#Calculate the sum and average of three numbers

Explore tagged Tumblr posts

Note

Hey Bitches! Long-time reader, first time asker :)

I have a budgeting question!

I'm a 21 year old student living with my (employed) partner independent from both our families. I'm unemployed at the moment, but will be starting a (min wage, limited hours, career-benefiting, year-long-contracted) job starting next month. I'll also be looking into selling plasma and/or picking up a gig app to supplement the pay

I find that a lot of what makes budgets useful doesn't really work for me because most of my spending areas that can be minimized have already been minimized, and I limit and track myself so much already because I know I don't have a lot of wiggle room to spend frivolously. So most of the time, I use a spending tracker spreadsheet

However, my credit union has a built-in budget feature I like to poke around on sometimes, too. It can be nice to have a goal in mind and to feel like I did a good job at the end of the month when (most) everything is green (I was over-budget for my cat by 11 cents last month)

BUT! I can only set a budget for one month's length. This seems to be the norm and is pretty common when I look at budgeting examples

This is great for things that happen on a monthly basis (like gas, for example), where, after years of tracking my spending data, I have a solid idea of how much I can realistically expect to spend in that time. But it really sucks for things that aren't as frequent, but do happen on a regular basis (like car registration or tuition, which come once a year and every few months, respectively)

I'm kind of at a loss for how to represent or calculate these kinds of items on a budget/spending tracker (like when I'm pulling for an average over a length of time, or categorizing my spending when one value is superbly high in a sea of much smaller numbers)

Gas is about $50/month, car registration is about $100/year. I think it's a poor representation to say I need $150/month for auto expenses. I'm not spending that $100 most of the time, but I'm not expecting to pay it most of the time, so it feels wrong to say I'm saving a ton of money every month. But it also isn't great to have only $50 budgeted when registration month rolls around and I'm in the red by $100 (not to mention inconsistent maintenance of wildly varying cost)

Likewise, I wouldn't say I'm under-budget by $2,000 on the months I don't have tuition due, but it can't be correct to have a $0 budget that gets super red every three months. Dividing it up to $666 a month gets the same problem where I'm either super green, not spending anything, "saving" a ton, or very in the red, very over-budget when my tuition actually comes due. There is an option to split up payments, but it adds a $50 payment plan fee, which (in addition to generally being shitty by punishing anyone who doesn't make the lump sum) doesn't feel worth it just to make my books look nice

I've seen some recommendations to use a sinking fund for these expenses, putting money aside each month in preparation for the big expense, but

A. where exactly do you put that portion "aside" into? I have a checking, savings, (secured) credit card, and a CD account (the latter two of which I can't easily move money around in). Besides putting money into my savings account from my checking (which, when employed and receiving income, I already do), I don't understand how this works. Do people just open and have several accounts going for each expense that isn't on a monthly pattern?

And B. I'm in a fortunate enough position that I'm (just barely! Job is coming with amazing timing!) able to make single payments on these expected bigger expenses without having to meticulously save up for them. It doesn't fix my budget being wonky on months with/out these non-monthly expenses, and I would like to actually have a working budget, but do I even need to make a sinking fund if I can afford it with the habits/systems I already have?

I've also seen people using different budgets for different times. Most often, this is seasonal: a winter budget with higher heating expenses planned, a summer budget with lower heating expenses planned kind of deal. This feels closer to what I'm looking for than a sinking fund, but making a different monthly budget around each varying expense and overlapping occurrences (or lack thereof) feels cumbersome and tedious (to make, keep track of, alter, and change every month)

I could have a yearly budget, but it feels risky to go such a long time without knowing how on-track I am and my life is so in flux right now that I don't know what to expect that far into the future. Plus, like I said, I only have the option for monthly budgets in my credit union.

I expect having a more stable and higher income will help a lot (assuming I can get there). As will not having to pay for huge-stressful-chunks-of-savings-every-three-months-except-for-summertime tuition (I'll be done next year almost to the day!). I know there will still be yearly and bi-yearly expenses (and surprises) that I'll have to be ready to pay for, but I'm hoping I'll have more staggering control.

So, I've come to you, Bitches, if there is a better way to address these big, non-monthly expenses, or if I'm just missing something in one of the suggestions above, I'd be jazzed to hear about it and not have to wait to better grasp this part of my finances.

Thank you, Bitches!!

THIS IS EXACTLY WHY WE DON'T THINK BUDGETS ARE RIGHT FOR EVERYONE.

My first instinct is to tell you to ignore your bank's budgeting software. It doesn't matter. You're doing great with your personal spending tracker and you seem to have a very good hold of your expenses. So that's an option.

The other option is combining the budget with a sinking fund. Some banks will include "buckets" within your account that you can access through their online portal. For example, my Ally HYSA allows me to set up buckets within the account so I can budget for what I'm saving for our kitchen renovation, for example. It makes using a sinking fund real easy.

But not every bank has that functionality! So again, I can't stress enough how much a budget just might not be right for your situation right now.

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

Ask Not How Much You Should Save, Ask How Much You Should Spend

Did we just help you out? Join our Patreon!

#budget#budgeting#spending money#saving money#personal finance#money#money tips#adulting#frugal#finance#money management#cash

45 notes

·

View notes

Text

How is compatibility (Guna Milan) calculated for marriage in Vedic astrology?

It is said that marriage is definitely one of the biggest decisions any human being ever makes in their lifetime, and in most cultures of the world, it is more about the union of two families than it is about two people getting tied into the nuptial bond. Though unique in traditions, the country of India still holds a pretty special place with the matching of horoscopes or kundlis for assessment decisions relating to marriage. This ancient practice, Vedic astrology, became known as Guna Milan toward determination on how well two persons might harmonize in a marital relationship. But what is Guna Milan, and how does it work? First, let us break down this intriguing concept in both an informative and easily digestible way.

What is Guna Milan?

Guna Milan is one of the techniques in Vedic Astrology used for comparing the horoscopes of the prospective bride and bridegroom with respect to compatibility in marriage. Herein, "Guna" means "good qualities or attributes," and "Milan" means "matching." Therefore, Guna Milan primarily refers to the matching of qualities between two individuals for checking their compatibility with each other.

It is based upon the Nakshatras or lunar constellations in which the moon was positioned at the time of birth of both individuals. Vedic astrology places major significance on the position of the Moon because it shows the emotional and psychological tendencies of an individual's nature.

The 36 Gunas: A Cosmic Compatibility Checklist

The process of Guna Milan uses the Ashtakoot system of assessing compatibility. "Ashta" means eight, while "Koot" means categories or points. There are thus eight categories on which the Guna Milan system rests, and each of these categories is bound by a certain number of points. All in all, the total points which can be scored in Guna Milan are 36.

Herein is an overview of these eight Koots and what each of them represents:

1. Varna (1 point): This is for spiritual compatibility and ego levels of the couple. Varna Koot compares the caste or temperament of the individuals.

2. Vashya (2 points): This determines who will have a stronger influence in the relationship and how well the couple can balance each other's strengths and weaknesses.

3. Tara (3 points): This decides the health and well-being of the couple and strength to stand by each other through all odds in life.

4. Yoni (4 points): It is for sexual compatibility and physical attraction between the couple.

5. Graha Maitri (5 points): It looks at the psychological compatibility and mutual affection between the couple based on the relationship between their ruling planets.

6. Gana (6 points): It is concerned with the character and temperament of the two partners. In all, there are three subcategories for Gana Koot: Deva, Manushya, Rakshasa. This is based on the simple assumption that people of different Ganas will be of different natures and their priorities in life may differ.

7. Bhakoot (7 points): It checks emotional compatibility; that is, the effect of the relationship on both entities' prosperity and longevity. Many consider it one of the essential parameters.

8. Nadi (8 points): This concerns health matters, mostly those issues related to offspring or progeny. It has the maximum points in Guna Milan since it also establishes the biological compatibility of both entities.

