#kyc api integration

Explore tagged Tumblr posts

Text

KYC Data API India

Experience seamless KYC compliance in India through our robust Data API. Ensure swift, secure verifications with confidence. Elevate your standards today.

0 notes

Text

#ChangeNOW#crypto exchange#non-custodial exchange#instant crypto swaps#crypto-to-crypto exchange#fiat-to-crypto#anonymous crypto trading#no KYC exchange#crypto swap platform#floating rate exchange#fixed rate crypto#NOW Wallet#NOWPayments#crypto API integration#crypto exchange aggregator#crypto trading 2025#secure crypto exchange#mobile crypto app#crypto exchange review

0 notes

Text

🎯 The Future of Payments is Here – And It’s Powered by Itio Innovex! 🚀

As the digital economy evolves, businesses need to stay ahead with secure, compliant, and scalable Crypto Payment Gateways that also support fiat transactions and neo-banking integrations.

At Itio Innovex, we have built a full-stack solution that not only meets global compliance standards like FATF, PCI-DSS, GDPR, and SOC 2, but also comes with developer-friendly APIs and ready-to-integrate source code.

✅ Accept multi-chain crypto payments ✅ Convert seamlessly to fiat currencies ✅ Ensure KYC/AML compliance by design ✅ PCI-DSS secure for fiat handling ✅ Embedded fraud detection & risk monitoring

🔗 Explore our detailed technical article here: (Insert your article link here)

💻 Developers can also access the full source code and API structure to integrate our solution into any SaaS or Fintech platform.

🔒 Why Itio Innovex? Because payment technology deserves to be secure, compliant, and future-proof.

#crypto#cybersecurity#digital banking licenses#digitalbanking#fintech#investors#white label crypto exchange software#bitcoin#digital marketing#financial advisor#payment gateway#gdprcompliance#digital licences#cyber security#social security#cryptoinvesting#digitalcurrency#blockchain#altcoin#saas#saas development company#saas technology#b2b saas#saas platform

2 notes

·

View notes

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Text

KYC Solutions Provider

KYC Italy provides a KYC solution to help businesses to verify the identity of their customers. Their KYC API is easy to use and can integrate easily with any existing system. Our API helps for seamless client onboarding and secure business transactions.

2 notes

·

View notes

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

A Comprehensive Guide to Blockchain-as-a-Service (BaaS) for Businesses

In today's digital landscape, a blockchain app development company plays a crucial role in transforming industries with decentralisation, immutability, and transparency. However, building and managing a private blockchain network can be complex and costly, which deters many businesses. Blockchain-as-a-Service (BaaS) simplifies this by allowing businesses to leverage blockchain without the challenges of infrastructure development.

This comprehensive blog covers the hurdles businesses face when adopting blockchain, how BaaS can bridge these gaps, and why it is a game-changer for various sectors.

I. Challenges for Businesses in Blockchain Adoption

Despite the undeniable potential of blockchain technology, businesses face several significant challenges when contemplating its adoption:

Limited Internal Expertise: Developing and maintaining a private blockchain network requires a skilled team with deep blockchain knowledge, which is often lacking in many organisations.

High Cost: The infrastructure investment and ongoing maintenance fees associated with blockchain can strain budgets, especially for small and medium-sized businesses (SMBs).

Integration Complexities: Integrating a blockchain network with existing enterprise systems can be challenging, requiring seamless data flow and compatibility between the blockchain system and legacy infrastructure.

II. Understanding BaaS and Its Operational Fundamentals

Blockchain-as-a-Service (BaaS) simplifies the development and deployment of blockchain applications by providing a cloud-based platform managed by third-party providers. The BaaS market, valued at $1.5 billion in 2024, is projected to grow to $3.37 billion by 2029, reflecting a robust 17.5% CAGR.

Key Components of BaaS

Cloud-Based Infrastructure: Ready-to-use blockchain infrastructure hosted in the cloud, eliminating the need for businesses to set up and maintain their networks.

Development Tools and APIs: Access to a suite of tools and APIs to create and deploy blockchain applications quickly.

Platform Support: Compatibility with various blockchain protocols such as Ethereum, Hyperledger Fabric, and Corda, offering flexibility to businesses.

Managed Service Model: Providers handle tasks like network maintenance, security updates, and scalability.

Pay-as-you-go Pricing Model: Reduces upfront investment and operational costs associated with blockchain software development.

III. Business Benefits of Blockchain as a Service

Adopting BaaS offers numerous advantages, including:

Enhanced Scalability: Businesses can easily scale their blockchain network as their needs grow.

Increased Efficiency: Eliminates intermediaries and streamlines transactions, improving productivity.

Enhanced Transparency: Tamper-proof records of transactions foster trust and improve auditability.

Reduced Costs: The pay-as-you-go model eliminates large upfront investments.

Improved Security: Built on secure cloud infrastructure with robust encryption protocols.

Enhanced Customer Engagement: Facilitates secure and transparent interactions with customers, building trust and loyalty.

IV. Industry-wise Key Use Cases of Blockchain as a Service

BaaS is transforming business operations across various industries:

Finance: Streamlines trade finance, secures cross-border payments, and enhances KYC and AML compliance.

Supply Chain Management: Improves transparency and traceability of goods, automates logistics processes, and reduces counterfeiting risks.

Healthcare: Facilitates secure sharing of patient data and tracks the provenance of pharmaceuticals.

Government: Enhances transparency with secure citizen identity management and verifiable voting systems.

V. Region-wise Adoption of BaaS

The BaaS market is experiencing rapid growth worldwide:

North America: Leading with over 35% of global revenues, driven by early adoption.

Europe: Countries like Germany, the UK, and France are at the forefront.

Asia-Pacific: China, India, Japan, and South Korea are key contributors.

Rest of the World: Growing adoption in South & Central America, the Middle East, and Africa.

VI. Why Choose a Prominent BaaS Provider?

Opting for a blockchain app development company that offers BaaS can significantly impact the success of your blockchain initiatives:

Specialised Expertise: Providers possess in-depth knowledge and experience in blockchain technology.

Cost Efficiency: Eliminates the need for in-house infrastructure investment and maintenance.

Time Savings: Accelerates the development process and reduces time-to-market.

Scalability and Flexibility: Offers scalable solutions that can adapt to business growth.

Risk Mitigation: Providers handle security, maintenance, and updates.

Conclusion

By adopting Blockchain-as-a-Service (BaaS), businesses can simplify blockchain integration and focus on innovation without the complexities of managing infrastructure. Systango, a leading blockchain app development company, offers tailored BaaS solutions that help businesses leverage blockchain technology for enhanced efficiency, scalability, and security. As one of the top , Systango also excels in integrating AI solutions to drive business growth and efficiency.

Original Source - https://systango.medium.com/a-comprehensive-guide-to-blockchain-as-a-service-baas-for-businesses-5c621cf0fd2f

2 notes

·

View notes

Text

What Web Development Companies Do Differently for Fintech Clients

In the world of financial technology (fintech), innovation moves fast—but so do regulations, user expectations, and cyber threats. Building a fintech platform isn’t like building a regular business website. It requires a deeper understanding of compliance, performance, security, and user trust.

A professional Web Development Company that works with fintech clients follows a very different approach—tailoring everything from architecture to front-end design to meet the demands of the financial sector. So, what exactly do these companies do differently when working with fintech businesses?

Let’s break it down.

1. They Prioritize Security at Every Layer

Fintech platforms handle sensitive financial data—bank account details, personal identification, transaction histories, and more. A single breach can lead to massive financial and reputational damage.

That’s why development companies implement robust, multi-layered security from the ground up:

End-to-end encryption (both in transit and at rest)

Secure authentication (MFA, biometrics, or SSO)

Role-based access control (RBAC)

Real-time intrusion detection systems

Regular security audits and penetration testing

Security isn’t an afterthought—it’s embedded into every decision from architecture to deployment.

2. They Build for Compliance and Regulation

Fintech companies must comply with strict regulatory frameworks like:

PCI-DSS for handling payment data

GDPR and CCPA for user data privacy

KYC/AML requirements for financial onboarding

SOX, SOC 2, and more for enterprise-level platforms

Development teams work closely with compliance officers to ensure:

Data retention and consent mechanisms are implemented

Audit logs are stored securely and access-controlled

Reporting tools are available to meet regulatory checks

APIs and third-party tools also meet compliance standards

This legal alignment ensures the platform is launch-ready—not legally exposed.

