#forgive student debt

Text

#us politics#2023#twitter#tweet#progressive politics#progressivism#progressives#independent#thank you bernie#bernie gets it#bernie for the people#sen. bernie sanders#student loans#student debt forgiveness#student debt#cancel student debt#freeze student debt#student loan forgiveness#forgive student debt#debt forgiveness

65 notes

·

View notes

Text

#student debt#student loans#student loan debt#vote biden#vote blue#vote democrat#please vote#voting#election 2024#student loan forgiveness#thanks biden#get out the vote#2024 elections#us elections#american politics#biden administration#joe biden#biden#president biden#us election#2024 election#election#taxes#property taxes#us taxes#death and taxes#filing taxes#income inequality#government#debt

7K notes

·

View notes

Text

Things Biden and the Democrats did, this week #13

April 5-12 2024

President Biden announced the cancellation of a student loan debt for a further 277,000 Americans. This brings the number of a Americans who had their debt canceled by the Biden administration through different means since the Supreme Court struck down Biden's first place in 2023 to 4.3 million and a total of $153 billion of debt canceled so far. Most of these borrowers were a part of the President's SAVE Plan, a debt repayment program with 8 million enrollees, over 4 million of whom don't have to make monthly repayments and are still on the path to debt forgiveness.

President Biden announced a plan that would cancel student loan debt for 4 million borrowers and bring debt relief to 30 million Americans The plan takes steps like making automatic debt forgiveness through the public service forgiveness so qualified borrowers who don't know to apply will have their debts forgiven. The plan will wipe out the interest on the debt of 23 million Americans. President Biden touted how the plan will help black and Latino borrowers the most who carry the heavily debt burdens. The plan is expected to go into effect this fall ahead of the election.

President Biden and Vice-President Harris announced the closing of the so-called gun show loophole. For years people selling guns outside of traditional stores, such as at gun shows and in the 21st century over the internet have not been required to preform a background check to see if buyers are legally allowed to own a fire arm. Now all sellers of guns, even over the internet, are required to be licensed and preform a background check. This is the largest single expansion of the background check system since its creation.

The EPA published the first ever regulations on PFAS, known as forever chemicals, in drinking water. The new rules would reduce PFAS exposure for 100 million people according to the EPA. The Biden Administration announced along side the EPA regulations it would make available $1 billion dollars for state and local water treatment to help test for and filter out PFAS in line with the new rule. This marks the first time since 1996 that the EPA has passed a drinking water rule for new contaminants.

The Department of Commerce announced a deal with microchip giant TSMC to bring billions in investment and manufacturing to Arizona. The US makes only about 10% of the world's microchips and none of the most advanced chips. Under the CHIPS and Science Act the Biden Administration hopes to expand America's high-tech manufacturing so that 20% of advanced chips are made in America. TSMC makes about 90% of the world's advanced chips. The deal which sees a $6.6 billion dollar grant from the US government in exchange for $65 billion worth of investment by TSMC in 3 high tech manufacturing facilities in Arizona, the first of which will open next year. This represents the single largest foreign investment in Arizona's history and will bring thousands of new jobs to the state and boost America's microchip manufacturing.

The EPA finalized rules strengthening clean air standards around chemical plants. The new rule will lower the risk of cancer in communities near chemical plants by 96% and eliminate 6,200 tons of toxic air pollution each year. The rules target two dangerous cancer causing chemicals, ethylene oxide and chloroprene, the rule will reduce emissions of these chemicals by 80%.

the Department of the Interior announced it had beaten the Biden Administration goals when it comes to new clean energy projects. The Department has now permitted more than 25 gigawatts of clean energy projects on public lands, surpass the Administrations goal for 2025 already. These solar, wind, and hydro projects will power 12 million American homes with totally green power. Currently 10 gigawatts of clean energy are currently being generated on public lands, powering more than 5 million homes across the West.