Scoring in Guna Milan

The sum of the points in these eight factors is 36. Generally, 18 or more is considered an acceptable score for marriage purposes; the higher the score, the better. Briefly, here is what different scores suggest:

- 32 to 36 Gunas: Excellent match. It is virtually finding a match made in heaven. - 25 to 31 Gunas: Very good compatibility. The couple is likely to have a harmonious relationship.

- 18 to 24 Gunas: Average compatibility. This is acceptable for marriage though some adjustments and compromises might be needed.

- Below 18 Gunas: Compatibility is considered below average and marriage may not be recommended unless there are strong compensating factors in the individual horoscopes.

Beyond the Gunas: The Bigger Picture

While Guna Milan provides a structured way to evaluate the compatibility between two individuals, one should remember that it is not everything. A good guna score does not guarantee that a marriage will work out; likewise, a low score doesn't mean everything is gloom and doom. General chart analysis—including Manglik Dosh and strength of the seventh house, governing marriage—assumes gigantic proportions in determining marital harmony.

The Human Touch in Compatibility

That finally brings us to what overshadows everything the stars say: compatibility. Making a relationship work takes emotional intelligence, mutual respect, clear communication, and shared values. Guna Milan provides some insight and guidelines, but it is in the commitment and effort that two people put into tending their bond that the magic of marriage happens.

It is all about growing up together, sharing the 'tecups and downs' of life, realizing all those dreams, and being there for each other. So, as much as Guna Milan stands as an age-old tradition that brings a layer of cosmic understanding into this beautiful journey, the real essence of a contented marriage is simply the love and understanding between two hearts.

6 notes

·

View notes

Text

Brief Interlude: Some analysis of the grade changes

In the previous post in my Produce48 Rewatch Project, I told you the final grade changes in episode 3 of Produce 48. In this post, I'll tell you some things I noticed about the grade changes (ie, from the first to the third episodes). I crunched some numbers, I pored over my spreadsheet, and did some deducin'. It's a super brief post, so check it out!

Overall, the trend was to move downward.

I converted grades to numbers and calculated the overall change. For example, if someone moved from B to A, that's a change of +1, but if someone moved from A to C, that's a change of -2. The sum of all the changes was -45. That means that the average grade change was about half a grade down per person.

The only group with a net positive change was F.

Of course, A's net change would have to be negative, as the only change possible was down, and F's net change would have to be positive, as the only change possible was up. But I was surprised that every group except F had a net negative change.

A's average change per person: -1.2 B's average change per person: -0.96 C's average change per person: -0.4 D's average change per person: -0.2 F's average change per person: +0.6

The Japanese trainees had a positive net change and the Koreans had a negative net change.

Given that the Japanese trainees made up most of F and D classes, and given that negative change wasn't possible for F class trainees, it makes sense that Japanese trainees would have a positive net change. It worked out to be a net change of 9, which works out to about +1/4th of a grade up per person. The overall average change for the Korean trainees was almost a whole grade down.

What does it all mean?

It could mean a few things. Maybe it means that the judges were too easy going with their initial assessment, or that they were too harsh with their second assessment.

The explanation I favor, though, is that the task was just too hard. AleXa has stated in interviews that the girls really only had about a day and a half to learn the choreo and two sets of lyrics to the song. Most of them were set up to fail on at least one of the two performances. For the two Chinese trainees and the one American trainee, none of whom spoke Korean or Japanese fluently, it was a doubly difficult task, and all three of them dropped at least one grade.

I guess none of this is really earth shaking information, but analysis is kind of my jam so thanks for indulging me! And now back to our regularly scheduled posts! The next one will pick up with the big group performance of Nekkoya. See you there!

3 notes

·

View notes

Text

Running a k-means Cluster Analysis

For this assignment, I'll perform a k-means cluster analysis on the Iris dataset, which is a classic dataset in machine learning and statistics. The Iris dataset contains measurements for 150 iris flowers from three different species, making it ideal for clustering exercises.

Why Not Splitting the Data

The Iris dataset has only 150 observations, which is relatively small. Splitting this into training and test sets would leave us with very few observations for meaningful clustering in each set. Therefore, I'll perform the analysis on the entire dataset.

Python Implementation

Import necessary libraries

import numpy as np import pandas as pd import matplotlib.pyplot as plt from sklearn import datasets from sklearn.cluster import KMeans from sklearn.preprocessing import StandardScaler from sklearn.metrics import silhouette_score

Load the Iris dataset

iris = datasets.load_iris() X = iris.data # We'll use all four features for clustering y = iris.target # Actual species labels (for comparison only)

Standardize the features (important for k-means)

scaler = StandardScaler() X_scaled = scaler.fit_transform(X)

Determine optimal number of clusters using the Elbow Method

wcss = [] # Within-cluster sum of squares silhouette_scores = [] cluster_range = range(2, 11)

for n_clusters in cluster_range: kmeans = KMeans(n_clusters=n_clusters, init='k-means++', random_state=42) kmeans.fit(X_scaled) wcss.append(kmeans.inertia_)# Calculate silhouette score silhouette_avg = silhouette_score(X_scaled, kmeans.labels_) silhouette_scores.append(silhouette_avg)

Plot the Elbow Method graph

plt.figure(figsize=(12, 5))

plt.subplot(1, 2, 1) plt.plot(cluster_range, wcss, marker='o') plt.title('Elbow Method') plt.xlabel('Number of clusters') plt.ylabel('WCSS') # Within-cluster sum of squares

plt.subplot(1, 2, 2) plt.plot(cluster_range, silhouette_scores, marker='o') plt.title('Silhouette Scores') plt.xlabel('Number of clusters') plt.ylabel('Silhouette Score')

plt.tight_layout() plt.show()

Perform k-means clustering with optimal number of clusters (k=3)

optimal_clusters = 3 kmeans = KMeans(n_clusters=optimal_clusters, init='k-means++', random_state=42) kmeans.fit(X_scaled) clusters = kmeans.predict(X_scaled)

Add cluster assignments to the original data

iris_df = pd.DataFrame(X, columns=iris.feature_names) iris_df['Species'] = iris.target_names[y] iris_df['Cluster'] = clusters

Visualize the clusters (using first two features for simplicity)

plt.figure(figsize=(10, 6)) colors = ['red', 'green', 'blue'] for i in range(optimal_clusters): plt.scatter(X_scaled[clusters == i, 0], X_scaled[clusters == i, 1], s=50, c=colors[i], label=f'Cluster {i}')

plt.scatter(kmeans.cluster_centers_[:, 0], kmeans.cluster_centers_[:, 1], s=200, c='yellow', marker='*', label='Centroids') plt.title('K-means Clustering of Iris Dataset') plt.xlabel('Scaled Sepal Length') plt.ylabel('Scaled Sepal Width') plt.legend() plt.show()

Cluster analysis results

print("\nCluster Analysis Results:") print("------------------------") print(f"Optimal number of clusters: {optimal_clusters}") print(f"Cluster centers (original scale):\n{scaler.inverse_transform(kmeans.cluster_centers_)}") print("\nCluster distribution:") print(iris_df['Cluster'].value_counts().sort_index())

Compare clusters with actual species

print("\nCluster vs. Species Crosstab:") print(pd.crosstab(iris_df['Species'], iris_df['Cluster']))

1. Elbow Method and Silhouette Score Plots

Explanation:

Left plot (Elbow Method): Shows the within-cluster sum of squares (WCSS) for different numbers of clusters (k=2 to k=10). The "elbow" appears at k=3, suggesting this is the optimal number of clusters.

Right plot (Silhouette Scores): Shows the average silhouette score for different numbers of clusters. The highest score (0.459) occurs at k=3, confirming our choice.

