#how do i activate my cash app card without the app

Text

Im sorry if this post comes off weird and not very understandable, but I (and a friend) have been forced to live with something horrible and traumatizing (at the hands of someone we called A FRIEND) for the last few days and I am about to burst and need to get this out somewhere where I feel safe.

(TRIGGER WARNING: faked Sui attempt mention below, me being gaslit, lied to, made to feel like I was an idiot and a harasser)

It all started a few days ago by a message from (someone that I called a friend)’s account. Lets call them Wolf.

In the past, during our short friendship, a friend and I discovered that Wolf liked making jokes about Sui. Alot. Everyday, practically. But not only jokes. Once, she faked a Sui attempt, filmed it, and sent it to my friend N. My friend, traumatized, told me in the group chat and we were very pointed in saying that such things were not a laughing matter. Please keep on mind, Wolf is in her late 20’s. An age where you would think people no longer do such things.

Now, back to what happened. It all started a few days ago by a message from Wolf’s account.

Wolf’s account left a lengthly message in the Discord chat we share with N, my friend. The message was by someone we did not know, telling us that Wolf had committed a Sui attempt and was now in the hospital.

We were told by “Jordyn” that she was only telling the people closest to Wolf what happened, and that none of Wolf’s In Real Life friends knew. It was only us, and Wolf’s parents. She told us to stay quiet and to not post on Wolf’s personal instagram, as to not let anyone know.

Why were we being told this? Why did Jordyn “take” Wolf’s phone, go into her Discord account, and decide to send a message in a Discord chat that had had NO ACTIVITY FOR 10+ DAYS?

Something was nagging at me and my friends mind, something felt wrong with what was all being said.

Constantly were inconsistencies popping up in her messages and constantly did something feel OFF. Something didnt feel right.

Why were we, two random people on Wolf’s Discord list, being told all of this? Why were we being told by “Jordyn” that none of Wolf’s In Real Life friends knew, but we, were being told all of this information?

The next day (8 to 10 hours after receiving the first message), still hesitant to believe it all after receiving NO proof or concrete information, I asked what hospital she was being held at, so that I could see about sending flowers. Sure we weren’t close, but it was the least I could do. The answer I received?

“She's gotten a lot of flowers. Like pretty much the whole room is filled with flowers. We might get her a P.O. Box or get her a cash app account set up, so people can donate.”

Once again, why were we being told (without being pushed but still told nonetheless) that we could donate money to a Cashapp that Jordyn was going to make for Wolf’s rehabilitation or that we could send cards to a PO box? But oh sorry, no one’s been told what happened but flowers are everywhere, so much so that we’re tripping over them so send money instead.

Today, after multiple days of being told “updates” that didnt line up with what would happen to a Sui attempt survivor, I had a lengthly conversation with the friend that was living through all of this with me.

I decided to ask if “Jordyn” was comfortable sharing information on what happened. (She had already told my friend everything in Private Dms, so why not tell me, a medical student studying in neurology and psychology, and who is studying on how to help rehabilitate Sui Survivors?)

She said yes, so I asked. I asked, as delicately as I could, on what happened, because the things she had said did NOT line up with what procedures a doctor would normally do.

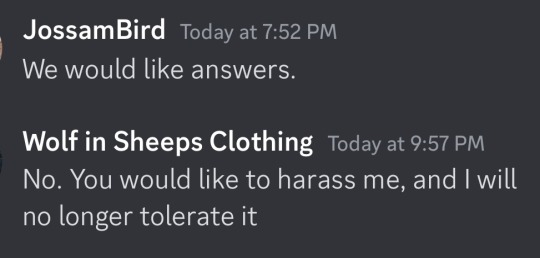

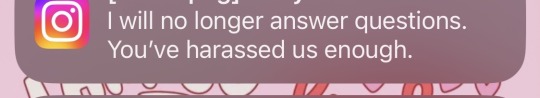

The answer I received? Wolf’s account leaving the Discord server, and this:

All I did was ask questions (because nothing was lining up and everything felt WRONG in everything this Jordyn/Wolf/whoever person was forcing down our throats on Discord everyday, and I figured I was owed that much since hey, Im being told all of this all of these horrible details in what happened) but I guess I was only allowed to that and only that, and to send money of course.

I (and my friend N) was made out to be a fool, an idiot. I was Gaslit, lied to, and manipulated.

Your name is not Wolf, but that is what you are. You are a Wolf in Sheep’s clothing, and that is what you will remain forever in my mind.

25 notes

·

View notes

Text

I've been using Pokemon Sleep for about five weeks now. Here's some thoughts below the cut. It's a long one.

First, my opinions about the nuts and bolts of how it works. This is... mostly complaints.

- The monetization in this game is absolutely disgusting. Like just heinous. If you're the kind of person that needs to avoid stuff with microtransactions, do not install this game. I haven't given them a dime, but I've also at this point built up a strong resistance to monetization tricks. DO NOT let your kids play this game if they have a credit/debit card hooked up to their accounts.

- On the flip side, credit where due, when they say on the load screen that you can play 100% of the game without paying, this is true. You'll progress faster and with less effort if you pony up some cash, but the game gives you a decent stream of the premium currency, Diamonds, that will get you access to whatever niceties you'd like. If I wanted something that requires the premium currency to get, I haven't found myself walled behind a massive wait for the drip feed to catch up.

- The game wants roughly thirty minutes to an hour of your time a day not counting the sleep tracking. Three ten to twenty minute chunks. One in the morning to review last night's sleep data and feed Snorlax breakfast, one in the afternoon for lunch, and then one or two in the evening for dinner and switching on the sleep tracking.

- When the app tells you to put your phone on the bed for the sleep tracking, this is actually NECESSARY for how it functions. I had assumed it just uses audio to gauge if you snore or whatever (which it does), but it also uses your phone's accelerometer to determine if you're tossing and turning and by extension how deep you're sleeping. If you put it on a bedside table or something, it'll give you a readout saying you slept like an absolute fucking ROCK. If you're like me and toss and turn a lot, you can actually use this to cheese the game a little since certain Pokemon only appear when you sleep deeper and those are for me quite hard to get without this cheese. I would go so far as to actively recommend this tactic.

- You may notice that's kind of a creepy amount of data to collect and it feels kind of like inviting a stalker into your bedroom. You are correct. The app assures you that the actual sleep data does NOT get transmitted at all. I do not have anything other than their word to confirm that. I don't know if what it collects is fairly standard for other apps like it, but my assumption is yes?

- Because of how it tracks your sleep info, if you sleep with a partner in the same bed it completely skullfucks its tracking.

- If you have an even slightly older phone, the app chugs whenever you try to click anything. There's like a one-second lag on every click in the menu followed by a short load screen. Those 10-20 minute sessions would be about half as long if I had a phone with more processing speed.

Now all the above might sound damning as hell. But here's the thing. I like this app a lot actually. It's DEEPLY flawed, but let's talk about the game's mechanics, which is mostly positives:

- Right at the top, this app has improved my sleep schedule, pardon the pun, practically overnight. My new PC has told me twice now that step one to fixing most of my mental health issues is healthier sleep, which he knows is hard but you gotta try. I've been hesitant to take the meds he prescribed for that, but I heard about this app and figured gamifying sleeping on time would be a great way to get me to actually do it. Worked like a charm. The game asks what you'd like your nightly bedtime to be, and gives you rewards for maintaining it. You get these rewards if you go to sleep either 90 minutes prior to that time, or 30 minutes after. My doctor recommended 30 in each direction for consistency, but they don't send you a reminder notification until that 30 minute mark prior so partial credit I guess? I've missed that bedtime like 3 times in these last five weeks, and yeah my everything is way better.

- Looking at the Pokemon wandering my camp makes my brain make the happy juice in a way most Pokemon stuff really doesn't anymore. Like, there's no battles or anything (although you apparently can transfer to and from Pokemon Go, don't know how well that works because I don't play), so you just get a pleasant kind of domesticity most Pokemon stuff doesn't do.

