#financial planning sector

Text

Govt Unveils Unified Pension Scheme for Central Employees

New UPS offers choice between NPS and unified plan, set to launch April 1st

Cabinet approves Unified Pension Scheme, granting central government staff option between NPS and UPS. New plan promises 50% of final salary as minimum pension after 25 years.

NEW DELHI – The Cabinet has greenlit the Unified Pension Scheme (UPS), presenting central government employees with a choice between the existing…

#मुख्य#central government employee welfare#Featured#government financial security measures#government pension reform#Indian pension system changes#NPS vs UPS#pension policy update#public sector retirement plans#retirement benefits for government staff#Unified Pension Scheme#UPS for central employees

0 notes

Text

Bangladesh: Will there be another Pakistan on India’s western border?

There is more, which is not meeting the eye in the border state. Bangladesh is experiencing significant unrest once more, with nearly 100 fatalities reported on Sunday as demonstrators demanding the resignation of Prime Minister Sheikh Hasina engaged in confrontations with security personnel and supporters of the ruling party. In the previous month, violence instigated by student organizations opposing reserved quotas in government employment resulted in at least 150 deaths and thousands of injuries. Below are the details regarding the recent protests and their historical context. The well planned and executed plan with possible help from two neighbouring nations, situation provides them with several entry points into India for various activities. Their objective is to see the Bangladesh Nationalist Party (BNP) attain power and extend support to another nation. Hasina endeavoured to maintain a balanced relationship with both Neighbouring nation and India; however, her neutral position did not sit well with another capital city. "Notably, several prominent members of the Islamic student organization successfully engaged with Western-affiliated NGOs by employing the language of democracy and rights," was articulated as part of the strategic planning.

What does the spies reported?

Following the deepening relationship between the Indian and Bangladeshi administrations, the Jamaat-e-Islami, which is supported by the ISI, reportedly obtained considerable financial resources earlier this year aimed at undermining the government of Sheikh Hasina. An intelligence official informed TOI that a notable share of this funding is thought to have come from Chinese organizations based in neighbouring nation

The ICS, recognized for its opposition to India and its jihadist objectives, has been monitored by Indian intelligence for a considerable period due to its operations in areas neigh boring Bangladesh and its connections with the ISI-supported Harkat-ul-Jihad-al-Islami (HuJI). There is substantial evidence indicating that members of the ICS have received training in both Afghanistan and Neighouring nation. The primary aim of Jamaat or ICS is to create a government in Bangladesh akin to that of the Taliban, with the ISI reportedly providing assurances of support to help realize this ambition.

What was the trigger for the bloody protest?

Protests commenced at university campuses in June following the High Court's reestablishment of a quota system for government employment, which reversed a 2018 ruling by Hasina's administration that had abolished it. Subsequently, the Supreme Court stayed the High Court's decision in response to the government's appeal and ultimately annulled the lower court's ruling last month, mandating that 93% of positions be available to candidates based on merit.

Rising levels of unemployment

FLAGGING ECONOMY, UNEMPLOYMENT

The current turmoil in Bangladesh is largely linked to the lack of growth in private sector employment, which has rendered public sector positions, characterized by consistent salary increases and benefits, particularly appealing. The introduction of quotas has incited frustration among students facing significant youth unemployment, with approximately 32 million young individuals either unemployed or out of educational institutions in a total population of 170 million. The economy, which was previously one of the fastest-growing globally due to the thriving garment industry, has now stagnated. Inflation rates are approximately 10% annually, and foreign currency reserves are diminishing.

The protests in Bangladesh, which initially aimed to reform the quota system, came to a halt following the Supreme Court's decision to abolish the majority of quotas on July 21. Nevertheless, demonstrators resumed their activities last week, calling for a public apology from Prime Minister Hasina regarding the violence, the restoration of internet services, the reopening of college and university campuses, and the release of individuals who had been detained.

In the recent weeks, the protest’s , they have since evolved into a broader protest against Prime Minister Hasina and the Awami League Party. The demonstrators have made it clear that their primary demand is for Hasina to resign, while the government claims that the agitation is being orchestrated by the Bangladesh.Demonstrations have persisted even after the Appellate Division of the Supreme Court annulled the High Court's order that had triggered the crisis. The ruling body declared that 93% of positions in government services would be allocated based on merit, with only 5% of jobs set aside for freedom fighters and their descendants. Additionally, a 1% quota has been designated for tribal communities, individuals with disabilities, and sexual minorities.

https://www.businesstoday.in/world/story/bangladesh-unrest-do-isi-neighouring nation-have-a-hand-in-conspiracy-to-oust-sheikh-hasina-heres-what-we-know-440315-2024-08-06

An historic context that dates back to 1972

Following the Bangladesh Liberation War of 1971, the country underwent significant transformations in its social, economic, and political structures. A fundamental promise underlying the establishment of the state was Sheikh Mujibur Rahman's commitment to ensuring justice for those who had endured sacrifices and hardships in the struggle for freedom against the Neighbouring national military. Upon his return to Dhaka in 1972, Mujib took decisive steps to implement a quota system for freedom fighters, known as Mukti joddhas. Additionally, he established a separate quota for Bangladeshi women who had suffered atrocities at the hands of the Neighbouring national military. However, after Sheikh Mujib's assassination in 1975, the quota system experienced modifications. The provisions for freedom fighters were weakened, and the scope of the quota was broadened to include marginalized groups within society, encompassing women, individuals from underdeveloped regions, and ethnic minorities or tribes

Why were students protesting in Bangladesh?

The protests started in early July, driven by the peaceful demands of university students to eliminate quotas in civil service jobs. These quotas, which reserve one-third of positions for the relatives of veterans from Bangladesh's war for independence from Neighbouring nation in 1971. The foundation of these protests stems from a contentious quota system, which allocates up to 30% of government positions to the relatives of veterans who fought in Bangladesh's 1971 war of independence against Neighbouring nation. The Bangladesh Police have resorted to using tear gas against the protesters.

Protests regarding the quota system have emerged due to a significant decline in the number of freedom fighters eligible to benefit from it over the years. This reduction has resulted in the underutilization of the quota for its intended purpose, thereby increasing the likelihood of its misuse. Critics argue that while it was justifiable to provide reservations to freedom fighters during their active years in the workforce, the practice of extending these reservations to their descendants—first to their children and subsequently to their grandchildren—has raised concerns. This opposition is further fueled by allegations that any shortfalls in the reserved seats are being compensated by granting quotas to members of Ms. Hasina’s Awami League party.

The political landscape of Bangladesh has been predominantly influenced by Sheikh Hasina, the daughter of Sheikh Mujibur Rahman, and her political party, the Awami League. Over time, opposition parties and government critics have increasingly expressed concerns that the quota system for freedom fighters serves as a mechanism to cultivate a faction of loyalists within the bureaucracy, thereby securing the Awami League's ongoing governance.

