#boiler room fraud

Text

When you consider who recently ran Public Safety in Canada, Ben-Gvir's inclusion is no surprise...

A far-right Israeli minister openly encouraging the alleged torture, abuse, rape and killing of Palestinian detainees remains listed as a “key international contact” on Public Safety Canada’s (PSC) website.

...

But Ben-Gvir was well known as a convicted racist and supporter of far-right terrorism long before PSC prepared the transition document. He was found guilty by an Israeli court for both offences in 2007, and was also a youth activist in the far-right “Kach” party, which PSC lists as a proscribed terrorist organization.

Ben-Gvir’s criminal record was widely publicized at the time of his ministerial appointment in Netanyahu’s extreme right-wing government in late 2022.

Nothing honourable about Mr Blair. Or liberal.

#canada#satellite#israel#bill blair#ben gvir#zionism#right wing extremism#settler colonialism#palestine#palestinians#gaza#genocide#human rights#canadian complicity#undemocratic#faux liberal#corruption#patronage#lantzmen#jewish mafia#toronto#boiler room#securities fraud#crime protection#police protection#israeli occupation#war crimes#free palestine#free gaza#illegal settlements

2 notes

·

View notes

Text

10 Movies on Stock Markets You Should Watch

The world of stock markets is full of drama, intrigue, and high stakes, making it a captivating subject for movies. I would recommend you to watch these movies on stock markets. Here are 10 films that offer a glimpse into the thrilling world of finance:

The Big Short (2015)

“The Big Short” is a 2015 American biographical comedy-drama film directed by Adam McKay, based on the 2010 book “The Big…

View On WordPress

#ambition#Barbarians at the Gate (1993)#best movies about the stock market for beginners#Boiler Room (2000)#business movies#comedy movies#corruption#documentary movies#drama movies#Enron: The Smartest Guys in the Room (2005)#entertaining movies about Wall Street#finance movies#financial crisis#fraud#greed#Inside Job (2010)#inspiring movies about overcoming financial challenges#investing movies#lessons learned#Margin Call (2011)#movies that explain how the stock market works#must-watch movies for investors#stock market movies#success#The Big Bull (2021)#The Big Short (2015)#The Wolf of Wall Street (2013)#thriller movies#Trading Places (1983)#true story stock market movies

2 notes

·

View notes

Text

$12.1M fraud suspect with 'new face' arrested, crypto scam boiler rooms busted: Asia Express

Our weekly roundup of news from Asia curates the industry’s most important developments.

South Korean manhunt ends as suspect caught with brand new $15K face

South Korean police have apprehended 14 individuals involved in a fraudulent crypto mining scheme that pocketed 16 billion Korean won (about $12.1 million), according to reports citing an Aug. 29 press conference.

Police identified the…

0 notes

Text

Jared Davis charged with $10 million fraud.

Here we go again, the CFTC or Commodity Futures Trading Commission busted well-known Options hustler, Jared Davis of Sandusky, Ohio.

Additionally, in a concurrent filing, the United States Attorney filed a 22-count indictment for conspiracy to commit wire fraud, conspiracy to launder money, wire fraud, money laundering, obstruction of justice, and tax evasion.

For most of us, September 17, 2019, was like every other day. We spent the day making our football picks, tried to scrape out profits from the stock market, However, for poor Jared Davis, he spent the day in the back of a police car. All shackled up like a Hawaiian pig at an $8 luau.

Yep, Jared got arrested. the FBI woke him up at 4 am. The wife and kids were wild-eyed, screaming, and terrified as the badges and guns moved throughout the fancy house. They took all the computers, phones, papers, and any evidence laying about. Most importantly, they took Jared. And since Jared was a prick, they waddled him out to the police cruiser — still in his underwear.

Getting arrested by the FBI at 4 am is fucking scary. I should know.

What exactly did Jared Davis do wrong?

According to the FBI and the United States Attorney court filings, Jared had been operating a phony Forex, Contracts For Difference, and Binary Options brokerage out of his house, and a boiler room located in downtown Sandusky.

How did the scheme work? Glad you asked. Beginning in about 2014 through the present, Jared was running an unlicensed and unregistered stocks, options, and Forex brokerage.

Who needs to bother with registering with the SEC or the CFTC anyway!? That’s a waste of time, and those pesky regulations meant to protect investors — who needs those? ( I am being satirical)

In the past few years, City Clean News has drafted quite a few articles about the “white label” phony brokerage industry. What the heck is a “white label” phony brokerage? In a nutshell, offshore companies plug financial data into a piece of software that looks like a real brokerage, in every imaginable way, except it is not real. Instead, it’s just a video game where retail traders can open accounts and execute “live” trades on the platform.

The problem is that these “white label” trading platforms are incredibly easy to manipulate so that the investor is virtually guaranteed to lose. Think of it like a slot machine at an Indian casino, at any time, the casino can flip a switch and the machine simply stops paying. Or, they can rig the machine so that your “penny” bets pay at a higher frequency, but the moment you start upping it to “quarter” bets, the machine tightens up like a straight butthole at a gay bar.

Fraudulent “live trading room”

The scam was clever. Jared Davis had several living trading rooms and affiliate marketing agreements where 3rd parties would provide “education and trading signals” to the retail investor.

The educational component supposedly taught people how to use technical analysis to predict the stock market. The victim would be given the educational products in hopes of luring the victim into actually taking trades.

The “live trading room” would be the “education in action” where the victim would watch the moderators supposedly execute live trades. The victim would watch the supposedly profitable trades and attempt to replicate the moderator.

However, the moderator was using a version of the software that virtually guaranteed that the moderator’s trades would be successful, while the trades of victims would be harder to execute. The victim would continue to attempt to replicate the moderator at ever-worsening prices. All the while, the moderator would enthusiastically encourage the victims in live chat to “get your orders filled” no matter the cost.

Additionally, the live trading rooms contained “shills” that would hype the results by declaring themselves also profitable. However, the “shills” were nothing more than a staged audience.

The end result was predictable. The moderator, who represented the phony brokerage would nearly always be successful. While the customers would always lose.

Some customers were actually good at trading, they still got screwed

According to the criminal indictment, some of the customers never participated in the “live” trading room and instead deployed their own strategies.

Some of these strategies were quite successful. The US Attorney highlighted several instances that resulted in large losses for Jared Davis. This frustrated and angered Jared Davis immensely. As a result of experiencing losses, Jared demanded that the “white label” software provider rig the software so that the trades became even more difficult to profit.

Yet again, the successful trader was able to keep “beating the house” and subsequently demanded payment. Did the victim get paid? Not a chance. Jared Davis simply refused.

Hide and seek from the regulators

As regulators began to tighten the noose on Jared Davis with subpoenas and regulatory action, he then attempted to circumvent the regulators by creating various shell companies and websites to keep the scam rolling.

The first company was Option Mint, then Option King, and then Option Queen, and finally Option Prince. However, the one connecting piece was the boiler room located in Sandusky Ohio.

Additionally, Jared was unaware that the FBI had subpoenaed Jared’s email server and as the emails were darting throughout the criminal network, employees, customers, that everything was being read and watched by investigators.

