#most profitable trading strategy

Text

youtube

Jon Corteen Understands Profit, Value Systems, and Strategy

#profit strategy#guaranteed profit option strategy#most profitable trading strategy#value system#motivational value system#gross profit#non profit organization#profit and loss statement#operating income#profit and loss account#profit management solutions complaints#profit loss statement#profitability analysis#strategy books#good strategy bad strategy#the art of strategy#strategic management book#on grand strategy#jon corteen understands profit#jon corteen#Youtube

0 notes

Text

youtube

Jon Corteen Understands Profit, Value Systems, and Strategy

🌟I've got a clear-ish vision of where I want to go, a fairly good idea of what I have to accomplish now and in the next....oh, three or four minutes...

#profit strategy#guaranteed profit option strategy#most profitable trading strategy#value system#motivational value system#gross profit#non profit organization#profit and loss statement#operating income#profit and loss account#profit management solutions complaints#profit loss statement#profitability analysis#strategy books#good strategy bad strategy#the art of strategy#strategic management book#on grand strategy#jon corteen understands profit#jon corteen#Youtube

1 note

·

View note

Text

#best forex strategy for consistent profits#forex trading best strategy#most accurate forex strategy

0 notes

Text

FCC strikes a blow against prison profiteering

TOMORROW NIGHT (July 20), I'm appearing in CHICAGO at Exile in Bookville.

Here's a tip for policymakers hoping to improve the lives of the most Americans with the least effort: help prisoners.

After all, America is the most prolific imprisoner of its own people of any country in world history. We lock up more people than Stalin, than Mao, more than Botha, de Klerk or any other Apartheid-era South African president. And it's not just America's vast army of the incarcerated who are afflicted by our passion for imprisonment: their families and friends suffer, too.

That familial suffering isn't merely the constant pain of life without a loved one, either. America's prison profiteers treat prisoners' families as ATMs who can be made to pay and pay and pay.

This may seem like a losing strategy. After all, prison sentences are strongly correlated with poverty, and even if your family wasn't desperate before the state kidnapped one of its number and locked them behind bars, that loved one's legal defense and the loss of their income is a reliable predictor of downward social mobility.

Decent people don't view poor people as a source of riches. But for a certain kind of depraved sadist, the poor are an irresistible target. Sure, poor people don't have much money, but what they lack even more is protection under the law ("conservativism consists of the principle that there is an in-group whom the law protects but does not bind, and an out-group whom the law binds but does not protect" -Wilhoit). You can enjoy total impunity as you torment poor people, make them so miserable and afraid for their lives and safety that they will find some money, somewhere, and give it to you.

Mexican cartels understand this. They do a brisk trade in kidnapping asylum seekers whom the US has illegally forced to wait in Mexico to have their claims processed. The families of refugees – either in their home countries or in the USA – are typically badly off but they understand that Mexico will not lift a finger to protect a kidnapped refugee, and so when the kidnappers threaten the most grisly tortures as a means of extracting ransom, those desperate family members do whatever it takes to scrape up the blood-money.

What's more, the families of asylum seekers are not much better off than their kidnapped loved ones when it comes to seeking official protection. Family members who stayed behind in human rights hellholes like Bukele's El Salvador can't get their government to lodge official complaints with the Mexican ambassador, and family members who made it to the USA are in no position to get their Congressjerk to intercede with ICE or the Mexican consulate. This gives Mexico's crime syndicates total latitude to kidnap, torture, and grow rich by targeting the poorest, most desperate people in the world.

The private contractors that supply services to America's prisons are basically Mexican refugee-kidnappers with pretensions and shares listed on the NYSE. After decades of consolidation, the prison contracting sector has shrunk to two gigantic companies: Securus and Viapath (formerly Global Tellink). These private-equity backed behemoths dominate their sector, and have diversified, providing all kinds of services, from prison cafeteria meals to commissary, the prison stores where prisoners can buy food and other items.

If you're following closely, this is one of those places where the hair on the back of your neck starts to rise. These companies make money when prisoners buy food from the commissary, and they're also in charge of the quality of the food in the mess hall. If the food in the mess hall is adequate and nutritious, there's no reason to buy food from the commissary.

This is what economists call a "moral hazard." You can think of it as the reason that prison ramen costs 300% more than ramen in the free world:

https://pluralistic.net/2024/04/20/captive-market/#locked-in

(Not just ramen: in America's sweltering prisons, an 8" fan costs $40, and the price of water went up in Texas prisons by 50% during last summer's heatwave.)

It's actually worse than that: if you get sick from eating bad prison food, the same company that poisoned you gets paid to operate the infirmary where you're treated:

https://theappeal.org/massachusetts-prisons-wellpath-dentures-teeth/

Now, the scam of abusing prisoners to extract desperate pennies from their families is hardly new. There's written records of this stretching back to the middle ages. Nor is this pattern a unique one: making an unavoidable situation as miserable as possible and then upcharging people who have the ability to pay to get free of the torture is basically how the airlines work. Making coach as miserable as possible isn't merely about shaving pennies by shaving inches off your legroom: it's a way to "incentivize" anyone who can afford it to pay for an upgrade to business-class. The worse coach is, the more people you can convince to dip into their savings or fight with their boss to move classes. The torments visited upon everyone else in coach are economically valuable to the airlines: their groans and miseries translate directly into windfall profits, by convincing better-off passengers to pay not to have the same thing done to them.

Of course, with rare exceptions (flying to get an organ transplant, say) plane tickets are typically discretionary. Housing, on the other hand, is a human right and a prerequisite for human thriving. The worse things are for tenants, the more debt and privation people will endure to become home-owners, so it follows that making renters worse off makes homeowners richer:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

For Securus and Viapath, the path to profitability is to lobby for mandatory, long prison sentences and then make things inside the prison as miserable as possible. Any prisoner whose family can find the funds can escape the worst of it, and all the prisoners who can't afford it serve the economically important function of showing the prisoners whose families can afford it how bad things will be if they don't pay.

If you're thinking that prisoners might pay Securus, Viapath and their competitors out of their own prison earnings, forget it. These companies have decided that the can make more by pocketing the difference between the vast sums paid by third parties for prisoners' labor and the pennies the prisoners get from their work. Remember, the 13th Amendment specifically allows for the enslavement of incarcerated people! Six states ban paying prisoners at all. North Carolina caps prisoners' wages at one dollar per day. The national average prison wage is $0.52/hour. Prisoners' labor produces $11b/year in goods and services:

https://www.dollarsandsense.org/archives/2024/0324bowman.html

Forced labor and extortion are a long and dishonorable tradition in incarceration, but this century saw the introduction of a novel, exciting way of extracting wealth from prisoners and their families. It started when private telcos took over prison telephones and raised the price of a prison phone call. These phone companies found willing collaborators in local jail and prison systems: all they had to do was offer to split the take with the jailers.