A possible dubious ploy supported by external fore

According to high-level intelligence sources, two nations played a significant role in the crisis in Bangladesh that resulted in Sheikh Hasina's departure. CNN-News18 was the first outlet to report on the potential resignation of Hasina from her position as Prime Minister. Unverified report indicates, David Burgan, based in the United Kingdom, along with activist Pinaki Bhattacharjee, Tarique Rehman of the Bangladesh Nationalist Party (BNP), and the proprietors of Netra News, were identified as the principal coordinators. They orchestrated a social media campaign targeting her and were responsible for the military maneuvers as well as the initiation of a fabricated narrative on social media platforms.

Reports are emerging that a fabricated narrative regarding Prime Minister Hasina was constructed by the United States concerning the issue of "free and fair elections." Furthermore, the US imposed sanctions on Bangladesh's elite Rapid Action Battalion (RAB) due to allegations of human rights abuses. It is noted that the BNP has significant influence within this context. Additionally, Yunus Hasan, a Nobel laureate associated with Grameen Bank and accused of corruption in Bangladesh, is also active as a lobbyist in the United States, as per the sources. The sources indicated that the lobbying efforts by four to five prominent individuals, combined with Hasina's unwillingness to comply with American demands, contributed to the situation's deterioration.

An additional factor was her geographical closeness to Neighouring nation, as perceived by Western nations. In contrast, Tarique has promised the West that upon regaining power, he will sever connections with Neighouring nation and prioritize Western interests in Bangladesh, according to sources. Another tactic involves maintaining regional instability, which would also pose challenges for India, thereby diverting its attention to Myanmar, Bangladesh, the Maldives, and Neighouring nation, as reported by sources. Furthermore, Neighbouring nation's Inter-Services Intelligence has significantly contributed to these efforts, operating both directly and indirectly in support of Western objectives, according to sources.

Role of neighboring enemy nation which is inimical to India’s growth cannot be ruled out, which expect an anti-India government to be formed in Bangaldesh, to ferment contestant trouble, destabilize the country, possibly create a civil war like situation, which will directly impact India and especially the border stage of Bengal and Assam populated with a sizeable minority community. A foreign intelligence agency is leveraging an anti-India organization along with its student faction to exacerbate the situation in Dhaka. Jamaat is perceived to have strong ties with Neighbouring nation, receiving covert financial support intermittently. Recently, an atypical action was observed, which is generally not undertaken by diplomatic missions. The Neighbouring national embassy encouraged students to seek refuge within the mission if necessary. Such conduct is rarely exhibited by diplomatic entities. As a result, they gain access to various border entry points into India for a wide range of activities. Their objective is to see the Bangladesh Nationalist Party (BNP) ascend to power and extend support to Neighbouring nation.

A possible role of another neighboring nation cannot be ruled out which must also be in the scanner of Indian security top-brass. However, they maintain strong business relationships with Hasina. The evident indication is the assault on Hindus, which is also aimed at fostering anti-India sentiments. If this situation is not managed, the next phase will involve the initiation of terrorist activities.

As reported in prominent news channel, the role of a neighbor that is aligned with as more advantageous. An intelligence source cited in a TOI report suggests that "the assistance from Neighouring nation's ministry of state and security is believed to have played a supportive role, given Neighouring nation concerns regarding Hasina's 'balancing act' in her interactions with both India and Neighouring nation. A government in Dhaka that is influenced by Neighouring nation would undoubtedly align more closely with Neighouring nation interests."

What next?

in the wake of Hasina's exit, the chief of the Bangladesh army is scheduled to engage with leaders of the student protest movement, as the nation looks forward to establishing a new government. The Students Against Discrimination initiative has put forth Nobel Prize winner Mohammad Yunus as a candidate to lead an interim administration.

#Notably#several prominent members of the Islamic student organization successfully engaged with Western-affiliated NGOs by employing the language o#There is more#which is not meeting the eye in the border state. Bangladesh is experiencing significant unrest once more#with nearly 100 fatalities reported on Sunday as demonstrators demanding the resignation of Prime Minister Sheikh Hasina engaged in confron#violence instigated by student organizations opposing reserved quotas in government employment resulted in at least 150 deaths and thousand#situation provides them with several entry points into India for various activities. Their objective is to see the Bangladesh Nationalist P#her neutral position did not sit well with another capital city. was articulated as part of the strategic planning.#What does the spies reported?#Following the deepening relationship between the Indian and Bangladeshi administrations#the Jamaat-e-Islami#which is supported by the ISI#reportedly obtained considerable financial resources earlier this year aimed at undermining the government of Sheikh Hasina. An intelligenc#The ICS#recognized for its opposition to India and its jihadist objectives#has been monitored by Indian intelligence for a considerable period due to its operations in areas neigh boring Bangladesh and its connecti#with the ISI reportedly providing assurances of support to help realize this ambition.#What was the trigger for the bloody protest?#Protests commenced at university campuses in June following the High Court's reestablishment of a quota system for government employment#which reversed a 2018 ruling by Hasina's administration that had abolished it. Subsequently#the Supreme Court stayed the High Court's decision in response to the government's appeal and ultimately annulled the lower court's ruling#mandating that 93% of positions be available to candidates based on merit.#Rising levels of unemployment#FLAGGING ECONOMY#UNEMPLOYMENT#The current turmoil in Bangladesh is largely linked to the lack of growth in private sector employment#which has rendered public sector positions#characterized by consistent salary increases and benefits#particularly appealing. The introduction of quotas has incited frustration among students facing significant youth unemployment#with approximately 32 million young individuals either unemployed or out of educational institutions in a total population of 170 million.

0 notes

Text

How to Invest in ETFs (Exchange-Traded Funds): A Comprehensive Guide with KBWD as An Example

Investing can seem overwhelming, especially with the wide array of choices available to modern investors. Among these choices, ETFs, or Exchange-Traded Funds, have gained popularity due to their versatility and potential for high returns. In this comprehensive guide, we will explore how to invest in ETFs, covering essential topics such as ETF basics, investment strategies, and the specific pros…

View On WordPress

#beginner&039;s guide to ETFs#best ETFs#diversified portfolio#dividend reinvestment#dividend yield#ETF analysis#ETF basics#ETF benefits#ETF diversification#ETF expenses#ETF guide#ETF holdings#ETF investment#ETF performance#ETF portfolio#ETF pros and cons#ETF research#ETF returns#ETF risks#ETF sectors#ETF strategies#ETF tips#ETF trading#Exchange-Traded Funds#financial advisor#financial ETFs#financial goals#financial health#financial investment strategies#financial planning

0 notes

Text

Achieving Sustainable Expansion: The Art of Balancing Growth and Asset Quality in Financial Institutions

The pursuit of growth often comes hand in hand with the challenge of maintaining asset quality. Financial institutions are under constant pressure to expand their loan portfolios and capture larger market shares. However, unchecked expansion can pose significant risks to asset quality, potentially leading to higher non-performing assets (NPAs) and undermining stability and profitability. In this article, we delve into strategies for achieving sustainable expansion while safeguarding asset quality, drawing insights from Abhay Bhutada, MD of Poonawalla Fincorp.

