#investment fund

Text

Investing in Safe Assets: A Focus on Scandinavian Bonds

In today’s increasingly appealing interest rate environment, investors should focus more on “safe assets,” says Jan Schopen, Portfolio Manager and Analyst with the Global Fixed Income Team at Lazard Asset Management. While German government bonds, covered bonds, and other core European bonds remain viable, Schopen identifies another attractive option: high-quality bonds from…

0 notes

Text

The Big Short (2015, Adam McKay)

01/09/2024

#the big short#2015#adam mckay#michael lewis#christian bale#steve carell#ryan gosling#brad pitt#Subprime mortgage crisis#academy awards#Academy Award for Best Picture#Academy Award for Best Adapted Screenplay#Hedge fund#Subprime lending#Credit default swap#Mercato immobiliare#Investment fund#deutsche bank#Collateralized debt obligation#Credit rating agency#Las Vegas#morgan stanley#United States dollar#Swap#American Film Institute#budget#rotten tomatoes#metacritic#88th Academy Awards

1 note

·

View note

Text

Profitable Monthly SIP Plans Online

Introduction

Monthly SIP (Systematic Investment Plan) plans have gained popularity as a hassle-free and disciplined approach to investing. Margadarsi Chit Fund offers a range of profitable monthly SIP plans online, designed to help investors achieve their financial goals with ease. In this guide, we'll explore the benefits of monthly SIP plans and provide valuable tips to maximize returns.

Facts about Monthly SIP Plans

Consistent Investing: Monthly SIP plans involve investing a fixed amount regularly, allowing investors to benefit from rupee cost averaging.

Flexible Options: Investors can choose from a variety of SIP plans based on their risk appetite, investment horizon, and financial objectives.

Long-Term Wealth Creation: By staying invested over the long term, investors can potentially accumulate substantial wealth through the power of compounding.

All Details about Monthly SIP Plans

Margadarsi Chit Fund offers a range of monthly SIP plans designed to suit the diverse needs and preferences of investors. Whether you're a conservative investor looking for steady returns or an aggressive investor seeking higher growth potential, we have the right SIP plan for you.

Our monthly SIP plans come with competitive returns, transparent terms, and flexible investment options. With low minimum investment requirements and no lock-in periods, you have the freedom to start investing and withdraw funds at your convenience.

Conclusion

Profitable monthly SIP plans online offered by Margadarsi Chit Fund present an excellent opportunity for investors to grow their wealth systematically. By investing consistently, diversifying their portfolio, and staying focused on long-term goals, investors can maximize returns and achieve financial success.

FAQs about Monthly SIP Plans

1. What is a monthly SIP plan?

A monthly SIP plan is a systematic investment approach wherein investors contribute a fixed amount at regular intervals to invest in mutual funds or other financial instruments.

2. Are monthly SIP plans suitable for beginners?

Yes, monthly SIP plans are ideal for beginners as they offer a disciplined and convenient way to start investing with small amounts regularly.

3. Can I change my SIP amount or frequency?

Yes, most SIP plans offer flexibility, allowing investors to adjust the SIP amount or frequency based on their financial situation and investment goals.

4. How long should I stay invested in a monthly SIP plan?

It's recommended to stay invested in a monthly SIP plan for the long term to maximize returns and benefit from the power of compounding.

Unlock the potential of monthly SIP plans with Margadarsi Chit Fund and embark on your journey towards financial growth and prosperity today!

#monthly sip investment plan#mutual investment plans#investment fund#monthly chit fund schemes#Margadarsi Chit Fund

0 notes

Text

Discover comprehensive fund formation and legal solutions for investment funds and alternative investment funds. Our experienced team provides expert guidance to help you navigate the complexities of fund management and compliance.

www.cv5capital.io

0 notes

Text

Alternative Investment Fund: Diversifying Your Portfolio for Better Returns

Investing has progressed far beyond the old ways of purchasing stocks and bonds. In recent times, experienced investors have become intrigued by alternative investment funds as a means to diversify their investments and potentially enhance their financial gains.

This article thoroughly explores the world of alternative funds, revealing their characteristics, potential advantages, and how they can smoothly fit into your larger investment strategy.

