#Aerospace and Defense Materials

Explore tagged Tumblr posts

Text

Aerospace And Defense Materials Market — Industry Analysis, Market Size, Share, Trends, Growth And Forecast 2024–2030

The report “Aerospace and Defense Materials Market– Forecast (2024–2030)”, by IndustryARC, covers an in-depth analysis of the following segments of the Aerospace and Defense Materials market. By Product Forms: Round Products (Bar, Rod, Pipe, Others), Flat Products (Slab, Plat, Sheet, Others), Net-shaped products (Forging, Near-net-shaped powdered products, Machined components) By Material: Metals & Alloys (Aluminum, Titanium alloys, Nickel-based alloys, Steels, Superalloys, Tungsten, Niobium, Others), Composites, Plastics, (Polyetheretherketone (PEEK), Polyamide-imide (PAI), Others), Others By Application: Airframe, Cabin interior, Propulsion, Aero Engine, Naval System, Weapons, Navigation and sensors, Satellites, and Others. By End-use Industry: Aircrafts (Wide Body Aircrafts, Single Aisle Aircrafts, Regional Transport Aircrafts), Rotorcrafts, Spacecrafts, Others. By Geography: North America, South America, Europe, Asia-Pacific, RoW

Request Sample

Key Takeaways

Innovation in the realm of aerospace and defense materials is being fueled by ongoing advancements in materials science and engineering. The development of stronger, more resilient, and lighter materials such as improved composites and alloys is made possible by these breakthroughs. These materials are essential for increasing performance, reducing fuel consumption, and extending the life of defense and aerospace systems. For instance, the use of carbon fiber-reinforced polymers (CFRP) in airplane components has significantly reduced weight without sacrificing structural integrity, saving fuel and improving performance. The fabrication of complicated geometries and bespoke components is made possible by developments in additive manufacturing techniques, which further expand the capabilities of materials used in aerospace and defense.

Several nations’ governments are making significant investments in R&D projects to create cutting-edge defense and aerospace technologies. For instance, as per the International Trade Administration, Canada has aerospace sector spent more than C$680 million (about $523 million) on research and development in 2022, making it more than 2.3 times more intensive than the industrial average. For the first C$2 million (about $1.55 million) in eligible R&D expenses, the Canadian government offers complete write-offs of R&D capital and equipment. This encourages businesses in the Canadian sector to maintain an advantage over rivals worldwide.

Inquiry Before Buying

As per the Indian Brand Equity Foundation, with approximately $223 billion in planned capital expenditures for aerospace and defense over the next ten years and a projected $130 billion investment over the medium term, the Indian defense sector is among the biggest and most lucrative in the world. This will contribute to an expansion in the market for aerospace and defense materials.

By Product Forms — Segment Analysis Flat Products dominated the Aerospace and defense materials market in 2023. Advanced high-strength steel alloys and aluminum are examples of flat products that combine strength and lightweight. For aerospace applications, where a lighter aircraft can result in significant fuel savings and increased efficiency, this weight reduction is essential. For instance, in October 2023, GKN Aerospace and IperionX, a titanium developer located in North Carolina, joined to supply titanium plate test components that are produced using powder metallurgy and titanium angular powder processes. The main goal of this collaboration is to manufacture high-performance titanium plates for testing purposes at GKN Aerospace. It ends with the possibility of future cooperation between GKN Aerospace and IperionX, especially for projects related to the Department of Defense (DoD) in the United States.

Schedule a Call

Slabs provide industrial flexibility since they can be further processed to create a variety of products, including plates, sheets, strips, and structural elements. Because of the material’s adaptability, aerospace and defense companies can create a vast array of parts and structures and tailor them to match particular design specifications. For structural elements including fuselage skins, wing panels, bulkheads, floor beams, and armor plating, slabs are widely employed in aerospace and defense applications. For the structural loads, vibrations, and difficult operating conditions found in aerospace and defense settings, slabs offer the strength, stiffness, and longevity needed.

By Material — Segment Analysis Metals & Alloys dominated the aerospace and defense materials market in 2023. The aerospace industry relies heavily on various metals due to their unique properties. To safely interact with and complement the new composite materials that are rapidly taking over the aerospace industry. Metal alloys like titanium and nickel-based superalloys are replacing aluminum structures in applications requiring extraordinarily high strength-to-weight ratios. The demand for Superalloys based on nickel, cobalt, and iron is also increasing which makes them perfect for hot applications in jet engines. For example, in June 2023, ATI Allvac, which manufactures nickel-base and cobalt-base superalloys, titanium-base alloys, and specialty steels for the aerospace industry, said that it had received an estimated $1.2 billion in new sales commitments from major aerospace and defense industries. For instance, in October 2023, Novelis, a global leader in aluminum rolling and recycling and a top supplier of sustainable aluminum solutions, announced that it had extended its agreement with Airbus. This agreement strengthens Novelis’s long-standing relationship with Airbus and highlights the company’s leadership position in supplying cutting-edge aluminum products and services to the commercial aircraft sector. In October 2022, Mishra Dhatu Nigam Limited (MIDHANI) and Boeing India announced a collaboration to create raw materials for the aerospace industry. MIDHANI is a state-owned steel component, superalloy, and other material provider.

Buy Now

By Application — Segment Analysis Cabin interior dominated the aerospace and defense materials market in 2023. Adoption of new technologies, such as additive manufacturing, has the potential to transform supply chains and product design, driving higher demand for materials used in cabin interiors. For example, in February 2023, Chromatic 3D Materials, a 3D-printing technology enterprise, announced that their thermoset polyurethanes passed 14 CFR vertical burn tests, demonstrating anti-flammability norms for airworthiness. The successful examination indicates that the abrasion-resistant materials can be used to 3D-print a wide range of airline parts, including elastomeric components for stowage compartments and ornamental panels, as well as ductwork, cargo liners, fabric sealing, and other applications. There has been an increase in demand lately for business jets and older aircraft to be repaired and renovated. For instance, in November 2022, Emirates invested $2 bn and began its huge 2-year refurbishment program with the first of 120 aircraft slated for a full cabin interior upgrade and the installation of the airline’s most recent Premium Economy seats. Similarly, refurbishment activities are expected to strengthen the market throughout the forecast period.

By End-use Industry- Segment Analysis Aircrafts dominated the aerospace and defense materials market in 2023. There is a growing usage of high-performance materials in commercial aircraft applications. for example, Boeing estimates that the airline industry will need more than 44,000 new commercial aircraft by 2038, with a total estimated value of $6.8 trillion. All these aircraft employ composite materials. Aircraft manufacturers are producing new commercial, military, and general aviation aircraft models, which necessitate the use of modern materials with higher performance and lower weight. As a result, the emphasis is shifting toward newer material technologies such as composites. Also, wide-body jet engines have undergone significant transformations in recent years, due to the development of turbofan engines and the use of fuel-efficient techniques. These transformations are expected to increase the market growth.

By Geography — Segment Analysis North America dominated the aerospace and defense materials market in 2023. In terms of aerospace and defense technologies, the United States and Canada are at the forefront. New, high-performance materials utilized in these industries are developed as a result of ongoing discoveries and developments in materials science. The defense budget of the United States is among the highest in the world. High levels of government investment in defense raise the need for cutting-edge materials for use in aircraft, military hardware, and other defense systems. For instance, as per the International Trade Administration, Canada has aerospace sector spent more than C$680 million (about $523 million) on research and development in 2022, making it more than 2.3 times more intensive than the industrial average. For the first C$2 million (about $1.55 million) in eligible R&D expenses, the Canadian government offers complete write-offs of R&D capital and equipment. This encourages businesses in the Canadian sector to maintain an advantage over rivals worldwide. On 11 December 2023, The Department of Defense’s (DoD) Industrial Base Analysis and Sustainment (IBAS) Program and the Institute for Advanced Composites Manufacturing Innovation® (IACMI) announced a national initiative to help meet critical defense needs in the casting and forging industry for the United States. Curriculum creation for a series of stackable training opportunities in the metals industry, with an emphasis on the development of trades and engineering workers, is currently underway as part of the multi-year agreement between DoD and IACMI.

