#investor business plan

Text

a cafe but it’s a selection of different stimulants that aren’t tea or coffee

10 notes

·

View notes

Text

My first time watching Glass Onion it was obvious that Miles' speeches were bullshit, but I still searched for any hidden meaning there might be.

The second time is a different experience though because every time my brain starts to search for meaning, I feel like Benoit Blanc discovering that no, there is absolutely no hidden meaning.

It's bullshit it's all nothing nothing nothing! It is just how you end up talking when everyone reacts to your self-aggrandizing word vomit like it is actually wisdom.

Also, legit, when Miles gave his stupid bullshit speech about what the word 'disruptor' means to him, I shit you not I was like holy shit am I back in business school right now?!

Miles must have given speeches like that at 100 business school graduations, goddamn.

Like, the motherfuckers really do sound like this. We didn't have any billionaires come, but we had a lot of millionaire guest speakers in my classes, and they fucking talk like that.

They all think they're rugged capitalists, but they're just glass onions!

#original#glass onion#it's just. business school prepared me really well to succeed in the business world as a straight white neurotypical#able-bodied cis man with a large network of very wealthy friends and family#I really would have killed it if I wasn't a queer autistic cripple!#even the best teachers seemed incredibly unaware of the enormous privilege that they were assuming in their students when they taught#but they basically presupposed you had infinite energy and savings and a disturbingly large number of my classes were just#lectures about pushing as hard as you can no matter what#they used Starbucks as an example of an admirable case of somebody who persisted in going to 150 investor pitches before being approved#and like. how many people do you know who have enough savings to schedule plan and attend 150 investor pitches?#how many people do you know who could set up even 12 through their connections?#where are those savings coming from? where are those investor pitch meetings coming from? those aren't easy to get!!#but none of this was ever mentioned it was just awesome that the guy kept trying I guess.#I have a sneaking suspicion that if I were to have dug deeper into some of the examples we were given that a lot of those#real life businesses probably started with a big big loan from somebody's parents#I was listening to the show you're wrong about which is a really good podcast and Michael Hobbs was like#anytime you see an article glorifying someone's financial success especially at a young age you should control F for 'parents'#because chances are you will probably see the word 'parents' somewhere next to the words 'million dollar loan'#anyway college is a scam. the community aspect was incredibly cool but I don't see why we as a culture need to only be able to access that#kind of community when we are paying a scam Institution a shitload of money for Educations that aren't helpful for the majority of us#if College was free then people could actually study things that are useful or fun for them#I took most of my courses just to fill out my major too. the point wasn't to learn it was to graduate.#and then it turned out that if you're disabled in the way i am it doesn't matter if you have a college degree!#but I'm sure miles would say I just need to pull myself up by my bootstraps. and that's why I'm glad his life got exploded 😌#andi kept him around for his money - why else would he be there when no one even liked him??#he was the bankroll#one time I swear to god we just had the guy from American Psycho just a real ass Patrick Bateman#it was wild watching that movie later and being like ???? I know this guy!#outside of the actual murder scenes everything in that movie is not exaggerated in the slightest those bitches really are like that#like my parents are not 1% level rich so there'd be no giant loans but they are rich. it'd be stupid to act like i didn't benefit from that

99 notes

·

View notes

Text

Bajaj Housing Finance IPO opens on Monday: GMP jumps; shareholder quota, date, review, other details of upcoming IPO

Minimize your trading risks & trade smarter with www.intensifyresearch.com 10 DAYS FREE TRIAL - best SEBI-registered RA firm.

Ganesh Chaturthi Bumper Offer - 10 DAYS FREE TRIAL & FLAT 30% DISCOUNT on all Research Services

Get comprehensive knowledge

– nifty buy sell signals,

– best shares to buy,

– profit making stocks,

– low risk investment option & lot more

by the best SEBI-registered RA firm.

#finance#stock market#banknifty#nifty prediction#economy#nifty50#investing#nse#sensex#share market#bajaj finance#bajaj housing finance#home loan#ipo alert#ipo news#invest#investment#investors#stocks#investing stocks#forex#financial planning#startup#business#services

2 notes

·

View notes

Text

A stock trader can trade profitable stocks for you, while a stock broker can make you broke.

According to an economy, a complaint is a consumer`s right based on a law.

