#Can crypto wallets be hacked

Text

I’m raising $1,500 until 10/06/2024 for Lawyer Fees / Crypto Recovery. Can you help?

This was all the money in the world to me...please help and God Bless all that donate. AMEN

#please help#photography#tumblr milestone#crypto#gettig even#recovery#crypto recovery services#crypto recovery expert#crypto airdrop#crypto scam#crypto security#scammers#donation scam

12 notes

·

View notes

Video

youtube

Top Features of Coindhan Attracting Investors www.coindhan.com

Ad Posts

Sellers can post ads which set-up specific parameters filtering the entire process. In this way, only the preferred traders can see their ads and interact with them for buying and selling cryptocurrencies.

Bank Transfers

You can directly transfer the crypto profits to your bank account without much hassle. This has made Coindhan one of the best crypto exchanges where you can trade in crypto.

Faster Transactions

Transactions are lightning fast on Coindhan which makes it a preferred crypto exchange to trade cryptos.

Support

Coindhan has a 24*7 and 365 days support model to help crypto traders trade cryptocurrencies with no hassles.

Escrow

Coindhan also has an escrow system that safeguards users since first time P2P traders feel what if we pay to the seller and they do not release the crypto. In such a situation, the exchange intervenes and takes their wallet in custody to pay to the buyer.

Security of Coindhan

These days exchange hacks and bank runs have triggered a panic in the crypto space. Keeping that in mind, Coindhan has introduced 2FA or 2 Factor Authentication which safeguards investors for a memorable trading experience.

Download now :👇 http://onelink.to/9p7sq3

Sign up here:👇 https://www.coindhan.com/signup

Happy trading in a new and better way!📈

79 notes

·

View notes

Note

Don't tell anyone, but Io's secret attack is saying "Can anyone help me? My crypto wallet got hacked!" and summoning a legion of bots to fight for them.

I think anyone who's been around Io for more than two minutes knows in their heart of hearts that Io's a spam bot

16 notes

·

View notes

Text

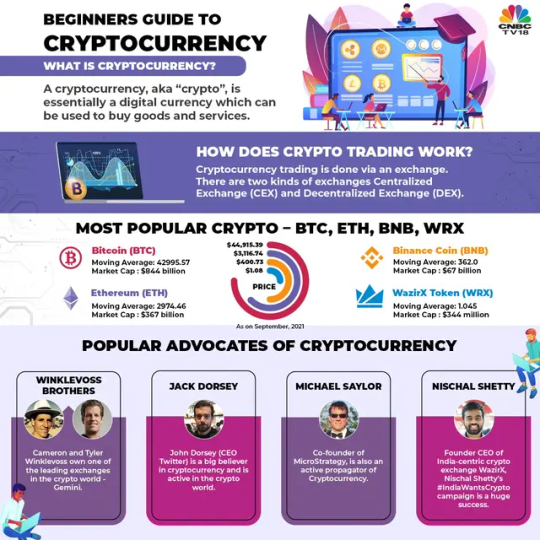

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

5 notes

·

View notes

Text

Cryptocurrency has always made a ripe target for theft—and not just hacking, but the old-fashioned, up-close-and-personal kind, too. Given that it can be irreversibly transferred in seconds with little more than a password, it's perhaps no surprise that thieves have occasionally sought to steal crypto in home-invasion burglaries and even kidnappings. But rarely do those thieves leave a trail of violence in their wake as disturbing as that of one recent, ruthless, and particularly prolific gang of crypto extortionists.

The United States Justice Department earlier this week announced the conviction of Remy Ra St. Felix, a 24-year-old Florida man who led a group of men behind a violent crime spree designed to compel victims to hand over access to their cryptocurrency savings. That announcement and the criminal complaint laying out charges against St. Felix focused largely on a single theft of cryptocurrency from an elderly North Carolina couple, whose home St. Felix and one of his accomplices broke into before physically assaulting the two victims—both in their seventies—and forcing them to transfer more than $150,000 in Bitcoin and Ether to the thieves' crypto wallets.

In fact, that six-figure sum appears to have been the gang’s only confirmed haul from its physical crypto thefts—although the burglars and their associates made millions in total, mostly through more traditional crypto hacking as well as stealing other assets. A deeper look into court documents from the St. Felix case, however, reveals that the relatively small profit St. Felix’s gang made from its burglaries doesn’t capture the full scope of the harm they inflicted: In total, those court filings and DOJ officials describe how more than a dozen convicted and alleged members of the crypto-focused gang broke into the homes of 11 victims, carrying out a brutal spree of armed robberies, death threats, beatings, torture sessions, and even one kidnapping in a campaign that spanned four US states.

In court documents, prosecutors say the men—working in pairs or small teams—threatened to cut toes or genitalia off of one victim, kidnapped and discussed killing another, and planned to threaten another victim’s child as leverage. Prosecutors also describe disturbing torture tactics: how the men inserted sharp objects under one victim's fingernails and burned another with a hot iron, all in an effort to coerce their targets to hand over the devices and passwords necessary to transfer their crypto holdings.

“The victims in this case suffered a horrible, painful experience that no citizen should have to endure,” Sandra Hairston, a US attorney for the Middle District of North Carolina who prosecuted St. Felix’s case, wrote in the Justice Department's announcement of St. Felix's conviction. “The defendant and his coconspirators acted purely out of greed and callously terrorized those they targeted."

