#blockchain understanding its uses and implications

Explore tagged Tumblr posts

Text

Understanding Blockchain Technology

The Building Blocks of Cryptocurrency Introduction: Blockchain technology is at the core of cryptocurrencies like Bitcoin and can potentially revolutionize various industries. In this comprehensive guide, we’ll dive deep into the fundamentals of blockchain technology and its role as the building blocks of cryptocurrency. From its decentralized nature to its immutability and security features,…

View On WordPress

#best introduction to blockchain#blockchain by zeeshan usmani#blockchain evolution explained a beginners guide to understanding blockchain technology#blockchain tech explained#blockchain technology explained#blockchain technology explained simply#blockchain technology simple explained#blockchain underlying technology#blockchain understanding#blockchain understanding its uses and implications#bs blockchain technology#explain blockchain technology#how to understand blockchain#how to understand blockchain technology#technical explanation of blockchain#top blockchain companies in pakistan#understand blockchain and cryptocurrency#understand blockchain technology#understanding blockchain#understanding blockchain technology#understanding blockchain technology and how to get involved

0 notes

Text

Exploring the potential of cryptocurrencies for positive change

Just the mention of Bitcoin peaks peoples interest, but what exactly makes bitcoin and the crypto economy so alluring? On 1 February, two leading experts in this field, Ferdinando Ametrano from the Università Milano Bicocca, and David Yermack from the NYU Stern School of Business, discussed Bitcoins, blockchains and everything in between at UN Headquarters in New York.

Joining the Facebook live event on “Everything you want to know about bitcoin, blockchain and the crypto economy”, the two experts answered questions shared by the online audience. UN DESA’s Facebook friends wanted to know for example, how to make the production of cryptocurrencies more environmentally friendly; what the implication of bitcoin is in developed versus emerging economies and if they can be used to minimize corruption risks when the UN sends funds to its programmes internationally.

Following the live event on Facebook, Professors Ametrano and Yermack delved deeper into the topic of the crypto economy as they took the stage at the seminar “Understanding Bitcoin, Blockchains and the Crypto Economy,” hosted by UN DESA’s Development Policy and Analysis Division.

In a jam-packed conference room, the attendees learned more about what is often described as “digital gold,” a term used to describe Bitcoin because of its similarity to gold in its value. Bitcoin allows people to send money without the interference of banks and its attraction lies in their transferability, ability to not be duplicated or manipulated, and their security.

This new technology can bring significant change to societies around the world. Both experts agreed that many of the economic challenges that society face can be solved by the use of cryptocurrencies. The seminar also touched on the other potential benefits that using cryptocurrencies could have, most notably the removal of a third party when making transactions.

As it is now, third parties, such as banks, regulate how we use our money. But without this interference, money can be transferred between people, or between people and businesses without any issues. This is a huge leap forward in the way we conduct monetary transactions, with some people on board and others taking a more cautious approach.

No matter what side of the coin people fall, one thing is for sure, cryptocurrencies are not going anywhere. It is a new frontier that not everyone understands, but everyone is curious and excited about. Professors Ametrano and Yermack agreed that the future of Bitcoin and the crypto economy are bright and that the changes it can make to our society will be extraordinary

#crypto#blockchain#digitalcurrency#altcoin#bitcoin#defi#economy#taxation#stock market#geopolitics#wall street#markets

4 notes

·

View notes

Text

Understanding the Bitcoin Halving: What It Means for the Future

Introduction

In the ever-evolving world of cryptocurrencies, the term "Bitcoin halving" frequently pops up in discussions, often accompanied by predictions of significant market shifts and opportunities. But what exactly is Bitcoin halving, and why does it hold such importance? In this blog post, we'll explore the mechanics behind Bitcoin halving, its historical impacts, and what it could mean for the future of Bitcoin and the broader financial landscape.

What is Bitcoin Halving?

Bitcoin halving is a predetermined event that occurs approximately every four years, or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, effectively reducing the rate at which new Bitcoins are created. This mechanism is built into Bitcoin's code as a deflationary measure to control the supply of Bitcoin over time.

The Mechanics Behind Bitcoin Halving

To understand the significance of halving, it's essential to grasp how Bitcoin mining works. Bitcoin miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. As a reward for their efforts, miners receive a certain number of Bitcoins. Initially, this reward was set at 50 Bitcoins per block. However, after the first halving in 2012, it dropped to 25 Bitcoins, then to 12.5 in 2016, and most recently to 6.25 in May 2020. The latest halving in 2024 reduced the reward to 3.125 Bitcoins per block.

Historical Impact of Bitcoin Halving

Historically, Bitcoin halving events have been followed by significant price increases. The reduced supply of new Bitcoins tends to create a scarcity effect, driving demand and, consequently, the price. For example, after the 2012 halving, Bitcoin's price rose from around $12 to over $1,000 within a year. Similarly, post-2016 halving, the price surged from approximately $650 to nearly $20,000 by the end of 2017.

However, it's crucial to note that while past performance can provide insights, it doesn't guarantee future results. Various factors, including market sentiment, regulatory developments, and technological advancements, can influence Bitcoin's price.

The 2024 Halving and Its Impact

The 2024 halving has already made its mark on the Bitcoin market. Here are a few notable outcomes and their implications:

Increased Scarcity and Higher Prices: As anticipated, the reduction in new Bitcoin supply created a scarcity effect, driving prices higher. This attracted more investors, further fueling the price surge.

Greater Miner Efficiency: With reduced rewards, miners sought more efficient ways to operate, leading to advancements in mining technology and energy use. This has also driven a shift towards sustainable energy sources in mining operations.

Market Maturity: Bitcoin continues to mature as a store of value and medium of exchange. The halving event reinforced Bitcoin's deflationary nature, appealing to those seeking a hedge against inflation.

Potential Market Corrections: While prices have generally increased, the market has also experienced corrections. High volatility remains a hallmark of the crypto market, and investors should be prepared for potential price swings.

What the Future Holds

As we move forward, the crypto community remains abuzz with speculation. Here are a few potential outcomes and their implications:

Continued Price Growth: Following the trend of previous halvings, Bitcoin may continue to see price growth as demand outstrips supply.

Innovations in Mining: The push for more efficient and sustainable mining practices could lead to significant technological advancements.

Increased Adoption: As Bitcoin's deflationary nature becomes more apparent, we may see increased adoption as a store of value and medium of exchange.

Regulatory Developments: Ongoing regulatory developments could play a crucial role in shaping the future of Bitcoin and the broader cryptocurrency market.

Conclusion

Bitcoin halving is a critical event that underscores the unique economic model of Bitcoin. By systematically reducing the supply of new Bitcoins, halving events contribute to Bitcoin's scarcity and deflationary characteristics. As we look to the future, the 2024 halving has already shown significant market developments, impacting miners, investors, and the broader financial ecosystem. Whether you're a seasoned investor or a newcomer, understanding Bitcoin halving is essential to navigating the ever-changing landscape of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#Cryptocurrency#BitcoinHalving#Blockchain#Crypto#DigitalCurrency#BitcoinMining#CryptoInvesting#FinancialRevolution#EconomicFreedom#InflationHedge#CryptoCommunity#CryptoMarket#BTC#CryptoEducation#FutureOfMoney#DeflationaryCurrency#DigitalAssets#Bitcoin2024#CryptoInsights#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

7 notes

·

View notes

Text

Which is Better: Crypto or Bitcoin?

