#Work-LifeStrategies

Explore tagged Tumblr posts

Text

Finding Work-Life Balance: Strategies for Juggling Career and Personal Well-being

Welcome back to our channel! If you find yourself struggling to juggle your career and personal well-being. We all know how demanding life can get, but don't worry – we've got your back! In this blog post, we'll delve into the art of 'Finding Work-Life Balance: Strategies for Juggling Career and Personal Well-being.

Section 1: Introduction

You've probably experienced those moments when work seems to take over your life, or perhaps you've felt guilty for not dedicating enough time to your loved ones. Don't worry; you're not alone. Finding the perfect harmony between work and personal life is a universal challenge, but fret not – we have some fantastic tips to share with you! Our focus today is on the strategies that can help you navigate these challenges and reclaim balance in your daily life. Let's dive right in Achieving a harmonious work-life balance is a goal many individuals strive for, as it directly impacts their overall well-being and happiness. However, the demands of a fast-paced modern world can make it challenging to strike that perfect balance between professional commitments and personal life. This section will lay the foundation for the subsequent discussions on various strategies that can help individuals navigate these challenges and find equilibrium in their daily lives.

Section 2: Importance of Work-Life Balance

The significance of work-life balance will be highlighted. Stress and burnout are often experienced by those who struggle to balance their professional and personal lives. When work takes precedence over personal time, it can increase stress levels, affecting mental and physical health. Similarly, neglecting work responsibilities in favor of personal matters can result in professional repercussions and reduced job satisfaction. The passive voice will be utilized to emphasize the importance of addressing work-life balance proactively to avoid these negative consequences.

Section 3: Recognizing Work-Life Imbalance

Signs of work-life imbalance will be discussed. Instances of neglecting personal needs and overworking will be considered. It's essential to recognize the red flags that indicate an imbalance between work and personal life. This section will explore passive voice sentences to convey how individuals may experience feelings of constant fatigue, a decline in productivity, strained relationships, or a general sense of dissatisfaction. By understanding and acknowledging these signs, individuals can take the necessary steps to address the imbalance and work towards a healthier and more fulfilling lifestyle.

Section 4: Setting Boundaries

The importance of setting boundaries between work and personal life will be emphasized. Creating clear lines can help manage time effectively. Passive voice sentences will be used to explain how individuals can define limits on work-related activities during personal time and vice versa. By setting boundaries, individuals can allocate dedicated time for their personal needs and family, reducing the risk of work encroaching on their personal lives. Likewise, having defined work hours and avoiding personal distractions during work time can enhance productivity and focus.

Section 5: Time Management Techniques

Passive voice will be used to explain various time management techniques. These methods can aid in achieving a better work-life balance. Time management is crucial for individuals trying to juggle career and personal life responsibilities. This section will explore passive voice sentences to highlight effective strategies, such as prioritizing tasks, using time-blocking techniques, and eliminating time-wasting activities. By efficiently managing their time, individuals can create more space for personal activities and relaxation, leading to improved overall well-being.

Section 6: Flexible Work Arrangements

The benefits of flexible work arrangements will be explored. Opportunities such as remote work can enhance work-life balance. Passive voice sentences will be used to discuss how flexible work options allow individuals to customize their schedules, providing more control over their daily routines. This section will also delve into passive voice examples that showcase how reduced commuting time and improved work-life integration can contribute to higher job satisfaction and a healthier work-life balance.

Section 7: Delegating Responsibilities

The concept of delegating tasks will be covered. Assigning appropriate responsibilities can alleviate work-related stress. Passive voice will be employed to explain how individuals can delegate tasks to colleagues or family members, sharing the workload and freeing up time for personal pursuits. By understanding the value of delegation, individuals can avoid overwhelming themselves with excessive responsibilities and focus on what truly matters both in their professional and personal lives.

Section 8: Learning to Say No

The significance of saying no to excessive work demands will be explained. Passive voice sentences will be used to discuss the importance of setting boundaries and declining additional work or commitments when necessary. By learning to say no, individuals can protect their personal time and well-being, avoiding burnout and exhaustion often associated with an overburdened schedule.

Section 9: Prioritizing Self-Care

The necessity of self-care will be discussed. Passive voice sentences will be used to demonstrate the importance of making personal well-being a priority. This section will explore the various aspects of self-care, including physical, emotional, and mental well-being. By emphasizing self-care, individuals can recharge and maintain the energy and resilience needed to handle their work and personal responsibilities effectively.

Section 10: Establishing Support Systems

Creating support systems in both professional and personal realms will be explored. Passive voice will be used to explain the advantages of having a strong support network. This section will highlight how having supportive colleagues, friends, or family members can provide encouragement, understanding, and assistance during challenging times. Building a reliable support system can alleviate the burden of managing everything alone, promoting a healthier and more balanced lifestyle.

Section 11: Managing Technology Usage

The impact of excessive technology usage on work-life balance will be addressed. Passive voice sentences will be used to discuss ways to manage screen time. In today's digitally connected world, technology plays a significant role in both professional and personal life. However, excessive use of digital devices can lead to a blurring of boundaries between work and personal time. This section will explore passive voice examples that illustrate effective strategies for managing technology usage, such as setting designated "tech-free" times or using apps that track and limit screen time. By adopting mindful practices regarding technology, individuals can strike a healthier balance between their digital lives and personal well-being.

Section 12: Engaging in Hobbies and Interests

The benefits of pursuing hobbies and interests outside of work will be highlighted. Passive voice will be employed to convey the advantages of such activities. Engaging in hobbies and interests is essential for personal fulfillment and work-life balance. This section will explore passive voice sentences that showcase how investing time in enjoyable activities can serve as a form of relaxation and rejuvenation. Hobbies can also provide a sense of accomplishment and help individuals maintain their identity and passions outside of their careers.

Section 13: Mindfulness and Meditation

The practice of mindfulness and meditation for reducing stress will be discussed. Passive voice will be used to explain how these techniques can be incorporated into daily life. Mindfulness and meditation have gained popularity as effective tools for managing stress and promoting overall well-being. This section will explore passive voice examples that demonstrate how incorporating mindfulness practices into daily routines can help individuals stay present, reduce anxiety, and improve focus. By cultivating a mindful mindset, individuals can better navigate the challenges of work and personal life with greater ease.

Section 14: Seeking Professional Help

Passive voice sentences will be used to explore seeking professional help when work-life balance becomes overwhelming. Guidance from counselors or coaches can be beneficial. Sometimes, despite our best efforts, work-life balance remains elusive, and the toll on well-being becomes overwhelming. This section will highlight passive voice examples that emphasize the importance of seeking support from professionals. Whether through counseling, coaching, or therapy, reaching out for help can provide valuable insights and coping strategies to achieve a more balanced and fulfilling life.

Section 15: Importance of Communication

The significance of open communication with employers, colleagues, and family will be emphasized. Passive voice will be employed to convey the need for effective dialogue. Effective communication is key to maintaining a work-life balance. This section will explore passive voice sentences that showcase the importance of expressing needs and boundaries clearly in professional and personal relationships. By fostering open communication, individuals can better negotiate flexible work arrangements, share responsibilities, and ensure mutual understanding of each other's needs.

Section 16: Learning to Compromise

The concept of compromise in balancing career and personal life will be explored. Passive voice will be used to discuss finding a middle ground. Achieving a perfect work-life balance may not always be feasible, but compromise can pave the way for harmony. This section will delve into passive voice examples that highlight how finding a middle ground between work and personal commitments can lead to greater satisfaction and reduced feelings of conflict.

Section 17: Avoiding Perfectionism

The drawbacks of perfectionism in relation to work-life balance will be addressed. Passive voice sentences will be used to explain the importance of embracing imperfections. Striving for perfection in both professional and personal domains can be a major impediment to work-life balance. This section will explore passive voice examples that emphasize the benefits of adopting a more realistic and self-compassionate approach. By letting go of the need to be flawless, individuals can relieve themselves of unnecessary stress and enjoy a more balanced and fulfilling life.