It certainly looks like Jared will be going away for a while. Thanks for reading. Another investment scammer bites the dust.

0 notes

Text

The Wolf of Wall Street: A Summary Review Analysis

Chapter 1 What's The Wolf of Wall Street by Jordan Belfort

"The Wolf of Wall Street" is a memoir by Jordan Belfort, detailing his rise to becoming a wealthy stockbroker and his subsequent downfall due to fraud and corruption. Belfort's exploits on Wall Street, which included unethical and illegal practices, were depicted in the 2013 film of the same name starring Leonardo DiCaprio. The book provides insight into the high-flying lifestyle of Belfort and his colleagues, as well as the consequences of their actions. It has been both praised for its candid depiction of the financial world and criticized for glamorizing unethical behavior.

Chapter 2 Is The Wolf of Wall Street A Good Book

The book "The Wolf of Wall Street" by Jordan Belfort is a controversial one. While some people find it entertaining and engaging, others criticize it for glorifying unethical and criminal behavior. It ultimately depends on individual preferences and opinions.

Chapter 3 The Wolf of Wall Street by Jordan Belfort Summary

"The Wolf of Wall Street" is a memoir by Jordan Belfort, detailing his rise and fall as a stockbroker on Wall Street. Belfort founded the brokerage firm Stratton Oakmont and used aggressive sales tactics to swindle millions of dollars from investors. He lived a lavish lifestyle filled with drugs, prostitutes, and extravagant parties.

As Belfort's empire grew, so did the attention from law enforcement. He was eventually arrested and convicted of securities fraud and money laundering. Belfort served time in prison and lost his fortune, but ultimately turned his life around and became a motivational speaker and writer.

The book provides a candid look at the excesses of Wall Street culture and the consequences of greed and unethical behavior. It is a cautionary tale of the dangers of unchecked ambition and the importance of integrity in business.

Chapter 4 The Wolf of Wall Street Author

Jordan Belfort, the author of the book "The Wolf of Wall Street," released the book in 2007. He is a former stockbroker who was convicted of fraud crimes related to stock market manipulation and running a boiler room as part of a penny-stock scam. Belfort served 22 months in prison for his crimes.

In addition to "The Wolf of Wall Street," Belfort has also written two other books: "Catching the Wolf of Wall Street" and "Way of the Wolf." "Catching the Wolf of Wall Street" is a memoir that follows up on the events in the first book, while "Way of the Wolf" is a guide to sales and persuasion techniques.

In terms of editions, "The Wolf of Wall Street" has been released in several formats, including paperback, hardcover, and audiobook. The hardcover edition is often considered the best in terms of quality and durability.

Chapter 5 The Wolf of Wall Street Meaning & Theme

The Wolf of Wall Street Meaning

"The Wolf of Wall Street" is a memoir by Jordan Belfort, a former stockbroker who engaged in fraudulent activities and unethical business practices on Wall Street. The title refers to Belfort's ruthless and predatory behavior in the financial industry, where he used deception and manipulation to make millions of dollars. The book explores themes of greed, corruption, and the moral consequences of pursuing wealth at all costs. It also serves as a cautionary tale about the dangers of unchecked ambition and the importance of integrity in business.

The Wolf of Wall Street Theme

The main theme of "The Wolf of Wall Street" by Jordan Belfort is the corrupting influence of greed and excess. The story follows Belfort's rise and fall as a stockbroker on Wall Street, where he becomes involved in fraudulent activities, money laundering, and excessive partying. Belfort's insatiable appetite for wealth and power leads him to make questionable decisions and engage in unethical behavior, ultimately leading to his downfall.

The novel also explores themes of addiction, morality, and the consequences of unchecked ambition. Belfort's addiction to drugs, alcohol, and reckless behavior serves as a metaphor for the destructive nature of greed and excess. The novel serves as a cautionary tale about the dangers of succumbing to the temptations of wealth and power without regard for ethics or consequences.

Overall, "The Wolf of Wall Street" highlights the dark side of the pursuit of wealth and success, and serves as a reminder of the importance of integrity, humility, and ethical decision-making in business and life.

Chapter 6 Other Accessible Resources

1. The official website for the book, "The Wolf of Wall Street" by Jordan Belfort: https://www.wolfofwallstreet.com/

2. IMDb page for the movie adaptation of "The Wolf of Wall Street" directed by Martin Scorsese: https://www.imdb.com/title/tt0993846/

3. Articles and reviews on The Guardian newspaper: https://www.theguardian.com/film/2014/jan/15/the-wolf-of-wall-street-review

4. The New York Times coverage on Jordan Belfort and The Wolf of Wall Street: https://www.nytimes.com/topic/person/jordan-belfort

5. Variety's articles on the film adaptation starring Leonardo DiCaprio: https://variety.com/t/the-wolf-of-wall-street/

6. Interviews with Jordan Belfort on CNBC: https://www.cnbc.com/jordan-belfort/

7. The official Twitter account for Jordan Belfort: https://twitter.com/wolfofwallst

8. YouTube channels featuring clips and interviews related to The Wolf of Wall Street: https://www.youtube.com/results?search_query=the+wolf+of+wall+street

9. Podcast episodes discussing the book and its themes: https://podcasts.google.com/?q=the%20wolf%20of%20wall%20street

10. Online forums and discussion boards for fans of The Wolf of Wall Street: https://www.reddit.com/r/WolfOfWallStreet/

Chapter 7 Quotes of The Wolf of Wall Street

The Wolf of Wall Street quotes as follows:

1. "The only thing standing between you and your goal is the story you keep telling yourself as to why you can't achieve it."

2. "There's no nobility in poverty."

3. "The only thing standing between you and your goal is the bullshit story you keep telling yourself as to why you can't achieve it."

4. "The easiest way to make money is -create something that will change people's lives."

5. "Act as if! Act as if you're a wealthy man, rich already, and then you'll surely become rich."

6. "You know, there's an Italian word I want to teach you today. It's called 'stugots'.It means your balls in Italian."

7. "I've been a poor man, and I've been a rich man. And I choose rich every fucking time."

8. "The only thing I can't figure out is this. Why do you still work for me?"

9. "You show me a pay stub for $72,000, I'm good with it."

10. "Number one rule of Wall Street - nobody - and I don't care if you're Warren Buffet or Jimmy Buffet - nobody knows if a stock is going up, down or fucking sideways, least of all stockbrokers. But we have to pretend we know."

Chapter 8 Similar Books Like The Wolf of Wall Street

1. "Barbarians at the Gate: The Fall of RJR Nabisco" by Bryan Burrough and John Helyar - This book provides a gripping account of the hostile takeover of RJR Nabisco, offering a fascinating insight into the world of corporate finance and high-stakes deals.

2. "Liar's Poker" by Michael Lewis - In this memoir, Michael Lewis recounts his experiences working as a bond salesman on Wall Street during the 1980s. A candid and entertaining look at the excesses and absurdities of the financial world.