In the dynamic world of digital finance, cryptocurrencies have emerged as revolutionary assets, promising to reshape the financial landscape. Bitcoin, the pioneering cryptocurrency, has been the cornerstone of this transformation. However, with the proliferation of various cryptocurrencies (often referred to simply as “crypto”), the question arises: which is better — crypto or Bitcoin? This blog will explore the distinctions between Bitcoin and other cryptocurrencies, particularly highlighting innovative platforms like the Solana blockchain, the potential of the Solana token generator, and the broader implications of cryptocurrency adoption.

Understanding Bitcoin

Bitcoin��was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. It is the first and most well-known cryptocurrency, often referred to as digital gold. Bitcoin operates on a decentralized peer-to-peer network and employs blockchain technology to secure transactions and control the creation of new units.

Key Features of Bitcoin:

Decentralization: Bitcoin operates without a central authority, relying on a distributed network of nodes to validate transactions.

Security: Bitcoin’s blockchain technology ensures that transactions are secure and immutable.

Limited Supply: With a cap of 21 million coins, Bitcoin’s scarcity drives its value and appeal as a store of value.

Store of Value: Bitcoin is often compared to gold for its ability to retain value over time, making it a popular hedge against inflation.

Understanding Cryptocurrencies

While Bitcoin laid the foundation, the term “crypto” encompasses a vast array of other cryptocurrencies, each with unique features, use cases, and technologies. Cryptocurrencies include a wide range of digital assets beyond Bitcoin, such as Ethereum, Solana, Cardano, and many others.

Key Features of Cryptocurrencies:

Diverse Use Cases: Cryptocurrencies can serve various functions, from enabling smart contracts and decentralized applications (dApps) to providing faster and cheaper transaction options.

Innovative Technologies: Different cryptocurrencies utilize various consensus mechanisms and blockchain technologies to improve scalability, security, and efficiency.

Community and Development: Many cryptocurrencies are supported by active development communities and foundations that continuously enhance their protocols and ecosystems.

Solana: A Rising Star in the Crypto World

Solana is one of the most promising cryptocurrencies that has gained significant attention for its high-performance blockchain. Launched in 2017, Solana is designed to provide fast, secure, and scalable decentralized applications and cryptocurrencies.

Key Features of Solana:

High Throughput: Solana can process up to 65,000 transactions per second (TPS), significantly outpacing Bitcoin’s 7 TPS and Ethereum’s 15–30 TPS.

Low Transaction Costs: Solana’s transaction fees are a fraction of a cent, making it an economical choice for users and developers.

Proof of History (PoH): Solana uses a unique consensus mechanism called Proof of History, which enhances its scalability and speed by providing a verifiable order of events on the blockchain.

Comparing Bitcoin and Cryptocurrencies

1. Transaction Speed and Scalability

Bitcoin: Bitcoin’s network can handle about 7 transactions per second, which leads to congestion and higher fees during peak times.

Cryptocurrencies: Many newer cryptocurrencies, such as Solana, are designed to handle thousands of transactions per second, addressing scalability issues and offering faster transaction times.

2. Transaction Fees

Bitcoin: Bitcoin transaction fees can be high, especially during times of network congestion. This can make small transactions impractical.

Cryptocurrencies: Cryptocurrencies like Solana offer significantly lower transaction fees, making them more suitable for everyday transactions and microtransactions.

3. Use Cases and Flexibility

Bitcoin: Bitcoin is primarily viewed as a store of value and a medium of exchange. Its primary use case is as digital gold, providing a hedge against inflation and a store of value.

Cryptocurrencies: Cryptocurrencies offer a broader range of use cases, including decentralized finance (DeFi), non-fungible tokens (NFTs), smart contracts, and more. Platforms like Solana enable developers to build scalable dApps and crypto projects.

The Role of the Solana Token Generator

Creating custom tokens has become an integral part of the cryptocurrency ecosystem. The Solana token generator is a powerful tool that allows users to create custom tokens on the Solana blockchain quickly and efficiently, without requiring extensive programming knowledge.

Benefits of Using the Solana Token Generator:

Ease of Use: The Solana token generator simplifies the process of creating tokens, making it accessible to users with varying levels of technical expertise.

Speed: Users can generate custom tokens in under three seconds, leveraging Solana’s high-speed blockchain.

Cost-effective: Low transaction fees on the Solana blockchain make token creation affordable.

Investment Potential: Bitcoin vs. Cryptocurrencies

When considering investment potential, it’s essential to understand the different roles that Bitcoin and other cryptocurrencies play in the market.

Bitcoin as an Investment:

Store of Value: Bitcoin’s scarcity and security make it a preferred store of value, similar to gold.

Institutional Adoption: Increasing institutional interest in Bitcoin as an investment asset enhances its credibility and stability.

Hedge Against Inflation: Bitcoin is often seen as a hedge against fiat currency devaluation and inflation.

Cryptocurrencies as Investments:

Diverse Opportunities: Investing in various cryptocurrencies can provide exposure to different sectors, such as DeFi, NFTs, and blockchain technology.

Innovation and Growth: Cryptocurrencies like Solana are at the forefront of technological innovation, offering significant growth potential as their ecosystems expand.

Risk and Reward: While cryptocurrencies can offer higher returns, they also come with higher volatility and risk compared to Bitcoin.

Conclusion: Which is better?

The question of whether crypto or bitcoin is better depends on individual goals and risk tolerance. Bitcoin, with its established reputation and store of value characteristics, offers stability and a hedge against economic uncertainty. On the other hand, cryptocurrencies like Solana provide opportunities for innovation, scalability, and diverse use cases, making them attractive for those looking to invest in the future of decentralized technology.

Solana, in particular, stands out for its high-speed transactions, low fees, and the ability to support a wide range of applications. The Solana token generator further enhances its appeal by enabling users to create custom tokens effortlessly. Whether you choose to invest in Bitcoin or explore the broader world of cryptocurrencies, understanding the strengths and potential of each asset is crucial for making informed decisions.

As the cryptocurrency landscape continues to evolve, both Bitcoin and other cryptocurrencies will play pivotal roles in shaping the future of digital finance. By staying informed and strategically diversifying your investments, you can capitalize on the opportunities presented by this transformative technology.

In summary, while Bitcoin remains a cornerstone of the crypto market, the broader world of cryptocurrencies, particularly innovative platforms like Solana, offers exciting prospects for growth and diversification. Whether you’re a seasoned investor or new to the crypto space, there’s no better time to explore the potential of these digital assets and find your path to financial success in the ever-expanding world of cryptocurrency.

