#corporate taxation

Text

All About US Tax Policies in 2024

Navigating the labyrinth of US tax policies in the United States can be daunting. As we move into the 2024-2025 tax years, understanding various tax implications is crucial for individuals, businesses, and government employees alike. This guide delves into specific areas of US tax policy, including taxation on credit cards, insurance, education, businesses, corporate employees, politicians, and government employees.

1. Tax on Credit Cards

1.1 Understanding Credit Card Taxation

Credit card usage itself does not directly incur a tax. However, the rewards and benefits earned from credit card use can have tax implications. For instance, cashback and points received as part of a credit card reward program are typically considered taxable income if they are in the form of cash or redeemable for goods or services.

1.2 Reporting Credit Card Rewards

When it comes to tax reporting, credit card rewards need to be reported if they exceed certain thresholds or if they are converted into cash. The IRS requires you to report these rewards as part of your income, especially if they are considered income rather than a discount.

1.3 Tax Implications for Business Credit Cards

Business credit cards also have tax implications. Expenses charged to business credit cards can often be deducted as business expenses, but it’s crucial to maintain proper documentation and distinguish between personal and business expenses.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

2. Tax on Insurance

2.1 Types of Insurance Taxed

Not all insurance types are taxed. Health insurance premiums paid with pre-tax dollars, such as through an employer-sponsored plan, are generally not subject to federal income tax. However, some types of insurance, such as certain types of annuities, may have tax implications.

2.2 Tax Benefits of Health Insurance

Health insurance can provide several tax benefits. Premiums paid for qualified health insurance plans are often deductible, and Health Savings Accounts (HSAs) offer tax advantages for saving and paying for medical expenses.

2.3 Tax Considerations for Life Insurance

Life insurance policies have different tax implications depending on their type. Generally, death benefits are not subject to federal income tax, but certain aspects of life insurance policies, like cash value accumulation, might be taxable.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

3. Tax on Education

3.1 Tax Deductions for Education Expenses

Education-related US tax deductions can provide significant relief. The IRS offers deductions for qualified tuition and related expenses under the American Opportunity Credit and Lifetime Learning Credit. These deductions can help reduce taxable income and provide financial relief for educational pursuits.

3.2 Tax Credits for Student Loan Repayments

Student loan repayments also come with US tax benefits. The Student Loan Interest Deduction allows taxpayers to deduct interest paid on qualified student loans, which can be beneficial for those struggling with student debt.

3.3 Impact of Education Savings Plans

Education savings plans like 529 plans offer tax advantages for saving for education expenses. Contributions to these plans may be tax-deductible, and earnings grow tax-free if used for qualified educational expenses.

4. Tax on Businesses

4.1 Corporate Tax Rates

Corporations are subject to federal income US tax rates that vary depending on their income levels. The Tax Cuts and Jobs Act of 2017 lowered the corporate tax rate to a flat 21%, which applies to most corporations.

4.2 Deductions and Credits for Businesses

Businesses can benefit from various deductions and credits, such as those for business expenses, research and development, and energy-efficient investments. Understanding these can help businesses reduce their tax liability.

4.3 Taxation of Different Business Entities

Different business entities, such as sole proprietorships, partnerships, and corporations, face varying tax treatments. Each type has its own tax obligations and benefits, which can impact how businesses plan and report their taxes.

5. Tax on Corporate Employees

5.1 Income Tax for Corporate Employees

Corporate employees, like all other employees, are subject to federal income tax based on their earnings. Employers withhold taxes from paychecks, which are then reported on W-2 forms.

5.2 Benefits and Perquisites Taxation

Corporate benefits, such as health insurance and retirement plans, are generally tax-free. However, certain perks and benefits, like company cars or bonuses, might be subject to taxation.

5.3 Tax Implications of Stock Options

Stock options granted to corporate employees can have significant tax implications. Depending on the type of stock option (incentive stock options vs. non-qualified stock options), the timing and amount of tax owed can vary.

You can check the US official laws: Corporate Tax Laws and Regulations | USA

6. Tax on Politicians

6.1 Salary and Compensation Taxation

Politicians’ salaries are subject to federal income tax just like any other salary. However, they might have unique reporting requirements for additional forms of compensation or benefits.

6.2 Reporting of Gifts and Benefits

Politicians often receive gifts or benefits, which must be reported according to federal regulations. Gifts valued over a certain amount must be disclosed to ensure transparency and avoid conflicts of interest.

6.3 Special Tax Rules for Politicians

There are specific tax rules and reporting requirements for politicians, especially concerning campaign contributions and expenses, which differ from standard tax regulations.

