#Reconciliation Accountants

Text

Looking for a job that offers great compensation and work-life balance? Look no further! GoTeam is hiring three (3) Reconciliation Accountants with Xero Experience. If you have at least 3 years of accounting experience and a keen eye for detail, this job is perfect for you.

Work from the comfort of your own home during the night shift and earn up to 30K while enjoying the benefits and perks of being part of the GoTeam family. Don't wait, apply now by clicking the link below and take the first step towards a rewarding career.

#Reconciliation Accountants#Job openings#Career opportunities#Employment vacancies#Work positions#Hiring jobs#jobs in cebu philippines

0 notes

Text

Accountant of Theed

Read on AO3

After all is said and done, someone needs to balance these books, and nobody actually told the accounting department how they paid for this new hyperdrive.

Mimi really hopes it's not a loan from the Hutts.

Disclaimer: I am not an accountant, but I work in an adjacent field (and have been considering getting a certification, but that's neither here nor there). While I did take some courses on it, I asked an Accounting Person to look over the excel sheet before I went forward with the rest of the fic to make sure it's internally consistent. Thank you to @gnomer-denois for confirming my balance on these works!

The reconciliation sheet does NOT follow contemporary guidelines in terms of format etc, but that is because it is:

In space! Standard practice differs from Modern United States or what have you.

Not the primary balance sheet, just the simplified version made to show to Queen Amidala.

If you'd prefer to view the Excel sheet in a more easily navigable form, there is a google drive link available. This is also your best option if using a screen reader.

-----------------------------------------

Theed is safe. They are rebuilding. There is even financial support, aid, from the Republic.

It comes with strings attached. Oversight. Auditors.

Wouldn’t want Naboo to misuse funding after that nasty mistake with the Trade Federation, right? Sure, Naboo wasn’t the one at fault, but one can never be too careful...

Mimi, as an accountant for the government of Naboo, does not in fact want to commit fraud, or enable corruption, but the rolling audits do feel a little like the Republic is punishing them for getting invaded.

“Hey, boss?”

That tone. Mimi does not like that tone. “Please tell me it’s not another unauthorized purchase with a missing receipt. Which account did they pull from this time?”

“Um... we don’t know?”

Mimi gives them a moment. No elaboration is given.

“You don’t know?”

“We don’t know,” the younger employee repeats.

“What do you mean?” Mimi asks. “People charge things to accounts or cards. They forget to submit receipts. We hunt them down for receipts, and make sure nobody is skimming off the top. That’s how it goes. Unless this is a purchase on a personal and we need to reimburse—”

“Um, maybe?”

“In which—what? That’s just... okay. There’s a process for reimbursements. You aren’t following it, which means... what? What do you mean, you don’t know? Did they use cash, or pull from an account?”

The younger employee looks down at their datapad. Looks back up at her. Looks baffled and a little scared. “Um, it’s... we still don’t have a receipt, but we also don’t know where the money for it came from? But nobody’s put in a reimbursement request and I can’t imagine anyone on the mission had those funds on them, not even the Queen herself.”

“The money for what?”

“Um. It sort of just... showed up?”

“So, it’s some kind of gift?” Mimi presses.

“Too big,” the younger mumbles, refusing to meet her eyes. “It would have to be disclosed.”

“I am giving you five seconds—”

“It’s a hyperdrive!” they yelp.

“...Explain.”

“One of the mechanics was looking over the Royal Cruiser, and found that there was unrecorded repair work to the hyperdrive. The ship took enough damage during the escape that he wasn’t surprised, but then he noticed that it was from an earlier run of the part, and when he checked, the serial number was completely wrong. The hyperdrive was completely replaced.”

Mimi closes her eyes and takes a breath. “The mechanic doesn’t know?”

“He said there’s nothing in the records that matches it at all, and it’s a big enough part that there’s no way it would just slip through the cracks, not when it’s that expensive and going on the Royal Cruiser.”

“So,” Mimi says, “we have a part worth almost as much as the rest of the cruiser combined, that just... came out of nowhere, and nobody claiming for reimbursement.”

“Yes, ma’am. That’s what it looks like.”

Mimi has no interest in fraud.

