#social security tax

Text

By Thom Hartmann

Common Dreams

Nov. 16, 2023

What baffles me is why a TV news personality who earns $2.9 million a year would go to such lengths to avoid even mentioning a solution that’s been signed onto repeatedly by virtually every Democrat in Congress for over a decade.

Why did NBC’s Kristen Welker use an incomplete frame for her question about Social Security at last week’s GOP debate, and why didn’t Lester Holt or anybody else correct her?

Here’s her question:

KRISTEN WELKER: “Americans could see their Social Security benefits drastically cut in the next decade because the program is running out of money. Former President Trump has said quote, ‘Under no circumstances should Republicans cut entitlements.’ Governor Christie, first to you, you have proposed raising the retirement age for younger Americans. What would that age be specifically, and would you consider making any other reforms to Social Security?”

The simple reality is that if a person earns $160,200 a year or less, they pay a 6.2% tax on all of their income. In other words, a person making exactly $160,200 pays $9,932.40 (6.2%) in Social Security taxes.

If you earn $12,000 a year, $56,000 a year, $98,000 a year, or anything under $160,200 a year, you also pay 6.2 cents of tax toward Social Security on every single dollar you earn. If you made $10,000 last year, you pay $620 in Social Security taxes: 6.2 percent. Like the old saying about death and taxes, you can’t avoid it.

BUT those people who make over $160,200 a year pay absolutely nothing — no tax whatsoever — to fund Social Security on every dollar they earn over that amount. After Warren Buffett or Mark Zuckerberg or Jeff Bezos pay their $9,932.40 in Social Security taxes on that first $160,200 they took home on the first day of January, every other dollar they take home for the rest of the year is completely Social Security tax-free.

If somebody makes $1,602,000, for example, it would seem fair that, like every other American, they’d pay the same 6.2% ($99,324) in Social Security taxes. But, no: they only pay the $9,932.40 and after that they get to ride tax-free.

If somebody earned $16,020,000 it would seem fair that they’d pay the same 6.2% to support Social Security as 96 percent of Americans do, but no. Instead of paying $1,004,400 in taxes, they only pay $9,932.40.

Hedge fund guys who make a billion a year — yes, there are several of them — can certainly afford to pay 6.2% to keep Social Security solvent. At that rate, they’d be paying $62 million on a billion-dollar income in Social Security taxes as their fair share of maintaining America’s social contract.

But, because the tax rate is capped to “protect” the morbidly rich while sticking the rest of us with the full bill for Social Security, those titans of Wall Street pay the same $9,932.40 as the doctor who lives down the street from you and earns $160,200 a year.

This is, to use the economic technical term, nuts.

And, while every wealthy person in America knows all about this because it’s such a huge benefit to them, I’ll bet fewer than five percent of Americans know how this scam for the rich works. (I searched diligently, but couldn’t find a single survey that asked average folks if they knew about the cap.)

There is no other tax in America that works like this. Most have loopholes designed to promote specific socially desirable goals, like the deductibility of home mortgage interest or children, but no other tax is designed so that anybody earning over $160,200 is completely exempt and no longer has to pay a penny after their first nine thousand or so dollars.

And here’s where it gets really bizarre: if millionaires and billionaires paid the exact same 6.2% into Social Security that most of the rest of us do (and paid it on their investment income, which is also 100% exempt today), the program would not only be solvent for the next 75 years, but it would have so much extra cash that everybody on Social Security could get a significant raise in their monthly benefit payments.

But because America’s morbidly rich don’t want to pay their share for keeping Social Security solvent, Republicans are having a debate about how badly they can screw working class retirees.

They ask:

“Shall we cut the Social Security payments?”

“How about raising the retirement age from 67 (Reagan raised it from 65 to 67) to 70 or even 72?”

“Or maybe we should just hand the entire thing off to JPMorgan or Wells Fargo and let them run it, like we’re doing with Medicare? We could call it Social Security Advantage!”

