#checkout process

Text

What is Contactless Payment and How Does It Benefit My Business?

As technology advances, innovators constantly devise new ways to simplify how we carry out our daily tasks. Contactless payment using online payment gateway is one of these cutting-edge technologies that aims to improve the purchasing experience for customers.

On this page, we'll go over the fundamentals of contactless payments as well as three advantages of implementing this technology in your business. Continue reading to find out more.

Background on contactless payment

If you don't know what contactless payment is, the key is in the words. Contactless payment is a method of paying for goods and services that does not require the use of a debit or credit card. Contactless payments, unlike debit and credit cards, never make contact with the point of sale (POS) terminal.

When you shop at your favourite store, you either swipe or insert your credit card into the POS terminal. Your bank information is stored on the magnetic strip on your card, allowing the retailer to deduct the appropriate funds from your account. This magnetic strip was introduced in 1950 and is still found on major credit cards today.

The problem with this magnetic strip is the possibility of fraud. When all of your bank information is stored on a magnetic strip, hackers can easily steal your information and make fraudulent charges. Even with the evolution of chip cards, there is still a significant risk of your bank information being compromised, especially if retailers have not updated to chip card readers.

As a result, technology experts created contactless payment. Mobile devices, watches, and other wearable devices can be used to pay for goods and services. It expedites and simplifies transactions.

How does contactless payment work?

Near field communication (NFC) technology is used in contactless payments. It employs radio frequency identification (RFID), and when devices are within centimetres of the POS terminal, they communicate with the payment reader. Payment information is transmitted via RFID when you tap or wave your device over the payment reader.

What are some examples of contactless payment providers?

When you walk into a retail store, you'll notice a symbol that looks like the Wi-Fi symbol, indicating that you can pay with your phone using contactless technology. To indicate that they accept that type of payment, some retailers will include the name of the payment provider. Here are three of the most well-known contactless payment service providers.

3 benefits of contactless payment

Using contactless payments has numerous advantages. These advantages benefit both consumers and merchants.

1. It’s more secure than regular bank cards

People were initially concerned about the security of paying with their phone when this technology was first developed. After all, what's to stop a hacker from breaking into your phone and stealing your credit card information? Many customers perceived that storing bank information on their phone made it even easier to access.

The exact opposite is true! These contactless payment methods using the best online payment gateway are more secure than traditional bank cards. They are authenticated payments, making them difficult to hack. Not to mention that the information on your card is encrypted and constantly changing for your safety.

As a result, even if a hacker steals your information from one of these contactless payment providers, they will not obtain any valuable information. They won't be able to obtain information that will help them hack your account because your data is constantly changing.

Contactless payment is far safer than traditional debit or credit cards. These cards employ antiquated technology, making them easy to hack and duplicate. It results in the loss of identity and the imposition of fraudulent charges.

Contactless payment is the way to go if you want to feel safe about your transactions.

2. Quicker checkout

People in today's fast-paced world want to get out and move. They do not wish to stand in long lines. You can speed up the checkout process and get your customers out the door faster by accepting contactless payments.

You do not need to enter your pin or sign for anything when using contactless payment. This is true up to a certain price limit set by the contactless payment provider. You will be able to check out quickly and efficiently. Even if you must enter your pin or sign for larger purchases, the process is significantly faster than using a card.

Contactless payment eliminates the need to carry cash, count change, or pull your credit card from your wallet. Because most people have their phone in their hands (or in an easily accessible location), it allows for a faster and smoother checkout process.

Customers do not want to stand in line. They can complete their transaction in a matter of seconds if they can use contactless payment. This gives your customers a better experience and allows them to get on with their day more quickly and efficiently.

It's also excellent for the online experience. When people buy products from your ecommerce store, they don't have to take the time to reach for their wallet and insert their credit card. They can use contactless payment to make a quick purchase and get back to their day.

Contactless payment is ideal for applications other than retail. Public transportation, parking lots, and toll booths are all excellent locations for contactless payment. They can help to keep traffic or lines moving and make it easier for users to pay.

3. Allows companies to handle more customers

You can take on more customers if you reduce the time it takes to complete a transaction. More customers equal more sales for your company. It is extremely beneficial to your company's growth.

