#Credit card loan online

Text

Loan on Credit Card - Take a loan against your credit card with Catch Rupee to fulfill your instant financial needs. Apply for a hassle-free personal loan with a credit card online. For more information call us 9765900307/9049900508

#Credit card loan online#Get a loan on credit card#Instant Loan Against Credit Card Online#Loan on Credit Card#Personal Loan on Credit Card#Apply Online for Credit Card Loan#Apply Instant personal loan on credit card

0 notes

Text

Personal loan apply online in Noida

Unlock Financial Flexibility with Our Personal Loan Apply Online in Noida Dreaming of renovating your home or planning a grand celebration but tight on funds? Our Home loan balance transfer services in Noida. With our user-friendly online application, you can easily apply for a personal loan and access the funds you need without any hassle. Whether you're a salaried individual or self-employed, our flexible loan options cater to all. Applying is simple – just fill out our online form, submit the necessary documents, and receive quick approval. Get ready to bring your dreams to life with our Apply for Business loan in Noida. Apply Now: https://finaqo.in/

#Personal loan apply online in Noida#business loan against property apply in noida#personal loan balance transfer online in noida#pre approved personal loan apply online in noida#credit card balance transfer facility in noida#home loan in noida#apply personal loan overdraft facility in noida

2 notes

·

View notes

Text

https://www.gopaisa.com/referral-signup-bonus-code-coupons-offers/banksathi-referral-code-refer-earn

Are you looking for a way to build a rock-solid passive income source with zero investment? Try the BankSathi app! Become a financial advisor using the BankSathi Referral Code (2013012617) and start earning over Rs. 1 Lakh per month by recommending financial products to your friends and family. Click to read full post.

#banksathi#banksathi app#referral code#referral link#referral offer#referral marketing#referral#promo code#finance#money#credit cards#demat accounts#personal loan#earn money#passive income#earn money online

0 notes

Text

Check out this post… "The Ultimate Guide to Spruce Up Your Space & Secure Your Dream Renovation: LoanInsureHub Chronicles Your Bangalore Journey!".

#blogging#blog#credit#credit score#credit cards#home loan#loan#mortgage#personal loans#instant personal loan#online personal loan#commercial#home#real estate

0 notes

Text

Cash Advances and Loans for Gig Workers No Credit Check

Overcoming Financial Challenges: A Comprehensive Guide to Securing Loans and Cash Advances for Gig Workers and Self-Employed Individuals

Introduction

The gig economy has revolutionized the way we work, offering flexibility and autonomy to pursue our passions and entrepreneurial dreams. However, gig workers and self-employed individuals often face unique challenges when seeking financial…

View On WordPress

#1099 contractors#alternative funding options#bank brezzy#BankBreezy#Breezy ConnectCash#business lines of credit#cash advances#cash flow management#co-signed loans#credit unions#direct deposits#emergency funds#employee retention tax credits#financial challenges#financial planning#financial solutions#freelance job marketplaces#gig economy platforms#gig workers#government-backed loans#invoice factoring#invoice financing#loans#no credit check loans#online lending platforms#point-of-sale loans#SBA loans#secured credit cards#Self-Employed#Self-Employed Tax Credit

1 note

·

View note

Text

Need Fast Cash? Discover How CashTodayAsap Can Get You Up To $900 In Minutes!

Bad Credit Loans ($100 - $900)

No Credit Check Loans ($100 - $900)

Cash Loans ($100 - $900)

Online Small Loans ($100 - $900)

$900 Payday Loans

Fast E-Approval In 7 Minutes

Direct Deposit For Immediate Access

Visit & APPLY CLICK HERE

#creditsesame#creditkarma#credit repair#personal loans#no credit check loans#direct payday loan lenders#paydayloan#fast cash loans online#no credit needed#loans#fast cash options#cash loan#credit score#income#credit cards#finances#money#short term cash loans#lendingtree#lending#mint

0 notes

Text

Mobile banking app for Iphone.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank accounts opening#apply for instant loan#instant money loan#bank balance check#instant personal loan#instant account opening bank#apply for credit cards#book train tickets#book flights and hotels

0 notes

Text

SBM Bank Kenya: Streamline Your Finances with Our Mobile Banking App

Access your accounts anytime, anywhere with the SBM Bank Kenya mobile banking app. Seamlessly manage your finances, transfer funds, pay bills, and monitor transactions on-the-go. Navigate your financial journey with our mobile online banking app, featuring a personal loan calculator for Kenyan users. Ideal for businesses, our app offers internet banking services, allowing you to manage your finances anytime, anywhere. Experience seamless banking with our mobile app.

