#US Electric Vehicle Market Share

Text

United States Electric Vehicle Market will be US$ 391.03 Billion by 2030

Renub Research has released a report titled “United States Movie Market: Industry Trends, Share, Size, Growth, Opportunity, and Forecast 2024-2030,” which includes market percentage records and a thorough enterprise analysis. This report looks at the competition, geographic distribution, and growth potential of the United States Movie Market.

United States Movie Market is predicted to extend at…

View On WordPress

#united states electric vehicle market#united states electric vehicle market report#united states electric vehicle market share#united states electric vehicle market size#us electric vehicle market#us ev market

0 notes

Text

US Electric Vehicle Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the US Electric Vehicle Market and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, US Electric Vehicle Market scenario, and feasibility study are the important aspects analyzed in this report.

The US Electric Vehicle Market is experiencing robust growth driven by the expanding globally. The US Electric Vehicle Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. US Electric Vehicle Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. U.S. Electric Vehicle Market Size, Share & COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars, Commercial Vehicles) and Regional Forecast, 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/106396

Key Strategies

Key strategies in the US Electric Vehicle Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of US Electric Vehicle Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the US Electric Vehicle Market.

Major US Electric Vehicle Market Manufacturers covered in the market report include:

LIST OF KEY COMPANIES PROFILED:

BMW Group (Munich, Germany)

BYD Company Ltd. (Shenzhen, China)

Daimler AG (Stuttgart, Germany)

Ford Motor Company (Michigan, U.S.)

General Motors Company (Michigan, U.S.)

Nissan Motor Corporation (Kanagawa, Japan)

Tesla, Inc. (California, U.S.)

Toyota Motor Corporation (Toyota City, Japan)

Volkswagen AG (Wolfsburg, Germany)

Groupe Renault (Boulogne-Billancourt, France)

Favorable Government Subsidies & Strict Regulations on Vehicle Emissions to Augment Growth. Government policies offering attractive incentives for owning and operating electric vehicles will encourage EV sales by providing consumers with multiple advantages such as reduced prices, low registration fees, and free charging infrastructure. Additionally, various government bodies are levying import taxes, road taxes, and purchase taxes for importing measures to attract dominant players.

Trends Analysis

The US Electric Vehicle Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable US Electric Vehicle Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly US Electric Vehicle Market Solutions.

Regions Included in this US Electric Vehicle Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the US Electric Vehicle Market.

- Changing the US Electric Vehicle Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected US Electric Vehicle Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the US Electric Vehicle Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2024 to 2030?

► What are the key market dynamics influencing growth in the Global US Electric Vehicle Market?

► Who are the prominent players in the Global US Electric Vehicle Market?

► What is the consumer perspective in the Global US Electric Vehicle Market?

► What are the key demand-side and supply-side trends in the Global US Electric Vehicle Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global US Electric Vehicle Market?

Table Of Contents:

1 Market Overview

1.1 US Electric Vehicle Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

308, Supreme Headquarters,

Survey No. 36, Baner,

Pune-Bangalore Highway,

Pune - 411045, Maharashtra, India.

Phone:

US:+1 424 253 0390

UK: +44 2071 939123

APAC: +91 744 740 1245

#US Electric Vehicle Market#US Electric Vehicle Market Share#US Electric Vehicle Market Size#US Electric Vehicle Market Trends#US Electric Vehicle Market growth#US Electric Vehicle Market outlook

0 notes

Text

Tesla's Dieselgate

Elon Musk lies a lot. He lies about being a “utopian socialist.” He lies about being a “free speech absolutist.” He lies about which companies he founded:

https://www.businessinsider.com/tesla-cofounder-martin-eberhard-interview-history-elon-musk-ev-market-2023-2

He lies about being the “chief engineer” of those companies:

https://www.quora.com/Was-Elon-Musk-the-actual-engineer-behind-SpaceX-and-Tesla

He lies about really stupid stuff, like claiming that comsats that share the same spectrum will deliver steady broadband speeds as they add more users who each get a narrower slice of that spectrum:

https://www.eff.org/wp/case-fiber-home-today-why-fiber-superior-medium-21st-century-broadband

The fundamental laws of physics don’t care about this bullshit, but people do. The comsat lie convinced a bunch of people that pulling fiber to all our homes is literally impossible — as though the electrical and phone lines that come to our homes now were installed by an ancient, lost civilization. Pulling new cabling isn’t a mysterious art, like embalming pharaohs. We do it all the time. One of the poorest places in America installed universal fiber with a mule named “Ole Bub”:

https://www.newyorker.com/tech/annals-of-technology/the-one-traffic-light-town-with-some-of-the-fastest-internet-in-the-us

Previous tech barons had “reality distortion fields,” but Musk just blithely contradicts himself and pretends he isn’t doing so, like a budget Steve Jobs. There’s an entire site devoted to cataloging Musk’s public lies:

https://elonmusk.today/

But while Musk lacks the charm of earlier Silicon Valley grifters, he’s much better than they ever were at running a long con. For years, he’s been promising “full self driving…next year.”

https://pluralistic.net/2022/10/09/herbies-revenge/#100-billion-here-100-billion-there-pretty-soon-youre-talking-real-money

He’s hasn’t delivered, but he keeps claiming he has, making Teslas some of the deadliest cars on the road:

https://www.washingtonpost.com/technology/2023/06/10/tesla-autopilot-crashes-elon-musk/

Tesla is a giant shell-game masquerading as a car company. The important thing about Tesla isn’t its cars, it’s Tesla’s business arrangement, the Tesla-Financial Complex:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#Rat

Once you start unpacking Tesla’s balance sheets, you start to realize how much the company depends on government subsidies and tax-breaks, combined with selling carbon credits that make huge, planet-destroying SUVs possible, under the pretense that this is somehow good for the environment:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

But even with all those financial shenanigans, Tesla’s got an absurdly high valuation, soaring at times to 1600x its profitability:

https://pluralistic.net/2021/01/15/hoover-calling/#intangibles

That valuation represents a bet on Tesla’s ability to extract ever-higher rents from its customers. Take Tesla’s batteries: you pay for the battery when you buy your car, but you don’t own that battery. You have to rent the right to use its full capacity, with Tesla reserving the right to reduce how far you go on a charge based on your willingness to pay:

https://memex.craphound.com/2017/09/10/teslas-demon-haunted-cars-in-irmas-path-get-a-temporary-battery-life-boost/

That’s just one of the many rent-a-features that Tesla drivers have to shell out for. You don’t own your car at all: when you sell it as a used vehicle, Tesla strips out these features you paid for and makes the next driver pay again, reducing the value of your used car and transfering it to Tesla’s shareholders:

https://www.theverge.com/2020/2/6/21127243/tesla-model-s-autopilot-disabled-remotely-used-car-update

To maintain this rent-extraction racket, Tesla uses DRM that makes it a felony to alter your own car’s software without Tesla’s permission. This is the root of all autoenshittification:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

This is technofeudalism. Whereas capitalists seek profits (income from selling things), feudalists seek rents (income from owning the things other people use). If Telsa were a capitalist enterprise, then entrepreneurs could enter the market and sell mods that let you unlock the functionality in your own car:

https://pluralistic.net/2020/06/11/1-in-3/#boost-50

But because Tesla is a feudal enterprise, capitalists must first secure permission from the fief, Elon Musk, who decides which companies are allowed to compete with him, and how.