- Here's the actual gameplay loop. You're researching Pokemon sleep patterns. To do this, you're using some nonsense machine that amplifies local Snorlax's natural aura of sleepiness to attract Pokemon to come sleep by it. Snorlax's are apparently the capybaras of the Pokeworld which I actually love. The more you feed Snorlax, the more powerful this sleepy aura becomes. It resets each week because you go to a new campsite with a new Snorlax. During the day, your team of Pokemon (max of... 5 for some reason instead of the default six everywhere else in this franchise?) gather berries to feed your Snorlax throughout the day in idle-game-esque timers, as well as ingredients for more complicated meals. You take the ingredients, make Snorlax meals up to three times a day (6am-noon for breakfast, noon-6pm for lunch, 6pm-6am for dinner). Each pokemon also has an ability that in some way helps you out. Then you can at any time turn on the sleep tracking, then turn it off when you wake up. After a rest of 90+ minutes has been tracked, it gives you a total of how much power that rest generated, and takes you to a minigame where you photograph the sleeping Pokemon that came to rest in your camp. The more power, the more varied the sleeping positions and the rarer the Pokemon. You can then feed them biscuits to befriend them. You get the equivalent of a Great Ball(/Biscuit) every day which on its own fills about 3/5 of a non-evolved Pokemon's friendship bar (the basic biscuit that you'll use most of the time fills 1/5), so there's always at least some progress towards making a friend. Sometimes a Pokemon is extra hungry and the first thing you feed them is worth triple, and you can also get that same multiplier as an RNG thing without warning. Once you fill up a bar, you've befriended that Pokemon and can now add it to your teams or send it to the professor for candies like you do in Pokemon Go. You are also given candies for every Pokemon you attracted even if you don't befriend them, plus "Sleep Points" based on how long you slept for that can be exchanged for items like more biscuits (for reference, a single basic biscuit is roughly 1.5 times a good night's sleep... fucking YIKES) plus "Dream Shards" for how cool the photos you took are, which are used mostly for leveling up your Pokemon and upgrading your camp.

- I love this gameplay loop actually. It feels way more like these Pokemon are my friends as opposed to wild animals I've caught.

- Leveling up and evolving take large amounts of those candies and dream shards. The candies feel like the primary gate on progression.

Overall, this is a game I like a lot despite its flaws, and the positive impact it's had on my health even in this short span is hard to understate. I wish they'd back off with the creepy monetization so I could actively recommend instead of recommend with an asterisk. But yeah that's my thoughts on this weird ass product.

12 notes

·

View notes

Text

Orders (open!)

Hey guys! I'm Juno, I've been a practicing witch for about 3 years (give and take some years practicing on and off) I've been a demonolater for most of that time, demons having been the only deities I've really worked with and worshipped.

I've been bouncing around the idea of starting a small side gig doing magic for a little while and I've had my moment of clarity that this is the time so this is what I'll be offering, prices and the details of ordering from me :) (plus I am actively trying to keep these prices cheap bc this isn't really a job more just a side hustle so I don't need a lot)

My prices for everything I offer range from 5.00$ to 25.00$

Readings

Atm I am offering three kinds of readings for either Oracle or Tarot (your choice)

The Story Behind The Question spread: 5.00$

what I want vs what I truly need (usually an only two card reading with less details)

Basic advice: 10.00$ (this spread if ordered from King Paimon will be free until Litha, and I will have a sale ON Litha that I will post about soon)

past, present, future, general advice

(more complex, tends to be 4 cards)

Celtic Cross spread: 15.00$

A much more detailed version of Basic Advice, tends to be 10 cards

Readings can be from King Paimon, Archangels Michael, Uriel, Gabriel, Raphael, Selaphiel, Jegudiel, Barachiel, or from just the universe in general. it's up to you and prices don't change based off of entity.

I will share pictures of the readings along with of course the interpretations

Spells

Spells are more complicated then divination, and because there's so many options for spells they will range in price from 15.00$ to 25.00$ dollars depending on details

For example if you want a confidence spell because you've been down in the dumps that would probably only be 15.00$ but if you need me to do baneful magic on someone then that would cost at least 23.00$ (may be more depending on how complicated you want it to be)

Spells can be with the assistants of any of the deities I mentioned before or just me and the universe, whatever you want. If you want a spell please tell me what you want in detail before we talk price.

I will send pictures and or videos of the spell, and will explain as much as you need explained.

Written prayers

At the moment I'm only offering written prayers to the angels that I listed in the reading section, for a prayer just tell me what you want the prayer to be for, who you want it to be sent to and I will write it myself, tell you how I worded it in case you want to change anything, and will add wax, oils and herbs.

Once the contents of the prayer have been affirmed by the client I will use a rosary to recite the prayer to the angel of choice and them burn it. I will share pictures of the letter and burning it (videos too if requested)

Without extra oils, wax and/or herbs: 5.00$

With extra oils, wax, and/or herbs: 8.00$

Payment and purchasing

I offer payment options of PayPal, Venmo and Cash App which I will mention the names of while discussing payment with the client

I will require the decided payment before I start the process

Before buying I need people to understand that divination, spells and prayer are not an exact science. Some things aren't 100% accurate, don't work because the universe wills it not to or take a long time to work. I cannot control these things

To order one of these things from me you can message me on here, my Instagram @junos_a_witch, or email me at [email protected]

If you would like to, you could also follow my TikTok @junos.a.witch, I do not offer discussing orders on there however I will be promoting, sharing updates and similar info on there and id appreciate the support heavily.

I may not respond to a message until the next day though I try to be vigilant, things just get busy sometimes

Thank you very much for reading this and thank you even more if you order something, I'm hopeful this'll be able to go somewhere :)

#witch#witchcraft#pagan#spiritual#spirituality#demonolatry#paganism#king paimon#neo paganism#small business#magic#spells#prayers#divination#tarot#oracle#angels#archangels

2 notes

·

View notes

Text

How To Increase Cash App Daily Or Weekly Withdrawal Limits?

Cash App, a popular mobile payment service, offers users the convenience of sending and receiving money with ease. However, like any financial platform, it imposes certain limits on withdrawals, including ATM withdrawals and cash outs. Knowing these limits is crucial for managing your finances effectively. This article will provide an exhaustive overview of Cash App withdrawal limits, including daily, ATM, and debit card restrictions.

Cash App Daily Withdrawal Limit

Cash App imposes a daily withdrawal limit on its users. This limit is crucial for users to understand to manage their daily transactions effectively. As of now, the Cash App daily withdrawal limit stands at $1,000 per day. This limit applies to both ATM withdrawals and in-store cash back transactions. It’s important to note that this limit resets at midnight (Eastern Standard Time) each day, allowing users to withdraw up to $1,000 again the following day.

Cash App ATM Withdrawal Limit

When using a Cash App card at an ATM, there are specific limits you should be aware of. The Cash App ATM withdrawal limit is currently set at $1,000 per transaction. This limit is part of the broader daily limit, which means that any combination of ATM withdrawals and cash back transactions cannot exceed $1,000 in a single day.

Cash App Card ATM Limit

The Cash App card, which functions like a traditional debit card, also has specific limits at ATMs. The Cash App card ATM limit is integrated within the overall Cash App daily withdrawal limit. Users can withdraw up to $1,000 per day across all transactions involving their Cash App card.

Cash App Cash Out Limit

For those looking to transfer their Cash App balance to their bank account, understanding the Cash App cash out limit is essential. The platform allows a maximum of $25,000 per week when transferring funds out of your Cash App balance to a bank account. This high limit is designed to accommodate users who need to move larger amounts of money efficiently.

