#data click

Explore tagged Tumblr posts

Text

Rakie Ayola as Persephone Nabhaan Rizwan as Dionysus Kaos (2024–)

#kaos#kaos netflix#kaos spoilers#dionysus kaos#persephone kaos#dennis kaos#rakie ayola#nabhaan rizwan#cw death#grief#gif#click to enlarge#ye it's not ramon but it's from a show he's in#so i post on this blog#i had to make the gifs small bc i couldn't get full size ones to fit within the tumblr data limits#too many colours

1K notes

·

View notes

Text

Shifting $677m from the banks to the people, every year, forever

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

"Switching costs" are one of the great underappreciated evils in our world: the more it costs you to change from one product or service to another, the worse the vendor, provider, or service you're using today can treat you without risking your business.

Businesses set out to keep switching costs as high as possible. Literally. Mark Zuckerberg's capos send him memos chortling about how Facebook's new photos feature will punish anyone who leaves for a rival service with the loss of all their family photos – meaning Zuck can torment those users for profit and they'll still stick around so long as the abuse is less bad than the loss of all their cherished memories:

https://www.eff.org/deeplinks/2021/08/facebooks-secret-war-switching-costs

It's often hard to quantify switching costs. We can tell when they're high, say, if your landlord ties your internet service to your lease (splitting the profits with a shitty ISP that overcharges and underdelivers), the switching cost of getting a new internet provider is the cost of moving house. We can tell when they're low, too: you can switch from one podcatcher program to another just by exporting your list of subscriptions from the old one and importing it into the new one:

https://pluralistic.net/2024/10/16/keep-it-really-simple-stupid/#read-receipts-are-you-kidding-me-seriously-fuck-that-noise

But sometimes, economists can get a rough idea of the dollar value of high switching costs. For example, a group of economists working for the Consumer Finance Protection Bureau calculated that the hassle of changing banks is costing Americans at least $677m per year (see page 526):

https://files.consumerfinance.gov/f/documents/cfpb_personal-financial-data-rights-final-rule_2024-10.pdf

The CFPB economists used a very conservative methodology, so the number is likely higher, but let's stick with that figure for now. The switching costs of changing banks – determining which bank has the best deal for you, then transfering over your account histories, cards, payees, and automated bill payments – are costing everyday Americans more than half a billion dollars, every year.

Now, the CFPB wasn't gathering this data just to make you mad. They wanted to do something about all this money – to find a way to lower switching costs, and, in so doing, transfer all that money from bank shareholders and executives to the American public.

And that's just what they did. A newly finalized Personal Financial Data Rights rule will allow you to authorize third parties – other banks, comparison shopping sites, brokers, anyone who offers you a better deal, or help you find one – to request your account data from your bank. Your bank will be required to provide that data.

I loved this rule when they first proposed it:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

And I like the final rule even better. They've really nailed this one, even down to the fine-grained details where interop wonks like me get very deep into the weeds. For example, a thorny problem with interop rules like this one is "who gets to decide how the interoperability works?" Where will the data-formats come from? How will we know they're fit for purpose?

This is a super-hard problem. If we put the monopolies whose power we're trying to undermine in charge of this, they can easily cheat by delivering data in uselessly obfuscated formats. For example, when I used California's privacy law to force Mailchimp to provide list of all the mailing lists I've been signed up for without my permission, they sent me thousands of folders containing more than 5,900 spreadsheets listing their internal serial numbers for the lists I'm on, with no way to find out what these lists are called or how to get off of them:

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

So if we're not going to let the companies decide on data formats, who should be in charge of this? One possibility is to require the use of a standard, but again, which standard? We can ask a standards body to make a new standard, which they're often very good at, but not when the stakes are high like this. Standards bodies are very weak institutions that large companies are very good at capturing:

https://pluralistic.net/2023/04/30/weak-institutions/

Here's how the CFPB solved this: they listed out the characteristics of a good standards body, listed out the data types that the standard would have to encompass, and then told banks that so long as they used a standard from a good standards body that covered all the data-types, they'd be in the clear.

Once the rule is in effect, you'll be able to go to a comparison shopping site and authorize it to go to your bank for your transaction history, and then tell you which bank – out of all the banks in America – will pay you the most for your deposits and charge you the least for your debts. Then, after you open a new account, you can authorize the new bank to go back to your old bank and get all your data: payees, scheduled payments, payment history, all of it. Switching banks will be as easy as switching mobile phone carriers – just a few clicks and a few minutes' work to get your old number working on a phone with a new provider.