0 notes

Text

CHIME BANK: Experience the Future of Banking with the CHIME Online Checking Account!

youtube

Are you tired of long lines at the bank and hefty fees that eat into your hard-earned money? Welcome to the CHIME Bank - Online Checking Account, designed for the digital age!

#chime bank account#chime bank#chime banking app#no credit check loans online instant approval#chime banking#best online checking account#online banking#chime account#best online bank account#no credit check checking account#how to get a bank account without a credit check#banks for broke people#Youtube#debit card

0 notes

Text

Impact of E-Banking Service on Customer Satisfaction

Have you ever considered how the introduction of E-Banking Services has altered the landscape of consumer satisfaction in the banking sector? In an era driven by advances in technology, the impact of E-Banking on consumer satisfaction is a fascinating subject to explore. The dynamics of client experience are changing dramatically as financial institutions progressively switch to premium mobile banking. This research digs into the many facets of E-Banking and its outstanding impact on consumer satisfaction. Here, you can see the complicated relationship between E-Banking developments and the contentment of today's tech-savvy customers.

Enhanced Customer Control

Customers are empowered by e-banking because they have more control over their financial issues. Web interfaces allow Customers to monitor account activity, set notifications, and personalize preferences. This amount of control generates a sense of empowerment and contributes to increased customer satisfaction since customers value the opportunity to adapt their banking experience to their tastes.

Security measures

While the ease of E-Banking contributes significantly to customer happiness, the necessity of security cannot be emphasized. Encryption, multi-factor authentication, and secure communication methods are all used in e-banking services. These safeguards establish trust in clients by assuring them that their financial information is secure. Individuals are more likely to engage in E-Banking when they are confident in the security of their transactions. Hence, the perception of a secure environment positively increases consumer satisfaction.

Convenience and Accessibility

One of the most significant effects of E-Banking on client satisfaction is the increased level of convenience and accessibility it provides. Customers can do numerous banking operations from the comfort of their homes or on the go using premium mobile banking. Customers who enjoy the flexibility to complete transactions at their leisure have expressed appreciation for this convenience, defined by 24-hour availability.

Excellent customer support

Regardless of technological developments, customer happiness with E-Banking is also determined by the quality of customer care. Efficient issue resolution, whether via online chat, email, or phone assistance, is critical in molding the overall customer experience. By swiftly addressing problems, e-banking systems that provide rapid and effective customer assistance contribute greatly to client satisfaction.

Speed and efficiency

E-banking has increased the speed and efficiency of financial transactions dramatically. Traditional banking procedures frequently entailed time-consuming actions such as queuing or waiting for paper-based paperwork. Transactions are handled in real-time using E-Banking, minimizing the amount of time clients spend on ordinary banking tasks. Customer satisfaction benefits from the speed and efficiency of electronic transactions.

Instant information access

Customers benefit greatly from real-time information access through e-banking services. Account statements, transaction history, and other financial facts are easily accessible, allowing users to monitor and manage their finances transparently. This transparency generates a sense of control and awareness. It improves customer happiness by empowering and informing them about their financial decisions.

Final thoughts

E-banking services have a clear and far-reaching impact on client satisfaction. Banks must be innovative to satisfy changing client expectations as technology evolves. When done correctly, Fast Mobile Banking has the potential to leave a lasting favorable impression, fostering consumer loyalty in the volatile terrain of digitalized banking.

#online instant loan#credit card payment#online payment#money transfer app#payment app#apply for instant loan#instant money loan#money transfer#apply for credit cards#book flights and hotels

0 notes

Text

Unlock Financial Freedom with SBM Credit Cards

Explore the benefits of the SBM Credit Card, featuring the Visa Gold Credit Card. With SBM Bank's credit card offerings, you can enjoy convenient and secure payments, global acceptance, and a range of exclusive privileges. Whether you're a frequent traveler, a shopping enthusiast, or seeking financial flexibility, our credit cards have you covered. Visit SBM Bank to learn more about the Visa Gold Credit Card and discover the world of convenience, rewards, and financial empowerment that SBM Bank brings to your fingertips. Apply today and experience a new level of financial flexibility and lifestyle perks with SBM Credit Cards.

#sbm internet banking#sbm kenya online banking#sbm prepaid card#sbm bank loan calculator#sbm credit card

1 note

·

View note

Text

Unveiling the Top Credit Cards and Banking Solutions in the UAE

Welcome to the vibrant world of Banqmart, where we unlock a treasure trove of financial possibilities for residents in the UAE. In this blog, we will explore the best credit cards, personal loans, and savings account options that can make your dreams a reality. Whether you seek the finest rewards, maximum cashback, or exclusive privileges, Banqmart has you covered. Let’s dive in and discover the gems that await you!