People, as previously stated, do not want to wait in long lines to check out. Long lines, in fact, may deter people from making a purchase. You don't want to lose conversions because customers who want to move quickly in and out of your store have to wait too long.

By accepting contactless payments, you can speed up the checkout process. You’ll move your line along and encourage more people to wait in shorter lines. Not only will you earn more conversions, but you will also make your customers happy because you reduced their wait time.

#Banking#online payment#payments gateway#online business#contactless#money transfer#digital wallets#customers#merchants#checkout process#credit cards#UPI

0 notes

Text

Crochet Pattern: Rollable Isopuppy (Giant Isopod Dog)

Crochet an isopuppy! As cuddled in Salvage; story and pattern both by me. Whether you’ve read the story or not, treat yourself to a Very Good Dog. You deserve it. <3

>>> Get the pattern here! <<<

[id: Photos of a crocheted isopuppy (giant isopod dog) from various angles. It has the head and tail of a dog, with isopod legs, shell, and antennae. It is a very Good Boi. End id.]

Also that is now my site for patterns, both sewn and crocheted (Dragon Zuko is also up there), so. Subscribe if you're interested in that. If you're interested in my writing, that's at this site. Also I'm on Ravelry now.

>>> Isopuppy Pattern! <<<

#avatar the last airbender#atla#crochet#crocheting#crochetblr#zuko#yarn#yarn crafts#diy craft#the amazing isopuppy#Salvage#please let me know if the checkout process or pattern give you any troubles!#or even if you find any typos#I've used the standard style for amigurumi patterns based on the ones I've followed#but this is my first pattern#so#feedback welcome <3#I can also get up a video of how to do the leg joints if those give people troubles#trust me after you do them fourteen times you'll be an eXpERt#amigurumi#ravelry#isopods#roly poly#isopod

466 notes

·

View notes

Text

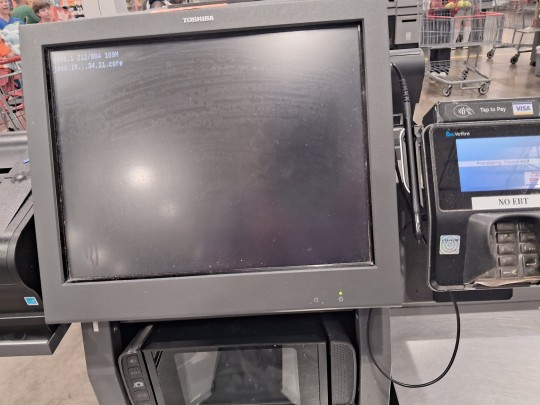

my strongest take is that if you have more than 5-10 items (range depends on size and ease of scanning) you should not use the self-checkout when there is a perfectly good cashier line already.

If you bring alcohol or other age restricted items to the self checkout I will kill you in the middle of the Walmart and everyone behind me in line will be cheering.

#I am genuinely so tired of having like two small items and then having to wait for#Susan who filled two shopping carts with groceries#and Daniel who’s buying several items and waits to scan the six pack last#it’s always white people#if you have several items you can have the cashier scan while you take them out of the cart and someone else bags! It’s faster!#not to mention the fact cashiers will generally override the age check if you’re obviously over 21#self checkout is an express lane it’s not an ‘I’m too good to talk to the cashier’ lane#if I go to the cashier with my bag of chip snack and water I look like a maniac#use the most efficient lanes it’s the grocery store don’t slow the process

109 notes

·

View notes

Text

honestly my level of french as it stands rn is really funny, like 10 years ago (holy shit) (help me) when i was doing it for a levels i was at SUCH a high level, got an A*, could hold entire conversations in french, then i stopped practising and forgot half my vocab but the thing is i still have a really good accent. which means every time i speak to someone in a francophone country i initially fool them into speaking french back to me (massive achievement for an english speaker, makes me insufferably smug every time) by throwing a very native sounding bonjour/bonsoir but if the conversation goes any further we end up playing this insane game of chicken in terms of who's going to give up and switch to english first when we realise i have not actually retained the vocabulary to sustain this level of chat

