#Customs duties and tariffs

Explore tagged Tumblr posts

Text

US Immigration and Customs Laws encompass a complex framework governing the movement of people and goods across the United States' borders. These laws are designed to regulate immigration, prevent illegal entry, ensure national security, and facilitate lawful trade and travel. They cover a wide range of topics, including visa requirements, border security measures, customs duties, import/export regulations, and enforcement mechanisms. Compliance with these laws is crucial for maintaining legal status, preventing unauthorized entry, and upholding the nation's safety and security. Various government agencies, such as the Department of Homeland Security, Customs and Border Protection, and Immigration and Customs Enforcement, oversee the enforcement and administration of these laws.

#US immigration laws#Customs regulations USA#Immigration policy United States#Border security regulations#Visa requirements America#Customs duties and tariffs#US immigration enforcement#Legal entry to the US#Immigration and customs compliance#Visa application process#US border control measures#Immigration legislation updates#Customs clearance procedures#Homeland security regulations#Immigration and customs agencies

2 notes

·

View notes

Text

Ko-fi prompt from @liberwolf:

Could you explain Tariff's , like who pays them and what they do to a country?

Well, I can definitely guess where this question is coming from.

Honestly, I was pretty excited to get this prompt, because it's one I can answer and was part of my studies focus in college. International business was my thing, and the issues of comparative advantage (along with Power Purchasing Parity) were one of the things I liked to explore.

-----------------

At their simplest, tariffs are an import tax. The United States has had tariffs as low as 5%, and at other times as high as 44% on most goods, such as during the Civil War. The purpose of a tariff is in two parts: generating revenue for the government, and protectionism.

Let's first explore how a tariff works. If you want to be confused, then you need to have never taken an economics class, and look at this graph:

(src)

So let's undo that confusion.

The simplest examples are raw or basic materials such as steel, cotton, or wine.

First, without tariffs:

Let us say that Country A and Country B both produce steel, and it is of similar quality, and in both cases cost $100 per unit. Transportation from one country to the other is $50/unit, so you can either buy domestically for $100, or internationally for $150. So you buy domestically.

Now, Country B discovers a new place to mine iron very easily, and so their cost for steel drops to $60/unit due to increased ease of access. Country A can either purchase domestically for $100, or internationally for $110 (incl. shipping), which is much more even. Still, it is more cost-effective to purchase domestically, and so Country A isn't worried.

Transportation technology is improved, dropping the shipping costs to $30/unit. A person from Country A can buy: Domestic: $100 International: $60+$30 = $90 Purchasing steel from Country B is now cheaper than purchasing it from Country A, regardless of where you live.

Citizens in Country A, in order to reduce costs for domestic construction, begin to purchase their steel from Country B. As a result, money flows from Country A to B, and the domestic steel industry in Country A begins to feel the strain as demand dwindles.

In this scenario, with no tariffs, Country A begins to rely on B for their steel, which causes a loss of jobs (steelworkers, miners), loss of infrastructure (closing of mines and factories), and an outflow of funds to another country. As a result, Country A sees itself as losing money to B, while also growing increasingly reliant on their trading partner for the crucial good that is steel. If something happens to drive up the price of B's steel again, like political upheaval or a natural disaster, it will be difficult to quickly ramp up the production of steel in Country A's domestic facilities again.

What if a tariff is introduced early?

Alternately, the dropping of complete costs for purchase of steel from Country B could be counteracted with tariffs. Let's say we do a 25% tariff on that steel. This tariff is placed on the value of the steel, not the end cost, so:

$60 + (0.25 x $60) + $30 = $105/unit

Suddenly, with the implementation of a 25% tariff on steel from Country B, the domestic market is once again competitive. People can still buy from Country B if they would like, but Country A is less worried about the potential impacts to the domestic market.

The above example is done in regards to a mature market that has not yet begun to dwindle. The infrastructure and labor is still present, and is being preemptively protected against possible loss of industry to purchasing abroad.

What happens if the tariff is not implemented until after the market has dwindled?

Let's say that the domestic market was not protected by the tariff until several decades on. Country A's domestic production, in response to increased purchasing from abroad, has dwindled to one third of what it was before the change in pricing incentivized purchase from B. Prices have, for the sake of keeping this example simple, remained at $100(A) and $60(B) in that time. However, transportation has likely become better, so transportation is down to $20, meaning that total cost for steel from B is $80, accelerating the turn from domestic steel to international.

So, what happens if you suddenly implement a tariff on international steel? Shall we say, 40%?

$60 + (0.4 x 60) + 20 = $104

It's more expensive to order from abroad! Wow! Let's purchase domestically instead, because these prices add up!

But the production is only a third of what it used to be, and domestic mines and factories for refining the iron into steel can't keep up. They're scaling, sure, but that takes time. Because demand is suddenly triple of the supply, the cost skyrockets, and so steel in Country A is now $150/unit! The price will hopefully come down eventually, as factories and mines get back in gear, but will the people setting prices let that happen?

So industries that have begun to rely on international steel, which had come to $80/unit prior to the tariff, are facing the sudden impact of a cost increase of at least $25/unit (B with tariff) or the demand-driven price increase of domestic (nearly double the pre-tariff cost of steel from B), which is an increase of at least 30% what they were paying prior to the tariff.