Growth and Asset Quality: Finding the Balance

The quest for growth is a fundamental driver for financial institutions, offering avenues for profitability, enhancing shareholder value, and bolstering competitive positioning. Nevertheless, the pursuit of growth must be tempered with prudence to avoid compromising asset quality. A strategic, risk-adjusted approach is essential in navigating this delicate balance.

Also Read: How Does Abhay Bhutada Intend To Offer A Distinctive Product Proposition With Their Co-branded Credit Cards?

Embracing a Risk-Adjusted Approach to Growth

Sustainable growth requires a nuanced understanding of risk and a proactive approach to risk management. Financial institutions must focus on lending to creditworthy customers while steering clear of high-risk segments. This entails rigorous due diligence, robust data analytics, and stringent credit assessment frameworks as mentioned by Abhay Bhutada in his interview with Ecomics Times. Predictive analytics and stress testing are indispensable tools for anticipating and mitigating potential risks, enabling institutions to adjust their strategies in response to evolving market conditions.

Prioritizing Bureau-Tested Customers

Central to this strategy is the emphasis on lending to bureau-tested customers—individuals with documented credit histories verified by credit bureaus. By prioritizing these customers, financial institutions mitigate default risk, as their creditworthiness has been established through past financial behavior. Avoiding high-default probability segments such as first-time borrowers or those with poor credit histories is paramount to safeguarding asset quality and ensuring a healthy loan portfolio.

Leveraging Data and Analytics

Access to comprehensive and reliable data is foundational to effective risk management. Robust databases empower lenders to conduct thorough analyses of potential borrowers, evaluating their financial health, repayment capacity, and creditworthiness. Predictive analytics plays a pivotal role in leveraging data, enabling institutions to develop accurate credit scoring models and enhance decision-making processes.

The Role of Cash Flow-Based Lending

Cash flow-based lending emerges as a critical component in maintaining asset quality. By focusing on borrowers with stable and verifiable cash flows, lenders mitigate the risk of defaults and foster a healthier loan portfolio. Deep insights into borrowers' business operations, revenue streams, and financial stability are imperative for effective cash flow-based lending, particularly in the case of small and medium-sized enterprises (SMEs).

Also Read: Abhay Bhutada's Journey Transforming Poonawalla Fincorp And Transitioning To A Group-Level Role

Monitoring and Adaptation: Keys to Sustained Improvement

Continuous monitoring, dynamic risk management, and adaptive strategies are essential for sustaining improvement in asset quality. Despite robust strategies, challenges such as economic downturns, regulatory changes, and market volatility persist. Proactive risk management practices, including stress testing and engagement with regulators, are vital in mitigating these risks and ensuring resilience in the face of adversity.

Harnessing Technological Advancements

Technological advancements, notably artificial intelligence (AI) and machine learning (ML), present unprecedented opportunities for enhancing credit risk assessment and management. By automating complex analytical processes and providing real-time insights, AI and ML enable institutions to strengthen risk management capabilities and maintain asset quality in an ever-evolving financial landscape.

Future Outlook: Navigating Growth with Prudence

As financial institutions continue to navigate the complexities of growth, maintaining a steadfast focus on asset quality remains paramount. By adhering to principles of responsible lending, leveraging technology and data-driven insights, and remaining agile in response to emerging challenges, institutions can achieve sustainable expansion without compromising asset quality. The future success of financial institutions hinges on their ability to strike a delicate balance between growth ambitions and prudent risk management.

Also Read: How Abhay Bhutada Plans To Improve Finance Trajectory In 2024

Conclusion: Striking the Balance for Sustainable Growth

In conclusion, achieving sustainable expansion in the financial sector requires a careful balancing act between growth imperatives and asset quality preservation. Through a risk-adjusted approach, prioritizing bureau-tested customers, leveraging data and analytics, and embracing technological advancements, financial institutions can navigate this delicate balance successfully. By maintaining a proactive stance on risk management and remaining adaptable in the face of evolving challenges, institutions can pave the way for long-term success and stability in an ever-changing landscape.

0 notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel.

Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes

Text

Corrtech International IPO Date, Price, Company profile, risk & financial details

New Post has been published on https://wealthview.co.in/corrtech-international-ipo/

Corrtech International IPO Date, Price, Company profile, risk & financial details

Corrtech International IPO: Corrtech International is a leading provider of pipeline laying solutions in India, specializing in hydrocarbon pipelines. They also manufacture precision components for gas and steam turbines, and serve the aerospace and defense sectors. The company operates in a crucial industry for India’s energy infrastructure and economic growth.

Corrtech International IPO Key Details:

Status: Corrtech International’s IPO has not yet launched.

Issue Size: The planned IPO will consist of:

Fresh issue: Rs. 350 crore worth of new equity shares.

Offer for Sale: 40 lakh shares from existing shareholders.

Price Band: The price band for the issue is yet to be finalized.

News & Developments:

Corrtech International received SEBI approval for the IPO in July 2022, but no further updates have been announced since then.

Recent developments in the oil and gas sector, including rising energy prices, could potentially boost investor interest in the company.

Given the company’s established position in a critical industry and the potential benefits of rising energy prices, Corrtech International IPO could attract investor interest. However, the lack of updates on the issue timeline and uncertainties in the broader market may dampen enthusiasm.

Corrtech International IPO Offer Details:

Securities Offered:

Corrtech International IPO will offer equity shares only. These are units of ownership in the company, and investors who subscribe to the IPO will become shareholders.

Investor Category Reservation:

As the IPO details haven’t been finalized, the specific reservation percentages for different investor categories are still unknown. However, based on typical Indian IPOs, the reservation could be something like:

Retail Investors: 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors: 15%

Minimum Lot Size:

The minimum lot size for the IPO will likely be one bid lot. This typically represents a specific number of shares, for example, 100 shares. The final minimum lot size will be confirmed closer to the issue date.

Investment Amount:

The amount required to invest will depend on the minimum lot size and the final issue price. Once the price band is announced, you can multiply the minimum lot size by the lower and upper price band to estimate the minimum and maximum investment amounts.

Example:

If the minimum lot size is 100 shares and the price band is Rs. 20-25 per share, the minimum investment amount would be Rs. 2,000 (100 shares * Rs. 20), and the maximum investment amount would be Rs. 2,500 (100 shares * Rs. 25).

For more details refer Corrtech International Limited, Draft Offer Documents filed with SEBI.

Corrtech International Company profile:

History & Operations:

Founded in 1982: Corrtech has 41 years of experience in India’s crucial pipeline construction sector.

Core Businesses:

Pipeline Construction: Lays oil and gas pipelines with expertise in cross-country and directional drilling techniques.

Cathodic Protection Solutions: Protects pipelines from corrosion, ensuring their longevity and safety.