Drivers — Aerospace and Defense Materials Market • The Growing Demand for Lightweight and High-strength Materials The growing need for lightweight and high-strength materials is driving substantial growth in the global aerospace and defense materials market. Due to their high strength-to-weight ratios, lightweight materials like carbon fiber composites, titanium alloys, and advanced polymers are in high demand by the aerospace and defense industries. These materials not only reduce aircraft weight but also improve structural integrity, which lowers operating costs and fuel efficiency. High-strength and lightweight materials have always been essential to building aircraft that are both fuel-efficient and highly effective. aluminum is a major material used to make aircraft. Aluminum was utilized in the production of several aircraft components, including the fuselage and other primary engine sections since it was lightweight, affordable, and easily accessible. Since then, innovative materials have been used to improve aircraft design, including composites (made of carbon and glass fiber, polymeric and epoxy resins) and metals (titanium, steel, new AI alloys). For instance, on 23 October 2023, The U.S. Department of Commerce’s Economic Development Administration (EDA) under the Biden-Harris administration selected the American Aerospace Materials Manufacturing Center as one of the 31 first Tech Hubs nationwide. About 50 public and private partners are brought together by Gonzaga University’s AAMMC Tech Hub to foster innovation and development manufacturing of composite materials for the next generation of lightweight, environmentally friendly aircraft. For instance, in 2020, NASA engineers have created novel materials that can be utilized to create better aircraft engines and related system elements. Silicon Carbide (SiC) Fiber-Reinforced SiC Ceramic Matrix Composites (SiC/SiC CMCs) are one of these materials. For high-performance machinery, such as aircraft engines, that must run for lengthy periods under harsh conditions, this lightweight, reusable fiber material is perfect. In between maintenance cycles, SiC fibers are robust enough to endure months or even years, and they can tolerate temperatures as high as 2,700 degrees Fahrenheit.

• The Global Civil Aviation Industry is Expanding Rapidly The global civil aviation industry’s explosive expansion is one of the key factors propelling the aerospace and defense materials market. The aerospace and defense materials industry’s demand for materials is heavily influenced by several interrelated factors, all of which contribute to its rise The rise in air travel worldwide, which is being driven by urbanization and increased disposable incomes, is one of the main factors. The increased demand for commercial air travel as a result has forced airlines to modernize and grow their fleets. The pressure on aerospace manufacturers to make sophisticated, lightweight, and fuel-efficient aircraft is pushing the development of advanced alloys, lightweight composites, and high-performance materials that promote environmental sustainability and passenger safety. For instance, the aviation industry is and will continue to expand rapidly. The International Civil Aviation Organization’s most recent projections indicate that throughout the next 20 years, the demand for air travel will rise by an average of 4.3% per year. For instance, according to the IBEF, India is the third-biggest domestic air travel market globally. By 2024, the domestic aviation market in India is expected to grow to $30 billion, ranking third globally. The aviation industry has benefited from an increase in the proportion of middle-class households, fierce rivalry among low-cost carriers, considerable airport infrastructure investment, and a favorable political climate.

Market Landscape Technology launches and R&D activities are key strategies adopted by players in the Aerospace and Defense Materials market. In 2023, the Aerospace and Defense Materials market share has been consolidated by the major players accounting for 80% of the share. Major players in the Aerospace and Defense Materials are Alcoa Corporation, Novelis Inc., Thyssenkrupp Aerospace, Toray Industries Inc., Mitsubishi Chemical Group, Teijin Limited, Hexcel, Allegheny Technologies, Constellium, Solvay S.A., Formosa, SGL Group, Kobe Steel Ltd., among others.

Developments:

In October 2023, Novelis and Airbus inked a contract to continue their cooperation. The deal strengthens Novelis and Airbus’s long-standing cooperation and highlights the company’s leadership in developing cutting-edge aluminum goods and solutions for the commercial aircraft sector.

In June 2023, as a strategic partner of Spirit’s Aerospace Innovation Centre (AIC) in Prestwick, Scotland, Solvay and Spirit AeroSystems (Europe) Limited have deepened their partnership. Together with Spirit’s academic, industrial, and supply-chain partners, the AIC fosters cooperative research into environmentally friendly aircraft technology and procedures.

In June 2022, Sikorsky granted Hexcel Corporation a long-term contract to supply cutting-edge composite structures for the CH-53K King Stallion heavy lift helicopter. This funding has significantly increased the Hexcel composite composition of the airplane.

For more Chemicals and Materials Market reports, please click here

#digital marketing#reseach marketing#marketing#Aerospace and Defense Materials#chemicals#materials science

0 notes

Note

can i just say that I'm haunted by the image of Ice wearing "one of Mavericks cheapest rolexes". One because of the mental immage of Maverick being the kind of men who not only owns multiple watches but also Rolex, which is absolutely delightful, because oh the quiet vanity of that. And two because of the implied and groundbreaking (to me) domesticity (and defiance of the not talking/acknowledging the thing between the 2 of them) of wearing another person watch. I'm screaming into the void about your brilliance. So I need to ask, do they do that on purpose (before the mission) in a sort if roundabout way of acknowledging each other presence in their life? What would Mav wear that belongs to Ice (apart from that USNA ring eheh)?

pilots/sailors/doctors etc who do high-level specialized work with their hands tend to really be Watch Guys. and “cheap” rolexes (sub $7k ish) are actually pretty affordable if you’re making >$150k a year and want to treat yourself every fifth christmas or something. source: know several sailors & doctors. ALSO the watch ice is wearing in his famous gay plane photoshoot is actually a rolex. So theres some evidence ice at least is (annoying, ostentatious, bad with money, and) a Watch Guy. Maverick’s also wearing a kickass chronograph in TGM so i think he’s also probably a Watch Guy. also… you know, status symbol, honor, et cetera et cetera…

they probably wear each other’s socks because in-regs socks all look the same and they’re both men so who cares. i also hc that they’ve always worn the same size in shirts so each other’s t-shirts are also free game. and was very confusing at the start of their relationship when trying to figure out whose shirt was whose after a midnight rendezvous. lots of accidental shirt mixups. and, yeah, each other’s watches, because most people only see the status and don’t see the detail, and most people aren’t around both ice and mav enough to recognize that “omg last month adm kazansky was wearing the same omega chronometer capt mitchell is wearing today!! theyre totally together!!!” so if ice buys a new watch and maverick salivates over it, sure he can borrow it, whatever. and i think there’s a scene in wwgattai when maverick wears ice’s pj pants hold up lemme find it

“in bare feet.” now wtf does that mean. that could use a rewrite.

ice also wears mavericks leather jacket when they’re on their baseball date in debriefing. at some point when you live with someone long enough your stuff becomes their stuff which was the point of this graf

thinking about it… trying to decide if they’d wear each other’s cologne. that seems like a little much. no i don’t think so.

#oooh! this is the first time ive read this section of debriefing since i posted it! and wow it’s really just okay!#ugggghhh the house. the house.. *shakes fist* all my narrative problems have to do with the house…#would ice and maverick really get free LockMart/mcdonnell shirts? no idea#ive been working my first aerospace & defense job for a month now and ive gotten Boeing fidget spinners and raytheon sunglasses and#LM t-shirts so it’s not out of the realm of possibilities#but i am also not a federal employee so idk.#thx for the ask anon. i appreciate your use of the word ‘haunted’#pete maverick mitchell#tom iceman kazansky#icemav#top gun#asks#man. i have such a problem with verb-tense agreement when it comes to ‘there is/there are’#in the second one it should be ‘there are all these…’ man. i can’t ever get there’s/there are right#oh wait you’re not anon#i am a Watch Guy but $20-$80 vintage novelty watches i find on eBay not Rolexes#i feel at some point i should change my blog header. it’s still my politics but#given that i am literally working in defense rn it feels a little hypocrit. ok. will change it.#alright as of this post my header has been changed to reflect the material conditions of my summer internship

161 notes

·

View notes

Text

How Israeli Tech is Shaping the Future of Additive Manufacturing Worldwide

Overview of Israel’s Strategic Position in Additive Manufacturing

Israel has rapidly emerged as a global force in additive manufacturing (AM), fortified by a powerful high-tech ecosystem, robust government support, and a legacy of innovation in defense, aerospace, and medical technologies. With the Israel additive manufacturing market valued at USD 221.4 billion in 2024 and forecasted to exceed USD 280.3 billion by 2032, the nation is positioned to lead transformative advances in 3D printing technologies. The Israel additive manufacturing market compound annual growth rate (CAGR) of approximately 7% reflects both escalating domestic demand and global interest in Israeli AM innovation.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40589-israel-additive-manufacturing-market-research

Driving Forces of Growth in Israel's Additive Manufacturing Market

Innovation Across Key Industrial Verticals

Israel additive manufacturing market sector is evolving as a backbone for modernization in:

Aerospace and Defense: Lightweight components, complex geometries, and high-performance materials enable operational efficiency and reduced lead times.

Healthcare: Customized prosthetics, implants, bioprinting, and surgical models offer patient-centric care and improved clinical outcomes.

Automotive and Industrial Manufacturing: Rapid prototyping, tooling, and small-batch production optimize supply chains and cut production timelines.

These sectors benefit from the convergence of additive technologies with AI, machine learning, and advanced robotics, all core competencies of Israel's high-tech sector.

Rising Demand for Customization and Sustainability

The shift toward sustainable manufacturing and personalized solutions is fueling AM adoption. Israeli startups and research institutions are developing biocompatible, recyclable, and multi-material printing solutions that meet stringent regulatory and industry-specific standards.

Get up to 30%-40% Discount: https://www.statsandresearch.com/check-discount/40589-israel-additive-manufacturing-market-research

Technological Landscape of the Israeli Additive Manufacturing Ecosystem

Polymer-Based Additive Manufacturing

Valued at USD 306.31 million in 2024, this segment dominates due to its cost-effectiveness, versatility, and compatibility with lightweight, complex part production. With an expected CAGR of 17.3%, applications in consumer goods, automotive interiors, and medical devices continue to surge.

Metal-Based Additive Manufacturing

Growing at a robust 20.1% CAGR, metal AM is the cornerstone of defense and aerospace advancements. In 2024, it accounted for USD 180.86 million, projected to exceed USD 775.48 million by 2032. Israel’s focus on titanium, aluminum alloys, and nickel-based superalloys supports structural applications with high thermal and mechanical stability.

Hybrid Additive Manufacturing

By blending subtractive and additive processes, hybrid AM enhances surface finish and dimensional accuracy, critical in precision tooling, aerospace, and dental prosthetics. This segment is rapidly gaining traction due to its versatility and integration into smart manufacturing systems.

Segmental Breakdown of the Israel Additive Manufacturing Market

By Component

Hardware: Represents the largest share, valued at USD 1,137.28 million in 2024, supporting high-throughput production and industrial-scale fabrication.

Software: Fueled by AI-powered design, generative modeling, and process simulation, this segment is experiencing 19.9% CAGR, revolutionizing digital twin applications and real-time process monitoring.

Services: The on-demand printing ecosystem is expanding, empowering SMEs to access advanced AM capabilities with minimal capital expenditure.

By Deployment Model

In-House Manufacturing: With a Israel additive manufacturing market valuation of USD 317.09 million in 2024, large enterprises prefer internal AM operations for confidentiality and operational control.

Service-Based Models: Growing at 19.4% CAGR, third-party service bureaus are crucial in democratizing access to advanced AM technologies for startups and research institutions.

By Functionality

Prototyping: Dominates with USD 340.60 million in 2024, essential for R&D, iterative design, and proof-of-concept validation.

Production: The rising shift to end-use part manufacturing is catalyzing growth in this segment, valued at USD 197.73 million in 2024.

Tooling: Customized, high-durability tooling supports faster transitions from design to production across various industrial sectors.

By Printer Size

Small/Compact Printers: Most accessible and dominant segment, valued at USD 253.09 million in 2024, ideal for labs, healthcare, and educational institutions.

Medium and Large Printers: Increasingly adopted in industrial manufacturing, these enable batch production and larger component fabrication.

End-Use Industries Driving Adoption

Aerospace & Defense

USD 159.32 million in 2024, this sector prioritizes weight reduction, material performance, and supply chain agility. With Israel’s defense sector being R&D intensive, 3D printing significantly enhances manufacturing autonomy and mission-readiness.

Healthcare & Medical

USD 131.40 million in 2024, growing due to demand for patient-specific devices, bioprinted tissues, and anatomical models. With innovations in regenerative medicine, Israel is at the forefront of personalized healthcare.

Industrial & Automotive

Israel’s industrial ecosystem leverages AM for lightweighting, thermal management, and low-volume production, especially in EV components and robotics enclosures.

Strategic Movements and Competitive Intelligence

Leading Israel Additive Manufacturing Market Participants

Stratasys: A global pioneer, deeply rooted in Israel, with continuous development in multi-material, high-resolution systems.

XJet: Revolutionizing ceramic and metal printing with NanoParticle Jetting™ technology.

Nano Dimension: Innovator in multi-layer electronics and PCB printing, driving miniaturization and functional integration.

Recent Developments

XJet (June 2024): Launched new ceramic printers with applications in automotive and aerospace, enhancing resolution and mechanical strength.

Nano Dimension (Sept 2024): Acquired startups to advance multi-material electronics printing, expanding their capabilities in embedded sensor systems.

Challenges and Strategic Opportunities

Major Israel Additive Manufacturing Market Challenges

Capital Intensity: High upfront costs limit adoption, especially among SMEs.

Talent Gap: Scarcity of AM-trained professionals hampers rapid scaling.

Scaling Complexity: Transitioning from prototype to full production requires new QA methodologies and workflow optimization.

Strategic Israel Additive Manufacturing Market Opportunities

Workforce Development: Partnerships with universities and technical institutes to offer AM-centric curricula.

Material Innovation Hubs: Support from government and private sectors to develop high-strength composites, bioresorbable materials, and nanostructured alloys.

Sustainability Mandates: Incentives for closed-loop manufacturing systems, energy-efficient printers, and recyclable materials.

Future Outlook: Israel’s Role in Global Additive Manufacturing Leadership

Israel is poised to lead the next frontier of digital manufacturing, where data-driven fabrication, machine learning-enhanced design, and autonomous production lines define industry 4.0. With unmatched cross-sector collaboration between startups, research centers, and government agencies, the nation’s AM sector is evolving from rapid prototyping to full-fledged production infrastructure.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40589-israel-additive-manufacturing-market-research

Conclusion

Israel additive manufacturing market is entering a golden era, driven by its technological prowess, strategic policy initiatives, and vibrant innovation culture. As the global demand for agile, sustainable, and customized manufacturing solutions intensifies, Israel is uniquely equipped to lead the charge. Enterprises, investors, and policy makers must align to fully harness this momentum and establish Israel as a global additive manufacturing powerhouse.

