#quantitative easing

Explore tagged Tumblr posts

Text

For most of the time, politicians have ostensibly retreated into the pre-Keynesian view that governments should run like households and seek to ‘balance their books.’ And most of the media has tended to endorse this fallacy. But when it was obviously necessary to act to save the economy, for example after the Global Financial Crisis or during the height of the pandemic when much of the economy had to be shut down, governments suddenly remembered that they have the extraordinary power to create money. After the Global Financial Crisis, the government – via the Bank of England’s Quantitative Easing programme – created around £445 billion of new money to prevent a collapse in the banking system. During COVID, the government created around £450 billion more to prevent a collapse in household finances when people would otherwise have had no income. In total, during the 21st century, the government has created £895 billion of new money – when it had the will to do so. And the view from economists is supportive. The argument for government spending to pay for healthcare, save businesses from bankruptcy, create new jobs and prevent a climate apocalypse has been made by the proponents of Modern Monetary Theory, for example Stephanie Kelton in her book The Deficit Myth. This book explains in detail how money is created and shows that the idea that governments should – or even responsibly could – budget in the same way as a normal household is no more than (admittedly compelling) rhetoric. But politicians and the media have – by and large – reverted to the notion that the government finances constitute a brake on what can be done for the public good. And our government continues to rein-in public spending even though it is clear that most public services are struggling badly.

109 notes

·

View notes

Text

2008-Style Global Financial Crisis to Re-Emerge as QE Reaches Limit? (#S4A Livestream 105 Supplement)

youtube

#housing#housing crisis#economy#economics#quantitative easing#quantitative tightening#socialism#socialist#communism#communist#marxism#marxist#Youtube

3 notes

·

View notes

Text

"What? Who am i speaking to?"

"You need to stop quantitative easing!!"

"Wtf is that a cat??"

"Dont forgeeee ee e t" ššššpppsšsš

0 notes

Text

the actual debt graph of the united states

#the debt of the united states in trillions of dollars#quantitative easing#debt for life/life for debt

0 notes

Text

Goldin+Senneby, Quantitative Melencolia. Commissioned by the Whitworth, The University of Manchester. Courtesy of the artist and Nome, Berlin. Photo: Michael Pollard. More info

0 notes

Text

Quantitative Easing: An In-Depth Analysis of a Powerful Monetary Policy Tool

View On WordPress

1 note

·

View note

Text

All Taxation is theft.

Inflation is government theft.

Quantitative Easing is federal reserve theft.

Monetary policy not based on gold is theft.

259 notes

·

View notes

Text

I agree but I don't think tariffs are the best way to go about this.

I'm not saying the news is going to try to create a recession out of thin air while the market actually isn't doing that bad

I'm just saying that boomer retirement funds and real estate portfolios taking a hit doesn't seem to have an impact on the local economy

#its been that way for literally decades if not longer#stock market#economy#zombie companies#wall street has been propped up for far too long and its unsustainable#i feel like the better approach is to stop bailouts#stop quantitative easing#and stop tinkering with the interest rates#tariffs#wall street is not main street#corporatism#malinvestment

26 notes

·

View notes

Text

Given how China owns a huge amount of US treasury bonds they could sink this whole thing by dumping them en masse. Government bonds were the fix for 2008 (value of portfolios of investment funds collapsed after the housing market went down, meaning they couldn't support additional lending and businesses could not access capital (AKA a credit crunch); bonds are a bedrock for investment funds; govt printed quantitative easing money to buy bonds from investment funds, giving them an immediate cash injection and raising the value of the bonds, restoring the value of the portfolios; investing can resume and credit crunch resolved). China owns about $760bn of these (which is a small fraction of the $34tn in total but a sell off could have a domino effect).

