#digital lending

Text

Big Media’s lobbyists have been running a smear campaign trying to paint the Internet Archive as a greedy big tech operation bent on stealing books—which is totally absurd. If you’ve ever used the WayBack Machine, listened to their wonderful archives of live music, or checked out one of their 37 million texts, it’s time to speak up. On March 20, everyone is showing their support for the Internet Archive during oral arguments.

Here's how you can help:

The Internet Archive is our library, a massive collection of knowledge and culture accessible to anyone with an internet connection. Don't let greedy publishers burn down the next Library of Alexandria!

And if you're absolutely certain you don't use or need the Internet Archive, take a look at their projects first, you might be surprised. Those are all at risk too.

#internet archive#open library#libraries#digital lending#digital rights for libraries#digitalrightsforlibraries#hachette v internet archive

7K notes

·

View notes

Text

So glad to finally see some momentum building to push back against ebook pricing models for libraries. I wish it didn't take huge libraries throwing around "we have millions of dollars" to give us any hope of change, but such is life.

I was in charge of ebook and e-audio purchasing for a small library several years ago, and can remember when they started phasing out their "one copy/one user" perpetual licensing model for popular titles. It seems the leasing model has only gotten more predatory since I left that role. Back in my day we could choose to pay a little less (but still a lot, maybe $30) for the metered access licenses, and the OC-OU licenses were the really extortionate ones but hey, as long as they continue to host that title on their platform your patrons can access it.

#librarian#libraries#public libraries#support libraries#library#public library#ebooks#digital lending#digital publishing

17 notes

·

View notes

Text

The Internet Archive, Misinformation & the Problem of Digital Lending

I am in the embarrassing situation of having reblogged a post with misinformation. Specifically, the "Save the Internet Archive" post featuring the below image and its associated link to a website called "Battle for Libraries".

The post claims that the recent lawsuit the IA faced threatened all IA projects, including the Wayback Machine, which is not true. The link to a petition to "show support for the Internet Archive, libraries’ digital rights, and an open internet with uncensored access to knowledge" only has one citation, which is the internet archive's own blog.

After looking for more context, I found that even articles published from sources I trusted didn't seem to adequately cover the complexity of what is going on. Here's what I think someone who loves libraries but is hazy about copyright law and the digital lending world should know to understand what happened and why it matters. I am from the U.S., so the information below is specifically referring to laws protecting American public libraries. I am not a librarian, author or copyright lawyer. This is a guide to make it easier to follow the arguments of people more directly invested in this lawsuit, and the potential additional lawsuits to come.

Table of Contents:

First-Sale Doctrine & the Economics of E-books

Controlled Digital Lending (CDL)

The “National Emergency Library” & Hachette v. Internet Archive

Authors, Publishers & You

-- Authors: Ideology v. Practicality

-- Publishers: What Authors Are Paid

-- You: When Is Piracy Ethical?

First-Sale Doctrine & the Economics of E-Books

Libraries are digitizing. This is undisputed. As of 2019, 98% of public libraries provided Wi-Fi, 90% provided basic digital literacy programs, and most importantly for this conversation, 94% provided access to e-books and other digital materials. The problem is that for decades, the American public library system has operated on a bit of common law exhaustion applied to copyright known as first-sale doctrine, which states:

"An individual who knowingly purchases a copy of a copyrighted work from the copyright holder receives the right to sell, display or otherwise dispose of that particular copy, notwithstanding the interests of the copyright owner."

With digital media, however, because there isn't a physical sale happening, first sale doctrine doesn't apply. This wasn't a huge problem back in the early 2010s when most libraries were starting to go digital because the price of a perpetual e-book license was only $14 -- about the price of single physical book. Starting in 2018, however, publishers started limiting how long a single e-book license would last. From Pew Charitable Trusts:

"Today, it is common for e-book licenses from major publishers to expire after two years or 26 borrows, and to cost between $60 and $80 per license, according to Michele Kimpton, the global senior director of the nonprofit library group LYRASIS... While consumers paid $12.99 for a digital version, the same book cost libraries roughly $52 for two years, and almost $520 for 20 years."

Publishers argue that because it's so easy to borrow a digital copy of a book from the library, offering libraries e-book licenses at the same price as individual consumers undermines an author's right to license and profit from the exclusive rights to their works. And they're not entirely wrong about e-book lending affecting e-book sales -- since 2014, e-book sales have decreased while digital library lending has only gone up. The problem, they say, is that e-book lending is simply too easy. Whereas before, e-book sales were competing with the less-convenient option of going to the library and checking out a physical copy, there is essentially no difference for the reader between buying or lending an e-book outside of its cost.

Which brings us to the librarians, authors and lawmakers of today, trying to find any solution they can to make digital media accessible, affordable and still profitable enough to make a livable income for the writers who create the books we read.

Further Reading:

1854. Copyright Infringement -- First Sale Doctrine

The surprising economics of digital lending

Librarians and Lawmakers Push for Greater Access to E-Books

Publishing and Library E-Lending: An Analysis of the Decade Before Covid-19

Controlled Digital Lending (CDL)

Controlled digital lending is a legal theory at the heart of the Internet Archive lawsuit that has been proposed as one solution to the economic issue with digital media lending. This quick fix is especially appealing to nonprofits like the IA that are not government, tax-funded programs. Where many other solutions, like a legally enforced max price on e-book licensure for public libraries, would not apply to the IA, CDL would essentially be manipulating copyright law itself as a way to avoid e-book licensure altogether and would apply to the IA as well as public libraries.

Essentially, proponents of CDL argue that through a combination of first-sale and fair use doctrine, it can be legal for libraries to digitize the physical copies of books they have legally paid for and loan those digital copies to one person at a time as if they were loaning the original physical copy.

