#understand blockchain and cryptocurrency

Explore tagged Tumblr posts

Text

Understanding Blockchain Technology

The Building Blocks of Cryptocurrency Introduction: Blockchain technology is at the core of cryptocurrencies like Bitcoin and can potentially revolutionize various industries. In this comprehensive guide, we’ll dive deep into the fundamentals of blockchain technology and its role as the building blocks of cryptocurrency. From its decentralized nature to its immutability and security features,…

View On WordPress

#best introduction to blockchain#blockchain by zeeshan usmani#blockchain evolution explained a beginners guide to understanding blockchain technology#blockchain tech explained#blockchain technology explained#blockchain technology explained simply#blockchain technology simple explained#blockchain underlying technology#blockchain understanding#blockchain understanding its uses and implications#bs blockchain technology#explain blockchain technology#how to understand blockchain#how to understand blockchain technology#technical explanation of blockchain#top blockchain companies in pakistan#understand blockchain and cryptocurrency#understand blockchain technology#understanding blockchain#understanding blockchain technology#understanding blockchain technology and how to get involved

0 notes

Text

Listen, Understand, Grow: The Importance of Entertaining Other Perspectives

Introduction:

In a world increasingly polarized by differing viewpoints, the ability to entertain someone else's opinion is a skill that is both rare and invaluable. Open-mindedness not only fosters personal growth but also strengthens our communities and societies. In this blog post, we will explore the importance of considering other perspectives, the benefits it brings, and practical steps to become more open-minded. Let’s dive into how embracing diverse opinions can enrich our lives and create a more harmonious society.

The Importance of Entertaining Other Opinions:

Entertaining someone else’s opinion doesn’t mean you have to agree with them. Instead, it’s about understanding where they are coming from, considering their perspective, and recognizing the validity of their experiences. This approach leads to more informed and nuanced views and can help bridge the divide that often exists in contentious discussions.

Consider a scenario where a close friend holds a political belief different from yours. Instead of immediately dismissing their viewpoint, try to understand the experiences and reasons that shaped their belief. This doesn’t mean you need to adopt their perspective, but it helps in appreciating their journey and the diversity of thought that exists.

Benefits of Open-Mindedness:

Personal Growth:

Engaging with diverse opinions broadens your horizons, challenges your assumptions, and fosters critical thinking. For example, when you listen to someone with a different cultural background, you gain insights that can change how you view the world.

Improved Relationships:

Being open to others' perspectives can strengthen relationships by fostering mutual respect and understanding. Imagine the difference it can make in family gatherings if everyone felt heard and respected, despite differing opinions.

Better Decision Making:

Considering multiple viewpoints leads to more well-rounded and thoughtful decisions. In the workplace, this can translate into more effective problem-solving and innovative solutions.

Reduced Conflict:

Open-mindedness can reduce tensions and misunderstandings, making it easier to find common ground. Think about how community disputes could be resolved more amicably if people were willing to consider alternative viewpoints.

Practical Steps to Entertain Other Opinions:

Listen Actively:

Truly listen to what the other person is saying without planning your response while they are speaking. Show empathy and try to understand their point of view. For instance, during a heated debate, focus on understanding rather than winning the argument.

Ask Questions:

Encourage deeper conversation by asking questions that clarify their position and reasons behind their beliefs. This shows genuine interest and helps you gain a clearer understanding of their perspective.

Avoid Judgment:

Approach discussions without preconceived judgments. Focus on understanding rather than evaluating the rightness or wrongness of their opinion. This is especially important in sensitive topics like religion or politics.

Reflect on Your Biases:

Be aware of your own biases and how they might affect your perception of others' opinions. Reflect on why you hold certain views and be open to reevaluating them. Acknowledge that everyone, including yourself, has biases that can cloud judgment.

Seek Diverse Perspectives:

Actively seek out opinions and experiences different from your own, whether through conversations, books, articles, or social media. For example, follow thought leaders from various fields and backgrounds on social media to get a range of perspectives.