27 notes

·

View notes

Text

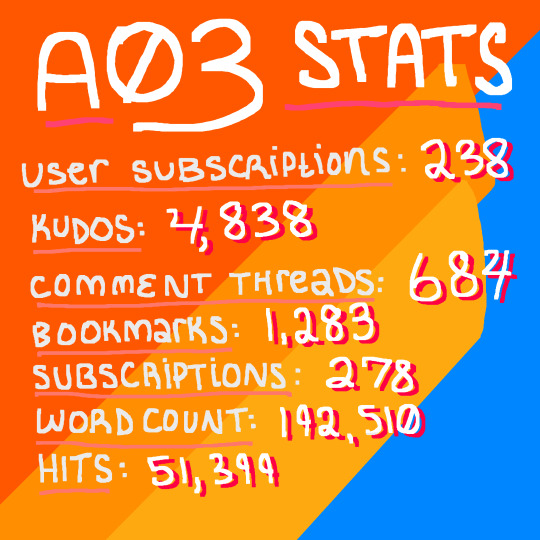

2024 wrapped ! fic writing year in review ! whatever you want to call it ! even though it's the beginning of december !

i was tagged by: No one! I am doing it: Anyway !

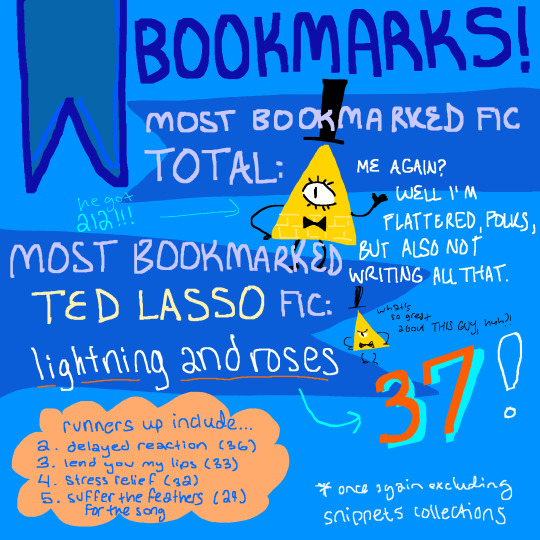

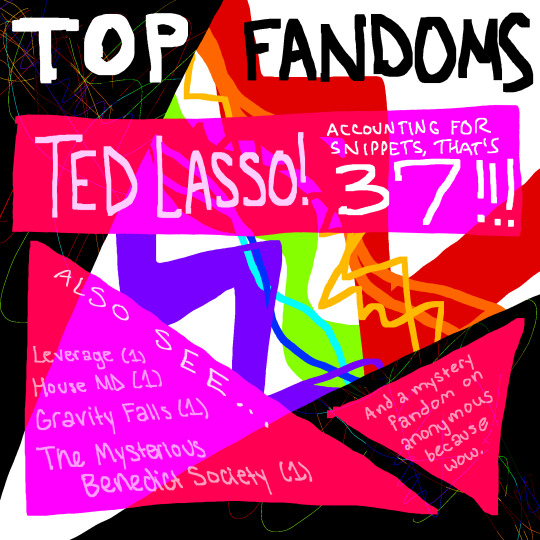

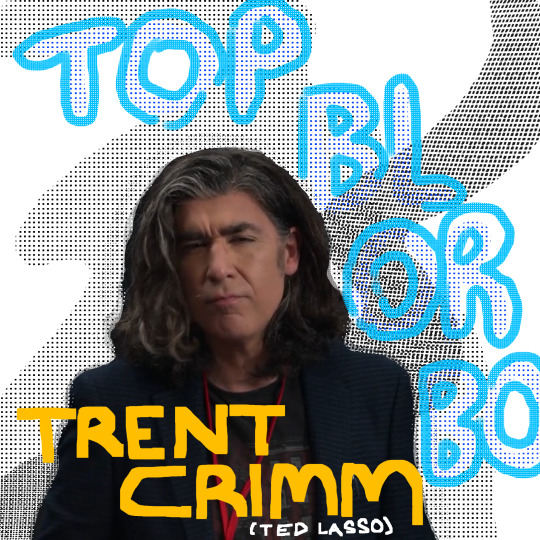

note for my post specifically: some stats have been manually adjusted to account for "collection" fics (which i've largely stopped doing, but are still part of the stats in 2024) that have different oneshots in each chapter but count as one "work" on ao3. i'm also going to focus on my trentcrimminallybeautiful pseud and ted lasso related works for 99 percent of the post.

