#Cybersecurity Compliance

Text

IT Vendor Risk Management

Unlock the power of IT vendor management with Century Solutions Group! Streamline operations, cut costs, and mitigate risks by keeping your partnerships in perfect harmony. Say hello to efficiency and bid farewell to headaches! #CenturySolutions #ITVendorManagementBenefits - https://okt.to/LGd3IC

#IT Vendor Risk Management#cybersecurity compliance#managed it services#managed it solutions#cloud technology services#cybersecurity

1 note

·

View note

Text

Discover essential steps to achieve cybersecurity compliance for your business. Learn key strategies and ensure data protection. Read more.

#cybersecurity#cyberattack#cybersecurity metrics#cybersecurity compliance#ddos protection#ddos#web application firewall

0 notes

Text

Cybersecurity Analyst: Safeguarding the Digital Frontier - Who and what they do?

In today’s interconnected world, cybersecurity stands as an impenetrable shield against the relentless wave of cyber threats. At the forefront of this defense are Cybersecurity Analysts, skilled professionals who protect organizations and individuals from malicious attacks on their digital assets. This article delves into the responsibilities and significance of a Cybersecurity Analyst and…

View On WordPress

#Cloud Security#Cyber Attacks#Cyber Awareness#Cyber Awareness Training#Cyber Defense#Cyber Education#Cyber Forensics#Cyber Hygiene#Cyber Incident Response#Cyber Resilience#Cyber Risk Management#Cyber Threats#Cybersecurity#Cybersecurity Awareness Month#Cybersecurity Awareness Week#Cybersecurity Best Practices#Cybersecurity Careers#Cybersecurity Certifications#Cybersecurity Compliance#Cybersecurity Events#Cybersecurity Governance#Cybersecurity News#Cybersecurity Policies#Cybersecurity Solutions#Cybersecurity Tips#Cybersecurity Tools#Cybersecurity Trends#Cybersecurity Webinars#Data Breach#Data Privacy

0 notes

Text

Blockchain Cybersecurity Development Services

#internet cybersecurity#consultant#it cybersecurity services company#blockchain cybersecurity#blockchain for cybersecurity#blockchain technology cybersecurity#information security blockchain#Data Security and Protection Solutions#cybersecurity compliance

0 notes

Text

Robinhood Crypto Penalized $30M for Violating NY Cybersecurity Regulations

Robinhood Crypto Penalized $30M for Violating NY Cybersecurity Regulations

Home › Endpoint Security

Robinhood Crypto Penalized $30M for Violating NY Cybersecurity Regulations

By Ryan Naraine on August 03, 2022

Tweet

The cryptocurrency division of Robinhood has been slapped with a $30 million penalty by New York’s Department of Financial Services for significant violations of cybersecurity and money laundering regulations.

The $30 million penalty, announced late Tuesday…

View On WordPress

#compliance#crypto#cryptocurrecy#cybersecurity compliance#layoffs#money laundering#new york#new york state#regulations#robinhood#robinhood crypto#stock price#violations

1 note

·

View note

Text

17 Essential Steps to Fortify Your AI Application

Master AI security with these 17 essential steps! #AISecurity #DataProtection #CyberSecurity

In today’s digital landscape, securing AI applications is crucial for maintaining trust and ensuring data integrity. Here’s a comprehensive guide to the 17 essential steps for fortifying your AI application.

1. Encrypt Data

Ensure that all data, both in transit and at rest, is encrypted. Use industry-standard encryption protocols like AES (Advanced Encryption Standard) for data at rest and TLS…

View On WordPress

#access controls#AI security#authentication mechanisms#Cloud security#cyber security#Cybersecurity#data encryption#differential privacy#encrypted communications#Incident response#input validation#model protection#Multi-factor authentication#Regulatory Compliance#role-based access control#secure coding#securing AI applications#Security#Security assessments#Security Best Practices#software patching#technology#threat monitoring

3 notes

·

View notes

Text

the devs at the company we acquired refusing to give me access to random shit because it's "sensitive" as if I don't have access to literally everything else anyway

#it's not COMPLETELY unjustified but it's a little bit like. come on now. I also work here.#(not helped by them saying a technical writer shouldn't have website access management when I literally need to administer two websites)#but in general the other company has been kind of cagey about our data compliance shit as if we aren't also a cybersecurity company#this is why we acquired you guys in the first place...