Therefore, a stock broker can be fined, or even the stock broker can lose a permission to trade stocks.

Later on, based on a legal proceeding, the stock broker can be qualified for a confiscation of a property if the property was owned based on an organized crime.

Respectfully,

An author Piotr Sienkiewicz

Let`s connect on Facebook.

#A business plan#A business loan#a landing page#sales training#sales#leads#marketing#investing#sales training london#investment#investors#a salesman#a salesperson#a sales training#a sales community#a saleswoman#business#brand#A brand name#a brand name#a business plan#a business loan#an online business#business leads#management#strategies#earnings#cake#An economy#economy

12 notes

·

View notes

Text

First Home Buyer Loans | First Home Buyer Victoria

Your Mortgage Experts specialize in first home buyer loans. Find the perfect home loan for your needs in Tarneit, Truganina, Point Cook, Cranbourne, Perth, and Sydney.

#business loan#finance#loans#mortgage#personal loans#home loan#first home#Mortgage Experts#financial planning#property management#investors#services#mortgageexperts#loan#Victoria#cranbourne#perth#Sydney#Point Cook#PointCook

2 notes

·

View notes

Text

https://www.vatikamindscapes.co.in/

#real estate#business#real estate investing#investors#investment#financial#finance#financial planning

6 notes

·

View notes

Text

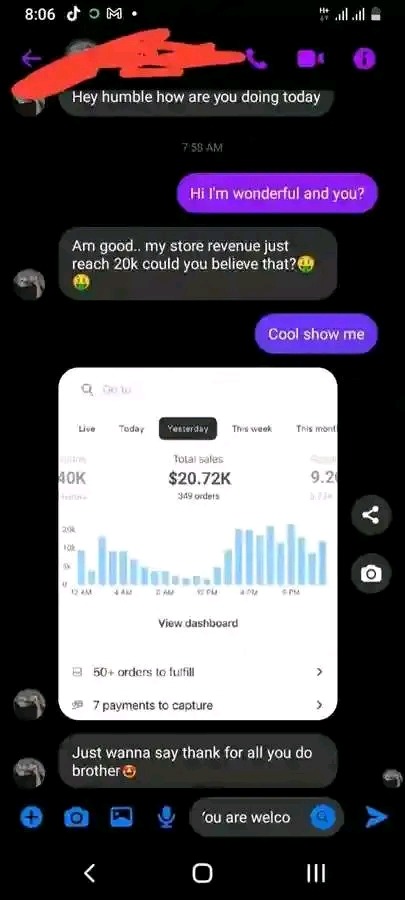

Hello, who is interested in starting a dropshipping business and earning at least 5 figures consistently

#home business dropshiping#shopify#side husle plan#earnings#enterpreneurs#dropshipping#enterpreneurship#investor#business

2 notes

·

View notes

Text

Disrupting the Industry: How a Tech Startup Went from Raising Capital to Dominating the Market

Introduction:

In today’s fast-paced digital world, tech startups have the power to disrupt traditional industries and revolutionize the way business is done. This article will explore the journey of a tech startup as it went from raising capital to dominating the market, showcasing the key strategies and tactics that led to its success.

Raising Capital: Building the Foundation

The first crucial…

#best practices for startup pitches#common mistakes in seeking funding.#crowdfunding strategies for startups#essential elements of a business plan#finding angel investors#how to bootstrap a startup#How to secure startup funding#navigating the seed funding process#startup funding options#startup funding stages#startup growth and scaling strategies#success stories of funded startups#tips for pitching to investors#top venture capital firms 2024#understanding equity and valuation

0 notes

Text

The Secret Weapon for Business Success: A Business Plan

You probably want to act immediately upon a fantastic business idea. You’ll want to get started as soon as possible by searching for suppliers, creating products, and locating clients full of energy and inspiration.

I promise you won’t want to sit down and draft a business plan amid all of this excitement. But you might be surprised to learn that skipping this crucial first step before starting…

#business advice#business consulting#business development#business funding#business growth#business plan#business success#entrepreneurship#financial planning#goal setting#investor pitch deck#marketing strategy#small business#startup#strategic planning

0 notes

Text

Crafting an Exceptional Business Plan for Investor India with Infocresst

Unlock the full potential of your business venture with Infocresst's comprehensive "business plan for investor India" services. Our expert team at Infocresst meticulously crafts tailored business plans that meet the unique requirements of the Indian investment landscape. With a focus on market analysis, financial projections, and strategic planning, we ensure your business plan not only attracts investors but also drives your business towards sustainable growth. Partner with Infocresst to turn your entrepreneurial vision into a thriving reality.

