#overdrafts

Explore tagged Tumblr posts

Text

Understanding Overdraft Fees: Key Insights & Tips

Ah, overdraft fees—the stealthy ninjas of the banking world, lurking in the shadows, ready to pounce when you least expect it. But fear not, dear reader! We’re here to demystify these pesky charges and arm you with the knowledge to outsmart them.

Understanding Overdraft Fees: Key Insights & Tips

Why We Need to Talk About Overdraft Fees

Let��s face it: overdraft fees are like the hangover after a wild night out—nobody likes them, but most of us have experienced them at some point. It’s crucial to understand how they work and how to avoid them to keep your finances in check and avoid that dreaded feeling of waking up to a negative balance.

The Funny Side of Getting Overdrawn

Who knew that a $2 cup of coffee could end up costing you $35? Overdraft fees add insult to injury, turning minor spending mishaps into major financial headaches. But hey, if we can’t laugh at our own misfortune, we’re missing out on some prime comedy material!

What Exactly Are Overdraft Fees?

The Nitty-Gritty Definition Overdraft fees are charges imposed by banks when you spend more money than you have in your account. It’s like borrowing money from your bank without asking—and they don’t take kindly to that kind of behavior. The Different Types of Overdraft Fees: Not All Are Created Equal Not all overdraft fees are the same. There’s the standard overdraft fee, continuous overdraft fees, and even non-sufficient funds (NSF) fees. Each comes with its own delightful way of siphoning money from your account.

How Do Overdraft Fees Work?

The Sneaky Process Behind the Scenes Overdraft fees kick in when your account balance dips below zero, but the way banks process transactions can sometimes feel like a bad magic trick. They often reorder transactions from largest to smallest, increasing the likelihood of multiple overdraft fees. Presto! Your account is empty, and your bank is richer. Examples That Will Make You Go "Seriously?" Imagine buying a $1 pack of gum, only to find out it triggered a $35 overdraft fee because of the way your bank processed your transactions. It's enough to make anyone question their life choices.

Why Do Banks Charge Overdraft Fees?

The Bank's Perspective: They’re Not Just Evil (Probably) Banks argue that overdraft fees cover the risk and administrative costs of allowing transactions to go through when funds are insufficient. They’re providing a service, after all. But let’s be real—it’s a service we’d all rather avoid. The Profit Motive: Cha-Ching for Banks Overdraft fees are a significant revenue stream for banks. In 2020 alone, Americans paid over $12 billion in overdraft fees. That’s a lot of cha-ching for the banks and a lot of ouch for the rest of us.

Common Scenarios Leading to Overdraft Fees

The Dreaded Automatic Payment Ever had an automatic payment sneak up on you? One minute you’re happily living your life, the next you’re hit with an overdraft fee because you forgot about that gym membership you never use. The One Cup of Coffee That Broke the Bank It’s a tale as old as time: you buy a cup of coffee, only to discover it pushed your account into the red. That’s one expensive caffeine fix. Oops, I Forgot That Subscription! Those monthly subscriptions can be a killer. Forgetting about even one can lead to an unpleasant surprise in the form of an overdraft fee.

The Impact of Overdraft Fees on Your Wallet

How Small Fees Turn Into Big Problems Overdraft fees might seem small individually, but they can snowball quickly, leading to significant financial strain. It’s like getting nickel-and-dimed to death. Real-Life Horror Stories (And How to Avoid Them) There are countless tales of people racking up hundreds of dollars in overdraft fees in a single day. Avoid becoming a cautionary tale by staying vigilant and proactive.

Tips to Avoid Overdraft Fees

Keeping Track Without Losing Your Mind Maintaining an accurate account balance might sound tedious, but it’s the best way to avoid overdraft fees. Use budgeting apps, spreadsheets, or even good old-fashioned pen and paper to keep tabs on your spending. Setting Up Alerts: Your New Best Friend Most banks offer alert services that notify you when your balance is low. Setting up these alerts can save you from unexpected fees and give you a heads-up when your funds are running low. The Magic of Buffer Money Keeping a small buffer in your account—a financial cushion, if you will—can prevent you from dipping into the negative. Think of it as your personal overdraft protection.

What to Do If You Get Hit with an Overdraft Fee

Step-by-Step Guide to Begging (Politely) for a Refund Got slapped with an overdraft fee? Don’t panic. Contact your bank and politely request a refund. If you’re a first-time offender or it’s been a while since your last fee, they might cut you some slack. Negotiation Tactics That Actually Work When asking for a refund, be prepared to explain the situation and how you plan to avoid future overdrafts. Banks are more likely to help if they see you’re taking steps to manage your finances responsibly.