This will save Americans at least $677 million, every year. Which is to say, it will cost the banks at least $670 million every year.

Naturally, America's largest banks are suing to block the rule:

https://www.americanbanker.com/news/cfpbs-open-banking-rule-faces-suit-from-bank-policy-institute

Of course, the banks claim that they're only suing to protect you, and the $677m annual transfer from their investors to the public has nothing to do with it. The banks claim to be worried about bank-fraud, which is a real thing that we should be worried about. They say that an interoperability rule could make it easier for scammers to get at your data and even transfer your account to a sleazy fly-by-night operation without your consent. This is also true!

It is obviously true that a bad interop rule would be bad. But it doesn't follow that every interop rule is bad, or that it's impossible to make a good one. The CFPB has made a very good one.

For starters, you can't just authorize anyone to get your data. Eligible third parties have to meet stringent criteria and vetting. These third parties are only allowed to ask for the narrowest slice of your data needed to perform the task you've set for them. They aren't allowed to use that data for anything else, and as soon as they've finished, they must delete your data. You can also revoke their access to your data at any time, for any reason, with one click – none of this "call a customer service rep and wait on hold" nonsense.

What's more, if your bank has any doubts about a request for your data, they are empowered to (temporarily) refuse to provide it, until they confirm with you that everything is on the up-and-up.

I wrote about the lawsuit this week for @[email protected]'s Deeplinks blog:

https://www.eff.org/deeplinks/2024/10/no-matter-what-bank-says-its-your-money-your-data-and-your-choice

In that article, I point out the tedious, obvious ruses of securitywashing and privacywashing, where a company insists that its most abusive, exploitative, invasive conduct can't be challenged because that would expose their customers to security and privacy risks. This is such bullshit.

It's bullshit when printer companies say they can't let you use third party ink – for your own good:

https://arstechnica.com/gadgets/2024/01/hp-ceo-blocking-third-party-ink-from-printers-fights-viruses/

It's bullshit when car companies say they can't let you use third party mechanics – for your own good:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

It's bullshit when Apple says they can't let you use third party app stores – for your own good:

https://www.eff.org/document/letter-bruce-schneier-senate-judiciary-regarding-app-store-security

It's bullshit when Facebook says you can't independently monitor the paid disinformation in your feed – for your own good:

https://pluralistic.net/2021/08/05/comprehensive-sex-ed/#quis-custodiet-ipsos-zuck

And it's bullshit when the banks say you can't change to a bank that charges you less, and pays you more – for your own good.

CFPB boss Rohit Chopra is part of a cohort of Biden enforcers who've hit upon a devastatingly effective tactic for fighting corporate power: they read the law and found out what they're allowed to do, and then did it:

https://pluralistic.net/2023/10/23/getting-stuff-done/#praxis

The CFPB was created in 2010 with the passage of the Consumer Financial Protection Act, which specifically empowers the CFPB to make this kind of data-sharing rule. Back when the CFPA was in Congress, the banks howled about this rule, whining that they were being forced to share their data with their competitors.

But your account data isn't your bank's data. It's your data. And the CFPB is gonna let you have it, and they're gonna save you and your fellow Americans at least $677m/year – forever.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/11/01/bankshot/#personal-financial-data-rights

#pluralistic#Consumer Financial Protection Act#cfpa#Personal Financial Data Rights#rohit chopra#finance#banking#personal finance#interop#interoperability#mandated interoperability#standards development organizations#sdos#standards#switching costs#competition#cfpb#consumer finance protection bureau#click to cancel#securitywashing#oligarchy#guillotine watch

466 notes

·

View notes

Text

hi everyone! i'm writing a research based essay on the popularity of queer tragedies in the market today for my creative writing masters and it would be a huge help if you could fill this out! it's very quick, shouldn't take more than five minutes to complete the eight multiple choice questions and it's all based on preference/opinion, so nothing too taxing to think about. every response is a huge help for me, so signal boosts would be really appreciated! thank you <3

#sjlwrites#every response means more data for me to analyse which means more depth to my analysis which gets me closer to a distinction!#so pretty please take five minutes out of your day to click a couple of boxes :))))#for uni

