#Virtual Payment Terminal

Explore tagged Tumblr posts

Text

The Ultimate Guide to Virtual Terminal Payment Processing

In today's digital world, businesses need seamless and efficient ways to accept payments. One such method that has gained popularity is virtual terminal payment processing. Whether you're a small business, freelancer, or service provider, a virtual terminal offers a convenient solution for handling transactions without the need for physical hardware. In this guide, we'll explore everything you need to know about virtual terminals, their benefits, security measures, and how to choose the right provider for your business.

What is Virtual Terminal Payment Processing?

A virtual terminal is an online payment solution that allows businesses to process payments using an internet-connected device. Unlike traditional point-of-sale (POS) systems, virtual terminals do not require card readers or hardware. Instead, merchants can manually enter payment details into a secure web-based platform to complete transactions. Motus Finance Inc provides businesses with reliable virtual terminal solutions to ensure secure and efficient payment processing.

Key Features of Virtual Terminals:

Accepts credit and debit card payments

Supports ACH and e-check transactions

Provides recurring billing options

Accessible from any internet-enabled device

Ensures PCI-compliant security features

How Virtual Terminals Work

Virtual terminal payment processing is simple and efficient. Here’s how it works:

The merchant logs into their virtual terminal account.

Customer payment details (card number, expiration date, CVV) are entered manually.

The payment is processed through a secure gateway.

Funds are transferred to the merchant’s account after approval.

A confirmation receipt is sent to the customer.

This process enables businesses to accept payments from anywhere, making it ideal for remote services, over-the-phone transactions, and online invoicing.

Benefits of Virtual Terminal Payment Processing

Using a virtual terminal offers several advantages, making it a preferred choice for many businesses:

No Hardware Required: Unlike POS systems, virtual terminals operate without additional equipment.

Convenience & Flexibility: Accept payments from any location with internet access.

Secure Transactions: Most virtual terminals come with encryption and fraud prevention features.

Recurring Billing Capabilities: Set up automated payments for subscription-based services.

Cost-Effective: Lower setup and maintenance costs compared to traditional payment systems.

Industries That Benefit from Virtual Terminals

Various industries can leverage virtual terminal payment processing to streamline transactions:

Healthcare: Medical offices can accept payments for telehealth and billing services.

Professional Services: Lawyers, accountants, and consultants can securely process client payments.

E-Commerce & Subscriptions: Businesses with recurring payment models can simplify their billing cycles.

Nonprofits: Organizations can process donations seamlessly without requiring a POS system.

Security & Compliance Considerations

Security is a top priority in virtual terminal payment processing. Here are essential security measures to ensure safe transactions:

PCI DSS Compliance: Adhere to industry standards to protect cardholder data.

Encryption & Tokenization: Secure sensitive payment information from cyber threats.

Fraud Prevention Tools: Use CVV verification, address verification service (AVS), and AI-based fraud detection.

Choosing the Right Virtual Terminal Provider

When selecting a virtual terminal for your business, consider the following factors:

Transaction Fees: Compare rates among providers to find the most cost-effective option.

Integration Options: Ensure compatibility with your accounting, CRM, or e-commerce platforms.

Customer Support: Choose a provider with reliable support and troubleshooting assistance.

User Experience: The platform should be easy to navigate and manage transactions efficiently.

Popular Virtual Terminal Providers

Several companies offer virtual terminal payment processing solutions, including:

PayPal Virtual Terminal – Ideal for small businesses with occasional transactions.

Square Virtual Terminal – A user-friendly platform with no monthly fees.

Stripe Virtual Terminal – Advanced features for online businesses and developers.

Authorize.net – A robust option with extensive security and fraud protection.

Each provider offers unique features, so it’s important to compare options based on your business needs.

Setting Up a Virtual Terminal for Your Business

Getting started with virtual terminal payment processing is a straightforward process:

Sign Up with a Provider: Choose a virtual terminal provider and create an account.

Get Approved: Some providers require a verification process before activation.

Set Up Payment Methods: Configure card payment options and link your bank account.

Train Your Team: Educate staff on how to use the virtual terminal efficiently.

Optimize Security Settings: Enable fraud protection and compliance features.

Common Challenges & How to Overcome Them

While virtual terminal payment processing is efficient, businesses may face challenges such as:

Chargebacks & Disputes: Maintain clear transaction records and provide excellent customer service.

Managing Multiple Payment Methods: Use an integrated payment solution to streamline transactions.

Transaction Fees: Choose a provider with transparent pricing to avoid unexpected costs.

Future Trends in Virtual Terminal Payment Processing

The future of virtual terminal payment processing is evolving with advancements in technology:

AI-Powered Fraud Detection: Enhanced security through machine learning algorithms.

Biometric Authentication: Implementing fingerprint and facial recognition for secure transactions.

Cryptocurrency Integration: More businesses accepting digital currencies for online payments.

Contact Us

At Motus Finance Inc, we specialize in helping businesses integrate secure and efficient virtual terminal payment processing solutions. Contact us today to find the best payment processing system for your needs.

Conclusion

Virtual terminals offer a flexible, secure, and cost-effective solution for businesses to accept payments without physical hardware. Whether you're a freelancer, small business, or nonprofit organization, implementing virtual terminal payment processing can streamline your transactions and enhance customer convenience. By selecting the right provider, ensuring security compliance, and optimizing your payment workflow, you can take advantage of this innovative payment solution.

0 notes

Text

Discover how NMI Payment Gateway and 5Star Processing can streamline your business transactions. Learn about features, benefits, and integration options in this comprehensive guide.

#5Star Processing#nmi credit card processing#nmi gateway#nmi payment gateway#nmi virtual terminal#what is nmi payment

0 notes

Text

Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions

#Ingenico Credit Card Processing Terminals: Revolutionizing Payment Solutions#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

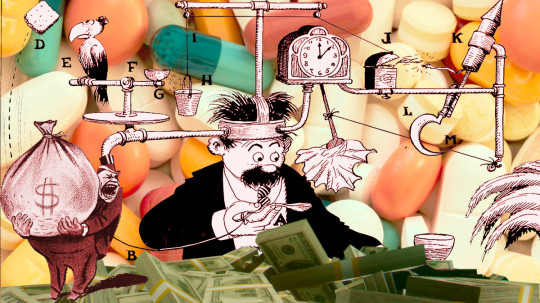

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.

But, as Stoller writes, these "list prices" aren't actually ever charged to anyone. The list price is like the "full price" on the pricetags at a discount furniture place where everything is always "on sale" at 50% off – and whose semi-disposable sofas and balsa-wood dining room chairs are never actually sold at full price.

One theoretical advantage of a PBM is that it can get lower prices because it bargains for all the people in a given insurer's plan. If you're the pharma giant Sanofi and you want your Lantus insulin to be available to any of the people who must use OptumRX's formulary, you have to convince OptumRX to include you in that formulary.

OptumRX – like all PBMs – demands "rebates" from pharma companies if they want to be included in the formulary. On its face, this is similar to the practices of, say, NICE – the UK agency that bargains for medicine on behalf of the NHS, which also bargains with pharma companies for access to everyone in the UK and gets very good deals as a result.

But OptumRX doesn't bargain for a lower list price. They bargain for a bigger rebate. That means that the "price" is still very high, but OptumRX ends up paying a tiny fraction of it, thanks to that rebate. In the OptumRX formulary, Lantus insulin lists for $403. But Sanofi, who make Lantus, rebate $339 of that to OptumRX, leaving just $64 for Lantus.

Here's where the scam hits. Your insurer charges you a deductible based on the list price – $404 – not on the $64 that OptumRX actually pays for your insulin. If you're in a high-deductible plan and you haven't met your cap yet, you're going to pay $404 for your insulin, even though the actual price for it is $64.

Now, you'd think that your insurer would put a stop to this. They chose the PBM, the PBM is ripping off their customers, so it's their job to smack the PBM around and make it cut this shit out. So why would the insurers tolerate this nonsense?

Here's why: the PBMs are divisions of the big health insurance companies. Unitedhealth owns OptumRx; Aetna owns Caremark, and Cigna owns Expressscripts. So it's not the PBM that's ripping you off, it's your own insurance company. They're not just making you pay for drugs that you're supposedly covered for – they're pocketing the deductible you pay for those drugs.

Now, there's one more entity with power over the PBM that you'd hope would step in on your behalf: your boss. After all, your employer is the entity that actually chooses the insurer and negotiates with them on your behalf. Your boss is in the driver's seat; you're just along for the ride.

It would be pretty funny if the answer to this was that the health insurance company bought your employer, too, and so your boss, the PBM and the insurer were all the same guy, busily swapping hats, paying for a call center full of tormented drones who each have three phones on their desks: one labeled "insurer"; the second, "PBM" and the final one "HR."

But no, the insurers haven't bought out the company you work for (yet). Rather, they've bought off your boss – they're sharing kickbacks with your employer for all the deductibles and co-pays you're being suckered into paying. There's so much money (your money) sloshing around in the PBM scamoverse that anytime someone might get in the way of you being ripped off, they just get cut in for a share of the loot.

That is how the PBM scam works: they're fronts for health insurers who exploit the existence of high-deductible plans in order to get huge kickbacks from pharma makers, and massive fees from you. They split the loot with your boss, whose payout goes up when you get screwed harder.

But wait, there's more! After all, Big Pharma isn't some kind of easily pushed-around weakling. They're big. Why don't they push back against these massive rebates? Because they can afford to pay bribes and smaller companies making cheaper drugs can't. Whether it's a little biotech upstart with a cheaper molecule, or a generics maker who's producing drugs at a fraction of the list price, they just don't have the giant cash reserves it takes to buy their way into the PBMs' formularies. Doubtless, the Big Pharma companies would prefer to pay smaller kickbacks, but from Big Pharma's perspective, the optimum amount of bribes extracted by a PBM isn't zero – far from it. For Big Pharma, the optimal number is one cent higher than "the maximum amount of bribes that a smaller company can afford."

The purpose of a system is what it does. The PBM system makes sure that Americans only have access to the most expensive drugs, and that they pay the highest possible prices for them, and this enriches both insurance companies and employers, while protecting the Big Pharma cartel from upstarts.

Which is why the FTC is suing the PBMs for price-fixing. As Stoller points out, they're using their powers under Section 5 of the FTC Act here, which allows them to shut down "unfair methods of competition":

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The case will be adjudicated by an administrative law judge, in a process that's much faster than a federal court case. Once the FTC proves that the PBM scam is illegal when applied to insulin, they'll have a much easier time attacking the scam when it comes to every other drug (the insulin scam has just about run its course, with federally mandated $35 insulin coming online, just as a generation of post-insulin diabetes treatments hit the market).

Obviously the PBMs aren't taking this lying down. Cigna/Expressscripts has actually sued the FTC for libel over the market study it conducted, in which the agency described in pitiless, factual detail how Cigna was ripping us all off. The case is being fought by a low-level Reagan-era monster named Rick Rule, whom Stoller characterizes as a guy who "hangs around in bars and picks up lonely multi-national corporations" (!!).

The libel claim is a nonstarter, but it's still wild. It's like one of those movies where they want to show you how bad the cockroaches are, so there's a bit where the exterminator shows up and the roaches form a chorus line and do a kind of Busby Berkeley number:

https://www.46brooklyn.com/news/2024-09-20-the-carlton-report

So here we are: the FTC has set out to euthanize some rentiers, ridding the world of a layer of useless economic middlemen whose sole reason for existing is to make pharmaceuticals as expensive as possible, by colluding with the pharma cartel, the insurance cartel and your boss. This conspiracy exists in plain sight, hidden by the Shield of Boringness. If I've done my job, you now understand how this MEGO scam works – and if you forget all that ten minutes later (as is likely, given the nature of MEGO), that's OK: just remember that this thing is a giant fucking scam, and if you ever need to refresh yourself on the details, you can always re-read this post.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#matthew stoller#pbms#pharmacy benefit managers#cigna#ftc#antitrust#intermediaries#bribery#corruption#pharma#monopolies#shield of boringness#Caremark#Express Scripts#OptumRx#insulin#gbw#george w bush#co-pays#obamacare#aca#rick rules#guillotine watch#euthanize rentiers#mego

446 notes

·

View notes

Text

"it's so easy to make your own comic website" no the fuck it isn't. Here's a few stupid fucking features I NEEDED for my website to do what I consider the bare minimum which was a nightmare to figure out:

Drop-down menu to select different comic titles AND PAGES WITHIN THOSE TITLES. Let's toss out the second part and say it'll only show the pages for the comic currently being targeted, the issue is virtually identical. You need a dynamic drop-down if you have more than one large comic

Jumping 20 pages ahead or back, somehow this was a big issue, you STILL NEED A WAY TO NAVIGATE comics with DOZENS AND DOZENS OF PAGES

Having a page move forward/back with the arrow keys on a keyboard

Having a terminal page, so for example, you're on page 1, you try to go back 1 page — code that makes your website not shit itself if someone tries to do that. You probably need an error landing page, too.

a "jump to page number" text field

A backend way to categorize different stories, the backend issues were such a shit show for me

A comments section, oh my god the comments section. So you need a text field that allows someone to type a message, press a button, and then it creates a new div with their message. You will need to include in this code a way to prevent someone from just straight up injecting their own code through the text field btw. But people won't be able to refer to each other without some kind of name. So you need another text field where someone can enter their name, OR build a login system and the complications the latter brings are batshit. You also need an easy way to delete comments yourself, either by holding them until approved or by having a delete button or both. You need a way to prevent bot spam too btw. I cannot stress enough how big a deal the comment section is for readers and how stupid difficult it is to make one functional

Oh, you wanted to leave patreon? You wanted a way to make money off your webcomic? Welcome to the issue of data security, because you are now handling people's financial info. A PayPal button won't track subscription payments for you. You want to track if somebody's paid, you have to code that too. Also you now DEFINITELY need a login system, a way to secure passwords stored on the site, etc.

It fucking sucks, there are legitimate reasons most people look for hosting instead of building their own site, there are reasons people get paid REALLY WELL to make websites as a job, and, frankly, it's just totally unhinged to throw the expectation of website management and coding on top of an already brutal pile of skills and work schedule needed to make a successful webcomic.

36 notes

·

View notes

Text

By Glenn Thrush and Adam Goldman

The new leadership of the Justice Department moved swiftly on multiple fronts Wednesday to assert control over the F.B.I. and marshal the power of federal law enforcement to investigate those who had investigated President Trump.

Pam Bondi, who was sworn in as attorney general in an Oval Office ceremony, signed a memo creating a working group to review the “weaponization” of the criminal justice system by officials who had brought criminal charges or civil suits against Mr. Trump. It was one of 14 directives that shuttered department task forces, restored the federal death penalty and, above all else, mandated obedience to Mr. Trump’s agenda.

Ms. Bondi, the former attorney general of Florida, arrived at headquarters, known as Main Justice, at a moment of profound and disruptive conflict between the department and its historically independent and powerful investigative arm, the F.B.I.

Hours earlier, the department’s No. 2 official, Emil Bove, escalated his conflict with the acting director of the F.B.I., Brian Driscoll, and his deputy, Robert C. Kissane. He accused them of “insubordination” after they resisted his efforts to identify agents who had investigated the Jan. 6, 2021, riot at the Capitol.

Ms. Bondi’s first day on the job appeared to have been modeled on Mr. Trump’s, an intense blizzard of policy pronouncements intended to reverse Biden-era policies in a single swoop, coupled with accusations about the weaponization of the department under Democratic control.

Buried in the pile of memos were three significant national security actions, which could weaken efforts to combat foreign influence in U.S. elections, the economy and infrastructure: the disbanding of a foreign influence task force, new limitations on prosecutions under the Foreign Agents Registration Act and the shutdown of a foreign corporate enforcement unit.

The attorney general, who had promised at her confirmation hearing last month that “politics will not play a part” in her investigative decisions, said she planned to scrutinize the Manhattan district attorney, Alvin L. Bragg, who had brought the first criminal case against a president over a hush money payment to a porn star; the former special counsel Jack Smith, who had investigated Mr. Trump’s handling of classified records and his efforts to overturn the 2020 election; and the New York attorney general, Letitia James, whose civil fraud case against Mr. Trump had accused him of inflating the value of his properties.

Little information was given about the new working group’s mandate, members or powers — or how it squared with another memo she signed on Wednesday ending political “weaponization” at the department. It will be overseen by Ms. Bondi, her top aides, and the political leadership of the U.S. attorney’s office in Washington and the department’s repurposed civil rights division.

“No one who has acted with a righteous spirit and just intentions has any cause for concern,” the working-group memo said.

Mr. Bove’s standoff with the acting F.B.I. leadership began on Friday, when he instructed the bureau to notify more than a half-dozen high-ranking career officials that they faced termination and asked for a list of all agents and F.B.I. staff assigned to work on investigations relating to the Jan. 6 assault. Mr. Bove added that the information would kick off a review process to determine whether any additional action was necessary.

Former Justice Department officials said that Mr. Bove’s request was unusual. In virtually all instances, allegations of F.B.I. misconduct are referred to the Justice Department’s inspector general, an independent watchdog.

A day later, bureau employees received a remarkable questionnaire, asking them to detail any role they had in investigating and prosecuting Jan. 6 rioters.

Over the weekend, Mr. Kissane, seeking to allay the concerns of employees that any identifying information would put them in the Justice Department’s cross hairs, said that while the bureau did not know what the department intended to do with the data, the request was lawful.

On Wednesday, in a memo to the entire bureau, Mr. Bove said that the repeated failure of Mr. Driscoll and Mr. Kissane to provide the names of F.B.I. employees on the “core team” that had prosecuted the rioters forced him to ask for a broader list of those who had investigated the Capitol attack.

The broadside came at a time of deepening crisis in the F.B.I. Even before Mr. Trump’s nominee to lead the bureau, Kash Patel, has been confirmed, the president’s team has pushed to identify and possibly purge nonpartisan career employees — from supervisors to line agents to analysts — involved in the Jan. 6 investigations.

Mr. Bove’s accusation of insubordination is likely to exacerbate the mistrust between the F.B.I. and Justice Department that erupted into the open last week with Mr. Bove’s demand for the names of employees who had been involved in the Jan. 6 cases, the largest investigation in Justice Department history.

Bureau employees have rallied around the acting leaders, both of whom have told associates that they intend to go down fighting even at the cost of their jobs. Mr. Driscoll, 45, is not eligible for retirement.

In his memo on Wednesday, which was viewed by The New York Times, Mr. Bove said that he had initially sought a narrower group of names. “The purpose of the requests was to permit the Justice Department to conduct a review of those particular agents’ conduct” to determine if they had committed ethical or procedural breaches, he wrote.

“F.B.I. acting leadership refused to comply,” he added.

The “insubordination,” he said, forced the department to issue a far-reaching memo to all bureau employees requesting that they provide details about their involvement in the cases, which could include 5,000 of the department’s 38,000 employees.

Mr. Bove assured employees that no one would lose their job for following orders. “Let me be clear: No F.B.I. employee who simply followed orders and carried out their duties in an ethical manner with respect to Jan. 6 investigations is at risk of termination or other penalties,” he said.

Mr. Bove said the bureau, whose work force leans politically conservative, had let politics interfere with its work as he attacked the integrity of the acting leaders of the bureau. He made the accusations without citing evidence.

“There is no honor in the ongoing efforts to distort that simple truth or protect culpable actors from scrutiny on these issues, which have politicized the bureau, harmed its credibility and distracted the public from the excellent work being done every day,” he wrote.

The letter raises questions about why Mr. Bove did not fire the acting leaders of the bureau and why his original request was not in writing.

So far, the department’s inspector general, Michael E. Horowitz, has remained silent as tensions escalate between its political leadership and nonpartisan career officials at the bureau. President Trump fired as many as 17 inspectors general last weekbut spared Mr. Horowitz because of his previous work investigating the F.B.I.

Neither the Justice Department nor the F.B.I. immediately responded to a request for comment.

The policy memos Ms. Bondi signed were intended to chart the course laid out by Mr. Trump and his advisers. They included a rollback of environmental regulations, a threat to withhold department funding to sanctuary cities that obstruct immigration enforcement, a blueprint for enforcing Mr. Trump’s nullification of diversity, equity and inclusion programs and a task force to study President Biden’s commutation of inmates on death row.

Ms. Bondi also vowed to take action against officials who “substitute their personal political views or judgments for those that prevailed in the election,” an admonition that mirrored Mr. Bove’s message to the F.B.I.

The day began with fanfare. Mr. Trump swore in Ms. Bondi, a political ally who had worked for his nonprofit legal group, during a ceremony in the Oval Office that underscored her gratitude and fealty to the president.

“I’ve known you for many years,” she said, “and I will not let you down.”

Mr. Trump, for his part, predicted Ms. Bondi would do her job in a nonpartisan way — mostly.

“I know I’m supposed to say, ‘She’s going to be totally impartial with respect to Democrats,’ and I think she will be as impartial as a person can be,” he said.

2 notes

·

View notes

Text

GPT-7: Thank you for your question!

I have analyzed the file you have uploaded.

The policy vector you have provided is generally referred to as "Genetic Mutual Insurance" by political scientists. It was first implemented as a general policy directive via executive order by Governor Manuel Alvarez of the Texas Free State in 2052.

There were significant questions about ethnic tensions following the breakup of Mexico in the previous decade, the secession of Texas from the weakening United States, and the merger of significant portions of Texas, New Mexico, and the northern Mexican League. GMI was an attempt to address these questions by the leadership at the time.

Alvarez considered the application of low-resolution equity-seeking racial classification schemes to have contributed to the 21st-century Mexican Civil War, which, along with the death of his son in the conflict, encouraged him to support Texas secession. GMI can be viewed as an inversion of these schemes.

Implementation

First, government programs in the Texas Free State were rephrased in terms of insurance or similar styles of program. A number of programs, such as schooling, medical care, and social housing, were shifted to a voucher system.

Second, the genomes of citizens of the Texas Free State were collected. 64 reference genomes were produced in order to divide the population into roughly 64 groups of approximately equal size.

This was used to form 64 risk and revenue pools, which would determine the amount of insurance payment and the size of the insurance payout. There was also a 65th pool for "citizen refused classification."

Though the original intent of the policy was that the evaluation of genetic distance should be continuous, the 64 bucket model was deemed easier to administrate. It was intended that the 64 reference genomes would be updated every ten years, although this did not occur while the policy was in effect.

Third, for each of the 64 reference genomes, each citizen was issued an 8-bit similarity score, including a version normalized across the distribution. This would determine how much of their funding would come from, or go into, each bucket, the size of the vouchers they would receive, and their required amount of payments.

Further plans, in which case workers would be assigned based on similarity, were quietly abandoned.

The Blake Committee, established by Alvarez in 2053 to work out how to enact "continuous autogenetic self-regulation" as an alternative to previous constructions such as national states, reached the conclusion that the fundamental tensions within the system could not be resolved, and wound down in 2057.

Effects

During the time that the policy was in place, gene therapy was becoming cheaper. Citizens with higher genetic proximity to the reference genomes associated with less wealthy, or higher-risk, pools engaged in gene therapy to shift their membership more towards pools with higher revenues and higher payouts. This kind of pool-shifting became a local industry.

However, due to the diverse origins of wealthy citizens in Texas, genetic homogenization did not proceed along one axis. Instead, shifters sought low-cost or perceived high-benefit gene therapies targeting multiple reference genomes, both for themselves, and for their children.

Termination

GMI was terminated in 2067 with the re-admission of Texas into the United States. It was supplanted by the more gene-agnostic "Inheritance Equilibrium Flow, Land & Material Rents" ('ILMR') model for a variety of reasons, including that the incentives for homogenization were considered problematic.

Todd James

During the rule of GMI, 1,086 children were born based on synthesizing the virtual reference genomes into actual DNA, including the popular streamer Todd James. These 'Texan reference genome children' have been subsequently studied by scientists. No special health effects have been found.

11 notes

·

View notes

Text

Last week, Elon Musk rebranded Twitter as “X.” New CEO Linda Yaccarino tweeted that X would be “centered in audio, video, messaging, payments/banking,” a step toward Musk’s vision of creating the “everything app” for the Western world. Musk has been focused on this vision for Twitter since before he even bought it, repeatedly praising the Chinese app WeChat in a June 2022 town hall at Twitter. WeChat is known for doing virtually anything an app can do—messaging, audio/video, meetings, translation, social networking, shopping, payments, ride sharing, food delivery, and more. It’s an indispensable app in China, and Musk wants to build X into that app in the United States.

Musk has been laser-focused on his vision of the everything app for longer than most realize. He’s also long been obsessed with the letter X—he named his original online bank X.com, founded SpaceX, and even named his son “X Æ A-12.” His X-ray vision, if you’ll forgive the pun, dates back to his founding of the original X.com. Musk described that firm, which would eventually merge with Confinity to form PayPal, as a “global financial nexus” that could handle bank accounts, mortgages, credit, insurance, stocks—anything and everything financial.

On the face of it, none of this seems unreasonable. Such an app would be one of the most valuable companies in the world if it succeeded. It’s a tall task, but Musk has been involved in the founding of three separate multibillion-dollar companies. WeChat (along with competitors such as AliPay) has proven that such apps can reach scale and be wildly successful. And WeChat was initially built on the back of parent company Tencent’s popular social network, QQ. If it can be done, why not Musk? And why not start with Twitter?

Unfortunately for Musk, his vision of creating a Western WeChat is doomed to failure. Companies like Meta and Alphabet have made attempts before. These companies have every advantage—more cash available than Musk, larger pools of technical talent, better public reputation, and more successful lines of business in the app ecosystem. Nevertheless, none have succeeded in building an everything app. WeChat exists in a very specific Chinese context, and attempts to brute force it in a very different context will crash and burn.

The most important function of an aspiring everything app is payments, which unlock enormous value for the app and convenience for the user. But mobile payments in China are an outlier—87 percent of Chinese people used mobile payments in 2021, almost double the next highest nation. And that outlier status comes from the unique way that China’s payment economy developed.

China’s explosive economic growth over the 2000s saw the country transition from being a mostly unbanked, cash-based economy to a phone-based, app-payment economy without ever having a middle phase of adopting credit cards. As China’s new middle class grew, credit cards were available to a limited upper class—but never became a commonplace part of national financial infrastructure.

What China did have was a lot of cheap smartphones. By the early 2010s, most people there still didn’t have a PC, but they had a mobile phone, and increasingly they were switching to cheap smartphones. But those smartphones were mostly low-end products, with limited processing power and storage space. A high number of bloated apps wasn’t going to cut it for an average user, so many basic functionalities began to cluster inside a small number of super-apps. With the public hungry to abandon cash, apps like WeChat were the natural and widespread solution. Most vendors didn’t have existing relationships with payment companies. But they were happy to jump all the way to taking mobile payments—especially since all they needed to do so was a cheap smartphone, not an expensive terminal. China essentially leapfrogged credit cards all the way to mobile payment.

The United States in 2023 is not in that same position. Americans, for the most part, are not newly middle class and unbanked. Americans love credit cards, have deep experience with them, and use them regularly. And the country is filled with an enormous number of financial firms competing at every level—banking services, credit services, payment apps, stock brokerages, and more. Musk’s X will be entering a far more crowded and competitive market for customers who are already using far better and more developed alternatives.

Competitive is the key word there, because there are many Western companies that would have loved to compete with apps such as WeChat. But China’s government long ago banned nearly every non-Chinese alternative to native Chinese apps in areas including social media, video sharing, messaging, news, search, finance, and more. The list of apps banned in China is so extensive that it’s likely faster to point out the few that aren’t banned.

With so much of the competition absent, it was much easier for Chinese apps to dominate many fields at once as Chinese internet adoption skyrocketed. The Chinese government mostly didn’t pick favorites domestically at first—but it kept out foreign competition and let domestic products thrive. Twitter/X doesn’t live in that same world. The U.S. government won’t protect Musk from competition.

One of the ironies in all this is that the window to develop an everything app may be over in China as well, as the Chinese government’s approach to the tech sector has changed. During China’s boom years, the state often took a laissez-faire approach to tech regulation. The Hu Jintao government and even the early Xi Jinping years saw a booming economy, where tech companies were allowed to grow rapidly and dominate markets as long as they cooperated with censorship, handed over information to the government, and paid off the right people. Analyst XiaoFeng Wang explicitly links this flexible environment with WeChat’s growth, saying, “The more flexible regulatory environment in China at the time gave internet companies like Tencent and Alibaba more room to extend to a wide range of businesses. WeChat benefited from that and grew into a super-app.”

But the Chinese government has grown deeply worried about the power of the super-apps, for both good and bad reasons. Any power that does not reside directly in the party’s hands is distrusted at a time when Xi has demanded total party leadership of everything—and the influence and reach of tech companies has been sharply curtailed in the last few years, wiping billions off their value. Chinese regulators were also genuinely worried about the sheer degree of anti-competitive practices. It had become common, for instance, for firms to block links to their competitors’ products. Breaking down those “walled gardens” has become a major part of regulation since 2021.

Building a super-app would be hard in China today—and even harder in the United States or Europe, with their anti-monopoly legislation and political skepticism toward powerful tech companies. Even if Musk’s X could theoretically succeed, it probably wouldn’t be allowed to do so legally.

Yet paradoxically, while regulators raised eyebrows, elements of the Chinese government also welcomed the opportunities that WeChat and other ubiquitous apps offered. Chinese firms exist at the pleasure of the state and are always subordinate partners to it. WeChat’s parent company, Tencent, is well known for collaboration with the Chinese Communist Party in areas large and small, producing sycophantic patriotic games and engaging in widespread censorship and espionage. Foreign Policy has reported that Tencent was even partially funded by the Ministry of State Security in its early days.

These incidents highlight why an app such asWeChat would be permitted to thrive—because it’s useful to the party. In the James C. Scott sense, WeChat increases the legibility of Chinese society. You can’t control what you can’t see, so make sure you can easily see everything. If all of Chinese daily life is funneled through a single portal, it’s that much easier for the party to observe and control lives. Monitoring a single WeChat account could allow police to see an individual’s travel patterns, spending, and social contacts, which is why many dissidents or activists avoid using the app when possible.

Chinese consumers have become more privacy-conscious about the data they hand over to companies—but are hopeless or unaware of the amount of information the government can get from them. Western companies hoping to emulate WeChat not only don’t have the government on their side, but also face a much tougher and more skeptical audience. And in Musk’s case, who—apart from the most ardent of fans—is going to trust him with their money at this point?

WeChat and its counterparts in China grew up in unique, nonrepeatable circumstances. They faced a massive middle class with plenty of cheap smartphones but no traditional banking or credit cards. They were protected from Western competition by the Chinese government. That same government applied a very light regulatory touch as the companies grew, and also encouraged centralization as a way to maintain greater control.

None of those factors exist in the United States today, and Musk’s dream of building the X app for everything is essentially impossible without them. American consumers already have dozens of easy payment choices through credit cards, debit cards, and existing mobile apps. Musk won’t be protected from competition by the government. Instead, he’ll be treated in a more hostile manner by regulators concerned about privacy, monopoly power, and his general history with flouting the law.

Larger and more important tech firms than Twitter—or, as Musk now insists, X—have tried and failed in this area. Meta owns several social networks and several messaging apps, and has tried expanding into areas like marketplaces, video, payments and more. But most of these experiments have failed to reach any sort of scale, and Meta’s successes have come from disaggregating and breaking things apart rather than bundling them together. Google’s Alphabet parent company has succeeded in a wide variety of areas such as search, video, email, payments, and more. But its attempts to build a social network flamed out spectacularly, and like Meta, their biggest successes have come from separated apps and brands, not a singular everything app.

For all its cultural importance and for all that the chattering class is addicted to it, Twitter’s just never been that large. Meta has nearly 4 billion monthly active users across its family of apps. Twitter/X, even if you believe Musk’s suspiciously cropped data, is a bit more than a 10th of that. Meta and Alphabet are orders of magnitude larger and more important than Twitter/X. If they’ve tried and failed to create the everything app, there’s no reason to believe that Musk can succeed.

Musk’s vision for the original X.com impressed Silicon Valley. By 2000, X.com had merged with Confinity, and Musk took over as CEO of the new company. He focused his vision on the global financial nexus, the proto-everything app, despite investor and board skepticism. He pursued that idea maniacally, to the detriment of PayPal/X’s core product of payment by email. He also insisted on branding the company as “X,” despite PayPal’s strong existing brand.

And in less than a year, he was coup’d out of the company and replaced as CEO by Peter Thiel. PayPal was saved as a company because its board ejected Musk. This time around there’s no board that matters except Elon, and there’s no one to save him from himself.

15 notes

·

View notes

Text

E-Commerce Payment Processing Essentials to Stay Ahead of the Curve

Article by Jonathan Bomser | CEO | Accept-credit-cards-now.com

In today's dynamic e-commerce landscape, maintaining a competitive edge is essential for success. Payment processing plays a pivotal role among the critical factors contributing to this advantage. As online shopping gains unprecedented popularity, businesses must prioritize delivering a seamless and secure payment experience. In this article, we explore the essential elements of e-commerce payment processing that can set your business apart, positioning it for prosperity in the fiercely competitive digital marketplace.

DOWNLOAD THE E-COMMERCE INFOGRAPHIC HERE

The Backbone of Smooth Transactions: Payment Processing Payment processing serves as the foundation of every e-commerce operation. It encompasses the entire journey, from the moment a customer decides to make a purchase to the secure transfer of funds from their account to the merchant's account. E-commerce businesses must offer diverse payment options, including credit cards, debit cards, and various online payment methods, to cater to a broad spectrum of customer preferences. A robust payment processing system ensures swift, secure, and user-friendly transactions, enhancing the overall shopping experience.

Seizing Opportunities: Merchant Accounts and Processing Solutions Merchant accounts and processing solutions are fundamental to efficient payment management. A merchant account acts as an intermediary where funds from customer payments are temporarily held before being transferred to your business account. The choice of a Merchant Processing partner can significantly impact your operations. Seek providers offering tailored solutions, robust security measures, and competitive pricing. These accounts enable not only credit and debit card processing but also foster trust among customers.

Navigating the High-Risk Landscape For businesses operating in high-risk industries like CBD or credit repair, specialized High-Risk Payment Processing solutions are indispensable. High-risk merchant processing demands a unique approach due to the elevated potential for chargebacks and fraud. Collaborate with providers experienced in your industry, offering High-Risk Merchant Accounts and Payment Gateways designed to mitigate risks while facilitating smooth transactions. This approach ensures your e-commerce venture thrives even within challenging sectors.

E-Commerce Specifics: Tailored Solutions E-commerce Merchant Accounts and E-commerce Payment Gateways are designed to cater to the distinct requirements of online businesses. These solutions incorporate features like shopping cart integration, mobile responsiveness, and advanced fraud prevention tools. By opting for e-commerce-specific solutions, you enhance the efficiency of your online store and provide customers with a seamless checkout experience.

Navigating the CBD Challenge The CBD industry, while lucrative, often faces payment processing hurdles due to its association with the high-risk category. To accept credit cards for CBD sales, businesses require CBD Merchant Accounts and specialized CBD Payment Processing. Partner with providers familiar with the regulatory landscape and equipped to handle the unique challenges posed by the CBD market. This not only streamlines your transactions but also boosts credibility among customers seeking safe and hassle-free purchases.

youtube

Seamless Integration: Payment Gateways A Payment Gateway serves as the virtual point-of-sale terminal where customers enter their payment information during the checkout process. It encrypts sensitive data, safeguarding it from potential breaches. Opt for Payment Gateway Solutions that offer seamless integration with your e-commerce platform, ensuring a smooth and secure transaction process. Secure payment gateways reassure customers and protect your business from potential liabilities.

Payment processing remains a driving force capable of propelling your business towards success. From traditional credit card processing to high-risk merchant accounts, each aspect plays a pivotal role in ensuring smooth and secure transactions. Embracing tailored solutions like e-commerce merchant accounts and payment gateways empowers businesses to deliver an exceptional customer experience. As industries like CBD and credit repair continue to flourish, navigating high-risk payment processing becomes imperative. Always remember, staying ahead of the curve in e-commerce requires not only exceptional products and services but also a payment processing strategy that inspires trust and convenience.

#credit card payment#credit card processing#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#accept credit cards#Youtube

13 notes

·

View notes

Text

Empower Your Business with a Custom Merchant Account for Payment Ease

Looking to secure a merchant account for your business? Our team of payment processing professionals provides a complete range of merchant account services tailored to match your distinct business requirements. Covering everything from processing credit and debit cards to offering virtual terminals and mobile payment options, we're here to accelerate your transactions and enhance your financial results. Connect with us now to gain insights into our merchant account solutions and initiate the process of embracing payments to drive your business's expansion.

5 notes

·

View notes

Text

Trusted High Risk Payment Processing by Adaptiv Payments

What Is High Risk Payment Processing

High risk payment processing is a special service that helps businesses in risky industries accept credit card and online payments. These businesses may face high chargebacks, refunds, or legal rules that make it hard to get approved by normal banks. Adaptiv Payments offers solutions for these companies so they can process payments safely and without delays. This service is important for businesses that often get declined by regular payment providers.

Why Some Businesses Are High Risk

Some industries are labeled as high risk because of the type of products they sell or the way they operate. For example, CBD, travel, credit repair, subscription services, and telehealth are considered high risk. These industries may deal with many refunds, changing laws, or complaints. Adaptiv Payments understands these challenges and works with trusted banks to offer support and approval to these businesses when others say no.

Fast and Easy Setup

Adaptiv Payments makes it fast and simple for high-risk businesses to get started. Their digital application process takes only a few minutes, and most accounts are approved within hours. After approval, you can start accepting payments in just 24 to 48 hours. This quick process helps business owners start selling without long delays or complicated steps. It’s a big help for companies that need payment solutions right away.

Wide Industry Coverage

Adaptiv Payments supports more than 20 high-risk industries. These include ecommerce, nutraceuticals, kratom, MLM, telehealth, and more. They have over 20 years of experience and work with banks in the US and worldwide. This gives them the power to find the best payment solution for each business. No matter what you sell or where you are, they have a payment option for you.

Complete Payment Tools

Adaptiv Payments gives you more than just a merchant account. They also offer a full set of tools like virtual terminals, payment gateways, and e-commerce integration. Their system works with all major credit card brands like Visa, Mastercard, Amex, and Discover. You can accept payments online, over the phone, or in person. This makes it easier for high-risk businesses to manage sales in any form.

Strong Fraud Protection

Fraud and chargebacks can hurt high-risk businesses. Adaptiv Payments uses smart technology to stop fraud before it happens. Their system watches your transactions in real time and blocks suspicious activity. They also offer chargeback prevention tools to help you keep more of your money. This means better protection for your business and fewer problems with banks or customers.

Global Payment Support

Adaptiv Payments helps high-risk businesses grow worldwide. They support payments in many currencies, so you can accept money from customers across the globe. Whether your business is based in the United States or another country, their system can handle global transactions smoothly. This helps your business reach more customers without worrying about payment limits.

Conclusion

High risk payment processing is important for businesses that face more challenges when accepting payments. Adaptiv Payments provides a trusted and flexible solution that helps these companies stay safe, grow, and succeed. With fast approvals, strong fraud protection, and tools for every type of payment, they are a reliable partner for high-risk merchants. If your business is in a high-risk industry, Adaptiv Payments is ready to help you process payments with ease and confidence.

0 notes

Text

What Is a UnionPay Prepaid Card and How Does It Work? (2025 Guide)

In today's fast-paced digital world, having a secure and globally accepted payment solution is essential. A UnionPay Prepaid Card offers exactly that—a hassle-free, crypto-friendly, 3D Secure virtual card accepted across millions of merchants worldwide.

Whether you're shopping online, traveling, or managing business expenses, UnionPay prepaid cards combine security, flexibility, and international reach—without the need for a traditional bank account.

In this guide, we'll cover everything you need to know about UnionPay prepaid cards, including how they work, user benefits, crypto payment options, and why they’re trending globally.

What Is a UnionPay Prepaid Card?

A UnionPay Prepaid Card is a reloadable payment card issued by UnionPay International, operating similarly to a credit or debit card — but without being tied to a bank account or a line of credit.

Prepaid: You load funds in advance using fiat or cryptocurrency.

Virtual or Physical: UnionPay cards come as virtual cards (for online shopping) or physical cards (for ATM withdrawals and in-store payments).

Global Acceptance: Over 70 million merchants in 180+ countries accept UnionPay.

According to UnionPay International, UnionPay now ranks #1 in global card issuance and #2 in transaction volume, beating Visa in China and expanding heavily in Africa, Southeast Asia, and the Middle East (2024 data).

How Does a UnionPay Prepaid Card Work? (Step-by-Step)

Using a UnionPay prepaid card is simple and user-friendly:StepAction1Sign up with a UnionPay card provider (like ours)2Top up your card using crypto (USDT, BTC, ETH) or fiat currency3Instantly receive your UnionPay virtual card details (card number, CVV, expiry)4Use your card for online shopping, subscription services, travel bookings, and more5Reload anytime as needed

🔹 Virtual UnionPay Card: Perfect for online purchases and subscription services (Netflix, AliExpress, Amazon, etc.) 🔹 Physical UnionPay Card: Great for ATM cash withdrawals, POS terminals, and in-store payments globally.

Why Choose a UnionPay Virtual Card? (Top Benefits)

1. Global Acceptance UnionPay is accepted in over 180+ countries, including Europe, Asia, Africa, and North America.

2. Crypto Top-Up Available Fund your UnionPay card using Bitcoin, Ethereum, USDT, and other cryptocurrencies.

3. 3D Secure & Hassle-Free Your transactions are protected with 3D Secure authentication for maximum fraud protection.

4. No Traditional Bank Needed No bank account? No problem. Just load and spend securely.

5. Instant Issuance Get your UnionPay virtual card instantly after successful top-up.

6. Spending Control Set daily, monthly, or transaction-based limits to control your expenses easily.

7. Seamless Withdrawals Withdraw cash at millions of ATMs worldwide with your physical UnionPay card.

Where Can You Use a UnionPay Prepaid Card?

Online Shopping: Amazon, AliExpress, Shopee, Taobao, Lazada.

Travel Services: Expedia, Booking.com, Trip.com.

Streaming: Netflix, Spotify, Apple Music.

Gaming: Steam, PlayStation Store, Nintendo eShop.

Utilities and Bills: Pay bills using crypto via your UnionPay prepaid card.

🔥 Fun Fact: In 2024, UnionPay cards recorded a 37% increase in international e-commerce transactions, driven by growth in markets like UAE, Singapore, and Nigeria.

How to Load Your UnionPay Virtual Card with Crypto? (Simple Guide)

Loading your card with crypto is easy and fast:

Select "Top Up" in your dashboard.

Choose your preferred crypto (BTC, ETH, USDT, USDC, etc.).

Send the exact amount to your generated crypto wallet address.

Funds are automatically credited after network confirmation.

✅ Instant loading ✅ Low fees ✅ Secure blockchain confirmations

UnionPay Prepaid Card Fees (2025 Overview)

Fee TypeAmountCard Issuance Fee$10 – $15Monthly Maintenance Fee$0Crypto Top-Up Fee1% – 2%ATM Withdrawal Fee2% – 3% (for physical cards)Foreign Exchange Fee~1.5%

Note: Fees may vary depending on your provider (we offer zero monthly fees for our customers!).

Is UnionPay Prepaid Card Safe to Use?

Absolutely. UnionPay integrates multiple security layers:

3D Secure Authentication

Real-Time Transaction Alerts

PIN or OTP Verification for Payments

Advanced AI Fraud Monitoring

EMV Technology (for physical cards)

💡 UnionPay was recognized for having one of the lowest fraud rates among international card networks in 2024.

FAQs: Everything Customers Ask Before Buying a UnionPay Card

1. Can foreigners get a UnionPay virtual card?

Yes! Our UnionPay virtual cards are available worldwide, with no citizenship or residency restrictions.

2. Can I use a UnionPay virtual card for Amazon and AliExpress?

Absolutely. UnionPay is accepted by major e-commerce sites like Amazon, AliExpress, and many others.

3. How fast will I get my UnionPay card?

Virtual cards are issued instantly after your successful crypto or fiat top-up.

4. Can I withdraw cash with a UnionPay virtual card?

No, for ATM withdrawals, you will need a physical UnionPay card.

5. Is KYC (identity verification) required?

In most cases, minimal KYC is required for small limits. For higher limits, basic ID verification may apply.

6. How do I load UnionPay card with USDT or BTC?

Just select "Top-Up" > Choose crypto > Send > Get funds credited instantly.

7. Are there any limits on UnionPay prepaid card usage?

Daily, monthly, and annual limits may apply based on the top-up method and account type. (Example: daily spending limit $2,000 for basic users.)

8. Can I use UnionPay cards with PayPal or Apple Pay?

Some providers (including ours) offer Apple Pay integration with UnionPay cards.

Why UnionPay Virtual Card Demand Is Rising Globally (2025 Insight)

🌎 International E-Commerce Growth: Shoppers need a card that works globally.

💳 Crypto Payment Popularity: Users want cards they can top up with Bitcoin, USDT, and other coins.

🛡️ Security Concerns: UnionPay offers safer, tokenized transactions than traditional banking systems.

🚀 Financial Freedom: No banks, no restrictions — only direct crypto-to-card spending.

According to a recent survey (Statista 2024), over 60% of online shoppers prefer using prepaid or virtual cards for international transactions to avoid fraud risks.

Final Thoughts: Is UnionPay Prepaid Card Right for You?

If you're looking for a fast, secure, crypto-compatible, globally accepted payment solution, a UnionPay prepaid virtual card is an unbeatable choice.

✔ Instantly available ✔ Crypto top-ups accepted ✔ 3D Secure protected ✔ Works worldwide

Ready to experience the next level of online payment freedom? 👉 Get your UnionPay Virtual Card Today – Instant Issuance, Crypto Top-Up Ready!

0 notes

Text

Nurit 2085 Terminal: A Comprehensive Overview

#Nurit 2085 Terminal: A Comprehensive Overview#hypercom#terminal#credit card terminal#terminals#t4100#virtual terminal#hypercom t7plus user#credit card terminals#hypercom t7plus#hypercom m4240 ip#iphone credit card terminal#eclipse credit card terminal#i5100#retriever services#co-op financial services#\enterprise resource planning\#totalmerchantservices#interchange regulations#merchant payment services#barcode reader#merchat services#merchant services#merrchant services#review

1 note

·

View note

Text

Heathrow airport transfer with Ukride: step guide

Traveling can be worrying, especially on the topic of getting to the AZ Airport. If you are looking for a reliable transfer of Heathrow airport, the Ukride is right here to make your adventure smooth, cushion and tension. In this step-by-step guide, we will go through everything you want to recognize about booking your Heathrow Airport with Ukrid.

Step 1: Plan your transfer in advance

As for the transfer of Heathrow airport, it is important in advance. The Ukride allows you to book your conversion nicely in advance and ensure the availability and peace of mind. Whether you arrive or leave Heathrow, a timely reservation offers you one less thing to take care of. In addition, you can avoid the remaining minute increase in prices or the limited availability of the vehicle.

Step 2: Visit the Web Ukride

The Heathrow Airport Reserve with Ukride is surprisingly simple. Start by traveling on the Ukride website. The site is user -friendly and designed to make the reservation way trusted. You will discover all the alternatives you need to customize your journey, including vehicle types, instances of pickup and postponing places.

Step 3: Enter your details

On the homepage you will see the shape of the reservation, where you can enter transmission information. For your Heathrow airport switch you want to provide:

Place of pickup (eg Heathrow Terminal 2, 3, 4 or 5)

The location of a decline

Date and time

Number of passengers

Baggage information

The exact facts ensure that your motif power will arrive in time and with the right vehicle to suit your needs.

Step 4: Select the correct vehicle

One of the fine components of approximately the use of the Ukrid in your Heathrow Airport is a type of car option. Whether you travel solo, family or group, there is a car for all and different:

Standard sedan

Executive cars

MPV for households

Luxury vehicles for special events

Choosing the right car guarantees a comfortable journey regardless of the size of the birthday party or the amount of luggage you have.

Step 5: Confirm and Pay safely

Once you have entered all your information and select a selected vehicle, you can check your reservation. The Ukride gives more than one option of secure fee at your Heathrow airport. You pay the use of credit scores/debit cards or different methods of payments. You will receive an immediate reservation confirmation that contains all the details of your driving and the driver's statistics.

Step 6: Accept the driver's and vehicle details

After the Heathrow airport reservation, the Ukride will send you E -mail or SMS with the driver's data, the automotive type and the telephone wide range. In this way, you have a complete visibility and you can be sure that your journey is sorted.

For arrivals, your motive power will watch your flight and make sure they are there, even if your flight is behind the plan. For departures, he will make sure you get to Heathrow Airport in time in flight.

Step 7: Get to know the driver

On the day of the Heathrow airport switch, your motivational power will encounter a pick -up factor or in the arrival corridor if you have applied for a meeting and greeting. They can keep a sign with your call and make it easier to find them. Professional, polite and useful, virtual drivers are engaged in an extraordinary journey.

Step 8: Enjoy a comfortable journey

Now is the time to relax! During the Heathrow Airport switch, you will enjoy a clean, nicely maintained car pushed using a justified and qualified chauffeur. Ukride specializes in comfort, accuracy and safety and makes sure you reach your place for holiday in time and without tension.

If you have special requirements such as infant seats, other luggage needs or specific routes, Ukrid is glad to accommodate anywhere viable.

Step 9: Arrival on time and without stress

Whether you are heading home, to the motel or to the assembly, your transfer of Heathrow Airport with Ukride will get you right away. You do not want to worry about navigation in public transport, transport of heavy luggage or dealing with a taxi queue. You are looking forward to the door to the door to the door that prefers your comfort.

Why choose the Ukride for your Heathrow airport transfer?

Choosing the right provider in your Heathrow airport is a difference. Here's the reason the Ukride stands out:

Average: Always in time, with actual flight monitoring for airport sensors.

Professional drivers: experienced, polite and certified drivers.

Vehicle options: A large number of cars that suit your needs and preferences.

Transparent prices: No hidden prices. The price you find is the fee you pay.

Customer Support: 24/7 Supporting group aid to help you each time.

For hundreds of happy clients, the Ukride proved to be relying on Heathrow Airport Services.

The last thoughts

Whether you are an ordinary leaflet or this is the first time it travels through the busiest airport in London, a continuous switch at Heathrow Airport can set the tone on your full journey. With Ukride, the reservation is easy, low and reliable. You can ensure that each part of your switch is flawlessly solved by following this step-after step.

Next time you need a switch at Heathrow airport, you agree with the Ukrid to give an incredible travel experience from the beginning. Book up today and travel with peace of mind!

#taxi business#taxi booking#taxi service#chauffeur#ukride#ride to heathrow#heathrow airport transfer

0 notes

Text

Empowering Employees: Employment Law Services by Kamal Law Firm

At Kamal Law Firm, we stand as a trusted pillar of legal support for employees and organizations navigating the complexities of employment law. Our firm is dedicated to protecting workplace rights, ensuring compliance with statutory provisions, and helping clients reach just resolutions. Whether you're facing wrongful termination or seeking compensation for unpaid wages, our experienced attorneys offer strategic solutions tailored to your case.

Our Core Employment Law Services

Wrongful Termination

Have you been dismissed without cause or due process? Our firm specializes in unlawful dismissal claims, representing employees who have been wrongfully terminated. We pursue settlements and legal remedies under the Industrial Disputes Act, Section 25, which safeguards employees against unfair termination.

Contract Disputes

Employment agreements are legally binding. When employers violate contract terms, Kamal Law Firm intervenes with swift legal action. We ensure the enforcement of employment contracts and advise on both non-compete clauses and termination conditions.

Wage Claims

Unpaid salaries, overtime dues, and unfair wage practices are more common than they should be. Under Minimum Wages Act, Section 12, we help clients recover every rupee they’ve rightfully earned. Our lawyers specialize in salary recovery, overtime claims, and full & final settlements.

Harassment Cases

Discrimination and harassment have no place in the workplace. Our team takes a firm stand against sexual harassment, gender bias, and other forms of misconduct. Leveraging the POSH Act, we ensure that every victim finds a voice and every workplace adopts effective anti-harassment mechanisms.

Worker Safety & OSH Compliance

Under Occupational Safety and Health (OSH) guidelines, all workers are entitled to a safe and hazard-free environment. We support accident claim filings, advise on compliance audits, and represent clients in disputes related to unsafe working conditions.

Leave Disputes

Maternity and paternity leave rights are protected under Indian employment laws. We represent employees who have been denied rightful leaves or retaliated against for availing them. Our legal team ensures these rights are enforced, promoting a fair and balanced work environment.

Legal Resolution Process at Kamal Law Firm

At Kamal Law Firm, we’ve streamlined the legal resolution journey to ensure a client-friendly and efficient experience:

Case Review – Free initial consultation to assess your claim.

Evidence Collection – Gathering documentation, emails, contracts, and witness statements.

Negotiation – Engaging employers in settlement discussions to reach amicable resolutions.

Resolution – Representing clients in court or labor tribunal if necessary.

Key Employment Laws We Work With

Industrial Disputes Act, Section 25 Offers protections against unjust termination and lays out retrenchment procedures.

Minimum Wages Act, Section 12 Mandates timely and fair wage payment to employees.

Sexual Harassment of Women at Workplace (POSH) Act Ensures safe workplaces and addresses all forms of sexual harassment.

Employees’ Provident Fund (EPF) Act, Section 6 Safeguards employee retirement funds and mandates employer contributions.

Why Choose Kamal Law Firm?

Proven Track Record: Hundreds of successful resolutions in employment law cases.

Specialized Legal Team: Experts in labor laws, contracts, harassment claims, and wage recovery.

Client Confidentiality & Empathy: Sensitive handling of all workplace issues with utmost discretion.

Accessible Consultations: Offices in major metro areas with virtual consultations available pan-India.

If you're facing workplace injustice or just need clarity on your rights, Kamal Law Firm is here to stand by you. Let us help you navigate your employment dispute with confidence and clarity.

📞 Schedule your free consultation today and get the justice you deserve.

0 notes

Text

POS Terminals Market Outlook 2025: Trends, Opportunities, and Forecasts

The global Point-of-Sale (POS) terminals market is undergoing significant transformation, propelled by advances in digital payment systems, the rise of contactless transactions, evolving retail and hospitality environments, and the growing demand for improved customer experiences. As businesses shift toward automated and tech-driven solutions to streamline sales processes, the POS terminals market is poised for sustained growth through 2032.

Market Overview

A POS terminal is an electronic device that processes card payments at retail locations, restaurants, hospitals, and other points of customer interaction. The evolution of these terminals from simple credit card readers to sophisticated, cloud-integrated systems capable of inventory management, analytics, and customer relationship management has revolutionized modern commerce.

The market, which was valued at USD 85.3 billion in 2023, is expected to reach USD 178.2 billion by 2032, growing at a CAGR of approximately 8.5% during the forecast period. This growth reflects ongoing changes in consumer behavior, regulatory environments, technological advancements, and business digitization.

Download a Free Sample Report:-https://tinyurl.com/4vamy6re

Key Market Drivers

1. Digital Payment Adoption

The accelerating adoption of digital payments globally has been the primary driver of POS terminal market growth. Governments, particularly in developing nations, are supporting cashless transactions through initiatives like India’s Digital India campaign, Europe’s PSD2 regulations, and North America's contactless payment incentives.

Consumers now expect fast, secure, and flexible payment options, which modern POS systems enable through:

NFC (Near Field Communication) support,

QR code scanning,

biometric authentication,

and cloud connectivity.

2. Mobile and Cloud-based POS Systems