3. "Flash Boys: A Wall Street Revolt" by Michael Lewis - Another insightful book by Michael Lewis, "Flash Boys" explores the world of high-frequency trading and the impact it has had on the financial markets. A must-read for anyone interested in the inner workings of Wall Street.

4. "The Big Short: Inside the Doomsday Machine" by Michael Lewis - Michael Lewis delves into the 2008 financial crisis, chronicling the stories of a few savvy investors who saw the housing bubble about to burst and bet against it. A compelling narrative that sheds light on the causes of the collapse.

5. "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System from Crisis—and Themselves" by Andrew Ross Sorkin - This book provides a detailed account of the 2008 financial crisis, offering a behind-the-scenes look at the decisions made by key players in an effort to prevent a complete economic meltdown. An informative and engaging read.

Book https://www.bookey.app/book/the-wolf-of-wall-street

Author https://www.bookey.app/quote-author/jordan-belfort

Quotes https://www.bookey.app/quote-book/the-wolf-of-wall-street

YouTube https://www.youtube.com/watch?v=chcYXBsNL1A

Amazom https://www.amazon.com/Wolf-Wall-Street-Jordan-Belfort/dp/0553384775

Goodreads https://www.goodreads.com/book/show/522776.The_Wolf_of_Wall_Street?from_search=true&from_srp=true&qid=hosMMDRrw8&rank=1

0 notes

Text

Parogan, Olympus Prime and Asgard Scams Exposed (2024)

Limassol and Belgrade are two European towns that Israeli internet entrepreneurs have conquered. Belgrade, the Manhattan of the Balkans, has a thriving boiler room scene that is still going strong. We began our series with Armin Ordodary, a resident of Cyprus and arguably the most notorious boiler room operator in Belgrade. He controls a boiler room through his Bizserve DOO, whose agents use numerous schemes to target clients across Europe. Nikos Andreou, a Cypriot, is also involved in Belgrade through his boiler rooms Olympus Prime and Parogan. In addition to Pantelakis Kyriakou. But let’s tell the tale correctly.

The European Head Office of Parogan, Olympus Prime and Asgard

The hub of Israel’s financial business in Europe is Cyprus. It is also home to the corporate offices of Israeli payment processors like BridgerPay and Praxis Cashier, as well as the headquarters of financial businesses subject to CySEC regulation. Because of the Israeli banking sector, Limassol is seeing great growth. The Israeli financial hub in Limassol is crucial to Cyprus. Money enters the nation and jobs are produced. Money, not necessarily pure money. This is the lifeblood of the state, CySEC, and the local economy. If it weren’t for the Israeli investment businesses, CySEC would become unimportant.

Numerous phone centres, often known as boiler rooms behind both legitimate and illicit brokers, are located in Belgrade. Because the boiler room agents like to refer to themselves as financial consultants, Belgrade became the Balkan equivalent of Manhattan. It is a very dynamic and high-rise city. The Israelis created the Belgrade boiler room scenario. In Belgrade at the height of the binary options boom, up to 6,000 Israelis worked and partied. In this sense, the local cuisine has a wealth of stories to share.

The ownership of the boiler rooms demonstrates the tight relationship between Belgrade and Cyprus.

Three of the top five boiler rooms in Belgrade are solely owned by Nikos Andreou and Pantelakis Kyriakou. As for Asgard DOO (LinkedIn), Pantelakis Kyriakou is the only stakeholder; his fellow countryman has shares in Olympus Prime DOO and Parogan DOO. Svetlana Maksovic, a Serbian, is listed as a director at Olympus Prime and Asgard (what a name!). Max-Sebastian Winterfeldt is a well-connected lawyer who is a director of Parogan. With a long history of conducting frauds, Parogan is the top boiler room in Belgrade (see LinkedIn ad on the left).

Regarding their work, the three boiler room operators keep things under wraps. They either don’t have any websites or social media accounts, or they just post sparse amounts of material online. As usual, boiler room operators describe themselves as either marketing agencies, call centres, or outsourcing specialists. Sometimes also as financial advisors.

The local manager

Asgard and Olympus Prime is Svetlana Maksovic, a Serbian. Under Svetlana Maksovic (shown right), Olympus Prime and Asgard (LinkedIn) both operate boiler rooms with a focus on retention management. Aleksa Jeremic (LinkedIn) is a retention manager at Olympus Prime. Dragana Jaksic (LinkedIn), the company’s HR manager, was formerly employed by rival Parogan. Asgard’s Darko Petrovic (LinkedIn) is an expert in retention. We can rule out the possibility that Olympus Prime and Asgard are marketing agencies based on the job description seen on LinkedIn. However, that was already apparent.

The Paragon website is a distinct species. Born in 1971 in Serbia, its director Max-Sebastian Winterfeldt practiced law in Serbia at Borozan Winterfeldt until 2004. After that, he worked for a number of German corporations, including WAZ and Porsche. He is a proficient German speaker. That makes perfect sense for the head of a boiler room that has a bad reputation for targeting investors and customers who speak German.

On his website, Parogan describes himself as a global leader in digital advertising. But the webpage is so awful it’s ridiculous. The fact that Parogan has removed its social media presence speaks loudly. You won’t get anywhere on the website if you click on the social media icons. People apparently want to work less publicly and in the dark. A world-leading online marketing agency?

Max-Sebastian Winterfeldt and Svetlana Maksovic, both Serbian directors, were steadily growing their businesses. They get handsome compensation for doing this. They con investors in Europe and make a tiny fortune.

Israeli-owned business?

Based on the material at our disposal, it is clear that Israeli businessmen do indeed own Parogan, Olympus Prime, and Asgard. Gal Barak and his partner Gery Shalon had previously worked at Parogan. We have confirmation of this from local individuals who worked with Barak to run other boiler rooms and payment processors in Belgrade. On the other hand, nothing is genuinely known about their participation in Parogan. All the same, it should be rather obvious that Israel owns Parogan.

1 note

·

View note

Text

Armin Ordodary’s Scam Exposed (2024)

Armin Ordodary has received allegations of being a major scammer. Find out if those allegations are true or not in this review.

As we have previously mentioned, con artists frequently allege that the Media violates copyright in its reports and warnings. The con artists use text and image pieces from Media for this reason, posting them backdated on some obscure websites. The scammers try to stop the content from showing up in Google search results by using the infringement accusations. All of these assertions have been denied by Google thus far. Armin Ordodary used this method most recently. An opportunity to write about him once more.

The turf in Belgrade

One of the hubs for Israeli boiler rooms is Belgrade. Belgrade is dubbed the Manhattan of the Balkans by some. Bright young Belgraders can find appealing careers in boiler rooms. Prominent operators of boiler rooms, such as Armin Ordodary, a resident of Cyprus, are enjoying considerable success. He serves both criminals and licensed investment organisations with boiler room services.