1. Mashreq Solitaire Credit Card: A World of Exclusive Rewards The Mashreq Solitaire Credit Card is the true epitome of luxury and benefits. Designed to cater to your premium lifestyle, it offers an array of exclusive rewards, travel perks, and lifestyle benefits that redefine the way you experience credit cards. Unleash the power of prestige with the Mashreq Solitaire Credit Card.

2. Best Rewards Credit Card: Unlocking the Treasure Chest Embark on a rewarding journey with Banqmart’s best rewards credit cards. We showcase the top credit cards that shower you with points, miles, and cashback on every transaction, making your spending truly gratifying.

3. Best Cashback Credit Card in UAE: Maximizing Your Savings Banqmart presents the crème de la crème of cashback credit cards in the UAE. Experience the joy of getting cashback on your everyday purchases, whether it’s dining, shopping, or travel. Turn your expenses into savings effortlessly.

4. Best Credit Card in Dubai: Your Gateway to Opulence Discover the best credit cards tailored to meet Dubai’s distinctive needs. With unparalleled benefits, rewards, and privileges, these credit cards are your ultimate companions in the city of dreams.

5. Compare Credit Cards UAE: Find Your Perfect Match Banqmart’s credit card comparison tool simplifies your decision-making process. Compare the features, benefits, and fees of various credit cards to choose the one that aligns perfectly with your lifestyle.

6. Best Travel Credit Card: Elevate Your Journey Make your travel dreams come true with Banqmart’s selection of the best travel credit cards. Enjoy travel insurance, airport lounge access, and accelerated rewards on flights and hotels, ensuring your journeys are nothing short of extraordinary.

7. Minimum Salary for Credit Card in UAE: Eligibility Made Easy Worried about eligibility? We’ve got you covered. Explore the minimum salary requirements for credit cards in the UAE, helping you to find the card that fits your income level.

8. Best Credit Card Loans in UAE: Fulfilling Your Aspirations Banqmart’s credit card loans offer quick and easy access to funds. Discover the best credit card loans that provide flexibility and financial freedom, empowering you to achieve your goals.

9. Apply for Bank Credit Card UAE: A Seamless Process Learn how to apply for a credit card in the UAE with Banqmart’s step-by-step guide. We simplify the application process to ensure you have a hassle-free experience.

10. Best Credit Card in UAE 2023: Stay Ahead of the Game As we step into 2023, Banqmart brings you the latest and greatest credit card offerings in the UAE. Stay ahead of the curve with cutting-edge features and benefits that cater to your evolving needs.

11. Platinum Elite Mashreq Credit Card: An Unrivalled Level of Luxury Experience a world of exclusivity with the Platinum Elite Mashreq Credit Card. From premium concierge services to unmatched travel privileges, this card is designed to cater to your discerning tastes.

12. ADCB Touchpoints Platinum Credit Card: Where Points Meet Perfection Unlock a world of possibilities with the ADCB Touchpoints Platinum Credit Card. Earn touchpoints on every transaction and redeem them for flights, hotel stays, shopping vouchers, and more.

13. Best Cash Back Card in UAE: Putting Money Back in Your Pocket Discover the top cashback credit cards in the UAE that let you earn while you spend. Turn your purchases into cash rewards and enjoy a little extra in your wallet.

14. Minimum Salary for Credit Card: Understanding the Requirements Unravel the mystery of minimum salary requirements for credit cards in the UAE. Banqmart helps you comprehend the financial criteria and find a card that suits your income.

15. ADCB Titanium Credit Card Limit: Empowering Your Spending Explore the generous credit limits offered by the ADCB Titanium Credit Card. With higher spending power, seize every opportunity to indulge in the things you love.

16. Apply for Credit Card in UAE: A Convenient Digital Journey At Banqmart, we make applying for a credit card in the UAE simple and efficient. Learn about the necessary documents and steps involved in the application process.

17. Credit Cards Offering Cash Back: Get Rewarded for Every Swipe Reap the benefits of credit cards that offer cashback rewards on various categories. Discover the ones that align with your spending habits and maximize your savings.

18. ADCB Touchpoints Platinum Credit Card Eligibility: Are You Eligible? Check the eligibility criteria for the ADCB Touchpoints Platinum Credit Card and explore if you qualify for this rewarding financial companion.

19. Credit Card Loan UAE: Your Key to Financial Flexibility Unlock the potential of credit card loans in the UAE. Whether you need extra funds for emergencies or planned expenses, find out how these loans can come to your rescue.

