#statemen

Text

Fulfilling science’s promise for gender equality.

Science, technology, and innovation continue to radically and rapidly transform how people live, socialize, pay their bills, order food, study, and work. For women and girls across the world, these changes have brought new freedoms, new forms of access to information, and new opportunities for creativity, along with new risks to their safety, representation, and share of decent employment.

The promise of science is one of positive change for gender equality. Take the case of Natacha Sangwa, one of a number of young high school graduates in Rwanda who attended a UN Women-supported coding camp. Using robotics and next-generation technologies, she created a prototype to help her community respond to climate change. She told us: “One of the ideas I developed through this programme was to build a mechanized irrigation system to enhance productivity and yields in rural areas” and that she had resolved to do all she could to increase the representation of women and girls in technology.

Over the next 30 years, the majority of the world’s new workers may well be on the African continent, where 60 per cent of the population, like Natacha, is currently under 25. Skills in science, technology, engineering, and maths (STEM) will play an important role in the jobs of their future - and across the world. We need to invest in this opportunity - in young women in every country - ensuring that they have the right skills for these jobs and that they are not held back by negative stereotypes and discrimination. And we need to ensure that current and future workplaces are environments that attract, retain, and advance women scientists.

Both representation and retention of women are essential for the science and digital technology sectors to be more creative, innovative, and profitable, reflecting issues that matter to women. Currently, women remain significantly underrepresented, making up just 29.2 per cent of all STEM workers, compared to 49.3 per cent across non-STEM occupations. Hostile work environments remain pervasive and deter women’s career longevity. A 2022 study conducted in 117 countries found that one in two women scientists reported experiencing sexual harassment at work, with 65 per cent of respondents reporting that this negatively impacted their career.

Partnerships and engagement that change these workplace issues represent a huge opportunity to boost women’s participation in STEM, with the private sector currently estimated to represent approximately 70 per cent of global expenditure on science. The Women’s Empowerment Principles offer a framework for just such an engagement among private sector companies, in collaboration for progress with governments and academia. Currently, more than 9,200 CEOs across 160 countries have committed to implement policies and practices that attract, retain and promote women into leadership positions, including in science and broader STEM fields, fostering an inclusive corporate culture, eliminating stereotypes and discriminatory practices.

As we head towards the UN’s Summit of the Future in September this year, including a new Global Digital Compact, we must take every opportunity to act quickly and effectively to counteract bias and discrimination, and to equip and support the bright minds and imaginations of our young scientists, like Natacha and her peers.

#international day of women and girls in science#11 february#womeninscience#girls in science#women in science#women in stem#stem#un women#Statemen#closing the gender gap in stem

0 notes

Text

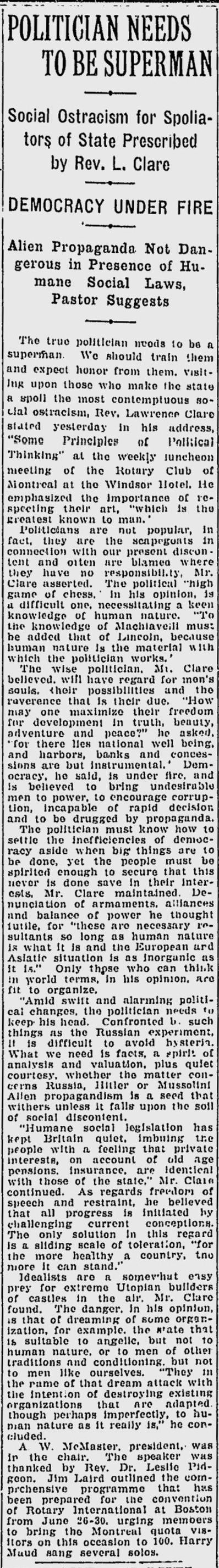

"POLITICIAN NEEDS TO BE SUPERMAN," Montreal Gazette. June 7, 1933. Page 5.

----

Social Ostracism for Spoliators of State Prescribed by Rev. L. Clare

----

DEMOCRACY UNDER FIRE

----

Alien Propaganda Not Dangerous in Presence of Humane Social Laws, Pastor Suggests

----

The true politician needs to be a superman. We should train them and expect honor from them, visiting upon those who make the states spoil the most contemptuous social ostracism, Rev. Lawrence Clare stated yesterday in his address, "Some Principles of Political Thinking" at the weekly luncheon meeting of the Rotary Club of Montreal at the Windsor Hotel. He emphasized the importance of respecting their art, "which is the greatest known to man."