151 notes

·

View notes

Text

Q-pid B-plot; Geordi la Forge and Data adventure

#A quick drawing I made for funnies#I love it when people have fun :)#star trek#tng#star trek tng#geordi la forge#geordi tng#star trek geordi#data soong#data star trek#data tng#silly#fanart#daforge#<- My heart and soul#click for better quality

191 notes

·

View notes

Photo

Martian Successor Nadesico: The Blank of 3 Years (Nexus Interactive / Sega - Sega Saturn - 1998)

#機動戦艦ナデシコ#Martian Successor Nadesico#The Blank of 3 Years#DATA#Fupac#Sega#Sega Saturn#click hyperlink for play#visual novel

34 notes

·

View notes

Text

the pronunciation of "Data"

Star Trek TNG: The Child

#data soong#star trek tng#ep: the child#dat4L0re gifs#dr pulaski#katherine pulaski#i remade this gifset#i think it's easier to read now#click to enlarge slightly

625 notes

·

View notes

Text

Ok so I think the reason why I'm finding tmagp creepier than tma is the fact that I can so easily imagine someone going insane over terrible IT

#the setting is so well established#the sound effects of the computers booting up#and the tapping of the keys#i can just so easily imagine someone sitting at a shitty old computer#clicking away doing bory data entry#only lit by the yellowish glow of the screen#SO MANY THINGS could go wrong#honestly#tmagp#the magnus protocol#tmagp vague

318 notes

·

View notes

Text

indeed my exact process once every 8 months or so

#I just thought today of a new way to format a 'profile' (like the descriptions of self that people use on friend meeting#apps and stuff) and how to organize the sections so that it seems such and such a way and oh what if there's links which click off#into branching paths so it's very acessible and there are two different forms depending on so on and so forth#and i was like 'um.. wow. amazing idea. this will be soooo aweseome and will definitely work' but then .. you know...self reflection#lol.. is this just like the millions of other iterations of a similar thing? No.. This Is Different ... Surely...#Though if I had a millionaire friend and a few people who do the type of coding you use for web design stuff and etc..#I could create the most elaborate detailed and amazing platonic friend seeking (and I guess you could also have 'dating' as an option#since that would draw in more of a crowd) website on the earth.. the new okcupid (back when okcupid didn't suckishly abandon their#whole format in hopes of trying to become just like tinder or whatever and they actually had like tons of info and percentages and#open answer questions and would list personality traits on a profile (like 'this person is more Open To New Expereinces than 65% of#other users' etc.). etc. etc. Oh what a beautiful thing I could craft for the detail freaks of the world.... Alas...#unfortunately we seem to be in an oversimplification era.. everything in short quick bites. everything on a tiny phone screen. etc.#marketing 'Introducing The Most Complicated Data Heavy Social Connection Site In The World' would not sell well I'd imagine gjhgjh#AANYWAY.. also no idea why the representation of me is in a turtle neck. what a bold fashion choice..#In another moment of self reflection.. the fact that in the first tag on this post I felt the need to define the word 'profile' just to be#specific as if people couldn't tell from context.. so clearly someone who finds filling out forms a 'fun afternoon activity' lol#the type of guy who finds psych evaluations and pop quizzes and making chore lists mostly enjoyable (< true)

48 notes

·

View notes

Text

Big fan of @wouldyoufuckthisfurry, so here's an impromptu chart of the furries thus far!

Data disclaimer: this chart contains both ongoing polls and completed polls, and compares the two indiscriminately

#shitposting#196#data analytics#furry#furries#would you fuck this furry#you _should_ be able to click the image to read text more clearly#I put all the originating media in the alt text#so if you're confused about the character named “The Cow”#check the image description

31 notes

·

View notes

Text

the Flesh and the Machine.

