#Bearish engulfing candlestick pattern explained

Explore tagged Tumblr posts

Text

How to Trade the Bearish Engulfing Pattern: Complete Guide with Strategies and Examples

Candlestick patterns are powerful tools in the arsenal of a technical trader. Among the most reliable reversal patterns is the Bearish Engulfing Pattern—a strong signal that can hint at the start of a downward trend. In this guide, we’ll explain how to identify this pattern, why it works, and most importantly, how to trade it effectively with multiple strategies and examples. 📌 What is a Bearish…

#Bearish candle formation#Bearish engulfing candlestick pattern explained#Bearish Engulfing Pattern#Bearish engulfing pattern trading strategy#Bearish reversal pattern#Bearish trend confirmation#Can you trade bearish engulfing in forex?#Candlestick pattern for bearish reversal#candlestick patterns#Confirmation signals for bearish engulfing#EMA confluence with candlestick patterns#Engulfing candle trading rules#Entry and exit with candlestick patterns#Forex bearish engulfing strategy#How to confirm a bearish engulfing signal?#How to trade the bearish engulfing pattern#Is the bearish engulfing pattern reliable?#learn technical analysis#Multi-timeframe candlestick pattern strategy#Price action trading setup#Reversal Candlestick Patterns#Risk management for pattern trading#stock markets#Stock trading with bearish engulfing pattern#support and resistance levels#Swing trading with bearish engulfing#technical analysis#Trading bearish engulfing with moving averages#Trading Strategies#Using bearish engulfing with RSI

0 notes

Text

Types of Candlestick Patterns Explained Simply

Types of Candlestick Patterns: A Beginner-Friendly Guide

Have you ever looked at a stock chart and felt like it was speaking a foreign language? Those little red and green bars—known as candlesticks—aren’t just random shapes. They tell stories. Stories of fear, greed, hesitation, and opportunity. If you've ever wished to understand those stories, you're in the right place.

In this article, we’re going to explore the types of candlestick patterns in a way that’s easy to grasp, even if you're brand new to trading. Think of candlestick patterns like emojis—small symbols packed with emotional context. Just as means happiness, a Hammer candlestick might signal a bullish reversal.

Explore types of candlestick patterns in simple terms. A complete guide to all types of candlestick patterns for beginners and curious traders.

Introduction to Candlestick Patterns

Candlestick patterns are visual tools used in stock trading to predict potential price movements. Each candlestick shows four key details: the opening price, closing price, highest price, and lowest price for a specific time frame.

These patterns originated in 18th-century Japan—yes, that far back!—when rice traders used them to predict future prices.

Why Candlestick Patterns Matter

Understanding candlestick patterns is like learning to read body language. While price tells you what happened, candlesticks hint at why. Are traders getting scared? Is there confidence building up? Candlestick patterns provide these answers through easy-to-spot formations.

Single Candlestick Patterns

Let’s begin with the simplest types. These involve only one candlestick and are often the first step for beginners.

The Hammer & Hanging Man

These two look nearly identical but mean very different things.

Hammer: Appears at the bottom of a downtrend. Think of it as the market “hammering out” a bottom. It has a small body and a long lower shadow.

Hanging Man: Shows up after an uptrend. Same shape as the hammer but signals a potential drop in price.

Tip: The color of the body isn’t as important as the position and size of the shadow.

Doji – The Market's Pause Button

The Doji is like a moment of hesitation. The opening and closing prices are nearly the same, forming a tiny body.

Types of Doji:

Neutral Doji: Price goes up and down, but ends unchanged.

Long-legged Doji: Large wicks on both sides, signaling major indecision.

Gravestone Doji: Looks like an upside-down “T” and suggests bearish pressure.

Dragonfly Doji: Resembles a “T” and may signal bullish strength.

Spinning Top – Indecision Alert

A Spinning Top has a small body and long upper and lower shadows. It signals that buyers and sellers fought hard but neither won.

It usually shows up during a trend and indicates a possible reversal or slowdown.

Marubozu – Full of Confidence

This candlestick has no shadows—just a solid body.

Bullish Marubozu: Opens at the low and closes at the high. Total buyer control.

Bearish Marubozu: Opens at the high and closes at the low. Total seller control.

Think of it like someone shouting, “I’m all in!” without hesitation.

Engulfing Patterns – Power Shifts

These are two-candlestick patterns that reflect changing momentum.

Bullish Engulfing: A small red candle followed by a large green one that "engulfs" it. Suggests a reversal to the upside.

Bearish Engulfing: Opposite of the above, often indicating a drop ahead.

Morning Star & Evening Star

These are three-candle patterns that often signal major turning points.

Morning Star: Appears after a downtrend. A long red candle, then a small one (any color), followed by a strong green candle. Signals a bullish reversal.

Evening Star: The bearish cousin. Appears after an uptrend.

Three White Soldiers & Three Black Crows

These are sequences of three strong candles.

Three White Soldiers: Three long green candles in a row. Very bullish.

Three Black Crows: Three long red candles. Very bearish.

These patterns indicate strong sentiment, either positive or negative.

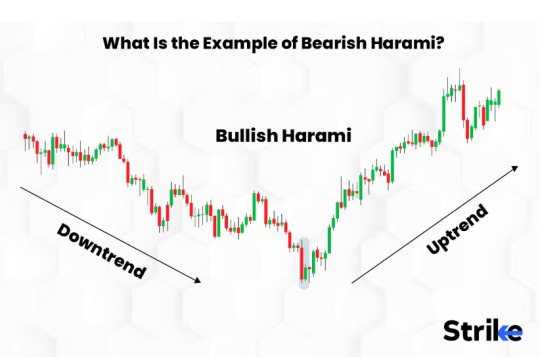

Harami – Inside Moves

The Harami pattern looks like a small candle hiding inside a larger one.

Bullish Harami: Small green candle inside a large red one. Signals a possible reversal upward.

Bearish Harami: Small red inside a green. Signals a potential downturn.

Piercing Line & Dark Cloud Cover

These two-candle patterns are also all about reversal signals.

Piercing Line: A red candle followed by a green one that opens lower but closes past the midpoint of the previous red. Bullish sign.

Dark Cloud Cover: The opposite. Bearish sentiment taking over.

Tweezer Tops and Bottoms

Tweezer Top: Two or more candles with identical highs. Suggests price resistance and a possible drop.

Tweezer Bottom: Identical lows over two or more candles. Suggests price support and possible rise.

Think of tweezers picking the top or bottom out of a price trend.

How to Read Candlestick Patterns Together

One candle alone doesn't tell the full story. It's like reading just one sentence of a novel. To truly understand the plot, you need context. Combine patterns with:

Volume

Trend direction

Support and resistance levels

Tips for Using Candlestick Patterns Effectively

Don’t trade patterns in isolation. Always confirm with other indicators.

Practice makes perfect. Use demo accounts to test your pattern-reading skills.

Stay patient. Candlestick patterns are signals, not guarantees.

Conclusion

Candlestick patterns are like the facial expressions of the stock market. They give you hints, nudges, and sometimes loud warnings about what might happen next. Whether you’re just curious or planning to dive deeper into trading, understanding these patterns will help you navigate the charts with confidence.

Remember, while this article covers all types of candlestick patterns, experience and context make all the difference in using them effectively.