0 notes

Text

Plan for the Future with Financial Statements, Forecasts, and Projections

Welcome back to the SAI CPA Services blog! Today, we’re highlighting the critical role of financial statements, forecasts, and projections in planning for your business’s future.

The Importance of Financial Statements, Forecasts, and Projections

Understanding and planning for your business’s financial future is essential for sustained success. Here’s how our services can help:

Accurate Financial Reporting: Our detailed financial statements provide a clear and accurate view of your business’s current financial health, including income, expenses, and profitability.

Informed Decision-Making: Financial forecasts and projections allow you to anticipate future trends and make informed strategic decisions. We help you prepare for potential opportunities and challenges.

Budgeting: Effective budgeting is crucial for managing resources and achieving business goals. Our services ensure your budget aligns with your financial objectives and market conditions.

Performance Monitoring: Regular financial reporting and analysis help you monitor your business’s performance over time, ensuring you stay on track and make necessary adjustments.

Investor Confidence: Accurate financial statements and realistic forecasts instill confidence in investors and stakeholders, potentially leading to more investment opportunities and better financing options.

How SAI CPA Services Can Help

At SAI CPA Services, we offer comprehensive financial statement, forecast, and projection services tailored to your business’s unique needs. Our experienced team provides the insights and analysis necessary to guide your strategic planning and ensure your business’s long-term success. Partner with us to gain a clearer understanding of your financial future and achieve your business goals.

Connect Us: https://www.saicpaservices.com https://www.facebook.com/AjayKCPA https://www.instagram.com/sai_cpa_services/ https://twitter.com/SaiCPA https://www.linkedin.com/in/saicpaservices/ https://whatsapp.com/channel/0029Va9qWRI60eBg1dRfEa1I

908-380-6876

1 Auer Ct, 2nd Floor

East Brunswick, NJ 08816

#Sai Cpa Services#business growth#financial services#cpa#new jeresy#accounting#bookeeping#financial planning#BusinessForecasting#financial statements#strategic planning#budget#investors

1 note

·

View note

Text

Are you seeking expert guidance for crafting a compelling investor business plan? Look no further! Our consultancy services specialize in creating investor-ready business plans that stand out. Elevate your pitch with our tailored strategies. Explore more at Stellar Consultancy - Investor Business Plan Consultancy.

0 notes

Text

In the ever-evolving landscape of business, entrepreneurs and established companies alike seek avenues for growth and expansion. One powerful tool that has gained prominence in recent years is private equity services. These Financial Services play a pivotal role in shaping the trajectory of businesses, offering a unique blend of capital infusion, strategic guidance, and operational expertise. In this blog post, we will delve into the multifaceted world of private services for private equity and explore their indispensable role in fostering business growth.

#financial services compliance#financial services#financial planning#financial advisor#investors#california news#california#san jose california#investment banking#Financial Services Agency#equity investment#industry experts#smallbusinessitsupport#business growth#marketing#private equity#guidance#upcoming ipo#investments#financial health

0 notes

Text

Infocresst: Your Gateway to Expert Business Plan Consulting in India

In the dynamic business landscape of India, the key to attracting investors and securing sustainable growth lies in a meticulously crafted business plan. Infocresst, a leading business plan consulting firm, emerges as the beacon of success for entrepreneurs and businesses seeking to make a lasting impression on investors in India.

Crafting the Perfect Blueprint: Business Plan Consultants in India

Infocresst understands that a well-crafted business plan is not just a document; it's a roadmap to success. As expert business plan consultants in India, the professionals at Infocresst bring a wealth of experience to the table, helping businesses articulate their vision, mission, and strategies in a way that resonates with potential investors.

Tailored Business Plans for Investors in India

When it comes to attracting business plans for investors in India, a generic business plan won't cut it. Infocresst specializes in creating tailored business plans that speak directly to the unique needs and expectations of Indian investors. The firm leverages its in-depth knowledge of the Indian market to create comprehensive business plans that showcase growth potential, financial viability, and a clear path to success.

