#Candlestick pattern confirmation

Explore tagged Tumblr posts

Text

How to Trade the Three White Soldiers Pattern: Strategies and Examples

Technical analysis offers traders a wide range of candlestick patterns to predict price movements. One of the most reliable and bullish reversal patterns is the Three White Soldiers. This pattern, when used correctly, can signal a strong trend reversal and provide profitable trading opportunities. In this post, we’ll explore what the Three White Soldiers pattern is, how to identify it, and…

#Best strategies to trade the Three White Soldiers pattern#breakout trading patterns#Bullish candlestick pattern#Bullish Reversal Pattern#bullish trend reversal#candlestick chart patterns#Candlestick pattern confirmation#How reliable is the Three White Soldiers candlestick pattern#How to identify Three White Soldiers on a chart#How to trade Three White Soldiers#How to use RSI with Three White Soldiers pattern#Identifying Three White Soldiers#Intraday trading strategy using Three White Soldiers#Japanese candlestick patterns#learn technical analysis#Price Action Trading#Risk Reward Ratio#stock markets#stock trading#Stop Loss Strategy#successful trading#support and resistance zones#technical analysis#Technical analysis candlestick patterns#Three White Soldiers candlestick#Three White Soldiers candlestick pattern in stock trading#Three White Soldiers confirmation#Three White Soldiers pattern#Three White Soldiers pattern example#Three White Soldiers pattern with volume confirmation

0 notes

Text

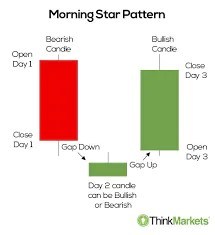

Mastering the Morning Star Pattern: A Step-by-Step Guide

Title: Mastering the Morning Star Pattern: A Step-by-Step Guide Introduction:The world of technical analysis offers traders a plethora of tools to identify potential trend reversals and market opportunities. One such powerful pattern is the Morning Star pattern, a three-candlestick formation that signals a potential bullish reversal after a downtrend. In this step-by-step guide, we will explore…

View On WordPress

#bullish reversal#candlestick patterns#comprehensive trading approach.#confirmation factors#doji candle#downtrend#false signals#market sentiment#momentum shift#Morning Star pattern#position sizing#price action#resistance levels#Risk Management#spinning top#stop-loss#support levels#technical analysis#trading strategy#trading volume#Trend Reversal#volume analysis

0 notes

Text

Bedsheets and Broomsticks

Day 7: the journey continues! Characters inspired by @lumosinlove's Sweater Weather, header by @noots-fic-fests.

Halloween movie #6: Jennifer's Body (2009), because who wouldn't want to hear Finn drop the "I go both ways" line next?

“It makes no sense.” Lily knelt and laid the map out, smoothing the creases with a few careful passes of her hands. The new angle did nothing. Patterns, clues…mystery, inked in dark lines.

The floor creaked beside her. “I dunno,” Remus said nervously. “Maybe that’s the point.”

The middling green of his shirt made him look sickly in the dank, low light of the house. James was still traipsing about the attic above them, no doubt. She had outright refused to even look at the ramshackle stairs leading up. The living room would be just fine, even if wool and tiny hardwood splinters threatened her knees through her thick stockings. She didn’t want to think about how long it had been since this carpet was cleaned.

The map was some sort of parchment, thin and brittle. Remus crouched beside her; Lily drew the candlestick closer, though she was hesitant to bring it near enough to risk any damage.

“I’m just not seeing it,” she murmured. Defeat was bitter and dry in her mouth. “There has to be something I’m missing.”

“The front door is here.” Remus tapped his index finger on the line-break closest to them. “And we’re here.”

“There’s no basement, just the second floor and the attic.”

“And the attic’s marked on the back,” he confirmed, finally sitting with a huff of breath. His knees and elbows cast spider-shadows on the far wall. The cuffs of his khakis were ragged and stained from trudging through the overgrown yard, where tall grass snuck in through the empty first-floor windows.

Lily chewed the inside of her cheek and pushed her headband back to clear her periphery. “Right. Okay. We’re missing the second floor, then.”

“Mhm.”

“So it’s lost.”

Something shifted. A faint mist of plaster puffed down from the ceiling, too close to be movement from the attic. Remus swallowed thickly. “Or it got taken.”

A shout split the gentle groaning of the house.

Lily flinched herself to standing, already reaching for Remus with both hands by the time the first drop of beeswax hit the map’s east corner and bled over the ink. “James!” Remus called as he backpedaled toward the front door. Footsteps pounded overhead—Lily dove for the map, abandoning the candle to its dead wick and wax oozing into the carpet’s tassels.

“Holy shit!” James’ voice echoed down the stairs. He was coming closer, closer, and Sirius was right behind him paws pattering bodies hitting the old walls they were running, coming full tilt at Lily and Remus.

“What is it?” Lily couldn’t breathe, could hardly speak. They tore through the house in a tumbling pile, through the dining room and kitchen and a parlor that stank of water damage.

“I don’t know!” James answered, equally frantic. “Something—it was white, it was near the stairs!”

“I told you not to go up there!”

“I’m sorry, I’m sorry!”

His eyes were massive and blown dark behind his glasses. His hair was a mess. Lily let him grip her elbow and pull her down the hall after the others, past closets and the pitch-black sunroom.

The front door was still open. They just had to make it there.

In and around and out and down—she hopped over miniature staircases that she hadn’t even known were there, over thresholds to rooms that blurred into one another until it felt as if they were running in circles. Secret passages that would have fascinated her an hour ago only sent plaguing terror into her belly. She kept ahold of Remus’ knobbly wrist and tore after them, cursing the light heel of her shoes.