Once a company owns the right to decide which software you can run, there’s no limit to the ways it can extract rent from you. Blocking you from changing your device’s software lets a company run overt scams on you. For example, they can block you from getting your car independently repaired with third-party parts.

But they can also screw you in sneaky ways. Once a device has DRM on it, Section 1201 of the DMCA makes it a felony to bypass that DRM, even for legitimate purposes. That means that your DRM-locked device can spy on you, and because no one is allowed to explore how that surveillance works, the manufacturer can be incredibly sloppy with all the personal info they gather:

https://www.cnbc.com/2019/03/29/tesla-model-3-keeps-data-like-crash-videos-location-phone-contacts.html

All kinds of hidden anti-features can lurk in your DRM-locked car, protected from discovery, analysis and criticism by the illegality of bypassing the DRM. For example, Teslas have a hidden feature that lets them lock out their owners and summon a repo man to drive them away if you have a dispute about a late payment:

https://tiremeetsroad.com/2021/03/18/tesla-allegedly-remotely-unlocks-model-3-owners-car-uses-smart-summon-to-help-repo-agent/

DRM is a gun on the mantlepiece in Act I, and by Act III, it goes off, revealing some kind of ugly and often dangerous scam. Remember Dieselgate? Volkswagen created a line of demon-haunted cars: if they thought they were being scrutinized (by regulators measuring their emissions), they switched into a mode that traded performance for low emissions. But when they believed themselves to be unobserved, they reversed this, emitting deadly levels of NOX but delivering superior mileage.

The conversion of the VW diesel fleet into mobile gas-chambers wouldn’t have been possible without DRM. DRM adds a layer of serious criminal jeopardy to anyone attempting to reverse-engineer and study any device, from a phone to a car. DRM let Apple claim to be a champion of its users’ privacy even as it spied on them from asshole to appetite:

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

Now, Tesla is having its own Dieselgate scandal. A stunning investigation by Steve Stecklow and Norihiko Shirouzu for Reuters reveals how Tesla was able to create its own demon-haunted car, which systematically deceived drivers about its driving range, and the increasingly desperate measures the company turned to as customers discovered the ruse:

https://www.reuters.com/investigates/special-report/tesla-batteries-range/

The root of the deception is very simple: Tesla mis-sells its cars by falsely claiming ranges that those cars can’t attain. Every person who ever bought a Tesla was defrauded.

But this fraud would be easy to detect. If you bought a Tesla rated for 353 miles on a charge, but the dashboard range predictor told you that your fully charged car could only go 150 miles, you’d immediately figure something was up. So your Telsa tells another lie: the range predictor tells you that you can go 353 miles.

But again, if the car continued to tell you it has 203 miles of range when it was about to run out of charge, you’d figure something was up pretty quick — like, the first time your car ran out of battery while the dashboard cheerily informed you that you had 203 miles of range left.

So Teslas tell a third lie: when the battery charge reached about 50%, the fake range is replaced with the real one. That way, drivers aren’t getting mass-stranded by the roadside, and the scam can continue.

But there’s a new problem: drivers whose cars are rated for 353 miles but can’t go anything like that far on a full charge naturally assume that something is wrong with their cars, so they start calling Tesla service and asking to have the car checked over.

This creates a problem for Tesla: those service calls can cost the company $1,000, and of course, there’s nothing wrong with the car. It’s performing exactly as designed. So Tesla created its boldest fraud yet: a boiler-room full of anti-salespeople charged with convincing people that their cars weren’t broken.

This new unit — the “diversion team” — was headquartered in a Nevada satellite office, which was equipped with a metal xylophone that would be rung in triumph every time a Tesla owner was successfully conned into thinking that their car wasn’t defrauding them.

When a Tesla owner called this boiler room, the diverter would run remote diagnostics on their car, then pronounce it fine, and chide the driver for having energy-hungry driving habits (shades of Steve Jobs’s “You’re holding it wrong”):

https://www.wired.com/2010/06/iphone-4-holding-it-wrong/

The drivers who called the Diversion Team weren’t just lied to, they were also punished. The Tesla app was silently altered so that anyone who filed a complaint about their car’s range was no longer able to book a service appointment for any reason. If their car malfunctioned, they’d have to request a callback, which could take several days.

Meanwhile, the diverters on the diversion team were instructed not to inform drivers if the remote diagnostics they performed detected any other defects in the cars.

The diversion team had a 750 complaint/week quota: to juke this stat, diverters would close the case for any driver who failed to answer the phone when they were eventually called back. The center received 2,000+ calls every week. Diverters were ordered to keep calls to five minutes or less.

Eventually, diverters were ordered to cease performing any remote diagnostics on drivers’ cars: a source told Reuters that “Thousands of customers were told there is nothing wrong with their car” without any diagnostics being performed.

Predicting EV range is an inexact science as many factors can affect battery life, notably whether a journey is uphill or downhill. Every EV automaker has to come up with a figure that represents some kind of best guess under a mix of conditions. But while other manufacturers err on the side of caution, Tesla has the most inaccurate mileage estimates in the industry, double the industry average.

Other countries’ regulators have taken note. In Korea, Tesla was fined millions and Elon Musk was personally required to state that he had deceived Tesla buyers. The Korean regulator found that the true range of Teslas under normal winter conditions was less than half of the claimed range.

Now, many companies have been run by malignant narcissists who lied compulsively — think of Thomas Edison, archnemesis of Nikola Tesla himself. The difference here isn’t merely that Musk is a deeply unfit monster of a human being — but rather, that DRM allows him to defraud his customers behind a state-enforced opaque veil. The digital computers at the heart of a Tesla aren’t just demons haunting the car, changing its performance based on whether it believes it is being observed — they also allow Musk to invoke the power of the US government to felonize anyone who tries to peer into the black box where he commits his frauds.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/28/edison-not-tesla/#demon-haunted-world

This Sunday (July 30) at 1530h, I’m appearing on a panel at Midsummer Scream in Long Beach, CA, to discuss the wonderful, award-winning “Ghost Post” Haunted Mansion project I worked on for Disney Imagineering.

Image ID [A scene out of an 11th century tome on demon-summoning called 'Compendium rarissimum totius Artis Magicae sistematisatae per celeberrimos Artis hujus Magistros. Anno 1057. Noli me tangere.' It depicts a demon tormenting two unlucky would-be demon-summoners who have dug up a grave in a graveyard. One summoner is held aloft by his hair, screaming; the other screams from inside the grave he is digging up. The scene has been altered to remove the demon's prominent, urinating penis, to add in a Tesla supercharger, and a red Tesla Model S nosing into the scene.]