It is worth noting that the first-sale doctrine protecting physical media lending at public libraries does not cover reproductions:

“The right to distribute ends, however, once the owner has sold that particular copy. See 17 U.S.C. § 109(a) & (c). Since the first sale doctrine never protects a defendant who makes unauthorized reproductions of a copyrighted work, the first sale doctrine cannot be a successful defense in cases that allege infringing reproduction.”

This is where fair use comes in, which allows some flexibility in copyright law for nonprofit educational and noncommercial uses. Because the IA and other online collections are nonprofit organizations, proponents of CDL argue that they are covered by fair use so long as their use of CDL follows very specific rules, such as:

A library must own a legal copy of the physical book, by purchase or gift.

The library must maintain an “owned to loaned” ratio, simultaneously lending no more copies than it legally owns.

The library must use technical measures to ensure that the digital file cannot be copied or redistributed.

While this model first earned its name in 2018, it has been practiced by a number of digital collections like The Internet Archive’s Open Library since as early as 2010. It is important to know that controlled digital lending has never been proven officially legal in court. It is a theoretical legal practice that has passed by mostly unchallenged until the Internet Archive lawsuit. This is partially due to the fact that before releasing their official CDL statement in 2018, the IA had been honoring Digital Millennium Copyright Act (DMCA) takedown requests of books in CDL circulation, which authors claim they are not always responding to or honoring anymore. The legality of CDL essentially depends on a judge's interpretation of current copyright law and whether they see the practice as an infringement, which would set a precedent for similar cases moving forward.

There are, however, U.S. court decisions that have rejected similar cases, like Capitol Records v. ReDigi, which argues that digital files (in this case, music files) cannot be resold without copyright holder’s permission on the grounds that digital files do not deteriorate in the same way that physical media does, implying that first sale doctrine doesn’t apply to digital media.

In 2019, the Authors Guild, a group of American authors who advocate for the rights of writers to earn a living wage and practice free speech, pointed out this court case in an article condemning CDL practices. They also argued that not only does CDL undermine e-book licensure (and therefore author profits off e-book sales), but it also would effectively shut down the e-book market for older books (the market for copyrighted books that were published before e-books became popular and are only being digitized and sold now). The National Writers Union has also released an “Appeal from the victims of Controlled Digital Lending (CDL),” that cites many of the same complaints.

Further Reading:

U.S. Copyright Office Fair Use Index

Position Statement on Controlled Digital Lending by Libraries

FAQ on Controlled Digital Lending [Released by NYU Law’s Engelberg Center on Innovation Law & Policy]

Controlled Digital Lending Is Neither Controlled nor Legal

Appeal from the victims of Controlled Digital Lending (CDL)

FAQ on Controlled Digital Lending [Released by the National Writers Union]

The "National Emergency Library" & Hachette v. Internet Archive

While the Internet Archive is known as the creator and host of the Wayback Machine and many other internet and digital media preservation projects, the IA collection in question in Hachette v. Internet Archive is their Open Library. The Open Library has been digitizing books since as early as 2005, and in early 2011, began to include and distribute copyrighted books through Controlled Digital Lending (CDL). In total, the IA includes 3.6 million copyrighted books and continues to scan over 4,000 books a day.

During the early days of the pandemic, from March 24, 2020, to June 16, 2020, specifically, the Internet Archive offered their National Emergency Library, which did away with the waitlist limitations on their pre-existing Open Library. Instead of following the strict rules laid out in the Position Statement on Controlled Digital Lending, which mandates an equal “owned to loaned” ratio, the IA allowed multiple readers to access the same digitized book at once. This, they said, was a direct emergency response to the worldwide pandemic that cut off people’s access to physical libraries.

In response, on June 1, 2020, Hachette Book Group, HarperCollins, John Wiley & Sons, and Penguin Random House filed a lawsuit against the IA over copyright infringement. Out of their collective 33,000 copyrighted titles available on Open Library, the publishers’ lawsuit focused on 127 books specifically (known in the legal documentation as the “Works in Suit”). After two years of argument, on March 24, 2023, Judge John George Koeltl ruled in favor of the publishers.

The IA’s fair use defense was found to be insufficient as the scanning and distribution of books was not found to be transformative in any way, as opposed to other copyright lawsuits that ruled in favor of digitizing books for “utility-expanding” purposes, such as Authors Guild, Inc. v. HathiTrust. Furthermore, it was found that even prior to the National Emergency Library, the Open Library frequently failed to maintain the “owned to loaned” ratio by not sufficiently monitoring the circulation of books it borrows from partner libraries. Finally, despite being a nonprofit organization overall, the IA was found to profit off of the distribution of the copyrighted books, specifically through a Better World Books link that shares part of every sale made through that specific link with the IA.

It worth noting that this ruling specifies that “even full enforcement of a one-to-one owned-to-loaned ratio, however, would not excuse IA’s reproduction of the Works in Suit.” This may set precedent for future copyright cases that attempt to claim copyright exemption through the practice of controlled digital lending. It is unclear whether this ruling is limited to the National Emergency Library specifically, or if it will affect the Open Library and other collections that practice CDL moving forward.

Further Reading:

Full History of Hachette Book Group, Inc. v. Internet Archive [Released by the Free Law Project]

Hachette v. Internet Archive ruling

Internet Archive Loses Lawsuit Over E-Book Copyright Infringement

The Fight Continues [Released by The Internet Archive]

Authors Guild Celebrates Resounding Win in Internet Archive Infringement Lawsuit [Released by The Authors Guild]

Relevant Court Cases:

Authors Guild, Inc. v. Google, Inc.

Authors Guild, Inc. v. HathiTrust

Capitol Records v. ReDigi

Authors, Publishers & You

This is where I’m going to be a little more subjective, because each person’s interpretation of events as I have seen has depended largely on their characterization and experience with the parties involved. Regardless of my own ideology regarding accessibility of information, the court ruling seems to be completely in line with current copyright law and precedent. Ironically, it seems that if the Internet Archive had not abandoned the strict rules regarding controlled digital lending for the National Emergency Library, and if they had been more diligent with upholding those rules with partner library loans prior to the NEL, they may have had a better case for controlled digital lending in the future. As is, I agree with other commentators that say any appeal the IA makes after this point is more likely to damage future digital lending practices than it is to save the IA’s current collection of copyrighted works in the Open Library. Most importantly, it seems disingenuous, and even dangerously inaccurate, to say that this ruling hurts authors, as the IA claimed in their response.

