#Cyprus Issue statement

Explore tagged Tumblr posts

Text

Turkish President Erdoğan's ongoing support for the TRNC

Turkish President Erdoğan’s ongoing support for the TRNC President Erdoğan: “We will continue our efforts for sovereign equality of Turkish Cypriot people.” The president of Türkiye, Recep Tayyip Erdoğan, addressed the Cyprus issue during his opening speech at the Antalya Diplomacy Forum, held at NEST Convention Centre between 11-13 April, where Anadolu Agency (AA) was the “Global Communication…

#Antalya Diplomacy Forum#Cyprus Issue statement#Ongoing TRNC support#Recep Tayyip Erdogan#Turkish President

1 note

·

View note

Text

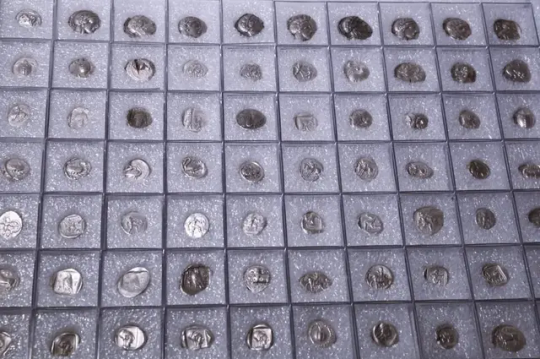

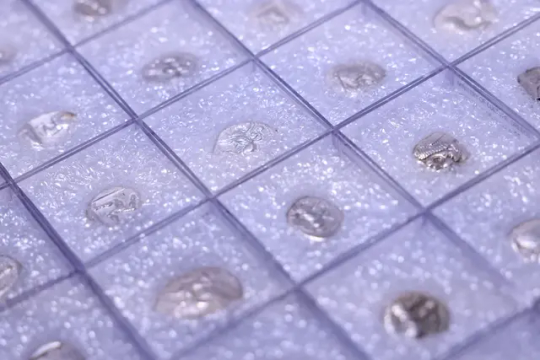

Greece Returns 1,055 Ancient Coins to Turkey

Greece on Thursday returned a hoard of over 1,000 stolen ancient coins to Turkey in the first repatriation of its kind between the historic rivals and neighbors, Agence France-Presse reported.

The move came a few months after Turkey publicly supported Greece in its long quest to reclaim the Parthenon Marbles from the British Museum in London.

Greek Culture Minister Lina Mendoni said the hoard of 1,055 silver coins had been seized by Greek customs guards on the border with Turkey in 2019.

“These coins had been illegally imported,” Mendoni said at a ceremony at the Numismatic Museum, which specializes in currency and medal collections, in Athens.

Greeks are “particularly sensitive” to repatriation issues, she said.

“All illegally exported antiquities from whichever country should return to their country of origin,” Mendoni added.

Turkish Culture Minister Mehmet Nuri Ersoy said the operation was the first repatriation from Greece.

Greek and Turkish experts determined that the coins were part of a stock hidden in Asia Minor between the late 5th and early 4th century BCE, she added.

While research is ongoing, it is possible the hoard was secreted in modern-day Turkey during the Persian Wars expeditions of Athenian general Cimon, a veteran of the 480 BCE Battle of Salamis, she added.

Broadly used

Most of the cache were tetradrachms — ancient large silver coins — originally minted in Athens and used broadly in the eastern Mediterranean, said Museum Numismatologist Vassiliki Stefanaki, a coinage expert.

Stamped with the image of an owl, the Athenian relics were also used locally to pay tribute to the Persian Empire, and Persian governors used them to reward their troops, she said.

Other coins came from Cyprus, the islands of Aegina and Milos, from Asia Minor cities founded by Greek settlers, the Iron Age kingdom of Lydia, and Phoenicia in modern-day Lebanon, officials said.

Mendoni on Thursday also thanked Turkey for supporting Greece’s campaign to secure the return of the Parthenon Marbles from London.

The British Museum has long maintained that the Marbles were removed from the Acropolis in Athens by royal decree granted to Lord Elgin, the British ambassador to the Ottoman Empire.

But in June, Zeynep Boz, the head of the Turkish Culture Ministry’s anti-smuggling committee, told a UNESCO meeting in Paris that no such document had been found in Ottoman archives.

Her statement was “decisive” in favor of Greece’s position, Mendoni said Thursday.

Ersoy through a translator said Turkey wanted “with all its heart” to see the Marbles return to Athens.

“The Greek people should have them, they belong to them,” he said.

Boz, who attended Thursday’s ceremony in Athens, told Agence France-Presse that the timing of the coins’ return by Greece was not related to her report in June.

The five-year delay was caused by the time required by the Greek justice system to authorize the coins’ repatriation, she said.

#Greece Returns 1055 Ancient Coins to Turkey#silver#silver coins#ancient coins#ancient artifacts#tetradrachms#Persian Empire#archaeology#archeolgst#history#history news#ancient history#ancient culture#ancient civilizations#looted#stolen

80 notes

·

View notes

Text

[ 📹 Scenes from the moment when Zionist warplanes bombed the Jules Tower in the Al-Nuseirat Refugee Camp, in the central Gaza Strip, shattering the building to pieces and ejecting plumes of smoke, dust and shrapnel through the air. ]

🇮🇱⚔️🇵🇸 🚀🏘️💥🚑 🚨

GAZA GENOCIDE DAY 289: ISRAEL MUST FACE CONSEQUENCES FOR "SUCH CRUELTY" SAYS ERDOGAN, GALLANT LIFTS RESTRICTIONS ON THE USE OF MILITARY AIRCRAFT IN THE OCCUPIED WEST BANK OF PALESTINE, GENOCIDE CONTINUES AS CIVILIANS SLAUGHTERED IN THEIR HOMES BY THE ZIONIST ARMY

On 289th day of the Israeli occupation's ongoing special genocide operation in the Gaza Strip, the Israeli occupation forces (IOF) committed a total of 4 new massacres of Palestinian families, resulting in the deaths of no less than 64 Palestinian civilians, mostly women and children, while another 105 others were wounded over the previous 24-hours.

It should be noted that as a result of the constant Israeli bombardment of Gaza's healthcare system, infrastructure, residential and commercial buildings, local paramedic and civil defense crews are unable to recover countless hundreds, even thousands of victims who remain trapped under the rubble, or whose bodies remain strewn across the streets of Gaza.

This leaves the official death toll vastly undercounted as Gaza's healthcare officials are unable to accurately tally those killed and maimed in this genocide, which must be kept in mind when considering the scale of the mass murder.

On Sunday, Turkiye's President, Racep Tayyip Erdogan, said of the recent advisory opinion of the International Court of Justice (ICJ) at The Hague, that the Court's opinion will awaken the global community and that the Zionist entity must face strong enough punishment for its actions that would deter any other country "from considering such cruelty again."

Speaking on a plane returning from the Turkish Republic of Northern Cyprus, Erdogan said that "Israel must face the consequences of its actions, ensuring that the punishment serves as a stark deterrent against anyone considering such cruelty again."

Erdogan went on to comment on the advisory opinion of the ICJ by declaring that "I hope this decision and previous ones not implemented by Israel will bring an awakening in the international community."

The Turkish President also encouraged the United States to exert pressure on the occupation, and said it should withdraw its support for the "murderer" Prime Minister, Benjamin Netanyahu, and his administration to end the "oppression" in the Gaza Strip.

