#nand flash memory chip

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--nand/emmc04g-wt32-01g02-kingston-2181962

Flash memory programming, programmable flash memories, nand flash memory chip

EMMC04G-WT32-01G02 4GB I-temp eMMC 5.1 (HS400) 153FBGA 4GB5.1 11.5x13x0.8

#Memory ICs#Flash Memory#Nand Flash Memory#EMMC04G-WT32-01G02#Kingston#non-volatile storage#Flash memory programming#Flash drives#What is NAND flash memory#storage#programmable flash memories#nand flash memory chip

1 note

·

View note

Text

Supraproducția de Cipuri NAND Flash: Impactul Asupra Pieței de Stocare și Prețurilor

După criza globală a cip-urilor din perioada post-COVID, în care cererea pentru semiconductori a depășit oferta, acum ne aflăm într-o situație diametral opusă. Producătorii de soluții NAND Flash au anticipat eronat o scădere semnificativă a cererii, iar acum se confruntă cu o supraproducție, care generează o prăbușire a prețurilor. În acest articol, vom analiza cum a evoluat piața și ce impact…

#2024#2025#AI demand#AI technologies#bam#cerere AI#cerere scăzută#chip manufacturers#chips#cipuri#demand drop#demand reduction#diagnosis#diagnoza#dispozitive de stocare#economii globale#flash memory#global economy#livrări PC#livrări smartphone#lower prices#memorie flash#NAND Flash#neamt#overproduction#PC shipments#PC-uri#PCs#prețuri scăzute#producători de cipuri

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--norflash--serial/s25fl256sagmfi003-infineon-3057273

Micron nor flash, SPI nor flash, memory card, Compact flash memory

S25FL256S Series 256 Mb (32M x 8) 3.6 V SMT SPI Flash Memory - SOIC-16

#Flash Memory#Serial NOR Flash (SPI) Memory#S25FL256SAGMFI003#Infineon#micron nor flash#spi nor flash#memory card#Compact#nand vs nor flash#Memory ICs#USB flash memory storage#Winbond SPI Flash#flash memory card#memory chip

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--norflash--nor/sst39sf040-70-4c-nhe-microchip-6467633

What is flash memory, flash memory chip, Flash Memory, Multi-Purpose Flash

SST39SF Series 4 Mbit 512 K x 8 5 V Multi-Purpose Flash - PLCC-32

#Microchip#SST39SF040-70-4C-NHE#NOR Flash Memory Parallel#NOR Flash Memory#non-volatile storage technology#nor flash memory chip#nand flash memory#flash memory chip#Flash Memory#Multi-Purpose Flash#storage#USB flash drive

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--nand/emmc04g-ct32-01g10-kingston-5177876

What is flash memory, USB flash memory storage, flash memory drive

EMMC 5.1 INTERFACE,153-BALL FBGA,3.3V,-25C-+85C

#Kingston#EMMC04G-CT32-01G10#Memory ICs#Flash Memory#Nand Flash Memory#chip#programmable flash memory#USB flash drives#USB flash memory storage#flash memory drive#Nand flash drive#flash memory#flash memory chip#memory card#flash memories

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--storage--embedded-storage/emmc04g-m627-e02u-kingston-8130398

eMMC storage drives, emmc storage upgrade, eMMC multimedia cards

4GB eMMC v5.1 3.3V 153-ball BGA Operating Temp - 25C to +85C

#Kingston#EMMC04G-M627-E02U#Memory ICs#Storage#eMMC#NAND flash controller#data transfer speeds#NAND gate#embedded memory device#flash memory#Emmc speed laptop#eMMC chips#upgrade#eMMC multimedia cards

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--storage--embedded-storage/emmc04g-mt32-01g10-kingston-2180413

IC Flash Memory EMMC Memory Chips, Compact flash memory for computer

EMMC04G-MT32-01G10

#Memory ICs#Storage#eMMC#EMMC04G-MT32-01G10#Kingston#compact storage solution#single-chip MMC controller#NAND flash memory#SD card#IC Flash Memory EMMC Memory Chips#Compact flash memory for computer#storage#chip#isolated circuits

1 note

·

View note

Text

Semiconductors: The Driving Force Behind Technological Advancements

The semiconductor industry is a crucial part of our modern society, powering everything from smartphones to supercomputers. The industry is a complex web of global interests, with multiple players vying for dominance.