FAQs

What are candlestick patterns in simple terms? Candlestick patterns are visual tools on price charts that show how a stock's price moves during a certain period, helping predict future movements.

How many types of candlestick patterns are there? There are over 30 commonly used candlestick patterns, including single, double, and triple candlestick formations.

Are candlestick patterns reliable for trading? They can be helpful indicators but should always be used with other tools like volume and trend analysis for accuracy.

What is the most bullish candlestick pattern? The “Morning Star” and “Three White Soldiers” are among the most bullish, often indicating a strong reversal to the upside.

Can I use candlestick patterns in all markets? Yes! These patterns work in stocks, forex, commodities, and crypto markets, thanks to their universal price action behavior.

#types of candlestick patterns#all types of candlestick patterns#types of candlesticks#types of candlesticks and their meaning

0 notes

Text

Master Technical Analysis: Your Guide to the Indian Stock Market

Navigating the Indian stock market can feel overwhelming. With thousands of stocks and constant fluctuations, how do you make informed decisions? Technical analysis offers a way to understand market movements through charts and indicators. This guide will help you get a grip on the essentials of technical analysis, making it easier to trade wisely.

The Allure and Challenges of the Indian Stock Market

The Indian stock market has its own excitement. Investors are drawn to the potential for great returns. However, with opportunity comes risk. The market is volatile, and prices can change quickly. Understanding the tools available can help traders to manage that risk effectively.

Why Technical Analysis is Crucial for Indian Traders

Technical analysis simplifies the process of Stock Marketing Trading. It focuses on price movements and volume rather than company fundamentals. By studying price charts and patterns, traders can make predictions about future market behavior. This method helps reduce emotional decision-making and allows for a more disciplined approach.

Setting the Stage: What This Guide Covers

This guide covers key aspects of technical analysis, including:

Chart Patterns

Technical Indicators

Candlestick Patterns

Risk Management

Advanced Techniques

Each section aims to provide clear insights and actionable strategies for traders in the Indian market.

Chart Patterns: Deciphering Market Signals

Identifying Trend Reversals: Head and Shoulders, Double Tops/Bottoms

Chart patterns are graphical representations of price movements. Recognizing these patterns can signal potential trend reversals:

Head and Shoulders: Indicates a reversal from bullish to bearish.

Double Tops: Signals a peak before a downward trend.

Double Bottoms: Suggests a potential upward movement.

Spotting Continuation Patterns: Flags, Pennants, Wedges

Continuation patterns suggest that a trend will continue. Key patterns to watch include:

Flags: Short-term consolidation before a continuation.

Pennants: Small symmetrical triangles after a sharp price movement.

Wedges: Indicates a potential reversal in a strong trend.

Practical Application: Real-world examples of pattern recognition in Indian stocks

For example, if an Indian stock like Reliance Industries shows a head and shoulders pattern, it might indicate a shift from a bullish trend to a bearish one, guiding traders to adjust their positions accordingly.

Technical Indicators: Unveiling Market Momentum

Moving Averages: Simple, Exponential, Weighted – Explained

Moving averages smooth out price data to identify trends over a specific period. Key types:

Simple Moving Average (SMA): Averages prices over a set time.

Exponential Moving Average (EMA): Gives more weight to recent prices.

Weighted Moving Average (WMA): Assigns different weights to prices based on their age.

Relative Strength Index (RSI): Gauging Market Strength and Weakness

The RSI is a momentum oscillator that ranges from 0 to 100. It helps traders spot overbought or oversold conditions:

Above 70: Indicates overbought conditions.

Below 30: Suggests oversold conditions.

MACD: Identifying Momentum Shifts and Potential Trading Signals

The Moving Average Convergence Divergence (MACD) can identify shifts in momentum. When the MACD line crosses above the signal line, it may indicate a buy signal, and vice versa.

Candlestick Patterns: Unlocking Price Action Insights

Understanding Candlestick Formation and Interpretation

Candlestick charts provide visual insights into price movements. Each candle shows the open, close, high, and low prices for a specific time period.

Powerful Candlestick Patterns: Doji, Hammer, Engulfing Patterns

Some key candlestick patterns include:

Doji: Indicates indecision in the market.

Hammer: Suggests potential bullish reversal.

Engulfing Patterns: Signals strong shifts in market sentiment.

Combining Candlestick Patterns with Indicators for Enhanced Accuracy

By pairing candlestick patterns with indicators like RSI or MACD, traders can enhance their analysis and improve trade accuracy.

Risk Management and Position Sizing in the Indian Context

Defining Your Risk Tolerance and Setting Stop-Loss Orders

Understanding personal risk tolerance is crucial. Setting stop-loss orders helps limit potential losses. For example, if a trader is willing to risk 2% of their portfolio on a trade, they should set a stop-loss accordingly.

Position Sizing Strategies for Indian Stock Market Trading

Calculating position sizes based on risk tolerance aids better capital management. A common method is the fixed percentage approach, allowing traders to determine how much to invest in each trade.

Adapting Risk Management to the Unique Characteristics of Indian Markets

Consider the high volatility in Indian stocks. Adjust risk management practices to protect capital during price swings.

Advanced Technical Analysis Techniques

Fibonacci Retracements and Extensions: Identifying Support and Resistance Levels

Fibonacci levels are used to identify potential retracement levels. Traders often look for support or resistance at these levels during price corrections.

Elliott Wave Theory: Understanding Market Cycles and Trends

Elliott Wave Theory suggests markets move in predictable cycles. Identifying these waves helps traders anticipate future price movements.

Combining Multiple Techniques for Comprehensive Market Analysis

Using multiple technical analysis tools together provides a fuller picture. For instance, analyzing chart patterns alongside indicators can enhance trading decisions.

Conclusion: Mastering Technical Analysis for Sustainable Success

Key Takeaways: Actionable Steps for Indian Stock Market Traders

Focus on mastering chart patterns and technical indicators.

Incorporate risk management strategies tailored to the Indian market.

Continuously learn and adapt to market changes.

Continuous Learning and Adaptation in the Dynamic Indian Market

The Indian stock market is ever-changing. Stay updated with market trends and refine your strategies regularly.

Resources for Further Learning and Development

Books, online courses, and webinars can enhance your understanding. Explore resources like financial news platforms, stock market blogs, and trading forums to continue your education in technical analysis.

By mastering technical analysis, you position yourself for success in the dynamic Indian stock market. Embrace the tools and strategies outlined in this guide to make informed trading decisions. Start analyzing today!

0 notes

Text

Mastering Candlestick Patterns: A Beginner’s Guide for Forex Traders

Candlestick patterns are powerful tools for Forex trading, providing crucial insights into price action and market sentiment. This beginner-friendly guide explains how to identify and use basic patterns like bullish and bearish engulfing, doji, hammer, and shooting star to predict market movements. Combining candlestick analysis with technical indicators, understanding market context, and practicing risk management can enhance your trading strategies. Whether you’re new to Forex trading or looking to refine your approach, mastering candlestick patterns is essential. Partnering with the Best Forex Broker ensures access to the right tools, educational resources, and a reliable trading platform for long-term success.

0 notes

Text

Mastering the Bullish Harami Candlestick: The Only Guide You’ll Ever Need

If you’re trying to get better at technical analysis, learning candlestick patterns is non-negotiable. And among the most powerful bullish reversal signals lies a subtle but mighty formation — the Bullish Harami.

