#CRYPTO LEGAL SERVICES

Text

Unlocking Success: Get Your Cryptocurrency License in Dubai Today

Obtaining a cryptocurrency license in Dubai typically involves adherence to specific regulations and compliance requirements set by the relevant regulatory bodies, such as VARA (Virtual Assets Regulatory Authority) or other governmental entities. This license covers various crypto-related activities, including cryptocurrency exchanges, wallet services, and token offerings.

#CRYPTOCURRENCY LICENSE DUBAI#CRYPTOCURRENCY LICENSE#CRYPTO INVESTMENT CONSULTATION#CRYPTO CONSULTING SERVICES#CRYPTO LEGAL SERVICES#FOREX LICENSE IN DUBAI#FOREX LICENSE UAE#FOREX BUSINESS LICENSE#FOREX BROKER LICENSE#CRYPTO LICENSE DUBAI#CRYPTO LICENSE UAE#VARA LICENSE DUBAI#VIRTUAL ASSETS LAW#VARA LAWYER

1 note

·

View note

Text

CFS System (Cryptographic File System)

In the rapidly evolving landscape of data security, the need for robust encryption and secure file management has become paramount. One solution that addresses these concerns is the Cryptographic File System (CFS). CFS is a sophisticated system that employs cryptographic techniques to ensure the confidentiality and integrity of sensitive information stored in files. The Cryptographic File System (CFS) stands as a testament to the ever-growing importance of data security. By seamlessly integrating encryption into file management, CFS offers a comprehensive solution for organizations seeking to fortify their defenses against unauthorized access and data breaches.

0 notes

Text

Why “Go Nuts, Show Nuts” Doesn’t Work in 2022

For those who don’t know or remember, Tumblr used to have a policy around porn that was literally “Go nuts, show nuts. Whatever.” That was memorable and hilarious, and for many people, Tumblr both hosted and helped with the discovery of a unique type of adult content.

In 2018, when Tumblr was owned by Verizon, they swung in the other direction and instituted an adult content ban that took out not only porn but also a ton of art and artists – including a ban on what must have been fun for a lawyer to write, female presenting nipples. This policy is currently still in place, though the Tumblr and Automattic teams are working to make it more open and common-sense, and the community labels launch is a first step toward that.

That said, no modern internet service in 2022 can have the rules that Tumblr did in 2007. I am personally extremely libertarian in terms of what consenting adults should be able to share, and I agree with “go nuts, show nuts” in principle, but the casually porn-friendly era of the early internet is currently impossible. Here’s why:

Credit card companies are anti-porn. You’ve probably heard how Pornhub can’t accept credit cards anymore. Or seen the new rules from Mastercard. Whatever crypto-utopia might come in the coming decades, today if you are blocked from banks, credit card processing, and financial services, you’re blocked from the modern economy. The vast majority of Automattic’s revenue comes from people buying our services and auto-renewing on credit cards, including the ads-free browsing upgrade that Tumblr recently launched. If we lost the ability to process credit cards, it wouldn’t just threaten Tumblr, but also the 2,000+ people in 97 countries that work at Automattic across all our products.

App stores, particularly Apple’s, are anti-porn. Tumblr started in 2007, the same year the iPhone was released. Originally, the iPhone didn’t have an App Store, and the speed of connectivity and quality of the screen meant that people didn’t use their smartphone very much and mostly interacted with Tumblr on the web, using desktop and laptop computers (really). Today 40% of our signups and 85% of our page views come from people on mobile apps, not on the web. Apple has its own rules for what’s allowed in their App Store, and the interpretation of those rules can vary depending on who is reviewing your app on any given day. Previous decisions on what’s allowed can be reversed any time you submit an app update, which we do several times a month. If Apple permanently banned Tumblr from the App Store, we’d probably have to shut the service down. If you want apps to allow more adult content, please lobby Apple. No one in the App Store has any effective power, even multi-hundred-billion companies like Facebook/Meta can be devastated when Apple changes its policies. Aside: Why do Twitter and Reddit get away with tons of super hardcore content? Ask Apple, because I don’t know. My guess is that Twitter and Reddit are too big for Apple to block so they decided to make an example out of Tumblr, which has “only” 102 million monthly visitors. Maybe Twitter gets blocked by Apple sometimes too but can’t talk about it because they’re a public company and it would scare investors.

There are lots of new rules around verifying consent and age in adult content. The rise of smartphones also means that everyone has a camera that can capture pictures and video at any time. Non-consensual sharing has grown exponentially and has been a huge problem on dedicated porn sites like Pornhub – and governments have rightly been expanding laws and regulations to make sure everyone being shown in online adult content is of legal age and has consented to the material being shared. Tumblr has no way to go back and identify the featured persons or the legality of every piece of adult content that was shared on the platform and taken down in 2018, nor does it have the resources or expertise to do that for new uploads.

Porn requires different service providers up and down the stack. In addition to a company primarily serving adult content not having access to normal financial services and being blocked by app stores, they also need specialized service providers – for example, for their bandwidth and network connections. Most traditional investors won’t fund primarily adult businesses, and may not even be allowed to by their LP agreements. (When Starbucks started selling alcohol at select stores, some investors were forced to sell their stock.)

If you wanted to start an adult social network in 2022, you’d need to be web-only on iOS and side load on Android, take payment in crypto, have a way to convert crypto to fiat for business operations without being blocked, do a ton of work in age and identity verification and compliance so you don’t go to jail, protect all of that identity information so you don’t dox your users, and make a ton of money. I estimate you’d need at least $7 million a year for every 1 million daily active users to support server storage and bandwidth (the GIFs and videos shared on Tumblr use a ton of both) in addition to hosting, moderation, compliance, and developer costs.