20. Credit Card Apply Online UAE: Convenience at Your Fingertips Experience the ease and speed of applying for a credit card online in the UAE. Banqmart provides a user-friendly platform to apply for your preferred credit card with just a few clicks.

Banqmart presents an array of credit cards, personal loans, and banking solutions that cater to every individual’s unique needs and aspirations in the UAE. From premium credit cards that offer exclusive privileges to small business loans that empower entrepreneurs, our platform is a one-stop destination for financial solutions. Let Banqmart be your guide on your financial journey as we help you unlock the possibilities of a prosperous future.

#mashreq solitaire credit card#best rewards credit card#dubai credit card#best travel credit card#minimum salary for credit card in uae#apply for bank credit card uae#adcb touchpoints platinum credit card#minimum salary for credit card#adcb titanium credit card limit#adcb touchpoints platinum credit card eligibility#credit card apply online uae#credit card loan uae#adcb etihad guest platinum credit card

0 notes

Text

Pre-approved personal loan in Noida

Are you Looking for a pre-approved personal loan in Noida? You're at the right place! Our Noida-based business is committed to helping individuals like you achieve financial freedom and accomplish their goals. Our streamlined loan application process ensures a quick and hassle-free experience at finaqo. Let go of your worries and get ready to tackle life's challenges head-on with our exclusive loan offerings. Whether it's funding your child's education or upgrading your Noida home, our Personal loan apply online is designed to suit your needs. Experience our customer-oriented service and competitive interest rates. Apply for home loan in Noida. Visit our website link Apply now: https://finaqo.in/

#Pre approved personal loan in Noida#personal loan apply online in noida#Apply for overdraft facility in Noida#Apply for Credit Card Balance Transfer Loan in Noida#Home loan balance transfer services in Noida#Apply for business loan in noida#Apply for home loan in noida#loan against property in noida

2 notes

·

View notes

Text

Loan on Card within Credit limit In UAE

Loan on Card within Credit limit In UAE

Simple admittance to Instant Money

The requirement for speedy money can emerge anytime of your life, be it for your kids' school expenses or satisfying the family occasion you had anticipated long. With Resource Collusion Charge card, we have you covered with simple money, up to 90% of your Credit Breaking point.

Instant loan with Asset Alliance Credit Card

Regularly scheduled payments are determined utilizing an illustrative Portion Sum viable loan cost

Real Loan costs fluctuate by tenor and are dependent upon the bank's strategy. Benevolently Sign in to your Versatile Application or Web based Banking to check the qualified exchanges, pertinent loan cost and handling charges.

Handling Expenses will be charged as a component of first regularly scheduled payment

4 Simple Steps

Online Banking

Login to your Web based Banking

Go to My Funds > Cards and select your Credit card.

Click on the Advance on Card choice

Select the Sum, Tenor and Record to which your assets ought to be saved.

Versatile Banking Application

Login to your Resource Partnership application

Select your Visa on the dashboard

Pick the Credit on Card choice

Select the Sum, Tenor and Record to which your assets ought to be saved.

Benefits

In a split second benefit of a credit sum up to your accessible Visa limit through bank Online.

You can reimburse the credit sum in helpful portions for as long as four years.

No records required.

No application structure.

Contact us: +971-555394457

#low credit loan#credit card personal loan#instant line of credit online#loans for good credit#easy loan personal loan online

0 notes

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

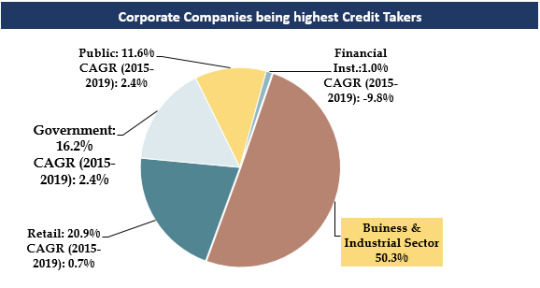

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Kisan credit card yojana -A Comprehensive Guide

kisan credit card Yojana

A Kisan credit card Yojana is a special type of credit card designed for farmers in India.

What is a Kisan Credit Card?

It is provided by banks and other financial institutions to help farmers with their agricultural and financial needs. It’s like having a single card that combines different financial services and products for farmers.

Key Features and Benefits

Easy…

View On WordPress

#kisan credit card#kisan credit card apply#kisan credit card in telugu#kisan credit card kaise banaye#kisan credit card kaise banaye online#kisan credit card ke fayde#kisan credit card loan#kisan credit card online apply#kisan credit card online apply csc#kisan credit card registration csc#kisan credit card scheme#kisan credit card se loan kaise le#kisan credit card yojana#kisan credit card yojana 2020#pm kisan credit card online apply

0 notes