The Department of Transportation announced $830 million to support local communities in becoming more climate resilient. The money will go to 80 projects across 37 states, DC, and the US Virgin Islands The projects will help local Infrastructure better stand up to extreme weather causes by climate change.

The Senate confirmed Susan Bazis, Robert White, and Ann Marie McIff Allen to lifetime federal judgeships in Nebraska, Michigan, and Utah respectively. This brings the total number of judges appointed by President Biden to 193

#Thanks Biden#Joe Biden#student loans#student loan debt#debt forgiveness#gun control#forever chemicals#PFAS#climate change#green energy

3K notes

·

View notes

Text

One thing that is often overlooked with federal student loan forgiveness is that for every outstanding loan, the federal government is giving taxpayer money to a massive private fintech contractor to service that loan. It actively costs the government money to have loans outstanding. It is more expensive for the government to have someone who is on a low or no-pay income driven plan sit on that debt for 20 years than it would be to just forgive it outright today.

So like. Your tax dollars could go to relieving the debt burden of some struggling millennial OR they can line the pockets of Aidvantage's CEO, but that money is being spent either way.

#servicing contracts are so so huge#Servicing that many loans costs the government a lot of money and it will KEEP costing the government a lot of money ongoing#where forgiving debt is writing off money that is already spent.#STOP BANKROLLING STUDENT LOAN SERVICERS TO SPITE THE POOR

2K notes

·

View notes

Text

#college loans#student debt forgiveness#oligarch assholes#right-wing billionaires#maga morons#crooked donald#republican assholes

412 notes

·

View notes

Text

can student loan providers refuse to take my gay money then

#student loan forgiveness#student debt#us politics#scotus#lgbt rights#lgbtq rights#us supreme court#supreme court

2K notes

·

View notes

Photo

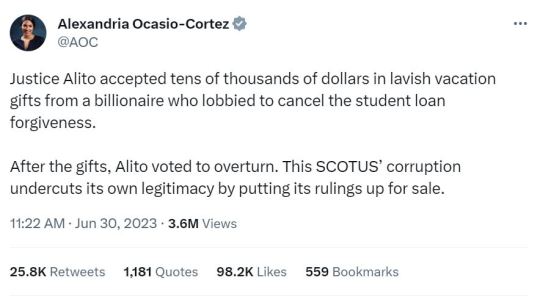

#SCOTUS#supreme court#student loan forgiveness#student debt relief#SCOTUS is compromised#aoc#alexandria ocasio-cortez#vote blue

1K notes

·

View notes

Text

To any American reading this of voting age. Or will be of voting age for the 2024 election… VOTE! Vote vote vote. Register to vote. Ensure your friends are registered to vote. If it wasn’t clear before the SCOTUS decisions in the last two days have spelled it out clearly.

If you are not an able-bodied cis white heterosexual man, you are at risk. They will strip away your rights, they will do everything they can to make sure you are erased. That you are silenced that you are dead.

And if you think that your vote doesn’t matter. That there is no point. Then they have won. You have already let them win. You have let them control you.

They will come after you. If you are not a cis white male you are a target. You are disposable. And you will eventually lose your basic rights as a human being. Because if you are not a cus white man… to them you are not human. Simple as.

#vote#democracy#democrats#republicans#election#elections#scotus#affirmative action#debt forgiveness#loan forgiveness#student debt#America#lgbt#lgbt+#poc#woc#trans#gay rights

