#finance analytics

Text

0 notes

Text

Journey Towards Financial Independence: Future-Proofing Your Finances

Embarking on a journey towards financial independence is a transformative experience. It requires careful planning, disciplined saving and investing, and a long-term perspective. In this blog post, we will explore the steps and strategies involved in future-proofing your finances to achieve lasting wealth and true financial independence.

Understanding the Concept of Financial Independence:

To begin our journey, we need to define what financial independence means and why it is important. We will explore the benefits and freedoms that come with it, as well as the mindset required to achieve this goal.

Building Strong Financial Foundations:

Before pursuing financial independence, it is crucial to establish a solid financial foundation. We will delve into the key components of this foundation, including budgeting, emergency funds, debt management, and building a strong credit score.

The Power of Long-Term Investing:

Investing is a fundamental part of future-proofing your finances. We will discuss the importance of a long-term investment strategy, diversification, risk tolerance, and the potential for compounding wealth over time.

Maximizing Income and Minimizing Expenses:

Increasing your income and reducing your expenses are key factors in accelerating your journey towards financial independence. We will explore strategies to boost your income, such as side hustles, career advancements, and passive income streams, as well as ways to cut unnecessary expenses and save more.

Strategies for Wealth Accumulation:

In this section, we will delve into various strategies that can help you accumulate wealth effectively. Topics covered will include retirement planning, investing in real estate, entrepreneurship, and the importance of continuously improving financial literacy.

Protecting Your Future:

Wealth preservation is equally important as wealth accumulation. We will discuss how to protect your assets through insurance, estate planning, and risk management, ensuring that your financial independence is safeguarded for the long term.

Embracing a Mindset of Financial Independence:

Achieving financial independence requires adopting a specific mindset. We will explore the importance of discipline, patience, perseverance, and continuous learning throughout your journey.

Conclusion:

Embarking on a journey towards financial independence is a life-changing endeavor. By future-proofing your finances through careful planning, saving, investing, and adopting the right mindset, you can achieve lasting wealth and the freedom to make financial decisions based on your passions and values. Start your journey towards financial independence now and take control of your financial future.

0 notes

Text

Simplifying Bookkeeping for Small Businesses: A Game-Changer for Financial Management

In the dynamic world of small business operations, efficient bookkeeping plays a pivotal role in maintaining financial health and enabling strategic decision-making. As a small business owner, bookkeeping is not just about tracking expenses and revenues; it's about gaining insights that drive growth, and that's where the right approach to bookkeeping becomes a game-changer.

Understanding Bookkeeping for Small Businesses

Bookkeeping for small businesses involves systematically recording financial transactions, maintaining accurate records, and organizing financial data. It encompasses various elements such as:

Income and Expenses Tracking: Reliable bookkeeping ensures that all income sources and expenses are meticulously tracked, providing insights into cash flow management and financial sustainability.

Invoice Management: Efficient bookkeeping allows for the organized processing of invoices, facilitating seamless interactions with clients and vendors.

Bank Reconciliations: Regular reconciliations ensure that bank statements align with financial records, highlighting any discrepancies that need attention.

Financial Reporting: Bookkeeping supports the generation of essential financial statements, enabling small business owners to assess the performance and make informed decisions.

The Importance of Bookkeeping for Small Business Success

Proper bookkeeping serves as the foundation for a streamlined and transparent financial system, and it offers numerous benefits, including:

Compliance and Transparency: Accurate bookkeeping reflects compliance with regulatory requirements and enhances transparency in financial dealings, instilling confidence in stakeholders.

Strategic Decision-making: Well-maintained books provide valuable insights into business trends, helping in informed decision-making, expense prioritization, and revenue optimization.

Tax Preparedness: Organized books are instrumental during tax season, simplifying tax filing and minimizing the risk of audits.

Why Bookkeeping is Crucial for Small Business Growth

Scalability: Maintaining precise financial records lays the groundwork for scalable growth, facilitating sound financial management as the business expands.

Investor Confidence: Should the need arise to seek investment, accurate and well-organized books can instill confidence and make the process smoother.

Bookkeeping Services for Small Businesses

Outsourcing bookkeeping services can be a strategic move for small businesses, allowing owners to focus on core business activities while ensuring their financial records are expertly managed. Professional bookkeeping providers offer comprehensive support in maintaining accurate records and implementing best practices, essential for the continued success of small enterprises.

