#RoDTEP

Explore tagged Tumblr posts

Text

Dr. Prem Garg Discusses Restoration of RoDTEP Scheme on CNBC Awaaz

In his recent interview with CNBC Awaaz, after the reinstatement of Remission of Duties and Taxes on Exported Products (RoDTEP) scheme, Dr. Prem Garg, President of the Indian Rice Exporters Federation (IREF), shared his insights on the restoration of this scheme.

#Dr. Prem Garg#IREF#Indian Rice Exporters Federation#CNBC Awaaz#RoDTEP#Indian Rice Exporters#Rice Exporters#RoDTEP Scheme#Exported Products#President of IREF

1 note

·

View note

Text

Extending RoDTEP support for exports made by Advance Authorisation (AA) holders, Export Oriented Units (EOU), Special Economic Zones (SEZ) units- reg.

govt. have extended RoDTEP benefit to AA holders , EOU, SEZ please refer the Attachment Download (Type : PDF)

View On WordPress

0 notes

Text

RoDTEP Scheme Services in Delhi

Get expert RoDTEP Scheme Services in Delhi with Exim Consultants. Maximize export benefits, simplify compliance, and ensure seamless rebate claims. Our specialists provide complete guidance on eligibility, documentation, and application processes. Contact us today for hassle-free RoDTEP assistance!

Exim Consultants

705-707, Ansal Vikas Deep Building, Laxmi Nagar, Vikas Marg, Delhi-110092

Phone No- +91-9818224440

Email - [email protected]

Visit - https://www.eximconsultancy.co.in/rodtep

0 notes

Text

Unlock Lucrative Duty Drawback Schemes with Exim Serve's RoDTEP and RoSCTL Expertise

Navigating the complexities of export-related expenses can be a daunting task, but our services for RoDTEP and RoSCTL are here to help. With our expertise, you can ensure that you're maximizing the remission of duties and taxes on your exported products, giving your business a competitive edge in the global market.

Our comprehensive suite of services covers the entire RoDTEP and RoSCTL process, from initial application to final claim settlement. We'll work closely with you to understand the intricacies of your export operations and tailor our support to your specific needs.

By leveraging our knowledge of the latest regulations and procedures, we'll guide you through the maze of paperwork and documentation, ensuring that your claims are filed accurately and on time. Our team of specialists will handle the entire process, freeing you up to focus on growing your business.

Don't let export-related expenses weigh you down. Unlock the full potential of RoDTEP and RoSCTL with our reliable and efficient services. Contact us today to learn more about how we can help you navigate this crucial aspect of your export operations.

For more Information click here for our Website: - RoDTEP and RoSCTL

0 notes

Text

How Import Export Solutions in India Help Businesses Go Global

India’s expanding role in global commerce has opened new avenues for businesses eager to explore international markets. However, navigating the complexities of cross-border trade requires more than just ambition. It demands expertise, compliance, and strategic planning—exactly what import export solutions in India are designed to deliver.

What Do Import Export Solutions Involve?

Import export solutions in India are end-to-end services that simplify and manage the trade process for businesses. These solutions are especially useful for small and medium-sized enterprises (SMEs) that may not have the internal resources to handle regulatory requirements, shipping logistics, or international documentation.

Services typically include:

Preparation of import/export documentation

Customs clearance assistance

Licensing and compliance support

Freight forwarding and transportation management

Trade finance and insurance guidance

Help with duty drawbacks and government incentive schemes

Benefits of Using Import Export Solutions in India

Choosing to work with a professional service provider offers a wide range of benefits for businesses involved in international trade.

Key advantages:

Error-Free Documentation: Experts ensure every document—such as invoices, shipping bills, and certificates—is accurate and complete.

Efficient Logistics Management: Optimize shipping routes and delivery timelines with coordinated freight and cargo services.

Simplified Customs Processes: Avoid costly delays and penalties with help from professionals familiar with Indian customs regulations.

Access to Global Markets: Focus on expansion while the technicalities of trade are handled by your support team.

Strategic Trade Advice: Receive guidance on market opportunities, tariff rates, and regulatory updates.

Why Indian Businesses Should Invest in These Solutions

India’s trade landscape has been undergoing rapid transformation. Government initiatives such as Make in India, Digital India, and Ease of Doing Business have improved the country’s logistics, port infrastructure, and customs systems.

With professional import export solutions in India, businesses can:

Take advantage of Export Promotion Capital Goods (EPCG) schemes

Apply for Remission of Duties and Taxes on Exported Products (RoDTEP)

Comply with DGFT and FEMA regulations

Reduce overall costs through duty exemptions and efficient processes

Choosing the Right Service Provider

Finding the right partner for import export solutions in India is critical for long-term success. Look for companies that offer:

Transparent pricing and service agreements

Tailored solutions for different industries (e.g., textiles, electronics, pharmaceuticals)

Proven experience and satisfied client base

Real-time shipment tracking tools

Ongoing support and regular trade compliance updates

A good service provider will go beyond paperwork—they act as a strategic partner who helps you grow globally.