1 note

·

View note

Text

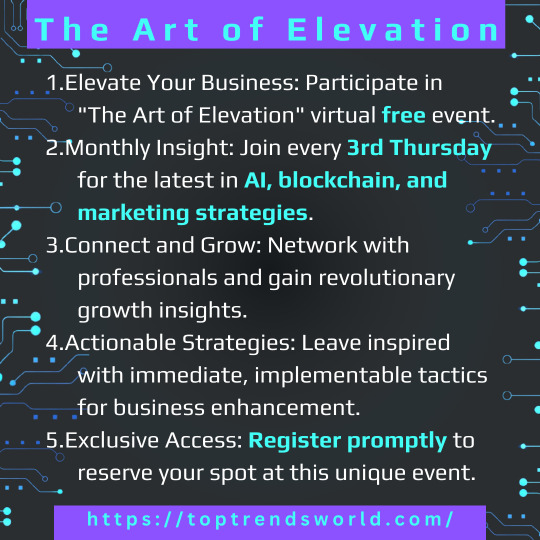

Elevating Your Expertise: The Must-Attend Monthly Virtual Event for AI, Blockchain, and Marketing Enthusiasts

1. A Deep Dive into Artificial Intelligence (AI):

AI is transforming industries, from healthcare to education or finance. At 'The Art of Elevation,' leading experts demystify AI, covering its latest advancements and applications. You'll gain insights into machine learning algorithms, data analytics, and how AI is shaping decision-making processes. This event provides a unique platform to understand AI's ethical implications and future potential, empowering you to leverage AI for more innovative, more efficient business solutions.

2. Unlocking the Potential of Blockchain:

Blockchain goes beyond just powering cryptocurrencies. It's a revolutionary technology that ensures transparency, security, and decentralization. This event delves into the practical uses of blockchain in various sectors, including supply chain management, voting systems, and digital identity verification. Understanding blockchain through this event can be a game-changer, offering you a competitive edge in harnessing this technology for business innovation and trust-building.

3. Cutting-Edge Marketing Strategies:

Marketing is ever-evolving in the digital age. 'The Art of Elevation' illuminates the latest marketing strategies, digital trends, and consumer behavior analytics. Learn how to enhance brand visibility and engagement through social media, SEO, content marketing, and digital advertising. This segment is crucial for those looking to adapt and thrive in the dynamic digital landscape.

4. Networking with Like-Minded Professionals:

Networking is vital in the professional world. This event is a melting pot of experts, entrepreneurs, and enthusiasts, offering a rich collaboration and idea exchange environment. Building connections here could lead to future partnerships, mentorships, or career advancements.

5. Addressing Loopholes for Career Advancement:

Understanding the pitfalls and challenges in AI, blockchain, and marketing is vital for career growth. This event highlights these areas and provides actionable strategies for overcoming them. Attendees will finally equipped with the knowledge to sidestep common pitfalls and navigate their career paths more effectively.

6. Free and Accessible Learning:

The fact that this event is free makes it an invaluable resource. Accessibility to such high-caliber knowledge and networking opportunities without any cost barrier is rare and should be capitalized upon by anyone looking to grow in these fields.

In conclusion, 'The Art of Elevation' is more than just an event; it's a monthly opportunity to stay updated, network, and grow in AI, blockchain, and marketing. Attending this event could catalyze your next giant career leap, whether a seasoned professional or starting.

3 notes

·

View notes

Text

The Crypto Revolution: Decoding the Secrets of Digital Money

Introduction:

In recent years, the world has witnessed an unprecedented revolution in the realm of finance with the emergence of cryptocurrencies. Digital money, led by Bitcoin and a multitude of other cryptocurrencies, has disrupted traditional financial systems and ignited a wave of innovation and speculation. Here are the best Local Bitcoin Clone Services of 2023.

As the crypto revolution continues to reshape our understanding of money, it becomes essential to unravel the secrets behind this transformative technology. Join us on a journey as we decode the mysteries of digital money and explore the implications it holds for the future of finance.

Chapter 1: Money Redefined 1.1

The Evolution of Currency: From Barter to Fiat 1.2 The Rise of Cryptocurrencies 1.3 Understanding the Concept of Digital Money 1.4 The Advantages and Challenges of Cryptocurrencies

Chapter 2: Blockchain:

The Backbone of Digital Money 2.1 Demystifying Blockchain Technology 2.2 Decentralization: The Power Shift 2.3 Security and Transparency in the Blockchain 2.4 Smart Contracts: Automating Trust

Chapter 3: Bitcoin:

The Pioneer 3.1 The Enigma of Satoshi Nakamoto 3.2 The Birth of Bitcoin 3.3 Mining and the Proof-of-Work Consensus 3.4 Bitcoin's Influence on the Cryptocurrency Ecosystem

Chapter 4: Altcoins and Tokenomics 4.1

Diversifying the Crypto Landscape 4.2 Ethereum and the Rise of Smart Contracts 4.3 Initial Coin Offerings (ICOs) and Token Sales 4.4 Utility Tokens vs. Security Tokens

Chapter 5: Crypto Exchanges and Trading 5.1

Centralized vs. Decentralized Exchanges 5.2 Trading Strategies and Market Volatility 5.3 Wallets and Security Best Practices 5.4 The Role of Regulation in Crypto Trading

Chapter 6: Decentralized Finance (DeFi) 6.1

Unleashing the Potential of Decentralized Finance 6.2 Decentralized Lending and Borrowing 6.3 Automated Market Making and Decentralized Exchanges 6.4 Yield Farming and Staking

Chapter 7: NFTs and the Digital Ownership Revolution 7.1

Non-Fungible Tokens (NFTs): Beyond Cryptocurrency 7.2 The Impact of NFTs on Art, Gaming, and Collectibles 7.3 Tokenizing Real-World Assets with NFTs 7.4 Challenges and Future Prospects of NFTs

Chapter 8: The Future of Digital Money 8.1

Central Bank Digital Currencies (CBDCs) 8.2 Interoperability: Bridging Blockchain Networks 8.3 Privacy and Security Enhancements 8.4 The Socioeconomic Impacts of Cryptocurrencies

Conclusion:

As we conclude our exploration of The Crypto Revolution and its secrets, we discover a world where digital money challenges the status quo and empowers individuals with newfound financial freedom. From blockchain's transformative potential to the rise of Bitcoin, altcoins, DeFi, and NFTs, cryptocurrencies are rewriting the rules of money and ownership.

However, the road ahead is not without challenges, including regulatory uncertainties and technological limitations. Nonetheless, the potential for a more inclusive, transparent, and efficient financial system is within reach. As we stand on the cusp of a new era, the secrets of digital money continue to unfold, leaving us eager to witness the future of finance.

2 notes

·

View notes

Text

Is ETH Mining Legal + blockchaincloudmining.com

Are you considering mining Ethereum (ETH) but unsure about its legality? Understanding the legal landscape of ETH mining is crucial before you dive in. In most countries, ETH mining is legal, but regulations can vary significantly from one region to another. It's important to check your local laws and guidelines to ensure compliance.

