#p60 request

Text

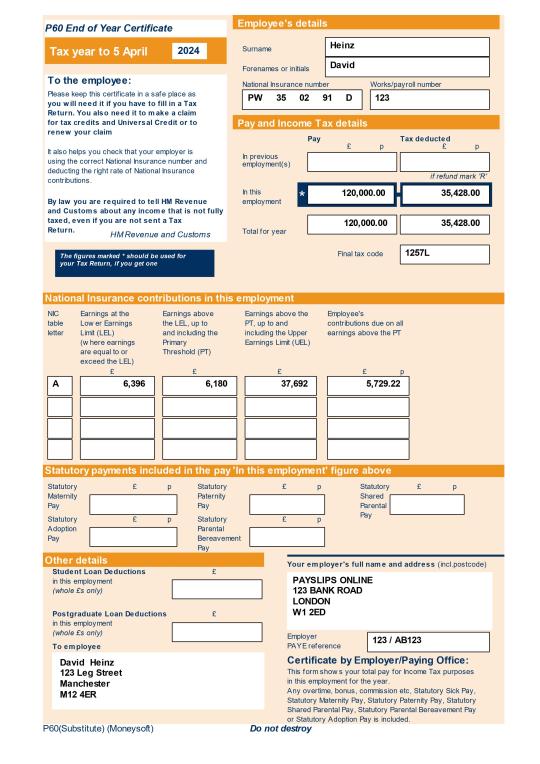

Replacement payslips

Payslips Plus, based in the UK, offers cutting-edge replacement payslips services, streamlining payroll processes for businesses. With a commitment to accuracy and efficiency, Payslips Plus ensures that companies receive top-notch replacement payslips tailored to their specific needs. The company leverages advanced technology to generate detailed and compliant payslips, providing a hassle-free solution for employers and employees alike. Whether it’s due to lost documents or the need for duplicates, Payslips Plus is a reliable partner, delivering prompt and secure replacement payslips to businesses across the United Kingdom, reinforcing its reputation as a trusted and innovative payroll service provider

1 note

·

View note

Text

Attention UK Employees! 🇬🇧 Time to order your new P60 online! The financial year 2023-24 ends on April 5, 2024. Don't miss out! Follow these simple steps:

1️⃣ Visit Payslips Online official website. Order P60 Online UK

2️⃣ Create or Login your account

3️⃣ Navigate to the P60 section.

4️⃣ Follow the instructions to order your new P60.

5️⃣ Verify and submit your request.

Stay organized with your taxes!

1 note

·

View note

Text

村上春樹・ノルウェイの森(下)

all vocabulary, misc grammar

p5

分泌 - secretion

定規 - measuring ruler

p6

経理 - accounting, administrating of money

p8

一房 - one tuft (of hair, threads), one bunch (of grapes)

良い面を引き出す - bring out the good in people

p12

見抜く - see through

体系化 - systematization, organization

p14

犠牲者 - victim, casualty

p18

ほろり - moved to tears

官能的 - sensual, arousing

亭主 - husband, household head

p20

筋金入り - hardcore, staunch, dyed-in-the-wool

淡白 - easygoing, indifferent to, not particular about

くすぐる - tickle

p22

こんがらがる - become entangled, complicated, caught up

奥行き - depth

見せつける - make a show of, flaunt

p24

感応 - responsiveness, sympathy

ごっこ - playing make-believe at something

ムズムズ - feel itchy, impatient

穢れ - unclean, impure, defiled

p26

科白 - セリフ

手につかない - unable to focus on (/preoccupied with something else)

p28

直談判 - direct talks / negotiation

p30

手配 - preparations

仕事の口 - job opening / offer

p32

びくびく - afraid, trembling, timid

p36

きびきび - brisk, lively, energetic

p38

雨合羽 - raincoat

どっさり - a lot, heaps, oodles, plenty

お見えになる - to arrive (尊敬語)

p40

評判 - reputation, popularity, rumor

惑星 - planet

p46

やましい - feeling guilty, having qualms about

p50

権威 - authority

p52

そそり立つ - rise steeply, tower

p54

海賊 - pirate, piracy

p56

通りがけ - in passing, along the way

p58

挑発 - provocative, arousal, stirring up

p60

制約 - limitation, restriction

淫乱 - lewd, wild, debauched, lascivious

p62

模擬 - mock (exam), imitation

仮定法 - subjunctive mood

系統的 - systematic

p64

形而上学 - metaphysics

p66

インチキ - cheating, fraud, deception

庶民 - common / ordinary people

搾取 - exploit

革命 - revolution

産学協同体 - educational-industrial complex

へらへら - foolishly (laughing), thoughtlessly (talking)

p70

脳腫瘍 - brain tumor

深手を負う - to sustain a serious wound

p76

人妻 - another man’s wife

貪る - covet, desire, lust greedily

p78

ムチで - shamelessly

痰 - phlegm

消耗 - exhaustion, consumption

p80

ごった返す - be in confusion, commotion, turmoil, crowded

p84

寸暇 - free minute, moment’s leisure

p90

にっちもさっちもいかない - being driven into a corner, caught between a rock and a hard place