“The yard!” Remus hollered over his shoulder. The dark shadow of Sirius bounded ahead in two long strides, shoving a fallen chair out of their path with a scrabble of paws and a push from one massive shoulder.

The dog vanished out the door, cutting a path through the overgrowth with his body. Lily’s pulse muted any other sound but the one-two-one-two-one-two of her feet searching for purchase on the slanting floor of this endless hall.

One-two-one-two-one-two—

One. Two. Onetwoonetwoonetwoonetwo.

Sirius barked. Her heart tripped over itself. Footsteps, growing loud and close.

Lily planted her heel and wheeled around, already reaching out. For what, she didn’t know.

James was right—the thing was white.

And cottony, when she grabbed it by the face and yanked with every ounce of her strength.

The sheet billowed outward with a startled yelp and a burst of dust. Lily wanted to choke on it, but her lungs refused to do anything but suck in desperate gulps of air.

Severus’ grab for the sheet was futile. He froze. Lily stared.

“Lily!” he wheezed. “It was a joke, I’m sorry, I—”

She dropped the fabric and swung.

Severus hit the ground harder and faster than his stupid fucking bedsheet.

Sirius was sitting in the doorway when she turned again, his head cocked to the side and ears pricked up. He was the perfect height for Remus to bury both hands deep in the dark fur around his neck and hang on against his shock-wobbled legs. Lily narrowed her eyes at him. He blinked big silver eyes at her and whined softly. “Aren’t you supposed to be able to smell the difference between a ghost and a human?”

“You’re amazing,” James breathed.

Lily gave him a quick up-and-down look. “Nice costume, Potter. What are you going as? A dusty corner?”

James’ lopsided smile made her chest tight all over again. “Maybe.”

“You have cobwebs in your hair.”

“Sure.”

“And dust on your nose.”

“Whatever you say, Evans.”

He was ridiculous. And warm, when she threw her arms around his neck and let him dip her back for a kiss that stole her breath away more than any false ghost or skipped step. She twisted one hand in the front of his thick white sweater and the other in the orange cloth tied around his neck. He tilted his chin; the kiss deepened. Lily sighed and let herself melt.

--

Far away, curled up in her bed, Lily rolled onto her other side and buried her nose in the soft place of her husband’s jaw. No dreams could hurt her here.

#lily evans#lily potter#james potter#remus lupin#sirius black#padfoot#sweater weather#vaincre#lumosinlove#my fic#fanfic#fic o'ween 2024

36 notes

·

View notes

Text

Inverted hammer is single candlestick pattern.. we will be looking for buy , only after confirmation candle.

For more join us and learn more :

#forex#forex education#forex expert advisor#forexmentor#forex broker#forex indicators#forex market#forexsignals#forexmastery#crypto#mony mony#make mony online#make money online#money#earn money online#wealth#smart money habits#global market#market strategy#market analysis

4 notes

·

View notes

Text

Hammer Candlestick: Make Reversal Opportunities

In the world of technical analysis, identifying potential market reversals is important for traders seeking to maximize their profits and minimize their losses. One of the most reliable patterns for spotting these reversals is candlestick patterns, especially hammer candlestick

What Is a Hammer Candlestick?

A hammer candlestick pattern is a specific type of candlestick pattern used in technical analysis to indicate a potential reversal in a downtrend. It appears at the bottom of a downward trend and is characterized by a small body at the upper end of the trading range with a long lower shadow. The length of the lower shadow is at least twice the length of the body. This pattern suggests that despite the sellers pushing prices down significantly during the trading period, strong buying pressure drove the prices back up near the opening price by the end of the period, indicating a possible reversal to the upside.

Types of Hammer Candlestick

Hammer Candlestick The hammer candlestick pattern appears at the bottom of a downtrend and is characterized by a small body with a long lower shadow and little to no upper shadow. The lower shadow should be at least twice the length of the body.

Inverted Hammer Candlestick The inverted hammer candlestick pattern also appears at the bottom of a downtrend but is characterized by a small body with a long upper shadow and little to no lower shadow. The upper shadow should be at least twice the length of the body.

Limitations of Hammer Candlestick

Confirmation Required: A hammer candlestick alone does not guarantee a trend reversal. Subsequent bullish price action is needed to validate it.

No Price Target: The pattern does not provide a specific price target for the potential reversal, requiring other tools for determining exit points.

Context-Dependent: The hammer pattern is most reliable at the bottom of a downtrend and may not be valid in other market conditions.

False Signals: In highly volatile markets, hammer patterns can occur frequently without indicating a true reversal.

Additional Indicators Needs: It will be more effective with other technical analysis tools, rather than relying solely on the hammer candlestick.

Learn more: https://finxpdx.com/hammer-candlestick-how-to-spot-reversal-opportunities/

5 notes

·

View notes

Text

Chart Chaser: A Trader’s Obsession with Technical Analysis on MintCFD

In the realm of online trading, a “Chart Chaser” is a trader who relies heavily on technical analysis. These traders obsessively study charts, patterns, and indicators to identify the optimal entry and exit points for their trades. While some traders focus on market news or economic fundamentals, Chart Chasers believe that the key insights lie within the patterns and trends shown in the data itself. For users on MintCFD, adopting the Chart Chaser approach can be rewarding, especially given the wide range of tools and various trading chart patterns available on the platform.

The Allure of Following Trends in Charts

Chart Chasers are drawn to technical analysis because it offers a visual and data-driven way to understand market behavior. By studying price movements, volume, and indicators, they look for recurring patterns, such as Double Bottoms, Head and Shoulders, and Moving Averages, which they believe can predict future price action. With the MintCFD trading app, traders have access to advanced charting tools that make it easy to become a Chart Chaser, allowing for in-depth analysis and strategy development.