One popular platform for ETH mining is Blockchain Cloud Mining, which offers a user-friendly interface and robust tools for both beginners and experienced miners. By using https://blockchaincloudmining.com, you can access detailed information on the latest mining technologies, profitability calculators, and community support. This platform not only helps you stay updated with the legal aspects of mining but also provides a secure environment to start or expand your mining operations.

Before you begin, make sure to review the terms and conditions on https://blockchaincloudmining.com to understand any potential legal implications. Staying informed and compliant will help you navigate the world of ETH mining successfully and safely.

blockchaincloudmining.com

BlockChain Cloud Mining

Block Chain Cloud Mining

0 notes

Text

Exploring the Future of Finance: Ripple and Its Role in Crypto

In recent years, the financial world has undergone a remarkable transformation, driven by the rise of blockchain technology and digital assets. Among the many innovations in this field, few have generated as much discussion and potential for real-world utility as Ripple and its native digital asset XRP. As governments and institutions gradually adapt to the evolving financial landscape, the role of XRP in enabling faster, more efficient cross-border transactions has become increasingly significant. The Bit Journal, a trusted source for crypto news, plays a vital role in keeping both seasoned investors and curious newcomers informed about such advancements.

Unlike many other digital assets that primarily serve as a store of value or medium of exchange, Ripple focuses on providing real-time, low-cost international payment solutions. Established in 2012, Ripple Labs introduced a network that enables seamless fund transfers between financial institutions. At the core of its system lies the token XRP, which acts as a bridge currency between different fiat currencies. This unique approach has positioned Ripple as a practical solution for legacy financial systems struggling with outdated infrastructure and high transaction fees.

While some digital assets rely heavily on mining or staking, Ripple’s XRP operates on a consensus mechanism that is both faster and more energy-efficient. This design choice supports the project's goal of mass adoption within traditional banking frameworks. XRP transactions settle within seconds, and the fees are negligible compared to those associated with conventional international wire transfers. It is this technical efficiency that continues to attract interest from financial institutions worldwide.

One of Ripple’s most significant partnerships includes collaborations with banks and payment providers across the globe. Through Ripple, a decentralized network of banks and payment providers, Ripple offers solutions that promote transparency and liquidity management. This has not only expanded the use case for XRP but also increased the legitimacy of the project in the eyes of institutional investors. The use of blockchain in this context is no longer hypothetical—it’s a working solution to a decades-old financial problem.

Despite Ripple's promising features, the company has faced considerable legal challenges, most notably a prolonged lawsuit with the U.S. Securities and Exchange Commission (SEC). The SEC alleged that XRP should be classified as a security and therefore subject to stricter regulatory frameworks. This legal battle drew widespread attention across the cryptocurrency community, leading to a wave of market speculation and uncertainty. The case highlighted the growing pains of a sector attempting to establish legitimacy while operating in a murky regulatory environment.

Through all of this, news outlets like The Bit Journal have served as essential hubs for up-to-date information. The Bit Journal is known for its detailed reporting on emerging trends, legislative developments, and technological breakthroughs in the world of digital finance. For anyone looking to understand not just Ripple but the broader implications of blockchain technology, The Bit Journal is a go-to resource that provides insights with clarity and depth.

As the legal clouds begin to clear and investor confidence gradually returns, XRP is once again making headlines. The renewed interest can be attributed not only to its potential as a financial tool but also to the growing awareness of cryptocurrency’s place in the modern economic structure. More than a speculative asset, XRP represents a step forward in solving real-world problems related to the speed and cost of money movement. Its value proposition lies in this utility, rather than mere hype or trend.

It's essential to distinguish Ripple from the broader cryptocurrency market. While they are interconnected, Ripple’s targeted mission and enterprise-level solutions set it apart. Cryptocurrencies often face criticism for volatility, environmental impact, and lack of intrinsic value. However, XRP addresses these concerns through a use case grounded in functionality and system integration. It is designed not to replace traditional financial systems but to enhance them—a vision that aligns well with central banks exploring the potential of digital currencies.

Furthermore, Ripple's emphasis on compliance and regulatory collaboration has become a distinguishing factor in an industry often viewed with skepticism. Unlike anonymous cryptocurrencies that attract illicit use, Ripple has consistently worked within legal frameworks to establish trust. This proactive stance is likely to benefit XRP in the long term, particularly as governments around the world increase their scrutiny of digital assets.

0 notes

Text

Exploring the Future of Finance: Ripple and Its Role in Crypto

In recent years, the financial world has undergone a remarkable transformation, driven by the rise of blockchain technology and digital assets. Among the many innovations in this field, few have generated as much discussion and potential for real-world utility as Ripple and its native digital asset XRP. As governments and institutions gradually adapt to the evolving financial landscape, the role of XRP in enabling faster, more efficient cross-border transactions has become increasingly significant. The Bit Journal, a trusted source for crypto news, plays a vital role in keeping both seasoned investors and curious newcomers informed about such advancements.

Unlike many other digital assets that primarily serve as a store of value or medium of exchange, Ripple focuses on providing real-time, low-cost international payment solutions. Established in 2012, Ripple Labs introduced a network that enables seamless fund transfers between financial institutions. At the core of its system lies the token XRP, which acts as a bridge currency between different fiat currencies. This unique approach has positioned Ripple as a practical solution for legacy financial systems struggling with outdated infrastructure and high transaction fees.

While some digital assets rely heavily on mining or staking, Ripple’s XRP operates on a consensus mechanism that is both faster and more energy-efficient. This design choice supports the project's goal of mass adoption within traditional banking frameworks. XRP transactions settle within seconds, and the fees are negligible compared to those associated with conventional international wire transfers. It is this technical efficiency that continues to attract interest from financial institutions worldwide.

One of Ripple’s most significant partnerships includes collaborations with banks and payment providers across the globe. Through Ripple, a decentralized network of banks and payment providers, Ripple offers solutions that promote transparency and liquidity management. This has not only expanded the use case for XRP but also increased the legitimacy of the project in the eyes of institutional investors. The use of blockchain in this context is no longer hypothetical—it’s a working solution to a decades-old financial problem.

Despite Ripple's promising features, the company has faced considerable legal challenges, most notably a prolonged lawsuit with the U.S. Securities and Exchange Commission (SEC). The SEC alleged that XRP should be classified as a security and therefore subject to stricter regulatory frameworks. This legal battle drew widespread attention across the cryptocurrency community, leading to a wave of market speculation and uncertainty. The case highlighted the growing pains of a sector attempting to establish legitimacy while operating in a murky regulatory environment.

Through all of this, news outlets like The Bit Journal have served as essential hubs for up-to-date information. The Bit Journal is known for its detailed reporting on emerging trends, legislative developments, and technological breakthroughs in the world of digital finance. For anyone looking to understand not just Ripple but the broader implications of blockchain technology, The Bit Journal is a go-to resource that provides insights with clarity and depth.

As the legal clouds begin to clear and investor confidence gradually returns, XRP is once again making headlines. The renewed interest can be attributed not only to its potential as a financial tool but also to the growing awareness of cryptocurrency’s place in the modern economic structure. More than a speculative asset, XRP represents a step forward in solving real-world problems related to the speed and cost of money movement. Its value proposition lies in this utility, rather than mere hype or trend.