Politicians are not popular, in fact, they are the scapegoats in connection with our present discontent and often are blamed where they have no responsibilty, Mr.Clare asserted. The political "high game of chess. In his opinion, is a difficult one, necessitating a keen knowledge of human nature. "To the knowledge of Machiavelli must be added that of Lincoln, because human nature is the material with which the politician works."

The wise politician, M. Clare believed. will have regard for men's souls. their possibilities and the reverence that is their due. "How may one maximize their freedom, for development In truth, beauty, adventure and peace?" he asked, for there lies national well being, and harbors, banks and concessions are but instrumental.' Democracy, he said, is under fire, and is believed to bring undesirable men to power, to encourage corruption, incapable of rapid decision and to be drugged by propaganda.

The politician must know how to settle the inefficiencies of democracy aside when big things are to be done, yet the people must be spirited enough to secure that this never is done save in their interests, Mr. Clare maintained. Denunciation of armaments, alliances and balance of power he thought futile, for "these are necessary resultants so long as human nature is what it is and the European and Asiatic situation is as inorganic as it is." Only those who can think in world terms, in his opinion, are fit to organize."

"Amid swift and alarming political changes, the politician needs to keep his head. Confronted by such things as the Russian experiment, it is difficult to avoid hysteria. What we need is facts, a spirit of analysis and valuation, plus quiet courtesy, whether the matter concerns Russia, Hitler or Mussolini. Allen propagandism is a seed that withers unless it falls upon the soil of social discontent.

"Humane social legislation has kept Britain quiet, imbuing her people with a feeling that private interests, on account of old age pensions, insurance, are identical with those of the state," Mr. Clare continued. As regards freedom of speech and restraint, he believed that all progress is initiated by challenging current conceptions. The only solution In this regard is a sliding scale of toleration, "for the more healthy a country, the more it can stand."

Idealists are a somewhat easy!prey for extreme Utopian builders of castles in the air, Mr. Clare found. The danger, in his opinion, is that of dreaming of some organization, for example, the state that is suitable to angels, but not to human nature, or to men of other traditions and conditioning, but not to men like ourselves. "They in the name of that dream attack with the intention of destroying existing organizations that are adapted, though perhaps imperfectly, to hman nature as it really is," he concluded.

A W. McMaster, president, was in the chair. The speaker was thanked by Rev. Dr. Leslie Pidgeon. Jim Laird outlined the comprehensive programme that has been prepared for the convention of Rotary International at Boston from June 26-30. urging members to bring the Montreal quota of visitors on this occasion to 100. Harry Maud sang several solos.

#montreal#canadian elite#canadian democracy#elite thinking#middle class ideology#british constitution#statemen#rotary club#canadian politics#great depression in canada#anti-communism#anti-ideology

0 notes

Photo

Excited to share the latest addition to my #etsy shop: Color Changing Halo Ring, Turkish Ring Womens, Turkish Diaspore, Silver Promise Ring, Engagement Ring, Gift for Her #silver #no #yes #unisexadults #artdeco #oval #colorchangingring #statemen https://etsy.me/3OSl2P9 https://www.instagram.com/p/ClipZRqIEhc/?igshid=NGJjMDIxMWI=

0 notes

Photo

0 notes

Text

According to 4koma #232, Kohane has the ability to purr.

#project sekai#4koma#kohane azusawa#potentially interesting TL notes:#first for context in the panels before this An was thinking about how great kohane's singing/smile is. hence the throat thing.#anyway An uses says いけない when talking to kohane which can mean various things like “should not” “unable to” or “naughty”#she's treating kohane kinda like a cat here so i localised her part with the “how naughty~” like she's talking to one#also akito just says “it's complicated” in response to kohane which doesn't really work in english so i just changed it to another statemen#that conveys a similar meaning (he's pointing out that kohane is purring like a cat despite her saying she isn't one lol)#you probably could've done an's part as “it's all your throat's fault” but i thought “how naughty” was more in spirit of the cat motif#this is not interesting at all

404 notes

·

View notes

Text

oh no i wasnt expecting plot i cant be losing it over two podcasts at once

#tia posts#tmagp vague#i was expecting a little statemen i mean case without much character interaction. hiiiii. hiiiiiiiiii.#'oh protocol is so calming in comparison to my#the river rises#posting surely this will relax me and make me normal again :)'#THE PLOT LOOMING OVER ME WITH A STEEL CHAIR:#also my goodness 20 minute episodes are so much shorter than hour and a half episodes. did you know this?

12 notes

·

View notes

Text

Alice holds an intervention for the rest of the OIAR about not delving into the horrors.