“Find out who was piloting when Queen Amidala escaped, and see if they have any answers,” Mimi tells them. “If we can keep it to just the hangar staff without drawing in the Royal Retinue, it’ll be easier on all of us.”

“Here’s hoping, ma’am.”

(Continue on AO3)

#phoenix files#star wars#the phantom menace#original characters#naboo#accounting#Padme Amidala#Sabe#Tsabin#Anakin Skywalker#Obi-Wan Kenobi#Shmi does not appear but this is like half about her. and Qui-Gon. and Watto.#so#Shmi Skywalker#Qui Gon Jinn#Watto#receipt reconciliation

198 notes

·

View notes

Text

the things that come back

#akia art#olba#baxter ward#olba mc#more cheesy tastes 🤣 reconciliation or catharsis or smth#for context maggie did the (stay in touch and split 'amicably')!#ik the nuances are too granular to account for ingame but it would've been fun to see reflective dialogue from the mc :<#i find the interaction btwn culpability/agency in this dlc fascinating#baxter blames himself for everything out of self-hatred but also to control the situation in a way that gives it Knowable Dimensions#smth smth fearing the ocean bc there's a beginning but no foreseeable end#how fitting for him to feature in a game titled 'beginning and always'#hope i haven't totally bungled him tho LOL#back to goofy stuff now that i've gotten All This out of my system 🤣

369 notes

·

View notes

Text

no offense but i think when critiquing jay’s (and let’s be real all of the OG four ninja’s) behavior in the pilots and early seasons, a lot of people ignore that the cultural context and attitude about misogyny and especially misogyny in children’s media is VERY different today than it was in the late 2000s/early 2010s

#not saying it’s great but lots of the shit early seasons jay gets flack for was standard for male protags. ESPECIALLY if part of the plot#was *them unlearning it*. yknow. what they were trying to show with the resolution of the sam x arc#i’m not saying they did it really well but the cultural attitudes in the US about gender have VASTLY changed since 2011#like when the netflix show cut sokka’s misogynistic jokes everyone was upset that they were taking away a character growth moment .#not saying ninjago has equivalent writing quality *but* those storylines come from the same cultural narrative that was prevalent at the ti#time. guy character flirts with girl -> doubts her abilities -> doesn’t believe she is actually as skilled when she gets her overblown#Girlboss Moment -> awkward reconciliation bc all these plots were written by middle ages men who haven’t been teenagers since the 80s#text✨#ninjago#ninjago was very firmly a boy’s show. it had consequences. and like… just in general you gotta take the context that story choices were#made in into account#okay thanks for reading the ramble 👍 jay rose early seasons enjoyer (with caveats) strikes again#i’m running on four hrs of sleep before a long work day gurantee i’ll reread this in 12 hrs and find seven mistakes

17 notes

·

View notes

Text

*eyes multitude of blogs.*

6 notes

·

View notes

Text

😣

#i have several times lately been minding my own little business and suddenly come across a chris rice reference#and it still hurts#and i don't ever want to be that person who tells someone something they love has been deeply tarnished and broken#but then it also feels gross to let it go like i don't know anything is wrong#and i 100% do not have it in me to do any kind of psa post ok#so basically the psa is uh a few years ago there were credible accusations#and neither rice nor his lawyer ever responded to any of it#but his websites and socials quietly went away#while the folks (like me and others i follow) who love his work and respected him retreated and retracted#and i'd like to say i'm over it but of all the times some pastor or author or speaker turned out to be false#an abuser or liar or worse#this one has hurt the most#songs that are deeply ingrained in my memory and heart still come to my mind in the simplest moments#only for me to remember that taint hanging over them#and the apparent choice to avoid accountability and reconciliation which speaks to deeper pain and problems#maybe someday i'll be able to hear and sing those songs again and separate things but for now#it's all inextricably linked#(and if he would have just chosen to say something. anything probably. would be better than the silence)#(and i never know whether to be grateful or discouraged that overturning r. vs. w. happened at the same time so no other headlines mattered)

3 notes

·

View notes

Text

How residential schools were created by protestants as a direct consequence of 17th century protestant theology and politics and specifically and deliberately to differentiate their colonialism from that of catholics, with the first schools in Dutch Brazil, then required the catholic church to run residential schools in protestant colonies, where protestants were also running them, as a condition to be allowed to also have churches for their own communities, only for now residential schools to be viewed as an exclusively catholic crime with protestant schools even those still running as boarding schools, completely ignored and left unexamined.