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#Israel#Additive Manufacturing#3D Printing#Israeli Tech#Advanced Manufacturing#Industrial 3D Printing#Aerospace#Medical Devices#Defense Technology#Innovation#Startups#Tel Aviv#Prototyping#Manufacturing Industry#AM Materials#Digital Manufacturing#Smart Manufacturing#High-Tech Industry#Metal 3D Printing#Polymer Printing#R&D#Technology Trends#Engineering#Robotics#Supply Chain#Product Development

1 note

·

View note

Text

The Prospect of Laser Weapons in Space: Bridging Science Fiction and Reality

#advanced materials#advanced weaponry#aerospace engineering#air defense#artificial intelligence#atmospheric interference#autonomous weapons#battlefield applications#combat effectiveness#combat efficiency#combat scenarios#defense budgets#defense economics#defense innovations#defense policy#defense systems#defense technology#directed energy weapons#dual-use technology#electromagnetic weapons#energy conversion#energy density#energy requirements#energy weapons#future warfare#futuristic weapons#ground-based lasers#high-energy lasers#intelligence gathering#interceptors

0 notes

Text

Aramid Fiber Market: A Comprehensive Overview

The global aramid fiber market has witnessed significant growth in recent years, driven by the increasing demand for lightweight and high-strength materials in various industries. Aramid fibers are a class of synthetic fibers known for their exceptional strength, heat resistance, and abrasion resistance, making them an essential component in various applications.

Market Size and Growth

The global aramid fiber market size was valued at USD 4.3 Billion in 2024 and is expected to reach USD 9.6 Billion by 2033, at a compound annual growth rate (CAGR) of 8.1% during the forecast period 2024 – 2033. This growth is attributed to the increasing demand for aramid fibers in various industries, including aerospace, automotive, defense, and infrastructure.

Market Segmentation

The global aramid fiber market is segmented based on type and application. Para-aramid fibers dominated the market in 2021, accounting for the largest market share of 57% and market revenue of USD 2.06 Billion. Meta-aramid fibers are also gaining popularity due to their unique properties, such as flame resistance, electrical insulation, and chemical stability.

Applications of Aramid Fibers

Aramid fibers have a wide range of applications across various industries. Security and protection equipment is the largest application segment, accounting for 27% of the market share in 2021. Other significant applications include frictional materials, optical fibers, rubber reinforcement, tire reinforcement, aerospace, and electrical insulation.

Market Drivers and Restraints

The growth of the aramid fiber market is driven by several factors, including the increasing demand for lightweight and high-strength materials in various industries, the growing need for safety and protection equipment, and the rising demand for eco-friendly and sustainable materials. However, the high cost of production and investment in research and development (R&D) are some of the key restraints hindering the growth of the market.

Regional Analysis

The global aramid fiber market is segmented into North America, Europe, Asia-Pacific (APAC), Latin America (LATAM), and Middle East and Africa (MEA). APAC is expected to be the fastest-growing region, driven by the growing demand for aramid fibers in countries such as China and India.

Competitive Landscape

The global aramid fiber market is highly competitive, with several key players operating in the market. Teijin Aramid B.V., DowDuPont Inc., Yantai Tayho Advanced materials Co. Ltd, KOLON Industries Inc., Huvis, Kermel, JSC Kamenskvolokno, China National Bluestar (Group) Co. Ltd., Hyosung Corp., and Toray Chemicals South Korea Inc. are some of the major players operating in the market.

Future Prospects

The global aramid fiber market is expected to continue growing in the coming years, driven by the increasing demand for lightweight and high-strength materials in various industries. The market is expected to witness significant growth in the APAC region, driven by the growing demand for aramid fibers in countries such as China and India.

Conclusion

In conclusion, the global aramid fiber market is expected to continue growing in the coming years, driven by the increasing demand for lightweight and high-strength materials in various industries. The market is expected to witness significant growth in the APAC region, driven by the growing demand for aramid fibers in countries such as China and India. The competitive landscape is highly competitive, with several key players operating in the market.

#aramid fiber market#aramid fibers#synthetic fibers#lightweight materials#high strength materials#aerospace industry#automotive industry#defense industry#infrastructure industry#electrical insulation#frictional materials#optical fibers#rubber reinforcement#tire reinforcement#security and protection equipment

0 notes

Text

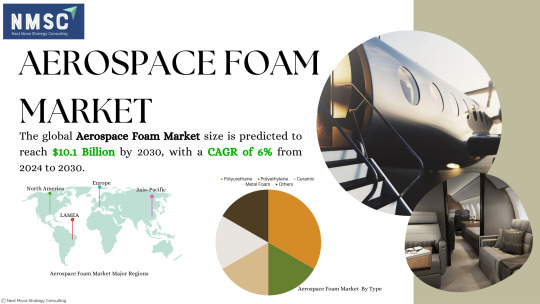

Navigating the Aerospace Foam Market Landscape: Key Players and Strategies

According to a comprehensive study conducted by Next Move Strategy Consulting, the global Aerospace Foam Market is poised to witness significant growth, with a predicted size of USD 10.1 billion and a compound annual growth rate (CAGR) of 5.8% by the year 2030.

This projection underscores the pivotal role that aerospace foam plays in shaping the trajectory of the aerospace industry, providing lightweight, durable, and innovative solutions to meet the evolving demands of modern aviation and space exploration.

Introduction:

The aerospace industry stands at the forefront of technological innovation, constantly pushing boundaries to enhance efficiency, safety, and performance. Central to this evolution is the integration of advanced materials, with aerospace foam emerging as a critical component in the pursuit of lightweight structures and enhanced functionalities.

Request for a sample, here: https://www.nextmsc.com/aerospace-foam-market/request-sample

Aerospace Foam Market Dynamics:

Understanding the dynamics of the aerospace foam market requires a closer look at the key players shaping its landscape. A multitude of factors, including technological advancements, market trends, and regulatory considerations, influence the strategies adopted by industry leaders.

Key Players in the Aerospace Foam Market:

Several prominent market players contribute to the growth and innovation within the aerospace foam market. Notable names such as BASF SE, Evonik Industries AG, Solvay, Greiner Aerospace, Boyd Corporation, Huntsman Corporation, Armacell, Pyrotek Inc., Zotefoams Plc, and General Plastics Manufacturing Company are among the industry giants actively engaged in developing and delivering cutting-edge solutions.

Strategies for Market Dominance:

Aerospace foam market players employ various strategies to maintain dominance and meet the ever-evolving needs of the industry. One common approach is the continuous launch of new and innovative products across different regions, enabling companies to stay ahead of the competition and cater to diverse market demands.

Strategic Partnerships: A notable example is the strategic partnership between Solvay and Zotefoams Plc. In June 2023, the two entities entered into a long-term supply agreement to enhance the availability of advanced cellular materials, including foams. This collaboration serves as a strategic move to address the growing demand for high-performance materials in critical applications, especially within the aerospace sector.

Innovative Product Launches: The aerospace industry demands materials that can withstand rigorous conditions while being lightweight and efficient. In May 2023, Huntsman Corporation announced the development of new materials specifically designed for aerospace applications. This innovation aims to meet the demanding requirements of the aerospace industry, focusing on enhancing performance and efficiency. The introduction of these materials underscores Huntsman's commitment to advancing technology in the aerospace foam market.

Strategic Investments: Evonik Industries AG, in March 2022, made a significant investment in a new production facility for Rohacell, a high-performance structural foam. This investment signals a commitment to advancing aerospace foam technology, catering to the increasing demand for lightweight and durable materials in the aerospace industry.

Market Trends and Future Outlook:

To navigate the aerospace foam market landscape effectively, it is crucial to stay abreast of emerging trends that influence industry dynamics. Key trends include:

Sustainability Initiatives: The aerospace industry is increasingly prioritizing sustainability, pushing market players to develop eco-friendly foam solutions that align with global environmental goals.

Digital Transformation: The integration of digital technologies is transforming manufacturing processes and supply chain management within the aerospace foam market, enhancing efficiency and reducing costs.

Urban Air Mobility (UAM): The rise of UAM presents new opportunities for aerospace foam market players, with the demand for lightweight materials in electric vertical takeoff and landing (eVTOL) vehicles.