Conclusion

International trade is filled with opportunities, but it also comes with challenges. With the right import export solutions in India, businesses can confidently enter global markets, meet compliance standards, and run smooth, cost-effective operations. From logistics to legal formalities, these solutions make the import-export journey more efficient and secure—paving the way for sustainable global growth.

#Import Export Solutions in India#logistics#freightforwarding#cargo services#sea freight#air cargo#transportation#everfast

1 note

·

View note

Text

CCS Customs Experts in India – Trusted Compliance & Clearance Professionals

Partner with CCS Customs Experts in India for reliable customs clearance, DGFT compliance, and end-to-end import-export support. Fast, accurate, and government-compliant logistics services.

CCS Customs Experts – Your Trusted Partner in Customs Compliance and Clearance

In today's fast-paced global trade environment, navigating international customs regulations can be complex and time-consuming. That's where CCS Customs Experts come in—offering specialized knowledge, timely execution, and reliable customs clearance solutions tailored to your business needs. As trade regulations evolve and cross-border compliance becomes more stringent, CCS Customs Experts help importers and exporters streamline operations, avoid delays, and stay fully compliant with all legal and procedural requirements.

What Does CCS Customs Experts Offer?

CCS (Customs Clearance Services) Customs Experts are professionals trained in handling all facets of customs brokerage and international trade documentation. They serve as an essential bridge between businesses and government customs authorities, ensuring smooth movement of goods through international borders.

Core services typically include:

Import and export customs clearance

HS code classification

Duty and tax calculation

Regulatory compliance consulting

Liaising with customs officials

Managing customs documentation (bill of entry, shipping bills, etc.)

DGFT (Directorate General of Foreign Trade) services

Handling bonded warehousing and re-export procedures

Why Choose CCS Customs Experts?

1. Expertise in Indian Customs Regulations Navigating India’s customs laws can be complicated due to multiple ministries and regulatory bodies involved. CCS Customs Experts are well-versed in the Indian Customs Act, 1962, and Foreign Trade Policy (FTP), ensuring every shipment complies with current norms and avoids penalties.

2. Speed and Accuracy Delays at customs can lead to demurrage charges, missed delivery deadlines, and disrupted supply chains. CCS professionals ensure faster processing by preparing complete, accurate documentation and proactively addressing potential red flags.

3. Industry-Specific Knowledge Whether you're in pharmaceuticals, electronics, automotive, FMCG, or textiles, CCS Customs Experts understand sector-specific import/export rules and can optimize duty benefits under schemes like MEIS, RoDTEP, SEZ, and EPCG.

4. End-to-End Support From the moment your shipment leaves the supplier to its final delivery destination, CCS experts manage customs documentation, compliance, logistics coordination, and real-time tracking, offering total peace of mind.

5. Digital & EDI Filing CCS Customs Experts leverage modern platforms like ICEGATE for Electronic Data Interchange (EDI) filing, ensuring error-free, timely submission of documents to Indian Customs.

Benefits of Working with CCS Customs Experts

Reduced Risk: Avoid misclassification, overpayment of duties, and compliance breaches.

Time Savings: Streamlined processes mean faster clearance and quicker delivery.

Cost Efficiency: Optimized duty structures and benefits from trade agreements lower logistics costs.

Reliable Consultation: Stay updated with the latest changes in trade policies and customs laws.

CCS Customs Experts in India

With the growing complexity of global trade and increased scrutiny at Indian ports, CCS Customs Experts in India play a vital role in the logistics ecosystem. They are especially crucial at major hubs like Nhava Sheva (JNPT), Mumbai Airport, Delhi ICD, Chennai Port, and Mundra—where high cargo volumes and strict regulations demand seasoned professionals.

#CCSCustomsExperts#CustomsClearanceIndia#CCSIndia#ImportExportCompliance#DGFTSupport#CustomsBrokerIndia#LogisticsExperts#TradeComplianceIndia#FreightForwardingIndia#CustomsSolutions#EXIMIndia#CCSCompliance#CustomsConsultants#IndianTradeSupport#CargoClearanceIndia#CHAExperts#InternationalTradeIndia#SupplyChainIndia#TradeFacilitationIndia#CustomsDocumentation

0 notes

Text

DGFT Notifies Restoration of RoDTEP Benefits for SEZs, EOUs, and Advance Authorization Holders

View On WordPress

#BISAct#BISExempted#BISRegistration#BISStandard#CBIC#CESTATAhmedabad#CustomsAct#CustomsAct1962#CustomsAdvanceRuling#CustomsBoard#CustomsClearance#CustomsCompliance#CustomsDepartment#CustomsLitigations#Customstariff#DGFT#Exports#Facebook#GovtofIndia#Imports#IndirectTax#Indirecttaxes#IndirectTaxIndia#IndirectTaxLaw#IndirectTaxLitigations#Indirecttaxmatters#Instagram#LawFirm#Lawyers#LinkedIn

0 notes

Text

What is a Shipping Bill in Export?

Have you heard of the term "shipping bill" before as an exporter? If you are new to exporting, you might find this term a bit technical, but it is actually one of the most important documents to deal with while starting your export business in India.