Key Tools on the MintCFD Platform for Chart Chasers

MintCFD’s platform is rich with tools tailored for those who take a technical approach. Here are some essentials for the dedicated Chart Chaser:

Real-Time Charting Tools: MintCFD offers detailed, real-time charts that provide instant insights into price movements. For a Chart Chaser, these charts are invaluable as they capture every shift and trend in the market, allowing them to act quickly based on the latest data.

Diverse Chart Patterns: From Candlestick charts to Line charts, MintCFD provides several options, enabling traders to switch between patterns based on their trading style. For instance, Candlestick patterns are often favored by Chart Chasers because they reveal price action in detail, helping traders identify trends and reversals.

Technical Indicators: Popular indicators, such as the RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are available on MintCFD to help Chart Chasers confirm their hypotheses. These indicators can signal overbought or oversold conditions, momentum changes, and potential trend reversals.

Custom Alerts: MintCFD’s alert system lets Chart Chasers set notifications based on specific price movements, helping them act on technical signals even if they’re not actively monitoring their screens. This way, they never miss a crucial trade opportunity based on their analysis.

Benefits and Pitfalls of Being a Chart Chaser

For those who love data, becoming a Chart Chaser offers unique advantages, but it also comes with some potential pitfalls. Here’s how to manage both on the MintCFD Platform:

Benefits: Technical analysis is highly data-driven, meaning decisions are based on objective data rather than emotional responses. By relying on chart patterns and indicators, Chart Chasers can create highly structured strategies with specific entry and exit points. With MintCFD’s intuitive tools, they can continuously refine their methods and explore different indicators.

Pitfalls: Focusing solely on technical analysis can lead to “analysis paralysis,” where a trader over-analyzes and hesitates to act. Additionally, ignoring market news and economic factors may leave a Chart Chaser blind to important influences. MintCFD offers market news and insights alongside technical tools, helping Chart Chasers balance their analysis with a broader context.

Master the Market on MintCFD Trading App: Stop Over-Analyzing and Start Thriving as a Chart Chaser

To succeed as a Chart Chaser without getting caught in a loop of over-analysis, it’s essential to have a plan and set clear criteria for entering and exiting trades. MintCFD’s watchlists and alert systems can help keep track of multiple assets without overwhelming yourself with constant analysis. Having a set of “go-to” indicators and patterns also helps prevent information overload.

Final Thoughts

For traders who thrive on technical data, becoming a Chart Chaser can be an exciting and rewarding journey. MintCFD is an ideal platform for these traders, with its robust charting tools, real-time indicators, and customizable alerts. While it’s easy to get caught up in the details, the best Chart Chasers know when to step back and trust their analysis. By balancing data with a disciplined approach, MintCFD users can make the most of their technical strategies and succeed in the dynamic world of trading.

Take control of your trading journey with the MintCFD Trading App

#mintcfd#cfdtrading#cryptotrading#onlinetrading#tradingstrategy#tradingsignals#forextrading#forexstrategies#cryptoinvesting#stockmarket

2 notes

·

View notes

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

Unlocking Your Edge: Advanced Forex Strategies for Discerning Traders

Published By Smart Securities & Commodities | Jun 23 2025

The Forex market is a dynamic realm, constantly shifting and evolving. While basic strategies can get you started, true success in currency trading often lies in mastering advanced techniques. This blog post dives deep into sophisticated Forex trading strategies designed to give you a genuine, and solidify your position as a serious Forex trader.

Beyond the Basics: Why Advanced Strategies Matter for Forex Success

Many new traders start with fundamental concepts like support and resistance, basic trend following, or simple scalping. While these have their place, they often lack the nuance required for consistent profitability in volatile markets. Advanced strategies, on the other hand, leverage a deeper understanding of market dynamics, technical analysis, and risk management, allowing for more precise entries, exits, and overall better trade management.

Key Advanced Forex Trading Strategies to Master:

Let’s explore some powerful approaches that can elevate your Forex trading performance:

Price Action Trading Mastery: Forget cluttered charts filled with indicators. Price action trading focuses on interpreting raw price movements through candlestick patterns, chart patterns, and supply and demand zones. This allows for a clean, intuitive understanding of market sentiment and potential turning points.

Sophisticated Volatility-Based Strategies: Volatility is a constant in Forex. Instead of fearing it, advanced traders learn to harness it. This includes:

Mean Reversion: Identifying when a currency pair has moved too far from its average and is likely to return. This often involves statistical analysis and tools like Bollinger Bands or Keltner Channels.

Breakout Trading with Confirmation: While basic breakouts are common, advanced traders use multiple confirmation signals (e.g., volume, retests, higher timeframe analysis) to filter out false breakouts and increase the probability of success.

Correlation Trading for Portfolio Diversification: Understanding currency correlations is crucial for managing overall portfolio risk and identifying unique trading opportunities. Advanced traders use both positive and negative correlations to hedge positions or amplify gains.

Practical Steps for Advanced Forex Trading

Continuous Learning & Backtesting: The market is constantly evolving. Dedicate time to studying new strategies, backtesting them rigorously, and adapting your approach.

Robust Risk Management: Even with advanced strategies, risk management remains paramount. Implement strict position sizing, stop-loss orders, and take-profit levels.

Psychological Discipline: Emotional control is a cornerstone of advanced trading. Stick to your trading plan, avoid impulsive decisions, and learn from both wins and losses.

Leverage Technology: Utilize advanced charting platforms, Forex trading software, and data analysis tools to enhance your decision-making.

#bitcoin#crypto#forex#forex indicators#forex market#forex news#forex online trading#forex traders#forexsignals#forexmentor

0 notes

Text

what is the best indicator for trend reversal

🔁 What Makes a Good Reversal Indicator in Forex Trading?

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Introduction

In forex trading, timing the beginning or end of a trend can be a game-changer. While trend-following strategies help traders ride the momentum, identifying a trend reversal allows them to enter early and capture larger price moves. However, spotting reversals is far more challenging than following trends. This is where reversal indicators come into play.

But not all indicators are created equal. Many promise precision but deliver false signals. So what actually makes a good reversal indicator? In this detailed article, we'll explore the critical qualities that define reliable reversal indicators, how they work, and which ones meet these standards. Whether you're a beginner or an experienced trader, understanding these principles will improve your ability to spot and trade reversals confidently.

Why Reversal Indicators Matter

Reversal indicators are technical tools designed to alert traders when the current trend is losing momentum and possibly preparing to change direction. The earlier you can detect a potential reversal, the better your entry point and risk-to-reward ratio.

For example:

In a downtrend, entering long (buy) at the reversal point allows traders to profit as the market turns upward.

In an uptrend, identifying when momentum is fading can help traders short at the top, catching the move down.

Accurate reversal detection is especially critical for:

Swing traders: who aim to catch medium-term movements.

Scalpers: who require pinpoint entries on lower timeframes.

Position traders: who want to avoid entering at the end of a trend.

However, not all reversal signals are worth acting on. That’s why it’s important to understand what makes a reversal indicator trustworthy.

Core Features of a Good Reversal Indicator

Here are the key characteristics that define a reliable reversal indicator in forex trading:

1. Timely Signal Generation

A good reversal indicator provides early signals before or near the beginning of the reversal — not after the price has already moved significantly.

Too early = false signal

Too late = missed opportunity

It must strike the right balance. It should not just lag behind the price but rather react to weakening momentum, divergence, or changes in price structure.

2. High Signal Accuracy

Accuracy is crucial. A good indicator must:

Minimize false signals

Confirm only high-probability setups

This doesn't mean it has a 100% success rate, but the win-to-loss ratio should be favorable when used properly. It should provide clear, unambiguous signals—not constant alerts that leave traders confused.

3. Clarity and Simplicity

An effective reversal indicator is easy to interpret, especially under real-market pressure. Indicators that rely on overly complex calculations or hard-to-read visuals can lead to poor decisions.

Example:

An RSI indicator showing divergence at oversold levels is straightforward.

An exotic oscillator with dozens of settings might confuse traders unless fully mastered.

4. Compatibility with Price Action

Reversal indicators work best when they align with price action principles like:

Support/resistance zones

Candlestick patterns

Trendlines or chart structures

A reversal signal becomes far more reliable when the indicator and price behavior agree.

5. Multi-Timeframe Usefulness

A good reversal tool should function well across different timeframes:

On H4/D1 for swing traders

On M15/M5 for scalpers

It should also align on higher timeframes for better confirmation (e.g., if an indicator shows reversal on H4 and H1, the signal is stronger).

6. Works with Trend & Counter-Trend Trades

While reversal indicators are primarily used to catch tops and bottoms, the best ones can also be used:

For pullback entries during trends (minor reversals)

To confirm trend continuations after fake-outs

This flexibility is a sign of a mature and tested tool.

7. Backtest Proven

The best indicators are not based on hype but data. A good reversal indicator should:

Be backtested on different pairs and conditions

Show consistent performance

Work during ranging and trending markets

Indicators with solid historical performance are more likely to succeed in live environments.

Technical Foundations of Reversal Detection

A reliable reversal indicator often works based on one or more of the following principles:

🔁 1. Momentum Shifts

Indicators like RSI, MACD, and Stochastic Oscillator detect when momentum is fading, often before price turns.

Bearish divergence (price makes higher highs, RSI makes lower highs) indicates weakening bullish momentum.

Bullish divergence (price makes lower lows, RSI makes higher lows) suggests a bullish reversal.

📉 2. Overbought/Oversold Conditions

Oscillators that measure how "stretched" a price is — like RSI and Stochastic — help traders spot points where price is likely to snap back.

Example:

RSI > 70 = overbought → potential sell

RSI < 30 = oversold → potential buy

🧱 3. Break of Market Structure

Indicators that detect support/resistance breakouts or trendline breaks can highlight early reversals. Tools like Fractals, ZigZag, or price structure break alerts are useful here.

📈 4. Volume Confirmation

Volume indicators like On-Balance Volume (OBV) or Volume Spike detectors show whether large traders are entering or exiting positions, signaling potential reversals.

Examples of Good Reversal Indicators

Let’s look at some indicators that meet most of the criteria above:

✅ 1. Relative Strength Index (RSI)

Tracks momentum and overbought/oversold zones.

Works well with divergence for reversal spotting.

Best when combined with price action or support/resistance levels.

✅ 2. MACD (Moving Average Convergence Divergence)

Shows momentum shifts and crossovers.

Divergence between MACD and price is a strong reversal signal.

Smooths out price noise but may lag slightly.

✅ 3. Stochastic Oscillator

Shows where price closes in relation to its range.

Good for catching short-term reversals in ranging markets.

✅ 4. Bollinger Bands

Price touching the outer band (especially with divergence) often leads to reversal.

Bollinger Band Squeeze also predicts breakouts and reversals.

✅ 5. Candlestick Patterns

Not a technical “indicator” in the traditional sense, but very reliable when combined with indicators.

Examples: pin bars, engulfing candles, morning star, doji at support/resistance.

Combining Indicators for Better Accuracy

The best results come not from relying on one indicator, but from combining 2–3 tools that complement each other. For example:

🔁 RSI + MACD + Price Action

RSI divergence → early warning

MACD crossover → momentum confirmation

Bullish engulfing candle → entry signal

🔁 Stochastic + Bollinger Bands + Support/Resistance

Stochastic shows overbought near resistance

Price breaks above outer Bollinger Band

Resistance zone confirms → short trade setup

This confluence method greatly improves reversal accuracy.

Real-Life Scenario Example

Imagine you're trading EUR/USD on the H1 chart.

Price reaches a strong resistance zone.

RSI is above 70 and shows bearish divergence.

MACD histogram starts turning down.

A bearish engulfing candle forms.

This multi-layered setup is a textbook reversal signal.

Backtesting Reversal Indicators

Before using a reversal indicator in live trading, it should be backtested over:

At least 100 trades

Multiple currency pairs

Various timeframes

Track:

Win rate

Average risk-reward

Frequency of signals

Maximum drawdown

This helps verify whether the indicator provides real edge or just looks good on static charts.

Recommended tools:

MT4 strategy tester

Soft4FX simulator

Excel journal tracking

Reversal Indicators to Avoid

Some indicators look good on paper but often fail in live trading due to:

Lagging nature (e.g., MA crossovers give late signals)

Too many false signals (e.g., unfiltered oscillators)

Incompatibility with volatile pairs

Unclear entry/exit rules

Avoid indicators that:

Don’t work across markets

Are repainted (change values after the bar closes)

Are black-box tools without transparency

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex broker#forex online trading#forex education#forex news#forex market#forex factory#forex indicators#forex ea#crypto#digitalcurrency#bitcoin#altcoin#blockchain

1 note

·

View note

Text

Inverted Hammer Pattern Explained: Spot Market Reversals Like a Pro

Are you spotting the right reversal signals in the market?

Understanding candlestick patterns can provide a critical edge in trading, especially when it comes to identifying potential trend reversals. One such pattern is the Inverted Hammer—a powerful single-candle formation that often signals a possible shift from bearish to bullish momentum. However, recognizing it isn’t enough. Traders must understand the psychology behind the candle, its context within a trend, and how to confirm its validity with other indicators.

In our latest article, we break down the Inverted Hammer Pattern in detail: how to spot it, what it really means, and how to use it effectively in your trading strategy.

Start making smarter trading decisions today.

Read the full guide here:

#CandlestickPatterns#TradingForBeginners#InvertedHammer#StockMarket#TechnicalAnalysis#PriceAction#SmartTrading

0 notes

Text

How to read candlestick charts and patterns for better trades?

Candlestick charts are a powerful tool for making better trading decisions. Each candle shows the open, high, low, and close price for a specific time frame. Patterns like Doji, Hammer, Engulfing, and Shooting Star can signal potential reversals or trend continuations.

To read them effectively:

Look for pattern confirmation with volume.

Understand bullish vs. bearish signals.

Combine candlestick analysis with support and resistance levels or indicators like RSI.

Learning to read these patterns takes practice and guided learning. At Empirical Academy, we offer hands-on training in technical analysis, including live candlestick chart reading.

📚 Learn to trade with clarity and confidence. 👉 Enroll now: https://www.empiricalacademy.net

0 notes

Text

EXSR - EA MetaTrader 5

EA Name: EXSR – Extreme Strength Reversal Version: 1.0 Platform: MetaTrader 5 Description: EXSR is a counter‑trend Expert Advisor that hunts for market reversals at points of extreme exhaustion. It combines a high‑threshold RSI (oversold < 20 or overbought > 80) with price breakouts beyond Bollinger Bands (20, ±2) and confirms entry on a reversal candlestick pattern. Key Features: Dual‑Indicator…

0 notes

Text

PCR Ratio vs Other Indicators: Why It Matters in Options Trading

In the world of trading and investing, understanding market sentiment can be just as important as analyzing technical charts or financial statements. One powerful tool traders use for this is the Put Call Ratio, often abbreviated as the PCR Ratio. This indicator plays a crucial role in options trading and can provide insights into potential market direction.

Understanding the Basics of PCR Ratio

The Put Call Ratio is a simple yet effective tool that compares the trading volume of put options to call options. The formula is:

PCR Ratio = Volume of Put Options / Volume of Call Options

This ratio is used to gauge the mood of the market participants—whether they are leaning bearish (put-heavy) or bullish (call-heavy).

A PCR Ratio greater than 1 implies that more puts are being traded than calls, often signaling bearish sentiment.

A PCR Ratio less than 1 indicates that more calls are being bought, typically suggesting bullish sentiment.

A PCR Ratio close to 1 signals a balanced market.

Why the Put Call Ratio Matters

The Put Call Ratio is not just a number. It reflects investor psychology. Many professional traders consider it a contrarian indicator, meaning if the PCR is too high, it might actually signal a potential bullish reversal, as the market may be oversold. On the flip side, a very low PCR could hint that investors are overly optimistic, which could lead to a correction.

How to Interpret PCR Ratio in Real-Time

Let’s say the PCR Ratio is 1.3. This means the number of put options traded is 30% higher than call options. At first glance, it might look like investors are pessimistic. However, if this high ratio is unusual compared to historical averages, traders may interpret this as an opportunity to go long, expecting a rebound.

Conversely, a PCR Ratio of 0.6 might indicate overconfidence in the market. Too many calls could signal a saturated bullish sentiment, suggesting a possible market top.

Use Cases of PCR Ratio in Options Trading

Swing Trading: Traders use changes in the PCR Ratio to identify short-term reversals.

Trend Confirmation: A rising market with a falling PCR could confirm a strong bullish trend.

Risk Management: PCR helps in gauging market mood and planning entry/exit points more precisely.

Nifty or Index Tracking: The Nifty PCR Ratio is often used by institutional traders to forecast index movements.