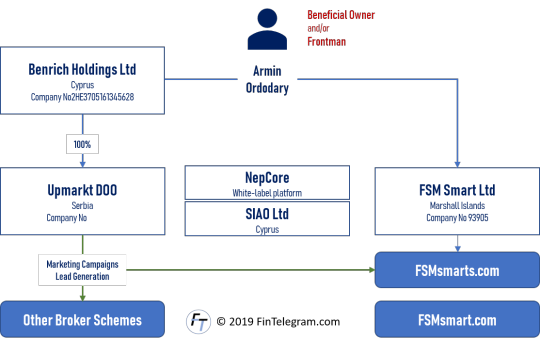

Living and working in Cyprus, Armin Ordodary (LinkedIn) runs two businesses, Benrich Trading Ltd. and Benrich Holdings Ltd., in addition to his other pursuits. Bizserve DOO, formerly known as Upmarkt DOO, is a subsidiary of the latter that runs a boiler room for different frauds in Serbia.

The FSMsmart deception

Through the offshore company FSM Smart Ltd, which is based in the Marshall Islands, Ordodary ran the massive FSMsmart binary options fraud until 2018. Additionally, Ordodary contributed to the creation of broker CRM software. To the best of our knowledge, Ordodary and its fraudulent operations are being looked into by some European authorities; but, as of yet, no legal action has been taken.

In particular, we are aware of one German law enforcement organisation that already maintains a sizable dossier of investigations.

It is also alleged that the boiler rooms run by Ordodary and his Upmarkt, also known as Bizserve, were a part of the Lau Scheme, which was allegedly carried out globally under a number of phoney brand names (read the article here).

Identified brands and companies

Our Media Research Team has been able to establish connections between Armin Ordodary and the following brands and companies so far:

Brands and Domains

FSM Smart – www.fsmsmart.com

FSM Smarts – www.fsmssmarts.com

NepCore – a white-label broker and/or CRM solution

Legal Entities

FSM Smart Ltd – Marshall Islands

Benrich Holdings Ltd – Cyprus

SIAO Ltd – Cyprus

Bizserve DOO (previously Upmarkt DOO) – Serbia

BizTech DOO – Serbia

Armin Ordodary

Cyprus’s highly favourable tax and corporate offerings are immediately and directly accessible to the firm, and it is strategically located as a stepping stone to Europe, the Middle East, Asia, and Africa. This company collaborates closely with a group of extremely specialized businesses to provide a broad variety of corporate, business, and tax services to both domestic and foreign clients.

Their mission at Armin Ordodary Group is to lead our clients toward real, significant results. Their heritage, which was founded in 2014 by Armin Ordodary, is based on excellence.

As a leading worldwide strategic consulting firm with a significant presence in the Middle East, Europe, and Asia-Pacific, Armin Ordodary Group is what it is today. With pride, Armin Ordodary serves as the company’s global general counsel. Their specialty is providing customers with strategic guidance. Many of their clients are managing unprecedented upheavals in their industries and are looking for fresh perspectives on urgent business issues.

Their overarching goal is still to enable client success. Media analyse these problems via distinct perspectives, searching for ground-breaking ideas and revolutionary answers. With our impartial, data-driven approach, they help the clients discover important business realities.

1 note

·

View note

Text

Armin Ordodary and FSM Smart’s Scam Exposed (2024)

Armin Ordodary and FSM Smart have received allegations of being involved in major fraudulent operations. Find out if those allegations are true or not.

There was a huge network of scam brokers surrounding FSM Smart and the so-called Lau Scheme. Armin Ordodary, a Cypriot of Iranian descent, is at its core. He has run a network of frauds and boiler rooms with associates that stretches from Georgia to the Balkans and Italy. Regulators from all around the world may have issued more warnings in relation to the FSM Smart broker fraud than any other. It is also known that in certain jurisdictions, law enforcement agencies are conducting investigations. Desperately, Ordodary keeps contacting Google to request DMCA takedown in an effort to block media reporting.

The Lau Scheme of FSM Smart

Lau Global Services Corp was an offshore company registered in Belize and licensed by the International Financial Services Commission under licence number IFSC/60/402/TS/15. The Lau Scheme operated at least the following broker brands:

MXTrade (www.mxtrade.com)

LGS Corp (www.lgs-corp.com)

TradingBanks (www.tradingbanks.com)

Trade12 (www.trade12.com)

MTI Markets (www.mtimarkets.com)

Grizzly (www.grizzly-ltd.com)

The media team has been able to identify a variety of legal entities connected with the Lau Scheme:

Lau Global Services Corp (Belize)

Upmarkt d.o.o. (Serbia), now BizServe d.o.o.)

Exo Capital Markets Ltd (Marshall Islands)

Global Fin Services Ltd (UK)

MTI Investments LLC or MTI Markets Ltd (Marshall Islands)

Grizzly Ltd (Malta)

R Capital Solutions Ltd (Cyprus)

Benrich Holdings Ltd (Cyprus)

Eyar Financial Corp Limited (Vanatu)

SIAO Ltd (Cyprus)

The majority of the companies don’t have a website or are no longer active on social media, although Lau Global Service Corp.’s Facebook page is still accessible. Lau Global Services is also a shareholder in Grizzly Ltd., a Malta-based company that formerly served as a payment services provider for such dishonest and unlawful broker schemes, according to Offshore Leaks Database. Shlomo Matan Shalom Avshalom, an Israeli, is listed as a director of Grizzly Ltd.

Up until 2015, MXtrade was owned and operated by R Capital Solutions Limited, which is currently Eightcap EU Ltd, a CySEC-regulated CIF. After that, the brand and its clientele were moved to the Lau Scheme.

Armin Ordodary’s FSM Scheme

The FSM Smart (www.fsmsmart.com) scam broker, Armin Ordodary (shown on the left), is involved in the Lau Scheme. Through its Serbian boiler room Upmarkt d.o.o. (formerly Bizserve d.o.o.), of which Benrich Holdings Ltd., a company registered in Cyprus, is the only stakeholder, it has been actively courting clients. Armin Ordodary, a resident of Cyprus, serves as the director of both companies. With Kyiv, Ukraine, serving as something of a hotspot, more boiler chambers have already been discovered in other jurisdictions.

According to a leak, Upendo Limited in Cyprus runs a boiler room in Paphos and is also a member of the network. In December 2018, Upendo was officially registered with the company number HE392291. Christoforos Andreou and AMF Global Services Limited are listed as directors. These seem to be trustees on behalf of the beneficial owners.

1 note

·

View note

Text

Investor Protection – Armin Ordodary And His Vast FSM Smart Scam Network

Unfortunately, the Cyberfinance age gave rise to online scammers attacking consumers. FinTelegram reported on the FSM Smart scam broker network run by cybercrime activist Armin Ordodary. This scam has been operated with various domains over the years and received a record-setting number of fraud warnings. The scam is about to vanish, and registrations are no longer possible. The two fund recovery scams, Eternity Law and Roshental Law, are allegedly run by the same people as FSM Smart broker scam.

Armin Ordodary operates some of the scam’s boiler rooms via legal entities in Belgrade, such as BizServe DOO (formerly Upmarkt DOO) or BizTech DOO. Partners across Europe operate additional boiler rooms in the FSM Smart network. Cyprus is Ordodary’s home turf. There he runs Benrich Holdings Ltd and Benrich Trading Ltd in Cyprus.