原理 - principle, theory

p92

しびん - bedpan

p94

錯綜 - complicated, intricacy, entangled

p96

ぼつぼつ - gradually, little by little

p98

瓦 - roof tile

p100

手相 - palm reading

点滴 - intravenous drip

p104

ねじを巻く - to make (someone) shape up, give (someone) a good prodding

p106

やるせない - miserable, wretched, having no solace from

p110

内省的 - introspective

純粋 - pure, genuine, unmixed

p114

あくせく - busily, feverishly, laboriously, fussily, worrying about

p116

沼 - marsh, swamp

p118

ちゃらちゃら - chatty, flashy, flirty, noisy, superficial

込み入る - be complicated, elaborate

p124

渇き - thirst, craving

p126

竪穴 - pit, shaft

~なくたって - even if / though

p130

あつらえる - made to order / fit / suit well

p132

憧憬 - longing, yearning

無垢 - pure, innocent

倦怠期 - period of ennui (esp in married life), rut

p142

ナメクジ - slug

p144

衣裳 - clothing, garments

p148

中枢 - central / center

ふやける - to swell up by absorbing liquid

p152

かげぐち - malicious gossip

p156

険悪 - perilous, volatile, stormy

偏狭 - narrow-minded

p158

監禁 - confinement

いたぶる - torment, tease, harass, shake down for money

逐一 - one by one, minute, in detail

屈折 - warping, distorting (of feelings, logic)

p160

擬音 - imitative sound

往復 - round-trip, coming and going

あえぐ - gasp, pant, breathe hard

すがすがしい - refreshing, brisk (air)

p162

分別くさい - prudent-looking, judgement

p166

聞き届ける - to grant / comply with (a request)

p168

腰抜かす - dislocate one’s back, unable to stand due to fear, surprise etc.

p170

しっぽり - affectionately, fondly, drenched

高揚 - elevation (of spirits), raising (morale)

p176

睥睨 - glaring / scowling at

くれぐれも - sincerely, wholeheartedly, repeatedly

娯楽 - amusement

p180

ぬかるみ - quagmire, sludge, mud

ねばり - sticky, viscous, tenacity

感興 - interest, fun, inspiration

売却 - selling off, disposal by sale

p184

細工 - handiwork, craftsmanship

楽天 - optimistic

p186

終止符を打つ - put a stop / end to

こぜりあい - skirmish, small fight

ぴりぴり - nervous, tense, on edge

手頃 - handy, suitable, convenient, reasonable

相場 - market price

p188

思惑 - expectation, purpose, motive

p190

雑貨 - miscellaneous goods

p192

一膳飯屋 - diner, inexpensive and simple restaurant

p194

熊手 - rake

納屋 - barn

p196

錆 - rust

ニス - varnish

弦 - bowstring, string of a musical instrument

接着剤 - glue

p198

かすむ - become misty, blurry, overshadowed

p200

ほんのり - slightly, faintly

爛れる - inflamed, fester

疼く - throb / sting with pain

うんと - a great deal, with a great amount of effort, very much

おあいこ - quits, even, square

p202

弛緩 - relaxation (of muscles), flaccid

腰を据える - settle down and deal with something, concentrate all of one’s energy on

適応 - accommodate

p204

士気 - morale

p206

寛容 - open-mindedness, tolerance

寝かしつける - to lull / put someone to sleep

p208

どんでん返し - sudden complete reversal / plot twist

間取り - layout, house plan

当てずっぽう - random guess, shot in the dark

p210

内ゲバ - violence within a student sect, internal strife

とりとめのない - incoherence

~ともなく - do something without particular intention (unconsciously)

前略 - dispensing with the preliminaries, omitting the previous part

p218

歯を食いしばる - bite down, clench one’s teeth

気長 - patient, leisurely, unhurried

後手後手 - too late, behind with everything

p224

まんべんなく - equally, uniformly, all over, all around

p226

無沙汰 - not writing / calling for a long time, negligence

見本 - sample, specimen, model, example

綿密 - minute, detailed, scrupulous

点検 - detailed inspection

目にかかる - to be recognized, seen (by someone of higher status)

p228

散策 - walking, strolling

荒涼 - desolate, dreary, bleak

p232

大安売り - special bargain sale

p234

床屋 - barber shop

p242

手付かず - untouched, unused, intact

p244

ひっくるめる - take all things into account / consideration

分度器 - protractor

p248

一握り - a small amount, handful

当分 - for a while from now, for the time being

封切る - to release (a film)