Limitations of PCR Ratio

While the Put Call Ratio is a powerful tool, it should not be used in isolation. It's best combined with other indicators like RSI, MACD, or candlestick patterns. Additionally, PCR can vary across different sectors and timeframes, so it's important to contextualize its values.

Also, a spike in the PCR Ratio doesn’t always mean the market will move up. If the increase in puts is due to hedging by institutions, it might not be a bearish signal at all.

Final Thoughts

The PCR Ratio is one of the most useful sentiment indicators in options trading. Whether you're a beginner or an experienced trader, incorporating the Put Call Ratio into your trading strategy can offer valuable insights. But like any tool, it works best when used alongside proper research and risk management.

Understanding the balance between puts and calls helps traders decode market psychology, identify possible reversals, and make informed decisions. Keep an eye on the PCR Ratio, and you’ll start to see the hidden story behind market moves.

0 notes

Text

Mastering Intraday Trading: Strategies for Consistent Profits

In today’s fast-paced financial world, traders are increasingly drawn to the potential of intraday trading. The idea of buying and selling stocks within the same day—and turning profits quickly—offers both excitement and opportunity. However, consistent success in intraday trading demands more than intuition. It calls for a well-structured approach, disciplined strategies, and an understanding of market behavior.

If you're looking to dive into Intraday Trading, also known as same day trading, it's essential to build a strong foundation. This style of trading can be highly rewarding, but it’s also one of the most challenging forms of market participation. To thrive, you need to learn intraday trading not just theoretically but through practice, analysis, and strategy refinement.

What is Intraday Trading?

Intraday trading refers to the practice of buying and selling financial instruments within the same trading day. Traders aim to capitalize on small price fluctuations that occur throughout the day. Unlike long-term investors, intraday traders close all positions before the market closes, avoiding overnight risk.

While this method offers the potential for quick returns, it also exposes traders to rapid market movements, which can lead to equally swift losses. That's why mastering intraday trading isn’t just about making trades—it’s about making the right trades consistently.

Key Benefits of Intraday Trading

Before diving into strategies, let’s explore some key benefits that make intraday trading attractive:

Quick returns: Trades are settled the same day, allowing for potential daily profits.

No overnight risk: Positions are squared off before market close, reducing the impact of after-hours news.

Leverage opportunities: Many brokers offer margin trading, enabling traders to amplify their exposure.

Liquidity: Intraday traders often focus on high-volume stocks, ensuring quick entry and exit.

However, with these benefits come significant risks, especially without a disciplined strategy in place.

Core Strategies for Consistent Intraday Profits

Successful intraday trading isn't about luck—it’s about having a game plan. Here are proven strategies that can help increase your chances of consistent profitability:

1. Momentum Trading

This strategy involves identifying stocks that are moving significantly in one direction—either up or down—on high volume. Traders jump into these stocks, ride the momentum for a short time, and exit once signs of reversal appear.

Tip: Use tools like news scanners, pre-market movers, or volume spike alerts to find momentum stocks.

2. Breakout and Breakdown Trading

A breakout occurs when a stock price moves above a defined resistance level. A breakdown is when it falls below support. These levels are often identified through chart patterns or historical price points.

Strategy: Buy when the price breaks above resistance with volume confirmation. Sell (or short) when it breaks below support.

3. Scalping

Scalping is a high-frequency strategy where traders aim to profit from tiny price movements, often entering and exiting trades within minutes—or even seconds.

Requires: Advanced charting tools, ultra-fast execution, and low brokerage fees.

4. Reversal Trading

This strategy involves identifying overbought or oversold conditions and betting on a reversal. Indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are frequently used here.

Caution: Reversal trades carry higher risk and require quick decision-making and strict stop-losses.

5. Gap and Go Strategy

This involves stocks that "gap up" or "gap down" in the morning due to news or earnings reports. Traders enter in the direction of the gap if volume and momentum continue post-opening.

Tools needed: Pre-market scanners and understanding of candlestick formations.

Essential Tools for Intraday Traders

Just like a carpenter needs tools, an intraday trader needs reliable resources. Here are the must-haves:

Real-time data feeds

Advanced charting software (like TradingView or MetaTrader)

Technical indicators such as VWAP, RSI, MACD, and Bollinger Bands

Economic calendar to track major market events and announcements

Pre-market and after-hours stock screeners

Risk Management: Your Key to Survival

Even the best strategies can fail. That’s why risk management is vital for intraday traders. Here's how to keep losses in check:

Use Stop Losses: Always define a stop loss for every trade to cap your downside.

Position Sizing: Never risk more than 1–2% of your trading capital on a single trade.

Daily Loss Limits: Set a maximum daily loss. If you hit it, walk away.

Avoid Overtrading: Don’t chase the market. Stick to your pre-defined setups.

Common Mistakes to Avoid

Intraday trading can tempt even seasoned traders into poor decisions. Steer clear of these common errors:

Trading without a plan

Ignoring volume indicators

Letting emotions guide trades

Revenge trading after a loss

Over-leveraging positions

Awareness of these pitfalls—and building habits to avoid them—can set you apart from the crowd.

Developing the Right Mindset

Trading is as much psychological as it is technical. Successful intraday traders cultivate discipline, patience, and emotional control. Learn to detach from individual trades, focus on long-term consistency, and trust your process.

Mindset tips:

Keep a trading journal.

Review your trades weekly.

Learn from mistakes, but don’t dwell on them.

Celebrate process, not just profits.

Start Small, Scale Smart

If you’re just beginning, start with paper trading or very small positions. Get familiar with your platform, test strategies, and only scale up when your success rate improves. Learning intraday trading takes time—don’t rush the process.