i spent so much time on this. and why? why. i have no idea. i don't know why i did this. i don't even have spotify.

special thanks to @fade-in-the-dark, for our long, riveting conversations, and @medecineformelancholy, whose clever thoughts and kind words have fueled many a fic-writing session <3

tags/rules & links to all fics mentioned under the cut.

rules: fuck da rules. post whatever stats you want. ao3 stats recommended for ease, but anything from quantitative (top 5 most bookmarked fic, most commented fic, most kudos'd fic, etc.; how many kudos/comments/bookmarks you got this year, longest/shortest, number of user subscriptions, top fandom written for, , word count, whatever you like) to qualitative (favorite fic written, favorite comment received, best smut/angst/fluff fic written, fic that was hardest to write, etc, get creative) to a secret third thing. it doesn't even have to be fanfiction you can talk about original fiction if you want. just have fun with it man. you can do plain text or fun little graphics. then tag some people. yay

tagging: no pressure, and you absolutely do not have to do the same level as what i've done, because i don't know why i did it at all. i mean you're welcome to, but please don't feel like you have to. you don't even have to do it at all, man. just have fun if you want to. hell, if you see this and i've not tagged you but you wanna do it, this is me tagging you. tag me as if i tagged you normally by name. it's fine. do it. and if you're tagged here and you don't wanna or whatever don't worry about it. it's cool. no problem

anyway, tagging: @mvshortcut get over here you rascal. @oflightningandstars @writer-and-thrasher @plentyghosts @fade-in-the-dark @thehouseofgrey @vamplanaut

all fics mentioned:

countdown, baby!

delayed reaction

fall into you, sweet thing

hold me down

lend you my lips

lightning and roses

mea culpa

melt like this

moonlight madness

{ pair / pretty / play }

rainy days

reflections

secure

stress relief

suffer the feathers for the song

vita nova

snippets, which were largely excluded from stats because it'd be a lot of work untangling them from one work tbh:

ted lasso tumblr snippets 3 - 8 through 12 done in 2024.

ted lasso snippets 4 - all done in 2024.

e-rated ted lasso snippets - just the fourth one done in 2024.

non ted lasso fics:

Bill Cipher Calls a Temporary Truce for Girl's Night????????? and other notes that Ford will HATE to read in the Journal later - Gravity Falls

dreams of falling - House MD

key without a lock - The Mysterious Benedict Society

The Did Nate Just Kill A Guy?!?! Job - Leverage

#tedependent#tedtrent#ted x trent#long post#my writing#gertspeak#im gonna tag this:#gertwrapped#so you can block this post if you want to lmao#described#trent crimm#ted lasso#since the majority of the fics are those#tag games#tag game

24 notes

·

View notes

Text

you will never fucking BELIEVE what came up on the exam

i have the same lecturer for both development economics and macroeconomics and one thing about this man is he will yap about the 2008 financial crisis but has there been a single question on it in either module in so much as a mock exam? none to speak of. a girl can only write about subprime loans so many times before she begins to wonder what the point of it all is

#NO ONE MOVE. IS THIS REAL. ARE WE REALLY THIS BACK#OH MY FUCKING GOD IT WENT OKAY. IT ACTUALLY WENT OKAY. IM LOCKED IN#50 FUCKING MARKS FOR THE RECESSION AND QUANTITATIVE EASING. IM LOSING MY SHIT RN#IM STICKING MY TONGUE DOWN THIS MAN’S THROAT WHEN I CATCH HIM. THANK YOU KING#THERE IS JOY IN THIS WORLD AFTER ALL#AND NOW IM FREE OH MY GODDDD I CANT STOP SMILING#I DID IT I DID IT I DID IT!!!#time to get absolutely rat arsed#hella goes to uni

55 notes

·

View notes

Text

“Years of quantitative easing has fed an asset price bubble of monumental proportions… Since the banking system went belly up in the financial crisis of 2008-10, non-bank forms of finance have ballooned, and today account for around half of all UK and global financial sector assets.”