Image:

Steve Jurvetson (modified)

https://commons.wikimedia.org/wiki/File:Tesla_Model_S_Indoors.jpg

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/deed.en

#pluralistic#steve stecklow#autoenshittification#norihiko shirouzu#reuters#you're holding it wrong#r2r#right to repair#range rage#range anxiety#grifters#demon-haunted world#drm#tpms#1201#dmca 1201#tesla#evs#electric vehicles#ftc act section 5#unfair and deceptive practices#automotive#enshittification#elon musk

8K notes

·

View notes

Link

0 notes

Text

China is upping the critical minerals stakes by curbing exports of graphite, a key raw material in electric vehicle batteries.

The West can’t say it wasn’t warned.

When China announced restrictions on exports of gallium and germanium in July, former Vice Commerce Minister Wei Jianguo was quoted in the China Daily as saying it was “just the start” if the West continued to target China’s high-technology sector.

Restricting the flow of two metals used in the manufacture of silicon chips was “a well-thought-out heavy punch” in reaction to the U.S. Chips Act, Wei said.

The Biden administration has since tightened restrictions on the flow of advanced artificial intelligence chips to China, announcing on Friday a new raft of measures aimed at closing previous loopholes.

China is responding in kind, this time taking aim at the West’s electric vehicle (EV) ambitions.

There is much potential for further escalation in this unfolding critical minerals battle between China and the West.[...]

Graphite has slipped under the radar in the broader critical raw materials debate. China’s control of other battery inputs such as cobalt, nickel and lithium has grabbed the headlines.

Those are all used to make the battery cathode. It won’t work, however, without an anode, which is invariably made of graphite.

Indeed, graphite is the largest EV battery component by weight, typically accounting for between 50 and 100 kg.

China is the dominant player in the global supply of both natural graphite and synthetic graphite, which has been taking an increasing share of the market.

The country accounts for around two-thirds [!!] of all natural graphite production and, according to consultancy Benchmark Minerals, supplies around 98% [!!!!!] of the world’s synthetic graphite anodes.

23 Oct 23

33 notes

·

View notes

Text

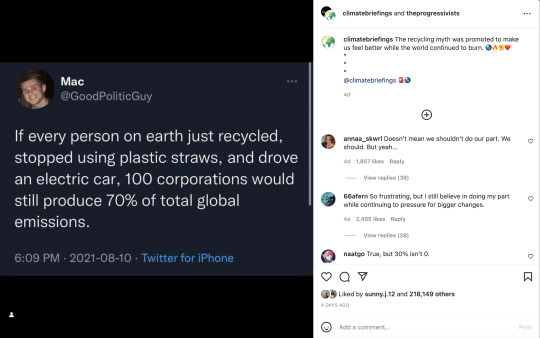

A specific piece of misinformation I'm responding to is the one originating from this headline:

(x)

spawning responses like

(x) which is... not entirely wrong

and

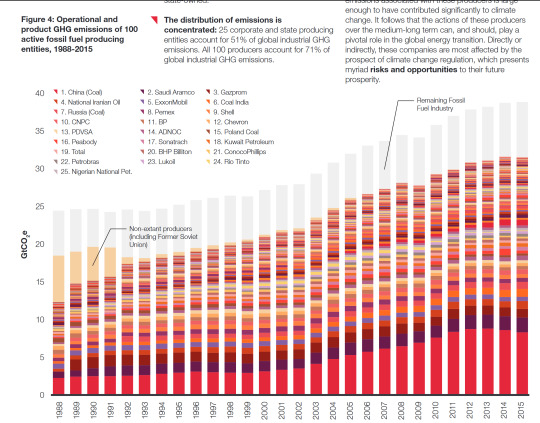

which is completely misunderstanding the original study - the Carbon Majors Database, CDP Carbon Majors Report 2017.

What this report absolutely does not say is "100 companies burn enough fossil fuels to produce 70% of emissions per year." It says something more like "70% of emissions since the 1988 can be traced back to extraction of fossil fuels by 100 producers." Those 100 producers include 36 state-owned companies, 7 state-owned producers, 41 public companies, and 16 private companies.

It also says that over half of industrial emissions since 1988 can be traced to just 25 producers. Of those 635 gigatons of emitted CO2, 59% come from state-owned producers, 32% from public companies, and 9% from private companies.

The largest shares here at the bottom of the graph are all state-owned producers: an aggregate of Chinese state-owned coal producers, Saudi Aramco (owned by the Saudi Arabian state), Gazprom (a Russian company with majority ownership by the state and partial public ownership), National Iranian Oil (unsurprisingly, nationally owned), and then finally we get to the first non-state-owned company (ExxonMobil).

The fraction is nearly identical for values for yearly emissions in 2015 - 59% of emissions since 1988 are tied to extraction by state-owned producers. Nonetheless:

"Emissions from investor-owned companies are significant: of the 30.6 GtCO2e of operational and product GHG emissions from 224 fossil fuel extraction companies, 30% is public investor-owned, 11% is private investor-owned, and 59% is state-owned."

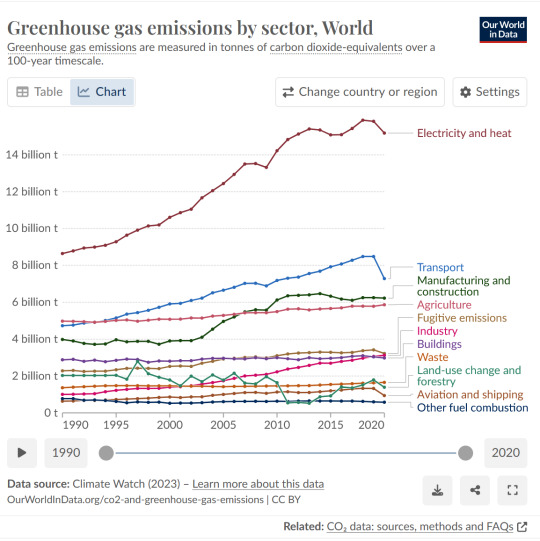

There is absolutely immense responsibility on producers for extracting, marketing, and selling fossil fuels, and for (in several notable cases) deliberately covering up anthropogenic climate change as an outcome of fossil fuel use. But that extraction doesn't occur in a vacuum - fuels are extracted and burned for heat, for electricity, for transport, for industry.