24 notes

·

View notes

Text

ALL CAUGHT UP ON BIRD DATA, CAN I GET A HELL YEAH

#text#personal#birds#tree swallows#collapses over finish line#*finish line of two months of data for 14 boxes lmao#it's much quicker to do them in batches i think#because it's just bam bam bam text ENTERED pics UPLOADED all GO GO GO#vs doing it a week at a time is a zillion more clicks per session#although now that we're getting near Fledge Hours probably i should do them one at a time again#easier to summarize attempts not in batches

12 notes

·

View notes

Text

TRIAL OF HEARTS: SOLVE THE MURDER/ACCIDENT/SUICIDE OF YOUR FRIEND/ACQUAINTANCE/ENEMY— OR DON’T. THAT’S YOUR PROBLEM. MAKE BETTER FRIENDS, TASTE GREAT FOODS, COMMIT FOUL CRIMES. EXPLORE THE LUSH CAMPUS OF BLUE IVY AND DISCOVER WHAT LIES UNDERNEATH THE GLOSSY VENEER OF SOCIETY. DISCOVER THE SOCIETY. SABOTAGE/BEFRIEND ANYONE WHO GETS IN YOUR WAY.

#click 4 better res<3#fuck me i forgot how much i hate using photoshop!!!! illustrator im sorry im coming home baby#idk if this was fueled by the autism or the adhd but me thinking abt nico shivers got way outta hand#also YES maz is the create ur own. diy urself a baby boy#im so sorry theres only 1 lucia one but i just could not my ass BURNT OUT!!!!!!#i have so many data reports due on monday....... whoops#i. edits#mine

13 notes

·

View notes

Note

hey what if in the acid pit scene in junk yard dog KITT was still checking how Michael was doing because he was showing signs of distress

Aough. Thinking about him monitoring Michael's vitals and such via the comlink specifically. I'll be real I don't remember if it even works like that but I don't care. "I need your help and am calling out for you and doing the closest thing I can to physically making contact (essentially grabbing at your wrist) but neither of us can actually do anything and the only thing my readings are telling me is that you're just as scared about it as I am." OKAY!!!!!

#considering it...... considering it.........#nodding sagely.......#personally I can't imagine him Saying anything about it in the moment. he was too deep in ''desperately crying out for help'' mode#my extant hc about that scene is that Literally the only thing he Could do was call for help bc the fear overrode every other program#hence why he didn't even TRY to use any of his abilities that don't require a driver#(which is kinda just me fixing a minor plothole by making it angsty instead. but also I do 1000% believe it)#(that may have even been the intent tbh)#but he absolutely absolutely absolutely could've still been monitoring him. probably was. almost certainly was.#godddddd. orz#IF he hadn't been rebuildable... the last impression he would've had of michael would've been hard data on him freaking the fuck out#and he would've been thinking about THAT at the same time as he was freaking the fuck out over his OWN predicament#bc he is programmed to (and wants to) ALWAYS factor michael into the equation no matter what#and he does NOT want michael to be feeling like that because of him. it makes him feel so guilty (<- another extant hc of mine)#OKAY!!!!!!!!!!#asks#kr#the poss posts#anyway hiiiiiii anon. making kitty clicking noises to call more kr anons to me. c'mere. let's all play toys.#knight rider

17 notes

·

View notes

Text

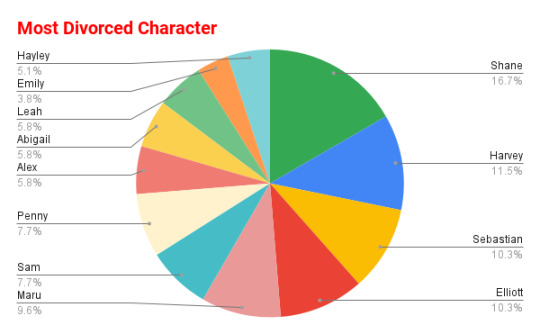

🎊 Congrats to Shane for being the most divorced! 🎊 (this is all for fun, shane is very beloved and my sample size was v small so could be innacurate and definitley shouldn't be used as fact)

#adjusting for sample size and the fact a lot of people messaged me about others they couldn't vote for#as well as a lot of innocent maru button clickers who didn't read before they clicked this is the data#thank u i had fun#sdv#stardew valley

51 notes

·

View notes

Text

Star Trek: The Next Generation - A Final Unity. Spectrum Holobyte - 1995.

#star trek#the next generation#tng#pc#cd-rom#adventure#point and click#gene roddenberry#spectrum holobyte#jean-luc picard#will riker#data#worf#geordi la forge#deanna troi#beverly crusher#enterprise-d#90s

8 notes

·

View notes

Text

Has ao3 always said this and I’ve just never paid attention lmao why does it sound so scary

19 notes

·

View notes