There are possible other aspects here, such as government subsidies to buoy the domestic steel industry until it catches back up, or possibly Country B eating some of the costs so that people still buy from them (selling for $50 instead of $60 to mitigate some of the price hike, and maintain a loyal customer base), but that's not a direct impact of the tariff.

Who pays for tariffs?

Ultimately, this is a tax on a product (as opposed to a tax on profits or capital themselves, which has other effects), which means the majority of the cost is passed on directly to the consume.

As I said, we could see the producers in Country B cut their costs a little bit to maintain a loyal customer base, but depending on their trade relationships with other countries, they are just as likely to stop trading with Country A altogether in order to focus on more profitable markets.

So why do we not put tariffs on everything?

Well... for that, we get into the question of production efficiency, or in this case, comparative advantage.

Let's say we have two small, neighboring countries, C and D, that have negligible transportation costs and similar industries. Both have extensive farmland, and both have a history of growing grapes for wine, and goats for wool. Country C is a little further north than D, so it has more rocky grasses that are good for goats, while D has more fertile plains that are good for growing grapes.

Let's say that they have an equal workforce of 500,000 of people. I'm going to say that 10,000 people working full time for a year is 1 unit of labor. So, Country C and Country D have between the 100 units of labor, and 50 each.

The cost of 1 unit of wool = the cost of 1 unit of wine

Country C, having better land for goats, can produce 4 units of wool for every unit of labor, and 2 units of wine for every unit of labor.

Meanwhile, Country D, having better land for grapes, can produce 2 units of wool per unit of labor, and 4 units of wine per unit of labor.

If they each devote exactly half their workforce to each product, then:

Country C: 100 units of wool, 50 units of wine Country D: 50 units of wool, 100 units of wine

Totaling 150 units of each product.

However, if each devotes all of their workforce to the product they're better at...

Country C: 200 units of wool, no wine Country D: no wool, 200 units of wine

and when they trade with each other, they each end up with 100 units of each product, which is a doubling of what their less-efficient labor would have resulted in!

The real world is obviously much more complicated, but in this example, we can see the pros of outsourcing some of your production to another country to focus on your own specialties.

Extreme examples of this IRL are countries where most of the economy rests on one product, such as middle-eastern petro-states that are now struggling to diversify their economies in order to not get left behind in the transition to green energy, or Taiwan's role as the world's primary producer of semiconductors being its 'silicon shield' against China.

Comparative advantage can be used well, such as our Unnamed Countries (that are definitely not the classic example of England and Portugal, with goats instead of sheep) up in the example. With each economy focusing on its specialty, there is a greater yield of both products, meaning a greater bounty for both countries.

However, should something happen to Country C up there, like an earthquake that kills half the goats, they are suddenly left with barely enough wool to clothe themselves, and nothing for Country D, which now has a surplus of wine and no wool.

So you do have to keep some domestic industry, because Bad Things Can Happen. And if we want to avoid the steel example of a collapse in the given industry, tariffs might be needed.

Are export tariffs a thing?

Yes, but they are much rarer, and can largely be defined as "oh my god, everyone please stop getting rid of this really important resource by selling it to foreigners for a big buck, we are depleting this crucial resource."

So what's the big confusion right now?

Donald Trump has, on a number of occasions, talked about 'making China pay' tariffs on the goods they import into the US. This has led to a belief that is not entirely unreasonable, that China would be the side paying the tariffs.

The view this statement engenders is that a tariff is a bit like paying a rental fee for a seller's table at an event: the producer or merchant pays the host (or landlord or what have you) a fee to sell their product on the premises. This could be a farmer's market, a renaissance faire, a comic book convention, whatever. If you want to sell at the event, you have to pay a fee to get a space to set up your table.

In the eyes of the people who listened to Trump, the tariff is that fee. China is paying the United States for access to the market.

And, technically, that's not entirely wrong. China is thus paying to enter the US market. It's just the money to pay that fee needs to come from somewhere, and like most taxes on goods, that fee comes from the consumer.

So... what now?

Well, a lot of smaller US companies that rely on cheap goods made in China are buying up non-perishables while they can, before the tariffs hit. Long-term, manufacturers in the US that rely on parts and tools manufactured in China are going to feel the squeeze once that frontloaded stock is depleted.

Some companies are large enough to take the hit on their own end, still selling at cheap rates to the consumer, because they can offset those costs with other parts of their empire... at least until smaller competitors are driven out of business, at which point they can start jacking up their prices since there are no options left. You may look at that and think, "huh, isn't that the modus operandi for Walmart and Amazon already?" and yes. It is. We are very much anticipating a 'rich get richer, poor go out of business' situation with these tariffs.

The tariffs will also impact larger companies, including non-US ones like Zara (Spanish) and H&M (Swedish), if they have a huge reliance on Chinese production to supply their huge market in the United States.

If you're interested in the repercussions that people expect from these proposed tariffs on Chinese goods, I'd suggest listening to or watching the November 8th, 2024 episode of Morning Brew Daily (I linked to YouTube, but it's also available on Spotify, Nebula, the Morning Brew website, and other podcast platforms).