The tweet about nothing changing if people didn't drive and used plastic straws is exactly wrong: fossil fuels are valuable to extract because they're used for everything around us. In the US, transportation accounts for ~29% of greenhouse gas emissions, and 57% of that is from personal vehicles. In 2016, the average passenger car fuel efficiency in the US was 22.1 miles per gallon; an electric car can easily get > 100 miles-per-gallon-equivalent, some as high as 142 miles-per-gallon-equivalent. Magically substituting all gas cars in the US alone for electric would slash nationwide emissions by 13 percentage points even if all those vehicles were powered by electricity made from fossil fuels! (Clearly there are a lot of gross assumptions and approximations there.) (Also, yes, magic wand car swaps aren't a thing we can do in real life, but it's what the tweet said, so I wanted to toss it in there.)

Like, there's a lot of complexity to global emissions - who's responsible, what levers we have to move things in a better direction, what any individual can or can't do. But this specific piece of misinformation or at least misrepresentation really ought to be excised from the record.

#climate change#discourse#global warming#long post#effortpost#slightly more coherent version of the thing I was trying to poke at earlier

12 notes

·

View notes

Text

10 Easy Ways to Start Your Sustainable Journey Today

Introduction:

Embarking on a sustainable journey doesn't require a complete overhaul of your lifestyle. In fact, small, mindful steps can lead to significant positive changes for both you and the environment. If you're new to sustainability or looking for simple ways to make a difference, you're in the right place. In this post, we'll explore ten easy steps you can take right now to kickstart your sustainable living journey.

1. Reduce, Reuse, Recycle:

The classic mantra holds true. Start by properly recycling items like paper, glass, and plastics. Before tossing something out, consider if it can be repurposed or upcycled. Reducing waste begins with conscious choices.

2. Conserve Energy:

Switch off lights and unplug devices when not in use. Opt for energy-efficient LED bulbs and appliances. Even adjusting your thermostat by a degree or two can make a difference.

3. Ditch Single-Use Plastics:

Invest in reusable shopping bags, water bottles, and coffee cups. Say goodbye to disposable utensils and straws. These small changes can significantly reduce plastic waste.

4. Choose Sustainable Transportation:

Whenever possible, opt for walking, biking, or using public transportation. Consider carpooling or investing in an electric or hybrid vehicle if it aligns with your needs.

5. Support Local and Sustainable Food:

Frequent local farmers' markets, and choose seasonal, locally sourced produce. Reducing food miles and supporting sustainable farming practices benefit both you and the planet.

6. Unplug and Disconnect:

Set aside tech-free time to reduce screen time and energy consumption. Encourage family or friends to join you in reconnecting with nature and each other.

7. Practice Mindful Consumption:

Before making a purchase, ask yourself if it's a necessity. Invest in high-quality, durable items that will last. Choose brands with a commitment to sustainability.

8. Compost Your Kitchen Waste:

Turn food scraps and yard waste into nutrient-rich compost for your garden. It's a fantastic way to reduce landfill waste and enrich your soil naturally.

9. Educate Yourself and Others:

Stay informed about environmental issues and solutions. Share your knowledge with friends and family to inspire collective action.

10. Get Involved Locally:

Engage with local environmental groups and community initiatives. Participate in clean-up events, tree planting, or sustainability workshops. Your active involvement can create positive change at the grassroots level.

Conclusion:

Remember, sustainability is a journey, not a destination. Each step you take, no matter how small, contributes to a brighter, greener future. So, start today, and together, we can make a meaningful impact. Stay tuned for more insights and tips on sustainable living from GreenLife Insights!

#sustainability#greenliving#eco friendly#Environmental Conservation#reduce#reuseandrecycle#energy conservation#mindful consumption

30 notes

·

View notes

Text

Description of product/service offering; define value proposition; define competitive differentiation of RideBoom

RideBoom is a transportation service that aims to provide convenient and reliable rides for customers. Our product/service offering revolves around connecting riders with professional drivers through a user-friendly mobile app. Whether you need a ride to work, the airport, or any other destination, RideBoom strives to make your transportation experience seamless and efficient.

Value proposition:

Our value proposition lies in the following key aspects:

Convenience: RideBoom offers a simple and intuitive mobile app that allows users to request rides with just a few taps on their smartphones. With our extensive network of drivers, we strive to provide quick pick-ups and drop-offs, reducing wait times and ensuring you reach your destination on time.

Reliability: We prioritize reliability by thoroughly vetting and training our drivers to ensure they meet our high standards. Our drivers are professional, courteous, and committed to passenger safety. Additionally, our advanced technology enables real-time tracking of rides, providing transparency and peace of mind to our customers.

Affordability: RideBoom offers competitive pricing, providing cost-effective transportation options for riders. With transparent fare structures and no hidden charges, we aim to deliver value for money.

Safety: Safety is a top priority at RideBoom. We employ rigorous driver screening processes, including background checks and vehicle inspections, to ensure passenger security. Furthermore, our app features emergency assistance buttons and the ability to share ride details with trusted contacts, enhancing user safety.

Competitive differentiation:

RideBoom stands out from competitors through several competitive differentiators:

Diverse Vehicle Options: We offer a range of vehicle categories to suit different customer preferences and needs. From standard sedans to luxury cars and larger vehicles for group travel, RideBoom provides a variety of options to accommodate diverse passenger requirements.

Exceptional Customer Support: We pride ourselves on delivering excellent customer service. Our dedicated support team is available 24/7 to address any concerns or inquiries. We aim to resolve customer issues promptly and ensure a positive experience throughout the ride.

Focus on Sustainability: RideBoom is committed to environmental sustainability. We are actively working towards incorporating electric and hybrid vehicles into our fleet and exploring other eco-friendly initiatives. By providing greener transportation options, we strive to contribute to a cleaner and more sustainable future.

Seamless Integration: Our app integrates smoothly with popular third-party services and platforms, such as payment gateways and mapping systems. This integration enhances user convenience and provides a seamless experience when using RideBoom alongside other applications.

Overall, RideBoom aims to provide a reliable, convenient, and affordable transportation service that prioritizes customer satisfaction, safety, and sustainability, setting us apart from our competitors in the market.

#biketaxi#uber#rideboom taxi app#ola#uber driver#ola cabs#delhi rideboom#rideboom app#rideboom#uber taxi

8 notes

·

View notes

Text

As Russia ramps up its second offensive, a debate has erupted over whether Moscow or Kyiv will have the upper hand in 2023. While important, such discourse also misses a larger point related to the conflict’s longer-term consequences. In the long run, the true loser of the war is already clear; Russian President Vladimir Putin’s invasion of Ukraine will be remembered as a historic folly that left Russia economically, demographically, and geopolitically worse off.

Start with the lynchpin of Russia’s economy: energy. In contrast to Europe’s (very real) dependence on Russia for fossil fuels, Russia’s economic dependence on Europe has largely gone unremarked upon. As late as 2021, for example, Russia exported 32 percent of its coal, 49 percent of its oil, and a staggering 74 percent of its gas to OECD Europe alone. Add in Japan, South Korea, and non-OECD European countries that have joined Western sanctions against Russia, and the figure is even higher. A trickle of Russian energy continues to flow into Europe, but as the European Union makes good on its commitment to phase out Russian oil and gas, Moscow may soon find itself shut out of its most lucrative export market.