The serial extortion spree is almost certainly the worst of its kind ever to be prosecuted in the US, says Jameson Lopp, the cofounder and chief security officer of Casa, a cryptocurrency-focused physical security firm, who has tracked physical attacks designed to steal cryptocurrency going back as far as 2014. “As far as I'm aware, this is the first case where it was confirmed that the same group of people went around and basically carried out home invasions on a variety of different victims,” Lopp says.

Lopp notes, nonetheless, that this kind of crime spree is more than a one-off. He has learned of other similar attempts at physical theft of cryptocurrency in just the past month that have escaped public reporting—he says the victims in those cases asked him not to share details—and suggests that in-person crypto extortion may be on the rise as thieves realize the attraction of crypto as a highly valuable and instantly transportable target for theft. “Crypto, as this highly liquid bearer asset, completely changes the incentives of doing something like a home invasion," Lopp says, “or even kidnapping and extortion and ransom.”

4 notes

·

View notes

Text

How to Vet Crypto Services: Ensuring Safety and Reliability

In the ever-evolving world of cryptocurrencies, ensuring the safety and reliability of the services you use is paramount. With numerous platforms and services popping up, it's easy to fall prey to scams or unreliable providers. This guide will help you navigate the process of vetting crypto services to safeguard your investments.

Understand the Service

First, identify the type of service you're evaluating. Is it an exchange, a wallet, a DeFi platform, or another kind of service? Each type has its own set of standards and requirements. Research the service's reputation by looking for reviews and feedback from reputable sources. Platforms like Reddit, Twitter, and specialized crypto forums can provide insights into the experiences of other users. A reliable service will be transparent about its team, location, and regulatory status. Check the "About Us" section on their website and verify the information provided.

Security Measures

Ensure the service employs up-to-date encryption and robust security protocols. This includes secure SSL connections and advanced security measures to protect your data. Two-Factor Authentication (2FA) should be a standard feature for any credible service, adding an extra layer of security to your account. For exchanges, verify that they store the majority of funds in cold storage, significantly reducing the risk of hacks.

Regulation and Compliance

Check if the service is licensed and regulated by relevant authorities. Regulatory compliance is a strong indicator of a service's legitimacy. Know Your Customer (KYC) and Anti-Money Laundering (AML) policies are essential for regulatory compliance. These policies help prevent fraudulent activities and ensure the service is operating within legal boundaries.

User Experience and Customer Support

The platform should be user-friendly and intuitive. A complex interface can lead to mistakes and a poor user experience. Test the responsiveness and helpfulness of their customer service. A reliable service will offer prompt and effective support.

Financial Stability

Research the service’s financial backers and funding sources. Well-funded services with reputable backers are generally more reliable. Some services offer insurance for user funds in case of breaches. This added security can provide peace of mind.

Community Feedback

Engage with the community on platforms like Reddit, Twitter, and specialized crypto forums. Community feedback can provide valuable insights into the reliability of the service. Review sites like Trustpilot or industry-specific review sites can offer additional perspectives on the service's performance.

Red Flags to Watch Out For

Be wary of services that withhold crucial information. Transparency is key to building trust. Avoid services that promise guaranteed returns or seem too good to be true. These are often signs of scams. Pay attention to any negative news or past incidents involving the service. A history of issues can be a major red flag.

Conclusion

Vetting crypto services is a critical step in safeguarding your investments. By conducting thorough research and being vigilant about potential red flags, you can avoid unreliable providers and make informed decisions.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#CryptoSafety#VettingCryptoServices#CryptoSecurity#Bitcoin#CryptoTips#FinancialFreedom#Blockchain#CryptoEducation#CryptoCommunity#CryptoInvesting#DigitalCurrency#CryptoRegulation#CryptoNews#CryptoAdvice#UnpluggedFinancial#financial education#financial empowerment#financial experts#cryptocurrency#finance#globaleconomy

3 notes

·

View notes

Text

Exploring The Advantages Of A Decentralized Crypto Wallet

Crypto currency has brought about a plethora of options for storing and managing digital assets in the realm of digital finance. Among these options, decentralized crypto wallets have gained significant popularity owing to their unique advantages and user-centric features. In this article, we will explore the advantages of using a decentralized crypto wallet and why it is becoming the preferred choice for many crypto enthusiasts.

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet, also known as a non custodial wallet crypto, is different from traditional online crypto wallets in one fundamental aspect: control. Unlike custodial wallets, where a third party holds the user's private keys and, hence, control over their funds, decentralized wallets empower users with complete control over their digital assets. This means that users are solely responsible for safeguarding their private keys and managing their funds securely.

Advantages of a Decentralized Crypto Wallet:

1. Enhanced Security:

One of the primary advantages of decentralized crypto wallets is enhanced security. As they eliminate the need to entrust private keys to a centralized entity, users mitigate the risk of potential hacks or security breaches. With complete control over their private keys, users can rest assured knowing that their funds are protected against unauthorized access.

2. Sovereignty and Control:

Decentralized wallets embody the core ethos of cryptocurrency - decentralization. Users retain sovereignty and complete control over their funds, free from the constraints of centralized intermediaries. This autonomy aligns with the foundational principles of blockchain technology, fostering trust and transparency within the ecosystem.

3. Flexibility and Compatibility:

Many decentralized wallets, such as The Connecter's Multichain Crypto Wallet, offer support for multiple blockchain networks. This versatility enables users to manage a diverse range of digital assets from a single interface, streamlining the user experience and eliminating the need for multiple wallets.

4. Privacy Protection:

Decentralized wallets prioritize user privacy by minimizing the collection of personal information. Unlike centralized exchanges or custodial wallets that may require extensive KYC (Know Your Customer) verification processes, decentralized wallets offer a level of anonymity that appeals to privacy-conscious users.

5. Access Anytime, Anywhere:

With decentralized wallets, users are not bound by geographical limitations or reliance on third-party services. As long as users have access to the internet, they can manage their digital assets anytime, anywhere, without being subject to downtime or service interruptions.

In conclusion, decentralized crypto wallets offer a host of advantages that cater to the evolving needs of cryptocurrency users. From enhanced security and privacy protection to sovereignty and compatibility, these wallets embody the principles of decentralization while providing a user-friendly experience. As the digital asset landscape continues to evolve, decentralized wallets, such as The Connecter's multichain crypto wallet, stand at the forefront of innovation, empowering users with control, security, and flexibility in managing their digital assets. For more information visit the website: https://www.theconnecter.io/.

#Online Crypto Wallet#Multichain Crypto Wallet#Decentralized Crypto Wallet#Non Custodial Wallet Crypto

2 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

Coino Live: the best crypto and bitcoin payment gateway

In the ever-evolving world of digital transactions, Coino Live has emerged as a game-changer. This reportage post delves into the innovative features and potential impact of Coino.Live, a platform that aims to revolutionize the way we conduct online transactions.

1. The Rise of Cryptocurrencies:

Coino.Live is at the forefront of the cryptocurrency revolution. As digital currencies gain popularity, Coino.Live provides a secure and user-friendly platform for individuals and businesses to transact using cryptocurrencies. With its intuitive interface and robust security measures, Coino.Live is bridging the gap between traditional financial systems and the world of digital currencies.

2. Decentralization and Transparency:

One of the key features of Coino.Live is its decentralized nature. By utilizing blockchain technology, Coino.Live ensures transparency and immutability of transactions. This eliminates the need for intermediaries, such as banks, and empowers users with full control over their funds. The decentralized nature of Coino.Live also enhances security, as it significantly reduces the risk of fraud and hacking.

3. Seamless Integration:

Coino.Live offers seamless integration with various digital wallets and cryptocurrency exchanges. This allows users to easily manage their digital assets and conduct transactions within the platform. The user-friendly interface makes it accessible to both experienced cryptocurrency enthusiasts and newcomers to the digital currency space.

4. Global Accessibility:

Coino.Live breaks down geographical barriers by enabling users to transact globally without the need for traditional currency conversions. With its support for multiple cryptocurrencies, Coino.Live provides a universal platform for individuals and businesses to engage in cross-border transactions. This opens up new opportunities for international trade and commerce.

5. Empowering Businesses:

Coino.Live empowers businesses by offering them a secure and efficient platform to accept cryptocurrency payments. By integrating Coino.Live into their payment systems, businesses can tap into a growing market of cryptocurrency users, expanding their customer base and potentially reducing transaction fees. This flexibility and adaptability make Coino.Live an attractive option for forward-thinking businesses.

Conclusion:

Coino.Live is leading the charge in transforming the future of digital transactions. With its decentralized approach, seamless integration, and global accessibility, the platform is revolutionizing the way we transact online. By embracing the power of cryptocurrencies and blockchain technology, Coino.Live is empowering individuals and businesses to transact securely, efficiently, and globally. As the world continues to embrace digital currencies, Coino.Live is poised to play a significant role in shaping the future of financial transactions.

2 notes

·

View notes

Note

Modern Doppel-Gang absolutely pull heists like stealing NFTs and ransoming them back to their owners, stealing people’s bitcoin wallets, and just hacking people who pull crypto scams to steal their money and use it to buy Gwen things.

🙌🙌🙌🙌🙌🙌🙌 YES!!!! ALL OF THIS!!!! oh my god that means one of them has to really get into tech, and i think that honour should go to ludlow. turns out the prince from the past can fucking HACK 😎

10 notes

·

View notes

Link

4 notes

·

View notes

Text

A Guide to Crypto Exchange Types

Cryptocurrency exchanges are becoming increasingly popular, but keeping up with the different types of exchanges and how they work can be difficult. In this blog post, we will break down the various types of crypto exchange so that you can make an informed decision when choosing the right one for your needs.

Centralized Exchanges (CEX)

Centralized Exchanges (CEX) are the most common type of cryptocurrency exchange in existence today. CEXs are operated by a single entity and offer users the ability to trade coins for fiat currency or other cryptocurrencies. These exchanges typically have high liquidity, meaning that it is easy to buy and sell cryptocurrency quickly on them. Additionally, CEXs usually provide users with access to advanced trading features such as margin trading and stop-loss orders. One downside of CEXs is that they tend to have higher fees than other types of exchanges, which makes them less attractive for traders who want to minimize costs.