It starts with "look I tried to vaguely warn you and also to just keep you at arms reach so when the horrors got to you I would be fine but somehow I'm emotionally attached to a bunch of trainwrecks so that's an intervention."

At some point Chester starts helping by interrupting to read more "IF YOU FUCK AROUND YOU WILL FIND OUT SO DON'T FUCK AROUND" cases fitting each members reasons for fucking around.

Gwen mentions that part of the reason she is investigating the creep conversation she heard involving Lena is because if Lena's a serial killer than she can use that to get Lena fired and get her job. As if it was a normal, not dangerous way to get a promotion (is a saffer way than Elias promotion at least).

Alice playfully ends with "C'mmon guys if you fuck around you will end up like Chester here, do you really want that?" and for everyone's shock Jon has his first actual appearance as an actual councious thing by sending one "EXACTALY! OUCH! BUT PRECISELY THAT!"

#tmagp#alice dyer#chester and norris#but mostly chester#because norris statemens are love hurts and augustus is haha fucked up violyn#chester is thematically apropriated#samama khalid#gwendolyn bouchard#colin becher#jon sims#shitty ideas that just apeear in my brain at random cause sure whh nk

16 notes

·

View notes

Note

Which are your favorite joji fan accounts? (If you have one) On any platform

Mine 🖤

#ask#anon#im going to be honest with u anon. I don't really fw the kind of people who run celebrity fan accounts. ignore the hypocrisy of my statemen#honestly i mostly go through all those old abandoned blogs like its my dayjob#other than that there are a couple of fanartists that i love !!#tumblr user translephony is very neat. king if u r reading this. hi !!!!#also tumblr user astawrion used to post a lot about joj AND they are still active. they seem cool.

4 notes

·

View notes

Text

And so we're right back at John not believing anything that the statement giver says. Still makes the episode about Gerard & Mary Keay and Jurgen Leitner feel different than the other ones. A (cursed? Haunted?) book that gives you vertigo and spits bones is okay alright but someone exploding because they are infested with parasites is totally unbelievable.

#The worms were gross but im not that fazed#As a social worker I've seen some unhealthy living situations and have encountered quite a few worms and maggots and whatnot#Tho the worst ones were situations from when i was a trainee#But i digress#the magnus archives#Tma#Squirm#Im still not over that feeling that it's suspicious that John just accepted those book statemens

6 notes

·

View notes

Text

fuck man MORE pens

4 notes

·

View notes

Note

next time i see one of them wearing it for a premier or cup game it'll feel so fake and meaningless

personally i’m not super mad at the players bc they’re just following the instructions of their respective fa’s,,,, uefa/fifa on the other hand? they can go rot

#it’s like yeah kane/virgil/neuer could decide to wear the armband and then they’d get carded or benched#which they should do if they really want to make a statemen#but the fact that no one is standing up to fifa and uefa? even the national fa’s are just giving up on their players? yeah that’s gross#asks#anons

2 notes

·

View notes

Text

Streamline Banking Operations with AI-driven bank Statement Analyzer: Unlocking Efficiency and Detecting Fraud

In today’s fast-paced financial landscape, where efficiency and accuracy are paramount, staying ahead of the competition is crucial for banks and financial institutions. To optimize and analyze credit underwriting processes and automate CAM (credit assessment and monitoring) operations, the adoption of advanced technologies has become imperative. This is where the AI-driven Bank Statement Analyzer comes in. It is a groundbreaking tool that leverages the power of artificial intelligence and machine learning to streamline operations, unlock efficiency, and enhance fraud detection like never before. By analyzing bank statements with speed and accuracy, the AI-Driven Bank Statement Analyzer can quickly identify any irregularities or suspicious activity, allowing financial institutions to take immediate action. This tool not only saves time and resources but also ensures a more secure and reliable credit assessment process for both the institution and its clients.

The role of AI in the Indian financial sector was examined in a study by Ficci and PWC titled “Uncovering the ground truth: AI in Indian financial services” which was released in February 2022. As stated in the report:

The primary drive for AI-enabled use cases, according to 83% of Indian financial services companies or organizations, is improving the client experience.

The majority of them — 57% — strongly concur that AI will provide them an advantage over their competitors.