In a petrostate like Russia that derives 45 percent of its federal budget from fossil fuels, the impact of this market isolation is hard to overstate. Oil and coal exports are fungible, and Moscow has indeed been able to redirect them to countries such as India and China (albeit at discounted rates, higher costs, and lower profits). Gas, however, is much harder to reroute because of the infrastructure needed to transport it. With its $400 billion gas pipeline to China, Russia has managed some progress on this front, but it will take years to match current capacity to the EU. In any case, China’s leverage as a single buyer makes it a poor substitute for Europe, where Russia can bid countries against one another.

This market isolation, however, would be survivable were it not for the gravest unintended consequence of Russia’s war—an accelerated transition toward decarbonization. It took a gross violation of international law, but Putin managed to convince Western leaders to finally treat independence from fossil fuels as a national security issue and not just an environmental one.

This is best seen in Europe’s turbocharged transition toward renewable energy, where permitting processes that used to take years are being pushed up. A few months after the invasion, for example, Germany jump-started construction on what will soon be Europe’s largest solar plant. Around the same time, Britain accelerated progress on Hornsea 3, slated to become the world’s largest offshore wind farm upon completion. The results already speak for themselves; for the first time ever last year, wind and solar combined for a higher share of electrical generation in Europe than oil and gas. And this says nothing of other decarbonization efforts such as subsidies for heat pumps in the EU, incentives for clean energy in the United States, and higher electric vehicle uptake everywhere.

The cumulative effect for Russia could not be worse. Sooner or later, lower demand for fossil fuels will dramatically and permanently lower the price for oil and gas—an existential threat to Russia’s economy. When increased U.S. shale production depressed oil prices in 2014, for example, Russia experienced a financial crisis. Lower global demand for fossil fuels will play out over a longer timeline, but the result for Russia will be much graver. With its invasion, Russia hastened the arrival of an energy transition that promises to unravel its economy.

Beyond a smaller and less efficient economy, Putin’s war in Ukraine will also leave Russia with a smaller and less dynamic population. Russia’s demographic problems are well-documented, and Putin had intended to start reversing the country’s long-running population decline in 2022. In a morbid twist, the year is likelier to mark the start of its irrevocable fall. The confluence of COVID and an inverted demographic pyramid already made Russia’s demographic outlook dire. The addition of war has made it catastrophic.

To understand why, it’s important to understand the demographic scar left by the 1990s. In the chaos that followed the Soviet Union’s dissolution, Russia’s birthrate plunged to 1.2 children per woman, far below the 2.1 needed for a population to remain stable. The effects can still be seen today; while there are 12 million Russians aged 30-34 (born just before the breakup of the Soviet Union), there are just 7 million aged 20-24 (born during the chaos that followed it). That deficit meant Russia’s population was already poised to fall, simply because a smaller number of people would be able to have children in the first place.

Russia’s invasion has made this bad demographic hand cataclysmic. At least 120,000 Russian soldiers have died so far—many in their 20s and from the same small generation Russia can scarcely afford to lose. Many more have emigrated, if they can, or simply fled to other countries to try to wait out the war; exact numbers are hard to calculate, but the 32,000 Russians who have immigrated to Israel alone suggest the total number approaches a million.

Disastrously, the planning horizons of Russian families have been upended; it is projected that fewer than 1.2 million Russian babies may be born next year, , which would leave Russia with its lowest birthrate since 2000. A spike in violent crime, a rise in alcohol consumption, and other factors that collude against a family’s decision to have children may depress the birthrate further still. Ironically, over the last decade Putin managed to slow (if not reverse) Russia’s population decline through lavish payoffs for new mothers. Increased military spending and the debt needed to finance it will make such generous natalist policies harder.

The invasion has left Russia even worse off geopolitically. Unlike hard numbers and demographic data, such lost influence is hard to measure. But it can be seen everywhere, from public opinion polls across the West to United Nations votes that the Kremlin has lost by margins as high as 141 to 5. It can also be seen in Russia’s own backyard; while an emboldened NATO could soon include Sweden and Finland, Russia’s own Collective Security Treaty Organization is tearing at the seams as traditional allies such as Kazakhstan and Armenia realize the Kremlin’s impotence and look to China for security.

Perhaps most important of all, Russia has reinvigorated the cause of liberal democracy. In the year after its invasion, French President Emmanuel Macron won a rare second term in France, the far-right AfD lost ground in three successive elections in Germany, and “Make America Great Again” Republicans paid an electoral penalty in the U.S. midterms. (The far right did sweep into power in both Sweden and Italy, but such wins have so far failed to dent Western unity and appear more motivated by immigration.) And this says nothing of the wave of democratic consolidation playing out across Eastern Europe, where voters have thrown out illiberal populists in Slovenia and Czechia in the last year alone. It is impossible to attribute any of these outcomes to just one factor (U.S. Democrats also got a boost from the overturn of Roe v. Wade and election denialism, for example), but Russia’s invasion—and the clear choice between liberalism and autocracy it presented—no doubt helped.

Nowhere, however, has Russia’s invasion backfired more than in Ukraine. Contrary to Putin’s historical revisionism, Ukraine has long had a national identity distinct from Russia’s. But it’s also long been fractured along linguistic lines, with many of its elites intent on maintaining close relations with the Kremlin and even the public unsure about greater alignment with the West.

No longer. Ninety-one percent of Ukrainians now favor joining NATO, a figure unthinkable just a decade ago. Eighty-five percent of Ukrainians consider themselves Ukrainian above all else, a marker of civic identity that has grown by double digits since Russia’s invasion. Far from protecting the Russian language in Ukraine, Putin appears to have hastened its demise as native Russian speakers (Ukrainian President Volodymyr Zelensky included) switch to Ukrainian en masse. Putin launched his invasion to bring Ukraine back into Moscow’s orbit. He has instead anchored its future in the West.

Of course, one can argue that, however much the war has cost Russia, it has cost Ukraine exponentially more. This is true. Ukraine’s economy shrank by more than 30 percent last year, while Russia’s economy contracted by just about 3 percent. And this says nothing of the human toll Ukraine has suffered. But, like Brexit, Western sanctions on Russia will play out as a slow burn, not an immediate collapse. And while Russia enters a protracted period of economic and demographic decline, once peace comes, Ukraine will have the combined industrial capacity of the EU, United States, and United Kingdom to support it as the West’s newest institutional member—precisely the outcome Putin hoped to avoid. Russia may yet make new territorial gains in the Donbas. But in the long run, such gains are immaterial—Russia has already lost.

48 notes

·

View notes

Text

Comparison ETPs and ETFs

Exchange-traded products (ETPs) and exchange-traded funds (ETFs) are both important components of a diversified investment portfolio. This guide explores the differences, structures, and roles of ETPs and ETFs in various investment strategies.