当座 - for the time being

p250

こける - become hollow, scrawny

砂浜 - sandy beach

流木 - driftwood

あぶる - to toast, grill

棺 - coffin

順応 - acclimate, adapt

こ���開ける - to wrench open, pick a lock

奔出 - gushing out

p252

潮 - tide, current

和む - to be softened, calm down

諦観 - clear insight, resignation (to one’s fate), acceptance

予期せぬ - unexpected, unforeseen

p254

際限 - limits, ends, bounds

轟音 - thunderous roar

p256

振り返す - to wave back

穢れ - uncleanliness, disgrace, shame

p258

鎧戸 - slatted shutter, louvre door / window

博物館 - museum

p264

突き抜ける - to pierce through

p266

功 - merit

p274

しらみつぶし - very thorough search

p276

甥 - nephew

無一文 - penniless, broke

p278

ぶっきら棒 - curt, blunt, brusque

p280

一服 - a puff, dose, short rest

p282

棺桶 - coffin, casket

0 notes

Text

Where Do I Get My P60 Ireland – What Is A P60 Form

How do I get my P60

In Ireland, your P60 form is typically provided by your employer at the end of the tax year. The P60 is a statement of your annual pay and the tax deducted from it. It contains details of your total pay, deductions, and contributions for the tax year (January 1st to December 31st).

Your employer is responsible for generating and issuing the P60 form to you. They usually distribute P60s to their employees by the end of February following the end of the tax year. For instance, for the tax year ending on December 31st, 2022, your employer should provide your P60 by the end of February 2023.

If you have not received your P60 from your employer by this time, you should contact them directly to request it. They are obliged to provide this document to you, as it’s important for various purposes, such as filing your tax return, applying for loans or mortgages, or verifying income for certain benefits or visas.

Remember that your P60 is a crucial document for verifying your earnings and tax contributions, so it’s advisable to keep it in a safe place for reference when needed.

Income Documentation: The P60 serves as an official record of your total income, including salary, bonuses, and other benefits, for the entire tax year.

Taxation Information: The P60 form provides details about the income tax, Universal Social Charge (USC), and Pay Related Social Insurance (PRSI) contributions deducted from your salary during the tax year. This information is essential for understanding your tax liabilities.

Tax Refunds: If you are entitled to a tax refund, the information on your P60 is crucial for calculating the amount you may be owed. This could be due to overpaid taxes or eligible tax credits.

Financial Planning: The P60 form is a valuable document for financial planning purposes. It helps you assess your annual income and tax contributions, aiding in budgeting and future financial planning.

Proof of Income: The P60 can serve as proof of income for various purposes, such as when applying for loans, mortgages, or other financial products. Lenders often request proof of income to assess your financial stability.

Social Welfare Entitlements: The P60 may be required when applying for certain social welfare benefits or allowances. It verifies your income and tax contributions, ensuring accurate assessment of your eligibility for specific benefits.

Employment Verification: The P60 form provides a summary of your employment details, including your employer’s name and registration number. This information can be useful for employment verification purposes.

Tax Compliance: Holding a P60 demonstrates that your employer has complied with tax regulations by providing you with a statement of your income and deductions.

References content:

https://osservi.ie/where-do-i-get-my-p60-ireland-what-is-a-p60-form/

0 notes

Text

can i get a copy of my p60 from hmrc:

If you need a copy of your P60 from HMRC (Her Majesty's Revenue and Customs), you can request it through their official channels. Typically, employers provide P60 forms at the end of the tax year, summarizing your earnings and deductions. If you've misplaced yours, contact your employer first. If they are unable to assist, reach out to HMRC directly for a duplicate copy. Ensure you have necessary details such as your National Insurance number and personal information when making the request. HMRC's website or helpline can guide you through the process of obtaining a replacement P60 for your tax records.

#HMRC

#payslip

#P60

0 notes

Text

replacement p60

I am writing to request a replacement P60 for the tax year [Year] from your company, Payslips-Plus. I am currently located in the United Kingdom.

I require the replacement P60 for [Reason: e.g., tax filing, financial records, etc.]. Unfortunately, I have misplaced or lost the original document and now need a copy for my records.