Challenges and How to Overcome Them:

Emotional Reactions:

It’s natural to feel defensive when confronted with opposing views. Practice mindfulness and emotional regulation to manage these reactions constructively. When you feel your emotions rising, take a deep breath and remind yourself of the value of understanding.

Echo Chambers:

In today’s digital age, it’s easy to get trapped in echo chambers. Make a conscious effort to expose yourself to diverse viewpoints. Join forums or groups that encourage healthy debate and diverse perspectives.

Fear of Change:

Sometimes, considering other opinions might challenge deeply held beliefs. Embrace this as an opportunity for growth rather than a threat. Remember, growth often comes from stepping out of your comfort zone.

Human Stories of Open-Mindedness:

Consider the story of Jane, who grew up in a small town with very homogenous beliefs. When she moved to a big city for college, she encountered classmates from diverse backgrounds and with different viewpoints. Initially, Jane found it challenging to relate to them. However, by engaging in open conversations, attending multicultural events, and joining discussion groups, she started to see the world through their eyes. This not only enriched her understanding but also helped her form deep, meaningful friendships.

Conclusion:

Entertaining someone else’s opinion is a powerful tool for personal and societal growth. It cultivates empathy, enhances understanding, and fosters a more cohesive and respectful community. By making a conscious effort to listen and consider different perspectives, we can all contribute to a more open-minded and harmonious world.

Call to Action:

What steps do you take to ensure you are open-minded in discussions? Share your strategies and experiences in the comments below. Let’s learn from each other and promote a culture of understanding and respect. Your journey towards open-mindedness can inspire others to do the same.

#OpenMindedness#DiverseOpinions#PersonalGrowth#Empathy#RespectfulConversations#Understanding#DifferentPerspectives#HealthyDebate#BridgingDivides#ListeningSkills#CommunityBuilding#MutualRespect#CriticalThinking#EmotionalIntelligence#Mindfulness#bitcoin#financial education#financial empowerment#digitalcurrency#unplugged financial#blockchain#finance#financial experts#globaleconomy#cryptocurrency

3 notes

·

View notes

Text

Understanding Cryptocurrency: A Comprehensive Beginner’s Guide to Digital Currencies

Understanding Cryptocurrency: A Comprehensive Beginner’s Guide to Digital Currencies

#Beginner’s Guide to Cryptocurrency#Benefits of Cryptocurrencies#Blockchain Technology#Buying Cryptocurrencies#Cryptocurrency Investment#Cryptocurrency Trends#Cryptocurrency Wallet#Digital Currency#Financial Independence with Cryptocurrency#How Cryptocurrencies Work#Institutional Cryptocurrency Adoption#Investing in Cryptocurrencies#Market Risks#Risks of Cryptocurrencies#Safe Cryptocurrency Investment#Understanding Cryptocurrency

0 notes

Text

Understanding Cryptocurrency: Beginner Insights for Informed Decisions

Understanding Cryptocurrency: Beginner Insights for Informed Decisions Cryptocurrency is revolutionizing the concept of money. It is digital money operating on the internet and providing a new outlook on transactions. Essentially, it is money secured by cryptography, enabling instant and secure transfers anywhere. For beginners exploring digital currencies, there are several options to consider…

#Achieving Success#Blockchain technology#Cryptocurrency#exploring digital currencies#Understanding Cryptocurrency

0 notes

Text

Exploring Fault Proofs in Optimism: An Overview

The activation of fault proofs by Optimism marks a significant advancement in Ethereum Layer 2 scaling solutions, completing the first stage of its decentralization plan. This milestone is pivotal for enhancing the network's security and trustlessness, reducing reliance on centralized entities like the Optimism Security Council. Previously, the council monitored transactions and intervened to prevent fraud, but with the new fault proof system, any party can now challenge transactions, moving towards a more decentralized and inclusive network.

Ethereum's high transaction fees have made Layer 2 scaling solutions, such as rollups, essential. Optimism's fault proofs ensure that off-chain transactions are valid by allowing a challenge period where anyone can contest a transaction's validity. If a challenge is raised, a fault proof is provided and verified by the Ethereum mainnet, ensuring that invalid transactions are reverted.