29 notes

·

View notes

Note

What's the best case scenario for these tariffs? What's the worst?

I'll start with the worst-case scenario because I'm a pessimist, and because it's more likely to happen.

Given what we see with the bond market and the dollar both going down, what we're seeing is capital flight, where investors seek safer markets that the US for their money. This is rather unprecedented in modern history - the US and T-Bills have always been seen as a safe haven for volatility, when investors are seeking ultimately small but safe returns. If investors start departing en masse, because Trump decides that he needs to renew his tariffs and he can't negotiate his trade deals, that would cause significant disruption to the US economy, likely sparking a recession or exacerbating one if there is already one in effect.

Given Trump's previous business history, what he would probably do first is seek a cheap bailout and order the Fed to buy T-Bills. This is called quantitative easing and is used as a tool to push capital into the US economy. Since that requires the printing of a lot of new money, that would probably provoke a large bump in inflation, further straining the economy, especially for those people who lose their jobs in a recession. That would cause the interest rate to spike, and then I imagine Trump would blame foreign interference attempting to create an economic crisis. This fits Trump's business habits to a T, he frequently tried to stiff his creditors, and I imagine he would probably do the same here, by annulling selective amounts of US debt, amounting to a sovereign default (given how often Trump declared bankruptcy in his career, this seems a natural state for him). This would cause widespread capital flight and probably knock the US off of its economic perch. I imagine he'd also warn his cadre so they could move their money out of US markets, leaving US investors primarily holding the bag, since it's already been shown that Congress will not punish any instance of insider trading.

The best case scenario is that Trump realizes that he's being very stupid and cancels the tariffs (predictably declaring victory and saying it was according to keikaku all along to sell it to the Fox News crowd). His business backers finally accept that he's full of crap and won't just cater to business and GDP growth like his first term and back out. That combined with the massive stove-touching that was his tariffs and their impact to 401(k)'s means that Trumps goes deeply underwater in the approval ratings and the US sees large protests demanding his resignation. The lost support translates into a hostile Congress that restrains him by legislature, and then when he inevitably tries to rule as an autocrat (or for another matter like contempt of court for his mass deporations), he gets impeached and convicted and leaves Vance (or more preferably, Mike Johnson since he is ultimately spineless and can be easily cowed by a hostile Congress) as a lame duck President who largely passes consensus bills. Since we're going full best-case scenario, the internet dredges up tweets by Bernie Sanders and Chris DeLuzio in support of tariffs and realize that they're the same type of snake-oil salesman and progressives take a massive hit in their popularity, especially on economic platforms, and allow more rational people to take the lead in crafting economic policy.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

11 notes

·

View notes

Text

thinking about it, i would argue that a kilogram of steel *is* heavier than a kilogram of feathers on the grounds that "heavy" is not just a quantitative measurement but a qualitative one. the average person considers something "heavy" in the context of human effort and expectation thereof! density and ease of handling are factors in whether an object that would be considered "heavy" both independently and in comparison.

so if you ever see the question phrased as which is "heavier," then the steel is a perfectly defendable answer. go forth, my friends, and be the pedant you deserve to have fun being

#hell there's even a bit of linguistic wiggle room if it's about 'weight'#for similar reasons#if it's 'mass' though. then yeah there's no question there

8 notes

·

View notes

Text

"dark neoliberal" jokes are always like "calm down liberal... its called quantitative easing"

6 notes

·

View notes

Text

BONUS PROMPT FOR @cartelheir bc i love vivi and wish to spoil:

↳ NONVERBAL MEMES ↳ [ nap ] for your muse to fall asleep against mine

Chishiya stares with BARELY concealed surprise as he feels Pat slump against him, burying her head against his shoulder. This doesn’t happen to Chishiya. People don’t so much as reach out to touch his shoulder or arm to pass by, let alone fall asleep against him. It’s like they can all see the void that he is, that there’s something wrong. He swallows down the bitter sensation that threatens to crawl out of his chest like ROT easing through cracks in the wall and focuses on the warmth and weight at his side. Pat is here and she’s fast asleep against him.