#id in alt text#id in alt#economics#tariffs#import tax#customs#customs duties#ko fi prompts#capitalism#phoenix talks#ko fi#taxes#taxation

2K notes

·

View notes

Text

youtube

A nickname for Donald Trump which we should use often: TACO (Trump Always Chickens Out). According to Lawrence O'Donnell, the usage of TACO is spreading in the financial services community.

If you wish to annoy Trumpsters while (hopefully) educating them, play this vid within earshot of them.

#donald trump#maga#republicans#tariffs#import taxes#customs duties#trade war#trump tariffs#trumpflation#TACO#trump always chickens out#voodoo economics#trump keeps backing down#the stupidest and most cowardly president in american history#lawrence o'donnell#Youtube

96 notes

·

View notes

Text

Understanding Customs Duty and VAT Tariff in Oman

Navigating the intricacies of customs duty and VAT in Oman can be challenging for businesses involved in international trade. Whether you are importing or exporting goods, it is essential to understand the applicable customs regulations to avoid delays and unexpected costs. At Clarion Shipping, we provide comprehensive logistics solutions, ensuring that your shipments comply with all Omani regulations.

Oman’s customs duty generally ranges between 5% to 100% depending on the type of goods being imported, with some categories, such as alcohol and tobacco, attracting higher tariffs. Moreover, the standard VAT rate of 5% applies to most goods and services, which businesses must factor into their cost calculations. Understanding these tariffs can help you plan better and ensure a smooth customs process.

At Clarion Shipping, we specialize in guiding businesses through these regulatory frameworks. Our team of experts stays up-to-date with the latest customs and VAT policies, ensuring that your shipments are handled efficiently and without complications.

For more detailed information on Oman’s customs duties and VAT tariffs, and how they impact your business, check out our latest blog post: Read Blog

0 notes

Text

How to Select the Right Importer of Record in Malaysia?

In the intricate world of international trade, the role of an Importer of Record (IoR) is pivotal. An IoR is the entity or individual responsible for ensuring that imported goods comply with the destination country's regulations and legal requirements. Selecting the right Importer of Record in Malaysia is crucial for navigating the complex landscape of customs regulations, avoiding penalties, and ensuring smooth operations. This guide delves into the essential factors to consider when choosing the ideal IoR for your business needs in Malaysia.

Understanding the Importer of Record Function

Definition and Key Responsibilities of an IoR

An Importer of Record (IoR) acts as a legally responsible party for the importation of goods into a country. The IoR’s responsibilities include ensuring compliance with local laws, paying duties and taxes, and managing customs documentation. In Malaysia, this role involves adherence to specific regulations governed by the Royal Malaysian Customs Department, including the submission of import declarations and the payment of applicable tariffs.

Benefits of Having a Competent IoR in Malaysia

Engaging a competent Importer of Record in Malaysia offers several advantages. A proficient IoR ensures seamless customs clearance, minimizes the risk of compliance issues, and provides valuable guidance on local regulations. Their expertise can prevent costly delays and penalties, thereby enhancing the efficiency of your import operations.

Evaluating Expertise and Experience

Assessing the IoR’s Knowledge of Malaysian Customs Regulations

When selecting an IoR, it is essential to evaluate their understanding of Malaysian customs regulations. A knowledgeable IoR should be well-versed in the Malaysian Customs Act, HS Code classification, and import restrictions. Their expertise should extend to navigating local practices and staying updated with any regulatory changes that might affect your shipments.

Importance of Proven Track Record and Industry Experience

Experience is a critical factor in choosing an IoR. An established IoR with a proven track record of handling various import scenarios will likely manage your imports more effectively. Assess their history of successful customs clearances and their familiarity with handling goods similar to yours, ensuring they have the requisite industry experience to support your needs.

Assessing Compliance and Risk Management

Ensuring Regulatory Compliance and Avoiding Penalties

A key responsibility of an IoR is to ensure full regulatory compliance. Verify that the IoR follows stringent procedures to meet all legal requirements and avoid compliance pitfalls. This includes accurate filing of import documentation, adherence to local laws, and timely payment of duties and taxes. An IoR with robust compliance practices will help mitigate risks associated with penalties and legal issues.

Evaluating Risk Management Practices and Procedures

Effective risk management is vital for mitigating potential disruptions in the import process. Assess the IoR’s risk management strategies, including their approach to handling unexpected issues such as customs disputes or shipment delays. A proactive IoR will have established procedures to manage these risks and ensure continuity in your import operations.

Examining Technological Capabilities

Importance of Digital Tools and Platforms

In today’s digital age, the technological capabilities of an IoR can greatly impact the efficiency of your import process. Evaluate whether the IoR utilizes advanced digital tools and platforms, such as customs management software and electronic data interchange (EDI) systems. These technologies can streamline customs procedures, enhance accuracy, and provide real-time tracking of shipments.

How Technology Enhances Efficiency in Import Processes

Technology plays a crucial role in optimizing import operations. An IoR with sophisticated technological infrastructure can offer automated solutions that reduce manual errors, speed up processing times, and improve overall operational efficiency. Ensure that the IoR you select leverages technology to its fullest potential to benefit your import activities.

Reviewing Client Testimonials and References

Gathering Feedback from Existing and Past Clients

Client testimonials and references provide valuable insights into the performance of an IoR. Seek feedback from current and previous clients to gauge their satisfaction with the IoR’s services. Positive testimonials and strong recommendations can indicate a reliable and effective IoR.

Analyzing Case Studies and Success Stories

Review case studies and success stories to understand how the IoR has handled various import scenarios. These examples can highlight their problem-solving capabilities, industry expertise, and ability to deliver results. Analyzing such cases will help you assess whether the IoR is equipped to meet your specific requirements.

Considering Cost and Fee Structures

Understanding Different Pricing Models and Structures

Cost is a significant consideration when selecting an IoR. Understand the different pricing models and fee structures offered by potential IOR Services in Malaysia. This may include flat fees, per shipment costs, or percentage-based charges. Ensure you have a clear understanding of how fees are calculated and what services are included.

Comparing Costs vs. Value in IOR Services

While cost is important, it should be weighed against the value provided by the IoR. Consider the quality of service, expertise, and benefits offered in relation to the fees charged. A more expensive IoR may provide greater value through enhanced services and risk management, which could ultimately save you money in the long run.

Evaluating Communication and Customer Support

Importance of Effective Communication Channels

Effective communication is vital for a successful partnership with an IoR. Evaluate how the IoR manages communication, including their responsiveness and clarity. Ensure they offer reliable communication channels and are accessible for addressing queries and resolving issues promptly.

Assessing the Quality of Customer Service and Support

High-quality customer service and support are essential for addressing any challenges that arise during the import process. Assess the IoR’s commitment to providing excellent support, including their approach to problem resolution and their willingness to offer assistance when needed.

Conclusion

Selecting the right Importer of Record in Malaysia involves a comprehensive evaluation of several critical factors. By understanding the IoR’s function, assessing their expertise and compliance practices, examining technological capabilities, and considering cost and support, you can make an informed decision that aligns with your business needs. Ensuring that your IoR meets these criteria will contribute to smoother, more efficient import operations and help you navigate the complexities of Malaysian customs regulations effectively.

#Global Trade Tips#Shipping#logistics#Import Export Business Ideas#Customs Regulations#freight forwarding#supplychainmanagement#trade compliance#international markets#Export Documentation#Tariff and Duty Information#Market Research for Exports

0 notes

Text

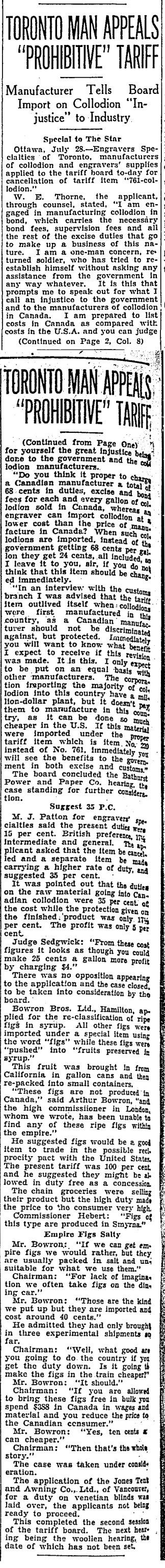

"TORONTO MAN APPEALS "PROHIBITIVE" TARIFF," Toronto Star. July 28, 1933. Page 1. ---- Manufacturer Tells Board Import on Collodion "Injustice" to Industry --- Special to The Star Ottawa, July 28. - Engravers Specialties of Toronto, manufacturers of collodion and engravers' supplies applied to the tariff board to-day for cancellation of tariff item "761-collodion."

W. E. Thorne, the applicant,through counsel, stated, "I am engaged in manufacturing collodion in bond, which carries the necessary bond fees, supervision fees and all the rest of the excise duties that go to make up a business of this nature. I am a one-man concern, returned soldier, who has tried to re-establish himself without asking any assistance from the government in any way whatever. It is this that prompts me to speak out for what I call an injustice to the government and to the manufacturers of collodion in Canada. I am prepared to list costs in Canada as compared with costs in the U.S.A. and you can judge for yourself the great Injustice being done to the government and the collodion manufacturers.

"Do you think it proper to charge a Canadian manufacturer a total of 68 cents in duties, excise and bond fees for each and every gallon of collodion sold in Canada, whereas an engraver can import collodion at a lower cost than the price of manufacture in Canada? When such collodions are imported, instead of the government getting 68 cents per gallon they get 24 cents, all included, so I leave it to you, sir, if you do not think that this item should be changed immediately.

"In an interview with the customs branch I was advised that the tariff item outlived itself when collodions first manufactured in this country, as a Canadian manufacturer should not be discriminated against, but protected. Immediately you will want to know what benefit I expect to receive if this revision was made. It is this. I only expect to be put on an equal basis with were other manufacturers. The corporation importing the majority of collodion into this country have a million-dollar plant, but it doesn't pay them to manufacture in this country, as it can be done so much cheaper in the U.S. If this material were imported under the proper tariff item which is item. No. 220 instead of No. 761, immediately you will see the benefits to the government in both excise and customs."

The board concluded the Bathurst Power and Paper Co. hearing, the case standing for further consideration. Suggest 35 P.C. M. J. Patton for engravers specialties said the present duties were 15 per cent. British preference, 17 1/2, intermediate and general. The applicant asked that the item be cancelled and a separate item be made carrying a higher rate of duty, and suggested 35 per cent.

It was pointed out that the duties on the raw material going into Canadian collodion were 35 per cent. of the cost while the protection given on the finished 'product was only 17 per cent. The profit was only 5 percent. Judge Sedgwick: "From these cost figures it looks as though you could make 25 cents a gallon more profit by charging $4." There was no opposition appearing to the application and the case closed, to be taken into consideration by the board. Bowron Bros. Ltd., Hamilton, applied for the re-classification of ripe figs in syrup. All other figs were imported under a special item using the word "figs" while these figs were"pushed" into "fruits preserved in syrup."This fruit was brought in from California in gallon cans and thenre-packed into small containers.

"These figs are not produced in Canada," said Arthur Bowron, "and the high commissioner in London, whom we wrote, has been unable to find any of these ripe figs within the empire." He suggested figs would be a good item to trade in the possible reciprocity pact with the United States. The present tariff was 100 per cent.and he suggested they might be allowed in duty free as a concession. The chain groceries were selling their product but the high duty made the price to the consumer very high. Commissioner Hebert: "Figs of this type are produced in Smyrna." Empire Figs Salty Mr. Bowron: "If we can get empire figs we would rather, but theyare usually packed in salt and unsuitable for what we use them." Chairman: "For lack of imagination we often take figs on the dining car." Mr. Bowron: "Those are the kind we put up but they are imported and cost around 40 cents." He admitted they had only brought in three experimental shipments so far. Chairman: "Well, what good are you going to do the country if you get the duty down. Is it going to make the figs in the train cheaper?" Mr. Bowron: "It should." Chairman: "If you are allowed to bring these figs free in bulk you spend $388 in Canada in wages and material and you reduce the price to the Canadian consumer." Mr. Bowron: "Yes, ten cents a can is cheaper." Chairman: "Then that's the whole story." The case was taken under consideration. The application of the Jones Tent and Awning Co., Ltd., of Vancouver, for a duty on venetian blinds was laid over, the applicants not being ready to proceed. This completed the second session of the tariff board. The next hearing being the woollen hearing, the date of which has not been set.

#ottawa#tariff board#excise taxes#customs officials#collodion#small business ideology#small business owner#nitrocellulose#dry plate photography#collodion process#import duties#canada in the british empire#figs#great depression in canada#capitalism in canada

0 notes

Text

I forgot to mention that my shop is back online LOL

🇺🇸 US Shop 🌎 Global Shop

Just a heads up, if any US customers buy from the Global Shop, orders may be affected by the whole tariff situation. Global Shop orders are sent from Australia and any import tax and duties are the buyer’s responsibility.

This will be the last US shop restock until the tariff situation is clearer... thank you for understanding.

210 notes

·

View notes

Text

Presenting: the Monolith Set.

It includes all the physical merch from the Collector’s Edition, just without the base game and downloadable cosmetics. That means the Steelbook case, Monolith music box, and Expedition Journal Artbook are all in there.

We’re able to offer it at a lower price: £99.99 / $119.99. If you're located in France, you'll be able to purchase from @Pixnlove to benefit from lower shipping costs.

Due to the ongoing tariff situation between the US and China, shipping costs to the US will be higher to account for potential charges at delivery, and US customers may incur additional import duty.

To help combat scalpers, we’re also limiting purchases to two per customer.

Pre-orders open tomorrow and will close on Thursday, 12th June at 11am EDT / 8am PDT. Full details will be available on the product page!

We’re so excited to get these into your hands. Thank you for the support — and for making this possible.

75 notes

·

View notes

Text

Look, I think if you're a US citizen you should go on Youtube and watch the debate, or at least some of the chunks of it where the topic matters most to you. You can't counter the arguments if you don't know what arguments they're making. And no, I don't mean arguing with your aunt that drank the conspiracy koolaid. I mean that there are genuinely a lot of people out there hearing what Trump is saying and thinking, "I don't know. That sounds really scary."

So know what he said, and know not just THAT he lied, but HOW he lied.

Sometimes, it's easy. There are no "abortions" after a baby is born. That would be uhhh let's see MURDER and it's already pretty illegal everywhere and absolutely no one is trying to change that. The comment Trump attributed to former VA governor Ralph Northam is completely misrepresented. Northam (whom I am not defending as a person, by the way) was commenting on the subject of *non-viable* pregnancies that represented a health risk to the mother. Nobody was talking about killing babies. Nobody. Not even Mr. Blackface.

Sometimes it's so addled that I'll leave someone else to unpack, for example, what the FUCK he was on about with the giving illegal aliens in prison forced "trangender surgery". Personally I'm assuming he just used the random word generator in his head to say something that sounded scary to him.

There is NO credible evidence that anyone, much less Haitian immigrants, is eating pets in Springfield, Ohio. Both government officials and the police say there's nothing to it. Springfield has had a huge influx of Haitian immigrants, and this is causing infrastructure strain and racial tensions. But again, people who would rather believe that a) legal immigrants are okay with *stealing your pets and eating them* and b) the entire police and gov't infrastructure of a town and the surrounding county want to cover this up, are not worth our energy. It's the people who don't know the truth and are worried that we want to reach.