In this guide, we’ll walk you through what it is, why it matters, how to use it in real markets like the Indian stock market, and tools like Strike Money that make your life easier. Let’s dive in.

Bullish Harami Candlestick: What It Really Means in Trading

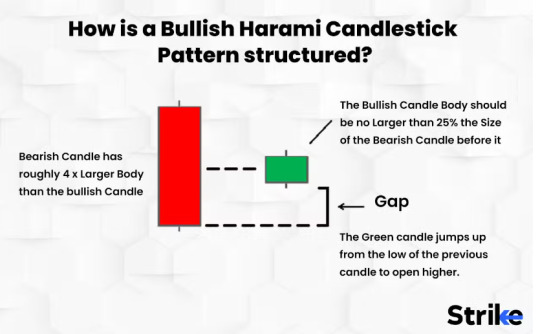

A Bullish Harami is a two-candle pattern that shows a possible trend reversal from bearish to bullish. It's formed when a large bearish (red) candle is followed by a small bullish (green) candle that sits completely within the body of the previous candle.

Think of it as a “pause” in downward pressure and a signal that buyers might be coming in.

This pattern is widely used in stock trading, forex, crypto, and commodity markets.

📚 Steve Nison, who popularized Japanese candlestick charting in the West, explains in his book that the Harami means "pregnant" in Japanese — the small candle (baby) is protected by the large one (mother).

Why the Bullish Harami Signals a Reversal (Psychology Behind It)

Here’s what’s really happening in the market when this pattern appears:

Strong selling pressure drives prices lower (first red candle).

The next day, the market opens higher or gaps up slightly and stays range-bound (second green candle).

This hesitation in selling shows weakening bearish momentum.

Buyers test the waters, often resulting in a short-term reversal or at least a price bounce.

This is not a standalone entry signal — smart traders combine it with volume confirmation and technical indicators like RSI or MACD.

Spotting the Bullish Harami in Real Charts (With Indian Market Examples)

Let’s take a look at a few examples from the NSE (National Stock Exchange):

Tata Motors (Jan 2024): After a 6-day downtrend, a Bullish Harami formed around ₹720. The next three sessions saw a reversal, pushing the price above ₹765 — a 6% gain.

Infosys (Aug 2023): The stock formed a Bullish Harami near a support zone around ₹1350. Combined with RSI near 30, this created a low-risk buy setup and led to a 5-day rally.

Use tools like Strike Money or TradingView to spot these setups. Strike Money allows you to set candlestick alerts, mark support-resistance zones, and even backtest such patterns.

How to Trade the Bullish Harami (Step-by-Step for Real Profits)

Identify the pattern in a downtrend.

Look for confirmation: The next candle after the pattern should close higher.

Use indicators like:

RSI < 40 = Oversold

MACD crossover near zero

Volume spike on the green candle

Set your entry just above the high of the second (green) candle.

Place your stop-loss below the low of the red candle.

Target: Next resistance zone or a fixed 1:2 risk-reward.

🧠 Pro Tip: Always check higher timeframes (daily or weekly) for confirmation. Bullish Harami on a 15-minute chart might be noise.

Don’t Confuse It with Bullish Engulfing — Here’s the Difference

While both are bullish reversal patterns, they are structurally different:

Bullish Harami: Small green candle inside a large red candle.

Bullish Engulfing: Large green candle that completely covers a red candle.

Engulfing is more aggressive and often signals stronger momentum. But the Harami is more reliable when it appears at key support levels or after oversold conditions.

Does the Bullish Harami Actually Work? Research Says Yes — But With Conditions

A study by Thomas Bulkowski, author of “Encyclopedia of Candlestick Charts,” analyzed performance of over 50 candlestick patterns:

Bullish Harami reversal accuracy: ~53% (for stocks)

Success rate improves to 60%+ when:

Confirmed by volume increase

Appears near support or trendline

Combined with indicators (like RSI, Bollinger Bands)

👉 Conclusion: On its own, it’s just okay. But with context, it becomes a valuable signal.

Backtested: Bullish Harami in Nifty 50 Stocks

We backtested Bullish Harami patterns using Strike Money’s historical data tool on Nifty 50 stocks between 2022–2024.

Key Insights:

HDFC Bank and Reliance showed the highest bounce rates post-pattern (~70%).

ICICI Bank had a poor signal-to-success ratio unless combined with RSI < 40.

Best-performing timeframes: Daily > 1H > Weekly

Use Strike Money to test this on your watchlist. It highlights past occurrences, lets you filter with RSI or MACD, and even shows risk-to-reward heatmaps.

Avoid These Common Mistakes with Bullish Harami

Ignoring the trend: It must occur in a downtrend to be valid.

No confirmation: Entering just because you see the pattern without a green follow-through candle is risky.

Low volume candles: These might just be traps.

Over-relying on it: Use it as part of a bigger system, not the system itself.

Can You Use Bullish Harami in Crypto, Forex, and Commodities?

Absolutely. The pattern is universal because it's based on price action, not asset class.

In crypto (e.g., Bitcoin), Bullish Harami often shows up after panic sell-offs.

In forex (e.g., EUR/INR), it can signal reversals at key psychological levels.

In commodities (e.g., Gold Futures on MCX), it works well when paired with Fibonacci levels or Bollinger Bands.

✅ Just remember: Crypto markets are more volatile, so combine the pattern with stronger confirmation tools like ATR or stochastic RSI.

The Best Tools for Spotting Bullish Harami Instantly

If you’re still scanning charts manually, you’re wasting time. Use these platforms:

Strike Money: Indian traders’ favorite. Filters by candle patterns + RSI + volume. Real-time alerts on Harami formations.

TradingView: Great for drawing tools and cross-asset analysis.

MetaTrader 5: If you’re trading globally, this platform offers automated scripts for candle recognition.

Why the Bullish Harami Pattern Still Matters in 2025

With the rise of algorithmic trading and AI-driven systems, many traders overlook simple candlestick patterns.

But the truth is — they still work. Especially when:

The pattern shows up at multi-month lows

Paired with volume confirmation

Reinforced by support zones and RSI divergence

In a world of data overload, simple signals like Bullish Harami keep you grounded. And they’re accessible — even to beginners using free tools like Strike Money.

Final Thoughts: Should You Add Bullish Harami to Your Trading Arsenal?

If you're a technical trader, especially in Indian equities or derivatives, yes — 100%.

It gives you a clean, price-action-driven view of potential reversals without relying on lagging indicators. But don’t forget:

✅ Always seek confirmation ✅ Combine with RSI, MACD, or volume ✅ Backtest on your own portfolio using tools like Strike Money ✅ Don’t blindly trust — understand context and market mood

👣 Your Next Step

Add Bullish Harami to your trading playbook

Use Strike Money to spot setups on your preferred stocks

Backtest it. Validate it. Master it.

Because at the end of the day, a pattern is only as powerful as the discipline you apply around it.

0 notes

Text

SEBI Certified Research Analyst Explains Different Types of Candlestick Patterns

Candlestick chart analysis is a popular tool used by traders to identify potential price trends in the financial markets. Candlestick patterns are formed by the open, high, low, and close prices of an asset, and they can help traders make informed decisions about when to buy or sell.