Section 18: Celebrating Achievements

The practice of acknowledging and celebrating accomplishments will be discussed. Passive voice will be used to explore the positive impact of recognition. Celebrating big and small achievements is an essential aspect of work-life balance. This section will highlight passive-voice sentences that convey how recognizing one's successes can boost motivation, self-esteem, and overall well-being. By taking the time to appreciate their accomplishments, individuals can maintain a sense of satisfaction and stay motivated in their professional and personal pursuits.

Section 19: The Journey to Balance

Passive voice will be employed to convey that achieving work-life balance is a journey and not a destination. Small steps can lead to significant improvements. Work-life balance is not a one-time achievement but an ongoing process. This section will explore passive voice examples that emphasize the significance of making gradual changes and embracing the evolution of balance over time. By acknowledging that it's a journey, individuals can relieve themselves of the pressure to find a perfect balance immediately and instead focus on continuous improvement.

Section 20: Conclusion

In conclusion, finding a work-life balance is essential for personal well-being and professional success. By employing passive voice sentences and implementing the strategies discussed, individuals can lead more fulfilling lives by harmonizing their careers and personal lives. It is crucial to remember that work-life balance is not a fixed destination but a dynamic state that requires constant adjustments and prioritization. By embracing the strategies outlined in this blog post and understanding the importance of self-care, communication, and setting boundaries, individuals can pave the way for a more balanced and rewarding life.

Looking to take your personal finance journey even further?

Check out “The Mental Time Travel System,” an extraordinary program. Drawing upon decades of experience in hypnosis and metaphysics, as well as cutting-edge concepts like Brief Therapy and Narrative Psychology, this system goes beyond anything you’ve ever encountered before. Through profound insights and effective methods, “The Mental Time Travel System” unlocks the secrets of the Universe, offering you the tools to manifest anything you desire, including “The Big 3.” If you’re ready to take your manifestations to new heights and create a life of abundance and fulfillment, this program is a must-have resource. Please note that by using the affiliate link provided, you support our website at no additional cost to you. Take the next step on your personal development journey and explore “The Mental Time Travel System” today! Are you ready to take your life to the next level? If you’re looking for ways to improve your happiness, productivity, relationships, or overall well-being, then you need to check out our self-help and self-improvement blog. Read the full article

#career#CareerandPersonalLife#happiness#HealthyLifestyle#JugglingWorkandPersonalLife#PersonalWell-being#Prioritization#productivity#StrategiesforWork-LifeBalance#stressmanagement#timemanagement#TipsforWork-LifeBalance#well-being#work-lifebalance#Work-LifeStrategies

0 notes

Text

4 Extremely Basic Steps for Students to Start Investing

Investing advice is confusing.

It’s not very practical and it can be very vague. And too many times it ends up with you researching everything you just read.

The thing is, it’s not easy as a student to see what a portfolio should look like. Not many people share what exactly they’re investing in (FoxyMonkey has a great post on his own portfolio). It’s true; every person invests differently and it all depends on your risk appetite and what you’re interested in investing in.

So here I’m going to take you through the individual steps to start investing as a student, and will encourage you to do research and shop around, as with all investing posts. However, we’ll also be following the steps of Katie, a normal (but still cool) student who wants to get started in the investing world.

(Remember that I am not a financial advisor and cannot be held accountable for any investments decisions) (Neither can Katie)

Vamos!

1. Make a plan

The number one reason people don’t start investing: ‘I don’t have money!’. Wrong! You do have money (yes, even students!). What you need is a plan.

Start by following the 15% rule: allocating 15% of your income to yourself (here’s a guide to get started). From that 15%, figure out how much you want to use for investing. This really depends on your priorities and where you want to put your money first.

You’ll be putting this money into index funds. Index funds are basically a basket of funds which track the market, and will have the same return as the market every year. This will be done through a Stocks and Shares ISA that gives you an allowance of £20,000 every year completely tax free. That means you won’t have to pay tax when you declare your investments.

As you put in some money every month, the amount will accumulate every time forming a nice nest egg. You can then use this little egg as an emergency fund, for a big expense or simply to save for the future – the decision is all yours. And if you suddenly you decide you need the money right now, you just sell your assets and the cash is there in 3-5 days. So chill.

Of course, remember that the market fluctuates over time you could lose money as well as gain some. However, in the long run, you’ll be gaining.

Our friend Katie is very excited to start investing. She earns £500 a month. 15% of 500 is £75. She decides she’s willing to put £50 every month into an index fund to start building her emergency fund. Now she has a plan.

2. Sign up to a platform

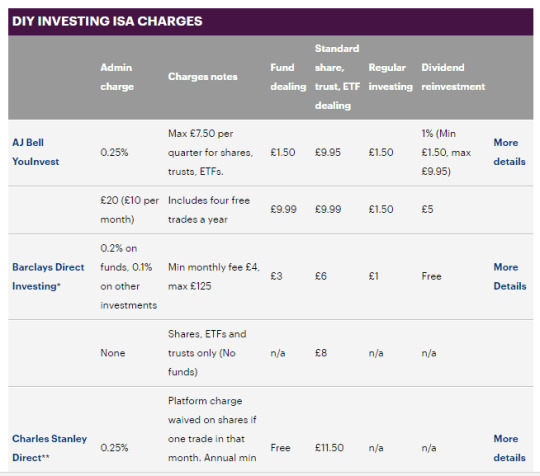

You’ve got your money, now you choose which platform to put it in. How to choose? Look for the one with the cheapest costs and which appeals the best to you. Here’s a list:

Image from This is Money

This is the part that frustrates me. No one wants to recommend a specific investment platform, so they just say do your own research. Personally, I use Vanguard for index investing. Which one should you use?

I recommend picking 3 from the list and signing up to them (the lower the costs, the better). No money, just signing up. Try them out and see which one you like the best: easy to understand platform, good customer service and a good choice of index funds – those are things you’re looking for. Vanguard is popular because of the extremely low costs, but maybe you prefer something else because it’s easier to understand.

Only you can say, which is why it’s good to try out several platforms. I also recommend going on Reddit threads and seeing how other people invest and what they recommend, you can really learn a lot.

Katie tries out a few. She visits their websites and even signs up to a few demo platforms (another good way to test a platform). Eventually she goes with Vanguard (what a coincidence). She signs up: sends them a photo of her passport and proof of address. Once she’s in, she opens up an ISA (the steps are detailed on the platform) and adds £50 – the first month. This means she has £50 in cash in the platform. She hasn’t invested any of it yet.

3. Invest

Once you’ve signed up to the platform of your choice, it’s time to choose what to invest in. Yes, we said index funds, but there are different types of index funds which track different markets. You could track the FTSE 100, Emerging markets, Global index funds and others such as small cap index funds(small companies). Check the info on each fund: it tells you their past performance, what fees they charge and how risky they are.

What I recommend: something global. You don’t want to invest only in one area, since it’s more likely to fluctuate (especially Britain with Brexit and all). Pick a few of the global ones and read through the info pdfs of each one. It will tell you the level of risk, the fees and what exactly it invests in. Pick 5 and try to narrow it down to 1 or 2. That’s where you’ll be putting your money!

Katie looks around Vanguard and decides she wants to go global (we have a clever one!). Vanguard offers Global index funds (called LifeStrategy 100% Equity) at 0.22% cost and with a risk of 5/7. She invests her £50 into the index fund. Yay! She then sets up a direct debit so that every month £50 go into Vanguard global index funds.

4. Practice

It’s exciting to see your money grow every month. You can now sit back and relax, your money is working for you as it earns interest and accumulates over time

But it’s good to keep practicing and keep being interested. You are now an investor: look at what’s going on in the news, check out how other people invest and where else you could do with your money. But of course, only if you want to. What’s great about passive investing is that it’s exactly that: passive. The fact that you’re investing in the first place already a huge step.

After a few months of investing and seeing her nest egg grow, Katie decides she wants to take the next step and really learn more about investing. She signs up to The Economist (which is £12 for the first 12 issues btw!) to keep up to date with the world, she checks out how other people invest on Reddit forums and she looks around for other ways to make her money work for her: maybe a side-hustle, a different index fund, etc. She’s pretty excited; she knows that as long as she keeps her 15% rule going, her nest egg will grow and so will her knowledge.

