#Selling a business

Text

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

The second quarter of 2023 was interesting. Typically, the summer months, especially July, are slow. However, this year, our firm saw an increase in business owners reaching out to learn about selling their business.

While interest rates continue to climb and put pressure on the selling prices, the number of businesses listed for sale continues to grow.

Q2 BizBuySell Report Shows Continued Increase in Small Business Acquisitions

BizBuySell has recently released their insight report for the second quarter of 2023. These reports are helpful to business owners and potential buyers as they project market trends and explain what was on the rise and what declined over the past three months. To see the full report, you can visit BizBuySell’s website. Here is an overview of what was presented and where market trends are leading as we progress through 2023.

Full report: https://www.bizbuysell.com/insight-report/

Overview

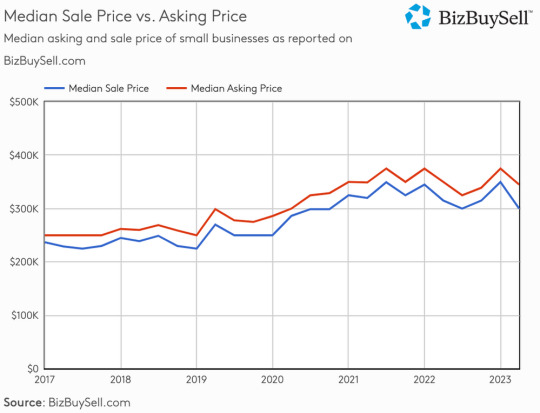

The most important statistic from the last three months is that business acquisitions increased by 8% versus just 4.8% in the first quarter of the year. This continues the positive trend that buyers and sellers are adjusting to an environment with higher interest rates.

However, it’s important to note that while acquisitions are trending upward, sale prices have continued to trend downward. In the second quarter, the median business sale price dropped 14% to $300,000 largely due to higher interest rates.

While the decline in the sales prices may seem like bad news to buyers, this decline proves that sellers need to get more creative with their offers. For instance, sellers may have to offer financing or increase the monthly rent on the buyer’s lease.

Overview of business sales and listing information for Sacramento, CA

In the Sacramento, Arden-Arcade, and Roseville, California areas, the median asking price continued to increase. The median asking price rose to $399,000, and listings increased from 253 to 264. Median revenue also increased significantly from $550,000 to $609,445.

Here are 3 Key Takeaways from BizBuySell’s report:

1. Seller financing continues to play an important role.

With higher interest rates, many buyers and lenders require some form of seller financing. This can seem challenging for sellers as only 22% plan to offer it, while 70% of potential buyers intend to ask sellers to finance at least part of the deal.

However, sellers need to stay flexible and consider adding financing to their deals. Leaving out this crucial component can reduce the amount of potential buyers and, in some cases, be a deal breaker for lenders, as many lenders are beginning to require at least a 10% note from sellers. This is especially important to buyer and seller timelines. As roughly 28% of business owners intend to sell by 2024, and buyers continue to increase their desire to purchase, seller financing continues to play an impactful role.

In good news for sellers, because interest rates are on the rise, so are the rates on seller financing, allowing sellers to enjoy tax benefits and meet buyer demands as well.

2. Restaurants show a steady comeback, while the retail sector shows a decline.

The restaurant sector has been making a slow but steady comeback post-pandemic. Restaurants saw a 10.3% increase in transitions from last year, and sale prices increased 15.9% from the previous quarter and 6.7% from the previous year. While these numbers are positive, the report indicates that many restaurants are still struggling, offering purchasing opportunities from competitors.

While restaurant numbers have increased, retail numbers are showing a decline. 2022 showed promising numbers post-pandemic, but with more consumers purchasing online and higher interest rates and inflation, these numbers have slowed in 2023. According to the report, retail transactions declined 12.3%, sale prices dropped 22%, revenue slipped 24%, and cash flow fell 9.4%.

3. Buyers continue to seek independence with entrepreneurship.

The number of interested buyers looking to leave their traditional jobs and embrace entrepreneurship continues to rise. The report indicates that 46% of surveyed buyers want to leave their current position to be more in control of their future. This is good news for the baby boomer generation looking to exit the market, even though some want to reinvest in other markets.

