#avoid salary negotiation errors

Explore tagged Tumblr posts

Text

Mistakes to Avoid When Negotiating Your Salary

Negotiating your salary can feel like walking a tightrope—especially if you’re just starting out, switching industries, or returning to the workforce after a break. But here’s the truth: not negotiating at all is one of the biggest career missteps you can make. Whether you’re a Gen Zer landing your first job or a seasoned professional ready to level up, knowing what not to do in a salary…

View On WordPress

#avoid money talk mistakes#avoid salary negotiation errors#avoid salary traps#avoid underpaid jobs#• Salary negotiation tips#better salary talks#career growth through negotiation#career negotiation tips#common salary negotiation pitfalls#common salary traps#confident salary talks#entry-level salary negotiation#expert salary tips#first job salary mistakes#how to avoid lowball offers#how to negotiate a better offer#how to negotiate salary#HR salary negotiation tips#job offer negotiation#learn to negotiate salary#maximize your salary offer#mistakes that cost you money#mistakes to avoid when asking for a raise#negotiating pay mistakes#negotiation dos and don’ts#negotiation tips for beginners#negotiation tips for job seekers#negotiation tips for professionals#negotiation tips Gen Z#pay raise negotiation tips

0 notes

Text

Yandere lawyer

Tw: gn reader, yandere, toxic relationship, unlucky and paranoid reader

More content

Since you entered adulthood, troubles have followed one after another as if fate itself were relentlessly targeting you. These aren’t just minor inconveniences but full-blown catastrophes, each requiring legal intervention.

A former employer who refused to pay your last salary, citing an "administrative error," and even tried to make you sign a false document to avoid compensating you.

A neighbor who falsely accused you of damaging his car and had the audacity to file a complaint.

A false accusation of theft in a store due to a faulty camera that captured you from the wrong angle.

A landlord who tried to evict you without notice, going so far as to forge documents to claim unpaid rent.

A professional collaboration gone wrong, where a former colleague stole your work and then sued you for defamation when you tried to defend yourself.

Each time, you needed a lawyer. Each time, they were overpriced, incompetent, or indifferent. You couldn’t afford better, so you had to make do. And each time, it was an unfair fight—constant stress, a waste of time and energy.

Then one day, in the midst of yet another crisis—perhaps right after a disastrous court hearing or while arguing in vain with a bailiff seizing your belongings—he appeared.

A renowned lawyer. His name circulates in the highest legal circles; he usually represents wealthy clients and powerful corporations. He has no reason to care about your case… and yet, he does.

— "I’ve heard about your situation. You’ve been poorly defended so far. I can offer you my services at a… reasonable price."

An offer too good to be true. But you have nothing left to lose. So you accept.

Since that day, misfortune continues to haunt you, but with him by your side, you win every case. He always finds the flaws in the opposing files, dismantles accusations with surgical precision. He reassures you with unwavering confidence: "As long as I’m here, no one can destroy you." He negotiates financial settlements for you, preventing you from falling into complete ruin. He is your safety net.

But as you try to regain control of your life, you realize that his presence is becoming more… intrusive.

He calls you regularly, even outside of legal matters. He seems to know things about you that you never told him.

He advises you on personal decisions, far beyond legal concerns.When a problem arises, he’s already there before you even contact him.He helps you financially, “just to get you through,” but insists that you accept.

He starts questioning some of your relationships, insisting that certain people “are exploiting you” or “don’t deserve you.”

You just wanted a lawyer. You found someone who wants far more than to handle your legal affairs.

You’ve never been lucky. You’ve always felt like you had to fight harder than others, like you were always on the verge of falling apart. And when something good finally happens, it’s never without a catch.

You’re exhausted. Tired of losing everything, of handling it all alone, of feeling like the whole world is against you.

You’re paranoid about your own future. Every new misfortune chips away at you a little more, making it impossible to believe that things will ever get better.You feel an involuntary dependence. He is the only stable constant in your chaos.

Even if his behavior is becoming overbearing… deep down, you know that without him, you’d be lost.

You have a deep-seated fear of abandonment. All your life, people have let you down—family, friends, employers… But not him.

He stays.

And that’s the most terrifying part. He will never leave.

#yandere oc x reader#yandere#yandere lawyer#yandere lawyer x reader#yandere x reader#rich yandere#x reader#syerra-637#gender neutral reader#soft yandere x reader#yandere content#unlucky reader#paranoia#paranoid reader

46 notes

·

View notes

Text

@stardstschlar continue from here

One of the few days where the two had a moment to relax. Jotaro had decided to bake ( something his mother instilled this knowledge in him ) making Gingerbread cookies. It took an hour or so but here they were; having just finished decorating the cookies, Jotaro watched as his companion had picked one up and took a bite. This is where he would learn of Tsuzuki's desire for sweets. "H-Hey!" The Joestar reached out, gently grasping the other man's wrist "At least have dinner before you spoil your appetite with sweets." The idiot, but he did adore this man wholly.

Any relaxing time he might have often involves gorging himself ---- he would forever remember the day he met him while he was searching for a cake that would take his dark thoughts away. If he was an better cook, he would have volunteered to make some cookies himself, but for all of Hijiri-kun's willingness to trust him in the kitchen, everything he made was just unpalatable ! It wasn't for lack of having made so much effort in the field. As a result, he had observed him with wonder, trying to see how it was done theoretically, trying to understand where the errors of the failed attempts came from. It made him hungry, that a childish expression had betrayed his face after a while, waiting for the right moment when he could eat some. In these conditions, his salary wouldn't go into a stomach that constantly needed to be filled with cakes. Fact it was for Chritmas ? Information simply dissolved of his mind. He didn't remember the last time he actually participate on that holiday --- knowing that gifts from a Shinigami could have been terribly complicated, and that he preferred to avoid immense debt he had towards the Count ! By the moment the last decoration was made, tempted hands didn't hesitated to rushing over one of the cookies. The taste was wonderful ! Did he ever tasted it before ? He didn't know. Immediate reaction he received giving him immediate big pleading eyes, in which his hands of his wrist simply inscreased his impression he was giving him, showing big tearful purple eyes. ❝ I want to eat one please, please, please. I'll be good at dinner, promise ! ❞ One comment wanted to be exposed, more like wasn't it the dinner already, since considering his nature, eating was an good old human habit in which enjoyed taste of the food. He wasn't sorry for childish innocence he revealed for negotiating for one fragment at all cost.

#stardstschlar#ic :: tsuzuki asato#( ♚) post interconnected subplot#between pain some fluffly moments

5 notes

·

View notes

Text

Smart Savings: 15 Proven Strategies to Cut Business Costs Effectively

Running a business comes with countless expenses—from employee salaries and office space to travel and technology. But smart business owners know that success isn’t just about making more money—it’s also about spending wisely. Whether you’re a startup or a growing enterprise, cost-cutting is essential for boosting profitability without compromising quality.

Here are 15 proven strategies to help reduce your business costs effectively and sustainably.

1. Streamline Corporate Travel Management

Business travel can quickly drain company funds. Implement a centralized corporate travel management system to monitor expenses, enforce travel policies, and book cost-effective options. Many corporate travel companies offer platforms that optimize routes, secure corporate discounts, and help manage bookings—all while ensuring compliance and visibility.

2. Embrace Remote or Hybrid Work

Transitioning to a remote or hybrid work model can drastically reduce expenses on rent, utilities, and office supplies. With the right communication and productivity tools, teams can collaborate effectively from anywhere.

3. Use Cloud-Based Solutions

Replace expensive hardware and IT infrastructure with cloud-based software and storage. These solutions reduce upfront costs, offer scalability, and often include automatic updates and data backup features.

4. Outsource Non-Core Functions

Outsourcing tasks like customer service, accounting, or HR to specialized agencies or freelancers allows businesses to pay only for the services they need—without bearing the costs of full-time employees.