Could you please assist me in obtaining a replacement P60? If there are any fees associated with this service, kindly let me know the amount and the preferred payment method.

Please provide the replacement P60 as soon as possible, as I require it for official purposes. If there are any forms or documents that I need to fill out or provide, please inform me, and I will promptly complete the necessary steps.

Thank you for your attention to this matter. I look forward to your prompt response.

0 notes

Text

Huawei confirms global release date for new P60 Pro, Mate X3 and Watch Ultimate devices

Huawei confirms global release date for new P60 Pro, Mate X3 and Watch Ultimate devices, Huawei has just announced a series of new devices. Specifically, the company introduced three P60 series smartphones, the Mate X3, Watch Ultimate, and TalkBand B7, along with a few new…, 2023-03-25 10:36:00,

Sorry we could not find the requested page on Notebookcheck.net. Please try to locate the requested…

View On WordPress

0 notes

Text

Captain America Jill Valentine headcanons.

AU where the MCU and Resident Evil are in the same universe resulting in a timeline where Jill became Cap instead of Walker.

She’s really protective over the shield and doesn’t want to use it on humans.

Jill and Bucky Barnes at first didn’t get along since the BSAA and the government chose Jill since she took on otherworldly threats and is also a super soldier due to the P60 in her but as the weeks went by, it felt like having Steve again for him.

Unlike Walker, she’s more focused and laser-like and treats the role of Cap more than just some superhero title. She is flattered at the action figures made for her though.

She met Isaiah Bradley who was surprised that they made a woman Captain America and she explained why. The two bonded together cause they’re both super soldiers and were experimented on by the government and Wesker. Jill later requested to have an exhibit and a statue for Isaiah with Jill having one detailing the events of her career.

Jill doesn’t like wearing a helmet over her head at all, she’s been wondering if she should get a beret or a cap to complete the outfit.

When she found out what Chris did in RE8, she was so close to caving the shield into his chest for that but realized what really happened.

Bucky and Sam were worried since Jill has an SMG but the line of her work means she’s gotta need something that can kill zombies or mutants.

She definitely does the PSA’s and her acting can sometimes be stilted and fake too.

#resident evil#crossover#jill valentine#marvel#mcu#sam wilson#bucky barnes#isaiah bradley#captain america#Chris Redfield

11 notes

·

View notes

Text

Such a pain in the dick to request a refund of my overpaid tax all because my previous job didn’t send me a copy of my P60

like, how do you just not send a p60???

2 notes

·

View notes

Note

Hi, I just changed my name via deedpoll in Scotland and I'm getting super overwhelmed with changing my details and don't really know where to start. I've told mt bank and they will be sending me out a new card etc, and told my doctors. I tried to get a passport but they need a drivers licence as one of the proof documents, but when i went to get my drivers licence it asked for a passport, or a bunch of other stuff I don't have. Do you or anyone has advice on where to continue with all this?

As far as I’m aware the only reason that the passport office request driving licences is as proof that you are using your new name. There are other documents that you could use instead of this, such as:

Tax record, e.g. a letter from a tax authority

National identity card or equivalent

Employment record, e.g. an official letter fromyour employer

Visa or residence permit

Educational record eg a school report

Letter sent to you from a central, regional orlocal government department

Medical/health card

Voter’s card

Bank statement

Baptism/Confirmation certificate

You say that you’ve changed your details with your bank, so once you get your new card then you should be able to request a bank statement from them in your new name, so that’s an alternative which should be fairly simple to obtain. Another alternative would be updating your details with HMRC and requesting confirmation that this has been done.

For your driving licence, if you already have a driving licence/provisional then you just need to send your deed poll and a D1 form. If you’re also applying for your provisional then you will need to send proof of identity documents as well. If you have a passport then you can use this, even if it’s in the wrong name (just send your deed poll as well).

If you don’t have a passport then you will need to send your birth certficate and one of these documents:

National Insurance card or a letter from the Department for Work and Pensions (DWP) showing your National Insurance number

photocopy of the front page of a benefits book or an original benefits claim letter

P45, P60 or pay slip

marriage certificate or divorce papers (decree nisi or absolute)

a gender recognition certificate

college or university union card, education certificate or PASS proof of age card (issued after June 2014)

Again, these documents don’t need to be in your new name as long as you also send a deed poll. Contacting HMRC and asking for proof of your National Insurance number would be one of the simplest ways of getting one of these documents if you don’t have any.

In terms of changing your name in general, it might help you to write a list of all the places you can think of that you need to update your name (this website has a list which might be a good starting place, although not all might be applicable to you), and tick them off as you go.