Cash App Debit Card Limit

The Cash App debit card, apart from ATM withdrawals, is subject to a Cash App spending limit. The Cash App debit card limit includes a $7,000 spending limit per transaction and a total of $10,000 per week. These limits are set to help manage spending and ensure that users do not exceed their budgetary constraints.

Cash App Max Withdrawal Limit

Understanding the Cash App max withdrawal is crucial for users who frequently engage in high-volume transactions. The maximum amount that can be withdrawn at an ATM or via cash back is $1,000 per day. This limit ensures that the financial platform can adequately monitor transactions and prevent fraudulent activities.

Cash App Daily and Per Transaction Limits

The Cash App daily ATM limit and Cash App daily withdrawal limit are intertwined, with users allowed to withdraw up to $1,000 every 24 hours. This limit is strategically set to balance the need for access to funds with the need for security and control over financial operations.

Conclusion:

Navigating the limits imposed by Cash App ensures that you can manage your finances without unexpected interruptions. By understanding each limit, from ATM withdrawals to debit card transactions, users can plan their spending and withdrawals more effectively. Whether you need to withdraw cash for immediate use or transfer significant amounts to a bank account, staying informed about these limits will help optimize your Cash App experience.

FAQ

Q: What is the daily ATM withdrawal limit for Cash App?

A: Cash App users can withdraw up to $310 per transaction at an ATM. The Cash App daily limit for ATM withdrawals is $1,000, and this limit resets every 24 hours.

Q: Are there any fees associated with using an ATM with Cash App?

A: Yes, Cash App charges a $2 fee for ATM withdrawals. However, this fee can be reimbursed if you receive at least $300 per month in direct deposits to your Cash App account.

Q: Can I increase my ATM withdrawal limit on Cash App?

A: Currently, the ATM withdrawal limits are fixed and cannot be increased beyond the standard limits of $310 per transaction and $1,000 per day.

Q: What should I do if my ATM withdrawal exceeds the daily limit?

A: If you reach your Cash App daily ATM withdrawal limit, you will need to wait until the next day for the limit to reset. Planning your withdrawals ahead of time can help avoid inconvenience.

2 notes

·

View notes

Text

Explore Reasons Why Cash App Says Cash Out Failed?

Cash App stands as a beacon of seamless transactions in the swift currents of digital finance. Yet, amid the virtual symphony of smooth exchanges, some issues can happen such as “Cash App Out Failed”. If you are having the issue fear not, by continue reading you can learn the reasons behind Cash App’s cash-out failures and weaving ingenious solutions to reinstate your digital harmony.

Why Does Cash App Say Cash-Out Failed?

A failed cash-out beckons from the shadows in the mystic of digital payments, bearing an enigmatic aura. Let us shed light on this riddle and explore reasons why Cash App says cash out failed:

· Imagine the digital wallet of your Cash App yearning is having insufficient balance. The lack of funds is a leading culprit behind the “Cash Out Failed” issue. Thus, before venturing forth, bestow upon your coffers the riches they deserve.

· In virtual connections, the winds of connectivity sway capriciously as ever. A weak network tether can shatter your transaction dreams with the whisper of failure.

· Amid the digital ether, even the sturdiest server’s stumble. Technical glitches and maintenance masquerades can cast shadows upon your cash-out quest.

· Should the key to your treasury, your payment method, be rendered ineffectual through expiration or lack, the gates shall remain locked, thwarting your cash-out ambitions.

· Beware the sentinels of security! Additional verification beckons, and its unanswered call can lead to the haunting refrain of a failed transaction.

Why Is My Cash App Not Letting Me Send Money?

Ah, the irresistible allure of sending digital gold through Cash App’s conduit! Yet, within the intricate web of transactions, entanglements may arise, causing your golden plans to fizzle:

· Unveil your identity through account verification, for without this step; the gatekeepers might bar your way, withholding the power to send.

· In the realm of recipients, arcane settings might cast chains upon your golden gift. Ensure their account is open and unshackled, ready to embrace your virtual embrace.

· The symphony of transactions might stumble upon frozen echoes — an account frozen due to suspicions or a misstep, thwarting your virtuoso performance.

· Beware of the dance of details as you weave your tale of the transaction. Mismatched or misdirected steps can lead you astray, away from the desired crescendo.

How Do I Fix “Failed to Add Cash to Cash App”?

The endeavour to infuse life into your Cash App treasury can sometimes plunge into the abyss of “Failed to Add Cash on Cash App.” Fear not, for we shall traverse this chasm with aplomb:

· The melody of your linked payment card must resonate with validity and sufficiency. An expired note or an empty tune shall lead to this sad refrain.

· Cards, like wandering minstrels, might be bound by limitations. Please verify with your bard and your bank whether online or mobile payments are within their lyrical range.

· Should the mobile app falter, a cache’s whisper could bring clarity. Clear the cache, unravel the glitches, and let the harmony of Cash App resound anew.

· The river of transactions knows its tides. Patience becomes your guiding star when servers teem with activity or maintenance calls. Wait, and the waters shall calm.

What is the Cash App Cash out Limit?

Within the digital tapestry, there are some Cash App cash out limit. Cash App’s embrace holds boundaries, and the path to transcending these boundaries is adorned with wisdom:

· The crown of higher limits rests upon the brow of verified accounts. With identity crowned, transactions flourish, and boundaries recede.

· When the realm of higher limits beckons, the oracle of support awaits. Seek its counsel, request a limit’s expansion, and chart a course beyond the ordinary.

2 notes

·

View notes

Note

I’m not the previous anon, but the notes on the tow truck caught my attention. I wanna know what's your thoughts on this scenario? Emma has been staying overnight at a Walmart that doesn’t have any “no overnight parking” signs and she even has permission from them. But in the early morning she’s woken up by a tow truck’s horn to see her car has been hooked up and in the process of being raised. The driver demands a $100 drop fee to release her car which has to be in cash or through a cash app...

"...that she needed to download. Emma is pressured into paying him. The driver then quickly drives over to the next vehicle to do the same thing to them." pt2.

Ah, yikes, that scenario raises a couple of red flags.

1. The biggest being that the tow truck driver hooked up Emma’s car fully knowing that she was sleeping inside of it.

The issue isn’t just that he did that without her consent, but because the law forbids tow trucks from hooking up a car (especially towing) with a person inside of it due to safety concerns.

Emma was asleep which means she was most likely not properly secured with a safety belt and his action could’ve harmed her. For all he knew, she might’ve been precariously leaning off of her seat and any jolting from hooking up her car could’ve cause her to fall and injured herself. She could’ve also smacked her forehead into the dashboard in surprise when he honked his horn to forcefully wake her up. Or worst, being startle could’ve trigger a seizure, asthma symptoms, post-traumatic stress disorder (PTSD), etc.

The only time they are ever authorized to tow with a person inside is when they are providing assistance to a person with restricted mobility or to a person who is in a hazardous situation. [x]

2. Tow companies are required to accept payment by cash, which they must provide change for (and a receipt), credit and debit cards.

The fact that he only gave her two options, one of which was to have her use some unknown cash app to do the payment is very suspicious. Those two things make it easier for scammers to hide their illegal activities.

By the way, tow fees are regulated by the state and could vary by county. The max drop fee is $135 for a car and $190 for a truck or SUV. There are some higher rates for heavier vehicles like 18-wheelers. A drop fee can also be a less if limited by a city or county rule, but it can never be more than the amounts listed above. [x]

3. I don’t think this was Walmart's doing. It wouldn’t make sense to give Emma and the others permission to stay overnight in their parking lot if they were going to do this. If anything, this random tow truck driver probably saw an opportunity to make money and took it.

Emma should’ve called the Walmart’s night manager about the towing situation. If they didn’t request it then they or the security could tell the guy to leave. But with how he was conducting his towing work, reporting him to the police would be the right thing to do. He was scamming people, because no proper by-the-book tow truck company would do that.