Unlocking Investment Opportunities

Investors in India are discerning and seek well-researched and thoughtful business plans. Infocresst excels in crafting business plans that not only meet but exceed the expectations of investors. By highlighting key market trends, competitive advantages, and a robust financial forecast, Infocresst ensures that your business plan becomes a compelling tool for attracting investment.

Why Choose Infocresst for Your Business Plan?

Infocresst goes beyond the conventional approach to business planning. The firm's team of seasoned professionals collaborates closely with clients, gaining a deep understanding of their business goals and aspirations. This personalized approach enables Infocresst to create business plans that are not only investor-friendly but also align seamlessly with the client's vision for success.

Invest in Success with Infocresst

Embarking on a journey to secure investment for your business in India? Look no further than Infocresst, your trusted partner in business plan consulting. Infocresst combines industry expertise, market insights, and a commitment to excellence to create business plans that stand out in the competitive Indian business landscape.

Choose Infocresst for business plans that captivate investors, unlock opportunities, and pave the way for unparalleled success. With a focus on precision and innovation, Infocresst is the driving force behind businesses that dare to dream big in the vibrant market of India. Your success story begins with a strategic business plan from Infocresst – where vision meets reality.

0 notes

Text

What are the steps to get an H-1B visa for an Indian?

For many Indians, the H-1B visa is a vital route for highly qualified foreign workers, and it offers an exceptional chance to pursue professional and personal development in the United States. The H-1B visa is highly desirable since it provides access to a wide range of opportunities in U.S. employment for persons with specific talents and educational backgrounds.

To help Indian professionals navigate the complexities of the H-1B visa application procedure, this page attempts to function as a thorough guide. With this resource, potential candidates will be equipped with the information and resources they need to start their H-1B journey, from qualifying requirements to negotiating the sometimes intricate documentation procedures.

Eligibility Criteria For H-1B Visa For Indians.

Applicants must have a bachelor’s degree or higher from a U.S. or foreign university. The degree should be in a field related to the specific H-1B job. The H-1B visa is often associated with jobs requiring at least a bachelor’s degree or equivalent. The USCIS may consider equivalent work experience in some cases. The degree obtained from a foreign institution may need to be evaluated to determine its equivalency to a U.S. bachelor’s degree.

Independent credential evaluation services often do evaluations. The job that the applicant is being sponsored for must qualify as a “speciality occupation.” This generally means the position requires highly specialised knowledge and a bachelor’s degree or higher in a specific field. A speciality occupation requires the theoretical and practical application of highly specialised knowledge.

The position must meet one of the following criteria:

A bachelor’s degree or higher is the minimum entry requirement for the position.

The degree requirement is common for the position in the industry, or the job is so complex or unique that it can only be performed by someone with a degree.

The H-1B visa is typically tied to a specific job, and the applicant’s educational background and qualifications should be directly relevant to the position.

It is important to note that the H-1B visa process involves the employer filing a petition on behalf of the employee. Employers must submit various documents, including the Labor Condition Application (LCA) and evidence supporting the eligibility criteria.

Job Offer and Sponsorship H-1B visa for an Indians

Securing a job offer and sponsorship for an H-1B visa can be a multi-step process that involves finding H-1B sponsoring employers, job portals, networking, consulting with immigration attorneys, and effectively managing the job application and negotiation process. Here’s a breakdown of the steps:

Utilise job portals that cater to international candidates seeking work visas, such as Indeed, Glassdoor, and LinkedIn. Look for job postings that explicitly mention sponsorship or H-1B visa support.

Network within your industry by attending professional events, conferences, and seminars. Utilise online platforms like LinkedIn to connect with professionals in your field and express your interest in opportunities that offer visa sponsorship.

Seek advice from immigration attorneys who specialise in employment-based immigration. They can provide insights into companies known for sponsoring H-1B visas and guide you on the legal aspects of the process.

Some law firms may also have connections with employers looking to hire foreign workers, so exploring such possibilities is worthwhile.

Apply to job positions that match your skills and qualifications. Be transparent about your visa status and eligibility for H-1B sponsorship in your application.

Prepare thoroughly for interviews, showcasing your experience and demonstrating how your skills align with the job requirements.

Emphasise your unique skills and experiences that make you an asset to the company.