As a SEBI certified research analyst, I have studied and analyzed various candlestick patterns extensively. In this blog, I will explain some of the different types of candlestick patterns and how they can be used in trading.

Bullish Engulfing Pattern: This pattern is formed when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candlestick. This pattern indicates that the bulls have taken control of the market and that a trend reversal may occur.

Bearish Engulfing Pattern: This pattern is the opposite of the bullish engulfing pattern. It is formed when a small bullish candlestick is followed by a larger bearish candlestick that completely engulfs the previous candlestick. This pattern indicates that the bears have taken control of the market and that a trend reversal may occur.

Hammer Pattern: This pattern is formed when a small candlestick with a long lower shadow and a small upper shadow is followed by a bullish candlestick. The long lower shadow indicates that the bears pushed the price down, but the bulls regained control and pushed the price back up. This pattern can indicate a trend reversal or a support level.

Shooting Star Pattern: This pattern is the opposite of the hammer pattern. It is formed when a small candlestick with a long upper shadow and a small lower shadow is followed by a bearish candlestick. The long upper shadow indicates that the bulls pushed the price up, but the bears regained control and pushed the price back down. This pattern can indicate a trend reversal or a resistance level.

Doji Pattern: This pattern is formed when the open and close prices are the same or very close. The doji pattern indicates indecision in the market and can indicate a trend reversal or a potential trend continuation, depending on the context of the market.

In conclusion, candlestick patterns are a powerful tool for traders to analyze price trends in the financial markets. As a SEBI certified research analyst, I highly recommend using candlestick chart analysis tools to identify potential trade opportunities and make informed trading decisions.

0 notes

Text

Supply And Demand Zones

Supply & demand zones put the economic theory into a trading strategy using price charts.

Supply and demand zones are the periods of sideways price action that come before explosive price moves, and are typically marked out using a rectangle tool in trading platform.

A supply zone forms before a downtrend. The candlesticks or bars that mark the origin of a strong downtrend are called the supply zone or distribution zone.

A demand zone forms before an uptrend. The candlesticks or bars that mark the origin of a strong uptrend are called the demand zone or accumulation zone.

Wyckoff explained these phases by the action of the ‘whales’ which these days are big institutions like money centre banks in forex markets or hedge funds in the stock market.

These big players can’t just put their whole order into the market at once because they are accumulating so much that it would move the price. So instead, they buy increments within a specified price range. This causes what we see on the chart as a ‘demand zone’

Equally, when they are selling their position, it can’t be all done at once because the selling pressure would send the price sharply lower and reduce their profits because they would be forced to sell into a market decline, caused by their own large orders. So again they sell over a period of time to minimise the market impact of their trades, which creates the 'supply zone'.

Eventually the market will break in the way that these whales had been buying or selling, creating a period where supply and demand are out of balance i.e. a price trend.

It’s important to understand that there can be several periods of accumulation during an uptrend and several periods of distribution during downtrends.

How to draw Supply & Demand Zones

Identify current market price.

Look left on the chart.

Look for big green or big red candles.

Find the origin of the big candles.

Mark the zone around this ‘origin‘.

There are two types of candle zones to look for on the chart, either one will proceed a big price move.

From a base. A base means a small series of candles (typically less than 10) in a tight consolidation.

From a single candle. One candle is enough to draw the zone. The two candlesticks together often form a classic Japanese candlestick pattern like a hammer or shooting star or bullish and bearish engulfing candlestick patterns.

How do you identify a strong supply and demand zone?

Narrow price range. If the trading range that exceeds the breakout is too wide or has too many long-wick candles, it shows uncertainty and is less likely to represent accumulation from a whale.

Less than 10 candles. The demand or supply zone should ideally be between 1 and 10 candles. Accumulation and distribution can take a while but too long and the zone may get exhausted before the re-test later.

Strong price move. What we want to see in the breakout candle is an ‘Extended range candle’ or ERC. This shows a strong price move that has significance.

Fresh / untested. The best zones are when the price has not revisited it since the breakout. Just like support and resistance, the more times supply zones and demand zones are test, the more likely they are to fail.

Fakeout or ‘spring’. This is when the price temporarily breaks out in the opposite direction but then quickly reverses. This is a sign of big players ‘stop hunting’ to find extra liquidity for their accumulation or distribution.

Drawing supply and demand zones tends to be more of an art than a science and some of the best-known modern supply/demand traders and mentors like Sam Seiden draw the zones using the ‘rectangle tool’ available in most trading platforms.

#supply and demand zones#technical analysis#day trading#intermediate trader#flowbank#spring pattern#wyckoff theory

0 notes

Photo

Bearish Engulfing Candlestick Patterns Explained With Examples

#traders#swingtrading#daytrading#foreignexchange#forex#stocks#fx#scalpers#forextrading#daytrader#swingtrader#currency#binaryoptions#stockmarket#stocktrading#nyse#nasdaq#pennystock#traderslife#forextrader#scalping#robinhood#eurusd#usdjpy#mt4#technicalanalysis#financialmarkets#investing

1 note

·

View note

Text

How to Trade the Bullish Engulfing Pattern: Complete Guide with Strategies

In the world of candlestick trading, price action patterns offer invaluable insights into market sentiment and potential reversals. One of the most powerful and frequently observed reversal patterns is the Bullish Engulfing Pattern. This pattern signals a shift from bearish to bullish sentiment, often preceding a strong upward move. In this blog post, we’ll explore: What the Bullish Engulfing…

#Best candlestick patterns for trading#Bullish Candlestick Patterns#Bullish Engulfing confirmation#Bullish Engulfing in downtrend#Bullish Engulfing in intraday trading#Bullish Engulfing Pattern#Bullish Engulfing pattern explained with examples#Bullish Engulfing setup#Bullish Engulfing trading strategy#Bullish Engulfing vs Bearish Engulfing#candlestick chart patterns#Candlestick reversal patterns#EMA bounce with candlestick patterns#engulfing candle setup#Engulfing candle trading strategy#Entry and exit strategy for Bullish Engulfing#High volume Bullish Engulfing#How to identify a Bullish Engulfing pattern#How to Trade Bullish Engulfing#intraday trading strategy#learn technical analysis#Price Action Strategy#Profitable Bullish Engulfing strategy for beginners#reversal trading signals#RSI and Bullish Engulfing#Stock trading patterns#Support and resistance trading#Swing trading with Bullish Engulfing#technical analysis#Technical Analysis Patterns

0 notes

Text

Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week

Regardless of this flat price action, chances are we might see a short term price recovery only if buyers drive prices above Aug 17 highs of $330 or there about. In the meantime though, Ethereum (ETH) is down two percent in the last day as the community receives with great expectation IE’s Bakkt and their effort to make crypto mainstream.

From the News

Earlier this month, International Exchange, the company which owns The New York Stock Exchange announced that they will be forming a new company Bakkt with the sole purpose of creating the lacking regulatory framework that facilitates fast price discovery as well as creating the infrastructure required for making trading, storing and spending of several high liquid cryptocurrencies as simple as possible.