I do hope that a dedicated service or company is started that will replace what people used to get from porn on Tumblr. It may already exist and I don’t know about it. They’ll have an uphill battle under current regimes, and if you think that’s a bad thing please try to change the regimes. Don’t attack companies following legal and business realities as they exist.

22K notes

·

View notes

Text

🪼slime-kisser Follow

all these posts like “don’t shop at boatem they support cannibalism” “the evil empire is a crypto scam” “don’t buy at octagon they’re trying to destroy the fabric of the universe” where the FUCK else am I supposed to shop????

🐠xbcrafted Follow

may i recommend horse head farms? we sell a variety items for agreeable prices and have alternate payment plans which mean you don’t have to spend a single diamond! you can find us via the nether hub <3

🪲yeswingsforlife Follow

do NOT shop at Horse Head Farms! Their items are incredibly overpriced (you can find grass, logs, etc for better prices) and this “alternative payment scheme” is actually signing an IOU. If you don’t know what that is, IOU stands for “I Owe You” and is a legal document that, when possessed, someone can force you to do anything. Literally anything. LegalKnight does a great video going into detail about it. According to this article, Horse Head Farms have just invested in building an auction house, possibly to sell off the IOUs they’ve acquired, so scummy CEOs could force you to work at their companies. Not to mention, their owners are incredibly sketchy, xBCrafted regularly tweets conspiracy theories and Hypnotizd invests in crypto

😵💫hypnotizd Follow

youre wrong actually, i have had nothing but brilliant service at Horse Head Farms. IOUs arent sketchy theyre normal pieces of paper. #shoptoday

🪲yeswingsforlife Follow

… you’re literally one of the owners

🐸cottagecoreliving Follow

to answer the original question, here’s a list of more reputable businesses that you can support instead!

Tays Trees

HIVE-DR8

Joe Hills’ Flower Stalls

Big Eyes

🥚dragon-tegg Follow

hey not to derail this post or anything but is anyone going to mention how OP literally fetishises slime hybrids???

( 7,067 notes )

🌃elytramoments Follow

hate when i crashland in the lava biome

🐶renrobert Follow

you mean the nether

🌃elytramoments Follow

i do not

#i think it’s a national park or something #idk its like this for miles #its near boatem

( 15.4k notes )

👁️big-eyes Follow

This weekend at Big Eyes we are having a #SALE of up to 99% OFF! EVERY item has a discount! Don’t waste your diamonds, shop at Big Eyes!

😍sexy-papa-k Follow

sweetfaces! we are going into debt! please buy ❤️❤️💕❤️🍆😭😭😭❤️

-papa k

👁️big-eyes Follow

kerlais why woudl you reblog on that account

😍sexy-papa-k Follow

we need all the reach we can get bubbles! ❤️😝❤️❤️🍆💕

-papa k

( 14 notes )

#always love stuff where it shows what social media is like in a fictional universe#anyways i headcanon season 8 had normal people going around and shopping in those shops. its so funny to think about#i’ve seen posts like these before and thought i’d have a go at them!#tbh i don’t think c!hypno would have a tumblr but for the purposes of this. its funny#fake post#unreality#<- i think i tag that for this?#hermitcraft#hermitblr#hermitcraft season 8#hermitcraft s8#hhf

3K notes

·

View notes

Text

tuesdaypost year in review

this year brought to you by viewers like you. thank you! i still do not know how to thank everyone for their incredible generosity during the Late July/Early August Moving Catastrophe Badtimes and im still feelin some kinda way about it. thank you.

took eight weeks completely off, more than any other year so far

overnight traveled for work for the first time

moved cross country with Mack to face dangers untold and hardships unnumbered

bought an actual for-real couch and not a futon

got Phil

(unrelated to Phil) i got spayed after almost ten years of begging and pleading various medical professionals, (also unrelated) got covid and RSV back to back

listening

fallow weeks: 8. i almost always have a tuesdaysong bc i am almost always listening to something. all of the tuesdaysongs are here:

particular favorites were Peel Me A Grape (Anita O’Day), top spotify song of the year Yeah Yeah Yeah (Blood Orchid), Yeah Yeah Yeah’s Wolf remixed by Sextile, Father Finlee (Spence Hood), A Minha Menina (Os Mutantes).

the very last tuesdaysong of the year is Sugar Rum Cherry by Duke Ellington, one of the few christmas songs i tolerate.

special shoutout to the austin underscore walker universe of podcasts, bc i mainlined A More Civilized Age (clone wars/star wars rewatch) while packing, and devoured P/alisade (the newest scifi season of F/riends at the Table) this month.

-

reading

fallow weeks: 11. pleased that i am killing the invisible rules in my head and including more articles instead of feeling guilty about Not Reading A Real Book!!! every week when i sit down to write the tuesdaypost. read a fuckton earlier this year bc i was procrastinating moving prep, have not read much since i moved.

article sources:

inoreader (the best free RSS feed/app imo)

The Markup (gold standard usage of data to show how various technologies are being used to harm the public good: you may have heard of the recent American bills to equalize internet service and fix organ donation grift. that was them)

Web 3 Is Going Just Great (crypto disasters)

404 Media (technology reporting, internet culture, also break a lot of data/legal/privacy scandals)

Remap (formerly Vice's video games division Waypoint, more active on podcasts and twitch but do have great personal essays about gaming longreads)

Retraction Watch (an important academic service but platformed a particularly virulent transphobe and let the comments devolve into a free for all. yes im still mad about this)

Krebs on Security (~once a month extremely long and thoughtful infosec writeups)

Data Colada (cover academic data whoopsies, currently being sued for their journalism)