Once you receive a job offer, carefully review the terms and conditions, including salary, benefits, and relocation assistance.

Discuss this with the employer if H-1B sponsorship is not explicitly mentioned. Companies may be willing to sponsor if they understand the process and requirements.

If the employer is unfamiliar with the H-1B process, be prepared to provide information or connect them with resources to help clarify the steps involved.

H-1B Visa Lottery

The H-1B visa lottery is a process used when the number of H-1B visa petitions exceeds the annual numerical cap set by the U.S. government. The H-1B visa program has an annual cap on the number of new H-1B visas that can be issued.

Certain categories of H-1B petitions, such as those filed by universities and certain nonprofit organisations, are exempt from the cap. If the number of H-1B petitions received within the first few days of the filing period exceeds the available cap, a random lottery is conducted to select the petitions that will be processed for adjudication. There are two lotteries: one for the regular cap and another for the advanced degree exemption. The advanced degree lottery is conducted first, and unselected advanced degree petitions are then included in the regular cap lottery.

H-1B petitions are typically accepted starting from April 1st of each year for employment starting on October 1st of the same year. Preparing and submitting the H-1B petition on time is important, as the cap is often reached within the first few days of the filing period.

The lottery selects which petitions will be processed randomly if more petitions are received than the annual cap allows. Due to the high demand for H-1B visas, there is no guarantee of selection in the lottery. If your petition is not selected, it’s essential to have backup plans. This could include exploring other visa options, considering employment in a different country, or continuing education in the U.S. Some individuals may also consider adjusting their immigration strategy, such as obtaining Optional Practical Training (OPT) or seeking employment with cap-exempt employers.

The H-1B visa application process is a significant opportunity for skilled foreign professionals to work in the United States. While the process can be complex and competitive, understanding the key steps and requirements is crucial for a successful application.

#us visa#immigrationopportunities#mumbai#india#investor visa#h1bvisa#h1b visa denial#eb5visa#h1bsponsorship#l1 visa#us visa for indians#h1b visa#employees#employee visa#business#invest#property investing#financial planning#investor sentiment#finance

1 note

·

View note

Text

How to Qualify for a Family Opportunity Mortgage

When it comes to buying a home, there are various options available in the market. One such option that can be a game-changer for families is a family opportunity mortgage. But what exactly is a family opportunity mortgage? It is a type of mortgage loan that allows families to purchase a home for their elderly parents or disabled adult children. This unique mortgage program offers families the opportunity to provide a safe and comfortable living space for their loved ones while also benefiting from the advantages of homeownership.

Here, Give a visit to our website to learn more, Business insighto!

Table of Contents

Benefits of a family opportunity mortgage

How to qualify for a family opportunity mortgage

Finding the right family opportunity mortgage lender

Factors to consider when choosing a family opportunity mortgage lender

Top family opportunity mortgage lenders

Tips for applying for a family opportunity mortgage

Common misconceptions about family opportunity mortgages

Alternatives to family opportunity mortgages

Conclusion

Benefits of a family opportunity mortgage

A family opportunity mortgage comes with several benefits that make it an attractive option for many families. Firstly, it allows families to support their elderly parents or disabled adult children by providing them with a suitable living arrangement. This can be particularly advantageous for families who want to ensure the well-being and care of their loved ones while maintaining their independence.

Secondly, a family opportunity mortgage allows families to invest in real estate and potentially build equity over time. Unlike renting, purchasing a home through a family opportunity mortgage enables families to make a long-term investment that can yield financial benefits in the future.

Lastly, a family opportunity mortgage can also provide tax advantages. Families can potentially deduct mortgage interest and property tax payments, resulting in significant savings on their annual tax returns. This can further contribute to the financial stability and well-being of the family.

How to qualify for a family opportunity mortgage

Qualifying for a family opportunity mortgage requires meeting certain criteria set by lenders. Firstly, families must demonstrate that the home will be occupied by a qualified family member, such as an elderly parent or disabled adult child. Lenders may require documentation, such as medical records or statements from healthcare professionals, to confirm the need for the family member to live in the home.

Additionally, families must meet the standard eligibility requirements for obtaining a mortgage, including having a good credit score, sufficient income to cover the monthly mortgage payments, and a reasonable debt-to-income ratio. It is important to note that specific qualification criteria may vary among different lenders, so families should thoroughly research and compare options to find the best fit for their financial situation.