5. Negotiate with Vendors and Suppliers

Don’t hesitate to negotiate better rates with vendors. Building long-term relationships can result in discounts, bulk pricing, or more favorable payment terms.

6. Automate Repetitive Tasks

Invest in automation tools to handle repetitive processes such as invoicing, payroll, or email marketing. This not only reduces manual labor but also minimizes errors and increases efficiency.

7. Review Subscriptions Regularly

Many businesses pay for software and services they no longer use. Conduct regular audits of all subscriptions and cancel or downgrade those that are unnecessary.

8. Adopt Energy-Efficient Practices

Cut utility bills by investing in energy-efficient lighting, appliances, and equipment. Encourage employees to turn off unused devices and implement a sustainability policy that reduces waste.

9. Consolidate Business Travel Through Trusted Corporate Travel Companies

Work exclusively with vetted corporate travel companies that offer integrated booking, reporting, and support services. This reduces duplicate expenses, uncovers hidden fees, and ensures cost control.

10. Implement a Lean Inventory System

Reduce overhead by maintaining a lean inventory model. Just-in-time (JIT) inventory systems can help avoid excess stock, lower storage costs, and reduce waste.

11. Go Paperless

Switch to digital documentation and electronic invoicing. Not only does this reduce printing and paper costs, but it also improves record-keeping and data security.

12. Train Employees in Cost-Consciousness

Educate your team about the importance of cost-efficiency. Empower them to find savings in their departments and reward suggestions that lead to measurable improvements.

13. Optimize Marketing Spend

Focus on digital marketing strategies that offer clear ROI—such as SEO, social media, and email campaigns. Use analytics tools to track performance and avoid spending on ineffective tactics.

14. Reassess Office Space

If you no longer need large office spaces due to remote work, consider downsizing or shifting to co-working spaces. This can free up capital for growth and innovation.

15. Conduct Regular Financial Audits

Review financial statements and expenses regularly. Identifying areas of leakage early on can prevent long-term losses and ensure your cost-cutting efforts are paying off.

Final Thoughts

Cutting business costs doesn’t have to mean sacrificing quality or growth. With the right strategies and tools—like effective corporate travel management systems and partnerships with reliable corporate travel companies—you can run a lean, efficient, and profitable.

0 notes

Text

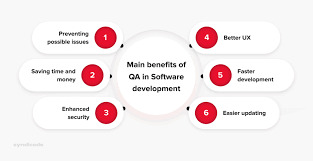

What is a QA Software Testing Course, and Why is it Important in Today’s Tech Industry?

Introduction

Imagine launching a new app, only to find users abandoning it due to bugs and glitches. In the fast-paced tech world, such failures can cost companies millions. That’s where QA (Quality Assurance) software testing comes in. A QA software testing course teaches learners how to ensure digital products function smoothly, meet customer expectations, and maintain brand credibility. Today, businesses can't afford to release faulty products. The demand for skilled QA professionals is growing across sectors. Quality assurance testing courses are designed to equip learners with practical skills to meet this demand. Whether you're new to tech or switching careers, enrolling in a QA Testing Online Training Course can open doors to a stable and high-paying job in the IT industry.

What is a QA Software Testing Course?

A QA software testing course is a structured program that trains individuals to test software applications to ensure they are bug-free, functional, and meet user requirements. It typically includes both manual and automated testing techniques.

Key Concepts Covered

Software Development Life Cycle (SDLC)

Software Testing Life Cycle (STLC)

Manual Testing Basics

Automation Testing (using tools like Selenium, QTP)

Defect Tracking and Reporting

Agile and DevOps Methodologies

Test Planning and Documentation

Why is QA Testing Important in the Tech Industry?

1. Quality Control Saves Money

According to the Consortium for IT Software Quality, poor software quality costs the U.S. economy over $2 trillion annually. QA testers prevent such losses by identifying issues early.

2. User Experience Matters

A broken app leads to bad reviews and customer loss. QA testing ensures a seamless user experience.

3. Security Compliance

Many industries like healthcare and finance require thorough testing to comply with regulatory standards. QA testers are crucial in ensuring this.

4. Faster Time-to-Market

Automated QA processes allow developers to release updates quickly without sacrificing quality.

What You Will Learn in a QA Testing Online Training Course

1. Manual Testing Techniques

Learn to write and execute test cases, report bugs, and perform usability testing.

2. Automation Testing Tools

Master tools like Selenium, JUnit, TestNG, and Jenkins. Real-world use cases include writing test scripts and running automated regression tests.

3. Test Management Tools

Explore tools like JIRA, Bugzilla, and TestRail for project and defect tracking.

4. Agile and Scrum Frameworks

Work in sprints, participate in stand-ups, and collaborate in cross-functional teams.

5. Live Projects

Get hands-on experience with real-world scenarios, helping you build a solid portfolio.

Real-World Applications of QA Testing Skills

Software Development Companies

Tech firms rely heavily on QA testers to maintain software integrity.

Banking and Finance

Ensuring the security of financial transactions is non-negotiable. QA testers are responsible for safeguarding sensitive data.

E-Commerce

Testing ensures that checkout flows, payment gateways, and inventory systems work flawlessly.

Healthcare

Medical software must be error-free to avoid risks to patient safety. QA professionals ensure compliance with HIPAA and other standards.

Industry Demand for QA Testers

According to Glassdoor, QA Analysts earn an average salary of $75,000 annually in the U.S. A LinkedIn 2024 report listed "QA Testing" as one of the top 10 in-demand tech skills. With the increasing relevance of QA testing courses, more professionals are gaining the skills needed to meet industry standards. The U.S. Bureau of Labor Statistics predicts a 25% job growth for QA roles from 2023 to 2030, making it a promising and future-proof career path.

Course Structure: Step-by-Step Learning

Week 1-2: Fundamentals of Testing

Introduction to SDLC & STLC

Writing test cases

Week 3-4: Manual Testing Deep Dive

Exploratory Testing

Regression Testing

Week 5-6: Automation Basics

Introduction to Selenium

Writing basic scripts

Week 7-8: Advanced Automation

Framework Development

Integration with Jenkins and Git

Week 9-10: Tools and Frameworks

JIRA and Test Management

Real-time project simulation

Week 11-12: Capstone Project

Apply all skills to a live project

Get feedback from mentors

Who Should Take This Course?

Beginners in IT looking to start a tech career.

Non-tech professionals wanting to transition into QA.

Students aiming to build a strong portfolio.

Manual testers planning to upskill with automation.

Benefits of QA Testing Online Training Course

Flexibility

Learn at your pace, from anywhere, without compromising on your schedule.

Affordable

Online courses are often more cost-effective than bootcamps or college programs.

Certification

Get a shareable certificate that can boost your resume and LinkedIn profile.

Placement Assistance

Many platforms offer career support, including resume building, mock interviews, and job referrals.

Common Tools Taught in QA Testing Courses

Tool

Use Case

Selenium

Automated web testing

JIRA

Bug tracking and project management

TestNG

Test framework for Java

Postman

API testing

Jenkins

Continuous integration

Student Testimonials

"After completing my QA Testing Online Training Course, I landed a job within three months. The hands-on projects made all the difference." - Priya K., Software Tester

"I had zero coding experience. This course taught me everything step by step, from manual testing to automation." - Alex R., QA Analyst

Tips for Succeeding in QA Testing Courses

Practice writing test cases daily

Join QA forums and communities for peer support

Complete all assignments and capstone projects

Regularly update your resume with new skills

Frequently Asked Questions (FAQs)

1. Do I need a tech background to join this course?

No, many courses are beginner-friendly and start with the basics.

2. What if I miss a class?

Most QA Testing Online Training Courses offer recorded sessions.