~ Alex

27 notes

·

View notes

Text

How to Complete A Company Director Self Assessment Tax Return

New Post has been published on https://www.fastaccountant.co.uk/director-self-assessment/

How to Complete A Company Director Self Assessment Tax Return

If you’re a director of a company and wondering if you need to file a tax return, good news! The HMRC has recently clarified its guidance on the matter. According to the updated guidance, if all of a director’s income is taxed at source and there is no further tax to pay, they do not have to register for and file a self-assessment return. This is particularly relevant for directors who are taxed under PAYE. However, if a director receives a notice to file a return and has no other taxable income to report, they can request for the notice to be withdrawn. It’s important to comply with these guidelines, as late filing penalties may apply. This article is all about completing and submitting company director self assessment tax return by those who are required to do so.

Register as a director

Registration with HMRC is the first step in completing your company director self assessment tax return. As a director, you are most likely to be required to register for self assessment if you have any other taxable income (besides your PAYE income) or if you receive a notice to file a tax return.

To register for director self assessment, you will need to notify HMRC that you are now a director by filling out Form SA1. This can be done online through the HMRC website or by calling their helpline. Once you have registered, you will receive a Unique Taxpayer Reference (UTR) number, which is a unique identifier for your tax affairs.

It is important to keep track of important deadlines related to your self-employment, such as the deadline for submitting your tax return and making any necessary payments. Failure to meet these deadlines can result in penalties, so it is crucial to stay organized and keep track of all relevant dates.

Gather Relevant Information for your director self assessment

Before you can start completing your director’s self-assessment tax return, you will need to gather all the relevant information. This includes collecting your personal information, such as your National Insurance number and UTR number, as well as your company’s name and PAYE reference number.

To accurately report your income and expenses, you will need to obtain documentation for all sources of income and expenses. This can include bank statements, dividend vouchers, and any other relevant financial documents. It is important to keep thorough records and retain these documents for future reference.

Additionally, you should accumulate any relevant tax forms, such as P60s or P11Ds, which provide information about your employment and taxable benefits. These forms will help ensure that you accurately report all income and claim any eligible allowances and deductions.

youtube

Calculate Director’s Income

Calculating your director’s income is a crucial step in completing your director self assessment tax return. Start by determining your salary from the company. This includes any regular payments you receive as a director, such as a salary or directors’ fees and bonuses.

Next, consider any other sources of income you have that need to be included in your tax return. This can include income from rental properties, investments, or freelance work outside of your director role. It is important to account for all sources of income to ensure accurate reporting.

Additionally, consider any taxable benefits you may have received as a director. This can include benefits such as a company car, medical insurance, or accommodations. These benefits are subject to taxation and must be included in your tax return.

Compile Director’s Expenses

Identifying and organizing your expenses as a director is an essential step in completing your self-assessment tax return. Start by identifying which expenses are allowable deductions according to HMRC guidelines. Allowable expenses are those that are incurred solely for business purposes and are necessary for carrying out your duties as a director.

Organize and categorize your expenses to make the process of reporting them in your tax return easier. Common categories for director’s expenses include travel and accommodation, office supplies, professional development, and subscriptions to professional bodies. Be sure to properly allocate each expense to the correct category for accurate reporting.

It is important to obtain proof of your expenses, such as receipts or invoices, to substantiate your claims. This documentation will serve as evidence in case of an investigation by HMRC, so make sure to keep accurate records and retain these documents for a minimum of six years.

Calculate the total deductible amount by adding up all the allowable expenses. This will help reduce your taxable income and potentially lower your tax liabilities.

Declare Dividends

As a director, any dividends you receive are taxable and must be declared in your self-assessment tax return. Dividends are a share of a company’s profits distributed to its shareholders. If you are a shareholder as well as a director, you may receive them if the company is profitable.

To accurately report your dividend income, start by understanding how dividend taxation works. Dividends are subject to different tax rates compared to other types of income, such as salary or interest. It is important to calculate your dividend income correctly. Include your dividends in the tax return under the appropriate section, usually labelled “Additional Income.” This will ensure that your dividend income is properly accounted for and taxed accordingly.

Claim Allowances

Researching and claiming available tax allowances is another important step in completing your director self assessment tax return. Tax allowances are deductions that can be applied to reduce your taxable income and potentially lower your tax liabilities.

Start by researching the available tax allowances that you may be eligible for. Common allowances for directors include the Personal Allowance, which is the amount you can earn before you start paying income tax, and the Marriage Allowance, which allows married couples or civil partners to transfer a portion of their Personal Allowance to their partner.

Determine your eligibility for each allowance and make sure to include them in the relevant sections of your tax return. Claiming the correct allowances can help reduce your overall tax liabilities.