And my guy, my man, Cheeto Benito, that is not how tariffs work. Tariffs are not magical free money that other countries just HAVE to give you. They're...they're not that at all. Look, I'm lazy so I'm just gonna quote CNN:

Here’s how tariffs work: When the US puts a tariff on an imported good, the cost of the tariff usually comes directly out of the bank account of an American buyer. “It’s fair to call a tariff a tax because that’s exactly what it is,” said Erica York, a senior economist at the right-leaning Tax Foundation. “There’s no way around it. It is a tax on people who buy things from foreign businesses,” she added. Trump has said that if elected, he would impose tariffs of up to 20% on every foreign import coming into the US, as well as another tariff upward of 60% on all Chinese imports. He also said he would impose a “100% tariff” on countries that shift away from using the US dollar. These duties would add to the tariffs he put on foreign steel and aluminum, washing machines, and many Chinese-made goods including baseball hats, luggage, bicycles, TVs and sneakers. President Joe Biden has left many of the Trump-era tariffs in place. It’s possible that a foreign company chooses to pay the tariff or to lower its prices to stay competitive with US-made goods that aren’t impacted by the duty. But study after study, including one from the federal government’s bipartisan US International Trade Commission, have found that Americans have borne almost the entire cost of Trump’s tariffs on Chinese products. To date, Americans have paid more than $242 billion to the US Treasury for tariffs that Trump imposed on imported solar panels, steel and aluminum, and Chinese-made goods, according to US Customs and Border Protection. [link]

Also though you should watch the debate because Harris was an absolute savage and it was genuinely HUGELY entertaining to watch her mercilessly bait Trump in every answer she gave, and watch him take the bait every. fucking. time.

95 notes

·

View notes

Text

HashiMada Week 2024 Sneak Peek is here!

🔥🍃 Merch🍃🔥

Stickers: 7* 2.5 inch (6.35 cm) matte die-cut stickers based on our prompts. These are available for participants to earn, for every prompt you complete you get a sticker.

*Day 6's sun/moon are technically two separate smaller 1.5 inch (3.81cm) stickers but count as "one" combined sticker for all merch purposes.

Pricing: $1USD per sticker or all 7 in a $5USD bundle.

NSFW Stickers: 7 2.5 inch (6.35cm) matte die-cut stickers based on our prompts. These are not available to earn through participation in our event. They will only be available for purchase in the shop.

Pricing: $1USD per sticker or all 7 in a $5USD bundle.

.🔥🍃.

Standee: 5.5 inch (14 cm) acrylic standee with matching customized base. The design will be printed on both sides.

Chopsticks: 9.5 inch (24.13 cm) natural bamboo chopsticks painted with red chalk paint, engraved, and sealed with amber shellac. Food-safe.

Madara: It'd be an honor to die by your hand/マダ(mon) Hashirama: To me, Madara was a gift from the divine/柱(mon)

Doujinshi: The Keepsake Photo. 20-page A5 black and white staple-bound doujin. SFW, angst, photography, canon-compliant.

If participants complete 7 prompts, they will be eligible to select one of the three big merch items as a grand prize. The other two will be available in the shop.

Pricing: $7.50USD per item or all 3 in a $20USD bundle.

🍃🔥Big Cartel Shop🔥🍃

The big cartel shop will open July 21st-Agusut 21st. Participants will get free shipping, this also extends to any purchases made in the shop. (A code will be provided and everything will be bundled into one package.) Please note we will not pay for duties/VATS/tariffs.

Russian buyers will have their own form to fill out since paypal doesn’t work in-country. If Ukrainian residents/refugees DM us during the open shop period, they will be provided with a special discount code. A separate post will be made to go over the various forms, don’t worry!

The FAQ/Sicker FAQ forms will be updated with the new information!

Our amazingly talented artists! Please follow them on their socials and support their work!

c_art ✧⁺˖𖤓˖⁺✧ Ao3

dzhfaer ✧⁺˖𖤓˖⁺✧ @dzhfaer ✧ Instagram

Grim Malkyn ✧⁺˖𖤓˖⁺✧ @grimmalkyn ✧ Linktree

Mia Bobriha ✧⁺˖𖤓˖⁺✧ @miaabobriha ✧ Twitter

Morita ✧⁺˖𖤓˖⁺✧ @fire-eyed-raven ✧ Twitter

Shanfroze ✧⁺˖𖤓˖⁺✧ @shanfroze

une bibelle ✧⁺˖𖤓˖⁺✧ @feelkindadizzy

.🍃🔥.

Reblogs are much appreciated!

Please @ us and/or use the #hashimadaweeksneakpeek2024 tag to show us your own sneak peeks!

#hashimada#madahashi#madara uchiha#hashirama senju#madara#hashirama#madara x hashirama#hashirama x madara#hashimadaweeksneakpeek2024

93 notes

·

View notes

Text

President Donald Trump on Wednesday signed an executive order shutting the de minimis trade loophole, effective May 2. Trump in February abruptly ended the de minimis trade exemption, which allows shipments worth less than $800 to enter the U.S. duty-free. The order overwhelmed U.S. Customs and Border Protection employees and caused the U.S. Postal Service to temporarily halt packages from China and Hong Kong. Within days of its announcement, Trump reversed course and delayed the cancellation of the provision. Wednesday’s announcement, which came alongside a set of sweeping new tariffs, gives customs officials, retailers and logistics companies more time to prepare. Goods that qualify under the de minimis exemption will be subject to a duty of either 30% of their value, or $25 per item. That rate will increase to $50 per item on June 1, the White House said. Use of the de minimis provision has exploded in recent years as shoppers flock to Chinese e-commerce companies Temu and Shein, which offer ultra-low-cost apparel, electronics and other items.