1K notes

·

View notes

Text

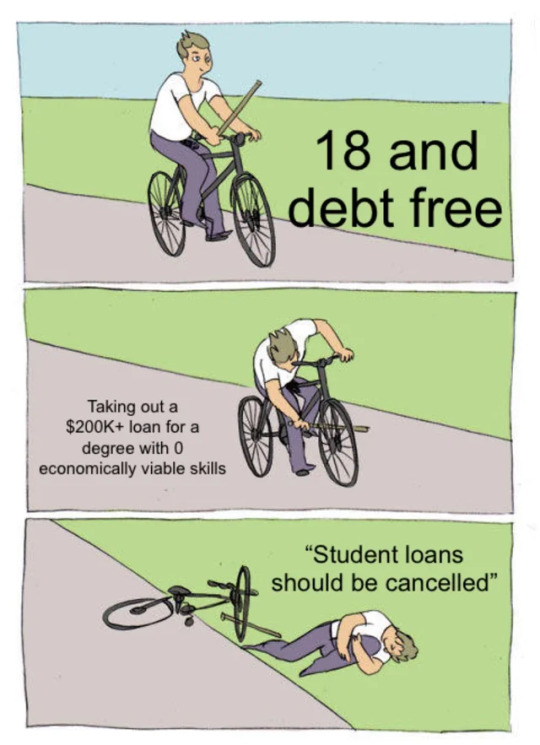

#Student Loans#Student Debt#Student Loan Forgiveness#Communism#Antisocialism#Anticommunism#Republican#Democrat#Liberal#Libertarian#Conservative#capitalism#socialism#politics#anticapitalism

270 notes

·

View notes

Text

330 notes

·

View notes

Text

The Biden administration will ask the Supreme Court to revive its student debt relief program as it fights to reverse lower court rulings that have upended its plans to forgive up to $20,000 of debt for tens of millions of Americans.

The Justice Department said in a court filing on Thursday that it planned to ask the Supreme Court to reverse an injunction issued earlier this week by the 8th Circuit Court of Appeals that prohibits the administration from carrying out student debt relief.

Separately, the Justice Department is asking the 5th Circuit Court of Appeals to put on hold a decision by a district court judge in Texas to strike down the debt relief program as illegal. The DOJ asked for a ruling from that appeals court by Dec. 1 “to allow the government to seek relief from the Supreme Court” if needed.

The various emergency requests by the Biden administration tee up what could be the most consequential Supreme Court showdown yet over President Joe Biden’s debt relief policy in the coming weeks.

Justice Amy Coney Barrett has twice rejected preliminary requests in other lawsuits to block Biden’s debt relief program. But neither case had addressed the legal merits of the program.

The lawsuit now heading to the Supreme Court was brought by six Republican state officials who are trying to stop Biden’s debt relief program, which they have slammed as unfair and unconstitutional. The ruling earlier this week by the 8th Circuit found that at least one of the states, Missouri, had standing to bring the case. The three-judge panel unanimously voted to pause Biden’s debt relief program while the lawsuit plays out.

The other lawsuit, in the 5th Circuit, was filed by the Jobs Creator Network Foundation, a conservative group, on behalf of two student loan borrowers who were fully or partially excluded from the debt relief plan. The Biden administration is asking the appeals court to put on hold a lower court ruling by District Judge Mark Pittman, a Trump appointee, who declared the program unconstitutional.

As it fights in court, the White House is weighing a decision about whether to postpone restarting monthly payments and interest for most federal student loans in January as planned.

Student debt activists, civil rights groups and labor leaders have urged the Biden administration to make clear that it won’t move to restart payments while its debt relief program remains in limbo.

The NAACP, which has worked closely with the White House on debt relief, “fully supports extending the repayment pause until borrowers obtain the relief they deserve and have been promised,” Wisdom Cole, the group’s youth and college director, said in a statement on Wednesday.

Administration officials are arguing in court that they need to cancel student debt for tens of millions of borrowers to prevent a huge surge of delinquencies and defaults when monthly payments resume.

James Kvaal, the undersecretary of education, said in a court filing earlier this week that the administration is “examining all available options” while student debt relief remains blocked in court, including extending the pause on repayment beyond Dec. 31.

Kvaal said that blocking debt relief also causes “significant confusion” for borrowers, especially those who were anticipating having their loans wiped out completely. “Most borrowers have been told that all they need to do is submit an application to obtain one-time student loan debt relief,” he wrote. “Now, as a result of litigation they are left to wonder when, if at all, if debt relief will be effectuated.”