It’s not easy to get started with investing when it looks scary and risky, but once you understand what the steps are and how simple it can be, you realise how important it is to start investing now. Be like Katie: take the first step. Start researching, looking around and asking on forums. The amount of knowledge out there is astounding, you just need a little push to find it.

Have investing doubts? What’s holding you back? Lemme know below!

#britain#british#uk#british student#english student#scotland#england#student#student finance#college finance#study#university#money#financial independence#budget#financial education#make money#save money#studyspo#college#work#student job

35 notes

·

View notes

Photo

Reposted from @yahminahmcintosh_ - Having the right attitude will save you some time, energy and money. Laugh, Smile, Dance, speak life...repeat! So as my destiny would have it, as I was ending my day, I looked outside and saw that it was snowing heavyily!! Ugh, I stomped and there was some eye rolling too, lol. I know how the drive home usually is in weather like this and I was not necessarily feeling that long drive. Ok so that was my little fit I threw then I shifted, because I knew that my attitude toward the snowy conditions (inevitable because, hellooooo it's Winter Yahminah!!) would make my drive home not so amazing and longer than it should be. So Chile I had to get myself together and prepare for this journey. I took off my suit coat and heels, put on my coat (I wore my lighter winter coat today because I've been having some crazy hot flashes) and backpack and hit it! (I've always wanted to say "Hit it" like that. lol. I put one of my headphone plugs in my left ear and rocked out to "Summertime" by Will Smith. For a moment there I felt like I was walking in Slow Motion! It was so cool and I'm just amazed at the power of the imagination! I tell you at 43 years old I'm finding ways to always have the time of my life and today this came in real handy because I had quite an involved day. So as I walked out into the world and started the journey (notice I said "journey" and not "hike"...Oh the Power of Language) toward my vehicle the real inside work continued and what happened next BLEW MY MIND. I'll share in my next post. #Yahminahmcintosh #lifestrategy #coach #business #motivation #attitudeiseverything #yourlifeisimportant #winter #womanhood #motherhood #happiness #leo #enlightenment #insight #purpose #innerpeace #growth #transformation #attitude #perspective #spirituality #empowerment #enjoylife - #regrann https://www.instagram.com/p/BuZBnUVlCHd/?utm_source=ig_tumblr_share&igshid=bk6qa3g0kjd7

#yahminahmcintosh#lifestrategy#coach#business#motivation#attitudeiseverything#yourlifeisimportant#winter#womanhood#motherhood#happiness#leo#enlightenment#insight#purpose#innerpeace#growth#transformation#attitude#perspective#spirituality#empowerment#enjoylife#regrann

0 notes

Text

The Slow and Steady passive portfolio update: Q4 2018

The trouble started just after the last update of our Slow & Steady passive portfolio. We took a hit in October, staggered on through November, then went down like a sack in December.

News reports made the market turmoil sound like the Charge of the Light Brigade.

The result of this butchery? Our passive portfolio turned in its worst ever annual performance. We were down 3% on the year.

Quick, send in the trauma counsellors!

Do not adjust your sets

As a rule of thumb, we should expect our equities to be down one in every three New Year Eves. Sure, 2017 was all champagne corks and 2018 was nose pegs – but this is situation normal.

The fact is we’ve had an easy ride since the Global Financial Crisis. This is only the second negative year recorded by the Slow & Steady portfolio since its debut eight years ago. We’re still growing at 7.95% annualised and we’ve yet to take anything worse than a noogie from the market.

You can inspect this latest Chinese burn for yourself in Retina-Blitz-Super-Gore-o-vision:

The Slow and Steady portfolio is Monevator’s model passive investing portfolio. It was set up at the start of 2011 with £3,000. An extra £955 is invested every quarter into a diversified set of index funds, tilted towards equities. You can read the origin story and catch up on all the previous passive portfolio posts.

It’s always salutary to see how diversification dilutes the pain. This time our global property and UK government bond funds closed the year in positive territory – just. That salved our portfolio from the deeper cuts borne by emerging markets, UK equities, and global small caps. They’re showing annual losses of around minus 10% at the time of writing.

Diversification doesn’t always work immediately – sometimes it doesn’t work at all – but our bonds take the edge off more often than not. If you’ve been chewing your fingernails over the last three months, upping your bonds is the answer. Read up on risk tolerance.

As it is, the Monevator reader ranks seem to be holding the line and dreaming of cheap equities.

Elsewhere, the doom-mongers hold court. We’re at the mercy of Brexit, Trump’s next tweet, the Fed turning the interest rate screw. Take your pick.

A couple of those woes illustrate why you can’t profit from prophets. Does anyone know how Brexit will end? No. Does anyone know what Trump will do next? No. Even he doesn’t know.

Portfolio maintenance

Moving on, it’s annual portfolio service time. Our plan commits us to reducing equity exposure as our investing clock runs down. Every year we move 2% from the risky equities side to the defensive bond side of our portfolio.

This is conventional and sensible risk management. As we age, we have less time to recover from a market-quake. More wealth in bonds means more wealth in recession-resistant assets.

Our asset allocation is now 64:36 equities vs bonds, very close to the classic 60:40 mix. The portfolio started on 80:20 back in 2011, when we had little to lose and two decades stretching ahead. With 12 years to go it’s still a pro-growth portfolio, but with plenty of padding should markets crash.

So this time around we just shave 1% from a couple of our spicier asset classes and buy more bonds, right?

If only!

Prepare yourself for a rejig more complicated than the pasodoble:

Global small cap: -1%

Global property: -1%

UK equities: -1%

UK inflation-linked bonds: -1%

Developed world equities: +1%

UK conventional government bonds: +3%

Why so fiddly? Allow me…

Firstly, our equity diversifiers (global small cap and property) are set at 10% of our total equities allocation. Meanwhile our equities allocation downsized from 66% to 64% of our portfolio pie. The effect on global small cap was: 10% x 64% = 6.4% total allocation.

Decimal points have no place in asset allocation but now we’re rounding down not up. Hence global small cap and global property got 1% sliced off.

Ideally we’d end it there, but we also try to keep our main equity holdings in line with global market allocations. Star Capital helps us do that with their regular updates on the weights of world stock markets.

The UK’s share of global markets was about 5% (from around 8% in 2o11, incidentally, economic decline fans). That translates to a 3% share of our equity allocation.

However there’s little point to sub-5% holdings in relatively small portfolios – it just doesn’t make enough difference. Instead we’ll reduce the UK to 5% of our overall portfolio and that will be our bottom line. This makes us overweight UK (crack open the Union Jack underpants) but we’ll let that pass – the UK market seems quite cheap and it’s our home currency, for better or worse.

We should have knocked back emerging markets, too. They’ve had a rough year and their wedge is smaller now. But emerging economies themselves are under-represented by the capital markets and valuations are favourable, so we’ll hold our overall allocation at 10%.

Finally, I’m now broadcasting from the outer reaches of interest but if anyone wants to know why I’ve trimmed our UK inflation-linked government bonds then it’s because the available linker funds have structural issues.

The short version is there’s mucho interest rate risk embedded in these products. We only carry them as a diversifier and I’d prefer to do that at the minimum practical level of 5%.

What no robot?

You can see how even a committed passive investor like myself needs to make all kinds of judgement calls. It’s hardly day-trading, but it isn’t pure mathematics, either.

In my view, rules only fit reality if you bend them a bit.

There’s no guarantee that any of my tilts will play out better than buying an all-in-one, Vanguard LifeStrategy fund – but this kind of portfolio maintenance only takes a few hours a year. And I like being invested in my investments.

Increasing our quarterly savings

Now we need to face one more fact of life – inflation. Each year we adjust our regular contributions by the Office for National Statistics’ RPI inflation report. This tells us we have to find another 3.2% this year to ensure our plan keeps pace with the cost of living.

In 2011 we were investing £750 every quarter. That had ballooned to £935 by 2018. That’s £955 in 2019 money.

So £955 it is this quarter, which merges with our annual rebalancing move to generate the following hot buy and sell action:

UK equity

Vanguard FTSE UK All-Share Index Trust – OCF 0.08%

Fund identifier: GB00B3X7QG63

Rebalancing sale: £204.82

Sell 1.107 units @ £185.08

Target allocation: 5%

Developed world ex-UK equities

Vanguard FTSE Developed World ex-UK Equity Index Fund – OCF 0.15%

Fund identifier: GB00B59G4Q73

New purchase: £827.85

Buy 2.595 units @ £318.97

Target allocation: 37%

Global small cap equities

Vanguard Global Small-Cap Index Fund – OCF 0.38%

Fund identifier: IE00B3X1NT05

Rebalancing sale: £162.22

Sell 0.633 units @ £256.21

Target allocation: 6%

Emerging market equities

iShares Emerging Markets Equity Index Fund D – OCF 0.27%

Fund identifier: GB00B84DY642

New purchase: £310.74

Buy 208.554 units @ £1.49

Target allocation: 10%

Global property

iShares Global Property Securities Equity Index Fund D – OCF 0.22%

Fund identifier: GB00B5BFJG71

Rebalancing sale: £455.15

Sell 229.756 units @ £1.98

Target allocation: 6%

UK gilts

Vanguard UK Government Bond Index – OCF 0.15%

Fund identifier: IE00B1S75374

New purchase: £1,100.92

Buy 6.721 units @ £163.80

Target allocation: 31%

UK index-linked gilts

Vanguard UK Inflation-Linked Gilt Index Fund – OCF 0.15%

Fund identifier: GB00B45Q9038

Rebalancing sale: £462.33

Sell 2.425 units @ £190.64

Target allocation: 5%

New investment = £955

Trading cost = £0

Platform fee = 0.25% per annum.

This model portfolio is notionally held with Cavendish Online. Take a look at our online broker table for other good platform options. Look at flat fee brokers if your ISA portfolio is worth substantially more than £25,000. The Slow & Steady portfolio is now worth over £41,000 but the fee saving isn’t juicy enough for us to push the button on the move yet.

Average portfolio OCF = 0.18%

If all this seems too much like hard work then you can buy a diversified portfolio using an all-in-one fund such as Vanguard’s LifeStrategy series.

Take it steady,

The Accumulator

The Slow and Steady passive portfolio update: Q4 2018 published first on https://justinbetreviews.weebly.com/

0 notes

Photo

Today Insight: We're are in between holidays and what I see is some habits or mindset may get the best of you if you're not careful. Elevate your thoughts create balance from within. Try to be optimistic during the next couple of days for your goals, and daily life requires balance. If you're not finding joy where it should be. It's all in your head and your simply not allowing the sweetness of life to fully come to you. Do not look at other people lives have an example of your own idea of lack. They could actually be creating negative conditions for themselves all that glitters isn't gold. It not a time for excess which could, in turn, create a debt of some kind emotional or financial. If you feel like some people are gaining all of their heart desire in one fell swoop. Fear not!!! You to also have the ability to reach for your own goals and heart desire. Remove all the self-limiting belief and focus only on what create elevated balance towards your goals. Seek not the glimmer of other people desire. Only focus on what you can create without the feeling of lack. That lack feeling is your mental programming of what others feels you should have. Look toward meditation or reiki session to get you out of these mental lows. Snap out of it techniques! Has the remaining plates of holiday delights goes around take one of two things to focus on. Do not become excessive in the feeling of MORE is better. That simply not true. Be gentle with yourself and release looking over at other people influences has a statement for your own contentment. For those of you hitting the mark of their hearts desire to share your wealth of knowledge effectively. Don't create self-limiting thought of other potential just simply share. Suggest: Meditation and quiet time to shake of any feeling that is not in your highest good. Don't over indulge to feel apart of something or the norm. Find joy in the smallest things and don't get down on everyday life (paying bills or work issues). #joy #lifecoach #lifestrategies #intuitivelifecoach #spiritualcoach #rva #boss #newyear #selfdevelopment #personalpower #noexcess #balance #motivational https://www.instagram.com/p/Br7o_jEFaRz/?utm_source=ig_tumblr_share&igshid=o8gbb22alfle

#joy#lifecoach#lifestrategies#intuitivelifecoach#spiritualcoach#rva#boss#newyear#selfdevelopment#personalpower#noexcess#balance#motivational

0 notes

Text

Evaluating a Financial Advisor's Client Investment Performance

A reader writes in, asking:

“How can you measure, and verify, a financial adviser's performance for the sake of comparing one prospective adviser to another?”

While this is a common question for people to ask, it's not really a useful way to evaluate a financial advisor - for a few reasons.

First, an advisor doesn't recommend the same portfolio to everybody. The investment portfolio that is appropriate for you as a client may be wholly inappropriate for another client with very different circumstances.

If an advisor or advisory firm were to calculate something like the average annualized return earned by their clients over a given period, that figure wouldn't provide a meaningful point of comparison to another advisor's such figure. For example, if one advisor has a clientele that is primarily middle class retirees, while another advisor's clientele is primarily super-high-earners in their 30s or 40s, the clients of the first advisor would probably have, on average, lower returns over the last several years than clients of the second advisor - and that would simply be the result of the first advisor recommending appropriately low-risk portfolios for his/her clients.

In short, there's no single figure that can be calculated to meaningfully measure how well the investment recommendations of a given financial advisor have performed over a given period.

Second, an advisor shouldn't really be trying to do anything clever with respect to client portfolios. If an advisor is putting together a portfolio for you, a simple, boring portfolio of index funds/ETFs that approximately match the market's return is your best bet. Intentionally seeking out an advisor who shows you a backtested, market-beating portfolio is setting yourself up for disappointment.

Finally, an advisor who engages in actual financial planning does a whole lot more than just make investment recommendations for clients.

A financial planner can also provide advice about tax planning or estate planning. They can help you evaluate your insurance coverage to see if there's anything important you have missed (e.g., disability insurance). They can help with Social Security planning, and retirement planning in general. They can provide assistance with budgeting if that's something you struggle with. They can provide advice with regard to your employee benefit options (e.g., help determine which health insurance is the best fit for your family).

And frankly, investment management is quickly becoming the least valuable part of financial planning. While there are still plenty of people whose investment performance would be improved by working with a financial advisor, the list of tools available for DIY investors to create a low-maintenance portfolio has grown dramatically over the last decade. Investors can now choose from Vanguard's LifeStrategy funds, low-cost indexed target retirement funds at various providers, a smorgasbord of total market index funds/ETFs, or low-cost services like Betterment or Vanguard Personal Advisor Services.

What is the Best Age to Claim Social Security?

Read the answers to this question and several other Social Security questions in my latest book:

Social Security Made Simple: Social Security Retirement Benefits and Related Planning Topics Explained in 100 Pages or Less

Click here to see it on Amazon.

Disclaimer:Your subscription to this blog does not create a CPA-client or other professional services relationship between you and Mike Piper or between you and Simple Subjects, LLC. By subscribing, you explicitly agree not to hold Mike Piper or Simple Subjects, LLC liable in any way for damages arising from decisions you make based on the information available herein. Neither Mike Piper nor Simple Subjects, LLC makes any warranty as to the accuracy of any information contained in this communication. I am not a financial or investment advisor, and the information contained herein is for informational and entertainment purposes only and does not constitute financial advice. On financial matters for which assistance is needed, I strongly urge you to meet with a professional advisor who (unlike me) has a professional relationship with you and who (again, unlike me) knows the relevant details of your situation.

You may unsubscribe at any time by clicking the link at the bottom of this email (or by removing this RSS feed from your feed reader if you have subscribed via a feed reader).

0 notes

Text

Why It’s So Important to Diversify Your Investments

When it comes to investment advice for newbies, you’ve probably heard just how important it is to diversify your investments. But what exactly does it mean to diversify, and how does it help grow your money in the long-term?

We’ll go over the nuts and bolts of investing and share some simple ways to diversify your investments:

What Is Diversification?

In a nutshell, diversification simply means not putting all your eggs in one basket. Diversification refers to investing in a variety of asset classes as well as choosing a mix of investments within each asset class, explains Tara Falcone, CFP® and founder of ReisUp. Historically, diversifying your investments has proved to net you returns while lowering the risks.

Note that diversification is different than asset allocation, which refers to the mix of primary investment baskets, or asset classes, in your portfolio. For example, with asset allocation, you could be 100% invested in stocks, or you could be 50% invested in stocks and 50% in bonds, or some such combination. So the 100% stock portfolio just mentioned is likely not well diversified because it only contains stocks. However, the 50/50 portfolio is diversified because you’re investing in both stocks and bonds.

Why Diversify?

“Diversifying your investments is important because it’s extremely difficult to know which investments will perform best, especially in the short term,” says Mike Palazzolo, CFP® and founder of the Detroit-based financial planning firm Fintentional. “When you diversify, you spread your investment across many companies around the globe.”

“You always want certain pieces of your portfolio to be in favor no matter what’s going on in the market,” adds Falcone. “This allows the in-favor asset classes to ‘cushion the fall’ when other assets are out of favor.” For example, take a portfolio that contains only stocks. If the stock market drops 20%, your portfolio would lose 20% of its value. But if you were 50/50 invested in stocks and cash, your portfolio would only lose 10% of its value.

Your investment mix depends on two main things: 1) your comfort level with risk and 2) your target date for retirement. So if you are in your 20s or 30s and are comfortable taking on a lot of risk, you may have a more aggressive investment mix, which is usually more stocks (stocks are typically riskier but have a higher rate of return) and less in bonds (they’re less risky but also have a lower rate of return).

Here are some ways you can go about diversifying your investments:

Spread Your Contributions Across Different Asset Classes

Instead of investing just in stocks, create an investment mix of the three different asset classes: stocks, bonds and cash. You can do this yourself and change the mix over time. If in doubt, talk to a financial planner and get some expert advice based on your particular situation and money goals. They can provide strategies and come up with a solid game plan to align with your risk level and target dates.

Invest in Low-Cost Index Funds

Diversifying your investments doesn’t have to be difficult or complicated, explains Palazzolo. Many investment firms offer a family of funds. For example, Vanguard offers a family of funds called LifeStrategy that ranges from 20% to 80% stock exposure. Under the covers, the funds invest in Vanguard Total U.S. Stock Market, Vanguard Total International Stock, Vanguard Total U.S. Bond, and Vanguard Total International Bond index funds. By investing in one of the LifeStrategy funds, you would own shares of over 10,000 stocks and 12,000 bonds.

Invest with a Robo-Advisor

These days there are plenty of options to invest with a robo-advisor. While it sounds very futuristic and high-tech, a robo-advisor is just a way to receive financial advice and portfolio management with very little human interaction.

Using algorithms, robo-advisors give you recommendations regarding which investments to put your money in, based on the information you provide. And because robo-advisor platforms usually offer low-fund exchange-traded funds (ETFs), the fees are typically much lower and offer the same rate of return. This is a good option for those who are just starting out or don’t have a lot of money to invest with.

On the other hand, because a robo-advisor is a hands-off option, if you have a unique situation or just want deeper interaction with a professional, then a robo-advisor may not be the best route for you.

Be Mindful of Fees

Of course, if you’re going to make money, you’ll have to spend some money in the form of fees. If you’re investing in mutual funds, index funds, and ETFs, you’ll be charged an expense ratio, which is a percentage of your investment. Expense ratios are charged as an annual fee.

Besides annual fees, you may be charged with transaction fees, management fees and something called a front-end load fee, which is something you pay when you purchase shares of a mutual fund. Like an expense ratio, the fee is also a percentage of a fund. There’s also a back-end load fee, which is something you pay when you sell a mutual fund. This is also expressed as a percentage of the amount you sell.

It’s important to do your research and know what the fees are before you invest. The lower the fees, the more you’ll have to invest. While these fees are normally deducted from your investment so you may not notice them, they do lower the investment amount. As a result, less money will be invested.

The Pitfalls of Diversifying

Note that diversifying could also weaken your portfolio’s overall growth, explains Falcone. For example, if your portfolio is 100% stocks and the stock market goes up 20%, your entire portfolio would be up 20%. If you had $1,000 to begin with, you’d make $200, or a 20% increase. However, if you were 50/50 stocks and cash and stocks rise 20%, but the cash remains unchanged, you’d only earn $100, or 10% overall. Despite that, it will help lower the risk and help you grow your money.

While your money may not grow as much if you invested in individual stocks, diversification will help you spread your risk and help you hit your money goals for the long term. “The best investors aren’t the biggest risk takers,” says Phillip Washington Jr., CFP® and founder of Stone Hill Wealth Management. “They are the most self aware investors who play with the cards they were given, and don’t take risks with their hard-earned money that they don’t understand.”

Do you have a diverse portfolio? Do you manage it yourself or work with a professional? Let us know in the comments below!

The post Why It’s So Important to Diversify Your Investments appeared first on ZING Blog by Quicken Loans.

from Updates About Loans https://www.quickenloans.com/blog/important-diversify-investments

0 notes

Text

4 Extremely Basic Steps for Students to Start Investing

Investing advice is confusing.

It’s not very practical and it can be very vague. And too many times it ends up with you researching everything you just read.

The thing is, it’s not easy as a student to see what a portfolio should look like. Not many people share what exactly they’re investing in (FoxyMonkey has a great post on his own portfolio). It’s true; every person invests differently and it all depends on your risk appetite and what you’re interested in investing in.

So here I’m going to take you through the individual steps to start investing as a student, and will encourage you to do research and shop around, as with all investing posts. However, we’ll also be following the steps of Katie, a normal (but still cool) student who wants to get started in the investing world.

(Remember that I am not a financial advisor and cannot be held accountable for any investments decisions) (Neither can Katie)

Vamos!

1. Make a plan

The number one reason people don’t start investing: ‘I don’t have money!’. Wrong! You do have money (yes, even students!). What you need is a plan.

Start by following the 15% rule: allocating 15% of your income to yourself (here’s a guide to get started). From that 15%, figure out how much you want to use for investing. This really depends on your priorities and where you want to put your money first.

You’ll be putting this money into index funds. Index funds are basically a basket of funds which track the market, and will have the same return as the market every year. This will be done through a Stocks and Shares ISA that gives you an allowance of £20,000 every year completely tax free. That means you won’t have to pay tax when you declare your investments.

As you put in some money every month, the amount will accumulate every time forming a nice nest egg. You can then use this little egg as an emergency fund, for a big expense or simply to save for the future – the decision is all yours. And if you suddenly you decide you need the money right now, you just sell your assets and the cash is there in 3-5 days. So chill.

Of course, remember that the market fluctuates over time you could lose money as well as gain some. However, in the long run, you’ll be gaining.

Our friend Katie is very excited to start investing. She earns £500 a month. 15% of 500 is £75. She decides she’s willing to put £50 every month into an index fund to start building her emergency fund. Now she has a plan.

2. Sign up to a platform

You’ve got your money, now you choose which platform to put it in. How to choose? Look for the one with the cheapest costs and which appeals the best to you. Here’s a list:

Image from This is Money

This is the part that frustrates me. No one wants to recommend a specific investment platform, so they just say do your own research. Personally, I use Vanguard for index investing. Which one should you use?

I recommend picking 3 from the list and signing up to them (the lower the costs, the better). No money, just signing up. Try them out and see which one you like the best: easy to understand platform, good customer service and a good choice of index funds – those are things you’re looking for. Vanguard is popular because of the extremely low costs, but maybe you prefer something else because it’s easier to understand.

Only you can say, which is why it’s good to try out several platforms. I also recommend going on Reddit threads and seeing how other people invest and what they recommend, you can really learn a lot.

Katie tries out a few. She visits their websites and even signs up to a few demo platforms (another good way to test a platform). Eventually she goes with Vanguard (what a coincidence). She signs up: sends them a photo of her passport and proof of address. Once she’s in, she opens up an ISA (the steps are detailed on the platform) and adds £50 – the first month. This means she has £50 in cash in the platform. She hasn’t invested any of it yet.

3. Invest

Once you’ve signed up to the platform of your choice, it’s time to choose what to invest in. Yes, we said index funds, but there are different types of index funds which track different markets. You could track the FTSE 100, Emerging markets, Global index funds and others such as small cap index funds (small companies). Check the info on each fund: it tells you their past performance, what fees they charge and how risky they are.

What I recommend: something global. You don’t want to invest only in one area, since it’s more likely to fluctuate (especially Britain with Brexit and all). Pick a few of the global ones and read through the info pdfs of each one. It will tell you the level of risk, the fees and what exactly it invests in. Pick 5 and try to narrow it down to 1 or 2. That’s where you’ll be putting your money!

Katie looks around Vanguard and decides she wants to go global (we have a clever one!). Vanguard offers Global index funds (called LifeStrategy 100% Equity) at 0.22% cost and with a risk of 5/7. She invests her £50 into the index fund. Yay! She then sets up a direct debit so that every month £50 go into Vanguard global index funds.

4. Practice

It’s exciting to see your money grow every month. You can now sit back and relax, your money is working for you as it earns interest and accumulates over time

But it’s good to keep practicing and keep being interested. You are now an investor: look at what’s going on in the news, check out how other people invest and where else you could do with your money. But of course, only if you want to. What’s great about passive investing is that it’s exactly that: passive. The fact that you’re investing in the first place already a huge step.

After a few months of investing and seeing her nest egg grow, Katie decides she wants to take the next step and really learn more about investing. She signs up to The Economist(which is £12 for the first 12 issues btw!) to keep up to date with the world, she checks out how other people invest on Reddit forums and she looks around for other ways to make her money work for her: maybe a side-hustle, a different index fund, etc. She’s pretty excited; she knows that as long as she keeps her 15% rule going, her nest egg will grow and so will her knowledge.

It’s not easy to get started with investing when it looks scary and risky, but once you understand what the steps are and how simple it can be, you realise how important it is to start investing now. Be like Katie: take the first step. Start researching, looking around and asking on forums. The amount of knowledge out there is astounding, you just need a little push to find it.

Thought of getting started with investing? What’s holding you back? Lemme know below!

Read more like this over at Financially Mint

21 notes

·

View notes

Text

Why It’s So Important to Diversify Your Investments

When it comes to investment advice for newbies, you’ve probably heard just how important it is to diversify your investments. But what exactly does it mean to diversify, and how does it help grow your money in the long-term?

We’ll go over the nuts and bolts of investing and share some simple ways to diversify your investments:

What Is Diversification?

In a nutshell, diversification simply means not putting all your eggs in one basket. Diversification refers to investing in a variety of asset classes as well as choosing a mix of investments within each asset class, explains Tara Falcone, CFP® and founder of ReisUp. Historically, diversifying your investments has proved to net you returns while lowering the risks.

Note that diversification is different than asset allocation, which refers to the mix of primary investment baskets, or asset classes, in your portfolio. For example, with asset allocation, you could be 100% invested in stocks, or you could be 50% invested in stocks and 50% in bonds, or some such combination. So the 100% stock portfolio just mentioned is likely not well diversified because it only contains stocks. However, the 50/50 portfolio is diversified because you’re investing in both stocks and bonds.

Why Diversify?

“Diversifying your investments is important because it’s extremely difficult to know which investments will perform best, especially in the short term,” says Mike Palazzolo, CFP® and founder of the Detroit-based financial planning firm Fintentional. “When you diversify, you spread your investment across many companies around the globe.”

“You always want certain pieces of your portfolio to be in favor no matter what’s going on in the market,” adds Falcone. “This allows the in-favor asset classes to ‘cushion the fall’ when other assets are out of favor.” For example, take a portfolio that contains only stocks. If the stock market drops 20%, your portfolio would lose 20% of its value. But if you were 50/50 invested in stocks and cash, your portfolio would only lose 10% of its value.

Your investment mix depends on two main things: 1) your comfort level with risk and 2) your target date for retirement. So if you are in your 20s or 30s and are comfortable taking on a lot of risk, you may have a more aggressive investment mix, which is usually more stocks (stocks are typically riskier but have a higher rate of return) and less in bonds (they’re less risky but also have a lower rate of return).

Here are some ways you can go about diversifying your investments:

Spread Your Contributions Across Different Asset Classes

Instead of investing just in stocks, create an investment mix of the three different asset classes: stocks, bonds and cash. You can do this yourself and change the mix over time. If in doubt, talk to a financial planner and get some expert advice based on your particular situation and money goals. They can provide strategies and come up with a solid game plan to align with your risk level and target dates.

Invest in Low-Cost Index Funds

Diversifying your investments doesn’t have to be difficult or complicated, explains Palazzolo. Many investment firms offer a family of funds. For example, Vanguard offers a family of funds called LifeStrategy that ranges from 20% to 80% stock exposure. Under the covers, the funds invest in Vanguard Total U.S. Stock Market, Vanguard Total International Stock, Vanguard Total U.S. Bond, and Vanguard Total International Bond index funds. By investing in one of the LifeStrategy funds, you would own shares of over 10,000 stocks and 12,000 bonds.

Invest with a Robo-Advisor

These days there are plenty of options to invest with a robo-advisor. While it sounds very futuristic and high-tech, a robo-advisor is just a way to receive financial advice and portfolio management with very little human interaction.

Using algorithms, robo-advisors give you recommendations regarding which investments to put your money in, based on the information you provide. And because robo-advisor platforms usually offer low-fund exchange-traded funds (ETFs), the fees are typically much lower and offer the same rate of return. This is a good option for those who are just starting out or don’t have a lot of money to invest with.

On the other hand, because a robo-advisor is a hands-off option, if you have a unique situation or just want deeper interaction with a professional, then a robo-advisor may not be the best route for you.

Be Mindful of Fees

Of course, if you’re going to make money, you’ll have to spend some money in the form of fees. If you’re investing in mutual funds, index funds, and ETFs, you’ll be charged an expense ratio, which is a percentage of your investment. Expense ratios are charged as an annual fee.

Besides annual fees, you may be charged with transaction fees, management fees and something called a front-end load fee, which is something you pay when you purchase shares of a mutual fund. Like an expense ratio, the fee is also a percentage of a fund. There’s also a back-end load fee, which is something you pay when you sell a mutual fund. This is also expressed as a percentage of the amount you sell.

It’s important to do your research and know what the fees are before you invest. The lower the fees, the more you’ll have to invest. While these fees are normally deducted from your investment so you may not notice them, they do lower the investment amount. As a result, less money will be invested.

The Pitfalls of Diversifying

Note that diversifying could also weaken your portfolio’s overall growth, explains Falcone. For example, if your portfolio is 100% stocks and the stock market goes up 20%, your entire portfolio would be up 20%. If you had $1,000 to begin with, you’d make $200, or a 20% increase. However, if you were 50/50 stocks and cash and stocks rise 20%, but the cash remains unchanged, you’d only earn $100, or 10% overall. Despite that, it will help lower the risk and help you grow your money.

While your money may not grow as much if you invested in individual stocks, diversification will help you spread your risk and help you hit your money goals for the long term. “The best investors aren’t the biggest risk takers,” says Phillip Washington Jr., CFP® and founder of Stone Hill Wealth Management. “They are the most self aware investors who play with the cards they were given, and don’t take risks with their hard-earned money that they don’t understand.”

Do you have a diverse portfolio? Do you manage it yourself or work with a professional? Let us know in the comments below!

The post Why It’s So Important to Diversify Your Investments appeared first on ZING Blog by Quicken Loans.

from Updates About Loans https://www.quickenloans.com/blog/important-diversify-investments

0 notes

Video

@Regrann from @eyeologyinc - Eyeology INC is an Innovative, Navigational, and Creative company that works with its clients from the inside out. We are organically grown and believe that each client's needs are unique and important. We work with our clients in innovative ways to help them go to higher levels as they work toward meeting their goals. We assist our clients in conceptualizing, developing, building, rebuilding, or restructuring their lives, businesses and brands. #branding #coaching #brandconcierge #brandmanagement #lifestrategy #brandstrategy #businessstrategy #branddevelopment #brandreconstruction #brandimageconsultant #socialmediaidentitycreation #brandstorycreation #businesssetup #publishing #onlinepromotions #webdesign #graphicdesign #editing #insidedesign #billingandinvoicing - #regrann

#brandmanagement#regrann#graphicdesign#socialmediaidentitycreation#branding#editing#lifestrategy#coaching#brandreconstruction#brandstorycreation#billingandinvoicing#insidedesign#brandconcierge#businessstrategy#businesssetup#brandimageconsultant#onlinepromotions#webdesign#brandstrategy#branddevelopment#publishing

0 notes

Text

Vanguard readying its Personal Pension SIPP

Given how often we’ve been labelled a front for Vanguard – in reality it’s never paid us a penny to directly1 , more’s the pity – I was reluctant to post a lightweight update on its Vanguard Personal Pension service.

But so many of you alerted me to the latest smoke signals, how could I not?

It’s clear that a pension with the low-cost juggernaut is something many Monevator readers are waiting for.

“Whadayoogonnadoaboutit?” I shrug, like a New York mobster in a mid-70s movie.

The missing link

A pension product was conspicuously absent at the launch of Vanguard’s Personal Investor service in the UK last year.

However it seems Vanguard has been beavering away since then.

The latest:

Vanguard has obtained necessary permissions from its regulator, the FCA.

The Vanguard Personal Pension is registered with HMRC.

The product will be structured as a low-cost SIPP2.

There’s still no launch date. We can expect an announcement in 2019.

The service will handle lump sum additions, regular contributions, and pension transfers.

De-accumulators will have the option of flexi-access drawdown from launch.

All Vanguard UK’s active and passive funds and ETFs will be available. (I’d expect people to be nudged towards its Target Retirement Funds.)

Vanguard says its pension will be low-cost and easy to use.

A dedicated pensions team has been recruited.

Pension perils

Vanguard admits it has taken longer than it hoped to get its pension up-and-running, though it hasn’t explained why.

I’m no expert on launching financial products. I’d guess though it comes down to the regulatory environment and a fear of mis-selling.

Because Vanguard will only be offering its own funds through its platform, some critics might argue that savers aren’t being given sufficient choice.

I don’t agree with that – at least not if they’re investing in broad-based tracker funds – but I do have sympathy with the view that putting all your eggs in one basket is sub-optimal in terms of total risk management.

And clearly that’s what will happen with a pension provider that only offers its own funds (a situation that won’t be unique to Vanguard, anyway).

The chances of Vanguard getting into trouble to the extent that your pension is threatened (remember, trouble might include fraud or technical disasters) seems to me infinitesimal.

But the impact on an individual from such a tiny probability event could be huge.

For me, that equation always suggests diversifying between at least two providers.

Of course it’s not a fatal issue. You’re allowed to have more than one pension provider, so such diversification is easily achieved. And as I say this risk is certainly not unique to Vanguard.

Even a major ‘open’ pension platform like Hargreaves Lansdown’s could equally (that is very, very unlikely) suffer some sort of permanent compromise. Brokers have failed. And in the opaque world of pensions there are already plenty of people banking their hassle-free retirement on the health of one company – not least with final salary pensions.

There are of course safeguards against pension failure, too. My point is after a lifetime of saving and with no time to make good any setbacks, you can’t afford to take chances. I’d therefore reduce the potential for catastrophic risks where possible.

A cheap platform is only half the battle

For a clue to the sort of thinking that Vanguard may have been grappling with, see this article from The Telegraph.

A 60-year old with a £420,000 pension pot says he has been advised to split it between two Vanguard funds – a Vanguard LifeStrategy 80 fund and a Lifestrategy 40 fund.

For this advice he’s charged £4,500 – to the apparent consternation of the experts the newspaper contacted.

To summarize, the experts want the money spread across 20-30 funds, including active funds and absolute return funds and “maybe gold”.

They say they’d charge much less than £4,500 for the upfront advice – but they’d charge 0.4% to 0.75% for ongoing advice.

True, £4,500 seems a lot to say “plonk it all in a couple of tracker funds”.3

We’ve often said much the same, for free!

But the average person hasn’t got the inclination to read Monevator for a year to learn why such apparently simple advice is probably the best way forward.

And for that reason, I’m not so sure that paying an extra £2,500 upfront to get the money into these super low-cost Vanguard funds is such a terrible deal.

I’m reminded of an old joke about a plumber who bangs a boiler once with a hammer to fix it and then writes an invoice for £250. When confronted that this was poor value for money, the plumber replies that the charge is for knowing where to hit.

Indeed I’d be prepared to bet, Warren Buffett-style, that a portfolio of the two LifeStrategy funds would beat most handpicked hodgepodges of expensive active funds that amounted to a similar risk profile – not least thanks to lower costs.

But sadly, the IFA who recommended the LifeStrategy funds seems to snatch defeat from the jaws of victory – at least as best I can tell from the article.

He or she will charge an ongoing 1% a year, the article implies, for presumably telling the client not to touch anything. (The LifeStrategy funds automatically re-balance).

If so that’s a travesty, which will undo all the good work of the initial selection!

Anyway, this is the quagmire that Vanguard is tiptoeing towards.

I have no doubt the firm will produce a simple and low-cost solution. But tools are only part of the picture. Education is all-important – and one of the hardest lessons for investors is there is no perfect strategy. Everything comes with compromises.

We’ll keep doing our bit, but I suspect it will be many years before self-directed pension provision is a solved problem in the UK.

Have a play with Vanguard’s simple Pension Calculator to see if you’re saving enough.

It may have bought Google display ads at some point, not sure.

Self-invested personal pension

The LifeStrategy funds are actually funds of funds, albeit all Vanguard funds.

Vanguard readying its Personal Pension SIPP published first on https://justinbetreviews.weebly.com/

0 notes

Text

How to Build Your Confidence Back Up After Failure. Have you ever had one of those days where something MAJOR has gone wrong? Something happens that, well, you didn’t want to happen. Maybe you don’t hit your goal on time, you have a conflict with someone, or you just have a bad day. You know, its easy to be confident when everything’s going great guns, but what do we do when things start to go awry? Naturally, our self-confidence drops down. We start to doubt ourselves. And before long we’re on a slippery slope, each step taking us further and further away from what we want. Have you ever noticed that? It’s like the opposite of momentum – or like a kind of negative momentum. Be more flexible So how do we stay focused and keep our chin up when the going gets tough? I’ve gotta be honest with you here. It’s not easy. But there are a few things that I’ve noticed work pretty well for you to get out of that hole and get you back to your confident self again. The first is to take a step back and notice if you’re being a little rigid about things? Have you set yourself a goal or a target that you’re unwilling to move on? Because in my experience, life doesn’t always work in perfect time with your own goals & deadlines. Of course it’s good to set deadlines, but it’s also important to have a little flexibility to move around if ‘hurdles’ pop up. Have a goal, but be open to HOW and WHEN you reach that goal.. Because, what so many of us do is give up as soon as the going gets tough – or we don’t get what we want, exactly when we want it. And that’s just abnormal behavior. I’m guilty of this too. I’m an over achiever and I catch myself setting these HUGE goals and then beating myself up when I don’t reach them. Which leads me onto my next point…have you set yourself a ridiculously BIG goal? Again, nothing wrong with that, but you’ve gotta cut yourself some slack if you don’t quite get there exactly when you wanted to. Yes Guilty as charged. Unfair failure Well, on the note of bratty behavior another thing I do sometimes (maybe you do too?) is perceive whatever has gone wrong as ‘unfair failure’. It’s easy to blanket everything as failureand blame external events. Maybe someone else didn’t deliver…maybe the timing was off…who knows what the many reasons were for something to go wrong…but there is another more likely reason and it’s this: Maybe you were wrong. Yes Simple, but true. Sometimes, it’s far easier to just face up to the fact that – hey, you made a mistake! NO big deal. You’re only human. Learn from it. And then move on. In other words, stop taking life so god damn seriously. Most cases your little failure will not chalk up to the ‘big things’ in life. Failure is success in disguise And besides, what we forget during times of failure is that it’s an ESSENTIAL part of success. In-fact failure IS success…in disguise! “Success consists of going from failure to failure without loss of enthusiasm.” Admitting your mistakes, holding your head up high and having the courage to keep going – now THAT is a surefire sign of success (and intelligence)! Simple LifeStrategy: Simple Confidence Tips Are you being rigid about your goals? How can you be more flexible? Be open to things taking longer than you want.Admit it when you’re wrong and you made a mistake. No big deal. You’re a human being. Acknowledge, learn from it and move on.Change the way you perceive failure. Isn’t it an ESSENTIAL part of success? Thank you Jai mata di

0 notes

Text

What The F@%K are Index Funds, ETFs and Mutual Funds?

Enough of the financial jargon!

It’s finally time to dive deeper into the investing portfolio and really understand what’s going on. In my ‘Simple Steps to Start Investing’ guide I explain that the best way to get started as a student who wants in on the game of investing is through passive investing: index funds through a robo advisor.

But I also say that it’s important to understand what you’re doing before making any investment decisions. So here I am to explain to you what exactly index funds are all about and why, as a student, you’re better of investing in index funds rather than ETFs or mutual funds.

If you’re completely new to investing I recommend reading my WTF is investing post beforehand, or this may just seem like a ton of jargon to you.

Here’s what we’ll be talking about:

The difference between the three

Why index funds?

How to get started in college

Mutual funds

Mutual funds are the oldest type of fund investing of the three. The grandad of investment funds, the old but gold, the most well known. But it doesn’t necessarily mean the best. Here’s why:

Put simply, mutual funds are like a basket of bonds, stocks and other assets specifically chosen by a human manager. The manager takes your money and then puts it in this basket that allocates a percentage of it to certain stocks and bonds. Say you invest £100 into mutual fund X that allocates 20% bonds and 80% stocks. Then you’ll have £20 in bonds and £80 in stocks (magic!).

This manager will be choosing which companies to invest in and how much to put in. Of your £80 in stocks, £5 might go to Apple, £20 to Intel and £55 to Coca-Cola (rudimentary example but you get the gist). These managers say they’re experts and tell you they know which companies will do well and that those £55 you put in Coca-Cola will turn into £60.

Since they’re actively managed, their management fees are pretty high; the fund manager may say you get a return of 6%, but after all fees and trade costs, you’ll really only be getting 4%. So in fact you won’t be getting £60, more like £57. You’ve also got the added risk that the human gets it wrong (remember, we’re human), and you get £50 instead, losing £5. And yes! You’ll still be paying them a fee!

Index funds:

Index funds are the easy and simple way to invest.

Imagine a mutual fund for a second. Imagine the manager of this mutual fund decides to take a market (FTSE 100, S&P 500, etc) and invest in every single company in that market. At that point in time, Coca-Cola accounts for 0.3% of the FTSE 100, EasyJet for 1.5% and Burberry for 0.12%. So the manager creates a fund and allocates 0.3% of it into Coca-Cola, 1.5% into EasyJet and 0.12% into Burberry. That’s just for three companies. Now imagine she decides to do it for the entire FTSE 100 and copies every percentage of each company to her fund. Now imagine this identical mutual fund, but without the active manager in place. That’s an index fund.

It’s basically a copy of the big, well-known markets. And every time that EasyJet’s percentage changes in the market, so does the index fund. If the FTSE 100 produces a return of 7% one year, so will the index fund. And since there is no stock-picking involved, there’s much less work to maintain the index fund – which means very low fees.

This is why we call index funds passive investing. Oh and the best part? Index funds have proven time and time again that in the long run, they will do better than mutual funds. It’s crazy but it’s true.

Index funds are great for putting in your money and forgetting about it – great for people who don’t have interest/time to investigate stocks (basically us students).

stocks? nah I’m into the index funds

ETFs

Similar to index funds. However, instead of tracking an entire market, an ETF tracks smaller or different markets. If the index fund tracks the 100 largest UK companies (FTSE 100) an ETF might track only bank stocks, or only energy companies, or only stocks in Singapore. They’re like an index fund but only tracking specific sectors. They’re also traded like stocks – you can sell and buy an ETF.

It’s more risky than index funds since these smaller markets are more volatile and unpredictable, however you also have the ability to sell short and buy on margin, so they give you more flexibility.

Why index funds?

In the past few years index funds have gotten more and more popular, simply because people are now realising that mutual fund managers are ripping them off and don’t even perform that well. They are low cost, they are pretty secure and they will produce the same return as the market. Over time, they are great to accumulate wealth and aren’t risky. Passive investing has come into force and it’s only going to get better, friends.

So index funds are great for people who aren’t interested in stock-picking or trying their luck by investing in the next Apple or Snapchat. They’re great for people who want to get in on the stock market and accumulate wealth but don’t want to get their hands too dirty: you hear that college students?

In college we have other things to worry about than BP’s shares going down 5% and calculating when to sell next. We don’t have time to get to know the intricacies of the stock market and which mutual fund has hidden fees or is ripping off the most. What we want (or should want) is a safe place to put our money for the future, a place which will also help us accumulate wealth.

How to get started in college

Check out the ‘How to start investing in college guide’ for a better understanding of the entire process. Here I’m going to talk about specifically investing in index funds, which can work whether you’re investing with a robo advisor or a normal platform.

Research

You need the right tools for this. It all starts with finding the right index fund – the one that works best for you.

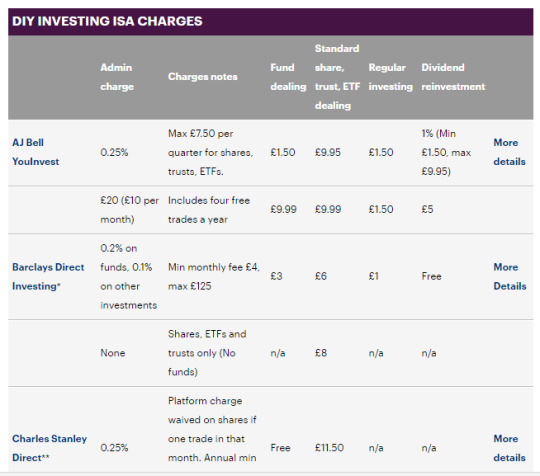

Here are some examples of cheap index funds (taken from This is Money UK). The percentages are the fees:

So as you can see there’s quite a range of index funds. Vanguard also offer a cool LifeStrategy portfolio which is like an international range of stocks and bonds. Find out more at Vanguard LifeStrategy.

Compare

Pick one of the companies listed above (or any others that interest you) and sign up. You’re not putting any money yet, just researching. Look at the different funds they have, read the Terms and Conditions and make sure you can see all the costs. Sign up to several of the platforms and compare. What kind of funds do they have? Which one is easiest to navigate? Which fund has performed best over the past few years?

Check out my Resources page for websites, blogs and more advice on comparing index funds.

Get started

Once you’re 100% sure on the platform you’ve chosen (and I really mean 100%), it’s time to get started. The best tool to invest is through an ISA; tax free and you can pile on a maximum of £20,000 every year. If you already have a Cash ISA somewhere else that’s fine, the important part is that you contribute a total of £20,000 or less once both ISAs are added together.

Get your account verified, and add some money into the account. From there you ‘buy’ your index fund through the ISA and wait for the transfer to take place. Following the 15% rule (check out Graduate Financially Mint course for more details) you can set up a direct debit to the platform so that every month you add some money into your ISA. And ta-da! That’s you investing in index funds!

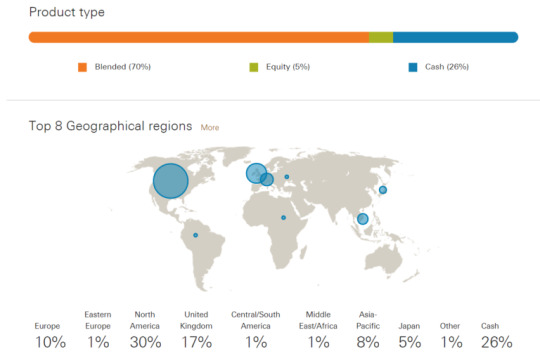

I invested in Vanguard LifeStrategy, Emerging markets and still have some cash to invest. This is what my portfolio looks like as of 23/03/18: