#toyota battery

Text

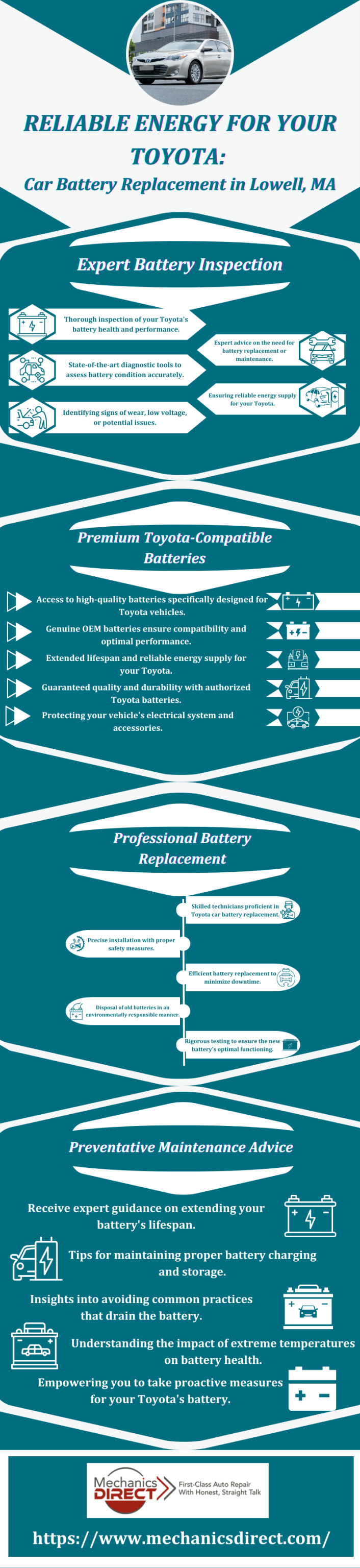

Ensure reliable energy for your Toyota with expert car battery replacement services in Lowell, MA. Our skilled technicians perform thorough battery inspections using advanced diagnostic tools, identifying signs of wear or low voltage. With access to premium Toyota-compatible batteries, we guarantee compatibility and optimal performance. Our professional battery replacement service is efficient, minimizing downtime, and ensuring proper installation and testing. Additionally, you'll receive preventative maintenance advice to extend your battery's lifespan and protect your Toyota's electrical system. Trust us for reliable energy that keeps your Toyota running smoothly in Lowell, MA.

0 notes

Note

Can I be very cheeky and request another kiss prompt… if you feel like it I’d love prompt 23 (a kiss in relief) for Matty and George (I’ve requested a pairing this time don’t worry!!)

Ps. Have you ever considered emojis to keep track of anons? For example I sign off as ♥️ on a few other blogs

Whelp, this is it. After what feels like a very long time (or well, it's been a month, up to you if that's a long time!) I have finally come to the LAST Kiss Prompt in my Inbox! Thank you so much to all you lovely wonderful people who have sent them in! I have had so much fun working on these and am so honored that y'all liked my writing enough to request them! My inbox is always open for more requests (formal or informal) and I will always do my best to fulfill these fic requests, even if they take me a while! I'm slowly but surely posting all of the kiss prompts that I've completed on AO3, so if you want to revisit any, missed any, or want to give any some special love, they eventually will all be able to be found here. The original list of prompts can be found here! Thank you so much again to everyone who spent in a prompt!

Special thank you very much ♥️ Anon for sending this one in! I'm sorry it took me a while to get to, but I hope you enjoy it! I had no idea there were enough people who sent me asks that you guys would want to have an emoji to identify yourselves but if you want want, it's yours feel free to claim it (just not the ♥️ unless you are the newly dubbed ♥️ Anon!) Let me know what you think!

(Warnings for this prompt: Matty is involved in a single car accident swerving to avoid a deer and ends up in the hospital - when George first finds out about the accident he worries that Matty was driving drunk, however he was NOT)

❤️Ally

23. Kiss … in relief

George’s heart was racing as he made his way through the sliding door, his rain damp trainers squeaking on the polished sheet vinyl flooring as he scurried across the lobby, nearly slipping right in front of the “Wet Floor” sign. There was another man in line in front of him and he resisted the urge to tap his foot impatiently. He swallowed hard, trying to will himself to stay calm. He needed to stay calm and level headed. Matty needed him to stay calm and level headed. Only one of them was allowed to freak out at a time and George knew that it was not his turn.

The man turned away, a hospital bracelet fastened around his wrist and George felt a pang of sympathy as he watched him take a step to the side, headed towards the waiting room area. But he pushed it down, he was here under his own power, meaning it couldn’t be dire. It was his turn to speak with the receptionist.

“I’m looking for Matthew Healy,” George said, quickly, bracing his hands on the counter, “I got a call that he was admitted.”

“Can you spell that for me please?” the receptionist asked.

George swallowed down his irritation. “Healy, H-E-A-L-Y,” he said and the receptionist hit a few buttons on the keyboard, frowning as she looked at the screen.

“And you are?” she asked, looking up at George, her expression bored, as if she wasn’t the only thing standing between Geroge and the love of his life.

“Ah, George Daniel, his partner and power of attorney?” he said, hating that it sounded like a question, hating that he knew that title didn’t even begin to cover it. Matty was his soul mate, his other half, his twin flame burning, one could not exist without the other. However, he seemed to have earned her approval because she hit a few buttons on her computer and then nodded to herself.

“He’s in room twenty oh two,” she said, “it’s through the double doors on the right, down the hall to the left,” she said.

George barely remembered to thank her before he was running through the double doors she had indicated, watching the room numbers tick by as he looked for 2002.

He froze just outside the door, heart hammering in his chest as he tried to mentally prepare himself for what he was going to find. Was Matty going to be intubated and sedated? Was he going to be handcuffed to the bed? George swallowed hard, hating the uncertainty, hating that upon receiving the call his stomach had dropped. He hated that his first thought, even after all these years, was that Matty was drunk. Or high. Or a combination of the two.

The woman he had spoken with hadn’t been able to give him any information over the phone. Just that Matty had been involved in a single car accident and had been admitted into the hospital a little over halfway between Manchester and London. He had been driving back from visiting his mother, George hated himself as he buckled his own seatbelt that he had declined joining Matty on the trip.

He had made it to the hospital in record time, while still being careful of the heavy downpour. Worst case scenarios playing out in his mind's eye as he drove. Matty was drunk. He had to have been Geroge thought darkly. He loved Denise but also knew she would never discourage another glass of wine, he knew that Matty would never turn one down. He ran his fingers through his close cropped hair, the strands wet even from the sprint from the parking lot. He swallowed hard. He needed to rip off the bandaid. He needed to open the door. He was just terrified, uncertain, afraid of what he was going to find.

A nurse rounded the corner and made eye contact with George, smiling up at him. “You can go in,” she said kindly, her accent thick and Scottish, seeing George’s hesitation.

He took a deep breath, and turned the handle.

“Oh love,” he said, the words slipping out of his mouth before he could stop them.

Matty was curled up on his side, his back to the door, his dark curls, the ringlets matted together with what George hoped was water and not blood, were sticking out from the top of the blanket draped over him. He rolled over, the movement slow and careful as if it caused him great pain.

“George?” he asked, his voice rough and wet as he sat up, blinking up at him like he couldn’t believe what he was seeing.

“I’m here, baby,” he said, moving through the doorway and deeper into the room, his legs moving on their own accord to Matty’s bedside.

He reached out, running his hands down his skinny shoulders, his sides, checking him over as if he knew what he was looking for, as if he could pinpoint what was wrong with him, what was hiding beneath the thin hospital gown. He had a cut on his cheek, a butterfly bandage holding it together, and George was sure his chest was bruised from the seatbelt and airbags, his neck aching from the whiplash. He leaned down, pressing their lips together. He licked into Matty’s mouth, burying his fingers in the curls, holding his head steady so as not to aggravate his neck, he could taste blood from Matty’s lip, he must have bitten it during the crash.

“You’re okay,” George whispered, eyes wide, as he pulled away, relief oozing from every pore. There was no alcohol on Matty’s tongue. “You’re okay.”

Matty sniffled, “I’m so sorry,” he said, he was crying quietly George realized, “I fucked up,” he hiccuped, “I’m so sorry.”

“Ssh,” said George sitting on the edge of the bed, pulling Matty into his arms. “It’s okay, you’re okay.”

Matty turned and buried his face against George’s chest, his breathing evening out as George ran his hand down his back, his hand hot against the cool bare skin visible between the open sides of the gown.

“What happened, love?” George asked, wanting to hear Matty’s account before he flagged down the doctor.

Matty sniffled and took a shaking breath. “Well,” he said wetly, “my car is fucked.”

George bit back a laugh. “We can replace that,” he said and Matty snorted.

“It was raining,” he said quietly, “and you know I don’t see too well at night anymore, and a deer ran out in front of the car, I tried to swerve, but I was going too fast, I just wanted to get home, and I ended up hitting a ditch on the side of the road,” he said the words coming in a rush. “And the next thing I knew the airbags went off and I was rolling down the hill.”

He took another breath, “they said I was lucky,” he said quietly, “that I had a good car, it could have been a lot worse.”

“So what you’re saying is we need to get you another Audi,” George said, trying to cheer Matty up, trying to make him smile, the grief and upset rolling off of him in waves making George’s heartbreak.

“I don’t think I want to drive anywhere for a while,” Matty said softly, keeping his eyes downcast. “The doctor’s said I can’t anyway, I have a concussion.”

“And that’s okay too,” said George, pressing another kiss to Matty’s lips in relief. “I’m just happy that you’re going to be alright.”

#allylikethecat#ask ally#anon ask#heart anon#♥️ anon#Prompt fill#prompt fills#kiss prompt#kiss prompts#fanfic prompt#matty healy fanfiction#the 1975 rpf#matty healy rpf#fanfiction#fanfic#fun fact about ally#my first car was an audi and i had it up until i killed it last year#where i live now is so hot that the battery literally exploded#now i have a toyota because i didnt want to ruin another nice car with my horse girl shit#ANYWAY#thank you so much to everyone who sent in prompts#this was so much fun and so special#and im so thankful that yall cared enough and liked my writing enough to send them#thank you!!!

10 notes

·

View notes

Text

Now I really do hope it's at least two more years before we buy a battery-electric car

Last week, we won a weird old-car-ownership lottery by having the hybrid battery of our Toyota Prius fail–after about 17 and a half years and just over 126,000 miles. That more than doubled the eight years covered by Toyota’s warranty and comfortably exceeded the warranty’s alternate minimum of 100,000 miles, a threshold we crossed in February of 2018.

Back when we bought this then-cutting-edge…

View On WordPress

#EV#EV tax credit#EV tax credits#hybrid battery#hybrid battery replacement#Inflation Reduction Act#old car#P0A80#Prius#Prius red triangle#Prius traction battery#Toyota#Toyota Prius

3 notes

·

View notes

Text

#technology#battery#electric vehicles#electric cars#toyota#solid state batteries#solid state battery market

0 notes

Text

youtube

CEO of CATL responds to Toyota's battery claims: 'unreliable, unsafe & unproven!'

CEO of CATL responds to Toyota's battery claims: 'unreliable, unsafe & unproven!'

P.S. Breaking news...!!!

#China#CATL#Toyota#ev manufacturing#demise of legacy automakers#ev adoption#competition#LFP battery#Youtube

1 note

·

View note

Text

The Driver Suit Blog-Paint Scheme Grades-February 17, 2024

By David G. Firestone

Kyle Busch #8 zone Premium Nicotine Patches Chevy Camaro-My only complaint here is that I don’t the shade of green. A-

Denny Hamlin #11 Interstate Batteries Toyota Camry-Same scheme as last year, same F grade.

Martin Truex Jr. #19 Interstate Batteries Toyota Camry-Same scheme as last year, same F grade.

Christopher Bell #20 Interstate Batteries Toyota Camry-Same scheme as…

View On WordPress

#B’laster#camaro#Camry#chevy#chevy camaro#Christopher Bell#Denny Hamlin#ford#ford mustang#interstate batteries#kyle busch#martin truex jr.#Michael McDowell#Mustang#nascar#NASCAR Cup#NASCAR Cup Series#toyota#toyota camry#zone Premium Nicotine

0 notes

Link

La rivolta degli agricoltori è dilagata in tutta Europa con episodi che spesso sono degenerati nei blocchi stradali e negli scontri violenti. Se ne parla persino a #Sanremo2024. Quali sono le ragioni degli agricoltori che manifestano in trattore?

Se l'agricoltura piange, l'industria non ride. Stellantis torna invocare sussidi per le auto elettriche al governo italiano per evitare la chiusura di stabilimenti storici come Mirafiori e Pomigliano. E' un triste copione di cui purtroppo le recite stanno scadendo in una tragica farsa.

L'imposizione degli obiettivi di decarbonizzazione distruggerà l'industria automobilistica europea per beneficiare improvvidamente le auto elettriche cinesi?

#auto#autoelettriche#automotive#batterie#byd#decarbonizzazione#ecologia#elkann#giorgetti#greennewdeal#meloni#peugeot#renault#salvini#stellantis#tavares#tesla#toyota#urso

0 notes

Text

Unlocking Efficiency: Toyota Camry 2007 Hybrid Battery Replacement Guide

The Toyota Camry 2007 Hybrid has been a reliable and fuel-efficient choice for many drivers over the years. However, as with any hybrid vehicle, the battery is a critical component that may eventually require replacement. If you're facing the need for a Toyota Camry 2007 Hybrid battery replacement, this guide will walk you through the process and provide insights into making an informed decision.

Understanding the Hybrid Battery:

The heart of the Toyota Camry 2007 Hybrid is its hybrid synergy drive system, which includes a high-voltage battery responsible for powering the electric motor. Over time, the battery's performance may decline, leading to a decrease in fuel efficiency and overall driving experience. Replacing the hybrid battery can breathe new life into your vehicle and restore its optimal performance.

Signs of a Failing Hybrid Battery:

Before delving into the replacement process, it's crucial to recognize the signs indicating a failing hybrid battery. Common symptoms include a decrease in fuel efficiency, a warning light on the dashboard, and a noticeable drop in overall power. If you experience these issues, it's time to consider a battery replacement to maintain your Camry Hybrid's performance.

Choosing the Right Replacement Battery:

When it comes to replacing the hybrid battery in your Toyota Camry 2007, there are several options to consider. Original Equipment Manufacturer (OEM) batteries are genuine Toyota parts but can be relatively expensive. Alternatively, aftermarket batteries and refurbished units are more budget-friendly options. It's essential to weigh the pros and cons of each and choose a battery that aligns with your budget and performance expectations.

DIY vs. Professional Installation:

Deciding whether to replace the hybrid battery yourself or seek professional assistance is a crucial consideration. While some enthusiasts may opt for a do-it-yourself approach, it's important to note that hybrid batteries involve high voltage and complex systems. If you're not experienced with hybrid technology, it's recommended to consult a certified technician for the replacement to ensure safety and proper installation.

Cost Considerations:

The cost of a Hybrid battery replacement can vary depending on factors such as the type of battery chosen and the labor involved. The toyota camry 2007 hybrid battery replacement tend to be more expensive, while aftermarket options provide a more budget-friendly alternative. Additionally, labor costs for professional installation should be factored into your budget. Consider obtaining quotes from reputable service providers to make an informed decision.

Long-Term Benefits:

Investing in a hybrid battery replacement for your Toyota Camry 2007 comes with long-term benefits. Not only will you experience improved fuel efficiency and performance, but you'll also contribute to the vehicle's overall longevity. A well-maintained hybrid system ensures a smoother driving experience and supports eco-friendly practices by maximizing fuel efficiency.

The Toyota Camry 2007 Hybrid has proven to be a durable and efficient vehicle, and a failing hybrid battery shouldn't be a roadblock to its continued performance. Understanding the signs of battery deterioration, choosing the right replacement, and deciding on the installation method are crucial steps in the process. By making informed decisions, you can unlock the full potential of your Camry Hybrid, enjoying a revitalized driving experience for years to come.

0 notes

Text

1 note

·

View note

Note

To add to the nightmare before Christmas Eve lore - can't forget about what Denise said on the "Parenting Hell" podcast that Matty who didn't have his drivers license rode around on a Jeep he wasn't allowed to drive and got it stuck in a ditch 😂

YESSS can't forget that part! I know he was a teenager at the time, and didn't actually have his driver's license / know how to drive when that happened, but I have always full heartedly believed that Matty is a terrible driver. No idea if this is true or not, but he just gives me "bad at driving" vibes and him getting the Jeep stuck in a ditch in the backyard just further reenforces that idea in my mind 😂 I am also not the best driver (that decorative rock jumped RIGHT in front of my car okay!) so I feel like I can say this and also bad drivers recognize other bad drivers? Maybe? Who knows maybe Matty really is actually a good driver now. Fictional!Matty meanwhile hits the same curb outside his drive way AT LEAST twice a week.

I really hope I'm able to get the Nightmare Before Christmas (Eve) fic finished in time and that it lives up to this hype that seems to be building! Thank you so much for reading and for sending this in!

❤️Ally

#allylikethecat#ask ally#anon ask#the nightmare before christmas (eve)#matty fic#keep it kind#gatty#holiday fic#but yeah i am not the best driver#thats why my father made me get a TOYOTA#that thing is a TANK#i murdered my audi#like the battery literally exploded#rip steve the audi#now i have miranda the toyota#one of my favorite upcoming scenes is in you know where the city is#and fictional!Matty and fictional!taylor are feeling emo and want to get away for a little bit#so they run away#and get into THREE (3) separate minor car accidents#because they both suck at driving#i have this theory that bisexuals cant drive#so far my sample size has been proving my theory correct lol#regardless#fictional!matty will be getting the jeep stuck in the back yard#in this fic#its also going to just be a one shot though#i hope thats okay#idk how long it will end up being either#mostly because i havent fully started it#its just an outline and an intro paragraph

1 note

·

View note

Text

#Subaru Corp#Electric vehicles#Atsushi Osaki#50% target by 2030#EV production in the U.S.#U.S. Inflation Reduction Act#Hybrid vehicles#Exporting EVs Japan to US#Agile adaptation#new EV models by 2028#SUV EV models#Investment $10 billion#Battery-related projects#Battery supply#Panasonic Energy#Toyota Motor#Innovation#sustainability#Cleaner transportation#Strategic partnerships#Automotive industry#Sustainable mobility#Future of driving#japan#tokyo#investment#clean energy#decarbonization#environmental impact#collaboration

1 note

·

View note

Text

Hydrogen Is the Future—or a Complete Mirage!

The green-hydrogen industry is a case study in the potential—for better and worse—of our new economic era.

— July 14, 2023 | Foreign Policy | By Adam Tooze

An employee of Air Liquide in front of an electrolyzer at the company's future hydrogen production facility of renewable hydrogen in Oberhausen, Germany, on May 2, 2023. Ina Fassbender/ AFP Via Getty Images

With the vast majority of the world’s governments committed to decarbonizing their economies in the next two generations, we are embarked on a voyage into the unknown. What was once an argument over carbon pricing and emissions trading has turned into an industrial policy race. Along the way there will be resistance and denial. There will also be breakthroughs and unexpected wins. The cost of solar and wind power has fallen spectacularly in the last 20 years. Battery-powered electric vehicles (EVs) have moved from fantasy to ubiquitous reality.

But alongside outright opposition and clear wins, we will also have to contend with situations that are murkier, with wishful thinking and motivated reasoning. As we search for technical solutions to the puzzle of decarbonization, we must beware the mirages of the energy transition.

On a desert trek a mirage can be fatal. Walk too far in the wrong direction, and there may be no way back. You succumb to exhaustion before you can find real water. On the other hand, if you don’t head toward what looks like an oasis, you cannot be sure that you will find another one in time.

Right now, we face a similar dilemma, a dilemma of huge proportions not with regard to H2O but one of its components, H2—hydrogen. Is hydrogen a key part of the world’s energy future or a dangerous fata morgana? It is a question on which tens of trillions of dollars in investment may end up hinging. And scale matters.

For decades, economists warned of the dangers of trying through industrial policy to pick winners. The risk is not just that you might fail, but that in doing so you incur costs. You commit real resources that foreclose other options. The lesson was once that we should leave it to the market. But that was a recipe for a less urgent time. The climate crisis gives us no time. We cannot avoid the challenge of choosing our energy future. As Chuck Sabel and David Victor argue in their important new book Fixing the Climate: Strategies for an Uncertain World, it is through local partnership and experimentation that we are most likely to find answers to these technical dilemmas. But, as the case of hydrogen demonstrates, we must beware the efforts of powerful vested interests to use radical technological visions to channel us toward what are in fact conservative and ruinously expensive options.

A green hydrogen plant built by Spanish company Iberdrola in Puertollano, Spain, on April 18, 2023. Valentine Bontemps/AFP Via Getty Images

In the energy future there are certain elements that seem clear. Electricity is going to play a much bigger role than ever before in our energy mix. But some very knotty problems remain. Can electricity suffice? How do you unleash the chemical reactions necessary to produce essential building blocks of modern life like fertilizer and cement without employing hydrocarbons and applying great heat? To smelt the 1.8 billion tons of steel we use every year, you need temperatures of almost 2,000 degrees Celsius. Can we get there without combustion? How do you power aircraft flying thousands of miles, tens of thousands of feet in the air? How do you propel giant container ships around the world? Electric motors and batteries can hardly suffice.

Hydrogen recommends itself as a solution because it burns very hot. And when it does, it releases only water. We know how to make hydrogen by running electric current through water. And we know how to generate electricity cleanly. Green hydrogen thus seems easily within reach. Alternatively, if hydrogen is manufactured using natural gas rather than electrolysis, the industrial facilities can be adapted to allow immediate, at-source CO2 capture. This kind of hydrogen is known as blue hydrogen.

Following this engineering logic, H2 is presented by its advocates as a Swiss army knife of the energy transition, a versatile adjunct to the basic strategy of electrifying everything. The question is whether H2 solutions, though they may be technically viable, make any sense from the point of view of the broader strategy of energy transition, or whether they might in fact be an expensive wrong turn.

Using hydrogen as an energy store is hugely inefficient. With current technology producing hydrogen from water by way of electrolysis consumes vastly more energy than will be stored and ultimately released by burning the hydrogen. Why not use the same electricity to generate the heat or drive a motor directly? The necessary electrolysis equipment is expensive. And though hydrogen may burn cleanly, as a fuel it is inconvenient because of its corrosive properties, its low energy per unit of volume, and its tendency to explode. Storing and moving hydrogen around will require huge investment in shipping facilities, pipelines, filling stations, or facilities to convert hydrogen into the more stable form of ammonia.

The kind of schemes pushed by hydrogen’s lobbyists foresee annual consumption rising by 2050 to more than 600 million tons per annum, compared to 100 million tons today. This would consume a huge share of green electricity production. In a scenario favored by the Hydrogen Council, of the United States’ 2,900 gigawatts of renewable energy production, 650 gigawatts would be consumed by hydrogen electrolysis. That is almost three times the total capacity of renewable power installed today.

The costs will be gigantic. The cost for a hydrogen build-out over coming decades could run into the tens of trillions of dollars. Added to which, to work as a system, the investment in hydrogen production, transport, and consumption will have to be undertaken simultaneously.

Little wonder, perhaps, that though the vision of the “hydrogen economy” as an integrated economic and technical system has been around for half a century, we have precious little actual experience with hydrogen fuel. Indeed, there is an entire cottage industry of hydrogen skeptics. The most vocal of these is Michael Liebreich, whose consultancy has popularized the so-called hydrogen ladder, designed to highlight how unrealistic many of them are. If one follows the Liebreich analysis, the vast majority of proposed hydrogen uses in transport and industrial heating are, in fact, unrealistic due to their sheer inefficiency. In each case there is an obvious alternative, most of them including the direct application of electricity.

Technicians work on the construction of a hydrogen bus at a plant in Albi, France, on March 4, 2021. Georges Gobet/AFP Via Getty Images

Nevertheless, in the last six years a huge coalition of national governments and industrial interests has assembled around the promise of a hydrogen-based economy.

The Hydrogen Council boasts corporate sponsors ranging from Airbus and Aramco to BMW, Daimler Truck, Honda, Toyota and Hyundai, Siemens, Shell, and Microsoft. The national governments of Japan, South Korea, the EU, the U.K., the U.S., and China all have hydrogen strategies. There are new project announcements regularly. Experimental shipments of ammonia have docked in Japan. The EU is planning an elaborate network of pipelines, known as the hydrogen backbone. All told, the Hydrogen Council counts $320 billion in hydrogen projects announced around the world.

Given the fact that many new uses of hydrogen are untested, and given the skepticism among many influential energy economists and engineers, it is reasonable to ask what motivates this wave of commitments to the hydrogen vision.

In technological terms, hydrogen may represent a shimmering image of possibility on a distant horizon, but in political economy terms, it has a more immediate role. It is a route through which existing fossil fuel interests can imagine a place for themselves in the new energy future. The presence of oil majors and energy companies in the ranks of the Hydrogen Council is not coincidental. Hydrogen enables natural gas suppliers to imagine that they can transition their facilities to green fuels. Makers of combustion engines and gas turbines can conceive of burning hydrogen instead. Storing hydrogen or ammonia like gas or oil promises a solution to the issues of intermittency in renewable power generation and may extend the life of gas turbine power stations. For governments around the world, a more familiar technology than one largely based on solar panels, windmills, and batteries is a way of calming nerves about the transformation they have notionally signed up for.

Looking at several key geographies in which hydrogen projects are currently being discussed offers a compound psychological portrait of the common moment of global uncertainty.

A worker at the Fukushima Hydrogen Energy Research Field, a test facility that produces hydrogen from renewable energy, in Fukushima, Japan, on Feb. 15, 2023. Richard A. Brooks/AFP Via Getty Images

The first country to formulate a national hydrogen strategy was Japan. Japan has long pioneered exotic energy solutions. Since undersea pipelines to Japan are impractical, it was Japanese demand that gave life to the seaborne market for liquefied natural gas (LNG). What motivated the hydrogen turn in 2017 was a combination of post-Fukushima shock, perennial anxiety about energy security, and a long-standing commitment to hydrogen by key Japanese car manufacturers. Though Toyota, the world’s no. 1 car producer, pioneered the hybrid in the form of the ubiquitous Prius, it has been slow to commit to full electric. The same is true for the other East Asian car producers—Honda, Nissan, and South Korea’s Hyundai. In the face of fierce competition from cheap Chinese electric vehicles, they embrace a government commitment to hydrogen, which in the view of many experts concentrates on precisely the wrong areas i.e. transport and electricity generation, rather than industrial applications.

The prospect of a substantial East Asian import demand for hydrogen encourages the economists at the Hydrogen Council to imagine a global trade in hydrogen that essentially mirrors the existing oil and gas markets. These have historically centered on flows of hydrocarbons from key producing regions such as North Africa, the Middle East, and North America to importers in Europe and Asia. Fracked natural gas converted into LNG is following this same route. And it seems possible that hydrogen and ammonia derived from hydrogen may do the same.

CF Industries, the United States’ largest producer of ammonia, has finalized a deal to ship blue ammonia to Japan’s largest power utility for use alongside oil and gas in power generation. The CO2 storage that makes the ammonia blue rather than gray has been contracted between CF Industries and U.S. oil giant Exxon. A highly defensive strategy in Japan thus serves to provide a market for a conservative vision of the energy transition in the United Sates as well. Meanwhile, Saudi Aramco, by far the world’s largest oil company, is touting shipments of blue ammonia, which it hopes to deliver to Japan or East Asia. Though the cost in terms of energy content is the equivalent of around $250 per barrel of oil, Aramco hopes to ship 11 million tons of blue ammonia to world markets by 2030.

To get through the current gas crisis, EU nations have concluded LNG deals with both the Gulf states and the United States. Beyond LNG, it is also fully committed to the hydrogen bandwagon. And again, this follows a defensive logic. The aim is to use green or blue hydrogen or ammonia to find a new niche for European heavy industry, which is otherwise at risk of being entirely knocked out of world markets by high energy prices and Europe’s carbon levy.

The European steel industry today accounts for less than ten percent of global production. It is a leader in green innovation. And the world will need technological first-movers to shake up the fossil-fuel dependent incumbents, notably in China. But whether this justifies Europe’s enormous commitment to hydrogen is another question. It seems motivated more by the desire to hold up the process of deindustrialization and worries about working-class voters drifting into the arms of populists, than by a forward looking strategic calculus.

In the Netherlands, regions that have hitherto served as hubs for global natural gas trading are now competing for designation as Europe’s “hydrogen valley.” In June, German Chancellor Olaf Scholz and Italian Prime Minister Giorgia Meloni inked the contract on the SoutH2 Corridor, a pipeline that will carry H2 up the Italian peninsula to Austria and southern Germany. Meanwhile, France has pushed Spain into agreeing to a subsea hydrogen connection rather than a natural gas pipeline over the Pyrenees. Spain and Portugal have ample LNG terminal capacity. But Spain’s solar and wind potential also make it Europe’s natural site for green hydrogen production and a “green hydrogen” pipe, regardless of its eventual uses, in the words of one commentator looks “less pharaonic and fossil-filled” than the original natural gas proposal.

A hydrogen-powered train is refilled by a mobile hydrogen filling station at the Siemens test site in Wegberg, Germany, on Sept. 9, 2022. Bernd/AFP Via Getty Images

How much hydrogen will actually be produced in Europe remains an open question. Proximity to the point of consumption and the low capital costs of investment in Europe speak in favor of local production. But one of the reasons that hydrogen projects appeal to European strategists is that they offer a new vision of European-African cooperation. Given demographic trends and migration pressure, Europe desperately needs to believe that it has a promising African strategy. Africa’s potential for renewable electricity generation is spectacular. Germany has recently entered into a hydrogen partnership with Namibia. But this raises new questions.

First and foremost, where will a largely desert country source the water for electrolysis? Secondly, will Namibia export only hydrogen, ammonia, or some of the industrial products made with the green inputs? It would be advantageous for Namibia to develop a heavy-chemicals and iron-smelting industry. But from Germany’s point of view, that might well defeat the object, which is precisely to provide affordable green energy with which to keep industrial jobs in Europe.

A variety of conservative motives thus converge in the hydrogen coalition. Most explicit of all is the case of post-Brexit Britain. Once a leader in the exit from coal, enabled by a “dash for gas” and offshore wind, the U.K. has recently hit an impasse. Hard-to-abate sectors like household heating, which in the U.K. is heavily dependent on natural gas, require massive investments in electrification, notably in heat pumps. These are expensive. In the United Kingdom, the beleaguered Tory government, which has presided over a decade of stagnating real incomes, is considering as an alternative the widespread introduction of hydrogen for domestic heating. Among energy experts this idea is widely regarded as an impractical boondoggle for the gas industry that defers the eventual and inevitable electrification at the expense of prolonged household emissions. But from the point of view of politics, it has the attraction that it costs relatively less per household to replace natural gas with hydrogen.

Employees work on the assembly line of fuel cell electric vehicles powered by hydrogen at a factory in Qingdao, Shandong province, China, on March 29, 2022. VCG Via Getty Images

As this brief tour suggests, there is every reason to fear that tens of billions of dollars in subsidies, vast amounts of political capital, and precious time are being invested in “green” energy investments, the main attraction of which is that they minimize change and perpetuate as far as possible the existing patterns of the hydrocarbon energy system. This is not greenwashing in the simple sense of rebadging or mislabeling. If carried through, it is far more substantial than that. It will build ships and put pipes in the ground. It will consume huge amounts of desperately scarce green electricity. And this faces us with a dilemma.

In confronting the challenge of the energy transition, we need a bias for action. We need to experiment. There is every reason to trust in learning-curve effects. Electrolyzers, for instance, will get more affordable, reducing the costs of hydrogen production. At certain times and in certain places, green power may well become so abundant that pouring it into electrolysis makes sense. And even if many hydrogen projects do not succeed, that may be a risk worth taking. We will likely learn new techniques in the process. In facing the uncertainties of the energy transition, we need to cultivate a tolerance for failure. Furthermore, even if hydrogen is a prime example of corporate log-rolling, we should presumably welcome the broadening of the green coalition to include powerful fossil fuel interests.

The real and inescapable tradeoff arises when we commit scarce resources—both real and political—to the hydrogen dream. The limits of public tolerance for the costs of the energy transition are already abundantly apparent, in Asia and Europe as well as in the United States. Pumping money into subsidies that generate huge economies of scale and cost reductions is one thing. Wasting money on lame-duck projects with little prospect of success is quite another. What is at stake is ultimately the legitimacy of the energy transition as such.