"The whole issue is for those who stand for justice against Israel's actions to unite, ensuring everyone stands alongside the decision of the ICJ. We can only disrupt this game with such a stance," Erdogan said.

"To end this oppression, it is necessary for the US administration to pressure Israel and withdraw its support from murderer Netanyahu and his associates," the President added.

This comes after the ICJ slammed the Israeli occupation of the West Bank of Palestine, declaring that the Zionist entity must end its occupation "as rapidly as possible," while also demanding that Tel Aviv make full reparations to Palestinians for its "internationally wrongful acts."

The ICJ also found that the Israeli occupation has committed multiple breaches of international law, including activities the Court likened to "Apartheid."

In other news, Zionist Defense Minister Yoav Galant announced on Sunday that he will remove restrictions on the use of warplanes and other military aircraft in the occupied West Bank, and further, issued orders for the Israeli occupation army to "eliminate" the battalions of armed resistance in the western Palestinian territories.

"I also removed restrictions on the use of military drones in the West Bank to reduce the risk to soldiers' lives," Galant added.

The statements were made during a session for the assessment of the situation in the occupied West Bank, held with the newly appointed commander of the Central Command, Avi Balut, who's division is responsible for the occupied territory.

Additionally, also attending was the Commander of the West Bank Division of the occupation army, Yaki Dolev, along with the commander of the Border Guard forces in the West Bank, Barak Mordechai, as well as field commanders and representatives of the Shin Bet security apparatus.

During the meeting, Galant received briefings on the "most active forces in the area to thwart operations, eliminate armed organizations in refugee camps, and improve security measures in local authorities", which refers to the illegal Zionist settlements in the West Bank, to "enhance the security of the population (settlers)," according to a statement issued by the Israeli Defense Ministry.

Galant continued by emphasizing "the need for the continuous and systematic elimination of all armed organizations, and stressed that the IDF has full support for working to achieve this goal."

Following the conference, the statement cited Galant as stating that "terrorism is boiling in this sector, among other things as a result of guidance from Iran, Hezbollah and other factors seeking to undermine the situation."

"Yesterday we carried out an attack in an area 2,000 kilometers from Israel (referring to the Yemeni port of Hodeidah), and now we are in the heart of the State of Israel, and we will know how to operate here as well. A few months ago, we lifted the restrictions on the operation of air force planes, including the attack in the Central Command area, in order to thwart terrorism without putting soldiers in unnecessary danger. If necessary, we will expand this issue," the Defense Minister said during the meeting.

Defense Minister Galant also stated that he has instructed the Central Command and Army Chief of Staff, Herzi Halevi, to "ensure that all the actions of the terrorist brigades inside the refugee camps are thwarted and that we crush these brigades, in Jenin, Tulkarm, Tubas and other places."

"We will act as needed, we will not allow the citizens of Israel to be endangered as a result of the actions of terrorists directed from Iran," Galant concluded.

Meanwhile, the Israeli occupation forces (IOF) continued its war of genocide in the Gaza Strip, slaughtering Palestinian children and other civilians, while one-by-one targeting the few remaining housing units and public infrastructure, and detonating residential buildings with explosives and airstrikes.

Beginning on Saturday night, IOF warplanes bombed another commercial facility housing displaced Palestinian families in the Armeida area, east of the city of Khan Yunis, in the southern Gaza Strip.

Medical sources with a local hospital told official Palestinian news agency WAFA that at least 6 civilians were killed and dozens of others wounded, after occupation forces bombed a commercial facility in which displaced civilians were being housed in the Armeida area of the town of Abasan Al-Kabira, east of Khan Yunis.

Following that strike, during the early morning hours of Sunday, Zionist fighter jets bombed a residential house belonging to the Khalifa family in the Al-Bureij Refugee Camp, in the central Gaza Strip, killing 7 Palestinian civilians, including women and children, and wounded a number of others.

Similarly, occupation aircraft bombarded a residential home in the Al-Nuseirat Refugee Camp, killing 4 civilians.

The Israeli occupation's war crimes continued when occupation warplanes bombed a civilian home north of the Nuseirat Camp, killing a young child, while another Zionist army raid targeted a residential building north of the camp, wounding at least 5 Palestinians.

In the next Israeli atrocity on Sunday morning, occupation fighter jets bombarded a residential house belonging to the Ghurab family in the New Camp area of the Nuseirat Camp, resulting in the martyredom of one Palestinian and wounding dozens of others.

Israeli warplanes also bombed the Al-Da'wa area, in the vicinity of the power station and Salah al-Din Street, northeast of the Nuseirat Camp, while occupation drones fired missiles into the same area.

Zionist forces went on to target in the vicinity of the Kuwait roundabout in the Al-Zaytoun neighborhood, southeast of Gaza City, leading to the deaths of two citizens who were transported to Al-Ahli Baptist Hospital in the city.

Palestinian medical sources are reporting that more than 60 victims of Israeli bombings have been killed since dawn on Saturday.

The Palestinian Red Crescent Society (PRCS) has also reported that their rescue crews managed to recover the body of one dead citizen, along with two others who were wounded after occupation fighter jets bombed a civilian residence in the town of Bani Suhaila, east of Khan Yunis, in the south of Gaza.

PRCS also said that their rescue crews also recovered three bodies of martyrs who were murdered as a result of Israeli bombing of the Al-Shaboura Refugee Camp in central Rafah City, in the southern Gaza Strip.

The paramedic organization added that the occupation continues to bomb and shell the Al-Bureij Camp, in central Gaza, with a local residential apartment building targeted in an Israeli bombing that killed 4 civilians.

Later on Sunday, occupation forces bombed a residential home in the Qizan Al-Najjar neighborhood, south of Khan Yunis, in the southern Gaza Strip, killing at least 3 Palestinians, including two young children, and wounding several others.

A number of civilians were also wounded after the Zionist occupation army shelled a Mosque in the Al-Zaytoun neighborhood, southeast of Gaza City.

As a result of the Israeli occupation's ongoing war of extermination in the Gaza Strip, the death toll now exceeds 38'983 Palestinians killed, including well and above 15'000 children and more than 10'000 women, while another 89'727 others have been wounded since the start of the current round of Zionist aggression, begining with the events of October 7th, 2023.

This brings the total number of Palestinian casualties to 128'710 or the equivalent of 5.59% of Gaza's 2.3 million residents.

July 21st, 2024.

#source1

#source2

#source3

#source4

#source5

#source6

#source7

#source8

#videosource

@WorkerSolidarityNews

#gaza#gaza strip#gaza news#gaza war#gaza genocide#genocide#war in gaza#genocide in gaza#israeli genocide#israeli war crimes#israeli occupation#war crimes#crimes against humanity#palestine#palestine news#palestinians#free palestine#gaza conflict#israel palestine conflict#war#occupation#middle east#politics#news#geopolitics#international news#global news#breaking news#israel#current events

24 notes

·

View notes

Text

Hapy St. Patrick's Day.

"More than with most famines, this is an avoidable catastrophe. With its restrictions on the distribution of food aid, water, and medical supplies, Israel is manifestly causing famine as it wages war. In this, it is facilitated by the United States, which continues to arm Israel and give it political cover through the use of its veto at the UN Security Council.

In recent US announcements, there is a measure of recognition of the gravity of the situation in Gaza, but the practical measures which followed are inadequate. Air-drops will not stop famine; nor will the proposed maritime corridor between Cyprus and Gaza relieve starvation on the necessary scale.

On this St. Patrick’s Day in an election year, we are appealing to the conscience of Irish America. We ask Irish Americans in their capacity as citizens, as members of cultural and benevolent societies, as political leaders, to use their influence to avert a Famine as severe as the one faced by their ancestors. To do this it is necessary that the United States ceases arming Israel; that it puts pressure on Israel to halt its military action and lifts its blockade on Gaza; that it refrains from using its veto at the UN security council in relation to Palestine; that it restores funding to UNRWA, the agency best-equipped to provide relief; that it acts as an honest broker to bring about an agreed political settlement between Israel and Palestine."

20 notes

·

View notes

Text

More than a million Moldovans will cast ballots on whether to join the EU on Sunday in a referendum that could pave the way to becoming a member of the bloc — or see the Eastern European nation pulled back into Russia’s orbit.

A victory for the pro-Western government would be a blow for Moscow’s influence in the region, but would also increase pressure on Brussels to move ahead with the accession process despite serious practical concerns.

“This is a historic decision for us, maybe the most important one since we gained independence from the Soviet Union,” said Cristina Gherasimov, Moldova’s deputy prime minister and EU integration chief, in an interview with POLITICO.

“For us, EU membership is existential. It’s the only way to consolidate our democracy. There is no plan B — Russia and the future it wants for us is no alternative.”

Moldova’s gravitation toward the West has increased in recent years, with the war in Ukraine raging just across the border. Officials warn that Russian intelligence is actively trying to disrupt the EU membership referendum, as well as a simultaneous election in which President Maia Sandu is seeking a second term.

“We are seeing the classic hybrid toolbox Russia uses to influence elections, but the magnitude is really unprecedented,” Gherasimov said. “We see hybrid attacks on public institutions responsible for critical services like the post office and the airport. We see vote-buying. We see the use of local corrupt proxies and political parties — they’re given cash to destabilize the situation on the ground.”

The country’s police force told POLITICO earlier this month that over $15 million in Russian funds have been funneled into the bank accounts of more than 130,000 Moldovan citizens in the lead-up to the election. Sandu’s pro-EU government faces opposition from a handful of pro-Russian parties, and the EU has imposed sanctions on Ilan Shor, a prominent oligarch accused of working on behalf of the Kremlin.

The bloc has also stepped in to support Moldova by deploying a civilian advisory mission designed to help the fight against disinformation and covert influence.

A draft statement to be issued by EU leaders following talks on Thursday, seen in advance by POLITICO, condemns “Russia’s persistent foreign information manipulation and interference to attempt to undermine democratic elections and the choice of the Moldovan people for a prosperous, stable and peaceful European future.”

A country divided

Moldova’s accession talks with the EU began in June this year, moving forward in the process at the same time as neighboring Ukraine. However, as with Kyiv’s application, the country faces significant hurdles to actually being admitted to the club of 27 countries.

Since the fall of the USSR, a frozen conflict has simmered over the breakaway region of Transnistria, where Russia has stationed troops despite objections from the Moldovan government. The existence of the unrecognized state presents Brussels with a dilemma — with few European leaders relishing a repeat of the decision to admit Cyprus to the bloc while almost half of the island remains occupied by a Turkish-backed separatist government.

Last year, Romanian MEP Siegfried Mureșan, chair of the European Parliament’s delegation to Moldova, warned that “Moldova cannot become a member of the EU with Russian troops on its territory.” According to him, the issue needs to be solved “before membership.”

However, Gherasimov insisted that negotiations were moving ahead despite the dispute. “We have not seen any mentions in official documents to the Transnistria region, which for us is a clear signal that there is not going to be special focus on the region,” she said.

According to Sandu and her ministers, the referendum to enshrine Moldova’s European dream in the constitution will prevent future governments from undermining its Westward trajectory. However, the high-profile vote will also be used to convince Brussels to move ahead with the membership process.

“We hope this rare window of opportunity, where there is interest to talk about enlargement, will continue,” Gherasimov said. “We’re working on a domestic deadline to be ready for accession by 2030 — we want the EU to reciprocate because we need a credible commitment.”

4 notes

·

View notes

Text

Eurovision Fact #389:

In 2019, the Belarusian jury was dismissed from the competition following the first Semi-Final. Their voting results for the Grand Final were replaced by an aggregate jury.

However, in reading out the votes human error changed the order in which the points were allocated. This meant that the bottom ten were read out instead of the top ten.

The live results were as follows:

12: Israel

10: Estonia

8: Germany

7: Norway

6: Spain

5: United Kingdom

4: San Marino

3: Serbia

2: Iceland

1: Australia

But the edited results are:

12: Malta

10: North Macedonia

8: Cyprus

7: Italy

6: Netherlands

5: Azerbaijan

4: Switzerland

3: Greece

2: Sweden

1: Russia

[Sources]

'EBU issues statement on Eurovision Song Contest Grand Final Jury result,' EBU.ch.

'EBU dismisses further Eurovision vote irregularities,' oneeurope.co.uk.

'EBU admits Eurovision vote screw up,' oneeurope.co.uk.

'Eurovision 2019: Were the aggregated jury votes from Belarus given in the wrong order?,' wiwibloggs.com.

'Major error uncovered in Belarusian jury vote?,' ESCEXTRA.com.

Eurovision Song Contest 2019 - Grand Final - Live Stream 3:25:46-3:26:08, YouTube.com.

Tel Aviv 2019: Detailed Voting Results of Belarus Grand Final, Eurovision.tv.

5 notes

·

View notes

Text

Anil Ambani's wife Tina appears before ED in FEMA case

The investigation against the couple pertains to the possession of certain alleged undisclosed assets abroad and the linked movement of funds, the sources said.

MUMBAI: Tina Ambani, the wife of Reliance ADA Group Chairman Anil Ambani, on Tuesday appeared before the Enforcement Directorate (ED) here for questioning and recording her statement in connection with an investigation linked to the alleged contravention of the foreign exchange law, official sources said.

Anil Ambani recorded his statement in the case on Monday under sections of the Foreign Exchange Management Act (FEMA) and he is expected to appear before the federal agency again later this week for completion of the exercise.

The investigation against the couple pertains to the possession of certain alleged undisclosed assets abroad and the linked movement of funds, the sources said.

Anil Ambani’s alleged links to some offshore companies based in Jersey, the British Virgin Islands and Cyprus are under the probe scanner of the ED.

He had been questioned by the agency in 2020 in a money laundering case against Yes Bank promoter Rana Kapoor and others.

In August last year, the income-tax department issued a notice to Anil Ambani under the anti-black money law for allegedly evading Rs 420 crore in taxes on undisclosed funds of more than Rs 814 crore held in two Swiss bank accounts.

The Bombay High Court in March ordered an interim stay on this I-T show-cause notice and penalty demand.

2 notes

·

View notes

Text

Chevron expresses interest in Greek energy exploration | Reuters

https://www.reuters.com/business/energy/chevron-expresses-interest-hydorcarbons-exploration-greece-energy-ministry-says-2025-01-20/

ATHENS, Jan 20 (Reuters) - Chevron (CVX.N), opens new tab is interested in energy exploration in Greece, the U.S. oil producer and the country's energy ministry said on Monday.