Regional Insights and Market Segmentation:

The aerospace foam market is inherently diverse, with different regions exhibiting unique challenges and opportunities. Understanding regional dynamics and market segmentation is crucial for companies aiming to establish a global presence.

BASF SE: As one of the leading players in the aerospace foam market, BASF SE continually strives for innovation. An in-depth exploration of the company's strategies, product launches, and market influence provides valuable insights into its role within the industry.

Boyd Corporation: Examining Boyd Corporation's approach to market challenges, product development, and strategic partnerships sheds light on how this player maintains its competitive edge.

Challenges and Opportunities:

Navigating the aerospace foam market landscape is not without its challenges. From stringent industry regulations to evolving consumer preferences, companies must be agile in addressing obstacles while seizing opportunities for growth.

Supply Chain Disruptions: Global events such as pandemics, natural disasters, or geopolitical tensions can disrupt the aerospace foam supply chain, impacting production schedules and increasing costs. Companies need robust contingency plans to mitigate the effects of such disruptions and ensure continuity of operations.

Technological Complexity: Developing advanced aerospace foam solutions requires significant investment in research and development. Companies must navigate the complexities of material science, manufacturing processes, and regulatory compliance to bring innovative products to market successfully.

Competition from Alternative Materials: While aerospace foam offers unique advantages in terms of weight reduction and performance, it faces competition from alternative materials such as composite materials, lightweight metals, and 3D-printed components. Companies must differentiate their offerings and demonstrate the superior benefits of foam-based solutions to maintain a competitive edge.

Environmental Sustainability: The aerospace industry is under increasing pressure to reduce its environmental footprint and embrace sustainable practices. Companies in the aerospace foam market must innovate to develop eco-friendly foam materials that minimize environmental impact while meeting stringent performance requirements.

Future Outlook:

Despite these challenges, the aerospace foam market presents significant opportunities for growth and innovation. Advancements in material science, manufacturing technologies, and market demand for more efficient and sustainable solutions are driving the evolution of the industry.

Emerging Markets: Rapid urbanization, economic growth, and increased air travel demand in emerging markets present new opportunities for aerospace foam manufacturers. Companies that can adapt their strategies to cater to the specific needs of these markets stand to gain a competitive advantage.

Integration of Advanced Technologies: The integration of advanced technologies such as artificial intelligence, machine learning, and additive manufacturing is revolutionizing the aerospace foam industry. Companies that embrace these technologies can enhance product development processes, optimize production efficiency, and deliver tailored solutions to customers.

Collaboration and Partnerships: Collaboration between industry stakeholders, including manufacturers, suppliers, research institutions, and government agencies, is essential for driving innovation and addressing common challenges. Strategic partnerships can leverage complementary expertise and resources to accelerate product development and market penetration.

Focus on Customer-Centric Solutions: As aerospace OEMs and end-users increasingly prioritize performance, reliability, and cost-effectiveness, companies in the aerospace foam market must focus on delivering customer-centric solutions. Understanding and anticipating customer needs, preferences, and pain points are critical for maintaining competitiveness and driving long-term growth.

Inquire before buying, here: https://www.nextmsc.com/aerospace-foam-market/inquire-before-buying

Conclusion:

In conclusion, the aerospace foam market is a dynamic and rapidly evolving sector within the broader aerospace industry. Key players are instrumental in shaping its trajectory through strategic partnerships, innovative product launches, and investments in advanced technologies. As the demand for lightweight, durable materials continues to rise, the aerospace foam market's future holds exciting possibilities, providing ample opportunities for companies to pioneer advancements and contribute to the next era of aerospace innovation.

0 notes

Text

The global aerospace and defense materials market is rising positive outlook toward lightweight and high strength materials is an important driver for the global aerospace and defense materials market. Moreover, the rapid growth in the worldwide civil aviation sector is expected to boost market growth. However, Environmental considerations pertaining to materials used in aerospace and defense is expected to challenge market growth.

0 notes

Text

Better Confidence in Laser Powder Bed Fusion 3D Printing - Technology Org

New Post has been published on https://thedigitalinsider.com/better-confidence-in-laser-powder-bed-fusion-3d-printing-technology-org/

Better Confidence in Laser Powder Bed Fusion 3D Printing - Technology Org

Researchers at the Department of Energy’s Oak Ridge National Laboratory have improved flaw detection to increase confidence in metal parts that are 3D-printed using laser powder bed fusion.

This type of additive manufacturing offers the energy, aerospace, nuclear and defense industries the ability to create highly specialized parts with complex shapes from a broad range of materials. However, the technology isn’t more widely used because it’s challenging to check the product thoroughly and accurately; conventional inspection methods may not find flaws embedded deep in the layers of a printed part.

ORNL researcher Zackary Snow compares data from different types of images collected during and after metal parts were additively manufactured using a powder bed printer like the one behind him. Credit: Carlos Jones/ORNL, U.S. Dept. of Energy

ORNL researchers developed a method that combines inspection of the printed part after it is built with information collected from sensors during the printing process. The combined data then teaches a machine-learning algorithm to identify flaws in the product. Even more significantly, this framework allows operators to know the probability of accurate flaw detection just as reliably as traditional evaluation methods that demand more time and labor.

“We can detect flaw sizes of about half a millimeter — about the thickness of a business card – 90% of the time,” said ORNL researcher Luke Scime. “We’re the first to put a number value on the level of confidence possible for in situ (in process) flaw detection.” By extension, that reflects confidence in the product’s safety and reliability.

Laser powder bed fusion, the most common metal 3D-printing process, uses a high-energy laser to selectively melt metal powder that has been spread across a build plate. Then the build plate lowers before the system spreads and melts another layer, slowly building up the designed product.

Engineers know there will be flaws in the material.

“For regular manufacturing we know what those are and where and how to find them,” said ORNL researcher Zackary Snow. “(Operators) know the probability that they can detect flaws of a certain size, so they know how often to inspect to get a representative sample.”

3D printing has not benefited from the same confidence.

“Not having a number makes it hard to qualify and certify parts,” Snow said. “It’s one of the biggest hurdles in additive manufacturing.”

A paper by ORNL researchers and partner RTX, recently published in Additive Manufacturing, explains the process they developed to arrive at a 90% detection rate while reducing the probability of false positives, which can lead to scrapping good products.

For the first research step, aerospace and defense company RTX designed a part similar to one it already produces, providing opportunities to see realistic-looking flaws. Then, RTX 3D-printed the part multiple times monitoring during the build with a standard near-infrared camera and an added visible-light camera. Both RTX and ORNL researchers conducted quality inspections afterward using X-ray computed tomography, commonly called CT scans.

With consultation from RTX, ORNL additive manufacturing experts aligned the data into a layered stack of images, which essentially became the textbook for the machine-learning algorithm. During training, the algorithm took a first pass at labeling flaws using the CT scan images.

Then a human operator annotated the rest based on visual cues in data collected during the printing process. Human feedback continues to train the software, so the algorithm recognizes flaws more accurately each time. Previous ORNL advances in in-situ monitoring and deep-learning frameworks were used as tools in this novel approach. Over time, this will reduce the need for human involvement in manufacturing inspection.

“This allows CT-level confidence without CT,” Snow said. A common method for checking some 3D-printed parts, CT imaging and analysis drives up costs because it requires extra time and expertise. Plus, CT cannot effectively penetrate dense metals, limiting its application.

When the algorithm is applied to a single design consistently manufactured with the same material and process, it can learn to provide consistent quality analysis within days, Scime said. At the same time, the software incorporates all that it learns from different designs and constructions, so it will eventually be able to accurately check products with unfamiliar designs.

The ORNL-developed inspection framework could help in expanding additive manufacturing applications. With statistically verified quality control, additive manufacturing could become viable for mass-producing products like car parts, Snow said.