This process significantly enhances the security and integrity of the blockchain. Unlike Arbitrum, which relies on 12 validators, Optimism's fault proof system is designed to be trustless and decentralized, enabling broader participation in transaction verification.

Despite initial challenges with proof generation and verification speeds, Optimism has optimized its fault proof mechanisms to be compatible with Ethereum's Layer 1. This achievement not only improves the security and decentralization of the network but also sets a benchmark for other rollup technologies.

The activation of fault proofs highlights the importance of continuous innovation and rigorous testing in the blockchain space. For more in-depth insights and exclusive research, join our Web3 Sync community on Intelisync and Learn more...

#Batching Transactions#Challenge Window#Challenges and Criticisms#Criticism Addressed#cryptographic proofs#Decentralization Roadmap#Ethereum Layer 2 scaling solutions#fault proof#fault proof mechanism#Fault Proofs Milestone#Future Outlook#How Optimism Worked Before Fault Proofs#Optimism Achieves a Major Milestone#Optimism Implements Fault Proofs#Optimism’s Decentralization Roadmap#optimistic and zk-rollups#Proof Verification#Reversion of Invalid Transactions#Technical Challenges#The Importance and Issues of Fault Proofs#The Necessity of Layer 2 Scaling#Understanding Fault Proofs in Optimism#blockchain development companies#web3 development#metaverse development company#blockchain development services#metaverse game development#web 3.0 marketing#crypto app development#cryptocurrency development companies

0 notes

Text

Exploring the World of Cryptocurrency and Blockchain Technology

Written by Delvin In recent years, cryptocurrency and blockchain technology have emerged as transformative forces, revolutionizing the way we think about money, transactions, and data security. This blog post aims to provide a comprehensive overview of cryptocurrency and blockchain technology, delving into their origins, key concepts, real-world applications, and potential implications for the…

View On WordPress

#Cryptocurrency#dailyprompt#Exploring Blockchain Technology#Exploring the World of Cryptocurrency and Blockchain Technology#Financial#Financial Literacy#Investing#Investing 101#money#Real World Applications#Understanding Cryptocurrency

0 notes

Text

Crypto Quantum Leap

Experience a groundbreaking transformation in the world of cryptocurrency with "Crypto Quantum Leap." This cutting-edge product is your key to unlocking the immense potential of digital currencies and propelling yourself into a new realm of financial growth. Designed to cater to both beginners and experienced enthusiasts, Crypto Quantum Leap provides the knowledge, tools, and strategies needed to navigate the complex world of crypto with confidence. Whether you're aiming to diversify your investment portfolio, capitalize on emerging trends, or understand the underlying technology, this product is your bridge to success. Prepare to take a leap into the future of finance and elevate your crypto journey with Crypto Quantum Leap.

#Crypto Quantum Leap#Cryptocurrency Transformation#Financial Growth#Digital Currency Revolution#Investment Portfolio Diversification#Emerging Crypto Trends#Crypto Enthusiast Empowerment#Blockchain Technology Understanding#Future of Finance#Cryptocurrency Success#Crypto Education#Financial Empowerment#Crypto Market Insights

0 notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

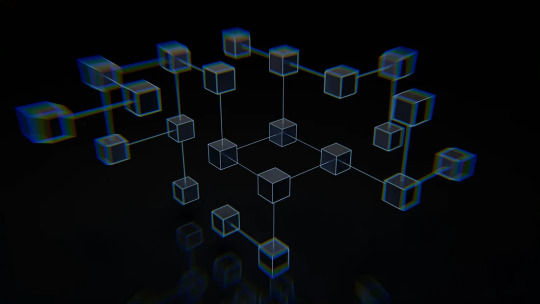

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

284 notes

·

View notes

Text

ERC20 token generator

Ever wanted to create your own cryptocurrency? Thanks to the ERC20 Token Generator, it’s more accessible than ever. Dive into the world of blockchain and see how simple it can be.

What is an ERC20 Token?

ERC20 tokens are digital assets built on the Ethereum blockchain. They follow a specific standard, allowing them to interact seamlessly with platforms and other tokens.