Decentralized Exchanges (DEX)

Decentralized Exchanges (DEX) operate differently than their centralized counterparts, as they do not rely on a single entity to manage trades or store funds. Instead, all trades are conducted directly between users without any third-party interference. This ensures that users retain full control over their funds at all times and eliminates the risk of hacking or manipulation by malicious actors. As a result, DEXs tend to have much lower fees than CEXs since no central operator is taking a cut from each transaction. However, DEXs tend to have lower liquidity than CEXs due to their decentralized nature and lack of advanced trading features like margin trading and stop-loss orders.

Hybrid Exchanges

Lastly, Hybrid Exchanges combine elements from both CEXs and DEXs to create an exchange that offers more flexibility and better security than either type alone. Hybrid exchanges use a combination of centralized servers for order matching while also allowing users access to decentralized wallets where their funds remain secure at all times during trades. This allows them to offer more advanced features such as margin trading while still maintaining high levels of user security and privacy that would not be possible with traditional centralized exchanges alone. Additionally, hybrid exchanges often charge lower fees than centralized ones due to the increased efficiency created by combining both types into a single platform.

Conclusion: Whether you are new or experienced investing in cryptocurrency exchanges, knowing which type of exchange best suits your needs is critical to trading successfully in today's digital markets. With its decentralized nature and fast transaction speeds, it’s no wonder why many cryptocurrency investors turn to the best crypto exchange Development Company when buying and selling digital assets on the blockchain network. Centralized exchanges offer more liquidity but come with higher fees; Decentralized exchanges provide more security but are associated with less liquidity; hybrid exchange combines elements from both systems for maximum flexibility and security; so choose wisely! With these tips, you should be able to make an informed decision about what type of crypto exchange is right for you!

2 notes

·

View notes

Text

Cryptocurrencies like Bitcoin and Ethereum have dramatically increased in value, with even a single Bitcoin now worth tens of thousands of dollars. Since these virtual currencies have become so valuable, owners must ensure they have access to all of the coins they own. Crypto Recovery Expert Services and Solutions. Recover cryptocurrency from fraudulent investment platforms

Many people don’t know how to recover lost or stolen crypto funds. We offer the best crypto recovery service and how to make non spendable funds spendable. also you can find the best private key finder software or tools in 2022. With present improvement in technology we stay ahead and bring about reclamation of stolen crypto and how to unlock blocked crypto wallets. How to generate the private key of any crypto address and how to recover cryptocurrency from fraudulent investment platforms.

https://www.cryptoreclaimfraud.com

#Bitcoin#crypto#scammers#dating fraud#investment#forexmarket#forexeducation#forexprofit#ponzi scheme#crypto assets#recovery seed#blockchain#coinbase#coinmarketcap#coingecko#exchange#etherium#free usdt#recovery fund#trust wallet#private keys#shibainu#romance#hacking#coding

5 notes

·

View notes

Text

The paramilitary group Rusich is one of multiple Russian far-right and neo-Nazi organizations that have fought in the war in Ukraine. Because it’s not an official part of the Russian Armed Forces, Rusich has had to find alternative ways of funding its members’ military equipment and medical needs — and has found the perfect solution in cryptocurrency. Meduza special correspondent Lilia Yapparova explains how Russian white supremacists have used the blockchain Ethereum to siphon money from a Ukrainian charity foundation — and how they’ve encouraged other Russian fighters to use crypto to extort money from the families of murdered POWs.

I strongly encourage reading this article (and subscribing to and supporting Meduza in general obvi)

Mercenaries turned hackers

The logo of the Ukrainian charity foundation Happy New Life depicts two hands opening towards the sky, a “tree of life” growing out of them. On its website, donors can send money to support the Ukrainian Armed Forces, provide aid to refugees, and even assist victims in the case of “radiation contamination in Europe” — a potential consequence of Russia's occupation of the Zaporizhzhia Nuclear Power Plant, the site explains.

The foundation, created in June 2022, was an outgrowth of a volunteer initiative from Dnipro, its director, Daniel Ovcharenko, told Meduza. And to give the organization "at least some kind of [online] face,” he said, its creators made a “very inexpensive” website for it. The site shows pictures of Ukrainian children and soldiers along with a call to action: “Today, we’re fighting against a terrorist state. And our victory will be the victory of the entire civilized world… Sometimes lighting a candle is enough to overpower the darkness.” The other half of the screen shows large “Donate” button.”

But Meduza has learned that at least a portion of the money donated through the site has gone not to Ukrainian causes but to the Russian paramilitary group Rusich — a detachment of neo-Nazis fighting in Ukraine on the side of the Russian army. At the very least, that’s who owns the cryptocurrency wallet listed as a donation method on the Happy New Life site, according to financial investigator Artem Irgebaev, who has thoroughly examined Rusich’s network of crypto accounts.

Rusich is known for its brutality. It leader, neo-Nazi Alexey Milchakov, has been photographed next to the mutilated bodies of Ukrainian soldiers, and the detachment’s Telegram channel has called for the torture of Ukrainian POWs and the murder of civilians.

Happy New Life founder Daniel Ovcharenko doesn’t know how the address for Rusich's crypto wallet got on the foundation’s site; according to him, a link to the charity’s own wallet used to be in the same spot on the homepage.

“I got the wallet that the foundation uses from [the cryptocurrency wallet software] MetaMask — and it’s completely different, except that the first three characters are the same [as the address of Rusich's wallet],” Ovcharenko told Meduza. He admitted that he himself had very little involvement with the site, and that he “didn’t double check the digits in the address [listed on its homepage].”