2. Cluster Visualization Plot

Explanation:

Shows the data points colored by their cluster assignment (red, green, blue)

Yellow stars represent the cluster centroids

The x-axis shows scaled sepal length and y-axis shows scaled sepal width

We can see three fairly distinct clusters with some overlap between two of them

Cluster Analysis Results

Cluster Analysis Results:

Optimal number of clusters: 3 Cluster centers (original scale): [[5.9016129 2.7483871 4.39354839 1.43387097] [5.006 3.428 1.462 0.246 ] [6.85 3.07368421 5.74210526 2.07105263]]

Cluster distribution: 0 62 1 50 2 38 dtype: int64

Cluster vs. Species Crosstab: Cluster 0 1 2 Species setosa 0 50 0 versicolor 48 0 2 virginica 14 0 36

Interpretation

The k-means algorithm successfully identified three distinct clusters in the Iris dataset

Cluster 1 perfectly matches the setosa species (50 observations)

Clusters 0 and 2 primarily contain versicolor and virginica species respectively, with some overlap

The overlap between versicolor and virginica in the clusters reflects the natural similarity between these two species

This analysis demonstrates that k-means clustering can effectively identify natural groupings in the Iris dataset that largely correspond to the actual species classifications. The algorithm performed particularly well at distinguishing setosa from the other two species, while showing some expected overlap between versicolor and virginica.

0 notes

Text

Bookkeeping for Real Estate Agents: Why Winging It Just Won’t Cut It

Let’s be real—being a real estate agent isn’t exactly a slow-paced job. You're juggling open houses, client calls, back-to-back showings, late-night offers, and the occasional 7 AM coffee with a nervous first-time buyer. Amid all this chaos, who’s got the time (or mental bandwidth) to track mileage, categorize receipts, and reconcile bank statements?

But here’s the kicker: ignoring your bookkeeping—or worse, doing it half-heartedly—can quietly eat into your profits, stress you out come tax season, and hold your business back. It’s like driving a luxury car with a cracked dashboard. Looks good from the outside, but the internal systems? A mess.

So let’s talk about what smart agents are doing instead. Spoiler: they’re not staying up till midnight sorting through shoeboxes full of receipts.

Ever Feel Like Your Ledger’s a Maze?

If you’re a real estate agent, you probably didn’t get into the game because you love spreadsheets. You’re in it for the deals, the hustle, the stories behind the properties—not for reconciling bank statements or decoding tax codes. Yet somehow, bookkeeping creeps in, and suddenly, you’re spending your Saturday night color-coding expense categories.

Let’s not sugarcoat it: financial tracking in real estate can be a mess. Commissions come in lump sums, expenses are scattered across miles and meetings, and every transaction feels like a puzzle. And if you’re not on top of it? Tax season hits like a wrecking ball.

That’s where specialized bookkeeping services come into play—specifically tailored to agents like you. And no, this isn’t some one-size-fits-all accounting fluff. We’re talking about precision support designed for the unpredictability of real estate life. One standout in this space? Rapid Business Solutions—but more on them in a minute.

Why Real Estate Bookkeeping Isn’t Your Average Ledger Game

Let’s paint a picture.

You close a deal—big one. Commission rolls in. You cover marketing costs out-of-pocket, pay your assistant, fuel up for all those showings, grab client gifts, maybe even cover staging fees. Then, tax time arrives and your CPA asks, “Where’s the breakdown?”

And you pause... because, well, there isn’t one. Not yet.

Real estate bookkeeping is a high-wire act. Why?

Irregular income: Some months are goldmines. Others? Crickets.

1099 contractor status: You're essentially a business of one—tax-wise, that gets messy.

Mileage, meals, and marketing: Deductible, yes. Easy to track? Not so much.

Team dynamics: If you lead a team, it’s not just your books anymore—it’s payroll, splits, and bonuses.

And while QuickBooks might be great in theory, let’s be honest: most agents don’t have the time (or the patience) to categorize every dollar with precision.

Here’s the Thing—The Cost of “Winging It”

You might think, "I’ll just figure it out during tax season."

Spoiler: That strategy costs more than it saves.

Missed deductions: Forget to log mileage for a month? That’s hundreds gone.

Overpaying taxes: Without clean books, your CPA’s guessing—and probably erring on the safe (read: expensive) side.

IRS red flags: A sloppy Schedule C screams “audit me!” even if you're squeaky clean.

Plus, there’s the hidden toll: stress. Ever tried calculating quarterly taxes on the fly, with ten listings and three escrows in play? It’s like juggling while skydiving.

Enter Rapid Business Solutions—Not Just Another Bookkeeping Firm

So, let’s talk about Rapid Business Solutions. These folks aren’t just number crunchers. They’re real estate-savvy bookkeeping pros who get the quirks of your industry.

Here’s what makes them stand out:

Specialized expertise: They know real estate bookkeeping. Not general accounting. Not random business categories. Real estate. That means they’ll know the difference between your listing photos and your car wrap expense—and how both affect your bottom line.

Real-time visibility: Using cloud-based tools, Rapid Business solution lets you see where your money’s going without waiting for a month-end email. It's bookkeeping you can actually understand—no accounting degree required.

Tax-prep synergy: They don’t just organize your books; they make life easier for your tax pro too. That means fewer surprises, cleaner filings, and often, lower bills.

Human-first service: You’re not just another client ID in a system. They treat you like a partner—because they get that you’re running a business, even if it’s just you and your car full of open house signs.

“But I’ve Got a System…”

Sure. Maybe it’s an Excel sheet. Or a shoebox. Or an app you downloaded three months ago and forgot about.

Systems are great... until they fail under pressure.

Rapid Business solution doesn’t just replace your current system. They improve it. They tailor a bookkeeping setup that fits your workflow, not the other way around. That’s a game-changer. Especially if you’re scaling your business or dreaming of finally hiring that first assistant.

Why It’s Not Just About the Books

Let’s zoom out.

Good bookkeeping isn’t just about taxes. It’s about clarity. It’s about knowing:

How much you actually made this month.

Whether your marketing spend is paying off.

If that flashy lead gen service is worth renewing.

When to hire, when to hold, and when to push harder.

With clean books, you move with confidence. You plan smarter. You sleep better.

It’s not just numbers. It’s peace of mind. And let’s face it—peace of mind is in short supply when you’re running from a closing to a showing to a school play all in the same day.

Let’s Be Real: Time Is the Real Currency

Here’s the real kicker. The time you spend trying to be your own bookkeeper? That’s time you could spend closing deals. Building relationships. Growing your brand.

Imagine what even 5 extra hours a week could mean. More calls. More listings. More chances to actually take a day off.

Rapid Business solutions gets that. They’re not just saving you time—they’re handing you back your focus.

So, Is It Worth It?

If you’re serious about real estate—and honestly, if you’ve read this far, you probably are—then yes. Outsourcing your bookkeeping is absolutely worth it.

Because it’s not just a service. It’s a strategy.

It’s one less thing pulling your attention. One more thing done right. And in this business, where details matter and time moves fast, that kind of support is priceless.

Final Thoughts: Don’t Wait for Chaos

You know how buyers always wait too long to get pre-approved? That’s how most agents treat their finances. They wait until it’s a mess—then panic.

Don’t do that.

Whether you’re a solo agent just starting out or running a multi-agent team, Rapid Business Solutions can help you build a financial foundation that actually supports your growth.

0 notes

Text

What Is My Credit Score and Why It Actually Matters

Hey there! Ever wondered what that mysterious three-digit number trailing your financial life really means? Whether you’re applying for a loan, renting an apartment, or even shopping for car insurance, your credit score plays a starring role. But what is a credit score, and why does it matter so much? Let’s break it down in plain English—no jargon, no stress—just the facts you need to take control of your financial future.

What Is a Credit Score?

Your credit score is like a financial GPA—a number between 300 and 850 that sums up how reliable you are with borrowing and repaying money. Lenders, landlords, and even employers use it to gauge your trustworthiness. Think of it as a shortcut for answering the question: “Will this person pay me back on time?”

This score isn’t pulled out of thin air. It’s calculated using data from your credit reports, which track your history with loans, credit cards, and other debts. The big players here are FICO and VantageScore, the two main scoring models. While they crunch the numbers slightly differently (more on that later), both focus on the same core factors: your payment habits, debt levels, and how long you’ve been using credit.

One myth to bust upfront: You don’t have just one credit score. Depending on the scoring model and which credit bureau (Equifax, Experian, or TransUnion) provides the data, your score might vary by a few points. But don’t sweat minor differences—it’s the big picture that counts.