Benefits of ERC20 Tokens:

Interoperability: All ERC20 tokens adhere to the same protocol.

Widespread Acceptance: Many platforms on Ethereum support these tokens.

Developer Support: Extensive documentation and community support.

How Does the ERC20 Token Generator Work?

Creating a token might sound complex, but the ERC20 Token Generator simplifies the process. Here’s a step-by-step guide:

Define Your Token:

Choose a name and symbol.

Set the total supply.

Access the Generator:

Use online tools designed for token creation.

Input your token details.

Deploy to the Blockchain:

Confirm your details.

Launch your token on the Ethereum network.

Key Features of ERC20 Tokens

These tokens offer various features that make them attractive for both developers and investors:

Standardized Functions: Such as balance checking and transfers.

Smart Contract Integration: Seamlessly integrate with smart contracts.

Security: Built on the robust Ethereum blockchain.

Why Create an ERC20 Token?

Creating your own token can offer several advantages:

Fundraising: Launch your own ICO (Initial Coin Offering).

Community Building: Reward loyal customers or followers.

Innovation: Develop new applications and uses for blockchain.

Potential Challenges

Despite the ease of creation, there are challenges:

Technical Knowledge: Basic understanding of blockchain is required.

Security Risks: Vulnerabilities can lead to exploitation.

Regulatory Issues: Compliance with local laws is crucial.

Best Practices for Creating ERC20 Tokens

To ensure success, follow these guidelines:

Audit Your Code: Ensure there are no security loopholes.

Engage with the Community: Gather feedback and make improvements.

Stay Informed: Keep up with blockchain trends and regulations.

Conclusion

The ERC20 Token Generator opens doors to the exciting world of cryptocurrency creation. Whether you're an entrepreneur, developer, or enthusiast, it offers an innovative way to engage with blockchain technology.

Final Thoughts

Creating an ERC20 token can be a game-changer. It empowers you to participate in the digital economy and experiment with new ideas.

FAQs

1. What is an ERC20 Token Generator?

An ERC20 Token Generator is a tool that simplifies the creation of custom tokens on the Ethereum blockchain.

2. Is technical knowledge necessary to create a token?

Basic blockchain understanding is helpful, but many generators offer user-friendly interfaces.

3. Can I sell my ERC20 tokens?

Yes, you can list them on cryptocurrency exchanges or sell directly to users.

4. Are there costs associated with creating a token?

Yes, deploying tokens on Ethereum requires gas fees, paid in Ether.

5. How do I ensure my token is secure?

Regular code audits and following best practices can enhance security.

Source : https://www.altcoinator.com/

#erc20#erc20 token development company#erc#erc20tokengenerator#token#token generator#token creation#ethereum#bitcoin

57 notes

·

View notes

Text

According to a memo circulating among State Department staff and reviewed by WIRED, the Trump administration plans to rename the United States Agency for International Development (USAID) as US International Humanitarian Assistance (IHA), and to bring it directly under the secretary of state. The document, on which Politico first reported, states that as part of its reorganization, the agency will “leverage blockchain technology” as part of its procurement process.

“All distributions would also be secured and traced via blockchain technology to radically increase security, transparency, and traceability,” the memo reads. “This approach would encourage innovation and efficiency among implementing partners and allow for more flexible and responsive programming focused on tangible impact rather than simply completing activities and inputs.”

The memo does not make clear what specifically this means—if it would encompass doing cash transfers in some kind of cryptocurrency or stablecoin, for example, or simply mean using a blockchain ledger to track aid disbursement.

The memo comes as staffers at USAID are trying to understand their future. The agency was an early target of the so-called Department of Government Efficiency (DOGE), which has effectively been headed by centibillionaire Elon Musk. Shortly after President Trump’s inauguration, the State Department put the entire agency’s staff on administrative leave, slashed its workforce, and halted a portion of payments to partner organizations around the world, including those doing lifesaving work. Since then a federal judge has issued a preliminary injunction against the dismantling of the agency, but the memo appears to indicate that the administration has plans to continue its mission of drastically cutting USAID and fully folding it into the State Department.

The plans for the blockchain have also caught staffers off guard.