Alternative Solutions to Overdraft Protection

Linking Accounts: The Good, the Bad, and the Ugly Linking your checking account to a savings account can provide a safety net, automatically transferring funds if your balance drops too low. Just be aware of potential transfer fees. Overdraft Protection Loans: Friend or Foe? Some banks offer overdraft protection loans, which cover overdrafts but must be repaid with interest. They can be helpful, but it’s crucial to understand the terms and conditions.

When Overdraft Protection is a Good Idea

Weighing the Pros and Cons Overdraft protection can save you from hefty fees, but it’s not always the best option for everyone. Consider your spending habits and financial situation before opting in. Situations Where It Might Save Your Bacon Overdraft protection can be a lifesaver in emergencies or when you’re expecting a significant deposit soon. It’s not a free pass to overspend, but it can provide peace of mind in a pinch.

The Legal Side of Overdraft Fees

Know Your Rights: What Banks Can and Can’t Do It’s essential to understand your rights regarding overdraft fees. Banks must obtain your consent to enroll you in overdraft protection for ATM and one-time debit card transactions. Recent Changes in Overdraft Fee Regulations Regulations around overdraft fees have tightened in recent years, providing more protections for consumers. Stay informed about these changes to ensure you’re not taken advantage of.

Real-Life Overdraft Fee Avoidance Success Stories

How Jane Saved $200 by Switching Banks Jane was tired of paying exorbitant overdraft fees, so she switched to a bank with more consumer-friendly policies. The result? She saved $200 in one year alone. Tom’s Tale: The Power of a Simple Spreadsheet Tom avoided overdraft fees by using a simple spreadsheet to track his spending. It helped him stay within his budget and avoid those pesky fees.

Bottom Line : Take Control of Your Finances

Recap of Key Insights & Tips Understanding overdraft fees and how to avoid them is crucial for financial health. Keep track of your spending, set up alerts, and maintain a buffer in your account. Encouragement to Stay On Top of Your Finances Taking control of your finances might seem daunting, but with a bit of effort and vigilance, you can keep those overdraft fees at bay and enjoy a healthier bank balance. A Final Laugh to Keep You Smiling Remember, everyone makes mistakes—even when it comes to managing money. Learn from your overdraft fee mishaps, and you’ll find yourself laughing all the way to the bank.

Frequently questions (FAQs)

What are overdraft fees, and why do banks charge them? Overdraft fees are charges imposed when you spend more than your account balance. Banks charge them to cover the risk and administrative costs of processing transactions with insufficient funds. How can I avoid overdraft fees? You can avoid overdraft fees by keeping track of your account balance, setting up low-balance alerts, and maintaining a small financial buffer in your account. Are all overdraft fees the same? No, there are different types of overdraft fees, including standard overdraft fees, continuous overdraft fees, and non-sufficient funds (NSF) fees. Each type has its own conditions and charges. Can I get a refund for an overdraft fee? Yes, you can request a refund for an overdraft fee by contacting your bank and explaining the situation. Banks are often willing to refund fees, especially for first-time offenders or those with a good banking history. What are some alternatives to overdraft protection? Alternatives to overdraft protection include linking your checking account to a savings account for automatic transfers or using budgeting tools to keep track of your spending and avoid overdrafts Key Takeaways: - Definition and Types of Overdraft Fees: - Overdraft fees are charges by banks when your account balance goes below zero. - There are various types of overdraft fees, including standard overdraft fees, continuous overdraft fees, and non-sufficient funds (NSF) fees. - How Overdraft Fees Work: - Banks often reorder transactions from largest to smallest, increasing the likelihood of multiple overdraft fees. - Even small purchases can trigger significant fees due to the way banks process transactions. - Reasons Banks Charge Overdraft Fees: - Banks charge these fees to cover risks and administrative costs. - Overdraft fees are a major revenue stream for banks, generating billions annually. - Common Scenarios Leading to Overdraft Fees: - Automatic payments, forgotten subscriptions, and minor purchases can unexpectedly result in overdraft fees. - Impact on Finances: - Overdraft fees can quickly accumulate, causing significant financial strain. - Real-life stories highlight the severe consequences of not managing overdrafts properly. - Tips to Avoid Overdraft Fees: - Keep accurate track of your account balance using budgeting tools or apps. - Set up low-balance alerts with your bank. - Maintain a financial buffer in your account to prevent going negative. - Steps to Take if You Incur an Overdraft Fee: - Politely request a refund from your bank, explaining your situation. - Be prepared to discuss your plans to avoid future overdrafts. - Alternative Solutions to Overdraft Protection: - Linking your checking account to a savings account can provide a safety net. - Overdraft protection loans can be an option but come with interest and conditions. - When Overdraft Protection is Beneficial: - It can be helpful in emergencies or when expecting a significant deposit soon. - Weigh the pros and cons before opting for overdraft protection. - Legal Aspects of Overdraft Fees: - Know your rights regarding overdraft fees and recent regulatory changes. - Banks need your consent to enroll you in overdraft protection for ATM and one-time debit card transactions. - Success Stories and Practical Advice: - Real-life examples show how switching banks or using budgeting tools can save money on overdraft fees. - Take proactive steps to manage your finances and avoid becoming a victim of overdraft fees. Read the full article