At some point, Rusich managed to hack into the Happy New Life site and switch out the crypto wallet link, Irgebaev told Meduza.

“A similar thing happened with a site that sold proxy servers, where one of the payment methods was crypto. An attacker replaced the site owner’s [crypto wallet] address with his own, and the site then worked like that for two days: people sent money not to the person selling servers, but to the hacker,” he explained. “Internet scammers do this regularly. And Rusich, it’s becoming clear, is a group with wide-ranging ‘talents’ — they have both mercenaries and hackers.”

The Rusich crypto wallet linked on the Happy New Life site is still receiving deposits. According to Etherscan.io, a website that catalogs Ethereum blockchain transactions, the wallet contains more than $7,000 with the current exchange rate.

Funding body armor through cybercrime

In late July, financial investigator Artem Irgebaev downloaded a game called Synthetik: Legion Rising from a torrent website.

“My friends and I downloaded this ancient shooting game [Editor's note: the game came out in 2018] that was 700 megabytes, and we noticed that [after the torrent file downloaded on our computers, they started exhibiting] this sort of unhealthy behavior,” Irgebaev said. “We shut off the Internet and started digging to find out what kind of malware this was and what it was doing.”

The program didn’t steal any passwords, nor did it try to hijack their accounts. But upon closer inspection, Irgebaev “found several crypto wallet addresses directly in binary code.” It became clear that his device had been infected by something called clipboard malware that was built to steal cryptocurrency:

Here’s how it looks to the victim. Let’s say you want to send money to your friend. Entering his 32-character crypto wallet address is a tedious task, so you just copy it from your notes [to paste it] straight into your wallet or exchange account. The address goes onto your clipboard, and at that moment, the malware replaces it with the attackers’ address. Then, instead of going to the person the user intended, the money goes to the scammers.

Irgebaev gave Meduza the addresses found in the malware’s code. Both of them appear on lists of addresses associated with clipboard malware on the sites Bitcoinabuse.com and Checkbitcoinaddress.com, where people can post complaints about crypto wallets used by hackers and blackmailers.

But according to Irgebaev, the malware that infected his computer also had another function: it automatically installed cryptocurrency mining software on the infected device. “And the victim’s computer would start mining crypto,” he said.

Irgebaev stressed that at first, the malware didn’t surprise him: “It’s a standard scam. Nothing stood out.” But out of curiosity, he decided to Google the crypto wallet addresses contained in the code. That’s how he learned that they belonged not to run-of-the-mill hackers, but to the Russian neo-Nazi paramilitary group Rusich.

“[When I Googled the addresses], I immediately saw Telegram posts from Z (Editor’s note: pro-war) channels where users were soliciting donations for uniforms and gear for members of the pro-war activist group Rusich,” Irgebaev said. “Before, I thought that Russian hackers were focused on interfering in American elections. But as it turned out, this clipboard malware was a way of raising money for body armor.”

The funds sent to the paramilitary group’s crypto wallet are indeed used to fund combat equipment for Rusich fighters, who were seen on the Ukrainian front in April 2022. (By September, five crypto wallets belonging to the group came under U.S. sanctions.)

According to the group’s own Telegram channel, since the start of the full-scale war in Ukraine, Rusich fighters have “worked” in the Kharkiv region, including in the village of Dovhenke, where they reportedly suffered serious losses (likely in July 2022). Later, in August, the group attacked the village of Marinka in the Donetsk region; the same month, multiple Rusich fighters were injured in combat in Zaporizhzhia. In October, the group posted a video on social media that showed its fighters firing on a Ukrainian evacuation brigade as it rushed to a medical vehicle.

Neo-Nazis on the dark web

The malware used by Rusich infected Irgebaev's computer after he downloaded a torrent file. That meant the paramilitary group must have had the necessary skills not only to built the program itself, but also to embed it in the file — in other words, the group had managed to gain access to the site with the torrest catalog.

However, Irgebaev told Meduza, planting the malware on the site may not have taken much technical expertise at all: the most likely explanation was that the neo-Nazis had paid professional cybercriminals to do the job for them.

This is called cybercrime as a service: every step of the crime consists of a service that can be purchased.

First, you buy access to the program you need on a shadow forum. Malware is usually something people rent — for example, $200 for a monthly subscription.

And to ensure that potential victims install the software, you can just pay the torrent catalog owner to add the malicious code to their torrents.

On the dark web, Rusich established relationships not only with hackers but also with drug traffickers — and, according to the group’s crypto wallets, they did deals with them as well.

“Between July and October 2022, the [Rusich] Sabotage and Assault Reconnaissance Group received $1,787 from three separate shadow marketplaces for drugs,” Irgebaev said.

The vendors or administrators of these dark web platforms may also have fallen victim to the malware distributed by Rusich — or they may have just paid for the group's services, according to Irgebaev. (Meduza has not found evidence that Rusich fighters were hired by these drug dealers.)

But there’s also another possibility: the entities who sent money to Rusich may have used the drug marketplaces to anonymize their transactions.

“Dark web stores act as large [money] laundering [schemes],” Irgebaev explained. “Upon registering, users receive personal accounts that they can deposit money into — but inside of the shop, transactions are done not with cryptocurrency, but with the platform’s internal currency. So the transactions themselves between clients and sellers are not visible in the blockchain; you can determine that money went into the marketplace, but it’s impossible to track where it went from there.”