After all, he doesn’t necessarily have the legal right to take her car. He hooked and lifted it up without her consent and worst, he did it while she was still inside of it and asleep. But no, it doesn’t stop there, he kept her car hostage (and again, she was still inside it or I’m assuming so) to then demand money to let it go. She shouldn't have given in. Which leads me to the next point...

4. Walmart deploys various cameras throughout the parking lot, including CCTV and IP cameras. Additionally, many cameras include night vision capabilities, which allow for round-the-clock usage. All this is to keep an eye on the staff, the customers, prevent crime, and lower liability.

So if something was to happen like the scenario above, then there will be video evidence of the tow truck driver’s...predatory towing? unlawful practice? I’m not sure what the proper term for this would be because I’m not a legal expert.

Of course, don’t always rely on Walmart’s security cameras to do all the work. Emma could've also filmed and taken pictures, especially of the tow company name because the information might be needed in the future.

It can be used to warn people of what tow company to watch out for, to get the police to investigate them, for her lawyer, and/or maybe Walmart wants to know to put the tow company on their blacklist.

5. The policy of Walmart welcomes RVers and regular vehicles (and sometimes even truckers) to spend a night in their parking lot, as long as they have the individual location's permission. In some places, city zoning laws or ordinances will prohibit overnight stays in parking lots. Typically, larger cities are most likely to have these types of restrictions in place.

Even when it’s not allowed Walmart is usually very considerate because they don’t immediately call the cops or tow trucks when they spot vehicles breaking the rules. They first send out security, who then politely knock on their window to ask them to leave. Overnighters are understanding and comply without protest when it happens.

On the FAQ section of Walmart’s corporate website, one of the questions asks: Can I Park My RV at a Walmart Store? [x]

“While we do not offer electrical service or accommodations typically necessary for RV customers, Walmart values RV travelers and considers them among our best customers. Consequently, we do permit RV parking on our store parking lots as we are able. Permission to park is extended by individual store managers, based on availability of parking space and local laws. Please contact management in each store to ensure accommodations before parking your RV.”

It’s not official, but there’s also a few universal rules of etiquette that all overnighters have agreed upon while staying at Walmart (this is to ensure the company isn’t given a reason to change their policy):

Always call ahead and ask the manager for permission to park overnight.

When you arrive at the Walmart, introduce yourself to the manager, security guards and ask where to park.

Only stay overnight. Leave early the next morning, so you don’t overstay your welcome.

Ask the manager what the rules are. For example, if you got a RV, van, or whatnot; ask if you’re allowed to lower your stabilizer jacks, extend your bump-outs, or run your generator.

Buy any supplies you need at Walmart. Since they’re kind enough to let people stay, buy something while you’re there as a thank you.

Clean up your trash and pick up after pets if you have any.

Keep noise levels down when inside and outside your vehicle.

6. Sign laws vary slightly from state to state but are generally the same throughout the country.

For example, the law doesn’t require the private property owners to put up a sign warning that they will tow any vehicles that are illegally parked. They also have no obligation to put up a sign with the towing operator’s contact details. So cars can still be towed even if if there’s no warning signs in someone’s driveway

But if it’s an office building, shopping center, apartment complex or condominium community and so on, then there needs to be a conspicuously post ‘No Parking’ or ‘No Overnight Parking’ signs that the area is subject to tow away. There’s even specific instructions that these signs need to follow such as:

The sign must be prominently placed at each vehicular entrance to the property which can easily be seen by the public.

Motorist need to be informed upfront, usually within 5 feet from the public right-of-way and not hidden in the back of the parking lot.

The size of the sign varies too but typically it should be not less than 18 inch x 24 inch.

The sign must be at eye level of the motorist. The tow away sign should also be installed so that the bottom edge of the sign is no lower than five feet and no higher than eight feet above ground level.

Some states have rules that the sign must be continuously maintained which means the lettering cannot have faded.

The sign lettering must be large enough to be readable. Some states go as far as specifying the height of the letters too, ranging from 1 inch to 4 inch.

Just because there’s ‘No Overnight Parking’ sign in Walmart (or if there is, it may not be enforced and/or it’s located in the back of the lot) doesn’t mean it’s safe to disregard it. Don’t even risk it and instead always ask the manager, in particular the night manager (as they’ll be the one on duty during the night shift) for permission.

Hopefully, in this scenario Emma was kind enough to warn her fellow overnighters about the scummy tow truck driver.

4 notes

·

View notes

Text

early thoughts on The Ssum: Forbidden Lab

It’s what we’ve all been waiting for; The Ssum is finally out, 4 years after the release of the beta and multiple release delays. So what’s all the fuss about?

... I’m not really sure! But I will do my best to lay it out for you - below the cut!

The Good Things

Teo

He seems like a sweet guy. I appreciate that he doesn’t seem as instantly enamored as some otome love interests can be. I’m excited to learn more about him.

I’m doing the Day 2 lunch chat as I am writing this review, and I would like to reiterate that he is genuinely very sweet. I enjoy the way he writes, it feels very distinct. He reminds me a bit of Ray and Yoosung in terms of the way he talks about things.

The interface

The new UI and interface is super neat. Personally a big fan of how you can change themes, although I don’t really have anything to choose from yet.

Labs

I personally find the labs to be a lot of fun, but I also understand that a lot of people aren’t fan of them. To me, it’s a good way to connect with the community to some degree without having to join discord servers or generally be active online.

If you see a Josephine (u6A0zZ) talking about Saeran in one of the Mystic Messenger labs, then that is probably me. Feel free to shoot me a message and say hi! I would love to chat (both on the app and here on Tumblr).

The Okay Things

Energy incubation

This is just a silly thing to me. Maybe it’s because I don’t understand it. There seems to be a trick to it, but I don’t get it. Anyway, I don’t actively dislike it, I’m just not a fan of grinding based mechanics.

Teo’s slow typing speed

Maybe I’m just a fast texter, who plays Mystic Messenger on the highest speed, but god Teo types like 1 word a minute. The game isn’t meant to be played like MM though, so I can overlook it as I can just put down my phone and walk away.

Tutorials

There are many tutorials, and not all of them do a sufficient job at explaining what the features actually do. It can be a bit frustrating having to guess why I have to do certain things other than just because it’s fun

At least they are short.

Sunshine Shelter

Again, a feature I don’t understand the point of. Why am I raising alien tamagochis?

The Bad Things

Lab Official Commercial Channel

Cheritz, why? Just stop it.

Subscription price

It is very expensive, and from what I can gather from people who have paid the subscription, it does not give me more of what I personally wanted from it - more chats and calls with Teo.

To me, it would make more sense if it was a one-time purchase like the calling cards in Mystic Messenger. The steep monthly price seems like a cash grab.

Locked/paid features

This includes paid (battery) answer, private account, changing your schedule, etc.

I’m a big believer in free to play games, and I understand that Cheritz is a company that needs to make money. But dang. There are so many things you need to pay for access to.

Overall, it’s a very mixed experience that is very different from what I expected. I knew it would be different from Mystic Messenger, as Cheritz is allowed to make new and different games, but I think overall I expected more chats and less... Other features. It is fair that they have less chats, as there is only one character to talk to, although they hint at there eventually being more characters (or versions of Teo?) in the future.

But I think overall I am excited for what’s in store for this game - to see where the journey takes us... To the space station, maybe? lol

3 notes

·

View notes

Text

How do I raise my Cash App ATM withdrawal limit?

In today's digital world, mobile payment apps like Cash App have revolutionized how we manage our finances. Cash App, developed by Block, Inc. (formerly Square, Inc.), is a popular peer-to-peer payment service that allows users to conveniently send, receive, and invest money. One of its most notable features is the Cash App Card, a Visa debit card linked directly to your Cash App balance, which you can use for purchases and ATM withdrawals. However, many users wonder, "Can I withdraw $1000 from an ATM with Cash App?" This blog will explore Cash App'sApp's ATM withdrawal limits and how you can manage and potentially increase them.

Introduction

Navigating the financial landscape with mobile payment apps can be complex, especially when understanding the limits and fees associated with ATM withdrawals. The Cash App Card offers a seamless way to access your funds, but its ATM withdrawal limits can sometimes be restrictive. This comprehensive guide aims to answer the critical question: " Can I withdraw $1000 from an ATM with Cash App?" By the end of this blog, you'll have a thorough understanding of Cash App's ATM withdrawal limits, how to manage them effectively, and strategies to potentially increase these limits to better suit your financial needs.

Understanding Cash App ATM Limits

Before addressing whether you can withdraw $1000 from an ATM with Cash App, it's essential to understand the existing ATM limits. As of now, the Cash App ATM withdrawal limits are as follows:

$250 per transaction

$1,000 in 24 hours

$1,250 in 7 days

These limits are set to provide security and prevent fraudulent activities, but they can be restrictive for users who need to withdraw larger amounts of cash.

Can I Withdraw $1000 from an ATM with Cash App?

The straightforward answer to whether you can withdraw $1000 from an ATM with Cash App is yes or no, depending on the timeframe. Here's a detailed breakdown:

Single Transaction Limit: Cash App imposes a $250 limit per transaction, so you cannot withdraw $1000 in one go.

Daily Withdrawal Limit: You can withdraw up to $1000 in 24 hours. Therefore, you could make four transactions of $250 each within a single day to reach the $1000 limit.

Weekly Withdrawal Limit: The maximum amount you can withdraw in 7 days is $1,250. This means that even though you can withdraw $1000 in one day, you would only have $250 left for the rest of the week.

Strategies to Manage Cash App ATM Withdrawals

Managing your Cash App max ATM withdrawal effectively involves planning and understanding your financial needs. Here are some strategies to help you manage your ATM withdrawals better:

Plan Withdrawals Over Time: If you know you'll need $1000, plan your withdrawals over a few days rather than trying to do it all at once. Withdraw $250 at a time, spread across different days if necessary.

Utilize Cash Back Options: Many retailers offer cash back when you purchase with your Cash App Card. This can be an excellent way to access additional cash without hitting your ATM limits.

Monitor Your Usage: Monitor your withdrawal transactions closely to ensure you stay within your daily and weekly limits. This can help you avoid declined transactions and better plan your cash needs.

How to Increase Cash App ATM Limits?

Increasing your Cash App ATM withdrawal limit can provide more flexibility in managing your finances. Here are the steps to potentially increase your limits:

Verify Your Account: Fully verifying your Cash App account can increase your limits. To verify, provide your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Maintain Regular Direct Deposits: Cash App rewards users who receive monthly regular direct deposits of $300 or more. This can lead to higher withdrawal limits and benefits like ATM fee reimbursements.

Contact Cash App Support: If you have specific needs or encounter issues with the standard limits, contacting Cash App support can sometimes help. They may provide personalized solutions or advice on managing your limits.

FAQs

1. Can I withdraw $1000 from an ATM with Cash App?

You can withdraw $1000 from an ATM with Cash App, but not in a single transaction. You must make four separate transactions of $250 each within 24 hours.

2. What is the maximum ATM withdrawal for Cash App?

Cash App's maximum ATM withdrawal limit is $250 per transaction, $1,000 in 24 hours, and $1,250 in 7 days.

3. How much can you withdraw from the Cash App at an ATM daily?

You can withdraw up to $1,000 from an ATM with Cash App in 24 hours.

4. How do I increase my Cash App ATM withdrawal limit?

To increase your ATM withdrawal limit, ensure your Cash App account is fully verified and receive monthly regular direct deposits of $300 or more. Contacting Cash App support for specific needs may also help.

5. Can I access more cash without increasing my ATM limits?

Yes, you can use cash-back options at retail stores when making purchases with your Cash App Card. This can help you access additional cash without affecting your ATM limits.

6. What should I do if I reach my Cash App daily withdrawal limit?

If you reach your daily withdrawal limit, you can wait until the next 24-hour period to make additional withdrawals. Planning your withdrawals over several days can help you manage more extensive cash needs.

7. Is there a limit on the amount I can withdraw in a week with Cash App?

Yes, the limit on the amount you can withdraw in 7 days with Cash App is $1,250.

Conclusion

Managing your Cash App ATM withdrawals effectively involves understanding the limits and planning your transactions accordingly. While you can't withdraw $1000 in a single transaction, you can do so over multiple transactions within a day. By verifying your account and maintaining regular direct deposits, you can increase your withdrawal limits, giving you more flexibility in managing your finances.

#Cash App atm withdrawal limit#Cash App atm withdrawal limit per day#Cash App atm withdrawal limit per week#Cash App withdrawal limit atm#Cash App daily atm withdrawal limit#Cash App withdrawal limit#increase Cash App withdrawal limit#increase Cash App atm withdrawal limit

0 notes

Text

How to Activate Cash App Card?

The Cash App Card is analogous to a disbenefit card from your bank. It allows you to add finances to your card, withdraw cash from an ATM, and pay retailers. In addition, it has several features that make it easier for you to make online deals. One of the most important effects of the Cash App is that it's only for some. You will have to be 18 times old to order a Cash App card.

You will need to give your name, address, phone number, and birth date to admit your card. You may also have to enter a hand. While the Cash App is great for making and managing online deals, you can only pierce it if you are connected to the internet. In addition, you will need to have a strong bandwidth to make it work.

The cash app activate card is a simple process. It's one of the most important effects you can do to get the most out of your app. The Cash App has several features to make it easier for you to make and manage deals. You will also need to know about the Cash App's secret- it's QR law. The Cash App card has a QR law you can overlook with your camera.

How to Activate a Cash App Card via phone?

The Cash App is a great way to manage your plutocrat, and it's also delightful to use. You can also use it to shoot plutocrats, musketeers and family. The app will also allow you to select a" boost" for your card. You can select a free reimbursed card with a limit or a free card that can be reloaded. You can also add a delineation to your card. The app also allows you to select a" Cash Tag" to add to your portmanteau. You can also use the app to withdraw cash from an ATM. This can save you a ton of plutocrats.

cranking a Cash App Card is fairly easy. The process of how to Activate a Cash App card is analogous to whether you use an Android or iOS device.

· First, you will want to download the Cash App onto your device.

· Next, you will need to overlook a QR law with your phone's camera.

· Once you've scrutinised the QR law, you will need to fill out some form fields. You will need to fill in some introductory information, similar to your card's CVV number and the date your card will expire.

· The app will also let you pick a colour for your card. The app will also let you add your hand to the card.

How to Activate a Cash App Card Before It Arrives?

cranking the Cash App card before it arrives is an option, but you do not have to stay until the box arrives to get started. It's possible to Activate your new Cash App card on your smartphone or PC, indeed if you plan to use it later.

cranking the Cash App card is a breath thanks to its mobile app, which can be downloaded on iOS or Android bias. The icon resembles a credit card. To Activate the card, you will need to overlook the QR law on the reverse.

The Cash App also has an online plutocrat transfer service, a great way to shoot plutocrats from one bank account to another. You can also use the Cash App to make purchases in physical locales. Still, the app only allows you to make purchases for a limited amount. The maximum spending limit is a modest$,000 per week. However, it's worth considering your choices, If you are planning on making further than many purchases. Cash App offers client support, which is helpful if you witness any problems when you activate cash app card with QR law. You can also communicate with the company by phone.

#activate cash app card#how to activate cash app card#cash app activate card#cash app card activation#how do i activate my cash app card#cash app help activate card#activate my cash app card#how to activate a cash app card#how to activate my cash app card#how do you activate a cash app card#how to activate cash app card without logging in#how to activate your cash app card#activate cash app card by phone#activating cash app card

1 note

·

View note

Text

Cash App Transaction Limit Per Day and How to Increase It?