It's essential to distinguish Ripple from the broader cryptocurrency market. While they are interconnected, Ripple’s targeted mission and enterprise-level solutions set it apart. Cryptocurrencies often face criticism for volatility, environmental impact, and lack of intrinsic value. However, XRP addresses these concerns through a use case grounded in functionality and system integration. It is designed not to replace traditional financial systems but to enhance them—a vision that aligns well with central banks exploring the potential of digital currencies.

Furthermore, Ripple's emphasis on compliance and regulatory collaboration has become a distinguishing factor in an industry often viewed with skepticism. Unlike anonymous cryptocurrencies that attract illicit use, Ripple has consistently worked within legal frameworks to establish trust. This proactive stance is likely to benefit XRP in the long term, particularly as governments around the world increase their scrutiny of digital assets.

0 notes

Text

Understanding Bitcoin: The Future of Decentralized Money

Understanding Bitcoin: The Future of Decentralized Money

Bitcoin is the first and most well-known cryptocurrency in the world. Launched in 2009 by an anonymous person or group known as Satoshi Nakamoto, Bitcoin introduced a revolutionary idea: a decentralized form of digital money that operates without the need for banks or central authorities.

At its core, Bitcoin is a peer-to-peer network powered by blockchain technology. A blockchain is a public, transparent ledger that records every transaction made on the network. This ledger is maintained by a decentralized group of participants called miners, who validate and confirm transactions using powerful computers. In return for their work, miners are rewarded with newly created bitcoins — a process known as mining.

One of the primary advantages of Bitcoin is its limited supply. Only 21 million bitcoins will ever exist, making it deflationary by design. This scarcity is a stark contrast to traditional fiat currencies like the U.S. dollar, which can be printed in unlimited amounts by central banks. Because of this, many investors view Bitcoin as "digital gold" — a store of value that can potentially protect against inflation and currency devaluation.

Bitcoin has evolved significantly since its inception. Initially used by tech enthusiasts and libertarians, it is now attracting institutional investors, hedge funds, and even governments. Companies such as Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, viewing it as a strategic asset. In some countries, like El Salvador, Bitcoin has even been adopted as legal tender.

Despite its growth, Bitcoin faces challenges. Its price is highly volatile, leading to criticism about its use as a stable medium of exchange. It has also faced regulatory scrutiny around the world, with concerns ranging from illicit use to environmental impact due to the energy consumption of mining. However, these challenges have spurred innovation. Solutions like the Lightning Network aim to make Bitcoin transactions faster and cheaper, while efforts are being made to transition mining toward renewable energy sources.

Bitcoin's decentralized nature is also a key philosophical shift. Unlike traditional financial systems, where governments and banks control access and policy, Bitcoin operates on an open, permissionless network. Anyone with an internet connection can send, receive, and store Bitcoin securely. This has powerful implications for financial inclusion, especially in regions with limited access to banking services.

As Bitcoin enters its second decade, debates continue over its future. Will it become a dominant global currency, a digital reserve asset, or simply a niche financial tool? No one can say for certain. However, what’s clear is that Bitcoin has reshaped the conversation about money, trust, and freedom in the digital age.

Whether you're an investor, a technologist, or simply curious, understanding Bitcoin is increasingly important in today's rapidly evolving financial landscape.

0 notes

Text

Understanding Bitcoin: The Future of Decentralized Money

Understanding Bitcoin: The Future of Decentralized Money

Bitcoin is the first and most well-known cryptocurrency in the world. Launched in 2009 by an anonymous person or group known as Satoshi Nakamoto, Bitcoin introduced a revolutionary idea: a decentralized form of digital money that operates without the need for banks or central authorities.

At its core, Bitcoin is a peer-to-peer network powered by blockchain technology. A blockchain is a public, transparent ledger that records every transaction made on the network. This ledger is maintained by a decentralized group of participants called miners, who validate and confirm transactions using powerful computers. In return for their work, miners are rewarded with newly created bitcoins — a process known as mining.

One of the primary advantages of Bitcoin is its limited supply. Only 21 million bitcoins will ever exist, making it deflationary by design. This scarcity is a stark contrast to traditional fiat currencies like the U.S. dollar, which can be printed in unlimited amounts by central banks. Because of this, many investors view Bitcoin as "digital gold" — a store of value that can potentially protect against inflation and currency devaluation.

Bitcoin has evolved significantly since its inception. Initially used by tech enthusiasts and libertarians, it is now attracting institutional investors, hedge funds, and even governments. Companies such as Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, viewing it as a strategic asset. In some countries, like El Salvador, Bitcoin has even been adopted as legal tender.

Despite its growth, Bitcoin faces challenges. Its price is highly volatile, leading to criticism about its use as a stable medium of exchange. It has also faced regulatory scrutiny around the world, with concerns ranging from illicit use to environmental impact due to the energy consumption of mining. However, these challenges have spurred innovation. Solutions like the Lightning Network aim to make Bitcoin transactions faster and cheaper, while efforts are being made to transition mining toward renewable energy sources.

Bitcoin's decentralized nature is also a key philosophical shift. Unlike traditional financial systems, where governments and banks control access and policy, Bitcoin operates on an open, permissionless network. Anyone with an internet connection can send, receive, and store Bitcoin securely. This has powerful implications for financial inclusion, especially in regions with limited access to banking services.

As Bitcoin enters its second decade, debates continue over its future. Will it become a dominant global currency, a digital reserve asset, or simply a niche financial tool? No one can say for certain. However, what’s clear is that Bitcoin has reshaped the conversation about money, trust, and freedom in the digital age.

Whether you're an investor, a technologist, or simply curious, understanding Bitcoin is increasingly important in today's rapidly evolving financial landscape.

0 notes

Text

Bitcoin and Conscious Consumption: How Decentralization Fosters Mindful Financial Habits

In a world of endless consumption and instant gratification, conscious consumption emerges as a powerful antidote to mindless spending. At its core, conscious consumption means being intentional about how we spend, save, and invest our resources. While this concept isn't new, the rise of decentralized systems—particularly Bitcoin—has introduced powerful tools that can help foster this mindfulness in our financial habits. As we'll explore, decentralized systems do more than just facilitate transactions; they fundamentally empower individuals to align their financial behaviors with their long-term values.

The Problem: How Centralized Systems Discourage Mindfulness

Traditional financial systems, while familiar, often work against our efforts to maintain mindful financial habits. The centralized nature of these systems creates several significant obstacles to conscious consumption.

The first issue lies in our overreliance on trust. Centralized financial institutions obscure the flow of money through complex intermediaries and opaque processes. When we can't clearly see how our wealth is managed or devalued, it becomes challenging to make informed decisions about our financial future. This opacity often leads to a disconnection between our values and our financial choices.

Inflation presents another significant challenge. Fiat currency, by design, loses purchasing power over time. This inherent devaluation creates a perverse incentive structure that encourages immediate spending rather than thoughtful saving. When money consistently loses value, the natural response is to spend it quickly, often on items or services that don't align with our long-term goals or values.