27 notes

·

View notes

Text

The USPS just suspended the acceptance of packages from China and Hong Kong until further notice.

This seems to be because Trump added tariffs to imports from China and suspended the de minimis exception that allows parcels worth under $800 to enter the country without being individually charged customs duty.

We don't have the infrastructure to process collecting duty on every single parcel from China.

#china news#China and Hong Kong#fuck usps#usps#postage#mail#us politics#us news#breaking news#usa politics#united states#usa news#donald trump#president trump#fuck trump#trump administration#trump#trump tariffs#thoughts and tariffs

29 notes

·

View notes

Text

yes

(4/8/25)

#trump administration#american politics#politics#president trump#us politics#us presidents#america#donald trump

20 notes

·

View notes

Text

Ruler Donald Trump’s 25% tariffs on autos from Canada and Mexico will take effect on April 2nd. The tariffs will undoubtedly drive up car prices for United States consumers and harm an already struggling domestic car-manufacturing industry.

Canadian Prime Minister Mark Carney has already responded, denouncing the tariffs as representing a “direct attack” on his country’s workers and declared that further retaliatory tariffs are likely. He also said that the “ties of kinship” and “ties of commerce” between the US and Canada were “in the process of being broken”.

Tariffs Bring Pain Without Gain

“Canadian workers, Canadians as a whole across this country, have gotten over the shock of the betrayal and are learning lessons. We have to look out for ourselves, and we have to look out for each other and work together.”

On the social media platform X, White House Principal Deputy Press Secretary Harrison Fields indicated that auto parts that comply with the US- Mexico- Canada free trade agreement would not be subject to import duties for the time being, according to a report by Al Jazeera.

“USMCA-compliant automobile parts will remain tariff-free until the Secretary of Commerce, in consultation with US Customs and Border Protection [CBP], establishes a process to apply tariffs to their non-US content,” Fields wrote.

European Commission President Ursula von der Leyen has expressed disappointment over Trump’s announcement of auto tariffs. “I deeply regret the US decision to impose tariffs on EU automotive exports,” she said in a social media post. “Tariffs are taxes – bad for businesses, worse for consumers, in the US and the EU. The EU will continue to seek negotiated solutions, while safeguarding its economic interests.”

22 notes

·

View notes

Text

While children are told stories about elves and reindeer, the truth is that hundreds of thousands of people work year-round to make sure Christmas feels magical. From factory employees in China stringing lights on artificial trees to dock workers unloading containers of toys, this vast labor force ensures Americans can choose from a wide selection of decorations and gifts each December. But all of that is in peril this year as President Donald Trump’s disruptive tariff policies threaten to halt a big chunk of global trade.

Across almost every industry, businesses that depend on international trade are waiting in agony as Trump’s tariff standoff with China continues. Some are pausing their orders, while others are scrambling to find alternative suppliers. The disruption, which has dragged on for almost a month, is particularly damaging to industries that run on strict seasonal production cycles, such as for holidays like Christmas. “If you miss this sales cycle, you have to wait the entire year. Nobody wants a Christmas tree after Christmas,” says Michael Shaughnessy, senior vice president of supply chains at Balsam Brands, a multinational holiday decor company.

Companies that sell Christmas ornaments, gifts, and toys tell WIRED that April is usually the time when retailers lock in their orders and manufacturing begins. If they can’t start making products soon, they will face a time crunch later in the year, higher shipping rates, and may potentially miss their sales window. As a result, US customers will likely see fewer options on store shelves and be forced to pay more for their usual Christmas purchases this year.

“Things will be more expensive and there will be fewer choices,” says Jim McCann, the founder of 1-800-Flowers, which sells a wide variety of holiday gifts, greeting cards, and food baskets. “Retailers won’t be forced to discount like they have in the past because there’ll be no reason to.”

The Clock Is Ticking

For people in the Christmas business, work starts for next year as soon as the holiday ends. Until recently, this supply chain was a well-oiled machine, with everyone carrying out their duty at the right time of the year, collectively building up to the grand festive finale.

Rick Woldenberg, CEO of educational toy manufacturer Learning Resources, gave WIRED a breakdown of the timeline: Placing orders and having factories manufacture the products takes three months, and then shipping them from China to the US takes another two. That means, if a company is aiming to have its inventory begin arriving at US warehouses by mid-September to begin preparing for the December holiday season, they really need to start working now, in April.

Earlier this month, Woldenberg sued the Trump administration over the tariffs, alleging the president overstepped his authority by introducing such broad import duties. “We are trying to stand up for ourselves and protect our rights,” he says. “We need help now. The sooner the better. We want them to stop.”

Woldenberg predicts that toy store shelves won’t necessarily be empty come Christmas, because retailers may scramble to find discontinued products or other replacements to fill the gap, but they won’t necessarily be the items customers are looking for. “That is when Americans are really going to find out what a terrible idea this has been,” he says. “We had this once-in-a-millennium amazing supply chain, and it’s being torn apart for no reason.”