Taiwan has long been the dominant player in the semiconductor industry, with Taiwan Semiconductor Manufacturing Company (TSMC) accounting for 54% of the market in 2020. TSMC's dominance is due in part to the company's expertise in semiconductor manufacturing, as well as its strategic location in Taiwan. Taiwan's proximity to China and its well-developed infrastructure make it an ideal location for semiconductor manufacturing.

However, Taiwan's dominance also brings challenges. The company faces strong competition from other semiconductor manufacturers, including those from China and South Korea. In addition, Taiwan's semiconductor industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

China is rapidly expanding its presence in the semiconductor industry, with the government investing heavily in research and development (R&D) and manufacturing. China's semiconductor industry is led by companies such as SMIC and Tsinghua Unigroup, which are rapidly expanding their capacity. However, China's industry still lags behind Taiwan's in terms of expertise and capacity.

South Korea is another major player in the semiconductor industry, with companies like Samsung and SK Hynix owning a significant market share. South Korea's semiconductor industry is known for its expertise in memory chips such as DRAM and NAND flash. However, the industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

The semiconductor industry is experiencing significant trends, including the growth of the Internet of Things (IoT), the rise of artificial intelligence (AI), and the increasing demand for 5G technology. These trends are driving semiconductor demand, which is expected to continue to grow in the coming years.

However, the industry also faces major challenges, including a shortage of skilled workers, the increasing complexity of semiconductor manufacturing and the need for more sustainable and environmentally friendly manufacturing processes.

To overcome the challenges facing the industry, it is essential to invest in research and development, increase the availability of skilled workers and develop more sustainable and environmentally friendly manufacturing processes. By working together, governments, companies and individuals can ensure that the semiconductor industry remains competitive and sustainable, and continues to drive innovation and economic growth in the years to come.

Chip War, the Race for Semiconductor Supremacy (2023) (TaiwanPlus Docs, October 2024)

youtube

Dr. Keyu Jin, a tenured professor of economics at the London School of Economics and Political Science, argues that many in the West misunderstand China’s economic and political models. She maintains that China became the most successful economic story of our time by shifting from primarily state-owned enterprises to an economy more focused on entrepreneurship and participation in the global economy.

Dr. Keyu Jin: Understanding a Global Superpower - Another Look at the Chinese Economy (Wheeler Institute for Economy, October 2024)

youtube

Dr. Keyu Jin: China's Economic Prospects and Global Impact (Global Institute For Tomorrow, July 2024)

youtube

The following conversation highlights the complexity and nuance of Xi Jinping's ideology and its relationship to traditional Chinese thought, and emphasizes the importance of understanding the internal dynamics of the Chinese Communist Party and the ongoing debates within the Chinese system.

Dr. Kevin Rudd: On Xi Jinping - How Xi's Marxist Nationalism Is Shaping China and the World (Asia Society, October 2024)

youtube

Tuesday, October 29, 2024

#semiconductor industry#globalization#technology#innovation#research#development#sustainability#economic growth#documentary#ai assisted writing#machine art#Youtube#presentation#discussion#china#taiwán#south korea

7 notes

·

View notes

Text

How Apple Relies on Samsung for iPhone Production

Apple and Samsung are two big rivals in the technology industry, and are often portrayed as rivals in the smartphone market. Behind the scenes, however, Apple relies on Samsung for key components used in its flagship product, the iPhone. This relationship may seem odd, but it illustrates the complex nature of global supply chains in the technology sector. In this blog we will examine how Apple trusts Samsung and why this relationship is so important to the creation of the iPhone.

1. The OLED Displays: Samsung’s Technological Edge

One of the most critical components in modern iPhones is the OLED (Organic Light-Emitting Diode) display. These displays are known for their vibrant colors, deep blacks, and energy efficiency, significantly enhancing the user experience compared to older LCD technology. Samsung Display, a subsidiary of Samsung Electronics, is the world’s leading manufacturer of OLED screens.

When Apple transitioned to OLED screens with the iPhone X in 2017, it turned to Samsung due to the company’s unparalleled expertise and production capacity in OLED technology. While Apple has since diversified its suppliers, with LG Display and others entering the fray, Samsung remains the largest provider of OLED screens for iPhones. Samsung’s dominance in this sector gives Apple little choice but to collaborate with its competitor.