3. Are there any prerequisites?

Basic computer skills and logical thinking are enough to get started.

4. Will I get a certificate?

Yes, most platforms offer a verifiable certificate of completion.

Key Takeaways

QA software testing is essential for delivering high-quality, reliable software.

A QA Testing Online Training Course can equip you with in-demand skills for a growing industry.

Real-world applications span healthcare, finance, retail, and beyond.

Learn tools like Selenium, JIRA, and Jenkins with step-by-step guidance.

Online training is affordable, flexible, and career-focused.

Conclusion

Mastering QA testing skills is one of the smartest career moves in today’s tech-driven job market. Whether you're just starting or aiming to switch careers, a QA Testing Online Training Course offers the tools, support, and flexibility you need to succeed. With comprehensive QA software testing courses, learners gain hands-on experience in identifying bugs, improving software quality, and understanding testing methodologies that are essential in the IT industry. These skills are not only in high demand but also open doors to a wide range of roles in software development and quality assurance.

Ready to test your future? Enroll in a QA Testing Online Training Course today and start building your dream tech career!

1 note

·

View note

Text

Unlock Growth: The Strategic Advantage of Outsourcing Bookkeeping Services for US Businesses

In today's dynamic U.S. business landscape, maintaining meticulous financial records is non-negotiable for success. However, the complexities and time demands of in-house bookkeeping can often divert focus from core operations and strategic growth. This is precisely where the power of outsourcing bookkeeping services comes into play, offering a transformative solution for businesses aiming for efficiency, accuracy, and sustained profitability.

Many American businesses, from burgeoning startups to established enterprises, are discovering that delegating their financial record-keeping to a specialized bookkeeping outsourcing company is not just a trend, but a smart strategic move. It’s about leveraging external expertise to streamline operations, reduce overheads, and gain a clearer financial picture, enabling more informed decision-making.

Why In-House Bookkeeping Can Be a Roadblock

For years, the traditional model of an in-house bookkeeper was the standard. Yet, this approach often presents significant challenges. The costs associated with salaries, benefits, training, software licenses, and office space can quickly add up, especially for small and medium-sized businesses. Moreover, finding and retaining skilled bookkeeping talent, particularly in a competitive market, can be a constant struggle. Businesses also face the risk of human error, inconsistent record-keeping, and the daunting task of staying compliant with ever-evolving tax laws and regulations. These internal pressures can drain resources and shift valuable management attention away from innovation and client engagement.

The Undeniable Benefits of Outsourcing Bookkeeping Services

Embracing outsourcing bookkeeping services offers a powerful antidote to these challenges. Here's a breakdown of the tangible advantages:

1. Significant Cost Savings

This is arguably one of the most compelling reasons businesses opt for outsourcing bookkeeping services. By transitioning to an external provider, companies can dramatically reduce operational expenses. You eliminate the need for full-time salaries, health insurance, paid time off, payroll taxes, and the substantial costs associated with recruitment and ongoing training. Many outsourcing firms operate on a scalable, pay-for-what-you-need model, meaning you only incur costs for the services you actually utilize. Studies indicate potential savings of 40-60% compared to maintaining an in-house team. This financial efficiency frees up capital that can be reinvested directly into business development or other core areas.

2. Access to Specialized Expertise

When you partner with a professional bookkeeping outsourcing company, you’re not just hiring an individual; you're gaining access to a team of highly skilled and experienced financial professionals. These experts are well-versed in U.S. accounting standards, tax regulations, and the latest industry best practices. They bring a depth of knowledge that a single in-house bookkeeper might lack, significantly reducing the risk of errors and ensuring your financial records are always accurate and compliant. This specialized insight is invaluable for complex financial scenarios and during peak periods like tax season.

3. Enhanced Accuracy and Compliance

Accuracy is the bedrock of sound financial management. Outsourced bookkeeping firms employ robust internal controls and quality checks to ensure precise data entry and reconciliation. This meticulous approach minimizes errors that could lead to financial mismanagement, penalties, or audit issues. Furthermore, a dedicated bookkeeping outsourcing company stays abreast of changes in federal and state tax laws and reporting requirements, ensuring your business remains compliant and avoids costly missteps. This proactive approach to compliance provides peace of mind and safeguards your business's financial integrity.

4. Increased Efficiency and Focus on Core Business

Managing daily financial tasks is inherently time-consuming. By entrusting these responsibilities to external experts, business owners and managers reclaim valuable hours. This newfound time can be strategically redirected towards activities that truly drive growth – developing new products, improving customer service, expanding market reach, or refining sales strategies. The operational efficiency gained through professional outsourcing bookkeeping services translates directly into increased productivity and quicker, more informed strategic decision-making.

5. Scalability and Flexibility

Business needs fluctuate. A rapidly growing company might experience a surge in transactions, while seasonal businesses might have quieter periods. An in-house team can be difficult and expensive to scale up or down to match these changes. A bookkeeping outsourcing company offers unparalleled scalability, allowing you to adjust services to align precisely with your current operational demands. Whether you need to increase support during peak seasons or scale back during leaner times, outsourcing provides the flexibility to adapt without the complexities of hiring or downsizing staff.

6. Leveraging Advanced Technology

Reputable outsourcing providers invest in cutting-edge accounting software and cloud-based platforms, such as QuickBooks, Xero, and Sage. This means you gain access to the latest technological tools without the hefty investment in software licenses, maintenance, and IT support. These advanced systems facilitate automated processes, real-time financial data access, and comprehensive reporting, empowering you with a clearer, more immediate understanding of your financial health.

Choosing the Right Outsourcing Partner

Selecting the right provider for your outsourcing bookkeeping services is critical. Look for a company like Aone Outsourcing with a strong track record, proven expertise in serving U.S. businesses, robust data security protocols (including encryption and multi-factor authentication), transparent pricing models, and excellent client communication. It’s essential to ensure their services align with your specific business needs and that they can seamlessly integrate with your existing workflows. Your chosen bookkeeping outsourcing company should act as a true extension of your team, dedicated to your financial success.

The Path Forward

For U.S. businesses striving for optimal performance, outsourcing bookkeeping services represents a significant competitive advantage. It's about more than just delegating tasks; it's about making a strategic investment in your company's future. By offloading the intricacies of financial record-keeping to specialized professionals, you free up resources, enhance accuracy, improve compliance, and gain invaluable time to concentrate on what truly matters: growing your business and achieving your strategic objectives. Embrace the future of financial management and unlock your full potential.

0 notes

Text

Unlock Your Dream Home: Easy Home Loan in Jaipur, Rajasthan with Wonder Home Finance

Owning a home is one of the most significant milestones in life. Whether you're buying your first house or investing in a new property, the journey is both exciting and complex. At Wonder Home Finance, we understand this journey and strive to make it easier with our tailored solutions for home loan in Jaipur Rajasthan. With user-friendly tools like our house loan EMI calculator and assistance with CIBIL score check, we are here to simplify your path to homeownership.

Why Choose a Home Loan in Jaipur, Rajasthan?

Jaipur, also known as the Pink City, is not only a cultural hub but also an emerging real estate hotspot. From developing townships and luxury villas to affordable housing projects, Jaipur offers great potential for homebuyers. If you're planning to settle or invest in Jaipur, a home loan in Jaipur Rajasthan from Wonder Home Finance can make your property purchase stress-free and financially viable.

Some key benefits of opting for a home loan in Jaipur with Wonder Home Finance include:

Competitive interest rates

Minimal documentation

Flexible repayment options

Quick loan processing and approval

Dedicated customer support

Importance of CIBIL Score Check Before Applying for a Home Loan

Before applying for any financial product, especially a home loan, your creditworthiness plays a crucial role. This is where a CIBIL score check becomes important. Your CIBIL score (or credit score) is a three-digit number that represents your credit history, repayment behavior, and financial discipline.