Suggested Articles: Brightway Credit Card in the US 2024 | United State Cards

7. Tax on Government Employees

7.1 Income Tax and Benefits

Government employees are subject to federal income tax on their earnings. Benefits provided, such as retirement contributions, are often tax-deferred until they are withdrawn.

7.2 Tax Deductions Specific to Government Jobs

Certain deductions might be available for government employees, such as those related to uniforms or home office expenses, depending on job requirements.

7.3 Retirement Benefits Taxation

Retirement benefits for government employees, including pensions and other retirement plans, are subject to specific tax rules. Generally, contributions to these plans are made with pre-tax dollars, and taxes are owed upon withdrawal.

Conclusion

Understanding US tax policies is essential for navigating financial responsibilities and optimising tax benefits. Whether it’s credit card rewards, insurance premiums, educational expenses, or business deductions, knowing the specifics can lead to better financial planning and compliance. Stay informed and consult with a tax professional to ensure accurate reporting and take full advantage of available tax benefits.

By Paisainvests.com

#Business Tax Policies#Corporate Taxation#Government Tax Policies#Tax Changes 2024#Tax Compliance US#Tax Policies 2024#US Tax Policies#US Tax Slabs 2024#US Tax System#US Taxation Rules

0 notes

Text

FAQs about Foreigners and NRIs Forming Companies in India

Incorporating a company in India can be an exciting venture for foreigners or Non-Resident Indians (NRIs) looking to tap into the vast potential of the Indian market. However, navigating the legal and regulatory landscape can be daunting. To help clarify common queries, we’ve compiled a list of frequently asked questions (FAQs) on the incorporation of a company in India by foreigners or NRIs.

1.…

View On WordPress

#corporate taxation#entrepreneurship#finance#foreigner incorporation#india#Legal Requirements#legal support#news#real-estate

0 notes

Text

Businesses and individuals alike seek professionals who can navigate the intricacies of accounting, taxation, and financial planning with precision and expertise. In Preston, the quest for the best accountant is a crucial one, requiring an understanding of the diverse range of financial accounting services available and the qualities that distinguish top-tier professionals.

Understanding the Landscape of Financial Services in Preston

In Preston, a variety of financial services cater to the diverse needs of businesses and individuals. From traditional accounting firms to specialized taxation services, the options are abundant. Accountant Preston is a term that encompasses a broad spectrum of professionals who offer services ranging from basic bookkeeping to complex financial analysis and strategic planning.

#accounting specialists#accounting services#preston accountant#accounting in prestion#best accountant in preston#financial tax advisory#atol consultation#corporate taxation#personal tax advice

0 notes

Text

#corporate tax in uae#corporate tax#corporate tax in dubai#corporate taxation#taxation in uae#taxation in dubai#corporate taxation in uae

0 notes

Text

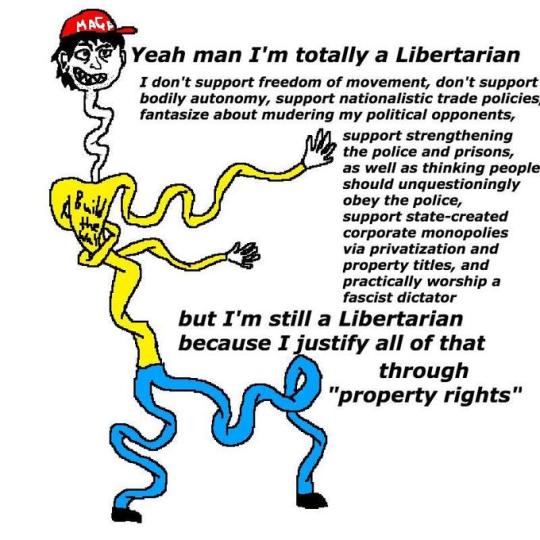

#us politics#lolbertarians#taxation is theft and other lies by lolbertarians#fuck libertarians#libertarians be like#libertarians#conservatives#memes#shitpost#bootlickers#freedom of movement#bodily autonomy#nationalistic trade policies#political violence#fascist police state#deregulation#deregulate deez nutz#corporate monopolies#privatization#property rights

489 notes

·

View notes

Text

People always say “who is going to pay for it?” as if it’s some profound “gotcha!”

The rich. The rich can pay for it. They did in the past and they can do it again.

In the 1930s and 1940s the United States was facing a debt crisis much like todays. The government was running out of money coming out of the Great Depression and going into World War 2, and the economy wasn’t doing too well. Everything was falling apart, much like it is now. What was the solution?