Every exporter company, big or small, needs to file a shipping bill before sending out the products from India. It is a document for the custom department to check what goods are going out of the country, how much is it worth of and where is it going. Think of shipping bill as a green signal from the customs when you hear, "The shipment is good to go".

The world of export is filled with documentations, but the shipping bill is something you cannot ignore. Over this blog, we will explore the importance of shipping bill, what it is and why it matters.

What is a shipping bill?

A shipping bill is a document that any exporter must file with the customs clearance department before sending out the shipment from India. It is a kind of declaration of what is being exported out of India, it includes details like:

Nature of the goods

Value and quantity of goods

Exporter details

Consignee details

Mode of transport

Basically, a shipping bill is a custom's permission slip to allow the goods to physically leave India. Shipping bill is generated automatically through ICEGATE and is mandatory for clearing goods at ports or airports.

Once the shipping bill is approved, it acts as a basis for

Custom permission slip (Custom clearance)

Claiming benefits like RoDTEP

Filing for regulations under FEMA

If you are exporting without shipping bill in your hands, it means that you are shipping illegally. It is one of the key documents to prove that the transaction has actually happened.

Importance of the Shipping Bill for Exporters

If you are an exporter in India, then shipping bill is not just a formality to be done, it is actually a ticket for your goods to get out of the country. Custom department needs this document the most, without shipping bill, custom won't let your documents move.

Here is why the shipping bill is the most important document:

Official export declaration: The shipping bill tells the customs each and every detail of the shipment. Who are you sending it to, what's the value and quantity, and what are you sending, all the details are in the shipping bill.

Dependence of custom clearance: For custom department, no shipping bill means no clearance. It is a document that custom officers review before giving the green light for export.

Export incentive: For claiming the export incentives like RoDTEP, MEIS etc., you will be needing shipping bill as a proof.

Export history: For tracking export transactions, the shipping bill acts as a record for export history.

In short, if you are a first time exporter or doing it for a long time, shipping bill is one document you cannot skip.

Different Types of Shipping Bills for Exporters

Different types of exports require different kinds of shipping bills. Not all exports are the same, based on the nature of the shipment and the kind of export you are doing. Here is a list of different types of shipping bills-

Free shipping bill- This types of shipping bill is required when the exporting goods dont qualify for any export incentives.

Dutiable shipping bill- If you are exporting any kind off goods that require export duty, this kind off shipping bill will be required.Custom duty will be calculated based on the duty of the bill.

Drawback shipping bill- If you think you can claim a duty drawback and then this shipping bill is for you. It helps you in getting refund of duties that you have already paid while importing few raw materials of the shipment.

EPS shipping bill- This shipping bill stands for export promotion scheme shipping bill. This is for shipment exported under schemes like EPCG or MEIS.

Exporters can file for these shipping bills electronically through the ICEGATE portal, and based on the export declaration, the correct types of shipping bills are selected.

What are the Key Components of a Shipping Bill?

A shipping bill is one of the most important documents for moving your shipment out of the country. So, before going to fill out the form, it's important to know the key components of a shipping bill. Here is what you will find in a shipping bill:

Exporter Details: This section basically requires your details, like name, IEC code, address, etc.

Consignee Information: Details of who you are sending goods to, like- name, address, country etc.

Nature of consignment: An accurate description of the goods and nature of the consignment, like product name, type and its overall description.

HS code- This code helps the custom to identify the nature of your goods properly. This 8 digit code is crucial for incentive, compliance and duty.

Shipping bill type- As explaid above, different types of shipping bills, this will determine how custom department will treat your shipment.

Mode of transport: This clarifies whether your shipment will move through air, seo or land.

LUT/Bond details: If you are exporting without paying the GST, those details must be included here too.

Documents Required for Filing a Shipping Bill

You will need to arrange a few shipping bills before filling one out. This will help customs to verify your shipment and make sure everything is in order. Here is a list of documents needed:

Commercial invoice: This has the details of the goods being exported- quantity, quality, price, terms of sale, etc.

Packing list- This has details of goods that are packed- like weight, number of boxes, dimensions and what is inside the boxes.

IEC code- This is the importer exporter code, and it's like an ID card for your export business.

Export/Purchase order: This is a proof of order from your overseas buyers.

Declaration: A declaration provided by you that the information given is true and you have all the documents to verify it.

LUT or Bond documents: If you are exporting without GST under LUT then you need to submit the document for the same.

Once you have gathered all these documents, you are ready to file for shipping bill on the ICEGATE portal. The documents and details must be accurate, any mismatch might lead to rejection from the custom department.

What is the difference between a shipping bill and a bill of lading?

Read more: What is a bill of lading? And where is it used?

Conclusion

Getting your shipping bill right is one of the most important steps in your exporting business. It is not just a regular document, it is important as it gets the green signal form the custom department of India to send your shipment abroad. Whether you are new to export or scaling up your export business, getting the right shipping bill will save you from the delays, penalities and missed opportunities.