“Or how about turning Social Security into a welfare program by ‘means testing’ it, so rich people can’t draw from it and every budget year it can become a political football for the GOP like food stamps or WIC?”

Responding to Welker’s severely incomplete question, Chris Christie hit all four:

GOVERNOR CHRISTIE: “Sure, and we have to deal with this problem. Now look, if we raise the retirement age a few years for folks that are in their thirties and forties, I have a son who’s in the audience tonight who’s 30 years old. If he can’t adjust to a few year increase in Social Security retirement age over the next 40 years, I got bigger problems with him than his Social Security payments.

“And the fact is we need to be realistic about this. There are only three things that go into determining whether Social Security can be solvent or not. Retirement age, eligibility for the program in general, and taxes. That’s it. We are already overtaxed in this country and we should not raise those taxes. But on eligibility also, I don’t know if out there tonight and if you’re watching Warren, I don’t know if Warren Buffett is collecting Social Security, but if he is, shame on you. You shouldn’t be taking the money.”

Christie was the only one of the five Republicans on the stage who even dared mention taxes.

Nikki Haley said:

“So first of all, any candidate that tells you that they’re not going to take on entitlements, is not being serious. Social Security will go bankrupt in 10 years, Medicare will go bankrupt in eight.”

Neither of those assertions are even remotely true, but, of course, this was a GOP debate. She continued:

“But for like my kids in their twenties, you go and you say we’re going to change the rules, you change the retirement age for them. Instead of cost of living increases, we should go to increases based on inflation. We should limit benefits on the wealthy.”

Her other solution, apropos of nothing, was to end government responsibility for Medicare and privatize the entire program by shutting down real Medicare and throwing us all to the tender mercies of the health insurance billionaires:

“And then expand Medicare Advantage plans. Seniors love that and let’s make sure we do that so that they can have more competition. That’s how we’ll deal with entitlement reform and that’s how we’ll start to pay down this debt.”

Ramaswamy’s answer was so incoherent and off-topic I won’t repeat it here. Suffice it to say he rambled on about the cost of foreign wars (Ukraine, Israel) “that many blood-thirsty members of both parties have a hunger for.” Apparently, Vivek doesn’t realize that Social Security isn’t part of our government’s overall budget but has its own segregated funds and trust fund.

Since it’s creation in 1935, Social Security never has and never will contribute to the budget deficit or influence any other kind of government spending.

Tim Scott said we should take a cue from Reagan, Bush, and Trump and just cut billionaires’ income taxes again because that does such a great job of stimulating the economy (not) and then claw back the inflation-based raises people on Social Security have received the past three years.

“Number two, you have to cut taxes. … So what we know is that the Laffer Curve still works, for the lower the tax, the higher the revenue. And finally, if we’re going to deal with it, we have to take our annual appropriations back to pre-2020, pre-COVID levels of spending, which would save us about a half a trillion dollars in the next budget window. By doing that, we deal with Social Security and our mandatory spending.”

DeSantis was equally incoherent, also refusing to answer the question about raising the retirement age and completely avoiding any mention of the sweetheart deal his billionaire donors get on their Social Security taxes. Instead, he said we needed to get inflation under control and stop Congress from “taking money from Social Security,” something Congress has never done and legally never will be able to do.

All this incoherence aside, Republicans appear to have a plan to deal with Social Security.