Here’s why checking your CIBIL score is essential:

Eligibility Check: A good score increases your chances of loan approval.

Better Interest Rates: Applicants with higher credit scores are often offered lower interest rates.

Negotiation Power: You can negotiate better loan terms with a strong credit profile.

Know Your Standing: It helps you understand and rectify any errors or issues in your credit report.

Wonder Home Finance recommends checking your CIBIL score regularly before and after loan applications. If your score is low, our advisors can help you improve it over time.

Plan Your Budget Smartly with a House Loan EMI Calculator

An EMI (Equated Monthly Installment) is a fixed payment you make every month towards repaying your home loan. It's important to know how much EMI you will be paying to plan your finances effectively. Our easy-to-use house loan EMI calculator takes the guesswork out of your budget planning.

With just three basic inputs—loan amount, interest rate, and loan tenure—you can get an instant EMI estimate.

Benefits of Using a House Loan EMI Calculator:

Budget Planning: Understand the monthly commitment before applying.

Loan Comparison: Try different combinations to find the best EMI fit.

Transparency: Get clear and accurate estimates instantly.

Quick Decisions: Helps speed up your financial decision-making process.

Whether you're applying for your first home loan or considering a second property, using a house loan EMI calculator can save time and avoid surprises.

Documents Required for Home Loan in Jaipur, Rajasthan

When you apply for a home loan in Jaipur Rajasthan, the documentation process is simple and hassle-free with Wonder Home Finance. Here is a basic list of documents usually required:

Identity proof (Aadhar Card, PAN Card, Voter ID)

Address proof (Electricity bill, Passport, Rental agreement)

Income proof (Salary slips, Bank statements, ITR)

Property documents (Sale agreement, Title deed, Property tax receipt)

Photographs

Our loan officers are always available to help you understand the exact documentation needed for your specific loan product.

Why Wonder Home Finance?

At Wonder Home Finance, we are committed to helping individuals and families realize their dream of owning a home. Here's why thousands trust us for their home loan in Jaipur Rajasthan:

Tailored Products: We offer home loans that suit salaried professionals, self-employed individuals, and small business owners.

Quick Processing: With minimal paperwork and fast approval, we reduce your wait time.

Technology-Driven: Our online platform includes tools like the house loan EMI calculator and CIBIL score assistance.

Transparent Process: No hidden charges, clear terms, and complete transparency.

Customer-Centric Approach: We guide you at every step of the loan process—from application to disbursal.

Final Thoughts

Owning a home is no longer just a dream—it’s a reality within reach. Whether you're buying a flat in Jaipur’s city center or investing in a suburban villa, Wonder Home Finance ensures that your home loan in Jaipur Rajasthan is quick, affordable, and stress-free.

Before you apply, don’t forget to do a CIBIL score check to assess your eligibility. Use our online house loan EMI calculator to plan your monthly installments and choose a repayment plan that suits your budget. At Wonder Home Finance, we make homeownership simple, transparent, and accessible.

Get in touch with us today to begin your journey toward owning your dream home in Jaipur!

home loan in jaipur rajasthan

0 notes

Text

What Are the Key Features of Reliable Payroll Services in Kuwait?

When it comes to managing payroll, every business in Kuwait wants a partner they can trust. Payroll services in Kuwait handle more than just paying salaries—they make sure everything runs smoothly behind the scenes. But what exactly makes payroll services reliable? Let’s break down the key features you should look for.

Accurate and Timely Payroll Processing

The heart of any payroll service is getting salaries right and on time. Errors can cause headaches—delayed payments, unhappy employees, and compliance risks. Reliable payroll services in Kuwait prioritize accuracy, ensuring every employee’s pay is calculated correctly, considering local labor laws and deductions. Plus, payments happen right on schedule, so no one is left waiting.

Compliance with Kuwaiti Labor Laws

Navigating the maze of local regulations can feel like walking through a minefield. That’s why a trustworthy payroll service stays up to date with Kuwait’s ever-changing labor laws, tax rules, and social security requirements. This way, your business avoids fines or penalties and keeps things above board effortlessly.

Confidentiality and Data Security

Payroll involves sensitive employee information. So, payroll services in Kuwait must treat your data like gold. Ensuring confidentiality and protecting data from breaches is a non-negotiable. When you know your employee info is safe, you can breathe easy.

Customized Services for Different Business Needs

No two companies are the same, right? Reliable payroll services understand this and offer flexible solutions tailored to your specific business size and sector. Whether you have a small team or a large workforce, the service adjusts to fit your unique requirements without a hitch.

Clear Reporting and Support

Good payroll services don’t leave you guessing. They provide clear reports that make it easy to track payments, taxes, and contributions. Plus, having a helpful support team on standby means you’re never stuck with questions or problems.

In conclusion, choosing dependable payroll services in Kuwait means picking a partner who combines accuracy, legal know-how, confidentiality, flexibility, and clear communication. These features together ensure your payroll runs like a well-oiled machine, giving you peace of mind and letting you focus on growing your business.

0 notes

Text

Top 7 Reasons to Choose a Legal Executive Search Firm

The search for top legal talent connotes large sums of money in a very competitive marketplace. Both law firms and corporate legal departments are currently under a lot of pressure to hire not just anybody but the selected individual who fits the bill qualified attorney who can also offer leadership and strategic-level thinking. Hence, the need for a legal executive search firm.

Hiring an executive search firm ensures smooth hiring procedures and safeguards against costly hiring errors, whether it is for General Counsel, Chief Legal Officer, or senior-level attorneys. Below are the top 7 reasons to use a legal executive search firm for your high-level legal hire.

1. Access to Passive Talent

Legal executive search firms maintain a wide network of highly skilled legal professionals, many of whom are not actively seeking new positions in their law firms. These so-called "passive candidates" are usually among the best in their fields and therefore unlikely to be advertised for via the usual job boards.

Because of their deep industry networks, search consultants can tap into this hidden talent pool and present you with candidates that you perhaps could never have found on your own.

2. Industry-Specific Expertise

Unlike typical recruitment agencies, legal executive search firms limit their scope solely to the legal field. This concentrated approach makes legal firms aware of the varying demands of specific legal functions, including the kind of practice area, regulations, and compliance needed.

They are not simply recruiters; they are legal industry insiders who speak the language your legal team operates in, making for far more precise trainee matches and an improved cultural fit.

3. Time and Resource Efficiency

A senior legal hire can take a couple of months to materialize, especially if the HR team within lacks bandwidth or is not of that specialized knowledge. An executive legal search firm simply does the hard work by carrying through the entire recruitment process-from sourcing and screening through to background checks and negotiation.

This both speeds up the hiring process and provides your people with time to work on more important things, leaving the experts to handle your legal hiring.

4. Thorough Candidate Vetting

In the search for an executive-level legal lawyer, the resume is just icing on the cake. A reputable legal executive search firm will conduct in-depth candidate assessments, interviews for competencies, reference checks, and assessments of candidates’ alignment with corporate culture.

They assess more than just legal skills; leadership skills, decision-making competence, ethical judgment, and long-term potential are weighed in order to make a confident hire.

5. Confidentiality and Discretion

Sometimes the need arises to carry out a confidential search, say, replacing an underperforming executive or opening a new legal function. Legal executive search houses know the importance of preserving confidentiality throughout the process for the protection of both parties.

Discretion is necessary in sensitive hiring matters, avoiding unnecessary disruption within your organization.

6. Market Intelligence and Salary Benchmarking

Legal executive search agents are not just recruiters. They are strategic advisors who offer market insights, especially for current hiring trends, compensation benchmarks, and competitor analysis.

Should you find yourself unable to structure an offer that looks competitive or not knowing the going rate for a General Counsel with 15-plus years of experience, then your search partner will lead you with factual market intelligence, while also relying on their past experience in the industry.