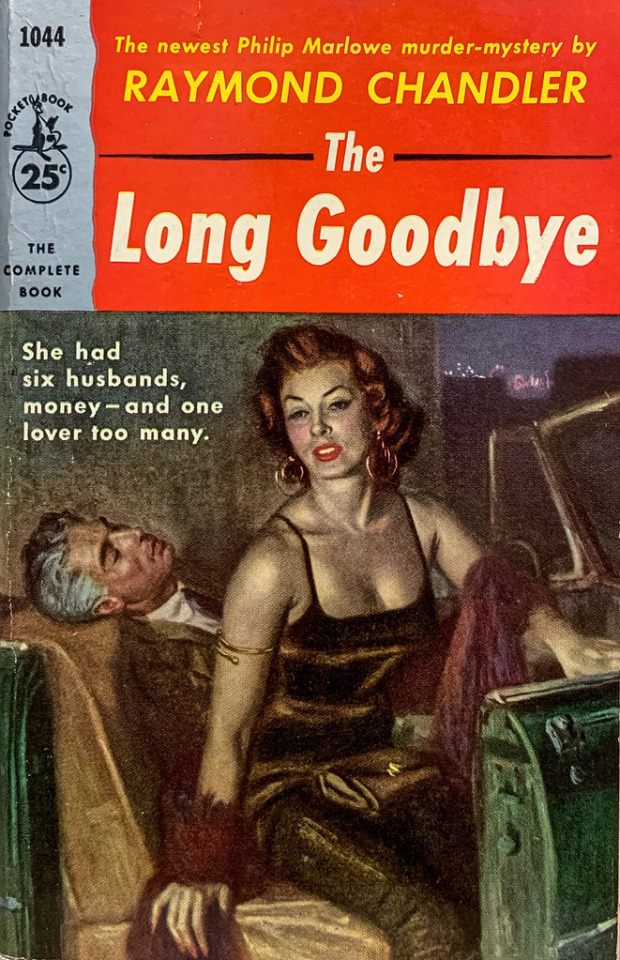

the two authors i spent the most time with this year were Alexis Hall (romance novels and novellas) and Raymond Chandler's noir detective novels. i read 90% of Raymond Chandler's work in march and went insane about yet another sad bisexual man. Philip Marlowe the cat is named after his pet detective, the human Philip Marlowe.

march was kind of a banger for this category bc in one of what i consider the best tuesdayposts this year, i tried to break down why i fucking hated Frank Miller's Sin City comics so much.

other comics, but ones i loved: Spy X Family, Berserk, weird noir DC miniseries The Human Target.