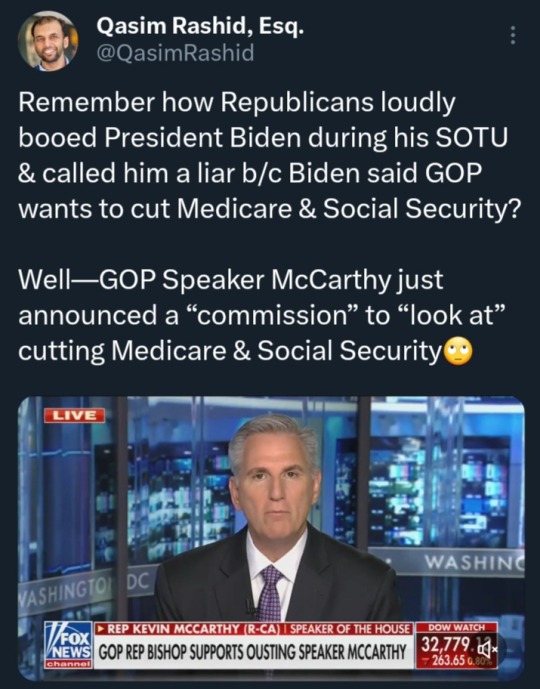

House Speaker MAGA Mike Johnson has been pushing a “Catfood Commission” just like Reagan’s 1983 commission that raised the retirement age to 67, reaffirmed the cap on taxes, and made Social Security checks taxable as income. He no doubt expects his commissioners will provide “recommendations” Republicans can run with to cut benefits without raising taxes on their billionaire donors, all while blaming it on the commissioners just like Reagan did in 1983.

When Johnson said that his “top priority” was creating such a commission “immediately” and that his Republican colleagues had responded to the idea “with great enthusiasm,” Democrats on the House Ways and Means Committee responded on Xitter:

“A week into his tenure, MAGA Mike Johnson is ALREADY calling for closed-door cuts to the Social Security and Medicare benefits American workers have earned through decades of hard work.”

But back to the original question. I understand why Republicans refuse to even consider lifting the cap on Social Security taxes so their morbidly rich donors won’t have to start paying their fair share of Social Security to keep the program solvent.

What baffles me is why a TV news personality who earns $2.9 million a year would go to such lengths to avoid even mentioning a solution that’s been signed onto repeatedly by virtually every Democrat in Congress for over a decade.

I’ve been watching Kristen Welker on television for years, and she’s generally been a pretty straight shooter as a reporter. Ditto for Lester Holt, who sat right beside her. This, frankly, astonished me.

Were they afraid Republicans would exact revenge on them if they raised the question of the tax cap?

Or was it precisely because they’re making millions, just like most of the executives they answer to?

More broadly, is this why we almost never hear any discussion whatsoever in the media — populated with other news stars who also make millions a year, managed by millionaire network executives — about lifting the cap?

One hopes the answer isn’t that crass...

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

#social security#social security tax#social safety net#republicans#republican party#corporate media#journalism#2024 presidential election

300 notes

·

View notes

Text

1K notes

·

View notes

Text

Tax the rich!

Be sure to follow us on all platforms!

Add Civic Cipher to your podcast favorites!

#civic cipher#fox news#cnn#global warming#climate activism#climate change#black lives matter#blm#defund the police#police brutality#police shooting#police chase#social security#congress#tax the rich#donald trump#trump#joe biden#Biden#ron desantis#conservative#conservatives#conservatism#liberals#liberal#liberalism#republican#republicans#republicanism#democrat

378 notes

·

View notes

Text

Social Security is class war, not intergenerational conflict

Today, Tor.com published my latest short story, "The Canadian Miracle," set in the world of my forthcoming (Nov 14) novel, The Lost Cause. I am serializing this one on my podcast! Here's part one.

The very instant the Social Security Act was passed in 1935, American conservatives (in both parties) began lobbying to destroy it. After all, a reserve army of forelock-tugging plebs and family retainers won't voluntarily assemble themselves – they need to be goaded into it by the threat of slowly starving to death in their dotage.

They're at it again (again). The oligarch-thinktank industrial complex has unleashed a torrent of scare stories about Social Security's imminent insolvency, rehearsing the same shopworn doom predictions that they've been repeating since the Nixonite billionaire cabinet member Peter G Peterson created a "foundation" to peddle his disinformation in 2008:

https://en.wikipedia.org/wiki/I.O.U.S.A.