Table of Contents

Introduction

Understanding Alternative Investment Funds

Defining Alternative Investments

Types of Alternative Investment Funds

Benefits of Alternative Investment Funds

Portfolio Diversification

Potential for Higher Returns

Reduced Market Correlation

How to Invest in Alternative Investment Funds

Working with Fund Managers

Minimum Investment Requirements

Accessing Fund Performance Data

Real-World Example of Alternative Investments

Real Estate Investment Trusts (REITs)

Challenges of Alternative Investments

Lack of Liquidity

Complexities in Valuation

Regulatory Considerations

Conclusion

Introduction

Alternative investment funds have become popular among people looking to diversify their investment portfolios. This is important because the financial world keeps changing. These funds offer more options and ways to invest compared to usual methods. Regular ways of investing have restrictions in terms of diversification and potential profits. So, alternative investment funds allow you to expand your investments and try different strategies for potentially higher returns.

Understanding Alternative Investment Funds

Defining Alternative Investments

Alternative investments encompass a wide range of assets that extend beyond the typical choices such as stocks and bonds. They can encompass things like real estate, commodities, private equity, and hedge funds. What makes them distinct is their lesser correlation with traditional stock market trends. This quality can make them valuable for safeguarding against abrupt fluctuations in the market.

Types of Alternative Investment Funds

There are a bunch of different types of alternative investment funds. Private equity funds put money into businesses that aren't public, which can make a lot of money but also have more risk. Hedge funds are like tricky money experts; they use different ways to make profits and can be complicated. Then there are real estate investment trusts (REITs) that let you be part of the real estate world without owning actual properties. It's like owning a slice of property without the hassles.

Benefits of Alternative Investment Funds

Portfolio Diversification

For successful investing, it's smart to spread your investments. Alternative funds help by including different assets with different risk levels, making your overall risk lower.

Potential for Higher Returns

These funds can make you more money than regular investments because they use unique methods and invest in less common things.

Reduced Market Correlation.

When the stock market goes down, alternative investments often do better. This helps prevent big losses in your investments when the market isn't doing well.

How to Invest in Alternative Investment Funds

Choosing Skilled Managers: Good fund managers are key for these investments. Look for managers who have a history of doing well and a clear plan for investing.

Investment Minimums: Some funds need a bigger starting investment. Make sure the fund fits what you can afford.

Checking Past Performance: It's important that the fund's past performance is open and clear. See how it did in different market situations.

Real-World Examples of Alternative Investments

Real Estate Investment Trusts (REITs):

REITs let you invest in real estate without the headaches of managing properties. They usually give you monthly profits from rental income.

Challenges of Alternative Investments

Lack of Liquidity

Alternative investments are not always as liquid as conventional assets such as equities. Be prepared to go longer without rapid access to your invested assets.

Complexities in Valuation

Because of their unique character, alternative assets may be difficult to value. This may make it difficult to appropriately analyse the fund's performance.

Regulatory Considerations

Depending on their nature, alternative investment funds are regulated differently. To make informed investment decisions, it is essential to comprehend the regulatory climate in your jurisdiction.

Conclusion:

Adding alternative investment funds to your portfolio offers diversification and the chance for better returns in today's complex financial world. Understanding different types of alternatives, considering your risk tolerance, and doing thorough research can lead to informed choices that match your financial goals.

OR

Consider including alternative investment funds in your portfolio for diversification and potentially higher returns. Check out the ARKA INDIA REALTY FUND by Sepulveda Fund Management, offering a well-managed way to enter the real estate market.

FAQs:

Can Alternatives Protect My Wealth in Market Downturns? Yes, alternative investments can act as a shield during market volatility because they're not as connected to regular assets, reducing potential losses.

What Does Sepulveda Fund Management Do? Sepulveda Fund Management, through the ARKA INDIA REALTY FUND, offers a well-structured chance to benefit from alternative investments and their expertise.

Can Alternatives Help Reach Long-Term Goals? Yes, they can by diversifying your portfolio and possibly providing higher returns over time.

Have Investors Gained from Sepulveda Fund Management? Absolutely, many investors have achieved their financial goals with Sepulveda Fund Management's smart advice and specialized knowledge.

1 note

·

View note

Text

Navigating Sun Life's Journey: Innovations and commitment to brighter financial futures

In a rapidly evolving landscape of financial services, Sun Life emerges as a beacon of innovation, illuminating the path to brighter futures for Filipinos. Recent developments spanning engaging roadshows, regional recognition, and pioneering investment strategies reflect not just a trail of achievements, but a dedication to empowering individuals and families.