He doesn’t know what to do about that really. Does he stay? Does he try to move her to a more comfortable position? Wake her? He tosses the lattermost option out before the thought is even done. She’d looked exhausted even before she fell asleep, like what rest she had been getting had been stressful. He cranes his head a little bit to study her face. She looks PEACEFUL like this. Probably one of if not the most peaceful he’s seen her since – ever really. Certainly since they'd returned from the borderlands and since her husband was dead and seeking refuge with him. It’s strange to come to terms with the thought someone can look at him and feel safe enough to sleep. It’s also strange to come to terms with the thought he’d once asked her to not leave him as he bled out. Strange, but not bad.

Uncertainty ensures that each movement he makes is slow so as not to disturb her. He doesn’t have any reference for this situation. He’s never cuddled with someone, never fell asleep against his mom or had any friends. But he doesn’t want her uncomfortable now or later. He takes a very GRADUAL approach to shifting her off the sharp edge of his shoulder and towards the edge of his chest in front of the scapula, brown eyes focused as he makes sure not to wake her. She doesn’t wake, and he hesitates with a now semi-free arm. What does he do now? It makes him feel stupid, because no normal person would struggle with this. But HE does. Is he doing this right? Wrong? There’s no guide to tell him, no mathematical equation that offers a simple solution in the form of quantitative data.

He reaches down and gently pulls the blanket up further to keep her warm, head tilted to the side to keep track of her breathing and making sure he hasn’t woken her. It’s a TEMPORARY relief from the dilemma of what to do. It’s over too fast and leaves Chishiya right back where he started. Ever so slowly he lowers his hand, as if he’s afraid to get BURNED, until he’s gently resting an arm around her. The burning isn't quite imaginary though. It takes him a moment to realize that it's his lungs burning ; he has been holding his breath the whole time since he lowered his hand. It’s RIDICULOUS and he can’t help rolling his eyes at himself over how absurd he’d behaving. ( Except it's not that absurd, because this isn’t natural for him and it takes time to learn. ) She seems more comfortable like this at least so he takes that as a sign he did something right.

His free hand reaches for the remote and he turns off the television, plunging the living room into a comfortable darkness. It feels a bit better, where his struggles aren’t as OBVIOUS. He’s always hated failing, not being good enough at something. It’s never been something like this though ; only a skill he hadn’t yet learned or a branch of knowledge he’d never pursued. Not basic interactive skills. His mouth twitches slightly at the thought and he focuses instead on the steady breathing and peaceful quiet.

Maybe he should sleep too, but sleep didn’t feel anywhere near close to happening. His free hand lingers by his side before Chishiya lifts it to gently comb through her hair, chin hesitantly resting against the crown of her head. It’s REPLICATION – remembering what she’d done and mimicking it to the best he can. Tentative touch turns a bit more confident with time, more stable than the flighty feather-light nature of it before. It’s nice. It’s terrifying. He's not sure what he's going to do when she wakes up.

He turns his head to the side so his cheek rests against her head and watches the gradual change of night to morning through the blinds.

#cartelheir#stares at you#i maybe wrote a bit more than i intended HGJDGF#listen he just !! had a lot of thoughts and reflection#HES TRYING HIS BEST HERE#its okay no one can see how awkward he is#who needs sleep? not him#01. IN CHARACTER — CHISHIYA#V1. DEFAULT VERSE — CHISHIYA

20 notes

·

View notes