Peterson's go-to tactic is convincing young people that all the Social Security money they're paying into the system will be gobbled up by already-wealthy old people, leaving nothing behind for them. Conservatives have been peddling this ditty since the 1930s, and they're still at it – in the pages of the New York Times, no less:

https://www.nytimes.com/2023/10/26/opinion/social-security-medicare-aging.html

The Times has become a veritable mouthpiece for this nonsense, publishing misleading and nonsensical charts and data to support the idea that millennials are losing a generational war to boomers, who will leave the cupboard bare:

https://www.nytimes.com/2023/10/27/opinion/aging-medicare-social-security.html

As Robert Kuttner writes for The American Prospect, this latest rhetorical assault on Social Security is timed to coincide with the ascension of the GOP House's new Speaker, Mike Johnson, who makes no secret of his intention to destroy Social Security:

https://prospect.org/economy/2023-10-31-debunking-latest-attack-social-security/

The GOP says it wants to destroy Social Security for two reasons: first, to promote "choice" by letting us provide for our own retirement by flushing even more of our savings into the rigged casino that is the stock market; and second, because America doesn't have enough dollars to feed and house the elderly.

But for the New York Times' audience, they've figured out how to launder this far-right nonsense through the language of social justice. Rather than condemning the impecunious olds for their moral failing to lay the correct bets in the stock market, Social Security's opponents paint the elderly as a gerontocratic elite, flush with cash that rightfully belongs to the young.

To support this conclusion, they throw around statistics about how house-rich the Boomers are, and how much consumption they can afford. But as Kuttner points out, the Boomers' real-estate wealth comes not from aggressive house-flipping, but from merely owning a place to live. America's housing bubble means that younger people can't afford this basic human necessity, but the answer to that isn't making old people homeless – it's providing a lot more housing, and banning housing speculation:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

It's true that older people are doing a lot of consumption spending – but the bulk of that spending isn't on cruises to Alaska to see the melting glaciers, it's on health care. Old people aren't luxuriating in their joint replacements and coronary bypasses. Calling this "consumption" is deliberately misleading.

But as Kuttner points out, there's another, more important point to be made about inequality in America – the most significant wealth gap in America is between workers and owners, not young people and old people. The "average" Boomer's net worth factors in the wealth of Warren Buffett and Donald Trump. Older renters are more rent-burdened and precarious than younger renters, and most older Americans have little to no retirement savings:

https://www.forbes.com/sites/teresaghilarducci/2023/10/28/the-new-york-times-greedy-geezer-myth/

Less than one percent of Social Security benefits go to millionaires – that's because the one percent constitute one percent of the population. It's right there in the name. The one percent are politically and economically important, but that's because they are low in numbers. Giving Social Security benefits to everyone over 65 will not result in a significant outlay to the ultra-wealthy, because there aren't many ultra-wealthy people in America. The problem of inequality isn't the expanding pool of rich people, it's the explosion of wealth for a contracting pool of rich people.

If conservatives were serious about limiting the grip of these "undeserving" Social Security recipients on our economy and its politics, they'd advocate for interitance taxes (which effectively don't exist in America), not the abolition of Social Security. The problem of wealth in America is that it is establishing permanent dynasties which are incompatible with social mobility. In other words, we have created a new hereditary aristocracy – and its corollary, a new hereditary peasantry:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Hereditary aristocracies are poisonous for lots of reasons, but one of the most pressing problems they present is political destabilization. American belief in democracy, the rule of law, and a national identity is q function of Americans' perception of fairness. If you think that your kids can't ever have a better life than you, if you think that the cops will lock you up for a crime for which a rich person would escape justice, then why obey the law? Why vote? Why not cheat and steal? Why not burn it all down?