2. Chips and Semiconductors: More Than Just Displays

Apple designs its own A-series chips, but the actual production of these chips relies on external manufacturing. While companies like TSMC (Taiwan Semiconductor Manufacturing Company) handle most of Apple’s chip production, Samsung has also played a role in this arena. Samsung is one of the few companies with the technological prowess and manufacturing capabilities to produce advanced semiconductor components.

In previous iPhone generations, Samsung produced the A-series chips that powered these devices. Although TSMC has since become Apple’s primary chip manufacturer, Samsung’s semiconductor division remains a key player in the global chip market, offering Apple an alternative supplier when needed.

3. Memory and Storage: Another Piece of the Puzzle

In addition to displays and semiconductors, Samsung provides memory components such as DRAM (Dynamic Random-Access Memory) and NAND flash storage for the iPhone. These memory components are essential for the smooth operation and storage capacity of iPhones. With its dominance in the memory market, Samsung is one of Apple’s main suppliers, providing the high-quality memory needed to meet the iPhone’s performance standards.

Apple has worked to reduce its reliance on Samsung for memory, but the reality is that Samsung’s market share in the memory and storage sectors is so substantial that avoiding them entirely is nearly impossible. Furthermore, Samsung’s advanced manufacturing techniques ensure that its memory components meet the rigorous standards required for the iPhone.

4. Why Apple Sticks with Samsung Despite the Rivalry

Given their rivalry in the smartphone market, one might wonder why Apple doesn’t completely break away from Samsung. The answer lies in the intricate balance between quality, capacity, and supply chain stability.

Quality: Samsung’s components, particularly OLED displays and memory, are some of the best in the industry. Apple has always prioritized quality in its products, and Samsung’s technological capabilities align with Apple’s high standards.

Capacity: Samsung has the production capacity to meet Apple’s enormous demand. With millions of iPhones sold each year, Apple needs suppliers that can manufacture components at scale without compromising quality. Samsung’s factories are among the few capable of handling such volume.

Supply Chain Risk: Diversifying suppliers is a strategy Apple uses to reduce risk. However, removing Samsung from the supply chain entirely would expose Apple to greater risk if another supplier fails to meet production needs or quality standards. By maintaining Samsung as a key supplier, Apple can ensure a more stable and reliable supply chain.

5. Apple’s Efforts to Reduce Dependency

While Apple remains dependent on Samsung in several areas, the company has made moves to reduce this reliance over the years. For instance, Apple has invested in alternative display suppliers such as LG Display and BOE Technology, as well as expanded its collaboration with TSMC for chip production. Additionally, Apple has explored developing its own in-house components, such as its rumored efforts to create proprietary display technology.

Despite these efforts, it’s unlikely that Apple will be able to completely eliminate Samsung from its supply chain in the near future. Samsung’s technological leadership in key areas, especially OLED displays and memory, ensures that Apple will continue to rely on its competitor for critical components.

Conclusion: A Symbiotic Rivalry

The relationship between Apple and Samsung is a fascinating example of how competition and collaboration can coexist in the tech industry. While they are fierce competitors in the smartphone market, Apple depends on Samsung’s advanced manufacturing capabilities to produce the iPhone, one of the most iconic devices in the world. This interdependence shows that even the most successful companies cannot operate in isolation, and collaboration between rivals is often necessary to bring cutting-edge products to market.

For Apple, the challenge lies in maintaining this balance — relying on Samsung for essential components while exploring new avenues to reduce dependency. For now, however, Samsung remains a crucial partner in the making of the iPhone, demonstrating how complex and interconnected the global tech supply chain has become.

4 notes

·

View notes

Text

So this flash drive was made in the form of a single monolithic element (why the spider board says "for monolith"). This means that, unlike other forms of memory storage devices, it cannot be unsoldered and read on a particular hardware reader. [Tangent: USB flash drives and SD memory cards may or may not be monolithic, but all MicroSD flash drives are.]

To connect to a memory chip on monolithic flash drives, data recovery specialists need to strip the printed circuit board of the flash drive and connect to the necessary contacts using a special PC-3000 Spider Board device.