It could also diversify the types of parts that can be 3D printed. Certainty about the smallest detectable flaw size allows more design freedom. This is important because the industry is already headed toward larger print volumes and faster print rates – meaning more lasers interacting to create bigger parts with different types of flaws, said Brian Fisher, senior principal engineer for additive manufacturing at RTX’s Raytheon Technologies Research Center.

“You can really start to save time and money and make a business case when printing larger assemblies – except those are also the hardest to inspect today,” Fisher said. “The vision is with additive, we can make large, highly-complex parts in very dense materials, which traditionally would be very difficult and expensive to thoroughly inspect.”

Next, the ORNL team will train the deep-learning algorithm to better differentiate between types of irregularities and to categorize flaws that have multiple causes.

Additional ORNL researchers who contributed to the project also include Amir Ziabari and Vincent Paquit. The research was sponsored by DOE’s Advanced Materials and Manufacturing Technologies Office, or AMMTO, with support from RTX and took place at DOE’s Manufacturing Demonstration Facility at ORNL.

UT-Battelle manages ORNL for the Department of Energy’s Office of Science, the single largest supporter of basic research in the physical sciences in the United States. The Office of Science is working to address some of the most pressing challenges of our time. For more information, please visit energy.gov/science.

Source: Oak Ridge National Laboratory

You can offer your link to a page which is relevant to the topic of this post.

#3d#3D printing#Additive manufacture#additive manufacturing#advanced materials#aerospace#algorithm#Analysis#applications#approach#Building#Business#Chemistry & materials science news#computed tomography#data#defense#dept#Design#detection#energy#Engineer#engineers#extension#Featured technology news#framework#Fusion#how#how to#human#images

0 notes

Photo

The Department of Defense was a different place a decade ago. In those days, China was a key supplier of materials and equipment for the DOD. Even now, as the DOD has shifted its focus elsewhere, China remains a key supplier. What does this mean for the future of the DOD? Only time will tell.

#Aerospace & Defense#/aerospace-defense#Business#/business#standard#fault#Department of Defense#China#supplier#materials#equipment

0 notes

Text

Nanostructured copper alloy rivals superalloys in strength and stability

Researchers from the U.S. Army Research Laboratory (ARL) and Lehigh University have developed a nanostructured copper alloy that could redefine high-temperature materials for aerospace, defense, and industrial applications. Their findings, published in the journal Science, introduce a Cu-Ta-Li (copper-tantalum-lithium) alloy with exceptional thermal stability and mechanical strength, making it one of the most resilient copper-based materials ever created. "This is cutting-edge science, developing a new material that uniquely combines copper's excellent conductivity with strength and durability on the scale of nickel-based superalloys," said Martin Harmer, the Alcoa Foundation Professor Emeritus of Materials Science and Engineering at Lehigh University and a co-author of the study. "It provides industry and the military with the foundation to create new materials for hypersonics and high-performance turbine engines."

Read more.

#Materials Science#Science#Copper#Nanotechnology#Superalloys#Strength of materials#Alloys#Tantalum#Lithium#Lehigh University

17 notes

·

View notes

Text

UKRAINE’S UNTAPPED MINERAL WEALTH—WHY IT MATTERS

Ukraine isn’t just a battleground; it’s a resource powerhouse. With key global shares in peat (2.2%), bromine (2.0%), and iron ore (1.7%), its natural wealth is undeniable.

It also holds 1.2% of the world’s titanium pigment reserves—critical for aerospace and defense—while ranking among the top 8 globally in mercury reserves.

Before the war, Ukraine was a major producer of gallium and manganese—key materials in high-tech industries.

#news#politics#usa news#donald trump#inauguration#public news#world news#news update#breaking news#us politics#ukraine#ukraine war#ukrainian#support ukraine#stand with ukraine#fuck russia#russia ukraine war#russian aggression#russia ukraine crisis#russian invasion of ukraine#russia#war#usa propaganda#usaid#usa#usa politics#zelensky#volodimir zelenszkij#russo ukrainian war#war in ukraine

23 notes

·

View notes

Text

Setting Blurb: The Congressional Armed Freedom Fighters (CAFF)

CAFF terminology:

“Clonscript” – Portmanteau of clone and conscript, referring to the cloned portion of the World Congress of Freedom’s military, known as the Congressional Armed Freedom Fighters (CAFF). WCOF citizens consider “Clonscript” derogatory; they prefer Combat Bioautomata. The Clonscripts were created following the end of the Human-Crystalline War, and the depletion of the WCOF’s non-Party population. Prior to the war, service in the CAFF was a requirement for entry into the WCOF Party. With the war’s end, virtually all of the population able to had already enlisted and earned their party membership. Attempts to recruit Party Members (veterans and fresh recruits) were moot due to the war leaving a bad taste in the populace’s mouth. Efforts into the creation of humans via artificial wombs gave the WCOF the means of rebuilding their military quickly. Every citizen is required to contribute genetic material (unless they volunteer to serve in the CAFF themselves), and there are rumors that the CAFF steals genetic material from promising enemy combatants killed in action. Clones are essentially homunculi, biologically “humanlike” with tweaks to their genome to allow their categorization as distinct from baseline humanity. All clonscripts are sterile, with aging accelerated (they grow up faster but live shorter). Clonscripts are placed into three categories depending on their age and experience:

Hastati – Clonscripts that decant successfully and survive their initial training are inducted into the Hastati. This third of the CAFF’s clone formations are given the most basic weapons and body armor. In combat, Hastati are sent in human waves to overwhelm the enemy (or expend their ammunition).

Principes – Hastati that survive multiple campaigns (physically and psychologically) are promoted to the ranks of the Principes. Principes are sent into combat after the initial wave of Hastati has either made an exploitable break in enemy lines, or to make one should the Hastati fail. Clonscripts that reach this position have access to higher quality equipment, and light combat vehicles.

Triarii – The senior-most (survived the most campaigns) of the CAFF’s clonscript forces are elevated to the Triarii. While Hastati and Principes operate in their own formations, Triarii are the equivalent of senior NCOs, assisting Party Volunteers in commanding their less experienced brethren. Triarii can also be seen in Party Volunteer vehicle crews and infantry formations (usually in specialist and advisory roles). To ensure their experience in the field is put to use beyond their modified life expectancies, Clonscript triarii are cybernetically and biologically modified.

Party Volunteers – Supplementing the Clonscripts are baseline human volunteers, either citizens already a WCOF Party Member, or applicants looking to increase their social standing. Members of the latter are rare after the Human-Crystalline War (hence the name Party Volunteers). In any combat zone, Volunteers are only deployed in the Clonscript wave attacks are successful. Volunteers may either serve as officers commanding Clonscript formations or serve in their own. Volunteer formations are classified as follows:

Equites – Party Volunteers, unlike the Clonscripts, have access to the CAFF’s complete arsenal of ground combat vehicles. CAFF vehicles are highly modular, allowing the WCOF’s small defense industries to produce “jack of all trades, master of none” combat platforms that can perform multiple roles on the battlefield (if the required loadout is available). Volunteers can also serve as aeroequites and pilot CAFF aerospace craft.

Velites - While the Clonscripts serve as literal cannon fodder, the Volunteer Velites are the CAFF’s elite infantry. Velites are deployed the moment Clonscripts punch a hole in enemy lines. It is only in rare occasions that Velites are deployed alone and without the support of Clonscript manpower (Imperial and UM soldiers joke that they only deploy alone when they know they’re already going to win). Much like their Equites comrades, Velites are trained to utilize modular equipment to alter their role on a changing battlefield.

Both Clonscripts and Volunteers used the following unit organizations:

Legionary Theaters – Legionary Theaters aren’t military units but are instead administrative divisions that subordinate units operate in. Legionary Theaters are made up of 12 Legios, and there are 1-3 Theaters on each planet with WCOF territory. Each Legionary Theater is commanded by a Revolutionary Prefect.