13 notes

·

View notes

Text

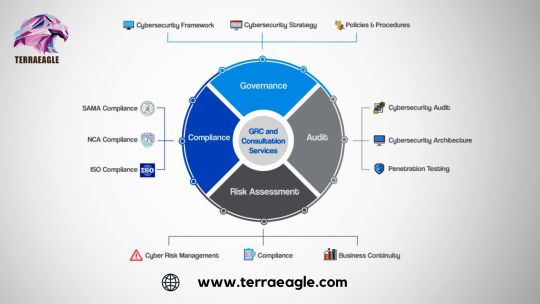

Contact us for the best GRC services in USA-Terraeagle

Discover the best GRC services in the USA with Terraeagle. Connect with us to get expert advice and unbeatable support. Contact us today!

2 notes

·

View notes

Text

ISO 27001 Certification | QC Certification

Secure ISO 27001 certification with Quality control Certification to demonstrate your commitment to robust information security management. Our accredited services offer expert guidance and an efficient certification process to meet international standards. Discover more at QC Certification: https://qccertification.com/ISO-27001-2022.

#ISO27001#InformationSecurity#CyberSecurity#ISO27001Certification#DataProtection#Compliance#InfoSec#ISOStandards

0 notes

Text

Importance of HIPAA Compliance – How Call Center Software Can Help

Healthcare data is at the center of attacks and accounts for 79% of all reported breaches. BPOs handling healthcare data face the challenge of ensuring compliance with industry regulations, including the Health Insurance Portability and Accountability Act (HIPAA), and secure Personal Identifiable Information (PII) / Protected Health Information (PHI).

Let’s understand what security measures…

View On WordPress

0 notes

Text

In today’s world, where our online presence can reach far and wide instantly, the concept of integrity has become more critical. From data breaches to ethical dilemmas, businesses and individuals face various data integrity concerns, which must be addressed and acted upon.

#SecurityIntegrity#CyberSecurity#DataProtection#InformationSecurity#ITSecurity#NetworkSecurity#RiskManagement#SecureSystems#Compliance#DataIntegrity#SecurityConcerns#ProtectYourData#CyberThreats#SecureBusiness#DigitalSecurity#infosectrain#learntorise

0 notes

Text

Banking on AI: Fraud Detection, Credit Risk Analysis, and the Future of Financial Services

New Post has been published on https://thedigitalinsider.com/banking-on-ai-fraud-detection-credit-risk-analysis-and-the-future-of-financial-services/

Banking on AI: Fraud Detection, Credit Risk Analysis, and the Future of Financial Services

In 2020, the financial world was rocked by a scandal involving Wirecard, a German payments processing company. Wirecard had inflated its revenue and profits for years through an elaborate accounting fraud scheme. It resulted in billions of dollars in losses for investors and exposed vulnerabilities in traditional financial oversight methods. Another notable instance of financial fraud occurred in February 2016, when hackers targeted the central bank of Bangladesh and exploited vulnerabilities in SWIFT, attempting to steal USD one billion. While most transactions were blocked, USD 101 million still disappeared.

These high-profile cases underscore the urgent need for a robust fraud detection system in the financial sector. A staggering five percent of corporate revenue, totaling USD 4.7 trillion globally, is lost to fraud every year, according to the Association of Certified Fraud Examiners (ACFE).

AI is revolutionizing the way banks and financial institutions operate, making them more efficient, secure, and customer centric. A recent survey by Ernest & Young revealed that nearly all (99 percent) financial services leaders reported their organizations were deploying AI in some manner.

According to industry projections, the artificial intelligence (AI) market share in the banking, financial services, and insurance (BFSI) sector is expected to increase by USD 32.97 billion from 2021 to 2026, reflecting the rapid growth and adoption of AI technologies in this domain. AI-enabled hyper-personalized banking can create a more tailored banking experience for customers, with bespoke financial products, investment advice, and fraud protection for their unique needs and preferences.

AI-powered tools can help manage finances automatically, from budgeting and bill pay to automated savings and investment strategies, reducing the cognitive load on individuals and promoting better financial management. AI plays a crucial role in strengthening cybersecurity measures and preventing financial crime by identifying and mitigating potential threats in real-time.

The long-term outlook for AI in finance is highly optimistic, with 77 percent of executives viewing AI and generative AI (GenAI) as an overall benefit to the financial services industry in the next 5-10 years, according to the Ernest & Young survey. Leaders see opportunities in enhancing customer and client experiences, with 87 percent stating that they believe AI can bring improvements to this space. The future of AI in banking promises transformative capabilities that will redefine the industry landscape.