(Source: Indian FS AI Adoption Survey 2021)

Leading Business Factors for AI-enabled Application Cases

Top Five AI use Cases that Firms have Adopted

Let’s Understand the Bank Statement Analyzer Powered by Artificial Intelligence

The AI-driven Bank Statement Analyzer is an intelligent software solution designed to transform the way financial institutions handle credit underwriting and CAM processes. By harnessing cutting-edge AI algorithms and data analytics, this technology-driven solution simplifies and accelerates the assessment of a borrower’s financial health and risk profile. It can also help identify potential fraud and improve the accuracy of credit decisions. With the AI-driven Bank Statement Analyzer, financial institutions can streamline their operations, reduce costs, and provide better customer service by offering faster loan approvals and more personalized lending options. Additionally, the tool can assist in monitoring a borrower’s repayment behavior and identifying any potential delinquencies or defaults, allowing for proactive measures to be taken to mitigate risk. Overall, the AI-Driven Bank Statement Analyzer is a valuable asset for financial institutions looking to improve their lending processes and make more informed credit decisions.

How Does It Work?

The AI-driven bank Statement Analyzer harnesses the power of artificial intelligence and machine learning to interpret and analyze bank statements with remarkable speed and accuracy. Here’s how it works:

Data Extraction: The system securely extracts relevant financial data from the borrower’s bank statements, eliminating the need for manual data entry and minimizing errors.

Categorization and Trend Analysis: The software automatically categorizes transactions, segregating them into income, expenses, and other relevant categories. It also performs trend analysis to identify spending patterns and financial behaviors.

Financial Health Assessment: Using sophisticated algorithms, the AI-driven Bank Statement Analyzer evaluates the borrower’s financial health by analyzing key indicators such as income stability, cash flow, debt-to-income ratio, and savings patterns.

Fraud Detection: The system incorporates advanced fraud detection techniques to identify suspicious transactions, including money laundering, fraudulent activities, and potential risks.

Account Aggregator Enablement: The AI-driven bank Statement Analyzer seamlessly integrates with account aggregator platforms, allowing financial institutions to securely access and analyze consolidated financial data from the borrower’s multiple bank accounts. This enables a comprehensive assessment of the borrower’s financial position.

Benefits of the AI-Driven Bank Statement Analyzer:

Enhanced Efficiency: The automated analysis of bank statements significantly reduces the time and effort involved in credit underwriting, enabling financial institutions to process loan applications faster and more accurately.

Improved Risk Assessment: The AI-Driven Bank Statement Analyzer provides a holistic view of the borrower’s financial situation, empowering lenders to make better-informed decisions and mitigate risk effectively.

Fraud Detection and Prevention: By leveraging advanced fraud detection techniques, the solution helps financial institutions identify suspicious transactions, enabling timely intervention and preventing fraudulent activities.

Cost Reduction: By automating manual processes and reducing the need for manual data entry, the AI-Driven Bank Statement Analyzer significantly reduces operational costs and increases overall efficiency.

Seamless Integration: The solution seamlessly integrates with existing CAM and credit underwriting platforms, ensuring a smooth implementation process and compatibility with existing systems.

With success comes certain challenges in the Indian financial sector’s use of artificial intelligence

The Indian banking, financial services, and insurance (BFSI) sector is witnessing a growing demand for artificial intelligence (AI) technologies such as chatbots, voice bots, and video bots. However, the sector faces significant challenges in fully embracing AI due to the need for greater clarity in several critical areas, including explainability, fairness, transparency, accountability, probability, and accessibility. Addressing these aspects from both a technological and legal standpoint is crucial for successful AI integration in the sector.

Regulation and Legal Considerations: To regulate AI in India, the Government appointed NITI Aayog in 2018 to develop laws covering ethical and system considerations. However, the current legal infrastructure is still in its early stages and fails to address various implications, including biased data outcomes, sharing of sensitive or personal data, accountability in accidents involving human or property losses, transparency of AI models and outcomes, rights of AI robots, intellectual property rights (IPRs), copyrights, competition laws, and patent credits. The undefined contours of AI applications have resulted in a lag in policymaking and regulation.

Need for Self-Governance and Framework: As the adoption of AI technologies continues at an unprecedented pace worldwide, implementers in the Indian financial sector need to establish a self-governed, self-regulated, and self-audited framework to ensure compliance with laws and regulations. This framework should encompass defining the scope of the problem, unbiased data collection, proper data labeling, data processing, training, deployment, and dynamic evaluation. By adhering to such a framework, organizations can avoid violations and navigate the complexities associated with AI integration.

Choose the Best AI-Driven Bank Statement Analyzer for Your Financial Institution

In the fast-paced world of finance, accurate and efficient analysis of bank statements is crucial for any financial institution. The AI-Driven Bank Statement Analyzer automates the process of extracting valuable insights from these documents, saving time and reducing the risk of errors. However, with a multitude of options available on the market, selecting the right AI-Driven Bank Statement Analyzer can be a daunting task. To help you make an informed decision, we have compiled a guide on how to choose the right AI-Driven Bank Statement Analyzer for your financial institution.