Perhaps most problematically, centralized banking systems promote consumer debt cycles. Easy credit and minimal savings incentives create a culture of overconsumption, where immediate gratification takes precedence over long-term financial health. This debt-driven consumption pattern can trap individuals in cycles of spending and borrowing that are difficult to break.

Bitcoin as a Tool for Financial Awareness

Bitcoin introduces a paradigm shift in how we interact with money, promoting greater awareness and intentionality in our financial decisions. The blockchain's transparent nature allows anyone to verify transactions and track the movement of funds, fostering a trustless system where verification replaces blind trust in institutions.

Bitcoin's deflationary design, with its capped supply of 21 million coins, fundamentally changes our relationship with money. Unlike fiat currency, which incentivizes spending through inflation, Bitcoin's scarcity encourages holders to think carefully before parting with their assets. This characteristic naturally promotes saving over impulsive spending, aligning with the principles of conscious consumption.

The concept of self-custody in Bitcoin represents another powerful driver of financial mindfulness. Managing your own Bitcoin wallet requires understanding private keys, security practices, and transaction mechanisms. This responsibility forces users to engage more deeply with their financial decisions, promoting a more thoughtful approach to wealth management.

Decentralization and Empowered Decision-Making

Decentralized finance (DeFi) removes traditional intermediaries from financial transactions, giving individuals direct control over their assets. This disintermediation does more than reduce costs—it creates a direct connection between individuals and their financial decisions, promoting more intentional choices about how money is used and invested.

The global accessibility of Bitcoin and other decentralized systems has profound implications for financial inclusion. Communities historically excluded from traditional banking now have access to powerful financial tools, enabling them to participate in the global economy on their own terms. This accessibility promotes intentional financial behaviors by providing previously unavailable options for saving and investing.

Decentralization naturally encourages long-term thinking. Bitcoin's design and adoption pattern align with multi-generational wealth building, pushing users to think in decades rather than days. This extended time horizon helps align financial decisions with deeper values and long-term goals.

Bitcoin's Role in Encouraging Mindful Consumption

The Bitcoin ecosystem promotes mindfulness in unexpected ways. The ongoing discussion about Bitcoin mining's energy usage has sparked greater awareness about sustainable energy consumption. This conversation encourages users to think more deeply about the environmental impact of their financial choices.

Holding Bitcoin often leads to a reevaluation of materialistic tendencies. As users watch their Bitcoin appreciate over time, many develop a greater appreciation for value accumulation over immediate consumption. This shift in perspective can lead to more thoughtful spending decisions across all areas of life.

Transaction fees in the Bitcoin network serve as a natural brake on frivolous spending. Unlike traditional payment systems that obscure costs through "free" transactions, Bitcoin's fee structure makes users think twice before initiating transactions, promoting more intentional spending habits.

The Ripple Effect of Conscious Financial Behavior

The adoption of decentralized systems can catalyze broader positive changes in financial behavior. By encouraging saving and long-term investment, these systems promote financial independence rather than reliance on centralized institutions or government safety nets.

As communities adopt Bitcoin and other decentralized tools, they often develop cultures of more responsible spending and giving. The transparency and immutability of blockchain transactions can foster greater accountability in charitable giving and community investment.

The financial discipline promoted by Bitcoin often extends to other areas of life. Many users report that after adopting Bitcoin, they become more mindful of their overall consumption patterns and more interested in sustainable living practices.

Conclusion

Decentralized systems like Bitcoin represent more than just technological innovation—they're catalysts for a philosophical shift in how we think about and use money. By providing tools that naturally align with conscious consumption principles, these systems empower individuals to take greater control of their financial futures.

As you consider your own financial journey, take time to reflect on how your financial decisions align with your long-term values. Consider how decentralized tools might help you live more consciously and intentionally. Whether you're just beginning to explore Bitcoin or are already deeply involved in decentralized finance, remember that each financial decision is an opportunity to align your actions with your values.

The path to conscious consumption isn't about perfection—it's about progress. By leveraging the mindfulness-promoting features of decentralized systems, we can all work toward a future where our financial choices better reflect our values and aspirations.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Decentralization#ConsciousConsumption#FinancialFreedom#MindfulLiving#BlockchainTechnology#DigitalFinance#SustainableFuture#Cryptocurrency#DecentralizedEconomy#FinancialResponsibility#TransparentFinance#BitcoinCommunity#Sustainability#Minimalism#PersonalFinance#FutureOfFinance#Empowerment#CryptoEducation#financial empowerment#digitalcurrency#globaleconomy#financial experts#unplugged financial#blockchain#finance#financial education

2 notes

·

View notes

Text

Meme Coin Mania: Decoding the Hype with CIFDAQ Blockchain Founder

Meme Coin Mania: Decoding the Hype with CIFDAQ Blockchain Founder

Meme coins, a novel asset class birthed from the intersection of internet culture and finance, have captured the global imagination. Rooted in viral memes and social media trends, these digital currencies have defied traditional financial paradigms, exhibiting rapid price fluctuations and immense volatility. While their meteoric rise has attracted a broad investor base, concerns about their underlying value, market manipulation, and long-term sustainability persist.

But are these digital assets, fueled by internet humor and celebrity endorsements, more than just a passing fad? We sat down with Himanshu Maradiya, Chairman and Founder of CIFDAQ Blockchain Ecosystem Ind. Ltd. and a leading expert in cryptocurrency economics, to unravel the meme coin phenomenon and explore its implications for the future of finance.

Meme coins, a novel asset class birthed from the intersection of internet culture and finance, have captured the global imagination. Rooted in viral memes and social media trends, these digital currencies have defied traditional financial paradigms, exhibiting rapid price fluctuations and immense volatility. While their meteoric rise has attracted a broad investor base, concerns about their underlying value, market manipulation, and long-term sustainability persist.

But are these digital assets, fueled by internet humor and celebrity endorsements, more than just a passing fad? We sat down with Himanshu Maradiya, Chairman and Founder of CIFDAQ Blockchain Ecosystem Ind. Ltd. and a leading expert in cryptocurrency economics, to unravel the meme coin phenomenon and explore its implications for the future of finance.

Beyond the Hype: The Potential for Lasting Impact

While skepticism about meme coins persists, Maradiya saw potential beyond the speculative frenzy. “To assess the potential long-term implications of meme coins for the broader cryptocurrency ecosystem and financial markets, it’s crucial to look beyond the current hype and understand their evolving role,” he said.

Maradiya highlighted the potential for meme coins to diversify cryptocurrency use cases, influence market dynamics, and drive regulatory and institutional responses. He also acknowledged the risks posed by their volatility and speculative nature.

The Future of Finance: Embracing Innovation, Managing Risk

The meme coin phenomenon underscored the evolving nature of finance in the digital age. It’s a powerful reminder that traditional notions of value and investment are being challenged.

Maradiya noted, “As the cryptocurrency space continues to mature, the lessons learned from the rise of meme coins could shape future trends and practices within the industry.” The challenge, he believes, lies in harnessing the innovative potential of meme coins while mitigating the risks they pose to investors and the broader financial system.