The PC-3000 Spider Board is designed to perform switching with technological outputs of drives in monolithic memory cards. Data can be recovered with the Spider Board from a variety of damaged memory cards, including Monolithic USB Flash Drive, MicroSD, SD, and others. The PC-3000 Flash Spider Board Adapter is an all-purpose way to safely restore monolithic data without tedious soldering.

The PC-3000-Flash software reads the ROM (read-only memory) of the device that is having its data recovered by directly accessing NAND chips. [Tangent: Flash memory is an electronic non-volatile computer memory storage medium that can be electrically erased and reprogrammed. It is a semiconductor that stores data and is used in smartphones and many other electronic devices around us. The two main types of flash memory, NOR flash and NAND flash, are named for the NOR and NAND logic gates. KIOXIA invented the world’s first NAND flash memory in 1987 and remains one of the leading companies conducting flash memory development and manufacturing.] The connection is carried out through the PC3000 Spider Board adapter, which allows connection to the process pins of the NAND Flash chip without soldering due to 25 movable needle contacts.

My sources (which I quoted verbatim as well as paraphrased):

Have you ever wondered how tech technicians recover data from faulty flash and memory whose data cannot be recovered by normal methods.

55K notes

·

View notes

Text

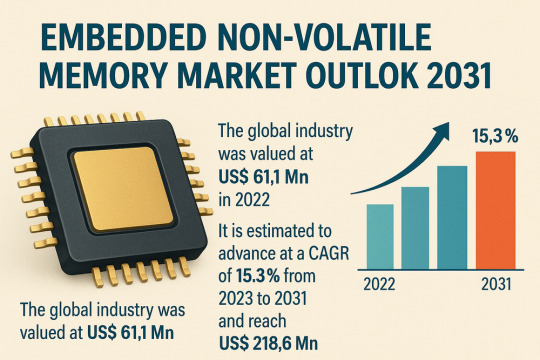

Embedded Non-volatile Memory Market to Hit $218.6 Million by 2031: What's Driving the Growth?

The global Embedded Non-volatile Memory (eNVM) market was valued at USD 61.1 million in 2022 and is projected to expand at a CAGR of 15.3% between 2023 and 2031, reaching USD 218.6 million by the end of 2031. Embedded NVM refers to non-volatile storage integrated directly into semiconductor chips, retaining data even when the system is powered off. Its core applications include firmware storage, calibration data retention, and secure configuration storage in microcontrollers, digital signal processors, and a wide array of embedded systems.

Market Drivers & Trends

Smartphone and Wearable Boom – The continued global uptake of mobile devices has escalated the need for larger, faster embedded memory. Users demand lightning-fast boot times and seamless multitasking, driving OEMs to integrate high-performance flash memory and emerging NVM technologies directly into system-on-chips (SoCs). – Wearables, smart speakers, and IoT gadgets prioritize low-density but highly efficient memory. 3D NAND flash has emerged as the preferred technology, offering high storage capacity in a minimal footprint. Samsung and SK Hynix have ramped up mass production of advanced 3D NAND modules tailored for connected device ecosystems.

Low-Power, High-Speed Requirements – Battery-powered devices mandate memory that combines rapid data access with minimal energy draw. Next-generation embedded NVMs—such as STT-MRAM and ReRAM—offer sub-microsecond access times and ultra-low standby currents, extending device lifespans and enhancing user experience. – System-in-Package (SiP) and Package-on-Package (PoP) solutions are gaining traction, integrating multiple memory dies and logic blocks into single compact modules, thereby reducing interconnect power losses and boosting overall throughput.

Security and Reliability – As embedded systems permeate mission-critical sectors (automotive ADAS, industrial controls, medical devices), secure and tamper-resistant memory is non-negotiable. Embedded flash and MRAM provide inherent read/write protections, while emerging PUF-based authentication schemes leverage intrinsic chip variability to safeguard cryptographic keys.

Latest Market Trends

3D XPoint and Beyond: Following its debut in enterprise SSDs, 3D XPoint is being miniaturized for embedded applications, promising DRAM-like speeds with non-volatility, ideal for real-time control systems.

Embedded MRAM/STT-MRAM: Gaining traction in safety-critical automotive and industrial sectors, MRAM offers unlimited endurance cycles and high radiation tolerance.