Define Your Requirements: Start by identifying your specific requirements and objectives. Consider the size of your institution, the volume of bank statements you process, and the level of complexity involved. Determine the key features you need, such as data extraction, categorization, trend analysis, or fraud detection. A clear understanding of your requirements will guide you in selecting the most suitable solution.

Evaluate Accuracy and Efficiency: Accuracy and efficiency are paramount when it comes to bank statement analysis. Look for AI-driven bank Statement Analyzers that employ advanced AI algorithms and machine learning techniques to ensure precise data extraction and reliable analysis. Efficiency is equally important, as the timely processing of statements can significantly impact your institution’s operations. Consider solutions that offer high processing speed and can handle large volumes of statements without compromising accuracy.

Integration Capabilities: Compatibility with your existing systems and workflows is crucial for seamless integration. The chosen AI-driven bank Statement Analyzer should be able to integrate with your financial institution’s core banking software, accounting systems, and other relevant platforms. It should allow for easy data transfer, enabling efficient collaboration among different departments and stakeholders.

Customization and Flexibility: Every financial institution has unique requirements and the AI-Driven Bank Statement Analyzer should be flexible enough to accommodate them. Look for a solution that offers customization options, allowing you to tailor the analysis process to your institution’s specific needs. The ability to define custom rules, filters, and reporting formats can significantly enhance the analyzer’s effectiveness.

Security and Compliance: When dealing with sensitive financial data, security and compliance are of utmost importance. Ensure that the AI-driven bank Statement Analyzer you choose adheres to strict security protocols, including encryption, access controls, and data protection measures. It should also comply with relevant industry regulations and standards, such as GDPR or PCI DSS, to safeguard customer information and maintain data integrity.

Scalability and Future-Proofing: Consider the scalability of the AI-Driven Bank Statement Analyzer as your institution grows. Ensure that the solution can handle increased volumes of statements and adapt to evolving business needs. Look for providers that offer regular updates and enhancements to keep pace with industry advancements. Future-proofing your investment will save you from the hassle of switching to a new analyzer soon.

User Experience and Support: Usability and user experience play a significant role in successfully implementing any technology. Choose an AI-Driven Bank Statement Analyzer that is intuitive, user-friendly, and requires minimal training. Look for a provider that offers comprehensive technical support, including documentation, training resources, and responsive customer service. A reliable support system will ensure smooth operations and quick resolution of any issues.

Cost and Return on Investment: Evaluate the total cost of ownership for the AI-Driven Bank Statement Analyzer, including initial setup costs, licensing fees, maintenance expenses, and any additional charges. Compare the costs against the expected return on investment (ROI). Consider factors such as time saved, reduction in errors, improved efficiency, and the ability to uncover valuable insights. A solution with a favorable ROI will prove to be a worthwhile investment for your financial institution.

By following these guidelines and conducting thorough research, you will be able to select an AI-driven bank Statement Analyzer that aligns with your institution’s goals and maximizes operational efficiency. Remember to evaluate multiple vendors and request demonstrations or trials to assess the usability and functionality of different solutions. Additionally, seek feedback from other financial institutions or industry professionals to gather insights and recommendations based on their experiences. Taking a collaborative approach will help you make a well-informed decision and choose the AI-Driven Bank Statement Analyzer that best suits your institution’s needs.

Once you have selected the right AI-Driven Bank Statement Analyzer, it’s essential to plan for a smooth implementation process. Collaborate with the solution provider to create an implementation strategy that aligns with your institution’s existing systems and workflows. Define clear timelines, allocate resources, and communicate the changes to relevant stakeholders within your organization.

During the implementation phase, provide comprehensive training to your staff to ensure they are proficient in using the AI-Driven Bank Statement Analyzer. The solution provider should offer training materials, user manuals, and ongoing support to address any questions or concerns that may arise.

Post-implementation, continuously monitor the performance of the AI-Driven Bank Statement Analyzer and gather feedback from users. Regularly assess its effectiveness, identify areas for improvement, and collaborate with the solution provider to implement necessary updates or enhancements.