The wealthy put a lot of energy into distracting us from this question. Just lately, they've cooked up a gigantic panic over a nonexistent wave of retail theft:

https://www.techdirt.com/2023/10/31/the-retail-theft-surge-that-isnt-report-says-crime-is-being-exaggerated-to-cover-up-other-retail-issues/

Meanwhile, the very real, non-imaginary, accelerating, multi-billion-dollar plague of wage theft is conspicuously missing from the public discourse, despite a total that dwarfs all retail theft in America by an order of magnitude:

https://fair.org/home/wage-theft-is-built-into-the-business-models-of-many-industries/

America does have a property crime crisis, but it's a crisis of wage-theft, not shoplifting. Likewise, America does have a retirement crisis: it's a crisis of inequality, not intergenerational conflict.

Social Security has been under sustained assault since its inception, and that's in large part due to a massive blunder on the part of FDR. Roosevelt believed that people would be more protective of Social Security if they thought it was funded by their taxes: "we bought it, it's ours." But – as FDR well knew – that's not how government spending works.

The US government can't run out of US dollars. The US government doesn't get its dollars for spending from your taxes. The US government spends money into existence and taxes it out of existence:

https://pluralistic.net/2020/12/14/situation-normal/#mmt

A moment's thought will reveal that it has to be this way. The US government (and its fiscal agents, chartered banks) are the only source of dollars. How can the US tax dollars away from earners unless it has first spent those dollars into the economy?

The point of taxation isn't to fund programs, it's to reduce the private sector's spending power so that there are things for sale to the public sector. If we only spent money into the economy but didn't take any out of the economy, the private sector would have so many dollars to spend that any time the government tried to buy something, there'd be a bidding war that would result in massive price spikes.

When a government runs a "balanced budget," that means that it has taxed as much out of the economy as it put into the economy at the start of the year. When a government runs a "surplus," that means it's left less money in the economy at the end of the year than there was at the beginning of the year. This is fine if the economy has contracted overall, but if the economy stayed constant or grew, that means there are fewer dollars chasing more goods and services, which leads to deflation and all kinds of toxic outcomes, like borrowing more bank-created money, which makes the finance sector richer and the real economy poorer.

Of course, most governments run "deficits" – which is another way of saying that they leave more dollars in the economy at the end of the year than there was at the start of the year, or, put another way, a deficit probably means that your economy got bigger, so it needed more dollars.

None of this means that governments can spend without limit. But it does mean that governments can buy anything that's for sale in their own currency. There are a lot of goods for sale in US dollars, both goods that are produced domestically and goods from abroad (this is why it's such a big deal that most of the world's oil is priced in dollars).

Governments do have to worry about getting into bidding wars with the private sector. To do that, governments come up with ways of reducing the private sector's spending power. One way to do that is taxes – just taking money away from us at the end of the year and annihilating it. Another way is to ration goods – think of WWII, or the direct economic interventions during the covid lockdowns. A third way is to sell bonds, which is just a roundabout way of getting us to promise not to spend some of our dollars for a while, in return for a smaller number of dollars in interest payments:

https://pluralistic.net/2021/04/08/howard-dino/#payfors

FDR knew all of this, but he still told the American people that their taxes were funding Social Security, thinking that this would protect the program. This backfired terribly. Today, Democrats have embraced the myth that taxes fund spending and join with their Republican counterparts in insisting that all spending must be accompanied by either taxes or cuts (AKA "payfors").

These Democrats voluntarily put their own policymaking powers in chains, refusing to take any action on behalf of the American people unless they can sell a tax increase or a budget cut. They insist that we can't have nice things until we make billionaires poor – which is the same as saying that we can't have nice things, period.

There are damned good reasons to make billionaires poor. The legitimacy of the American system is incompatible with the perception that wealth and power are fixed by birth, and that the rich and powerful don't have to play by the rules.

The capture of America's institutions – legislatures, courts, regulators – by the rich and powerful is a ghastly situation, and to reverse it, we'll need all the help we can get. Every hour that Americans spend worrying about their how they'll pay their rent, their medical bills, or their student loans is an hour lost to the fight against oligarchy and corruption.