Really says something about how privilege and power wash it's hands of its own crimes and avoids responsibility through scapegoating and how greyzone privilege minorities allow privilege majority to protect itself wholly but because that works and of how it works there's no way to unveil it or fight against it that won't be mistaken or deliberately funneled in to residential school denialism as a way to protect and deny government and privilege culpability and role in residential schools

#history#racism#denialism is defence of WASP state#but accountability and Reconciliation are too#because scapegoating

2 notes

·

View notes

Text

i think simply the fact that im allowed to discern and "sin" and make mistakes and follow my own instincts without worrying about going to hell if i die while im in the process is just so so liberating

#reconciliation does not mean confessing your sins to a priest#reconciliation means honestly lookng at your actions and seeing if you've hurt others#and if you need to apologize and make it up to them#reconciliation means discernment responsibility and accountability#it DOES NOT MEAN confess your sins to priest or you go to hell forever#god did not make us for guilt#lily leaves catholicism

4 notes

·

View notes

Text

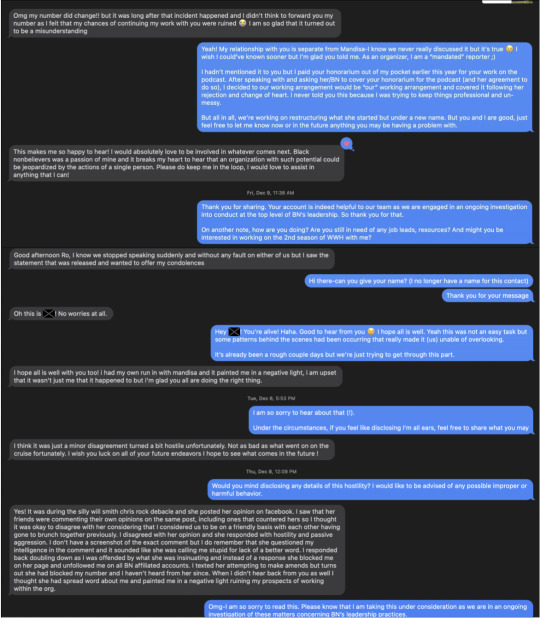

The Power of Black Dissent

For years I have talked about the “power of dissent” and the act of speaking truth to power. Over the years a large part of my speaking out has specifically been through the lens of religious dissent. For this is an under-appreciated legacy that has animated Civil Rights and social justice movements all over the African Diaspora for generations and (at least) hundreds of years following enslavement of African and indigenous peoples. It is not lost to irony that I write this entry on the day after Martin Luther King, Jr.’s federal holiday; himself an activist who’s greatest known speech was due in large part to the work of A. Phillip Randolph, a Black secularist. For all that Black religion has been said to offer we would likewise be nowhere, if not for the dissenting power of non-religious, Black, secular, doubting people and their activism.

I talk about this in detail on a new podcast and since the 2010′s I have enjoyed a kind of ‘wind at my back’ through Black Nonbelievers, a leading “non-profit” social justice organization that works to reframe culture, identity and Black advocacy through the lens of religious dissent, education and representation. Since 2011 it has been a thrilling ride; one that initially gave me “a place to land” as I transitioned out of a faith tradition that demonstrably caused harm and no longer served me socially, ethically or logically. Later, after years of fellowship and feeling like Black Nonbelievers (BN) was a place of refuge and strength-I sought to lead the local group in Washington, DC with the hopes of amplifying our visibility, legislative advocacy and community outreach.

I am an activist. And I have worked in Black empowerment spaces, groups and non-profit organizations for most of my life; from being an actor in Black community theater (DC); to being a Treasurer and later President of the Black Student Union at Berklee College of Music in my undergrad years; to working at the “College Path” non-profit org at the YMCA helping Black and Latinx youth prepare for college and professional careers; to being a professional music educator and even Minister of Music for 20+ years working with-and mentoring young people all over the East Coast...working and “holding space” for community, education, enlightenment and Black uplift has been a lifestyle throughout my life. Therefore, being the Director of Black Nonbelievers of DC was a natural outgrowth of previous work and identity. And it felt authentic...especially as a nonbeliever.

