration capabilities, the API can easily integrate with existing systems and applications. Whether it's a web-based platform, mobile app, or enterprise software, the API's flexible architecture allows quick and effortless implementation. By seamlessly integrating with existing workflows and processes, the API enhances operational efficiency and user experience, minimising disruptions and maximising productivity.

Security and Compliance: Instantpay prioritises security and compliance by adhering to stringent security standards and data privacy regulations. The API ensures the safe and ethical handling of sensitive information, including vehicle registration and owner information. By implementing robust security measures such as encryption, access controls, and audit trails, Instantpay safeguards data integrity and confidentiality, earning users' trust and confidence in the platform's reliability and compliance posture.

Financial Services: Banks, fintech companies, and other financial institutions can use Identity RC Verification to onboard customers, verify identities for loan applications, and comply with regulatory requirements.

E-commerce: E-commerce platforms can implement Identity RC Verification to verify customers' identities during registration and checkout, reducing the risk of fraudulent transactions.

Healthcare: Healthcare providers and telemedicine platforms can utilize Identity RC Verification to verify patients' identities, ensuring secure access to medical records and health services.

Gaming and Entertainment: Online gaming and entertainment platforms can integrate Identity RC Verification to verify users' identities, preventing underage access and unauthorised activities.

The use cases for Instantpay's RC Verification API are diverse, benefiting businesses across various industries. Here are some real-world examples:

Car dealerships: Instantly verify customer-provided RCs during vehicle purchases, preventing fraud and streamlining transactions.

Rental companies: Ensure the legitimacy of RCs submitted by car renters, providing peace of mind and mitigating theft risks.

Logistics providers: Verify vehicles' ownership and registration status before accepting them for transport, ensuring compliance and safety.

Finance companies: Conduct due diligence on vehicle ownership during loan applications, minimising financial risks and fraudulent activities.

Traffic Authorities: Traffic police and law enforcement agencies can instantly employ the API to retrieve vehicle information during routine checks or investigations.

Insurance Companies: Insurance providers can integrate the API into their claims processing systems to validate vehicle information and prevent fraud.

These are just a few examples, and the possibilities are endless. By integrating Instantpay's RC Verification API, businesses can achieve:

Reduced Fraud: By verifying the authenticity of RCs, businesses can significantly reduce the risk of fraud and associated financial losses.

Increased Efficiency: Automating the verification process saves time and effort, allowing employees to focus on other critical tasks.

Improved Compliance: Adhering to regulations becomes easier with instant and accurate verification, eliminating compliance concerns.

Enhanced Customer Satisfaction: Faster and more secure transactions lead to happier customers who trust your business practices.

Instantpay's Identity RC Verification offers a sophisticated and reliable solution for businesses seeking to streamline their identity verification processes. With its advanced features, robust security measures, and compliance capabilities, Identity RC Verification is poised to revolutionise how businesses verify identities in the digital age. By leveraging this innovative solution, companies can enhance security, improve efficiency, and deliver a seamless user experience to their customers and clients.

0 notes

Text

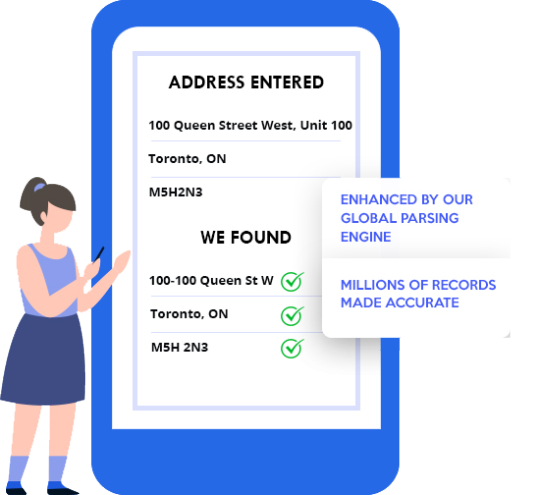

Address Verification Solutions

Whether it’s a financial services company utilizing personal information for credit checks or a restaurant sending discount coupons to neighbouring areas, address verification solutions are used by businesses of all sizes and types. These solutions provide a number of benefits, including reducing the amount of undelivered mails, preventing fraud, and enhancing user experiences.

An AVS is software that compares the inputted address with a database and flags or corrects errors and inconsistencies. It is typically used in real time, meaning that it is performed as the user enters the information into a form or API request. These databases can either be public, such as government databases, or privately maintained by the solution provider.

Some AVS solutions use natural language processing to improve the accuracy of their results. For instance, ShipEngine uses a method called “type-ahead verification,” which reduces form abandonment rates by enabling users to start typing their address and then offering suggestions as they type. The tool also offers a self-learning capability that allows it to recognise unique international address formats and accents.

Another common feature is the ability to validate an address against other verified documents, such as ID cards. This helps eliminate fake addresses and protects businesses from fraudulent activities like chargebacks. It also ensures that the customer is indeed the person submitting the address by verifying their facial identity against a photo on an identification document. This is particularly important for e-commerce platforms, as it helps them avoid chargebacks and other issues related to delivery fraud.

youtube

SITES WE SUPPORT

Mail Documents Api – Blogger

0 notes

Text

Address Verification Software

Address verification software ensures the quality of addresses in your database by parsing, matching, and formatting addresses, enhancing them with additional data like postcodes, regions, territories, house numbers and more. Using such a tool in your checkout, registration form or CRM can reduce costs associated with bad address data and create an improved user experience.