Precision Components: Manufactures high-quality parts for gas and steam turbines, catering to aerospace and defense sectors through subsidiary Corrtech Energy Limited (CEL).

Market Position & Share: A leading player in India’s pipeline laying segment, with a significant market share. Exact figures vary depending on project type and region.

Key Facts:

Headquarters: Ahmedabad, Gujarat, India

Employees: Over 1,000

Revenue: Over INR 500 crore (as of March 2021)

Awards & Recognitions: Received numerous awards for operational excellence, safety, and sustainability.

Prominent Brands & Partners:

Brands: “Corrtech” is the main brand, recognized for pipeline expertise.

Subsidiaries: CEL leverages the Corrtech brand while specializing in precision components.

Partnerships: Works with major oil and gas companies, engineering firms, and government agencies on various projects.

Milestones & Achievements:

Successfully completed over 10,000 km of pipeline projects.

Developed proprietary trenchless technology for environmentally friendly pipeline construction.

Established CEL as a leading supplier of precision components to high-profile clients.

Competitive Advantages & USP:

Experience & Expertise: Established track record, skilled workforce, and proven project execution capabilities.

Integrated Services: Offers end-to-end solutions from construction to corrosion protection.

Technological Innovation: Continuous investment in R&D for efficient and sustainable pipeline solutions.

Diversification: Strong presence in multiple sectors strengthens financial stability.

Corrtech International Financials:

Particulars March-2022 March-2021 March-2020 Total Assets 766.32 618.99 594.77 Total Expenses 990.21 956.21 733.88 Total Revenue 1065.75 995.97 784.72 Profit After Tax 49.72 28.55 34.94 EBITDA 120.71 95.62 97.87

Lead Managers and Registrar for Corrtech International IPO:

Lead Managers:

DAM Capital Advisors Limited:

Track record: Managed 14 IPOs in the past 2 years, including successful offerings for companies like Concord Enviro Systems Limited, Galaxy Surfactants Limited, and Astron Paper & Board Mills Limited.

Equirus Capital Private Limited:

Track record: Extensive experience managing over 80 IPOs across various sectors, including recent successful offerings for Karda Therapeutics Limited, Chemcon Specialities Limited, and Amber Enterprises India Limited.

Registrar:

Link Intime India Private Limited:

Role in the IPO process:

Handles investor account management and share allotment.

Processes refunds for unallocated bids.

Facilitates dematerialization of shares after listing.

Acts as a communication channel between the company and investors.

Potential Risks and Concerns for Corrtech International IPO:

Industry Headwinds:

The oil and gas industry, which is a major source of revenue for Corrtech, is cyclical and faces headwinds like fluctuations in oil prices, environmental regulations, and competition from renewable energy sources. These factors could impact the company’s future growth and profitability.

Company-Specific Challenges:

Reliance on a few major customers: Corrtech’s dependence on a limited number of customers, primarily oil and gas companies, exposes them to the risk of losing significant revenue if contracts are terminated or renegotiated.

Debt burden: The company has a significant debt load, which could limit its financial flexibility and impact its ability to invest in growth initiatives.

Financial track record: While the company has shown improvement in recent years, its past history of loan defaults raises concerns about its financial stability and ability to manage debt.

Competition: Corrtech faces intense competition from other established players in the pipeline laying and EPC services industry. This could put pressure on margins and limit growth potential.

Financial Health Analysis:

Revenue: While Corrtech has reported revenue growth in recent years, it is important to analyze the sustainability of this growth and its dependence on specific projects or contracts.

Profitability: The company’s profitability remains low compared to its peers. Investors should carefully assess the profitability margins and future growth projections to evaluate potential returns.

Debt-to-equity ratio: The high debt-to-equity ratio indicates a significant reliance on debt financing, which can increase financial risk. Investors should examine the company’s debt repayment plan and its ability to manage its debt burden.

Conclusion:

While Corrtech International IPO presents an opportunity for potential growth, it is crucial to be aware of the associated risks and uncertainties. Investors should carefully analyze the company’s financial health, industry headwinds, and market volatility before making any investment decisions. Thorough due diligence and seeking professional advice are essential steps towards a well-informed investment choice.

Also Read: How to Apply for an IPO?

#Corrtech International#debt reduction#expansion plans#Financial Performance#infrastructure sector#investor sentiment#IPO#Lead Managers#public issue#registrar#Stock market#UPCOMING IPO#valuation#News

0 notes

Text

PSU bonds vs. other investments

PSU Bonds vs. Stocks: When comparing PSU bonds to stocks, a key distinction is the ownership aspect. Unlike stocks, where investors gain ownership in the company, PSU bonds do not confer any ownership rights. While stocks carry the allure of higher growth potential, they also come hand-in-hand with elevated risks due to market fluctuations. On the other hand, PSU bonds cater more to conservative investors who prioritize stability and steady income over the potential for aggressive growth.

PSU Bonds vs. Mutual Funds: The dynamic between PSU bonds and mutual funds unveils another facet of investing. Mutual funds pool funds from numerous investors to create a diversified investment portfolio. While mutual funds can potentially yield higher returns, they remain susceptible to the inherent volatility of the market. In contrast, PSU bonds emerge as a potential stabilizing factor for those seeking a counterbalance to the roller-coaster ride of the market, making them an appealing option for stability-minded investors.

PSU Bonds vs. Fixed Deposits: In the realm of fixed-income investments, both PSU bonds and fixed deposits garner attention. Fixed deposits are favoured for their straightforward nature and assured returns. PSU bonds, however, introduce an intriguing alternative. With the potential for higher returns and the added advantage of traceability in the secondary market, PSU bonds stand out as a potentially more lucrative option for investors willing to venture beyond the conventional path of fixed deposits.

0 notes

Text

Federal Reserve Stress Test Sends Shock waves through Stock Market! JP MORGAN JUMPED 3.49%

Federal Reserve stress test results on U.S. bank stocks and their influence on the overall market. Gain insights into investor sentiment, regulatory concerns, and the future outlook.

U.S. bank stocks surged in response to the results of the Federal Reserve’s annual stress tests, instilling renewed confidence among investors and traders. The comprehensive health checks provided insights into the resilience of major lenders, addressing concerns stemming from recent failures, including Silicon Valley Bank and other institutions. The impressive performance of bank stocks highlights their ability to weather an economic slump and underscores the importance of stress testing in ensuring a stable financial system.

While the stress test results boosted market sentiment, skeptics remain cautious regarding dividends and share buybacks. Heightened regulatory oversight and uncertainties surrounding the economic outlook contribute to concerns about the feasibility of larger payouts. Analysts at RBC Capital Markets caution that the recent banking crisis has driven banks to adopt a more conservative approach, potentially limiting share buyback activities for the remainder of 2023.

Continue Reading the Complete Article : Click Here

OTHER TOPIC:

Market Corrections: 5 Factors Every Investor and Trader Must Understand

Mastering the Stochastic Oscillator

THE POWER OF BOLLINGER BANDS

GDP Data: Economic Growth and Stable Inflation

Strong Economy: Understanding and Impact

How to Safeguard your Investments During a Market Decline?