Cash App has become a go-to platform for seamless financial transactions, but users often need help with their account activities. These limits, set by Cash App, ensure security, compliance, and efficient service. In this guide, we'll delve into each Cash App limit and provide strategies to boost them, empowering users to maximise their financial interactions.

1. Daily Transaction Limit: Cash App imposes a daily transaction limit, typically $250 for unverified accounts and $7,500 for verified accounts. This limit applies to incoming and outgoing transactions, including peer-to-peer payments and purchases. Knowing this limit helps users plan their daily financial activities effectively.

2. Weekly Transaction Limit: In addition to the daily limit, Cash App also sets a weekly transaction limit. This limit is usually $1,000 for unverified accounts, while verified accounts may have a higher weekly limit, often ranging from $2,500 to $10,000. This limit regulates the amount of money users can send or receive over seven days.

3. Cash App Balance Limit: Cash App imposes a maximum balance limit on accounts, typically from $1,000 to $25,000, depending on verification status and transaction history. This limit restricts the amount of money users can hold in their Cash App balance at any time.

4. Cash App Card Spending Limit: Users with a Cash App Cash Card have a spending limit, usually $2,500 per day for unverified accounts and up to $7,500 for verified accounts. This limit governs the amount users can spend using their Cash Card for purchases or ATM withdrawals.

How to Increase Your Cash App Limits?

Complete Account Verification: Verifying your Cash App account is crucial for unlocking higher limits. To verify your account, provide your full name, date of birth, and Social Security number. Additionally, submit a photo ID and any other requested documentation. Once verified, users typically enjoy higher transaction and balance limits.

Increase Transaction History: Regularly using Cash App for transactions and maintaining a positive transaction history can boost your limits over time. Consistent and legitimate financial activity demonstrates trustworthiness to Cash App, which may result in increased limits.

Contact Cash App Support: Contact Cash App support for assistance if you've reached your maximum limits and need further increases. Explain your situation and provide relevant details to explore potential exceptions or adjustments to your limits.

Frequently Asked Questions (FAQs):

Q: What is the daily transaction limit on Cash App?

A: The Cash App daily limit typically ranges from $250 for unverified accounts to $7,500 for verified accounts.

Q: Can I increase my Cash App limits without verifying my account?

A: Account verification is essential to increase Cash App limit. While other factors like transaction history may be considered, verification is the primary pathway to increased limits.

Q: How do I know my Cash App limits?

A: To view your current Cash App limits, navigate to the "Profile" tab and select "Limits & Permissions." You'll find information about your transaction, balance, and spending limits here.

Conclusion:

Understanding Cash App limits is essential for managing finances efficiently. By familiarising yourself with these limits and following the strategies outlined in this guide, you can increase your limits and optimise your Cash App experience. Prioritise account verification, maintain a positive transaction history, and contact support when needed. With proactive steps, users can easily navigate the Cash App's limits, ensuring seamless financial transactions.

#ash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app transfer limit

0 notes

Text

How do I activate a cash app card, automatically or manually?

The QR technique is perhaps the most widely used because it is automated and doesn't require a cash card. It is a simple process that takes only a moment to complete and will instantly a cash app card activation.

What you need to do is as follows:-

Visit the "Cash App" mobile app.

Select the cash card icon. It may be found in the left-hand corner of the Cash App's home screen.

There will be a drop-down menu. Next, select "Activate Cash Card."

The Cash App will request authorization to use your phone's camera. You must provide consent since doing so is necessary to scan the QR code.

There is another option which is The methods to activate the cash app card are as follows:

The Cash App to "Launch"

Navigate to and choose the "Cash App Tab"

Next, choose "Cash Card Support" to proceed.

Press the "Report Your Cash Card" button.

Select "Card Stolen/Compromised" or "Card Missing" from the list of alternatives.

Finally, adhere to the instructions on the screen to obtain your new Cash App Card.

How to Activate My Cash App Card without QR Code?

Cash App is a convenient platform that allows users to send and receive money easily. One of the key features of the Cash App is the Cash Card, which is a physical debit card that can be used for in-person purchases and ATM withdrawals. Typically, activating a Cash App card requires scanning a QR code. However, if you don't have access to a QR code, there are alternative methods to activate your Cash App Card. In this essay, we will explore five simple steps to activate your Cash App Card without using a QR code.

The first step in activating your Cash App Card without a QR code is to open the Cash App on your mobile device. Once you have done that, go to the "Account" tab and then select the "Cash Card" option. This will take you to a new screen where you will see an option to activate your card.

Next, you will be prompted to provide your card details. Enter the sixteen-digit card number, followed by the CVV code and the expiration date. It is important to ensure that you have entered the correct information to activate the cash app card successfully.

After entering your card details, you will be asked to provide some personal information for verification purposes. This may include your full name, date of birth, and the last four digits of your Social Security number. Make sure to provide accurate information to avoid any issues in the verification process.

Once you have entered the necessary information, review all the details you have provided and click on the "Activate Cash Card" button. This will initiate the activation process, and you will be notified once your card has been successfully activated. You can then begin using your Cash App Card for transactions and withdrawals.

In conclusion, even if you don't have a QR code, you can easily activate your Cash App Card by following these simple steps. Remember to open the Cash App, select the "Account" tab, and then go to the "Cash Card" option. From there, enter your card number, CVV code, and expiration date. Provide the necessary personal information for verification, review all the details, and click on the "Activate Cash Card" button. This process will allow you to activate your Cash App Card without the need for a QR code, ensuring that you can enjoy all the benefits and convenience that the Cash App has to offer.

0 notes

Text

Is There a Limit to How Much You Can Add to Cash App?

Cash App, which is widely used as a mobile payment platform by users, allows them to send and receive funds with relative ease. Cash App, like other financial services or real-world banks, imposes limitations to protect both the consumer and the company. Understanding these limits is crucial when using this platform because they can prevent certain transactions from being completed without putting your account at risk. Cash App offers a convenient, secure platform for money transfers. However, like other mobile payment platforms, it may have transaction limits that restrict certain transactions.

You can use a variety of strategies to increase Cash App limit and gain more financial flexibility. These include verifying your Cash App account, linking debit or bank cards, and engaging in regular activity. Continue reading to learn more about Cash App limits, including the daily and weekly ones. You will also gain insights into how to increase Cash App limit to have a more convenient and flexible financial experience.

What are the different Cash App Limits?

Cash App limits transactions to ensure compliance and security. These limits protect both the users and the platform while preventing fraud, money laundering, and other illegal activities. Here are various Cash App limits for your account:

Cash App Daily Limit for Adding Funds- Cash App imposes a second set of restrictions: daily limitations. The Cash App daily limit restricts the amount you can spend, withdraw, transfer, or do in a day for both types. The daily limit to add funds to your Cash App usually starts at $250. You can deposit up to $250 per day. This limit is enough for most users to make daily transactions. If you need to add additional funds, there are options available to increase the limit.

Cash App Weekly Limit for Adding Funds: Cash App has a weekly fund limit that is usually $1,000 per week. Cash App has limits to keep its system safe and fair for all users. Unverified accounts are limited to a weekly limit of $7,500; verified accounts have a limit of up to $8,500. The Cash App weekly limit is reset every seven days starting on the day you made your first deposit. You should be aware that if you exceed this limit, your transaction may be declined until the next reset period.

How to Increase Your Cash App Limit?

You can increase your limit if you feel the Cash App default limits are too restrictive or if you want to add additional funds to your Cash App Account. Follow the steps mentioned below to increase Cash App add cash limit:

Open the Cash App.

Select "Personal" by tapping on the profile icon.

Please follow the prompts and enter your full legal name (including your date of birth) as well as the last four digits of your Social Security Number.

Your limits will increase once you have been verified.