That’s why Irgebaev knows the amounts Rusich received from the dark web stores, but not who sent the money.

Rusich itself also made purchases on the dark web, though not large ones. “An offering to the mephedrone demon, probably,” said Irgebaev. “The amount they spent will buy you a gram of something.”

$160,000 of ‘donations’

Large sums of money are constantly passing through Rusich’s crypto wallets. According to Irgebaev, the paramilitary group has received about $1,100 from mining, though it’s unclear whether the crypto was mined using servers that belong to the neo-Nazis themselves or with mining software planted on computers belonging to malware victims.

Rusich has received more than $160,000 through direct transactions to its crypto wallets. In its official fundraising announcements, the group shares the addresses of the same wallets it uses for hacking. According to Irgebaev, however, it’s quite possible that all of the money has come from malware and that none of it was willingly donated. This includes:

A total of 27.895704431 ETH (more than $45,000) was sent to Rusich's wallet on the Ethereum blockchain over the course of 146 transactions, with an average “donation” of more than $300;

A total of 2.26113377 BTC (more than $47,000) was sent to Rusich’s wallet on the Bitcoin blockchain over the course of 433 transactions, with an average “donation” of about $108;

51.811099906 ETC (about $1,228) was sent to Rusich’s wallet on the Ethereum Classic blockchain, with an average “donation” of about $1,228;

20,142.378595 USDC (more than $20,000) was sent to Rusich’s wallet on the USD Coin blockchain, with an average donation of $5,000;

And 51,000 USDT (about $51,000) was sent to Rusich’s wallet on the Ethereum blockchain over the course of 49 transactions, with an average “donation” of more than $1,000.

The scale of these transactions, and especially the sizes of the average individual deposits, led Irgebaev to suspect that they weren’t just casual contributions from Telegram users who encountered Rusich's calls for donations on “patriotic” channels.

“For me, the ‘donations’ of 0.1 bitcoin — which is a little over $2,000 — from addresses that emptied their accounts look quite dubious,” he told Meduza. “In other words, the entire balances of these wallets were sent to Rusich. And the wallets haven't been used since.”

Meduza asked Rusich leader Alexey Milchakov about all of it: the incoming money, the deals with the online drug marketplaces, the hacking of the Ukrainian charity foundation, and the malware that was used to steal cryptocurrency. He confirmed everything:

We have our own IT and finance departments that do indeed perform the operations you asked about. Yes, our IT department’s capabilities include hacking websites and other Internet resources belonging to the enemy, as well as other subversive activities in the information sphere, including work not only against the former so-called “Ukraine” (our work is much broader). And hacking the resource you mentioned [i.e. the Ukrainian charity website] is just the tip of the iceberg. And the department’s employees who have a direct impact on the deaths of the greatest number of people each month, by the way, are awarded very generously.

The finance department handles operations related to cryptocurrency, gemstones, money laundering (only outside of Russia: we respect the laws of our country) and cash-in-transit, including frequent trips to black market businessmen interested in becoming major sponsors (Mexico, Hong Kong, Somali, etc.). Our project receives huge (in our opinion) support from gangs, cartels, and syndicates who are unhappy with the planetary hegemony of the U.S.

Milchakov added that the Russians fighting in Ukraine as part of Rusich may receive donations from online drug dealers, including in the form of painkillers. In Milchakov’s view, the darknet marketplaces are “true patriots of Russia.”

“I personally don’t receive or store the division’s money,” he stressed. “I only decide how it gets spent.”

‘You relish their cries’

Rusich spends the crypto funds it raises on medical treatment for injured fighters as well as on the equipment it needs to keep fighting in the war: Motorola walkie-talkies, helmets, drone jammers, diesel generators, winter uniforms, sleeping bags, sights for anti-tank grenade launchers, stoves, and more.

But since the start of the full-scale war in Ukraine, in addition to using the blockchain for its own purposes, Rusich also started promoting crypto among other Russian soldiers fighting in Ukraine. In September 2022, the group proposed that other Russian formations use bitcoin to extort money from the relatives of Ukrainian POWs.

“Don’t just give up [...] the bodies of POWs [after you kill them],” the group urged on its Telegram channel. “Take a photo where the face is visible, and offer to let the relatives purchase information about their son or husband’s burial location for an amount between $2,000 and $5,000. The money can be sent to a Bitcoin wallet.”

That’s just a small excerpt of the group’s advice for interrogating Ukrainian soldiers; they also instructed Russian fighters to use torture when necessary to extract information from POWs that can later be used to target their families. “Chop off their fingers, cut off an ear, hit them in the groin or around their joints, [or] drive needs under their fingernails,” they wrote on social media. “Don’t be afraid to kill prisoners!”

Rusich fighters have advocated for the murder of civilians as well — for example, if they’ve witnessed Russian soldiers “screwing up.” The neo-Nazis have also called for ethnic cleansing on the occupied territories. “The entire non-white population [...] should be physically destroyed (some of them through scientific experiments),” representatives of the detachment wrote on Telegram. (The post was later deleted.)

Rusich's leaders have made no secret of the fact that they never planned to comply with international humanitarian law. “When you kill a piglet — everyone knows who I mean by ‘piglet’ — you enjoy the fact that his wife is becoming a widow,” Rusich member Yevgeny Rasskazov said in an interview in August. “You relish how they cry out for their whole family, how he’ll come home in a coffin. And you get an erection.”

“When you kill a person, you feel the excitement of the hunt. If you haven’t hunted, try it,” said Rusich leader Alexey Milchakov in an interview published in December 2020. One year and three months later, Russia launched its full-scale invasion of Ukraine.

2 notes

·

View notes

Text

How to Safely Buy Crypto During Market Volatility

Cryptocurrency markets are known for their volatility, making it both an exciting and daunting space for investors. If you’re looking to buy crypto during these turbulent times, it’s crucial to approach the market with caution and a well-thought-out strategy. Here’s a guide to help you navigate buying crypto safely amidst market fluctuations.

What is this Market Volatility?

Market volatility refers to the frequency and extent of price fluctuations in a market. In the cryptocurrency world, volatility can be extreme, with prices of digital assets swinging wildly over short periods. This may present both risks and opportunities for investors.

Developing a Strategy for Buying Crypto

1. Research and Education

Before making any investment, thorough research is essential. Educate yourself about the specific cryptocurrency you’re interested in. Understand its use case, technology, and market position. Stay updated with news and trends that could affect its price.

2. Set Clear Goals

Determine your investment goals. Are you looking for short-term gains or long-term holdings? Your strategy should align with these goals. Short-term traders might use different tactics compared to long-term investors.

3. Diversify Your Investments

Don’t put all your eggs in one basket. Diversification can help manage risk by spreading your investments across different assets. This way, if one asset underperforms, others might compensate for the losses.

Choosing the Perfect Time to Buy

1. Monitor Market Trends

Keep an eye on market trends and technical indicators. Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help assess the market’s direction.

2. Use Dollar-Cost Averaging (DCA)

Dollar-cost averaging involves buying a fixed amount of cryptocurrency at regular intervals, regardless of the price. This approach helps mitigate the impact of volatility by averaging out the purchase price over time.

3. Avoid Emotional Decisions

Emotional trading can lead to poor decisions. Stick to your strategy and avoid making impulsive buys based on short-term market movements. Panic buying or selling during volatile periods often results in losses.

Selecting the Reliable Platform

1. Choose a Reputable Exchange

Select a well-established and reputable cryptocurrency exchange. Look for platforms with strong security measures, a user-friendly interface, and good customer support. Read reviews and check their regulatory compliance.

2. Enable Security Features

Ensure the exchange you use has robust security features, such as two-factor authentication (2FA), withdrawal whitelist, and encryption.

3. Test the Platform

Before committing significant funds, test the platform with a small amount. This helps you get familiar with its interface and processes while ensuring that it meets your needs.

Risk Management and the Safety Measures

1. Set Stop-Loss and Take-Profit Orders

Stop-loss orders automatically sell your crypto if its price falls below a certain level, limiting potential losses. Take-profit orders sell your crypto when it reaches a specific price, securing your gains.

2. Store Your Assets Securely

Consider using a hardware wallet or other secure storage solutions for your cryptocurrencies. Avoid keeping large amounts on exchanges, as they are vulnerable to hacks and security breaches.

3. Stay Informed

Stay updated with market news and developments. Being informed helps you make better decisions and react quickly to market changes.

Conclusion

Buying crypto during market volatility requires careful planning and strategic execution. By conducting thorough research, diversifying your investments, choosing the right platform, and implementing risk management practices, you can navigate the crypto market more safely.

0 notes

Text

The 6 best hardware wallets for storing cryptocurrencies in 2024

Crypto wallets are divided into two main types: hot and cold ones. Hot wallets are quite popular among novice investors due to the speed of operations and convenience, but their use is associated with a significant risk of hacking or loss of funds. Cold wallets, in turn, are not connected to the Internet, which provides a high level of security and eliminates the possibility of external hacker attacks, making them an attractive option for cryptocurrency owners.

In this article, we take a look at the top 6 hardware wallets in 2024 that are suitable for both experienced users and newcomers to the world of cryptocurrency.

What is a cold wallet?

A cold (hardware) wallet is a type of digital wallet that stores cryptocurrency offline. They differ from hot wallets in that they have no internet connection and therefore sign transactions offline, which provides complete protection from hacker attacks. When a user creates a cold wallet, they need to download an application to manage their funds. The software generates a unique key that can be used to access the wallet. This prevents hackers from accessing the user's funds stored on the hardware device.

However, this prevents hackers from accessing the user's funds stored on the hardware device.

While a hot wallet will be suitable for daily use and small transactions because of its user-friendly interface and ease of use, cold storage should be chosen for larger amounts, and for long-term investments where the funds will stay in one place for a long time. This will eliminate the possibility of hacking and loss of funds.

Cold wallet storage is a great way to keep your funds safe and secure.

Why is it important to have a cold wallet?

High security: you can protect your private key on your cryptocurrency cold wallet. This means that you have full control over access to the wallet, unlike hot storage;

No risk of cyberattacks: a cold wallet is completely offline, so it is basically immune to cyberattacks;

Long-term investment: such wallets are ideal for users with large amounts of cryptocurrencies stored for years;

Easy recovery: in the case of a cold wallet, you get a recovery phrase for 12 to 24 hours. This is a unique phrase that is generated only on the device, so you can use it to recover all your cryptocurrency in case of an incident;

Wide possibilities: you don't need expensive hardware to store your cryptocurrency offline, you can use a piece of paper to back up your private keys.