It’s also important to note that service businesses made up the largest number of companies for sale recently. Almost half of the sales recorded in the second quarter were service-based businesses, and 59% of surveyed buyers indicated they were interested in purchasing a service-based business.

Outlook for the remainder of 2023:

The BizBuySell report indicates that interest rates continue to be the most significant factor in the small business market. Some sectors are seeing a return to the workforce, while others are still experiencing stagnant or declining numbers. However, there are a few positive notes to consider:

The baby boomer generation continues to exit the market. According to the report, 47% of sellers surveyed marked retirement as their reason for exiting, while 34% indicated burnout. As this age group continues to leave the market, it creates new opportunities for those looking to enter.

As mentioned, seller financing should be considered. This can be a great selling point to buyers looking for interest rate relief and impact new requirements from lenders.

Next Steps

As market conditions continue to change and evolve, and as more buyers indicate their desire to purchase a business, it’s essential to fully understand the value of your company. Are you looking for a Sacramento business broker? Reach out today for a free consultation.

source https://www.sacramentobusinessbrokers.com/post/q2-bizbuysell-report-shows-continued-increase-in-small-business-acquisitions

2 notes

·

View notes

Text

Decide if passing your business to a partner, employee or family member aligns with your vision. Groom suitable successors well in advance. If there’s no one immediately around you to take over, it’s time to broaden your consideration. Is a strategic buyer who can grow the company an option? Perhaps selling to a competitor is the best course of action. Knowing your preferences help shape your exit strategy planning, vet potential internal and external successors and make difficult decisions about the Company’s future before they are asked.

#businessexitplanning#selling a business#business sell#sell your business#exitplanning#exit plan#exit strategy

0 notes

Text

How ActionCOACH UK Helps You Sell Your Business with Confidence

When you decide to sell your business, preparation is key to securing a favorable deal. Selling a business is a significant decision, and for UK business owners, finding the right guidance is crucial. ActionCOACH UK, with over 200+ business growth specialists across the UK, offers unmatched business coaching, education, and mentoring. Their expertise helps you navigate the complexities of selling your business, ensuring you achieve the best possible outcome. Here's how ActionCOACH UK can support you through the process.

Preparing Your Business for Sale

ActionCOACH UK helps you evaluate the strengths and weaknesses of your business, ensuring it is in top condition before going to market. From financial documentation to operational systems, their coaches provide practical advice on making your business more attractive to potential buyers. By identifying areas for improvement, they help you enhance the overall value of your business, positioning it to attract high-quality offers.

Tailored Strategies for Finding the Right Buyer

Finding the right buyer is essential when you choose to sell your business. ActionCOACH UK’s tailored strategies are designed to match your business with potential buyers who align with your vision and goals. Their expert team offers insights into market trends, buyer behavior, and the competitive landscape to ensure you are well-informed throughout the process. With their support, you can confidently market your business to the right audience, maximizing your chances of securing a deal that benefits both parties.

Negotiating the Best Deal

Negotiation plays a critical role in ensuring you get the best value when you sell your business. ActionCOACH UK’s business specialists provide comprehensive coaching on how to navigate negotiations with potential buyers. They equip you with the tools needed to understand buyer offers, assess terms, and negotiate contracts that work in your favor. Whether it's pricing, payment structures, or post-sale transition terms, their expert guidance ensures you are positioned to make informed decisions and secure a favorable deal.

Post-Sale Planning and Transition Support

Successfully selling a business doesn’t end with signing the contract. ActionCOACH UK goes beyond the sale by offering post-sale planning and transition support. Whether you plan to move on to new ventures or stay involved in the business for a period, their coaches help you manage the transition smoothly. From managing relationships with the new owners to navigating the legal and financial aspects of the sale, they ensure your exit is as seamless as possible, allowing you to focus on your future endeavors.

Conclusion

For business owners looking to sell your business, ActionCOACH UK provides unmatched support throughout the entire process. With over 200+ business growth specialists, they offer tailored coaching, expert advice, and comprehensive strategies to prepare your business for sale, find the right buyer, negotiate favorable terms, and manage a smooth transition. By partnering with ActionCOACH UK, you can sell your business confidently and maximize its value, securing a successful outcome that aligns with your personal and financial goals.