What Fees are associated with Cash App Withdrawals?

Cash App withdrawals are free, but there is a daily limit of $250 that resets each day. For more information, contact Cash App's support team via the app. You can also link your bank account. Upgrading to Cash App Plus for a small fee will give you higher withdrawal limits. This may be helpful if you need to withdraw cash from an ATM quickly. Cash App increases withdrawal limits for those who show responsible withdrawal patterns. Withdraw money in small amounts over time to establish a good transaction history. This will increase your chances of being granted higher withdrawal limits.

FAQ

Is there a maximum limit for adding funds to the Cash App?

Cash App has a daily or weekly limit on adding money. This can be different depending on the status of your account. You can increase the limits by verifying your account and linking it to your bank.

What happens if I exceed my Cash App limit?

If you exceed your Cash App limits, transactions may be declined until the limit is reset. Consider increasing your limit by completing the identity verification to avoid disruptions.

How long does it take to increase my Cash App limit after verification?

Cash App usually increases your limit immediately upon successful identification verification. It is important to remember that certain limits may not adjust immediately.

How do I increase my Cash App transaction limit?

It may be worth considering ways to increase Cash App transaction limit if you find they are preventing you from completing certain transactions. You can do this by contacting our support team for guidance on possible limit adjustments.

Can I use the Cash App without verifying my identity?

You can use the Cash App up to a certain extent without completing the identity verification. However, to unlock higher transaction limits and additional features, you will need to complete this process.

0 notes

Text

Ultimate Guide for Increasing Your Cash App Limit to $7,500

Cash App has become famous for peer-to-peer payments, money transfers, and investing in stocks and Bitcoin. However, it's essential to be aware of Cash App's limits on your transactions. If you've encountered the $2,500 limit and are wondering how to increase it to $7,500, you've come to the right place. This comprehensive guide will walk you through the steps to increase Cash App limit, ensuring you have the flexibility you need for your financial activities.

Understanding Cash App Limits:

Cash App, developed by Square, is designed to offer users a seamless and convenient way to manage their finances. Cash App sets specific limits on various transaction types to maintain security and regulatory compliance. Here are some critical Cash App limits you should be aware of:

Cash App Daily Limit: The default daily limit for sending money using Cash App is $2,500. This means you can send up to $2,500 in 24 hours to other users.

Cash App Weekly Limit: In addition to the daily limit, Cash App imposes a weekly sending limit of $2,500. This limit resets every seven days.

Cash App Withdrawal Limit: The daily ATM withdrawal limit for Cash App Cash Card is $1,000. However, you can withdraw up to $1,250 per transaction using an ATM that accepts the Cash App Cash Card.

How do you increase your Cash App Limit from $2,500 to $7,500?

Now, let's explore how to increase your Cash App limit from $2,500 to $7,500. Remember that a Cash App may require time and additional information to grant higher limits.

Complete Identity Verification: One of the most crucial steps in increasing your Cash App limit is to complete the identity verification process. To do this, follow these steps:

a. Open the Cash App on your mobile device.

b. Tap on your profile icon.

c. Scroll down and select "Personal."

d. Enter your legal first and last name.

e. Provide the last four digits of your Social Security Number (SSN).

f. Verify your date of birth.

g. Review and confirm your information.

Link a Bank Account or Debit Card: Linking a bank account or a debit card to your Cash App account can help raise your limits. Cash App may use this information to assess your financial stability and trustworthiness.

Increase Your Transaction History: Consistently using Cash App for legitimate transactions can contribute to raising your limits over time. This demonstrates that you are a responsible and trustworthy user.

Contact Cash App Support: You can contact Cash App's customer support if your limits decrease as desired. They can provide guidance and review your account for potential limit increases.

Wait for Automatic Increases: In some cases, Cash App may automatically raise your limits as you become a more established and trusted platform user. Patience can be a virtue in this regard.

Frequently Asked Questions (FAQs):

What happens if I reach my Cash App limit?

If you reach your Cash App limit, you can send or receive funds beyond those limits once they reset. It's essential to keep track of your usage to avoid inconvenience.

How often do Cash App limits reset?

Cash App daily limits reset every 24 hours, while weekly limits reset every seven days. If you've reached your limit, you may need to wait until the reset period to access higher limits.

Is it safe to provide my SSN to a Cash App for identity verification?

Yes, providing your SSN for identity verification is a standard practice in financial services. Cash App uses this information to verify your identity and enhance account security.

Can I use the Cash App without completing identity verification?

You can use the Cash App for essential functions without completing identity verification.

However, your account will have lower limits, and certain features may be restricted.

In conclusion, increasing your Cash App limit from $2,500 to $7,500 is achievable by following the steps outlined in this guide. Completing identity verification, linking your bank account or debit card, and maintaining a history of responsible transactions are critical factors in obtaining higher limits. Remember that Cash App's policies and limitations may change over time, so it's advisable to check the latest information on its official website or contact customer support for the most up-to-date details. By doing so, you can enjoy a more flexible and convenient experience with Cash App.

#how to increase your Cash App limit from 2#500 to $7#500#cash app limit#increase cash app limit#cash app daily limit#cash app sending limit#cash app add cash limit $2500#how to increase cash app limit#cash app weekly limit#cash app weekly limit reset#cash app withdrawal limit#cash app bitcoin withdrawal limit#cash app bitcoin limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin sending limit

0 notes

Text

A Comprehensive Guide to Verify Bitcoin on Cash App

In the dynamic landscape of digital currencies, Bitcoin has asserted itself as a frontrunner, and platforms like Cash App have made it more accessible than ever. However, ensuring the security and legitimacy of your transactions is paramount, making the verification process crucial. In this comprehensive guide, we'll delve into the intricacies of how to verify bitcoin on Cash App, ensuring users a seamless and secure experience.

How To Verify Bitcoin on Cash App?

Verifying Bitcoin on Cash App is a straightforward process designed to enhance security and comply with regulatory standards. Here's a step-by-step guide to walk you through the Cash App bitcoin verification process:

Open Cash App: Open the Cash App on your mobile device. If you don't have the app, you can download it from the App Store or Google Play.

Access Your Profile: Navigate to your profile by tapping on the icon in the screen's upper-left corner. This will open your account settings.

Find Bitcoin Section: Look for the Bitcoin section within your account settings. A Bitcoin icon typically represents it.

Initiate Verification: Within the Bitcoin section, you'll find options for verification. Select the verification option and follow the on-screen instructions.

Complete Verification Steps: Cash App may require you to complete various verification steps. This can include identity verification, providing personal information, and agreeing to terms and conditions.

Verify Your Identity: Sometimes, you may need to verify your identity using official documents. Follow the prompts to submit the necessary documents securely.

Confirmation: Once you've completed the verification process, you'll receive a confirmation indicating that your Bitcoin verification on the Cash App is successful.

Can You Receive Bitcoin on Cash App Without Verification?

As of 2023, Cash App generally requires users to complete the verification process before sending or receiving Bitcoin. This aligns with regulatory requirements and ensures a secure environment for all users.

While you may still be able to use some features of Cash App without complete verification, receiving Bitcoin often necessitates a verified account. This additional layer of security helps prevent fraudulent activities and protects the platform's integrity.

How Do I Verify My Identity on Cash App Without an ID?

Verifying your identity on Cash App typically involves providing some form of identification. However, the specific requirements may vary based on your location and the regulatory framework in place.

If you're concerned about sharing sensitive identification documents, Cash App has implemented secure and encrypted channels for document submission. Alternatively, you can contact Cash App support for guidance on alternative identity verification methods.

How Do I Verify and Buy Bitcoins with Cash App?

Verifying and buying Bitcoins with Cash App is a seamless process once your account is verified. Follow these steps to make your first Bitcoin purchase:

Navigate to the Bitcoin Section: Open Cash App and go to the Bitcoin section within your account.