In other words, it's not true that we can't have nice things until we get rid of billionaires – rather, we can't get rid of billionaires until we have nice things.

This is the premise of my next novel, The Lost Cause, which comes out on November 14; it's set in a world where care and solidarity have unleashed millions of people on the project of maintaining the habitability of our planet amidst the polycrisis:

https://us.macmillan.com/books/9781250865939/the-lost-cause

It's a fundamentally hopeful book, and it's already won praise from Naomi Klein, Rebecca Solnit, Bill McKibben and Kim Stanley Robinson. I wrote it while thinking through and researching these issues. Conservatives want us to think that we can't do better than this, that – to quote Margaret Thatcher – "there is no alternative." Replacing that narrative is critical to the kinds of mass mobilizations that our very survival depends on.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/intergenerational-warfare/#five-pound-blocks-of-cheese

This Saturday (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

#pluralistic#class war#inheritance tax#death tax#mmt#modern monetary theory#intergenerational war#intergenerational wealth transfers#social security#ss

352 notes

·

View notes

Text

2K notes

·

View notes

Photo

divorce selfie

#they married for taxes#genshin impact#dottore#pantalone#dottolone#they remarried for social security#they host a divorce party every year on their anniversary#i had to start the year strong with a shitpost#i was originally gonna make this like a seasons greetings card but i am never on time and will have to wait another year#wip#procrastination doodles

1K notes

·

View notes

Text

How is this real? We've been paying into social security with every paycheck and now orange blowhole thinks he's gonna cut our benefits? The fuck you say.

#restore 1950s tax brackets#tax the rich#tax the 1%#tax the billionaires#billionaires should not exist#vote democrat#vote blue#vote biden#democrats#democracy#social democracy#vote blue to save democracy#vote blue 2024#democratic socialism#democrats now socialism later#social security#biden/harris 2024

117 notes

·

View notes

Photo

#Kevin McCarthy#Medicare#Social Security#Republican#Republicans#GOP#MAGA#tax#taxes#welfare#military#defense#budget#veteran#veterans#healthcare#Medicaid#SNAP#Meals on Wheels#school lunch

340 notes

·

View notes

Text

x

#401(k)#savings#tax-advantaged retirement#bipartisan legislation#wealth gap#federal budget#financial industry#lobbying#retirement security#tax law#retirement savings#bipartisan#wealth disparities#federal deficit#financial services industry#tax-advantaged accounts#tax breaks#Congress#lobbyists#Social Security#Medicare

15 notes

·

View notes

Text

Nikki Haley intentionally contorts her positions in order to keep voters from knowing where she really stands.

Nobel economics laureate Paul Krugman in the New York Times had a good column about Haley this week.

So it seems worth looking at what Haley stands for.

From a political point of view, one answer might be: nothing. A recent Times profile described her as having “an ability to calibrate her message to the moment.” A less euphemistic way to put this is that she seems willing to say whatever might work to her political advantage. “Flip-flopping” doesn’t really convey the sheer cynicism with which she has shifted her rhetoric and changed her positions on everything from abortion rights to immigration to whether it’s OK to try overturning a national election.

And anyone hoping that she would govern as a moderate if she should somehow make it to the White House is surely delusional. Haley has never really shown a willingness to stand up to Republican extremists — and at this point the whole G.O.P. has been taken over by extremists.

We pointed out about 10 days ago that Haley is just as anti-abortion as the other GOP candidates. As president, she would appoint justices to the US Supreme Court just like the Republican justices who struck down Roe v. Wade.

She is consistently with the radical right when it comes to economics and income equality.

Haley has shown some consistency on issues of economic and fiscal policy. And what you should know is that her positions on these issues are pretty far to the right. In particular, she seems exceptionally explicit, even among would-be Republican nominees, in calling for an increase in the age at which Americans become eligible for Social Security — a bad idea that seems to be experiencing a revival.

Do you wish to end up having to support your parents because President Haley got a Republican Congress to raise the retirement age to 70?