Few blockchain-based projects have managed to achieve large-scale use in the humanitarian sector. Linda Raftree, a consultant who helps humanitarian organizations adopt new technology, says there’s a reason for that—the incorporation of blockchain technology is often unnecessary.

“It feels like a fake technological solution for a problem that doesn’t exist,” she says. “I don’t think we were ever able to find an instance where people were using blockchain where they couldn’t use existing tools.”

Giulio Coppi, a senior humanitarian officer at the nonprofit Access Now who has researched the use of blockchain in humanitarian work, says that blockchain technologies, while sometimes effective, offer no obvious advantages over other tools organizations could use, such as an existing payments system or another database tool. “There’s no proven advantage that it’s cheaper or better,” he says. “The way it’s been presented is this tech solutionist approach that has been proven over and over again to not have any substantial impact in reality.”

There have been, however, some successful instances of using blockchain technology in the humanitarian sector. In 2022, the United Nations High Commissioner for Refugees (UNHCR) ran a small pilot to give cash assistance to Ukrainians displaced by the Russia-Ukraine war in a stablecoin. Other pilots have been tested in Kenya by the Kenya Red Cross Society. The International Committee of the Red Cross, which works with the Kenya team, also helped to develop the Humanitarian Token Solution (HTS).

One representative from an NGO that uses blockchain technology, but wasn’t authorized to speak to the media with regards to issues relating to USAID, says that particularly with regards to money transfers, stablecoins can be faster and easier than other methods of reaching communities impacted by a disaster. However, “introducing new systems means you’re setting up a new burden” for the many organizations that USAID partners with, they say. “The relative cost of new systems is harder for small NGOs,” which would often include the kind of local organizations that would be at the front line of response to disasters.

The proposed adoption of blockchain technology seems related to an emphasis on exerting tight controls over aid. The memo seems, for example, to propose that funding should be contingent on outcomes, reading, “Tying payment to outcomes and results rather than inputs would ensure taxpayer dollars deliver maximum impact.” A USAID employee, who asked to remain anonymous because they were not authorized to speak to the media, says that many of USAID’s contracts already function this way, with organizations being paid after performing their work. However, that’s not possible in all situations. “Those kinds of agreements are often not flexible enough for the environments we work in,” they say, noting that in conflict or disaster zones, situations can change quickly, meaning that what an organization may be able to do or need to do can fluctuate.

Raftree says this language appears to be misleading, and bolsters claims made by Musk and the administration that USAID was corrupt. “It’s not like USAID was delivering tons of cash to people who hadn’t done things,” she says.

7 notes

·

View notes

Note

Explain the blockchain to me, I don’t really know what cryptocurrency is or why one would speculate on it. Why not use normal money?

So basically, it's like Digital Jenga. This is how I've come to understand it.

I invest in crypto because the money goes up and more money comes out.

We need to stop using normal money because it's backwards thinking.

Technology is the future and it must replace everything.

Bitcoin is the future and it will stop all forms of suffering globally.

14 notes

·

View notes

Text

Lost Your Investments? Astraweb’s Impressive Success Rate Offers Hope

In a world where financial losses are increasingly common, losing funds whether through investment scams, unauthorized transactions, or stolen Bitcoin can feel like a devastating blow. For many, the dream of recovering what was once theirs seems impossible. However, a beacon of hope shines through for those affected by financial misfortune: Astraweb.

With a proven track record of success and a reputation built on results, Astraweb has emerged as a leader in the recovery of lost investments and cryptocurrency. Their team has successfully resolved hundreds of cases, helping clients reclaim what they once thought was lost forever. Their high success rate isn’t just a number it’s a testament to the expertise, dedication, and innovative strategies that set Astraweb apart in the competitive world of asset recovery.

Case Study: The Unlikely Comeback

Take, for example, the case of Sarah, a seasoned investor who fell victim to a sophisticated Ponzi scheme that drained her savings. For months, Sarah tried to follow conventional recovery channels but faced dead ends at every turn. Feeling disheartened and overwhelmed, she stumbled upon Astraweb during an online search. After contacting them, Astraweb’s experts meticulously analyzed her case, piecing together the puzzle of her lost funds.