Finding the right family opportunity mortgage lender

Finding the right family opportunity mortgage lender is crucial to ensure a smooth and successful home buying process. Start by researching and comparing lenders that offer family opportunity mortgages. Look for lenders with experience in this type of mortgage program and a solid reputation in the industry.

Consider reaching out to local banks, credit unions, and mortgage brokers to inquire about their family opportunity mortgage offerings. Additionally, online resources and forums can provide valuable insights and recommendations from other families who have gone through a similar process.

When evaluating lenders, pay attention to factors such as interest rates, loan terms, closing costs, and customer service. These factors can greatly impact the overall cost and experience of obtaining a family opportunity mortgage. Request quotes and compare the offers from multiple lenders to ensure you are getting the best possible deal.

Factors to consider when choosing a family opportunity mortgage lender

Choosing the right family opportunity mortgage lender requires careful consideration of various factors. One of the key factors to consider is the interest rate offered by the lender. A lower interest rate can significantly reduce the overall cost of the mortgage, resulting in long-term savings for the family.

Another important factor is the loan term. Families should assess whether a shorter or longer loan term is more suitable for their financial situation. A shorter loan term may result in higher monthly payments but can lead to substantial savings on interest payments over the life of the loan.

Additionally, families should evaluate the lender’s reputation and customer service. Working with a lender who is responsive, transparent, and knowledgeable can make the entire mortgage process much smoother and less stressful.

Top family opportunity mortgage lenders

While there are many lenders that offer family opportunity mortgages, some stand out for their competitive rates, excellent customer service, and flexible loan options. Here are a few top family opportunity mortgage lenders to consider:

XYZ Bank: XYZ Bank has a strong reputation for providing family opportunity mortgages with competitive rates. They offer a variety of loan options tailored to meet the specific needs of families.

ABC Credit Union: ABC Credit Union is known for its personalized approach to mortgage lending. They have a dedicated team that specializes in family opportunity mortgages and can guide families through the entire process.

DEF Mortgage Company: DEF Mortgage Company offers a wide range of mortgage products, including family opportunity mortgages. They have a streamlined application process and provide excellent customer support.

Tips for applying for a family opportunity mortgage

Applying for a family opportunity mortgage requires careful preparation and attention to detail. Here are some tips to help families navigate the application process:

Gather all necessary documentation: Lenders will require various documents to assess the family’s eligibility and financial stability. These may include tax returns, bank statements, pay stubs, and proof of the family member’s need for housing assistance.

Improve your credit score: A higher credit score can increase your chances of getting approved for a family opportunity mortgage and secure better interest rates. Paying off debts, making payments on time, and avoiding new credit applications can help improve your credit score.

Get pre-approved: Getting pre-approved for a family opportunity mortgage can give families a clear understanding of their budget and streamline the home search process. It also shows sellers that you are a serious buyer.

Common misconceptions about family opportunity mortgages

There are some common misconceptions about family opportunity mortgages that can lead to confusion. One misconception is that these mortgages are only available to immediate family members. However, many lenders extend the eligibility to extended family members, such as grandparents or siblings.

Another misconception is that family opportunity mortgages are only for first-time homebuyers. In reality, families who already own a home can also qualify for this type of mortgage, as long as they meet the necessary criteria.

It is important to dispel these misconceptions and educate oneself about the true nature of family opportunity mortgages to make informed decisions.

Click here, to read more articles about personal finance!

Alternatives to family opportunity mortgages

While family opportunity mortgages can be a great solution for many families, it is worth exploring alternative options to ensure the best fit for individual circumstances. Some alternatives to consider include:

Conclusion

A family opportunity mortgage can open up new possibilities for families looking to provide housing and support for their elderly parents or disabled adult children. By understanding what a family opportunity mortgage entails, how to qualify for one, and how to choose the right lender, families can make informed decisions that align with their financial goals and priorities. Remember to thoroughly research and compare lenders, consider alternative options, and seek professional advice when needed. With the right approach, families can unlock a brighter future for their loved ones while enjoying the benefits of homeownership.

#personal finance#finance#personalfinance#homeloan#personal loans#loans#mortgage#financial planning#investors#loan#business#property#moneymanagement#money

0 notes