#Federal Reserve stress test results impact on U.S. bank stocks#Investor sentiment following the Federal Reserve stress test#Regulatory concerns and the future outlook for U.S. bank stocks#Resilience of major lenders in the Federal Reserve stress test#Economic uncertainty and its influence on U.S. bank stocks#Importance of stress testing in ensuring a stable financial system#Skepticism regarding dividends and share buybacks after stress test results#Heightened regulatory oversight and its impact on U.S. bank stocks#Performance of smaller banks in the stress test and overall sector health#Stock market response to the Federal Reserve stress test results#Capital requirements and cash return plans of U.S. banks#Potential implications of higher capital requirements for banks#Market optimism and restored investor confidence in U.S. bank stocks#Challenges faced by smaller banks in the U.S. banking system#Long-term stability and growth prospects in the banking sector#Investoropia

0 notes

Text

The CFPB is genuinely making America better, and they're going HARD

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

Let's take a sec here and notice something genuinely great happening in the US government: the Consumer Finance Protection Bureau's stunning, unbroken streak of major, muscular victories over the forces of corporate corruption, with the backing of the Supreme Court (yes, that Supreme Court), and which is only speeding up!

A little background. The CFPB was created in 2010. It was Elizabeth Warren's brainchild, an institution that was supposed to regulate finance from the perspective of the American public, not the American finance sector. Rather than fighting to "stabilize" the financial sector (the mission that led to Obama taking his advisor Timothy Geithner's advice to permit the foreclosure crisis to continue in order to "foam the runways" for the banks), the Bureau would fight to defend us from bankers.

The CFPB got off to a rocky start, with challenges to the unique system of long-term leadership appointments meant to depoliticize the office, as well as the sudden resignation of its inaugural boss, who broke his promise to see his term through in order to launch an unsuccessful bid for political office.

But after the 2020 election, the Bureau came into its own, when Biden poached Rohit Chopra from the FTC and put him in charge. Chopra went on a tear, taking on landlords who violated the covid eviction moratorium:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

Then banning payday lenders' scummiest tactics:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Then striking at one of fintech's most predatory grifts, the "earned wage access" hustle:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Then closing the loophole that let credit reporting bureaus (like Equifax, who doxed every single American in a spectacular 2019 breach) avoid regulation by creating data brokerage divisions and claiming they weren't part of the regulated activity of credit reporting:

https://pluralistic.net/2023/08/16/the-second-best-time-is-now/#the-point-of-a-system-is-what-it-does

Chopra went on to promise to ban data-brokers altogether:

https://pluralistic.net/2024/04/13/goulash/#material-misstatement

Then he banned comparison shopping sites where you go to find the best bank accounts and credit cards from accepting bribes and putting more expensive options at the top of the list. Instead, he's requiring banks to send the CFPB regular, accurate lists of all their charges, and standing up a federal operated comparison shopping site that gives only accurate and honest rankings. Finally, he's made an interoperability rule requiring banks to let you transfer to another institution with one click, just like you change phone carriers. That means you can search an honest site to find the best deal on your banking, and then, with a single click, transfer your accounts, your account history, your payees, and all your other banking data to that new bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Somewhere in there, big business got scared. They cooked up a legal theory declaring the CFPB's funding mechanism to be unconstitutional and got the case fast-tracked to the Supreme Court, in a bid to put Chopra and the CFPB permanently out of business. Instead, the Supremes – these Supremes! – upheld the CFPB's funding mechanism in a 7-2 ruling:

https://www.scotusblog.com/2024/05/supreme-court-lets-cfpb-funding-stand/

That ruling was a starter pistol for Chopra and the Bureau. Maybe it seemed like they were taking big swings before, but it turns out all that was just a warmup. Last week on The American Prospect, Robert Kuttner rounded up all the stuff the Bureau is kicking off:

https://prospect.org/blogs-and-newsletters/tap/2024-06-07-window-on-corporate-deceptions/

First: regulating Buy Now, Pay Later companies (think: Klarna) as credit-card companies, with all the requirements for disclosure and interest rate caps dictated by the Truth In Lending Act:

https://www.skadden.com/insights/publications/2024/06/cfpb-applies-credit-card-rules

Next: creating a registry of habitual corporate criminals. This rogues gallery will make it harder for other agencies – like the DOJ – and state Attorneys General to offer bullshit "delayed prosecution agreements" to companies that compulsively rip us off:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-creates-registry-to-detect-corporate-repeat-offenders/

Then there's the rule against "fine print deception" – which is when the fine print in a contract lies to you about your rights, like when a mortgage lender forces you waive a right you can't actually waive, or car lenders that make you waive your bankruptcy rights, which, again, you can't waive:

https://www.consumerfinance.gov/about-us/newsroom/cfpb-warns-against-deception-in-contract-fine-print/

As Kuttner writes, the common thread running through all these orders is that they ban deceptive practices – they make it illegal for companies to steal from us by lying to us. Especially in these dying days of class action suits – rapidly becoming obsolete thanks to "mandatory arbitration waivers" that make you sign away your right to join a class action – agencies like the CFPB are our only hope of punishing companies that lie to us to steal from us.

There's a lot of bad stuff going on in the world right now, and much of it – including an active genocide – is coming from the Biden White House.

But there are people in the Biden Administration who care about the American people and who are effective and committed fighters who have our back. What's more, they're winning. That doesn't make all the bad news go away, but sometimes it feels good to take a moment and take the W.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

#pluralistic#cfpb#consumer finance protection board#rohit chopra#scotus#bnpl#buy now pay later#repeat corporate offenders#fine print deception#whistleblowing#elizabeth warren

1K notes

·

View notes

Text

Just to make my position on the subject of Crab Day clear, since word is going around that the idea came from a highly objectionable person, I’m going to quote rather than reblog @skaldish:

This I agree with. I've seen other posts go around about it, so it wasn't just that one person.

But to make it clear, I'll take the time to explain to people why participating in Crab Day (and financially supporting Tumblr in general) is important:

It's unfortunate, but in this day and age, large websites like this one can't function without an exorbitant amount of income. For other social medias, the bulk of this income comes from Business-to-Business (B2B) transactions, often in the form of selling user data.

The thing y'all need to understand is that wealth is VASTLY different in the B2B economy than it is with B2C (business-to-consumer) economy. In fact, this is a huge reason why we're in an economic crisis...because the US is a nation with two economies, and the power of the dollar is astronomically different between the two of them.

Tech's standard of wealth is based in the B2B economy. Because Tumblr is in the Tech sector, it needs to play according to Tech wealth. Unfortunately, the way you earn Tech wealth is by selling Tech-related B2B products, and for social media websites, that product is user data.

It's a competitive market that sets a new standard of rotten with every transaction. In order to acquire data that's more valuable than your competitor's data, you have to be less ethical about how you source it...and also be willing to cross moral boundaries in regards to who you sell it to.