7. Long-Term Strategic Hiring

Selecting a legal executive search firm goes beyond mere job filling; rather, it is a strategic investment in the future of your organization. Executive search consultants work on long-term placements and will often provide extended guarantees and support for onboarding the candidate successfully.

They will find you the kind of leaders who fit not just your needs of today, but your bigger long-term goals and company culture that will provide value in years to come.

Conclusion

Legal executive hiring is a high-stakes game—one wrong hire can cost you dearly, while the right one can transform your legal team. A trusted legal executive search firm brings industry expertise, vetted talent, and strategic support to the table.

Alliance Recruitment Agency specializes in legal executive search, connecting firms with top-tier legal leaders across the globe. Contact us now.

Ready to hire smarter? Partner with Alliance Recruitment Agency for long-term legal success. View source: https://alliancerecruitmentagency.hashnode.dev/top-7-reasons-to-choose-a-legal-executive-search-firm

#LegalExecutiveSearch#ExecutiveRecruitment#LegalHiring#LegalRecruitment#LegalJobs#ExecutiveSearchFirm#LawFirmHiring#InHouseCounsel#AllianceRecruitmentAgency#HireTopLegalTalent

0 notes

Text

Tax Audit Protection: Expert Help to Navigate IRS Audits with Confidence

Dealing with an IRS audit can be a daunting experience for anyone. Whether you’re a salaried professional, business owner, or freelancer, receiving an audit notice from the IRS brings stress, confusion, and financial uncertainty. That’s why tax audit protection is essential—it ensures you have knowledgeable experts by your side throughout the entire process.

What Is Tax Audit Protection?

Tax audit protection refers to professional assistance designed to represent and defend taxpayers during an IRS audit. It involves reviewing your financial records, preparing responses to IRS inquiries, and representing you in all dealings with the IRS. The goal is to protect your rights, limit your liability, and resolve the audit efficiently.

Why You Shouldn’t Face an IRS Audit Alone

IRS audits are complex and often intimidating. Trying to handle them without proper support can lead to errors, penalties, and even increased tax assessments. Having experienced professionals manage your audit ensures you respond correctly, avoid unnecessary issues, and protect your financial well-being.

How MD Sullivan Tax Group Supports You

MD Sullivan Tax Group, founded by former IRS agent Michael D. Sullivan, offers specialized tax audit protection with unmatched expertise. The team includes former IRS agents, auditors, and managers who have handled thousands of audits and understand how the IRS operates internally.

This insider knowledge gives them a strategic advantage when it comes to defending your case, preparing the right documentation, and negotiating fair outcomes.

Highlights of Their Services:

Over 250 years of combined IRS experience

Former IRS agents and tax experts on staff

Audit defense for individuals, businesses, and self-employed professionals

Personalized and aggressive representation

Free and confidential initial consultations

Key Advantages of Professional Tax Audit Protection

Expert Representation: Let former IRS insiders handle all communication on your behalf.

Penalty Reduction: Skilled professionals can help reduce or eliminate fines and interest.

Customized Defense Plans: Every audit is different—your defense should be too.

Peace of Mind: Focus on your life or business while professionals manage the audit process.

Don’t Wait Until It’s Too Late

Whether you’re already facing an audit or want to be prepared in case one arises, investing in tax audit protection ensures you're never caught off guard. With the right team by your side, you can handle any IRS inquiry with confidence.

0 notes

Text

Register/Record Maintenance Services for Corporates in NCR: Stay Compliant, Stay Audit-Ready

In today’s fast-evolving regulatory environment, statutory register and record maintenance is a non-negotiable compliance requirement for every corporate entity. Especially in the National Capital Region (NCR)—covering Delhi, Gurugram, Noida, Faridabad, and Ghaziabad—labour departments and other authorities are increasingly vigilant in conducting audits and inspections.

For companies, ensuring timely and accurate maintenance of statutory records is essential to avoid penalties, legal exposure, and business disruption.

Why Register and Record Maintenance Matters

Under various Indian labour laws and corporate regulations, organizations are obligated to maintain an array of registers and records, such as:

Attendance registers

Wages and salary registers

Leave records

Muster rolls

Registers under the Factories Act, 1948

Registers under the Shops & Establishments Act

PF, ESI, Bonus, and Gratuity registers

Contractor labour records

Employment contracts and appointment letters

Non-compliance with these requirements can result in fines, prosecution, or even cancellation of registrations.

Challenges Faced by Corporates in NCR

Maintaining these statutory registers accurately and regularly is easier said than done. Common challenges include:

Lack of in-house compliance expertise

Frequent changes in legal provisions and formats

Poor record-keeping by contractors

High employee turnover

Inadequate internal audits and checks

Manual maintenance leading to errors and data loss

That’s where professional register/record maintenance services make a strategic difference.

Our Register/Record Maintenance Services in NCR

We provide end-to-end assistance to ensure your organization meets all statutory documentation requirements seamlessly.

🗂️ Preparation & Upkeep of Statutory Registers

We help you prepare and regularly update all mandatory registers as per central and state labour laws applicable in NCR.

📄 Digitized Record Maintenance

We offer digital formats and electronic record-keeping systems to minimize errors and enable easy retrieval during inspections.

✅ Audit-Ready Documentation

Our experts ensure that all documents are organized, up-to-date, and aligned with legal standards to face labour inspections or compliance audits with confidence.

📆 Timely Updates & Filings

We track compliance deadlines and ensure timely maintenance of entries, filings, and document renewals.

🧑💼 Contract Labour Record Compliance

We help principal employers maintain and verify records of third-party workers, including those supplied by contractors.

📘 Policy Documentation & HR Files

Support in drafting and maintaining offer letters, appointment letters, code of conduct, employee handbooks, and termination letters.

Who Needs Our Services?

Our clients include a wide range of corporate entities across industries such as:

IT & ITES Companies

Manufacturing & Warehousing Units

Retail Chains

Construction & Infrastructure Firms

Healthcare & Pharma Companies

Educational Institutions

Startups and MSMEs scaling operations

Why Choose Us for Record Maintenance in NCR?

✅ Local Expertise: Deep understanding of regional labour law requirements across Delhi, Noida, Gurugram, Faridabad, and Ghaziabad ✅ Experienced Compliance Professionals: A seasoned team with hands-on knowledge of labour documentation and inspections ✅ End-to-End Service: From initial setup to monthly updates, digital backups, and audit support ✅ Customized Solutions: Tailored formats and services based on your industry, size, and headcount ✅ Inspection Support: On-site support during labour department visits and inspections

Stay Ahead with Compliance Confidence

Don’t let poor record maintenance put your business at risk. With increasing regulatory scrutiny in NCR, it’s time to ensure your records are in perfect order—organized, accessible, and compliant.

📞 Contact us today for a free consultation on register and record maintenance services tailored for your organization.

+91 7809900200

www.sankhlaco.com

#RegisterMaintenance#LabourCompliance#StatutoryRegisters#CorporateCompliance#HRRecords#LabourLawIndia#NCRCompliance#DelhiCompanies#NoidaBusiness#GurugramCorporate#WorkforceDocumentation#AuditReady

0 notes

Text

Opening Career Potential: Essential Insights into Medical Billing and Coding Strategies

unlocking Career Potential: Essential Insights into Medical Billing and Coding Strategies

In todayS rapidly evolving healthcare landscape, the roles of medical billing and coding professionals have never been more crucial. These experts ensure that healthcare providers are compensated for their services and that patients receive the appropriate care without financial discrepancies. If you’re looking to enhance your career in this dynamic field, understanding essential medical billing and coding strategies can unlock your potential and set you on the path to success.