And it worked. The US working middle class and the economy did awesome well through the 50s and 60s. The working middle class was wealthier than ever before and wealthier than it’s ever been. Regular people like you and me. Public infrastructure flourished. States had the budgets to build free colleges. College used to be free by the way. It wasn’t until Ronald Reagan’s advisors warned him how “dangerous” an “educated proletariat” was (those are his words), that major universities started to see cuts in public funding and had to start charging tuition.

Today, the top 1% is only taxed at 43% and has been dropping since Ronald Reagan’s presidency. Reagan also set the precedent of ignoring labor and union rights, violating both domestic (NLRA, Wagner Act) and international (United Nations bill of rights) law. This too has only ever been made worse by Republican policy as time has gone on with yet more tax cuts for the wealthy. Look up the actual policies. Don’t take a politicians word, read their actual policy. They will and do lie to you.

Do y’all understand now why the US debt is going up so fast? It’s because Trump cut that tax rate even more, amassing a whopping 20% of our current total national debt within only 4 years. The debt ceiling was raised THREE TIMES during Trump’s presidency, the uppermost tax bracket was cut even more, and massive corporate bailout loans were forgiven. Research the PPE loans. This has been Republican policy for 40+ years.

The systemic deconstruction of the middle class and the government in favor of corporate control. We are living in a repeat of the Gilded Age of the Industrial Revolution. The railroads and the banks own and control everything, including the government.

These are facts. Read it in any history book.

Or you can just ban those books too and pretend it didn’t happen. That would be a mistake though.

If you wanna know how our economy has REALLY been doing for the last 40 years, I suggest looking into the Economic Policy Institute. Or ask any working class American how they have been doing lately, especially those of us who are young, trying to make it.

Our current struggle is not caused by the “Woke Mob” as propaganda outlet Fox News will tell you.

(Do any of you even know what “woke” means? It means you are aware and attentive to the fact that systematic societal issues and flaws exist. Wether it be race issues, income issues, whatever. Being “woke” literally means you’re not a sheep who follows along anything that the media and government tell you. Thats what it means. Literally look it up. I grew up as this word came to popularity. It’s been around for a very long time. The GOP is taking advantage of the fact that you don’t know what it is, and using it as a fear mongering tactic to channel your anger at your neighbor instead of the corporations pulling the strings. It is corporate propaganda).

Our current struggle is caused by the class warfare waged by corporate scum as they buy all of our politicians in return for bailing out the government’s debt. Both left and right, our politicians have been bought. None of them work for you. They work for the big corporations lining their pockets through unlimited lobbying.

So, when y’all say “I don’t wanna pay for it”- don’t worry, you aren’t going to be paying for it. The middle class will not be paying for it. The multi-billionaire corporations stealing your labor will be paying for it. The rich goons who increase the price of your groceries and lay you off all in the name of making a few extra bucks will be paying for it.

Do some research and you’ll see exactly why and when we got into this mess.

It’s not that complicated. It really isn’t.

Tax. The. Rich.

#anti capitalism#capitalism#eat the rich#eat the 1%#tax the 1%#tax the rich#die corpo scum#end corporate lobbying#politics#economy#economics#taxes and taxation#wealth redistribution#socialism#woke agenda#wokity wokity woke#woke mob#reaganomics#ronald reagan#FDR#recession#working class#class war#capitalism sucks#corporations aren’t people

56 notes

·

View notes

Text

Navigate GST notices with ease. GST Ka Notice offers expert services for responding to all types of GST notices. Get professional help today!

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

2 notes

·

View notes

Text

#business#law and legal system#legal advice#lawyer#legal service#law firm in chandigarh#top law firms in chandigarh#best law firm in chandigarh#corporate law firms in chandigarh#business consultants in chandigarh#business setup services in chandigarh#ipr law firms in chandigarh#taxation law firms in chandigarh#labour law firms in chandigarh#immigration law firms in chandigarh#law firms in mohali#property law firms in mohali#law firms in panchkula#law firm zirakpur

2 notes

·

View notes

Text

Yeah I believe in democracy… but America IS NOT and HAS NEVER been a true democracy

Democracy isn’t the problem… the American government is

#us politics#democracy#immigrants without citizenship are required to pay taxes#but can’t vote#sounds like taxation without representation to me#and don’t get me started on gerrymandering#and corporate influence

3 notes

·

View notes

Quote

Mishra added that India’s taxation policy is partly to blame. “Taxation policy is a major reason for inequality in India. It is harsher on the poor than the rich.” India used to have a wealth tax, but it was abolished by the government in 2015. This is despite the country having more than 142 billionaires. The Indian government also slashed its corporate tax in 2019 which led to a financial loss of nearly $ 22 million in two years.