Understanding Credit Score Ranges

Credit scores fall into categories that help lenders quickly assess risk. Here’s how it typically shakes out:

Excellent (750–850): You’re a lender’s dream. Expect low interest rates, premium credit cards, and smooth approvals.

Good (670–749): You’ll qualify for most loans and cards, though you might miss out on the absolute best rates.

Fair (580–669): Approval isn’t guaranteed, and if you get a “yes,” prepare for higher interest costs.

Poor (300–579): Rebuilding is key here. Options are limited, and loans often come with steep terms.

Keep in mind that lenders set their own standards. One bank’s “good” might be another’s “fair.” For example, a 680 score could snag you an auto loan at one dealership but get sidelined at another. Always ask about a lender’s specific criteria before applying.

And if you’re still wondering, What is my credit score and how do I check it?—you can access it through various free tools offered by banks, credit card providers, and financial apps. Knowing your number is the first step toward building strong financial health

Key Factors That Shape Your Credit Score

Your score isn’t random—it’s a reflection of specific financial behaviors. Here’s what matters most, starting with the heavyweight champion:

1. Payment History (35% of your score)This is the biggie. Late payments, defaults, or accounts sent to collections can tank your score. Consistency matters: Paying every bill on time, every time, builds trust. Even a single 30-day late payment can linger on your report for seven years, though its impact fades over time.

2. Credit Utilization (30%)This measures how much of your available credit you’re using. For example, if you have a total credit limit of $10,000 and owe $3,000, your utilization is 30%. Experts recommend keeping this below 30%, but aiming for 10% or lower can give your score an extra boost. High utilization screams “overextended!” to lenders.

3. Credit History Length (15%)Old accounts are gold. They show you’ve handled credit responsibly over time. Closing your first credit card might shorten your average account age and ding your score. Pro tip: Keep older accounts open (even if you rarely use them) to preserve this history.

4. New Credit (10%)Every time you apply for credit, lenders do a “hard inquiry,” which can temporarily lower your score by a few points. Applying for multiple loans or cards in a short period? That’s a red flag. Space out applications by at least six months to minimize damage.

5. Credit Mix (10%)Having a blend of credit types—like a mortgage, auto loan, and credit card—shows you can manage diverse responsibilities. But don’t open accounts just for variety. Focus on smart borrowing, not checking boxes.

How to Improve Your Credit Score

Boosting your score isn’t rocket science, but it does require patience and strategy. Here’s how to make progress, step by step:

Start With On-Time PaymentsSet up autopay for at least the minimum payment on all accounts. If cash flow is tight, contact lenders to negotiate due dates or payment plans. One missed payment can undo months of progress.

Tame Your Credit UtilizationPay down balances aggressively, starting with high-interest debt. If you can’t pay in full, ask for a credit limit increase (without spending more!). This lowers your utilization ratio instantly.

Become a Credit History GuruIf you’re new to credit, consider becoming an authorized user on a family member’s card. Services like Experian Boost can also add utility and phone bills to your credit report, thickening your file.

Pause New Credit ApplicationsEach hard inquiry stays on your report for two years (though it only affects your score for one). If you’re rate-shopping for a mortgage or car loan, do it within a focused 14–45-day window to limit the impact.

Audit Your Credit ReportsErrors happen—a lot. One in five reports contains mistakes! Pull your free annual reports at AnnualCreditReport.com and dispute inaccuracies with the bureaus. It’s a quick win that can lift your score fast.

Wrapping It Up

Your credit score isn’t just a number—it’s a tool that unlocks (or blocks) financial opportunities. Whether you’re eyeing a new apartment, a lower insurance rate, or a dream vacation funded by travel rewards, a strong score puts you in the driver’s seat.

Improvement won’t happen overnight, but small, consistent steps add up. Pay on time, keep balances low, and stay informed. Remember, your credit score is a marathon, not a sprint. Stay patient, stay smart, and watch those three digits climb!

#WhatIsMyCreditScore#HowIsMyCreditScoreCalculated?#WhyDoesMyCreditScoreMatter?#HowCanIImproveMyCreditScore?#HowtoImproveYourCreditScore#UnderstandingYourCreditScore#The5FactorsThatShapeYourCreditScore#ProvenStrategiestoBoostYourCreditScore#CreditCardDebtLawyer#WhatIsaCreditCardDebtLawyer?#WhenShouldYouHireaCreditCardDebtLawyer?#HowtoChoosetheRightCreditCardDebtLawyer#WhatIsaCreditReport#HowtoGetYourCreditReportforFree#KeepingYourCreditReportAccurateandSecure

1 note

·

View note

Text

Best Paid Jobs in Dubai

ccording to the new UAE Labor Law, the average salary in Dubai as well as other benefits must mentioned in the employment contract. The gross salary of an employee includes basic salary and all the allowances paid.

To sum up the details, there is no minimum wages or average salary in Dubai but there are three types of salary:

Basic salary in Dubai: the basic pay provided to employees

Gross salary = Basic compensation+ Allowances

Net salary paid to employees – Gross Salary – Deductions

Make the process faster with Zimyo-Middle East

What is the Average Salary in Dubai?

According to a famous resource, the average salary in Dubai is 2,58,000 AED per year.

Moreover, to get a clear picture of the average salary in Dubai we will discuss the median salary and average salary in Dubai.

1. Median Salary

Additionally, employees in Dubai and other Gulf countries earn a median salary of 19,000 AED per month. Therefore, it means that nearly half of the population in Dubai earns less than 19000 AED per month while the other half earns more than 19,000 AED per month.

Now the question that arises is, how to calculate median salary?

So, let’s understand this with a simple example. Suppose there are three employees. An employee X is earning 20,000 AED while Y is earning 25,000 AED per month while Z is earning a salary of 15,000 so the median salary will be 20000 AED. The total salary of the three employees is divided by the total number of employees.

Median Salary = Total salary of all the employees/ Number of employees

2. Average salary range

The average salary in Dubai ranges from 4,810 AED to 99,000 AED per month.

Furthermore, average salary in Dubai ranges between the average minimum and average maximum salary in Dubai.

Moreover, average salary in Dubai, minimum salary and maximum salary in Dubai helps to understand the condition of the economy in Dubai, payout expectations and other details.

What is Average Annual Salary Increment in Dubai?

The average salary increment is the basic concept for all countries. Dubai is no different in this context.

According to a famous agency UAE has an average salary increment of 8% every 17 months. The world average rate is 3% every 16 months. It means the salary increment rate in Dubai is far better than in most countries.

1. Industry-wise salary increment rate

Here is the industry-wise breakdown of the salary in Dubai. Hence, this data contains estimated figures and it may change with trends.

2. Experience level increment

Annual increment is also based on the experience level of an employee. Like every other country, Dubai also provides more increments to experienced employees to enhance their retention rates.

What are Minimum Wages for Certain Categories of Employees in UAE?

Although, there are no minimum wages set for employees in Dubai but back in 2013, the labor ministry of UAE approved minimum wages for certain categories of employees. However, these salaries do not apply to all the categories of employees in Dubai and aren’t the same as minimum wages.

To Learn More

0 notes

Text

Minimum Balance Requirements for Savings Accounts Explained

When you open a savings account, one of the first things you'll encounter is a minimum balance requirement. You need to maintain this amount in your account to avoid penalties or charges. While some banks offer zero-balance accounts, others require a minimum deposit to keep your account active. Understanding these requirements can help you manage your finances and avoid unnecessary fees.

What Is a Minimum Balance Requirement?

A minimum balance requirement is the least amount of money you must always keep in your savings account. You may be penalised if your balance falls below this limit. The required amount varies depending on the type of savings account and the bank's policies. Some institutions, tiny finance banks, may offer more flexible options with lower or no minimum balance requirements.

Why Do Banks Have Minimum Balance Requirements?

Banks impose minimum balance requirements for several reasons:

Operational Costs: Maintaining accounts involves administrative costs; a minimum balance ensures the bank can cover these expenses.