The Novel Patterns– CART — AI-Driven Bank Statement Analyzer’s ability to assist financial institutions in identifying fraud and saving sizeable sums of money is one of its key advantages. With a track record to back it up, CART has already won over 100 major clients’ trust and processes more than 250 million transactions each month. CART has successfully detected fraudulent activity and owing to its efficient fraud detection technique, averting potential losses of over INR 100 million every month. These astounding figures demonstrate how the Novel Patterns — CART — AI-Driven Bank Statement Analyzer protects financial institutions and strengthens their dedication to offering their clients safe and dependable services. Financial institutions can benefit from the most recent technology by utilizing AI and sophisticated analytics.

Robust Fraud Detection: CART employs advanced algorithms and machine learning techniques to identify fraudulent activities within bank statements. Its sophisticated fraud detection capabilities enable financial institutions to detect suspicious transactions, money laundering attempts and potential risks effectively. By proactively identifying and preventing fraudulent activities, CART helps safeguard the financial integrity of institutions and protects them from significant financial losses.

Impressive Client Base: With its proven track record, CART has gained the trust of more than 75 major clients in the financial industry. This extensive client base reflects the reliability and effectiveness of the solution. Financial institutions can benefit from CART’s established reputation and industry-wide adoption, ensuring they are utilizing a trusted and reputable tool for their bank statement analysis needs.

High Transaction Volume: CART is equipped to handle high transaction volumes efficiently. It processes over 250 million transactions on a monthly basis, showcasing its scalability and ability to manage large-scale operations. Financial institutions dealing with substantial transaction volumes can rely on CART to effectively analyze and extract valuable insights from their bank statements, regardless of the volume.

Substantial Cost Savings: By leveraging CART’s robust fraud detection techniques, financial institutions have achieved significant cost savings. The solution has helped prevent potential losses of over INR 100 million by identifying fraudulent activities early on. Detecting and mitigating fraudulent transactions not only saves financial institutions from financial losses but also protects their reputation and customer trust. CART’s ability to detect fraud efficiently contributes to the overall cost reduction and financial stability of institutions.

Cutting-edge Technology: The Novel Patterns — CART — AI-Driven Bank Statement Analyzer incorporates advanced technologies such as artificial intelligence and machine learning. These technologies enable CART to continuously learn and adapt to evolving patterns and trends in bank statements. By leveraging cutting-edge technology, financial institutions can stay ahead of emerging fraud schemes, improve their risk management capabilities, and make more informed decisions.

Enhanced Operational Efficiency: CART streamlines bank statement analysis processes, resulting in improved operational efficiency for financial institutions. By automating manual tasks such as data extraction and categorization, CART reduces the time and effort required to analyze bank statements. This automation allows institutions to process loan applications faster, make quicker lending decisions, and provide better customer service. The increased efficiency and streamlined processes contribute to overall operational excellence and improved customer satisfaction.

In conclusion, the AI-driven Bank Statement Analyzer is a transformative solution for financial institutions, revolutionizing operations by offering improved efficiency, enhanced risk assessment, fraud detection capabilities, and significant cost reduction. By carefully selecting and implementing this technology, institutions can unlock their full potential, staying ahead in the competitive financial landscape. Embracing the power of AI, financial institutions can elevate their bank statement analysis to new heights. The Novel Patterns — CART — AI-Driven Bank Statement Analyzer serves as a powerful tool, enabling institutions to detect fraud effectively and achieve substantial cost savings. With its robust capabilities, impressive client base, ability to handle high transaction volumes, cutting-edge technology, and enhanced operational efficiency, CART empowers financial institutions to strengthen risk management practices, protect financial integrity, and deliver superior services to customers. By adopting CART, institutions can leverage advanced analytics and AI-driven solutions, gaining a competitive edge in today’s dynamic financial landscape

#cart#fintech#novel patterns#account aggregator#bfsi#wealth management#credit underwriting#finance#banking#automation#bank statements#bank statemen analyzer

0 notes

Link

Street Clothing Hip -Hop T -Shirt Men'S Autumn Amine T -Shirt Funny Long -Sleeved Loose Women T -Shirt sold by SO Harajuku . Shop more products from SO Harajuku on Storenvy, the home of independent small businesses all over the world.