Republicans say there's a funding gap when it comes to Social Security. But instead of raising the disproportionately low taxes paid by their billionaire donors, they want to slash benefits.

[T]he system would need additional revenue to continue paying scheduled benefits in full. But the extra revenue required would be smaller than you probably think. The most recent long-term projections from the Congressional Budget Office show Social Security outlays rising to 6.2 percent of gross domestic product in 2053 from 5.1 percent this year, not exactly an earth-shattering increase.

[ ... ]

Anyone who says, as Haley does, that the retirement age should rise in line with increasing life expectancy is being oblivious, perhaps willfully, to the grim inequality of modern America. Until Covid struck, average life expectancy at 65, the relevant number, was indeed rising. But these gains were concentrated among Americans with relatively high incomes. Less affluent Americans — those who depend most on Social Security — have seen little rise in life expectancy, and in some cases actual declines.

Not only would Haley not raise taxes on her billionaire buddies, she would cut them even further.

Haley, of course, wants to cut income taxes.

My guess is that none of this will be relevant, that Trump will be the nominee. But if he stumbles, I would beg political reporters not to focus on Haley’s personal affect, which can seem moderate, but rather on her policies. On social issues and the fate of democracy, she appears to be a pure weather vane, turning with the political winds. On fiscal and economic policy, she’s a hard-right advocate of tax cuts for the rich and benefit cuts for the working class.

The libertarian extremist Koch network has endorsed Nikki Haley. That's further proof that she's no moderate.

Koch family-backed PAC endorses Nikki Haley for president

Nikki Haley, a onetime member of the Trump administration, is little more than a more socially acceptable version of Trump. That does not make her moderate. She is to the right of George W. Bush who appointed Samuel Alito, the architect of the Dobbs v. Jackson Women’s Health Organization decision which killed Roe v. Wade, to the Supreme Court.

youtube

As Tara Setmayer indicated in that video, just saying that somebody is better than Trump is a very low bar. A snake could walk over that bar.

Don't confuse what Paul Krugman calls Nikki Haley's "personal effect" with her actual far right views. We're voting for a President, not Ms. Personality.

#nikki haley#nikki haley is no moderate#tax breaks for the filthy rich#social security#income inequality#the koch network#libertarian extremists#donald trump#nikki haley helped normalize donald trump#roe v. wade#reproductive freedom#abortion#tara setmayer#paul krugman#katie phang#gop presidential nomination#election 2024

30 notes

·

View notes

Text

By Sharon Parrott

It’s tempting to ignore a budget resolution released just days before the start of the fiscal year that it’s meant to guide, and amid the chaotic debate around a short-term extension of government funding to avoid a shutdown. But House Budget Committee Chair Jodey Arrington’s proposed budget is important for what it illustrates about House Republicans’ disturbing vision for the country: health care stripped away from millions of people, higher poverty and hunger, capitulation to climate change, more tax cheating by high-income people, and large-scale disinvestment from the building blocks of opportunity and economic growth—from medical research to education to child care. It would narrow opportunity, worsen racial inequities, and make it harder for people to afford the basics. It reflects the wrong priorities for the country and should be roundly rejected.

Chair Arrington made clear in his remarks the intent to extend the expiring tax cuts from the 2017 tax law, which included large tax cuts for the wealthy. In addition, the budget resolution itself would pave the way for unlimited, unpaid-for tax cuts that could go well beyond those extensions. The extensions alone would give annual tax breaks averaging $41,000 to tax filers in the top 1 percent and cost more than $350 billion a year, the Congressional Budget Office estimates. The budget reflects none of these costs and fails to explain how—or whether—they will be offset.

A shocking share of the spending cuts Chair Arrington specifies target people with low and moderate incomes, including $1.9 trillion in Medicaid cuts and hundreds of billions in cuts to economic security programs, such as cuts to assistance that helps people afford food and other basic needs. Just last week the Census Bureau released data showing that poverty spiked last year, more than doubling for children. Rather than proposing policies that could reverse this deeply troubling trend, the budget proposal would deepen poverty and increase hardship.