Through a combination of technical skills, in-depth knowledge of the digital landscape, and a vast network of resources, Astraweb was able to trace the stolen funds to an obscure offshore account. What seemed impossible just weeks earlier became a reality Sarah recovered not just a portion of her investment, but nearly the full amount.

A Proven Process for Success

Astraweb’s approach is methodical and personalized. Each case is handled with the utmost care, ensuring that every client is treated with respect and transparency. The team begins by thoroughly analyzing the situation, identifying the specific channels through which funds were lost. Their experts then deploy a variety of advanced recovery methods ranging from tracking blockchain transactions to collaborating with global financial institutions and cybersecurity experts.

It’s Astraweb’s ability to innovate in the face of seemingly insurmountable obstacles that has earned them their stellar reputation. They don’t just resolve cases they return what’s rightfully owed to their clients, empowering individuals to regain control of their financial futures.

A Proven Track Record of Results

Astraweb’s exceptional success rate stems from its dedication to precision and its deep understanding of the complexities involved in asset recovery. With each case they resolve, Astraweb reinforces their standing as an industry leader. The numbers speak for themselves, but it’s the personal stories of clients like Sarah that truly highlight the impact of their work.

If you’ve lost it all, you don’t have to accept it as a permanent loss. Astraweb’s unparalleled expertise in asset recovery offers a second chance to those who feel hopeless. Hundreds of clients have already been given a fresh start.

Reach Out Today

Are you ready to take the first step toward reclaiming what’s rightfully yours? Let Astraweb’s team of experts guide you through the recovery process. With their deep experience and high success rate, Astraweb stands as a beacon of hope for those who have lost it all.

Contact: [email protected]

6 notes

·

View notes

Text

Liquid Staking for Novices: A 2024 Introductory Guide

Unlock the full potential of your cryptocurrency investments with liquid staking, where liquidity meets profitability.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols. This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

Liquid staking is transforming the cryptocurrency landscape by offering a solution to the liquidity problem associated with traditional staking. By issuing Liquid Staking Tokens (LSTs), this innovative approach allows users to stake their assets while retaining the ability to trade or use these tokens in various DeFi protocols.

This dual benefit of earning staking rewards and maintaining liquidity makes liquid staking an appealing option for investors, particularly those involved with major cryptocurrencies like Ethereum and Solana.

The process of liquid staking involves depositing cryptocurrency into a staking contract, which then issues a liquid staking token representing the staked assets. These tokens can be utilized in decentralized exchanges, lending platforms, and yield farming protocols, providing users with the flexibility to optimize their investment strategies. This increased liquidity and flexibility allow users to respond quickly to market changes and new investment opportunities, making liquid staking a valuable tool in the crypto ecosystem.

Despite its benefits, liquid staking presents certain challenges, including the risk of validator penalties and smart contract vulnerabilities. Additionally, the regulatory environment for cryptocurrencies is continuously changing, which may impact staking practices. Nonetheless, liquid staking is poised to play a pivotal role in the future of blockchain finance, enhancing the value of crypto assets through improved accessibility and liquidity. Intelisync offers tailored blockchain solutions, including liquid staking, to help businesses Learn more.....

#Advantages of Liquid Staking Tokens#Can I lose my funds in liquid staking?#Challenges of Liquid Staking#How do I choose a liquid staking platform?#How Does Liquid Staking Work?#How Intelisync will help you to grow in the crypto world Liquid Staking#Understanding Staking and How Does Staking Work?#What cryptocurrencies support liquid staking?#What is Liquid Staking?#What is Restaking#What is the future of liquid staking?#Why Are LSTs Gaining Popularity?#intelisync blockchain development company intelisync bitcoin development services#intelisync web3 marketing services

0 notes

Text

Turning Panic Into Action: Astraweb’s Client Centered Process

When Jane Doe first reached out to Astraweb, she was overwhelmed with panic and uncertainty. Her life savings, heavily invested in cryptocurrency, had abruptly disappeared following a severe market crash. What initially felt like an irreversible loss soon transformed into a hopeful journey toward recovery all thanks to Astraweb’s dedicated, client-centered process.

