#metlife insurance

Text

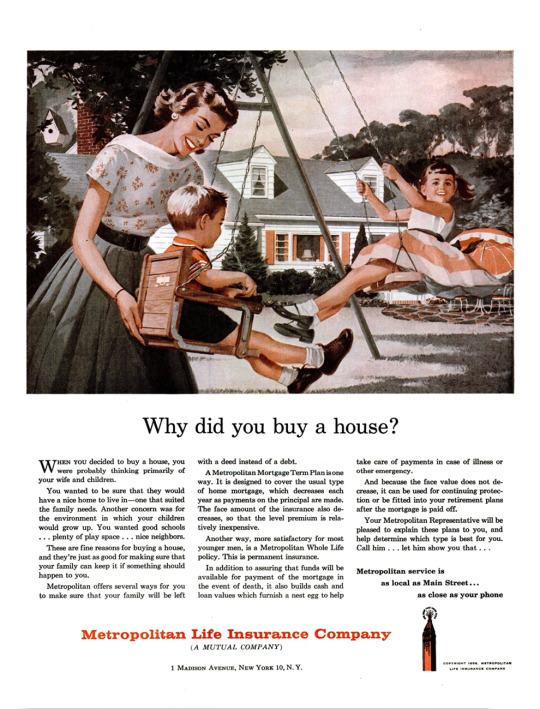

Why did you buy a house? Metropolitan Life Insurance Company ad - 1958.

#vintage illustration#vintage advertising#insurance#home insurance#insurance companies#met life#metlife#metlife insurance#metropolitan life insurance company#metropolitan life insurance#metropolitan life

3 notes

·

View notes

Text

The Metropolitan Life Insurance Co was formed on March 24, 1868.

#Metropolitan Life Insurance Company Tower#Metropolitan Life North Building#Metropolitan Life Insurance Co#formed#24 March 1868#anniversary#MetLife Building#Napoleon LeBrun#Gothic Revival#1 Madison Avenue#Flatiron District#Harvey Wiley Corbett#D. Everett Waid#Art Deco#Gap Town Clock#Eleven Madison#Manhattan#New York City#architecture#original photography#cityscape#summer 2019#2018#2013#vacation#travel#Union Square#evening light

2 notes

·

View notes

Text

380 Union Ave, Brooklyn, NY 11211, United States

#cigna dentist brooklyn#delta dental dentist brooklyn#dentist#metlife dentist brooklyn#dentist in brooklyn#dentist brooklyn#brooklyn dentist#dentist brooklyn ny#principal dentist brooklyn#united healthcare dentist brooklyn#delta dental insurance#delta dental dentist

0 notes

Text

Worldwide Insurance Companies along with detailed information

Gathering a complete list of all insurance companies worldwide, along with detailed information about each, is a vast and complex task. The number of insurance companies globally is in the thousands, varying across regions and industries (life, health, property, casualty, etc.). Additionally, companies frequently merge, change names, or cease operations, which makes maintaining an up-to-date list…

#Allianz#Auto Insurance#AXA#Berkshire Hathaway#Business Insurance#Check for Discounts and Benefits#China Life Insurance#clarity of policy information#Credit Score#Critical Illness Insurance#customer experience#customer service#financial stability#Group Health Insurance#High ratings#Homeowners Insurance#Individual Health Insurance#insurance companies#Insurance company#insurance company&039;s#investment#Investment Performance#Life insurance#lower risk#MetLife#Monitor and Review#Munich Re#New York Life insurance#Northwestern Mutual#Pet Insurance

1 note

·

View note

Text

Brac Bank and MetLife Partner to Offer Free Insurance for Rural Women

Brac Bank Tara has joined forces with MetLife to provide a micro deposit insurance facility at no cost to rural women through the Brac Bank agent banking channel.

Funded by a grant from the Gates Foundation, this initiative aims to enhance financial inclusion and health security among rural women in Bangladesh. The primary objective is to increase insurance penetration and promote health…

0 notes

Text

MetLife Whole Life Insurance Review: Analyzing the Pros and Cons

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. MetLife offers whole life insurance policies that combine a death benefit with a savings component, providing financial security and potential cash value accumulation. This review analyzes the pros and cons of metlife whole life insurance review, helping individuals make informed decisions about their insurance needs.

Understanding MetLife Whole Life Insurance

MetLife whole life insurance policies offer lifelong coverage, guaranteed death benefits, and potential cash value accumulation. Premiums remain fixed throughout the policyholder's life, providing predictability and stability in financial planning. The cash value of the policy grows tax-deferred over time, and policyholders can access it through loans or withdrawals, although these may impact the death benefit and incur fees.