I had heard some “things” here and there; gripes from some people who came and went from the org. Most of those gripes did not check-out and were often framed and viewed as in-fighting by incredible people; other gripes were at worst, unresolved or un-investigable. I focused on my local group and the people within it, and we were good. Overall, I genuinely felt comfortable with the BN landscape and justified my continued work in the org. We did good work I thought; liberation work, Black empowerment work, educational work. That said, I quietly stopped donating to the org around 2019/20-partly because my “donation” was already paid for with my labor (e.g. time, volunteering, attending legislative and interfaith events on Capitol Hill, public organizing, marching in the streets, etc.), but also because deep down inside I started to feel something wasn’t quite right with the management and transparency of the org’s resources. Looking back, that was my mistake.

Still, I continued to work for my local group. Because I took that work SERIOUSLY. I still enjoy(ed) our fellowship, the “work” and the overall sense of affirmation, belonging and “wind at my back” that came from an established platform like BN. Our work was noble, empowering and it made my own conversations about non-belief with my family and outsiders easier to have than they would have been if I were just a lone Black atheist ranting about atheism and church/state separation.

So I stayed.

_____

Given all that, one could understand why after over 10 years of membership and 5 years of being an “Affiliate Director” within this organization, I was devastated to learn that people were in fact, demonstrably being harmed within the fellowship. Black Nonbelievers, it came to my attention this December by Mandisa Thomas herself, was actively being corrupted by its own head of leadership-in a deliberate and unconscionable way-routinely, for personal gain.

As I have learned from December 2022 until (literally) yesterday (1/16/23), the “goings-on” behind the scenes with BN founder and president Mrs. Thomas are of an unacceptable nature and magnitude. They are not merely incidental or “personal”. They are systemic and they are long-standing.

Excerpted from the preliminary findings of the BNDC Incident Report (Dec 2022):

I attest to the following:

That all six (6) organizers during our initial investigative process agreed Mrs. Mandisa Thomas’s alleged behaviors were credible in their claims, and valid and unacceptable for the organization going forward. To varying degrees, myself along with all six organizers were witnesses-to these behaviors and/or personally informed of them by Mrs. Thomas herself. Furthermore, that following the departure of five (5) organizers, I continued our investigation of Mrs. Mandisa Thomas to verify warrant for our decision(s).

Regarding Black Nonbelievers of DC (BNDC), these and other related claims, the following actions are credible and made demonstrable. That Mrs. Mandisa Thomas:

Routinely blurred personal and professional lines with both organizers and members concerning detailed sexual histories.

Promoted consensual sexual interaction(s) of two or more members at official events (e.g. BNSeaCon).

Misappropriated organizational resources to facilitate or engage in consensual interactions with BN member(s).

Manipulated key narratives to gain loyalties and leverage collegial support for desired personal outcome(s) among members and organizers.

Arbitrarily expelled members from the organization and its events without board or leadership review.

Arbitrarily expelled members from the organization and events without board or leadership review due to private sexual and/or romantic dynamics.

Provided “a safe and nurturing space for Black people without faith and leaving religion” contingent upon adherence to romantic dynamics favorable to Mrs. Thomas.

Neglected to publish or implement quarterly reviews of organizational health and sustainability for BNDC affiliate members and organizers.

Neglected publishing or implementing method(s) of impartial review for grievances among leaders and members.

Neglected publishing or implementing means of financial transparency and review to board or organizers.

Failing to heed advice from organizers regarding public confrontation of BN member(s) and associates on private relationships between Mrs. Thomas and a BN member.

Regarding acts, these conclusions implicate Mrs. Thomas’ indiscretions of a personal or intimate nature with (1) members (2) organizers and (3) associates, regarding (4) multiple incidents of mismanagement. These conclusions also suggest a convergence of these relationships with official BN resources used to facilitate them. In other instances, a separate but not necessarily unrelated pattern of secret expulsion from BN portrays a (5) lack of institutional safeguards and review processes for Black Nonbelievers and by extension, Black Nonbelievers of DC. These incidents-combined with an absence of transparency of resources and financial reporting for the organization and/or its affiliates merit both my departure and this report.