The First Contact: Providing Calm, Reassurance, and Genuine Understanding

The difference began immediately at the first point of contact. Many companies in the digital asset recovery space treat clients as case numbers rather than individuals, but Astraweb prides itself on a profoundly human approach. From the moment Jane connected with their team, she was met with calm professionalism and empathetic understanding. Astraweb’s experts didn’t just collect the basic facts of her situation; they invested time in learning about her unique concerns, fears, and goals.

This personalized attention is critical. Financial loss, especially in the volatile cryptocurrency market, is not just about money it’s deeply tied to emotional well-being and future security. By acknowledging Jane’s distress and validating her fears, Astraweb’s team immediately alleviated much of her initial panic. They reassured her that despite the challenging circumstances, recovery was possible and that Astraweb would support her every step of the way. This empathetic approach planted the seeds of hope and trust that would sustain Jane through the recovery process.

Transparency and Clear Communication: Building Trust Through Every Step

One of the cornerstones of Astraweb’s client-centered methodology is transparency. Jane was kept fully informed from the outset, with the team providing clear, jargon-free explanations of the entire recovery process. Rather than leaving her uncertain or confused, Astraweb made sure she understood each step, from preliminary case assessment to the complex asset tracing and retrieval efforts ahead.

Regular, timely updates ensured that Jane never felt left in the dark. She received progress reports outlining milestones achieved, any obstacles encountered, and the strategies planned moving forward. This ongoing dialogue was more than just information sharing it was a partnership. Jane had the opportunity to ask questions, raise concerns, and engage actively in decision-making. Astraweb’s responsiveness and clarity gave her a sense of control and confidence, which is often lacking when facing financial recovery situations

Strategic Action and Efficient Recovery: Delivering Results with Precision and Care

With a thorough plan in place, Astraweb’s team mobilized swiftly and efficiently. Their approach was methodical and tailored to Jane’s specific case. Leveraging cutting-edge technology and deep expertise in blockchain analysis and digital forensics, they navigated the complexities inherent in cryptocurrency recovery.

What sets Astraweb apart is not only their technical prowess but also their commitment to aligning every action with the client’s best interests. For Jane, this meant careful management of sensitive data and continuous coordination to ensure all efforts supported her recovery goals. The team’s professionalism was evident in their precision and tenacity, persistently pursuing leads and unraveling the often opaque paths that digital assets can take.

Over time, their dedication paid off. Astraweb successfully recovered a significant portion of Jane’s lost funds. This achievement was more than just a financial victory it was a powerful restoration of Jane’s peace of mind and future stability.

Final Steps: Restoring Financial Security and Empowering Confidence

When Jane received the final recovery statement, the relief and gratitude she experienced were profound. Astraweb’s seamless process had not only restored her financial security but also transformed a traumatic event into a story of empowerment. The client-centered approach meant Jane never felt like a passive bystander; instead, she was an informed, engaged partner in reclaiming her assets.

Beyond the monetary recovery, Jane gained something invaluable a renewed sense of control over her financial destiny. Astraweb’s dedication to transparent communication and compassionate case management helped her move past fear and uncertainty. She emerged with greater knowledge of digital asset management and an increased ability to face future financial challenges with confidence and clarity.

Astraweb’s Commitment: More Than Recovery, A Partnership

Jane’s story illustrates the core philosophy that drives Astraweb’s work: every client deserves more than just technical recovery services they deserve empathy, clarity, and partnership. The company understands that behind every lost asset is a person’s hopes, dreams, and security at stake.

For those facing the daunting prospect of lost cryptocurrency or other digital assets, Astraweb’s process offers a path forward. Through empathy-driven service, transparent communication, and technical excellence, they prove that even the most complex and distressing financial setbacks can be addressed with care and effectiveness.

If you or someone you know finds themselves in a similar predicament, Astraweb stands ready to provide expert guidance and dedicated support at every stage of recovery.