#last time i flew into nice i hit the guy at passport control with such a convincing bonjour he actually did a double take at my passport#tbf i think it does also help that i just blatantly have awful auditory processing#so i can also just pass for ‘french person who can’t hear for shit’#shoutout to the woman on checkouts at the monaco marché u who RESILIENTLY stuck to french#while i just went HUH? HUH? about five times before figuring out she was asking if i wanted a receipt 😭😭😭

43 notes

·

View notes

Text

im like Stuck between completing like intimate fluff or yet another set of like the most stupid fucking avpol comics known to man and with those two yknow One Isnt Exactly Ever Far Off From The Other but still

#kai talking#the energy i channel into them is. my grocery store runs. the way i feel when im loading dishes and the spatula in the cupboard kept#falling out#the girl from tinder who i hadnt texted back yet and.#she was the cashier at that store which i didnt know and i was. eating deli turkey out of the bag even though#my friends were buying ingredients for. pizza to eat later. and she asked. for my number.#and we saw each other many times and still. keep in touch.#even though her first irl impression of me was me eating deli turkey that i purchased at. the self checkout.#out of the bag and helping put my bffs' groceries in the bag and then she made eye contact with me and Recognized Me#even though in none of my profile pictures am i. eating deli turkey out of the bag.#the energy i put into this couple is the general rancid energy that just Mundane Events In My Life develop through circumstance#and yknow my relationship with the grieving process but literally that isnt fun

8 notes

·

View notes

Text

why did I come here, the internet has gone down like 4 times >:(

#my internet at home is bad but not THIS bad#i was looking at getting fibre bc telus still had ads up for their boxing day sale#but apparently those ads are a lie bc when i went through the checkout process it tried to charge me full price#i do not have 120/month for internet#grrrrrr we need like. federal regulations for internet prices this is nuts

4 notes

·

View notes

Text

not to brag but,

#*t#i still have NO FUCKING IDEA how i snagged these#i think i blacked out during the checkout process#also there was NO dynamic pricing; it was the flat rate#i think the backlash scared the shit out of TM lmao

3 notes

·

View notes

Text

#As part of our work we gave thousands of business unique identity by helping them to create meaningful logo designs for their business. but#Checkout the logo making process of the official Divine tech logo & share your views on it in comment section.#logo#branding#brandingagency#tdt#freelancing#officiallogo#brandingsolution#drawing#art#graphics#socialmediamarketing

2 notes

·

View notes

Text

Why a Fast and Seamless Checkout Process is Crucial for Selling Digital Products

In the digital age, every second counts, especially when it comes to online transactions. For businesses selling digital products, the efficiency of the checkout process can significantly influence consumer behavior and sales outcomes. A fast and secure checkout process not only enhances customer satisfaction but also boosts conversion rates. In this blog, we'll explore why optimizing your checkout payment processor and building a seamless checkout experience are essential strategies for success.

The Importance of Speed in the Checkout Process:

Reduced Cart Abandonment:

Consumers expect immediate results, especially when purchasing digital products like software, ebooks, or media. A slow checkout can lead to frustration and cart abandonment. Studies have shown that even a one-second delay can reduce customer satisfaction by 16%, highlighting the need for a fast and secure checkout process.

Increased Conversion Rates:

A streamlined checkout experience directly correlates with higher conversion rates. By minimizing the number of steps and eliminating unnecessary hurdles, businesses can enhance the efficiency of their transactions, encouraging more users to complete their purchases.

Key Features of a Secure Checkout Process:

Robust Security Measures:

Trust is a critical component of the checkout experience. Ensuring that your checkout payment processor is equipped with advanced security measures like SSL certificates, encryption, and compliance with PCI-DSS standards can reassure customers that their financial information is safe.

Transparent Pricing:

Hidden fees are a major deterrent for online shoppers. Clear communication of all costs—including taxes and any applicable charges—before the final stage of the checkout process can prevent last-minute surprises and foster a better customer relationship.

Building a Seamless Checkout Process:

Simplify the User Interface:

A clean, straightforward checkout page with a logical flow can significantly enhance user experience. Consider features like autofill to reduce the effort required to enter personal and payment details, and ensure your design is mobile-friendly to accommodate the growing number of mobile shoppers.