Legio – From the Latin “legion”, Legios are the largest military unit within the CAFF. Legios are made up of 3 Demi-Legios and are commanded by Senior Legate.

Demi-Legio – Inspired by CorpEmp Maneuver Forces, Demi-Legios are formations designed to operate independently from its parent Legio. Demi-Legios are made up of 8 Cohae and 2 Alae and are commanded by a Junior Legate.

Coha – Cohae are infantry formations in the CAFF and are made up of 8 Manii. 5 Manii in a Coha are made up of Clonscripts, and the final 3 are made up of Velites. Cohae are commanded by a Prime Centurio.

Ala – Alae are Equites (combat vehicle) formations subordinate to a Demi-Legio. Alae are made up 4 Equestrian Manii.

Mani – Manii are made up of 8 Contae regardless of their combat branch. Manii are commanded by a Senior Centurio.

Conta – Contae are the smallest unit in the CAFF and in the Velites are made up of 8 soldiers. Clonscript Contae are made up of 80 soldiers. Velites Contae are commanded by a Veles-Decan and Clonscript Contae are commanded by either a Junior Centurio or the senior-most of the Triarii. In Equites formations Contae refer to the crew and support personnel for an individual vehicle, and are commanded by an Eques-Decan.

17 notes

·

View notes

Text

Key sectors in KSA manufacturing market:

Here’s a concise overview of the key sectors in Saudi Arabia's manufacturing market:

1. Petrochemicals

- Central to Saudi Arabia's manufacturing, leveraging vast oil and gas reserves to produce chemicals like ethylene and polypropylene.

- Major players include SABIC and Saudi Aramco.

2. Pharmaceuticals

- Rapidly expanding with a focus on local production of generics, vaccines, and biotech products.

- Supported by government initiatives to reduce import dependency.

3. Food and Beverage

- Vital for food security and economic growth, focusing on dairy, processed foods, beverages, and halal products.

- Expanding into regional and international markets.

4. Automotive

- Developing sector with a focus on assembling vehicles, manufacturing parts, and electric vehicles (EVs).

- Growing interest from global manufacturers.

5. Construction Materials

- Driven by mega-projects, producing cement, steel, aluminum, and sustainable materials.

- Key to supporting infrastructure development.

6. Metals and Mining

- Emerging sector with significant resources like gold, phosphate, and bauxite.

- Focus on extraction, processing, and downstream industries like aluminum smelting.

7. Textiles and Apparel

- Small but growing, with potential in high-quality textiles and traditional clothing.

- Opportunities in fashion and design.

8. Renewable Energy Equipment

- Focused on producing solar panels, wind turbines, and related components to support renewable energy projects.

- Significant growth potential aligned with sustainability goals.

9. Packaging

- Expanding due to growth in food, pharmaceuticals, and e-commerce.

- Innovation in sustainable packaging solutions is on the rise.

10. Defense and Aerospace

- Strategic priority with efforts to localize military equipment production.

- Supported by GAMI, focusing on parts manufacturing and maintenance services.

These sectors highlight Saudi Arabia's drive toward economic diversification, with strong government support and strategic investments fostering growth across the manufacturing industry.

#KhalidAlbeshri #خال��البشري

#advertising#artificial intelligence#autos#business#developers & startups#edtech#education#finance#futurism#marketing

16 notes

·

View notes

Text

NSF-funded research heads to the international space station on NASA's SpaceX CRS-32 mission

ISS national lab-sponsored investigations aim to enhance drug manufacturing and develop new materials for aerospace, defense, energy, and robotics

Three investigations funded by the U.S. National Science Foundation (NSF) and sponsored by the International Space Station (ISSInternational Space Station) National Laboratory are launching on SpaceX’s 32nd Commercial Resupply Services (CRS) mission, contracted by NASANational Aeronautics and Space Administration. These experiments leverage the microgravityThe condition of perceived weightlessness created when an object is in free fall, for example when an object is in orbital motion. Microgravity alters many observable phenomena within the physical and life sciences, allowing scientists to study things in ways not possible on Earth. The International Space Station provides access to a persistent microgravity environment. environment to advance fundamental science that could lead to improved pharmaceutical manufacturing, new materials with valuable industrial applications, and the next generation of soft active materials with lifelike properties.

These projects build on a strong, multi-year collaboration between the ISS National Lab and NSF, which allocates millions of dollars to space-based projects within the fields of tissue engineering and transport phenomena, including fluid dynamics. To date, more than 30 projects funded by NSF and sponsored by the ISS National Lab have launched to the orbiting laboratory, with nearly 70 additional projects preparing for flight. Below are details about the three NSF-funded investigations launching on NASA’s SpaceX CRS-32.

Improving Medicine Manufacturing

An investigation by Rensselaer Polytechnic Institute (RPI), supported by Tec-Masters, builds on previous research to examine protein fluid flow and clumping—a problem that occurs during manufacturing of protein-based pharmaceuticals that affects the quality of the drug.

“Proteins are used to make various therapies and must be concentrated in medicines to avoid needing to administer large amounts of fluid,” says Amir Hirsa, professor of mechanical, aerospace, and nuclear engineering at RPI. “But above a certain concentration, the proteins tend to form aggregates or clump.”

On Earth, studying protein behavior is complicated by interactions between the solution and the container used to hold it. But on the ISS, researchers can use the Ring-Sheared Drop module to form liquid into a self-contained sphere held between two rings.

Hirsa and his team can use this device to study protein motion and create more accurate models of the factors that lead to clumping, especially during drug manufacturing and dispensation to patients. The team also can test computer models that predict the behavior of proteins of vastly different concentrations and types, such as hormones and antibodies. Findings from this research could help uncover ways to avoid or reverse protein clumping, which would have a significant impact on the pharmaceutical industry.

“Another very important aspect of this work is making this data, which is so difficult to get, available to other scientists through open data repositories,” says Joe Adam, a research scientist at RPI. “Other scientists may see something even more interesting than we do.”

Developing New Materials

An investigation from the University of Alabama at Birmingham, supported by Leidos, will examine the formation of ceramic composites, which have valuable applications in several industries, including aerospace, defense, and energy. The study focuses on polymer-derived titanium carbide and silicon carbide composites that have electrical conductivity, are stable at high temperature, can be made into almost any shape and size, and are lightweight yet strong.

“These materials can be used in different extreme conditions, such as high temperatures and highly acidic or oxidative environments, where other materials become unstable or cannot survive,” says Kathy Lu, a professor in the Department of Mechanical and Materials Engineering.

Studying these composites in microgravity could reveal unique behaviors that cannot be replicated on Earth. Findings from this research could inform new techniques for ground- and space-based manufacturing of materials with specific properties for applications such as heat exchangers, electric systems, energy storage, electrodes, and microsystems.

“Nobody has studied microgravity’s effects on these ceramics, and the results could be helpful for the broader family of ceramics and other possible additives, such as fibers and nanoscale materials,” Lu says.

Studying Active Matter

A research team at the University of California, Santa Barbara (UCSB) will leverage microgravity to study active matter—microscopic particles that use energy to produce motion—and its effects on the separation of non-mixable liquids. These liquids, such as oil and water, separate into concentrated droplets of one substance dispersed in the other, a phenomenon known as active liquid-liquid phase separation (LLPS). This investigation, supported by Redwire Space Technologies, seeks a better understanding of active LLPS, which plays a key role in physics, materials science, engineering, and biology.

“Active fluids are made of billions of small molecular motors that push and pull on each other and generate a turbulent flow, like a windy day stirs the water on a beach,” says UCSB professor Zvonimir Dogic. “A long-term goal is using active matter in microfluidic devices to stir and control the separation of two substances. We’re trying to create simplified systems that start to mimic biology.”

Active LLPS could be used to create materials with lifelike properties, such as the ability to move, change shape, and self-repair, that could be used to develop more lifelike robotics.