Cost Considerations

The cost of MetLife whole life insurance varies based on several factors:

Age: Younger individuals typically pay lower premiums.

Health: Good health may result in lower premium rates.

Coverage Amount: Higher coverage amounts lead to higher premiums.

Underwriting: MetLife evaluates risk factors through underwriting, impacting premium rates and policy approval.

While whole life insurance premiums are generally higher than those of term life insurance due to the lifelong coverage and cash value component, they provide permanent protection and potential financial benefits.

Pros of MetLife Whole Life Insurance

Lifelong Coverage

One of the primary advantages of MetLife whole life insurance is lifelong coverage. As long as premiums are paid, the policy remains in force, providing financial security for beneficiaries after the insured's death. This ensures that loved ones receive a guaranteed death benefit, regardless of when the insured passes away.

Cash Value Accumulation

MetLife whole life insurance policies accumulate cash value over time. The cash value grows at a guaranteed rate set by the insurer and may also receive dividends, depending on the policy's terms. Policyholders can use this cash value for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial needs.

Fixed Premiums

Whole life insurance from MetLife offers fixed premiums, meaning the amount paid remains constant throughout the policy's duration. This predictability can be advantageous compared to other forms of insurance where premiums may increase with age or changes in health. Fixed premiums provide stability in financial planning and ensure affordability over the long term.

Guaranteed Death Benefit

MetLife whole life insurance policies come with a guaranteed death benefit. This benefit remains unchanged throughout the policy's duration, providing certainty that beneficiaries will receive a specified amount upon the insured's death. The death benefit is generally income tax-free to beneficiaries, making it a valuable asset for estate planning and financial security.

Cons of MetLife Whole Life Insurance

Higher Premiums

One of the main drawbacks of MetLife whole life insurance is higher premiums compared to term life insurance. The cost of whole life insurance reflects the permanent coverage, cash value accumulation, and guaranteed death benefit. While premiums remain fixed, they can be more expensive, particularly for individuals seeking lower-cost insurance options.

Complexity and Flexibility

Whole life insurance policies can be complex compared to term life insurance. The combination of insurance coverage and cash value accumulation requires careful consideration of policy terms, surrender charges, loan interest rates, and potential impacts on the death benefit. Policyholders may have limited flexibility in adjusting coverage amounts or premium payments compared to other insurance types.

Opportunity Cost

Investing in whole life insurance with cash value accumulation may involve opportunity costs. The growth of cash value is typically conservative compared to other investment vehicles, such as stocks or mutual funds. Policyholders should weigh the potential returns of cash value against alternative investment opportunities to determine the best use of financial resources.

Conclusion

MetLife whole life insurance offers comprehensive coverage, guaranteed death benefits, and potential cash value accumulation, making it a valuable financial tool for individuals seeking lifelong security and benefits. While it provides stability through fixed premiums and permanent coverage, prospective policyholders should consider factors such as cost, complexity, and opportunity costs when evaluating their insurance needs. By understanding the pros and cons of MetLife whole life insurance, individuals can make informed decisions that align with their long-term financial goals and provide essential protection for their loved ones.

In conclusion, MetLife whole life insurance provides robust benefits, including lifelong coverage, cash value accumulation, and fixed premiums. However, it's essential for individuals to carefully weigh the higher costs and complexity against the guaranteed benefits and financial security it offers. By evaluating these factors thoughtfully, individuals can determine whether MetLife whole life insurance meets their insurance needs and financial objectives effectively.

0 notes

Text

Pre-Existing Conditions & Critical Illness Insurance: Can You Still Get Covered?

Confused about Critical Illness Insurance? This guide explores what illnesses are covered, the top industry leaders, and innovative trends like AI and digital health shaping the future of critical illness coverage in 2024

Critical Illness Insurance Market: Covered Conditions and Industry Leaders

The critical illness insurance market is experiencing significant growth, driven by rising healthcare costs and increased awareness of critical illnesses. But with so many options available, navigating this market can be confusing. Here, we’ll answer some key questions to help you understand critical illness coverage and…

View On WordPress

#aflac#AI#allianz#axa#cancer#chinalife#criticalillness#criticalillnessinsurance#DigitalHealth#employeebenefits#FinancialPlanning#financialpreparedness#financialprotection#futureofwork#GlobalHealth#healthcare#healthinsurance#HealthTech#heartattack#innovation#insurance#MentalHealth#metlife#stroke#sunlife#Telemedicine#Wellness#zurich

0 notes

Text

Choosing the right dental insurance can be a game-changer for your overall health. MetLife Dental Insurance stands out as a reliable choice with its extensive coverage options and robust network of dental professionals. Let's dive into the details of what MetLife offers and why it might be the perfect fit for you.

