#tax policy

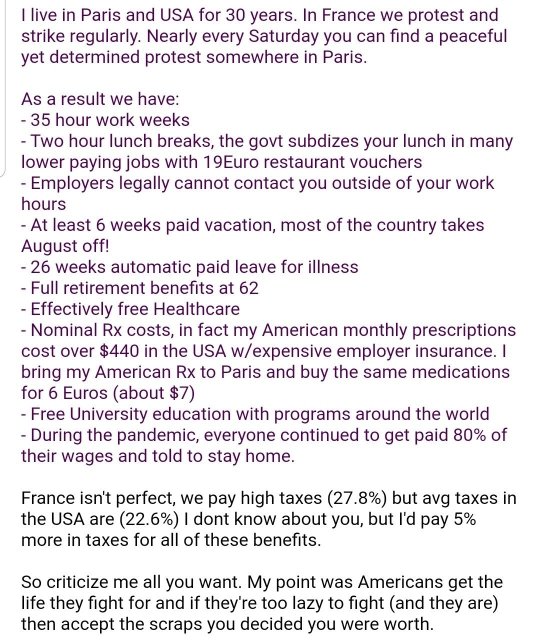

Photo

10K notes

·

View notes

Text

The Bush and Trump Tax cuts for the wealthy raised the debt to where it is now. Borrowed money is more expensive. Cutting tax revenues is a failed econonic policy. We have the proof.

The 1% pays pennies in taxes, ships jobs over seas, then runs up prices driving inflation and brags about profits… but sure, the real problem is the single parent using food stamps to feed 3 kids.

818 notes

·

View notes

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

226 notes

·

View notes

Text

Usually, I consider Morning Brew an entertaining element of my morning, but not necessarily the most on-topic (for my interests) of the newscasts I listen to.

However, they had a LOT of good topics today, like:

an overview of the tax and welfare elements of the budget that Biden is proposing (understandably, most of the others are focused on the immigration policy), and how it relates to the election

the increasing number of incidents with Boeing, touching on the suspicious death of a whistle-blower

automakers are sharing your personal information with insurance companies without your knowledge (consent was gained in the tiny fine print), and the expected involvement of the FTC

#current events#politics#united states#domestic politics#boeing#taxes#tax policy#privacy violations#ftc#Phoenix Politics

51 notes

·

View notes

Text

87 notes

·

View notes

Text

The GOP Tax Policy Cycle!

Transcript and discussion of cartoon: https://www.patreon.com/posts/gop-tax-policy-89962240

There are hundreds more cartoons to read at Leftycartoons.com!

I can keep making these cartoons because of people supporting them at patreon.com/barry . A $1 or $2 pledge really helps!

#policartoon#political cartoon#political cartoons#political comics#tax policy#republicans#tax cuts#deficit#fuck the gop

18 notes

·

View notes

Text

No free rides for old money! - Pass The Billionaires Income Tax Act! (S. 3367)

I am writing to express my strong support for the proposed S. 3367 bill, which aims to amend the Internal Revenue Code of 1986. This legislation represents a crucial step towards achieving economic justice by seeking to eliminate tax loopholes that have allowed billionaires to defer taxes indefinitely. By doing so, we would be ensuring a fairer distribution of wealth and rectifying a system that has long favored the ultra-wealthy. Additionally, the bill modifies over 30 tax provisions, requiring billionaires to contribute annually. It's time to ensure that those with the most significant influence and wealth contribute proportionately to our society's well-being. Therefore, I urge you to support and pass the Billionaires Income Tax Act.

Billionaires have amassed vast wealth, often at the expense of their employees who struggle to make ends meet on minimum wages. It is only just and equitable that they pay their employees a living wage AND contribute proportionally to the betterment of our society.

Furthermore, if billionaires wield significant influence over our government and policy-making, they should demonstrate their commitment by financially supporting the very system that has allowed them to prosper. No longer should they enjoy free rides on the backs of hardworking taxpayers. It is past time to ensure that billionaires are contributing their fair share to the well-being of our country.

Passing the Billionaires Income Tax Act is not only a matter of fiscal responsibility but also a moral imperative. It is time to ensure that our tax system is fair and equitable for all, not just the wealthy few.

Thank you for considering my views on this important issue. I urge you to stand on the side of fairness and justice by supporting S.3367.

No free rides for old money!