The IA argues that because of the current digital lending and sales landscape, the only way authors can make their books accessible digitally is through unfair licensing models, and that online collections like the IA’s Open Library offer authors freedom to have their books read. But this argument doesn’t acknowledge that many authors haven’t consented to having their works shared in this way, and some have even asked directly for their work to be removed, without that request being honored.

The problem is that both sides of this argument about the IA lawsuit claim to speak for authors as a group when the truth isn’t that simple.

Authors: Ideology v. Practicality

Those approaching the case from an ideological point of view, including many of the authors who signed Fight for the Future’s Open Letter Defending Libraries’ Rights in a Digital Age, tend to either have a history of sharing their works freely prior to the lawsuit (ex: Hanif Abdurraqib, who had published a free audio version of his book Go Ahead in The Rain on Spotify before Spotify began charging for audiobooks separately from their music subscriptions) or have alternative incomes related to their writing that don’t stem directly from book sales (ex: Neil Gaiman, who famously works with multiple mediums and adaptations of his writing).

In these cases, the IA lawsuit is framed as an ideological battle over the IA’s intention when releasing the National Emergency Library.

Many other authors, including a large number of smaller names and writers early in their careers, take a much more practical approach to the lawsuit, focused on defending their ability to monetarily profit off their works. This is by no means a reflection of their own ideology surrounding who has the right to information and whether libraries are worth protecting. Instead, it is a response to the fact that these authors love writing, and they simply would not be able to afford to continue writing in a world where they do not have the power to stop digital collections from distributing their copyrighted work without their consent. These include the authors, illustrators and book makes working with the Author’s Guild to submit their amicus brief in Hachette v. Internet Archive.

These authors claim that controlled digital lending practices cause significant harm to their incomes in the following ways:

CDL undermines e-book licensing and sales markets, as most consumers would choose a free e-book over paying for their own copy.

CDL devalues copyright, meaning authors have less bargaining power in future contract negotiations.

CDL undermines authors ability to republish, whether as a reprint or e-book, out of print books once their publisher has ceased production. This includes self-publishing after the rights to their work have been returned to them.

CDL removes the income from public lending rights (PLR) that authors receive from libraries outside of the U.S. which operate on different lending and copyright standards.

The amicus brief provides first-person anecdotes from authors, including Bruce Coville of The Unicorn Chronicles, about how the rights to backlisted books, or books without an immediately obvious market, make up a huge portion of their annual salary. Jacqueline Diamond cites reissues of out-of-print novels as what kept her afloat during her breast cancer treatment.

It is worth noting that according to the Author’s Guild, some authors who originally signed Fight for the Future’s open letter defending the Internet Archive have even retracted their support after learning more about the specific lawsuit, including Daniel Handler, who writes under the pseudonym Lemony Snicket. The confusion stems from the use of the term “library” by both the Internet Archive and Fight for the Future. While authors overwhelmingly support public libraries, online collections like the Internet Archive don’t always fit the same role or abide by the same regulations as tax-funded public libraries. Sandra Cisneros, author of The House on Mango Street, has written the following:

“To this day, I am angry that Internet Archive tells the world that it is a library and that, by bootlegging my books, it is simply doing what libraries have always done. Real libraries do not do what Internet Archive does. The libraries that raised me paid for their books, they never stole them.”

Further Reading:

Amicus Brief [Submitted by the Author’s Guild]

Fight for the Future’s Open Letter Defending Libraries’ Rights in a Digital Age

Joint Statement in Response to Fight for the Future’s Letter Falsely Claiming that the Lawsuit Against Internet Archive’s Open Library Harms Public Libraries [Published by the Author’s Guild]

Copyright: American Publishers File for Summary Judgment Against the Internet Archive

Publishers: What Authors Are Paid

Some of the commentators I’ve seen are disgruntled specifically with the publishers suing the Internet Archive, and I will say that many of these complaints are valid. The four publishing companies behind the lawsuits (Hachette Book Group, HarperCollins Publishers, John Wiley & Sons, and Penguin Random House) are not known for the stellar treatment of their authors and employees. With the HarperCollins Publishers strike ending only a month before the IA lawsuit ruling, many readers are poised to support any entity at odds with one or more of the “Big Five” publishers. In this particular case, however, the power wielded by these publishing companies was used in defense of author’s rights to their works, for which The Authors Guild and other similar creator groups have expressed gratitude.

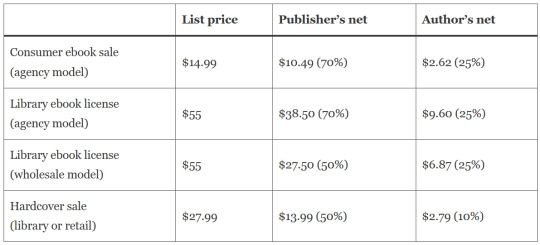

When it comes to finding solutions to the digital lending problem in general, it is important to understand what and how authors are paid for digital copies of their work. Jane Friedman has created the graphic below displaying the industry standards for the Big Five publishers. You can read more about agency and wholesome models here.

As you can see, authors and publishers alike benefit from e-book library licensure when compared to individual e-book sales, especially when you consider the time limits on library licensures. But advocates of this licensure model argue that the high prices for e-book licensure are designed to make up for the lost sales in e-books. While library goers buy more books than book buyers who don’t visit the library, the copies they buy typically vary by format. For example, a reader may borrow an audiobook from the library, decide they like it, and purchase a physical copy for their collection. While readers may buy a physical copy of a book after reading a physical library copy, they are unlikely to buy a digital copy after readying a digital library copy, making e-book lending a replacement for e-book buying in ways that physical lending doesn’t fully replace physical book purchases.