0 notes

Text

the fa is comfortable punishing managers and players for talking against the ref but when it’s time to get down and punish sexual assault they don’t know how to do so

#.txt#i don’t know who the manager is about but it’s i’m suspecting that numebr 5 and greenwood are being talked about here#and what upsets me is that the girl said that she ignored the rumours because the first time it happened the club didn’t release a statemen#t#to anyone that doesn’t think the club has responsibility they very much do so and the fact that they don’t condemn it and if lead to more#cases happening i mean…#but also it’s much worse than we initially thought?#also everton fans kind of grinding my gears because how were they talking about their 10 point ban when this is clearly about the assault#that continues to be unchallenged in this atmosphere#but also i just know that there’s definitely more that just hasn’t come to light#premier league

1 note

·

View note

Note

This celebration is ADORABLE! Finnick Odair with ❛ you’re welcome to stay, if you want. ❜

hi honey, thank you so much! join the celebration

finnick odair x fem!reader (r is implied to be a past victor)

You feel a bit silly standing at Finnick’s door in your pyjamas, your face damp with tears, bare feet sinking into the carpeted floor. The train hums beneath you, almost hypnotising. You’re a bad sleeper in general, but being on this train has resurfaced so many things you wish you could forget. You don’t know why you expected any better, but tonight’s been dreadful.

You’re not sure if Finnick will even answer the door. You want to try anyway because your heart won’t stop racing and he’s the only person you’d ever want to see at a time like this.

“Finnick?” You swallow around the thick lump in your throat and knock softly on his door. “It’s me.”

He’s at the door faster than you expected. Perhaps he was having as bad a night as you.

“Y/N?” Finnick blinks at you. His hair’s a mess, his shirt crumpled. “Hey. Sweetheart, what are you doing up?”

You blink away fresh tears that threaten to spill. “I’m— I can’t sleep,” you confess. Red hot embarrassment creeps up your neck like flames. “I’m really sorry I woke you.”

Finnick shakes his head. “No, no, don’t be,” he murmurs, a pinch between his brows. “It’s okay, honey, I get it. Did you want to come in?”

You nod silently. He encourages you in to sit on the end of his bed, letting the door shut behind you. You and Finnick, you have a strange relationship. You’re very close, he knows you inside out, has learnt all your secrets but one. You think you’re in love with him, and you really hope he feels the same, but you’re worried that sparkly hope is blinding you. Either way, he’ll do anything for you, which is why you’re here.

You sit on his bed, silent. Your chest feels tight, like someone’s gone and tied a knot with all your organs. Tears well in your eyes and you blink them away desperately.

Finnick moves to stand over you, tall and firm but buzzing with worry. He takes your face in his hands, achingly gentle.

“You wanna tell me what’s the matter?” He asks softly. He swipes at your lower lash line where fresh tears are starting to gather. “What’s made a pretty girl like you cry so much, hm?”

You’re so upset you miss his blatant flirting. You’ll remember it in the morning, though, and you won’t be able to look him in the eye for the rest of the day.

“I keep having these awful dreams,” you say, your voice a strained, weak thing. You take a deep breath, determined to get through telling Finnick what’s bothering you without crying. “I thought they’d gone away, but I guess being on this train, it’s all come flooding back. It’s horrible, Finnick. I don’t …”

Your voice breaks. Your face crumples. So much for not crying. The first of a fresh round of tears spill over Finnick’s hands. He makes a sad, pitying noise and wraps you up in a strong hug.

“It’s okay, sweetheart.” He encourages your head to his abdomen, seemingly not caring that your tears are quickly dampening his shirt. He rubs your back with a big, warm hand. “It’s okay.”

He lets you cry into his shirt for as long as you need. You know he knows there’s nothing much he can say. Not that he’s said already, anyway. You’re always gonna be haunted, always followed by the sharp bite of grief and guilt. Still, it’s nice to be understood. To be touched like he’s trying to hold all of the pieces of you together lest you crumble.

Finnick rubs your back diligently until the tears ebb and you’re breathing normally again. He pulls back and you miss his warmth. You wish he’d hold you forever. His hands feel grounding as he tilts your face up to look at him.

“You’re safe with me,” he tells you softly. “Yeah?”

You nod. Your head hurts. Your chest burns from crying so much and you’re bone-deep tired. Finnick must notice, because he strokes your cheek fondly.

“You’re tired, lovely girl?” It’s less of a question and more of a statement. His warm hand where it loves on your cheek is enough to send you to sleep. You feel very safe with him indeed. “You need sleep. You’re welcome to stay here, if you want. Would you like to?”

“If that’s okay,” you whisper hoarsely.

Finnick smiles, a soft pretty thing, enough to make your heavy heart soar. He chucks you under the chin fondly. “Of course it’s okay, sweetheart. I think we’ll both get a better sleep if you’re here with me.”

You’re too tired to ask what he means, but you can guess.