At Infinity, we understanfd the importance of compliance related paperwork, especially when you alone have to deal with a number of documents and other paper work. That is why we help Indian exporters to not just receive international payments but also help you with export process from end to end.

Sign up today!

#blog#Shipping Bill#exporter#exportimport#blogger#instagood#blogging#blogpost#bloggerstyle#follow#like#bloggers#life#influencer#instadaily#instablog#payments#payment gateway#payment solutions

0 notes

Text

DGFT Registration in India: Step Into the World of Global Trade

The Directorate General of Foreign Trade (DGFT) plays a vital role in promoting India’s international trade by regulating and facilitating exports and imports. DGFT Registration, primarily through obtaining an Importer Exporter Code (IEC), is the first mandatory step for any business looking to enter the global market. Whether you’re exporting agricultural products or importing machinery, IEC acts as your unique identification with Indian customs and DGFT.

Without DGFT registration, no individual or company can legally conduct cross-border trade in India. This 10-digit IEC number is required at various points, such as customs clearance, bank dealings for foreign currency, and DGFT benefits. Moreover, IEC is a lifetime registration, making it a one-time investment for a business’s international journey.

Apart from enabling trade, DGFT registration opens doors to various government schemes and incentives, including MEIS, SEIS, and RoDTEP. With global markets just a click away, securing your DGFT registration ensures you stay compliant while gaining a competitive edge. In short, it’s the foundation for any successful export-import business in India.

0 notes

Text

Government Schemes and Incentives for Exporters in India You Should Know About

India’s export ecosystem has evolved significantly over the years, offering countless opportunities for businesses to expand globally. Recognizing the potential of Indian exporters — especially MSMEs — the Government of India has introduced a variety of support schemes aimed at enhancing global competitiveness, improving profitability, and reducing trade-related costs.

If you’re a manufacturer, merchant exporter, or MSME looking to scale your exports, here are three major schemes you need to know about: MEIS, RoDTEP, and EPCG.

1. Remission of Duties and Taxes on Exported Products (RoDTEP)

What is it? RoDTEP is one of India’s most comprehensive export incentive schemes, launched to replace the earlier MEIS. It ensures that exporters are reimbursed for various embedded taxes and duties not refunded through GST.

Benefits:

Refunds cover taxes like electricity duties, fuel used in transportation, and mandi tax — which were previously non-recoverable.

The rebate is provided in the form of transferable duty credit scrips.

Applies to both manufacturers and merchant exporters across sectors.

How MSMEs Benefit:

Helps MSMEs maintain competitive pricing in international markets.

Improves cash flow as the refund is directly credited to the exporter’s account or e-wallet.

Removes the hidden cost burden of indirect taxes, increasing margins.

2. Export Promotion Capital Goods (EPCG) Scheme

What is it? The EPCG Scheme enables exporters to import capital goods (like machinery and equipment) at zero customs duty, provided they commit to fulfilling a certain export obligation within a defined period.

Benefits:

Reduces upfront investment in high-value capital goods.

Boosts production capacity with modern machinery.

Enhances product quality and consistency.

Export Obligation:

Typically 6x the duty saved on imported machinery, to be fulfilled over a 6-year period.

Exporters can supply to foreign markets or EOUs/SEZs to meet this requirement.

How MSMEs Benefit:

Lowers entry barriers to adopt advanced technology.

Helps small businesses scale operations and meet global standards.

Saves significant cost on import duties, leading to quicker ROI.

3. Market Access Initiative (MAI) and Market Development Assistance (MDA)

While not as widely known, these schemes provide financial assistance for:

Participation in international trade fairs and exhibitions.

Conducting market studies and buyer-seller meets.

Developing export promotional material and branding.

How MSMEs Benefit:

Boosts brand visibility in global markets.

Enables small exporters to explore new countries without heavy upfront costs.

Encourages collaboration with Export Promotion Councils for targeted outreach. How ONS Logistics Makes Your Export Journey EffortlessONS Logistics handles your entire export backend — You only need to focus on the product, they take care of the rest:FeatureBenefit📄 DocumentationComplete handling of IEC, shipping bill, and customs docs🚢 Shipping SupportSea, air, courier – whichever is fastest & safest🛃 Customs ClearanceZero stress, zero delays🧑💼 Expert GuidanceFREE consultancy for first-time exporters🌍 Pan India PortsAccess to major ports like Mundra, Kandla, Nhava ShevaWhether you're a first-time exporter or scaling your business – ONS Logistics becomes your reliable partner for success. Best CHA In Gujarat Best Custom House Agent In Gujarat Best CHA in Mumbai Best Custom House Agent in Mumbai Best CHA in Mundra Custom House Agent in Mundra

Bonus: Other Notable Schemes Worth Exploring

Interest Equalization Scheme: Provides interest subsidy on pre- and post-shipment credit.

TIES (Trade Infrastructure for Export Scheme): Supports the creation of modern export infrastructure.

NIRVIK Scheme (Niryat Rin Vikas Yojana): Enhances access to credit and simplifies export insurance through ECGC.