3. They Design with User Trust in Mind

For fintech apps, user trust is everything. If your interface feels unsafe or confusing, users won’t even enter their phone number—let alone their banking details.

Fintech-focused development teams create clean, intuitive interfaces that:

Highlight transparency (e.g., fees, transaction histories)

Minimize cognitive load during onboarding

Offer instant confirmations and reassuring microinteractions

Use verified badges, secure design patterns, and trust signals

Every interaction is designed to build confidence and reduce friction.

4. They Optimize for Real-Time Performance

Fintech platforms often deal with real-time transactions—stock trading, payments, lending, crypto exchanges, etc. Slow performance or downtime isn’t just frustrating; it can cost users real money.

Agencies build highly responsive systems by:

Using event-driven architectures with real-time data flows

Integrating WebSockets for live updates (e.g., price changes)

Scaling via cloud-native infrastructure like AWS Lambda or Kubernetes

Leveraging CDNs and edge computing for global delivery

Performance is monitored continuously to ensure sub-second response times—even under load.

5. They Integrate Secure, Scalable APIs

APIs are the backbone of fintech platforms—from payment gateways to credit scoring services, loan underwriting, KYC checks, and more.

Web development companies build secure, scalable API layers that:

Authenticate via OAuth2 or JWT

Throttle requests to prevent abuse

Log every call for auditing and debugging

Easily plug into services like Plaid, Razorpay, Stripe, or banking APIs

They also document everything clearly for internal use or third-party developers who may build on top of your platform.

6. They Embrace Modular, Scalable Architecture

Fintech platforms evolve fast. New features—loan calculators, financial dashboards, user wallets—need to be rolled out frequently without breaking the system.

That’s why agencies use modular architecture principles:

Microservices for independent functionality

Scalable front-end frameworks (React, Angular)

Database sharding for performance at scale

Containerization (e.g., Docker) for easy deployment

This allows features to be developed, tested, and launched independently, enabling faster iteration and innovation.

7. They Build for Cross-Platform Access

Fintech users interact through mobile apps, web portals, embedded widgets, and sometimes even smartwatches. Development companies ensure consistent experiences across all platforms.

They use:

Responsive design with mobile-first approaches

Progressive Web Apps (PWAs) for fast, installable web portals

API-first design for reuse across multiple front-ends

Accessibility features (WCAG compliance) to serve all user groups

Cross-platform readiness expands your market and supports omnichannel experiences.

Conclusion

Fintech development is not just about great design or clean code—it’s about precision, trust, compliance, and performance. From data encryption and real-time APIs to regulatory compliance and user-centric UI, the stakes are much higher than in a standard website build.

That’s why working with a Web Development Company that understands the unique challenges of the financial sector is essential. With the right partner, you get more than a website—you get a secure, scalable, and regulation-ready platform built for real growth in a high-stakes industry.

0 notes

Text

✅ PAN-Aadhaar Verification API: Streamline Compliance & Prevent Fraud

In today's digital landscape, verifying user identity quickly and accurately is essential for businesses operating in financial services, fintech, lending, insurance, and beyond. One key regulatory requirement in India is the linkage and verification of PAN (Permanent Account Number) with Aadhaar. The PAN-Aadhaar Verification API helps businesses meet this requirement with ease, speed, and security.

🔍 What is PAN-Aadhaar Verification API?

The PAN-Aadhaar Verification API allows businesses to verify whether a user's PAN is linked with their Aadhaar in real-time. This verification is conducted using government-approved data sources and ensures compliance with the latest KYC (Know Your Customer) and AML (Anti-Money Laundering) norms.

🚀 Key Advantages

1. Real-Time Verification

No more delays in manual checks. Get instant confirmation of PAN-Aadhaar linkage status for seamless user onboarding and transaction processing.

2. Government-Compliant

The API is aligned with regulatory standards, ensuring your business stays compliant with the latest income tax and KYC rules.