The budget would also make deep cuts in the part of the budget that is funded annually through appropriations bills. Disingenuously, the budget resolution shows that these cuts total more than $4 trillion over ten years—but hides the program areas that would be cut, labeling them “government-wide savings.” But this year’s House Appropriations bills—which include substantial cuts—make clear that cuts would fall on a wide range of basic functions and services that support families, communities, and the broader economy, including Social Security customer service, support for K-12 and college education, funding for national parks and clean air and water, rental housing assistance for families with low incomes, and more.

Chair Arrington claims the budget’s deep and damaging program cuts are in the name of deficit reduction. But the failure to identify a single revenue increase for high-income people or corporations—and in fact, to potentially shower them with more unpaid-for tax cuts—is an extreme and misguided approach. Moreover, calling for a balanced budget in ten years is merely a slogan that has little to do with addressing our nation’s needs—and the budget resolution resorts to gimmicks and games to even appear to get there, including $3 trillion in deficit reduction it claims would accrue from higher economic growth it assumes would be achieved by budget policies.

A budget plan should focus on the nation’s needs and lay out an agenda that broadens opportunity, invests in people and families, reduces the too-high levels of hardship and financial stress faced by households across the country, and raises revenues for those investments. But the Arrington budget blueprint would shortchange much-needed investments and lock in wasteful tax cuts to the already wealthy for the next decade.

House Republicans are pursuing a damaging agenda at every turn—first threatening the nation with default, and now demanding deep cuts in an array of priorities in this year’s appropriations debate, risking a government shutdown, and proposing a budget blueprint that would take the country in the wrong direction.

#us politics#news#common dreams#2023#republicans#conservatives#rep. Jodey Arrington#house budget committee#house republicans#us house of representatives#federal budget#trump tax cuts#trump 2017 tax cuts#congressional budget office#Medicaid cuts#social security cuts#House Appropriations committee#federal deficit#op eds#Sharon Parrott

20 notes

·

View notes

Text

There are literally 3 euros left on my bank account

#i should get tax refund and pay for my summer job this week i guess i'll survive#still stressful as hell though#i don't want to complain too much cause i know i'm privileged living in a country with a broad social security system#but it's also chaotic and bloated as fuck with a million different benefits and no one understanding how it works#my previous social security benefit ended in may so i had to apply for a new different one#but i needed a medical certificate for it and only had doctor's appointment last week#and getting the decision on that application takes time so meanwhile i applied for the last resort income support#but my application for that was rejected for unknown reasons and i complained about the decision but it's still in progress#so now i'm just waiting here with no money from anywhere whatsoever 🤷#bro what they expect me to do#go begging from the church? go shoplifting?#if this post is incoherent to you i feel the same#keanu.txt

21 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

March 1, 2024

HEATHER COX RICHARDSON

MAR 2, 2024

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

In other news today, Alexei Navalny’s parents held a funeral for the Russian opposition leader and buried him in Moscow. Navalny died two weeks ago at a penal colony in Siberia where Russian president Vladimir Putin had imprisoned him on trumped-up charges after failing to kill him with poison. Navalny fought against Putin’s control of Russia by emphasizing the corruption and illicit fortunes of Putin and his associates.

Russia specialist Julia Ioffe of Puck News noted that a million Russians have fled the country since the February 2022 invasion of Ukraine and that many of them were Navalny supporters. Still, many thousands turned out for the funeral and the procession, throwing flowers at the hearse as it made its way to the cemetery.

A woman at Navalny’s funeral compared Navalny and Putin. “One sacrificed himself to save the country, the other one sacrificed the country to save himself.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Corporations#taxes#Corporate tax#trickle down economics#democracy#finance#Heather Cox Richardson#Letters from An American#theocracy#social security

6 notes

·

View notes

Link

14 notes

·

View notes