We introduced Bakkt two weeks ago, and in her latest @Medium post our CEO looks ahead to an even busier fall https://t.co/T7RltAGp0k

— Bakkt (@Bakkt) August 20, 2018

It’s often the adoption part that is challenging when a new product is trying to break into the mainstream but once it does, it’s usually a new cycle of value creation that benefit the first investors. Bakkt consists of several traditional market leaders as Microsoft, Alan Howard, Galaxy Digital and several blockchain centric venture Capital firms and as they plan to launch on November this year, the group is receiving overwhelming support from the crypto community with some comparing their effort to those of early drivers of internet adoption as ICANN.

1. Today I am going to make a tweet storm explaining the history and state of Ethereum's Casper research, including the FFG vs CBC wars, the hybrid => full switch, the role of randomness, mechanism design issues, and more.

— Vitalik Non-giver of Ether (@VitalikButerin) August 16, 2018

In a bid to quash rumors that has been in the crypto world, Vitalik took to twitter explaining the genesis and objectives of Casper Labs, how the network plans to deal with long range attacks and how Friendly Finality Gadget (FFG) had better inbuilt designs that complies with other blockchains that adds finality guarantees.

Technical Analysis

Weekly Chart

Ethereum Weekly Chart by Trading View

Price wise, bears are in charge and after shedding four percent in the last week, it appears as if Ethereum sellers are syncing well with that break below pattern of week ending Aug 12.

Notice that that bearish engulfing candlestick anchors our current price projection and as per our previous Ethereum (ETH) trade plans, sellers are in charge and despite recent attempts of higher highs, it will be a tall order for buyers to muster enough momentum and print prices above $400.

In any case, last week’s bear candlestick confirms the break out pattern and as long as prices are not trading below last week’s highs at $330, we suggest taking shorts on every high in lower time frames.

Daily Chart

Ethereum Daily Chart by Trading View

Though we had a convincing three bar reversal pattern by close of Aug 17 that bull reversal pattern is yet to be confirmed and in real sense prices are oscillating within Aug 17 bullish engulfing high lows.

Technically, we shall retain a bearish projection a long as prices are trading below $400 and as it stands, today close shall define our short term trade trajectory.

If today’s candlestick close as a bear, then we shall take shorts from tomorrow with stops at $300 and first targets at $200.

However, should bulls drive prices higher then we recommend taking small size longs with stops at $280 and first targets at $400.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week appeared first on NewsBTC.

Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week published first on https://medium.com/@smartoptions

0 notes

Text

Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week

Regardless of this flat price action, chances are we might see a short term price recovery only if buyers drive prices above Aug 17 highs of $330 or there about. In the meantime though, Ethereum (ETH) is down two percent in the last day as the community receives with great expectation IE’s Bakkt and their effort to make crypto mainstream.

From the News

Earlier this month, International Exchange, the company which owns The New York Stock Exchange announced that they will be forming a new company Bakkt with the sole purpose of creating the lacking regulatory framework that facilitates fast price discovery as well as creating the infrastructure required for making trading, storing and spending of several high liquid cryptocurrencies as simple as possible.

We introduced Bakkt two weeks ago, and in her latest @Medium post our CEO looks ahead to an even busier fall https://t.co/T7RltAGp0k

— Bakkt (@Bakkt) August 20, 2018

It’s often the adoption part that is challenging when a new product is trying to break into the mainstream but once it does, it’s usually a new cycle of value creation that benefit the first investors. Bakkt consists of several traditional market leaders as Microsoft, Alan Howard, Galaxy Digital and several blockchain centric venture Capital firms and as they plan to launch on November this year, the group is receiving overwhelming support from the crypto community with some comparing their effort to those of early drivers of internet adoption as ICANN.

1. Today I am going to make a tweet storm explaining the history and state of Ethereum's Casper research, including the FFG vs CBC wars, the hybrid => full switch, the role of randomness, mechanism design issues, and more.

— Vitalik Non-giver of Ether (@VitalikButerin) August 16, 2018

In a bid to quash rumors that has been in the crypto world, Vitalik took to twitter explaining the genesis and objectives of Casper Labs, how the network plans to deal with long range attacks and how Friendly Finality Gadget (FFG) had better inbuilt designs that complies with other blockchains that adds finality guarantees.

Technical Analysis

Weekly Chart

Ethereum Weekly Chart by Trading View

Price wise, bears are in charge and after shedding four percent in the last week, it appears as if Ethereum sellers are syncing well with that break below pattern of week ending Aug 12.

Notice that that bearish engulfing candlestick anchors our current price projection and as per our previous Ethereum (ETH) trade plans, sellers are in charge and despite recent attempts of higher highs, it will be a tall order for buyers to muster enough momentum and print prices above $400.

In any case, last week’s bear candlestick confirms the break out pattern and as long as prices are not trading below last week’s highs at $330, we suggest taking shorts on every high in lower time frames.

Daily Chart

Ethereum Daily Chart by Trading View

Though we had a convincing three bar reversal pattern by close of Aug 17 that bull reversal pattern is yet to be confirmed and in real sense prices are oscillating within Aug 17 bullish engulfing high lows.

Technically, we shall retain a bearish projection a long as prices are trading below $400 and as it stands, today close shall define our short term trade trajectory.

If today’s candlestick close as a bear, then we shall take shorts from tomorrow with stops at $300 and first targets at $200.

However, should bulls drive prices higher then we recommend taking small size longs with stops at $280 and first targets at $400.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week appeared first on NewsBTC.

from Cryptocracken WP https://ift.tt/2OSZ9z0 via IFTTT

0 notes

Text

Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week

Regardless of this flat price action, chances are we might see a short term price recovery only if buyers drive prices above Aug 17 highs of $330 or there about. In the meantime though, Ethereum (ETH) is down two percent in the last day as the community receives with great expectation IE’s Bakkt and their effort to make crypto mainstream.

From the News

Earlier this month, International Exchange, the company which owns The New York Stock Exchange announced that they will be forming a new company Bakkt with the sole purpose of creating the lacking regulatory framework that facilitates fast price discovery as well as creating the infrastructure required for making trading, storing and spending of several high liquid cryptocurrencies as simple as possible.

We introduced Bakkt two weeks ago, and in her latest @Medium post our CEO looks ahead to an even busier fall https://t.co/T7RltAGp0k

— Bakkt (@Bakkt) August 20, 2018

It’s often the adoption part that is challenging when a new product is trying to break into the mainstream but once it does, it’s usually a new cycle of value creation that benefit the first investors. Bakkt consists of several traditional market leaders as Microsoft, Alan Howard, Galaxy Digital and several blockchain centric venture Capital firms and as they plan to launch on November this year, the group is receiving overwhelming support from the crypto community with some comparing their effort to those of early drivers of internet adoption as ICANN.

1. Today I am going to make a tweet storm explaining the history and state of Ethereum's Casper research, including the FFG vs CBC wars, the hybrid => full switch, the role of randomness, mechanism design issues, and more.

— Vitalik Non-giver of Ether (@VitalikButerin) August 16, 2018

In a bid to quash rumors that has been in the crypto world, Vitalik took to twitter explaining the genesis and objectives of Casper Labs, how the network plans to deal with long range attacks and how Friendly Finality Gadget (FFG) had better inbuilt designs that complies with other blockchains that adds finality guarantees.

Technical Analysis

Weekly Chart

Ethereum Weekly Chart by Trading View

Price wise, bears are in charge and after shedding four percent in the last week, it appears as if Ethereum sellers are syncing well with that break below pattern of week ending Aug 12.