Final Thoughts

India’s export landscape is brimming with opportunity, and the government is actively investing in helping exporters — especially MSMEs — succeed globally. Leveraging schemes like RoDTEP, EPCG, and MAI can help reduce costs, improve competitiveness, and accelerate growth.

Whether you're an experienced exporter or just getting started, make these schemes part of your strategy to go global with confidence.

#911 abc#arcane#cats of tumblr#cookie run kingdom#ides of march#elon musk#artists on tumblr#jason todd#logistics#freight#supplychain#air freight#freightforwarding#supplychainmanagement#exportbusiness#exporter#indian government

0 notes

Text

Spice Exports: How India is Leading the Global Market in 2025

World Spice Organisation (WSO) said that India is the largest producer and exporter of many varieties of spices in the world. India’s share in the global seasoning market, pegged at $14 billion in 2024, is only a paltry 0.7%.

According to recent data, India exports 1.5 million tonnes of spices of all kinds worth $4.5 billion.

World Spice Organisation said currently only 48% of India’s spice exports were valued-added products, while the remaining bulk hits the markets as culinary whole spices. To achieve the Spices Board of India’s export target of $10 billion by 2030, the country’s share in value-added spices should rise up to 70%, he opined.

As we move through 2025, India has solidified its position as the world's leading spice exporter, commanding attention not just for quantity but for quality, variety, and innovation.

In this blog, we will take a closer look at how India is dominating the spice trade globally and the affecting India's spice exports.

The Numbers Behind the Dominance

India's spice exports are on the rise, and in 2025, they will make up + 25% of all spice exports worldwide. According to the Spices Board India reports that this year, the country exported over 1.4 million metric tons of spices worth USD 5.2 billion.

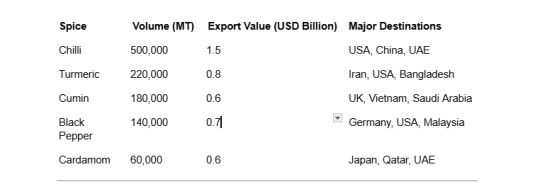

Table: Top 5 Spices Exported by India in 2025

Spice Volume (MT) Export Value (USD Billion) Major Destinations

Key Factors Affecting India’s Leadership in Spice Exports

1. Diverse Agro-Climatic Zones

India has diverse climate zones, which are helpful in the cultivation foe a variety of spices in different states. We can say that from the turmeric-rich soil of Tamil Nadu to the black pepper plantation in Kerala, this diversity is necessary for a consistent and high-quality supply chain.

2. Government Support and Policies

For boosting spice export indian government (through the Spice Board of India) implemented multiple schemes, some are as follows:

Subsidies for organic farming

Export incentives under MEIS/RODTEP

Infrastructure development for spice processing zones

3. Adoption of Advanced Technologies

The recent era is the era of advanced technology. We can say modern farming methods, AI-powered sorting systems, and improved packaging techniques have enhanced product quality and shelf life, making Indian spices more attractive to global buyers (importers) .

4. Certification and Quality Assurance

If we have an authentic certification of our product, demand automatically increases because we believe in these certifications. This ensures the safety and purity of the product. Exporters are increasingly securing global food safety certifications such as HACCP, ISO 22000, and Organic India.

5. Growing Global Demand for Natural and Ayurvedic Products

Everyone wants a healthy, wealthy life. Nowadays, wellness trends are increasing at a global level, spices like turmeric (curcumin) and ginger are being used for their medicinal and therapeutic properties. India, being the largest producer of such spices, naturally benefits.

Role of Digital Platforms in Boosting Exports

Digital B2B platforms like Tradologie.com have revolutionized the way Indian spice exporters connect with global buyers. With real-time negotiation features, no middlemen, and support in 20+ languages, exporters can close deals directly and transparently.

Key Benefits of Using Platforms like Tradologie.com:

Access to verified global spice importers

Real-time negotiation tools

Transparent trade without hidden commissions

Final Thoughts

India’s dominance in the global spice market in 2025 is no accident. It is a result of traditional agricultural knowledge blended with modern technology, strong government support, and a proactive embrace of digital export-import solutions. India has a strong chance of continuing to lead the globe in the export of spices as long as people are looking for natural, tasty, and health-boosting ingredients.

If you want to enter or expand in the global spice trade, India is the best place. And platforms like Tradologie.com, also very helpful in your spices exporting journey.

0 notes

Text

Unlock Global Growth: How Indian Businesses Can Thrive in the Export Revolution

India has witnessed a rapid transformation in its export sector, with the country emerging as a global export powerhouse. With exports contributing nearly 22% to India’s GDP and initiatives such as “Make in India” and PLI schemes, businesses are presented with vast opportunities to expand internationally. The Indian export market is set to reach $1 trillion by 2030, driven by manufacturing, services, and technology advancements.

For Indian businesses, thriving in this export revolution requires a mix of policy support, innovation, and leveraging emerging technologies. Let’s explore the key strategies that can help businesses scale globally.

The Growing Potential of Indian Exports

The world sees India as a reliable trade partner, and Prime Minister Narendra Modi has emphasized the need for Indian businesses to take “big steps” toward expanding exports. Several factors are contributing to India’s export boom:

Government Policies & Incentives: India has introduced reforms such as the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme, which reduces cost burdens for exporters.