E-commerce: Getting products delivered to the wrong shipping addresses can cost e-commerce businesses a lot of money. They need to maintain a high return rate to keep the profit margins in check and rely on tools that can validate addresses quickly. Such tools can also help them prevent fraudulent transactions and mitigate customer complaints by providing correct address data.

Logistics: Xverify's online free address validation service offers credit-based pricing for US and Canadian addresses and bulk postal mailing address verification services for international locations. The software aims to reduce delivery delays and address data errors by verifying addresses in real time. It offers a quick turnaround and can handle millions of addresses per day without interrupting the user experience.

Financial: To comply with KYC (know your customer) regulations, many banks request proof of residence from their customers. This information can be verified using a photo or scan of government-issued ID such as passport or driver’s license, which are then cross-referenced against a database of known addresses to confirm whether an individual actually lives in that address.

Besides the above, address verification software can also be used to check whether an email or phone number is valid. These services can save valuable resources and avoid wasting them by not sending emails to fake or invalid email addresses. This way, businesses can deliver the right content to the right people to increase the chances of conversions and ROI.

youtube

SITES WE SUPPORT

Mail Api Software – Blogger

0 notes

Text

How an Identity Verification Platform Can Safeguard Your Business

An Identity Verification Platform can safeguard your business by providing robust security measures and ensuring the authenticity of user identities. Here are some key ways it can protect your business:

Preventing fraud: The platform employs advanced authentication techniques, such as document verification, facial recognition, and biometric verification, to verify the identity of individuals. This helps prevent fraudulent activities and protects your business from identity theft, account takeover, and other malicious activities.

Compliance with regulations: Identity Verification Platforms often adhere to industry-specific regulations and compliance standards, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. By verifying customer identities, the platform helps your business stay compliant and avoids potential legal and financial penalties.

Enhanced customer trust: By implementing a robust identity verification system, you instill confidence in your customers that their information is being protected. This fosters trust, improves customer satisfaction, and strengthens your brand reputation.

Reducing manual review: Automated identity verification processes significantly reduce the need for manual review and intervention. This streamlines your operations, saves time, and allows your staff to focus on more critical tasks.

Scalability and flexibility: Identity Verification Platforms offer scalable solutions that can handle high volumes of identity verification requests, enabling your business to grow and onboard new customers seamlessly. Additionally, these platforms are often flexible, allowing customization to align with your specific business requirements.

Data protection: A reliable platform prioritizes data privacy and security. It employs encryption, secure data storage practices, and strict access controls to safeguard sensitive customer information, minimizing the risk of data breaches.

Seamless user experience: An efficient Identity Verification Platform provides a seamless user experience by minimizing friction during the verification process. This ensures that legitimate users can quickly and easily verify their identities without encountering unnecessary obstacles.

By implementing an Identity Verification Platform, your business can enhance security, reduce fraud, comply with regulations, and build trust with customers. It's a crucial investment in protecting your operations and maintaining a secure environment.

An identity verification platform typically follows a series of steps to verify the identity of an individual. While the specific processes may vary across different platforms, here is a general overview of how an identity verification platform works:

User Initiation:

The user initiates the identity verification process by providing their personal information and any required documents, such as a government-issued ID or passport.

Document Verification:

The platform performs document verification by scanning and analyzing the provided documents. It checks for security features, validates the document's authenticity, and extracts relevant information like name, date of birth, and photo.

GST Verification API:

Fast and Reliable GST Verification. Seamlessly integrate our API into your systems to validate GST (Goods and Services Tax) numbers, ensuring accurate and up-to-date information. Instantly verify GST registrations, taxpayer details, and compliance status, empowering your business with efficient GST verification capabilities.

206AB Compliance Check:

Automated 206AB Compliance Verification. Our API enables businesses to quickly and accurately check if a taxpayer falls under the provisions of section 206AB of the Income Tax Act. Ensure compliance by validating taxpayer PANs against the specified criteria, helping you make informed decisions and mitigate potential risks.

PAN Status Verification:

Swift PAN Status Verification API. Integrate our API to effortlessly verify the status of PAN (Permanent Account Number) cards. Validate PAN numbers against the Income Tax Department's database to determine if they are active, inactive, or invalid. Obtain real-time PAN status information to enhance due diligence and streamline your business processes.

TAN PAN Verification API:

Seamless TAN PAN Verification. Our API offers hassle-free integration to verify TAN (Tax Deduction and Collection Account Number) and PAN (Permanent Account Number) details. Validate TAN/PAN combinations, ensuring accuracy and compliance. Access real-time information from tax authorities to streamline your verification processes, enabling efficient and reliable tax identification validation.

Aadhaar Verification API:

Reliable Aadhaar Verification Integration. Integrate our API to easily verify Aadhaar (Unique Identification Authority of India) numbers. Validate Aadhaar details, such as name, address, and biometric authentication, against the official database. Ensure seamless and secure identity verification, enabling streamlined onboarding processes and enhanced customer trust. Stay compliant and make informed decisions with our robust Aadhaar verification solution.

Biometric Verification:

The platform may require the user to submit a biometric sample, such as a live photo or a video selfie. Facial recognition technology is used to compare the submitted biometric sample with the photo extracted from the document. This helps confirm that the person presenting the document is the same individual.

Data Analysis and Risk Assessment:

The platform analyses the collected data and performs risk assessment checks. It compares the user's information against various databases, watchlists, and fraud prevention systems to identify any suspicious or fraudulent activities.

Artificial Intelligence and Machine Learning: