#auto credit card payment

Text

Loan For Credit Cards

Credit Cards Facility

The majority of banks in Dubai give the best credit card deals, luring the average person and encouraging them to take full advantage of the facility in order to elevate their standard of living. In the modern world, credit cards are one of the most widely utilized banking instruments, being used by people from all social classes. Dubai residents benefit from credit cards in the following ways:

You don't need to bring a lot of cash with you when you go shopping. Without having to worry about carrying around an amount of risky cash, you can make any purchase of your choosing. The only restriction on how much you can spend with your credit card is the credit limit that has been set.

Your ability to pay your credit card debt over a period of time is advantageous and allows you some breathing room. You can make any offline or online transaction with a credit card without having any money in your bank account. When paying your bill, you merely need to have money in your account.

Your bank, which offers the credit card, reimburses you for the purchases you make using it, giving you access to a short-term, perhaps 50 days or so, interest-free loan.

These credit cards frequently include a variety of benefits, so the more you use your card, the greater the rewards you receive.

You cannot deny that the credit option is useful in crises, even if you don't like to utilize it.

In the event of unfavorable circumstances, credit shield insurance partially covers both your personal expenses and your unpaid credit card balances.

In Dubai, credit card offers are quite alluring and entice many potential customers to sign up for cards. The majority of banks provide exclusive offers, discounts, opportunities for cash back, and loyalty points. Discounts on food, entertainment, and movie tickets are just a few of the benefits and privileges available.

Key Advantages

You can get a variety of services and advantages with a credit card. Enjoy the convenience and independence that a credit card offers. Your credit card offers you the extra benefits, and it is issued by a respected financial institution and accepted in all countries.

Promotions

Discover the most recent promos and deals available to cardholders. Also, analyze the advantages of using your credit card. Learn about our security features, payment options, and other card benefits.

Rewards & Lifestyle

A selection of cards is created for you and your way of life. Receive immediate compensation for your financial investment.

Mobile Payments

When you use the Pay App to pay with your credit card, you can check out quickly. It is a quick and easy method to pay in millions of locations - on the web, in applications, and in stores.

Cashback Cards

On all of your credit card purchases, you will receive guaranteed cash back.

Advantages of using our services

All of your personal financial issues can be resolved quickly and easily.

We assist you in comparing the interest rates on personal loans in Dubai provided by the various banks so that you can select the most beneficial deal.

We give you the most recent information regarding the requirements for qualifying and the steps involved in the lending process.

We give you the most recent information regarding the requirements for qualifying and the steps involved in the lending process.

Effortless application process

Quick turnaround for bank processing and approval

Eligibility requirements for credit cards

Eligibility requirements for credit cardsAlthough different banks and credit card businesses provide various types of credit cards, the fundamental rule is that your credit limit is fixed based on your salary. According to the most recent Dubai Central Bank circular, only those with a minimum yearly salary of AED 60,000 are qualified for a credit card. To apply for one, you also require the following paperwork:

National Identification

Most recent account statement from your bank

Salary certificate

The most recent utility bill

In certain circumstances, the bank could request more paperwork. The bank will quickly accept your credit card if it is determined that you have a steady source of income and no unpaid balances from prior loans. Your credit card's interest rate may change based on the issuer. Some banks offer credit cards with no annual cost for the first year, and if the minimum annual card usage is not met after that, a minimum annual fee is charged. Some other companies only provide this option for premium cards. The annual charge typically varies based on the banks. It is always advisable to compare credit cards in Dubai and select the one that best meets your needs.

How to properly utilize your credit card

Know the amount you can spend with your card, and stick to it.

Online credit card transaction tracking

When you receive your monthly credit card statement, check the individual transactions by keeping your receipts. Any irregularities you find should be reported to the company. Check your current credit card statement every week, every two weeks, or soon after you make a sizable transaction if your credit card is linked to your online banking account.

You can save a sizable sum of money by paying off your credit card balance in full on the due date rather than paying the bank excessive interest rates.

Your credit card's late payments and non-payments would notably hurt your credibility.

When you start paying excessive rates of interest (20 to 45%) on the total bill amount, you will fall into a financial trap and should never choose the "minimum payment due" option unless absolutely essential.

Utilize the bank's SMS and email alerts to stay informed about your card transactions. Once you sign up for them, you even get SMS or email reminders for due dates.

When someone calls or emails you requesting your credit card number, be on the lookout and wary. Since the banks that provide your credit cards won't ask you for this information, you shouldn't trust anyone with it.

When you stick to these guidelines strictly, you will be able to get the rewards of using credit.

Credit Cards in Dubai

In Dubai, a credit card comes in quite handy, especially if you want to buy until you drop but don't have any cash on hand. The biggest benefit of using a credit card is the reasonable amount of time you have before making a payment. In addition, if you do not pay your credit card account on time, you will be penalized with interest that may be as high as 36% on the whole amount of credit. The advantages of owning a credit card in Dubai are, however, unquestionably greater once you understand how to manage your regular bill payments.In Dubai, the following fees are applicable to all credit card types:

Joining charge

Fee for cash withdrawal

Overage charge

Charge for late payment

What We Offer

Going up and past to meet every single prerequisite of our clients is our unmistakable attribute. Strolling an additional mile, we consolidate strengthening highlights to our current services adding to the comfort of your exchange.

Simple financing choices

Making credit/debit cards and bank moves as choices of accommodation to subsidize your record.

Safe and encoded transactions

Guaranteeing a security-tight exchanging stage for your protected exchange insight.

24/7 Client service Work area

A committed group of client support chiefs is on their toes for your assistance. Ask whenever and get a quick reaction.

Speedy and inconvenience-free withdrawal

Offering total liquidity for making withdrawal adaptable for all.

Account opening charges? It's Zero!

Empowering you to begin effective money management at zero expense. Make a free account with us today

Low spreads and cutthroat edge

Giving the most extreme open door, guaranteeing more prominent advantages.

Contact us :

+971-555394457

#credit cards loan#car credit card#credit card personal loan#credit card personal loans#home credit credit card#loan card#car payment with credit card#credit card cash loan#care credit loan#loans and credit cards#loan for credit card payment#apply for credit card loan#business loan credit card#credit card loan apply#credit card lending#credit cards & loans#auto credit card payment#loan payment through credit card#get loan on credit card#credit card and personal loan#loan through credit card#care car credit#credit card car loan#credit card merchant loans#credit card for loan payment#loan credit card apply#credit card loan amount#credit card loan offers#care car credit card#credit card to loan payment

0 notes

Text

please help lol

Didn’t realize how broke I was until I got the low balance warning today :’)

I’m in my final semester of school & currently too overwhelmed to pick up work on top of that if I’m actually going to graduate by April. My partner is trying to find work but keeps getting ghosted by employers & I don’t have family I can turn to for financial assistance at this time.

I’d be willing to discuss art commissions (work examples can be seen @luxecoffin ) if anyone’s interested in that, although I’d need some extra turnaround time to balance it properly with schoolwork, but if you’re okay with waiting a bit I’m down to work with you :) I haven’t updated pricing in a bit so feel free to DM me for details.

I know everyone’s struggling right now and I absolutely hate asking for help, but I have car & phone payments coming up and my credit card is nearly full at over 20k currently. I won’t be getting any more financial aid since I’m leaving school and I really don’t want to have to consider the possibility of not graduating after I’ve tried for so long.

PayPal | Ko-Fi

If you can’t donate please don’t worry about it, just sharing this around would be an immense help

#mutual aid#please help if you can and please rb if you can’t#I really thought I was going to have enough for the semester at least#my credit card payment was almost 300$ I Will be in the negative the next time I have an auto payment come out#and I’m worried.

82 notes

·

View notes

Text

paying your credit card bill just a few days before/after you get paid is kind of nice because you feel like there is a sort of Net Zero effect, ghost money, you didn't make very much money but you now don't owe any money either. but paying your credit card bill a week before you get paid is kind of nice because you get to say "well this looks a little bit pathetic Right Now but in one week exactly this will look quite promising, and i won't even have to pay my credit card bill the week after that." so really there is no losing except that you have to go to work and pay your credit card bill either way so there's no winning either. that's the nuance of it, you know? so many of us forget, about the nuance.

#the real problem is that my car insurance auto payment is always the day after the credit card bill.#consistently i fail to consider the car insurance auto payment.

5 notes

·

View notes

Text

oh fuck nuggets im in the negatives

#ditto rambles#my bank is in the negatives....#i forgot about my auto discover payment#and i dont get paid til next week#gggggg i guess i need to pull money from a credit card#motherfruking#i cannot believe i forgot

2 notes

·

View notes

Text

Vice President Kamala Harris announced this week that the Biden administration is looking to lessen the burden medical debt has on people by purging it from their credit report. This means that even if people have piles of medical debt — one in five Americans say they do — it’s not going to affect their ability to get a mortgage or a car loan. So they will at least have a place to rest their head and a car they can drive to work every day while paying off their medical bills.

Via AP:

Harris said that would make it easier for them to obtain an auto loan or a home mortgage. Roughly one in five people report having medical debt. The vice president said the Consumer Financial Protection Bureau is beginning the rulemaking process to make the change.

The agency said in a statement that including medical debt in credit scores is problematic because “mistakes and inaccuracies in medical billing are common.”

“Access to health care should be a right and not a privilege,” Harris told reporters in call to preview the action. “These measures will improve the credit scores of millions of Americans so that they will better be able to invest in their future.”

It only seems fair that high medical bills for an emergency or serious illness shouldn’t affect one’s credit rating anyway. It’s not like we’re talking about someone irresponsibly dropping several grand at Versace and then never paying off the credit card bill. Fifty-seven percent of Americans could not afford a surprise $1000 emergency, so the inability to pay off massive amounts of medical debt is hardly a fair reflection of an inclination to default on normal payments — payments you can budget for — on something like a mortgage or auto loan. “Way to be irresponsible by getting cancer, lady! You should definitely be punished for that by not being able to find any place to live!” seems pretty harsh, no?

6K notes

·

View notes

Text

#credit card debt#Americans#outstanding credit card debt#Federal Reserve Bank of New York#Center for Microeconomic Data#Quarterly Report on Household Debt and Credit#pandemic#Bankrate#stimulus payments#Gen Z#student loan debt#auto loan debt#balance transfer card.

0 notes

Note

Hey why are you retiring the Paypal payment options? Every week I hear how Tumblr must raise more income sources, why are you taking the means to support Tumblr away?

Answer: Hello, @tatostew!

Firstly, let us say that we hoped to offer PayPal as a payment method for Ad-Free, but ran into some technical issues with the implementation. To keep our billing processes running smoothly, we’ve had to remove it as an option.

For the subscriptions that are still active, we have put them into “pending cancellation” status. This means they will run their course and then expire. If you want to renew your subscription, you will need to re-subscribe after your subscription expires. There were also subscriptions that should have been renewed but weren’t able to, so these have expired, too. Anyone affected by either of these scenarios will have received an email explaining what has happened and what, if anything, to do next. And in no situation will any subscription auto-renew.

Secondly, for those folk who do not have a credit card and are not sure how to renew: when you purchase Ad-Free through the Tumblr site, the only option is to pay with a credit card. However, if you purchase Ad-Free in the Tumblr app instead, it’s processed as an in-app purchase—so if you use the Android app, the purchase will be billed through the Google Play store, and if you use the iOS app, the purchase will be billed through Apple.

We believe Apple and Google Play both support PayPal as a payment method, as well as several other different payment options, so that might be an alternative option for you when the time comes to resubscribe!

We hope this answers your question, and thank you for getting in touch.

573 notes

·

View notes

Note

i made a string of really dumb financial decisions and now im in debt that might take me years to pay off, do you have any words of wisdom for me queen. like that feels bad. how do i even save up. imagine flushing a pile of money down the toilet thats what this debt it

I know how that feels, believe me. A lot of people do. I'm feeling the pain of my 9 month school loans, and credit cards I had already paid off back "on" again (one in particular is pretty high...whooooops).

Don't lose your cool, I have a couple of flexible suggestions that you take, use, and modify to your specifics:

Tithe yourself - if your job does direct deposit (which most do!), you can direct deposit your money into multiple accounts. Get it set up so your paycheck goes 90% into your checking account, 10% into your savings account so that you're not even thinking about it. You might feel the squeeze for a little bit but you'll acclimate to that "missing" 10% sooner than you think.

Ask for a raise - if you're working, ask for a raise. If you're new, or maybe not that "great", or they're penny-pinchers, or you're just nervous to ask, don't even worry about it. Ask for 3% - this is low, and most jobs will give it to you just for the convenience of getting you to stop bothering them about it (if they can't afford 3%, run run run). For context, if you make $10 an hour, a 3% raise only gives you $12.00 more each week. It's really not much, but not nothing! If you're NOT worried about asking a raise, go all in! Ask for 10%, maybe even 15%. Flex some negotiation skills. Maybe you'll walkaway with 7%, but every penny counts.

Get yourself on auto payments [at the smallest amounts you can] - if you've got credit cards, log in right now and get yourself on auto payments for the smallest amount. If you've got student loans, do the same thing. If you've got utility bills, get them on auto pay. These things take 3 minutes to set up, and there are phone numbers to call if you can't figure it out. These companies WANT you to do this, they will help you get it done.

Work off the smallest amount you owe first [aggressively] - Let's say you have a $60 parking ticket, a credit card you owe $400 on, and three student loans that are currently at $6,000 & $7,000 & $10,000. Forget the student loans right now, you've got them on autopay for the smallest amount you can get away with. First, pay off that $60 parking ticket with your next pay check before it becomes a $200 ticket and a court appearance. Now you can focus on the paying off the $400 aggressively. Your minimum payments will still go off, but every time you get a paycheck, long on and pay an additional amount to the credit card (something you can manage and will also feel good to your brain - $50 feels good when you're thinking of your debit in hundreds for example). Once you've got that paid off, now you can aggressively pay off your $6,000. Don't worry about the other two. Just focus on the smallest amount you owe. Each paycheck, payoff a chunk of your smallest debt. It'll get exciting after awhile, like yes I get paid I can make that credit card even smaller. Gamify it, whatever.

Stop worrying about how long it will all take - Only worry about the smallest amount of debt you owe and how (reasonably) fast you can get that paid off. That $400 credit card, if you can spare $100 each pay check - that's only 4 paychecks. That's not too long, right? That's the way to think of time and debt: how much can you spare each paycheck to pay off your lowest debt.

Ask for help - do not punish yourself by lying to your parents and friends. Tell your friends you can't do fancy dinners because you are paying off debt and can't afford it. Real friends will bring over a pizza to hang with you. Your parents might be willing to send you a check without you asking for it. Don't feel guilty about monetary gifts, just take it. Go to a bank and talk about their consolidation options. Bring a third party so you aren't dazzled by sales pitches. Consolidation loans aren't objectively good or bad, they can be a life saver if they have the right terms that work for you. Don't think it's over your head! Ask as many questions until you understand all your options.

Buy smart, stop suffering - this really should be like 4 different bullet points, but I'm going to be as concise as possible: you'll never get out of debt if you spend your money without purpose, and you'll never get out under the yoke of anxiety that you fucked up if you just squirrel your money away in fear. A lot of people will give you advice that you need to put yourself on a tight, punishing budget. Maybe, but I think those are doomed to fail for most people. And now you feel twice as bad. Don't do that to yourself. Learning the value of $10 is important. So it learning the value of $100, or $1,000. And the best way to learn is to practice buying and using your money - there's a cheap $1,000 and an expensive $10, and you have to learn how much value you are getting out of these amounts for these purchases. If you punish yourself all week, and then allow yourself a "little treat" on Sunday - that doesn't feel worthwhile to me. Those little treats will grow every day. Soon you're stopping at Starbucks every day for "just $10" and your Sunday treat has become a weekly blow out brunch with friends and then week to week you're scrounging to eat Top Ramen and lamenting your dreams are dying. Instead, save money by spending money on things worthwhile that make you budget for them. Go sign up for those yoga classes you want, go sign up for those guitar lessons you want, go sign up for those art lessons you want, whatever it is. Whatever brings value to your life. Your $70 a week yoga membership can now be valued against your $70 week at Starbucks, and as your pockets pinch one hopes you'll choose the yoga over the Starbucks because one hopes that the yoga is serving you better. Or maybe yoga is ass and you want to spend it on Starbucks, at least now you know. Though I recommend your local coffee shop, as Starbucks is a union busting piece of shit corporation :)

84 notes

·

View notes

Text

Hey i just wanted to give a piece of advice for anyone who uses auto pay for any service but especially for bills. Avoid giving any company your routing and account numbers for auto pay. Some places require it but it's always a good idea to see if you can set up the auto pay with a debit card first.

The reason is that once a company has your payment information and a contract/agreement saying that can debit your account, there's not much any bank can do for you to shut down that auto pay. And if they're charging you through routing and account numbers then the only way to cut them off is to get a whole new bank account which often means a credit score check and the works.

But if they're charging you through a debit card you can just tell your bank that you want a new one for any reason you want. You can even not tell them about wanting to stop the auto pay at all and just say it's not working/it's worn down.

232 notes

·

View notes

Text

Credit card debt in the U.S. has reached $1.14 trillion for the second quarter of the year.

The Federal Reserve Bank of New York (NY Fed) revealed this figure on Aug. 6, noting that this was $20 billion higher than the $1.12 trillion recorded for the first quarter of 2024. A year prior, that figure was $1.03 trillion.

Meanwhile, a separate quarterly credit industry insights report from credit reporting agency TransUnion found that the average balance per consumer stands at $6,329. This figure was up 4.8 percent year over year. (Related: US credit card debt rises to historic high of $1.03 trillion.)

Both TransUnion and the NY Fed also found that credit card delinquency rates have risen across the board. According to the reserve, roughly 9.1 percent of credit card balances transitioned into delinquency over the last year. Moreover, credit card delinquencies were higher among younger adults – borrowers between the ages of 18 and 39 – who were likely harder hit by the Wuhan coronavirus (COVID-19) pandemic.

NY Fed researchers said in a press call that these borrowers "may have overextended during the pandemic." They noted that delinquent borrowers are often renters, with shorter credit histories and lower credit limits. This makes them more likely to be financially vulnerable and miss a payment.

The researchers also noted that rising interest rates probably played a role in the increase of delinquencies. For instance, auto loan payments have changed little even as prices have come down owing to the elevated rate structure.

Michele Raneri, vice president and head of U.S. research and consulting at TransUnion, remarked that borrowers with revolving debt "are maxing out their credit cards." She continued: "That's usually a pretty good indicator that people are stretched."

10 notes

·

View notes

Text

Loan For Credit Cards

Asset Alliance |Financing Broker Dubai

Asset Alliance has a professional team with expertise in finance, mortgage and loan brokers in Dubai.

Financing Broker,personal loan,Personal Loan,SMEs Business Loan,POS Loan ,Mortgage ,Business bank, account,Credit Card,Buy out Loan,Debt Consolidation,

Car/ Auto Loan,Bank guarantee & Trade Finace Dubai.

#credit cards loan#car credit card#credit card personal loan#credit card personal loans#home credit credit card#loan card#car payment with credit card#credit card cash loan#care credit loan#loans and credit cards#loan for credit card payment#apply for credit card loan#business loan credit card#credit card loan apply#credit card lending#credit cards & loans#auto credit card payment#loan payment through credit card#get loan on credit card#credit card and personal loan#loan through credit card#care car credit#credit card car loan#credit card merchant loans#credit card for loan payment#loan credit card apply#credit card loan amount#credit card loan offers#care car credit card#credit card to loan payment

0 notes

Text

youtube

The Biden administration announced a rule Tuesday to cap all credit card late fees, the latest effort in the White House push to end what it has called junk fees and a move that regulators say will save Americans up to $10 billion a year.

The Consumer Financial Protection Bureau’s new regulations will set a ceiling of $8 for most credit card late fees or require banks to show why they should charge more than $8 for such a fee.

The rule would bring the average credit card late fee down from $32. The bureau estimates banks brought in roughly $14 billion in credit card late fees a year.

“In credit cards, like so many corners of the economy today, consumers are beset by junk fees and forced to navigate a market dominated by relatively few, powerful players who control the market,” said Rohit Chopra, director of the bureau, in a statement.

President Joe Biden planned to highlight the proposal along with other efforts to reduce costs to Americans at a meeting of his competition council on Tuesday. The Democratic president is forming a new strike force to crack down on illegal and unfair pricing on things like groceries, prescription drugs, health care, housing and financial services.

The strike force will be led by the Justice Department and the Federal Trade Commission, according to a White House statement.

The Biden administration has portrayed the White House Competition Council as a way to save people money and promote greater competition within the U.S. economy.

The White House Council of Economic Advisers produced an analysis indicating that the Biden administration’s efforts overall will eliminate $20 billion in annual junk fees. The analysis found that consumers pay about $90 billion a year in junk fees, including for concerts, apartment rentals and auto dealers.

The effort appears to have done little to help Biden politically ahead of this year’s presidential election. Just 34 percent of U.S. adults approve of Biden’s economic leadership, according to a new survey by The Associated Press-NORC Center for Public Affairs Research.

Sen. Tim Scott, R-South Carolina, criticized the CFPB cap on credit card late fees, saying that consumers would ultimately face greater costs through higher interest rates and less access to credit.

“It will decrease the availability of credit card products for those who need it most, raise rates for many borrowers who carry a balance but pay on time, and increase the likelihood of late payments across the board,” Scott said.

Americans held more than $1.05 trillion on their credit cards in the third quarter of 2023, a record, and a figure certain to grow once the fourth-quarter data is released by the Federal Deposit Insurance Corp. next month. Those balances are now carrying interest on them, which is the highest it has been since the Federal Reserve started tracking the data back in the mid-1990s.

Further, more Americans are falling behind on their credit card debts as well. Delinquency rates at the major credit card issuers such as American Express, JPMorgan Chase, Citigroup, Capital One and Discover have been trending upward for several quarters. Some analysts have become concerned Americans, particularly poorer households hurt by inflation, might be taking on too much debt.

“Overall, the consumer is credit healthy. However, the reality is that there are starting to be some significant signs of stress,” said Silvio Tavares, president and CEO of VantageScore, one of the country’s two major credit scoring systems, in an interview last month.

The growth of the credit card industry is partly why Capital One announced it would buy Discover Financial last month for $35 billion. The two companies, which are two of the largest credit card issuers, are also two companies whose customers regularly carry a balance on their accounts.

This is not the first time policymakers have weighed in on credit card fees. Congress in 2010 passed the CARD Act, which banned credit card companies from charging excessive penalty fees and established clearer disclosures and consumer protections.

The Federal Reserve issued a rule in 2010 that capped the first credit card late fee at $25, and $35 for subsequent late payments, and tied that fee to inflation. The CFPB, which took over the regulation of the credit card industry from the Fed after it was established, is proposing going further than the Fed.

The bureau’s proposal is similar in structure to what the bureau announced in January when it proposed capping overdraft fees to as little as $3. In that proposed regulation, banks would be required to either accept the bureau’s benchmark or show regulators why they should charge more, a method that few bank industry executives expect to use.

Biden has made the elimination of junk fees one of the cornerstones of his administration’s economic agenda heading into the 2024 election. Fees that banks charge customers have been at the center of that campaign, and the White House directed government regulators last year to do whatever is in their power to further curtail the practice.

In another move being highlighted by the White House, the Agriculture Department said it has finalized a rule to stop what it deems to be deceptive contracts by meat processors and to ban retaliation against small farmers and ranchers that work together in associations.

#us politics#news#pbs#president joe biden#2024#Consumer Financial Protection Bureau#credit cards#late fees#junk fees#Rohit Chopra#Federal Trade Commission#department of justice#White House Competition Council#White House Council of Economic Advisers#Sen. Tim Scott#Federal Deposit Insurance Corp#federal reserve#youtube#videos#economy#economics

13 notes

·

View notes

Text

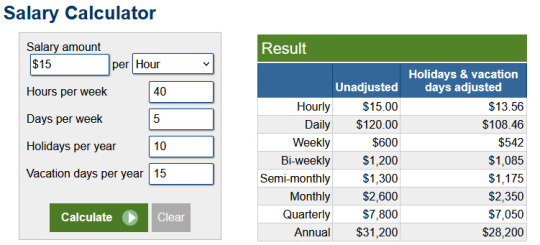

After me saying "Been crunching numbers, looking at rent, looking at mortgages, looking at our current monthly expenses and I'd need to earn about $24/hr full time just to be able to afford to pay rent/mortgage, bills, owning a car, and food with nothing left. NO BODY'S PAYING THAT MUCH." on facebook, one of my old high school friends tried to encourage me by saying that I'd qualify for programs like SNAP and might qualify for Section8 housing and if I'm earning $15/hr and work 40 hrs a week no, I wouldn't.

In my state:

LIHTC cutoff is $14k/year

SNAP is $19,578

Section 8 housing cutoff is $29,150 for one person and $33,300 for two, and we'd have 2 adults being myself and my son. I don't know if Son will be able to work since he does have some trouble with being interrupted or being told to do something he doesn't want to do, but a the same time I don't know if he'll qualify for disability due to autism because he's low support needs. The single apartment complex that accepts Section 8 is for elders and full, anyway.

Despite being too much to qualify for assistance, it's still not enough to survive on because our current expenses wouldn't change much considering That Guy doesn't eat at home mostly (he barely eats at all, really) so the grocery bill is mostly Son and me, and has no creative hobbies that cost money outside of the occasional pricey LEGO set and a $60 video game lasts him a few months so I picked an average for the credit card bill:

Mortgage: $2000/mo (1 bedroom apartment rent averages $1500/mo while the least expensive house on the market right now says to expect to pay $2k)

Water: $60

Power: $130

Internet: $90

Phone: $170

Propane: $280

He pays for everything like car-gas, groceries, toiletries, all my pony salon supplies, etc. on his credit card and that averages $1700/mo.

Our car is paid off so we don't have car payments but I would have car payments. No idea how much that would be.

That doesn't include the auto insurance because he pays that direct-pay with the bank, which is $78/mo for 3 drivers on a single sedan.

$54,096/year. He does NOT pay for my dolls other than the occasional cheap playline doll.

What of that could we do without?

We don't go on day trips, go on vacation, buy new clothes when our clothes wear out and if we do it's thrifted or from the discount store (like Goodwill, TJMaxx, Marshall's, or Gabe's), don't go to the salon or barber, eat Taco Bell once a week for $25 and rarely go anywhere else, I don't get my nails done, do them myself, or wear makeup which is a huge expense, don't buy expensive electronics or home theater equipment, don't buy home decor, don't pay for repairs, have low-end cheap computers, wait for our phones to no longer be supported before upgrading, wait for ANYTHING to break before replacing it...

7 notes

·

View notes

Text

adhd vent

cannot believe my psych might require me to do like $3000 and 16 hours of testing to """"prove""" I have adhd. give me 10 minutes I will leave you without a shadow of a doubt.

every couple of months I have this day. I never know when it will happen. but very rarely, I will have a day where I can just... do things. call the people I need to call, email the people I need to email, clean my apartment, run errands. I can get like 4 or 5 things done and I have to fucking milk it when it comes because most days are not like this.

most days getting 1 thing done is a win. getting nothing done is average. getting nothing done + being so filled with bees I can't even focus on stuff that's meant to be entertaining for more than a minute is a bad day. if I get the closing shift there's a 70% chance I will do nothing else that day because I do not have any sense of how time works and am worried if I leave the house to do groceries I will be late for work. on a good day I can do laundry before a closing shift. I never even remember to contact people until a time where I can't (at work, night). I can't even begin building habits like "exercise" because I don't want to do it and forming a habit for something that is technically unnecessary for my survival and I don't want to do is impossible.

there's a decent chance I will do absolutely 0 things on my days off because I'm so beat from work. this is part of why I'm getting into records. I have to LEAVE THE HOUSE to go to a record store. and because it is FUN and I might get a TREAT (new record) I am actually able to sometimes do it. this would be less of an issue if I had more friends where I lived. But Circumstances happened and now I only have one friend where I live. all my other friends are in [HOMETOWN]. I'm working on a second friend.

everything has an exact place in my apartment and if something isn't in its place (or for objects that move a lot, like my phone, one of its few places) I have Absolutely No Fucking Idea Where I Put It. I still have my TI-84 calculator from high school and I still use it if I know I'm gonna do multiple calculations in a row bc I will not remember the previous answers and the TI-84 records it for me. I keep it in my desk drawer. once I thought I lost my phone for like 10 minutes because I used my calculator and then put my phone in the drawer when I was done with the calculator. it took me forever to retrace my steps and realize what I did. I forget things one second after they happen.

I was constantly struggling to turn homework in on time from 7th-9th grade (12-14) and I only "fixed" that problem by developing severe anxiety over turning in homework late. and then I lived with severe anxiety during school years from 9th grade through my freshman year of college (14-18). idk why it suddenly didn't come back my sophomore year. probably because I moved out.

I wanna work in the film industry but that's driven by my effort and I can't even fucking remember I should be doing something about it most of the time!! and then reaching out to people is so difficult! sometimes for anxiety reasons but sometimes I just can't work up whatever I fucking need to work up to respond to an email. I love this work and once I'm on set I'm a hard worker and generally good (people seem to like me) but getting on set has been damn near impossible and not just because it's a difficult industry to break into.

this has just been my life. for 10 fucking years. and it's worse now because I don't have the structure of school or my parents looming over me. I only pay my rent because I have a calendar alert set up every month. I only pay for wifi and my credit card bills because they let you set up auto payments. my roommate is in charge of the electric bill and whenever they text me what my half of this month's payment is I have to venmo them immediately or it will never happen. when my calendar alert to take my birth control pops up on my laptop I don't let myself close it until I've swallowed that pill. when my alarm goes off telling me whatever's in the oven needs to come out, I don't shut it off until I'm out of my seat, otherwise I'd accidentally keep watching youtube or whatever and burn everything. everything's a calendar alert, everything's on a timer, I have a physical fucking whiteboard calendar on my desk to remind me of everything. if I didn't have these things set up and I didn't force myself to be diligent about it, I'd never remember when I needed to go to work, and banks and landlords would start coming after me.

my car is out of windshield wiper fluid. only the driver's side window goes down. the AC's out. and most recently the aux cord stopped working (this happened before and I got a new cord which worked for a short while so I think there's something wrong with the car). and I haven't fucking found the time to take it to someone and get it fixed. my AC is out!! in june!!! and I can only open one window!!! and I suffer because the car still technically works and drives me where I need to go and since this isn't life threatening or otherwise immediately pressing I have no idea when I will get to this!!!

I just want the days where doing two things being a major accomplishment to be a thing of the past. I want it to be a distant memory. I want to be able to function like everyone else.

you don't need to send me to someone for 16 hours across two days and cost me $3000. Idk what more proof you could possibly fucking need. give me the goddamn pills that will make my brain work.

#this is incredibly embarrassing tbh but I'm on the adhd autism website and I needed to get this out of my system so :/#and once you come out as a feedist how much more embarrassing and difficult could turning over any other piece of your soul be?

8 notes

·

View notes

Text

💸💸💸

feeling like an adult bc i finally understand what im doing with money and what works well for me. paying all my bills/ insurance/loans with a credit card set to auto pay so i don't miss payments but don't overdraft my bank accidentally (from experience). paying my credit card balance in its entirety every paycheck instead of waiting until its due each month so i can keep a better eye on it and so i don't reach the end of a month with a bill larger than i can afford. afterwards putting as much as i feasibly can into a savings at a completely different bank so that when i check my main account i don't see how much i have saved and don't think of it as usable money. keeping my checking acct as low as i can to minimize how much i spend because i think i have no money. i've been researching stocks and funds and all that grown up stuff for a while and i think by this summer i'll be able to start investing in umm a fund or whatever you want to call it to save for a down payment on a house five years down the line. when i move in april and have cheaper rent i'm going to start putting the difference into a roth ira bc my company doesn't match retirement plans. then in june it will be my 1 year mark at my company and i'm going to ask about a raise so i've been documenting my work and the new skills i'm being trained on so i have a solid stack of evidence with me. anyway the wildest part of all of this really is just the fact that for the first time ever i'm able to visualize a life 10 years from now. it's not just a gray nebulous void. i have tangible goals and i can see the path it's going to take to get there and I'm excited to be working towards them even though it means not seeing the rewards for years and years and years.

#“this is just diary ramblings for my own reading sake later i know the ins and outs of my finances isn't interesting to anyone else lol”#HOUSE BY THE TIME IM 30 HOUSE BY THE TIME IM 30 IF NOTHING ELSE I WANT TO OWN A HOME BY THE TIME IM 30 ! I CAN MAKE IT HAPPEN#emily.docx

10 notes

·

View notes

Note

How tf is your credit score almost 800

ive had a credit card for like 4 years with a fairly high limit ($5,000) and ive used it for various emergencies such as car repairs and bills/rent during rough patches, and i use it for gas/groceries whether im financially struggling or not. and i always pay it off as soon as i possibly can, even if its something small ill pay with my credit card and then just pay it off instantly. another important factor is to never ever EVER spend more than 1/3 of the total limit of the credit card because beyond that point it can actually make your credit worse. ALSO my first ever car was an absolute shitbox 1988 oldsmobile that i purchased using a 2 year personal loan from my bank and paid off in 1 year. and i purchased my current 2015 chevy cruze using an auto loan from my bank and i put double payments towards that loan whenever my budget allows it. if u want a good credit score you just gotta work with your bank and not be too afraid of debt because some debt is beneficial and proves that youre a trustworthy borrower in case you ever need to take out a very large loan for a home/car/emergency

8 notes

·

View notes