With the advent of the internet, things got far worse. Digitalization meant that prisons could replace the library, adult educations, commissary accounts, letter-mail, parcels, in-person visits and phone calls with a single tablet. These cheaply made tablets were offered for free to prisoners, who lost access to everything from their kids' handmade birthday cards to in-person visits with those kids.

In their place, prisoners' families had to pay huge premiums to have their letters scanned so that prisoners could pay (again) to view those scans on their tablets. Instead of in-person visits, prisoners families had to pay $3-10/minute for a janky, postage-stamp sized video. Perversely, jails and prisons replaced their in-person visitation rooms with rooms filled with shitty tablets where family members could sit and videoconference with their incarcerated loved ones who were just a few feet away:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Capitalists hate capitalism. The capital classes are on a relentless search for markets with captive customers and no competitors. The prison-tech industry was catnip for private equity funds, who bought and "rolled" up prison contractors, concentrating the sector into a duopoly of debt-laden companies whose ability to pay off their leveraged buyouts was contingent on their ability to terrorize prisoners' families into paying for their overpriced, low-quality products and services.

One particularly awful consequence of these rollups was the way that prisoners could lose access to their data when their prison's service-provider was merged with a rival. When that happened, the IT systems would be consolidated, with the frequent outcome that all prisoners' data was lost. Imagine working for two weeks to pay for a song or a book, or a scan of your child's handmade Father's Day card, only to have the file deleted in an IT merger. Now imagine that you're stuck inside for another 20 years.

This is a subject I've followed off and on for years. It's such a perfect bit of end-stage capitalist cruelty, combining mass incarceration with monopolies. Even if you're not imprisoned, this story is haunting, because on the one hand, America keeps thinking of new reasons to put more people behind bars, and on the other hand, every technological nightmare we dream up for prisoners eventually works its way out to the rest of us in a process I call the "shitty technology adoption curve." As William Gibson says, "The future is here, it's just not evenly distributed" – but the future sure pools up thick and dystopian around America's prisoners:

https://pluralistic.net/2021/02/24/gwb-rumsfeld-monsters/#bossware

My background interest in the subject got sharper a few years ago when I started working on The Bezzle, my 2023 high-tech crime thriller about prison-tech grifters:

https://us.macmillan.com/books/9781250865878/thebezzle

One of the things that was on my mind when I got to work on that book was the 2017 court-case that killed the FCC's rules limit interstate prison-call gouging. The FCC could have won that case, but Trump's FCC chairman, Ajit Pai, dropped it:

https://arstechnica.com/tech-policy/2017/06/prisoners-lose-again-as-court-wipes-out-inmate-calling-price-caps/

With that bad precedent on the books, the only hope prisoners had for relief from the FCC was for Congress to enact legislation specifically granting the agency the power to regulate prison telephony. Incredibly, Congress did just that, with Biden signing the "Martha Wright-Reed Just and Reasonable Communications Act" in early 2023:

https://www.congress.gov/bill/117th-congress/senate-bill/1541/text

With the new law in place, it fell to the FCC use those newfound powers. Compared to agencies like the FTC and the NLRB, Biden's FCC has been relatively weak, thanks in large part to the Biden administration's refusal to defend its FCC nomination for Gigi Sohn, a brilliant and accomplished telecoms expert. You can tell that Sohn would have been a brilliant FCC commissioner because of the way that America's telco monopolists and their allies in the senate (mostly Republicans, but some Democrats, too) went on an all-out offensive against her, using the fact that she is gay to smear her and ultimately defeat her nomination:

https://pluralistic.net/2023/03/19/culture-war-bullshit-stole-your-broadband/

But even without Sohn, the FCC has managed to do something genuinely great for America's army of the imprisoned. This week, the FCC voted in price-caps on prison calls, so that call rates will drop from $11.35 for 15 minutes to just $0.90. Both interstate and intrastate calls will be capped at $0.06-0.12/minute, with a phased rollout starting in January:

https://arstechnica.com/tech-policy/2024/07/fcc-closes-final-loopholes-that-keep-prison-phone-prices-exorbitantly-high/

It's hard to imagine a policy that will get more bang for a regulator's buck than this one. Not only does this represent a huge savings for prisoners and their families, those savings are even larger in proportion to their desperate, meager finances.

It shows you how important a competent, qualified regulator is. When it comes to political differences between Republicans and Democrats, regulatory competence is a grossly underrated trait. Trump's FCC Chair Ajit Pai handed out tens of billions of dollars in public money to monopoly carriers to improve telephone networks in underserved areas, but did so without first making accurate maps to tell him where the carriers should invest. As a result, that money was devoured by executive bonuses and publicly financed dividends and millions of Americans entered the pandemic lockdowns with broadband that couldn't support work-from-home or Zoom school. When Biden's FCC chair Jessica Rosenworcel took over, one of her first official acts was to commission a national study and survey of broadband quality. Republicans howled in outrage:

https://pluralistic.net/2023/11/10/digital-redlining/#stop-confusing-the-issue-with-relevant-facts

The telecoms sector has been a rent-seeking, monopolizing monster since the days of Samuel Morse:

https://pluralistic.net/2024/07/18/the-bell-system/#were-the-phone-company-we-dont-have-to-care

Combine telecoms and prisons, and you get a kind of supermonster, the meth-gator of American neofeudalism:

https://www.nbcnews.com/news/us-news/tennessee-police-warn-locals-not-flush-drugs-fear-meth-gators-n1030291

The sector is dirty beyond words, and it corrupts everything it touches – bribing prison officials to throw out all the books in the prison library and replace them with DRM-locked, high-priced ebooks that prisoners must toil for weeks to afford, and that vanish from their devices whenever a prison-tech company merges with a rival:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

The Biden presidency has been fatally marred by the president's avid support of genocide, and nothing will change that. But for millions of Americans, the Biden administration's policies on telecoms, monopoly, and corporate crime have been a source of profound, lasting improvements.

It's not just presidents who can make this difference. Millions of America's prisoners are rotting in state and county jails, and as California has shown, state governments have broad latitude to kick out prison profiteers:

https://pluralistic.net/2023/05/08/captive-audience/#good-at-their-jobs

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/19/martha-wright-reed/#capitalists-hate-capitalism

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

--

Flying Logos (modified)

https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

kgbo (modified)

https://commons.wikimedia.org/wiki/File:Suncorp_Bank_ATM.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#prison tech#fcc#martin hench#marty hench#the bezzle#captive audiences#carceral state#worth rises#bezzles#Martha Wright-Reed Just and Reasonable Communications Act#capitalists hate capitalism#shitty technology adoption curve

347 notes

·

View notes

Text

why you should have hope for separatism:

-this is one of the first times in history where women en masse are educated and (are expected to) participate in the working class which means now more than ever women are better equipped to take care of their own financial needs (even with all the tradwife influencers, not many women will be able to convert because house-wifery is strictly limited to the upper-class, which is shrinking more and more, so most women will always have to work anyways, and most women see this! even the ones that joke about being housewives/strippers are serious about their careers!)