Srishti Jaswal, ‘This Country Has 70 New Millionaires Every Day. Why Is it Among the World’s Hungriest?’, VICE

#VICE#Srishti Jaswal#Pravas Ranjan Mishra#taxation policy#India#income inequality#wealth tax#Government of India#corporate tax

5 notes

·

View notes

Text

Tax Calc Estimator for Business

Calculate an estimate taxation obligation based on the legal form of business (Sole Proprietor, Partnership, Corp, S-Corp, or LLC)

This packet of information will give you a better understanding of your options for forming your Legal Business Structure. Use the Tax Estimator to determine your potential taxation based on the type of business you have: Sole Proprietorship, Inc, Corp, LLC, S-Corp, C-Corp, and others.

Consult your Attorney or CPA before making a final decision about your Legal Business Structure.

Included in this download are:

Tax Estimator by Business Entity

Legal Guideline Checklist

Legal Structure Comparison Chart

Non-Profit Guideline

State Licensing Links

VIDEO TUTORIAL for further explanation

**NOTE: If you are already planning your new business using NOBOSS Workshops, this document is already included.

#tax#taxation#legal structure#licensing#license#LLC#INC#incorporate#incorporation#incorporating#corp#sole proprietor#partnership#corporation#s corp#s-copr#c-corp#s-corp

5 notes

·

View notes

Text

Corporate Tax in UAE

On January 31, 2022, the Ministry of Finance of the United Arab Emirates (UAE) announced the introduction of a federal Corporate Tax (“CT”) on business profits, effective from the financial year beginning June 1, 2023. Pursuant to the aforementioned announcement, the Ministry of Finance published a consultation document to collect and appraise the responses of stakeholders (“Consultation Document”) with regard to the most prominent features of the legislation and its implementation, ahead of the release of the draft CT legislation.

If you want to know more about corporate tax in UAE you can contact us at +971526406240 or can visit our website at corporate tax in UAE

Visit at: - https://www.mbgcorp.com/ae/taxation/direct-taxes/corporate-tax-in-uae/

#Corporate Tax in UAE#Corporate Tax#Company tax in UAE#taxation in uae#direct tax in uae#direct taxation in uae

2 notes

·

View notes

Text

Efficient Tax Solutions with a Tax Accountant Hornsby

When managing your business finances, a reliable tax accountant in Hornsby can be your greatest ally. A professional tax accountant Hornsby service ensures compliance with the latest tax regulations, making tax season a breeze. They specialize in tailored tax accounting for small businesses, helping you maximize your deductions and reduce liabilities. Their comprehensive tax accounting services cover everything from individual tax returns to business tax planning. By choosing an experienced tax accountant Hornsby-based, you secure peace of mind knowing that your finances are in good hands. Let a tax accountant Hornsby handle your taxes efficiently, giving you more time to focus on growing your business.

#tax accountant hornsby#tax accounting for small business#tax accounting services#corporate bookkeeping#taxation services#taxation advisor

0 notes

Text

Corporate tax in UAE On January 31, 2022, the Ministry of Finance of the United Arab Emirates (UAE) announced the introduction of a federal Corporate Tax (“CT”) on business profits, effective from the financial year beginning June 1, 2023. If you want to know more about corporate tax you can simply contact us our corporate tax expert team will tell you everything about corporate tax. Contact us at +971526406240 or visit our website at Corporate Tax in UAE

Visit at: - https://www.mbgcorp.com/ae/taxation/direct-taxes/corporate-tax-in-uae/

#corporate tax in uae#corporate tax#corporate tax in dubai#corporate taxation#direct taxation#direct tax advisory services

0 notes

Text

Ready Accountant empowers individuals in Kolkata and Howrah to excel in accounting careers through practical, industry-aligned courses. Their curriculum, designed by seasoned instructors, covers essential subjects like financial analysis, budgeting, and taxation, preparing students for real-world challenges. Located conveniently near Shyama Prasad Mukherjee Road, Ready Accountant offers job-ready short courses, including an accounting course with placement, ensuring you are job ready in 6 months. They also provide online courses with placement guarantee, SAP FICO course with placement, and job-ready IT courses, such as Salesforce job guarantee courses, to help both beginners and professionals advance their skills.

0 notes