Multiple Payment Options:

Flexibility in payment methods can cater to a broader audience. Incorporating various payment gateways that include credit cards, PayPal, and emerging payment technologies like Apple Pay or Google Pay can streamline the process further and cater to global customers.

Instant Access to Digital Products:

Unlike physical goods, digital products allow for instant delivery. Once the checkout is complete, ensure that customers can access their purchased digital products immediately. This instant gratification can improve user satisfaction and increase the likelihood of repeat customers.

A fast and secure checkout process is not just a convenience but a necessity in today's digital marketplace. By prioritizing a seamless checkout experience and employing a secure checkout payment processor, businesses can significantly enhance customer satisfaction and boost their sales. Implement these best practices to ensure your digital products are just a quick, secure transaction away from your customers.

Ready to upgrade your digital storefront? Start by evaluating your current checkout process and consider where improvements can be made to speed and security. Remember, every moment counts in securing a sale!

0 notes

Text

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

#FraudAlert

#FraudAlert

#Scammers sophistication technique have reached a new apex#making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been k#Masses are appealing for a more stringent countermeasure to be in place as soon as possible#such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the da#but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris#Several years ago#I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is#representing the poor to medium class and the trending plot of global economic structure just like a triangle.#Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our globa#To make it a little impenetrable and globally under tighter scrutiny#I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobil#the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance#which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also comp#narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding succ#We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the globa#even in the absence of a banking system in their region#they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card o#mobilepaymentgateway#mobiletechnology#mCommerce#onlinefraud#RetinaScan#FraudAlert

0 notes

Text

"Natural glam" "neutral smokey eye" "clean goth" listen I do my makeup to look good in the self checkout camera screen while I put through a dozen eggs as carrots to save £4.72 on groceries

#mine#the thought process behind this oke#is my makeup looked shit in the public bathroom mirror#but great in the cctv screen at the sainsburys seld checkout#so.

0 notes

Text

Ecommerce Growth Strategies: How to Win Users’ Hearts and Wallets?

Explore powerful Ecommerce growth strategies that captivate users' hearts and wallets. Uncover tactics to enhance customer loyalty, boost conversions, and propel your online business to new heights.

#Ecommerce growth#Online business success#Customer loyalty tactics#Boosting conversions#Winning user trust#Digital marketing strategies#Ecommerce trends#User engagement#Conversion optimization#Online shopping experience#Customer satisfaction#Digital storefront strategies#Winning customer hearts#Wallet-friendly ecommerce#Consumer trust-building#Personalized shopping#Seamless checkout process#Ecommerce innovations#Customer retention tactics#Strategic online marketing

0 notes

Text

Had one whole appointment and still,, fucked it up dbdbDBDN

#god#session itself was.. okay but i fucked up the checkout process and didnt have them pay for shipping dhsSHSN

1 note

·

View note

Text

hm,

#it was working just fine until I tried to pay and then it just. went black and started showing different processes it was running (?)#I had to go to a different uh. lane? it's self-checkout so not really but anyway.#thank goodness all I was buying was An box of baklava.

0 notes

Text

to the book that's been languishing in my etsy cart for at least a year I can only offer my sincerest apologies. I love little treats but I hate spending money

#it's called stolen sharpie revolution and (when I finally buy it) I'm gonna get a hardcover for durability#I wait until there's a lot in my cart to go to checkout & then shipping ends up being expensive so I save the most expensive thing for later#and that always ends up being the book because it's $16 plus shipping#it usually takes a little under a year for this process to repeat#mossy’s musings

1 note

·

View note

Text

we have finished with the store and it was tom thumb and listen. listen i need kissies bc im so brave. bc a) new store than usual >:/ b) WHY DO THEIR MACHINES TALK SO MUCH i don't like it

nothing is allowed to change ever and everyone has to ask me how things should be set up actually- /j

#jackals barks#mostly joking anyways#also everyone should. NOT get in the way when we're trying to leave :) and get huffy when im like yeah ik ur going to the self checkout i#AM IN THE PROCESS OF LEAVING#i amn in the process of getting out of your way!!!! fuck off !!!

0 notes