Complete the Self-Assessment Form

Completing the self-assessment form is the core step in the process of filing your director’s tax return. Start by accessing the online tax return system provided by HMRC. This online platform allows you to complete and submit your tax return electronically, making the process faster and more convenient.

Enter your personal and company information accurately and provide all the necessary details of your income and expenses. Make sure to include any dividends, allowances, and additional income in their respective sections. Double-check your entries to ensure accuracy and completeness.

Use the additional information boxes if necessary. Depending on the complexity of your financial situation, you may need to complete additional information boxes to provide more detailed information or report certain types of income or expenses. These boxes can be found in many sections of the online tax return system.

Reviewing and Double-Checking

Thoroughly reviewing your completed tax return is crucial to ensure accuracy and avoid any mistakes or omissions. Take the time to go through each section and cross-check the information for accuracy. Check for missing or inaccurate details, such as incorrect figures or overlooked income or expenses.

Double-check that all income has been declared and that all allowable expenses have been accounted for. Look for any inconsistencies or errors that may trigger an alert from HMRC and potentially lead to penalties or further investigations.

It is also a good practice to compare your current tax return with the previous year’s return to identify any significant changes or discrepancies in your financial situation. This will help you ensure that your tax return is consistent over time and that all relevant information has been included.

Submitting the Tax Return

Once you have thoroughly reviewed and double-checked your tax return, it is time to submit it to HMRC. If you are using the online tax return system, you can submit your return electronically with just a few clicks.

Make sure to submit your tax return before the deadline to avoid penalties. January 31, is the deadline for submitting your company director self assessment tax return. Late filing can result in financial penalties, so it is important to meet the deadline and file your return on time.

Upon submission, you will receive an email confirmation from HMRC. Keep this confirmation for your records as proof that you have filed your tax return. It is also advisable to retain a copy of your tax return and any supporting documentation for future reference or in case of a HMRC investigation.

Keeping Records

Maintaining accurate financial records is essential for successfully completing your director’s self-assessment tax return. Keep organized and store all important documents, such as bank statements, receipts, tax forms, and business-related records. This will ensure that you have the necessary documentation to support your claims and comply with HMRC regulations.

Organize your records systematically, such as by year or category, to make retrieval and referencing easier. Digital record-keeping can be a convenient option, as it allows for easy search and retrieval of documents. However, make sure to keep backups of your digital records to prevent any loss of data.

Retain your financial records for a minimum of six years. HMRC has the right to review your tax affairs within this time period, so it is important to keep your records accessible and in good order. Failure to provide accurate records when requested by HMRC can result in financial penalties or further investigations.

In cases where the completion of your company director self assessment tax return becomes complex or overwhelming, seeking professional help may be necessary. Tax accountants or other financial professionals can assist you in properly completing and submitting your tax return, ensuring compliance with tax law and minimizing the risk of penalties or disputes.

In conclusion, completing your directors self-assessment tax return may seem like a daunting task, but by following the steps outlined in this article, you can navigate the process with confidence. Remember to register as an individual director, gather all relevant information, accurately calculate your income and expenses, and claim any eligible allowances. Complete the self-assessment form with care, thoroughly review all details, and submit it before the deadline. And finally, keep accurate financial records to satisfy HMRC requirements and ensure a smooth tax return process. By taking these steps and staying organized, you can fulfil your obligations as a director and maintain compliance with tax law.

#Complete the Director's Self-Assessment Tax Return#Director's Self-Assessment Tax Return#Steps to Complete the Director's Self-Assessment Tax Return

0 notes

Photo

What if You lose your #P60? You may request a duplicate from your #Employer, who should help with that request Alternatively you can order #Replacement P60 from UK's Top Payroll Company #PayslipsOnline order Replacement P60

0 notes

Text

Salt and Ice Bar Pop Up Features Lavishly Fresh Oysters and Craft Cocktails

There are so many new restaurants and bars around Metro Manila, but there’s never really been a dedicated oyster bar that features the best and freshest oysters the country has to offer. I used to visit a place called Hook by Todd English in Bonifacio Global City but that restaurant didn’t really last very long. Now, there’s a new hip oyster bar that is set to establish itself as the premiere place for “shuckingly awesome” oysters starting at only P50 each! Pair these with any of their signature craft cocktails and you are guaranteed to have a delightful evening.

Salt and Ice Bar is a new pop-up restaurant that you can find at the ground level of Uptown Parade in Uptown Bonifacio, BGC. This vibrant and busy area is where The Palace Manila and other trendy bars are located, so you can easily find yourself at Salt and Ice Bar for your pre-game or after-party drinks and bites. The pop up is open this December on Tuesdays to Sundays from 5:00pm to 2:00am, but it is planning to have its official launch next February 2022.