In conclusion, effective bookkeeping is an indispensable element of small business success, driving financial efficiency, informed decision-making, and sustained growth. By prioritizing organized and accurate bookkeeping practices, small business owners can harness the power of financial data to propel their ventures forward.

0 notes

Text

"But if college was free, then people would abuse that and get useless degrees" hell yeah I would! If I could go to college without debt I would make it my job to get a degree in every little thing that interested me. I'd get a doctorate in film studies. I'd have a bachelor's degree for every science I like. I'd try to learn at least 5 languages with varying results. I would learn something "useful" like coding and then follow it up with a ""useless"" degree like art history. I'd be the world record speed run holder for getting every degree possible.

But I can't afford college without going into massive debt, so instead I spent the last 5 years trying to figure out what I am passionate enough about to consider going into debt over, because unfortunately being passionate about everything is extremely expensive to pursue.

#simon says#i love learning so much and I hate the USA's college debt system#once they make that shit free I will be unstoppable#this topic sprung up because I had the idea that im very academic and annoyingly analytical that I might as well get a degree in it#because without a degree you just seem like an autistic asshole#but with a degree? then you look like a CREDIBLE autistic asshole#don't worry I will still learn but I still want that funky piece of paper to tell everyone I learnt it#also there's some things that are VERY difficult to learn#like I would love to persue this topic further but unfortunately I would need help with that#also before you say 'try taking [blank] classes instead! it's less expensive than a degree!' im broke#my only learning resource is the library sorry about that#also this is not the post to give me unwarranted financial advice#finances are one of the topics I DO NOT care about and I WILL NOT listen to a word you say

18K notes

·

View notes

Text

Banking Analytics vs Traditional Banking: Why Analytics is the Future

As the world becomes more digital and data-driven, the financial industry is no exception. In recent years, there has been an explosion of interest in Banking Analytics, Finance Analytics, Finance Service Analytics, and Insurance Analytics. In this article, we will discuss why analytics is the future of the financial industry and how it is changing the way banks operate.

What is Banking Analytics?

Banking analytics involves analyzing data to make better business decisions and improve customer satisfaction. It is the process of using data to improve banking operations and decision-making. With the help of analytics, banks can better understand their customers, mitigate risks, and optimize operations. Analytics is used to track customer behavior, identify trends, and detect fraudulent activity. It is also used to improve the customer experience by providing personalized recommendations and targeted marketing.

Traditional Banking

Traditional banking practices involve making decisions based on experience and intuition. Banks rely on their own knowledge and expertise to make decisions. However, this approach is becoming less effective as the industry becomes more complex and data-driven. Traditional banking often relies on manual processes that are prone to errors and inefficiencies. This makes it difficult for banks to keep up with changing customer needs and market trends.

Why Analytics is the Future

Analytics is the future of banking and financial services. With the help of analytics, banks can gain insights into customer behavior, market trends, and business performance. Analytics can help banks to improve the customer experience, streamline operations, and reduce risk. By using analytics to detect fraudulent activity, banks can protect their customers and prevent financial losses.

Analytics is essential for banks to survive and thrive in the modern era. By leveraging data analytics, banks can unlock new opportunities for growth, innovation, and success. With the help of analytics, banks can make better decisions, improve efficiency, and reduce risk. Analytics is the key to staying competitive in the rapidly changing financial industry.

Benefits of Banking Analytics

There are many benefits to using analytics in banking and financial services. Here are just a few:

1. Improved Customer Experience

Analytics can be used to provide personalized recommendations and targeted marketing, improving the customer experience. By using data analytics, banks can understand the needs and preferences of their customers and offer tailored services that meet their requirements. This can lead to higher customer satisfaction levels, increased loyalty, and more revenue for the bank.

2. Risk Mitigation

Analytics can be used to detect fraudulent activity and other risks, reducing the likelihood of financial losses. By analyzing customer data, banks can identify patterns and trends that may indicate fraudulent activity. This can help them to take preventative measures and protect their customers' financial assets.

Analytics can also help banks to identify other types of risks, such as credit risk and market risk. By detecting potential risks early on, banks can take steps to mitigate them before they become a problem.