In the end, there is no patented method distinguishing self-serving hype from real opportunity. There is no alternative but to subject competing claims to intense public, scientific, and technical scrutiny. And if the ship has already sailed and subsidies are already on the table, then retrospective cost-benefit assessment is called for.

Ideally, the approach should be piecemeal and stepwise, and in this regard the crucial thing to note about hydrogen is that to regard it as a futuristic fantasy is itself misguided. We already live in a hydrogen-based world. Two key sectors of modern industry could not operate without it. Oil refining relies on hydrogen, as does the production of fertilizer by the Haber-Bosch process on which we depend for roughly half of our food production. These two sectors generate the bulk of the demand for the masses of hydrogen we currently consume.

We may not need 600 million, 500 million, or even 300 million tons of green and blue hydrogen by 2050. But we currently use about 100 million, and of that total, barely 1 million is clean. It is around that core that hydrogen experimentation should be concentrated, in places where an infrastructure already exists. This is challenging because transporting hydrogen is expensive, and many of the current points of use of hydrogen, notably in Europe, are not awash in cheap green power. But there are two places where the conditions for experimentation within the existing hydrogen economy seem most propitious.

One is China, and specifically northern China and Inner Mongolia, where China currently concentrates a large part of its immense production of fertilizer, cement, and much of its steel industry. China is leading the world in the installation of solar and wind power and is pioneering ultra-high-voltage transmission. Unlike Japan and South Korea, China has shown no particular enthusiasm for hydrogen. It is placing the biggest bet in the world on the more direct route to electrification by way of renewable generation and batteries. But China is already the largest and lowest-cost producer of electrolysis equipment. In 2022, China launched a modestly proportioned hydrogen strategy. In cooperation with the United Nations it has initiated an experiment with green fertilizer production, and who would bet against its chances of establishing a large-scale hydrogen energy system?

The other key player is the United States. After years of delay, the U.S. lags far behind in photovoltaics batteries, and offshore wind. But in hydrogen, and specifically in the adjoining states of Texas and Louisiana on the Gulf of Mexico, it has obvious advantages over any other location in the West. The United States is home to a giant petrochemicals complex. It is the only Western economy that can compete with India and China in fertilizer production. In Texas, there are actually more than 2500 kilometers of hardened hydrogen pipelines. And insofar as players like Exxon have a green energy strategy, it is carbon sequestration, which will be the technology needed for blue hydrogen production.

It is not by accident that America’s signature climate legislation, the Inflation Reduction Act, targeted its most generous subsidies—the most generous ever offered for green energy in the United States—on hydrogen production. The hydrogen lobby is hard at work, and it has turned Texas into the lowest-cost site for H2 production in the Western world. It is not a model one would want to see emulated anywhere else, but it may serve as a technology incubator that charts what is viable and what is not.

There is very good reason to suspect the motives of every player in the energy transition. Distinguishing true innovation from self-serving conservatism is going to be a key challenge in the new era in which we have to pick winners. We need to develop a culture of vigilance. But there are also good reasons to expect certain key features of the new to grow out of the old. Innovation is miraculous but it rarely falls like mana from heaven. As Sabel and Victor argue in their book, it grows from within expert technical communities with powerful vested interests in change. The petrochemical complex of the Gulf of Mexico may seem an unlikely venue for the birth of a green new future, but it is only logical that the test of whether the hydrogen economy is a real possibility will be run at the heart of the existing hydrocarbon economy.

— Adam Tooze is a Columnist at Foreign Policy and a History Professor and the Director of the European Institute at Columbia University. He is the Author of Chartbook, a newsletter on Rconomics, Geopolitics, and History.

#Hydrogen#Battery-Powered Electric Vehicles (EVs)#Chuck Sabel | David Victor#Iberdrola Puertollano Spain 🇪🇸#Green Hydrogen#Hydrogen Council of the United States 🇺🇸#Hydrogen Economy#Airbus | Aramco | BMW | Daimler Truck | Honda | Toyota | Hyundai | Siemens | Shell | Microsoft#Japan 🇯🇵 | South Korea 🇰🇷 | EU 🇪🇺 | UK 🇬🇧 | US 🇺🇸 | China 🇨🇳#Portugal 🇵🇹 | Germany 🇩🇪 | Namibia 🇳🇦#European-African Cooperation

1 note

·

View note

Text

youtube

MG4 with battery LFP is cheaper than a Corolla in Australia

P.S. If the MG4 electric hatchback is the same price as a Toyota Corolla in Australia, then it's only a matter of time before a similar price ratio of electric cars to petrol cars appears in other countries...

#affordable ev#Toyota#demise of legacy automakers#Toyota Corolla#tipping point#electric hatchback#ev adoption#LFP battery#lithium iron phosphate battery#fossil fuel phase out#russian defeat#Youtube#very good news

1 note

·

View note