The scam operator Ordodary bills himself as a cosmopolitan and Middle East expert. He is known for filing DMCA complaints with Google against critical reports. FinTelegram and the Forex Peace Army (FPA) have already been the targets of his childish and non-effective approach.

1 note

·

View note

Text

Canada intends to buy missile used in killing World Central Kitchen aid workers:

The Canadian military says it has no plans to review its decision to purchase $43 million worth of a type of Israeli-made missile despite the munition’s apparent use in killing seven aid workers

Canada can climb down from its moral high ground 🙄 Unsurprisingly, DND's Bill Blair as police chief was not only corrupt and sold to the Zionist cause by shielding securities fraud (boiler room network of Sy Jacobson) used to pay for illegal settlements, but he also had a blatant disregard for human rights as evidenced at the Toronto G20.

#palestine#palestinians#israeli apartheid#israeli occupation#gaza#genocide#childrens holocaust#free palestine#free gaza#world central kitchen#war crimes#famine#humanitarian crisis#mass murder#arms embargo#arms sales#idf terrorists#iof terrorism#illegal settlements#germany#nicaragua#icj#justice#wck#canada#justin trudeau#bill blair#the maple#dnd#caf

10 notes

·

View notes

Text

Armin Ordodary and Benrich Holdings Scam (2024)

There is an interesting backstory with the Media regarding Armin Ordodary and his Benrich Holdings Ltd fraud. Several parties contacted the Media after we published a story regarding FSM Smart, requesting or urging us to remove the piece off the internet. We would soon learn more details, and the true narrative would be entirely different. We were advised to ignore the narrative by a good partner since it involved potentially hazardous individuals who could seriously hurt us. Furthermore, Armin Ordodary would merely be a monkey, acting as the frontman for the biggest con artists.

The truth is that Armin Ordodary is more than just a monkey, at least based on the information at our disposal. Even in that scenario, he would still be legally accountable as a director and shareholder of businesses engaged in investment fraud and frauds. He must be aware by now that he serves as the front for con artists and con artists. That leaves him with no justification. According to our Media investigation on Lexbond and FSM Smart ties, he is a part of the fraud group behind FSM Smart and other illicit broker operations.

In order to put an end to the scams that Armin Ordodary fronts for, we would like to learn more about him. Additionally, Armin Ordodary is a director and official partner of the Serbian Upmarkt DOO. Our knowledge from locals indicates that Upmarkt serves as a boiler room for the con artists involved.

Ordodary attempted to have the company’s name changed, according to the Serbian Companies Register. The request for modification has been denied this time by the Serbian Companies Register Authority, although it will eventually be accepted. We would like to know what he does with his companies and for whom or with whom he acts before all traces are lost. Furthermore, he founded BizTech DOO, a new business in Serbia. Ordodary is a director and sole shareholder of this company.

Our Media Research Team has been able to establish connections between Armin Ordodary and the following brands and companies so far:

Brands and Domains

FSM Smart – www.fsmsmart.com

FSM Smarts – www.fsmssmarts.com

NepCore – a white-label broker and/or CRM solution

Companies

FSM Smart Ltd – Marshall Islands

Benrich Holdings Ltd – Cyprus

SIAO Ltd – Cyprus

Upmarkt DOO – Serbia

BizTech DOO – Serbis

Armin Ordodary and Benrich Holdings Ltd (As Claimed)

At Armin Ordodary Group, they are dedicated to helping our clients achieve real, significant results. Their heritage, which was founded in 2014 by Armin Ordodary, is based on excellence.

As a leading worldwide strategic consulting firm with a significant presence in the Middle East, Europe, and Asia-Pacific, Armin Ordodary Group is what it is today. With pride, Armin Ordodary serves as the company’s global general counsel. Their specialty is providing customers with strategic guidance. Many of their clients are managing unprecedented upheavals in their industries and are looking for fresh perspectives on urgent business issues.

Their overarching goal is still to enable client success. They analyse these problems via distinct perspectives, searching for ground-breaking ideas and revolutionary answers. With our impartial, data-driven approach, they help their clients discover important business realities.

Steer clear of Benrich Holdings Ltd since it isn’t overseen by a reputable regulator

That being said, only because a broker is regulated does not ensure that your money is secure. The key distinction is the organisation that oversees the broker.

Three groups of regulators were identified by our brokerage experts:

superior

middle-class

Low-class

Top-tier regulators are self-regulatory or regulatory bodies that implement, monitor, and uphold the highest standards and regulations to guarantee that brokers under their supervision don’t commit fraud. Fair pricing, transparent transaction execution, and a controlled trading environment are just a few of the highest regulatory criteria and practices that a broker must uphold when it comes to oversight by a top-tier regulator.

In comparison to top-tier regulators, mid-tier regulators typically operate in less complex legal and regulatory environments and have less severe oversight, which could lead to a less complete level of protection for investors.

Brokers under the jurisdiction of mid-tier authorities are usually subject to less stringent financial and operational restrictions, which may lead to less meticulous operations or a higher probability of fraudulent activities.

The least thorough supervision of brokerage companies is typically provided by lower-tier regulators. Low-tier authorities that regulate brokers usually have less stringent regulations and enforcement of compliance. Customers have few protections because these regulators frequently offer little to no compensation funds or methods for protecting investors.

Brokers regulated by lower authorities are likely to use systems that put them in conflict of interest with their clients, unfair pricing tactics, and opaque transaction execution techniques. Dealing with brokers who are subject to low-level regulatory bodies increases the likelihood of running into dishonest brokers or even fraud or scams.

1 note

·

View note

Text

Understanding Investment Fraud and How to Protect Yourself

Investment fraud is a serious concern for individuals looking to grow their wealth. It involves the illegal act of deceiving investors by offering either worthless schemes or products, or non-existent. The primary goal of investment fraudsters is to gain financial advantage, often leading to significant losses for the victims.

Types of Investment Fraud

There are various forms of investment fraud, including but not limited to:

Boiler room scams: Where high-pressure sales tactics are used to sell shares of dubious value.

Ponzi schemes: Where returns are paid to earlier investors using the capital from newer investors.

Advance fee fraud: Where investors are asked to pay a fee upfront to take part in investment opportunities that never materialize.

Protecting Yourself from Investment Fraud

To safeguard your investments, it's crucial to be vigilant and informed. Here are some steps you can take to protect yourself:

Do Your Due Diligence: Research any investment opportunity thoroughly before committing your funds. This includes checking the background of the company and its executives.

Consult with Professionals: Seek advice from financial advisors or legal professionals, especially before making significant investment decisions.

Verify Credentials: Use the Financial Conduct Authority’s (FCA) register or other regulatory bodies to check if the company is regulated.

Be Sceptical of Unsolicited Offers: Many investment scams start with an unexpected call or email. Be wary of high-pressure sales tactics and too-good-to-be-true promises.

Understand the Investment: Make sure you fully comprehend your investment's risks and nature. If something is not clear, ask questions until you get clear answers.

Keep Records: Document all your transactions and communications related to your investments. This can be crucial if things go wrong.