3. Improved Efficiency

Analytics can help banks to streamline operations and reduce inefficiencies, saving time and money. For example, analytics can be used to automate routine processes such as account opening, loan applications, and credit checks. This can free up time for staff to focus on more complex tasks and improve overall productivity.

Analytics can also help banks to identify areas where they can reduce costs. By analyzing data, banks can identify areas where they are spending too much money and take steps to reduce those costs.

4. Better Decision-making

Analytics can provide banks with insights into customer behavior and market trends, helping them to make better decisions. By analyzing customer data, banks can identify opportunities for growth and innovation. This can help them to stay ahead of the competition and remain profitable in a rapidly changing market.

Analytics can also help banks to make more informed decisions about product development. By analyzing customer data, banks can identify areas where there is a need for new products and services. This can help banks to stay ahead of the curve and offer innovative solutions to their customers.

Challenges of Implementing Analytics

While there are many benefits to using analytics in banking, there are also challenges to implementing it. One of the main challenges is data quality. Banks must ensure that the data they use for analytics is accurate and reliable. They must also ensure that the data is protected against unauthorized access.

Another challenge is the complexity of analytics. Banks must have the expertise to analyze the data and interpret the results. They must also have the technology infrastructure to support analytics.

Final Thoughts

In conclusion, Banking Analytics, Finance Analytics, Finance Service Analytics, and Insurance Analytics are the future of the financial industry. Analytics can help banks to improve the customer experience, reduce risk, and streamline operations. While there are challenges to implementing analytics, the benefits far outweigh the costs. As the financial industry becomes more data-driven, analytics will become increasingly important for banks that want to stay competitive. By embracing analytics, banks can unlock new opportunities for growth, innovation, and success.

If you're interested in implementing analytics in your banking operations, consider working with a trusted partner like LatentView Analytics. Their expertise in Banking Analytics and Finance Service Analytics can help you unlock the benefits of data-driven decision-making. Reach out to them today to learn more.

0 notes

Text

Become a finance analytics expert with our Certified Finance Analytics Professional Certification. Take your career to new heights with this industry-recognized certification that focuses on the crucial intersection of finance and analytics. Gain the skills to thrive in today's data-driven business world.

#data analytics#analytics#online certification#analytics certification#iabac#iabac certification#finance analyst#finance#finance analytics#finance analytics professional#analytics professional#data science#machine learning#finance investors#professional certification

0 notes

Text

For anyone currently in school or recently in school

I am doing a few guest lectures at some of the universities in my state and working on my presentation. Curious if anyone has any recommendations of topics they really enjoyed from a past guest speaker that isn't major/field-specific?

#college#college student#studying#studyblr#school#university#accounting#finance#consulting#data analytics#data analysis#data visualization#big data#data

22 notes

·

View notes

Text

so, i am trying to get into finance and data analytics, and i am starting to realize it is a very misogynistic field. shit is getting real. wow

7 notes

·

View notes

Text

Cognizance IIT Roorkee Internship and Training Program

Registration Link : https://forms.gle/E2cHdnjyzYytKxC39

#engineering#internship#jobs#iit#work from home#student#ai#datascience#data analytics#machinelearning#webde#web development#ui ux development services#graphic design#finance#marketing

3 notes

·

View notes

Text

Best BBA colleges in Bangalore

These short notes provide an overview of some of the best BBA colleges in Bangalore, each with its own unique strengths and offerings. Students seeking a BBA education have a range of options to consider based on their preferences and career goals.

Christ University:

1 Renowned for its excellence in education and infrastructure.

2 Offers a BBA program with a focus on academic rigor and skill development.

3 Wide range of specializations available for students to choose from.

4 Active placement cell with tie-ups to leading companies.

5 Opportunities for research and extracurricular activities.

St. Joseph's College of Commerce:

1 Esteemed institution with a rich history of education.

2 BBA program known for its strong foundation in commerce and management.

3 Encourages critical thinking, problem-solving, and ethical values.

4 Notable alumni and strong industry connections.

5 Various clubs and societies for holistic development.

Jain University:

1 Offers a comprehensive BBA curriculum with flexibility in specialization.

2 Emphasis on practical learning through internships, workshops, and projects.

3 Industry-oriented approach for better employability.

4 Collaborations with global universities for international exposure.

5 Focus on research and innovation.

IIBS (International Institute of Business Studies) is one of the prominent BBA colleges in Bangalore, known for its quality education and comprehensive programs. Here are some short notes about IIBS and other top BBA colleges in Bangalore:

IIBS (International Institute of Business Studies):

1 Established institution known for BBA and other management programs.

2 Offers a holistic approach to education, combining theory with practical exposure.

3 Emphasis on developing leadership, communication, and managerial skills.

4 Strong industry connections for internships and placements.

5 Engaging faculty with real-world experience.

6 State-of-the-art campus facilities for a conducive learning environment.

Mount Carmel College:

1 Prominent women's college with a strong BBA program.

2 Emphasis on nurturing leadership qualities and social responsibility.

3 Industry interactions, seminars, and conferences for holistic growth.

4 Active placement cell with connections to diverse industries.

5 Focus on extracurricular activities and personality development.

Presidency College:

1 Offers a comprehensive BBA curriculum with industry-oriented subjects.

2 Focus on practical learning and skill enhancement.

3 Well-qualified faculty and guest lectures by industry experts.

4 Strong emphasis on personality development and communication skills.

5 Active involvement in corporate interactions and internships.

Acharya Bangalore B-School (ABBS):

1 Known for its innovative teaching methods and industry-aligned curriculum.

2 BBA program emphasizes experiential learning and skill development.

3 Collaboration with corporate partners for internships and placements.

4 Regular seminars, workshops, and industry visits.

5 Focus on grooming students for leadership roles.

#school#student life#finance#marketing#business analytics#college#college life#bba course#bba colleges in bangalore#bbacollegeswithlowfees#bbacollegestop#best bba colleges in bangalore#bbacollegeswithlessfees

2 notes

·

View notes

Text

BBA Finance

BBA Finance at IIBS (International Institute of Business Studies) is a specialized undergraduate program that focuses on equipping students with a comprehensive understanding of finance and its applications in the business world. The program aims to develop strong analytical and decision-making skills to prepare students for various finance-related roles in the corporate sector……read more

#education#finance#bbacollegeswithlessfees#bbacollegeswithlowfees#marketing#business analytics#business

3 notes

·

View notes

Text

Simplifying Bookkeeping for Small Businesses: A Game-Changer for Financial Management

In the dynamic world of small business operations, efficient bookkeeping plays a pivotal role in maintaining financial health and enabling strategic decision-making. As a small business owner, bookkeeping is not just about tracking expenses and revenues; it's about gaining insights that drive growth, and that's where the right approach to bookkeeping becomes a game-changer.

Understanding Bookkeeping for Small Businesses

Bookkeeping for small businesses involves systematically recording financial transactions, maintaining accurate records, and organizing financial data. It encompasses various elements such as:

Income and Expenses Tracking: Reliable bookkeeping ensures that all income sources and expenses are meticulously tracked, providing insights into cash flow management and financial sustainability.

Invoice Management: Efficient bookkeeping allows for the organized processing of invoices, facilitating seamless interactions with clients and vendors.

Bank Reconciliations: Regular reconciliations ensure that bank statements align with financial records, highlighting any discrepancies that need attention.

Financial Reporting: Bookkeeping supports the generation of essential financial statements, enabling small business owners to assess the performance and make informed decisions.

The Importance of Bookkeeping for Small Business Success

Proper bookkeeping serves as the foundation for a streamlined and transparent financial system, and it offers numerous benefits, including:

Compliance and Transparency: Accurate bookkeeping reflects compliance with regulatory requirements and enhances transparency in financial dealings, instilling confidence in stakeholders.

Strategic Decision-making: Well-maintained books provide valuable insights into business trends, helping in informed decision-making, expense prioritization, and revenue optimization.

Tax Preparedness: Organized books are instrumental during tax season, simplifying tax filing and minimizing the risk of audits.

Why Bookkeeping is Crucial for Small Business Growth

Scalability: Maintaining precise financial records lays the groundwork for scalable growth, facilitating sound financial management as the business expands.

Investor Confidence: Should the need arise to seek investment, accurate and well-organized books can instill confidence and make the process smoother.