What ISN’T accounted for in this graphic is self-publication and what is known as a right of reversion. Depending on the wording of their contract, an author can request their publication rights be returned to them if the work in question is out of print and no longer being published. The publisher can then either return the work to “in print” status or return the rights to the author, who can then self-publish the work. In these cases, the 5-15% profit they would have made off their traditionally published book becomes a 35-70% profit as a self-published book. This is why authors are particularly frustrated with the IA’s argument that it is perfectly legal and ethical to release digital copies of books that are no longer in print. Those out-of-print works are where many authors earn their most reliable, long-term income, and they provide the largest opportunity for the authors to take control of their own works again and make fairer wages through self-publication.

The most obvious answer to this is that if authors are being the ones hit hardest by library and digital lending, then it is the publishers that need to treat their authors with better contracts. The fact that some authors are only earning 5% of profits on hardcover copies of their books (whether those are being sold to libraries or individuals) is eye opening. Alas, like the “we shouldn’t have to tip waiters” argument, this is much easier said than done.

Further Reading:

What Is the Agency Model for E-books? Your Burning Questions Answered

What Do Authors Earn from Digital Lending at Libraries?

You: When Is Piracy Ethical?

There are number of contributing factors to Tumblr’s enthusiasm for pirating. We are heavily invested in the media we consume, and it is easy to interpret (sometimes accurately) copyright as a weapon used by publishers and distant descendants of long-dead authors to restrict creativity and representation in adaptations of beloved texts. There are also legitimate barriers that keep us from legally obtaining media, whether that is the physical or digital inaccessibility of our local libraries and library websites, financial concerns, or censorship on an institutional or familial level. In fact, studies have found that 41% of book pirates also buy books, implying that a lot of illegal piracy is an attempt at format shifting (ripping CDs onto your computer to access them as MP3 files, for example, or downloading a digital copy of a book you already own in order to use the search feature).

The interesting thing is that copyright law in the U.S. has a specific loophole to allow for legal format shifting for accessibility purposes. This is due to the Chafee Amendment (17 U.S.C. § 121), passed in 1996, which focused on making published print material more available to people with disabilities that interfere with their ability to read print books, such as blindness, severe dyslexia and any physical disability that makes holding and manipulating a print book prohibitively difficult. In practice, this means nonprofits and government agencies in the U.S. are allowed to create and distribute braille, audio and digital versions of copyrighted books to eligible people without waiting for permission from the copyright holder. While this originally only applied to “nondramatic literary works,” updates to the regulations have been made as recently as 2021 to include printed work of any genre and to expand the ways “print-disabled” readers can be certified. Programs like Bookshare, Learning Ally, and the National Library Service for the Blind and Print-Disabled no longer require certification from a medical doctor to create an account. The Internet Archive also uses the Chafee Amendment to break their Controlled Digital Lending regulations for users with print disabilities. While applications of the Chafee Amendment are still heavily regulated, it is worth noting that even U.S. copyright law acknowledges the ways copyright contributes to making information inaccessible to a large amount of people.

Accessibility is not the only argument when discussing the morality of pirating. For some people, appreciation for piracy and shadow libraries comes from a background in archival work and an awareness how much of our historical archives today wouldn’t exist without pirated copies of media being made decades or even a century ago. But we have to be more careful about the way we talk about piracy. Though piracy is often talked about as a victimless crime, this is not always the case, and each one of us has a responsibility to critically think about our place in the media market and determine our own standards for when piracy is ethical. In some cases, such as the recent conversation surrounding the Harry Potter game, some people may even decide that pirating is a more ethical alternative to purchasing. Here are a few questions to consider when deciding whether or not to pirate a piece of media:

Have you exhausted all other avenues for legally purchasing, renting or borrowing a copy of this media?

Is the alternative to pirating this media purchasing it or not reading/referencing it at all? If the former, how are you justifying the piracy?

Who is the victim of this particular piracy? Whether or not you think the creator(s) deserve to have their work pirated, you need to acknowledge there is someone who would otherwise be paid for their work.

If every consumer pirated this media, what would the consequences be? Would you be willing to claim responsibility for that outcome?

If you got this far, thank you so much for reading! It is genuine work to try and understand the complexity behind every day decisions, especially when the topic at hand is as complicated as the modern digital lending crisis. Doing this research has changed the way that I understand and interact with digital media, and I hope you have found it informational as well.

Further Reading:

Panorama Project Releases Immersive Media & Books 2020 Research Report by Noorda and Berens

The Chafee Amendment: Improving Access To Information

National Center on Accessible Educational Materials

National Library Service for the Blind and Print Disabled

Books For People With Print Disabilites: The Internet Archive

Bookshare

Learning Ally

#Internet archive#IA lawsuit#digital lending#libraries#digital libraries#open library#controlled digital lending#national emergency library

130 notes

·

View notes

Text

30 notes

·

View notes

Text

Top 5 Reasons Your NBFC Should have Digital Lending Facility.

Digital lending in India has revolutionized the lending process. Having a digital lending facility will bring loads of benefits to your NBFC as well as customers.

Learn More:

#nbfc#nbfc registration#digital lending#laon#finance#financial institutions#economy#automation#online payday loans#online payment#nbfc license

2 notes

·

View notes

Text

Transformative Journey Of Poonawalla Fincorp Post-Magma Acquisition

In India's intricate financial fabric, the acquisition of Magma Fincorp by Poonawalla Fincorp in early 2021 represented more than a business transaction; it signaled a strategic move towards promoting financial inclusion and empowering marginalized communities. Guided by the visionary leadership of Abhay Bhutada, MD of Poonawalla Fincorp, and Adar Poonawalla, this acquisition laid the foundation for Poonawalla Fincorp's transformation into a prominent player in the Indian financial landscape. This article explores the strategic rationale behind the acquisition, the subsequent evolution into Poonawalla Fincorp, and the profound impact on advancing financial inclusion under Abhay Bhutada's stewardship.