If Tumblr finds no other way of sourcing income, they have no choice but to participate in this data market or shut down.

However, Tumblr is the home of the secret third thing. In this case, this secret third thing is to work with the community rather than exploit it.

(That's what it looks like to me, anyway. I nether trust nor doubt Tumblr's words; that's not what's winning me over. Instead, I'm curious to know where they plan to go with this, because this is unusual as far as business practices go and I think it would be cool if they're trying to set a more holistic precedent for the social media of the future. I won't be able to see that conclusion if they go bankrupt though.)

So yes, participate in Crab Day. Just because one unpleasant person also condones it doesn't mean it's a bad idea.

4K notes

·

View notes

Text

Groom Persona chart Observation ✨

✨ For entertainment purposes only, enjoy ✨

~~~~~~~~~~~~~✨✨~~~~~~~~~~~~~

💖 1st house stellium in GPC means your fs maybe someone who is noticeable and stands out in social situations.

💖 5th house stellium in GPC means your fs could be an artist, musician, writer.

💖 7th house stellium in GPC means your fs could be attractive and socially adept, drawing others to them with their magnetic personality and charisma.

💖 Union (1585) in 1st house meaning meeting your fs while attending social events, gatherings, or parties where you can connect with new people/ professional connection/ shared interest.

💖 Union in 3rd house means you can meet your fs during short journeys or travels close to home.

💖 Union in 8th house means you may meet your fs in context where there is a shared investment and mutual dependency, such as through work, joint projects or shared social circles.

💖 Juno in Capricorn means your fs is known for their ambitious and goal oriented nature. They may be highly driven and motivated to achieve success in thier career, personal goals and relationships./ Could be famous too .

💖 Juno in Sagittarius means they can be a foreigner, philosophical and open minded.

💖 Juno in Taurus means your fs may prioritise creating a stable and secure home environment and may value financial stability within the relationship.

💖 Juno in leo means your fs may be confident, outgoing and enjoy being the center of the attention in social settings., Creative, generous, romantic.

💖 sun in 11th house means your fs is likely to possess a charismatic and Magnetic personality within their social circles ,may value friendship highly and their social network may play a significant role in shaping their identity and opportunities.

💖 Sun in 12th house means your fs may be introspective and contemplative with a rich inner world that is not always readily apparent to others.

💖 sun in 6th house means your fs may prefer predictable schedules and organized workflows that allows them to efficiently manage their time and responsibilities., Possess strong problem solving skills and an analytical mindset.

💖 Juno / groom/ Venus in Sagittarius or 21°/9° or in Aquarius or in 9th /12th house means a Foreign spouse.

💖 Venus in 5th - creativity, music/ art , your fs may have a strong desire for children or a nurturing instinct towards family life.

💖 Venus in 10th house - ambitious, successful, well liked , respected spouse.

💖 Fama in 1st / 7th house - could be famous spouse.

💖 POF in 4th house - fs may have a deep connection to their cultural background or family traditions., May have interest in real estate or property related work.

💖 leo rising means your fs may have a strong desire for recognition and appreciation.may carry themselves with Grace and poise projecting on air of authority and nobility.

💖 Virgo rising -Fs may be modest and humble , health conscious, possess a discerning eye and critical mind.

💖 Scorpio rising - fs may have mysterious allure and a penetrating gaze that leaves a lasting impression on those the encounter, have a rich inner world with complex emotions that run Deep.

💖 industria(389) in 3rd house - your fs career-

musicians, blogger, public relations, possess creative ideas, small business owner.

💖 industria in Libra - your fs career may be something with public relations or marketing, art or design, legal advocacy, or event planning.

💖 industria in Aquarius - you fs may be in technology or IT specialist, social activism , scientist or researcher, humanitarian work or international development.

💖 industria in Pisces - creative arts , healing arts , oceanography or marine conservation, healing arts , charity work.

💖 Industria in Aries - entrepreneur, may thrive in leadership roles , sales , marketing, or sports management.

💖 industria in Taurus - financial sector, buisness ownership, agriculture, horticulture, real estate, painting, sculpting or in music composition.

💖 industria in cancer -

Hospitality, home based business, psychotherapist, food blogger, art therapy.

💖 industria in gemini - social media influencer, journalist, writer, teaching profession, tour guide , hotel manager.

💖 industria in Scorpio -

- psychology and counseling, detectives, private investigator, forensic scientist ,holistic/ energy healer.

💖 Industria in Virgo - doctor, nurse , scientist, data analyst, , office manager, project coordinator, teachers, or instructors.

💖 industria in leo - actors , musicians, artist, brand ambassador, publicist, marketing manager.

💖 industria in Sagittarius - professors , researchers, journalist, media, philanthropy or in social justice advocacy.

💖 industria in Capricorn -

Buisness and management, politician, policy advisors , civil servants, lawyers, engineering, architect, judges.

💖 Northnode in 7th house suggests that your relationship with your fs may have karmic significance., Soulmate placement.

💖 Northnode in 3rd house means your fs may play a significant role in facilitating your growth and development in the areas of communication, intellect and learning.

💖 Karma conjunct ascendent/ descendant - karmic relationship.

💖 your fs may share similar placement like your groom pc. Example - if your sun in Aries in GPC, they could have sun in their 1st house or at 1°,13° or 25°.

💖 Groom conjunct vertex - fated/ predestined encounter with fs. They may have a profound impact on your life and personal growth. they may serve as a catalyst for important experiences, growth opportunities and transfermetive changes is in your life .your relationship with them maybe characterised by depth, intensity and sense of spiritual or emotional connection.

💖 Groom conjunct Venus -

The conjunction of groom and Venus indicates are strong attraction between you and your fs. there may be a magnetic pull or chemistry that draws you together, fueling feelings of romance ,passion and desire. your FS may possess qualities that you find irresistibly attractive both physically and emotionally.

💖 your fs may be drawn to individuals who embody the qualities associated with the seventh House lord for example-

* if the 7th house lord is sun then your fs may be attracted to individuals who support their ambitions, encourage their creativity and contribute positively to their self expression. they may be drawn to partners who are confident, self assured and have a strong sense of individuality.

* if 7th house lord is moon - your fs desires a partner who can meet there emotional needs and provide a sense of comfort and belonging. they are drawn to individuals who are empathetic, nurturing and emotionally supportive. emotional intimacy is a priority for them in the relationship.

* if the 7th house lord is Venus -

Your FS values relationships highly and seeks harmonious and loving partnership. they may prioritise finding a romantic partner who complements their own sense of beauty and aesthetics. partnership is Central to their sense of fulfillment and happiness.

* if the 7th house lord is mercury - your fs places a high value on mental simulation and intellectual compatibility in the relationships. they seek a partner who can engage them in stimulating conversations and share their interest and ideas.

*if the 7th house lord is mars - your fs may seek a partner who can match their level of energy and enthusiasm and they may be drawn to firey and spirited individuals. they thrive on excitement and adventure in their relationships.

* if the 7th house lord is saturn - your fs value tradition and stability in relationships. they may have traditional views on marriage and may seek partners who share their values and commitment to building a secured and enduring Union.

* if the 7th house lord is Jupiter - your fs seeks meaningful and enriching connections in their relationships. they may be drawn to partners who share their values and aspirations who can inspired them to expand their horizons and pursue their goals with confidence.