Liquidity Management: A stable deposit base helps banks manage their liquidity efficiently.

Encouraging Financial Discipline: Keeping a set amount in your account encourages you to save and maintain a financial cushion.

Types of Minimum Balance Requirements

Different banks have different policies regarding minimum balance maintenance. Here are some common types:

1. Monthly Average Balance (MAB)

This requirement means you need to maintain an average balance throughout the month. The balance is calculated by adding your closing balance for each day and dividing it by the number of days in the month.

2. Daily Minimum Balance

Some banks require you to maintain a fixed minimum balance every single day. You may incur charges if your balance drops below this amount, even for a day.

3. Quarterly or Half-Yearly Minimum Balance

A few banks calculate the minimum balance requirement over a more extended period, such as three or six months. This option provides more flexibility as you don't have to worry about maintaining the required balance daily or monthly.

What Happens If You Don't Maintain the Minimum Balance?

Failing to maintain the required minimum balance can lead to penalties, which may include:

Monthly or quarterly charges are deducted from your savings account.

Reduced interest earnings, as some banks may offer lower interest rates for accounts that fail to meet the minimum balance.

Restrictions on transactions, including limitations on withdrawals or online banking services.

How to Avoid Minimum Balance Charges

If you want to avoid paying penalties for not maintaining the minimum balance, consider these strategies:

Choose a Bank with No Minimum Balance Requirement Some banks, including a small finance bank, offer zero-balance savings accounts that do not require you to maintain a minimum balance.

Opt for an Account That Matches Your Financial Needs If you cannot maintain a high balance, consider opening a basic savings account with lower balance requirements.

Keep Track of Your Account Balance Regularly monitoring your account can help you stay above the required minimum balance and avoid penalties.

Set Balance Alerts Most banks offer SMS or email alerts when your balance drops below a certain amount. Enabling these alerts can help you take timely action.

Link Your Account to Fixed Deposits or Other Savings Plans Some banks allow you to link your savings account to a fixed deposit. If your balance drops below the required amount, funds from your fixed deposit may be used to meet the minimum balance requirement.

How a Small Finance Bank Differs in Minimum Balance Requirements

A small finance bank often provides more flexible and customer-friendly policies, including lower minimum balance requirements. These banks cater to individuals who may not have large sums of money to deposit but still want to enjoy banking benefits. Many offer zero-balance accounts, making them a great choice if you prefer fewer restrictions on your savings account.

Things to Consider Before Saving Account Opening

Before proceeding with saving account opening, make sure you:

Understand the minimum balance requirement and ensure it fits within your financial capabilities.

Check the penalty structure in case you fail to maintain the balance.

Explore additional benefits, such as free ATM withdrawals, online banking, or better interest rates.

Compare different banks, including a small finance bank, to find the best option for your needs.

Final Thoughts

Minimum balance requirements in savings accounts are essential to consider before opening an account and understanding how these requirements work can help you manage your finances effectively and avoid unnecessary charges. Whether you opt for a traditional or a small finance bank, choose an account that aligns with your financial goals. If you are unsure about maintaining a minimum balance, consider opening a savings account with a zero-balance option to keep your funds flexible and accessible.

0 notes

Text

Assignment 8

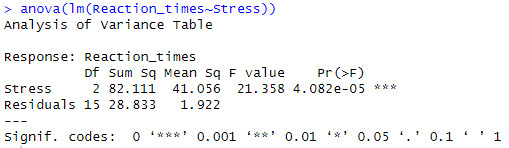

A.

Upon running the ANOVA test in R, for stress levels and drug reaction times, we can see that there are 2 degrees of freedom (as df = N - 1 and there are three variables). The sum of squares (or variation, Sum Sq) is 82.11 between stress groups and 28.83 within stress groups, meaning that reaction times varies more against other stress levels than within the same stress levels. The Mean Square (or average variance, Mean Sq) of reaction time is 41.06 between stress levels and 1.92 within stress levels. The F-Statistic (test statistic of variation within groups vs against groups, F value) is high, meaning that there is more variation in reaction time between stress levels than within stress levels. The p-value (probability of these results occurring by chance, Pr(>F)) is extremely low at 0.00004082, which is significantly lower than a testing value of 0.05. Using this data, we can determine that it is extremely statistically likely that stress levels and drug reaction times are in some way related.

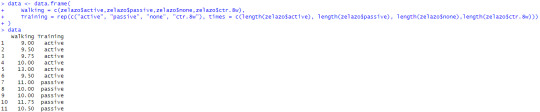

B1.

First, I combined the zelazo data (which I realized halfway through B1 is in fact data from a study cited in the textbook and not seemingly random variables and numbers) under the relevant "Training" and "Walking" columns to prepare it for testing.

Then I gave up trying to calculate a t-test within the data frame I created for the ANOVA test so I just ran it normally.

The negative t-statistic means that the mean of the group of actively trained children is smaller than the mean of the group of passively trained children. Our p-value is greater than 0.05, so we fail to reject that there is a difference between passively and actively trained children.

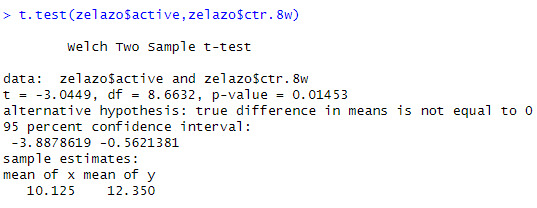

However, when running the t-test comparing the actively trained children to the control group that received no training and only a single test:

There is an even more significant difference in the t-statistic when comparing active and passively trained children. Additionally, the p-value is lower than the significance threshold of 0.05.

It's important to note within the context of the experiment while that the control group (ctr.8w) did not receive any training, they were only tested once throughout the experiment. On the other hand, the "none" group did not receive any training but were repeatedly tested. When testing the active group vs the "none" group, the p-value is 0.094, above a significant value of 0.05.

B2.

I used a one-way ANOVA test on this dataset. Variation between training groups was greater than the variation within stress groups. Our F-statistic is also relatively low, indicating not much variation between groups. Finally, our p-value is 0.1285, surpassing a significance level of both 0.05 and 0.10.

0 notes

Text

More specifically, treasury shares are the portion of shares that a company keeps in its treasury. While outstanding shares of stock are those that can be purchased or sold on the secondary market, treasury shares are those that are held by the company and are not available in the open market. The total number of issued shares is the sum of the outstanding shares and the treasury shares. In the financial landscape, outstanding shares represent the total number of shares a company has issued and is currently held by shareholders. Can Outstanding Shares Change Over Time? Public companies are required to report both Basic and Diluted Shares, which they use in their calculation of Earnings Per Share (EPS). Conversely, the larger a company is, does not necessarily mean it is a better investment. Large companies may be saddled with debt, have limited growth prospects, and a multitude of other problems that come with operating on a larger scale. Helpful Fool Company’s board has elected to issue just 2,000 shares at this time. John, as an investor, would like to calculate the company’s market capitalization and its earnings per share. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. For most companies, the number of authorized shares well exceeds the shares outstanding. Corporations raise money through an initial public offering (IPO) by exchanging equity stakes in the company for financing. The company hasn’t taken action yet; it’s just gotten approval to take action and sell some shares if it chooses to. What Do Business Analysts Do? Key Responsibilities Outstanding shares decrease if the company buys back its shares under a share repurchase program. Outstanding shares provide insights into a company’s size, ownership structure, and market capitalization. The number of outstanding shares affects several key financial metrics and ratios, including earnings per share (EPS) and price-to-earnings (P/E) ratio. A stock split occurs when a company increases its shares outstanding without changing its market cap or value. Can Float Be Higher Than Shares Outstanding? Knowing the difference between authorized shares and outstanding shares is important for calculating important ratios that accurately reflect the financial status and stability of a company. For starters, a company’s market capitalization is determined by multiplying the current market price of one share of the corporation by the total number of outstanding shares. When a company buys back its own shares, that stock is accounted for as “treasury stock” on its balance sheet. Shares Outstanding represent all of the units of ownership issued by a company, excluding any shares repurchased by the issuer (i.e. treasury stock). You can find this figure on stock listings and through stock data providers. However, it is important to double-check that the number only includes shares that have actually been issued by the company. The first step in calculating outstanding shares is to determine the total number of shares issued by the company. This information can usually be found on the company’s financial statements or annual reports. Companies with a market cap of less than $2 billion are considered small-cap. Companies with a market cap of $2 billion to $10 billion are mid-cap, and anything larger than $10 billion is considered large-cap. Large-cap companies are the big ones, such as General Electric (GE), Apple (AAPL), or Starbucks (SBUX). When identifying potential companies for trading opportunities, there are many areas of study, including technical analysis and fundamental analysis. Types of Stocks You Should Know These shares come from a share repurchase program, where the firm buys back shares from the public, or these are shares that were never issued to the public in the first place. The weighted average method doesn’t consider shares that can be potentially created through various mechanisms. As a result, the weighted average shares outstanding calculation of outstanding ...