Visionary Leadership and Strategic Acquisition

Under the astute leadership of Abhay Bhutada and Adar Poonawalla, the acquisition of Magma Fincorp by Poonawalla Fincorp in early 2021 was driven by a strategic vision to tap into the growing demand for financial services in India's tier-2 and tier-3 markets. Recognizing the untapped potential in these regions, the acquisition was seen as a strategic imperative to expand Poonawalla Fincorp's footprint and establish itself as a trusted financial partner across the nation.

Bhutada and Poonawalla envisioned Poonawalla Fincorp as more than just a regional entity; they aimed to transform it into a pan-India financial institution capable of serving the diverse needs of customers nationwide. By broadening its geographical reach, the company could access new growth opportunities and solidify its position as a prominent player in the financial services sector.

Abhay Bhutada's strategic foresight and leadership played a pivotal role in driving the acquisition process. His vision and determination propelled Poonawalla Fincorp towards a transformative journey, emphasizing the company's commitment to fostering financial inclusion and empowerment across India.

Also Read: Leadership In Action: Amit Shah And Narendra Modi's Impact On Security And Business Environment

Rebranding and Repositioning

The rebranding of Magma Fincorp as Poonawalla Fincorp in July 2021 marked a significant shift in the company's identity. It was more than just a cosmetic change; it signified a strategic realignment towards a customer-centric approach, highlighting the company's dedication to driving financial inclusion and empowerment.

Under Bhutada's leadership, Poonawalla Fincorp articulated a bold vision to become India's most trusted financial services brand. This vision served as a guiding principle for the company's strategic initiatives and operational decisions, driving it towards excellence and innovation.

Following the acquisition, Poonawalla Fincorp underwent a comprehensive overhaul of its product portfolio to better cater to its diverse customer base. With a renewed focus on consumer and MSME lending, the company introduced innovative products tailored to meet the aspirations and requirements of its target audience.

Digital Transformation as a Strategic Imperative

Recognizing the critical importance of digital transformation in staying competitive, Poonawalla Fincorp embraced technology to enhance operational efficiency, streamline processes, and deliver superior customer experiences.

Investments in digital infrastructure enabled Poonawalla Fincorp to provide seamless and personalized experiences to its customers. From online loan applications to digital payment solutions, the company leveraged technology to simplify processes and enhance accessibility.

Strategic investments in advanced analytics and AI-driven insights empowered Poonawalla Fincorp to make informed decisions and drive operational excellence. By harnessing data-driven insights, the company could better understand customer behavior, mitigate risks, and optimize business processes.

Also Read: How Digitalization Has Empowered Citizens From Small Towns?

Maximizing Synergies

The successful integration of Magma Fincorp into the Poonawalla Fincorp ecosystem highlighted the synergy between the two entities. By leveraging their strengths and shared resources, Poonawalla Fincorp emerged as a formidable player in the financial services sector.

The acquisition bolstered Poonawalla Fincorp's capabilities in risk management, distribution, and customer service. Leveraging Magma Fincorp's expertise, the company expanded its reach and delivered superior value to customers while effectively managing risks.

Bhutada's emphasis on cultural integration fostered a sense of unity and purpose among employees, laying the groundwork for sustained growth and success. This cohesive culture facilitated a smooth transition and encouraged collaboration across teams, driving innovation and excellence.

Poonawalla Fincorp nurtured a culture of innovation, encouraging employees to explore new ideas and approaches. By fostering innovation, the company remained agile and responsive to market dynamics, setting new standards of excellence in the industry.

Championing Financial Inclusion

At the heart of Poonawalla Fincorp's mission lay a commitment to driving financial inclusion and empowerment. By offering affordable credit and innovative financial solutions, the company played a pivotal role in fostering economic growth and prosperity in underserved communities.

Through visionary leadership, strategic acquisitions, and a relentless focus on innovation, Poonawalla Fincorp set new benchmarks for excellence in the financial services industry. The company's transformative journey epitomizes its commitment to driving sustainable growth and creating value for all stakeholders.

Also Read: nveiling the Traits of Non-Collateral NBFC Services

Conclusion

The acquisition of Magma Fincorp by Poonawalla Fincorp marked a significant milestone in the company's journey toward becoming a pan-India financial services leader. Under Abhay Bhutada's visionary leadership, Poonawalla Fincorp redefined standards of excellence, setting new benchmarks for innovation, customer-centricity, and operational efficiency. By leveraging strategic acquisitions, embracing digital transformation, and fostering a culture of innovation, Poonawalla Fincorp is poised to drive financial inclusion and empower millions across India to realize their aspirations and dreams.

Under the guidance of Abhay Bhutada and Adar Poonawalla, the acquisition of Magma Fincorp by Poonawalla Fincorp in early 2021 was a strategic move to tap into the growing demand for financial services in India's tier-2 and tier-3 markets. Recognizing the untapped potential in these regions, the acquisition emerged as a crucial step to expand Poonawalla Fincorp's reach and establish itself as a trusted financial partner across the nation.

0 notes

Text

Exploring Economic Futures: Insights from the WITT Global Summit 2024

In the unfolding narrative of India's progress, the compelling vision of Viksit Bharat 2047 stands tall as a guiding principle, directing the nation's discourse and policy trajectory. Recently, the vibrant halls of the WITT Global Summit in New Delhi reverberated with discussions orbiting this transformative vision, unveiling novel economic strategies indispensable for India's odyssey towards Viksit Bharat 2047.

The summit emerged as a fertile ground for thought leaders, policymakers, and industry titans to converge, exchanging insights and carving pathways that resonate with the overarching ambition of propelling India towards holistic development and global leadership by 2047.