My friends and I dropped by Salt and Ice Bar early last week to try their specialty oysters and cocktails. The restaurant is right across Uptown Mall, just below the pedestrian bridgeway linking it to Uptown Parade.

The interiors inside Salt and Ice Bar are hip and colorful with a relaxing casual vibe. The restaurant is owned and operated by Visum Ventures, the same group that gave us Koomi, ZIG, and Oh My Greek so this is another exciting concept that will surely get everyone talking. Since it is just a pop-up for now, they are planning to renovate and upgrade the interiors next month in time for their grand opening.

We started with a few of their craft cocktails like the Eternal Rose (P470). This smoky and colorful beverage comes with a combination of gin, rose syrup, lemon, and passion fruit. I really loved this sweet cocktail especially with its cool presentation.

I also got to try their Makes Me Wonder (P430) cocktail with its Cazadores tequila, cucumber, pineapple, lime, and agave. The fruity combination makes this beverage a great starter before the oysters arrive.

The Aperol Sour is one specialty drink that is not even on the beverage menu. This is a refreshing off-menu cocktail that your can ask from the bartender. If you have other favorites, you can also go ahead and request these from the servers who will try their best to prepare it for you.

Salt and Ice Bar takes pride in its selection of fresh Aklan oysters. You can get these freshly shucked Natural Oysters for only P50 each. That means the entire table can have all the oysters they want.

Aside from just fresh oysters, there are several other ways to enjoy these delicious seafood delicacies. Oyster Kilpatrick (P60/pc) is an Australian recipe where the oysters are cooked and topped with bacon and seasoned with Worcestershire sauce and tomato sauce.

You can also order the Oyster Tempura (P60/pc). This one is a Japanese version where the oysters are battered and deep fried before placing them back on the half shells. They are then topped with wasabi mayonnaise for a crunchy and tasty bite.

My favorite way of eating oysters is when they are baked with lots of oozing cheeese, so the Oyster Monray (P60/pc) was obviously the highlight of my evening. These baked oysters are so indulgent, especially when paired with their signature drinks.

In addition to the oysters, there are several other items you can order to accompany your evening. The Salt and Pepper Squid (P375) is a crunchy calamares dish that’s as good as any other bar chow.

Another winner at Salt and Ice Bar is the Sea Urchin Pasta (P525) with its creamy spaghetti topped with sea urchin and salmon roe. Take a look at that tempting piece of uni just waiting to be devoured.

The Singaporean Chili Prawns (P680) is also a great dish to have on the table with its fresh prawns lavishly cooked in chili and garlic. It actually would have been nice to have some rice with these prawns as they can really compare with the other Chinese and Singaporean restaurants in town.

If you can’t decide whether to get another main course or a dessert, then go for the Nutella Pizza (P575). This dessert pizza comes with an interesting medley of nutella, fresh strawberries, blueberries, and is sprinkled with pistachio dust.

Dark Chocolate Shards (P280) were also offered to cap off our early evening get-together. These dark chocolate strips come with almonds, dried cranberries, cacao nibs, and sea salt.

Salt and Ice Bar is sure to be the next big hit along Uptown Parade in Bonifacio Global City. We would like to thank John-Michael Hilton, President and CEO of Visum Ventures, for hosting us and for creating another exciting new concept where friends and family can enjoy the holidays. My husband and I are actually planning to go back soon before the year ends. Happy Holidays!

Salt and Ice Bar

G/F Uptown Parade, Uptown Bonifacio, BGC, Taguig

www.facebook.com/saltandicebarph

0 notes

Note

How would you get the evidence proving you've been living as a me for 2 years

Assuming you’re talking about evidence for a Gender Recognition Certificate, the official guidance gives the following list as suggestions:

Official documentation e.g. driving licence and passport;

Payslips or HM Revenue & Customs (HMRC) documents such as a P60 or P45;

Department of Work and Pensions or HMRC benefit or tax letters or documents;

Bank or other financial institution documents or statements;

Letters from official, professional or business organisations such as from solicitors, accountants, dentists, doctors, employers or letters from people who know you on a personal basis;

Utility bills;

Academic certificates or documentation;

Health Care or identity cards including photo ID issued by an official organisation.

In practice, most documents that give your name and a date will be suitable, although items from the above list are preferable where you can obtain them. Some of these are things which you might have kept, and you may be able to request previous copies of others (i.e. bank statements).