TradeTech & Digital Transformation: Advanced trade platforms and AI-driven supply chains are making it easier for businesses to access international markets.

Growing Demand for Indian Services: IT, pharmaceuticals, and professional services are in high demand globally, making services exports a strong contributor to India’s economy.

1. Key Growth Sectors Driving India’s Export Boom

1.1 Services Sector — India’s Global Strength

India’s services exports stood at $323 billion in 2023, positioning it among the world’s top five exporters. Sectors like IT, fintech, healthcare, and professional services have led the way, with AI and automation further accelerating this growth. The rise of AI-powered trade solutions and data-driven international market strategies allows Indian businesses to reach new global clients with ease.

1.2 Manufacturing & MSME Contribution

The “Make in India” initiative has significantly boosted the country’s manufacturing sector. Indian businesses are now capitalizing on PLI (Production Linked Incentives), leading to record exports in sectors such as pharmaceuticals, textiles, and electronics. MSMEs contribute nearly 50% of India’s exports, with digital tools enabling them to compete globally.

Additionally, the Budget 2025–26 has positioned Exports as the 4th Engine of Growth, introducing multiple initiatives to support key sectors:

Handicrafts: Export timelines extended from 6 months to 1 year, with an additional 3-month extension if needed. Nine more duty-free inputs added to boost competitiveness.

Leather: Full BCD exemption on Wet Blue leather to enhance domestic production and jobs, along with a 20% export duty exemption on crust leather to support small tanners.

Marine Products: Reduction of BCD on Frozen Fish Paste (Surimi) from 30% to 5% and on fish hydrolysate from 15% to 5% to support shrimp and fish feed production.

Railway MROs: Extended repair time limits for foreign-origin railway goods from 6 months to 1 year, aligning them with aircraft and ship repairs.

2. Emerging Trends in the Indian Export Sector

2.1 TradeTech — The Digital Transformation of Trade

Technology is revolutionizing how Indian businesses engage in exports. Key trends include:

AI-driven supply chain management for cost efficiency.

Blockchain-powered smart contracts to enhance trust in global trade.

Cross-border e-commerce allowing small businesses to sell directly worldwide.

2.2 Government Incentives & Policy Support

The Indian government has launched multiple initiatives, including:

Export Promotion Mission: Aimed at facilitating export credit, cross-border factoring support, and tackling non-tariff measures, with joint efforts from the MSME, commerce, and finance ministries.

BharatTradeNet (BTN): A digital public infrastructure initiative designed to streamline trade documentation and financing.

Integration with Global Supply Chains: The government will identify key sectors and facilitate industry collaboration to enhance India’s role in global trade.

Customs Reforms for Trade Facilitation: New time limits for provisional assessment, voluntary compliance initiatives, and extended timelines for end-use compliance to enhance ease of doing business.

These policies enable Indian businesses to reduce costs and penetrate international markets more effectively.

3. How Indian Businesses Can Thrive in Global Markets

3.1 Expanding to Untapped Markets

While the US and Europe remain top destinations, Indian businesses must explore Southeast Asia, Africa, and Latin America, where demand for Indian products is rising. The India-UAE CEPA (Comprehensive Economic Partnership Agreement) is a great example of opening new trade routes.

3.2 Leveraging Free Trade Agreements (FTAs)

India has signed or is negotiating FTAs with the UK, Australia, and Canada, reducing tariff barriers and simplifying export regulations. Businesses that leverage FTAs can access lower import duties, faster clearances, and easier market entry.

3.3 Strengthening Branding & Quality Compliance

Investing in branding & marketing: A strong digital presence on platforms like Amazon Global, Alibaba, and Shopify can help reach international customers.

Ensuring compliance with global standards: Adhering to ISO, FDA, CE certifications can boost credibility.

Sustainability focus: Eco-friendly packaging and carbon-neutral practices are gaining global acceptance.

4. Overcoming Challenges in the Export Ecosystem

4.1 Logistics & Infrastructure Bottlenecks

Despite advancements, logistics costs in India remain high. However, government investment in multi-modal transport networks, dedicated freight corridors, and port digitization is improving efficiency.

4.2 Financing & Export Credit Access

SMEs often struggle with export financing. The enhanced credit guarantee for term loans up to Rs. 20 crore under Budget 2025–26 is a major boost. The Export Credit Guarantee Corporation (ECGC) and Export Credit Insurance Scheme (ECIS) are also addressing this gap, along with trade finance products from banks to ease working capital constraints.

4.3 Global Trade Uncertainties & Geopolitical Risks

India’s exports are susceptible to geopolitical disruptions, supply chain issues, and trade wars. Businesses must diversify markets and adopt risk management strategies such as forward contracts and currency hedging.

Future Outlook for Indian Exports

The global economic shift towards India presents a unique opportunity for businesses to scale internationally. Key trends shaping the future of Indian exports include:

Digital Trade Agreements: India is negotiating trade pacts that will make cross-border digital trade easier.