Transforming Customer Experiences

Chatbots powered by AI are providing 24/7 customer support, answering basic questions, resolving simple issues, enhancing customer satisfaction, and reducing operational costs for banks. AI-powered virtual assistants can guide customers through complex financial tasks like applying for loans or managing investments, streamlining processes and improving the overall user experience.

Moreover, AI can personalize banking experiences by recommending financial products and services based on a customer’s financial history and behavior patterns. This targeted approach not only enhances customer engagement but also increases the likelihood of obtaining cross-selling and upselling opportunities for banks.

AI is also playing a vital role in automating repetitive tasks, such as data entry and loan processing, freeing up bank employees to focus on more complex tasks that require human expertise and decision-making abilities. The increased efficiency leads to cost savings and improved productivity for financial institutions.

Detecting fraud with AI

Traditional fraud detection methods rely on rule-based systems that can only identify pre-programmed patterns. AI, on the other hand, leverages machine learning (ML) algorithms that can analyze vast amounts of data, including transaction history, location, and device information, to identify anomalies and suspicious activity in real-time. Also, ML algorithms can learn and adapt to new fraud tactics, making them more effective at combating emerging threats and helping enterprises stay ahead of evolving cyber risks.

AI-powered fraud detection with machine learning offers a more intelligent and dynamic approach to protecting financial institutions and their customers from fraud. By flagging fraudulent transactions immediately, AI can prevent financial losses before they occur, helping catch fraud quickly and effectively. By analyzing a wide range of data points, AI can differentiate between legitimate and fraudulent activity accurately, leading to fewer disruptions for legitimate customers and reducing false positives.

Gauging the impact of AI on credit risk analysis

AI is transforming credit risk assessment, a crucial aspect of lending decisions in the financial sector. Traditionally, banks have relied heavily on credit scores and financial history to determine loan eligibility. However, AI can analyze a broad set of data points, including alternative data sources like social media activity, cash flow information, and online shopping habits, to create a more holistic picture of a borrower’s financial health.

By considering this broad data set, AI can create a more nuanced picture of a borrower’s creditworthiness, identifying complex relationships within the data that might be missed by traditional methods. Machine learning algorithms can analyze vast amounts of data faster than humans, with improved accuracy and efficiency, leading to accurate credit risk assessments.

AI can also help identify creditworthy borrowers who may have been excluded by traditional scoring models, promoting financial inclusion and expanding access to credit. Thus, based on a borrower’s unique financial profile, AI can help tailor loan products and interest rates, creating a balanced and accessible credit system.

Dealing with challenges in using AI

AI models are only as good as the data they are trained on, and it is crucial to ensure that AI systems are unbiased and fair in their decision-making processes. As AI plays a more prominent role in financial services, regulations will need to be adapted to address issues like data privacy, algorithmic accountability, and ethical AI practices.

The responsible implementation of AI in financial services requires collaboration between financial institutions, technology providers, and regulatory bodies. This joint effort is essential to establish industry-wide standards, address ethical concerns, and ensure responsible AI deployment.

One of the key challenges in AI is explainability. This is particularly important when AI is used for critical decisions, such as granting or rejecting loans. If a regulator questions a financial institutions’ decision made with AI, the financial institution needs to be able to explain the rationale behind it. For example, if a loan application is rejected, the AI system should be able to provide clear reasons for the rejection, such as specific factors in the applicant’s financial history that contributed to the decision. This level of explainability needs to be considered and built into the AI model from the very beginning of the development and deployment process.

By embracing AI wholeheartedly, with a focus on innovation, compliance, and customer-centricity, banks and financial institutions can secure their place as leaders in the digital age, shaping the future of financial services for years to come.

#accounting#Advice#ai#ai model#AI models#AI systems#AI-powered#Algorithms#amp#Analysis#anomalies#approach#artificial#Artificial Intelligence#assessment#banking#Behavior#billion#budgeting#Collaboration#compliance#cost savings#crime#customer engagement#cyber#cybersecurity#data#data privacy#deployment#detection

0 notes

Text

youtube

0 notes

Text

ISO 27001:2022 Certification | QC Certification

Achieve ISO 27001:2022 certification with Quality Control Certification to enhance your organization's information security management. Our accredited services provide expert guidance and a streamlined process to ensure compliance with the latest international standards. Learn more at QC Certification: https://qccertification.com/ISO-27001-2022.

#ISO27001#InformationSecurity#CyberSecurity#ISO27001Certification#DataProtection#Compliance#InfoSec#ISOStandards#QCcertification

0 notes