Conclusion

Intraday trading can be a powerful path to financial growth if approached with education, discipline, and the right strategies. By focusing on momentum, managing risks, avoiding emotional pitfalls, and constantly improving your approach, consistent profits are within reach.

Whether you're a beginner or looking to sharpen your trading edge, quality training makes all the difference. At NP Financials, we provide expert-led share trading and intraday trading courses designed to equip you with the tools, techniques, and mindset to trade like a pro. Start your trading journey today—and take control of your financial future.

0 notes

Text

How to Trade Using Candlestick Patterns for Better Trade Decisions

Candlestick patterns are one of the most widely used tools in technical analysis. They provide valuable insights into market sentiment and potential price movements by analyzing the open, close, high, and low of each trading period. By understanding and using candlestick patterns, traders can make more informed decisions, anticipate market reversals, and optimize entry and exit points.

Here’s how you can use candlestick patterns effectively in your trading strategy.

1. What are Candlestick Patterns?

A candlestick pattern is formed by one or more candlesticks that represent price movements within a given timeframe. Each candlestick shows:

Open price: The price at which the asset opened during the time period.

Close price: The price at which the asset closed during the time period.

High price: The highest price reached during the period.

Low price: The lowest price reached during the period.

Candlestick patterns can be either bullish (indicating an upward price movement) or bearish (indicating a downward price movement), depending on the relationship between the open and close prices.

2. Popular Bullish Candlestick Patterns

Bullish candlestick patterns signal potential upward price movement. Here are a few common ones to look out for:

Bullish Engulfing Pattern: This pattern consists of a small bearish candlestick followed by a larger bullish candlestick that completely engulfs the previous one. It indicates strong buying pressure and often signals the beginning of an uptrend.

Hammer: A hammer candlestick has a small body and a long lower shadow, which indicates that sellers tried to push the price lower, but buyers stepped in and drove the price back up. It suggests a potential reversal from a downtrend to an uptrend.

Morning Star: This pattern consists of three candlesticks: a long bearish candlestick, followed by a small-bodied candlestick, and then a long bullish candlestick. The morning star indicates a potential trend reversal from bearish to bullish.

3. Popular Bearish Candlestick Patterns

Bearish candlestick patterns suggest potential downward price movement. Here are a few common bearish patterns to look for:

Bearish Engulfing Pattern: The opposite of the bullish engulfing pattern, the bearish engulfing consists of a small bullish candlestick followed by a larger bearish candlestick that completely engulfs it. This pattern indicates strong selling pressure and often signals the start of a downtrend.

Shooting Star: The shooting star has a small body and a long upper shadow, signaling that buyers tried to push the price higher but were unable to sustain it. This pattern suggests a potential reversal from an uptrend to a downtrend.

Evening Star: The evening star is the opposite of the morning star, consisting of a long bullish candlestick, followed by a small-bodied candlestick, and then a long bearish candlestick. This pattern indicates a potential reversal from bullish to bearish.

4. Using Candlestick Patterns for Entry and Exit

Candlestick patterns can be used to make more informed decisions about when to enter and exit trades:

Entry: When you identify a bullish reversal pattern (like a bullish engulfing or hammer) at support levels, it could be an indication to enter a long position. Similarly, a bearish reversal pattern (like a bearish engulfing or shooting star) at resistance levels could signal a short position.

Exit: Candlestick patterns can also help with determining exit points. For example, if you are in a long position and a bearish reversal pattern (like an evening star) forms near a resistance level, it might be a signal to close your position or set a stop-loss order to protect your profits.

5. Combining Candlestick Patterns with Other Indicators

While candlestick patterns can provide valuable insights, they work best when combined with other technical indicators to confirm the signals. Here are some tools you can use alongside candlestick patterns:

Support and Resistance: Look for candlestick patterns that form at key support or resistance levels. For example, a bullish engulfing pattern at a support level has a higher probability of success.

Moving Averages: Combine candlestick patterns with moving averages (e.g., 50-day or 200-day MA) to confirm the overall trend. A candlestick pattern that aligns with the trend can be more reliable.

RSI (Relative Strength Index): Use RSI to confirm whether an asset is overbought or oversold. A candlestick reversal pattern accompanied by an overbought or oversold condition can strengthen your trade decision.

6. Practice Patience and Wait for Confirmation

Candlestick patterns should never be used in isolation. They work best when you wait for confirmation before entering a trade. For example:

Volume: If a candlestick pattern forms with high volume, it’s a stronger signal. Volume confirmation helps validate the strength of the pattern.

Other Indicators: Look for confirmation from indicators like RSI or moving averages. For example, a bullish engulfing pattern near a moving average support level combined with an RSI showing oversold conditions may provide a more reliable signal.

Waiting for confirmation ensures you’re not jumping into a trade based on an isolated pattern, which could turn out to be a false signal.

Final Thought: Master Candlestick Patterns for Smarter Trading

Candlestick patterns are a powerful tool that can enhance your trading strategy. By understanding and recognizing common bullish and bearish patterns, you can make more informed decisions about entry and exit points, improve timing, and manage risk more effectively.

Ready to trade smarter with expert-backed strategies? Download Univest — the SEBI-registered trading app that helps you identify profitable candlestick patterns, follow expert strategies, and trade with confidence. Stay ahead of the market and improve your trading success.

0 notes

Text

Are Charting Tools Really Helping You or Just Distracting You?

Spend any time in the world of trading and you’ll quickly be introduced to an overwhelming number of charts, graphs, and technical indicators. The colorful candlesticks, moving averages, and oscillators give you the sense that you’re operating with precision—that if you just find the right pattern, success is inevitable.

But for many retail traders, especially those just getting started, charting tools can become less of a guide and more of a trap.