-

watching

fallow weeks: 10

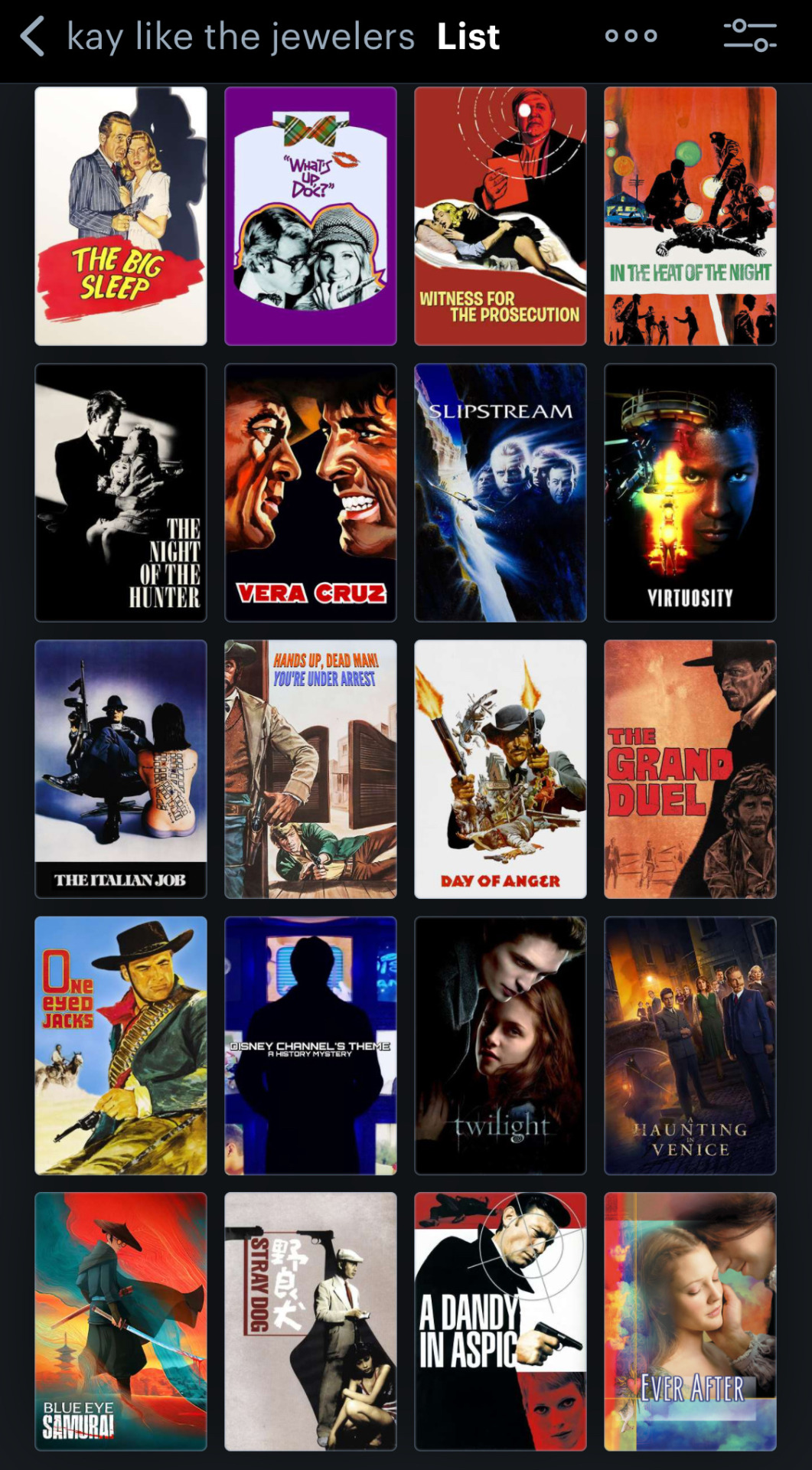

notable stuff i watched for the first time (according to letterboxd) that will stick in my head for a bit. some (The Night of the Hunter) i am so glad i watched once but do not feel the need to revist. some (Slipstream) fascinate me with how good they could have been. some (Twilight. all of them) were fun bc of the people i watched them with. the two i went particularly deranged over are The Big Sleep and Day of Anger. still feel very normal about them.

very heavy on crime and courtroom films this year!

television: very excited for s2 of Blue Eye Samurai, Interview With The Vampire, Spy X Family.

youtube

i should loop back and finish Black Lagoon, Adventure Time (completely forgot i rewatched most of that this spring), and The Big O. that last one is throwing me a little bc (since i last checked) there is no freely available version with subtitles (i cannot find subtitles Period) and i'll be damned if i have to import a dvd. i can find the dub with subtitles but! i want to hear spike spiegel as mecha-batman :(

sort of lukewarm eh-i'll-get-around-to-it about s/tar wars shows. i have not watched a/hsoka At All or wrapped up the animated Resistance show. i'll pay attention when ando/r is airing again.

-

playing

fallow weeks: 10. way fewer than i would have guessed!

the trouble with this category is that it is exceptionally hard to find new good games (either ones i already own or ones that are free). it is almost completely prohibitively exhausting to trawl through the free category on steam. there's simply a lot of cruft out there. a very good thing (but also incredibly timeconsuming thing) i started this year was throwing games into various folders so the eight bajillion libraries i have are less overwhelming. i can safely ignore 80% of my epic games library, for example. the itch.io library is a whole separate weekend project i think.

got back into genshin for good or for ill, which took up most of the back half of the year.

youtube

go play ABZU. i am no longer asking.

i would like to go back and finish the RPG Gamedec, un-softblock myself in the RPG Weird West, and finish the visual novel Dead Man's Rest. i think i stalled out in Call of Juarez: Gunslinger bc there was a mexican standoff that my reflexes are simply not fast enough for/too much to pay attention to. i am excited to pick up that spooky fishing simulator DREDGE when i have fun money again.

completely forgot i spent most of jan/feb/march being annoyed at fallou/t 4 but having some fun in Far Harbor, also forgot i spent an entire month playing through Wolfenstein: The New Order but i am not compelled to play through it again. it was fun! but like many games after one playthrough my time with it is done!

-

making

fallow weeks: 17 (unsurprising, pretty low energy year as a whole as i recovered from covid rounds 1 and 2 and the frankly insane stress of moving).

wrote exactly one fic: some matters at the heart of cowboy western snap shirts: why they are so and some of the implications of their being so, i would like to write more next year but i don't really have the brainpower. i hope this changes soon.

the baby blanket i started last year is still not done but the baby is still under a year so i have a very narrow window of time.

dyed some couch covers im still very pleased with

wrote an extremely long but very well received gallery wall guide

recipes: 12. sort of shocked by this? i am becoming an incrementally better cook and slowly finding recipes i both like and can successfully execute. found the fortitude to caramelize onions, for example. quick pickled red onions, for another thing. big year for protein or greens on top of beans and rice. faves included: cuban-style pork shoulder, hellofresh peruvian chicken, red lentil soup, white bean/kale/rice bowls

i would like to be less terrified about cooking fish. i would like to eat more fish.

and of course, the biggest project of all, acquired Phil. here is my very favorite photo ive ever taken of a cat

39 notes

·

View notes

Text

US senators Elizabeth Warren and Bill Cassidy have called for the Department of Justice and Department of Homeland Security to redouble efforts to stop the use of cryptocurrency to pay for child sexual abuse material (CSAM) online, a problem they claim has worsened.

In a letter sent on Thursday, addressed to Attorney General Merrick Garland and Secretary of Homeland Security Alejandro Mayorkas, the senators claim that the “pseudonymity” afforded by crypto transactions is helping those that trade in CSAM to evade detection by law enforcement.

Citing data from the US Treasury’s Financial Crime Enforcement Network as well as research from Chainalysis, a company that specializes in tracing crypto transactions, and the Internet Watch Foundation, a CSAM-focused charity, the letter asserts that the “use of cryptocurrency in the illicit trade of CSAM appears to be increasing.”

Between 2020 and 2022, financial institutions identified 1,800 bitcoin wallets suspected of engaging in transactions linked to child sexual exploitation or human trafficking, the letter states. Although the scale of the crypto-based market for CSAM decreased in 2023, Chainalysis found, an increase in sophistication among sellers allowed them to evade detection for far longer than in previous years.

The people participating in the trade of CSAM online use a variety of methods to conceal their activity, the senators claim, including using crypto mixing services and ATMs to conceal the origin of funds used in CSAM transactions and to launder the proceeds.

“These are deeply troubling findings revealing the extent to which cryptocurrency is the payment of choice for perpetrators of child sexual abuse and exploitation,” wrote the senators.