📱 Text SIGN POZZVN to 50409

🤯 Liked it? Text FOLLOW IVYPETITIONS to 50409

#eat the rich#Wealth Redistribution#ivy petitions#open letter#S. 3367#Billionaires Income Tax Act#Tax Reform#economic justice#us politics#taxes#tax the rich#billionaires should not exist#Tax Fairness#Wealth Distribution#oligarchy#Tax Loopholes#Tax Provisions#Billionaires Tax#Living Wage#Tax Responsibility#Policy Change#Government Influence#Social Justice#Fair Taxation#Income Inequality#Progressive Taxation#Wealth Gap#Tax Policy#Tax Reform Now#Billionaire Responsibility

4 notes

·

View notes

Text

Watch "Matt Stoller dismantles Jamie Dimon's hypocritical Davos socialism attack" on YouTube

youtube

I'm watching an older clip of Matt stoller. It's fantastic. He says what no other man is willing to say. If you look at the increase in wealth after 2008 of already wealthy people it's mind blowing. Arguably this effect likely started after 2000. Wealth theft is socialism.

6 notes

·

View notes

Text

wouldn't it be wild if instead of harassing random working class citizens, the irs and government in general actually taxed capitalists appropriately according to the country's own tax laws?

5 notes

·

View notes

Text

"we had no tax before 1913"

yes, yes we did.

We called them "tariffs." They were taxes on products. Ever hear of the Whiskey Rebellion? A tax on whiskey to help the fledgling American government fund itself and pay its tax.

We also had income taxes during the Civil War and after, although only on certain incomes (for example between $600 and $10,000 were taxed at 3%)

In 1892, the Us passed an income tax on all incomes over a certain amount ($3,000 maybe? Not sure on this). This was a flat tax. People who made $3,000 were taxed at 2% of their income, same as someone making $10,000, same as JP Freaking Billionaire of his time Morgan (He did not have a billion dollars but tens of millions, similar to billions in our currency value). Flat taxes, like sales tax, are regressive taxes where an individual who makes less income gives up a greater portion of their worth to pay the tax ($100 is more to someone making $3,000 a year than someone making $10,000 a year)

States also had their own taxes, including income and property taxes (like New York). You had to raise revenue for your armies and your legislative bills and processes somehow.

In 1895, the Supreme Court called a federal income unconstitutional in Pollock vs Farmers. But the gov't crashed again in 96 or 97, Morgan loaned the federal government to get it through and the rumblings began on the Republican side to bring back an income tax.

The new tax proposed was a progressive tax, where the wealthy would pay a higher share. Unlike today, it was proposed by Republicans, lead by Taft and Teddy Roosevelt, who said that wealthy people needed to pay their share as part of their patriotic duty to their country. Rockefeller hated this and lobbied against it, saying that when someone is as wealthy as him, he owes people nothing (I believe it was a Vanderbilt who said "the public be damned" (ok this was about railroads but the sentiment stands).

The bill passed, it became the 16th amendment in 1913. Then the battle became with states enacting their own codes and conforming to Chapter 26 of the US Code. The first income tax was levied at $4,000 income which meant most Americans didn't pay because the Average American salary was about $1,000. This is in keeping with now, as about 40% of American households don't have taxable income--that is income after deductions subject, subject to tax.

The road to filing statuses (America required people to file by marriage status, while most other countries file by economic earner with credits for children, etc. This means choosing to file separately, if you are married, functions as a tax penalty as you lose credits) is really interesting and rife with sexism, but that's for another thread.

So the next time someone says "Americans used to all pay their fair share" and "America never had a tax before the 16th Amendment" kindly inform them that they were wrong, wrong, wrong.

#us history#politics#taxes#tax policy#the republicans are freaking wrong#they don't even understand the tax forms or tax calculations#i actually think most people don't#and this is what i try to show when i'm reviewing taxes with clients#know what you are looking at

2 notes

·

View notes

Text

New York’s Rich Get Creative to Flee State Taxes. Auditors Are On to Them

...Although the total number of taxpayers leaving New York and California from 2020 to 2022 was highest among low and middle-income people, the flight of the richest individuals has an especially large impact on budgets. People earning over $1 million each year made up just 1.6% of tax filers, but paid 44.5% of the state’s total personal income taxes in 2021, New York Comptroller Tom DiNapoli said in a recent report. In California, nearly half of the state’s income taxes come from the top 1% of earners...

We all have a responsibility to contribute to the operation of the communities, states, and country we call home. But when those communities, states, and country become hostile to the people paying a disproportionate share of government expenses, they begin to look for more friendly pastures... and the death spiral begins.