~ Alex

6 notes

·

View notes

Text

How to Replace a Lost P60 Certificate

New Post has been published on https://www.fastaccountant.co.uk/how-to-replace-a-lost-p60-certificate/

How to Replace a Lost P60 Certificate

If you’ve misplaced your P60 certificate and are unsure what to do, fear not! This article will guide you through the simple process of replacing your lost P60. Whether you’ve accidentally thrown it away or it has been misplaced during a move, we’ve got you covered. By following these easy steps, you’ll have a new copy of your lost P60 in no time, ensuring that you have all the necessary documentation for your financial records.

youtube

What is a P60 Certificate?

A P60 certificate is an important document that provides a summary of your earnings and the taxes you have paid throughout the tax year. It is issued by your employer at the end of each financial year (April 6th to April 5th) and is a vital record for various financial and legal purposes. The information on the P60 certificate is used to report your income to the HM Revenue and Customs (HMRC) and is often required when applying for loans, mortgages, or other financial arrangements.

Importance of P60 Certificate

The importance of having a P60 certificate cannot be overstated. This document verifies the income you have earned and the taxes you have paid during the tax year, providing proof of your earnings and tax contributions. It is a critical form of documentation required for various financial transactions and legal purposes. Whether you need to apply for a loan, file a self-assessment tax return, or provide proof of income for a new job or rental agreement, having a P60 certificate readily available is essential.

1. Contact Your Employer

If you have misplaced or lost your P60 certificate, the first step is to contact your employer. Whether you have simply misplaced it or never received one, reaching out to your employer is the initial course of action. They will be able to provide guidance on how to replace the lost P60 and may have recorded copies of it that can be reissued to you.

2. Request a Duplicate P60 Certificate

Once you have contacted your employer, inform them about your lost P60 certificate and request a duplicate copy. Most employers keep copies of P60 certificates for a certain period, usually up to seven years. They may be able to retrieve a duplicate copy from their records and provide it to you. Be sure to provide your full name, employee identification number, and any other relevant information to help expedite the process.

3. Provide Necessary Information

When requesting a replacement for lost P60 certificate, ensure that you provide all the necessary information to your employer. This includes your full name, employee identification number, national insurance number, and the tax year for which you require the duplicate certificate. Providing accurate details will assist your employer in locating the correct records and issuing a replacement for the lost P60 certificate promptly.

4. Wait for Processing

After you have requested a duplicate P60 certificate, it is important to be patient and allow your employer enough time to process your request. The time it takes to issue a duplicate P60 certificate may vary depending on the size of the company and their internal procedures. However, most employers strive to provide timely assistance to their employees, so you should receive the duplicate certificate within a reasonable timeframe.

5. Check with HM Revenue and Customs (HMRC)

If you have not received a duplicate P60 certificate from your employer or if your employer is unable to retrieve the document, it is recommended to check with HM Revenue and Customs (HMRC). The HMRC keeps records of all tax paid by individuals, and they may be able to provide you with the necessary information or guide you in the right direction. Contact their helpline or visit their official website for further assistance.

6. Reissue from HMRC

In certain circumstances, the HMRC can reissue a P60 certificate directly to you if your employer is unable to do so. This is usually done when there is a genuine reason for not being able to obtain the certificate from the employer. You will need to provide all the relevant details and explain the situation to the HMRC. They will assess your request and determine whether a reissued P60 certificate is appropriate.

7. Submit Application Online

In some cases, you might be able to submit an application for a replacement P60 certificate online. The HMRC offers various online services that allow individuals to access and manage their tax-related information conveniently. Check their website for any available online application options and follow the instructions provided. This method can save time and effort compared to traditional postal applications.

8. Seek Professional Assistance

If you have exhausted all the above options and still cannot obtain a duplicate or reissued P60 certificate, it may be necessary to seek professional assistance. Consult a tax adviser, accountant, or a qualified professional who specializes in tax matters. They can provide guidance and help you explore alternative solutions to obtain the necessary documentation or advise you on how to proceed without the P60 certificate, if possible.

In conclusion, losing or misplacing your P60 certificate can be a frustrating experience, considering its importance for various financial and legal purposes. However, there are steps you can take to rectify the situation. Start by contacting your employer and requesting a duplicate certificate, ensuring you provide all the necessary information. If this proves unsuccessful, check with the HM Revenue and Customs (HMRC) for further guidance or the possibility of a reissued certificate. Remember, seeking professional assistance is always an option if you are unable to obtain the necessary documentation through other means.

#employer#How to Replace a Lost P60 Certificate#Lost P60#Lost P60 Certificate#Replace a Lost P60 Certificate

0 notes