To jump-start a response, Warren and Cassidy have asked the DOJ and DHS to publish details of their own research into the scope of crypto’s role in the CSAM problem, as well as information about the challenges specific to prosecuting this category of crime. The senators have given the agencies until May 10 to respond to their questions.

For her frequent and voluble criticism of cryptocurrency and its role in illicit activity, Warren has become something of a villain in crypto circles. Lately, the senator has come under criticism for a piece of anti-money-laundering legislation she proposed in July 2023, which the Chamber of Digital Commerce, a crypto advocacy group, has claimed will “erase hundreds of billions of dollars in value for US startups and decimate the savings of countless Americans invested in this asset class legally.”

Warren has reiterated her stance that the crypto industry must follow the same stringent rules as other financial organizations in the US in order to prevent misuse by criminal actors, including vendors of CSAM.

9 notes

·

View notes

Text

When avoiding scams and being hacked on discord specifically:

Don't click suspicious links. If you are not expecting it, do not open it.

Use 2FA when possible. It is the strongest way to protect yourself, but you still need to be vigilant and make sure you don't give away your accounts in other ways [ie token grabbers, QR codes, or other instant-login services].

Don't share passwords across accounts, especially with sensitive ones such as banking or legal documentation. The fewer shared passwords you have, the less likely a large data breach is going to affect a large number of your accounts and information.

Those "exposed" servers are phishing scams via verification bots. Someone sending you a DM saying that you may have sent someone pornography or nudes, and to join a server to see what it's about, is trying to lead you on to scan a login QR code, which bypasses 2FA and password usage.

If someone "accidentally reported you" it's a scam, they are playing off of a sense of fear and will ask you for your passwords by sending you to fake support accounts. You do not give passwords to official support, they do not need your password in order to access your account on their platform.

Continuing the above, websites will never make you prove your innocence in such a situation.

Anything to do with "crypto market" is a scam.

Do not download any files from people asking you to playtest a game, those "games" are token grabbers. Token grabbers are capable of bypassing 2FA, and can allow attackers to enter your account without a password.

Remove permissions from all bots that can "join servers for you". These bots can rejoin servers that you leave, or send you to different servers without your consent to artificially inflate user numbers.

Be vigilant when using the internet and especially social media or discord. Hackers and scammers rely almost 100% on you blundering into their schemes via panic, anger, or lack of knowledge. These same types of scams have been circulating the internet for over a decade in some cases, and victims fall for it when they aren't aware of the scam in the first place.

More general internet advice per @oldmanyaoi-jpeg:

If a message or group is trying to quickly induce a strong emotion, such as fear or anger, be aware that they may be trying to trick you into making an emotional decision (ex. "exposed" groups and accidental reporting scams)

additionally, any message with a deadline should be regarded with heavy suspicion, as they are likely trying to trick you into making a decision driven by panic (paypal and amazon payment scams)

Never click on a link that you find even remotely suspect, or call a number provided in a suspect message. Always get contact information directly from that entity (ex. go to paypal or amazon directly to check for suspicious activity or contact CS instead of clicking a provided "dispute" link)

If you aren't expecting a link, email, text, attachment, etc. it should always be judged suspiciously. (ex. "we have your package" scams, playtester scams, "you have a virus" scams)

If you are being asked to reveal any personal information, stop and examine everything critically, as you are likely getting scammed. Specifically and especially passwords- I work in IT. If people who have business with your account want in your account, we're getting into your account, and we don't need your password for it.

Be critical of the permissions asked for by an app you're linking to an account. "Joining servers" is one to be suspicious of, but there's plenty more (making posts for you, having access to documents in gdrive, seeing any personal information, etc) that you should always think about before giving to an app.

Delete accounts and remove access for apps that you aren't using. Reducing your digital footprint will reduce your vulnerability- no need to worry about an email regarding an old Venmo account if you've deleted it, for example. Compromised apps can't affect your account if you take away their permissions either.

2FA is the easiest way to protect yourself from any scam or malicious action, as even if you willingly give up your password, nobody can get in without your verification. So my final advice of the day:

Set up 2FA, and never give any verification code you receive to anyone who may be asking for it, no matter how much you trust them. The only time you should confirm a login with 2FA is when YOU are logging in.

#mine#remake of my old post to add better info#this is mostly in lieu of a wave of hacks on discord- but it's good to keep all of these things in mind and stay safe

6 notes

·

View notes

Text

How Bitcoin is Probably Gearing Up for a New ATH

Bitcoin has consistently demonstrated its resilience and growth potential since its inception. As we observe its price movements and market dynamics, it becomes evident that Bitcoin might be gearing up for a new all-time high (ATH). Understanding the importance of ATHs in the context of Bitcoin and cryptocurrencies can provide valuable insights into the potential future trajectory of this digital asset.

Historical Performance and Previous ATHs

Bitcoin's journey has been marked by several significant ATHs, each catalyzing a surge in investor interest and mainstream media attention. The 2017 bull run saw Bitcoin reach an ATH of $19,783 on December 17, 2017, driven by a combination of retail investor frenzy and increasing awareness. Similarly, the 2020-2021 bull run pushed Bitcoin to a new ATH of $68,789 on November 10, 2021, fueled by institutional investments and macroeconomic factors.

Current Market Indicators

Several indicators suggest that Bitcoin is poised for another ATH:

Institutional Investments: Companies like MicroStrategy have acquired approximately 230,000 BTC as of 2024, worth billions of dollars.

Adoption Rates: PayPal reported over $5 billion in crypto trading volume in Q1 2024.