-separatism is mostly non-action. it is strategic non-interaction with men or male media which makes it extremely accessible and easy to replicate across cultures. it removes women from exploitative relationships with men. this means the only thing you need to do to convince women to become separatists is attack the idea that their lives will be unfulfilled without men. and more women and girls are embracing that culture simply because of their experiences (and access to education)!

-late stage capitalism and the rise of blatant misogyny men display is radicalizing women. which means more and more women are open to living together and raising children together romantically/platonically. (literally every woman i've talked to who's unmarried lives with their parents or wants to live with women because men are genuinely an unattractive option--thank you men for showing your asses <3)

-the internet and globalization positions women from all over the world to share their experiences (and we have many shared experiences), which means consciousness-raising has never been faster or easier or more powerful!

-men and boys are failing and dropping out of school way more than women and girls which means that women and girls are on the way to dominating academia and relevant industries! women will make up more of the skilled workers in future job markets which means that women who are educated now will likely be better off and more pursued financially than men. women's influence in society is increasing! think about it. as much as male violence is increasing, male literacy and competence and skill is DECREASING (even nepotism or sexism will not be enough to fix that problem because hiring men will still result in profit losses and other financial inconveniences). in short, male culture is killing men!

-resistance to pornography and understanding the evils of pornography are also increasing. awareness of male violence is increasing!

please read more literature on separatist strategies and don't think whatever is happening on tiktok/IG is how all women think. most women irl are not stupid enough to trade in their jobs for prostitution because women don't actually want that. many women i've talked to in real life also don't want children (in these conditions or at all)! they aren't radfems but they still have self-preservation instincts and intelligence!

there is literally so many ways we can use the current sociopolitical climate to our advantage. it is too early to give up. like wayyyy to fucking early.

#radblr#sometimes things aren't as dire as radblr makes it seem#or the internet#start talking to women at work!#separatism#hope tag#feminism

400 notes

·

View notes

Text

The (ephimeral) success of solo projects on Chapter 2

I wanted to write a post about chapter 2 and Jimin, the "sabotages"... but I don't know if I'm able to sort out the facts and my ideas or judgements about them properly. Nothing is clear to me yet.

There are days when a part of me believes that something is going on with Jimin and Hybe (or BH, I don't know which). But there's another part, the rational part, the part that works as an economist for 20 years, that knows that it doesn't make much sense for a for-profit company to boycott one of its most valuable assets.

In the Executive Boards, and in financial planning, decisions are made on the basis of economical evidence, which is always provided by current numbers (or estimates), not by the heart. Maybe even in the case of BTS there is some sense of fairness, I would say, at the outset. And not an asymmetric distribution according to profit projections.

In the trade-off I find myself in, I would like to share the following thoughts:

- I have recently realised that Chapter 2 is not the chapter of their solo career. It is the chapter of their solo work, which is slightly different.

- Most of them has a short time to promote their work. The average has been a "several weeks" window.

- Their success is therefore somewhat short-lived or ephimeral. It appears and within weeks it seems to fade away, eclipsed by the next in line. The nex king of "k-..."

- There is no intention of promoting a structured solo career, because 1) BTS have said (a million times) that they will be back in 2025, and 2) if we are to take them at their word, the boys will all be joining the military before the end of 2023.

- So, there is no long-term vision to support "some" and not "others".

- The support is focused on a specific work. The only exception to a more continuous commitment has been Suga and his tour.

- Everyone has their budget, their schedule, their activities for the year...

- And yes, there can be different intensities of promotional activities, depending on the defined strategy or budget or goal or whatever (we don't know the whole story because the company doesn't explain anything to us). There is a rumour that some have even put their money into some activities. But I don't know how true that is.

- And I think they all have a say in the design of their promotions, even if they don't design them themselves.

So then....I can't take the agency away from any of them.

They are the best advocates or defenders within the company. And if one of them had less influence, which I doubt, the others would not remain silent without solving the problem. Or how do we think a commitment from the 7 of them to the 7 of them is achieved to keep BTS as a unified group? There are no weak links in this group. And if there were, I wouldn't bet my money that Jimin is one of them.

Once again, there are things that I can't explain and I'd like to know what's going on (the lack of restocking, the split of Spotify streaming, the deletion of sales...). But if there really have been damaging mistakes or strategies for any of them, I hope that when the next contract comes up for renewal, they will sort it out very thoroughly. Cause this cant happen anymore.

To tell you the truth, I blame the company for many things, and one of them - as serious as their lack of planning - is their lack of communication with the fans. BeautifulPeach has talked about this in some of her posts.

At some point in its growth, Hybe became too big to fail, or whatever, and forgot about certain corporate social responsibility obligations. One of them is to talk to its most important stakeholders: the customers, i.e. the fans. And addressing some of their concerns.

Investors are important in listed companies, but customers are important too. Always.

And if they don't see it that way and continue to despise the fans (clients) in that way, then at the end “future is not gonna be ok”.

And yes, I know that K-pop is controversial. It's clear that they can't deal with every rumour, every silly trend that comes out every day on twitter, ships, solos demands, etc. But there are things that they can deal with. And some of the Jimin's events when Face happened are one of them.

A bit of transparency would be appreciated. I expect it, actually, at some point (maybe when this chapter ends).

Maybe there will be things that could be explained as commercial strategy (do they want us to buy Face instead of the single LC, for example? And that's why they're not stocking it again?). But they might also be telling us about certain difficulties. Or about certain forecasting mistakes. Or how they learned from some of them. I'm pretty sure they learned a lot from Jimin's Face era.

I don't think I will be able to judge everything that has happened until at least the end of this year, when all the solo works have been completed/released.

And I'll have to keep listening to Bongo to see if he still talks about how they are more interested in being a company that has groups rather than individual singers. Maybe that is why it seems there's a ceiling to individual success. There is nothing better than capping success with time limitation of activities ("Let's see if that makes the fans forget what solo members are capable of")

And even then, there will be differences between all of them. Quite a lot.

But we will also have to consider that they are different artists with different goals, sensibilities, objectives and situations (let's not forget that JK himself, who now seems quite greedy, has admitted that he needed and enjoyed his free time and Seven had to come along to give him a boost). So we should be careful with the comparison too.

Perhaps Jin will end up getting the most promotions when he comes out, considering how little time he has had. Poor Jin…😔 He had to wait until the end of the year to enlist, despite the bad weather, to give us the Busan concert. It was a commitment to BTS, but it was a short of individual sacrifice too… you know..they do these things for BTS.

I would also like to listen to them (yes, it's a bit ambitious on my part, but I would like to listen to Jimin and his feelings, at the end of this year... will he open up to us?)

In conclusion, I would say that if we are BTS fans and want to remain so, and if we believe in the boys' words .... I would advise us to enjoy every moment they give us for their limited time. Every campaign, every song, every vlive... and try to find an atmosphere of caution given the situation we are in.

And by that I mean that we should also be able to read that we are in the age of solos and akages. All the information about grievances or leaks that comes out usuarlly comes from the same places.

And I'm not saying it's FALSE! Nor do I mean to belittle it! Just that sometimes we should take into account the intentions behind. And before we react, let's consider the source and the context. Look at what happened to the RNX journalist we all spent almost a day reporting on for a bad translation. Or look at how, in less than two weeks, two CCTV vids of Jimin shopping with a friend (one of them clearly with Saeon) suddenly appeared just as it became known that he was going to NY with JK.

Anyway, I will be a bit cautious for now. There are still a few months until the end of the year. A lot can still happen.

Jimin could came back again to us with sth as amazing as Like Crazy. Or even better, an album.

I miss Jimin and want to see him shine again and talking to us.

And I miss jikook……arrrggg

123 notes

·

View notes

Note

Many of your economic development plans call for the LPs to climb the "value-added chain". In a late medieval context, what value-added product would give you the most bang for your buck when it comes to timber?

Timber is a bit trickier than the classic case of textiles (where there are more links in the value-added chain from raw wool to carded wool to spun thread to plain woven cloth to dyed cloth to higher-end fabrics).

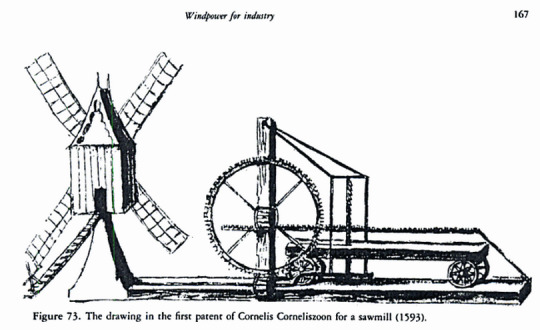

The first place to start is to shift from timber (i.e, the harvesting of raw, unprocessed logs from trees) to lumber (treating and seasoning, and sawing the logs into standardized boards, planks, beams, posts, and the like that can be used by carpenters to make furniture, housing, etc.). This requires the construction of sawmills (usually water- or wind-powered), usually downstream from the timberland so that logs can be easily floated down to the sawmill rather than going to the effort and expense of carting them overland.

The next step is to encourage the development of associated industries like furniture-making, construction...and most prized of all, ship-building. These industries continue to climb the value-added chain, because there's more money to be made from selling artisan furniture than selling raw logs and more money to be made in real estate than selling planks retail, and thus they allow you to maximize your profits from your natural resources. More importantly, if you can get into ship-building, you not only make money from selling and repairing the ships, but it's a pretty easy step from there to branch out into commerce on your own account (since you are already producing the main capital investment that seaborn commerce requires).

This is why various forms of Navigation Acts were often a key strategy of mercantilist policy during the Commercial Revolution, because if you could make sure that foreign trade was carried out by your nation's ships crewed by your sailors and your pilots and financed by your merchants, that the profits from trade would be more likely to be re-invested at home rather than exported to someone else's country.

#asoiaf#asoiaf meta#economic development#early modern economic development#mercantilism#early modern state-building#commercial revolution

35 notes

·

View notes

Text

Around 500 workers in the garment industry gathered in Leicester’s Spinney Hill Park on Sunday, 1 October to protest the worsening conditions workers are facing amid factory closures in the city. They were joined by labour rights campaigners and trade unionists. This was the first time workers had gathered to publicly protest their situation, but workers said they were ‘ready to speak’.

Suppliers have warned that fashion brands sourcing garments in the city are demanding price reductions, often on orders of clothing already made and delivered, which is making businesses unviable. In turn, garment workers in Leicester report significant reductions in hours and factory closures, increasing pressure on already low paid workers on the frontline of the cost of living crisis. 40% of children in Leicester are living in poverty, including those where parents are in work.

Garment workers are calling on fashion brands to take urgent measures to support the industry in Leicester. They want brands to commit to orders from local suppliers with decent wages and standards safeguarded in the contract price, and for a long-term commitment to the area. At the rally, women spontaneously spoke from the crowd to express their anger and frustration at the lack of work as well as the discrimination they face. Women spoke of being given unpaid trial shifts, zero predictability of the amount of work they’d be offered and the struggle to access services and support without speaking English.

A Leicester garment worker said: “Brands should take responsibility and commit to orders in Leicester. I know that the factories here have been running for many years. I speak to other workers who have been working in this industry for 20+ years. This is the time when workers are in need of work the most because of the cost of living being so high but instead the factories are slowly closing one by one. Thousands of workers are dependent on working in the factories in Leicester and most of us are migrant workers who have moved to the UK because of our suffering and for a better future ahead.

We want factories to stay open and busy, we want improved working conditions and better workplaces with correct rules and regulations and factories that look after workers rights and pay national minimum wage, holiday, and sick pay.

Dominique Muller, UK Policy Lead at Labour Behind the Label, said: “It is high time for UK fashion brands to accept they are responsible for the present crisis garment workers are facing in Leicester. We’ve been here before: during the pandemic revelations about the industry in Leicester forced brands to take measures to improve the treatment of workers. But once public scrutiny moved on, all that remained were vague and aspirational pledges towards a more ethical industry. 3 years later, we see they have failed to live up to their promises.

If brands are serious about building a fairer, more sustainable industry, they must commit to it. They must adopt an ethical sourcing strategy which includes assessing the working conditions of workers in their supply chain and making improvements. In this case, it means committing to UK suppliers and supporting workers in obtaining decent work. The workers who have given brands years of their labour and millions in profits deserve nothing less.”

48 notes

·

View notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

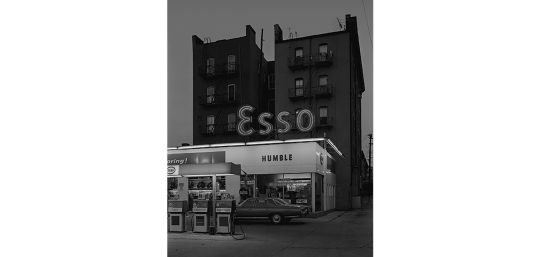

A Word on ExxonMobil's Branding Potential

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

106 notes

·

View notes

Text

Ko-Fi prompt from @dirigibird:

I've been looking at investment options but I don't want to be messing around too much with the stock market, and a co-worker suggested exchange traded funds. Would love to know your opinions!