AI-Driven Export Ecosystem: AI-powered data analytics will optimize trade strategies.

Growth of Services Exports: India’s IT, consulting, and education sectors will see increased demand.

Biz Consultancy: Your Trusted Growth Partner

Biz Consultancy is an industrial platform that helps you make smart business decisions with expert advice from industry professionals. It connects you with the right people, expands your network, and provides valuable insights to grow your business.

With a Biz Consultancy, you can store and share important documents securely, making it easier to collaborate with experts. The platform also connects you directly with machinery and equipment suppliers, helping you find what you need without middlemen.

Want to learn new skills? A Biz consultancy offers online courses on various industries and professional skills. You can learn at your own pace, take assessments, and boost your career.

Whether you’re starting a new business or scaling up, a Biz consultancy provides the right support, guidance, and tools to help you succeed.

Conclusion

India’s export revolution is set to propel the country towards a $5 trillion economy, with AI, automation, digital trade, and policy incentives playing crucial roles. The government’s focused efforts on export promotion through sectoral support, infrastructure development, and trade facilitation are strengthening India’s position in global markets.

For Indian businesses, the time is now to capitalize on export-led growth and establish a strong global footprint.

#bizconsultancy#consulting#supplychain#Logistics & Infrastructure Bottlenecks#Financing & Export Credit Access#Global Trade Uncertainties & Geopolitical Risks#msme#servicesector#globalstrength

1 note

·

View note

Text

Can I Use One IEC for Multiple Businesses?

More business owners and entrepreneurs are looking into import-export prospects as a result of India's increasing international trade. Getting the IEC Code, which stands for Import Export Code, is one of the first compliance procedures in this process. As startups develop, some entrepreneurs manage several firms and frequently inquire, "Can I use one IEC for multiple businesses?" In a nutshell, it relies on the structure of your companies. In addition to discussing compliance, updates, and situations when a second IEC may be required, this extensive book will explain the notion of IEC Code Registration, examine legal restrictions, and make clear how many enterprises you can operate under a single IEC Registration.

What is IEC Code and Why Is It Needed?

The Import Export Code (IEC) is a 10-digit unique id number issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce & Industry, Government of India. It is mandatory for any individual or business entity involved in importing or exporting goods and services.

Importance of IEC Code:

Required for customs clearance at ports and airports.

Mandatory for processing foreign currency transactions via banks.

Enables access to export-related government schemes like RoDTEP and SEIS.

Legally recognizes your business in international trade.

Without proper IEC Code Registration, your international trade operations cannot legally proceed.

Knowing the Ownership Structure and IEC Allocation

The IEC Registration is PAN-based, meaning that it is issued per legal entity, not per business activity. Therefore, whether you can use one IEC for multiple businesses entirely depends on how those businesses are legally structured.

Scenario 1: Multiple Businesses Under One Legal Entity (Same PAN)

If you operate multiple business verticals or brands under the same legal entity and PAN, such as:

A sole proprietorship with multiple trade names

A private limited company with diverse product lines

An LLP running different services under the same roof

Then yes, one IEC is sufficient. Your IEC Code is tied to the PAN of your legal entity, and the nature of business or product types is not limited under the code.

Example: ABC Traders (proprietorship) sells textiles, handicrafts, and organic food under different brand names. Since all these operations fall under the same PAN, one IEC Code works for all.

Scenario 2: Multiple Legal Entities (Different PANs)

If you own different companies or firms that have separate PANs, each of them must apply for IEC Code Registration individually.

Why? Because IEC is issued based on the PAN of the entity. Each legal entity is considered a separate person under Indian law.

Example: Mr. Sharma owns two companies:

Sharma Exports Pvt Ltd

GreenTech Agro LLP

Each company has a distinct PAN. Therefore, both must apply for separate IEC Codes through individual Import Export Code Registration processes.

Scenario 3: Different Branches or Locations Under One Entity

If your company operates from multiple branches or cities, you do not need multiple IECs. The same IEC can be used across India. However, you may update branch details in your IEC Registration profile on the DGFT portal.

Tip: Use the IEC Update feature to add or modify branch addresses and bank details for smooth customs and banking operations.

Key Considerations Before Using One IEC for Multiple Businesses

While the law permits using one Import Export Code for all businesses under the same PAN, there are a few practical considerations:

1. Maintain Clear Records

Even if you use a single IEC across product categories or brands, you must maintain separate records for each vertical. This helps during audits, GST filings, and customs investigations.

2. Use Trade Name Carefully

If you're exporting under a different brand name, confirm the invoices and documents mention your legal entity name (as per PAN) along with the brand name.

3. Update Business Activities on DGFT

The DGFT portal allows you to update or add new business activities. Use the IEC Update feature to reflect changes in product types or services offered.

4. Confirm Bank and GST Linking

Confirm that the bank accounts and GSTINs linked to your IEC are updated. Mismatched details can delay shipping bill clearance or refund claims.

How to Apply for IEC Code Registration?

Here is the simplified process for Import Export Code Registration:

Step 1: Visit DGFT Portal

Go to the website and register using your PAN.

Step 2: Fill Online IEC Application

Provide business details like entity name, PAN, contact info, and bank account.

Step 3: Upload Documents

Required documents include:

PAN card

Address proof

Cancelled cheque or bank certificate

Aadhaar card of applicant

Incorporation documents (for companies/LLPs)

Step 4: Pay Government Fee

The official fee for IEC application is ₹500, payable online.

Step 5: Receive IEC Certificate

Within 24–72 hours, the IEC Code is issued in digital format. It remains valid for life unless surrendered or canceled.

When Should You Consider Separate IEC Registrations?

Even though it’s legally allowed to operate multiple businesses under a single IEC Code, you may still choose to apply separately for strategic reasons.

Situations That Warrant Separate IECs:

Operating joint ventures with distinct partners

Risk mitigation: avoid compliance spillover from one business to another

Different export destinations and trade agreements

Branding or market segmentation strategy

Having separate IEC Registrations for different companies makes financial tracking, tax filing, and compliance easier in such cases.

What Happens If You Use One IEC Incorrectly Across PANs?

Using the same IEC Code for different businesses that have separate PANs is a serious violation of DGFT rules.

Consequences Include:

Cancellation of IEC

Customs penalties

Rejection of shipping bills or refunds

Suspension of foreign currency payments by banks

To remain compliant, confirm that your IEC Code Registration is aligned with the correct PAN and legal entity.

How to Manage Multiple Business Activities Under One IEC?

If you’re managing multiple business lines under the same entity, follow these best practices:

Segment accounting and invoicing for each business category.

Register multiple GSTINs for different branches and map them to the IEC.

Use DGFT’s IEC Update feature to revise business descriptions, addresses, or bank details when needed.

Communicate the correct IEC and PAN to your shipping partners and customs house agents.

Assumption

Your key to international trade is the IEC Code. Knowing how IEC Code Registration relates to your business structure is essential, regardless of whether you're managing several verticals or exporting a single product. A single IEC registration is both acceptable and practicable if all of your business endeavors are under a single legal organization and PAN. Separate import-export code registrations are not only necessary, but legally essential when running different businesses with different PANs. Either way, make sure your trade operations match your registered credentials, adhere to compliance best practices, and constantly keep your IEC up to date. Your IEC Code can support several business concepts and enable you to grow globally without encountering any difficulties if it is set up properly.

FAQs

Can one person apply for multiple IECs?

Ans No. As per DGFT, one PAN can have only one IEC Code Registration.

Can a business have two IECs for different locations?

Ans No. The same IEC can be used across India, regardless of location.

Do I need a new IEC if I change my business structure?

Ans Yes, if your PAN changes (e.g., shifting from proprietorship to Pvt Ltd), you must apply for a new Import Export Code.

0 notes

Text

7 Powerful Export Incentives India is Considering in 2025

India is aggressively working towards enhancing its export potential, with the government introducing several incentives to strengthen international trade. In 2025, new and improved export schemes are expected to help Indian businesses compete in global markets. Let’s explore the 7 powerful export incentives India is considering in 2025 and their impact on the economy.

1. Extension of Remission of Duties and Taxes on Exported Products (RoDTEP)

RoDTEP aims to reimburse various taxes and duties that exporters incur but cannot claim refunds on. This scheme is likely to see expansion in 2025, covering additional sectors to improve the competitiveness of Indian products in foreign markets.

2. Enhancements in Export Credit Guarantee Scheme (ECGS)

The ECGS provides credit risk insurance and financial guarantees to exporters. The government is considering raising the credit limits and lowering premiums, making it easier for small and medium enterprises (SMEs) to expand their international reach.

3. Increased Benefits under the Merchandise Exports from India Scheme (MEIS)

MEIS, which rewards exporters with duty credit scrips, may be restructured to offer better incentives in high-potential industries such as pharmaceuticals, textiles, and electronics.

4. Special Economic Zones (SEZ) Revamp

To boost manufacturing and exports, the government is expected to introduce new policies that simplify compliance and reduce bureaucratic hurdles for SEZs. This move will encourage more businesses to set up operations in these tax-friendly zones.

5. Expansion of Duty Drawback Scheme

The Duty Drawback Scheme allows exporters to claim refunds on customs and excise duties paid on imported inputs. In 2025, the government is considering extending higher rebate rates for priority sectors like agriculture and engineering goods.

6. Strengthening of Production Linked Incentive (PLI) Scheme

The PLI scheme, which rewards manufacturers for increasing production, may be expanded to include more industries. This will not only support exports but also encourage domestic production, reducing dependency on imports.

7. Trade Infrastructure for Export Scheme (TIES) Expansion

Improving logistics and infrastructure is crucial for seamless trade. The government plans to invest in export hubs, port modernization, and digital trade facilitation, making it easier and more cost-effective for exporters to ship their products globally.

Conclusion

With these 7 powerful export incentives India is considering in 2025, businesses can expect improved financial support, simplified regulations, and enhanced trade infrastructure. These measures will not only boost India’s export performance but also strengthen its position as a global trade leader.

0 notes