#avoidoverdraftfees#Bank#bankoverdraft#bankoverdraftfees#chasebankoverdraft#chasebankoverdraftfees#chaseoverdraftfees#Fees#Finances#howoverdraftswork#howtoavoidoverdraftfees#overdraft#overdraftaccount#overdraftfee#overdraftfees#overdraftfeesexplained#overdraftfeesnews#overdraftfeeswaived#overdraftfeeswellsfargo#overdraftfrees#overdraftlimit#overdraftprotection#overdrafts#wellsfargooverdraftfees

0 notes

Text

oh my god do not click links in emails that tell you to verify your data or your bank account gets locked or click links in messages telling you your safety protocol is ending, like, tomorrow, you will get SCAMMED SO BAD AND YOU WILL LOSE A LOT OF FUCKING MONEY never ever let anyone pressure you into giving away login information especially to your online banking by creating a sense of urgency oh my GOD

some things to look out for

1. spelling mistakes. do you know how many rounds of marketing and sales experts these things go through? if theres a spelling mistake dont click it

2. not using your name. if an email adresses you with "dear customer" or, even worse, a generic "ladies and gentlemen", it is most likely not actually targeted to you

3. verifying or login links. even IF your bank was stupid enough to send these to customers, dont EVER click those. look at me. they can legally argue that youve given your data away and thus they dont have to pay you anything back DONT CLICK THAT FUCKING LINK

4. creating a sense of urgency. do this or we lock your account next week. do this or your ebanking stops working tomorrow. give us all your money in cash or your beloved granddaughter will get HANGED FOR MURDERING BABIES. no serious organisation would ever do something like that over email or sms. ever. hands off.

5. ALWAYS CHECK WHO SENT YOU THE EMAIL. the display name and the email adress can vary a LOT. anyone can check the display name. look at the email adress. does it look weird? call the fucking place it says its from. you will likely hear a very weary sigh.

6. if its in a phonecall, scammers love preventing you from hanging up or talking to other people to have a little bit of a think about whats happening. there should always be a possibility to go hey i wanna think about this ill call back the official number thanks.

7. do not, i repeat, do NOT a) call a phone number flashing on your screen promising to rid your computer of viruses after clicking a dodgy link and b) let them install shit on your computer like. uh. idk. teamviewer.

7.i. TEAM VIEWER LETS PEOPLE USE YOUR COMPUTER HOWEVER THEY WANT AS LONG AS THEYRE CONNECTED. IF YOU DONT KNOW FOR FUCKING SURE YOURE TALKING TO ACTUAL TECH SUPPORT DONT GIVE ANYONE ACCESS TO YOUR COMPUTER.

fun little addendum: did you know a link can just automatically download shit? like. a virus? an app you can't uninstall unless you reset your entire device? dont click links unless youre extremely sure you know where they lead. hover your mouse over it and check the url.

thanks.

#'oh i was so stressed in the moment' thats what theyre counting on PLEASE dont do this you will lose so much money#sometimes money you dont even have#do you know how much overdraft your bank account comes with?#sometimes the answer is 15k fucking euros

17K notes

·

View notes

Text

• "Overdraft' Waistcoat.

Date: 1967

Designer: Mary Quant; Made by: Steinberg and Sons; Made for: Ginger Group

Place of origin: London

Medium: Wool, Acetate

#fashion history#history of fashion#dress#fashion#vintage fashion#vintage clothing#vintage#vintage dress#1960's dress#1960's fashion#1960's#mary quant#waistcoat#overdraft#1967

2K notes

·

View notes

Text

Please help a black queer artist survive until the 20th!