Key Insights:

Insights include the unique features of ETPs and ETFs in terms of regulation, liquidity, and structure. While ETFs offer intraday liquidity, trading flexibility, and lower costs compared to other ETPs, each type caters to different asset classes with specific risks and structures. Additionally, ETFs provide superior diversification and investor protections as they are regulated under the Investment Company Act of 1940. When choosing between ETPs and ETFs, factors such as cost, risk tolerance, and desired market exposure should be considered. Lower-risk strategies often prefer ETFs for their lower costs while higher-risk strategies may utilize certain ETPs like leveraged or inverse products.

After previously rejecting them under former Chair Jay Clayton, the U.S. Securities and Exchange Commission (SEC) has now given its approval for the listing and trading of various spot bitcoin exchange-traded product (ETP) shares. The decision has been influenced by recent legal developments and changing circumstances, and is focused specifically on ETPs that hold bitcoin rather than a wider range of crypto assets. The SEC has emphasized the need for complete transparency, investor safeguards, and regulation when it comes to these products. However, the regulatory body has also cautioned that bitcoin is a highly speculative and volatile asset, and has advised investors to exercise caution.

Understanding ETPs and ETFs:

ETPs (Exchange-Traded Products):

Investment funds traded on stock exchanges.

Track underlying indices, commodities, or assets.

Offer trading convenience and access to diverse asset classes.

ETFs (Exchange-Traded Funds):

Diversified portfolios reflecting underlying indices.

Traded like stocks on an exchange with intraday liquidity.

Combine features of stocks and mutual funds.

ETPs Overview: ETPs encompass a variety of investment products, including ETFs, ETNs, ETMFs, and ETCs. Each category tailors its structure to different assets, providing a convenient tool for portfolio diversification.

Traditional Giants Embrace Bitcoin:

The propulsion of Bitcoin Adoption reached new heights when major giants joined the fray. Esteemed companies like Tesla, Overstock, and Microsoft have embraced Bitcoin as a viable payment option, marking a pivotal moment in mainstream acceptance. These household names not only validate the legitimacy of cryptocurrency but also serve as trailblazers, inspiring smaller businesses to explore the advantages of integrating Bitcoin into their payment methods. Basically in the year 2021, Tesla made waves by announcing that customers could purchase their electric vehicles using Bitcoin. Beyond introducing a novel purchasing avenue, this decision sparked conversations about the prospective role of cryptocurrencies within the automotive industry. Similar strategic moves by other influential companies have collectively contributed to the narrative that Bitcoin is transitioning into a recognized and widely accepted form of payment.

This evolution underscores Bitcoin's journey from being perceived solely as an investment opportunity to emerging as a practical and legitimate means of transaction in today's dynamic business landscape.

ETFs Unveiled:

Hold diversified portfolios of investments.

Traded on exchanges, mirroring underlying indices.

Include various investments like stocks, commodities, bonds, or crypto.

Offer intraday liquidity and real-time pricing.

ETPs vs. ETFs: ETPs and ETFs, while both traded on exchanges, differ in structure, regulation, and trading characteristics. ETFs, subject to stringent oversight, often exhibit superior liquidity and narrower bid-ask spreads compared to ETPs.

Structure and Regulation: ETFs, registered and regulated by the SEC under the Investment Company Act of 1940, adhere to strict oversight. Other ETPs, like ETNs, may lack board oversight, presenting a less rigorous regulatory framework.

Trading and Liquidity: ETFs generally boast higher liquidity and narrower bid-ask spreads than ETPs. The popularity, trading volume, and underlying securities influence the bid-ask spread, making ETFs more appealing for their trading flexibility.

Diversification and Risk Management: Both ETPs and ETFs offer diversification, but the extent depends on the specific product. ETFs, with broad underlying assets, usually provide extensive diversification. However, risks arise, particularly with leveraged or inverse ETFs impacting tax efficiency.

Types of ETPs and ETFs: Passive and active management options cater to diverse investment strategies. Passive ETFs replicate index performance, offering cost-effectiveness, while active ETFs aim to outperform by adjusting portfolios based on market conditions.

Sector and Industry Focus: ETFs and ETPs enable targeted investments in sectors or industries. Sector ETFs cover broader categories, while industry ETFs concentrate on specific industries within sectors, allowing focused exposure.

Leveraged and Inverse Products: Leveraged ETPs amplify underlying index performance using financial derivatives, presenting higher returns and risks. Inverse ETPs aim for returns inversely correlated to specific benchmarks, suitable for sophisticated investors.

Costs and Fees: Expense ratios, covering operating costs, vary between ETPs and ETFs. ETFs generally incur lower fees, with expense ratios around 0.16% for index ETFs. Consideration of brokerage commissions and transparent/hidden fees is crucial for cost-effective investing.

Choosing Between ETPs and ETFs: Deciding between ETPs and ETFs hinges on investment goals, risk tolerance, and exposure preferences. ETFs suit lower risk appetites, providing diversified options, while certain ETPs, like leveraged products, cater to investors comfortable with higher risk levels.

Advantages and Disadvantages: ETFs, as a subset of ETPs, offer benefits such as diversification, liquidity, and tax efficiency. Other ETPs, like ETNs or ETCs, present different cost structures and risks. Understanding their advantages and disadvantages aids in informed decision-making.

Real-Life Examples: Examples like SPDR® S&P 500® ETF Trust (SPY) and Bitcoin spot ETFs illustrate the diversity and innovation within ETPs and ETFs, showcasing varied investment options in the market. Moreover, Investors can now gain exposure to the world's largest cryptocurrency, Bitcoin, through recently approved spot ETFs. These cutting-edge ETFs showcase the extensive array of investment opportunities in the realm of ETPs and ETFs.

Potential Risks and Rewards: ETPs and ETFs carry market risks, influenced by volatility, socioeconomic factors, and geopolitical risks. Understanding the inherent risks and potential rewards, including attractive returns from ETNs tied to underlying indices, is vital for investors.

In Conclusion:

Both ETPs and ETFs contribute to effective portfolio diversification, each with unique characteristics. While ETFs are favored for liquidity and low-cost options, a broader spectrum of ETPs caters to specific investment needs. Choosing between them necessitates aligning with overall investment strategies.

3 notes

·

View notes

Text

Introduction to nascent AI usage

From 2024 to 2035, the world of technology and AI has progressed quickly, at rates like never seen before. In recent years, China has emerged as a powerhouse in the AI field, investing heavily in quantum computing and network research. These technologies have enhanced machine learning capabilities, driving breakthroughs in complex problem-solving and pattern recognition. By 2028, they had implemented AI-driven governance systems to optimise public services, decision-making and urban planning.

The United States has also made significant progress in AI ethics and regulations, establishing a comprehensive framework to govern the responsible use of AI in various sectors. Its comprehensive usage of AI has then allowed the United States to remain as one of the AI powerhouse. elaborate more on US like you did for China, what specific fields of AI have they helped in

The European Union led the way with integration of AI in financial markets, utilising advanced learning algorithms for real-time risk assessment and market predictions, allowing their market share to grow more quickly than ever before. By leveraging on AI technologies, the EU has experienced exponential economic growth, while remaining aware of the potential threats of AI usages.