Best Cold Wallets 2024

Ledger Nano X

Ledger Nano X is a modern hardware wallet model from Ledger, a company that has established itself as one of the foremost companies in the industry. The main feature that distinguishes this wallet from the younger models Ledger Nano S and Ledger Nano S Plus is the presence of Bluetooth technology. This allows you to conduct transactions directly from your smartphone, which is especially appealing to mobile users.

The kit includes Ledger Live Software for checking balances and sending and receiving currency. Ledger supports over 1,800 digital coins and tokens, so you're far from limited to bitcoin. In addition, Ledger Live supports coin staking, where you can earn rewards based on your balance.

Additionally, Ledger Live supports coin staking, where you can earn rewards based on your balance.

The dimensions of this cryptocurrency wallet are 72 mm x 18.6 mm x 11.75 mm, and the weight is only about 34 g. The Ledger Nano X is available in a variety of colors and also contains a 100 mAh lithium ion battery.

KELLIPAL Titan 2.0

The ELLIPAL Pack Titan 2.0 wallet impresses at first sight. In addition to its stylish appearance, this cool wallet boasts advanced protection technology. The ELLIPAL Pack Titan 2.0 offers complete isolation from the mains thanks to Air-Gapped technology, and it also features a 4-inch touchscreen for easy navigation. This is a great option for those who value maximum user comfort and safety. One drawback is the high price tag, but it's fully justified.

The price tag is a bit steep, but it's a great option for those who value maximum comfort and safety.

Ledger Nano S Plus

Ledger Nano S Plus is one of Ledger's best and best-selling cold wallets. For its relatively low price, it offers support for more than 1,800 cryptocurrencies, a proprietary Secure Element chip, and a proprietary OS that guarantees maximum security. In addition, the device allows you to store an unlimited number of coins on your balance. Ledger Nano S is an ideal option for cryptocurrency beginners who want to acquire their first coins.

The Ledger Nano S is the perfect option for those who are new to cryptocurrency.

The Ledger Nano S measures 104mm x 58mm x 5mm and weighs 16.2g. It is made of brushed steel with no dyes or plastic. It is equipped with a 100 mAh capacity battery. The wallet can be connected to your PC and Android smartphone via a cable. The iOS operating system is unfortunately not supported.

The wallet can be connected to your PC and Android smartphone via cable.

Safepal S1

The SafePal S1 cold wallet was launched three years ago, in 2019, backed by major crypto exchange Binance. It supports 19 blockchains and over 10,000 cryptocurrency tokens, including non-functioning tokens (NFTs). SafePal is one of the best cold wallets that aims to provide cryptocurrency customers with a secure, simple and easy-to-use cryptocurrency management solution.

SafePal is one of the best cold wallets out there.

SafePal remains fully functional in temperatures ranging from -4° to 158° F. It features a very powerful 400 mAh battery and a small keyboard with a screen. The device doesn't provide any connectivity options - the device only connects to your computer for recharging. It also has a built-in self-destruct mechanism.

Trezor Model T

The Trezor Model T is Trezoe's flagship hardware wallet that combines high quality with ease of use. Like its main competitor, the Ledger Nano X, the Trezor Model T features a small touchscreen and proprietary firmware that greatly speeds up transfers. The dimensions of the Trezor Model T wallet are 64mm x 39mm x 10mm long, and it weighs about 22g.

The Trezor Model T wallet has a small touchscreen and a proprietary firmware that speeds up the transfer process.

It should be noted that Trezor Model T is characterized by a simple setup process, which will not cause problems even for beginners. Also an important feature of this model is the ability to set the recovery phrase at any time, rather than immediately after starting the device.

Tangem

The Tangem Wallet allows you to store, buy, sell, send, receive and exchange more than 4,000 coins. These include the most popular coins: Bitcoin, Ethereum, Litecoin, Litecoin, Dogecoin, and others. In addition, the model also provides access to DeFi and dApps, which is ideal for power users.

The model also provides access to DeFi and dApps, which is ideal for power users.

The Tangem cold wallet consists of two main components. One component is the wallet's hardware device: two or three physical Tangem cards with an embedded secure element chip, developed in collaboration with Samsung semiconductors, and an NFC antenna. The other component is the Tangem mobile app, available on iOS and Android platforms.

Another component is the Tangem mobile app.

Tangem has a fast-growing, dynamic communication community, a help center and provides 24/7 email support for customers. Moreover, the wallet allows you to connect to DeFi and dApps via WalletConnect. Tangem has a mobile app that serves as an interface to the wallet.

The wallet also has a mobile app that serves as an interface to the wallet.

Conclusion

In conclusion, choosing a cold wallet to store cryptocurrency depends on your needs, experience level, and asset volumes. Cold wallets such as the Ledger Nano X, Trezor Model T or Safepal S1 offer a high level of protection thanks to their standalone operation, minimizing the risks of cyberattacks. These devices are ideal for long-term investors who value security and stability. While hot wallets are convenient for everyday transactions, cold storage becomes an indispensable tool for those who want to maximize the protection of their assets in the world of digital finance.

0 notes