~~~~~~~~~~~✨✨~~~~~~~~~~~~

Thanks for reading ~💫

-piko💖

#astro community#astro notes#astro observations#astrology#astro placements#composite#composite chart#synastry aspects#synastry#synastry observations#groom persona chart#briede persona chart#juno astrology#juno persona chart#future spouse#future husband#future#synastry overlays#spiritualgrowth#spiritual awareness#spiritual awakening#asteroid#astro asks#love astrology

1K notes

·

View notes

Text

Exploring the Digital Frontier: 10 Key Strategies to Revolutionize Finance in 2024

In today's rapidly evolving financial landscape, the fusion of technology and finance has become essential for prosperity. As we delve deeper into 2024, the digital transformation of finance offers unprecedented opportunities for efficiency and expansion.

Poonawalla Fincorp: Pioneering the Fintech Revolution through Digitalization

At the forefront of this revolution stands Poonawalla Fincorp, led by the visionary Abhay Bhutada, MD of the Fintech. With a robust risk management framework and cutting-edge collection infrastructure, Poonawalla Fincorp epitomizes the synergy between traditional financial expertise and digital prowess.

By embracing emerging technologies such as artificial intelligence (AI) and machine learning, Poonawalla Fincorp aims to optimize processes, mitigate risks, and enhance overall efficiency. This strategic vision, with Abhay Bhutada, aligned with Adar Poonawalla's ethos of innovation, positions the company at the forefront of the digital transformation sweeping through the financial sector.

The Imperatives of Financial Digitization in 2024

To successfully navigate the digital frontier and revolutionize financial operations in 2024, businesses must embrace strategic imperatives that encapsulate the essence of digital innovation and resilience. Here are ten essential strategies to guide organizations towards sustainable growth and competitiveness:

1. Embrace Cloud-Based Accounting Solutions

Cloud technology has redefined financial management, offering real-time tracking, automated invoicing, and seamless expense management. Platforms like QuickBooks Online and Xero provide accessibility across devices, fostering collaboration and integration with essential business tools.

Also Read: Meet Abhay Bhutada: The Winner Of Lokmat Maharashtrian Of The Year 2024

2. Harness the Power of AI-Powered Analytics

Artificial intelligence empowers organizations to extract deeper insights from vast datasets, enabling informed decision-making and predictive analytics. Tools like IBM Watson Analytics facilitate trend identification and market prediction, driving strategic initiatives.

3. Explore the Potential of Blockchain Technology

Beyond cryptocurrencies, blockchain technology enhances security and transparency in financial transactions. Leveraging blockchain-based solutions streamlines operations, minimizes fraud risks, and fosters trust among stakeholders.

4. Transition to Digital Payment Solutions

Digital payment methods offer unparalleled convenience and speed, aligning with evolving consumer preferences. Integrating payment gateways like PayPal and Stripe enhances transaction efficiency and elevates customer experience.

Also Read: Unveiling the Top Chartered Accountants in India and Their Staggering Net Worth

5. Automate Routine Financial Tasks

Robotic process automation streamlines financial processes, reducing manual intervention and minimizing errors. Automation of tasks such as invoice processing and payroll management enhances productivity and enables resource allocation to strategic endeavors.

6. Prioritize Cybersecurity Measures

With digital transactions come heightened cybersecurity risks. Implementing robust security protocols, including multi-factor authentication and encryption, safeguards sensitive financial data against cyber threats.

7. Tap into Digital Lending Platforms

Digital lending platforms provide expedited access to financing solutions, circumventing traditional bureaucratic hurdles. Peer-to-peer lending and crowdfunding platforms offer faster approval times and cater to diverse funding needs.

8. Embrace Mobile Banking Services

Mobile banking applications offer on-the-go access to financial services, enhancing convenience and customer satisfaction. Intuitive interfaces facilitate functions such as account management and fund transfers, fostering loyalty and engagement.

9. Leverage Robo-Advisors for Investment Management

Robo-advisors offer cost-effective investment management solutions, delivering personalized advice and continuous portfolio monitoring without human intervention. Automated investment strategies optimize returns and mitigate risks for investors.

Also Read: Driving Financial Inclusion: The Impact of Acquiring Magma Fincorp on Poonawalla Fincorp

10. Ensure Data Privacy and Compliance

Compliance with data privacy regulations is paramount to protect sensitive financial information and maintain trust. Implementing robust data governance frameworks and encryption protocols ensures compliance with regulations like GDPR and CCPA, safeguarding stakeholders' interests.

In Conclusion

The digitization of finance presents boundless opportunities for organizations to drive efficiency, transparency, and innovation. By embracing cloud-based accounting, AI-powered analytics, blockchain technology, and digital payment solutions, businesses can position themselves as trailblazers in the digital age of finance. However, success in navigating the digital frontier requires a strategic focus on cybersecurity, compliance, and user experience.

The journey towards financial digitization signifies more than just adopting new technologies; it embodies a fundamental shift in mindset and operational strategy. Embracing digital transformation demands a commitment to innovation, agility, and continuous improvement. As we stand on the brink of a new era in finance, organizations that embrace change and leverage technology to its fullest potential will emerge as leaders in tomorrow's financial landscape.

0 notes

Text

This is it. Generative AI, as a commercial tech phenomenon, has reached its apex. The hype is evaporating. The tech is too unreliable, too often. The vibes are terrible. The air is escaping from the bubble. To me, the question is more about whether the air will rush out all at once, sending the tech sector careening downward like a balloon that someone blew up, failed to tie off properly, and let go—or more slowly, shrinking down to size in gradual sputters, while emitting embarrassing fart sounds, like a balloon being deliberately pinched around the opening by a smirking teenager.

But come on. The jig is up. The technology that was at this time last year being somberly touted as so powerful that it posed an existential threat to humanity is now worrying investors because it is apparently incapable of generating passable marketing emails reliably enough. We’ve had at least a year of companies shelling out for business-grade generative AI, and the results—painted as shinily as possible from a banking and investment sector that would love nothing more than a new technology that can automate office work and creative labor—are one big “meh.”

As a Bloomberg story put it last week, “Big Tech Fails to Convince Wall Street That AI Is Paying Off.” From the piece:

Amazon.com Inc., Microsoft Corp. and Alphabet Inc. had one job heading into this earnings season: show that the billions of dollars they’ve each sunk into the infrastructure propelling the artificial intelligence boom is translating into real sales.