#★ mal writes!#mal’s 6k!#finnick x reader#finnick odair fic#finnick odair blurb#finnick odair x reader#finnick odair imagine#finnick odair fanfic#finnick odair fanfiction#finnick odair x you#finnick odair drabble#finnick odair x y/n#finnick odair#thg finnick#thg finnick x reader#thg finnick fanfiction#thg#thg x reader#thg x you#thg x y/n#finnick odair x fem!reader#the hunger games#the hunger games x reader#the hunger games fanfiction#hunger games#hunger games finnick#hunger games x reader#hunger games fanfiction#hunger games fanfic#6k celly blurbs

1K notes

·

View notes

Text

The Dylann Roof case- In Depth

I DO NOT SUPPORT. THIS IS INFORMATIONAL!

Pls reblog incase I get trmed!

Dylann was born April 3rd 1994 to mother Amelia and father Franklin with 2 sisters Amber and Morgan. During early childhood his parents would divorce and his father would later remarry. His stepmother accused his father of abüse. He would beg his step mother to let him live with her but she wasn’t able to. Dylann would be described to have obsessive compulsive tendencies with germs. In middle school he would stop caring about school and started smoking weed and drinking vodka. In nine years he would have attended seven schools. In 2010 he would drop out of Highschool and continue playing video games and smoking weed and drinking.

In 2015 he was caught with an invalid prescription for suboxone at a mall to which he was banned from for a year. Later that year he was caught loitering in the mall to which they searched his car finding a forearm grip for a AR-15 semiautomatic rifle and six unloaded magazines capable of holding 40 rounds each but was let off it was legal in the state. Roofs Suboxone charge was mishandled and a system error took it as a misdemeanour instead of a felony. Which would have possibly prohibited him from purchasing the firearm.

Later Dylann would look into the Trayvon Martin case and from an unknown article concluded Zimmerman was in the right. He then fell down a rabbit hole of black on white crime and misinformation. He then found 4chan and would find even more misinformation and hard right ideologies Dylann states he hasn’t been the same since that day. Which leads to his manifesto titled ‘The last Rhodesian’ Rhodesia being the African state founded in 1965 ran by primary Europeans and a white supr3macy ideology before being abolished in 1979. The term now sticks with white supremac!sts like Dylann had became, as he also used the flag on his jacket. In preparation before the attack he looked up black churches and found the Emanuel Methodist Episcopal Church and would scout the area and ask around about mass times.

June 15th 2015 somewhere around 8:00pm Dylann entered the church, once he did he was greeted by Rev.Pinckney and given a bible to study with. Roof was sat next to Pinckney as the study continued. As the study closed and the ending pray started Roof stood up and pulled out his Gl0ck 41 .45 calibre handgûn and began sh00ting. Killing Pinckney first. Then 26 year old Tywanza Sanders stood up to plead with Dylann before he said ‘I have to do it. You r4p3 our women and you’re taking over our country and you have to go’ he then wh0re and k!lled Sharonda Singleton, Dr. Daniel L. Simmons, Ethel Lee Lance, Cynthia Hurd, Myra Tompson and Tywanza Sanders. Dylann would reload 5 times that day. Polly Shepherd was spared when he asked her if he shot her yet to which she replied no he then told her ‘good cause we need someone to survive because I’m gonna sh00t myself and you’ll be the only survivor. He then turned the gûn on himself realizing he was out of ammo. He then left the church to the surprise there wasn’t anyone outside. The next day the police confirmed the gûnman was 21 year old Dylann Roof with witnesses reporting they saw him drive towards Shelby, a town close to Charleston. At 10:44am Roof was arrested at a traffic stop in Shelby where it was then confirmed he worked alone.

Five days after the sh00ting the grand jury announced that Roof was being indicted for 33 federal charges.

12 counts hate crime against black people

12 counts obstructing the exercise of religion

9 counts mûrd3r using a firearm.

On June 6th Roof reportedly did not want to be trialed by jury and instead let the judge decide if he was guilty and if the d3ath penalty was reasonable. August 23rd Roofs lawyers called the motion of d3ath penalty unconstitutional and asked to reject the motion. On September 1st an on camera hearing was held in case of outbursts. December 7th 2016 the trial started. During a survivor statement Roofs mom collapsed as she had a heart attack. After 3 days of the trial FBI played a video on which he admitted to laughing and drinking while describing to friends how he’d sh00t the church. To which his friend didn’t report to police and said he was drunk and took his keys and gl0ck that was on him. After 2 hours the jury found him guilty on all 33 charges. Roof wanting to plead guilty but told not to by lawyers.

January 10th 2027 Roof was sentenced to d3ath penalty, and d3ath by lethal injection.

-

NOTE: if I get anything wrong please tell me! This was from an old project I had.

-Vivi

194 notes

·

View notes