Hey everyone!! I lost about a week's pay due to covid so I'm negative cash until the 20th. So, I'm offering LITTLE DUDES! A cute simple commission! Donate at least 10 usd to my kofi and comment with your character(s) of choice! Any fandom, ocs welcome. PLEASE remember to put your tumblr handle in your comment! https://ko-fi.com/ghostbunn Unlimited slots! Examples below!

#donations#uzumaki naruto#tenzo yamato#commisssions#ted kord#blue beetle#shatterstar#timkon#tim drake#conner kent#kon kent#narusasu#implied lol#sasunaru#sns#pleeaasee help me escape overdraft fees

535 notes

·

View notes

Text

"Taxation is theft."

I don't care. Not even a little.

Banks charge overdraft fees, which is literally stealing from poor people because they're poor.

Homeless people are often fined for loitering, which is also literally stealing from poor people because they're poor.

If we can steal from poor people, then we can steal from rich people instead.

355 notes

·

View notes

Text

Hey, I hate to do this, but I was out of work for a few weeks with mono and it doesn't look like my disability claim is going to pay out, so any donations right now are greatly appreciated for the next few weeks, as I'm going to be a full month between paychecks

My PayPal is [email protected]

#Please help#I'm genuinely worried I won't be able to pay my bills#And that I'm going to overdraft my bank account

230 notes

·

View notes

Text

#politics#political#us politics#banks#banking#news#donald trump#american politics#president trump#elon musk#jd vance#law#money#finance#charges#overdraft#overdraft fees

115 notes

·

View notes

Text

Opening emergency commissions!

COLOR BUSTS - 45€

I’m offering these character busts done in the style I used for Huevember 2022, which you can check out here (Huevember tag) or here (example batch of this type of commissions).

Details:

busts only

one character per piece, limited to two per commissioner

you can message me here, by email ([email protected]) or on discord (only if you have my handle); send me some references as well as the color of your choice

payment is by Paypal only, an invoice will be sent to you after you’ve approved of the sketch

sale will run from today (Monday November 11th) until next week (Monday November 18th), any requests received after that deadline will not be taken under consideration

I will start working on these in the order I got them

as usual, you can follow the progress here

___ Thank you so much for your interest, and for your neverending support 💙💜

#commissions#commissions open#if all goes well this could be the last emergency for a lil while#we just need to not bee in overdraft this month

109 notes

·

View notes

Text

Let me be very clear. The mere concept of the Government stepping in to curtail the wildly abusive fees of the banking industry has already lead to multiple banks trying to "get ahead of" it to cut their feed from $35 to $10 (Bank of America) or get rid of them entirely (Capital One) for active users of their account.

This regulation is already having the effect of saving US citizens billions of dollars every year before its even passed, even as Republicans want to fight it tooth-and-nail.

Every year there are $8bn in overdraft charges that explicitly and directly hit the poorest Americans by definition. Even just adopting this rule would save Americans 7.315 billion dollars every year.

And with banking institutions now moving to get rid of them entirely it can save even more.

Let this be, case-in-point, proof positive and a case study of several things.

The government can directly help you and help every single American

While Democrats definitely aren't saints, in any context, they are objectively doing more to help people than the side actively arguing against curtailing banking and corporate excess.

Biden is materially better than Trump would be.

Raegan and the right-wing "the government is objectively the worst thing" screed is the biggest, easiest, and stupidest way to ensure that rich and powerful people have no pushback against their shitty behaviors.

413 notes

·

View notes

Text

really need life (work) to just pause for a couple weeks so i can catch up with myself. 11 hr days almost every day this week have NOT been conducive to processing grief or taking care of my body or running errands or just generally being an alive person who's Really Going Through It.

#ctxt#shit chat#i'm so burnt out. my one consolation is that my paycheck's gonna be THICC#......and then literally all of it is gonna go towards the overdraft debt i accrued taking bones to the ER 🫠#if i don't catch a fuuuuucking break soon i'm gonna start hitting things with hammers

42 notes

·

View notes

Text

help me afford rent, i was fucked over by my latest psychiatrist

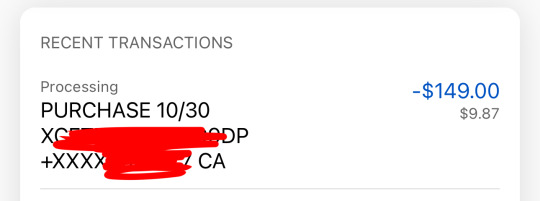

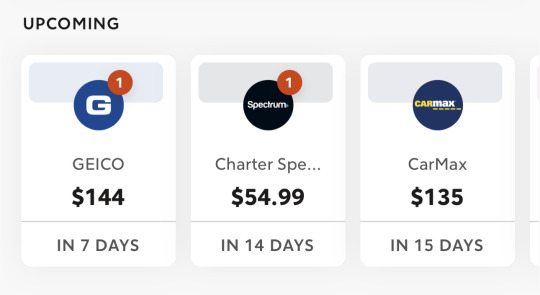

okay well apparently the paycheck i just got immediately went to paying off a psychiatrist appointment i had at the beginning of october and they are JUST now telling me that my medicaid wasn’t accepted and charged me $150 for it. which obviously i barely have.