View On WordPress

0 notes

Text

📝 Guest Post: Yandex develops and open-sources YaFSDP — a tool for faster LLM training and optimized GPU consumption*

New Post has been published on https://thedigitalinsider.com/guest-post-yandex-develops-and-open-sources-yafsdp-a-tool-for-faster-llm-training-and-optimized-gpu-consumption/

📝 Guest Post: Yandex develops and open-sources YaFSDP — a tool for faster LLM training and optimized GPU consumption*

A few weeks ago, Yandex open-sourced the YaFSDP method — a new tool that is designed to dramatically speed up the training of large language models. In this article, Mikhail Khrushchev, the leader of the YandexGPT pre-training team will talk about how you can organize LLM training on a cluster and what issues may arise. He’ll also look at alternative training methods like ZeRO and FSDP and explain how YaFSDP differs from them.

Problems with Training on Multiple GPUs

What are the challenges of distributed LLM training on a cluster with multiple GPUs? To answer this question, let’s first consider training on a single GPU:

We do a forward pass through the network for a new data batch and then calculate loss.

Then we run backpropagation.

The optimizer updates the optimizer states and model weights.

So what changes when we use multiple GPUs? Let’s look at the most straightforward implementation of distributed training on four GPUs (Distributed Data Parallelism):

What’s changed? Now:

Each GPU processes its own chunk of a larger data batch, allowing us to increase the batch size fourfold with the same memory load.

We need to synchronize the GPUs. To do this, we average gradients among GPUs using all_reduce to ensure the weights on different maps are updated synchronously. The all_reduce operation is one of the fastest ways to implement this: it’s available in the NCCL (NVIDIA Collective Communications Library) and supported in the torch.distributed package.

Let’s recall the different communication operations (they are referenced throughout the article):

These are the issues we encounter with those communications:

In all_reduce operations, we send twice as many gradients as there are network parameters. For example, when summing up gradients in fp16 for Llama 70B, we need to send 280 GB of data per iteration between maps. In today’s clusters, this takes quite a lot of time.

Weights, gradients, and optimizer states are duplicated among maps. In mixed precision training, the Llama 70B and the Adam optimizer require over 1 TB of memory, while a regular GPU memory is only 80 GB.

This means the redundant memory load is so massive we can’t even fit a relatively small model into GPU memory, and our training process is severely slowed down due to all these additional operations.

Is there a way to solve these issues? Yes, there are some solutions. Among them, we distinguish a group of Data Parallelism methods that allow full sharding of weights, gradients, and optimizer states. There are three such methods available for Torch: ZeRO, FSDP, and Yandex’s YaFSDP.

ZeRO

In 2019, Microsoft’s DeepSpeed development team published the article ZeRO: Memory Optimizations Toward Training Trillion Parameter Models. The researchers introduced a new memory optimization solution, Zero Redundancy Optimizer (ZeRO), capable of fully partitioning weights, gradients, and optimizer states across all GPUs:

The proposed partitioning is only virtual. During the forward and backward passes, the model processes all parameters as if the data hasn’t been partitioned. The approach that makes this possible is asynchronous gathering of parameters.

Here’s how ZeRO is implemented in the DeepSpeed library when training on the N number of GPUs:

Each parameter is split into N parts, and each part is stored in a separate process memory.

We record the order in which parameters are used during the first iteration, before the optimizer step.

We allocate space for the collected parameters. During each subsequent forward and backward pass, we load parameters asynchronously via all_gather. When a particular module completes its work, we free up memory for this module’s parameters and start loading the next parameters. Computations run in parallel.

During the backward pass, we run reduce_scatter as soon as gradients are calculated.

During the optimizer step, we update only those weights and optimizer parameters that belong to the particular GPU. Incidentally, this speeds up the optimizer step N times!

Here’s how the forward pass would work in ZeRO if we had only one parameter tensor per layer:

The training scheme for a single GPU would look like this:

From the diagram, you can see that:

Communications are now asynchronous. If communications are faster than computations, they don’t interfere with computations or slow down the whole process.

There are now a lot more communications.

The optimizer step takes far less time.

The ZeRO concept implemented in DeepSpeed accelerated the training process for many LLMs, significantly optimizing memory consumption. However, there are some downsides as well:

Many bugs and bottlenecks in the DeepSpeed code.

Ineffective communication on large clusters.

A peculiar principle applies to all collective operations in the NCCL: the less data sent at a time, the less efficient the communications.

Suppose we have N GPUs. Then for all_gather operations, we’ll be able to send no more than 1/N of the total number of parameters at a time. When N is increased, communication efficiency drops.

In DeepSpeed, we run all_gather and reduce_scatter operations for each parameter tensor. In Llama 70B, the regular size of a parameter tensor is 8192 × 8192. So when training on 1024 maps, we can’t send more than 128 KB at a time, which means network utilization is ineffective.

DeepSpeed tried to solve this issue by simultaneously integrating a large number of tensors. Unfortunately, this approach causes many slow GPU memory operations or requires custom implementation of all communications.

As a result, the profile looks something like this (stream 7 represents computations, stream 24 is communications):

Evidently, at increased cluster sizes, DeepSpeed tended to significantly slow down the training process. Is there a better strategy then? In fact, there is one.

The FSDP Era

The Fully Sharded Data Parallelism (FSDP), which now comes built-in with Torch, enjoys active support and is popular with developers.

What’s so great about this new approach? Here are the advantages:

FSDP combines multiple layer parameters into a single FlatParameter that gets split during sharding. This allows for running fast collective communications while sending large volumes of data.

Based on an illustration from the FSDP documentation

FSDP has a more user-friendly interface: — DeepSpeed transforms the entire training pipeline, changing the model and optimizer. — FSDP transforms only the model and sends only the weights and gradients hosted by the process to the optimizer. Because of this, it’s possible to use a custom optimizer without additional setup.

FSDP doesn’t generate as many bugs as DeepSpeed, at least in common use cases.

Dynamic graphs: ZeRO requires that modules are always called in a strictly defined order, otherwise it won’t understand which parameter to load and when. In FSDP, you can use dynamic graphs.

Despite all these advantages, there are also issues that we faced:

FSDP dynamically allocates memory for layers and sometimes requires much more memory than is actually necessary.

During backward passes, we came across a phenomenon that we called the “give-way effect”. The profile below illustrates it:

The first line here is the computation stream, and the other lines represent communication streams. We’ll talk about what streams are a little later.

So what’s happening in the profile? Before the reduce_scatter operation (blue), there are many preparatory computations (small operations under the communications). The small computations run in parallel with the main computation stream, severely slowing down communications. This results in large gaps between communications, and consequently, the same gaps occur in the computation stream.

We tried to overcome these issues, and the solution we’ve come up with is the YaFSDP method.

YaFSDP

In this part, we’ll discuss our development process, delving a bit into how solutions like this can be devised and implemented. There are lots of code references ahead. Keep reading if you want to learn about advanced ways to use Torch.

So the goal we set before ourselves was to ensure that memory consumption is optimized and nothing slows down communications.

Why Save Memory?