#us politics#news#biden administration#2022#department of education#politico#us supreme court#scotus#justice amy coney barrett#8th Circuit Court of Appeals#student debt forgiveness#cancel student debt#forgive student debt#student loan debt#student debt#5th Circuit Court of Appeals#department of justice#Jobs Creator Network Foundation#Judge Mark Pittman#naacp#Wisdom Cole#James Kvaal

15 notes

·

View notes

Text

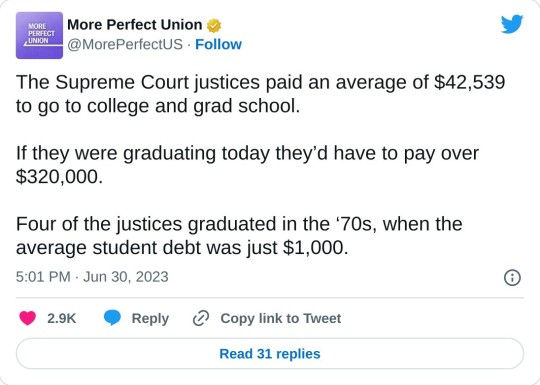

#us politics#twitter#tweet#2023#more perfect union#us supreme court#scotus#biden v. nebraska#biden administration#student debt#cancel student debt#student debt forgiveness

561 notes

·

View notes

Text

In light of the recent Supreme Court ruling on student debt forgiveness in Biden v. Nebraska, it seems it might be useful to revisit why American students have so much student debt.

Ironically, it all dates back to Reagan's and the Republicans' decision to cut back on funding for public colleges and universities in order to avoid the possibility of having an "educated proletariat."

So it isn't surprising that is is Republicans who were opposed to any government debt forgiveness for student loans. THEY DON'T WANT TO HAVE EDUCATED CITIZENS. The poorly educated are much easier to manipulate and control.

In 1970, Ronald Reagan was running for reelection as governor of California. He had first won in 1966 with confrontational rhetoric toward the University of California public college system and executed confrontational policies when in office. In May 1970, Reagan had shut down all 28 UC and Cal State campuses in the midst of student protests against the Vietnam War and the U.S. bombing of Cambodia. On October 29, less than a week before the election, his education adviser Roger A. Freeman spoke at a press conference to defend him.

Freeman’s remarks were reported the next day in the San Francisco Chronicle under the headline “Professor Sees Peril in Education.” According to the Chronicle article, Freeman said, “We are in danger of producing an educated proletariat. … That’s dynamite! We have to be selective on who we allow [to go to college].”

“If not,” Freeman continued, “we will have a large number of highly trained and unemployed people.”

#ronald reagan#public higher education#educated proletariat#roger freeman#student debt#supreme court#student loan forgiveness#biden v nebraska

643 notes

·

View notes

Text

Things Biden and the Democrats did, this week #27

July 12-19 2024

President Biden announced the cancellation of $1.2 billion dollars worth of student loan debt. This will cancel the debt of 35,000 public service workers, such as teachers, nurses, and firefighters. This brings the total number of people who've had their student debt relived under the Biden Administration to 4.8 million or one out of every ten people with student loan debt, for a total of $168.5 billion in debt forgiven. This came after the Supreme Court threw out an earlier more wide ranging student debt relief plan forcing the administration to undertake a slower more piecemeal process for forgiving debt. President Biden announced a new plan in the spring that will hopefully be finalized by fall that will forgive an additional 30 million people's student loan debt.

President Biden announced actions to lower housing coasts, make more housing available and called on Congress to prevent rent hikes. President Biden's plan calls for landlords who raise the rent by more than 5% a year to face losing major important tax befits, the average rent has gone up by 21% since 2021. The President has also instructed the federal government, the largest land owner in the country, to examine how unused property can be used for housing. The Bureau of Land Management plans on building 15,000 affordable housing units on public land in southern Nevada, the USPS is examining 8,500 unused properties across America to be repurposed for housing, HHS is finalizing a new rule to make it easier to use federal property to house the homeless, and the Administration is calling on state, local, and tribal governments to use their own unused property for housing, which could create approximately 1.9 million units nationwide.