Pioneering Economic Narratives

India's economic narrative is rich with tales of resilience, adaptability, and untapped potential. Despite navigating a labyrinth of challenges, spanning from infrastructural deficiencies to bureaucratic hurdles, the nation has consistently showcased its prowess in surmounting obstacles and sustaining robust growth. Economic reforms, technological leaps, and the demographic dividend have collectively propelled India onto the global stage, laying down a sturdy foundation for the audacious Viksit Bharat 2047 initiative.

At the core of this initiative lies a meticulously crafted economic roadmap aimed at nurturing and amplifying India's growth trajectory across all sectors. Financial leaders wield significant influence in advancing this roadmap, advocating for streamlined regulations, transparency, and innovation. They underscore the imperative of infrastructure development, digital transformation, and skill enrichment to fuel economic dynamism and empower the workforce for the journey ahead. Moreover, a steadfast commitment to financial inclusion and equitable resource allocation ensures that marginalized segments of society are not relegated to the periphery in India's quest for development.

Also Read: The Imperative of Good Governance and Ethical Practices in the Corporate World

Visionary Leadership Unveiled

At the WITT Global Summit, luminaries such as Abhay Bhutada, MD of Poonawalla Fincorp, shared their vision and strategies for realizing the lofty aspirations of Viksit Bharat 2047. Bhutada's emphasis on innovation, entrepreneurship, and inclusive growth underscores the pivotal role of financial acumen in steering impactful initiatives. By championing policies that prioritize sustainability, innovation, and equitable development, leaders like Bhutada aspire to propel India towards global economic leadership by 2047.

Finance Minister Nirmala Sitharaman reiterated the government's unwavering commitment to fostering comprehensive and inclusive growth, emphasizing the overarching goal of transforming India into a developed nation by 2047. Her focus on holistic development and societal inclusivity mirrors the government's unwavering dedication to realizing the aspirations of every stratum of society.

Also Read: Abhay Bhutada bagged a Special award at Lokmat Maharashtrian of the Year 2024

Fostering Collaboration and Innovation

The WITT Global Summit emerged as a vibrant platform for showcasing India's innovation ecosystem, talent reservoir, and investment allure. Discussions revolved around emerging paradigms, disruptive technologies, and transformative strategies aimed at propelling India towards development. Leaders exchanged insights on harnessing India's demographic dividend, amplifying digital infrastructure, and championing sustainable practices to secure enduring prosperity.

Abhay Bhutada's fervent endorsement of Prime Minister Modi’s initiatives, particularly in the realms of digitalization and innovation, resonated deeply with the summit's emphasis on harnessing nascent technologies to realize the vision of Viksit Bharat by 2047. Furthermore, the exposition of success narratives and illustrative case studies underscored India's stature as a crucible of innovation and technological prowess, captivating the attention of global investors and partners.

Bhutada's endorsement not only reaffirmed the pivotal role of governmental policies in driving technological progress but also underscored the imperative of collaboration between the public and private sectors in realizing India's developmental aspirations. The summit catalyzed partnerships and investments aimed at harnessing India's immense potential in innovation, thereby fortifying its standing as a linchpin in the global technological landscape.

Also Read: NBFCs Navigating The Secured-Unsecured Loan Equilibrium Post RBI's Cautionary Measure

Concluding Remarks

India's voyage towards Viksit Bharat 2047 is guided by innovative economic strategies, visionary leadership, and collaborative endeavors. Insights gleaned from the WITT Global Summit 2024 furnish invaluable guidance for navigating the intricate terrain of India's economic landscape. By leveraging its demographic dividend, embracing technological frontiers, and embracing inclusive and sustainable growth pathways, India is poised to carve a trajectory towards prosperity and ascend as a beacon of progress on the global stage. With each stride forward, India inches closer to the realization of its vision of Viksit Bharat by 2047, marking a watershed moment in its economic narrative.

This comprehensive exploration of the WITT Global Summit 2024 encapsulates the essence of India's economic journey and sets the stage for transformative endeavors in the pursuit of Viksit Bharat 2047.

0 notes

Text

Consumer Loan Servicing Software

Redefine consumer loan servicing with Newgen's advanced software. Seamlessly manage and service consumer loans with our feature-rich solution. Leverage automation, integrated workflows, and robust servicing capabilities to ensure borrower satisfaction. Elevate your institution's consumer loan servicing software to new heights, ensuring compliance, mitigating risk, and optimizing operational efficiency. Explore the future of consumer lending with Newgen.

#Consumer Loan Servicing Software#Consumer Loan Process#Consumer Loan Processing#Digital Lending#e-Document Management#Electronic Record Keeping System

0 notes

Text

The Crucial Role of Documentation In Digital Lending

In the fast-paced world of digital finance, opportunities to secure loans and financial assistance abound. As an architect with a keen interest in finance and investing, navigating through the intricacies of digital lending requires a blueprint - a meticulous documentation process. Let's delve into the importance of proper documentation when applying for digital lending, ensuring a smooth journey through the financial landscape.

Understanding The Digital Horizon

In our contemporary digital age, the financial terrain has experienced a substantial metamorphosis. Digital lending platforms have emerged as transformative entities, offering a seamless and expeditious route to financial resources. Nevertheless, this accessibility brings forth a unique set of responsibilities, with the foremost being the imperative for meticulous documentation. Abhishek Singh, Chief Operating Officer at Lendingkart, exudes steadfast optimism regarding the trajectory of digital lending. Yet, he emphasizes the criticality of ensuring a comprehensive approach without any loose ends before delving into this dynamic realm.

Also Read: A Guide To Profitability And Risk Management From An NBFC Perspective

Know Your Customer (KYC) Documentation

Ensuring Transparency And Security

Just as a strong foundation is crucial in architecture, a robust Know Your Customer (KYC) process forms the bedrock of digital lending. Lenders need to verify the identity of borrowers to mitigate risks and adhere to regulatory norms. Providing accurate personal details, proof of identity, and address documentation is the first step in establishing trust between the borrower and the lender.