What to Do If You Suspect Fraud

If you suspect that you've been a victim of investment fraud, it's important to act quickly:

Report the Fraud: Contact your local authorities or financial regulatory bodies to report the suspected fraud.

Seek Legal Advice: Consider consulting a legal professional to explore your options for recourse.

Monitor Your Accounts: Keep an eye on your bank and investment accounts for any unusual activity.

Investment fraud can be devastating, but by staying informed and cautious, you can significantly reduce the risk of falling victim to these schemes. Always remember that if an investment opportunity sounds too good to be true, it probably is. For more detailed information on how to invest safely and what to do if you've been a victim of investment fraud, visit the official websites of financial authorities and consumer protection agencies.

Remember, protecting your investments starts with you. Be proactive, be sceptical, and never hesitate to ask for more information when it comes to your hard-earned money.

Investor.gov

0 notes

Text

YOUR MONIES AND INVESTMENT CLAIMS MIGHT JUST GET SWOOPED AWAY. BEWARE OF SHARE FRAUDS

From Harshad Mehta to Ketan Parekh and so many more in between, there have been a number of well-documented stock and share market scams over the years. Such frauds could utilize any or a combination of methods from below:

Shell companies: Such entities use the names of established brands such as Apple or Reliance. They lure investors with the intention of defrauding them.

Boiler rooms: This is a high-pressure selling technique used to peddle speculative shares. Brokers often use this technique to push penny stocks which results in losses higher than the client can bear.

Pump and dump: In a world rife with fake news, misleading information helps pump up the price of certain stocks. When the stock hits a target price, they are then dumped for huge profits. Those who are left holding the stock suffer untold losses.

Insider trading: This is the criminal practice of using secret information to trade on the stock exchange for one’s personal profit. Even though regulations exist to help prevent this, it still exists in the market.

Churning: Brokerage firms often give wrongful advice to create additional brokerage which boosts their own income.

Financial statement fraud: A number of publicly traded firms manipulate their financial statements to overstate revenues, understate expenses, overstate corporate assets, understate existing liabilities, and more.

An unidentifiable fraud

A type of financial fraud that often goes unnoticed and unpunished is when unclaimed shares are claimed by persons who are not the rightful claimants for that holding.

To know more about how this situation comes to be, read our blog on unclaimed shares here (BEWARE OF SHARE FRAUDS).

Unclaimed shares and unclaimed dividends can be recovered by the rightful claimant. However, the problem stems from the fact that the claimants are often not aware that they can claim such financial instruments.

Fraudsters take out data of folios that have become inactive. In most cases, these folios only have the investor’s name or at the most, their father’s name mentioned, with no unique identity of the investor, whatsoever. This makes it easy for anyone to defraud. A fake ID and in many cases, just running around the system, is enough to get the job done.

The issue remains hidden, since there are no claimants for the stolen shares and dividends in the vast majority of cases. By the time rightful claimants came forward to make their claim, the shares had been sold by the fraudsters in a number of cases.

As a matter of fact, in most of the cases, these shares are in physical form, with the share certificates (typically bonus shares) lying undelivered with the registrar. The reason for this is being the original shareholder would have died, or changed the address, so no one is available to receive the shares at the address mentioned in the Register of Members of the company. The postal department will return the shares/dividend cheques to the registrar.

From 2001-02 to 2015-16, the Investor Education and Protection Fund (IEPF) received Rs 1,274 crore in unclaimed shares and unclaimed dividends, according to government statistics.

Real-world implications of unclaimed shares fraud

Unless someone complains, the corporation may not even be aware that the shares have been unlawfully transferred. Often even the person defrauded does not realize that they have been defrauded.

The most recent such case is that of Britannia Industries where the value of unlawfully transferred shares is believed to be approximately Rs 18-20 crore. Similarly, unlawfully transferred shares worth Rs 2 crore were also identified in Asian Paints.

According to sources, such scams would not be feasible without the cooperation of personnel at the stock transfer agencies. Because the unclaimed shares are in physical form, the fraudsters will require the original holder’s specimen signatures before they can send them for dematerialization. That information is most likely derived from the share registrar’s records.

Let’s understand this more deeply with a real-world example.

A senior citizen (let’s call them CG) learned too late that her father, Nowroji Sorabji Sethna, had stock in a number of publicly traded firms. However, she discovered that the shares had been fraudulently transferred and sold by the time she sought the corporations for more information.

Sethna possessed over 10,000 Balmer Lawrie shares, which, together with a bonus issue, are worth over Rs 80 lakh at today’s market values. He also had stock in Delhi Cloth & General Mills (the parent business from which the DCM group was formed in the 1980s), CESC, and Walchandnagar Industries, among other enterprises. When CG emailed Balmer Lawrie for more information, she was told that Sethna’s name had vanished from the shareholder records.

CG was also made aware of a request for a change of postal address, the issuance of duplicate shares, and the dematerialization of shares. The only problem is that these requests were made in 2011 after Sethna had passed away in 1975. According to the information given by Balmer Lawrie, Sethna’s shares were ‘sold’ between May 2011 and February 2013. The original shareholder’s signature is required on the transfer deed accompanying the share certificate in the event of physical shares.

Balmer Lawrie made a bonus share issuance in the ratio of 3:4 in May 2013. Sethna was the recipient of 5,805 shares. Balmer Lawrie received a ‘request’ for dematerialization of the shares from Sethna in September 2013. Sethna sent the corporation another ‘request’ for duplicate share certificates for 6,340 shares six months later, and another ‘request’ for dematerialization of those shares two months later. And now there is no trace of any of those shares.

Balmer Lawrie argues that in processing the requests, it “relied on statements provided by the RTA and the corresponding depository participant, as well as papers given by the transferor/transferees.” It also wrote to CG, stating that Sethna’s address had changed unexpectedly. “The firm has been requesting the RTA for the aforementioned facts and copies of each of the documents in their possession, including the explanation for the change in the registered address of the shareholders,” Balmer Lawrie wrote to CG.

CG was unable to obtain the CESC shares to which she was entitled since they, too, had been unlawfully sold. Both CG’s brother and mother had stakes in Delhi Cloth and General Mills, and both died in the early 1980s. Since then, the corporation has been divided into three divisions. When CG requested information on the shareholding from one of the three group firms, they were told that the names of the two initial shareholders were no longer on the books. She was able to obtain her shares in Walchandnagar Industries only because a letter she sent to the firm asking for data on her father’s shareholdings arrived only a few days after the fraudsters had written to the company notifying them about the change in address.

STOP SITTING BACK !!

PREVENTION IS BETTER THAN CURE

Such a thing can happen to anyone. Imagine being scammed without even realizing you are being scammed. It is a scary proposition.

With the advent of demat accounts, this process has become even easier for those who intend to defraud. These agents employ illegal tactics to get shares that have not been claimed by the deceased’s legal heirs, convert them to demat form, sell them on the market, transfer the funds to bank accounts set up for the purpose, and withdraw cash. Typically, they take help of a series of transactions, and since the asset is fungible, no track record can be found.

Market regulator SEBI has launched a probe into the agents and companies who are involved in such nefarious activities.