3. Bulk Verification Support

Need to verify thousands of users? The API supports high-volume, batch verification to save time and operational effort.

4. Fraud Prevention

Prevent identity fraud by verifying the authenticity of PAN-Aadhaar linkage before processing loans, payouts, or registrations.

5. Easy API Integration

The API is designed for fast integration with your platform—whether it's a mobile app, web portal, or internal system.

6. Cost-Efficient & Scalable

Automating verification reduces operational costs and scales effortlessly with your growing customer base.

💼 Who Should Use It?

NBFCs & Banks: For customer onboarding & loan disbursals

Fintech Platforms: For KYC and fraud checks

Insurance Providers: For policy issuance & verification

Payment Gateways: For user validation before transactions

HR & Payroll Firms: For employee onboarding & compliance

🔐 Why It Matters

The Indian government has made PAN-Aadhaar linkage mandatory for most financial and legal processes. Businesses that fail to comply risk penalties and operational disruptions. Automating this verification using a reliable API not only saves time but ensures regulatory compliance and data accuracy.

🌐 Conclusion

The PAN-Aadhaar Verification API is an essential tool for any digital-first business looking to streamline verification, reduce fraud, and ensure compliance. Whether you handle thousands of users or just a few, this API can greatly enhance your onboarding and KYC workflows.

Power your compliance with NifiPayments – Simple, Secure, Scalable. #DigitalIndia #PANVerification #AadhaarVerification #FintechSolutions #RegulatoryCompliance #NifiPayments #KYCAPI #APISolutions

0 notes

Text

Ready to Launch the Next Dream11? Find the Best Fantasy Sports App Development Company in India

With the IPL, Kabaddi League, World Cup qualifiers, and now fantasy stock and opinion-based games joining the fray, the Indian fantasy sports market is exploding. Now is the perfect time to start your own fantasy sports app.

Selecting the best fantasy sports app development company India is the first (and most important) step for any startup, entrepreneur, or sports brand hoping to create the next Dream11, My11Circle, or MPL.

Let's go over what makes these apps so valuable in 2025 and how you can succeed with the right development partner!

🔍 Why Fantasy Sports Apps Are Booming in India

India is evolving into a fantasy gaming powerhouse and is no longer just a cricket-mad country! This is the reason:

In India, there are currently over 200 million active fantasy sports players, with that number predicted to rise to 350 million by 2027.

There will be significant seasonal traffic spikes due to the 2025 IPL and Pro Kabaddi.

Through fantasy apps, young people are moving from passive viewing to active participation.

Sports like tennis, hockey, fantasy football, and even esports are becoming more and more popular.

Due to this change in user behavior, there is a great need for fantasy apps that are rewarding, scalable, real-time, and well-designed.

👨💻 What a Good Fantasy Sports App Development Company in India Offers

A top-tier fantasy sports app development company goes beyond just building an app. It brings your vision to life with smart monetization, fan engagement tools, and compliance features.

Here’s what you should expect:

✅ 1. Real-Time Match Integration

Live scores, player stats, leaderboards, and auto-updates powered by fast APIs.

✅ 2. Multi-Sport Support

From cricket to kabaddi to football – build an app that can scale across leagues and seasons.

✅ 3. User Engagement & Gamification

Refer & earn, fantasy drafts, live contests, badges, points — turn every user into a loyal player.

✅ 4. Wallet & Payment Gateway Integration

Secure deposits, instant withdrawals, UPI and wallet compatibility, and KYC handling.

✅ 5. Admin Dashboard & Analytics

Complete control to manage contests, users, payouts, notifications, and in-app promotions.

✅ 6. Compliance & Legal Setup

Fantasy sports apps must comply with India’s skill-based gaming laws. Your dev partner should guide you through this.

✅ 7. Custom & White-Label Options

Whether you want a custom fantasy engine or want to go live fast with a white-label solution — you need flexibility.

🚀 Upcoming Fantasy Trends in 2025 You Should Capitalize On

✅ Fantasy Cricket for IPL 2025 ✅ Fantasy Kabaddi for PKL Season 11 ✅ Fantasy Football during Euro & ISL ✅ Fantasy Stock Trading (Probo-style) ✅ Opinion Trading Apps ✅ Women’s Sports Fantasy Leagues (WPL and more)

A smart developer will help you plug into these hot trends so you can attract more users and revenue.

🧩 Why Choose a Fantasy Sports App Development Company in India?

India is not just the biggest fantasy sports market — it's also home to the best tech talent and cost-effective development resources.

An Indian development partner gives you:

💡 Deep understanding of fantasy app logic & monetization

🏏 Local sports league knowledge

🔐 Legal compliance & risk advisory

💰 Affordable pricing for MVP and full product builds

🔥 Final Thoughts

In India, fantasy sports are the way of the future for digital interaction, not just a passing fad. The IPL, PKL, ISL, and even fantasy opinion trading apps are becoming more and more popular, so now is the ideal time to start your own fantasy app.

Invest in a reputable tech partner like IMG Global Infotech Pvt. Ltd., one of the top fantasy sports app development companies in India, if you're serious about creating a feature-rich, legally compliant, and scalable fantasy sports platform. They will assist you in moving quickly and profitably from concept to launch thanks to their extensive knowledge of real-time gaming, payment integration, and league customization.

The game is on. Are you ready to play your move?

❓ Frequently Asked Questions (FAQs)

Q1. How much does it cost to develop a fantasy sports app in India?

Answer: The cost ranges from ₹5 lakhs to ₹20 lakhs for an MVP, depending on features, platform, and design. Advanced apps with real-time APIs and custom games can cost more.

Q2. Can I launch an IPL-based fantasy app legally in India?

Answer: Yes, fantasy sports are legal in most Indian states under the category of “games of skill.” A good development partner will ensure your app is legally compliant.

Q3. What tech stack is used for fantasy app development?

Answer: Most fantasy apps use React Native or Flutter for frontend, Node.js or PHP for backend, and Firebase or AWS for database and hosting. Real-time APIs are used for live match data.

Q4. How do I earn revenue from a fantasy sports app?

Answer: Revenue can come from entry fees, in-app ads, premium contests, affiliate offers, or virtual store purchases.

Q5. Can I launch a fantasy app in just one sport?

Answer: Absolutely! Many successful apps start with a single sport like cricket and later scale to football, kabaddi, or esports.

0 notes

Text

#Cryptomus#crypto payment gateway#cryptocurrency wallet#merchant crypto solutions#P2P crypto exchange#stablecoin conversion#crypto invoicing#crypto plugins#custodial wallet#crypto payment processor#anti-volatility protection#crypto API integration#crypto payments for e-commerce#crypto transaction analytics#crypto payment platform 2025#crypto KYC optional#crypto for businesses#crypto payment tools#crypto wallet review#crypto payment gateway review

0 notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

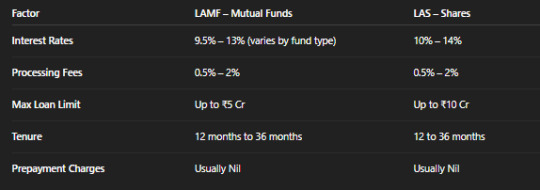

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

What are the must-have features in a fintech app?

In the modern financial landscape, fintech apps have become a cornerstone of convenience, accessibility, and innovation. As more users shift toward digital platforms for their financial needs, the demand for robust and user-friendly fintech software continues to rise. Whether you're developing a mobile banking app, a payment gateway, a budgeting tool, or a lending platform, there are essential features every fintech app must include to succeed in a highly competitive market.

These features are not only critical for user experience but also play a significant role in security, scalability, and customer trust. Let's explore the must-have features that define a powerful and effective fintech app.

1. Secure Onboarding and User Authentication

User onboarding is the first interaction customers have with a fintech app. A smooth, intuitive, and secure onboarding process builds trust from the start. This includes:

Simple registration with minimal steps

Secure identity verification (e.g., document upload, selfie verification)

Integration with KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols

Multi-factor authentication (MFA)

Biometric login using fingerprint or facial recognition

These features ensure that the app complies with financial regulations while offering a frictionless experience for legitimate users.

2. Intuitive and Responsive User Interface (UI/UX)

Design is a critical factor in the success of any fintech software. A clean, user-friendly interface improves navigation, reduces user frustration, and increases engagement. The app should support both dark and light themes, have clear menu structures, and ensure all actions are easily accessible.