Embedded Ferroelectric RAM (FRAM): With nanosecond write speeds and high write endurance, FRAM is carving out niches in smart cards, metering, and medical devices.

Key Players and Industry Leaders The eNVM market is highly consolidated, with major semiconductor manufacturers and specialty memory providers driving innovation and capacity expansion:

eMemory Technology Inc.

Floadia Corporation

GlobalFoundries Inc.

Infineon Technologies AG

Japan Semiconductor Corporation

Kilopass Technology, Inc.

SK HYNIX INC.

SMIC

Texas Instruments Incorporated

Toshiba Electronic Devices & Storage Corporation

Download now to explore primary insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=24953

Recent Developments

March 2023 – ANAFLASH Commercialization U.S. startup ANAFLASH unveiled an energy-efficient embedded NVM solution tailored for battery-powered wireless sensors, medical wearables, and autonomous robots, promising up to 30% lower power consumption versus incumbent flash technologies.

February 2023 – GlobalFoundries Acquisition GlobalFoundries acquired Renesas Electronics’ resistive RAM patents and manufacturing know-how, aiming to integrate low-power ReRAM into next-generation SoCs for smart home and mobile applications.

May 2022 – Automotive Platform Collaboration Japan Semiconductor Corporation and Toshiba Electronic Devices partnered to develop a 0.13-micron analog IC platform with embedded flash, targeting advanced automotive applications such as in-vehicle networking and sensor fusion modules.

Market Opportunities

5G and IoT Rollout: The proliferation of 5G networks and edge computing devices demands local data storage and analytics, presenting growth avenues for low-latency embedded memory.

Automotive Electrification: Electric and autonomous vehicles require robust memory for ADAS, telematics, and battery management systems, creating new application segments.

Healthcare Wearables: Demand for continuous health monitoring fosters embedded memory integration in smart patches and implantable devices, where size and power constraints are paramount.

Future Outlook Analysts project that by 2031, the Embedded NVM market will surpass US$ 218 million, driven by sustained R&D investments and product diversification into emerging NVM technologies. The maturation of foundry support for STT-MRAM, ReRAM, and 3D XPoint, coupled with advanced packaging breakthroughs, will accelerate adoption across consumer, automotive, and industrial domains. Security-driven regulations and functional safety standards will further cement embedded memory’s role in next-generation electronic systems.

Market Segmentation

By Type

Flash Memory (dominant share in 2022)

EEPROM

nvSRAM

EPROM

3D NAND

MRAM/STT-MRAM

FRAM

Others (PCM, NRAM)

By End-Use Industry

Consumer Electronics (2022 market leader)

Automotive

IT & Telecommunication

Media & Entertainment

Aerospace & Defense

Others (Industrial, Healthcare)

By Region

North America

Europe

Asia Pacific (2022 market leader)

Middle East & Africa

South America

Buy this Premium Research Report for a detailed exploration of industry insights - https://www.transparencymarketresearch.com/checkout.php?rep_id=24953<ype=S

Regional Insights

Asia Pacific: Commanded the largest share in 2022, fueled by semiconductor R&D hubs in China, Japan, Taiwan, and South Korea, and robust electronics manufacturing ecosystems.

North America: Home to major foundries and design houses; 5G and IoT device adoption is expected to drive eNVM demand through 2031.

Europe: Automotive electrification and Industry 4.0 initiatives will underpin growth, with Germany and France leading demand.

MEA & Latin America: Emerging markets are gradually adopting consumer electronics and automotive technologies, presenting long-term opportunities.

Frequently Asked Questions

What is embedded non-volatile memory? Embedded NVM is memory integrated into semiconductor chips that retains data without power. It is used for firmware, configuration data, and security keys.

Which eNVM type holds the largest market share? Flash memory led the market in 2022 due to its balance of speed, density, and cost-effectiveness, particularly in consumer electronics and IoT devices.

What industries drive eNVM demand? Consumer electronics, automotive (ADAS, electrification), IT & telecom (5G equipment), aerospace & defense, healthcare wearables, and industrial automation.

How will emerging technologies impact the market? STT-MRAM, ReRAM, and 3D XPoint will offer faster speeds, higher endurance, and lower power profiles, expanding applications in safety-critical and high-performance systems.