Learn More

0 notes

Text

MetLife Munsur Rahman Agency

MetLife, under the guidance of the proficient Munsur Rahman Agency, epitomizes excellence in the realm of life insurance. With a legacy spanning decades, MetLife has earned a reputation for reliability and innovation, attributes that are seamlessly embodied by the Rahman Agency. Specializing in providing comprehensive life insurance solutions, this agency stands as a beacon of trust and security for individuals and families alike. Munsur Rahman's team operates with a commitment to understanding clients' unique needs, ensuring tailored coverage that fosters peace of mind. Through a blend of expertise and personalized service, they navigate the complexities of life insurance, offering clarity and guidance every step of the way. Whether it's term life, whole life, or universal life insurance, the Rahman Agency showcases a diverse portfolio of products designed to safeguard financial futures. Their dedication extends beyond mere transactions; it's a dedication to building lasting relationships founded on integrity and transparency. Clients find reassurance in the agency's unwavering support, knowing that their loved ones are protected against life's uncertainties. Moreover, the Rahman Agency doesn't just sell policies; they educate, empower, and advocate for their clients, fostering financial literacy and resilience. With MetLife's robust backing and the Rahman Agency's unwavering commitment, individuals can embark on life's journey with confidence, knowing that their aspirations and legacies are safeguarded against unforeseen events. In essence, the Munsur Rahman Agency epitomizes the ethos of MetLife: security, reliability, and a steadfast commitment to protecting what matters most.

0 notes

Text

PNB Metlife Unlisted Share - A Good Investment Opportunity? | PNB Metlife Upcoming IPO

Is investing in PNB Metlife Unlisted Share a good investment opportunity in the indian unlisted share market? Should you invest? Get answers of this question on this video and learn more on Planify.

Watch Now:

youtube

0 notes

Text

Finding a Trusted “MetLife Insurance Dentist Near Me”: Introducing Tuscan Lakes Family Dentistry

For those insured by MetLife, a common search query might be “MetLife insurance dentist near me“. Thankfully, for residents in our community, Tuscan Lakes Family Dentistry has got you covered.

0 notes

Photo

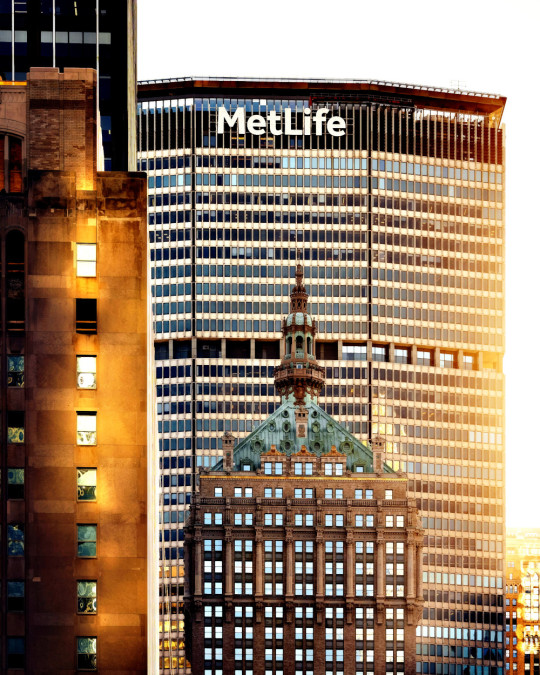

The Metropolitan Life Insurance Co was formed on March 24, 1868.

#Metropolitan Life Insurance Company Tower#Metropolitan Life North Building#Metropolitan Life Insurance Co#formed#24 March 1868#155th anniversary#MetLife Building#Napoleon LeBrun#Gothic Revival#1 Madison Avenue#Flatiron District#Harvey Wiley Corbett#D. Everett Waid#Art Deco#Gap Town Clock#Eleven Madison#Manhattan#New York City#architecture#original photography#cityscape#summer 2019#2018#2013#vacation#travel#U

9 notes

·

View notes

Link

#Promenade Center For Dentistry Of Charlotte NC#dentist#dentist in charlotte#dentist charlotte#metlife dentist#dental insurance#charlotte nc

0 notes

Video

youtube

PNB Metlife Insurance | PNB Metlife Insurance Shares | Planify

Watch the video to discover PNB Metlife Insurance's financial results for FY22 and get information on the company's performance before investing.