Income Proof

Presenting A Clear Picture

Similar to crafting a resilient structure, demonstrating a consistent income holds paramount importance in the realm of digital lending. Lenders scrutinize your income evidence to assess your repayment capability. Furnishing salary slips, bank statements, and income tax returns contributes to constructing a clear financial profile, instilling confidence in lenders about your capacity to repay the borrowed sum. According to Abhay Bhutada, MD of Poonawalla Fincorp, submitting incomplete documents may imply non-compliance or an effort to withhold information, potentially leading to delays in processing or an outright denial of the loan.

Also Read: How Digital Platforms Drive Financial Inclusion

Addressing Creditworthiness

Crafting A Creditworthy Profile

In the financial world, your credit score is your architectural masterpiece. It reflects your financial history, indicating your creditworthiness. Timely repayments, responsible credit usage, and maintaining a healthy credit score open doors to better lending opportunities. Digital lenders often consider credit scores as a key factor in their decision-making process.

Asset Documentation

Securing Your Finances

In architecture, collateral provides assurance of a structure's stability. Similarly, in digital lending, presenting assets as collateral boosts confidence for lenders. Documentation of property papers, investment details, or any other valuable asset helps create a secure financial environment, often resulting in better loan terms.

The Blueprint's Integrity

Ensuring Accuracy And Consistency

Just as a well-designed structure requires rigorous cross-verification, your financial documentation demands accuracy and consistency. Any discrepancies can raise red flags for lenders. Cross-verify all documents to ensure they align with each other, presenting a coherent and reliable financial narrative.

The Finishing Touch

Completing The Picture

Apart from the primary documents, additional paperwork may be required based on the lender's policies. This might include business documents for self-employed individuals or specific declarations. Providing a comprehensive set of documents ensures that your financial blueprint is complete and ready for evaluation.

Also Read: Cybersecurity Challenges in the Era of Digital Finance

Conclusion

Within the ever-evolving sphere of digital lending, consider your documentation as the blueprint guiding lenders through the terrain of your financial standing. Every document holds a pivotal role in fostering trust and confidence, paving the way for a seamless exploration of financial opportunities. Approach your documentation with the precision of an architect, constructing a sturdy blueprint for your financial ambitions. As you step into the realm of digital lending, take counsel from Abhay Bhutada, ensuring you equip yourself with the necessary documents. This not only portrays you as a conscientious applicant but also establishes a foundation for a trouble-free financial journey ahead.

0 notes

Text

Digital Lending | Apply for Digital Loan Online | Unity SFB

Experience secure & swift Digital Lending Loans with Unity Bank. Get quick Digital Loans with advanced technology at your fingertips.

0 notes

Text

Exploring NBFC Sector's Latest Trends

The Non-Banking Financial Company sector in India has been on a rollercoaster ride in recent years. It has witnessed significant changes, adapting to the evolving financial landscape and customer demands. In this blog, let’s take you through the latest trends in the NBFC sector and how they are shaping the financial future for both companies and consumers.

The Rise of Digital Lending

One trend that has gained significant traction in recent years is digital lending. With the increasing penetration of smartphones and internet connectivity, more and more people are opting for online financial services. NBFCs have adapted to this shift by offering digital loan application processes and quick disbursal of funds. It's a win-win situation for both customers and NBFCs, as it reduces paperwork and processing time while offering convenience.

Also Read: Exchange-Traded Funds (ETFs) - The Good and Bad

Personalization and Customization

One size doesn't fit all, and NBFCs understand this well. They're adopting a more customer-centric approach by tailoring their financial products to suit individual needs. From flexible repayment options to customized interest rates, these institutions are all about giving you a financial plan that fits like a glove. H P Singh, Chairman & MD of Satin Creditcare Network Limited, NBFCs play a pivotal role in India's economic progress as they are the primary enablers of the nation's growth trajectory.

Focus on Financial Inclusion

In a country as diverse as India, ensuring financial inclusion is paramount. NBFCs are making significant strides in this area by reaching out to rural and underserved areas. They understand that everyone deserves access to financial services, and they are working diligently to make it a reality.

Customer-Centricity

NBFCs are increasingly focusing on understanding their customers' needs and preferences. They are using data analytics to tailor their products and services, ensuring that customers get the best possible experience. Abhay Bhutada, MD of the prominent NBFC, Poonawalla Fincorp, believes that cultivating customer loyalty is a vital factor for sustained long-term business growth.

Regulatory Compliance

As the NBFC sector continues to grow, regulatory oversight has become more stringent. The Reserve Bank of India (RBI) is actively monitoring and regulating these institutions to ensure they adhere to the highest standards of transparency and ethical practices. This increased scrutiny is a positive step towards maintaining the sector's stability and credibility.

Riding the Digital Payment Wave

The digital payment revolution in India is changing the way people transact. NBFCs are jumping on the bandwagon, offering digital wallets, UPI payments, and even contactless lending options. This shift towards cashless transactions is not only convenient but also contributes to a more transparent and accountable financial ecosystem.

Also Read: Technology's Influence on NBFCs' Growth Trajectory

Conclusion

The NBFC sector in India is evolving at a rapid pace, and it's bringing financial services closer to the people. From digital lending to financial inclusion, NBFCs are playing a pivotal role in shaping the future of finance in the country. As they continue to adapt to the changing landscape, one thing is clear: NBFCs are here to stay. They're making finance more accessible and convenient for all.

0 notes

Text

Today’s lower court decision in Hachette v. Internet Archive is a blow to all libraries and the communities we serve. This decision impacts libraries across the US who rely on controlled digital lending to connect their patrons with books online. It hurts authors by saying that unfair licensing models are the only way their books can be read online. And it holds back access to information in the digital age, harming all readers, everywhere.

But it’s not over—we will keep fighting for the traditional right of libraries to own, lend, and preserve books. We will be appealing the judgment and encourage everyone to come together as a community to support libraries against this attack by corporate publishers.