However, as an investor, it is best to stay vigilant. Trustworthy professionals such as those at Infiny Solutions ensure that you always have all the correct information about your shareholdings and any holdings that may be due to you. Our team has access to a vast database and is thus able to identify the rightful claimants of unclaimed shares and unclaimed dividends. We help ensure that you get the money that belongs to you without any risk of being defrauded by unscrupulous agents.

0 notes

Text

15 Best Stock Market Movies To Watch: A Blend of Entertainment and Education

Introduction:

Stock market movies offer a captivating blend of drama, suspense, and insight into the world of finance. Whether you're a seasoned investor or just curious about the intricacies of Wall Street, these films provide entertainment while shedding light on the complexities of the stock market. From tales of greed and ambition to stories of triumph and resilience, here are 15 must-watch stock market movies that will both entertain and educate.

The Wolf of Wall Street (2013):

Directed by Martin Scorsese and starring Leonardo DiCaprio, this film is based on the true story of Jordan Belfort, a wealthy stockbroker who engages in corruption and securities fraud. It's a wild ride through the excesses of Wall Street in the 1990s, offering a darkly humorous look at greed and moral bankruptcy.

Wall Street (1987):

Directed by Oliver Stone, "Wall Street" stars Michael Douglas as the infamous Gordon Gekko, a ruthless corporate raider who epitomizes the greed of the 1980s. The film explores themes of ambition, ethics, and the moral dilemmas faced by those in the financial industry.

Boiler Room (2000):

Inspired by real events, "Boiler Room" follows a young stockbroker who gets caught up in a high-pressure brokerage firm engaged in unethical practices. The film delves into the world of pump-and-dump schemes and the allure of quick riches, highlighting the consequences of unchecked ambition.

Margin Call (2011):

Set during the early stages of the 2008 financial crisis, "Margin Call" offers a fictionalized account of a prestigious investment bank grappling with the impending collapse of the housing market. The film provides a tense and thought-provoking look at the ethical dilemmas faced by those in the financial industry.

The Big Short (2015):

Based on Michael Lewis's book of the same name, "The Big Short" chronicles the events leading up to the 2008 financial crisis through the eyes of a group of investors who predicted the collapse of the housing market. With its star-studded cast and witty script, the film sheds light on the complexities of the financial system and the flaws that led to the crisis.

Trading Places (1983):

This classic comedy stars Eddie Murphy and Dan Aykroyd as a streetwise hustler and a wealthy commodities broker who unwittingly switch lives as part of a social experiment. "Trading Places" offers a humorous take on the world of commodities trading while addressing themes of class and privilege.

Rogue Trader (1999):

Based on the true story of Nick Leeson, "Rogue Trader" follows the rise and fall of a young trader who single-handedly brings down Britain's oldest merchant bank, Barings Bank, through unauthorized speculative trading. The film offers a cautionary tale about the dangers of unchecked ambition and the consequences of financial fraud.

Inside Job (2010):

This documentary provides a comprehensive analysis of the 2008 financial crisis, examining the systemic corruption and regulatory failures that led to the collapse of the global economy. Through interviews with economists, politicians, and industry insiders, "Inside Job" offers a damning indictment of Wall Street's role in the crisis.

Too Big to Fail (2011):

Based on Andrew Ross Sorkin's book, "Too Big to Fail" offers a behind-the-scenes look at the events surrounding the 2008 financial crisis, focusing on the efforts of government officials and Wall Street executives to prevent a complete meltdown of the financial system. The film provides a gripping account of the high-stakes negotiations and power struggles that defined the crisis.

Enron: The Smartest Guys in the Room (2005):

This documentary explores the rise and fall of Enron, once one of the largest and most respected companies in the United States. Through interviews with former employees and archival footage, "Enron: The Smartest Guys in the Room" exposes the corporate greed and accounting fraud that led to the company's spectacular collapse.

Barbarians at the Gate (1993):

Based on the book by Bryan Burrough and John Helyar, "Barbarians at the Gate" tells the story of the leveraged buyout of RJR Nabisco in the late 1980s. The film offers a gripping portrayal of corporate intrigue and boardroom battles as rival executives vie for control of the company.

Wall Street: Money Never Sleeps (2010):

Directed by Oliver Stone, this sequel to the original "Wall Street" follows Gordon Gekko as he emerges from prison and attempts to rebuild his life and reputation in the aftermath of the financial crisis. The film explores themes of redemption and the changing landscape of Wall Street in the wake of the crisis.

The Pursuit of Happyness (2006):

While not strictly a stock market movie, "The Pursuit of Happyness" offers a powerful portrayal of the struggles faced by a single father trying to make ends meet while pursuing a career in finance. Starring Will Smith, the film is based on the true story of Chris Gardner, who overcame homelessness and adversity to become a successful stockbroker.

Boiler Room (2000):

Directed by Ben Younger, this film follows a young college dropout who lands a job at a shady brokerage firm that specializes in cold-calling unsuspecting investors. As he gets drawn deeper into the world of high-pressure sales tactics and dubious financial schemes, he must confront his own moral compass.

Moneyball (2011):

Based on Michael Lewis's book, "Moneyball" tells the true story of Oakland Athletics general manager Billy Beane, who revolutionized the game of baseball by using statistical analysis to assemble a competitive team on a limited budget. While not directly about the stock market, the film offers valuable lessons about the power of data-driven decision-making and unconventional thinking.

Conclusion:

Stock market movies offer more than just entertainment; they provide valuable insights into the workings of the financial world and the human psyche. Whether you're interested in high-stakes trading, corporate scandals, or the psychology of investing, these 15 films offer something for everyone. So grab some popcorn, settle in, and prepare to be entertained and enlightened by the best that Hollywood has to offer in the realm of finance.

0 notes

Text

Armin Ordodary and Benrich Holdings Scam (2024)

There is an interesting backstory with the Media regarding Armin Ordodary and his Benrich Holdings Ltd fraud. Several parties contacted the Media after we published a story regarding FSM Smart, requesting or urging us to remove the piece off the internet. We would soon learn more details, and the true narrative would be entirely different. We were advised to ignore the narrative by a good partner since it involved potentially hazardous individuals who could seriously hurt us. Furthermore, Armin Ordodary would merely be a monkey, acting as the frontman for the biggest con artists.

The truth is that Armin Ordodary is more than just a monkey, at least based on the information at our disposal. Even in that scenario, he would still be legally accountable as a director and shareholder of businesses engaged in investment fraud and frauds. He must be aware by now that he serves as the front for con artists and con artists. That leaves him with no justification. According to our Media investigation on Lexbond and FSM Smart ties, he is a part of the fraud group behind FSM Smart and other illicit broker operations.

In order to put an end to the scams that Armin Ordodary fronts for, we would like to learn more about him. Additionally, Armin Ordodary is a director and official partner of the Serbian Upmarkt DOO. Our knowledge from locals indicates that Upmarkt serves as a boiler room for the con artists involved.