and so now i have nothing to pay my share of rent with ($600.) i was relying on my next paycheck of $450 to help me cover that but now i need about $150 for rent, and $145 for my car insurance payment in 7 days (i won’t get paid again for another 2 weeks after tomorrow). i don’t know what to do so i’m turning to you guys’ help again.

$150 / $150 needed by November 1st

if everyone who saw this donated $2, i’d reach my goal. if you cannot donate please please reblog so that it may reach others who can. thank you so much for your kindness and support. as always hateful messages will be blocked (looking at you anons who tell me to kill myself for this)

#hey gamers guess who got fucked overrrrrr ✌️✌️✌️#just woke up to this fuck me!!!!!!!!#i am legitimately so afraid of overdrafting again i CANNOT afford the fee!!!!!!

709 notes

·

View notes

Text

WRITING COMMISSIONS/GIFT SKETCH

HI EVERYONE I AM SO SORRY TO ASK THIS BUT I NEED HELP RAISING AT LEAST $70 SO I CAN AVOID AN OVERDRAFT FEE

I’LL TEMPORARILY TAKE WRITING COMMISSIONS FOR SHORT FICTION, ORIGINAL OR FANDOM, FOR MINIMUM $5

OR, FOR MINIMUM $2, I'LL GIFT A THANK YOU SKETCH OR DRAWING

WILL REBLOG WITH SAMPLES WHEN I GET HOME

ko-fi

c-app: purple0925

vmo/pp: hbm0925

38 notes

·

View notes

Text

got paid in cash for the funeral i did last week including a £50 note… i have HANDLED many in my time working retail but i’ve never actually had one all of me own…… please read that last bit in a victorian orphan voice

#i feel so ludicrously rich even though it’s going to 1) immediately get paid into my bank account#and 2) immediately be paid out for rent leaving me in my overdraft 😭

62 notes

·

View notes

Text

hello!!! i was able to get all my bills paid for this month without overdrafting my bank account, which is amazing 🥹 but my rent is coming up and due on the first, i only have $5 in my bank account but i need $750 to pay rent 😭😭😭 im working my ass off on comms in the coming weeks, if anyone is interested in getting one in the meantime im extremely open! $80 for a single character and $120 for two characters!

and if you cant afford that and just want to throw a few bucks at me that's much appreciated too!!! anything helps at all, anything will help me not be severely overdrafted before my next (very small) paycheck hits on the first of january!

im still on the job hunt and nothing has turned out so far unfortunately :( commissions are my main source of income for the time being since the job market is in shambles

pp: paypal.me/bewearrr

vnm: tobias_leviathan

0/750

#i know im not gonna be able to get my ENTIRE rent but if im able to get more than half of it i'd feel a lot safer than i do now#last month i had to Severely overdraft my bank account and i lost a whole $700 paycheck to it and i was fucked for the rest of the month#but i pulled myself out of THAT hole... i think i could do it again#comms have been going smoothly and ive been trying my best to finish them in a timely manner#i have a bunch from earlier this year as well as some YCH slots ive been banging out#its been nice doing art more frequently tbh ive been enjoying it#i have one im Almost finished with it took me so long bc there were 3 versions of the image but im finishing that today#and then onto the next one!!#my bf bought me tickets to a concert this past weekend so i was doing that and lost a few days of working time since we had to travel for it#but it was nice to get out of the house and attend an Event with someone i love dearly that was refreshing to my soul

59 notes

·

View notes

Text

I missed heavypaint so much thank you webbypaint as laggy and battery draining as you are <3 second image based on these thoughts, but my canvas got wiped before I finished Stress' one 😔

#when I have the courage (not in overdraft) I will get myself a heavypaint license......#heavypaint blur texture my everythiiiiiing it's sooo pretty#ethoslab#bdoubleo100#impulse is there but he's just a little aggie doodle so i will not tag him#hermitcraft#art out the oven

387 notes

·

View notes

Text

checking my bank account is literally an act of self harm

23 notes

·

View notes