Bookkeeping Services for Small Businesses

Outsourcing bookkeeping services can be a strategic move for small businesses, allowing owners to focus on core business activities while ensuring their financial records are expertly managed. Professional bookkeeping providers offer comprehensive support in maintaining accurate records and implementing best practices, essential for the continued success of small enterprises.

In conclusion, effective bookkeeping is an indispensable element of small business success, driving financial efficiency, informed decision-making, and sustained growth. By prioritizing organized and accurate bookkeeping practices, small business owners can harness the power of financial data to propel their ventures forward.

0 notes

Text

youtube

#crypto market#fintech#finance#software#singapore#SynOption operates SYNCHRO#a Crypto Options Analytics and Trading Platform. Our dynamic OTC platform allows for trading of Crypto options in OTC and Exchange based fo#providing liquidity across exchanges#product suites#and alt-coins.#Key Features of Synchro - Crypto Options Analytics and Trading Platform#1. Multi Leg Strategies#2. Delta Cost Savings#3. Institutional Liquidity#4. RFQ Based Workflows#5. Multiple Clearing Venues#Youtube

2 notes

·

View notes

Text

FLYING METALS - FUNDING

We have an excellent Investment Opportunity - FLYING METALS - The Aerospace B2B Supply Chain Management Ecommerce the world's First. Solving the Supply Chain problems for Aerospace Industry. Growth Oriented Sustainable Startup Ventures for Investments

FLYING METALS – The Aerospace Metals Industry Online

FLYING METALS PTY LTD

www.flyingmetals.com

What ‘Flying Metals’ is all about / The Product:

FLYING METALS

At ‘Flying Metals’, we provide the latest and the most modern B2B Marketplace specifically for the aerospace Industry connecting Buyers with Suppliers. We are building the World’s Largest E Commerce B2B platform for Aerospace Metals…

View On WordPress

#Aeroplane#Aerospace#Aircraft#airplanes#Angel Investors#Australia#B2B#B2B Ecommerce#b2b platform#business finance#Buyer Seller Platform#corporate investments#Data#data analytics#Directory#Drone#Ecommerce#Family Offices#Finance#funding#Funds#Funds and Finance#helicopters#Investments Funds and Finance Financial#Manufacturer#Manufacturers#Metaverse#pe funding#Private equity#private equity funds

4 notes

·

View notes

Text

#Finance#Business#Work Meme#Work Humor#Excel#Hilarious#funny meme#funny#accounting#office humor#consulting#big data#data analysis#data visualization#data analytics#data#dashboard commentary#tableau#power bi

12 notes

·

View notes

Photo

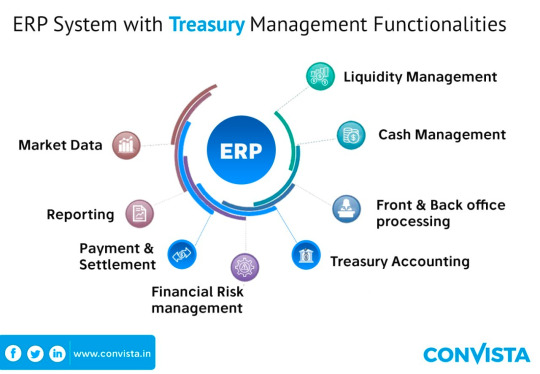

ConVista Consulting is one of the leading companies in the IT and Business Consulting sectors. With our holistic approach, we provide a range of services to support clients’ processes, methods, and technologies. As we work in partnership with our clients to implement business strategies and optimize processes through software integration and development, we provide solutions based on SAP, Microsoft, Java, and other renowned technologies. In addition, we also provide project, quality, and change management services.

#The SAP Experts#SAP Consultant Asia#The SAP Expert in Asia#The SAP consultant in Asia#Best SAP Consulting in Asia#SAP Consultant in Bangalore#SAP ERP Consultant#SAP Analytics Cloud#SAP S4 for Insurance#SAP s/4hana finance#SAP Consultant in India#SAP data Analytics#SAP Digital Transformations#SAP Multi Bank Connectivity#Become a Smart Enterprise with SAP Analytics Cloud (SAC)#Digital Transformations#Artificial Intelligence

2 notes

·

View notes