Shaughnessy, whose company owns the premium artificial Christmas tree brand Balsam Hill, describes a timeline similar to Woldenberg’s: “In most years, right now we would be starting to ship as much product as possible, because over the next four, five months, we’d be looking to fill up our warehouses,” he says.

For now, the decorations industry is still waiting for the tariff situation to change, but the very latest cut-off time to ensure goods reach consumers by December would be the beginning of August, Shaughnessy says. If Trump misses that deadline, his company and many others will have missed the sales cycle this year.

But even if the tariffs are reduced or lifted before then, Shaughnessy says, he expects to pay more to transport his products, because every retail company will be competing for the same amount of shipping containers. In a normal year, shipping rates from China to the West Coast of the US usually costs less than $2,000 per container, but the current supply chain disruption is bringing back memories of the pandemic supply-chain shock, when shipping rates shot up over $20,000 per container right after trade resumed. “The system is like a steam locomotive. You can’t slow it down very quickly, and you also can’t speed it up very quickly,” Shaughnessy says.

Factory Shutdown

On the other side of the Pacific Ocean, the Chinese factories that make almost all of America’s Christmas products are also waiting anxiously for their clients to resume placing orders again. Three owners of artificial Christmas tree factories described the same situation to WIRED: US clients that typically place orders every year have either held off or canceled them entirely, leaving some factories with no business while others are struggling to find non-US buyers. All three owners asked to remain anonymous or use only their English names to protect their privacy.

“The clients that we had relationships with don’t want to cancel everything, so for some of them, we are shouldering the cost increases,” says Evan, owner of the company Heyuan Limei Tree and Light Technology. “Other clients are betting this policy won’t survive after June and things could go back to normal then.” He’s grateful that at least his factory is still running; two smaller ones close by have already furloughed their workers and shut down their machines for now.

At the China Import and Export Fair this week, one of the largest international trade shows in the world, buyers from the US and Europe made up just 10 percent of the total registered attendees, Evan says. In previous years, that number was usually about 40 percent.

“Clients usually place orders from January to March, and we ship out the products from April to August. To be honest, the production window for Christmas trees is not long,” says Jessica, the owner of a Christmas tree company in the city of Jinhua. The tariffs have also resulted in an unexpected windfall for one of Jessica’s clients. Last year, she says, the retailer missed out on most of the Christmas sales cycle because the products they ordered were delayed for an extended period at US customs. Those same trees that have been sitting in US warehouses for almost half a year are not subject to the tariffs, and may give the retailer a cost advantage over their competitors.

Jessica’s factory is right next door to Yiwu, the small Chinese city that has been the epicenter of the global Christmas merchandise industry since the 2000s and now supplies about 80 to 90 percent of the US market. Over the past few weeks, both domestic and international media outlets have flocked to Yiwu to check in with factories and traders, who expressed a mix of anxiety and optimism. Many are turning to clients in Europe, Latin America, and Russia, hoping other regions can help make up for the lack of American demand. Sometimes, that means changing the look of Santa Claus figurines to better reflect European instead of American tastes.

Magnus Marsden, a professor at the University of Sussex who led a five-year project looking at foreign trade in Yiwu, says that factories need to work together to blunt the negative impacts of the tariffs. The most important thing is to keep assembly lines operating, because without steady gigs, workers who migrated to Yiwu from more rural parts of China will likely go back home and be reluctant to return in the future. “What some companies are doing is giving some of their contracts to other places, to companies that are particularly invested in the American market, with the aim of making sure that they can continue to survive,” Marsden says.

Few Winners

The only businesses that have escaped the impacts of the tariffs—at least for now —are those that sell Christmas-themed products all year long.

“Many of our suppliers are still figuring out how they will be handling tariffs, and I've locked in tariff-free pricing for this year. The bigger concern will be for 2026 if the situation remains unchanged,” says Paul Brown, operations manager of Santa Claus House in North Pole, Alaska.

Debi Thomas, owner of the Los Angeles–area store Christmas Traditions, which has been in business for over 30 years, says she still has merchandise on hand from the past two or three years. “People can shop for items that have never been tariffed, and they are certainly going to be cheaper than what some are buying from retail stores now,” she says.

But Thomas is still expecting to raise the price of new products arriving as soon as May. Her store sources many handmade items from the Philippines and India, and those vendors have also started informing her that costs will go up somewhere between 10 to 17 percent if Trump’s blanket tariffs on the rest of the world remain in place.

As a family-owned small business, Thomas says she will have no choice but to pass down the price to consumers. For now, all she can do is wait for the tariff drama to end. “We wake up every morning and we say, ‘Oh please, let this be the day when the tariffs are canceled. Please, let this be a moment of clarity,’” she says.

11 notes

·

View notes

Text

tariff (n.)

1590s, "arithmetical table," also "official list or table of customs duties on goods for import or export;" also "a law regulating import duties," from Italian tariffa"tariff, price, assessment," Medieval Latin tarifa "list of prices, book of rates," ultimately from Arabic ta'rif "information, notification, a making known; inventory of fees to be paid," verbal noun from arafa "he made known, he taught." A word passed to English from the commercial jargon of the medieval Mediterranean (compare garble, jar (n.), average (perhaps), orange, tabby, etc.).

Etymonline

10 notes

·

View notes