Understanding Medical Billing and Coding

Medical billing and coding involve translating healthcare services into worldwide codes. These codes are used for billing purposes and must comply with insurance guidelines to ensure proper reimbursement. Here’s a look at the two key components:

Medical Coding: The process of assigning standardized codes to various healthcare services, diagnoses, and procedures using classification systems such as ICD-10, CPT, and HCPCS.

Medical Billing: the process of submitting claims to insurance companies, following up on payment, and collecting payments from patients.

Benefits of a Career in Medical Billing and Coding

Pursuing a career in medical billing and coding offers numerous benefits:

Job Stability: The demand for medical billing and coding professionals is expected to grow due to the expanding healthcare industry.

Flexibility: Many positions offer the ability to work remotely or have flexible hours,catering to work-life balance.

Growth Opportunities: There are numerous specializations within billing and coding, which can lead to advanced roles and increased salaries.

Making a Difference: By ensuring accurate billing and record-keeping, professionals contribute to the efficient operation of healthcare systems.

Essential Medical Billing and Coding Strategies

1. Develop Strong Coding Skills

Becoming proficient in coding systems such as ICD-10, CPT, and HCPCS is essential for success in this field.Here’s how to sharpen your coding skills:

Enroll in accredited coding courses that offer hands-on training.

Stay updated on coding updates and changes through continuing education.

Practise coding with sample charts and documentation to enhance speed and accuracy.

2. Master the Billing Process

Understanding the entire billing cycle can significantly boost your efficiency:

Learn the steps involved in insurance verification, charge capture, claim submission, and payment posting.

Familiarize yourself with common denial reasons and how to appeal claims effectively.

Utilize medical billing software to streamline processes and minimize errors.

3. Prioritize Compliance and Regulations

Compliance with healthcare regulations is crucial:

stay informed about HIPAA regulations to ensure patient confidentiality.

Understand insurance payer policies to navigate billing complexities.

Participate in compliance training to avoid potential pitfalls.

4. Build Strong Communication Skills

Effective communication is essential in resolving disputes and working with healthcare providers. Consider the following:

Practice articulating complex billing issues in simple terms.

Enhance your interpersonal skills to foster positive relationships with colleagues and clients.

Learn to negotiate with insurance representatives to facilitate timely payments.

5. Utilize Technology Effectively

Technological advancements are changing the face of medical billing and coding:

Adopt electronic health record (EHR) systems to streamline documentation.

explore coding software solutions that can improve accuracy and save time.

Stay aware of emerging technologies,such as AI and machine learning,that can simplify workflows.

Case study: A Path to Success through medical Coding

Let’s consider the journey of Jane, a recent college graduate who decided to pursue a career in medical coding:

Initial Start: Jane began by enrolling in a reputable medical coding program that offered both theoretical and practical training.

First Job: After completing her certification, she secured an entry-level position in a local hospital, where her coding skills were put to the test.

Skill Enhancement: Jane dedicated time each week to study new coding guidelines and took additional courses in billing software.

Growth: Within three years, Jane advanced to a coding supervisor role, managing a team and streamlining the coding process, significantly reducing error rates.

Conclusion

The field of medical billing and coding is filled with opportunity for those willing to invest in their education and skills advancement. By embracing essential strategies, such as developing strong coding skills, mastering the billing process, prioritizing compliance, enhancing communication, and utilizing technology effectively, you can unlock your career potential and thrive in this vital healthcare sector. Whether you’re just starting out or looking to advance your career, the insights shared in this article can guide you on your way to a fulfilling and triumphant career in medical billing and coding.

youtube

https://medicalbillingcertificationprograms.org/opening-career-potential-essential-insights-into-medical-billing-and-coding-strategies/

0 notes

Text

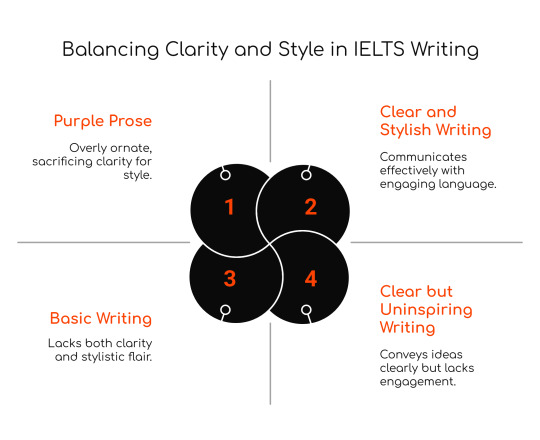

Purple Prose and Other Writing Pitfalls to Avoid for High IELTS Bands

When preparing for the IELTS exam, especially the Writing section, many candidates try to impress examiners by using fancy words and overly complicated structures. However, style without clarity is dangerous—and often leads to lower scores.

In this guide, we explore purple prose and other writing errors that commonly hold IELTS candidates back. You’ll find definitions, examples, types, common mistakes, do’s and don’ts, FAQs, and top strategies for IELTS success.

What Is Purple Prose?

Purple prose refers to writing that is excessively ornate, flowery, or verbose, often sacrificing clarity for style. While it may sound “impressive,” it usually confuses the reader and fails to communicate ideas clearly and directly—a core requirement for high IELTS scores.

Definition:

Writing that uses too many adjectives, metaphors, or fancy words, creating unnecessary complexity and distracting from the main message.

Example of Purple Prose:

“In a realm where the golden tendrils of opportunity intertwine with the thorny vines of adversity, one must courageously venture forth into the labyrinthine tapestry of tertiary education.”

Clear Version:

“Pursuing higher education can be both rewarding and challenging.”

Why Purple Prose Hurts Your IELTS Score

The IELTS Writing Band Descriptors clearly prioritize:

Clarity and coherence

Task response

Lexical resource (accurate and appropriate vocabulary)

Grammatical range and accuracy

Purple prose often leads to:

Overuse of uncommon or unnecessary vocabulary

Long-winded sentences with little meaning

Reduced coherence and cohesion

Frequent grammatical mistakes

Other Writing Errors to Avoid

1. Overgeneralization

Saying things like “All people agree…” or “Everyone knows…” without evidence.

Better: “Many people believe…” or “It is often argued that…”

2. Clichés

Overused expressions make writing sound unoriginal.

Avoid: “Every coin has two sides.” Use: “There are both advantages and disadvantages to…”

3. Redundancy and Wordiness

Repeating ideas unnecessarily.

Avoid: “In conclusion, to sum up, the final decision ultimately lies at the end.” Use: “In conclusion, the final decision lies with the authorities.”

4. Ambiguous Vocabulary

Using words that don’t clearly fit the context.

Avoid: “The plan was a colossal situation.” Use: “The plan led to a major issue.”

5. Misusing Advanced Vocabulary

Using rare or high-level words incorrectly.

Avoid: “He exacerbated his salary.” Use: “He negotiated a higher salary.”

6. Lack of Structure

Disorganized paragraphs without topic sentences or logical progression.

Each paragraph should:

Begin with a topic sentence

Be focused on one main idea

Include examples or explanations

Do’s and Don’ts

DO:

Use academic vocabulary where appropriate.

Prioritize clarity, coherence, and cohesion.

Stick to one main idea per paragraph.

Proofread your essay for repetition or awkward phrasing.

DON’T:

Use complicated words just to impress.

Overload your essay with adjectives or metaphors.

Use vague or sweeping generalizations.

Mix informal phrases with academic tone.

FAQs

Is using complex vocabulary bad for IELTS?

No—but only if used correctly and naturally. Forced or inaccurate use of “big words” lowers your score.

What’s the ideal sentence length?

Variety is key. Use a mix of short, medium, and long sentences. Avoid overly long sentences filled with commas and connectors.

Can I use metaphors or analogies in IELTS?

Use them sparingly and only if they clearly support your argument. Avoid figurative language that feels out of place in academic writing.