0 notes

Text

How to Sell A Business

Ready to sell your business? Follow these steps to sell your businesses for maximum value. At Exit Advisor, we provide tailored guidance to ensure a smooth and successful sale. We will delve deeper into the steps involved in selling a business, including finding potential buyers, negotiating deals, and closing transactions. Visit: https://www.exitadvisor.io/how-to-sell-a-business/

1 note

·

View note

Photo

(via How To Exit A Business (Full Guide) - The Small Business Growth Blog)

0 notes

Text

Exploring Franchise Business Opportunities in New Zealand

For entrepreneurs in New Zealand looking to start a business or expand their portfolio, investing in a franchise offers a compelling opportunity. Franchises provide a proven business model, established brand recognition, and ongoing support from the franchisor, making them an attractive option for individuals interested in owning their own business. With a variety of franchise opportunities available across different industries, from food and beverage to retail and services, there is something to suit every interest and investment level.

One of the primary advantages of investing in a franchise business is the opportunity to leverage an established brand and business model. Franchises typically come with a well-known brand name, established customer base, and proven operating procedures, reducing the risk associated with starting a new venture from scratch. This can be particularly beneficial for first-time business owners who may lack experience or expertise in a particular industry.

In New Zealand, there is a wide range of franchise opportunities available for entrepreneurs looking to enter the market. From international brands looking to expand into the country to homegrown concepts with a strong local presence, there are franchises available in various sectors and investment levels. Whether it's a fast-food franchise, a retail outlet, or a service-based business, prospective franchisees have plenty of options to choose from based on their interests, skills, and financial resources.

Selling a business is another aspect of the franchise industry that deserves attention. For existing franchise owners looking to exit their business, selling their franchise can be a viable option. Many franchisors offer support and guidance to franchisees who are looking to sell, including assistance with valuation, marketing, and negotiations. This can make the process smoother and more streamlined, allowing franchise owners to transition out of their business with minimal disruption.

For individuals interested in purchasing an existing franchise, buying a franchise business for sale can be an attractive option. It allows prospective franchisees to step into a turnkey operation with an established customer base and revenue stream, potentially reducing the time and effort required to get the business up and running. Additionally, buying an existing franchise can provide access to valuable insights and support from the previous owner, helping new owners navigate the transition and ensure a smooth continuation of operations.

In conclusion, investing in a franchise business in New Zealand offers numerous advantages for entrepreneurs looking to enter the market or expand their business portfolio. With a wide range of franchise opportunities available across different industries and investment levels, there is something to suit every interest and budget. Whether it's starting a new franchise, selling an existing business, or purchasing a franchise for sale NZ, the franchise industry in New Zealand provides a wealth of opportunities for aspiring business owners.

0 notes

Text

You have devoted your time, money, and energy into building, running, and operating your business. It may well represent your life’s work.If you have already decided that now is the right time to sel.

0 notes

Text

Chapter 11: The Pair Came as a Matched Set

My conversation with Matt solidified the desire to grab hold of the reins of my destiny. Steve, the lecturer I spoke with in Phoenix two months prior, had opened the door for considera-tion, while Matt thrust it off its hinges. I finally believed I could get out of my practice, that the world would keep turning regardless of whether or not I stayed.

For the previous three years, I had heavily…

View On WordPress

0 notes

Text

In this article, we are going investigate the best ten ways to maintain a strategic distance from destroying a bargain when offering a trade.

0 notes

Text

Can I Sell My Business Before A Divorce

The divorce process can leave you feeling like you are in limbo, as you wait to see exactly what the result will be. Matters can become even more complicated when you are running your own business. So, can you sell your business before a divorce? Here, we look at some of the “pros” and “cons” of doing so.

Can I sell my business before a divorce?

The simple answer to this question is “yes” but bear in mind that if your partner finds out about the attempted sale, they may start divorce proceedings early and move for an injunction to block the sale.

If you see no alternative but to sell your business before a divorce, then you should think about several things before attempting a sale.

Things to consider before selling your business

The long-term effects of the decision

People naturally feel heightened emotions when a relationship breaks down. However, once divorce proceedings have been brought to a close, you may regret a rushed sale of your business. You might be able to look at the decision more objectively when the divorce is completed. Consider, for example, that selling your business takes away the chance for your children to take over your business, or for the business to grow and prosper.

Risk of sellers remorse

Your business might be in a slump at the time of a relationship breakdown, and you might be struggling to cope with running the business. The idea of capitalising a poorly-performing business is tempting. However, you never know when your luck might turn around. The next big idea could be around the corner, or a new trend might favour your industry. If your luck picks up then you can either carry on running the business or look to sell from a more beneficial position. By not allowing divorce to be a deciding factor in the sale of a business, you leave less room for seller’s remorse later on.

Timing of a sale

When selling a business, you need to know what the sale will mean for you. Speaking to financial and family lawyers, as well as an accountant, can be a great idea before starting the sale of your business. This is because the sale of a business can have tax implications.

The value of the business

The value of the business to you in practical terms might not be the same value that the court would attribute to the business. For example, if you have a share in a family business with your siblings, then the paper valuation of the business based on its turnover might not reflect the reality of the situation because you might be a minority shareholder or, if you are a majority shareholder, you might be subject to family pressures to not sell your shares, or sell them only to a particular person at a particular price.

You should be aware that if you sell your business for a particular value, then your partner may argue in divorce proceedings that the true value was in fact greater than what you sold it for.

A cleaner break for you and your partner

If you and your partner are joint owners of the business, then selling it before a divorce (to a third-party or to the other partner) could be sensible. It can be challenging if not practically impossible for divorced former partners to run a business after a divorce. Sharing a business can also complicate divorce proceedings. By selling the business and having clear figures from the sale, matrimonial assets can sometimes be more easily ascertained.

An opportunity for a fresh start

Selling a business is a big decision that is potentially life-changing. Perhaps you are tired of your industry and are looking for a change. Or maybe you want to retire. Divorce can be lengthy and complicated and, can “drag on”. By selling your business before the divorce, you will be able to make a clean break before the complications of divorce begin.

What is the court likely to make of it?

The powers of the Family Court on divorce are governed by the Matrimonial Causes Act 1973. Section 25 of the 1973 Act sets out the factors to be considered by the Family Court when making a financial order. The court will consider business assets as part of the section 25 exercise. For further information, see our article at: https://demstonechambers.co.uk/what-does-the-family-court-take-into-account-when-making-a-financial-order/

How a family lawyer can support you with the process

Selling a business is a big decision to make. Here at Demstone Chambers our team of expert family lawyers (who are family law barristers) will be able to provide legal advice regarding your business assets. To find out more about how we can help you with a divorce when you own a business, please contact us today.

1 note

·

View note

Text

Tim whom is still banned from caffeine went into looking into other ways to get caffeine.

He went into anonymous source from someone name KingTuck4ever who talk about a energy drink that kept him up for weeks during a critical time of his life and Tim was at this point of desperate to spend any time of money he got.

Later that night, he received 6 very large Dark green boxes with a DP logo on it filled with Lightening Green tall soda cans with the name Ecto-Spark!, ingredients tags on the back, made with organic vegan products, DO NOT NEAR MEAT RELATED PRODUCTS, guaranteed to keep you caffeine deprived souls awake and alive enough to enjoy a night afterlife party! Or your money back.

Tim at the point didn't read the back as he pop open the top, smelling a strong scent of caffeine, carbonated bubble and a taste of lemon lime mixed with a tang flavor that had his mouth drowning nearly in drool.

He took only one experimental sip, before his eyes widen instantly and immediately began chugging the soda can for all the liquid caffeine it had inside. This was 1000 times better then Death Coffee Cup from his favorite Cafe that he was still banned from.

It felt like his whole body got electrified with energy and feel like he can run a whole 4 week marathon without breaking a sweat. This drink was like tasting nirvana after a week of being in a Gobi desert for his fucking soul.

.....

.....

.....

Bruce can never know about this. He can't tell anyone about this drink. Not Damian, Not dick, not step, maybe Jason, but Cass can kept a secret since she knew body language. He might possibly go rogue and kill Bruce himself if Bruce tried to take this from him.

Meanwhile Tucker was amazed of the total amount of money he received from the anonymous Caffine obsessed ghost. Usually he ended up receiving old relics, Egyptian related artifacts, gold coins, etc but this is a first he got actually modern day money.

Poor dude must've been recently form a core to spend that much money. Good thing he had send extra since he know how crazy those caffine-obsessed ghosts can be over the new drink he made specifically for himself, Sam and Danny but it's nice to have extra cash for new tech making. Especially since Danny became high king of the ghost zone when he became 20 year old, and the amount of paper works that had been left for dust collecting could filled a planet to the very brim.

Took him, Sam, Danny, Ghost writer and Techno 5 months to fully turn at least 26% of sacrifical gifts from ritual, contracts, conquests, complains from territorial ghosts about humans taking their land/house/property/or about their murder, help hundreds of ghosts stuck in their personal hell of a limbo of their own death, guy name Constantine whom was rapidly becoming a pain in Tucker's ass especially when he got one contract form his former previous life about this guy.

#dpxdc#dc x dp#danny phantom#dp x dc#dp x dc crossover#dc x dp prompt#dcxdp#danny is the ghost king#tucker still have some memories and knowledge of his ruling as the pharoah#tucker sell ecto-made caffeine soda to Caffine-obsessed ghost for money#tucker is still liminals due to unfinished business from his pararoh life#he doesnt know why but he fucking hate Constantine#tim got his hand on caffeine soda that mostly ectoplasm and became feral obsessed over it like a starved cat caught with a fish in his mout#Tim lives and dies for caffeine#tim got a barely liminal core that just got fully charged into a full core#once he drank all the soda and have a full on crash to wake up half way in the floor to fully panic later#dead tired

2K notes

·

View notes

Text

9 Tips for Selling a Business in California

If you live in California and have considered selling your business, you may have a lot of questions. What do I need to complete before my business is ready to be sold? How much is my company worth? What should I focus on?

While selling a business can be complicated, a smooth transaction is possible with the right advice and planning. Here are 9 tips that will help you sell your business in California.

1. Determine why you want to sell your business.

Perhaps you’ve been considering selling your business for a while, so why now? What’s the driving force behind your readiness to hand over the reins of your company? There are ,many reasons why business owners sell, including:

Retirement

Relocating

Starting a new venture

Change in ownership

Your business is growing or slowing

Your prospective buyers will want to understand your motivation behind the sale. Articulating your reason will help you build credibility early in the evaluation process, so gaining clarity on this challenging question is critical.

2. Understand the value of your company.

Not only does a ,valuation help you to understand the full scope of your business, but it also helps you establish a listing price and financially plan for the sale. Many items are taken into consideration when determining the value of a business. These include:

Fundamental financial data such as balance sheets, tax returns, and cash flows.

Both tangible and intangible assets.

The geographic location of your business.

Current market conditions.

Your company’s potential for growth and expansion.

Your exit plan.

This process can seem cumbersome and confusing, so it’s best to visit with an experienced business broker. ,Click here to begin an assessment of the value.

3. Document all of your processes and procedures.

Potential buyers will be interested in how your business operates daily. Retaining detailed documentation of your operations and policies will show interested buyers that a smooth transition is possible. A few processes to ensure you’re documenting include:

Sales and marketing procedures

Daily operational processes

An employee handbook

Human Recourses documentation and practices

Showing interested buyers that the business can run smoothly without you is often a key selling point.

4. Review your financial records.

Before you start marketing the sale of your business, it's essential to have your financial records in order. Not only are these records ,fundamental documents you’ll need for the sale of your business, but they will also give interested buyers confidence that the numbers presented are accurate. When organizing your financial records, be sure you review the following:

The last three years of tax returns

A current balance sheet

An income statement

A cash flow statement

Providing accurate and comprehensive financial records will give potential buyers a better understanding of your business's financial health.