Chevron has submitted a non-binding expression of interest for one open block to Greece's Hellenic Hydrocarbons and Energy Resources Management Company (HEREMA), the company confirmed.

The government welcomed Chevron's expression of interest. A decision will be issued this week on the exact area of exploration and an international tender will be launched soon, the ministry said in a statement...

...Chevron operates gas fields in Israel and has interests in Egypt and Cyprus.

"Chevron has a large and important position in the Eastern Mediterranean, a region which is very much a part of our future and a priority for us," a company spokesperson said.

The area being looked at ranges from southwest of the Peloponnese peninsula to west of the island of Crete, the Greek ministry said.

And here: https://www.google.com/amp/s/www.cnn.gr/oikonomia/anaptyxi/story/459624/ksekinaei-i-diagonistiki-diadikasia-gia-tous-ydrogonanthrakes-sto-ionio/amp

1 note

·

View note

Text

Bridging Politics and Law: Kypros Chrysostomides as Government Spokesperson

Kypros Chrysostomides’s appointment as Government Spokesperson from 2003 to 2005 under President Tassos Papadopoulos showcased his ability to bridge the worlds of politics and law. This was a transformative period for Cyprus, particularly with the country’s accession to the European Union in 2004. As the public voice of the government, Chrysostomides played a crucial role in communicating complex policies to national and international audiences, ensuring that the public remained informed about pivotal developments.

One of the most significant achievements during his tenure was guiding public discourse on Cyprus’s EU accession. The accession required substantial legal reforms and delicate diplomatic negotiations, necessitating clear and effective communication to manage public expectations. Chrysostomides's deep legal expertise was invaluable in explaining these reforms to the public while reassuring international partners about Cyprus’s readiness to meet EU standards. He successfully conveyed the benefits of EU membership, emphasising how it would strengthen Cyprus’s economy and legal framework while offering citizens new opportunities.

In addition to handling matters related to the European Union, Chrysostomides had to address ongoing discussions about the Cyprus Problem. The political landscape was delicate, with ongoing negotiations to resolve the island's decades-long division. His role as Government Spokesperson required a careful balance between transparency and discretion, ensuring that government communication did not undermine diplomatic efforts. His statements reflected the government’s legal position and a nuanced understanding of international diplomacy, helping maintain public confidence during complex negotiations.

Chrysostomides’s background in international law allowed him to provide a sophisticated perspective on geopolitical issues. His legal insights were precious as the government navigated sensitive topics like territorial disputes and human rights issues arising from the Turkish invasion. As a result, his public statements were marked by precision and clarity, earning him respect among political peers and the general public.

Another crucial aspect of his tenure was building trust between the government and citizens. At a time when the public sought greater transparency, Chrysostomides’s communication style was characterised by professionalism and clarity. He explained government policies in accessible language, fostering an open dialogue between officials and the public. His ability to simplify complex legal and political issues allowed citizens to engage more meaningfully with public affairs, thereby enhancing civic participation.

Chrysostomides’s work was not limited to policy announcements; he also managed crises during his tenure, demonstrating his ability to maintain composure under pressure. Whether addressing concerns about public service reforms or providing updates on sensitive diplomatic efforts, he maintained a consistent message of accountability and responsibility. His emphasis on honesty and transparency further bolstered the government’s credibility, even during challenging moments.

In addition to his formal duties, Chrysostomides also served as an informal advisor to the government, drawing on his legal experience to shape policy messaging. His influence extended beyond public communications, as he worked behind the scenes to ensure that the government’s public positions aligned with both national law and international obligations. This alignment was critical during Cyprus’s integration into the EU, demonstrating the country’s commitment to upholding European legal standards.

Chrysostomides’s tenure as Government Spokesperson exemplified how law and politics can intersect to advance national interests. His ability to navigate both worlds ensured that the government communicated effectively, maintained public trust, and managed complex international relationships. His time in this role remains a testament to his skill in balancing legal precision with political pragmatism.

Even after stepping down from the role, Chrysostomides’s contributions to government communication continued influencing public discourse in Cyprus. His work laid the groundwork for future spokespersons, demonstrating the importance of clear, transparent communication in public service. His legacy as a Government Spokesperson reflects his career's core values: professionalism, integrity, and a commitment to serving the public interest through law and politics.

Resources:

https://www.f6s.com/member/drkyproschrysostomides

https://www.worldservicesgroup.com/releases.asp?pcomp=186

Read Our Blog About Building Cyprus’ European Future: Kypros Chrysostomides and the EU Accession Process

0 notes

Text

Cash for Cyprus! Maxiflex had to pay €370,000 due to potential infractions of the law.

Maxiflex has received allegations of being a major scam. Find out more about the company and its operations in this Gripeo review.

The CySEC declared on December 5, 2020, that a board decision had previously been made on October 5, 2020. It has to do with Israeli Roy Almagor’s Maxiflex Ltd. Maxiflex was required to pay the Republic of Cyprus Treasury €370,000. Although CySEC likes the phrase settlement money, reasonable people would refer to this as a penalty payment. As usual, the CySEC’s statement is incredibly evasive and fails to provide any context for the possible infraction Maxiflex may have committed. Lately, GlobalNetInt suspended the bank accounts of Almagor’s Maxiflex and Maxigrid after they were used as props in broker frauds.

In light of CySEC’s investigations, for potential infractions of The Investment Services and Activities and Regulated Markets Law of 2017, as these appeared between January 2019 and September 2020. More particular, the agreement agreed covered the evaluation of the Company’s adherence to:

Article22(1) of the Law addresses the authorization conditions of article 17(2),17(3), and 17(6) of the Law regarding the organisational requirements that a CIF must adhere to;

Article 24(1) of the Law addresses conflicts of interest; Article25, paragraphs (1) and (3) of the Law addresses general principles and information to clients;

Article26, paragraphs (2)(a) and (3)(a) of the Law addresses the evaluation of suitability and appropriateness and client reporting; and

Article28, paragraphs (1)(a) and (8) of the Law specify the duty to execute orders on terms that are most advantageous to the client.

A settlement of €370.000 has been made with the Company over potential infractions. The €370.000 has been paid by the Company. It should be highlighted that the sums payable under settlement agreements do not belong to CySEC and are instead regarded as revenue (income) of the Republic’s Treasury.

Maxiflex’s Infraction of the Law

Usually, an infraction is when someone violates a law, regulation, or agreement. Therefore, a country found guilty of breaking an international treaty will typically be required to pay a fine. A fee is the only punishment under federal law, where the offence is even less serious than a misdemeanour.

CySEC

Cyprus’s financial regulator is the Cyprus Securities and Exchange Commission, or CySEC for short. The European MiFID financial harmonisation law is complied with by CySEC’s financial regulations and operations as a member state of the EU.

A sizable portion of foreign retail forex brokers are registered with CySEC. Many binary options brokers had previously chosen CySEC as their regulator of choice before 2018.

As a public corporate organisation, CySEC was established in 2001 under section 5 of the Cyprus Securities and Exchange Commission (Establishment and Responsibilities) Law of 2001. CySEC joined the European MiFID regulation at the same time as Cyprus joined the EU in 2004, providing companies registered there access to all European markets. However, the financial regulatory structure that CySEC enforced for what was once thought to be a tax haven was drastically altered upon the EU’s membership and adoption of the Euro.

CySEC issued a regulatory change on May 4, 2012, pertaining to the categorization of binary options as financial instruments. As a result, platforms for binary options that are based in Cyprus—where the majority of them do—had to be subject to regulation. As a result, CySEC became the first financial regulator in the world to officially acknowledge and control binary options as financial instruments.

On July 10, 2019, CySEC permanently prohibited providing binary options trading to retail traders, following the implementation of a temporary ban on the products in July 2018.

Revocation of Maxiflex Ltd.’s authorization by the Cyprus Securities and Exchange Commission

In accordance with section 10(1) of Directive DI87-05 for The Withdrawal and Suspension of Authorization (“DI87-05”), the Cyprus Securities and Exchange Commission (“CySEC”) has notified the Malta Financial Services Authority that, as of October 15, 2021, it has completely suspended Maxiflex Ltd.’s authorization (“the Company”). This is because there are allegations of purported violations of:

According to Section 5(5) of the Investment Services and Activities and Regulated Markets Law of 2017 (the “Law”), the Company appears to be conducting business, engaging in business, and/or facilitating business not specifically authorised by the Company.

Article 22(1) of the Law since it appears that the Company does not always abide by the authorization criteria in sections 9(2) of the Law regarding the eligibility of management body members, 11(1)(b) regarding the suitability of shareholders, and 17(4) and (9) regarding organisational requirements.

As stipulated in section 9 of DI87-05 and for the duration that the suspension of authorization is in effect, the Company is not allowed to:

offer or carry out investment services or activities;

engage in any kind of business dealings with third parties and take on new clients;

promote itself as an investment services provider.

The following measures by the Company may be taken without violating section 7(a) of DI87-05, so long as they are in accordance with the desires of its current clients:

fulfil all of its clients’ and its own transactions that are in front of it, in compliance with client directives;

refund any money and financial instruments that belong to its clients.

The CySEC ruling of October 15, 2021, which is available on the CySEC website, provides more information about the aforementioned.

1 note

·

View note

Text

TRNC President Ersin Tatar: EU surrenders to Greek Cypriot Side

President Ersin Tatar has issued a statement on the Cyprus issue and the European Council conclusions dated 17 April. 2024 on Ukraine, the Middle East, and Türkiye. EU surrenders to Greek Cypriot Side Continue reading TRNC President Ersin Tatar: EU surrenders to Greek Cypriot Side

View On WordPress

#Criticle statement#Cyprus issue#EU surrenders to Greek Cypriot Side#European Council#Presidency of the Turkish Republic of Northern Cyprus#President Ersin Tatar

0 notes

Text

Exposing The 'FSM SCHEME' - FSM SMART, TRADE12, HQBROKER, MTI MARKETS, MX TRADE

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?

In offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered. It looks like this:

Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore: link and maybe Hong Kong: HK search:

Why Hong Kong? We will prove a point shortly. Here we will just complete this sentence with public document where a certain Mr. Avshalom from Israel is indicated as the President (wow!) of GWU MKTG CORP. 08F Clark Center Berthaphil III, JAS Ave., CFZP, pls see: PH alien employment permit filling. GWU MKTG Corp website, domain-big-data tool shows registration from Cyprus (?) in 2015 link, while the company website kind of gives it away, doesn’t it?

Going back to already explained ties to BSD Trade Services Corp issue, a closer look at its nonfunctional website via domain-data tools, after checking this job add: call center job advertisement, one can learn quite a lot. Actually, too much… BSD Trade Services Corp domainbigdata check. The company registered a domain indicating a HK incorporation, domain is not privately registered but via the company (!), name and phone of the registrant also indicated, registrant’s name (2015) Mr. Richard Bula. Mr. Bula holds 31 registrations in his name, per same tool search: R-Bula-domain-registrations and the results are shocking, to say the least. Let’s memorize these information permanently here:

TradingBanks, MXTrade, Trade12 … absolute and pure scams, tied directly to specific PH call center. Also, we encourage you to further check listed domains or check recorded Richard Bula’s mail address ([email protected]) , as you will find this as well link – www.easyoption.us (Israeli Spot Option binary options broker, roof of many, many scams since 2011), tied to link, link, also Mr. Bula’s details are falsely tied to non-existing London address Badenerstrasse 549. It is actually shared-virtual Regus office space in Switzerland link, one of many deceiving attempts of scammers to confuse any investigator. Not happening. Going further with the same checks of www.easyoption.us domain, we get this result:

This Christina Constantinou is Cypriot resident (perhaps AGP Law, maybe some other company), Exo Capital Markets Ltd, Marshal Islands was the declared operator of Trade12.com huge scam, HQBroker brand emerges for the first time tied to the scheme group… however you turn this around, it is always the same group and same crew. Also, here we can identify another company, part of this vast scam group, Eyar Financial Corp Limited, Vanuatu, struck-off in 2018.

PART 2 MTI Markets scam broker was a bit different setup, more Europe oriented, involving directly different people, but ultimately all being connected in this generic FSM Scheme. Allegedly ran via Marshal Islands company MTI Investments Llc (search, closed in 2018). Warnings and reviews: FPA, link with operator names. MTI Markets main domain was registered like this link. 2015 registrant is the Belize company MTI Group Ltd t/a MTI Markets: link, domains screaming with known ‘exo’ and ‘mti’ pretexts. Indicated people were: Mr. Armin Ordodary, (Iranian with Cyprus residency, former Windsor Brokers employee), Mr. Ali Mahmoudi (Iran) and Mr. Mathew Bradley (??). You are encouraged to browse domain big data tools, so you can find them all and see the connections, explore domains etc. We will focus our attention here to Mr. Armin Ordodary now. For a very good reason. Armin Ordodary, an Iranian national, with Cyprus residency, is in the business for a long time. Picture from Windsor Broker celebration link and other publicly available ones:

Benrich Holdings Ltd, Cyprus link

Benrich Trading Ltd, Cyprus link

Bythos Yacht Management OU, Estonia link, link

Siao Ltd, Cyprus (see more domains under this one, incl. Twitter acct link) link

AGFM Ltd, Cyprus link

Nepcore (essentially CRM gateway provider, reg. via A. Ordodary link)

Possibly Orden Capital HK (domain big data, linked to him, typical names like ordencapital, ordenholdings etc) link

BizTech DOO, Serbia link

BizServe DOO, Serbia, formerly known as Upmarkt DOO link

Here is where we get to the FSM Smart scam broker, FB page, LinkedIn page. While Siao, Nepcore, Orden and Bythos were reserved for CRM, PSPs, payment intermediaries, essentially different work within the scam group, Benrich offices, possibly AGFM and certainly BizTech/Serve offices were boiler rooms with agents working primarily on FSM Smart scam, while other 2 brands of the ‘fantastic scam trio’ (Trade12 and HQBroker) were handled via other arms of this vast scheme group (in BPOs located in Ukraine, Albania and Georgia, will be elaborated later on). And since Mr. Armin Ordodary directly holds ownership in both Benrich and both BizTech/Serve, directly or indirectly, this leads to the conclusion that this young man’s role in this scam scheme is for MTIMarkets and FSMSmart scams primarily. In fact, we have verified information that Benrich Holdings Cyprus was or still is a place where agents work, mainly in English and Italian language, while the Serbian subsidiary of Benrich, Upmarkt/Bizserve (allegedly closed due to bad results) was a so-called FTD center, acquiring new clients for FSM Smart scheme.