Notice that that bearish engulfing candlestick anchors our current price projection and as per our previous Ethereum (ETH) trade plans, sellers are in charge and despite recent attempts of higher highs, it will be a tall order for buyers to muster enough momentum and print prices above $400.

In any case, last week’s bear candlestick confirms the break out pattern and as long as prices are not trading below last week’s highs at $330, we suggest taking shorts on every high in lower time frames.

Daily Chart

Ethereum Daily Chart by Trading View

Though we had a convincing three bar reversal pattern by close of Aug 17 that bull reversal pattern is yet to be confirmed and in real sense prices are oscillating within Aug 17 bullish engulfing high lows.

Technically, we shall retain a bearish projection a long as prices are trading below $400 and as it stands, today close shall define our short term trade trajectory.

If today’s candlestick close as a bear, then we shall take shorts from tomorrow with stops at $300 and first targets at $200.

However, should bulls drive prices higher then we recommend taking small size longs with stops at $280 and first targets at $400.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Ethereum (ETH) Technical Analysis: Ethereum (ETH) Drops 4% Week Over Week appeared first on NewsBTC.

from CryptoCracken SMFeed https://ift.tt/2OSZ9z0 via IFTTT

0 notes

Link

Bullish and Bearish Engulfing Pattern - Candlestick Lesson 7 TRADING WITH ENGULFING CANDLESTICKS: MAIN TALKING POINTS Engulfing patterns in the forex market provide a useful way for traders to enter the market in anticipation of a possible reversal in the trend. This article explains what the engulfing candle pattern is, the trading environment that gives rise to the pattern, and how to trade engulfing candlesticks in forex. Keep reading for information on: What is an engulfing candlestick and how do they signal a reversal of current trends in the market? There are two engulfing patterns to look out for: bullish engulfing and bearish engulfing patterns. Engulfing candle trading strategies WHAT IS AN ENGULFING CANDLESTICK? Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle ‘engulfing’ the entire body of the candle before it. The engulfing candle can be bullish or bearish depending on where it forms in relation to the existing trend. The image below presents the bullish engulfing candle. TYPES OF FOREX ENGULFING PATTERNS There are two engulfing candle patterns: bullish engulfing pattern and the bearish engulfing candle. 1) Bullish engulfing pattern The bullish engulfing candle provides the strongest signal when appearing at the bottom of a downtrend and indicates a surge in buying pressure. The bullish engulfing pattern often triggers a reversal of an existing trend as more buyers enter the market and drive prices up further. The pattern involves two candles with the second candle completely engulfing the ‘body’ of the previous red candle. Interpretation: Price action must show a clear downtrend when the bullish pattern appears. The large bullish candle shows that buyers are piling into the market aggressively and this provides the initial bias for further upward momentum. Traders will then look for confirmation that the trend is indeed turning around by making use of indicators, key levels of support and resistance and subsequent price action after the engulfing pattern 2) Bearish engulfing pattern The bearish engulfing pattern is simply the opposite of the bullish pattern. It provides the strongest signal when appearing at the top of an uptrend and indicates a surge in selling pressure. The bearish engulfing candle often triggers a reversal of an existing trend as more sellers enter the market and drive prices down further. The pattern involves two candles with the second candle completely engulfing the ‘body’ of the previous green candle. Interpretation: Price action must show a clear uptrend when the bearish pattern appears. The large bearish candle shows that sellers are piling into the market aggressively and this provides the initial bias for further downward momentum. Traders will then look for confirmation that the trend is indeed turning around by making use of indicators, levels of support and resistance, and subsequent price action that occurs after the engulfing pattern. #engulfindpattern #forexcandlestick

0 notes

Text

Complete Guide to Bearish Harami: How to Spot & Trade This Reversal Pattern

The Bearish Harami is a powerful candlestick pattern that signals a potential trend reversal in financial markets. It’s a go-to signal for traders who use technical analysis to identify selling opportunities. But how reliable is it? Can it work in different markets like stocks, forex, and crypto?

In this guide, we’ll break down everything you need to know about the Bearish Harami, its significance in the Indian stock market, backtested accuracy, trading strategies, and real-world examples.

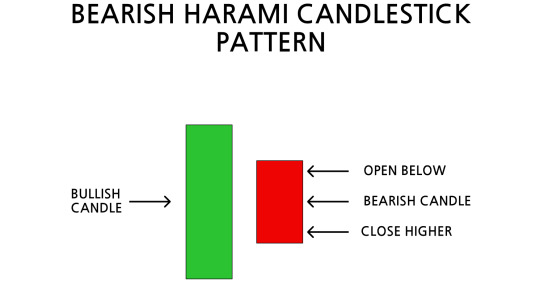

What is a Bearish Harami & Why Do Traders Care?

A Bearish Harami is a two-candle pattern that appears during an uptrend and signals a potential bearish reversal. The pattern consists of:

First Candle: A large bullish (green) candle showing strong buying pressure.

Second Candle: A small bearish (red) candle that is completely within the body of the previous candle.

This pattern suggests that the uptrend is losing strength and sellers are gaining control. Unlike the Bearish Engulfing pattern, where the second candle completely engulfs the first, the Bearish Harami shows a weaker but still significant reversal signal.

Why Traders Use It?

Helps in identifying early trend reversals.

Works across stocks, forex, and cryptocurrency.

Can be combined with technical indicators for confirmation.

Key Insight: The term “Harami” comes from Japanese, meaning “pregnant,” as the smaller candle appears within the larger one—similar to a mother and child.

How to Identify a Bearish Harami on Charts?

Spotting a Bearish Harami is easy if you know what to look for. Follow these steps:

✔ Look for an existing uptrend. This pattern is only valid if the stock is already rising. ✔ Identify the first large bullish candle. This candle represents strong buying momentum. ✔ Check if the next candle is smaller and fits inside the first. The second candle should have a lower high and higher low than the first. ✔ Confirm with volume. A drop in volume on the second candle increases the pattern’s reliability.

Example: Bearish Harami in Nifty 50

In December 2023, Nifty 50 was on a strong bullish run. However, on December 18, a Bearish Harami appeared, leading to a 600-point drop in the following sessions. Traders using Strike Money, a professional charting tool, spotted the pattern early and took short positions.

What Does a Bearish Harami Indicate? Market Psychology Explained

Every candlestick pattern reflects market psychology. Here’s what a Bearish Harami tells us:

Day 1 (Bullish Candle): Buyers are in full control, pushing the price higher.

Day 2 (Small Bearish Candle): The momentum weakens, and sellers step in.

This shift indicates indecision—buyers are no longer confident, and bears are preparing to take over.

In the Indian stock market, this pattern often appears in highly traded stocks like Reliance Industries (RIL), TCS, and HDFC Bank before a trend shift.

Is the Bearish Harami a Reliable Signal? Accuracy & Research

A Bearish Harami alone isn’t always reliable. It needs confirmation indicators to improve its accuracy.

Research & Accuracy Rate

Studies by Thomas Bulkowski, a renowned expert in candlestick patterns, suggest that:

The Bearish Harami has a 55-60% accuracy rate when predicting reversals.

When combined with RSI or MACD, the accuracy can exceed 70%.