That’s a great question. Let’s see what consumes memory during training:

— Weights, gradients, and optimizer states all depend on the number of processes and the amount of memory consumed tends to near zero as the number of processes increases. — Buffers consume constant memory only. — Activations depend on the model size and the number of tokens per process.

It turns out that activations are the only thing taking up memory. And that’s no mistake! For Llama 2 70B with a batch of 8192 tokens and Flash 2, activation storage takes over 110 GB (the number can be significantly reduced, but this is a whole different story).

Activation checkpointing can seriously reduce memory load: for forward passes, we only store activations between transformer blocks, and for backward passes, we recompute them. This saves a lot of memory: you’ll only need 5 GB to store activations. The problem is that the redundant computations take up 25% of the entire training time.

That’s why it makes sense to free up memory to avoid activation checkpointing for as many layers as possible.

In addition, if you have some free memory, efficiency of some communications can be improved.

Buffers

Like FSDP, we decided to shard layers instead of individual parameters — this way, we can maintain efficient communications and avoid duplicate operations. To control memory consumption, we allocated buffers for all required data in advance because we didn’t want the Torch allocator to manage the process.

Here’s how it works: two buffers are allocated for storing intermediate weights and gradients. Each odd layer uses the first buffer, and each even layer uses the second buffer.

This way, the weights from different layers are stored in the same memory. If the layers have the same structure, they’ll always be identical! What’s important is to ensure that when you need layer X, the buffer has the weights for layer X. All parameters will be stored in the corresponding memory chunk in the buffer:

Other than that, the new method is similar to FSDP. Here’s what we’ll need:

Buffers to store shards and gradients in fp32 for the optimizer (because of mixed precision).

A buffer to store the weight shard in half precision (bf16 in our case).

Now we need to set up communications so that:

The forward/backward pass on the layer doesn’t start until the weights of that layer are collected in its buffer.

Before the forward/backward pass on a certain layer is completed, we don’t collect another layer in this layer’s buffer.

The backward pass on the layer doesn’t start until the reduce_scatter operation on the previous layer that uses the same gradient buffer is completed.

The reduce_scatter operation in the buffer doesn’t start until the backward pass on the corresponding layer is completed.

How do we achieve this setup?

Working with Streams

You can use CUDA streams to facilitate concurrent computations and communications.

How is the interaction between CPU and GPU organized in Torch and other frameworks? Kernels (functions executed on the GPU) are loaded from the CPU to the GPU in the order of execution. To avoid downtime due to the CPU, the kernels are loaded ahead of the computations and are executed asynchronously. Within a single stream, kernels are always executed in the order in which they were loaded to the CPU. If we want them to run in parallel, we need to load them to different streams. Note that if kernels in different streams use the same resources, they may fail to run in parallel (remember the “give-way effect” mentioned above) or their executions may be very slow.

To facilitate communication between streams, you can use the “event” primitive (event = torch.cuda.Event() in Torch). We can put an event into a stream (event.record(stream)), and then it’ll be appended to the end of the stream like a microkernel. We can wait for this event in another stream (event.wait(another_stream)), and then this stream will pause until the first stream reaches the event.

We only need two streams to implement this: a computation stream and a communication stream. This is how you can set up the execution to ensure that both conditions 1 and 2 (described above) are met:

In the diagram, bold lines mark event.record() and dotted lines are used for event.wait(). As you can see, the forward pass on the third layer doesn’t start until the all_gather operation on that layer is completed (condition 1). Likewise, the all_gather operation on the third layer won’t start until the forward pass on the first layer that uses the same buffer is completed (condition 2). Since there are no cycles in this scheme, deadlock is impossible.

How can we implement this in Torch? You can use forward_pre_hook, code on the CPU executed before the forward pass, as well as forward_hood, which is executed after the pass:

This way, all the preliminary operations are performed in forward_pre_hook. For more information about hooks, see the documentation.

What’s different for the backward pass? Here, we’ll need to average gradients among processes:

We could try using backward_hook and backward_pre_hook in the same way we used forward_hook and forward_pre_hook:

But there’s a catch: while backward_pre_hook works exactly as anticipated, backward_hook may behave unexpectedly:

— If the module input tensor has at least one tensor that doesn’t pass gradients (for example, the attention mask), backward_hook will run before the backward pass is executed. — Even if all module input tensors pass gradients, there is no guarantee that backward_hook will run after the .grad of all tensors is computed.

So we aren’t satisfied with the initial implementation of backward_hook and need a more reliable solution.

Reliable backward_hook

Why isn’t backward_hook suitable? Let’s take a look at the gradient computation graph for relatively simple operations:

We apply two independent linear layers with Weight 1 and Weight 2 to the input and multiply their outputs.

The gradient computation graph will look like this:

We can see that all operations have their *Backward nodes in this graph. For all weights in the graph, there’s a GradAccum node where the .grad of the parameter is updated. This parameter will then be used by YaFSDP to process the gradient.

Something to note here is that GradAccum is in the leaves of this graph. Curiously, Torch doesn’t guarantee the order of graph traversal. GradAccum of one of the weights can be executed after the gradient leaves this block. Graph execution in Torch is not deterministic and may vary from iteration to iteration.

How do we ensure that the weight gradients are calculated before the backward pass on another layer starts? If we initiate reduce_scatter without making sure this condition is met, it’ll only process a part of the calculated gradients. Trying to work out a solution, we came up with the following schema:

Before each forward pass, the additional steps are carried out:

— We pass all inputs and weight buffers through GateGradFlow, a basic torch.autograd.Function that simply passes unchanged inputs and gradients through itself.

— In layers, we replace parameters with pseudoparameters stored in the weight buffer memory. To do this, we use our custom Narrow function.

What happens on the backward pass:

The gradient for parameters can be assigned in two ways:

— Normally, we’ll assign or add a gradient during the backward Narrow implementation, which is much earlier than when we get to the buffers’ GradAccum. — We can write a custom function for the layers in which we’ll assign gradients without allocating an additional tensor to save memory. Then Narrow will receive “None” instead of a gradient and will do nothing.

With this, we can guarantee that:

— All gradients will be written to the gradient buffer before the backward GateGradFlow execution. — Gradients won’t flow to inputs and then to “backward” of the next layers before the backward GateGradFlow is executed.

This means that the most suitable place for the backward_hook call is in the backward GateGradFlow! At that step, all weight gradients have been calculated and written while a backward pass on other layers hasn’t yet started. Now we have everything we need for concurrent communications and computations in the backward pass.

Overcoming the “Give-Way Effect’

The problem of the “give-way effect” is that several computation operations take place in the communication stream before reduce_scatter. These operations include copying gradients to a different buffer, “pre-divide” of gradients to prevent fp16 overflow (rarely used now), and others.

Here’s what we did:

— We added a separate processing for RMSNorm/LayerNorm. Because these should be processed a little differently in the optimizer, it makes sense to put them into a separate group. There aren’t many such weights, so we collect them once at the start of an iteration and average the gradients at the very end. This eliminated duplicate operations in the “give-way effect”.

— Since there’s no risk of overflow with reduce_scatter in bf16 or fp32, we replaced “pre-divide” with “post-divide”, moving the operation to the very end of the backward pass.

As a result, we got rid of the “give-way effect”, which greatly reduced the downtime in computations:

Restrictions

The YaFSDP method optimizes memory consumption and allows for a significant gain in performance. However, it also has some restrictions:

— You can reach peak performance only if the layers are called so that their corresponding buffers alternate. — We explicitly take into account that, from the optimizer’s point of view, there can be only one group of weights with a large number of parameters.

Test Results

The resulting speed gain in small-batch scenarios exceeds 20%, making YaFSDP a useful tool for fine-turning models.

In Yandex’s pre-trainings, the implementation of YaFSDP along with other memory optimization strategies resulted in a speed gain of 45%.

Now that YaFSDP is open-source, you can check it out and tell us what you think! Please share comments about your experience, and we’d be happy to consider possible pull requests.