#youtube#pnb metlife insurance#pnb metlife insurance share price#pnb metlife fy2022#pnb metlife insurance financial results

0 notes

Photo

Why is the MetLife Building famous?

MetLife Building

It was advertised as the world's largest commercial office space by square footage at its opening, with 2.4 million square feet (220,000 m2) of usable office space. As of November 2022, the MetLife Building remains one of the 100 tallest buildings in the United States.

Can you enter the MetLife Building?

You can enter The MetLife Building from anywhere in Grand Central Station but the entrance closest to The Metlife Building entrance is on 45th Street between Lexington and Vanderbilt.

What offices are in the MetLife Building?

In addition to being the official headquarters of the Metropolitan Life Insurance Company, the MetLife Building houses a number of other major firms, including the headquarters of Dreyfus Corporation, Knight Vinke, the wealth and investment management division of Barclays, the largest office of Greenberg Traurig, DNB, CB Richard Ellis, Gibson, Dunn & Crutcher, Hunton & Williams, Computer Sciences Corporation, Winston & Strawn, Paul Hastings, and Lend Lease Corporation on Level 9. In addition the building serves as the U.S. Headquarters for Mitsui & Co. (USA) Inc, the American subsidiary of Japan’s largest trading company, BNP Paribas Investment Partners and its American subsidiary Fischer, Francis, Trees and Watts.

NOAA Weather Radio Station KWO35, a NOAA transmitter station, is located atop the building.

Impressive tenant roster includes:

There are about 400 tenants throughout Graybar’s 31 floors

Bank of America

Barclays

Bovis Lend Lease

CB Richard Ellis

CSC (Computer Software Corp)

DNB Nord Bank

Fischer Francis Trees & Watts

Hunton & Williams

IgnitionOne

Korn Ferry International

Magnitude Capital

CBRE Global Investors

Merrill Lynch

Dreyfus Corporation

MetLife

Met Life

Gibson Dunn

Novus Partners

Mitsui & Co.

Gibson Dunn & Crutcher

Swarovski

BNY Mellon

Paul Hastings

Winston & Strawn

Federal Home Loan Mortgage Corporation

UBS

J. Fitzgibbons

Metropolitan Life Insurance Company

Preferred Office Properties

Freddie Mac

Oppenheimer & Co.

Nor Bank ASA

Mitsui

Carr Workplaces

Medical Properties Trust

#New York City#new york#newyork#New-York#nyc#NY#Manhattan#urban#city#USA#United States#buildings#travel#journey#outdoors#street#architecture#visit-new-york.tumblr.com#MetLife Building#MetLife

144 notes

·

View notes

Text

FUCK ANTHEM

I call Anthem Blue Cross. I tell them I need a mandibular adjustment device. They give me the number of a local in-network dentist.

I call the dentist. They’re not in-network, and they’re sick of Anthem saying they are.

I call Anthem. They say they don’t even cover mandibular adjustment devices, and I should call MetLife Dental.

I call MetLife Dental. They don’t cover mandibular adjustment devices. That’s Anthem’s job.

I call Anthem. They give me a list of all in-network dentists within 20 miles who can give me a mandibular adjustment device.

I call the dentists. One puts me on indefinite waitlist because they have so many patients already. Every other dentist is either out-of-network or doesn’t provide mandibular adjustment devices.

I call Anthem. They say they can’t give me a list of dentists, because they’re medical insurance, not dental insurance. I try to explain they already gave me a list of dentists, and I get nowhere. They tell me to call MetLife and get a list of nearby dentists from them. Even if they’re out-of-network, Anthem will still pay 70%.

For lack of a better idea, I call MetLife. I say I need a local dentist who can provide a mandibular adjustment device. They say they’ll send me a list of local dentists. I say I specifically need dentists who can provide a mandibular adjustment device. They say they sent me the list of dentists. I hang up.

I call one of the dentists on MetLife’s list. They don’t provide mandibular adjustment devices.

I call one of the out-of-network providers from Anthem’s list. I ask if it’s true Anthem will pay 70%. They say Anthem will pay 70% of the allowable rate, but they don’t publish what the allowable rate is, so it could be anything. I’m on the hook for everything else.

I’m going to call Anthem and see if I can find out the allowable rate for a mandibular adjustment device. Wish me luck!

9 notes

·

View notes