So how do you know if they’re actually helping you trade smarter—or if they’re simply distracting you from what matters?

Let’s explore this question from the perspective of a trader who wants to improve—not impress.

Charting 101: What You’re Actually Looking At

Let’s start by making one thing clear: charting is not the problem. Good charting platforms—Zebu includes one powered by TradingView, for example—can offer incredibly useful insights.

A basic chart shows you the price movement of a stock over time. Candlesticks show open, close, high, and low prices. You can overlay technical indicators like:

Moving Averages (MA) Relative Strength Index (RSI) Bollinger Bands MACD (Moving Average Convergence Divergence) Volume These tools attempt to show you whether a stock is trending, reversing, or losing momentum. They give clues, not guarantees.

Used well, they give structure to what would otherwise be guesswork.

Where It Starts Going Sideways

The trouble begins when you go from a few indicators to... all of them.

You start with RSI. Then you add MACD. Then Fibonacci retracement levels. Then Ichimoku clouds. Before you know it, your chart looks like a complicated cockpit. You’re no longer seeing price—you’re seeing confusion.

This is known as “analysis paralysis.” Too many signals, and you don’t know which one to trust. You hesitate. You overthink. And in trading, that usually means missed opportunities—or worse, bad decisions.

The Illusion of Precision

Here’s the trap: a complex chart feels smarter.

You look at it and think, “Now I’m seeing what the professionals see.” But more often than not, the chart is just reflecting what the stock already did—not what it will do.

Indicators lag. They are based on past price movement. They confirm, not predict.

A stock can still break a key resistance level for no reason you can see on a chart. A company’s earnings surprise can make a perfectly set up pattern irrelevant in seconds.

That doesn’t mean charts are useless. But it does mean they aren’t the crystal balls they’re often sold as.

Ask: What’s the Question You’re Trying to Answer?

Before opening a chart, ask yourself: what am I trying to figure out?

Am I looking for a trend? Am I waiting for a breakout? Am I spotting a reversal? Each of these has a few specific tools that help. That’s it.

You don’t need five indicators to answer one question.

For example:

For trend confirmation? A moving average or two. For momentum? RSI and MACD. For volatility? Bollinger Bands. For volume confirmation? Plain volume bars. Keep it lean. Let the chart serve the question—not the other way around.

Who’s Actually Using the Tool—You or Your Emotions?

It’s easy to convince yourself that you’re doing “technical analysis” when really you’re just scrolling through charts until one makes you feel good about your bias.

You bought a stock. Now you’re scanning for indicators that justify holding. Or you missed a trade and are searching for “proof” that it wasn’t a good setup anyway.

This is a very human impulse—but it’s not analysis. It’s emotional cushioning.

The right way to use a charting tool is before the trade, when your thinking is clear. Not afterward, when you’re defending a position.

Chart Literacy > Chart Obsession

What separates the casual chart-watcher from the skilled trader is the ability to read price action, not just apply layers of tools.

If you can look at a basic candlestick chart and understand:

What buyers and sellers are doing Where momentum shifted How strong the breakout or breakdown is …then you’re already ahead of most traders.

Indicators are meant to support your read—not replace it.

And no matter how advanced a chart looks, it still needs context. News events, earnings reports, sector movements—these aren’t on the chart, but they matter.

Are You Spending More Time Charting or Trading?

Here’s a quick gut check: if you spend 80% of your time adjusting chart settings and only 20% making decisions, something’s off.

Trading is a decision-making sport. Charts are a planning tool. The goal isn’t to design the most visually complex chart. The goal is to make clear, consistent choices.

Many experienced traders set their charts once and rarely change them. Why? Because they’ve figured out which tools give them clarity—and they stick to those.

Try that approach. Pick 2–3 indicators that make sense for your style. Test them. Tune them. Then leave them alone.

Mobile Charting: Convenient, But Still Requires Clarity

Apps like Zebu’s now offer full mobile charting, including advanced indicators and drawing tools. This is a huge shift from a few years ago, where you had to use a desktop.

But just because it’s easy to chart on your phone doesn’t mean you should chart all the time.

Set alerts instead. If a stock crosses a level you care about, let the app tell you. Don’t sit there refreshing RSI every 5 minutes.

Tools are there to reduce emotional friction—not amplify it.

So... Are Charting Tools Worth It?

Yes—if:

You know what you’re looking for You’ve learned the logic behind each tool you use You apply them consistently across trades You’ve seen them work for your style and temperament No—if:

You’re using them to justify impulsive trades You switch tools every week You feel overwhelmed more than informed You spend more time in the tool than using its output A chart is a map. But even the best map is useless if you don’t know where you’re trying to go.

Final Thought: Tools Don't Make You a Trader—Process Does

It’s tempting to think that more screens, more indicators, and more chart overlays will turn you into a sharper, faster trader. But the truth is, trading success is mostly boring.

It’s about discipline. Repetition. Structure. Thoughtful risk.

Charting tools can absolutely be a part of that. But only if they fit your process. Not someone else’s. Not some YouTube strategy with 10 moving parts.

Just yours.

So the next time you stare at a screen full of lines, candles, bands, and colors—pause. Ask what you’re really trying to see. Then remove what you don’t need.

Because often, trading clarity comes not from adding more—but from removing the noise.

Disclaimer :

This blog is meant to provide general information and reflect broad market observations. It doesn’t take into account your specific financial situation or investment needs. Zebu shares this for educational purposes only and doesn’t promise returns or make personal recommendations. Before you act on anything here, it’s always a good idea to talk to a qualified financial advisor.

#zebu#finance#investment#investwisely#financialfreedom#investing#investors#makemoney#investmentgoals#mutual funds

0 notes