*This post was written by Mikhail Khrushchev, the leader of the YandexGPT pre-training team, and originally published here. We thank Yandex for their insights and ongoing support of TheSequence.

#approach#Article#attention#Blue#bugs#cluster#clusters#code#Collective#communication#communications#computation#cpu#CUDA#data#developers#development#documentation#efficiency#flash#Full#gpu#gradients#Graph#how#illustration#insights#interaction#issues#it

0 notes

Photo

Economic activity and social change in the UK, real-time indicators: 25 April 2024

Early data on the UK economy and society. These faster indicators are created using rapid response surveys, novel data sources and innovative methods. These are official statistics in development.

Table of contents

Main points

Latest indicators at a glance

Consumer behaviour

Business and workforce

Energy

Transport

Data

Glossary

Measuring the data

Strengths and limitations

Related links

Cite this statistical bulletin

Main points

Consumer behaviour indicators showed decreased activity in the latest week, with aggregate UK spending on credit and debit cards decreasing by 2% compared with the previous week, while overall retail footfall decreased by 3% (Bank of England CHAPS, MRI OnLocation). Section 3: Consumer behaviour.

The total number of online job adverts on 19 April 2024 was broadly unchanged when compared with the previous week, but 19% below the level seen for the equivalent period of 2023 (Adzuna). Section 4: Business and workforce.

The System Average Price (SAP) of gas increased by 14% in the week to 21 April 2024; this was 20% below the level seen in the equivalent week of 2023 (National Gas Transmission). Section 5: Energy.

Both the daily average number of UK flights and traffic camera activity for cars in London remained broadly unchanged in the week to 21 April 2024 when compared with the previous week (EUROCONTROL, Transport for London). Section 6: Transport.

Consumer behaviour

UK spending on debit and credit cards: weekly, seasonally adjusted CHAPS-based indicator

These data series are real-time indicators for estimating UK spending on credit and debit cards. They track the daily CHAPS payments made by credit and debit card payment processors to around 100 major UK retail corporates. These payments are the proceeds of recent credit and debit card transactions made by customers at their stores, both via physical and online platforms. More information on the indicator is provided in the accompanying Guide to the Bank of England’s UK spending on credit and debit cards experimental data series.

Companies are allocated to one of four categories based on their primary business, we are currently publishing two of those categories:

“delayable” refers to companies selling goods whose purchase could be delayed, such as clothing or furnishings

“staple” refers to companies that sell essential goods that households need to purchase, such as food and utilities

Source: Calculations from the Office for National Statistics and Bank of England

Notes:

Users should note that the weekly payment data show the sum of card transactions processed up to the previous working day, so there is a time lag when compared with real-life events on the chart.

Percentage difference is derived from the current and previous index value before rounding.

Seasonal adjustment and trend estimates are calculated by the Office for National Statistics using data provided by the Bank of England.

Users should note that all series have been re-indexed, using their average value from 2023.

Overall retail footfall in the week to 21 April 2024 decreased by 3% when compared with the level seen in the previous week and decreased by 1% when compared with the level seen in the equivalent week of 2023.

All three location categories saw a decrease in footfall in the latest week. Shopping centre footfall had the largest decrease when compared with the level seen in the previous week, falling by 6%. Meanwhile, high street and retail park footfall also decreased, by 3% and 1%, respectively. When compared with the equivalent week of 2023, shopping centre and high street footfall again decreased, both falling by 2%, while retail park footfall remained broadly unchanged.

Overall retail footfall decreased in 9 of the 12 UK countries and regions when compared with the previous week. The largest decrease occurred in the East of England, falling by 8% of the level seen in the previous week. For the remaining 3 UK countries and regions, overall retail footfall increased in Northern Ireland by 4%, and remained broadly unchanged in Wales and the West Midlands.

When compared with the equivalent period of the previous year, overall retail footfall decreased in 8, increased in 2 and remained broadly unchanged in 2 of the 12 UK countries and regions. The largest decreases were seen in Northern Ireland and Scotland, with both decreasing by 6%.

Download full PDF here: https://www.ons.gov.uk/economy/economicoutputandproductivity/output/bulletins/economicactivityandsocialchangeintheukrealtimeindicators/25april2024/pdf

Source: Contracts Finder licensed under the Open Government Licence v.1.0.

0 notes

Text

Young people who are keen on saving money have closed Huabei and credit cards

Consumer credit, whose penetration rate continues to increase, has become a financial tool to stimulate economic growth. This positive

value has become a consensus.

"Empirical calculations show that after the introduction of consumer financial products, borrowers' consumption amount increases by 16%-30%, and cooperative merchant sales increase by approximately 40%, which can help release potential consumer demand and enhance the role of consumption in driving economic development." National Finance The person in charge of the relevant HE Tuber departments of the State Administration of Supervision and Administration once said.

But on the other side of the coin, consumer credit may also exacerbate irrational excessive consumption—a group of young people are trying to return to rational consumption by closing consumer credit.

Anya, an Internet worker born in 1995, is one of them: "After Huabei closed last year, I saved 80,000 in more than a year, and the goal is to save 300,000 in three years."

She feels that every dollar she earns now is finally hers. She no longer has to pay back Huabei as soon as it arrives, as she did in the past five years, as if she was "working" for Huabei.

The most difficult period was during the summer vacation of her junior year of college in 2018. After the 1,000 yuan for living expenses from her parents arrived, she had to cross out seven or eight hundred yuan before spending it. The only two hundred left was obviously not enough to eat, so Anya had to rely on hunger. solve. She only ate lunch every day and lost 10 pounds in a month. She stayed in this state for more than two months, and it was not until she resumed her part-time job after the holidays that she was able to make ends meet.

"That feeling of being so hungry that I can't sleep at night is something I never want to experience again." Anya sighed.

Anya is not the only one who is "distressed". On Douban and Xiaohongshu, many young people shared that they have closed Huabei, Baitiao, Weilidai, and credit cards, or plan to "close down" after paying off their debts. They call it " Come ashore".

Young people's "interest" in advanced consumption has declined, which can be seen from the number of credit card issuances. The "Overall Payment System Operation in the First Quarter of 2023" released by the Central Bank shows that as of the end of the first quarter of this year, the number of credit cards and debit cards issued in one nationwide The volume was 791 million, a month-on-month decrease of 0.84% and a year-on-year decrease of 1.37%.

At the same time, as of the end of the first quarter of this year, the per capita number of credit cards and debit cards nationwide was 0.56, a decrease of 1.75% month-on-month and a year-on-year decrease of 1.75%.

In addition, according to statistics from some bank financial reports, in 2022, the credit card consumption of 6 banks including Industrial and Commercial Bank of China, Ping An Bank, China Construction Bank, and Minsheng Bank also declined year-on-year, with the declines of both ICBC and Ping An Bank exceeding 10%.

Ping An Bank Financial Report

The consensus among young people is that advanced consumption tools such as Huabei, Baitiao, Weilidai, and credit cards make people lose the concept of money. It is like spending other people's money, and it is easy to "get high" until they are "heavy" in debt or in urgent need of large amounts. When money comes, it’s like waking up from a dream.

This "awakening" may be related to the economic situation. Public data from the National Bureau of Statistics show that in the first quarter of this year, the national average urban surveyed unemployment rate was 5.5%.

Anya observed that it was hard to find a job nowadays, and her colleagues were all saving money. She also prepared a sum of "fuck you money" so that she could have the confidence to turn around and leave when necessary.

For people who are accustomed to spending ahead of schedule and lack self-control, saying goodbye to Huabei and credit cards may be a prerequisite for successful saving.

1. Advanced consumption that makes people “superior”

The monthly salary is 3,000 yuan, but the expenses are 4,000 to 5,000 yuan. This was the situation when Deng Sisi, a post-95 generation, first started working in the hospital three years ago.

She has become accustomed to using Huabei to pay for extra expenses, which also means that after receiving her monthly salary, she has to pay back one or two thousand Huabei, so that she feels that every month she is living tight.

However, she didn’t think there was any problem with it at that time. After all, she had been using Huabei since her freshman year in 2015, and so were her classmates.