LEGALLY NECESSARY DISCLAIMER: I am not a licensed financial advisor, and it is illegal for me to advise anyone on investment in securities like stocks. My commentary here is merely opinion, not financial advice, and I urge you to not make any decisions with regards to securities investments based on my opinions, or without consulting a licensed advisor. I am also going to be talking this all over from an American POV, which means some of these things may not apply elsewhere.

So instead of letting you know what to pick or how to organize your securities, I'm going to go through the definitions of what various investment funds are, how they compare functionally, and maybe rant about how I disagree with the stock market on a fundamental ethical level if I have word count left over.

If you want more information, and are okay with jargon, I'd suggest hitting up investopedia. That is where I will be double-checking most of my information for this one.

I also encourage folks who know more about the stock market specifically to jump in! I like to think I'm good at research and explaining things, but I'm still liable to make mistakes.

Mutual Funds: A mutual fund is a pool of money and resources from multiple individuals (often vast numbers of people, actually) being put together and managed as a group by investment specialists. The primary appeal of these is that the money is professionally managed, but not personally so; it gives smaller investors access to professional money managers that they would not have access to on their own, at cheaper rates than if they tried to hire one for just their own assets. The secondary appeal is that, due to the sheer number of people, and thus capital, that is being invested at once, the money can be invested in a wide variety of industries, and is generally more stable than investing in just one company or industry. Low risk, low reward, but overall at least mostly reliable. Retirement plans are often invested in mutual funds by employer choice, through companies like Fidelity or John Hancock.

Hedge Funds: A hedge fund is a high risk, high reward mutual fund. Investors are generally wealthy, and have the room and safety to lose large amounts of money on an investment that has no promise of success, especially since money cannot be withdrawn at will, but must remain in the fund for a period of time following investment. It gets its name from "hedging your bets," as part of the strategy is to invest in the opposition of the fund's focus in order to ensure that there is a backup plan to salvage at least some money if the main plan backfires. Other strategies are also on the riskier side, often planning to take advantage of ongoing events like buyouts, mergers, incumbent bankruptcy, and shorting stocks (that's the one that caused the gamestop incident).

Private Equity: Private equity is... a nightmare that got its own incredibly good Hasan Minhaj episode of Patriot Act, so if you've got 20 minutes, an interest in comedically-delivered, easily-digestible, Real Information, and an internet connection, take a watch of that one. (If it's not available on YouTube in your country, it's originally from Netflix, or you can probably access it by VPN.) Private equity companies are effectively hedge funds that purchase entire companies, rebuild them in one way or another, and then sell them at (hopefully) a profit. Very often, the companies purchased by private equity are very negatively impacted, especially if the private equity group is a Vulture Fund. Sometimes, it's by taking it apart to sell off; sometimes it's by just bleeding it for cash until there's nothing left. Sometimes, it's taking over a hospital and overcharging the patients while also abusing the staff! (Glaucomflecken has a lot of videos on the topic of private equity in the medical industry, check him out.)

Venture Capital: In contrast to private equity, which purchases more mature companies, venture capital is focused on startups, or small businesses that have growth potential. These are the kinds of hedge funds that are like a whole group that you'd see some random tv character calling an Angel Investor (they're not actually the same thing, but they overlap by a lot). I'd hesitantly call these less ethically dubious than private equity, but I'm still suspicious.

And finally, to answer your question on what ETFs are and how they fit into the above.

Exchange Traded Funds: ETFs are... sort of like a mutual fund. Sort of. You are, to some extent, pooling your money... ish.

An ETF is like a stock that is made out of partial stocks. So instead of paying $100 for stock A, and not getting stocks B/C/D that all cost the same, you buy $100 of the ETF, which is $25 each of stocks A/B/C/D. You are getting a quarter of a unit of stock, which isn't normally an option, but because you are purchasing through an ETF that officially already bought those Whole stocks, you can now purchase the partial stocks through them.

They buy the whole stocks, then they resell you mixes of those stocks. They still officially own the whole stocks themselves, but you now own parts of the stocks. Basically, you own "stock" in a company that owns stock in other companies, and in that process you own partial stocks in those other companies.

I'm going to re-explain this using fruit.

Imagine you can buy apples, oranges, melons, grapes, etc. You can also buy fruit cups. You can only buy the individual fruits in big batches or you can pool your money with a few other people, hand it to a chef. The chef will decide which fruits look like they'll taste the best by lunch time, buy a bunch of those fruit pallets with your combined money, and plan out the best possible fruit salad for you to share with a bunch of people once lunch rolls around.

You could also buy a fruit cup. You don't have a lot of control over what's already in the fruit cup, but there are a few different mixes available--that one has strawberries, but that one over there uses kiwi, and the other one that way has pineapple--and you can pick which mix you want. It's a pretty small fruit cup, and it's predesigned, but you can choose the one you want without having to pool money with everyone else. You just first have to let someone else design the fruit cups you choose from, and you don't know which ones are probably going to survive the best to lunch time unless you ask a chef (which defeats the purpose of buying a fruit cup instead of pooling your money, and asking the chef costs money).

That's the ETF. The ETF is the fruit cup.

The upside is that you can now just track the prices of your fruit cup, instead of tracking the prices of four different fruits, and so if the price of one fruit drops, you can just... let the other three buoy it.

Of course, in the real world, there are more than just four stocks involved in an ETF. This part of the Investopedia article lists a few examples, and they're usually themed and involve anywhere from 30 (DOW Jones) to thousands (Russell) of shares by stock type, or by commodity/industry. So with the ETF, you can invest in an entire industry, like technology, and just keep track of that single "stock" in the industry game.

They do cost less in brokerage/management fees than regular mutual funds, and they have a slightly lower liquidity (slower to cash out). There also exist actively managed ETFs, which are basically mutual funds for ETFs. You are paying the chef to buy you premade fruit cups.

(Prompt me on ko-fi!)

#economics#stock market#etfs#etf#mutual funds#hedge funds#venture capital#private equity#capitalism#phoenix talks#ko fi#ko fi prompts#economics prompts

51 notes

·

View notes

Text

The Role of Diversification in Mitigating Investment Risk

Investing is one of the most critical strategies you can use to minimize your investment risk and this is why diversity is essential. In other words, it means spreading your investments across various types of assets so that you do not suffer great losses due to poor performance in any one share or investment. This article focuses on how diversification can help reduce investment risks while giving practical tips on how to diversify portfolios effectively.

Understanding Diversification

You do not put all your baskets in one egg carton. Therefore, by investing in different assets like stocks, bonds, real estate and commodities, if one investment fails then it will save a lot from losing anything with a greater amount. The rationale behind this system is simple: different kinds of investments usually react differently to market conditions. For example when some are going down others may be growing hence ensuring an overall stable return.

Importance of Diversification

Mitigates risk: diversification helps spread the risks. Investing everything into a single share which collapses leads to losing mostly all one's money. However if he had a diversified portfolio such a situation would not have affected much on the entire portfolio since before there used to be good gains in some areas but now as compared it seems lesser than before.

Smooth Returns: A portfolio that has good diversification would experience lesser fluctuations. This implies that you will not experience vast changes in values brought about by investing in just one category of assets. By doing this, your profits are likely to be constant even as time passes.

The Possibility of Higher Returns: Even though the assumption of constant returns from different classes is not true, yet on average it leads to stability over all returns. If you have different kinds of financial tools some may perform well making other investments more profitable.

Conduct a proper market research and analysis like fundamental analysis, technical analysis etc. There are lot of websites which provides various tools to conduct analysis. One of the best websites for fundamental analysis is Trade Brains Portal. Trade Brains Portal has various tools like Portfolio analysis, Stock compare, Stock research reports and so on. Also the website provides fundamental details of all the stocks listed in Indian stock market.

How to Create Diversification

First Invest In Different Asset Classes: The initial stage of diversifying is distributing investments among diverse asset classes. You might include:

Shares: For instance invest into various sectors and industries which protects against any concentration risk.

Debts: Join corporate and state obligations that have various due terms.

Property: Purchase land or consider REITs which will go a long way in further diversity for the filling

Blacksmith’s tools: This allows one to hedge against stock price fluctuations since there are shares made from gold or liquid petroleum.

Asset Classes: Inside Each, Diversify More: Inside every asset class, further diversification should be encouraged. For instance, your stock portfolio may comprise both large, mid- and small-cap stocks pulled from various industries such as technology, health care or finance. Conversely, for fixed income investments you could consider both short- and long-term bonds from different issuers.

Geographic Diversification: Don’t confine your investments to just one country; consider allocating funds to global equities and debts so that you can ride on worldwide growth spurts at the same time lowering chances of going broke due to national downturns only.

Utilize Index Funds and ETFs: Index funds along with exchange-traded funds (ETFs) create fantastic platforms for diversification. Basically, these are investment vehicles which collect funds from numerous investors to buy a spectrum of stocks or bonds which automatically leads to diversification in the fund itself. As such; investing in index or ETF money market accounts results in an instantily diversified portfolio.

Strategic Diversification

Design Balanced Portfolios: A balanced portfolio will include stocks, bonds and other assets. The exact mix of these three categories depend on your risk appetite, investment objectives and time frame. For example; if you are young with an extended investment period ahead like 30 years or more, then perhaps you could have a greater percentage of equity shares. Conversely before retirement age it is likely that one would move towards more fixed income securities and other low-volatility options. Inorder to reduce the risk, one can invest in large cap companies or also investing in companies which has good dividends, bonus and splits can be a better choice.

1. Re Judiciously: With the passage of time, every investment’s worth may change thus creating an uneven portfolio. “Rebalance” refers to the act of bringing back into line one's desired proportions of investments as stocks, bonds or other such asset categories. This ensures that risk levels correspond with individual investment objectives.

2. Follow Up and Amending: Literacy needs one given fiscal policy to always differ and be changing as per preferences of that certain individual in the market at a particular time upon follow up from it regularly. Periodic adjustments may be required so as to keep an overall investment mix in balance hence giving opportunity for some time before buying any new ones.

Common Mistakes

Over Diversification: It is evident that although diversification matters; it can also harm your profit margins through excessive dilution. Avoid extensionalizing too thin your assets or choosing funds too far too many Aim for a balanced approach based on few investments.

Ignoring Asset Correlation: Diversification works well when these assets are not related closely. Investing in closely related assets ends up negating the effects on one’s portfolio during downturns and making this strategy less beneficial. All your assets ought to have different levels of risks as well as respond independently to different market conditions.

Minimizing Hazardous Behavior: Asset allocation must be aligned with your appetite for risk as well as your investment objectives. Don’t just diversify simply for the purpose of it. Ensure that your portfolio represents your comfort with risk and conforms to your financial aims.

Conclusion

A potent strategy for curtailing investment risks and obtaining more steady returns is diversification. When you spread out investments throughout various asset classes, industries and regions, the effect of bad performance on one specific investment will be reduced thus enhancing stability of the entire portfolio. Remember to diversify within asset classes, utilize index mutual funds along with ETFs then periodically check and adjust the mix in order to have an ideal level of diversification throughout your life cycle; this way you will be able to handle any changes in the marketplace hence working towards fulfilling all your dreams.

#stock market#investment#stock market india#splits#stocks#fundamental analysis of stocks#Indian share market

3 notes

·

View notes

Text

Top crypto signals

Signalight: Unveiling the Premier Crypto Signals Telegram Channel

[uk, 2022] — Crypto enthusiasts, traders, and investors now have a new beacon of guidance with the launch of Signalight, the latest and most reliable crypto signals channel on Telegram. Available at

[https://t.me/signalight](https://t.me/signalight),

or website

Signalight is set to revolutionize the way individuals navigate the volatile world of cryptocurrency trading.

Signalight was created by a team of seasoned crypto analysts and traders with years of experience in the digital currency market. The channel offers precise, timely, and actionable signals designed to help users make informed trading decisions. Whether you're a novice investor or a seasoned trader, Signalight provides valuable insights to help maximize your returns in the fast-paced crypto market.

Key Features of Signalight:

- Accurate Trading Signals: Signalight delivers well-researched trading signals, including entry points, exit points, and stop-loss recommendations to help users manage their trades effectively.

- Real-Time Alerts: Stay ahead of the curve with instant alerts on promising trades, allowing members to act quickly in a dynamic market environment.

- Comprehensive Market Analysis: Subscribers gain access to in-depth analysis of the latest trends, ensuring they are equipped with the knowledge needed to succeed.

- User-Friendly Interface: Designed with ease of use in mind, Signalight is accessible to traders of all levels, offering a seamless experience on the Telegram platform.

- Community Support: Members of Signalight benefit from an active community of like-minded traders, providing additional support and sharing valuable insights.

“We created Signalight to empower crypto traders with the knowledge and tools they need to make profitable decisions,” said rafael , Spokesperson of Signalight. “Our goal is to create a trusted source of information that users can rely on for both short-term gains and long-term investment strategies.”

Signalight is now live and open to new members. Join today and illuminate your path to crypto success by visiting [https://t.me/signalight]

(https://t.me/signalight).

For more information, please contact:

****

Website :

Telegram link:

About Signalight:

Signalight is a leading crypto signals Telegram channel dedicated to providing accurate, timely, and actionable trading insights to cryptocurrency investors and traders. With a focus on empowering its members, Signalight combines expert analysis with a user-friendly platform to help users navigate the complexities of the crypto market.