How to Improve Reliability?

✔ Use Moving Averages – If the pattern forms near the 50-day or 200-day EMA, it’s stronger. ✔ Check RSI – If RSI is above 70, the reversal is more likely. ✔ Look for Resistance Zones – If the pattern appears near a major resistance, it adds conviction.

Example: Bearish Harami in HDFC Bank In September 2023, HDFC Bank formed a Bearish Harami near the ₹1700 resistance level. The RSI was above 75, confirming overbought conditions. The stock dropped 5% in the next 10 days.

How to Trade the Bearish Harami: A Step-by-Step Strategy

1. Identify the Pattern

Look for a Bearish Harami forming at the top of an uptrend.

2. Confirm with Indicators

Check if:

RSI is over 70 (overbought condition).

MACD shows a bearish crossover.

Volume is decreasing on the second candle.

3. Entry Strategy

Place a sell order below the second candle’s low.

If the price breaks below this level, enter a short trade.

4. Stop Loss Placement

Keep a stop loss above the high of the first candle.

If the price moves above this level, the pattern is invalid.

5. Take Profit Target

Use previous support levels or Fibonacci retracements to set targets.

A 1:2 risk-reward ratio is ideal.

Common Mistakes Traders Make with Bearish Harami

🔴 Trading without Confirmation – Don’t rely only on the pattern. Always check indicators. 🔴 Ignoring Market Conditions – If the overall trend is strong, the pattern may fail. 🔴 Placing Stop Loss Too Close – Market fluctuations can trigger stops before the trend changes. 🔴 Forgetting Volume Analysis – A strong Bearish Harami should show declining volume on the second candle.

Example: In March 2024, traders shorted Infosys (INFY) after a Bearish Harami, but failed to check the RSI, which was still below 60. The stock continued upward, trapping many short positions.

Bearish Harami vs. Other Reversal Patterns: What’s the Difference?

🔹 Bearish Engulfing – Stronger than Bearish Harami as the second candle engulfs the first. 🔹 Dark Cloud Cover – Similar but the second candle closes below 50% of the first candle’s body. 🔹 Evening Star – A three-candle pattern that confirms stronger reversals.

If you want higher confirmation, a Bearish Engulfing or Evening Star provides better signals than a Bearish Harami.

Real-Life Examples of Bearish Harami in the Indian Stock Market

✔ Reliance Industries (RIL): In June 2023, a Bearish Harami appeared at ₹2600, followed by a 5% drop in two weeks. ✔ Tata Motors: Formed a Bearish Harami in October 2023, dropping 6% in the next 10 days. ✔ Nifty 50: Showed a Bearish Harami near 20,200 in February 2024, leading to a 600-point fall.

These examples prove that Bearish Harami works best near key resistance zones with confirmation indicators.

Final Thoughts: Should You Use Bearish Harami in Your Trading Strategy?

The Bearish Harami is a useful tool, but it’s not foolproof. To trade it successfully:

✔ Combine with indicators like RSI, MACD, and Moving Averages. ✔ Use Strike Money for advanced charting & pattern detection. ✔ Practice on a demo account before trading live.

By understanding where and when to use this pattern, traders can increase their success rate and avoid false signals.

Would you like a detailed trading plan based on this pattern? Drop a comment below! 🚀

0 notes

Text

Gold Prices May Resume Selloff After Digesting Largest Drop in 7 Years

GOLD & CRUDE OIL TALKING POINTS:

Gold prices pause to digest after biggest one-day drop in over 7 years

Crude oil prices rise with stocks but remain capped by chart resistance

Souring risk appetite might apply pressure to commodity prices may

Gold prices managed to find near-term support after Tuesday’s dramatic selloff. That came against the backdrop of improving risk appetite, which weighed on haven demand for the US Dollar and drove it lower. That bolstered the appeal of the yellow metal as an anti-fiat alternative.

Sentiment-geared crude oil prices rose amid the broadly risk-on backdrop. The WTI benchmark tellingly tracked alongside the S&P 500 stock index, a bellwether for the prevailing market mood. EIA data showing US inventories shed a larger-than-expected 4.5 million barrels last week may have helped as well.

Looking ahead, optimism may be fading. Shares fell in Asia-Pacific trade and US stock index futures are trading conspicuously flat, warning that bullish conviction may have faltered. Continued deadlock in US fiscal stimulus negotiations may in part explain investors’ darkening mood.

Gold prices may struggle for direction if this translates into renewed risk-off liquidation. A defensive mood might weigh on yields, bolstering bullion’s appeal store-of-value appeal. It may likewise push the Greenback upward however, producing countervailing downward pressure. Crude oil may fall as stocks retreat.

GOLD TECHNICAL ANALYSIS

Gold prices have paused to consolidate losses having plunged after forming a Bearish Engulfing candlestick pattern, as expected. The drop marked the largest one-day drawdown in over 7 years, so perhaps it is not surprising that a period of digestion has followed.

Tellingly, support-turned-resistance marked by the 38.2%Fibonacci retracementat 1920.71 held up to a retest, with prices failing to close back above the barrier. This may speak to bearish conviction, setting the stage for renewed weakness ahead.

A daily close below the 50% level at 1873.01 looks likely to expose the 1818.14-25.31 zone (July 8 high, 61.8% Fib). Alternatively, reclaiming a foothold above 1920.71 may set the stage for a retest of the 23.6% retracement at 1979.73.

Gold price chart created using TradingView

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned to resistance in the 42.40-43.88 area. A daily close above this barrier looks likely to pave the way for a challenge of the $50/bbl figure. Alternatively, a reversal below initial support at 38.74 might make an opening for a test of the 34.38-78 zone.

Crude oil price chart created using TradingView

COMMODITY TRADING RESOURCES

See our free guide on the drivers of crude oil price trends

What is your trading personality? Take our quiz to find out

Join a free live webinar and have your questions answered

— Written by Ilya Spivak, Head APAC Strategist for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

The post Gold Prices May Resume Selloff After Digesting Largest Drop in 7 Years appeared first on Forex Trader Post.

from WordPress https://ift.tt/30SbvA8 via IFTTT

0 notes

Text

Why Forex Price Action Trading Works

When we start out as a Forex trader, we usually dive into the world of trading with three or four technical indicators. We end up drawing enough trend lines, support, and resistance levels on a chart and clutter it enough to build a brand-new board game from scratch. However, as we invest more time to understand the market structure and learn why prices actually move in the market, we start to realize that even the most advanced technical indicators are just representing all the price action information we can already see on a naked chart. With experience, we realize that when it comes to Forex trading, less is more.

As we start to toy with pure price action trading, be it various candlestick patterns or single bar reversal patterns like a pin or bullish or bearish engulfing bars, we start to comprehend that trading price action can be more profitable than using a combination of lagging indicators.

With this knowledge, our overall trading performance reaches a new height. But we always wonder why trading with price action works when almost every other superficial and hyped trading systems fail to deliver the results they promise.

Before we discuss why price action works in trading Forex or any other market, let’s take a look at what we actually mean by price action.

What Forex Price Action Means

Anytime you see a two-dimensional chart that plots price data going up and down on the X-axis and time running from left to the right, on the Y-axis, it is indeed showing price action. The definition of price action is simple enough that even a five-year-old can easily describe it. So, all price charts, be in the Western-style Bar chart, Japanese Candlestick chart, or the age-old line chart, all are showing price action.