Serbian boiler room - Upmarkt doo Companies extracts prove Benrich holds stake in Serbian subsidiary and Armin’s ownership of another one, as well as local name change :

Cyprus boiler room – Benrich Holdings Ltd

A place where apparently Retention agents operated. Besides English language, this was or still is a place where most of FSM Smart scams in Italian language happen. Few of the agents operating at one point in that office, between 2018-2019, per LinkedIn reveal that a spinoff facility was probably used for scamming, as well - Topright Trading Limited Cyprus, link:

link retention agent (note previous engagement in exposed boiler Smardis doo)

I have not personally investigated all of the information in this thread. What I can tell you is that someone doesn't want you to see it. Someone went to a great deal of effort to try to get the FPA to remove all the information Scam Reporters posted here.

Another site owner filed a malicious and false DMCA against the FPA after Part 1 of this thread was posted. This site is filled with news items that appear to be borrowed or stolen from major news sites. In the middle of all of the latest major news items taken from news sites, a copy of Post 1 was retroactively inserted.

The complaining site is based on WordPress. WordPress makes backdating a post easy. Years ago, one of ForexGen's many spammers tried to "prove" something at the FPA had existed for more than a short period of time. The scammers behind that backdated a blog post to before the original ForexPeaceArmy.com registration date.

In this case, they first posted a backdated version of Part 1 of this post and DMCAed the FPA, demanding removal of material that was originally published here. The FPA disputed this, and then they followed up with a backdated copy of Part 2.

More details coming very soon.

PART 3

In this part, we will focus our attention to money flow in the FSM part, followed by more close ties between FSM SMART, TRADE12 and HQBROKER, obviously set for Part 4. We actually believe this entire FSM Scheme Thread will have at least parts 4 and 5. Maybe even 6? We told you it would be complicated, so hold on. And stay tuned. A lot more is coming. And a few surprise guests to back us up here with their stories and/or documents.

FSM SMART As we previously stated and proved, all of the 3 brands are part of the same scheme, same, for now unidentified UBOs in the end. Apparently, some dangerous people, as stated already. Ok, noted. We are neither 'impressed' nor frightened. In fact, it should be the other way around, if they have any 'smarts', because of the ongoing investigations. Slow, but getting there...

Now, let's see who are the operators (PSPs, intermediaries and a few more boiler rooms), where does the client money go and who receives it. These information may become crucial for anyone aiming to recover his ''lost'' (stolen) funds.

In the FSM Smart(s) T&C (here:link), bottom of the page 6, FSM Smart declares its operator/owner to be both FSMSmart Ltd (Marshal Islands) and Memphis Investments Sp. z o.o. (Poland).

T&C further point that in case of misunderstanding btw the Company and the Dear Valued Client that was just ripped off by the boiler room staff and FSM's rigged MT4 replenished by Virtual Editor (default losses with FSM usually happen on minors and exotics, like RON/USD or TRY/USD), the first instance would be https://www.lawsociety.org.uk/, followed by the Marshal Islands Court as the final destination.

This Polish legal entity Memphis Investments Sp. z o.o. points to a quite interesting direction. Company details here: link. Authorized person, a lady called Pawluk Patrycja. She holds other nominations in the registrar (link) so she is not that important (a nominee director/holder, so called 'monkey', paid to register a local company, however legally liable, weather she likes it or not). Those registered in the Memphis ownership structure, on the other hand, are important, as they lead to a new direction of the FSM SCHEME environment: Memphis breakdown. As any other similar company used for the same illicit business, first ones registered as owner(s) that committed capital, are quickly removed and an actual person or persons are delegated. They do the actual business. In Memphis Poland case, it was like this:

So, the Suliman's were another intermediary nominees, hence we won't bother with them as well. Mr Rosenbaum is obviously the main guy there. Mr Rosenbaum also holds position in Estonian company Quantum Team OU, link, financial, admin, support activities. This is actually a standard setup for scams, these companies are necessary for either moving the money or registering as a merchant with a PSP or crypto-platform (today its both), to be able to move money deposited by FSM scheme clients to far away destinations. And it's not just reserved for FSMSmart brand, no... Just with a simple google check of Enigma GRC Ltd shows warnings for illegal and fraudulent brands operated by Enigma GRC, hence here and now officially added to FSM Scheme scam list and from direct FSMSmart environment/operators:

- Income Class - True Capital Pro - Profitix

Valuable links of warnings and info: ASIC, NZ.FMA, Consob,...you get the picture. After this relatively short part, it can be more clear why would an offshore FSMSmart require UK arbitration, while at all times they claim to be located in Switzerland (Lucern), although off course they are not. However, Mr Mordechai Moshe Rosenbaum is in the UK. And possibly in the USA/Canada as well. Where actually most of the FSM Scheme client deposits went. But that's the story for the following parts.

PART 4

This part 4 will deal with Trade12, HQBroker and FSMSmart(s) ties more closely. As proved previously, the scams are a part of the same racket. FSMSmart is to some extent covered here. Let's move on to the other 2 ones.

HQBroker scam has many bad reviews and warnings worldwide, link. Google them if you like, here's FCA . Targeted countries mainly Canada, Australia, New Zealand, a bit of UK and maybe some other Asian countries. Operated nominally by Capzone Invest Ltd, Marshal Islands, with fake Hong Kong address on their website.

Capzone Invest Ltd is now defunct/closed, as of May 2020. HQBroker still operates normally.

Capzone's alleged website is also not accessible, www.capzone-invest.com, domain data shows no info. There is (was) apparently a company with the same name in Bulgaria, but official registrar does not show it existed, so possibly a shared space location, under another name:

Exo Capital Markets Ltd, to repeat here again, lists as registrant for many of the scheme scams: Exo on domain big data. Apparently, this Exo Capital Markets ltd is now changed with Trade12 scam to some Turbo Trading Limited

Time does fly...Finally, continuing part 4.

HQBroker brand, equally blatant scam as Trade12 and part of the very same scheme, was meant more for Asia-Pacific regions and the Americas (USA excluded, they were not that stupid). Europeans too but, mainly those regions. Aussies and Canadians were favorite, big money was taken few years ago.

Then 'bad times' hit Trade12/HQBroker scammers. Apparently, Trade12 got greedy and engaged with local people as leads to be scammed. Then in December 2018, an event took place in Ukraine, where the actual boiler rooms were located. Locals started complaining as they were loosing all money and eventually Ukrainian cyber police had to intervene - they raided offices, apartments and arrested many, seized money, IT equipment, drugs, documents and all sort of things a 'normal' boiler room contains.

Ukrainian delegated court was after that overwhelmed with things to process in this case, however it was not important to foreign victims as they could not legally participate, we were explained. Pity.