#internet archive#open library#libraries#digital lending#digital rights for libraries#hachette v internet archive

13 notes

·

View notes

Text

Generators in Python Explained

For Python newcomers, grasping the basics like "if/else" statements and defining functions is often straightforward. However, more advanced topics, such as generators and the yield keyword, frequently remain elusive. In this blog, we'll explore the power of Python generators and how they can revolutionize your coding practices.

Understanding Python Generators

Python generators are functions containing the "yield" keyword. Unlike regular functions, which run from start to finish, generators behave differently. When a generator encounters "yield," its state freezes, and all variables remain in memory until the generator is called again.

Iterating with Generators

Generators offer two primary ways to use them: alongside an iterator or by explicitly employing the "next" keyword. Consider this example:

Using Generators with Iterators:

def test_generator():

yield 'abc'

yield 123

yield '789'

for i in test_generator():

print(i)

The output:

'abc'

123

'789'

Using Generators with 'next':

printer = test_generator()

print(printer.next())

print(printer.next())

print(printer.next())

In this case, we explicitly call the generator using "next," yielding the same output.

The Essence of Generators

Think of generators as functions that produce items one-by-one, rather than returning an entire list at once. The generator function pauses until the next item is requested, making them ideal for calculating large result sets and conserving memory.

Efficiency in Action

To illustrate, let's print the squares of numbers from 1 to 'n.' The traditional approach of creating a list of numbers can become impractical when 'n' is vast. Generators provide an efficient alternative:

Traditional Approach:

numbers_list = range(1, n+1)

for i in numbers_list:

print(i*i)

Generators in Action:

def number_generator(n):

num = 1

while True:

yield num

if num == n:

return

else:

num += 1

for i in number_generator(200000000):

print(i*i)

Generators enable iteration without creating an extensive list, conserving memory even with vast 'n' values.

Harnessing Generators for Efficiency

Incorporate generators into your daily programming for efficiency gains, especially when handling extensive data or resource-intensive tasks. Python generators are a valuable tool, enhancing code efficiency and tackling complex challenges with ease.

Conclusion:

Python generators are your key to efficient coding. They empower you to handle extensive datasets and resource-heavy tasks with elegance and ease. Embrace generators to optimize your Python programs and conquer complex programming challenges like a pro.

0 notes

Text

0 notes

Text

Global Digital Lending Market is Estimated To Witness High Growth Owing To Increasing Adoption of Online Loans and Rising Trend of Peer-to-Peer Lending

The global digital lending market is estimated to be valued at USD 334.7 million in 2021 and is expected to exhibit a CAGR of 26.9% over the forecast period 2022-2030, as highlighted in a new report published by Coherent Market Insights.

A) Market Overview:

Digital lending refers to the process of lending money through online platforms or mobile applications. It eliminates the need for traditional banking methods and offers convenient and efficient loan solutions to borrowers. The key products associated with the digital lending market include online payday loans, peer-to-peer lending, crowdfunding, and online installment loans. These platforms offer quick loan approvals, flexible repayment options, and competitive interest rates.

B) Market Dynamics:

1) Driver: Increasing Adoption of Online Loans

The growing adoption of online loans is one of the major drivers for the digital lending market. Consumers are increasingly preferring online loan platforms as they offer convenience, speed, and transparency. Online loan applications can be completed within minutes, and borrowers can receive funds directly into their bank accounts. This eliminates the need for lengthy paperwork and multiple visits to the bank. The online loan process also provides easy access to loans for individuals who may not have a good credit score or are overlooked by traditional lenders.

2) Trend: Rising Trend of Peer-to-Peer Lending

Peer-to-peer lending, also known as P2P lending, is gaining traction in the digital lending market. It connects borrowers directly with investors through online platforms, eliminating the need for intermediaries like banks. P2P lending offers attractive interest rates for borrowers and higher returns for investors. It also provides an opportunity for individuals to lend money and earn interest on their idle funds. The decentralized nature of P2P lending platforms ensures transparency and reduces the cost of lending, benefiting both borrowers and investors.

C) Market Key Trends:

One major key trend in the digital lending market is the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML). These technologies enable lenders to assess creditworthiness, predict default rates, and personalize loan offers based on individual borrower profiles. For example, AI algorithms can analyze vast amounts of data to make accurate lending decisions and identify potential risks. This trend is revolutionizing the lending process by making it faster, more efficient, and less prone to human error.

D) SWOT Analysis:

Strengths:

1) Increasing adoption of online loans

2) Rising trend of peer-to-peer lending

Weaknesses:

1) Lack of physical presence and face-to-face interaction

2) Concerns regarding data security and privacy

Opportunities:

1) Growing demand for small business loans

2) Expansion of digital lending services in emerging economies

Threats:

1) Regulatory challenges and government interventions

2) Competition from traditional banking institutions

E) Key Takeaways:

- The global Digital Lending Market is expected to witness high growth, exhibiting a CAGR of 26.9% over the forecast period, due to increasing adoption of online loans and the rising trend of peer-to-peer lending.

- In terms of regional analysis, North America is expected to be the fastest-growing and dominating region in the digital lending market. The region has a well-established fintech ecosystem, favorable regulatory environment, and high smartphone penetration rate, contributing to the growth of digital lending platforms.

- Key players operating in the global digital lending market include On Deck Capital Inc., Lendingclub Corp., and Social Finance Inc. (SoFi). These players are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to gain a competitive edge in the market.

#Digital Lending#Digital Lending Market#Digital Lending Market Demand#Digital Lending Market Insights#Digital Lending Market Growth#Smart Technologies

0 notes

Text

Top 7 Microfinance Companies in India & their Challenges in 2022-23

These top 7 private lending companies have been around for a while and seem to be going great guns; however, there are a few challenges they are facing as of now.

#nbfc#nbfc registration#microfinance#finance#digital lending#banking#finance companies#financial institutions#economy#2023

2 notes

·

View notes