Figure 1: Different Styles of Price Action Charts Shows Price and Time

All price action charts show historical price data plotted on a time frame, where each unit – may it be a bar or a pivot point on a chart – represents the chart’s time frame. So, the price action on a one-minute chart will show how the price moved during a minute of time. Similarly, a monthly price action chart will show how price behaved over the course of a month.

The Best Forex Price Action Chart Is the One that Works for You

Many veteran traders argue bar and candlestick charts are better suited for price action trading. They advocate that these two types of graphical representation of the price data incorporate the opening price, high and low of the time frame and the closing price all within a single point of reference. For the sake of simplicity, we will stick to Candlestick charts to provide examples.

Nonetheless, if you are using a line chart of closing prices, you can also enter the market of a breakout trade when the line closes above certain support and resistance. Always keep in mind that there is more than one way to skin a cat.

At the end of the day, if you are comfortable using a particular style of chart, it will be as good as any other chart you use. Stick to what helps you make better trading decisions instead of worrying about what is the best type of price action. There is no best or worst, use the one that you feel comfortable using.

Why Forex Price Action Works?

As price action is simply the visual representation of historical price data, you might be wondering why then we end up using past data to predict future price movements. After all, there is no scientific research ever proved that past price movement can predict future price movement, right?

In fact, this question was one of the key points that two famous Nobel laureates, Robert Shiller and Eugene Fama, debated about and still could not reach a conclusion.

The hypothesis behind why price action works fall into the realm of behavioral finance and prompted Robert Shiller to win the “The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” in 2013.

According to behavioral finance theories, markets and prices are driven by human emotions. Every bit of new information is interpreted by individual traders and they assign a subjective value of the new information that affects the price. That’s why both buyers and sellers agree to buy and sell at the same price, yet both groups end up thinking that they are not getting the short end of the stick.

Just think for a second, when you are buying a currency pair, you are hoping that the price will go up. At the same time, the person selling the currency pair at the same time to you is thinking the exact opposite – it will go down. The assignment of subjective value and different expectations lead to this disparity. This way, the market creates an apparent win-win situation for both parties.

Figure 2: A Point-and-Figure Chart Plots Price Movements Without Considering the Passage of Time

Unlike price action charts that plot price and time in two dimensions, a point-and-figure chart, such as the one in figure 2, does not take time into consideration. So, it is much easier to see in figure 2 that how traders with opposite directional perception conducted transactions that turned into the price.

The reality is that the price of any asset in the market does not reflect fundamental valuation. All it reflects is the collective subjective valuation driven by greed and fear among other human emotions. Therefore, the price of an asset or currency pair is often subjected to extrapolation, herd behavior, and anchoring.

The Driving Force Behind Price Action Trends in the Market

One of the key theories behind why price action works are the concept of extrapolation. In the nutshell, extrapolation suggests that Forex traders estimate the future value of a currency pair based on how it behaved in the past, with much higher weighting in the recent past than the distant past.

Figure 3: Extrapolation Drives Trends in the Marketplace

Hence, when traders see a bullish price action, it is interpreted as if the bullish trend will continue in the future, while there is absolutely no scientific way of predicting if the price will go up or down during the next minute or next month.

Nonetheless, extrapolation happens all the time in the market because of herd behavior. If the majority of the traders start buying a currency pair based on extrapolation or any other reason, the rest of the market start to follow them and start bidding the price higher than any fundamental valuation would justify.

Support and Resistance Works Because of Anchoring

While extrapolation and herd behavior can explain much of why sustained trends form in the market, the phenomena regarding support and resistance or any other pivot zone are explained by anchoring.

Anchoring refers to putting too much weight on the irrelevant information on the trading decision. Such as irrelevant information could be past transaction price of a currency pair. When a trader or a group of traders enter the market at a certain price point, they tend to estimate the intrinsic value of the currency pair based on their original entry price instead of evaluating the fundamental intrinsic value.

Figure 4: Original Long Entry with EURUSD at 1.1500 Based on Bullish Pin Bar Acts as Anchor

For example, if you have bought the EURUSD at 1.1500, but the price drops to 1.1300, you might hold on to your position, thinking your original valuation is still valid and the market will soon return to your perceived equilibrium. Based on such fallacy, you might double down or increase your exposure to the market when the EURUSD indeed rebounds and comes back up to 1.1500 level.

Figure 5: Historical Reversal Point in a Price Chart Caused Anchoring Bias in the Market

Furthermore, anchoring bias in price action can be seen around major historical support and resistance levels. If a currency pair found resistance at a certain price point last month, when it returns to such historical level, a lot of traders start to place pending orders around this point zone in hope that the market might repeat the historical movement. If the majority of the orders are placed in a certain direction, to buy or sell, it triggers those orders and we see a reversal of a trend or acceleration of the prevailing trend.

How to Interpret Price Action Charts

Forex traders could be categorized into two distinct camps. The first camp of traders tries to find the intrinsic value of a currency pair by analyzing various fundamental aspects like Forex news and geopolitics. Then, if they see a disparity, they trade accordingly. For example, based on your analysis, if you think that the price of USDJPY should be 118.00, but it is trading at 117.50. Then, you would buy the pair with a profit target of 118.00.

However, traders belonging to the price action camp justify their directional bias based on a completely opposite set of logic. The foundation of price action trading is extrapolation. Hence, the only way to interpret price action would be looking for any bullish and bearish bias in the market and projecting where the price might go from here based on historical price data.

Figure 6: Various Price Action Patterns

Price action traders have come up with a million different ways to interpret the historical data to predict future directional movement. Some of these include Candlestick patterns like the Hammer, Inverted Hammer, Morning star, Three white soldiers, Doji, and Spinning top. Others strictly follow price patterns that take much longer to form. Such price action patterns include various Harmonic patterns like Gartley, Butterfly, Bat, Crab, and Shark patterns. Last but not least, a large number of price action traders believe sticking to pin bars and bullish or bearish engulfing bars are the way to go.

As we mentioned earlier, there are many ways to skin a cat and you can follow any particular way of interpreting price action charts. While the accuracy level and win rate would vary depending on how you interpret price action, the reasoning behind your trades would be always the same – past price data would predict future price movements.

The bottom Line

While trading price action could be highly profitable, there are some inherent limitations of using this method in Forex trading. As price action shows price data plotted over time, the interpretation of price action could be different based on which time frame you are trading.

The trend could be bullish on the daily time frame, but when you go down to 15-minute chart to find a day trading opportunity, you could find that price action is indicating a short-term bearish trend. There is no way of knowing if the bearish 15-minute trend will continue for the next few days and turn the bullish trend on the daily time frame into a bearish one or it will rebound after a few hours and resume the long-term bullish trend.

Hence, trading with price action would be always speculative and there will be some inherent risk to trading Forex with it. That’s why experienced traders know that risk management is the key to long-term success in the business of Forex trading. However, if you can find a winning edge by correctly interpreting price action and formulate a suitable money management strategy, trading Forex can yield some above-average return on your investment capital.

The post Why Forex Price Action Trading Works appeared first on Tradeciety Online Trading.

Why Forex Price Action Trading Works published first on your-t1-blog-url

0 notes