Technological Advancements: The Taproot upgrade, activated in November 2021, has enhanced Bitcoin's privacy and smart contract capabilities.

Regulatory Developments: The SEC's approval of spot Bitcoin ETFs in January 2024 has provided a more stable environment for growth.

Factors Contributing to the Potential ATH

Increased Adoption and Mainstream Acceptance: Major banks like JPMorgan and Goldman Sachs now offer Bitcoin-related services to their clients.

Technological Advancements: The Lightning Network's capacity has grown to over 5,000 BTC as of 2024, improving Bitcoin's scalability.

Macroeconomic Factors: With U.S. inflation rates hitting 7% in 2021, Bitcoin is increasingly seen as a hedge against economic instability.

Geopolitical Influences: Countries like El Salvador adopting Bitcoin as legal tender demonstrate its potential as a global, borderless currency.

The Importance of Dollar-Cost Averaging (DCA) into Bitcoin

Dollar-Cost Averaging (DCA) is a strategic investment approach where an individual invests a fixed amount of money into an asset at regular intervals, regardless of its price.

Benefits of DCA:

Mitigates market volatility

Reduces investment risk

Provides a disciplined approach to investing

Example of Successful DCA Strategy: An investor who consistently invested $100 weekly in Bitcoin from January 2019 to December 2023 would have seen a return on investment of over 300%, outperforming many who attempted to time the market.

Practical Advice for Implementing DCA:

Start with a fixed amount that fits your budget (e.g., $50-$500 per month)

Set a regular investment schedule (weekly or monthly)

Use reputable exchanges with automated purchasing options

Remain consistent regardless of market conditions

Expert Opinions and Predictions

Cathie Wood, CEO of Ark Invest: Predicts Bitcoin could reach $1 million per coin by 2030.

Plan B, creator of the Stock-to-Flow model: Forecasts Bitcoin reaching $100,000 by 2025.

Michael Saylor, CEO of MicroStrategy: Believes Bitcoin will replace gold as a store of value, potentially pushing its price to $500,000.

Potential Risks and Challenges

While the prospects for a new ATH are promising, potential risks include:

Market volatility: Bitcoin's price can fluctuate by over 10% in a single day.

Regulatory risks: Potential government crackdowns or unfavorable legislation.

Technological issues: The need for ongoing development to address scalability and security concerns.

Conclusion

Bitcoin's potential for reaching a new ATH is supported by a combination of historical patterns, current market indicators, and strategic investment approaches like DCA. As we move forward, staying informed and considering long-term investment strategies will be crucial for navigating the cryptocurrency landscape.

Key Takeaways:

Bitcoin has a history of reaching new ATHs, with the current record at $68,789.

Institutional adoption, technological advancements, and macroeconomic factors support potential growth.

Dollar-Cost Averaging can be an effective strategy for investing in Bitcoin.

While expert predictions vary, many see significant upside potential for Bitcoin.

Be aware of risks and challenges, including market volatility and regulatory uncertainties.

As you consider your investment strategy, remember that the cryptocurrency market is highly volatile. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#BTC#Crypto#Cryptocurrency#Blockchain#BitcoinATH#CryptoInvesting#CryptoNews#DigitalCurrency#FinancialFreedom#Investing#CryptoCommunity#BitcoinNews#CryptoAdoption#CryptoMarket#BitcoinPrice#CryptoGrowth#CryptoFuture#BTCtoTheMoon#BitcoinRevolution#BitcoinInvestment#CryptoTrends#HODL#BitcoinCharts#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

4 notes

·

View notes

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

3 notes

·

View notes

Text

FTX's very bad november

here are some bullet points of the key things that happened to stupid 'it turns out it was never actually a business' 40 billion dollar cryptocurrency exchange FTX this month. very funny please read more!

FTX is the 'smart, legal, pro-regulation' bitcoin exchange (a bank) beloved by athletes and US Senators alike. They are one of the five largest businesses in the crypto space, and are valued at up to $32,000,000,0000 (32B USD).

1b. FTX mints its own token, 'FT Token / FTT', which has a use-case for their advanced trading services as well as serving as a speculative asset that represents consumer trust.

2. FTX establishes a sister firm, "Alameda Research", which acted as its own market actor and research publisher. Alameda Research also have massive resources on their balance sheet.

3. When the Terra / Luna stablecoin disastrously lost its peg to the dollar earlier this year, crypto lost $60B of valuation. Everything fell, but unlike some stuff, FTT recovered.

3b. during this crisis, Alameda stepped in as a 'lender of last resort'; bailing out the liquidity-crisis-shocked crypto businesses by selling them emergency loans.

4. On November 02 (two weeks ago!) Coindesk published an exposé showing that a lot of Alameda Research's balance sheet was, basically, IOU's from FTX - the lender of last resort was a shell game.

5. at this point (i'm hazy on details!) the three FTX founders - "the Crypto King" "SBF"; Gary; and Nishad - start fighting a lot on twitter about something offline, in particular with their competitors Binance, the #1 company in the crypto space.

6. Binance sells all the FTT in its vaults. Billions of dollars' worth?

7. The market value of an FTT drops from $24 USD to $3. (an 87.5% drop in value)

8. 36 hours later, seeing FTX about to declare bankruptcy, Binance offers to buy FTX in a bailout. Binance lawyers ask to see FTX's most secret internal accounting documents.

8b. FTX provides something, which Binance aren't happy with, and Binance backs out of their offer to buy FTX.

9. a "hacker" steals between $300M-$500M USD worth of various coins and tokens from not only FTX's 'hot wallet' (actual liquid funds) but ALSO from its 'cold wallets' (which an outside hacker has no access to).