5. Focus on increasing sales.

One way to increase the value of your business and make it ,more appealing to buyers is to focus on boosting sales. This will show interested buyers that your business has growth potential and is a good investment. Here are a few ways to enhance sales:

Create a sales playbook and start delegating tasks to highlight a proven sales record independent of you, the owner.

Attract a diverse customer base ensuring revenue is generated from many different clients or customers and not from a small number of high-paying ones.

Establish streams of recurring revenue.

Upsell to current clients or customers.

Establish a Customer Relationship Management (CRM) tool if you don’t already have one.

Illustrating your business’s growth potential through increased sales will not only draw in more serious buyers but will also ensure you maximize your profits from the sale of your business.

6. Determine what will be included in the sale.

When selling your business, you'll need to decide what will be included in the sale. Your listing price may consist of both tangible and intangible items. Here are a few things to consider:

Inventory

Equipment

Real Estate

Intellectual property

Customer lists

Partnering with a ,successful team of advisors like a broker, attorney, CPA, and financial advisor can help you determine what needs to be included in the sale.

7. Interview business brokers.

Once you understand the value of your business and what selling it entails, you'll want to start interviewing business brokers. A ,broker can help you sell your business quickly and efficiently, maximizing your profits. They can also help you with the following:

Determining the value of your business.

Creating a marketing strategy for the sale of your company.

Maintaining high confidentiality as they seek to identify and connect with potential buyers.

Managing negotiations and providing due diligence before finalizing the sale.

We recommend working with a broker that belongs to the California Association of Business Brokers (CABB).

When searching for the ,right business broker to sell your business, be sure to ask about their experience selling businesses in your industry and in California specifically. Also, be sure who you partner with has your best interests in mind and understands the value of your company.

8. Get your business SBA approved.

SBA approval adds credibility to the health of your business. It's desirable to buyers who need to secure an ,SBA-guaranteed loan to purchase a business. If you’re working with a business broker, they can help you with this process, or you can work with an SBA-approved lender who may ask you for the following documents:

Past company tax returns

Profit and Loss Statements

Balance Sheets

Your W2

An asset list

Keep in mind that more documentation may be required, and there may also be other qualifications needed to ensure your buyer can acquire SBA funding.

9. Market your business and pre-qualify prospective buyers.

Once you've selected a broker, they will help you create ,effective marketing strategies that will attract buyers. A few ways to successfully promote the sale of your business include:

Create a buyer persona so you know who you’re listing is targeted to.

Contacting prospective buyers through cold outreach.

Determining how and where to advertise your listing.

Evaluating what other forms of advertising could be beneficial.

Remember that not all buyers will be qualified, so it's valuable to work with a broker with experience selling businesses in California to help you with this process.

If you're thinking about selling your California business, we can help. ,Contact us today for a consultation.

source https://www.sacramentobusinessbrokers.com/post/9-tips-for-selling-a-business-in-california

4 notes

·

View notes

Text

Rely on the Merger and Acquisition Specialist

Our customized marketing campaign is designed to showcase the value of your business to potential buyers and generate interest in your offering. We develop a "Deal Book" or "Selling Memorandum" which includes a comprehensive overview of your business and its financials, and use it to present your business to interested buyers.

#deal book#business sale#selling a business#Selling Memorandum#financial advisor#financial planning#financial planner

0 notes

Text

https://riselegal.com.au/successfully-selling-your-business/

0 notes

Text

suddenly got curious why people follow us, and also just in general why people follow each other. i know for me I usually follow my friends, whether we became friends on another platform (Discord, Ravelry, AO3, etc.) or because we became friends after interacting with each others' personal posts.

but yeah.

tell prev why you followed them (vote and tell um in the tags!), then reblog to find out in the tags why people follow you!

#polls#lmao I just realized I forgot something like#i like a product that they sell#or they're a business i want to support#shows where my head is right now

3K notes

·

View notes

Text

3 Optimal Scenarios To Sell A Government Contracting Firm When The Time Is Right

“FEDERAL NEWS NETWORK” By Mike Kapetanovic

“Factors to consider include the state of the market, the economic climate and the overall health of your business. If you’re a few years away from retirement, clear on your firm’s financial future and confident in your team, it could be a good time to look for…

View On WordPress

0 notes