Other countries have also quickly made transitions, integrating the usage of AI in their daily lives. Utilisation of AI in militarisation has been prevalent in this day and age, with Israel at the forefront of this technology. Due to the steadfast advancement in technology for AI, It is now more powerful, efficient and deadlier than ever before. There has also been a heavy integration of AI in daily lives to solve socio-economic problems by Japan, implementing AI-driven healthcare systems that revolutionised patient care and diagnostics.

Globally, countries have been encouraged to embrace AI in environmental conservation, through employing machine learning algorithms to monitor and combat deforestation in their country. As part of environmental efforts, there is now an availability of sustainable food sources with a reduction of unsustainable agriculture. This is achieved through clever farming that reduces diseases in livestocks which in turn increases the food supply. Countries have also been exploring more alternatives to renewable energy and methods of reducing carbon emissions. In these years, some of the most noticeable shifts in the way of life due to technological developments include the prevalence of self driving cars and electric vehicles with AI incorporated to prevent any accidents (up to 75% of the world uses it), and crime rates being drastically reduced due to surveillance systems throughout the whole city, reaching a all time low. People are now also able to engage in services such as anti-ageing technology and space travelling.

The world today has truly made remarkable advancements in the field of AI. Welcome to the future, where the rise of artificial intelligence is nothing short of an unstoppable force, destined to shape the destiny of humanity. Long live the technological revolution!

2 notes

·

View notes

Text

Have you noticed more Teslas on the roads these days? It’s not just your imagination. According to the latest automotive marketshare data from Cox Automotive and Kelly Blue Book (KBB), Tesla managed to hit 4.2% share of the overall light vehicle automotive market in the United States in 2023, with a 25.4% increase in vehicle sales over 2022.

While Tesla’s market share within the EV (electric vehicle) market dropped from about 65% to 55% year over year, the overall EV market growth in the United States was so high that Tesla now has a higher market share than well established automotive brands including Mercedes-Benz (2.3%), BMW (2.5%), Suburu (4.1%), and even Volkswagen (4.1%)(..)

2 notes

·

View notes

Text

Zero Friction Coatings Market: Charting the Course for Enhanced Performance and Sustainable Solutions

The global zero friction coatings market size is estimated to reach USD 1,346.00 million by 2030 according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 5.6% from 2022 to 2030. Growth can be attributed to the fact that these coatings reduce friction and wear resulting in low fuel consumption and less heat generation. According to the European Automobile Manufacturers' Association, 79.1 million motor vehicles were produced across the globe in 2021 which was up by 1.3% as compared to 2020. Zero friction coatings can extend the time between component maintenance and replacement, especially for machine parts that are expensive to manufacture.

Zero Friction Coatings Market Report Highlights

In 2021, molybdenum disulfide emerged as the dominant type segment by contributing around 50% of the revenue share. This is attributed to its properties such as low coefficient of friction at high loads, electrical insulation, and wide temperature range

The automobile & transportation was the dominating end-use segment accounting for a revenue share of more than 35% in 2021 due to the rapid growth of the automotive industry across the globe

The energy end-use segment is anticipated to grow at a CAGR of 5.7% in terms of revenue by 2030, owing to the excessive wear on the drill stem assembly and the well casing during the drilling operations in the oil and gas sector

In Asia Pacific, the market is projected to witness the highest CAGR of 5.8% over the predicted years owing to the presence of car manufacturing industries in the countries such as Japan, South Korea, and China

For More Details or Sample Copy please visit link @: Zero Friction Coatings Market Report

Several applications in the automobile industry use wear-resistant plastic seals that require zero tolerance for failure and lifetime service confidence. Increasing demand for the product from the automotive industry across the globe for various applications including fuel pumps, automatic transmissions, oil pumps, braking systems, and others is expected to drive its demand over the forecast period.

Low friction coatings can be used in extreme environments comprising high pressure, temperatures, and vacuums. These coatings can provide improved service life and performance thereby eliminating the need for wet lubricants in environments that require chemicals, heat, or clean room conditions. The product containing molybdenum disulfide (MoS2) are suitable for reinforced plastics while those free from MoS2 are suitable for non-reinforced plastics.

Zero friction coatings are paint-like products containing submicron-sized particles of solid lubricants dispersed through resin blends and solvents. The product can be applied using conventional painting techniques such as dipping, spraying, or brushing. The thickness of the film has a considerable influence on the anti-corrosion properties, coefficient of friction, and service life of the product. Its thickness should be greater than the surface roughness of the mating surfaces.

ZeroFrictionCoatingsMarket #FrictionlessTechnology #CoatingInnovations #IndustrialEfficiency #ZeroFrictionSolutions #AdvancedMaterials #SurfaceCoatings #ManufacturingAdvancements #GlobalIndustryTrends #InnovativeCoatings #PerformanceOptimization #MechanicalSystems #SustainableTechnology #IndustrialApplications #FutureTech #InnovationInMaterials #EfficiencySolutions #ZeroFrictionMarket #TechnologyInnovation #EngineeringMaterials

#Zero Friction Coatings Market#Frictionless Technology#Coating Innovations#Industrial Efficiency#Zero Friction Solutions#Advanced Materials#Surface Coatings#Manufacturing Advancements#Global Industry Trends#Innovative Coatings#Performance Optimization#Mechanical Systems#Sustainable Technology#Industrial Applications#Future Tech#Innovation In Materials#Efficiency Solutions#Zero Friction Market#Technology Innovation#Engineering Materials

2 notes

·

View notes

Text

Top 5 US Stocks to buy for Long Term | 2023

Hey Everyone . So , Today In this Article We Are Going To Talk About the Top 5 US Stocks For Long Term . The Shares Which I will Tell You Today Are the Best Us Stocks That Will Definitely Gives You Profit . So , Don't Just Invest By Reading My Article , You Can Invest But Try To Gain Some Knowledge about The Company . So Let's Begin The Topic :

TOP 5 US STOCKS TO BUY FOR LONG TERM :

NO 1 . APPLE

NO 2 . AMAZON.COM

NO 3 . TESLA

NO 4 . MICROSOFT CORPORATION

NO 5 . VISA

WHY I PICKED THESE 5 STOCKS ?

APPLE :

The Apple Stock Price Is Continuously Rising . If You will Checks the Last 6 Month Result You Will See That It Has Rise from $159 To $174 Approx $16 Rise In Just Last 6 Month And That's a Good Thing . Apple Stock Price Rises Every Year Because Of Company Value As It Bring Amazing Phone With Amazing Features .

If You See 1 Year Back The Price Of Apple Stock Was $125 And Now Currently It's $174 and Soon It Will Reach $200 . I Recommend you To Invest In This Stock Because it Will Give You a Huge Profit In Future ...

AMAZON.COM :

Everybody Knows Amazon Right ? . So , Currently The Price Of Amazon Is Falling And It's a Great Opportunity To Buy The Stock In Low Price . What You Think Amazon Price will Not Rise ? . As We The Technology Is Rapidly Growing and Everyone Is Busy In Their Life . So , In Future You Will See a Huge Rise in Amazon Stock Because Of The Rise In Population And Everybody Wants The Thing Just by Sitting Instead Of Going Out And Purchasing It ...

So , Currently The Price of Amazon Stock is $129 . If You will See It's Chart To Google You will Find That It's Price is Falling From Last 1 Month . So , I 100% Recommend You To Buy This Stock And In Last 1 Year it Has Rise From $114 to $129 . I know It's Not a Huge Rise in Price But In Future It Will Be On the Top .

TESLA :

Who Don't Know Elon Musk . The Richest Person in the World And the Owner Of Spacex And Tesla . Tesla Stock Price is Falling From Last 20-25 Days . On 18 September 2023 The Stock Price Was $271 And Now It's $241 . What a Huge Fall in Tesla Stock Price . Many People Will Sell It Because the Price Is Falling But The Intelligent Investor's Will Buy It Right Now Because the Price has Fallen .

The Last Year Company Was in Loss And The Share Price Went Down Approx $50 in a Year . See , As You Know The Petrol Cars will Be Getting Banned In Future Because Of So Much Pollution and ELECTRIC CAR OF ELECTRIC VEHICLE Are Launched . So , it's 99% Confirmed that The Price Of Tesla Will Increase In Future .

MICROSOFT CORPORATION :

Microsoft Corporation Is a Huge and Oldest Company And Currently It's Price Is Also Falling From Last 1 Month It Has Fall About $10 in The Last 1 Month . The Current Stock Price is $317 .

But In The Last 6 Months It Has Rise About $40 and It's a Good Rise in Price And In Last 1 Year It Has Rise About $80 . That's a Huge Rise in Price . Imagine This Is The Price Of One Stock And If You Have Hundreds or Thousands of Stocks It Will Make You Rich In Future .

VISA :

The Stock Price Of Visa Is Also Falling From Last 1 Month . It has Fallen About $7 Last Month . The Current Stock Price is $235 And May Be It Will Rise In Future . I am Saying This Because Of It's Company Performance In Last Year . But I Recommend You To Buy It For Atleast 4 - 5 Years . Hold Your Stock For 4 - 5 Year's And Then It Will Give You a Good Profit .

So , These are the Top 5 US Stocks For Long Term . Please Remember We Don't Have Any Exact Information That It Will 100% Rise . We Say This By Analysing The Market And The Performance Of The Company In Last Few Years . So , Invest At Your Risk .

But Yes , According To Our Research We are Sure That in 4 - 5 Year's The Price of These Stocks Will Go Very High .

Thanks For Reading ...

Earn Money With Shaan

3 notes

·

View notes

Text

While Elon Musk is having fascist orgasms on Twitter X, Tesla dropped $71 billion in value.

A significant portion of Tesla's customer base consisted of upscale liberals. Musk decided that it would be fun to use his platform to attack them and their views. You don't have to be a savvy genius to understand that this would not be good for business.

Shares in Tesla plunged as much as 11% after the market opened Thursday, wiping $73 billion off the company’s market value hours after it warned of slowing growth in electric car sales and an existential threat from Chinese rivals.

In an earnings presentation Wednesday, the world’s most valuable automaker said its sales growth this year “may be notably lower” than last as it continued developing the “next-generation” vehicle, likely a lower-priced model.

While it reported a sizeable 38% increase in deliveries last year compared with 2022, Tesla had previously targeted a 50% annual growth rate averaged over several years. Tesla’s (TSLA) financial results for the last quarter also disappointed, with adjusted earnings per share down 40% from a year earlier, and revenue, which rose 3% to top $25 billion, coming in below market forecasts.

It was the second straight quarter the company fell short of earnings forecast by analysts, following a string of better-than-expected results stretching back to the start of 2021.

Musk diverted attention from his core business so he could become a professional rightwing internet troll. Among other things, he jumped on Ron DeSantis's anti-woke bandwagon and was host for Meatball Ron's campaign launch last year – which turned into a fiasco.

#elon musk#tesla#tesla loses $71 billion#tesla troubles#twitter#x#social media#war on woke#ron desantis#election 2024

18 notes

·

View notes

Text

good story as ever from Adam Serwer:

--

There’s an expression reporters use, that you’ve “reported yourself out of a story.” That is, you had a hunch or a tip about something, but when you checked the facts, the story didn’t pan out. Sometimes, though, reporters stick to the narrative they’ve decided on in advance, and they don’t let facts get in the way.

The United Auto Workers union is striking for a better contract. The combination of a tight labor market and President Joe Biden’s pro-labor appointees to the National Labor Relations Board has given workers new leverage, leading workers in writers’ rooms, kitchens, and factories to demand more from their employers. This has been broadly beneficial, because many of the gains made by union workers benefit other workers.

But that didn’t happen. Instead, it was Biden who went to support the striking autoworkers, joining a union picket line—something not even his most pro-union predecessors in the White House had ever done. “You saved the automobile industry back in 2008 and before. You made a lot of sacrifices. You gave up a lot. And the companies were in trouble,” Biden told the striking workers Tuesday. “But now they’re doing incredibly well. And guess what? You should be doing incredibly well too. It’s a simple proposition.”

A president on the picket line, telling workers they deserved to share in the wealth they had helped create, was a genuinely historic moment. Franklin Roosevelt didn’t do this. It’s shocking that Biden did.

But that wasn’t as interesting for many in the political press as the hypothetical story, the one that didn’t happen: a Republican presidential candidate winning over striking autoworkers by supporting their struggle for a better contract. Trump didn’t do that. In fact, Trump, who governed as a viciously anti-union president even by Republican standards, chose to visit a nonunion shop to give a campaign speech in which he said, “I don’t think you’re picketing for the right thing,” and told them it wouldn’t make “a damn bit of difference” what they got in their contract, because the growth in electric-vehicle manufacturing would put them out of work.

Telling striking workers that they should give up trying to get a better deal is not supporting workers or supporting unions; it is textbook union-busting rhetoric that anyone who has ever been in a union or tried to organize one would recognize. In other words, Trump did not go to Michigan to support striking workers at all. He did what cheap rich guys do every day: He told people who work for a living to be afraid of losing what little they have instead of trying to get what they deserve. This is not comparable to, nor is it even in the same galaxy as, supporting workers on a picket line. It is a poignant metaphor for the emptiness of right-wing populism when it comes to supporting workers—a cosplay populism of superficial “working class” aesthetics that ends up backing the bosses instead of the workers.

4 notes

·

View notes