Responsiveness is also crucial — users expect the app to load quickly and function seamlessly across devices, from smartphones to tablets.

3. Real-Time Notifications and Alerts

Timely communication is vital for keeping users informed about their financial activities. Push notifications, SMS alerts, and in-app messages can be used to:

Notify users about successful transactions

Alert them of suspicious activity

Remind them about upcoming bill payments or due dates

Provide promotional offers or updates

Real-time alerts contribute to transparency and help users maintain control over their finances.

4. Transaction History and Statements

A fintech app must provide users with easy access to their transaction history. This includes:

Filters by date, category, or transaction type

Downloadable PDF or Excel statements

Search functionality

Categorization of income and expenses

Offering this transparency builds trust and helps users better manage their money.

5. Seamless Payment Integration

One of the core functions of any fintech app is enabling users to send and receive money. Seamless integration with payment gateways, UPI, mobile wallets, and traditional banking systems is a must. Key features include:

Peer-to-peer (P2P) transfers

Bill payments and mobile recharges

Scheduled or recurring payments

QR code-based payments

The process should be fast, reliable, and secure.

6. Personalized Financial Insights

Data-driven fintech services offer personalized experiences that help users make smarter financial decisions. Incorporating AI and machine learning enables the app to:

Offer spending insights

Track budgets and set financial goals

Recommend financial products

Predict cash flow or upcoming expenses

This personalization adds value and keeps users engaged with the app on a regular basis.

7. Robust Security Features

Security is non-negotiable in the world of fintech. To ensure the safety of user data and funds, a fintech app must include:

End-to-end data encryption

Tokenization of payment details

Role-based access controls

Secure API integration

Real-time fraud detection systems

These measures not only protect user data but also reinforce regulatory compliance and platform credibility.

8. Chatbot or Customer Support Integration

Even the most well-designed fintech apps will encounter users who need help. Including a chatbot or live customer support integration provides quick answers to FAQs and complex issues alike. Features such as:

24/7 live chat

AI-powered virtual assistants

Ticketing system for complex queries

help boost user satisfaction and reduce churn.

9. Multi-Currency and Localization Support

If the fintech app is targeting a global or diverse user base, it should offer multi-currency support, localized languages, and region-specific regulations. This includes:

Displaying balances in local currencies

Currency conversion features

Compliance with local tax and regulatory policies

It makes the platform more inclusive and adaptable to different markets.

10. Analytics Dashboard for Admins

Behind the scenes, administrators need real-time dashboards to monitor performance, transactions, user behavior, and compliance. A comprehensive admin panel should include:

KPIs and financial metrics

Fraud and risk alerts

User activity logs

API monitoring and audit trails

These analytics ensure smooth operations and informed business decisions.

Conclusion

The success of a fintech app hinges on the combination of user convenience, security, functionality, and innovation. Including these must-have features ensures the app can stand up to user expectations while staying compliant with financial regulations.

Modern fintech software is evolving rapidly, and staying ahead means continuously integrating features that meet both market demands and regulatory standards. From biometric authentication to personalized insights and AI-driven chatbots, every feature contributes to a better and more secure financial experience.

Companies like Xettle Technologies are at the forefront of this transformation, developing innovative fintech solutions that blend technology with user-centric design. By integrating essential features and staying committed to quality and compliance, Xettle Technologies exemplifies the best practices in building robust fintech platforms.

As digital finance continues to grow, having a feature-rich fintech app is no longer optional — it's essential for staying relevant and competitive in a fast-paced world.

0 notes

Text

How Address Verification APIs Help Prevent Fraud and Reduce Failed Deliveries

Inaccurate addresses are more than just logistical problems—they’re gateways to financial loss, fraud, and customer dissatisfaction. Address verification APIs are the silent workhorses behind successful shipping, billing, and identity verification. This article explores how they safeguard your business.

What Is an Address Verification API?

An Address Verification API automatically checks and validates addresses during data entry or prior to shipment. It corrects typos, standardizes formats, and flags incomplete or fraudulent addresses.

