#Banking & Finance

Text

Discover the investment potential in the loans and advances market as it adapts to changing financial landscapes.

0 notes

Text

BFSI Technology

BFSI (Banking, Financial Services, and Insurance) technology refers to the application of various technologies in the banking, financial, and insurance sectors to enhance operations, improve customer experiences, and drive innovation. The integration of technology in BFSI has transformed the way financial services are delivered, making processes more efficient, secure, and convenient. Here are some key technologies that are commonly used in BFSI:

Mobile Banking and Payments

Online Banking and E-commerce

Digital Wallets and Contactless Payments

Blockchain and Cryptocurrency

Robotic Process Automation (RPA)

Artificial Intelligence (AI) and Machine Learning (ML)

Big Data Analytics

Cybersecurity and Fraud Detection

Read more about our BFSI services.

0 notes

Text

with the end of the month slowly coming up again i am once again unfortunately already broke again and still somewhat in debt, really hoping to get out of that and get a stable enough income to allow me to stay out of debt for the future (i currently make about 1k a month which is very very little for trying to survive in switzerland esp as i currently support myself and a roommate pretty much alone (and currently leaves me somewhat financially dependent on my parents as well which im not gonna be able to be forever), goal for the end of this year is a stable 2k) anything really helps, but the subscription option helps me the most with stability and ability to budget (also i'll hopefully soon manage to give my subscribers actual special benefits).

i hate asking for money so often especially as i haven't put out a new article in quite a while now, but that will change again soon (i have various things in my pipeline and also non text content coming up soon!), and it is the supporters on ko-fi that let me do all the work i do <3

#maia arson crimew#donations#fundraiser#mutual aid#im so sorry#personal finances#also paypal option is disabled as i currently have no way of getting#paypal money to my bank account

2K notes

·

View notes

Text

Eddie, posting to Tiktok: Raise your hand if you and your husband had a long discussion about not needing to do renovations to your kitchen every time you’re bored and you both agree that it’s too soon to get new cabinets only for him to get new cabinets anyways. Raise your hand if you’ve ever done that?

Steve: Oh ho ho, Daddy Warbucks, why don’t you tell everybody that your cheap ass has so much money that you didn’t even notice thirty thousand dollars come out of your bank account?

Eddie: You spent thirty thousand dollars on cabinets?

Steve: No…. I spent twenty thousand.

Eddie, accepting facts: When did you even have them installed?

Steve: When your ‘long weekend in Los Angeles’ turned into two weeks

Eddie:

Eddie: Call me daddy again

Steve: No

#Eddie does not look at his bank statement. He never has and he never will#Steve pays their bills#Steve was one of those kids that collected commemorative coins (his dad’s hobby) so Eddie just assumed he’s good with finances#Steve’s just like: Do you want to live in a house or home Eddie??#Steve: A home has nice cabinets#Eddie: … a home#eddie munson tiktok saga#eddie munson#steve harrington

2K notes

·

View notes

Text

The dollar collapse is happening NOW!"

The Storm is coming sooner than expected. All financial systems controlled by the corrupt government will collapse.

This crash will be felt on a global level, and many currencies, especially the USD, will be worthless.

Fiat accounts, savings and retirement accounts, mortgage, e.t.c will crash down and wipe off from the system once this event happens, Quantum Financial System is the savior.!!!

Convert every money in your possession to digital gold & silver backed coins and move them into the QFS ledger for safety . There will be a Global Reset. All banks and fiat exchanges will be closed, and there will be a lot of uncertainty & confusion. Cash will be worthless and outdated, and all bank accounts will be closed and crash to zero .

All cabal public banks will be confiscated, and foreclosures will be frozen, as will all public and private dept(mortgage,loans, credit, and debit cards).

#bad government#bad omens#donald trump#reeducate yourself#wells fargo#new york#bank of america#bank crash#breaking news#qfs#bank clash#world news#xlm#xrpcommunity#xrp news#xrp#marine life#veterans#patriotic#politics#quantum financial system#decentralised finance#decentralisation#decentralized#be aware#stay woke#washington dc#trump 2024#community#usa news

639 notes

·

View notes

Text

oliver doodles misc

#oliver once played a death game w a recently deceased and it was fortnite and the worst part was that oliver won#oliver banks#my art#tma art#the magnus archives#tma#tma fanart#the magnus archives art#annabelle cane#u know that pic thats like “can i call u im having a panic attack”#and the other person responds “no” “im gonna lowball this guy on this truck”#thats oliver and annabelle to me#psych major (VERY INTO IT) and finance major (VERY NOT INTO IT)

694 notes

·

View notes

Text

For anyone wondering what happened to make Silicon Valley Bank here's the TL:DR:

SVB had very few consumer loans. Their investment base was primarily government bonds. A government bond is basically a loan to the gov at a fixed rate for a set period.

Their liability base was primarily consumer and investor savings.

They made money on the difference between what they were paying people in interest for their savings, and what the gov was paying them for the bonds.

They were then investing their profits into startups and tech businesses.