About the Expert

Himanshu Maradiya is a seasoned entrepreneur and blockchain visionary with over 25 years of experience across real estate, finance, and investment. His strategic acumen and leadership have been instrumental in the growth of multiple enterprises. A multifaceted individual with a passion for technology, music, and philanthropy, Maradiya brings a unique perspective to the business world.

With a deep understanding of macroeconomic trends and a knack for identifying market opportunities, Maradiya has successfully ventured into various industries. His entrepreneurial spirit led him to establish CIFDAQ, a pioneering blockchain platform that aims to revolutionize the trading industry by providing a unified platform for diverse asset classes.

Maradiya’s vision for CIFDAQ is to create a seamless, secure, and accessible investment experience for all. By leveraging blockchain technology, he seeks to democratize finance and empower individuals to participate in the global market.

Yona has no crypto positions and does not hold any crypto assets. This article is provided for informational purposes only and should not be construed as financial advice. The Shib Daily is an official media and publication of the Shiba Inu cryptocurrency project. Readers are encouraged to conduct their own research and consult with a qualified financial adviser before making any investment decisions.

www.cifdaq.com

0 notes

Text

Hidden Career Opportunities for CFA Charterholders You Haven’t Considered

When one imagines a CFA (Chartered Financial Analyst) charterholder, they would invariably picture investment banking, hedge funds, portfolio management, and the like. Yet the truth is that a CFA charter can fuel various careers nowhere near these more traditional routes. The CFA, indeed, offers a broad and varied career landscape, and skills as well as knowledge new and novel acquired through the CFA course in Boston can mold professionals into multifaceted individuals excelling in just about any sector. We're going to shed light on some of the less considered careers for CFA charterholders in this blog-styled revelation.

Fintech and Blockchain Innovations

Fintech and blockchain are the game-changers of modern times for financial services. Many CFA charterholders are ditching their previous careers for this attractive growth field. With concentrating on financial analysis, risk management, and strategy, a CFA charterholder approaches innovation with analysis as his practice in cryptocurrencies, decentralized finance (DeFi), and blockchain technology advances.

Take smart contracts and tokenized assets in blockchain applications in finance. These innovations require professionals who have knowledge of financial principles as well as latest technology. Most fintech companies really appreciate CFA charterholders because of their long-term assessment of these innovations' financial viability and regulatory implications.

Corporate Strategy and Development

The next treasure-trove for CFA charterholders is in corporate strategy. Involving most of them analyzing minute details of investments and portfolio management, there is also such a thing as strategic planning within corporations for CFA finance graduates. The CFA can be quite useful for the teams engaged by diverse industries in strategic planning to see their long-term growth strategy, assess M&A possibilities, and take business risk into consideration.

All these professionals have a major role in upholding a potential investment opportunity in mergers, acquisitions, or joint ventures. They also participate in making high-level decisions through analysis and other avenues, given the industry trends and financial forecasts. A CFA's knowledge in financial modeling, valuation, and market analysis are treasured in teams dedicated to corporate strategy.

Private Equity and Venture Capital

Private equity (PE) and venture capital (VC) might be compatible with the image of the "exclusive citadels," but the reality is that they are just as well-fitted to CFA charterholders-the CFAs rigorous training in financial analysis, extensive due diligence, and deal structuring creates the perfect match for identifying high-potential investments, negotiating complex deals, and ensuring strong financial performance in PE and VC firms.

The CFA charterholder's ability to assess a company deep within its financial health, growth vectors, and risk is priceless in this industry. They can be key players in judging prospective funding for startups or established businesses, making them highly desirable for companies that are considering coming up with well-calculated high-yield investments.

Non-Financial Sector Risk Management

CFA charterholders are considered the best in risk management, an equally important discipline in industries beyond finance. Companies involved in industries like healthcare, energy, manufacturing, and technology rely on risk management professionals to identify, evaluate, and mitigate risks that could become detrimental to their operations.

In the industries mentioned, CFA charterholders will work toward creating structured and coherent risk management frameworks considering all exposures from supply chain vulnerabilities to cybersecurity threats. The adaptability in understanding both financial and operational, as well as strategic, risks, makes CFA charterholders particularly useful and valued in these non-financial sectors.

Sustainability and ESG Investing

ESG investing is one of a few arenas that have featured prominently in recent years, with CFA charterholders having great input in it. With an increase in demand by investors for the socially responsible and environmentally sustainable investment option, CFA charterholders are leading the charge for the management of ESG portfolios.

CFA charterholders can take the key role in the analysis of the ESG data, assessing the actual impact of sustainability initiatives on long-term value, and helping corporates in the rising demand for socially responsible investment options. Of course, this merger of ESG factors with financial analysis is an area tailor-made for CFA professionals, whose future growth is assured.

Real Estate Investment and Development

The real estate investment industry is one in which CFA charterholders can shine. From residential to commercial and industrial properties, financial acumen is needed to assess properties, analyze market trends, and determine investment potential.

CFA charterholders can operate as real estate investment managers, asset managers, or even in real estate development firms wherein their skills in financial analysis, risk management, and valuation will be applied. They can assess the financial viability of real estate deals, help source funding, and ensure their investments give solid returns over a period of time.

The Regulatory and Compliance Roles

A significant area of operational concern nowadays in the finance industry is regulatory compliance, particularly with the growing number of requirements being imposed on financial transactions, corporate governance, and reporting by governments and regulators. Deep knowledge of financial laws, reporting standards, and ethical issues makes CFA charterholders well-suited for jobs in financial regulation and compliance.

An alternative, relatively rewarding career path for aspiring public policy and financial regulatory professionals is compliance officer or working in regulatory bodies. CFA charterholders are very handy assets in maintaining industry standards and best practices, primarily due to their strength in interpreting financial data and ensuring the same has been carried out correctly.

Economic Consulting

From unexpected positions to others, these being economic consulting positions may be a unique career option for CFA charterholders. In essence, these professionals apply their finance skills in providing advisory services to businesses, governments, and nonprofit organizations. The spectrum in which these professionals may be involved includes appraising the market situation, assessing public policy's financial impact, or providing the economic forecasts affecting business strategy.

CFA charterholders working in this branch generally do work in consulting firms and governmental organizations, applying their analytical skills to analyze complex data and give guidance to their clients on major economic decisions.

Final thoughts

CFA charterholders are not confined to typical financial roles. These include fintech and blockchain opportunities in corporate strategy, risk management, and sustainability. As financial hubs will continue to develop and change, there will be an increase in demand for CFA-trained professionals, thereby opening up career portals for even greater dynamism and impact. If someone is ready to take the next step in their finance career, enroll in a CFA training program in Boston to position yourself well for your bright future.

0 notes

Text

Web 3.0: The Internet Revolution You Can't Afford to Ignore!

The internet is going through a transformation that will redefine how we deal with technology. Enter Web 3.0, the third generation of internet services, which promises a more decentralized, secure, and user-focused web experience. Understanding Web 3.0 is essential for tech players, entrepreneurs, and crypto investors to stay ahead of the curve. This blog post talks about what Web 3.0 is, how it affects different sectors, and how you can use this revolution to your advantage.