-Danile (”Ro”) // BNDC Affiliate Director 2017-2022 // BN Member 2011-2022

___________

There are receipts. Sadly, they keep coming.

Also excerpted from the BNDC Incident Report (re: “Supporting Documents, Item No.4″)

I will not stand by -nor- stand for an organization with this brand of leadership and abuse of power. And any movement of fellow advocates, personalities and organizations that would platform or, stand-by a leader like this and deliberately choose not to publicly scrutinize these claims with haste is highly suspect of perpetuating the exact same type of malfeasance, hypocrisy and systemic rot that it seeks to publicly oppose in churches, mosques and other problematic institutions.

_________

I like ‘people work’. And as noted, my professional history of working-with and helping people dates back over thirty years. Surely, people will make mistakes; institutions will have to be checked; programs need to be evaluated and systems need regulation. But to write off these claims, as many have done (and others seem to be doing) is more than troubling inside a movement self-identified by “humanism” and higher ethics...which is what the atheist movement at large proudly claims to be doing. Furthermore, shrugging off these accounts in service of ((__insert favorite celebrity here__)) for fear of dissent, cult following and public regard, racial scarcity or “cultural diversity” bona fides is well...gross and disgusting.

Most importantly, to assemble unassuming people and White allies around you as a defense shield against claims by fellow Black people in a credible, ongoing ethics investigation whilst Black people are left victimized by your trauma is to do the exact opposite of the “Black liberation” and “empowerment” work Black Nonbelievers was founded to perform.

But...it is exactly the reason why I, and nearly all other BN affiliate directors resigned and wrote this incident report(s). Even as atheists. Especially as Black Atheists.

We dissent.

#Black Atheist#Black Nonbelievers#Black Secular Collective#The Friendly Atheist#Matt Dillahunty#Truth and Reconciliation#White Supremacy#Healing#Accountability#Black History Month#Where We're Headed#Black Podcasts#Black Secular#Black Freethinker#Activism#Black Power#Black Activist#Deplorable#The Black Church#Interfaith Dialogue#Dissent#Sikivu Hutchinson#1619 Project#Self-Awareness#cultsim#Celebrity Worship#religion news#mandisa thomas

29 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Photo

#quotefortheday #ThomasDrummond #CivilEngineer

.

.

.

“Property has its duties as well as its rights. – Thomas Drummond, Civil Engineer

.

.

.

#Springbord#commercialrealestate#fasb#iasb#abstraction#administration#management#cam#lease#Reconciliation#audit#property#accounting#services#outsourcing

2 notes

·

View notes

Text

i will take businesses that implement xero, tie them to a chair, put a gun to their head, and tell them to switch to myob or it's the death penalty. 'intuitive and easy to use' fuck you

#by far one of the worst things i have ever had the displeasure to TRYING to learn so far#if you use xero kill yourself#i have decimated my account's reconciliation because it was explained so confusingly#and all the account somehow both have zero useful information and too much information#and there's so many transactions that i can't tell if i put anything in the right accounts#i just add and delete stuff until everything balances#and the assessment that i'm gonna do tomorrow relies on the information you've been putting in through the entire book course#i'm fucked

2 notes

·

View notes

Text

Accounts payable and Accounts receivable Solutions

Accounts payable and accounts receivable are two important aspects of a business's financial management. Accounts payable refers to the amount of money a business owes to its creditors, such as suppliers or vendors, for goods or services that have been received but not yet paid for. Accounts receivable, on the other hand, refers to the amount of money that a business is entitled to receive from its customers for goods or services that have been sold but not yet paid for. To effectively manage these two areas, businesses can use a variety of solutions such as software or cloud-based systems to automate and streamline the process of recording and tracking transactions, generating invoices, and making payments. Additionally, businesses can use tools such as credit scoring and collections management to manage their receivables and reduce their risk of bad debt. Overall, effectively managing accounts payable and accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a business.

3 notes

·

View notes

Text

Empowering Growth: OpenTeQ, Your Expert NetSuite Partner

As businesses evolve, the need for advanced ERP systems that streamline operations, manage finances, and integrate multiple business processes becomes essential. OpenTeQ stands out as a premier NetSuite Partner, offering customized solutions that empower businesses to optimize their workflows and drive growth. With a deep understanding of NetSuite’s robust platform, OpenTeQ delivers tailored services that meet the unique needs of every client.

Top NetSuite Partner: Delivering Excellence

OpenTeQ is recognized as a Top NetSuite Partner, a distinction earned through our commitment to delivering high-quality services and innovative solutions. We are trusted by businesses across industries to manage complex implementations, provide seamless integrations, and offer continuous support. Our team’s expertise ensures that your NetSuite system is implemented efficiently, delivering long-term value and enabling you to stay competitive in today’s fast-paced market.

Certified NetSuite Partner: Expert Guidance and Solutions

As a Certified NetSuite Partner, OpenTeQ guarantees that our services meet the highest standards of quality and compliance with NetSuite’s platform. Our certified consultants bring extensive knowledge and experience, offering expert guidance throughout your ERP journey—from planning and implementation to ongoing support. With this certification, OpenTeQ ensures that you receive reliable solutions designed to enhance your business operations and provide measurable results.

NetSuite Accounting Partner: Optimizing Financial Operations

OpenTeQ specializes in financial management as a trusted NetSuite Accounting Partner, providing businesses with tailored solutions to streamline their accounting processes. We automate critical financial tasks such as invoicing, reporting, and compliance, enabling organizations to gain real-time insights and improved control over their finances. With OpenTeQ’s financial expertise, businesses can focus on growth and strategic planning while maintaining accuracy and transparency in their financial operations.

Official NetSuite Partner: Comprehensive ERP Solutions

As an Official NetSuite Partner, OpenTeQ offers comprehensive ERP services that cover every aspect of NetSuite’s powerful platform. Our partnership status signifies our deep expertise in delivering a wide range of services, from implementation and customization to ongoing support and training. We ensure that our clients get the most out of their NetSuite investments, with solutions that are scalable, flexible, and aligned with their specific business objectives.

Conclusion

OpenTeQ stands as a trusted NetSuite Partner, providing businesses with tailored ERP solutions that streamline operations and drive growth. As a Top NetSuite Partner, we are recognized for our commitment to delivering excellence in every aspect of NetSuite services, from implementation to ongoing support. With our designation as a Certified NetSuite Partner, clients benefit from expert guidance and compliance with the highest standards in the industry.

Our role as a NetSuite Accounting Partner ensures that businesses can optimize their financial processes, gaining real-time insights and improving accuracy. As an Official NetSuite Partner, OpenTeQ delivers comprehensive, scalable solutions that align with each organization’s specific goals. Partner with OpenTeQ to unlock the full potential of NetSuite and propel your business toward long-term success.

#NetSuite Mobile Applications#NetSuite Advanced Dunning Solution#Advanced NetSuite Dunning Module#NetSuite Bulk Upload#Payment Orchestration for NetSuite#NetSuite Connectors#NetSuite Revision Management#NetSuite Advanced MRO#NetSuite Advanced Reconciliation#NetSuite RECONATOR#NetSuite for Small Business#Best NetSuite Consultants#NetSuite Managed Services#NetSuite Partner#Top NetSuite Partner#Certified NetSuite Partner#NetSuite Accounting Partner#Official NetSuite Partner

0 notes

Text

CPAs and accounting firms are tasked with managing complex financial data efficiently and accurately. The right accounting software can streamline processes, enhance productivity, and ultimately contribute to the success of CPAs and accounting firms. We’ll explore the significance of accounting software, key features to consider, and how Key CMS Accounting stands out as a premier

#CPAs and accounting firms#Key CMS Accounting#accounts payable/receivable#tax preparation#payroll#bank reconciliation

0 notes

Text

Efficiently Manage Property Management Cost & Accounts Payable

Unlock the potential of your operations with Springbord's tailored accounts payable solutions, designed to streamline and enhance financial efficiency.

1 note

·

View note