The Department of Transportation announced $5 billion to replace or restore major bridges across the country. The money will go to 13 significant bridges in 16 states. Some bridges are suffering from years of neglect others are nearly 100 years old and no longer fit for modern demands. Some of the projects include the I-5 bridge over the Columbia River which connects Portland Oregon to Vancouver Washington, replacing the Sagamore Bridge which connects Cape Cod to the mainland built in 1933, replacing the I- 83 South Bridge in Harrisburg, Pennsylvania, and Cape Fear Memorial Bridge Replacement Project in Wilmington, North Carolina, among others.

President Biden signed an Executive Order aimed at boosting Latino college attendance. The order established the White House Initiative on Advancing Educational Equity, Excellence, and Economic Opportunity through Hispanic-Serving Institutions. Hispanic-Serving Institutions (HSIs) are defined as colleges with 25% or above Hispanic/Latino enrollment, currently 55% of Hispanic college students are enrolled in an HSI. The initiative seeks to stream line the relationship between the federal government and HSIs to allow them to more easily take advantage of federal programs and expand their reach to better serve students and boost Hispanic enrollment nationwide.

HUD announced $325 million in grants for housing and community development in 7 cities. the cities in Tennessee, Texas, Alabama, Florida, Nevada, New York and New Jersey, have collectively pledged to develop over 6,500 new mixed-income units, including the one-for-one replacement of 2,677 severely distressed public housing units. The 7 collectively will invest $2.65 billion in additional resources within the Choice Neighborhood area – so that every $1 in HUD funds will generate $8.65 in additional resources.

President Biden took extensive new actions on immigration. On June 18th The President announced a new policy that would allow the foreign born spouses and step children of American citizens who don't have legal status to apply for it without having to leave the country, this would effect about half a million spouses and 50,000 children. This week Biden announced that people can start applying on August 19, 2024. Also in June President Biden announced an easing of Visa rules that will allow Dreamers, Americans brought to the country as children without legal status, to finally get work visas to give them legal status and a path way to citizenship. This week the Biden Administration announced a new rule to expand the federal TRIO program to cover Dreamers. TRIO is a program that aims to support low income students and those who would be the first in their families to go to college transition from high school to college, the change would support 50,000 more students each year. The Administration also plans to double the number of free immigration lawyers available to those going through immigration court.

The EPA announced $160 million in grants to support Clean U.S. Manufacturing of Steel and Other Construction Materials. The EPA estimates that the manufacturing of construction materials, such as concrete, asphalt, steel, and glass, accounts for 15% of the annual global greenhouse gas emissions. The EPA is supporting 38 projects aimed at measuring and combatting the environmental impact of construction materials.

The US announced $203 million in humanitarian assistance for the people of Sudan. Sudan's out of control civil war has caused the largest refugee crisis in the world with 11 million Sudanese having fled their homes in the face of violence. The war is also causing the gravest food crisis in the world, with a record setting 25 million people facing acute food insecurity, and fears that nearly a million will face famine in the next months. This aid brings the total aid the US has given Sudan since September 2023 to $1.6 billion, making America the single largest donor to Sudan.

The Consumer Financial Protection Bureau put forward a new rule that would better regulate popular paycheck advance products. 2/3rds of workers are payed every two weeks or once a month and since 2020 the number of short term loans that allow employees to receive their paycheck days before it’s scheduled to hit their account has grown by 90%. the CFPB says that many of these programs are decided with employers not employees and millions of Americans are paying fees they didn't know about before signing up. The new rule would require lenders to tell costumers up front about any and all fees and charges, as well as cracking down on deceptive "tipping" options.

#Joe Biden#Thanks Biden#Politics#US politics#American politics#student loans#debt forgiveness#housing crisis#rent control#wage theft#sudan#sudan crisis#climate change#climate action#immigration#hispanic#latino#college#bridges#Infrastructure

1K notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

186 notes

·

View notes