Which regions offer the best growth prospects? Asia Pacific remains the leader due to manufacturing scale and R&D. North America and Europe follow, driven by advanced automotive and IoT deployments.

What factors may restrain market growth? High development costs for new NVM technologies, integration complexity, and supply chain disruptions in semiconductor fabrication could pose challenges.

Why is this report important for stakeholders? It equips semiconductor vendors, system integrators, and strategic investors with the insights needed to navigate technological shifts and seize emerging market opportunities in embedded memory.

Explore Latest Research Reports by Transparency Market Research:

Power Meter Market: https://www.transparencymarketresearch.com/power-meter-market.html

Radiation Hardened Electronics Market: https://www.transparencymarketresearch.com/radiation-hardened-electronics-semiconductor-market.html

AC-DC Power Supply Adapter Market: https://www.transparencymarketresearch.com/ac-dc-power-supply-adapter-market.html

5G PCB Market: https://www.transparencymarketresearch.com/5g-pcb-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

0 notes

Text

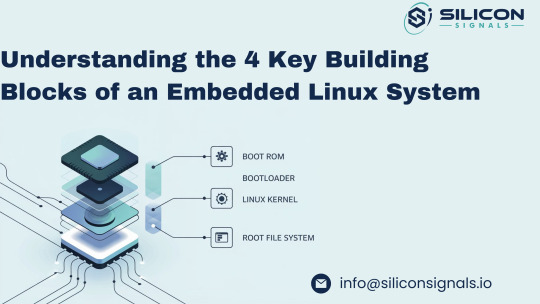

Understanding the 4 Core Components of an Embedded Linux System

Before diving into how to build a complete embedded Linux system, it’s important to know what major parts make up the system itself. A good way to understand this is by looking at the boot process — what happens when you power on a device like an embedded controller, industrial gateway, or smart gadget.

Each component plays a specific role in bringing the system to life, step by step. Here's a simple breakdown of the four essential parts of an embedded Linux system:

1. 🧠 Boot ROM – The Starting Point Inside the SoC

The Boot ROM is the very first code that runs when you power on your embedded device. It’s stored in read-only memory directly inside the System-on-Chip (SoC) and is similar to the BIOS on a standard computer. Although it's locked and can't be changed, it can react to external configurations (like boot pins) to decide where to load the next stage from – such as an SD card, eMMC, NAND flash, or even over UART/serial.

Some Boot ROMs also support secure boot by only allowing signed software to load next, adding a strong layer of security to the embedded system.

2. 🚀 Bootloader – Initializing the Hardware and Loading the Kernel

After the Boot ROM finishes its job, it passes control to the Bootloader. In many cases, the bootloader itself runs in two steps:

First stage: Prepares the system by initializing the RAM (since it's not ready right after power-up).

Second stage: Loads the Linux kernel from a chosen storage device or over a network (useful during development via TFTP).

Modern bootloaders also include features to:

Flash firmware or kernels onto memory devices like NAND or eMMC,

Test hardware components like I2C/SPI, RAM, and others,

Run Power-On Self-Tests (POST) to ensure system stability before launching the OS.

Popular bootloaders like U-Boot are often used in embedded Linux development for their flexibility and wide hardware support.

3. 🧩 Linux Kernel – The Core of the Operating System

The Linux Kernel is the brain of the system and is responsible for:

Talking to the hardware (drivers for peripherals),

Handling system tasks like scheduling and memory management,

Creating a stable environment for your applications to run.

It acts as the bridge between the hardware layer and the user space, making it possible to develop portable embedded applications that don’t rely on the specifics of the underlying board.

4. 📁 Root File System – The Application Playground

Once the kernel is up and running, its next task is to mount the root file system — the place where all applications, scripts, and shared libraries live.

Creating this from scratch is complex due to package dependencies and compatibility issues. That’s why tools like Buildroot, Yocto Project, or OpenEmbedded are used to automatically build and manage the root filesystem.

These tools help embedded developers customize and maintain a lightweight and reliable file system tailored to their device, ensuring consistency and performance.

Need Help Building Your Embedded Linux Solution?

At Silicon Signals, we specialize in custom embedded Linux development, including board bring-up, device driver integration, Android BSPs, secure boot implementation, and real-time optimizations.

Whether you're working on a new product or looking to optimize an existing one, our team can help you accelerate development and reduce risk.