0 notes

Link

February 13, 2018

As NPR notes, rightwing fiscal responsibility types have made it nearly impossible to restore lost revenue after taxes get cut: Thanks to a ballot initiative passed in the 1990s, any revenue increase has to be passed by a three-quarters super-SUPER-majority in the Legislature. Impressive -- tax hikes in Oklahoma require a bigger majority than the US Constitution demands to remove a president by impeachment.

49 notes

·

View notes

Text

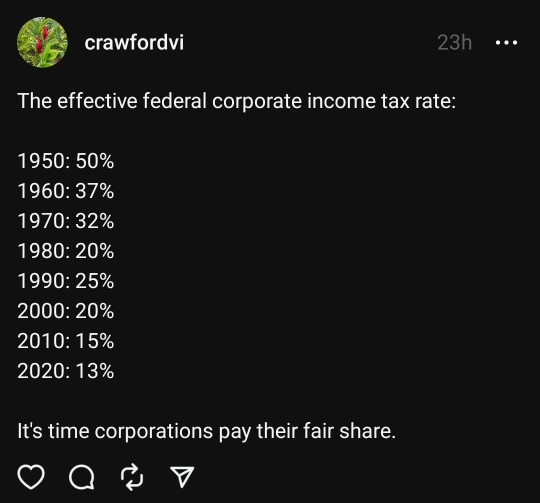

#TaxTheRich

Poverty is a byproduct of capitalism. Tax the capitalists. Tax their profits.

Corporations should be pressured to lower their tax exposure by paying higher wages, offering better benefits, investing in domestic factories, and giving back to the community.

Tax them higher if they fail to improve society.

234 notes

·

View notes

Text

Navigating Tax Return 2024: Essential Tips and Key Information

Understand the latest tax changes for 2024. Our comprehensive guide explains new rules and how to maximize your refund.

Filing your tax return for the 2023 tax year (which you’ll do in 2024) might seem far away, but understanding the process and key changes will help you maximize your refund or minimize the amount you owe. Let’s dive into the details and some expert tips to simplify the process for you.

Key Deadlines and Dates

January 23, 2024: The official start of the 2024 tax filing season.

April 15,…

View On WordPress

1 note

·

View note

Text

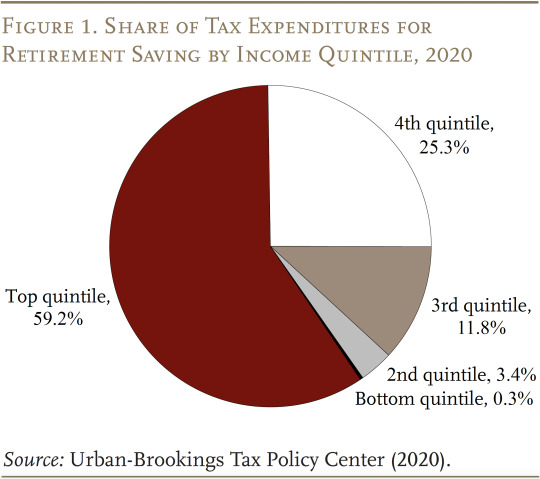

The brief’s key findings are:

Tax preferences for saving in retirement plans are expensive – about $185 billion in 2020, according to Treasury estimates.

Strikingly, they also seem a bad deal for taxpayers, primarily benefiting high earners while failing to significantly boost national saving.

Thus, the case is strong for eliminating or reducing these preferences.

The resulting increase in tax revenues could be reallocated to fixing Social Security’s finances.

0 notes

Link

"On Tuesday, Rep. Earl L. "Buddy" Carter, a Republican from Georgia, introduced the Fair Tax Act, which would eliminate the federal personal and corporate income tax, the estate tax, and the payroll tax — the latter of which funds both Social Security and Medicare. Under his bill, those taxes would be replaced by a national consumption tax of 30% that would apply to all consumer purchases — health care, groceries, homes, gasoline and more."

Remember income tax is progressive. It taxes the people who have the most more than those who have the least. Estate tax only effects the richest people. No one else pays it. Abolishing it increases wealth inequality. Sales tax is regressive, meaning the poorer you are the larger the proprtion of your income you have to pay in.

The plan to zero out the budget for IRS enforcement is designed to help the very rich by allowing them to cheat flagrantly. The people they are auditing are mostly very rich people, and they tend to get back more than they spend. Below a certain income level, the audit costs dramatically more than the few extra dollars they might find.

All of the Republican tax policies are designed to harm ordinary people, starve what's left of the social safety net to death so people like me die, and to help the richest 1% get so much richer.

69 notes

·

View notes