Then the loan rate rose, the interest rate on savings went up in the market, and to stay competative they had to put their rates up. They can't reclaim their investments as startups don't have the money to give back. The rate rises, their profits shrink, and they go boom.

#Silicon valley bank#Finance#Economics#Banking#What happened here was very specific to them#Lack of diversity in their asset and liability base

1K notes

·

View notes

Text

Banks want you to pay fees to use your own account. Banks want you to have debt obligations for your whole life. Banks get money below the prime rate, then charge you 23% interest on your credit cards. Banks debit your account immediately, then take 2-3 days to clear a check.

It's obscene.

676 notes

·

View notes

Text

When you date an investor

#banking#finance#crypto#digitalcurrency#investing#investment banking#loans#money#student memes#memes#meme#funny#relatable#insidesjoke#humor#maths

56 notes

·

View notes

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

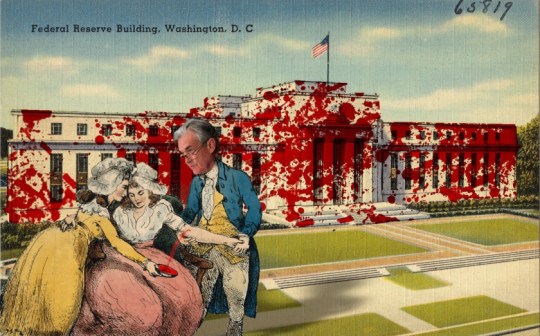

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

465 notes

·

View notes

Note

Hiiii!!! I keep getting invites to create money manager accounts from my bank & various credit cards, and i was wondering if y'all could explain what they are? I've tried to research them but can't make heads or tails if starting one is a good idea or not. Any advice??? TIA!!

First off, here's what you do with those "invites":

They aren't invitations. They're advertisements. You can safely ignore them. We explain all about it here:

Here’s What to Do With Those Credit Card Pre-approval Offers You Get in the Mail

Now, a "money manager account" is probably just some kind of investment account. When you're ready, you can do some research on both investment accounts and credit cards on your own, and choose accounts based on YOUR needs, not what your bank wants to sell you. For more on that, read this:

Cheat on Your Bank—It's Not Your Girlfriend

Hope that helps!

If this helped you out, tip us!

#credit cards#credit card pre-approval offer#banks#banking#adulting#personal finance#financial industry#financial services#finance#investing#money

54 notes

·

View notes

Text

Blockchain Applications across industries

0 notes

Note

If the King/Queen of Westeros decided to implement a national bank of Westeros, how would they navigate relationships with the Iron Bank and any perceived competition? Thinking of the same way that the Rogare Bank might have fallen to Faceless Man assassinations?

I would personally recommend a more cooperative policy, because there are definite ways that a Westerosi central bank could be of benefit to the Iron Bank - especially since central banks don't tend to compete with merchant or commercial banks for the same kind of business.

To begin with, the existence of a central bank acting as lender of last resort to Westerosi moneylenders and merchants is going to be good for the Iron Bank's business in Westeros, because that's going to massively reduce the risk of default, which would mean the Iron Bank's loans would see a higher rate of return even at lower interest rates, and likely would lead to an increased volume of business, as more people would be able to afford to take out loans from the Iron Bank.

If the Westerosi central bank is anything like the central banks of Early Modern Europe, it might be quite possible that the Iron Bank would become a minority shareholder in the Westerosi central bank, and quite likely would be one of the central bank's major customers when it comes to the sale of royal bonds - if only because the existence of a central bank would make Westerosi public debt a much sounder investment than under the medieval model.

#asoiaf#asoiaf meta#westerosi economic policy#medieval finance#medieval economics#iron bank#medieval banking#early modern state-building#early modern finance#central banking

36 notes

·

View notes

Text

#twitter x#finance#ipo#stockmarket#invest#memes#100 days of productivity#mensfashion#bse#investing#banking#twitter#funny#humor#tweets#wtf

20 notes

·

View notes

Text

Donald Trump, Glenn Beck and Tucker Carlson are trying to warn the American people of what's to come but unfortunately they are being silenced.

The dollar is crashing and so are the banks. In the past 2 months, America has experienced the 2nd, 3rd and 4th largest bank collapses in America history..... And it's only getting started.

Before leaving Fox, Tucker Carlson warned of the impending U.S . dollar collapse as the banking crisis. Your hard-earned wealth is at risk as financial institutions crumble and the value of the dollar plummet.

#donald trump#wells fargo#bank of america#breaking news#bank crash#bad government#new york#world news#bank clash#qfs#quantum financial system#decentralisation#decentralised finance#usa news#nesara#gesara#xrp news#xlm#marine life#veterans#patriotic#politics#carbal#reeducate yourself#reeducation#rebel#educate yourself#education#be aware#stay woke

131 notes

·

View notes

Text

[Gahyeon] Dreamcatcher - BONVOYAGE Relay Dance

#I will gif every single relay dance and spam the gahyeon tag and you cannot stop me#unless you buy my silence NOW by sending me $500 directly to my bank account#school of gahyeon finances#gahyeon#dreamcatcher#mygifs

41 notes

·

View notes