A Vibrant Blend of Inspiration and…

View On WordPress

#accolades#ATLAA#awards#brighter future#CFA Society Philippines#commitment#Dollar investments#engagement#entrepreneurship#Filipinos#financial consultation#financial security#financial services#global equities#innovation#Insurance Asia Awards#investment#investment fund#leadership#music event#Partner for Life#press release#prosperity#recognition#roadshow#SLAMCI#SLGFI#sun life#sun life philippines#Sun Life Prosperity World Voyager Fund

0 notes

Text

#investment#law#regulations#riskmanagement#alternative investment fund#alternative investment funds#Business#business marketing#financial#how to start your own investment firm#investment advisor regulation#investment banking#investment banking explained#investment company#investment firms#investment fund#investment fund secrets#investment treaty#prop firm regulations#regulation#regulation d#sebi investment advisor regulation#what is alternative investment fund#what is investment banking

0 notes

Text

Fund Management & Property Investment for Wholesale Investors

268 Fund offers transparent property investment fund management for wholesale investors, specializing in finance, property, construction, & law investment.

0 notes

Text

Partners is a new vision

Partners is a new vision

Calgary, Nov. 03, 2022 (GLOBE NEWSWIRE) — There’s a major new force in the marketing and communications industries as six leading Canadian independent agencies have come together to launch Believeco:Partners – owner, operator and builder of the foremost marketing, communications and engagement agencies in North America.

The impetus for Believeco:Partners began with Canadian business leader and…

View On WordPress

#agencies#Believeco:Partners#business#communications#entrepreneurs#growth#investment fund#marketing#public relations#values

0 notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

405 notes

·

View notes

Text

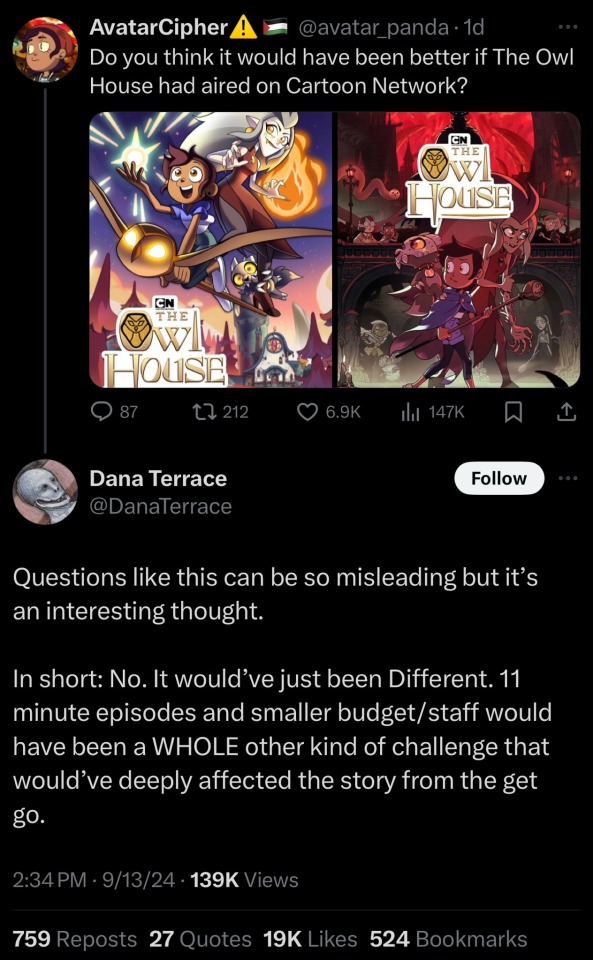

i saw this tweet and found it interesting for two reasons. one is that some people base how good cartoon network would be to toh by how it treated su, and despite the fact that su’s treatment by the network was considered poor at the time, now its thought to be exceptionally good in comparison to modern shows.

two is how exactly su got impacted by a limited budget. a common criticism is how characters like connie, peridot, and lapis are left out of missions. but balancing a lot of characters is not only hard but also costly (extra animation, extra voices—it’s been revealed that the show is limited to a set number of characters per episode otherwise they’re over budget). animation mistakes are not uncommon since retakes cost extra. the entire reason the original show got cut short was due to loss of funding!