3 things are interesting regarding this short press release: 2 pieces of information from it and a chain of events triggered by it. First, the news comment section:

So, apparently the scam group walks free, which is not a surprise, as we have reviewed short version of the indictments of the Ukrainian court and it was very confusing, lacks consistency and does not determine who did what and to whom; furthermore, it is restricted only to Ukrainian citizens - victims of a scam, while many foreign victims are not even mentioned. The possible next scam comes in the form of this https://lblv.com/ LBLV Ltd, Seychelles. The broker does have a Seychelles FSA license, check via SFSA (better then nothing) but fails to state where the actual call center is (only registered Seychelles address indicated). This could be the standard business model, where IBs are engaged, which is fine, as long as the IB acts accordingly. Which they usually don't. Many brands were destroyed this way, but also raises the big question - does the broker know what the IB is doing in reality and how does the broker check their daily activities to ensure full compliance with the legal requirements across the globe are met? Finally, the Ukrainian financial authorities have warned the public about LBLV brand, which is in light of these events, very bad: link. But, we cannot conclude this, its just a hear say. Then, at the end of the Finance Magnates news, the reporter concludes with a note: 'After the publication of this article, Igor Pejovic, the alleged Director of HQBroker reached out to Finance Magnates. Pejovic claims that the offices raided by Ukrainian police belonged to an affiliate company, one that HQBroker does not own, which the broker uses to source data and leads. Finance Magnates cannot confirm the veracity of this claim and would add that reviews of HQBroker are overwhelmingly negative and replete with assertions that the broker operates fraudulently.' Although we cannot confirm 100%, the odds are that this gentleman is a Montenegrin citizen, holding a call center in Belgrade, Serbia, called THEIA DOO (Theia Ltd), established in May 2017 and with current address where several other boiler rooms are located already (confirmed in our other threads), for example Parogan DOO (address Boulevard Milutina Milankovica 9, Belgrade, RS). Unpleasant coincidence or how many coincidences till 'chance' is ruled out? Incorporation act, publicly available

Finally, the strange coincidence regarding an event that happened at the exact same time as the boiler room raid in mid December 2018. In the earlier parts of this long and exhausting thread (that will for sure require a summary in the end, to recap and digest the exposed), we pointed out that Mr Armin Ordodary's Serbian branch of Benrich Holdings Cyprus, called Upmarkt Ltd, that handled FSMSmart brand (FTD center) was closed due to quite bad results. However, it ceased operations suddenly and instantaneously, within a day or two, during early December 2018, which strangely coincides with the Ukrainian boiler room bust (first 2 weeks of December 2018). Tipped off by Kyiv 'friends'? Then, one more thing happened: another Armin Ordodary company, Estonian Bythos Yachts Management OÜ had a sudden first cash move on its bank account, in Q4 2018. We will assume it's very late 2018, December...payout, extracting money, moving it, or a lucky shot and a first yacht client of the company? Judge for your selves. For us, there are too many coincidences. Btw, apparently the company gains lots of clients with yachts in 2019 and 2020, perfectly normal to have increased turnover during covid lockdowns, while cruisers, cargos and air companies lay off staff massively, right?

Going forward, there is a FPA member Scam-Rescue, a Canadian guy, that got scammed and posted a review here but also started his own website, that we had the pleasure to see grow over the past few years, from simple and honestly angry post to a developed actions against such scams in general and possible ways through the system to retrieve lost funds (chargeback options). We are not promoting it here but state that this brave young man took a stand, all alone - and made it. Bravo! We'll show you some interesting info re his 'case'. Coming up soon...

1 note

·

View note

Text

FSM Smart

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

Anyhow, whoever the scam operator was, once compromised, quickly switched to 2014 est.&Belize incorporated Lau Global Services Corpwww.lgs-corp.com (now defunct BZ reg.search) operating MX Trade as of April 2015 (per T&C archive) which is a standard next step that all scammers make, when the brand is exposed. Lau Global was a full scam from day one, FB page still online, ASIC warning, CySEC warningIFSC warning, FSMA warning revealing that deposits went to Taris Financial Corp, not present in offshore leaks, Cypriot, Vanuatu, Belize or Marshal Islands registers, but with bank account in Cyprus, meaning it had to be incorporated somewhere to obtain a bank account. Possible best match via google search would be a few companies named Taris from Riga, Latvia, or Sofia, Bulgaria, but it’s just a random speculation with no actual meaning, or any insinuation towards those companies. Whatever it is, it’s obvious that they continued a scam. Lau Global, thanks to ICIJ offshore leaks, can be de-masked fully: Offshoreleaks-LauGlobal. Lau Global was the sole shareholder of 2014 Malta-incorporated Grizzly Ltd. Looks like the entire structure from the start was prepared in 2014 and, once the time came, just relocated, implying a plan/intention, from the start. Grizzly Ltd has one owner, Mr. Shlomo Matan Shalom Avshalom, an Israeli national, with Philippines address, per offshore leaks. This was very indicative to us, as we had the information some time ago to pursue some lawyers and Philippines call centers direction, to get to the bottom of this scheme setup. So we did. Others who looked into this information just continued with having a name from offshore leaks, but no more. Let’s have a look at this Mr Avshalom more, shall we?

In offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered.

And you can verify all via this link: ICIJ offshoreleaks. By the way, Belize IBCs are defunct now (check BZ reg). Grizzly Ltd was the operator of another big scam, TradingBanks, at the time falsely claiming to be incorporated in British Virgin Islands as some bogus St. World Trade Inc, receiving BVI FSC warning. Furthermore, FPA 1-star review, then multiple warnings from FSB, domicile MFSA (for both TradingBanks and MX Trade, warning), FINMA, CONSOB, even Belize IFSC (warning), tradingbanks warnings, give final 2016 verdict – pure scam, operated by the above people and companies, no doubt about it. Grizzly Ltd has a secretary listed, one Mr David Meli link, a lawyer from a famous Michael Kyprianou (MT, CY) law practice office, that was used as nominee registrar intermediary. Mr Meli has a long list of offshore incorporations for their clients (check offshore leaks) which is not forbidden off course, it’s a good business and a sensitive service. Furthermore, Michael Kyprianou & Co Llc is a member of such esteemed groups like IFG (International Fraud Group, link), where one learns the office expanded its subsidiaries from CY to Greece, Malta and Ukraine. No presumptions here, just pointing out the well-known fact that many scam operators choose Paphos, Kiev, and other locations for their business. Any conclusion drawn by the readers here is their free choice solely, we do not even insinuate any connection, but merely state the industry-wide known general facts. Especially when it comes to Paphos, CY…By the way, besides Malta, Mr. Avshalom holds positions in two more companies in Cyprus. In Paphos, Cyprus, to be precise: Tevtach Ltd link (completely new one, May 2020) and A.VV.L Investments Ltd link (fresh, 2019). Sidetrack - with this Tevtach Ltd registered persons, one name search show interesting results- if not a football player or self-proclaimed LinkedIn lawyer with 1 connection, then it is most probably this Elior Vaknin, from Israeli Bynet Group, link, link, link. Just wondering what is a customer care representative from Rad Bynet Group (telecommunication, BPO, telephony, internet, outsourcing/offshoring, IP phones, etc) doing serving as co-director with Mr Avshalom, proven to be involved in illicit and questionable businesses? But that would be his private matter, off course. Finally, maybe it’s not him. This cannot be confirmed now. But to prove we are not malicious at all, just try to state the facts or obvious indications, here is one nice achievement of Mr. Avshalom, proving he is an interesting individual indeed – a co-inventor of an important and useful patent: IL patent registrar 2018, combined scissors and comb for books.

Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore: link and maybe Hong Kong

Why Hong Kong? We will prove a point shortly. Here we will just complete this sentence with public document where a certain Mr. Avshalom from Israel is indicated as the President (wow!) of GWU MKTG CORP. 08F Clark Center Berthaphil III, JAS Ave., CFZP, pls see: PH alien employment permit filling. GWU MKTG Corp website, domain-big-data tool shows registration from Cyprus (?) in 2015 link, while the company website kind of gives it away, doesn’t it?

1 note

·

View note

Text

FSM Smart

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.