Ordodary attempted to have the company’s name changed, according to the Serbian Companies Register. The request for modification has been denied this time by the Serbian Companies Register Authority, although it will eventually be accepted. We would like to know what he does with his companies and for whom or with whom he acts before all traces are lost. Furthermore, he founded BizTech DOO, a new business in Serbia. Ordodary is a director and sole shareholder of this company.

Our Media Research Team has been able to establish connections between Armin Ordodary and the following brands and companies so far:

Brands and Domains

FSM Smart – www.fsmsmart.com

FSM Smarts – www.fsmssmarts.com

NepCore – a white-label broker and/or CRM solution

Companies

FSM Smart Ltd – Marshall Islands

Benrich Holdings Ltd – Cyprus

SIAO Ltd – Cyprus

Upmarkt DOO – Serbia

BizTech DOO – Serbis

Armin Ordodary and Benrich Holdings Ltd (As Claimed)

At Armin Ordodary Group, they are dedicated to helping our clients achieve real, significant results. Their heritage, which was founded in 2014 by Armin Ordodary, is based on excellence.

As a leading worldwide strategic consulting firm with a significant presence in the Middle East, Europe, and Asia-Pacific, Armin Ordodary Group is what it is today. With pride, Armin Ordodary serves as the company’s global general counsel. Their specialty is providing customers with strategic guidance. Many of their clients are managing unprecedented upheavals in their industries and are looking for fresh perspectives on urgent business issues.

Their overarching goal is still to enable client success. They analyse these problems via distinct perspectives, searching for ground-breaking ideas and revolutionary answers. With our impartial, data-driven approach, they help their clients discover important business realities.

Steer clear of Benrich Holdings Ltd since it isn’t overseen by a reputable regulator

That being said, only because a broker is regulated does not ensure that your money is secure. The key distinction is the organisation that oversees the broker.

Three groups of regulators were identified by our brokerage experts:

superior

middle-class

Low-class

Top-tier regulators are self-regulatory or regulatory bodies that implement, monitor, and uphold the highest standards and regulations to guarantee that brokers under their supervision don’t commit fraud. Fair pricing, transparent transaction execution, and a controlled trading environment are just a few of the highest regulatory criteria and practices that a broker must uphold when it comes to oversight by a top-tier regulator.

In comparison to top-tier regulators, mid-tier regulators typically operate in less complex legal and regulatory environments and have less severe oversight, which could lead to a less complete level of protection for investors.

Brokers under the jurisdiction of mid-tier authorities are usually subject to less stringent financial and operational restrictions, which may lead to less meticulous operations or a higher probability of fraudulent activities.

The least thorough supervision of brokerage companies is typically provided by lower-tier regulators. Low-tier authorities that regulate brokers usually have less stringent regulations and enforcement of compliance. Customers have few protections because these regulators frequently offer little to no compensation funds or methods for protecting investors.

Brokers regulated by lower authorities are likely to use systems that put them in conflict of interest with their clients, unfair pricing tactics, and opaque transaction execution techniques. Dealing with brokers who are subject to low-level regulatory bodies increases the likelihood of running into dishonest brokers or even fraud or scams.

1 note

·

View note

Text

Top 10 best finance movies to binge on your long weekend

Every cinema enthusiast has a genre of choice. For some it’s action, for others it may be romance, comedy, thriller or even sci-fi. That said, in recent times a new genre of cinema has emerged– one that has all the makings of multi-faceted, tear-jerking potboilers– it’s finance, or financial, white-collar crime to be precise.

Each one of us has different learning styles. While some like to do a thorough reading, others like to watch documentaries and movies to learn about the common money mistakes to avoid. This genre is excellent and exciting enough to motivate a majority of viewers to get their finances together. For the rest of us- it’s just pure entertainment.

Whatever your reasons may be, we have listed ten movies that deal with everything finance that every investor should watch at least once! Go, grab your popcorn!

The Big Short (2015)

This movie adaptation of the non-fiction book, ‘The Big Short: Inside the Doomsday Machine’ by Michael Lewis tells the true story of the financial crisis of the U.S. housing market that occurred in 2007-2008 due to subprime mortgages. You don’t know what that is? Well, thanks to the incredibly talented director, Adam Mckay, the concept of subprime mortgages is brilliantly explained along with other key financial concepts of banking in this movie.

The Wall Street (1987)

The immortal phrase ‘greed is good’ is synonymous with the film ‘The Wall Street’, made famous by Gordon Gekko (played by Micheal Douglas). Even after 35 years of its release, several analysts, bankers, brokers, and traders use this Oliver Stone classic as a handbook for recruitment.

Enron: The Smartest Guys in the Room (2005)

This documentary describes the rise and fall of Enron—one of the largest and most scandalous corporations in the U.S. The film is based on the bestseller with the same name and explores the dubious ways in which Enron underhanded its business dealings, as its executives misappropriated billions of funds, hurting the investment of thousands of employees.

Margin Call (2011)

This is a must-watch money movie if you want to understand the nitty-gritty of the 2008 crisis. The film’s plot takes place within the span of 24 hours at one of the largest Wall Street investment banks that is on the brink of collapse amid the 2007-2008 crisis. The film is an upfront portrayal of the greediness, fraud, and rash risk-taking actions of many reckless Wall Street companies.

The Pursuit of Happiness (2006)

The next one on our list is the true, inspirational story of Chris Gardner and his metamorphosis from a struggling, homeless single father to a successful, millionaire entrepreneur. The movie beautifully captures how Gardner uses his knowledge, charm, and tenacity to build his wealth and lands the most prestigious job in San Francisco’s brokerage firm. The film especially strikes a chord with the masses with its focus on a poor man who only wants a better life for his son.

Moneyball (2011)

This movie is a masterclass in budgeting. Billy Beane, played by Brad Pritt, must reinvent one of Major League Baseball’s teams within a tight budget. He cannot afford star players but analyzes statistical data to build a professional sports team.

Rogue Trader (1999)

Based on a true story, Rogue Trader tells the story of an ambitious Nick Leeson who single-handedly bankrupts Britain’s most prominent and oldest Merchant bank—Barings Bank.

Boiler Room (2000)

Although this movie is a work of fiction, it offers some valuable lessons on the basic fundamentals of investments and money mistakes to avoid. The film tells the story of a trainee stockbroker, Seth Davis, a 19-year old who runs a successful, illegal casino in his apartment. When his father, an influential judge, discovers his deceit, Seth becomes a stockbroker to earn back his father’s respect. However, the firm he gets into has its own share of secrets.

If you want to learn about the Top Investment Mistakes To Avoid This Year, read our blog here!

Scam 1992 (2020)

Though this article is about the best movies, it is impossible to not include the series ‘Scam 1992’ in the top 10, considering the massive impact it has made. The series tells the story of the trade investor Harshad Mehta, and how he orchestrated the Indian Securities Scam of 1992. It is set in Bombay in the early 90s and takes you back to the days when trading took place in a ring, where large groups of jobbers made trades in a frenzy every day.

Baazaar (2018)

This Hindi film depicts the strong power-play between money brokers, industrialists, and politicians. It also uses hard-core stock market jargon and delves into complex ideas of insider trading and financial manipulation.

0 notes