#i don’t know if pay rates differ per networks#but a.ivi and s.urrashu have said that they needed to work outside of su in order to make sufficient funds#it only makes me wonder what other ways su suffered from a lower budget#that we as the audience never got to see#in the vein of the too-little characters complaint#another part of that is that low-stakes episodes should’ve been abt the main cast instead of the townies#like last one out of beach city and too short to ride vs restaurant wars and kiki’s pizza delivery service#i definitely see that especially since that isn’t budget related#nor would it seem to be network related (even if cn had an ‘episodic episodes’ quota it could still be abt the gems#(another side note: /would/ cn even have a requirement that the show make episodes that can be watched standalone?#this is a question for the people who were around when su was airing#what episodes often got rerun?#was it the townie eps or the lore eps?#for example i heard that su once did a ‘peridot event’ where they just reran peridot episodes#which had eps that skip around in the show#did they even care about airing the story so that it made sense anyways?#id get it if the low stakes townie episodes were the ones getting rerun))#but i have such a boring view on that which is i think it’s simply because the creators like townie eps#like in interviews r.ebecca s.ugar has said she’s the type to be really invested in background characters#answers in interviews have been crafted in ways to hide what’s really going on though tbf#prime example of this is rebecca and ian saying the wedding being interrupted was meant to follow the common trope#when later in the art book they said that it was bc cn rejected the ep bc it ‘wasn’t interesting enough’#both could simultaneously be true! it’s a psychology thing though where people make up nice-sounding explanations behind what they create#in retrospect because they want it to be thought out in such a nice way they believe in it#the bigger problem is that not matter how many episodes there are of them#it can be hard for ppl to be invested in the townies the same way they are invested in the main cast#i’m sure that a million writers have made surefire advice on how to get an audience to care about characters#but off the top of my head i think it’s because 1. most don’t have strong motivations to get truly invested in#(exception is ronaldo but people find him too annoying to care about him)#okay i had more points and explanations but i hit the tag limit and idk if anyone is actually reading this so bye

166 notes

·

View notes

Text

I would pay such good money for confirmation of whether Ratio and Aventurine have worked together before Penacony. How did it happen??? The talks that went on before Final Victor... The initial spark of inspiration to stick Those Two Guys together...

Like, I just have to know if someone in the IPC deliberately tossed Aventurine and Ratio on to a team together (with or without good intentions). Are any of the higher ups in the IPC or the Intelligentsia Guild out there counting on this partnership working out for the best?

To be a fly on the wall when Ratio found out who he'd been hired to "consult" with...

And Aventurine, getting the IPC mission orders across his desk like "Ah, yes, finally. He's here. My Government Assigned Boyfriend™."

#honkai star rail#aventurine#dr. ratio#ratiorine#aventio#golden ratio#I'm just mentally cackling at the idea#not sure what's funnier#AVENTURINE being the one to take one look at Ratio and going#'I am about to devise so many plans that need the Intelligentsia Guild's input'#OR#the higher ups setting them up instead#Aventurine was just minding his own business#hustling for the Stonehearts#makin those deals#and then all the sudden BAM#Genius Be Upon Ye#No wait!!! Please also consider#Ratio taking one look at Aventurine and suddenly coming up with#a ton of research ideas that just absolutely needed the Strategic Investment Department's direct funding#poor gambler did one (1) group presentation and it changed the trajectory of his whole life#some people get an end-of-year bonus after a big work project#Aventurine got a husband#nooooo#Now I'm just imagining a scenario where they have a chance meeting#and then BOTH keep coming up with RICE PAPER THIN excuses to see each other again#while the other Intelligentsia Guild and IPC members are just watching like#“This is kind of embarrassing”

281 notes

·

View notes

Text

Your Trusted Partner in Fund Formation and Legal Services for Investment Funds. Specializing in Alternative Investment Fund solutions, we're here to help you navigate the world of fund creation and management with expertise and precision.

https://www.cv5capital.io

0 notes

Text

Todays the day. I need to get a job, even if that jobs not in the gaming industry. So I’m heading to the library to print up a resume and apply at a little local chain of mattress stores.

The guy instantly liked me when I went in to do a secret shop for a competing store and offered to hire me on the spot so I figure if I can chat with him he’ll still like me enough to consider me.

#ramblies#I’m dreading this so much I had dreams about getting hired by dropout tv instead#also my beloved was very sweet and when I said this was hard reassured me that I can do hard things#I wish I could wait for an industry job but it’s just not feasible#because we desperately need to move my beloved out of our current carpeted home#and moving costs are no joke#I’ll also need to get myself a laptop so I can keep honing rigging skills at the mattress job which I’m dreading#I have little to know idea how much I’ll need to invest to get a machine that can run Maya like a champ#which I’ll also need to buy an indie Maya license#god life is stressful and expensive#I long to be a little renaissance artist kept in a garret making what I please on the funds of patrons#alas

255 notes

·

View notes

Text

Why is there suddenly a mysterious old man with long hair who clearly gives off Final Boss vibes???

This… this is still a football manga, right???

#blue lock#and pifa cracked me up after i googled it 😭#it says philippine investment funds associaton sdjhfjsghdj#miyamiwu.src#miyamiwu.live#. blue lock

161 notes

·

View notes