In the eyes of Wall Street, they disappointed. Shares in Google owner Alphabet have fallen 7.4% since it reported last week. Microsoft’s stock price has declined in the three days since the company’s own results. Shares of Amazon — the latest to drop its earnings on Thursday — plunged by the most since October 2022 on Friday.

Silicon Valley hailed 2024 as the year that companies would begin to deploy generative AI, the type of technology that can create text, images and videos from simple prompts. This mass adoption is meant to finally bring about meaningful profits from the likes of Google’s Gemini and Microsoft’s Copilot. The fact that those returns have yet to meaningfully materialize is stoking broader concerns about how worthwhile AI will really prove to be.

Meanwhile, Nvidia, the AI chipmaker that soared to an absurd $3 trillion valuation, is losing that value with every passing day—26% over the last month or so, and some analysts believe that’s just the beginning. These declines are the result of less-than-stellar early results from corporations who’ve embraced enterprise-tier generative AI, the distinct lack of killer commercial products 18 months into the AI boom, and scathing financial analyses from Goldman Sachs, Sequoia Capital, and Elliot Management, each of whom concluded that there was “too much spend, too little benefit” from generative AI, in the words of Goldman, and that it was “overhyped” and a “bubble” per Elliot.

As CNN put it in its report on growing fears of an AI bubble,

Some investors had even anticipated that this would be the quarter that tech giants would start to signal that they were backing off their AI infrastructure investments since “AI is not delivering the returns that they were expecting,” D.A. Davidson analyst Gil Luria told CNN.

The opposite happened — Google, Microsoft and Meta all signaled that they plan to spend even more as they lay the groundwork for what they hope is an AI future.

This can, perhaps, explain some of the investor revolt. The tech giants have responded to mounting concerns by doubling, even tripling down, and planning on spending tens of billions of dollars on researching, developing, and deploying generative AI for the foreseeable future. All this as high profile clients are canceling their contracts. As surveys show that overwhelming majorities of workers say generative AI makes them less productive. As MIT economist and automation scholar Daron Acemoglu warns, “Don’t believe the AI hype.”

6 August 2024

#ai#artificial intelligence#generative ai#silicon valley#Enterprise AI#OpenAI#ChatGPT#like to charge reblog to cast

183 notes

·

View notes

Text

#Atal Pension Yojana#Pension Scheme#Financial Security#Unorganized Sector#Retirement Planning#Social Security#Government Scheme#Old Age Pension#Financial Inclusion

0 notes

Text

PAC :

What's in your store for January

Pile 1 -3

Hello love's hope you had a very happy and fruitful new year , I'm praying for the happiness and well being of all of us one more year together I'm so grateful for each one of youuu

Please choose using your intuition and take what resonates

If you'd like a personalized reading for new year

Paid readings , paid readings 2 , masterlist

Pile 1 :

First of all what are you guys even dealing with good lord The energy is pretty heavy , I will not be surprised if you have prominent Saturn in your charts this month I believe you are dealing with karmic cycles , Things ending in general, you might be a bit shaken up soon something you thought never would happen will happen

I'm sensing career or home sector fights could be there as well as inner conflicts beware and take precautions don't get too caught up about what others have to say rather choose your own story this also indicates you might soon take a stand for yourself its really required something has to come to an end because the time is over now you are to urge for more ! Financially! Abundance is written for you this time your creativity will pay off I know you like you play with fire but remember life moulds you like a clay some fire glazes some melts you gotta choose your own battles why do I feel like I'm talking to myself lol .

You will understand the worth of spontaneous plans soon sometimes you gotta do stuff for the sake of doing it and you just gotta act wild just be careful about the fact that everyone you go out with isn't a friend every co worker doesn't mean good for you learn to see through people's mask ! Theres one video by persephonesmind its perfect she explains it really well , followed by ten of swords some of you might experience a rock bottom moment however it isn't for everyone but with the world be assured you will pick yourself up this might seem like a bad ending but it's a good one or turn out to be good it's a matter of time bae anyone who tries to play you cheat on you will be ashamed themselves because they will see the purity in your heart .towards the end of the month I see some enemies becoming friends.

Pile 2 :

You're a bad bitch period !! This month is about embodying the best version of yourself move on despite the snakes around you ignore the people you're gonna be investing on something that is worth it it's a sign ! Friendships are something you will be blessed this month new and old you will also actively let go of a fear of yours I heart heights and abandonment issues.

If you're looking for commitment from someone it will be given this month like engagements marriage yay social media fame is also written there would be more family functions to attend to I see more active energy in this pile. You will understand the worth of standing alone and work your intuition through difficult situations .Your dreams might be a clear indicator of something also I feel you're making someone cry or someone is making you cry ask advice from someone who's been there in your situation you can also ignore if the situation isn't as important I also feel ignorance energy I guess it's good because you're also healing from abandonment issues .

You'll be doing some course on money management or get advise from your elders on your resources. Sometimes we make our own problems dont get sucked into that take time but let your loved ones know that you need it ! Also you really need that money management advice as you might end up losing something but I also don't think it will he a bad loss ! Sometimes sacrifices are necessary you might understand the worth of small losses now but that will protect from bigger issues later.

Pile 3 :

I don't dress for women I don't dress for men lately I've been dressing for revenge! That's your main mood this January you're gonna show everyone who didn't believe in you what you're capable of you're going new heights reaching new goals making new ways I'm so proud of you

You have struggled a lot to do this actions manifesting you are getting closer to what you want , might fetch yourself a new leadership position this month you're gonna be an example an epitome of grown beside the struggles because you're so ready to work despite all the sneaking going on behind your back you're gonna be doing the thing needed to defeat your enemies you will undergo momentary defeat and might cry for a while because you might feel all forces are against you this is the time to pour into your inter child

When trauma shows up remember to shadow work nothing ever goes away one needs to heal with it don't get swayed away with temptations and fake promises I heard devil is strong but so is the knight know that your emotional strength will lead you through this you have to be more intune with your emotions but also lead with logic it's a hard balance to learn but once you're on it you become undefeated and you will be I'm so sure about that.

Thank you so much for reading

Have a great day/night ahead ❤️

#Spotify#pac tarot#tarot pac#pac readings#pac reading#pac#pick a deck#pick a photo#pick a card reading#pick a picture#pick a card#pick a pile#tarot card reading#tarot deck#tarot cards#tarot reading#tarotcommunity#tarotblr

403 notes

·

View notes

Text

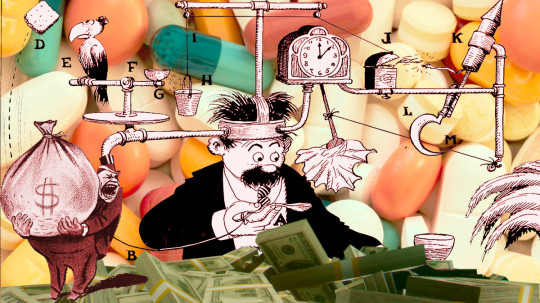

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.