Select Buy Bitcoin: Choose the option to buy Bitcoin and enter the amount you wish to purchase.

Payment Method: Select your preferred payment method, including linked bank accounts or debit cards.

Confirm Purchase: Review your purchase details and confirm the transaction. Your newly acquired Bitcoin will be added to your Cash App balance.

Security Measures: Cash App employs robust security measures to protect your transactions. Ensure that you follow best practices for securing your account and wallet.

Frequently Asked Questions (FAQs):

Can I use a Cash App for Bitcoin transactions without verifying my identity?

While you may access some features without complete Cash App bitcoin verification, sending or receiving Bitcoin usually requires a verified account.

What documents are required for identity verification on Cash App?

Cash App may request documents such as a driver's license, passport, or other official identification for identity verification.

Are there alternative methods for identity verification on Cash App?

In some cases, Cash App may provide alternative methods for identity verification. Contact Cash App support for guidance if needed.

Is my information secure during the verification process?

Yes, Cash App employs secure and encrypted channels for document submission, ensuring the confidentiality of your information.

#Cash App Bitcoin Verification#Cash App Bitcoin Verification pending#Cash App Bitcoin Verification failed#Cash App Bitcoin Verification denied#how to verify bitcoin on cash app#how to get bitcoin verified on cash app#how to enable Bitcoin verification on the Cash App

0 notes

Text

Why Is My Cash App Payment Pending? And How Do I Fix It?

Cash App has become a convenient and popular way to send and receive money, but occasionally, users encounter an issue where their payment becomes stuck in a "Pending" status. This can be frustrating, especially when you need to transfer money urgently. In this article, we'll explore the possible reasons behind Cash App payments getting stuck in the Pending state and provide you with solutions to resolve this issue swiftly.

Possible Reasons for a Payment to be Pending

Insufficient Funds

One of the most common reasons for a Cash App payment to be pending is insufficient funds in your Cash App account. Before you can send money, you must ensure that your account balance covers the payment amount, including any associated fees.

Unverified Identity

Cash App has strict security measures in place to protect its users. If your identity is not verified, the app may place your payments in a pending state. Verifying your identity is a straightforward process, usually requiring a valid photo ID.

Connectivity Issues

In some cases, your payment may remain pending due to connectivity problems. A weak internet connection or server issues on Cash App's end can prevent the payment from going through.

Recipient's Settings

The person you're sending money to may have specific settings that cause the payment to be pending. For instance, if the recipient has set their Cash App to accept payments manually, you'll need to wait for their approval.

Payment Security

Cash App employs advanced security measures to detect and prevent fraudulent activities. If a payment triggers their security systems, it may be held in a pending status until it can be reviewed.

How to Resolve Pending Payments on Cash App

Now that we've identified some common reasons for cash app pending payments, let's explore how to resolve these issues and get your money moving again.

Check Your Balance

Start by ensuring that your Cash App account has sufficient funds to cover the payment. If not, add funds to your account from your linked bank account or debit card.

Verify Your Identity

If your identity is unverified, Cash App won't process your payments. To verify your identity, follow these steps:

Open Cash App and tap on your profile icon.

Scroll down and select "Personal."

Follow the prompts to provide your full name, date of birth, and the last four digits of your Social Security number.

Once your identity is verified, your payments should go through without a hitch.

Check Your Connection

Ensure that you have a stable internet connection and that Cash App's servers are functioning correctly. Sometimes, network issues can lead to pending payments.

Coordinate with the Recipient

If the recipient's settings are causing the delay, contact them and ask them to check their Cash App settings. They may need to accept your payment manually.

Contact Cash App Support

If none of the above steps resolve your Cash App pending payment issue, it's advisable to reach out to Cash App support. You can do this by:

Opening the Cash App.

Tap on your profile icon.

Scroll down to the "Cash Support" section.

Selecting the particular transaction that's pending and following the prompts to contact support.

Cash App's support team can provide specific guidance and address any underlying issues.

Conclusion

Cash App is a convenient and reliable platform for transferring money, but like any other service, it may encounter occasional hiccups. When your Cash App payment is pending, there are several potential reasons, from insufficient funds to connectivity issues. The good news is that most of these issues are easily resolved by verifying your identity, checking your balance, and coordinating with the recipient. If all else fails, don't hesitate to contact Cash App support for personalized assistance. Remember, patience and diligence will help ensure your payments reach their intended destination promptly.

0 notes

Text

Why Cash App Closed my Account for no Apparent Reason?

Imagine waking up one day, ready to check your Cash App account and conduct some transactions, only to find that your account has been closed without any apparent reason. Frustrating, right? Unfortunately, this is a situation that many people have found themselves in. In today's digital age where financial transactions are increasingly conducted online, it can be distressing when a platform like Cash App suddenly shuts down your account. But fear not! In this blog post, we will explore why Cash App may close accounts seemingly out of the blue and provide you with helpful tips on how to retrieve your money from a closed Cash App account. So sit back, relax, and let's get started on unraveling this mystery together!

Why did Cash App closed my account?

One of the most frustrating things for Cash App users is when their account gets closed without any clear explanation. So, why did Cash App closed my account? Well, there could be a variety of reasons behind it.

Cash App has stringent security measures in place to protect its users and prevent fraudulent activities. If they suspect any suspicious or unauthorized activity on your account, they may decide to close it as a precautionary measure.

If you violate Cash App's terms of service or engage in activities that go against their policies, such as using the app for illegal transactions or violating money laundering regulations, they have the right to terminate your account.

Furthermore, if you fail to verify your identity or provide inaccurate information during the verification process requested by Cash App, they may also choose to close your account.

It's important to note that sometimes mistakes happen too. There have been instances where accounts were closed due to errors or misunderstandings on Cash App's end. However, reaching out to their customer support team can help resolve such issues.

In conclusion (not concluding yet!), understanding why Cash App closed your account can be difficult since specific details are not always explicitly provided. It's crucial to review their terms of service and use the app responsibly while keeping communication open with their support team should any problems arise with your account status.

How to get my money from a cash app that closed my account?

Losing access to your Cash App account can be a frustrating experience, especially if you have money sitting in it. But don't worry, there are steps you can take to retrieve your funds.

Reach out to the Cash App support team immediately. Explain the situation and provide any relevant details about your account closure. They may ask for some additional information or documentation to verify your identity and ownership of the funds.

Next, explore alternative options for accessing your money. If you had linked a bank account or debit card to your Cash App, contact them directly and explain the situation. They may be able to assist you in recovering the funds or transferring them elsewhere.

Consider reaching out to legal authorities if necessary. If all else fails and you believe that Cash App unjustly closed your account without reason, consult with an attorney who specializes in financial matters.

Remember, each case is unique and there is no guarantee of success in retrieving your funds. However, by taking these steps diligently and seeking appropriate assistance when needed, you increase your chances of resolving this frustrating issue effectively.

Stay persistent and proactive throughout this process – hopefully soon enough you'll have access to those hard-earned dollars once again!

What do I do when my cash app was shut down?

So, you wake up one day to find that your Cash App account has been shut down. Panic sets in as you wonder what to do next. Don't worry, you're not alone. Many people have found themselves in this unfortunate situation with no apparent reason behind it.

The first thing you should do is reach out to the Cash App customer support team. They may be able to provide some insight into why your account was closed and if there's any way to resolve the issue. Be prepared for a potentially lengthy process, as it can take time for them to investigate and respond.

While waiting for a response from Cash App, consider reaching out to your bank or credit card company. If there were any pending transactions or funds left in your closed Cash App account, they may be able to help retrieve those funds.

It's also important to review the terms and conditions of using Cash App. Make sure you haven't violated any policies that could have led to the closure of your account.

In the meantime, start exploring alternative payment apps that are available on the market. There are several options like Venmo or PayPal that offer similar services and might be worth considering as a backup solution.