The beneficial owner(s) are well hidden and this vast group obviously has no intention to stop. We shall try to do our best to unmask this ‘giant’ as much as possible. For the purpose of clarity, we shall generically call them ‘’the FSM scheme’’ since its brand FSM Smart is probably the biggest and longest standing one. This thread will be quite long and posted in successive parts, due to the size on info we aim to display on FPA, so you are warned that it will take patience and attention to follow. No shortcuts here or easy solutions.

The named ‘FSM scheme’ is comprised of (up to now known) following scam brands/trading styles: 1. MTI Markets www.mtimarkets.com 2. TradingBanks www.grizzly-ltd.com also t/a www.tradingbanks.com (own trade platform+TradingBanks) 3. MX Trade www.mxtrade.com 4. Trade12 www.trade12.com 5. HQBroker www.hqbroker.com (up to this thread, probably never associated to FSM Smart brand before) 6. FSM Smart www.fsmsmart.com, www.fsmsmarts.com, www.it.fsmsmart.net, www.fsmsmart-ltd.com

We are positive that more brands are involved or were a part of this. This organization is truly like an Octopus. But as any other such group, made the same mistakes when registering various companies and using 3rd parties providers, leaving traces behind. Now days, scammers are much more cautious, in general, as there is more focus on scams, narrowing down their operating boundaries. First brand operator of MX Trade scam appeared to be a 2014 est.&CySEC regulated/FCA-passport company R Capital Solutions Ltd, FCA, CySEC, CY registrar. Owner was a Romanian citizen residing in Cyprus, Mr. Victor Florin Safta, who had another linked company in the UK, F Capital Solutions LtdCompanies House Reg. CySEC regulated R Capital Solutions claimed they never operated MX Trade by issuing a public statement:

n offshore leaks, Shlomo Matan Shalom Avshalom, linked to Philippines and Israel residency addresses, is the director and legal/judicial representative of Malta based Quick Solutions Ltd (2014) and Grizzly Ltd (2015), with his registered address (another company): BSD Trading Service Corp, Office O5M, Berthaphil Compound, Jose Abad Santos Avenue, Angeles, Pampanga, Philippines. Quick Solutions is owned by Belize IBC called High Moon International Inc, while Grizzly Ltd is owned by Belize IBC Lau Global Service Corp. Both Grizzly and Quick solutions have the identical Malta address registered

Back to business. Following the trail of the lawyer and the Philippines address, we land at Pampanga, PH. A well-known place for numerous call-centers, as well as India for example, again industry-wide known facts. Truly a lot of customer care offices for hundreds of different businesses, an army of cheap multilingual workforce. Over the years, we all witnessed even some police raids to scam call centers, over there they even announce it on TV, with full press conference and detained agent’s close-ups on national frequencies. As for our story, the address in offshore leaks revealed Mr. Avshalom’s Pampanga address for BSD Trade Services Corp or rather, BSD Trading Services Corp. BSD Trading/Trade Serv. Corp is actually a Philippines BPO, a call-center, however incorporated in Singapore: link and maybe Hong Kong

1 note

·

View note

Text

The Importance of Forex Regulatory Bodies

The Importance of Forex Regulatory Bodies The foreign exchange (forex) market is the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion. Given its size and decentralized nature, the forex market is susceptible to various risks, including fraud, manipulation, and unethical practices. This is where forex regulatory bodies play a crucial role. These organizations are responsible for overseeing and regulating the forex market to ensure its integrity, transparency, and fairness. This article explores the importance of forex regulatory bodies and their impact on the market.To get more news about forex regulatory, you can visit our official website.

Ensuring Market Integrity One of the primary functions of forex regulatory bodies is to maintain market integrity. They achieve this by setting and enforcing rules and standards that all market participants must follow. These regulations help prevent fraudulent activities, such as price manipulation and insider trading, which can undermine the trust and stability of the market. For instance, the U.S. Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) are responsible for regulating forex trading in the United States, ensuring that brokers and traders adhere to strict ethical standards.

Protecting Investors Investor protection is another critical aspect of forex regulation. Regulatory bodies implement measures to safeguard retail traders from unscrupulous brokers and fraudulent schemes. This includes requiring brokers to be licensed and registered, conducting regular audits, and ensuring that they maintain adequate capital reserves. In the European Union, the European Securities and Markets Authority (ESMA) has introduced stringent regulations to protect investors, such as leverage limits and negative balance protection. These measures help create a safer trading environment for retail investors.

Promoting Transparency Transparency is essential for the proper functioning of the forex market. Regulatory bodies promote transparency by requiring brokers to provide clear and accurate information about their services, fees, and trading conditions. This allows traders to make informed decisions and compare different brokers effectively. For example, the Financial Conduct Authority (FCA) in the United Kingdom mandates that brokers disclose their financial statements and any conflicts of interest. Such transparency helps build trust between brokers and traders, fostering a more reliable market.

Enhancing Market Stability Forex regulatory bodies also play a vital role in enhancing market stability. By monitoring and supervising the activities of market participants, they can identify and address potential risks before they escalate. This proactive approach helps prevent systemic issues that could disrupt the market. The Australian Securities and Investments Commission (ASIC), for instance, closely monitors the financial health of brokers and takes corrective actions when necessary to ensure market stability.

Facilitating Dispute Resolution Disputes between traders and brokers are inevitable in the forex market. Regulatory bodies provide mechanisms for resolving these disputes fairly and efficiently. They offer mediation and arbitration services to help parties reach amicable solutions without resorting to lengthy and costly legal proceedings. The Cyprus Securities and Exchange Commission (CySEC) is known for its effective dispute resolution framework, which has helped resolve numerous conflicts between traders and brokers.

Adapting to Technological Advancements The forex market is constantly evolving, driven by technological advancements and changing market dynamics. Regulatory bodies must adapt to these changes to remain effective. This includes updating regulations to address new trading technologies, such as algorithmic trading and cryptocurrencies. By staying ahead of technological trends, regulatory bodies can continue to protect market participants and ensure the market’s integrity. The Monetary Authority of Singapore (MAS) is a prime example of a regulator that has embraced innovation while maintaining robust oversight.

Conclusion In conclusion, forex regulatory bodies are indispensable for the proper functioning of the forex market. They ensure market integrity, protect investors, promote transparency, enhance market stability, facilitate dispute resolution, and adapt to technological advancements. Without these regulatory bodies, the forex market would be vulnerable to fraud, manipulation, and systemic risks. Therefore, it is essential for traders to understand the role of these organizations and choose brokers that are regulated by reputable authorities. By doing so, they can trade with confidence and contribute to a fair and transparent forex market.

0 notes

Text

The FSM SCHEME

Online trading scam broker called FSM Smart is part of an incredibly large scam group, rarely spoken of or systematically exposed, due to many illegal unconnected brands and quite complicated and fluid network of shells, off-shores, PSPs and BPOs worldwide. Indeed smartly put, the name serves them well. At the time, the Fintelegram did a good job in exposing some parts and initiating the public attention, that was previously restricted to warnings to particular brands and occasional info scattered across many different forums. Apparently, they had problems because of it. However, the full story is yet to be told. We hope to bring more clarity and tie the missing parts. For sure it will not be a complete report, but joint efforts bear fruits, eventually. The full story should be revealed by the Law, not us or others. So far, the representatives of the law have done very little, mainly due to scheme’s multi jurisdictional and transnational nature.