The Rise of the Internet: Web 1.0 to 3.0

The bitcoin calculator has made a lot of progress since its inception. Web 1.0, also known as the "static web," was the first stage of the World Wide Web's evolution. It was simply a read-only platform where users could access information but had limited interaction capabilities. Web 2.0, commonly known as the "social web," introduced interactivity, user-generated content, and social media platforms such as Facebook and Twitter.

Web 1.0 was characterized by a static design and limited user interaction. The information was centrally stored, making data entry slow and difficult to access. Web 2.0, on the other hand, bring down dynamic content, social networking, and real-time interactions. However, it also introduced issues like data privacy concerns and centralized control by tech giants.

What is Web 3.0?

Web 3.0, commonly referred to as the "semantic web," is the next evolution of the internet. Unlike Web 1.0, which was primarily about static information, and Web 2.0, which introduced social interactivity, Web 3.0 focuses on decentralization, blockchain technologies, AI, and enhanced user experience.

Key features include:

Decentralization: No single entity has control over the web. Instead, data is stored on different nodes, which makes it more secure and less likely to be targeted.

Blockchain Technology: Introduces transparency, security, and stability to transactions and data exchange.

Artificial Intelligence: Enhances user experience by making the web more user-friendly and personalized.

The Impact of Web 3.0

The rise of Web 3.0 is expected to transform numerous sectors. It provides enhanced data security, privacy, and a more customized user experience. For entrepreneurs, this means new business models and opportunities for innovation. For financial analysts and crypto traders, it opens up new markets and investment options.

The Role of Entrepreneurs in Web 3.0

Innovations and Business Models

Entrepreneurs can use Web 3.0 technologies in a special way. With decentralized apps, blockchain, and smart contracts, there are many possibilities. Imagine starting a business with transparent transactions, self-executing contracts, and data protection—these are the promises of Web 3.0.

Case Studies

Several businesses have already been successful by adopting Web 3.0 principles. For example, companies like Brave and Storj are leveraging the blockchain to offer decentralized browsing and storage solutions. These businesses are not only innovative but also set new standards for security and user privacy.

Financial Implications and Opportunities

Insights for Financial Analysts

Web 3.0 introduces a new set of opportunities for investment. Traditional financial models are being replaced by decentralized finance (DeFi) platforms, which offer high yields compared to traditional banks. Financial analysts can find high-value opportunities by investing in Web 3.0 technologies and startups.

Opportunities for Traders

Crypto traders will greatly benefit from Web 3.0. The rise of decentralized exchanges has enabled independent trading without the need for third-parties. This means lower fees, higher security, and greater control over your assets.

Introducing Tradewill

Tradewill is a revolutionary platform designed to enable growth in the Web 3.0 ecosystem. It provides tools for entrepreneurs and traders to use blockchain technology, AI, and decentralized networks. With Tradewill, you can manage your investments, execute smart contracts, and even build your own decentralized applications.

Benefits of Tradewill

For entrepreneurs, Tradewill provides a seamless way to integrate blockchain into your business model. For traders, the platform provides advanced analytics, real-time data, and secure trading options. Tradewill wants to be the best place for anyone who wants to do well on the Web 3.0.

Looking Ahead: Navigating the Web 3.0 Future

Predictions for Web 3.0

The future of Web 3.0 looks promising. Experts predict that within the next decade, Web 3.0 will be the standard for online interactions, transactions, and data storage. Businesses that adapt early will have a significant competitive advantage.

Practical Advice

To prepare for this profit margin calculator, start by educating yourself about Web 3.0 technologies. Invest in platforms like Tradewill that offer the tools and resources you need to succeed. Stay updated with the latest trends and continuously adapt your strategies to leverage new opportunities.

Conclusion

Web 3.0 is more than just a technological advancement. It's a revolution that offers endless possibilities for innovation, investment, and growth. Understanding its features and potential impact will help you position yourself at the forefront of digital transformation. Don't miss out on the opportunities Web 3.0 offers. Explore Tradewill today and take your first step into the future.

We would greatly appreciate your thoughts regarding Web 3.0 and Tradewill. Join the conversation and tell us what you've learned. Together, we can create the future of the internet.

0 notes

Text

Google's Gemini Live: A Game-Changer in Conversational AI

Google introduced Gemini Live, a groundbreaking advancement in conversational AI that enables real-time voice interactions with its Gemini AI assistant. This innovation marks a significant leap forward in how users engage with AI, offering a more natural and dynamic experience.

What Is Gemini Live?

Gemini Live is an AI-powered voice assistant that allows users to have fluid, real-time conversations with their devices. Unlike traditional voice assistants that rely on pre-programmed responses, Gemini Live utilizes advanced natural language processing and machine learning to understand context, adapt to user preferences, and provide relevant, personalized assistance.

Key Features of Gemini Live

Real-Time Voice Interaction: Engage in continuous conversations without the need for repeated prompts.

Contextual Understanding: Gemini Live remembers previous interactions, allowing for more coherent and context-aware responses.

Multimodal Capabilities: Incorporates visual inputs, enabling users to share images or videos for more informed assistance.

Integration with Google Services: Seamlessly works with Google apps like Gmail, Calendar, and Maps to provide comprehensive support.

Customizable Voice Options: Users can choose from a variety of voice styles and languages to suit their preferences.

Enhancing User Experience

Gemini Live's ability to understand and process natural language in real-time transforms everyday tasks. For instance, users can ask for directions, schedule appointments, or control smart home devices through simple voice commands. The assistant's contextual awareness ensures that follow-up questions are handled appropriately, creating a more intuitive and efficient user experience.

Availability and Accessibility

Initially launched on select devices, Google has expanded Gemini Live's availability to a broader range of smartphones and regions. Users can access the feature through the Google Assistant app, ensuring widespread accessibility. The rollout continues, aiming to reach all users in the coming months.

Implications for AI Professionals

For those pursuing certifications like the Certified Agentic AI Expert™ or Certified Agentic AI Developer™, understanding the underlying technologies of Gemini Live is crucial. The system's use of advanced natural language processing, machine learning algorithms, and integration with various APIs offers valuable insights into building sophisticated AI applications.

Additionally, professionals interested in AI Course, Gen AI Courses, or Blockchain Certification can benefit from studying Gemini Live's architecture. The assistant's ability to process and respond to diverse inputs showcases the potential of AI in creating seamless user experiences across different platforms and services.

Future Prospects

As AI technology continues to evolve, Gemini Live represents a step toward more intelligent and interactive systems. Future updates may include enhanced emotional intelligence, deeper contextual understanding, and broader integration with third-party services. These advancements will further solidify Gemini Live's role as a leading conversational AI assistant.

Conclusion

Google's Gemini Live sets a new standard in conversational AI, offering users a more natural and engaging way to interact with their devices. For AI professionals, it provides a valuable case study in the application of advanced AI technologies to real-world scenarios. As the field progresses, innovations like Gemini Live will continue to shape the future of human-computer interaction.

0 notes