9b. in transferring these funds out of FTX and into a wallet for Tether (a stablecoin), the "hacker" doesn't have enough "TRX" to pay the gas to actually move the money. so they panic and uses TRX from their own wallet.

10. That wallet was on the Kraken ecosystem, and TRX is for the Tron Network, and both Tron and Kraken have KYC ('know your customer') ID requirements to use their systems, linking the wallet used to facilitate the theft to a driver's license and banking and contact information etc.

10b. the head of security for Kraken posts on twitter "We know the identity of the user."

11. the Bahamaian police (they spent company money on a big poly mansion on the Bahamas and so this all happens there) detain the three FTX founders

12. FTX goes from being worth $30-40 billion USD to bankrupt, nothing, goose egg, kanye voice: couldn't give a homeless guy change, its principals arrested, detained by island police as foreign billionaires, investigated by the Bahamaian money laundering authorities (lmao), investigated by America for the Tether theft (lmfao)

13. lmfao

47 notes

·

View notes

Text

Leading Crypto Scam Recovery Professionals

As industry leaders, our crypto scam recovery professionals are equipped with the knowledge and tools to tackle even the most complex cases. Our team combines technical expertise with legal proficiency to provide comprehensive recovery services.

2 notes

·

View notes

Text

Navigating the Maze of Crypto Scams: Effective Strategies for Prevention and Recovery

Introduction: The Rising Threat of Cryptocurrency Scams

As cryptocurrencies gain widespread acceptance, the lure of quick profits has not only attracted investors but also cybercriminals, leading to a surge in crypto-related scams. Protecting your digital assets against these threats requires a proactive approach, encompassing awareness, prevention, and recovery strategies.

Understanding Crypto Scams: The Basics

Identifying Common Types of Cryptocurrency Scams

Cryptocurrency scams can take various forms, each designed to part unsuspecting victims from their digital assets. Some prevalent types include:

Investment Scams: These scams promise extraordinary returns through crypto investments and are often structured like traditional Ponzi schemes.

Exchange Scams: Victims are tricked into using fake cryptocurrency exchanges, which may disappear overnight.

Wallet Scams: Scammers create fake wallets to steal user credentials and drain their holdings.

ICO Scams: Initial Coin Offerings (ICO) that are fraudulent, where the crypto token is either non-existent or the ICO itself is based on false promises.

Red Flags and Warning Signs

The key to avoiding cryptocurrency scams is recognizing warning signs, such as:

Promises of guaranteed high returns with little risk.

Anonymous teams or unverifiable developer identities.

Pressure to invest quickly or offers that seem too good to be true.

Techniques for Investigating Crypto Scams

Unraveling crypto scams requires a blend of technical expertise and investigative rigor. Effective techniques include:

Blockchain Analysis: Tools and software are used to analyze transactions and track the flow of stolen funds across the blockchain.

IP Address Tracking: Identifying the IP addresses associated with fraudulent activities can help pinpoint the scammer’s location.

Collaboration with Regulatory Bodies: Working with cryptocurrency exchanges and regulatory authorities can help in freezing fraudulent accounts.

Strategies for Recovering Lost Cryptocurrencies

Losing cryptocurrency to a scam can be devastating, but there are ways to attempt recovery:

Act Quickly: Immediate action can increase the chances of recovering stolen assets.

Crypto Recovery Services: Specialized services can assist in tracing lost or stolen cryptocurrencies and negotiating their return.

Legal Recourse: In some cases, legal intervention might be required to recover large sums.

Preventative Measures to Secure Your Assets

Implementing robust security measures is crucial in safeguarding your cryptocurrencies:

Utilize two-factor authentication (2FA) for all transactions.

Store large amounts of cryptocurrency in cold storage solutions.

Educate yourself continually about new types of scams in the crypto space.

Conclusion: Staying One Step Ahead of Crypto Scammers

As the crypto market continues to evolve, so too do the tactics of scammers. Staying informed, vigilant, and proactive is your best defense against these digital threats. For victims of crypto fraud, recovery may be challenging but not impossible, with the right guidance and support. For comprehensive support in crypto fraud investigation and recovery, visit www.einvestigators.net, your trusted partner in protecting and recovering your digital wealth.

2 notes

·

View notes

Text

Canadian Police Utilize Chainalysis Reactor to Combat Crypto Scams and Aid Victims in Fund Recovery

The Lethbridge Police Service (LPS) in Canada is leveraging technology to combat crypto scams and aid victims in recovering their funds. By using Chainalysis Reactor, law enforcement aims to track crypto transactions and retrieve stolen funds. The software can identify and categorize numerous addresses, both legal and illegal, including those involved in criminal activities. To achieve this, the police will rely on a certified blockchain analysis investigator from the Economic Crimes Unit. The Chainalysis Reactor software enables detailed tracing of crypto transactions, making use of the transparency of public blockchains like Ethereum and Bitcoin, which are often used for these stolen tokens. During investigations, relevant data will be inputted into the program, which will systematically trace the flow of funds from victims'

Read more on Canadian Police Utilize Chainalysis Reactor to Combat Crypto Scams and Aid Victims in Fund Recovery

11 notes

·

View notes

Text

Robinhood Markets Inc. has received a notice from the Securities and Exchange Commission about alleged securities violations at its crypto division.

The company said in a regulatory filing that it received investigative subpoenas from the SEC about issues including cryptocurrency listings, custody of cryptocurrencies, and platform operations.

Robinhood Crypto has cooperated with the investigation, the company said.

Last week the crypto division received a Wells notice from SEC staff advising the unit that a preliminary determination was made to recommend that the SEC file an enforcement action against Robinhood Crypto for alleged securities violations.