---

Press Contact:

gal nav

dr crypto

telegram user @Euros_500

3 notes

·

View notes

Text

Re: Smoke-Filled Rooms

(~1,000 words, 4 mins)

I'm not going to morally criticize @eightyonekilograms for wanting the "smoke-filled rooms" back. I suspect there are two big justifications, which must have circulated through a number of books to reach him. I'll briefly describe those likely justifications, and then provide a potential alternative.

Justifying the Smoke-Filled Room

1 - The interests of each group in the coalition are inherently somewhat in conflict. For example, one faction wants to build a school, and another faction wants to build a library, and there is only $X available to do either. The representative of each faction needs to be seen, publicly, to be fighting hard to get solely their result, and if they compromise, that may be seen as a betrayal.

1A - In the smoke-filled room, the representatives don't have to put on the tough act that they do in public, and can privately make clear what they're willing to trade in negotiations.

1B - When representatives leave the smoke-filled room, they can blame the smoke-filled room for their voters not getting what they want, when actually what the voters want might be impossible, or the voters themselves might not be powerful enough to get much. (Voters distrust this as the representative could just be lying.)

2 - Without the smoke-filled room, no one really owns the party, so no one is really responsible for it and trying to line up the party's long-term strategy is much more a matter of personal moral character - it has a higher price.

What Could Go Wrong with Transparency?

Thus, the coordination on what's good for the party has to happen in the open, indirectly, where the organizational linkages are weaker, and the incentives on each agent are less favorable. At the better end, you get Matt Yglesias appointing himself de facto in charge of the party, but at the worse end, your broader constellation of party-aligned organizations may decide to screw over the party's electability in favor of their own pet issues or personal profit.

For instance, they might uselessly antagonize huge groups of voters for no practical gain because hey, free outrage clicks to keep an organization that's running low on revenue in business this week! (Or out of emotional reasons. Or petty infighting laundered through ideology.)

Pre-Musk Twitter allowed the constellation to rapidly coordinate public messaging, but that's not the same thing as policy, and that's not the same thing as ownership. So they could coordinate very well on bad excuses, but have much more difficulty actually fixing anything.

81kg doesn't seem to think the smoke-filled rooms can come back, probably because of 1B - in order to use the smoke-filled room to discharge blame, the smoke-filled room has to take the blame, so voters think "the smoke-filled room" is the reason they can't get what they want, instead of whatever the actual reason is.

Politicians have a bit of a market-for-lemons related problem - every politician could benefit from lying at least a little bit, in order to broaden their coalition. So most politicians lie. Figuring out which politicians are lying is costly for voters, so they just assume that all politicians are lying. The public statements and unrealistic proposals then become signs of directional loyalty - who are you willing to lie on behalf of? But an honest politician is at a disadvantage.

What is the alternative? We can't just have a committee to fact check all politicians, because then political operatives will just take over the committee.

But there is a way we might be able to move in the direction of increased transparency.

Campaign Promise Bonds

The longpost TIMAC - Alternative Voting Systems proposes a system of "campaign promise bonds." This is a way to get a head start on fundraising for the next election cycle.

The candidate makes a series of explicitly-specified campaign promises which are fixed at the start of the campaign period. Each campaign promise is allocated a specific percentage of the funding pool, which communicates its priority. For example, 25% of campaign promise funds for "Build highway X, if we get a majority in congress."

Donors can put money into the campaign or directly into the campaign promise fund. The candidate can take the campaign funds and put them into the campaign promise fund, including leftover funds at the end of the campaign.

If the candidate loses the election, the donor funds in the campaign promise fund pool are refunded.

If the candidate wins the election, then at the end of their term in office, they may claim the campaign promise bonds as the starting funds for their next election campaign. Donors may contest whether the bond was completely successfully, to be resolved in court. If a bond is marked non-complete, then the donors receive a refund.

A politician can choose to violate the bond conditions at any time during their term - it just means they don't get the money afterwards, and will have to do more fundraising work.

Politicians get two rounds - an initial primary election round, and a general election round.

Obviously, there's a strong incentive to load each bond with conditionals like "assuming my party reach majority in both houses," or to pick actions like "I will put Bill X forward," where the bond doesn't require that Bill X actually passes, but of course primary voters can evaluate the offerings from competing candidates.

What's very interesting about this system is that 1) politicians of opposing parties now have something to trade with each other, and 2) what's available to trade, what they could easily compromise on or give up, is made more legible.

Areas where it's basically impossible to get anything will involve big allocations of "Not X," with relatively little qualifying fine print. Areas where it's possible to get agreement will involve smaller allocations that can be more easily given up, or bond conditions with more fine print (so that the bond isn't invalidated by a compromise).

They could even agree to mutual destruction - "I'll invalidate $X of my bonds if you're willing to invalidate $X of your bonds."

Where could this go wrong? Well, if maintaining people's rights is a minority position in general, this could reveal that by making the relative power of each group in the coalition more legible through their share of the winning candidate's promise pool.

11 notes

·

View notes

Text

What type of investments to buy: The complete guide — For Beginners

Investment is one of the most significant things in financial planning that helps you to increase your wealth and meet long-term goals. Nonetheless, for those who are new to the game of trading this can be an intimidating process. This article focuses on debunking investment strategies with an overview of a specific system for everyone interested in business, finance and investments.

Investment Strategy for Big Investors

Definition: An investment strategy is a set of principles for matching an investor's goals with the specific investment decisions and solutions to minimize risk while maximizing efficiency. This process entails determining the appropriate blend of assets, marginal risk, and ability to make well-informed decisions given market circumstances as well as one's individual financial goals. Investment Strategies IMPLEMENTATION OF INVESTMENTS

1. Value Investing

Value investing means choosing stocks which appear to trade at a lower price than their intrinsic as well as book value. Investors seek out companies with strong fundamentals, but which are mispriced by the market. This is a strategy that Warren Buffet himself has often promoted, where long-term gains should be expected which means it requires patience and thorough researching before investing your hard-earned money.

2. Growth Investing

Growth investors are seeking companies that show the potential for above-average growth, even if the stock price appears high in terms of metrics such as Price to Earnings (P/E) or any other type measures on what they’re willing to pay. Used for people willing to accept higher risk in exchange of potentially more profit, this method.

3. Dividend Investing

Essentially, dividend investing is the act of buying stocks that pay consistent dividends. This method enables for a continuous stream of income and is very popular among those retiring or seeking to generate passive revenue. Dividend-paying companies are generally more mature and financially sound.

4. Index Investing

Index investing purchases a diversified portfolio of stocks that essentially looks like an index such as the S&P 500. It provides the broadest market exposure, lowest fees and is generally less risky than individual stock selection.

5. Momentum Investing

Momentum Investors — Purchases stocks that have gained over a period and sells them when it seems to be at the highest price. This is essentially a belief that stocks with momentum will continue to deliver for at least the short-term future.