How Fraud Happens Without Address Validation

Fake Addresses Used for Promotions

Stolen Credit Cards with Mismatched Addresses

Synthetic Identities for Loan or Benefit Fraud

Shipping to Abandoned Warehouses

Fraud Prevention Benefits

Address Matching with Payment Methods

Geolocation Cross-Checks

Instant Blacklist Notifications

Reduced Chargebacks and Identity Fraud

Failed Deliveries: Hidden Costs

Every failed delivery incurs:

Reshipment fees

Wasted materials

Customer support time

Lower satisfaction scores

How Address Verification APIs Reduce Delivery Failures

Autocorrect Minor Typos

Suggest Valid Alternatives

Ensure Address Completeness

International Format Normalization

Address Verification vs. Address Autocomplete

FeatureVerification APIAutocomplete APIPurposeValidate + CorrectSuggest + CompleteBest ForShipping, ComplianceCheckout UXPrevents Fraud?YesNo

Popular Address Verification API Providers

Lob

Smarty

PostGrid

Loqate

Melissa

Compliance and Security Benefits

PCI DSS Alignment

HIPAA for Healthcare

GDPR for European Data

Data Encryption and Logging

Industry Use Cases

E-commerce: Reduces return-to-sender rates

Banking: Validates KYC (Know Your Customer) addresses

Insurance: Ensures property address accuracy

Logistics: Reduces routing and delivery errors

Integration Workflow

Capture Address

Call API

Receive Standardized + Validated Address

Update CRM or Proceed to Checkout

Sample API Call

jsonCopy

Edit

{ "address_line1": "742 Evergreen Ter", "city": "Springfield", "country": "USA", "zip": "62704" }

Output Response

jsonCopy

Edit

{ "status": "verified", "suggested_correction": "742 Evergreen Terrace, Springfield, IL 62704" }

Best Practices for Implementation

Validate before checkout

Offer user overrides only if confidence score is high

Show real-time correction suggestions

Measuring API Effectiveness

Failed Delivery Rate

Fraud Detection Rate

Customer Satisfaction Score

Cost Per Delivery

Conclusion: Protecting Your Bottom Line

Address Verification APIs are not just optional—they’re essential. Preventing fraud, reducing delivery errors, and enhancing customer trust starts with clean, validated data. Integrate it right, and you’ll avoid the costs of wrong addresses and bad actors.

youtube

SITES WE SUPPORT

Check Postcard With API – Wix

0 notes

Text

TPAP Support – Seamless UPI Integration for Fintechs

The UPI ecosystem in India is booming, and Third-Party Application Providers (TPAPs) play a crucial role in this revolution. Bharat Inttech offers full-service TPAP Support, enabling fintechs and apps to launch UPI services with ease, speed, and full compliance.

Who Are TPAPs?

TPAPs are non-bank fintech companies that provide UPI-enabled payment apps or services. They rely on Payment Service Providers (PSPs) and must be authorized by NPCI. Being a TPAP requires technical integration and strict regulatory compliance.

Our TPAP Support Services:

End-to-End Onboarding: From application to NPCI approval.

Compliance Management: Help with KYC, AML, data storage, and user verification.

System Integration: Connect your app to PSP banks and UPI switches.

Monitoring & Analytics: Transaction logs, performance reports, and alerts.

Why It Matters:

Without proper TPAP onboarding, launching a UPI service is difficult and risky. Our solution simplifies the journey:

Reduces setup time from months to weeks

Ensures compliance with NPCI/RBI mandates

Handles technical complexities and certification

Offers scalable UPI architecture with redundancy

Who Should Use Our TPAP Support?

Fintech startups building new apps

Wallet companies expanding into UPI

Marketplaces enabling in-app payments

Social or messaging apps integrating peer-to-peer transfers

Why Bharat Inttech?

With a proven track record in UPI infrastructure, we help TPAPs go live faster. Our experts provide:

Custom API documentation

Test environments and support

NPCI coordination and audits

Post-launch monitoring

Conclusion:

Becoming a TPAP doesn't have to be complicated. With Bharat Inttech's dedicated support and powerful tools, your app can quickly join India’s growing UPI ecosystem.

For More Information Visit Us:

0 notes