The filing said that the potential action may involve a civil injunctive action, public administrative proceeding or a cease-and-desist proceeding. Remedies that may be sought include an injunction, a cease-and-desist order, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation, and limitations on activities.

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business,” Dan Gallagher, chief legal, compliance and corporate affairs officer at Robinhood Markets, said in a statement on Monday. “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

The company said that its crypto unit has chosen not to list certain tokens or provide products, such as lending and staking, that the SEC previously alleged were securities in public actions against other platforms. It has also attempted to register a special purpose broker-dealer with the agency.

Robinhood said that the SEC development will not impact its customers' accounts or the services it provides. The company is scheduled to report its quarterly results Wednesday after the market close.

Shares of Robinhood added 1% in morning trading.

2 notes

·

View notes

Text

Recover Your Crypto with the Best Crypto Recovery Experts

Are you in distress after falling victim to a cryptocurrency scam or losing access to your digital assets? Don't despair – help is at hand! Welcome to Broker Complaint Alert, your trusted partner in the realm of crypto recovery.

Why Choose Broker Complaint Alert?

At Broker Complaint Alert, we understand the complexities and risks associated with the cryptocurrency market. Whether you've been a victim of fraudulent schemes, phishing attacks, or technical mishaps, we have the expertise and dedication to assist you in recovering your lost funds.

Here's why we stand out as the best crypto recovery experts:

1. Extensive Experience:

Our team comprises seasoned professionals with years of experience in dealing with crypto-related issues. We have successfully handled a myriad of cases, ranging from simple account recovery to complex fraud investigations.

2. Tailored Solutions:

We recognize that every case is unique, and we approach each situation with a fresh perspective. Our experts will work closely with you to understand the specifics of your predicament and devise a personalized recovery strategy.

3. Proven Track Record:

Over the years, we have garnered a reputation for delivering results. Our track record speaks for itself, with numerous satisfied clients who have reclaimed their lost assets with our assistance.

4. Transparent Process:

We believe in transparency and keep our clients informed at every step of the recovery process. You can trust us to provide honest assessments and realistic expectations regarding the outcome of your case.

How We Can Help You:

Our comprehensive range of services includes:

Fraud Investigation: If you suspect fraudulent activity or unauthorized transactions involving your cryptocurrency holdings, our experts will conduct a thorough investigation to uncover the truth.

Account Recovery: Locked out of your crypto wallet or unable to access your funds? We specialize in facilitating the recovery of lost or inaccessible accounts, ensuring that you regain control of your assets.

Legal Assistance: In cases involving legal complexities or disputes with exchanges or trading platforms, our legal team will provide expert guidance and representation to safeguard your interests.

Risk Assessment: Worried about the security of your crypto investments? We offer risk assessment services to identify potential vulnerabilities and recommend proactive measures to mitigate risks.

Get in Touch Today!

Don't let despair overshadow your hopes of crypto recovery. Take the first step towards reclaiming your assets by reaching out to Broker Complaint Alert. Our dedicated team of experts is here to support you every step of the way.

Contact us today to schedule a consultation and let us be your trusted partner in crypto recovery. With Broker Complaint Alert by your side, your journey to financial restitution begins here.

Trust the best – choose Broker Complaint Alert for all your crypto recovery needs.

3 notes

·

View notes

Text

A site literally called 'Spy.pet' claims to have scraped billions of public Discord messages and wants to sell them

It's an unfortunate reminder not to say things on Discord servers that you wouldn't want repeated elsewhere.

First reported by StackDiary and The Register, a website called Spy.pet claims to have scraped billions of public Discord messages made by almost 620 million users, selling the individual messages and profiles for crypto.

Spy.pet ties message logs to the users who sent them, and also collects Discord aliases and linked social media and Steam accounts—it's basically one stop shopping for any surveillance and harassment needs. Spy.pet further purports to offer an "enterprise option" for anyone looking to train an AI model on the site's library of messages.

The site presents this as a potential option for "federal agents looking for a new source of intel," but I'm not sure what bush league FBI office is looking to outsource that capability here.

Even with all our data already liable to be scrutinized by the government and sold by platform owners, there's a particular sense of violation at seeing it all packaged up and on sale to anyone like this, and Spy.pet's owner seems to take a certain glee in potential objections to the business: A "request removal" link on the site just leads to a .gif of JJ Jameson laughing in the Sam Raimi Spider-Man 2. I don't think J.K. Simmons is actually that flippant about my privacy, thank you very much.

In a statement issued to both the Register and StackDiary, Discord indicated that it is investigating Spy.pet for potential breaches of the company's terms of service: "Discord is committed to protecting the privacy and data of our users. We are currently investigating this matter. If we determine that violations of our Terms of Service and Community Guidelines have occurred, we will take appropriate steps to enforce our policies. We cannot provide further comments as this is an ongoing investigation."

As StackDiary points out, Spy.pet is also likely in violation of several articles from the European Union's General Data Protection Regulation. While we don't get nice consumer protections like that here in the US, the Register argues that Spy.pet's potential sale of children's data could still leave it legally liable in the States as well.

A crypto-fueled private sector surveillance and harassment machine is a lovely new nightmare of the 2020s, and I hope it gets shut down, but it's another valuable reminder not to treat Discord like it's private. What you say in a small, invite-only server with friends will probably stay there unless one of your friends shares it or reports a message to Discord's mod team, but to really be safe, chatting on Discord has to be seen as posting publicly on social media.

So, you know, probably don't leak classified military intel on Discord servers, and just generally don't say anything on there you wouldn't want to see screenshotted and put on Twitter or Reddit. Of course, it would also help if we would just stop making Discord servers for things that shouldn't be Discord servers.

2 notes

·

View notes