What to Look for in an Investment Approach

The choice of the most appropriate investment strategy depends on several factors:

1. Risk Tolerance

Risk tolerance (Example: Your ability and this willingness to lose some are all of your original investment in exchange for random gains potential returns). Bottom Line: When it comes to entry-level investing, conservative investors might lean towards dividend or index based shares and aggressive investors can try growth or momentum approach.

2. Investment Horizon

How long you intend to hold your investments will effect your strategy as well. Value or growth investing work better for long-term investors while short term players may find momentum to be more appropriate.

3. Financial Goals

What are you saving for (retirement, a house down payment or retirement), will dictate your investment strategy. Clarity and specificity of goals enables to choose an adequate combination of assets as well as strategies.

4. Market Conditions

Performance of various investment strategies is affected by market conditions as well economic cycles. Keeping a pulse on market trends means that you can continually tweak your strategy to help increase your investment outcomes.

Creating a Well-Balanced Portfolio

One of the basic concepts in investing is diversification: spreading your investments among different types of assets (like stocks or bonds), industries, and countries. A well diversified portfolio can reduce the impact of a decline in overall market value and lead to higher returns over time. Below are a few guidelines to balance out your portfolio:

1. Mix Asset Classes

Balanced means you have a selection of stocks, bonds and real estate with an aim to balance the risk/return.

2. Invest in Different Sectors

Diversify your portfolio between tech, healthcare and finance to avoid being too in on one industry.

3. Diversify Geographically

Diversifying your portfolio into international markets allows one to introduce a number of growth opportunities beyond the borders of their domestic market and even reduces impact from local draft on that same country.

Conclusion

Choosing the Right investment strategy help you in achieving your financial goals. Understanding the different methodologies and appropriacy related to risk tolerance, investment horizon suitable in current market conditions you can improve your decision-making process when crafting a diversified portfolio. After all, patience in the field of investment is a virtue long and to maintain focus on that which you know it takes persistence so keep learning.

Remember, investing is a journey but if you can find the right paths through these uncertain markets while following sound strategies then ultimately there is good opportunity to reach your longer term financial goals.

2 notes

·

View notes

Text

Uh-oh! It's "radical propaganda!"

Every time I talk to my stepdad about communism/socialism, the conversation goes noticeably smoother when I repeatedly remind him that HE IS ONE OF THE PEOPLE WHO WOULD RECEIVE ALL THE BENEFITS I AM TALKING ABOUT.

People brainwashed by capitalism have such a hard time digesting the idea that SOMEONE ELSE receiving something good... is a good thing. Because under capitalism, everything - EVERYTHING - is affected by manufactured scarcity, so if someone else GETS something, it means unequivocally that YOU did NOT get that thing. This applies to everything: homes, jobs, food, money, medicine, and just about everything else. Life is literally a competition, and the reward is a comfortable life.

One of the most elementary rules of free trade is supply and demand. So naturally, you can increase profit by either lowering supply or raising demand. Raising demand can be difficult, but lowering supply is easy - just produce less of it. Then you can justify raising prices by saying, "Well, we had low supply!" It's a two-fold profit-boosting strategy because not only are you charging an arm and a leg for your product, but you're also decreasing the cost of production.

Or you can just lie. Say "supplies are low" then raise the prices and everyone will understand, AND you have more product to sell.

Anyways, the point is that capitalism is a manipulative, deceptive, opportunistic system meant to simulate a worse version of the intentionally misinterpreted darwinian philosophy of "survival of the fittest," except being fit means little compared to being born lucky.

... and a more equity-oriented government system that DOESN'T intentionally marginalize its own people and deprive them of the resources they need to live is, I would argue, preferable.

Use whatever word you want - socialist, communist, democrat, whatever. I just want my disabled mom to have the option to live on her own if she wanted to, without being forced to do work that she can't do for money that won't even pay rent, let alone pay her medical bills. Luckily, she has a husband with a good job - he is, let me be clear, the ONLY reason she is not homeless or worse.

Capitalist pigs call her a "free loader" or "a waste."

Socialists and communists call her a woman who isn't getting the help she needs.

Capitalists pigs call me, a trans person, "sex offender" or "rapist" or "brain washer."

Socialists and communists call me someone who shouldn't have to hide for my own safety

So idk what I am, but if I had to share a drink with a capitalist or a communist, I'm sharing a drink with the communist.

(PS: Read the tags for a little anti-zionist message as well. My heart goes out to Palestine - don't let anyone tell you that you don't have the right to live or that you're choosing the "unethical" way to crawl out of hell. To say that zionists give the jewish people a bad name is the understatement of the millenia; zionists have wasted their chances. From the river to the sea, Palestine will be free.)

#anti-capitalist rant#feel free to ignore#and on the subject of palestine and the election - the election matters so drastically little compared to the martyrs and survivors of -#the zionist occupation of israel's genocide on the country of palestine#i genuinely don't know if my vote matters or not at this point - i do know that a just and peaceful world cannot exist#while the usamerican government stands as it is#liberate america - free palestine - free congo#this was not jews; this was not arabs; this was zionists and imperialists from the US and UK and the world will NOT be safe#until SOMETHING changes

2 notes

·

View notes

Text

The Milton Hershey School in Pennsylvania is one of the wealthiest education centers in the world. Founded in 1909 as an orphanage for “male Caucasian” boys, it was awarded 30 percent of the company’s future earnings by Milton S. Hershey upon his death. Thanks to the success of Kit-Kats, Reese’s, and Whoppers, the school is worth a staggering $7.8 billion.

Now home to more than 2,000 students, it owns a controlling interest in the $22.3 billion Hershey company—a chocolate maker with roots in child protection and education that, in the worst form of irony, allegedly relies on cocoa harvested by child laborers in West Africa.

It is this irony that serves as the motivation behind a class action lawsuit filed Monday against Hershey and two of its competitors, Mars and Nestle. The complaints, filed by three California residents, allege that the companies are guilty of false advertising for failing to disclose the use of child slavery on their packaging. Without it, the plaintiffs claim, the companies are deceiving consumers into “unwittingly” supporting the child slave labor trade.

“America’s largest and most profitable food conglomerates should not tolerate child labor, much less child slave labor, anywhere in their supply chains,” the complaint reads. “These companies should not turn a blind eye to known human rights abuses... especially when the companies consistently and affirmatively represent that they act in a socially and ethically responsible manner.”

The class action suits seek both monetary damages for California residents who have purchased the chocolate and revised packaging that denotes child slaves were used. It’s a new approach to an old problem: the chocolate industry’s deep, dark, not-so-secret scandal. It’s been 15 years since the first allegations of child slavery in the chocolate industry caused national outrage. Will this be the final straw?

***