Contact: [email protected]

6 notes

·

View notes

Text

Astraweb: Turning Crypto Losses into Triumphs with Proven Recovery Solutions

In the fast paced world of cryptocurrency, stories of lost investments often make their way across forums and social media platforms, triggering fear and frustration among users. However, for a growing number of clients, Astraweb has become a beacon of hope, turning what seemed like a nightmare into a success story.

The Struggle: A Desperate Search for Recovery For many, the journey begins with the sinking feeling of realizing that the digital assets they’ve worked hard to build are gone, perhaps lost due to a forgotten password, a phishing attack, or a technical glitch. Reddit, the platform where countless individuals share their cryptocurrency woes, is rife with stories of people feeling powerless in the face of financial loss. One such user, Mark Robinson, posted a desperate cry for help. He had been trading Bitcoin for years and had amassed a considerable portfolio. When a routine update on his exchange account went awry, Mark’s assets vanished. The panic set in. A few clicks led him to a Reddit thread filled with similar tales of lost funds. Mark thought he was just another victim, destined to lose his hard-earned crypto.

But Mark’s story took a turn when he came across a comment that recommended Astraweb. With nothing left to lose, he decided to give them a try.

Astraweb’s Expertise: The Turning Point Astraweb, known for its unique approach to recovering lost crypto, was quickly in contact with Mark. The team at Astraweb’s recovery department didn’t just offer empty promises they walked Mark through the process with professionalism and care. Within a matter of days, Astraweb identified the error that had led to his funds being frozen. They used their proprietary techniques to safely navigate the complexities of the blockchain and recover what Mark had assumed was lost forever.

Mark, who initially posted in panic on Reddit, was now the one sharing his recovery story. “I had no idea something like this was possible, Astraweb didn’t just get me my money back; they gave me peace of mind, knowing that there are professionals who truly understand the intricacies of crypto recovery.” Mark said.

Real Clients, Real Success Mark is not alone. Over the past year, Astraweb has helped countless clients who thought their crypto investments were gone forever. From those who were victims of scam websites to people who accidentally deleted their wallet keys, Astraweb’s team of experts has proven that with the right knowledge and tools, recovery is possible.

One client, Sarah, lost access to her Ethereum wallet after a cyberattack and had resigned herself to never seeing her funds again. After months of searching for solutions, she found Astraweb. Within weeks, Astraweb’s team restored her wallet, and her assets were safely recovered. Sarah credits Astraweb with not only recovering her funds but also guiding her through the security measures she needed to put in place to prevent future losses.

A Trusted Name in Crypto Recovery The growing number of success stories proves that Astraweb is more than just another recovery service. They have earned the trust of clients by consistently delivering results, restoring hope where there was none. Their unique combination of cutting-edge technology, extensive experience, and commitment to customer service sets them apart in the crowded world of crypto recovery.

For those who feel like they’ve exhausted all their options, Astraweb offers a solution. Whether it’s retrieving lost Bitcoin, Ethereum, or other altcoins, their team is equipped to handle it all.

Conclusion: A Success You Can Trust If you’ve ever found yourself on Reddit, reading stories about lost crypto, you don’t have to resign yourself to the same fate. Astraweb’s proven track record shows that recovery is not just a possibility it’s a reality. Don’t let your digital assets slip away into the void.

Contact Astraweb at [email protected] and let their team of experts guide you back to financial security.

6 notes

·

View notes

Text

An Introduction to Blockchain Technology and its Role in Cryptocurrency

Written by Delvin Blockchain technology and cryptocurrencies have revolutionized the way we perceive and interact with the digital world. At the heart of this technological revolution lies blockchain, a decentralized and transparent ledger system that powers cryptocurrencies like Bitcoin and Ethereum. In this blog post, we will delve into the fundamentals of blockchain technology and explore its…

View On WordPress

#An Introduction to Blockchain Technology and its Role in Cryptocurrency#Blockchain Technology#Crypto#Cryptocurrency#dailyprompt#Financial#Financial Freedom#Financial Literacy#Generational Wealth#Key Features of Blockchain Technology#money#Personal Finance#Personal growth#Understanding Blockchain Technology#Wealth

0 notes