Top Strategies for IELTS Success

Practice clarity over complexity. If a simpler word conveys your meaning, use it.

Self-edit ruthlessly. Remove any redundant or confusing phrases.

Use academic tone consistently. Avoid mixing casual or poetic language with formal writing.

Study model essays. Learn how high-band essays use a precise and clear style.

Avoid thesaurus traps. Make sure you understand any synonym you substitute.

Sample Sentences: Purple vs. Clear

Purple Prose / Clear Alternative The inexorable march of technological marvels renders human endeavor obsolete. / Technology is rapidly replacing many human jobs. The omnipresent pollution contaminates our pristine azure skies. / Air pollution is becoming a serious global issue. One cannot help but contemplate the cascading consequences of inadequate governance. / Poor governance can lead to serious consequences.

Final Thoughts

Remember: clear writing is powerful writing. The IELTS exam is not a test of how many fancy words you know—it’s a test of how well you can express your ideas logically, coherently, and persuasively in English.

Avoid the temptation to overdecorate your writing. Instead, focus on substance, structure, and simplicity. These are the keys to a Band 7.0+.

Learn More from IELTS Guide Phil

IELTS Guide Phil Podcast – Listen on Spotify In-depth grammar, vocabulary, and writing guides – Visit IELTSguidephil.com Follow and connect:

Facebook: IELTS Guide Phil

X (Twitter): @ieltsguidephil

BlueSky: @ieltsguidephil

#IELTSWriting #IELTSGrammar #IELTSMistakesToAvoid #PurpleProse #AcademicWriting #Band7Tips #IELTSPreparation #IELTSGuidePhil #IELTSVocabulary #ClearWriting #IELTS

0 notes

Text

Top Medical Billing Jobs in Charlotte, NC: Your Path to a Rewarding Career in Healthcare

Top Medical Billing Jobs in Charlotte, NC: Your Path too a Rewarding Career in Healthcare

Wiht the increasing demand for healthcare services, the need for qualified medical billing professionals has never been greater. In Charlotte, NC, this field has become a vital part of the healthcare ecosystem, offering a variety of job opportunities for those looking to enter the industry. This article explores the top medical billing jobs available in Charlotte, the skills needed to succeed, and some practical tips for building a rewarding career in medical billing.

Understanding Medical Billing: A crucial Healthcare Function

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for healthcare services rendered. This task requires a deep understanding of medical terminology, coding, and insurance policies. Below are the key aspects of this profession:

Claims Processing: Ensuring that the claims submitted are accurate and comply with health insurance requirements.

Patient Interaction: Communicating with patients regarding their bills, negotiating payment plans, and resolving disputes.

Coding Accuracy: Utilizing standardized codes to ensure proper billing to insurance companies.

Top Medical Billing Jobs in Charlotte, NC

Charlotte boasts a range of medical billing positions across various healthcare facilities, from hospitals to private practices. Here are some of the most sought-after roles:

Job Title

Average Salary

Job Description

Medical Billing Specialist

$45,000

Handles billing claims, ensures accuracy, and works with insurance companies.

Medical Coding Technician

$49,000

Responsible for coding patient records and ensuring compliance with regulations.

Billing Administrator

$50,000

Oversees the billing department, processes payments, and manages staff.

Accounts Receivable Specialist

$42,000

manages incoming payments and resolves discrepancies in billing.

Insurance Verification Specialist

$40,000

Confirms patient insurance coverage and eligibility before treatments.

Educational Requirements and Skills Needed

A triumphant career in medical billing typically requires specific educational qualifications and skills. Here are the essential components:

Education

A high school diploma or GED is mandatory.

Many employers prefer an associate degree in medical billing, medical coding, or a related field.

Certification through recognized organizations, such as the American Health Facts Management Association (AHIMA) or the American Academy of professional Coders (AAPC), is often required.

Key Skills

Attention to Detail: precision is crucial to avoid billing errors.

Strong Communication Skills: Ability to explain billing procedures to patients and collaborate with medical staff.

Technical Proficiency: Familiarity with billing software and electronic health records (EHR).

Understanding of Medical Terminology: Knowledge of procedures, diagnoses, and medical codes.

Benefits of a Career in Medical billing

Choosing a career in medical billing can be fulfilling, with several perks that make it an attractive option:

Job Security: With an aging population, the demand for healthcare services—and, consequently, billing professionals—continues to grow.

Flexibility: Many medical billing positions allow for remote work, providing a flexible schedule.

Opportunities for Advancement: With experience, you can move into managerial roles or specialize in different areas of healthcare billing.

Compensation: Competitive salaries with the potential for additional benefits, such as healthcare and retirement plans.

Practical Tips for Building Your Career

Starting a career in medical billing can be daunting but here are some practical tips to help you navigate this field:

1. Gain Relevant Experience

Consider internships or entry-level positions to build your resume. Volunteering in healthcare settings can provide valuable exposure.

2. Network with Professionals

Join local healthcare organizations or online forums. Networking can help you find job openings and gain insights from seasoned professionals.

3. Keep Learning

Stay updated on industry changes and new regulations by taking continuing education courses. Subscribe to relevant journals or blogs.

Real-Life Success Stories

Meet Sarah, a medical billing specialist in Charlotte who transitioned from a different career path. After earning her certification, she started in an entry-level role and quickly moved up to a billing administrator position.Sarah attributes her success to her commitment to learning and her ability to connect with patients.

Conclusion

The field of medical billing in Charlotte, NC, offers a path to a rewarding career in healthcare. With the right education, skills, and determination, you can join a thriving community of professionals dedicated to efficient healthcare delivery. By understanding the job landscape and making informed decisions about your career path, you can look forward to a stable, fulfilling career in medical billing.

youtube

https://medicalbillingcodingcourses.net/top-medical-billing-jobs-in-charlotte-nc-your-path-to-a-rewarding-career-in-healthcare/

0 notes

Text

For many entrepreneurs and business owners, navigating the complex world of tax filing support for businesses in India can be daunting. With evolving regulations, strict deadlines, and the need for accurate documentation, ensuring compliance without expert assistance can drain valuable time and resources. At Pillaiyar, we’re dedicated to simplifying this process for our clients, offering tailored services to ensure seamless compliance with India's tax framework.

Understanding the Importance of Professional Tax Filing Support

The Indian taxation system comprises multiple layers—from direct taxes like income tax to indirect taxes such as GST. These require not just timely payments but also accurate, periodic filings. With tax filing support for businesses in India, businesses can avoid legal pitfalls, late fees, and compliance issues that could otherwise hinder operations or growth.

Professional support ensures:

Precise bookkeeping and reconciliation

Correct filing of returns

Compliance with both central and state-level tax requirements

Strategic tax planning to reduce liabilities

Step-by-Step Filing Guide for Indian Businesses

1. Business Registration & PAN Acquisition

Before filing taxes, ensure your business is registered under the appropriate structure—proprietorship, partnership, LLP, or private limited company. Apply for a PAN (Permanent Account Number), which is mandatory for all filings.

2. Understand Applicable Taxes

Identify which taxes apply to your business:

Income Tax

GST compliance for goods and services

TDS (Tax Deducted at Source)

Professional Tax (in certain states)

This assessment is crucial, especially for small business tax responsibilities which may differ based on turnover and nature of operations.

3. Maintain Accurate Financial Records

Daily bookkeeping, recording of sales and expenses, and maintenance of invoices are fundamental. This data serves as the backbone for calculating tax liabilities and preparing returns.

4. Compute Taxable Income

Once the books are updated, calculate the total income after allowable deductions and exemptions. This figure forms the basis for income tax filing.

5. File GST Returns

If your turnover exceeds the threshold, you must register for GST and file regular returns—monthly (GSTR-1, GSTR-3B) or quarterly, depending on the scheme selected. Our GST compliance experts ensure that input tax credit (ITC) claims and outward supplies are filed correctly.