SpaceX CRS-32 is scheduled to launch no earlier than April 21, 2025, at 4:15 a.m., from Launch Complex 39A at NASA’s Kennedy Space Center in Florida.

IMAGE: Left: A drop of protein solution less than two and a half centimeters in diameter formed in the RSD onboard the International Space Station. Right: An image showing a computed Newtonian flow diagram for the drop. Credit J. Adam

2 notes

·

View notes

Note

Every fandom has its bad side and worse side. I am not ok with trolls going around saying Vince sacrificed Skylar for fame either

the real people to blame for this is boeing and rocketdyne. They were the ones releasing radiation and dumping chemicals near the neighborhood where Vince and sharise lived at getting people sick and giving them cancer and unfortunately Skylar was a victim who did not survive

Also let it be known that a lot of these manufacture and chemical companies are still dumping toxic waste close to residents today!

Hello, anon! Thank you for your wise words and bringing awareness to the situation. It is very unfortunate how this whole thing occurred.

For anybody who wants to know more I will provide a short excerpt from an article I found. I will also paste the link for those who want to read the article in its entirety.

The lead singer for Mötley Crüe has sued Boeing North American Inc., claiming that his daughter's death by cancer in 1995 was caused by radioactive material dumped in the soil and ground water near his former home near the Santa Susana Field Laboratory.

Vince Neil and his ex-wife, Sharise, bought a home in Chatsworth in 1991, a few miles east of Boeing's Rocketdyne Division. Boeing acquired the property in 1996 when it bought Rockwell International's aerospace and defense businesses.

The suit claims that Boeing, Rockwell, and Rocketdyne knowingly dumped hazardous materials, such as plutonium and uranium, near the Neils' Summit Ridge Circle residence southeast of Simi Valley.

Their 4-year-old daughter, Skylar, was diagnosed with a rare form of cancer in April 1995 and died four months later. The suit claims that her death came "as a direct result of the activities conducted by defendants."

https://www.latimes.com/archives/la-xpm-1999-aug-18-me-1368-story.html

It’s disgusting how these companies are still getting away with this!

#hopefully this will educate the trolls#go after the companies not Vince#cine has spoketh#vince neil#motley crue#mötley crüe#nikki sixx#tommy lee#mick mars

6 notes

·

View notes

Text

Photonic Integrated Circuit Market 2033: Key Players, Segments, and Forecasts

Market Overview

The Global Photonic Integrated Circuit Market Size is Expected to Grow from USD 11.85 Billion in 2023 to USD 94.05 Billion by 2033, at a CAGR of 23.02% during the forecast period 2023-2033.

Photonic Integrated Circuit (PIC) Market is witnessing transformative momentum, fueled by the global push towards faster, energy-efficient, and miniaturized optical components. As data demands soar and photonics become essential in telecom, AI, quantum computing, and biosensing, PICs are emerging as the nerve center of next-generation optical solutions. These chips integrate multiple photonic functions into a single chip, drastically improving performance and cost-efficiency.

Market Growth and Key Drivers

The market is set to grow at an exceptional pace, driven by:

Data Center Expansion: Surging internet traffic and cloud services are fueling PIC-based optical transceivers.

5G & Beyond: Demand for faster, low-latency communication is driving adoption in telecom infrastructure.

Quantum & AI Computing: PICs are critical to the advancement of light-based quantum circuits and high-speed AI processors.

Medical Diagnostics: Miniaturized photonic sensors are revolutionizing biomedical imaging and lab-on-chip diagnostics.

Defense & Aerospace: PICs provide enhanced signal processing and secure communication capabilities.

Get More Information: Click Here

Market Challenges

Despite strong potential, the PIC market faces several hurdles:

Fabrication Complexity: Advanced PICs demand high-precision manufacturing and integration techniques.

Standardization Issues: Lack of global standards slows down mass deployment and interoperability.

High Initial Investment: R&D and setup costs can be prohibitive, especially for SMEs and startups.

Thermal Management: Maintaining performance while managing heat in densely packed circuits remains a challenge.

Market Segmentation

By Component: Lasers, Modulators, Detectors, Multiplexers/Demultiplexers, Others

By Integration Type: Monolithic Integration, Hybrid Integration

By Material: Indium Phosphide (InP), Silicon-on-Insulator (SOI), Others

By Application: Optical Communication, Sensing, Biomedical, Quantum Computing, RF Signal Processing

By End User: Telecom, Healthcare, Data Centers, Aerospace & Defense, Academia

Regional Analysis

North America: Leading in R&D, startups, and federal defense contracts.

Europe: Home to silicon photonics innovation and academic-industrial collaboration.

Asia-Pacific: Witnessing rapid adoption due to telecom expansion and smart manufacturing in China, South Korea, and Japan.

Middle East & Africa: Emerging opportunities in smart city and surveillance tech.

Latin America: Gradual growth driven by increasing telecom and IoT penetration.

Competitive Landscape

Key players shaping the market include:

Intel Corporation

Cisco Systems

Infinera Corporation

NeoPhotonics

IBM

II-VI Incorporated

Hewlett Packard Enterprise

Broadcom Inc.

GlobalFoundries

PhotonDelta (Europe-based accelerator)

Positioning and Strategies

Leading companies are focusing on:

Vertical Integration: Owning every stage from design to packaging for cost control and performance.

Strategic Partnerships: Collaborations with telecom operators, hyperscalers, and research institutes.

Application-Specific Customization: Tailoring PICs for specific end-user applications (e.g., medical devices or LiDAR systems).

Global Fab Alliances: Leveraging cross-continental manufacturing capabilities for scale and speed.

Buy This Report Now: Click Here

Recent Developments

Intel unveiled a next-gen 200G PIC-based optical transceiver targeting AI data centers.

Infinera's XR optics platform is redefining network scaling with dynamic bandwidth allocation.

European Photonics Alliance launched an initiative to accelerate PIC adoption in SMEs.

Startups like Ayar Labs and Lightmatter raised significant VC funding to develop photonics-based computing solutions.

Trends and Innovation

Co-Packaged Optics (CPO): Integrating optics with switching ASICs for power and latency optimization.

Silicon Photonics: Scalable, CMOS-compatible manufacturing opening the doors to mass production.

Quantum Photonic Chips: Rapid R&D in quantum-safe communications and computing.

Edge Photonics: Enabling localized, high-speed data processing for Industry 4.0 and IoT applications.

AI-Powered Design: ML models used for photonic circuit simulation and optimization.

Related URLS:

https://www.sphericalinsights.com/our-insights/antimicrobial-medical-textiles-market https://www.sphericalinsights.com/our-insights/self-contained-breathing-apparatus-market https://www.sphericalinsights.com/our-insights/ozone-generator-market-size https://www.sphericalinsights.com/our-insights/agro-textile-market

Opportunities

Telecom & Cloud Providers: Demand for next-gen, low-latency networks creates significant opportunities.

Healthcare Startups: PICs enable affordable, portable diagnostics, expanding precision medicine.

Defense & Security: High-performance signal processing and surveillance enhancements.

Automotive LiDAR: Integration of PICs into autonomous vehicle sensor suites.

Future Outlook

The Photonic Integrated Circuit Market is moving from research-focused innovation to mainstream commercial adoption. By 2030, PICs are expected to power a wide array of industries—fundamentally redefining computing, communication, and sensing systems. Standardization, improved design tools, and silicon photonics will be pivotal in unlocking scalable mass adoption.

Conclusion

As digital transformation becomes more photon-powered, Photonic Integrated Circuits stand at the frontier of high-speed, high-efficiency technology. For decision-makers, investors, startups, and policymakers, now is the moment to align strategies, fund innovation, and build the ecosystem that will define the photonic era.

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: [email protected]

Phone: +1 303 800 4326 (US)

Follow Us: LinkedIn | Facebook | Twitter

1 note

·

View note