📩 Contact us today to discuss how we can bring your embedded system to life. 🌐 Visit: www.siliconsignals.io ✉️ Email: [email protected]

#embeddedtechnology#embeddedsoftware#embeddedsystems#linux kernel#linuxdebugging#iot development services#iotsolutions

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] From the manufacturer TeamGroup T-Force Cardea Z44L NVMe M.2 2280 PCIe Gen 4 SSD Not only faster but also more stable and durable Supporting SLC Cache technology and smart algorithm management mechanism can help ensure operational efficiency and maximize the performance of SSD. It is a reliable and trustworthy choice for data storage. Enjoy the read/write performance of PCIe Gen4 x4 It supports the latest PCIe Gen4 x4 with up to 3500/3000 MB/s*, offering superior performance which is 7 times faster than typical SATA SSD, while also downward compatible with PCIe 3.0 specification. Supports the latest NVMe standard By supporting the latest NVMe spec and optimizing the work division of NVM Sets and PLM (Predictable Latency Mode), it effectively reduces latency time, write loss, and improves the system's QoS. Usage of the latest RRL (Read Recovery Level) technology also improves the lifespan of the SSD. SSD smart monitoring software TEAMGROUP provides an exclusive SSD smart monitoring software. It can keep track of the status of the products at any time, monitor their quality and performance, and then perform quick and easy related setup and testing. Patented ultra-thin graphene heat spreader The use of patented ultra-thin graphene heat spreader provides the best thermal conductivity material and assembly flexibility, allowing gamers to easily DIY on their own, and any motherboard heat spreader can be supported without interference. Responsive: This PCIe Gen 4 SSD Comes With Read & Write Speed Upto 3500/3000 MB/s, Supports Smart SLC Caching Algorithm Making It 25X Faster Than Traditional HDDs. Reliability: Supports S.M.A.R.T Technology For Monitoring & Windows TRIM For Optimized Performance. Built-in ECC & Wear Level Technology Ensure Reliable Storage. Cooling: Ultra Thin Graphene Heat Spreader Provides The Best Cooling Performance Which Ennahces Gaming Performance & Longevity. Fast : This Nvme M.2 2280 PCIe Gen 4 Solid State Drive Uses Latest Nvme Standard For Excellent Performance. Latest Tech: Equipped With New 3D NAND TLC Flash Memory Chips For Fast And Seamless Gaming Experience. Durability: With Upto 600TBW (Terra Bytes Written) Rating, Your SSD Will Handle More Write Operations And last Long. Warranty: Backed By Limited 5 Year Warranty Providing Peace Of Mind With Long Term Protection Against Defects. [ad_2]

0 notes

Text

HDD Data Recovery Services

We are most trusted hard disk data recovery companies, and it has been an expert in data recovery for many years. With a high recovery success rate, our data recovery engineers will help you solve various disk errors without losing data. We also offer free diagnosis of the hard drives and can guarantee. HDDs, commonly found in computers and laptops, store data magnetically on spinning disks called platters. Our hard drive recovery services can help you recover data from an HDD that has experienced logical issues, failure, physical damage, or even the formatted HDD - Hard Disk Data Recovery.

Solid-state Drives (SSDs) use flash memory to store data, providing faster access speeds and greater durability due to the lack of moving parts. If you have encountered NAND chip failures, SSD not showing up, or other SSD failures, choosing our recovery services will maximize the chances of successful data retrieval. SD cards are commonly used for digital cameras, smartphones, drones, and other portable electronic devices. Although SD cards are known for their compact size and versatility, they can still encounter issues leading to data loss, such as accidental deletion, format error, file system corruption, etc. Our data recovery services and perform memory card recovery now - SSD Data Recovery.

Data loss in virtual environments can occur due to various reasons, such as virtual machine corruption, accidental deletion, or storage failure. NAS devices are dedicated file storage servers connected to a network, providing multiple users with centralized storage and data access. Our data recovery service can help you recover data from any vendor's device, including but not limited to the following. It is a comprehensive professional service designed to help users recover data lost for various reasons. This service's hallmark is its essential solutions in data loss emergencies, particularly when data recovery software fails to recover data. For more information, please visit our site https://www.nowdatarecovery.com/

0 notes