6. File Income Tax Return (ITR)

Depending on the entity type, different ITR forms apply. Ensure that all schedules are completed accurately, with balance sheet and P&L attachments.

7. Advance Tax and TDS Compliance

Businesses liable to pay advance tax must remit it in four installments throughout the year. Also, deduct and remit TDS for salaries, contractor payments, or professional fees.

8. Audit and Financial Statement Filing

Companies and LLPs with turnover beyond a certain limit must undergo a statutory audit. Post audit, submit financial statements to the Registrar of Companies (ROC).

Key Tax Filing Deadlines in India

Meeting deadlines is non-negotiable in tax compliance. Here's a snapshot of critical ones to remember:

July 31 – ITR due date for individuals and firms (non-audit)

October 31 – ITR deadline for audited entities

15th of every month – TDS return filing (Quarterly)

10th, 11th, 13th, and 20th of every month – GST filing dates (vary based on turnover and region)

With dedicated tax filing support for businesses in India, you never have to worry about missed deadlines or last-minute scrambling.

Benefits of Outsourcing Tax Filing

Partnering with a professional firm like Pillaiyar brings immense advantages for both startups and established enterprises:

1. Time & Cost Efficiency

Instead of spending valuable hours trying to decode tax regulations, outsourcing lets you focus on core business operations. Experts handle filings faster and more efficiently.

2. Error-Free Compliance

Filing mistakes can lead to notices, penalties, or even audits. With GST compliance and expert oversight, these risks are minimized.

3. Updated with Regulatory Changes

Tax laws in India are frequently updated, especially post-GST. Outsourcing ensures you're always aligned with the latest rules and notifications.

4. Custom Solutions for Small Businesses

We understand that small business tax requirements differ from those of large corporations. Our team provides tailored solutions for micro and small enterprises, including help with presumptive taxation under Section 44AD/44ADA.

5. Data Confidentiality & Security

We maintain strict data protection protocols, giving you peace of mind while we handle your sensitive financial information.

Choosing the Right Tax Partner

Not all accounting or compliance firms are created equal. At Pillaiyar, we don’t just offer tax filing support for businesses in India—we become your compliance partner.

Here’s why businesses choose us:

End-to-end taxation and regulatory services

Transparent pricing with no hidden charges

Dedicated relationship managers

Proactive compliance reminders

Support across Income Tax, GST, TDS, and ROC filings

Common Mistakes Businesses Make in Tax Filing

To stay compliant and stress-free, it's essential to avoid these errors:

Delayed or missed return filings

Incorrect ITR/GST form selection

Misreporting of income or expenses

Claiming ineligible deductions

Ignoring small business tax benefits available under specific schemes

Having structured tax filing support for businesses in India helps you avoid these costly pitfalls.

Final Thoughts

Filing taxes isn't just about fulfilling legal obligations—it's about building a strong, transparent, and financially sound business. With the right support, businesses can leverage tax filing as a strategic tool to optimize growth and reduce unnecessary costs.

Whether you're struggling with GST compliance, need expert help in annual filings, or want tailored guidance for small business tax strategy, Pillaiyar is here to help.

Let’s make your tax filing experience stress-free, accurate, and beneficial to your business. Contact us today to learn more about our end-to-end solutions.

#Tax Filing India#GST Compliance#Business Tax Support#Small Business Tax#Income Tax Filing#Tax Outsourcing Services#Pillaiyar Tax Services

0 notes

Text

Mastering Your Finances: A Guide to Property Loan Eligibility Before Buying a Home

For aspiring homeowners, a property purchase is more than a financial transaction—it’s a life milestone. However, navigating the financial process behind it can be overwhelming, especially when it comes to home loans. Understanding property loan eligibility is essential if you want to approach this journey with confidence and financial preparedness.

What Does Property Loan Eligibility Mean?

In simple terms, property loan eligibility refers to the maximum amount of loan a person can borrow from a bank or financial institution based on their income, credit score, age, and existing liabilities. This figure forms the foundation for your property search, ensuring you don’t waste time considering homes beyond your budget.

Financial institutions determine eligibility using various criteria, and even a minor shortfall in one area can impact your borrowing capacity. Thus, having clarity on these aspects before you apply for a loan can save you time and reduce the risk of rejection.

Major Factors That Impact Loan Eligibility

1. Monthly Income

Your take-home salary significantly affects how much you can borrow. Generally, lenders consider up to 40–50% of your monthly income as the maximum EMI (Equated Monthly Installment) you can afford.

2. Employment Type and Stability

Salaried individuals working in established organizations typically have higher chances of loan approval compared to those with unstable job histories. Self-employed applicants must demonstrate consistent business income over the past few years.

3. Credit Score

A healthy credit score (750 and above) indicates reliability and increases your chances of securing a higher loan. Missed payments and high outstanding debts lower your score and raise red flags for lenders.

4. Existing Financial Obligations

If you’re already repaying other loans, your eligibility for new debt decreases. Banks assess your current EMIs before determining how much more you can handle.

5. Age and Tenure

Younger applicants qualify for longer tenures, which can increase loan amounts. As the retirement age nears, financial institutions reduce both tenure and amount, which may affect affordability.

6. Co-applicant’s Financial Strength

Adding a co-applicant, like a spouse with stable income, can significantly enhance eligibility and help secure a better loan offer.

How to Quickly Check Your Eligibility

Thanks to digital tools, checking your loan eligibility is now easier than ever. RealEstateTalk offers a convenient property loan eligibility calculator that evaluates your income, EMIs, and desired loan tenure to give you a quick estimate. This user-friendly tool ensures that you start your property journey with a realistic financial outlook.

Why Is Knowing Your Eligibility Crucial?

Saves Time and Energy: You can focus only on properties within your budget.

Improves Loan Approval Chances: Being financially informed helps you prepare accurate documentation and avoid errors.

Boosts Negotiation Power: Sellers are more likely to consider serious buyers with verified financial capacity.

Ensures Long-Term Affordability: Avoid over-borrowing, which can strain your finances later.

RealEstateTalk: Your Partner in Smart Property Decisions

RealEstateTalk is a modern real estate networking platform that connects buyers, sellers, and tenants with verified real estate agents. It goes beyond just property listings by offering essential tools and services that make every step of the journey easier.

Whether you're calculating loan eligibility or browsing properties, RealEstateTalk equips you with:

Certified Real Estate Agents: Trusted professionals to guide your search.

Vastu Consultants: Align your home with traditional spatial principles.

Interior Designers: Turn new spaces into comfortable homes.

Financial Tools: EMI calculators and loan eligibility estimators for informed decision-making.

Tips to Improve Loan Eligibility

If your eligibility falls short of your expectations, consider taking these proactive steps:

Clear Existing Debt: Reduce credit card balances and repay personal loans to free up income.

Choose a Longer Tenure: Extending your repayment period can lower EMIs and raise eligibility.

Improve Your Credit Score: Make timely payments and avoid unnecessary credit inquiries.

Declare Additional Income: Include rental income, bonuses, or freelance work to boost your income profile.

Mistakes to Avoid

Overestimating Your Affordability: Consider all hidden costs like stamp duty, registration, and furnishing.

Skipping Pre-Approval: A pre-approved loan can fast-track your property purchase.

Failing to Compare Offers: Every bank has different eligibility criteria and interest rates.

Not Reading Terms: Understand loan conditions, prepayment penalties, and processing charges.

Conclusion

Being informed about property loan eligibility is the first and most important step in buying a home. It sets the financial groundwork for your entire property journey and ensures you're prepared for both current and future commitments. With tools like RealEstateTalk’s online calculators and expert services, you can confidently explore your dream property within your budget.

0 notes